UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the Month of November 2025

Commission File Number: 001-38104

IMMURON LIMITED

(Name of Registrant)

Level 3, 62 Lygon Street, Carlton South, Victoria, 3053, Australia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-Immuron Limited (the “Company”) published two announcements (the “Public Notices”) to the Australian Securities Exchange on November 11, 2025 titled:

IMMURON LIMITED

EXPLANATORY NOTE

| 99.1 | CEO Address | |

| 99.2 | Results of Annual General Meeting |

A copy of the Public Notice is attached as an exhibit to this report on Form 6-K.

This report on Form 6-K (including the exhibit hereto) shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

EXHIBITS

| Exhibit Number |

Description | |

| 99.1 | CEO Address | |

| 99.2 | Results of Annual General Meeting |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| IMMURON LIMITED | ||

| Date: November 12, 2025 | By: | /s/ Phillip Hains |

| Phillip Hains | ||

| Company Secretary | ||

3

Exhibit 99.1

ASX/NASDAQ Announcement

11 November 2025

2025 Annual General Meeting - CEO Address

Immuron Limited (ASX: IMC; NASDAQ: IMRN) attaches the CEO Address to be delivered by Chief Executive Officer, Steve Lydeamore, at this morning’s Annual General Meeting.

- - - END - - -

This release has been authorised by the Directors of Immuron Limited.

Further information

Steven Lydeamore

Chief Executive Officer

steve@immuron.com

About Immuron

Immuron Limited (ASX: IMC, NASDAQ: IMRN), is an Australian biopharmaceutical company focused on developing and commercializing orally delivered targeted polyclonal antibodies for the treatment of infectious diseases.

Immuron Platform Technology

Immuron’s proprietary technology is based on polyclonal immunoglobulins (IgG) derived from engineered hyper-immune bovine colostrum. Immuron has the capability of producing highly specific immunoglobulins to any enteric pathogen and our products are orally active. Bovine IgG can withstand the acidic environment of the stomach and is resistant to proteolysis by the digestive enzymes found in the Gastrointestinal (GI) tract. Bovine IgG also possesses this unique ability to remain active in the human GI tract delivering its full benefits directly to the bacteria found there. The underlying nature of Immuron’s platform technology enables the development of medicines across a large range of infectious diseases. The platform can be used to block viruses or bacteria at mucosal surfaces such as the Gastrointestinal tract and neutralize the toxins they produce.

For more information visit: https://www.immuron.com.au/ and https://www.travelan.com

Sign up to Immuron’s Investor Hub: Here

FORWARD-LOOKING STATEMENTS:

This press release may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended. Such statements include, but are not limited to, any statements relating to our growth strategy and product development programs and any other statements that are not historical facts. Forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties that could negatively affect our business, operating results, financial condition, and stock value. Factors that could cause actual results to differ materially from those currently anticipated include: risks relating to our growth strategy; our ability to obtain, perform under and maintain financing and strategic agreements and relationships; risks relating to the results of research and development activities; risks relating to the timing of starting and completing clinical trials; uncertainties relating to preclinical and clinical testing; our dependence on third-party suppliers; our ability to attract, integrate and retain key personnel; the early stage of products under development; our need for substantial additional funds; government regulation; patent and intellectual property matters; competition; as well as other risks described in our SEC filings. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations or any changes in events, conditions, or circumstances on which any such statement is based, except as required by law.

AGM PRESENTATION 11 NOVEMBER 2025 S teve n Lyde a m ore - C EO NASDAQ: IMRN ASX: IMC 2 2 Certain statements made in this presentation are forward - looking statements and are based on Immuron’s current expectations, estimates and projections.

Words such as “ anticipates,” “expects,” “intends,” “plans,” “believes,” “ seeks,” “estimates,” “guidance” and s imilar expressions are intended to identify forward - looking statements. Although Immuron believes the forward - looking statements are based on reasonable assumptions, they are subject to certain r i sks and uncertainties, some of which are beyond Immuron’s control, including those r i sks or uncertainties inherent in the process of both developing and commercializing technology. As a result, actual results could materially differ f rom those expressed or forecasted in the forward - looking statements. The forward - looking statements made in this presentation relate only to events as of the date on which the statements are made. Immuron will not undertake any obligation to release publicly any revisions or updates to these forward - looking statements to reflect events, circumstances or unanticipated events occurring after the date of this presentation except as required by l aw or by any appropriate regulatory authority. FY 2026 results in this presentation are subject to audit review.

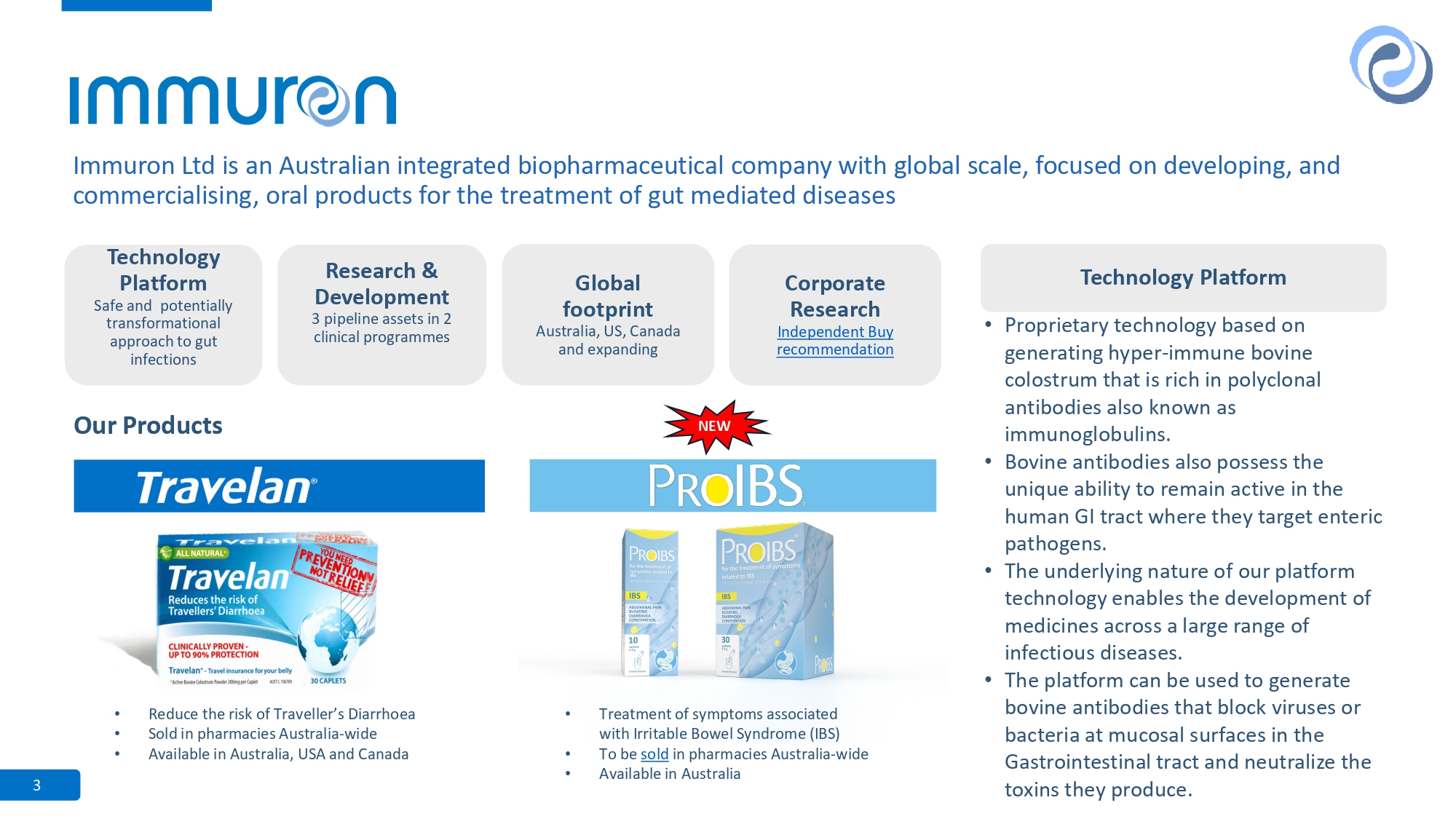

SAFE HARBOR STATEMENT 3 Immuron Ltd is an Australian integrated biopharmaceutical company with global scale, focused on developing, and commercialising, oral products for the treatment of gut mediated diseases Research & Development 3 pipeline assets in 2 clinical programmes Global footprint Australia, US, Canada and expanding Technology Platform Safe and potentially transformational approach to gut infections Our Products • Reduce the risk of Traveller’s Diarrhoea • Sold in pharmacies Australia - wide • Available in Australia, USA and Canada • Treatment of symptoms associated with Irritable Bowel Syndrome (IBS) • To be sold in pharmacies Australia - wide • Available in Australia NEW • Proprietary technology based on generating hyper - immune bovine colostrum that is rich in polyclonal antibodies also known as immunoglobulins. • Bovine antibodies also possess the unique ability to remain active in the human GI tract where they target enteric pathogens. • The underlying nature of our platform technology enables the development of medicines across a large range of infectious diseases. • The platform can be used to generate bovine antibodies that block viruses or bacteria at mucosal surfaces in the Gastrointestinal tract and neutralize the toxins they produce.

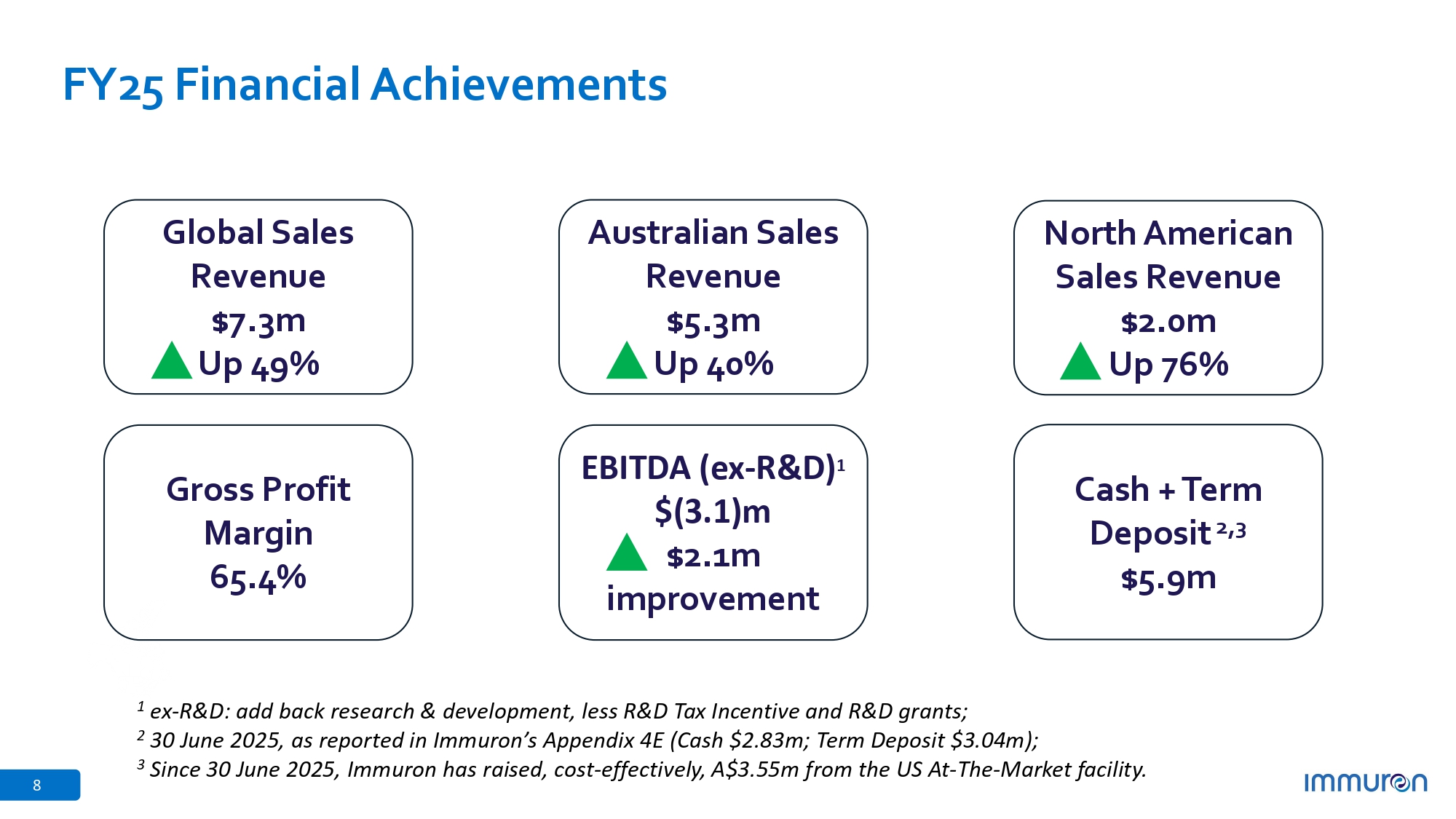

Technology Platform Corporate Research I ndependent Buy recommendation 8 FY25 Financial Achievements Global Sales Revenue $7.3m Up 49% Australian Sales Revenue $5.3m Up 40% North American Sales Revenue $2.0m Up 76% Gross Profit Margin 65.4% EBITDA (ex - R&D) 1 $(3.1)m $2.1m improvement Cash + Term Deposit 2,3 $5.9m 1 ex - R&D: add back research & development, less R&D Tax Incentive and R&D grants; 2 30 June 2025, as reported in Immuron’s Appendix 4E (Cash $2.83m; Term Deposit $3.04m); 3 Since 30 June 2025, Immuron has raised, cost - effectively, A$3.55m from the US At - The - Market facility.

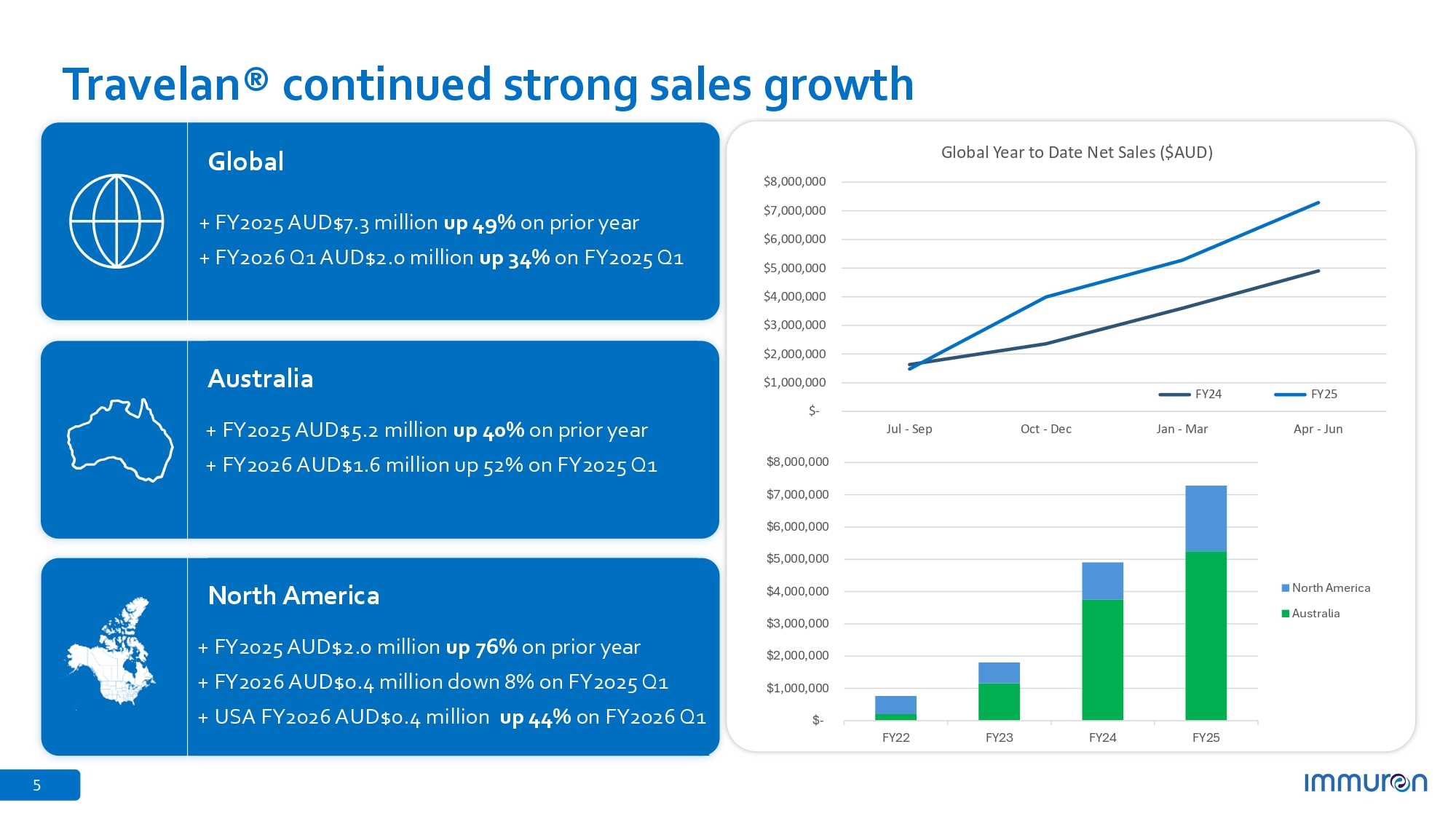

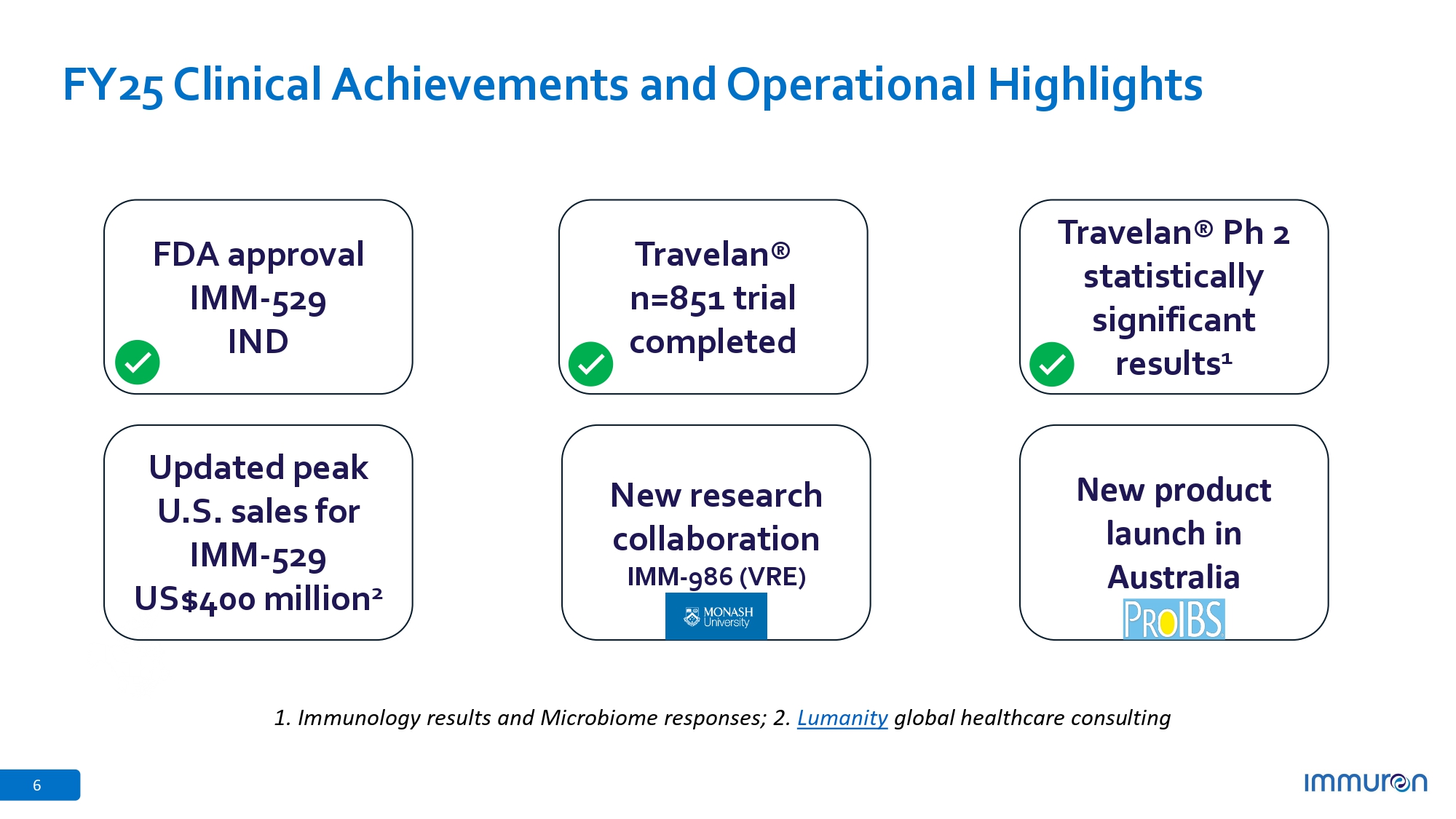

5 Travelan® continued strong sales growth Global + FY2025 AUD$7.3 million up 49% on prior year + FY2026 Q1 AUD$2.0 million up 34% on FY2025 Q1 Australia + FY2025 AUD$5.2 million up 40% on prior year + FY2026 AUD$1.6 million up 52% on FY2025 Q1 North America + FY2025 AUD$2.0 million up 76% on prior year + FY2026 AUD$0.4 million down 8% on FY2025 Q1 + USA FY2026 AUD$0.4 million up 44% on FY2026 Q1 $ - $1,000,000 $4,000,000 $3,000,000 $2,000,000 $5,000,000 $6,000,000 $7,000,000 $8,000,000 Jul - Sep Oct - Dec Jan - Mar Apr - Jun Global Year to Date Net Sales ($AUD) FY24 FY25 $ - $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $7,000,000 $6,000,000 $8,000,000 FY22 FY23 FY24 FY25 North America Australia 6 FY25 Clinical Achievements and Operational Highlights FDA approval IMM - 529 IND Travelan® n= 851 trial completed Travelan® Ph 2 statistically significant results 1 New research collaboration IMM - 986 (VRE) New product launch in Australia Updated peak U.S. sales for IMM - 529 US$400 million 2 1. Immunology results and Microbiome responses; 2. Lumanity global healthcare consulting

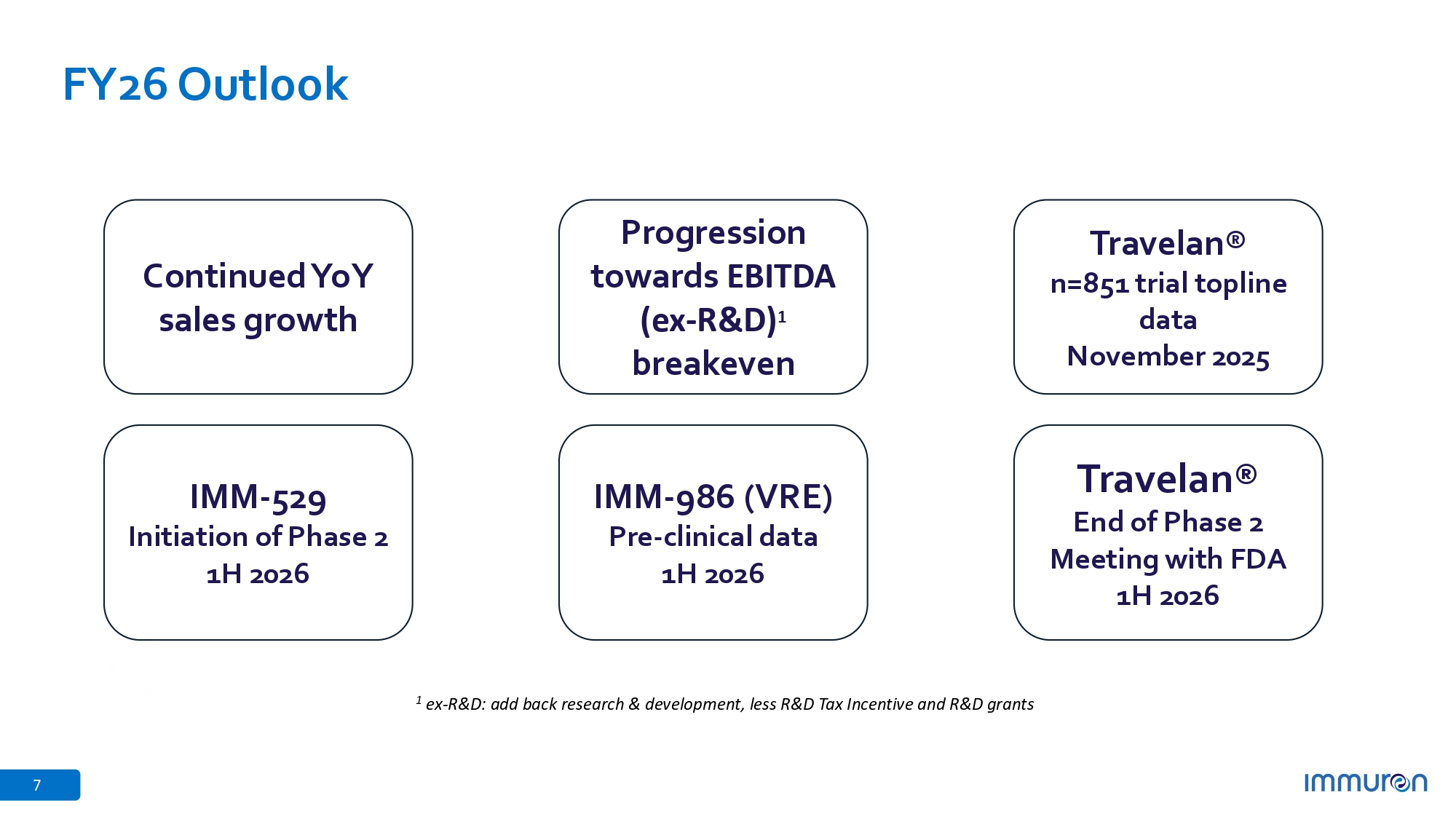

7 FY26 Outlook Continued YoY sales growth Progression towards EBITDA (ex - R&D) 1 breakeven Travelan® n=851 trial topline data November 2025 IMM - 986 (VRE) Pre - clinical data 1H 2026 Travelan® End of Phase 2 Meeting with FDA 1H 2026 IMM - 529 Initiation of Phase 2 1H 2026 1 ex - R&D: add back research & development, less R&D Tax Incentive and R&D grants STEVEN LYDEAMORE CHIEF EXECUTIVE OFFICER IMMURON LIMITED CONTACT INFORMATION: EMAIL: STEVE@IMMURON.COM PHONE: AUSTRALIA: +61 438 027 172 IMMURON I NVESTOR HUB COMMUNICATION AND CONTENT INCLUDING ANNOUNCEMENTS AND CORPORATE RESEARCH

Exhibit 99.2

ASX/NASDAQ Announcement

11 November 2025

2025 Annual General Meeting Results

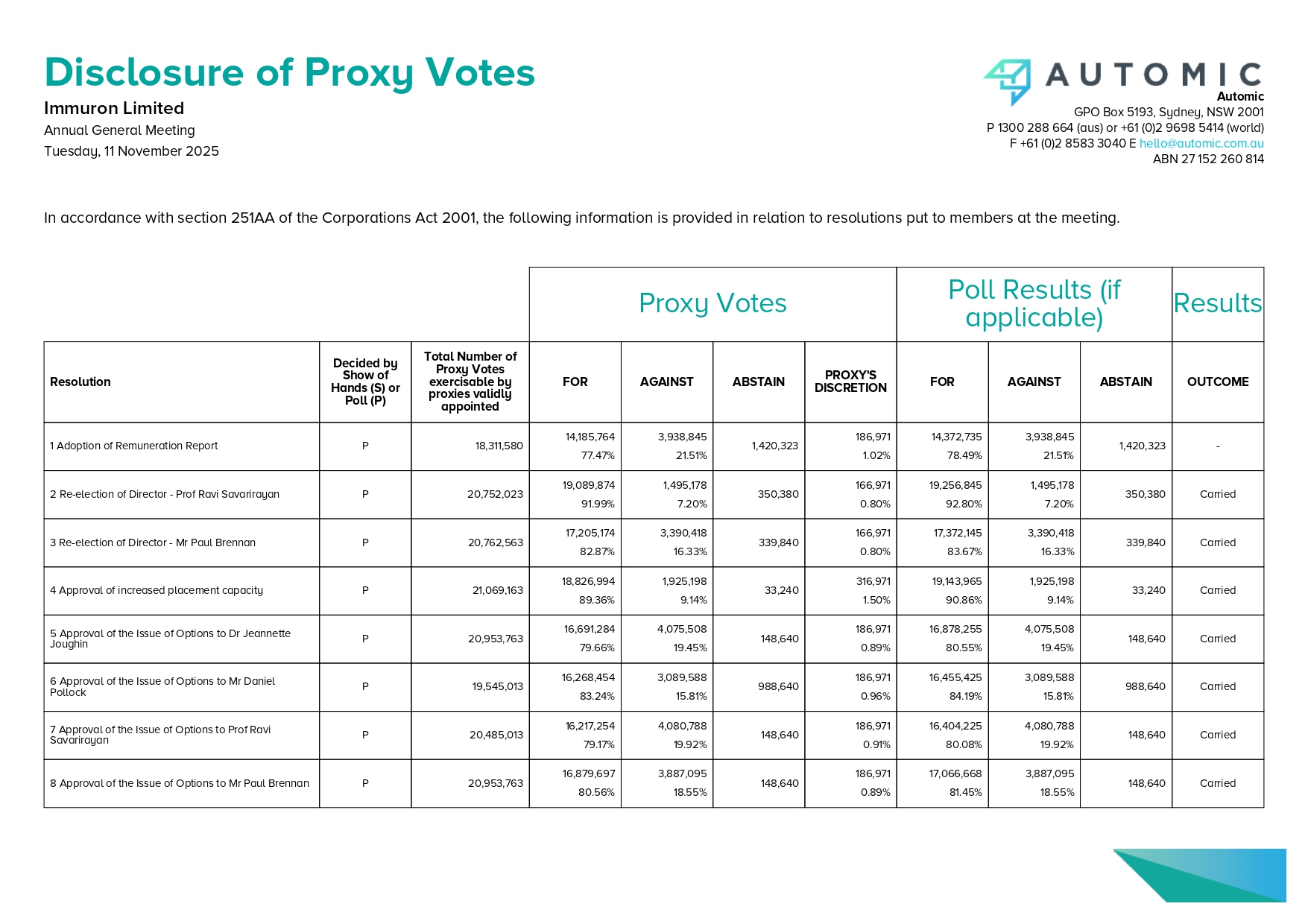

In accordance with ASX Listing Rule 3.13.2 and Section 251AA of the Corporations Act 2001 Immuron Limited (ASX: IMC; NASDAQ: IMRN or the Company) advises that the shareholders of the Company passed all resolutions in the Notice of Meeting at the 2025 Annual General Meeting held earlier today.

All resolutions put to the meeting were carried by way of a poll. All resolutions were carried. Details of the resolutions and the proxies received in respect of each resolution are set out in the attached proxy summary.

- - - END - - -

This release has been authorised by the Directors of Immuron Limited.

Further information

Steven Lydeamore

Chief Executive Officer

steve@immuron.com

About Immuron

Immuron Limited (ASX: IMC, NASDAQ: IMRN), is an Australian biopharmaceutical company focused on developing and commercializing orally delivered targeted polyclonal antibodies for the treatment of infectious diseases.

Immuron Platform Technology

Immuron’s proprietary technology is based on polyclonal immunoglobulins (IgG) derived from engineered hyper- immune bovine colostrum. Immuron has the capability of producing highly specific immunoglobulins to any enteric pathogen and our products are orally active. Bovine IgG can withstand the acidic environment of the stomach and is resistant to proteolysis by the digestive enzymes found in the Gastrointestinal (GI) tract. Bovine IgG also possesses this unique ability to remain active in the human GI tract delivering its full benefits directly to the bacteria found there. The underlying nature of Immuron’s platform technology enables the development of medicines across a large range of infectious diseases. The platform can be used to block viruses or bacteria at mucosal surfaces such as the Gastrointestinal tract and neutralize the toxins they produce.

For more information visit: https://www.immuron.com.au/ and https://www.travelan.com

Sign up to Immuron’s Investor Hub: Here

FORWARD-LOOKING STATEMENTS:

This press release may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended. Such statements include, but are not limited to, any statements relating to our growth strategy and product development programs and any other statements that are not historical facts. Forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties that could negatively affect our business, operating results, financial condition, and stock value. Factors that could cause actual results to differ materially from those currently anticipated include: risks relating to our growth strategy; our ability to obtain, perform under and maintain financing and strategic agreements and relationships; risks relating to the results of research and development activities; risks relating to the timing of starting and completing clinical trials; uncertainties relating to preclinical and clinical testing; our dependence on third-party suppliers; our ability to attract, integrate and retain key personnel; the early stage of products under development; our need for substantial additional funds; government regulation; patent and intellectual property matters; competition; as well as other risks described in our SEC filings. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations or any changes in events, conditions, or circumstances on which any such statement is based, except as required by law.

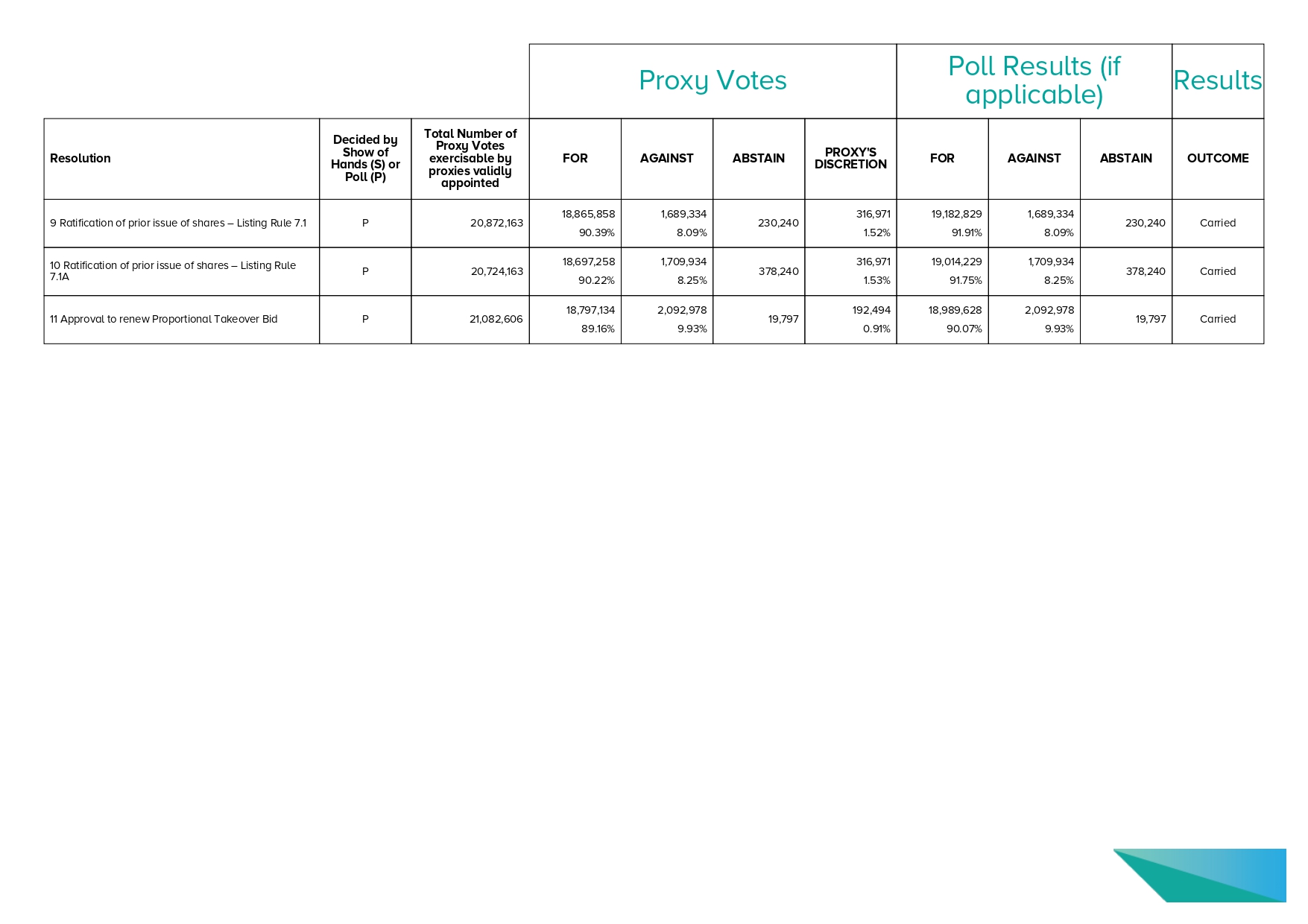

Disclosure of Proxy Votes Immuron Limited Annual General Meeting Tuesday, 11 November 2025 In accordance with section 251AA of the Corporations Act 2001, the following information is provided in relation to resolutions put to members at the meeting. Automic GPO Box 5193, Sydney, NSW 2001 P 1300 288 664 (aus) or +61 (0)2 9698 5414 (world) F +61 (0)2 8583 3040 E hello@automic.com.au ABN 27 152 260 814 Results Poll Results (if applicable) Proxy Votes OUTCOME ABSTAIN AGAINST FOR PROXY'S DISCRETION ABSTAIN AGAINST FOR Total Number of Proxy Votes exercisable by proxies validly appointed Decided by Show of Hands (S) or Poll (P) Resolution - 1,420,323 3,938,845 21.51% 14,372,735 78.49% 186,971 1.02% 1,420,323 3,938,845 21.51% 14,185,764 77.47% 18,311,580 P 1 Adoption of Remuneration Report Carried 350,380 1,495,178 7.20% 19,256,845 92.80% 166,971 0.80% 350,380 1,495,178 7.20% 19,089,874 91.99% 20,752,023 P 2 Re - election of Director - Prof Ravi Savarirayan Carried 339,840 3,390,418 16.33% 17,372,145 83.67% 166,971 0.80% 339,840 3,390,418 16.33% 17,205,174 82.87% 20,762,563 P 3 Re - election of Director - Mr Paul Brennan Carried 33,240 1,925,198 9.14% 19,143,965 90.86% 316,971 1.50% 33,240 1,925,198 9.14% 18,826,994 89.36% 21,069,163 P 4 Approval of increased placement capacity Carried 148,640 4,075,508 19.45% 16,878,255 80.55% 186,971 0.89% 148,640 4,075,508 19.45% 16,691,284 79.66% 20,953,763 P 5 Approval of the Issue of Options to Dr Jeannette Joughin Carried 988,640 3,089,588 15.81% 16,455,425 84.19% 186,971 0.96% 988,640 3,089,588 15.81% 16,268,454 83.24% 19,545,013 P 6 Approval of the Issue of Options to Mr Daniel Pollock Carried 148,640 4,080,788 19.92% 16,404,225 80.08% 186,971 0.91% 148,640 4,080,788 19.92% 16,217,254 79.17% 20,485,013 P 7 Approval of the Issue of Options to Prof Ravi Savarirayan Carried 148,640 3,887,095 18.55% 17,066,668 81.45% 186,971 0.89% 148,640 3,887,095 18.55% 16,879,697 80.56% 20,953,763 P 8 Approval of the Issue of Options to Mr Paul Brennan Results Poll Results (if applicable) Proxy Votes OUTCOME ABSTAIN AGAINST FOR PROXY'S DISCRETION ABSTAIN AGAINST FOR Total Number of Proxy Votes exercisable by proxies validly appointed Decided by Show of Hands (S) or Poll (P) Resolution Carried 230,240 1,689,334 8.09% 19,182,829 91.91% 316,971 1.52% 230,240 1,689,334 8.09% 18,865,858 90.39% 20,872,163 P 9 Ratification of prior issue of shares – Listing Rule 7.1 Carried 378,240 1,709,934 8.25% 19,014,229 91.75% 316,971 1.53% 378,240 1,709,934 8.25% 18,697,258 90.22% 20,724,163 P 10 Ratification of prior issue of shares – Listing Rule 7.1A Carried 19,797 2,092,978 9.93% 18,989,628 90.07% 192,494 0.91% 19,797 2,092,978 9.93% 18,797,134 89.16% 21,082,606 P 11 Approval to renew Proportional Takeover Bid