UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

November 10, 2025

Date of Report (Date of earliest event reported)

Health In Tech, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 001-42449 | 87-3545722 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

| 701 S. Colorado Ave, Suite 1 Stuart, FL |

34994 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (888) 373-0333

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Class A Common Stock, $0.001 par value per share | HIT | The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On November 10, 2025, Health In Tech, Inc., a Nevada corporation (the “Company”) prepared an investor presentation that officers and other representatives of the Company intend to present at conferences and meetings. A copy of the investor presentation is furnished as Exhibit 99.1 of this Current Report on Form 8-K. The information set forth in this Item 7.01 of this Current Report on Form 8-K and in the attached Exhibit 99.1 is deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information set forth in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing.

Forward-Looking Statements

Certain statements in this Current Report on Form 8-K are forward-looking statements for purposes of the safe harbor provisions under the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements may include estimates or expectations about Health In Tech’s possible or assumed operational results, financial condition, business strategies and plans, market opportunities, competitive position, industry environment, and potential growth opportunities. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “should,” “design,” “target,” “aim,” “hope,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “project,” “potential,” “goal,” or other words that convey the uncertainty of future events or outcomes. These statements relate to future events or to Health In Tech’s future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause Health In Tech’s actual results, levels of activity, performance, or achievements to be different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond Health In Tech’s control and which could, and likely will, affect actual results, levels of activity, performance or achievements. Some of the risks and uncertainties, although not all risks and uncertainties, that could cause the Company’s actual results to differ materially from those presented in its forward-looking statements are set forth in the “Risk Factors” section in the Company’s Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q, and all of its other filings with the U.S. Securities and Exchange Commission, as such risks, uncertainties and other important factors may be updated from time to time in the Company’s subsequent reports. Any forward-looking statement reflects Health In Tech’s current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to Health In Tech’s operations, results of operations, growth strategy and liquidity.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| Exhibit No. | Description | |

| 99.1 | Investor Presentation. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: November 12, 2025 | ||

| HEALTH IN TECH, INC. | ||

| By: | /s/ Tim Johnson | |

| Name: | Tim Johnson | |

| Title: | Chief Executive Officer | |

Exhibit 99.1

Nasdaq: HIT

This Presentation has been prepared by the Company solely for informational purposes . The information included herein in this presentation has not been independently verified . No representations, warranties or undertakings, express or implied, are made by the Company or any of it’ s affiliates, advisers or representatives or the underwriters as to, and no reliance should be placed upon, the accuracy, fairness, completeness or correctness of the information or opinions presented or contained in this presentation . By viewing or accessing the information contained in this presentation, you acknowledge and agree that none of the Company or any of its affiliates, advisers or representatives or the underwriters accept any responsibility whatsoever (in negligence or otherwise) for any loss howsoever arising from any information presented or contained in this presentation or otherwise arising in connection with the presentation . The information presented or contained in this presentation is subject to change without notice and its accuracy is not guaranteed . None of the Company or any of its affiliates, advisers or representatives or the underwriters make any undertaking to update any such information subsequent to the date hereof . This presentation should not be construed as legal, tax, investment or other advice . This presentation contains statements that reflect the Company’s intent, beliefs or current expectations about the future . These statements can be recognized by the use of words such as “expects,” “plans,” “will,” “estimates,” “projects,” “intends,” or words of similar meaning . These forward - looking statements are not guarantees of future performance and are based on a number of assumptions about the Company’s operations and other factors, many of which are beyond the Company’s control, and accordingly, actual results may differ materially from these forward - looking statements . Caution should be taken with respect to such statements, and you should not place undue reliance on any such forward looking statements . The Company or any of its affiliates, advisers or representatives or the underwriters has no obligation and does not undertake to revise forward looking statements to reflect newly available information, future events or circumstances . This presentation does not constitute an offer to sell or an invitation to purchase or subscribe for any securities of the Company for sale in the United States or anywhere else . No part of this presentation shall form the basis of or be relied upon in connection with any contract or commitment whatsoever . Specifically, these materials do not constitute a “prospectus” within the meaning of the U . S . Securities Act of 1933 , as amended, and the regulations enacted thereunder . This presentation does not contain all relevant information relating to the Company or its securities, particularly with respect to the risks and special considerations involved with an investment in the securities of the Company . In evaluating its business, the Company uses certain non - GAAP measures as supplemental measures to review and assess its operating and financial performance . These non - GAAP financial measures have limitations as analytical tools, and when assessing the Company’s operating and financial performances, investors should not consider them in isolation, or as a substitute for any consolidated statement of operations data prepared in accordance with U . S . GAAP . 2 Disclaimer Health In Tech is Changing Healthcare through Digital Innovation 3

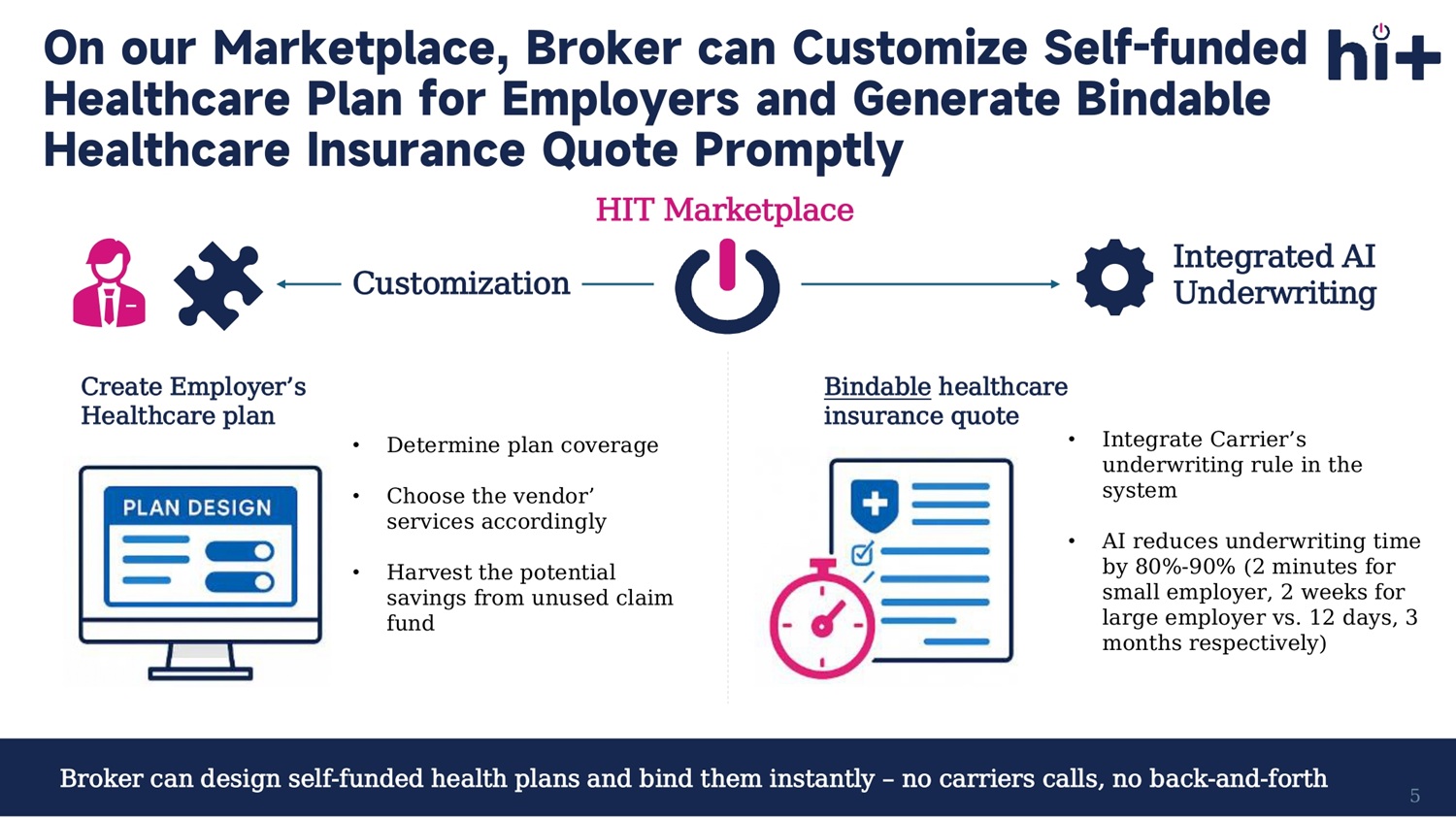

Transforming Healthcare Benefits through Technology Complete wellness Who we are: • An insurance marketplace innovating the self - funded healthcare insurance market for the businesses (employers). • Powered by third - party AI, businesses can design their own healthcare plans and purchase the health insurance seamlessly. Our AI - driven platform streamlines a complex process, enhances transparency, and empowers every participant in healthcare insurance ecosystem. • Brokers, employers, third party administrators, carriers, hospital, clinics are integrated and connected on our marketplace. 4 On our Marketplace, Broker can Customize Self - funded Healthcare Plan for Employers and Generate Bindable Healthcare Insurance Quote Promptly Create Employer’s Healthcare plan Integrated AI Underwriting • Determine plan coverage • Choose the vendor’ services accordingly • Harvest the po tential savings from unused claim fund • Integrate Carrier’s underwriting rule in the system • AI reduces underwriting time by 80% - 90% (2 minutes for small employer, 2 weeks for large employer vs. 12 days, 3 months respectively) Broker can design self - funded health plans and bind them instantly – no carriers calls, no back - and - forth Customization HIT Marketplace Bindable healthcare insurance quote 5

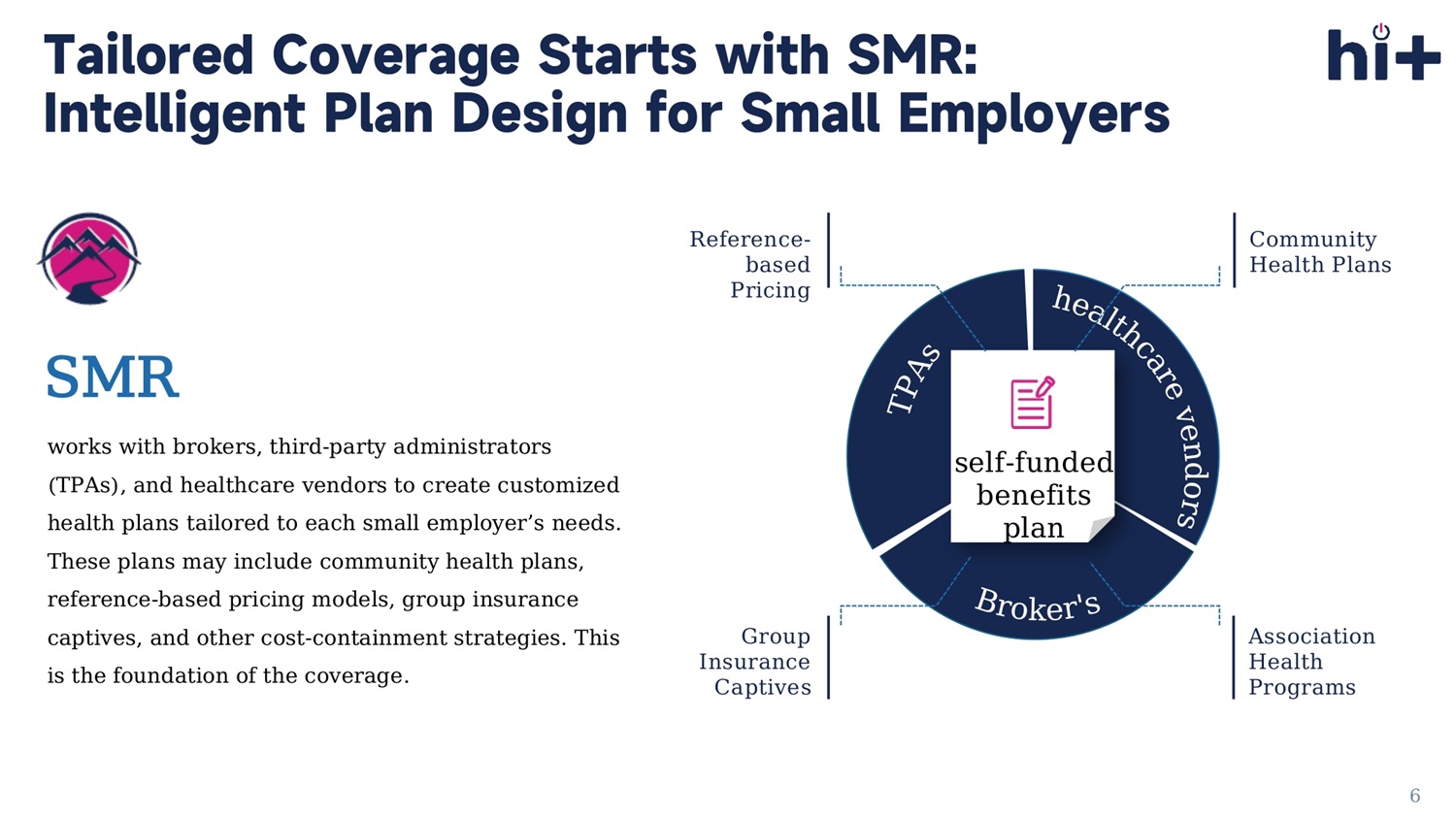

self - funded benefits plan Reference - based Pricing Group Insurance Captive s Community Health Plans Association Health Programs works with brokers, third - party administrators (TPAs), and healthcare vendors to create customized health plans tailored to each small employer’s needs. These plans may include community health plans, reference - based pricing models, group insurance captives, and other cost - containment strategies. This is the foundation of the coverage.

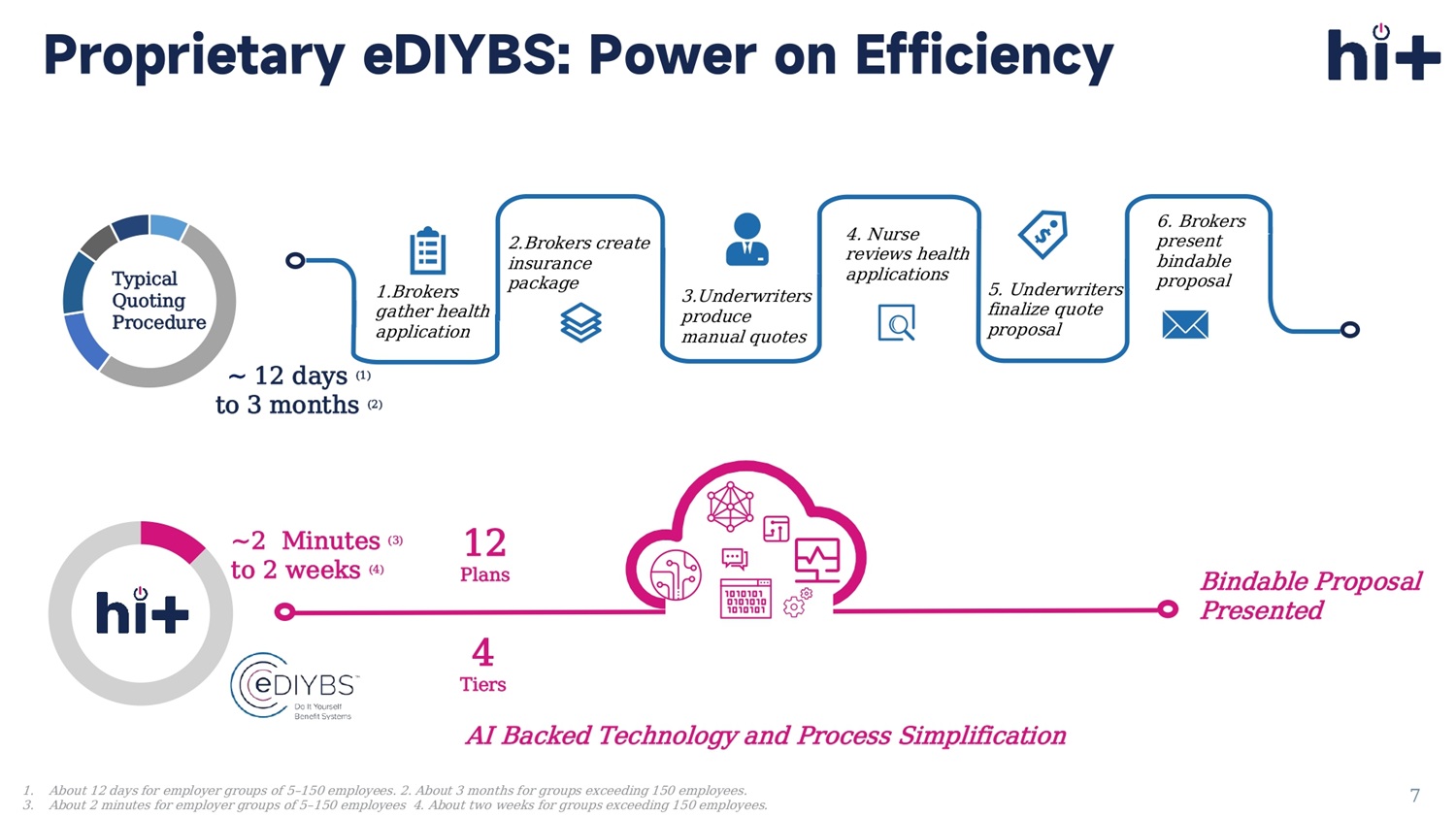

SMR 6 Tailored Coverage Starts with SMR: Intelligent Plan Design for Small Employers ~ 12 days (1) to 3 months (2) Typical Quoting Procedure Bindable Proposal Presented AI Backed Technology and Process Simplification ~2 Minutes (3) to 2 weeks (4) 4 Tiers 12 P lans 1.Brokers gather health application 2.Brokers create insurance package 3.Underwriters produce manual quotes 4. Nurse reviews health applications 5. Underwriters finalize quote proposal 6. Brokers present bindable proposal 7 Proprietary eDIYBS : Power on Efficiency 1. About 12 days for employer groups of 5 – 150 employees. 2. About 3 months for groups exceeding 150 employees. 3. About 2 minutes for employer groups of 5 – 150 employees 4. About two weeks for groups exceeding 150 employees.

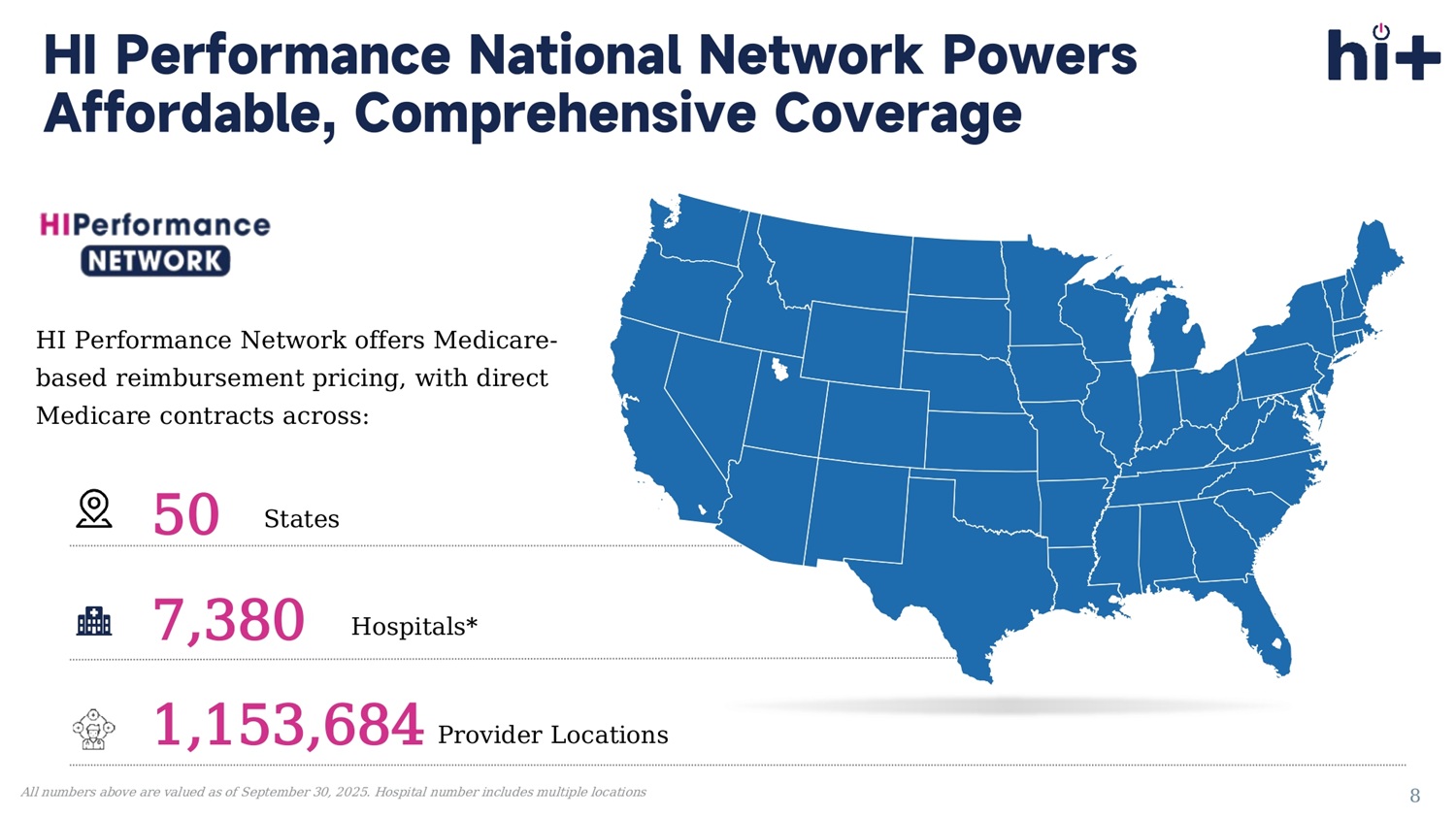

HI Performance Network offers Medicare - based reimbursement pricing, with direct Medicare contracts across: 50 States 7,380 Hospitals* Provider Locations 1,153,684 All numbers above are valued as of September 3 0 , 2025. Hospital number includes multiple locations 8 HI Performance National Network Powers Affordable, Comprehensive Coverage LIMITED ACCESS LACK OF TRANSPARENCY COMPLEX PROCESS 9 Today’s Healthcare Market Challenges for Small Business are Trends for Innovation

Source: Forbes Advisor + Embed 45.9% of private sector employees 43.5% of total GDP 99.9% of all U.S. firms 34.8 million Number (as of 2024) Total Employees (as of 2024) 59 million GDP Contribution (in 2024) $12.7 trillion All figures refer to small businesses 59 Million People are Employed by Small Businesses Contributing 44% of GDP 10 . 1. https://advocacy.sba.gov/2024/07/23/frequently - asked - questions - about - small - business - 2024/ 2. https://www.statista.com/statistics/188105/annual - gdp - of - the - united - states - since - 1990/ Note: About 82% of small businesses have no employees and are not part of the employer - based market.

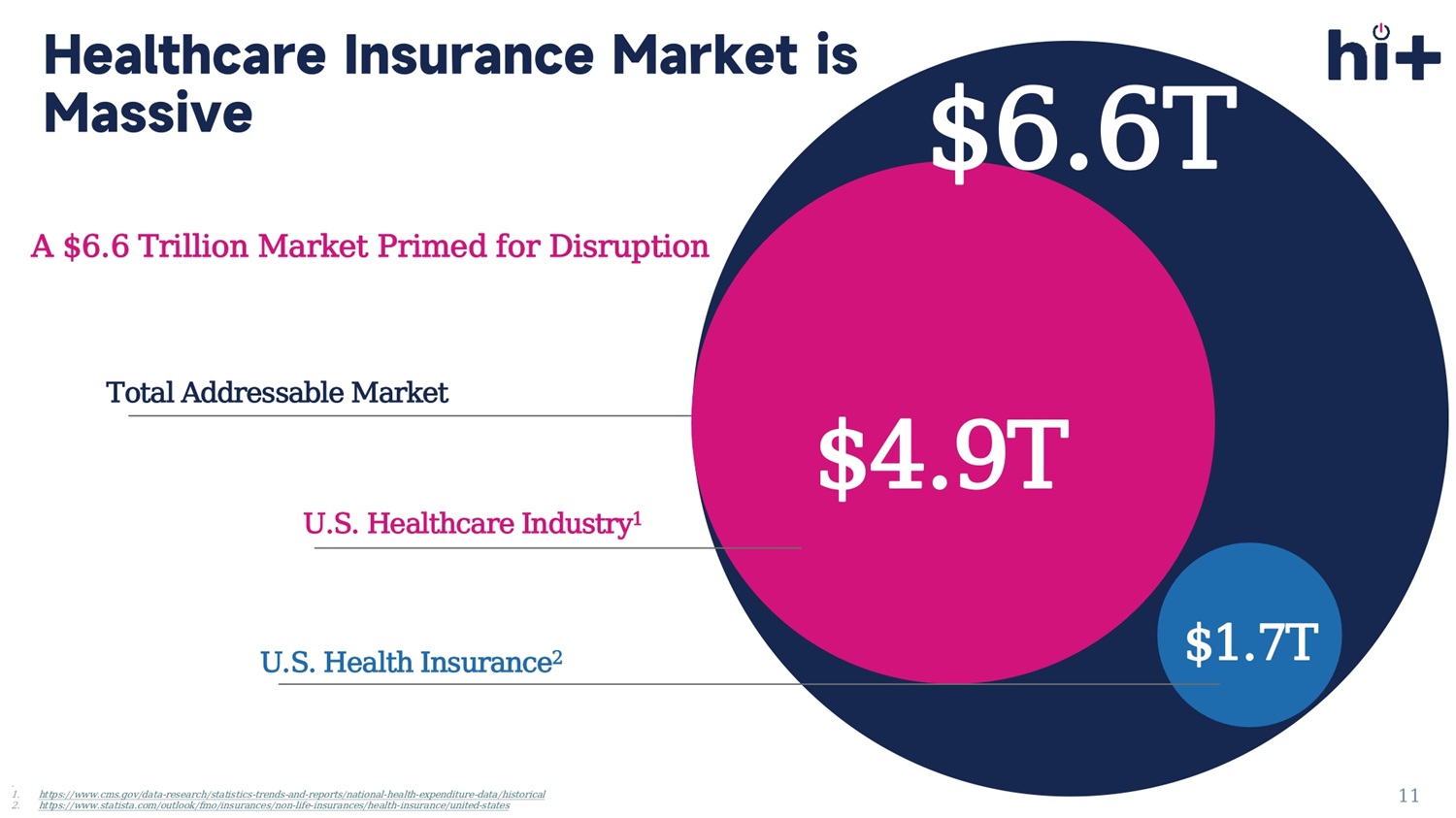

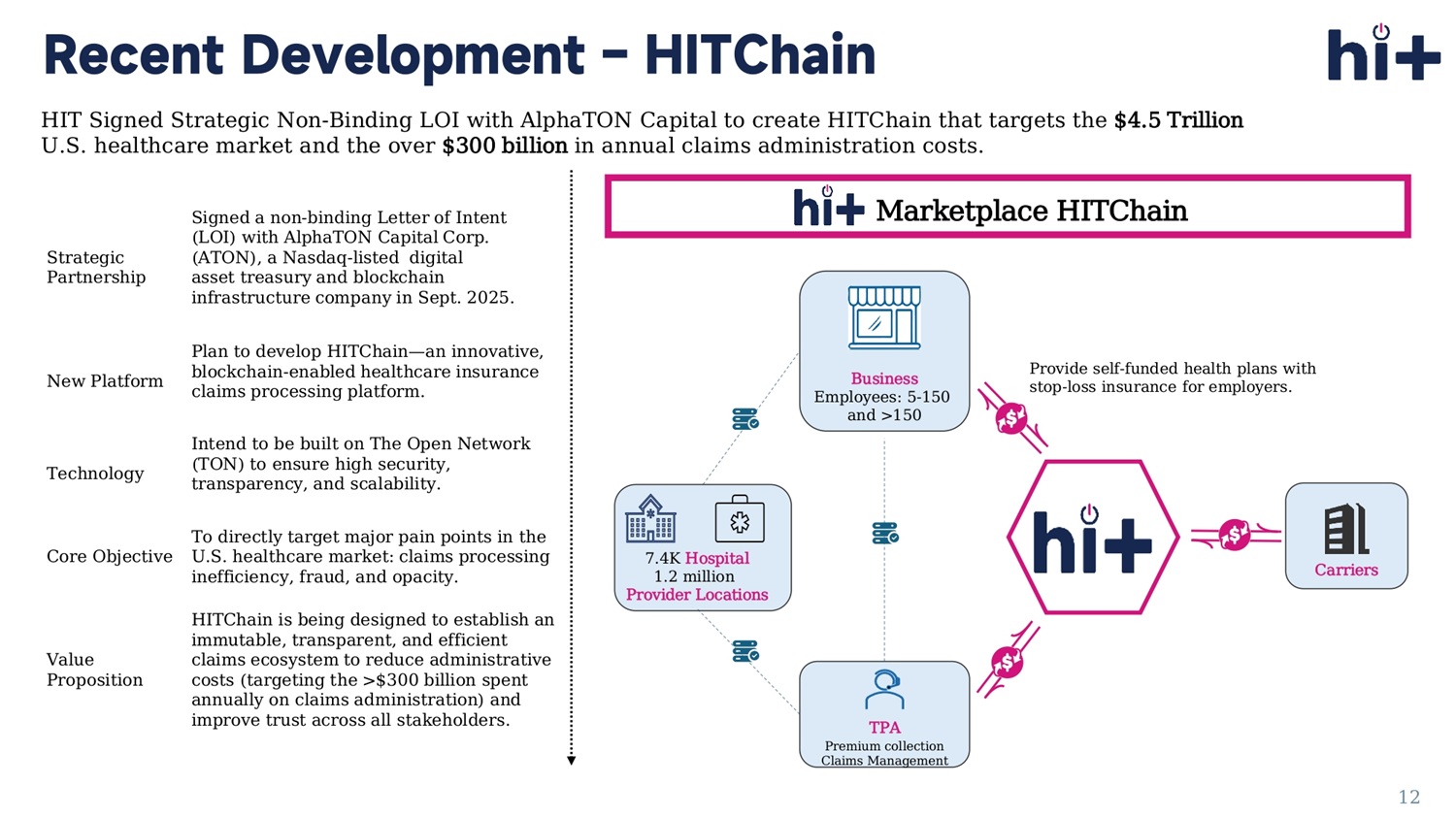

U.S. Healthcare I ndustry 1 $1.7 T $ 4.9 T $ 6.6 T U.S. Health I nsurance 2 . 1. https://www.cms.gov/data - research/statistics - trends - and - reports/national - health - expenditure - data/historical 2. https://www.statista.com/outlook/fmo/insurances/non - life - insurances/health - insurance/united - states A $6.6 Trillion Market Primed for Disruption Total Addressable Market 11 Healthcare Insurance Market is Massive 12 Recent Development – HITChain Signed a non - binding Letter of Intent (LOI) with AlphaTON Capital Corp.

(ATON), a Nasdaq - listed digital asset treasury and blockchain infrastructure company in Sept. 2025. Strategic Partnership Plan to develop HITChain — an innovative, blockchain - enabled healthcare insurance claims processing platform. New Platform Intend to be built on The Open Network (TON) to ensure high security, transparency, and scalability. Technology To directly target major pain points in the U.S. healthcare market: claims processing inefficiency, fraud, and opacity. Core Objective HITChain is being designed to establish an immutable, transparent, and efficient claims ecosystem to reduce administrative costs (targeting the >$300 billion spent annually on claims administration) and improve trust across all stakeholders. Value Proposition HIT Signed Strategic Non - Binding LOI with AlphaTON Capital to create HITChain that targets the $4.5 Trillion U.S. healthcare market and the over $300 billion in annual claims administration costs. Business Employees: 5 - 150 and >150 Provide self - funded health plans with stop - loss insurance for employers.

Financial Overview 13

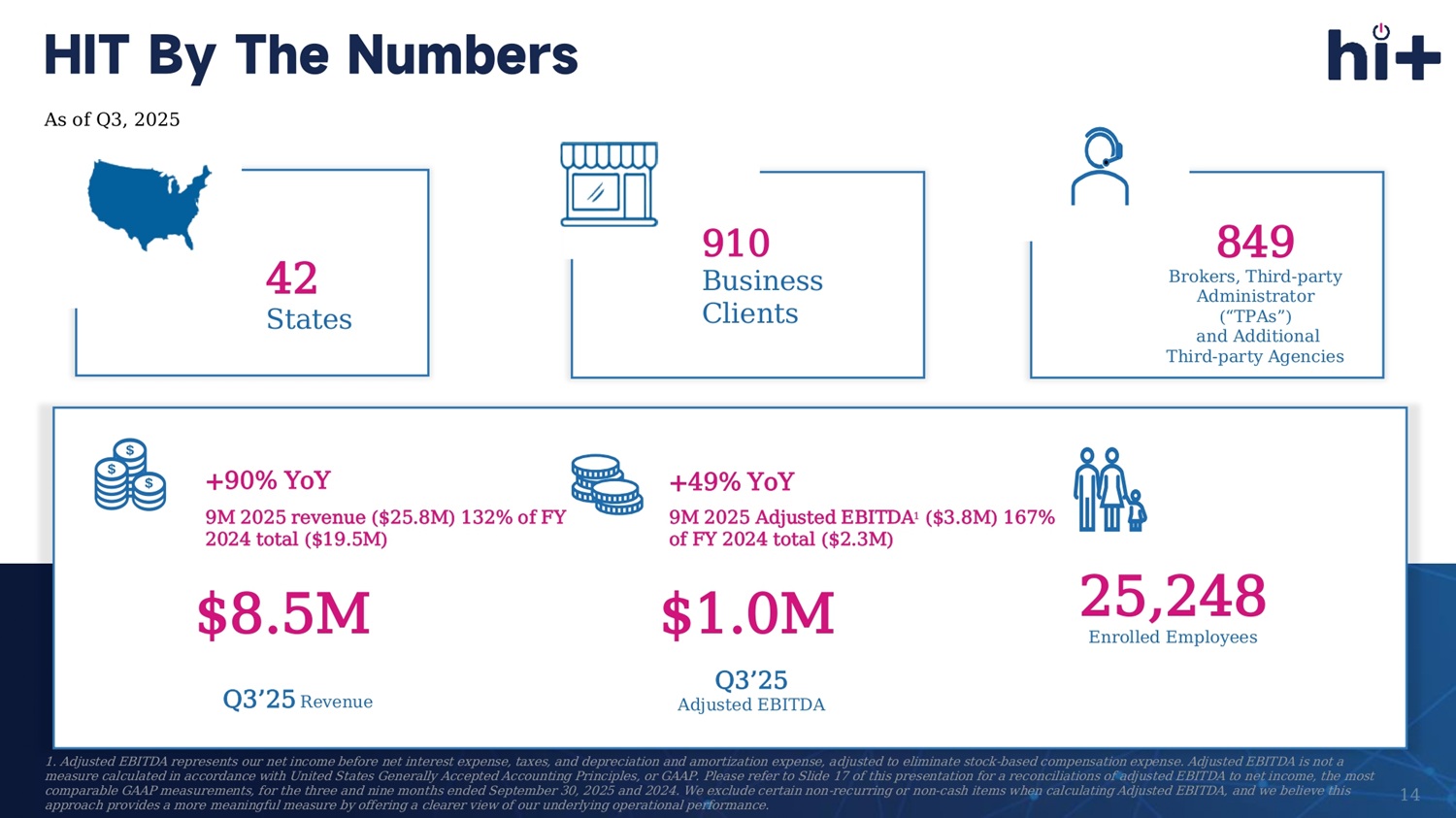

7.4K H ospital 1.2 million Provider Locations Carriers TPA Premium collection Claims Management Marketplace HITChain 14 HIT By The Numbers $8.5M Q3’25 Revenue $1.0M Q3’25 Adjusted EBITDA 25,248 Enrolled Employees 42 States 910 Business Clients As of Q3, 2025 +49% YoY +90% YoY 9M 2025 revenue ($25.8M) 132% of FY 2024 total ($19.5M) 849 Brokers, Third - party Administrator (“TPAs”) and Additional Third - party Agencies 9M 2025 Adjusted EBITDA 1 ($3.8M) 167% of FY 2024 total ($2.3M) 1. Adjusted EBITDA represents our net income before net interest expense, taxes, and depreciation and amortization expense, a dju sted to eliminate stock - based compensation expense. Adjusted EBITDA is not a measure calculated in accordance with United States Generally Accepted Accounting Principles, or GAAP. Please refer to Slide 17 of this presentation for a reconciliations of adjusted EBITDA to net income, the most comparable GAAP measurements, for the three and nine months ended September 30, 2025 and 2024. We exclude certain non - recurring or non - cash items when calculating Adjusted EBITDA, and we believe this approach provides a more meaningful measure by offering a clearer view of our underlying operational performance.

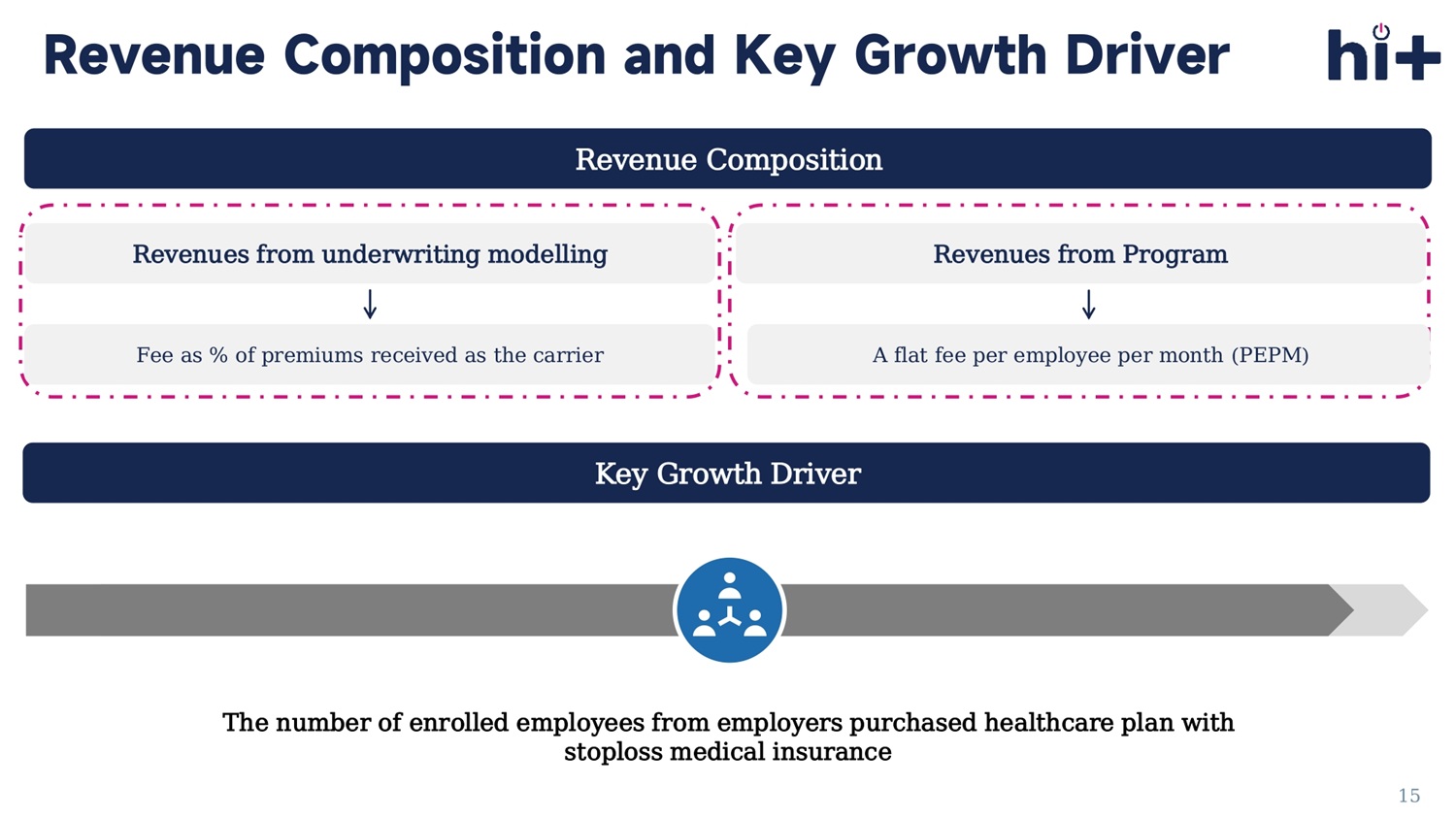

Revenue Composition Revenues from underwriting modelling Revenues from Program Fee as % of premiums received as the carrier Key Growth Driver The number of enrolled employees from employers purchased healthcare plan with stoploss medical insurance A flat fee per employee per month (PEPM) 15 Revenue Composition and Key Growth Driver $4.5 $8.5 $14.6 $25.8 Q3'24 Q3'25 9M'24 9M'25 $0.4 $0.6 $1.0 $2.1 Q3'24 Q3'25 9M'24 9M'25 Total Revenues ($ in millions) Income before Income Tax ($ in millions) 16 Financial Highlights: Q3 2025 & 9M 2025 2.1x YoY (112%) 1.5x YoY (48%) 1.9x YoY (90%) 1.8 x YoY (77%)

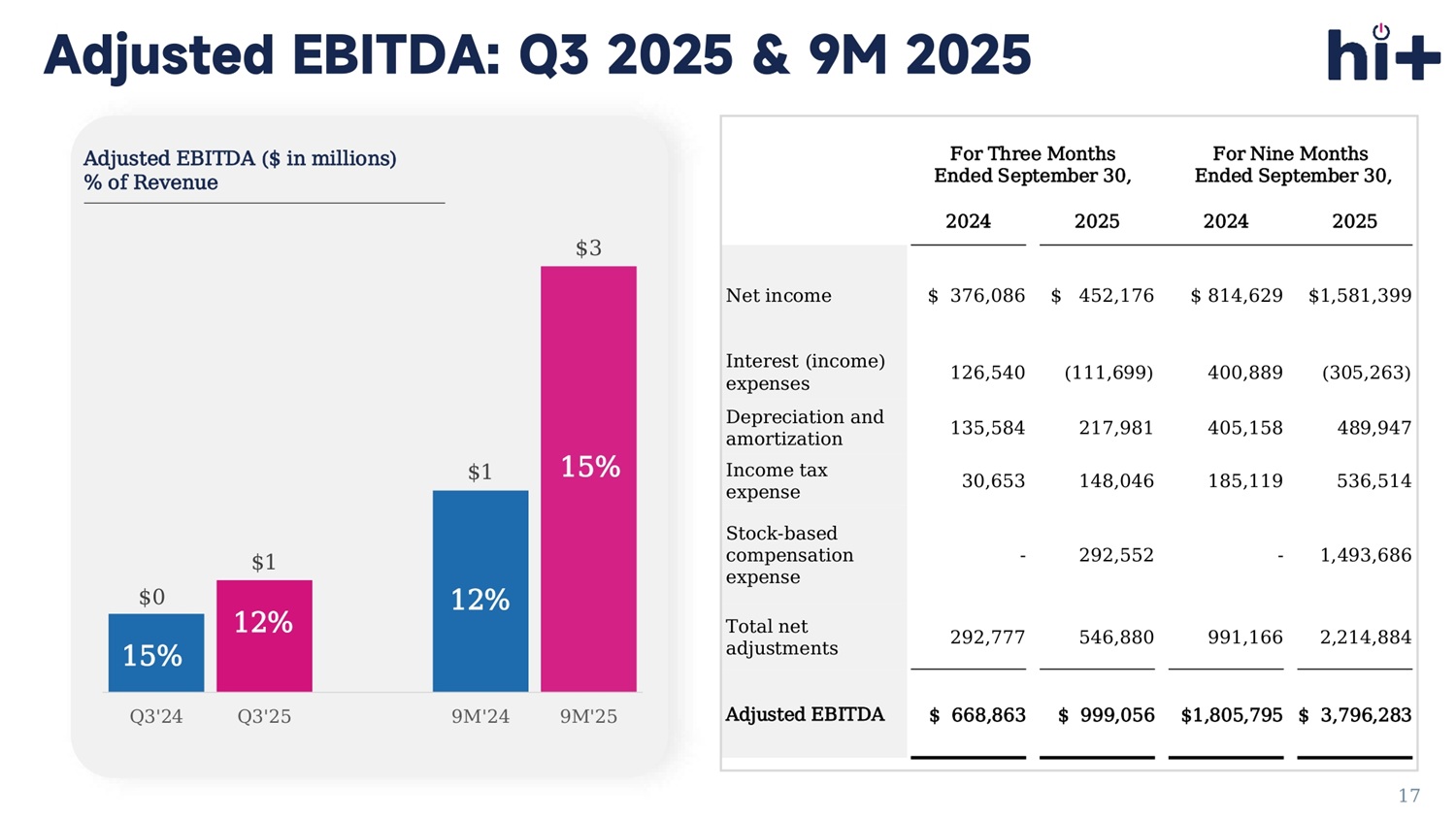

17 For Nine Months Ended September 30, For Three Months Ended September 30, 2025 2024 2025 2024 $1,581,399 $ 814,629 $ 452,176 $ 376,086 Net income (305,263) 400,889 (111,699) 126,540 Interest (income) expenses 489,947 405,158 217,981 135,584 Depreciation and amortization 536,514 185,119 148,046 30,653 Income tax expense 1,493,686 - 292,552 - Stock - based compensation expense 2,214,884 991,166 546,880 292,777 Total net adjustments $ 3,796,283 $1,805,795 $ 999,056 $ 668,863 Adjusted EBITDA $0.7 $1.0 $1.8 $3.8 Q3'24 Q3'25 9M'24 9M'25 Adjusted EBITDA ($ in millions) % of Revenue 15 % 1 2 % Adjusted EBITDA: Q3 2025 & 9M 2025 12 % 1 5 % $1.7 $8.0 September'24 September'25 $0.93 $0.87 September'24 September'25 Cash And Cash Equivalents ($ in millions) Accounts Receivable, net ($ in millions) Sufficient cash reserves 18 Cash & Accounts Receivable: September 2025

• “ Broker” or “insurance broker” is an intermediary who sells, solicits or negotiates insurance policies on behalf of a client for compensation. A broker typically acts on behalf of a client by negotiating with multiple insurers • “Carrier” refers to an insurance company or insurer that provides stop loss insurance. • “ eDIYBS ” refers to our Enhanced Do It Yourself Benefits System. Licensed brokers log in to this online platform to select vendors, net wor ks, and stop loss insurance programs. The broker can design and sell the self - funded benefits plan to small employers • “MGU” refers to Managing General Underwriter and is an entity that performs underwriting and administrative functions on behalf of an insurance company. International Captive Exchange, LLC, a wholly - owned subsidiary of the Company (“ICE”) is an MGU. ICE is grant ed the authority by insurance carriers to underwrite policies, meaning ICE can assess risks, set premiums, and determine coverage te rms within the guidelines provided by the carrier. • “Self - funded benefits plan” or “self - insured group health plan” is an insurance plan in which the employer assumes the financial risk for providing health care benefits to its employees. In practical terms, self - insured employers pay for each out - of - pocket claim a s they are incurred instead of paying a fixed premium to an insurance carrier, which is known as a fully - insured plan. Typically, a self - in sured employer will set up a special trust fund to earmark money (corporate and employee contributions) to pay incurred claims. • “Stop - loss insurance ” (also known as excess insurance) is a product that provides protection for self - funded employers by serving as a reimbursement mechanism for catastrophic claims exceeding pre - determined levels. • “Third - party administrator (TPA)” is a company that manages claims and administrative tasks for an employer’s self - funded employee benefits plan. TPAs are often the primary point of contact for employees. 19 Certain Terms and Definitions

T HANK YOU