UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 31, 2025

Ramaco Resources, Inc.

(Exact name of Registrant as specified in its Charter)

| Delaware | 001-38003 | 38-4018838 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

250 West Main Street, Suite 1900

Lexington, Kentucky 40507

(Address of principal executive offices)

Registrant’s telephone number, including area code: (859) 244-7455

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Class A common stock, $0.01 par value | METC | Nasdaq Global Select Market | ||

| Class B common stock, $0.01 par value | METCB | Nasdaq Global Select Market | ||

| 8.375% Senior Notes due 2029 | METCZ | Nasdaq Global Select Market | ||

| 8.250% Senior Notes due 2030 | METCI | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On October 31, 2025, Ramaco Resources, Inc. (the “Company”) posted a list of frequently asked questions along with answers (the “FAQ”) related to the Company’s Brook Mine rare earth elements and critical minerals project to its website at www.ramacoresources.com. The FAQ is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

None of the information furnished in this Item 7.01 or the accompanying Exhibit 99.1 will be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Frequently Asked Questions released by Ramaco Resources, Inc. dated October 31, 2025 | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Ramaco Resources, Inc. | ||

| By: | /s/ Randall W. Atkins | |

| Name: Randall W. Atkins | ||

| Title: Chairman and Chief Executive Officer | ||

Date: October 31, 2025

Exhibit 99.1

Frequently Asked Questions (FAQs) About Ramaco’s Brook Mine - Rare Earths and Critical Minerals

This page covers many of the top questions about the Brook Mine rare earth elements and critical minerals project, and reflects Ramaco’s ongoing commitment to transparency, and its desire to keep the public and its shareholders informed about the unique and transformative nature of the project.

LEGAL NOTE: This FAQ contains forward-looking statements, including statements about expected development timelines, production, costs, economics, grades, pricing, market demand, permitting, and strategy. Actual results may differ materially due to risks and uncertainties, including those described below and in our SEC filings. We undertake no duty to update these statements. See our full cautionary statement regarding forward-looking statements and reserve, resource and exploration target statements below.

Where is Ramaco’s Brook Mine located and how were rare earths and critical minerals discovered?

| ● | The Brook Mine is in northern Wyoming, approximately 9 miles northwest of Sheridan and 6 miles east of Ranchester. Rare earth elements (REEs) and critical minerals were discovered following an extensive core drilling and chemical analysis campaign conducted by the Company in collaboration with the U.S. Department of Energy’s National Energy Technology Laboratory (NETL). At the time, roughly 7 years ago, NETL was in the process of doing a national assessment to find heavy rare earth elements for national defense purposes. According to NETL, this discovery revealed what is believed to be the largest unconventional deposit of REEs in the United States, with particularly high concentrations of magnetic rare earth elements such as neodymium, praseodymium, terbium, and dysprosium. |

| ● | NETL played a pivotal role by providing scientific expertise and conducting independent analyses that confirmed the world-class scale of the deposit. The deposit is considered unconventional because REEs are located in the coal seams and the associated carbonaceous strata making them more accessible and potentially easier to extract than traditional hard-rock sources. |

Is Ramaco’s Brook Mine permitted?

| ● | Yes. The Brook Mine spans nearly 16,000 acres, with roughly 4,500 acres fully permitted for mining. Permitting for the mine has been overseen by the Wyoming Department of Environmental Quality’s Land Quality Division, which renewed Ramaco’s mining permit for a second 5-year term in July 2025, affirming the Company’s compliance with environmental and operational standards. |

| ● | Ramaco is actively working on plans to expand its ability to produce coal and increase the size of the permitted acreage at the Brook Mine. To support this growth, the Company will be working with both state and federal agencies to secure expanded permit authority including reviewing recent Presidential and Secretary Executive Orders, including Presidential Executive Order 14154, Unleashing American Energy and other opportunities to expedite and simplify the permitting approval process. |

Is the Brook Mine on private land or federal land?

| ● | The Brook Mine is situated on privately controlled land, encompassing more than 15,800 acres of Ramaco-owned and leased mineral holdings in Sheridan County, Wyoming. The owned property was acquired from the Sheridan-Wyoming Coal Company in 2011. Additionally, Ramaco has engaged with federal agencies—including the Permitting Council and Bureau of Land Management (BLM)—to facilitate approval for exploration and potential development on adjacent federal lands. |

Is the Brook Mine different than traditional hard-rock REE mining?

| · | Yes, the Brook Mine distinguishes itself from traditional hard rock mining by potentially offering a more accessible, cost-effective, and environmentally responsible pathway to rare earth element (REE) recovery. Unlike hard rock deposits that are often accompanied by elevated radioactive elements —the Brook Mine’s REEs are hosted in soft carbonaceous strata and coal seams within Wyoming’s Powder River Basin. |

| · | Moreover, the deposit contains both light and heavy REEs—including high-value elements such as dysprosium, and terbium—as well as critical minerals such as gallium, germanium, and scandium, all with minimal radioactive content. |

Has Ramaco started active mining at the Brook Mine?

| ● | Yes, Ramaco officially broke ground on the Brook Mine in Sheridan, Wyoming on July 11, 2025, and has actively mined the Monarch seam. As of October 2025, Ramaco had mined sufficient projected quantities of coal and carbonaceous ore to meet the Company’s near-term needs to fully supply the pilot processing facility currently under construction and expected to be operational in mid-2026. |

| ● | Additional mining activity is expected to occur as needed to meet future pilot or commercial processing needs and coal sales demand. This mining activity marked the launch of the first new rare earth mine in the United States in more than 70 years and the first new coal mine in Wyoming in more than 50 years. |

| ● | The groundbreaking ceremony, themed “American Independence: A Rare Earth Revolution,” was attended by prominent federal and state leaders, including U.S. Secretary of Energy Chris Wright, United States Senators John Barrasso and Cynthia Lummis, United States Representative Harriet Hageman, and Wyoming Governor Mark Gordon. Ramaco’s Brook Mine is notable for its large deposit of rare earth elements and critical minerals, which are essential for advanced technologies and national defense. The mine is expected to play a key role in helping to establish a secure, domestic supply chain for strategic minerals in the U.S. |

What role has Weir International played in the Brook Mine project?

| · | Weir is a globally recognized mining, geology, and energy consultancy that has played a pivotal role in advancing Ramaco’s initiatives at the Brook Mine. As independent resource geologists, Weir has delivered multiple Technical Report Summaries, including an update in 2025 that confirmed the presence of approximately 1.4 million tons of total rare earth oxide (TREO) in the global inferred resource. |

| · | Their work has been instrumental in validating the scale, quality, and commercial viability of the deposit. Weir’s expertise spans geological assessments, reserve modeling, and technical reporting, and their collaboration with Ramaco has helped de-risk the project. |

What REEs and critical minerals have been found in the Brook Mine deposit?

| ● | The Brook Mine is believed to host a rich and unconventional deposit of rare earth elements (REEs) and critical minerals embedded in coal seams and carbonaceous clays and shales. According to multiple technical reports the mine contains both light and heavy magnetic REEs—including neodymium (Nd), praseodymium (Pr), dysprosium (Dy), terbium (Tb), yttrium (Y) and samarium (Sm)—which are essential for permanent magnets, lasers, and defense systems. |

| ● | In addition, the deposit includes high-value critical minerals such as gallium (Ga), germanium (Ge), and scandium (Sc), which are used in semiconductors, aerospace alloys, and advanced communication technologies. |

Explain the role the production of Scandium could play in the project?

| ● | The Brook Mine project has the potential to be the nation’s leading producer of natural scandium. The United States is reportedly 100% reliant on imports mainly from China and there is currently no domestic recycling capacity. The Department of War’s Defense Logistics Agency recently signed an offtake to purchase 6.4 metric tons of scandium at more than $6.2 million a ton. That pricing is two thirds higher than the $3.75 million level used in our current published economic modeling. |

| ● | While the world scandium market is small today, experts indicate demand is limited due in part to the fact that there is currently no reliable large-scale western supply available as almost all supplies are sourced from China. |

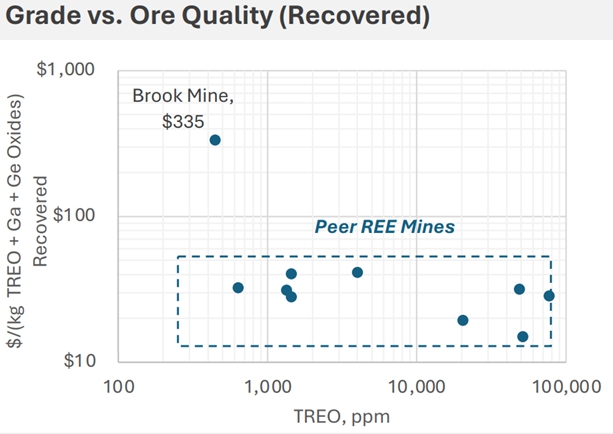

How do Ramaco’s grades fit into the overall REE and Critical Mineral landscape?

| ● | Ramaco has publicly released multiple reports on the grade of the Brook Mine deposit. Unlike other commodities such as gold and copper which often report “equivalent grades” to account for by-product credits, the rare earth industry does not account for this in reporting “ppm TREO” and does not have a “Nd or Pr” equivalent grade concept. |

| ● | As a result, deposits with high grade critical minerals such as the Brook Mine must be compared on an equivalent basis which is referred to in the industry as a “basket price”. Comparing the Brook Mine “based price” on an “NdPr equivalent grade, it is more than 10X higher than the industry trend for our “ppm TREO”. |

| ● | Furthermore, typically higher ppm TREO deposits are dominated by low value lanthanum (La) and cerium (Ce). Many of the highest-grade deposits are about 70% to more than 80% La and Ce, and the cost to remove must be considered. |

| ● | Typical hard rock deposits often include beneficiation steps to reject gangue minerals and concentrate these earth elements prior to downstream extraction processing. One of the consequences of producing a rare earth concentrate prior to extraction is recovery losses. Hard rock deposits often lose 35-45% of the rare earths to tails prior to extraction and thus, the overall recoveries are lower compared to the Brook Mine’s expected flowsheet. Therefore, the recovered value per TREO grade is further diminished compared to the unconventional Brook Mine deposit. |

Note: Data points based on management estimates of peer mines, using equivalent REE + critical mineral prices, actual prices may vary.

Has Ramaco hired a firm to design and build the Pilot Plant?

| ● | Yes, Ramaco hired Zeton Inc., a world-leading designer and builder of pilot plants, with more than 1,000 successful projects completed across 45 countries since its founding in 1986. Zeton specializes in modular, scalable systems that bridge the gap between bench-scale research and full-scale production, offering integrated design-build services from concept to commissioning. Zeton’s expertise spans a wide range of industries, and its facilities in Canada and the Netherlands enable rapid, cost-effective construction of custom pilot plants tailored to each client’s process technology. |

Has Ramaco started construction on the Pilot Plant facility?

| ● | Yes, Ramaco officially broke ground on the facility for its pilot processing plant and laboratory in October 2025. This marked the launch of site development activities for the facility aimed at converting domestic carbonaceous ore into high-purity rare earth oxides. All required local and county zoning permits have now been issued; high voltage electrical power installation to the site has been completed; geotechnical work for the facility’s foundation has been completed and site excavation has begun. Ramaco has also awarded a design build contract for the facility. The pilot plant is expected to begin initial operation in mid-2026 to allow potential customers to test our various oxides. |

What is a rare earth and critical minerals processing Flow Sheet?

| ● | A rare earth and critical minerals processing flow sheet is a detailed diagram or plan that outlines the steps and equipment used to extract, separate, and refine rare earth elements (REEs) and other critical minerals from raw ore. It typically includes stages such as: |

| o | Ore handling and comminution (crushing and grinding) |

| o | Extraction (e.g., pre-treatment and leaching) |

| o | Purification (by various chemical methods) |

| o | Separation of individual rare earth oxides (solvent extraction and ion exchange) |

| o | Final product recovery (precipitation, finishing and packaging) |

| o | Waste management (effluent treatment and filtration) |

The flow sheet is essential for designing pilot and commercial-scale facilities, estimating costs, and ensuring technical feasibility.

Who is developing the Flow Sheet and how does this fit into the Prefeasibility Study?

| ● | Ramaco has retained Hatch Ltd. to develop the pilot processing plant flow sheet and lead the Pre-Feasibility Study (PFS) for the Brook Mine rare earth and critical minerals project. The PFS is anticipated to be delivered by mid-2026. Hatch’s scope includes: |

| o | Designing the pilot processing facility |

| o | Developing and optimizing the process flow sheet |

| o | Coordinating test-work programs with national and private laboratories |

| o | Integrating downstream purification strategies to produce final products |

| · | Hatch is a global, employee-owned engineering and management consultancy headquartered in Mississauga, Ontario, Canada. With more than 10,000 professionals across 70+ offices worldwide, Hatch specializes in complex projects in the metals and minerals, energy, and infrastructure sectors. The company is renowned for its expertise in process design, hydrometallurgy, project delivery, and technology development, particularly in areas like rare earth element processing. |

Has Ramaco received any financial support from the State of Wyoming for the Brook Mine rare earths and critical minerals project?

| ● | Yes, Ramaco was awarded a $6.1 million matching grant from the Wyoming Energy Authority. The grant was authorized by Governor Mark Gordon and is part of the state’s initiative to promote energy innovation and economic development. The funding is designated to help design, construct, and equip Ramaco’s pilot processing facility for rare earth elements (REEs) and other critical minerals at Ramaco’s Brook Mine near Sheridan, Wyoming. |

| ● | This facility will deploy innovative technologies to extract and produce concentrated mixed rare earth oxides from Wyoming’s coal-based resources, supporting the development of a domestic supply chain for strategic minerals. |

What is a Preliminary Economic Assessment (PEA) and has one been prepared for Ramaco’s Brook Mine project?

| ● | A Preliminary Economic Assessment (PEA) is an early-stage technical and financial study used to evaluate the potential viability of a mining project. It typically includes estimates of capital and operating costs, projected revenues, mine life, and economic indicators such as net present value (NPV) and internal rate of return (IRR). |

| ● | While less detailed than a feasibility study, a PEA helps guide investment decisions and project planning by outlining the project’s conceptual framework and commercial potential. |

| ● | Yes, a PEA has been completed for the Brook Mine project by Fluor Corporation, confirming its technical and economic viability. Annual production is expected to include 1,242 short tons of oxide, featuring key elements such as terbium, dysprosium, and neodymium. |

Why did Ramaco release a Summary of the PEA prepared by Fluor?

| ● | Ramaco released a Summary Preliminary Economic Assessment (PEA) for the Brook Mine via a Form 8-K filing and a shareholder letter on July 1, 2025, and made it available on the Company’s website. The Summary highlighted Fluor’s conclusion that the Brook Mine is both technically and economically viable, with an estimated net present value (NPV) of up to $1.2 billion and an internal rate of return (IRR) of 38%. It also emphasized that the Brook Mine could become the world’s only primary source mine for gallium, germanium, and scandium. |

| ● | Ramaco released a summary of the PEA findings that omitted proprietary information considered intellectual property. This is consistent with industry practice and the PEA summary was followed by an SEC compliant Technical Report Summary. The PEA summary was reviewed by Fluor prior to its release. |

| ● | Post the Summary PEA getting released, the Company published a shareholder letter that demonstrated our plan to upsize the amount of REEs and Critical Minerals getting produced from the Brook Mine. The upsized case used the same price assumptions as the Summary PEA, while increasing the amount of coal tonnage from the current 2 million tons per year to up to 5 million tons per year, which could increase the amount of REEs and Critical Minerals from ~1,240 to ~3,400 tons a year. The NPV of the upsized case is $5.1 billion, and the IRR is greater than 150%. The details can be found in the shareholder letter on our website. |

Who is the Fluor Corporation and what is their expertise?

| ● | The Fluor Corporation is a Fortune 500 engineering, procurement, and construction company headquartered in Irving, Texas, with more than 26,000 employees worldwide. The company operates in over 40 countries across North America, South America, Europe, Africa, the Middle East, Asia-Pacific, and Australia, delivering complex infrastructure and industrial projects globally. |

| ● | Fluor has extensive expertise in rare earth elements (REEs) and critical minerals projects. Through its Mining & Metals business line, Fluor has established a dedicated team focused on the growing demand for minerals essential to clean energy, advanced manufacturing, and national security, including lithium, cobalt, nickel, and rare earths like neodymium and dysprosium. |

How much coal and carbonaceous ore is being mined at the Brook Mine?

| ● | As of October 2025, initial mining at the Brook Mine has generated sufficient projected quantities of coal and carbonaceous ore to meet the company’s near-term needs to fully supply the pilot processing facility currently under construction, once operational in 2026. The thermal coal is also being marked for sale for use in electric power generation. |

| ● | Additional mining activity will occur as needed to meet future pilot and commercial processing needs and coal sales demand. |

While Ramaco is constructing the pilot processing plant and facility, is the Company processing any of the coal and carbonaceous ore that it is mining at the Brook Mine?

| ● | Yes, Ramaco has engaged ElementUSA, SGS, and the National Energy Technology Laboratory (NETL) to conduct advanced processing test work for the company’s rare earth project. ElementUSA is leveraging its Critical Resource Accelerator to develop and scale midstream infrastructure for transforming coal-hosted rare earth elements into market-ready products. |

| ● | SGS, a Swiss-based firm, is performing mineralogical analyses to characterize the ore deposits and support process optimization. |

| ● | NETL is collaborating with the company to chemically and physically characterize coal, beneficiated coal, and byproducts to evaluate their rare earth content and extraction potential. |

| ● | Together, these organizations are contributing to a comprehensive testing program that includes caustic leach trials, flow sheet simulations, and recovery modeling to refine extraction methods and reduce operational costs. The results of this work will inform the design of Ramaco’s pilot processing facility and support the upcoming prefeasibility study for commercial-scale rare earth oxide production. |

How has the U.S. Department of Energy’s National Energy Technology Laboratory been involved in the Brook Mine project?

| ● | Since inception, the NETL has been instrumental in advancing the Brook Mine project in Wyoming. It was involved in the original discovery of the Brook Mine rare earth (REE) deposit and has continued to partner with Ramaco on a variety of novel science and engineering aspects of the project’s development. |

| ● | One current area of cooperation is that Ramaco is partnering with NETL to apply its GAIA artificial intelligence platform for REE mapping and validation. This collaboration helped confirm the Brook Mine’s significant unconventional REE resource and accelerating the identification of critical magnetic. NETL’s large data resource modeling and heat maps have guided the Company’s mine planning, while their validation of the deposit’s scale and quality has bolstered the project’s credibility. |

| ● | In support of this effort, the Company has also entered into multiple agreements, including with independent third parties for sample preparation and AI-driven exploration. A recently announced Cooperative Research and Development Agreement (CRADA) between the Company and NETL will soon support continued collaborative research on REE processing, ore deposit modeling, and commercialization strategies. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND RESERVE, RESOURCE AND EXPLORATION TARGET STATEMENTS

Certain statements contained in this FAQ constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, including statements about expected development timelines, production, costs, economics, grades, pricing, market demand, permitting, and strategy, represent Ramaco Resources’ expectations or beliefs concerning, among other things, Ramaco’s plan for the Brook Mine, guidance, future events, anticipated revenue, future demand and production levels, macroeconomic trends, the development of ongoing projects, costs and expectations regarding operating results, and it is possible that the results described in this FAQ will not be achieved. These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of Ramaco Resources’ control, which could cause actual results to differ materially from the results discussed in the forward- looking statements. These factors include, without limitation, unexpected delays in our current mine development activities, the ability to successfully ramp up production at our complexes in accordance with the Company’s growth initiatives, failure of our sales commitment counterparties to perform, increased government regulation of coal in the United States or internationally, the impact of tariffs imposed by the United States and foreign governments, the further decline of demand for coal in export markets and underperformance of the railroads, the Company’s ability to successfully develop the Brook Mine REE/CM project, including whether the Company’s exploration target and estimates for such mine are realized, the timing of the initial production of rare earth concentrates, the development of a pilot and ultimately a full scale commercial processing facility. Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law, Ramaco Resources does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for Ramaco Resources to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements found in Ramaco Resources’ filings with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. The risk factors and other factors noted in Ramaco Resources’ SEC filings could cause its actual results to differ materially from those contained in any forward-looking statement.

This FAQ also includes various statements about our mineral reserves and resources which are derived, for the most part, from the technical report summaries prepared in compliance with the Item 601(b)(96) and subpart 1300 of Regulation S-K. The terms “mineral resource” and “mineral reserve” are defined and used in accordance with subpart 1300 of Regulation S-K. Under subpart 1300 of Regulation S-K, mineral resources may not be classified as “mineral reserves” unless the determination has been made by a qualified person that the indicated and measured mineral resources can be the basis of an economically viable project. You are specifically cautioned not to assume that any part or all of the mineral resources will ever be converted into mineral reserves, as defined by the SEC. You are cautioned that, except for that portion of mineral resources classified as mineral reserves, mineral resources do not have demonstrated economic value. Inferred mineral resources are estimates based on limited geological evidence and sampling and have a too high of a degree of uncertainty as to their existence to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Estimates of inferred mineral resources may not be converted to a mineral reserve. In particular, our estimates of rare earth and critical minerals at the Brook Mine are reported as in-place inferred resources. Rare earth and critical minerals is a new initiative for us and, as such, has required and will continue to require us to make significant investments to build out our rare earth capabilities. As a new facet of our business, there are heightened risks and uncertainties, and there is no assurance that we will be able to successfully develop the Brook Mine into a commercial scale mine. We have little to no demonstrated track record of commercial, operational or financial success outside of our core business, and given the uncertainties associated with rare earth and critical minerals and the mining thereof, we cannot assure you that this initiative will be successful. Therefore, you are cautioned not to assume that all or any part of an inferred mineral resource exists, that it can be the basis of an economically viable project, or that it will ever be upgraded to a higher category. Likewise, you are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted to mineral reserves. This FAQ also includes various statements regarding our exploration targets at the Brook Mine Property, which are derived, for the most part, from the exploration report technical report summary prepared in compliance with the Item 601(b)(96) and subpart 1300 of Regulation S-K as well as a preliminary economic analysis completed by Fluor. The estimates derived from the technical report summary are, in part, a function of the quality and quantity of available data at the time such report was prepared and are considered reasonable; however, the estimates should be accepted with the understanding that with additional data and analysis subsequent to the date of the report, the estimates may necessitate revision, which may be material. Similarly, Fluor’s preliminary economic analysis is based in part on information not within the control of Ramaco and entirely on information not within the control of Fluor. While it is believed that the information contained therein will be reliable under the conditions and subject to the limitations set forth therein, neither Ramaco nor Fluor guarantees the accuracy or completeness thereof.