UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2025

Commission File Number: 001-41752

Earlyworks Co., Ltd.

5-7-11, Ueno, Taito-ku

Tokyo, Japan 110-0005

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Convocation of the Extraordinary General Meeting of Shareholders of Earlyworks Co., Ltd.

In accordance with the rules and regulations of the Japanese Companies Act, Earlyworks Co., Ltd. (the “Company”) has caused a notice and accompanying information, including voting instructions, to be sent to all holders of its ordinary shares and American Depositary Shares with respect to its extraordinary general meeting of shareholders to be held in Tokyo, Japan on November 14, 2025. Copies of the meeting notice and the form of proxy card are furnished hereto as Exhibit 99.1 and Exhibit 99.2, respectively.

For the avoidance of doubt, the agenda items described in Exhibit 99.1 do not seek shareholders’ approval for the acquisition of PrimeDelta Corp. Rather, they authorize potential share issuances that may be used in connection with a possible future acquisition, subject to the completion of due diligence on PrimeDelta Corp. and execution of a definitive agreement.

Exhibit 99.1 and Exhibit 99.2 furnished hereto shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

EXHIBIT INDEX

| Exhibit No. | Description | |

| 99.1 | Notice of Convocation of the Extraordinary General Meeting of Shareholders | |

| 99.2 | Form of Proxy Card |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Earlyworks Co., Ltd. | ||

| Date: October 30, 2025 | By: | /s/ Satoshi Kobayashi |

| Name: | Satoshi Kobayashi | |

| Title: | Chief Executive Officer and | |

| Representative Director | ||

| (Principal Executive Officer) | ||

3

Exhibit 99.1

【This is an English Translation of the original issued in Japanese】

[NOTE] Earlyworks Co., Ltd. assumes no responsibility for this translation or for direct, indirect, or other forms of damages arising from the translation. This document has been translated from the Japanese original for reference purpose only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail.

October 29, 2025

To Shareholders

5-7-11 Ueno, Taito-ku, Tokyo, Japan

Earlyworks Co., Ltd. (the “Company”)

Satoshi Kobayashi

Chief Executive Officer

Notice of Convocation of the Extraordinary General Meeting of Shareholders

We would like to take this opportunity to thank you for your continued support.

Notice is hereby given that the Extraordinary General Meeting of Shareholders of the Company will be held as described below.

If you are unable to attend the meeting, you may exercise your voting rights in writing. Please review the reference documents for the Extraordinary General Meeting of Shareholders as described below, indicate your approval or disapproval of the proposals on the enclosed voting rights Exercise Form, and return the form to us so that it reaches us by 6:00 p.m. on November 13, 2025. (JST).

| 1. | Date and Time | 10:00 a.m., Friday, November 14, 2025 (JST) |

| 2. | Venue | Conference Room, Head Office |

| 3F MR Building, 5-7-11 Ueno, Taito-ku, Tokyo, Japan | ||

| 3. | Matters to be Resolved | |

| Item No.1 | Issuing Shares for Subscription | |

| Item No.2 | Issuing Shares for Subscription | |

| Item No.3 | Issuing Share Option for Subscription | |

| Item No.4 | Issuing Share Option for Subscription | |

| Item No.5 | Issuing Share Option for Subscription | |

| Item No.6 | Election of Two (2) Directors | |

| Item No.7 | Partial Amendments to the Articles of Incorporation |

If you plan to attend the meeting, please submit the enclosed voting rights Exercise Form to the receptionist at the meeting.

In the event of any revision to the reference documents for the General Meeting of Shareholders, the revised items will be posted on the Company’s website (address: https://e-arly.works/).

Reference Documents for the General Meeting of Shareholders

Proposal No.1: Issuing Shares for Subscription

Pursuant to the provisions of Articles 199 and 200 of the Companies Act, we hereby request your approval for the issuance of ordinary shares for subscription, where the subscription price is particularly favorable to subscribers for the ordinary shares for subscription, according to the following outline.

| 1. | Subscription requirements |

| (1) | Number of shares for subscription |

3,049,045 ordinary shares

(2) Amount to be paid in (amount of the monies to be paid in in exchange for one of the Shares for Subscription, or the amount of any property other than monies to be contributed) for the shares for subscription or the method for calculating such amount

The amount to be paid in for each share for subscription shall be the amount obtained by dividing the total valuation of the contributed property stated in (3) by the number of shares for subscription in (1).

(3) If property other than monies will be the subject of the contribution, a statement to such effect and the description and value of such property

3,000,000 shares of common stock of PrimeDelta Corp. (PrimeDelta)

(Valuation: JPY 4,500,000 in total)

(4) Day or period for the payment of the monies in exchange for the shares for subscription, or the contribution of the property under the preceding item

From the day following the resolution date of this Shareholders’ Meeting until December 31, 2025

| (5) | If shares are issued, matters regarding the capital and capital reserves that is to be increased. |

The amount of increase in stated capital shall be one-half of the limit on increase in stated capital, etc., calculated in accordance with Article 14, Paragraph 1 of the Ordinance for Enforcement of the Companies Act. If the calculation results in a fraction less than JPY 1, the fraction shall be rounded up. The amount of increase in capital reserve shall be the amount obtained by deducting the above amount of increase in stated capital from the said limit on increase in stated capital, etc.

| (6) | Subscriber(s) |

Third-party allotment (to the stockholders of PrimeDelta or, if stockholders desire to acquire ADSs, to The Bank of New York Mellon Corporation (The Bank of New York Mellon as depositary bank for ADS holders) in accordance with the stockholder’s instructions).

| (7) | Others |

The execution of this issuance of shares for subscription shall be conditional upon the following matters:

| a) | Completion of due diligence on PrimeDelta |

| b) | Execution of a definitive acquisition agreement (including customary closing conditions set forth therein). |

| 2. | Reason for issuing shares for subscription at a particularly favorable price to subscribers |

This proposal and Proposal No. 2 are being submitted in accordance with the condition of the capital increase conducted on October 10, 2025, under which the Company is required to use its reasonable best efforts to submit these matters to the shareholders’ meeting and obtain shareholder approval.

The capital increase conducted on October 10, 2025 was indispensable for maintaining and strengthening the Company’s financial soundness and stability, as well as ensuring the continuity of its business.

For further details regarding the terms and related conditions of the capital increase, please refer to the Company’s disclosure document below:

https://www.sec.gov/Archives/edgar/data/1944399/000121390025100906/ea0261727- 6k_earlyworks.htm

This proposal and Proposal No. 2 are intended to acquire 100% of outstanding shares of common stock of PrimeDelta by issuing shares to PrimeDelta’s stockholder(s), thereby making PrimeDelta a wholly-owned subsidiary.

Prime Delta engages in the development of a next-generation financial infrastructure based on blockchain technology, focusing on digital asset settlement, tokenized payment networks, and cross-border remittance systems.

The company aims to build a secure and transparent financial platform that connects traditional finance with Web3 ecosystems.

The acquisition of PrimeDelta is expected to generate synergies, including expansion into international markets, increased revenue by integrating our proprietary blockchain technology with PrimeDelta’s business know-how, and accelerated global market adoption of blockchain technology.

We believe this will contribute to our medium- to long-term growth strategy and have a positive impact on our share price (our ADS price listed on Nasdaq in the US).

The acquisition of PrimeDelta is considered to hold significant value from a management strategy perspective and is also expected to contribute to the interests of all our stockholders.

Based on these reasons, we wish to proceed with the issuance of these shares for subscription at the subscription price stated in 1. (2).

[Reference: Overview of PrimeDelta]

Name: PrimeDelta Corp.

Location: 420 Lexington Avenue Ste 2320, New York, NY 10170

Representative: Paul Goodman

Business Activities: Next-generation financial infrastructure business based on blockchain technology

Date of Establishment: August 27, 2025

Proposal No.2: Issuing Shares for Subscription

Pursuant to the provisions of Articles 199 and 200 of the Companies Act, we hereby request your approval for the issuance of ordinary shares for subscription, where the subscription price is particularly favorable to subscribers for the ordinary shares for subscription, according to the following outline.

1. Subscription requirements

(1) Number of shares for subscription

22,000,000 ordinary shares

(2) Amount to be paid in (amount of the monies to be paid in in exchange for one of the Shares for Subscription, or the amount of any property other than monies to be contributed) for the shares for subscription or the method for calculating such amount

US$0.0001 per share.

(3) Day or period for the payment of the monies in exchange for the shares for subscription, or the contribution of the property under the preceding item

From the day following the resolution date of this Shareholders’ Meeting (indefinitely)

(4) If shares are issued, matters regarding the capital and capital reserves that is to be increased.

The amount of increase in stated capital shall be one-half of the limit on increase in stated capital, etc., calculated in accordance with Article 14, Paragraph 1 of the Ordinance for Enforcement of the Companies Act. If the calculation results in a fraction less than JPY 1, the fraction shall be rounded up. The amount of increase in capital reserve shall be the amount obtained by deducting the above amount of increase in stated capital from the said limit on increase in stated capital, etc.

(5) Subscriber(s)

Third-party allotment (to the stockholders of PrimeDelta or, if stockholders desires to acquire ADSs, to The Bank of New York Mellon Corporation (The Bank of New York Mellon as depositary bank for DR holders) in accordance with the stockholder’s instructions).

(6) Others

The issuance of the shares for subscription shall be carried out in three phases after PrimeDelta becomes a subsidiary of the Company, depending on the conditions set with respect to the business progress and performance of PrimeDelta.

The details of these conditions shall be stipulated in the Allotment Agreement for the shares for subscription.

Milestone Schedule:

Milestone 1: Release of 8,250,000 ordinary shares

Milestone 2: Release of 8,250,000 ordinary shares

Milestone 3: Release of 5,500,000 ordinary shares

2. Reason for issuing shares for subscription at a particularly favorable price to subscribers

The reason for this proposal is the same as that for Proposal No. 1.

Furthermore, this issuance is conditional upon the business operations status and the achievement of certain performance targets by PrimeDelta. Therefore, it is considered that the issuance under this proposal will contribute to the interests of both our company and stockholders.

Based on these reasons, we wish to proceed with the issuance of these shares for subscription at the subscription price stated in 1. (2).

Proposal No.3: Issuing Share Options for Subscription

Pursuant to the provisions of Articles 236, 238 and 239 of the Companies Act, we hereby request your approval for the issuance of share options for subscription, where the subscription price is particularly favorable to subscribers for the shares for subscription, according to the following outline.

(1) Class and Number of Shares Underlying the Share Options

Each share option shall be for one (1) ordinary share (“Share Option”).

However, if the Company conducts a stock split or stock consolidation of its Common Stock after the resolution date for the issuance of the Share Options, the number of shares granted (the “Allotted Share Number”) shall be adjusted according to the following formula. Such adjustment shall only be made to the number of shares underlying the Share Options that have not yet been exercised at that time, and any fraction of a share resulting from the adjustment shall be rounded down.

Adjusted Number of Shares Granted

= Unadjusted Number of Shares Granted × Split or Consolidation Ratio

In addition to the above, if the Allotted Share Number needs to be adjusted due to the Company’s merger, company split, share exchange, share transfer, or other forms of corporate reorganization (hereinafter collectively referred to as “Company Reorganization”) after the resolution date for the issuance of the Share Options, or in other cases similar thereto, the Company shall appropriately adjust the Allotted Share Number within a reasonable scope.

(2) Amount to be Paid Upon Exercise of the Share Options

US$0.0001 per ordinary share.

If the Company conducts a share split or share consolidation after the resolution date for the issuance of the Share Options, the exercise price shall be adjusted according to the following formula, and any fraction of less than one yen arising from the adjustment shall be rounded up.

Adjusted Exercise Price

= Exercise Price Before Adjustment / Split or Consolidation Ratio (expressed as a fraction)

Furthermore, if the Company issues new shares or disposes of treasury shares at a price below the market value of its Common Stock after the resolution date for the issuance of the Share Options (excluding the issuance of new shares or disposal of treasury shares due to the exercise of Share Options, or in connection with a Company Reorganization), the exercise price shall be adjusted according to the following formula, and any fraction of less than one yen arising from the adjustment shall be rounded up.

Adjusted Exercise Price = Exercise Price Before Adjustment x (Number of Outstanding Shares + Number of Newly Issued Shares x (Amount Paid Per Share / Market Value Per Share Before New Issuance) / (Number of Outstanding Shares + Number of Newly Issued Shares)

For the purpose of the above formula, “Number of Outstanding Shares” shall mean the total number of issued shares of the Company’s Common Stock minus the number of treasury shares of the Company’s Common Stock. If the Company disposes of its treasury shares of Common Stock, “Number of Newly Issued Shares” shall be replaced with “Number of Treasury Shares Disposed of,” “Amount Paid Per Share” shall be replaced with “Disposal Price Per Share,” and “Market Value Per Share Before New Issuance” shall be replaced with “Market Value Per Share Before Disposal of Treasury Shares.”

In addition, if the exercise price needs to be adjusted due to a Company Reorganization after the resolution date for the issuance of the Share Options, or in other cases similar thereto, the Company shall appropriately adjust the exercise price within a reasonable scope.

(3) Period During Which Share Options May Be Exercised

from the day after the resolution date of this General Meeting of Shareholders (indefinitely)

(4) Conditions for Exercise of the Share Options

None.

(5) Events and Conditions for the Company’s Acquisition of the Share Options

None.

(6) Treatment Upon Corporate Reorganization

If the Company conducts a merger (limited to cases where the Company is the absorbed company), absorption-type company split, incorporation-type company split, share exchange, or share transfer, the Company shall deliver Share Options of the succeeding company (hereinafter referred to as the “Post-Reorganization Company”) to the holders of the Share Options on the effective date of such action, in accordance with the following conditions for each case, pursuant to Article 236, Paragraph 1, Item 8, Sub-items (a) through (e) of the Companies Act. This shall apply only if the contract for the absorption-type merger, incorporation-type merger, absorption-type company split, incorporation-type company split plan, share exchange agreement, or share transfer plan stipulates that the Share Options of the Post-Reorganization Company will be delivered in accordance with the following conditions.

| a) | Number of Share Options of the Post-Reorganization Company to be Delivered |

The number delivered shall be the same as the number of Share Options held by the holder.

| b) | Class and Number of Shares of the Post-Reorganization Company Underlying the Share Options |

The class of shares shall be the Common Stock of the Post-Reorganization Company. The number of shares shall be determined in accordance with (1) above.

| c) | Value or Calculation Method of Assets to be Contributed Upon Exercise of the Share Options To be determined in accordance with (2) above. |

| d) | Exercise Period of the Share Options |

The period shall commence on the later of the start date stipulated in (3) or the effective date of the merger (limited to cases where the Company is the absorbed company), absorption-type company split, incorporation-type company split, share exchange, or share transfer, and end on the expiration date stipulated in (3).

| e) | Increase in Stated Capital and Capital Reserve Upon Issuance of Shares through Exercise of Share Options |

To be the same as provided for in (9) below.

| f) | Events and Conditions for the Company’s Acquisition of the Share Options None. |

| g) | Restrictions on Transfer of Share Options None. |

| h) | Conditions for Exercise of the Share Options |

To be the same as provided for in (4) above.

(7) Restrictions on Transfer of the Share Options

None.

(8) Issuance of Share Options Certificates

None shall be issued.

(9) Matters Concerning the Increase in Stated Capital and Capital Reserve Upon Issuance of Shares through Exercise of Share Options

| a) | The amount of the increase in Stated Capital upon the issuance of shares through the exercise of Share Options shall be one-half (1/2) of the maximum limit on capital increase calculated in accordance with Article 17, Paragraph 1 of the Ordinance for Enforcement of the Companies Act. Any fraction of less than one yen resulting from this calculation shall be rounded up. |

| b) | The amount of the increase in Capital Reserve upon the issuance of shares through the exercise of Share Options shall be the amount remaining after deducting the amount of the increase in Stated Capital stipulated in (a) above from the maximum limit on capital increase stipulated in (a) above. |

2. Number of share options for subscription

5,000,000 ordinary shares.

3. Amount to be paid in for the share option for subscription

US$0.416 per share option.

4. Allottee

Third-party allotment

5. Payment Date

December 31, 2025

6. Reason for issuing the share options for subscription at a particularly favorable price to the subscribers

This issuance of the Share Options for Subscription is to be made to the investors who participated in our capital increase conducted on October 10, 2025.

This proposal is being submitted in accordance with the terms of that capital increase, under which such investors have the right to require the Company to issue these Share Options for Subscription, subject to compliance with applicable Japanese laws, including obtaining approval at this General Meeting of Shareholders.

The capital increase conducted on October 10, 2025 was indispensable to maintaining and strengthening the Company’s financial soundness and stability, as well as ensuring the continuity of our business.

For further details regarding the terms and related conditions of the capital increase, please refer to our disclosure document:

https://www.sec.gov/Archives/edgar/data/1944399/000121390025100906/ea0261727- 6k_earlyworks.htm

In addition, we believe that this issuance of Share Options will further strengthen our relationship with these investors and help advance our future management strategy.

For these reasons, we wish to proceed with this issuance of Share Options under the conditions set forth in this proposal.

Proposal No.4: Issuing Share Options for Subscription

ursuant to the provisions of Articles 236, 238 and 239 of the Companies Act, w we hereby request your approval for the issuance of share options for subscription, where the subscription conditions are particularly favorable to subscribers for the shares for subscription, according to the following outline.

(1) Class and Number of Shares Underlying the Share Options

Each share option shall be for one (1) ordinary share.

However, if the Company conducts a stock split or stock consolidation of its Common Stock after the resolution date for the issuance of the Share Options, the number of shares granted (the “Allotted Share Number”) shall be adjusted according to the following formula. Such adjustment shall only be made to the number of shares underlying the Share Options that have not yet been exercised at that time, and any fraction of a share resulting from the adjustment shall be rounded down.

Adjusted Number of Shares Granted

= Unadjusted Number of Shares Granted × Split or Consolidation Ratio

In addition to the above, if the Allotted Share Number needs to be adjusted due to the Company’s merger, company split, share exchange, share transfer, or other forms of corporate reorganization (hereinafter collectively referred to as “Company Reorganization”) after the resolution date for the issuance of the Share Options, or in other cases similar thereto, the Company shall appropriately adjust the Allotted Share Number within a reasonable scope.

(2) Amount to be Paid Upon Exercise of the Share Options

US$0.544 per ordinary share.

If the Company conducts a share split or share consolidation after the resolution date for the issuance of the Share Options, the exercise price shall be adjusted according to the following formula, and any fraction of less than one yen arising from the adjustment shall be rounded up.

Adjusted Exercise Price

= Exercise Price Before Adjustment / Split or Consolidation Ratio (expressed as a fraction)

Furthermore, if the Company issues new shares or disposes of treasury shares at a price below the market value of its Common Stock after the resolution date for the issuance of the Share Options (excluding the issuance of new shares or disposal of treasury shares due to the exercise of Share Options, or in connection with a Company Reorganization), the exercise price shall be adjusted according to the following formula, and any fraction of less than one yen arising from the adjustment shall be rounded up.

Adjusted Exercise Price = Exercise Price Before Adjustment x (Number of Outstanding Shares + Number of Newly Issued Shares x (Amount Paid Per Share / Market Value Per Share Before New Issuance) / (Number of Outstanding Shares + Number of Newly Issued Shares)

For the purpose of the above formula, “Number of Outstanding Shares” shall mean the total number of issued shares of the Company’s Common Stock minus the number of treasury shares of the Company’s Common Stock. If the Company disposes of its treasury shares of Common Stock, “Number of Newly Issued Shares” shall be replaced with “Number of Treasury Shares Disposed of,” “Amount Paid Per Share” shall be replaced with “Disposal Price Per Share,” and “Market Value Per Share Before New Issuance” shall be replaced with “Market Value Per Share Before Disposal of Treasury Shares.”

In addition, if the exercise price needs to be adjusted due to a Company Reorganization after the resolution date for the issuance of the Share Options, or in other cases similar thereto, the Company shall appropriately adjust the exercise price within a reasonable scope.

(3) Period During Which Share Options May Be Exercised

from the day after the resolution date of this General Meeting of Shareholders (indefinitely)

(4) Conditions for Exercise of the Share Options

None.

(5) Events and Conditions for the Company’s Acquisition of the Share Options

None.

(6) Treatment Upon Corporate Reorganization

If the Company conducts a merger (limited to cases where the Company is the absorbed company), absorption-type company split, incorporation-type company split, share exchange, or share transfer, the Company shall deliver Share Options of the succeeding company (hereinafter referred to as the “Post-Reorganization Company”) to the holders of the Share Options on the effective date of such action, in accordance with the following conditions for each case, pursuant to Article 236, Paragraph 1, Item 8, Sub-items (a) through (e) of the Companies Act. This shall apply only if the contract for the absorption-type merger, incorporation-type merger, absorption-type company split, incorporation-type company split plan, share exchange agreement, or share transfer plan stipulates that the Share Options of the Post-Reorganization Company will be delivered in accordance with the following conditions.

| a) | Number of Share Options of the Post-Reorganization Company to be Delivered The number delivered shall be the same as the number of Share Options held by the holder. |

| b) | Class and Number of Shares of the Post-Reorganization Company Underlying the Share Options |

The class of shares shall be the Common Stock of the Post-Reorganization Company. The number of shares shall be determined in accordance with (1) above.

| c) | Value or Calculation Method of Assets to be Contributed Upon Exercise of the Share Options |

To be determined in accordance with (2) above.

| d) | Exercise Period of the Share Options |

The period shall commence on the later of the start date stipulated in (3) or the effective date of the merger (limited to cases where the Company is the absorbed company), absorption-type company split, incorporation-type company split, share exchange, or share transfer, and end on the expiration date stipulated in (3).

| e) | Increase in Stated Capital and Capital Reserve Upon Issuance of Shares through Exercise of Share Options |

To be the same as provided for in (9) below.

| f) | Events and Conditions for the Company’s Acquisition of the Share Options |

None.

| g) | Restrictions on Transfer of Share Options |

None.

| h) | Conditions for Exercise of the Share Options |

To be the same as provided for in (4) above.

(7) Restrictions on Transfer of the Share Options

None.

(8) Issuance of Share Options Certificates

None shall be issued.

(9) Matters Concerning the Increase in Stated Capital and Capital Reserve Upon Issuance of Shares through Exercise of Share Options

| a) | The amount of the increase in Stated Capital upon the issuance of shares through the exercise of Share Options shall be one-half (1/2) of the maximum limit on capital increase calculated in accordance with Article 17, Paragraph 1 of the Ordinance for Enforcement of the Companies Act. Any fraction of less than one yen resulting from this calculation shall be rounded up. |

| b) | The amount of the increase in Capital Reserve upon the issuance of shares through the exercise of Share Options shall be the amount remaining after deducting the amount of the increase in Stated Capital stipulated in (a) above from the maximum limit on capital increase stipulated in (a) above. |

2. Number of share options for subscription

5,000,000 ordinary shares.

3. Amount to be paid in for the share option for subscription

None.

4. Allottee

Third-party allotment

5. Reason for issuing the share options for subscription under conditions particularly favorable to the subscribers

This issuance of the Share Options for Subscription is to be made to the investors who participated in our capital increase conducted on October 10, 2025.

This proposal is being submitted in accordance with the terms of that capital increase, under which such investors have the right to require the Company to issue these Share Options for Subscription, subject to compliance with applicable Japanese laws, including obtaining approval at this General Meeting of Shareholders.

The capital increase conducted on October 10, 2025 was indispensable to maintaining and strengthening the Company’s financial soundness and stability, as well as ensuring the continuity of our business.

For further details regarding the terms and related conditions of the capital increase, please refer to our disclosure document: https://www.sec.gov/Archives/edgar/data/1944399/000121390025100906/ea0261727- 6k_earlyworks.htm Pursuant to the provisions of Articles 236, 238 and 239 of the Companies Act, we hereby request your approval for the issuance of share options for subscription, where the subscription conditions are particularly favorable to subscribers for the shares for subscription, according to the following outline.

In addition, we believe that this issuance of Share Options will further strengthen our relationship with these investors and help advance our future management strategy.

For these reasons, we wish to proceed with this issuance of Share Options under the conditions set forth in this proposal.

Proposal No.5: Issuing Share Options for Subscription

(1) Class and Number of Shares Underlying the Share Options

Each share option shall be for one (1) ordinary share.

However, if the Company conducts a stock split or stock consolidation of its Common Stock after the resolution date for the issuance of the Share Options, the number of shares granted (the “Allotted Share Number”) shall be adjusted according to the following formula. Such adjustment shall only be made to the number of shares underlying the Share Options that have not yet been exercised at that time, and any fraction of a share resulting from the adjustment shall be rounded down.

Adjusted Number of Shares Granted

= Unadjusted Number of Shares Granted × Split or Consolidation Ratio

In addition to the above, if the Allotted Share Number needs to be adjusted due to the Company’s merger, company split, share exchange, share transfer, or other forms of corporate reorganization (hereinafter collectively referred to as “Company Reorganization”) after the resolution date for the issuance of the Share Options, or in other cases similar thereto, the Company shall appropriately adjust the Allotted Share Number within a reasonable scope.

(2) Amount to be Paid Upon Exercise of the Share Options

US$0.416 per ordinary share.

If the Company conducts a share split or share consolidation after the resolution date for the issuance of the Share Options, the exercise price shall be adjusted according to the following formula, and any fraction of less than one yen arising from the adjustment shall be rounded up.

Adjusted Exercise Price

= Exercise Price Before Adjustment / Split or Consolidation Ratio (expressed as a fraction)

Furthermore, if the Company issues new shares or disposes of treasury shares at a price below the market value of its Common Stock after the resolution date for the issuance of the Share Options (excluding the issuance of new shares or disposal of treasury shares due to the exercise of Share Options, or in connection with a Company Reorganization), the exercise price shall be adjusted according to the following formula, and any fraction of less than one yen arising from the adjustment shall be rounded up.

Adjusted Exercise Price = Exercise Price Before Adjustment x (Number of Outstanding Shares + Number of Newly Issued Shares x (Amount Paid Per Share / Market Value Per Share Before New Issuance) / (Number of Outstanding Shares + Number of Newly Issued Shares)

For the purpose of the above formula, “Number of Outstanding Shares” shall mean the total number of issued shares of the Company’s Common Stock minus the number of treasury shares of the Company’s Common Stock. If the Company disposes of its treasury shares of Common Stock, “Number of Newly Issued Shares” shall be replaced with “Number of Treasury Shares Disposed of,” “Amount Paid Per Share” shall be replaced with “Disposal Price Per Share,” and “Market Value Per Share Before New Issuance” shall be replaced with “Market Value Per Share Before Disposal of Treasury Shares.”

In addition, if the exercise price needs to be adjusted due to a Company Reorganization after the resolution date for the issuance of the Share Options, or in other cases similar thereto, the Company shall appropriately adjust the exercise price within a reasonable scope.

(3) Period During Which Share Options May Be Exercised

From the effective date of the allotment agreement, which is to be concluded within three months after this General Meeting, until the anniversary day five years thereafter.

(4) Conditions for Exercise of the Share Options

None.

(5) Events and Conditions for the Company’s Acquisition of the Share Options

None.

(6) Treatment Upon Corporate Reorganization

If the Company conducts a merger (limited to cases where the Company is the absorbed company), absorption-type company split, incorporation-type company split, share exchange, or share transfer, the Company shall deliver Share Options of the succeeding company (hereinafter referred to as the “Post-Reorganization Company”) to the holders of the Share Options on the effective date of such action, in accordance with the following conditions for each case, pursuant to Article 236, Paragraph 1, Item 8, Sub-items (a) through (e) of the Companies Act. This shall apply only if the contract for the absorption-type merger, incorporation-type merger, absorption-type company split, incorporation-type company split plan, share exchange agreement, or share transfer plan stipulates that the Share Options of the Post-Reorganization Company will be delivered in accordance with the following conditions.

| a) | Number of Share Options of the Post-Reorganization Company to be Delivered The number delivered shall be the same as the number of Share Options held by the holder. |

| b) | Class and Number of Shares of the Post-Reorganization Company Underlying the Share Options |

The class of shares shall be the Common Stock of the Post-Reorganization Company. The number of shares shall be determined in accordance with (1) above.

| c) | Value or Calculation Method of Assets to be Contributed Upon Exercise of the Share Options |

To be determined in accordance with (2) above.

| d) | Exercise Period of the Share Options |

The period shall commence on the later of the start date stipulated in (3) or the effective date of the merger (limited to cases where the Company is the absorbed company), absorption-type company split, incorporation-type company split, share exchange, or share transfer, and end on the expiration date stipulated in (3).

| e) | Increase in Stated Capital and Capital Reserve Upon Issuance of Shares through Exercise of Share Options |

To be the same as provided for in (9) below.

| f) | Events and Conditions for the Company’s Acquisition of the Share Options |

None.

| g) | Restrictions on Transfer of Share Options |

None.

| h) | Conditions for Exercise of the Share Options |

To be the same as provided for in (4) above.

(7) Restrictions on Transfer of the Share Options

None.

(8) Issuance of Share Options Certificates

None shall be issued.

(9) Matters Concerning the Increase in Stated Capital and Capital Reserve Upon Issuance of Shares through Exercise of Share Options

| a) | The amount of the increase in Stated Capital upon the issuance of shares through the exercise of Share Options shall be one-half (1/2) of the maximum limit on capital increase calculated in accordance with Article 17, Paragraph 1 of the Ordinance for Enforcement of the Companies Act. Any fraction of less than one yen resulting from this calculation shall be rounded up. |

| b) | The amount of the increase in Capital Reserve upon the issuance of shares through the exercise of Share Options shall be the amount remaining after deducting the amount of the increase in Stated Capital stipulated in (a) above from the maximum limit on capital increase stipulated in (a) above. |

2. Number of share options for subscription

200,000 ordinary shares.

3. Amount to be paid in for the share option for subscription

None.

4. Allottee

Third-party allotment

5. Reason for issuing the share options for subscription under conditions particularly favorable to the subscribers

This issuance is to be made to the Placement Agent as part of the compensation in connection with the issuance share options for subscription described in Proposal No. 3, pursuant to the Placement Agency Agreement executed on October 10, 2025, provided that such issuance complies with applicable Japanese laws, including obtaining shareholder approval.

For these reasons, the Company intends to proceed with the issuance of these warrants for subscription under the terms described in this proposal.

Proposal No. 6: Election of Two (2) Directors

We request your approval for the election of the following two new Directors to promote our future global strategy, including the acquisition of PrimeDelta related to Proposal No. 1 and Proposal No. 2.

1. Jason D. Sawyer

| Date of Birth | 1971/9/20 |

| Professional History | He has approximately 30 years of experience in the alternative investment sector and currently serves as the General Manager of Access Alternative Group S.A. (AAG). AAG invests in and advises a wide range of companies, including those in software, FinTech/blockchain, biotech, clean technology, healthcare, and consumer goods, with a cumulative investment track record exceeding $200 million over the past decade. |

| Important Outside Positions |

● Access Alternative Group S.A. – General Manager ● Entero Thereapeutics, Inc. - Interim CEO, Board of Directors ● Quantum BioPharma Ltd. – Head of Finance & M&A ● Lixte Biotechnology Holdings, Inc. – Board of Directors, Chair of the Compensation Committee, Member of the Audit Committee ● FUTR Corporation – Board of Directors |

| Number of Shares Held | 0 |

[Reason for Nominating as Outside Director Candidate]

Mr. Sawyer is nominated for election as a Director because his extensive experience as an executive in the finance sector and his broad insights are expected to be utilized in our company’s management, thereby strengthening our corporate governance and enhancing the oversight of our financial strategy.

[Notes]

| 1. | There are no special conflicts of interest between the candidate and our company. |

| 2. | Mr. Sawyer is a candidate for Outside Director. |

| 3. | Our company and Mr. Sawyer are scheduled to enter into an agreement that limits the liability for damages under Article 427, Paragraph 1 of the Companies Act for having neglected his/her duties. The limit of liability for damages under said agreement is the minimum liability limit prescribed by law. |

| 4. | Our company and Mr. Sawyer are scheduled to enter into an indemnity agreement under Article 430-2, Paragraph 1 of the Companies Act, whereby the company shall indemnify the candidate for the costs referred to in item (i) of the same paragraph and the losses referred to in item (ii) of the same paragraph, to the extent permitted by law. |

| 5. | Our company has entered into a Directors and Officers (D&O) liability insurance contract with an insurance company, as stipulated in Article 430-3, Paragraph 1 of the Companies Act, which includes our directors and corporate auditors as insured parties. Under this insurance contract, damages and litigation costs incurred by an insured party due to a claim for damages arising from an act (including omissions) performed by the insured party based on their status as a company officer are covered. Our company fully bears all premiums for the insured parties. If the election of Mr. Sawyer is approved, he will be included as an insured party under this insurance contract. |

2. Michael Hilmer

| Date of Birth | 1968/5/13 |

| Professional History |

He has over 30 years of leadership experience spanning the fields of financial technology (FinTech), data monetization, structured finance, and digital transformation. He has also served as a trusted advisor and director for private companies and early-stage ventures, providing counsel on the oversight of risk management, capital allocation, and data ethics. He currently serves as the Chairman and Chief Executive Officer (CEO) of FUTR Corporation. |

| Important Outside Positions | ● FUTR Corporation – Chairman & CEO |

| Number of Shares Held | 0 |

[Reason for Nominating as Outside Director Candidate]

Mr. Hilmer is nominated for election as a Director because his extensive experience and broad insights as a corporate executive are expected to be utilized in our company’s management, thereby enhancing the supervision of our business operations

[Notes]

| 1. | There are no special conflicts of interest between the candidate and our company. |

| 2. | Mr. Hilmer is a candidate for Outside Director. |

| 3. | Our company and Mr. Hilmer are scheduled to enter into an agreement that limits the liability for damages under Article 427, Paragraph 1 of the Companies Act for having neglected his/her duties. The limit of liability for damages under said agreement is the minimum liability limit prescribed by law. |

| 4. | Our company and Mr. Hilmer are scheduled to enter into an indemnity agreement under Article 430-2, Paragraph 1 of the Companies Act, whereby the company shall indemnify the candidate for the costs referred to in item (i) of the same paragraph and the losses referred to in item (ii) of the same paragraph, to the extent permitted by law. |

| 5. | Our company has entered into a Directors and Officers (D&O) liability insurance contract with an insurance company, as stipulated in Article 430-3, Paragraph 1 of the Companies Act, which includes our directors and corporate auditors as insured parties. Under this insurance contract, damages and litigation costs incurred by an insured party due to a claim for damages arising from an act (including omissions) performed by the insured party based on their status as a company officer are covered. Our company fully bears all premiums for the insured parties. If the election of Mr. Hilmer is approved, he/she will be included as an insured party under this insurance contract. |

Proposal No. 7: Partial Amendments to the Articles of Incorporation

We request your approval for the following amendments to the Articles of Incorporation.

1. Issuance of Share Certificates

Our company issues American Depositary Shares (ADSs) and currently issues share certificates primarily for administrative purposes related to the ADSs. In the event of a large-scale capital increase through ADSs in the future, the current types of share certificates alone would necessitate the issuance of an excessively large number of certificates. To reduce this administrative burden, we will change the types of the share certificates to be issued.

| Before Amendment | After Amendment |

|

(Issuance of Share Certificates)

Article 8 The Company shall issue share certificates for the shares it issues.

2) The share certificates issued by the Company shall be of five denominations: 1-share certificates, 100-share certificates, 1,000-share certificates, 10,000-share certificates, and 100,000-share certificates. |

(Issuance of Share Certificates)

Article 8 The Company shall issue share certificates for the shares it issues.

2) The share certificates issued by the Company shall be of eight denominations: 1-share certificates, 10-share certificates, 100-share certificates, 1,000-share certificates, 10,000- share certificates, 100,000-share certificates, 1,000,000-share certificates, and 10,000,000- share certificates. |

2. Change in the Total Number of Authorized Shares

We will increase the Total Number of Authorized Shares as follows, conditioned upon the issuance of shares for subscription under Proposal No. 1 and Proposal No. 2, in preparation for a future large-scale capital increase through the issuance of ADS (American Depositary Shares).

| (1) | In the event that the issuance of shares under Proposal No. 1 is completed |

| Before Amendment | After Amendment |

|

(Total Number of Authorized Shares)

Article 6 The total number of authorized shares of the Company shall be 55,300,000 shares. |

(Total Number of Authorized Shares)

Article 6 The total number of authorized shares of the Company shall be 73,207,588 shares. |

| (2) | In the event that the issuance of shares under Proposal No. 2 Milestone 1 is completed |

| Before Amendment | After Amendment |

|

(Total Number of Authorized Shares)

Article 6 The total number of authorized shares of the Company shall be 73,207,588 shares. |

(Total Number of Authorized Shares)

Article 6 The total number of authorized shares of the Company shall be 106,207,588 shares. |

| (3) | In the event that the issuance of shares under Proposal No. 2 Milestone 2 is completed |

| Before Amendment | After Amendment |

|

(Total Number of Authorized Shares)

Article 6 The total number of authorized shares of the Company shall be 106,207,588 shares. |

(Total Number of Authorized Shares)

Article 6 The total number of authorized shares of the Company shall be 139,207,588 shares. |

| (4) | In the event that the issuance of shares under Proposal No. 2 Milestone 3 is completed |

| Before Amendment | After Amendment |

|

(Total Number of Authorized Shares)

Article 6 The total number of authorized shares of the Company shall be 139,207,588 shares. |

(Total Number of Authorized Shares)

Article 6 The total number of authorized shares of the Company shall be 161,207,588 shares. |

Memo

18

Exhibit 99.2

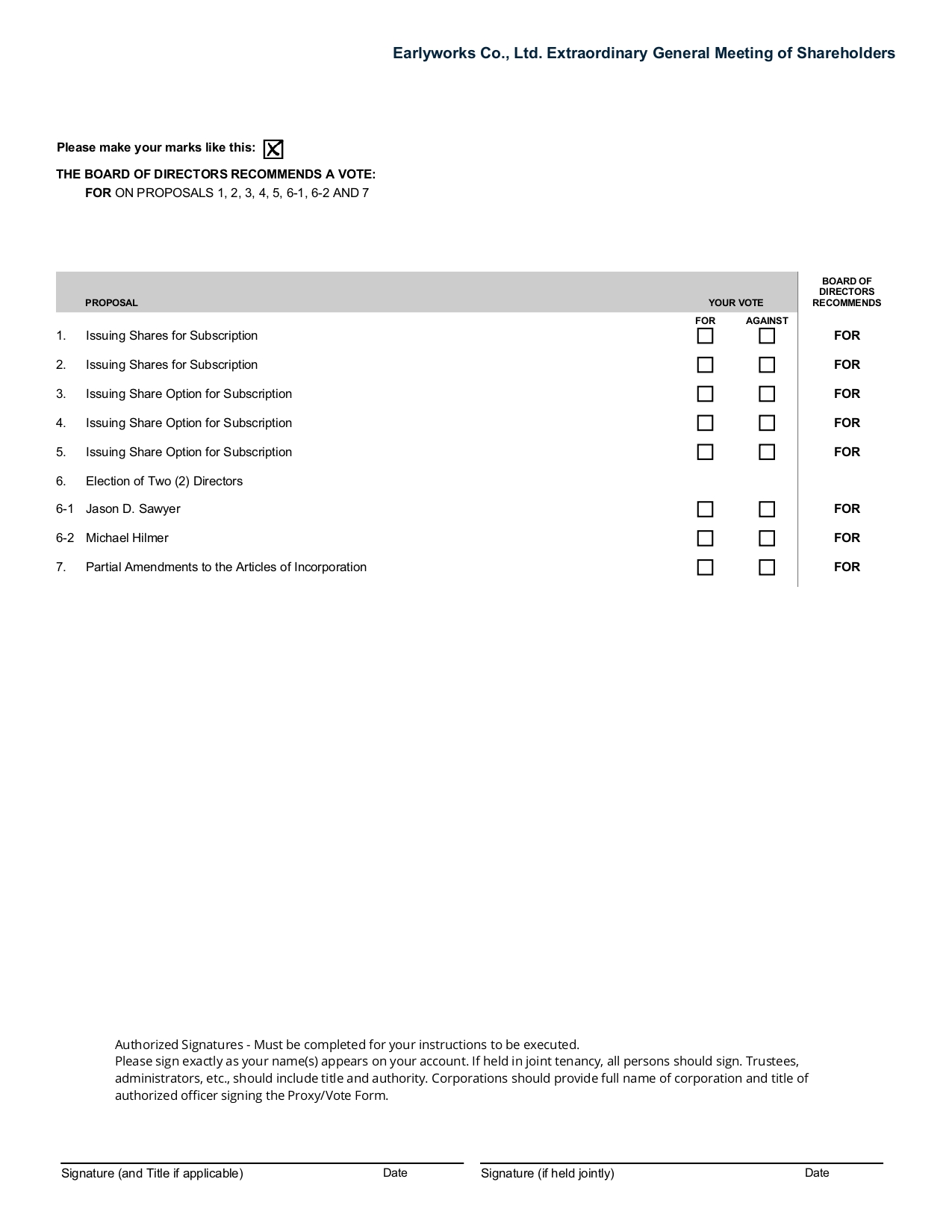

PLEASE BE SURE TO SIGN AND DATE THIS PROXY CARD AND MARK ON THE REVERSE SIDE Copyright © 2025 BetaNXT, Inc. or its affiliates. All Rights Reserved YOUR VOTE IS IMPORTANT! PLEASE VOTE BY: 12:00 p.m. EST on November 10, 2025 Earlyworks Co., Ltd Instructions to The Bank of New York, as Depositary (Must be received prior to 12:00 p.m. EST on November 10, 2025) The undersigned registered holder of American Depositary Receipts hereby requests and instructs The Bank of New York, as Depositary, to endeavor, insofar as practicable, to vote or cause to be voted the amount of shares or other Deposited Securities represented by such Receipts of Earlyworks Co., Ltd registered in the name of the undersigned on the books of the Depositary as of the close of business on August 15, 2025 at the Extraordinary General Meeting of Shareholders of Earlyworks Co., Ltd to be held on November 14, 2025 in Japan. NOTE: 1. Please direct the Depositary how it is to vote by placing an X in the appropriate box opposite the resolution. 2. It is understood that, if this form is signed and returned but no instructions are indicated in the boxes, then the Depositary will not vote such items. 3. It is understood that, if this form is not signed, or not returned, the Depositary will not vote such items. Earlyworks Co., Ltd. Extraordinary General Meeting of Shareholders For Shareholders of record as of August 15, 2025 Friday, November 14, 2025 BNY: PO BOX 505006, Louisville, KY 40233 - 5006 Mail: • Mark, sign and date your Proxy Card • Fold and return your Proxy Card in the postage - paid envelope provided Your vote matters! Have your ballot ready and please use one of the methods below for easy voting : Your control number Have the 12 digit control number located in the box above available when you access the website and follow the instructions.

Earlyworks Co., Ltd. Extraordinary General Meeting of Shareholders Please make your marks like this: THE BOARD OF DIRECTORS RECOMMENDS A VOTE: FOR ON PROPOSALS 1, 2, 3, 4, 5, 6 - 1, 6 - 2 AND 7 PROPOSAL YOUR VOTE BOARD OF DIRECTORS RECOMMENDS FOR AGAINST 1. Issuing Shares for Subscription FOR 2. Issuing Shares for Subscription FOR 3. Issuing Share Option for Subscription FOR 4. Issuing Share Option for Subscription FOR 5. Issuing Share Option for Subscription FOR 6. Election of Two (2) Directors 6 - 1 Jason D. Sawyer FOR 6 - 2 Michael Hilmer FOR 7. Partial Amendments to the Articles of Incorporation FOR Authorized Signatures - Must be completed for your instructions to be executed. Please sign exactly as your name(s) appears on your account. If held in joint tenancy, all persons should sign. Trustees, administrators, etc., should include title and authority. Corporations should provide full name of corporation and title of authorized officer signing the Proxy/Vote Form. Signature (and Title if applicable) Date Date Signature (if held jointly)