UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 27, 2025

TREASURE GLOBAL INC

(Exact name of registrant as specified in its charter)

| Delaware | 001-41476 | 36-4965082 | ||

| (State or other jurisdiction of Incorporation) |

(Commission File Number) | (IRS Employer Identification Number) |

|

276 5th Avenue, Suite 704 #739 New York, New York |

10001 | |

| (Address of registrant’s principal executive office) | (Zip code) |

+6012 643 7688

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

||

| Common Stock, par value $0.00001 per share | TGL | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Management Consultancy Agreement

On October 27, 2025, the Treasure Global Inc (the “Company”) entered into a management consultancy agreement with Astute All Advisory Ltd (the “Service Provider”), a Malaysian company (the “Management Consultancy Agreement”), pursuant to which the Company engaged the Service Provider to provide in relation to management consultancy and business strategy planning as described in the Management Consultancy Agreement (the “Services”) in accordance to the terms and conditioned set forth therein. The Management Consultancy Agreement shall commence from October 27, 2025 and remain in force for a period twenty-four (24) months unless otherwise frustrated, rescinded and/or terminated in accordance to Clause 10 of the Management Consultancy Agreement provided that both parties shall be opened to commercial negotiations from time to time pertaining to the contents of the Management Consultancy Agreement whereby should any such negotiation materialize.

In consideration of the performance of the Service Provider of its obligations, and the provision of the Services pursuant to this Agreement, the Company shall pay to the Service Provider a total sum of US$1,500,000.00 (the “Service Fee”) in the manner outlined in the Management Consultancy Agreement. The Service Fee shall be due and earned upon execution of the Management Consultancy Agreement and the Company has the absolute discretion to choose to pay in cash and/or its equivalent in common stock of the Company (“TGL Shares”). If the Company opt to be satisfied the Service Fees through the issuance and allotment of TGL Shares, the Parties agrees and acknowledge that issue price per TGL Shares shall be at USD0.90 per share.

The Management Consultancy Agreement contains customary representations, warranties, and agreements by the Company and the Service Provider, with other obligations of the parties and termination provisions.

The above summary of the Management Consultancy Agreement is qualified in its entirety by reference to the full texts of the Management Consultancy Agreement and, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

See Item 1.01, which is incorporated herein by reference.

The TGL Shares will be issued pursuant to the exemption from registration provided by Regulation S promulgated under the Securities Act.

Item 9.01. Financial Statement and Exhibits.

(d) Exhibits.

| Exhibit No. | Description | |

| 10.1 | Management Consultancy Agreement between Treasure Global Inc. and Astute All Advisory Ltd dated October 27, 2025 | |

| 104 | Cover Page Interactive Data File (embedded with the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 29, 2025 | TREASURE GLOBAL INC. | |

| By: | /s/ Carlson Thow | |

| Name: | Carlson Thow | |

| Title: | Chief Executive Officer | |

2

Exhibit 10.1

DATED OCTOBER 27, 2025

Between

TREASURE GLOBAL INC

(“the Company”)

AND

The Party whose name and particular described in Section 2 of the Schedule

(“Service Provider”)

MANAGEMENT CONSULTANCY AGREEMENT

AN AGREEMENT is made on this date and year more particularly described in Section 1 of the Schedule (“the Agreement Date”) between TREASURE GLOBAL INC (Delaware Department of State’s File No. 7908921) a company incorporate in Delaware, of the one part and having its address for service at 276, 5th Avenue Suite, 704 #739 New York, NY10001 and the party whose name and particularly described in Section 2 of the Schedule (“the Service Provider”) of the other part. The Company and Service Provider are hereinafter individually referred to as “Party” and collectively referred to as “the Parties”.

RECITAL:

| A. | The Company desires to engage the Service Provider to provide certain bona fide management and business strategy services to the Company, and the Service Provider agrees to render such services to the Company, upon the terms and conditions contained in this Agreement. |

NOW THEREFORE, in consideration of the foregoing, the terms and conditions hereinafter set forth, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereto hereby agree as follows:

| 1. | DEFINITION AND INTERPRETATIONS |

| 1.1 | In this Agreement, the following words and expression shall have the means ascribed to them below unless contrary intention appears: |

| Agreement | means this Management Consultancy Agreement | |

| Board | means the board of directors of the Company | |

| Business Day | means a day except for a Saturday, Sunday or Public Holiday whereby the licensed bank is opened for general banking business in the City of New York, United States of America and British Virgin Island | |

| Commencement Date | has the meaning ascribed in Clause 3.1 | |

| Designated Persons | refers to the auhtorized representatives of each Party responsible to manage the provision and service and the operation and management Service as well as this Agreement in accordance with the terms therein | |

| Initial Term | has the meaning ascribed in Clause 3.1 | |

| Renewed Term | has the meaning ascribed in Clause 3.2 | |

| Services | Means the Management Consultancy Services and the scope of Services set out in Second Schedule |

| 1.2 | Interpretation |

Save to the extent that the context or the express provisions of this Agreement otherwise require:

| (a) | words using the singular or plural number also include the plural or singular number, respectively; |

| (b) | the terms “hereof”, “herein”, “hereby”, “hereto” and similar words refer to this entire Agreement and not any particular clause, schedule or any other subdivision of this Agreement; |

| (c) | a reference to a clause is to a clause to this Agreement; |

| (d) | the word “include” or “including” shall be deemed to be followed with “without limitation” or “but not limited to” whether or not they are followed by such phrases or words of like import; |

| (e) | references to any statute or statutory provision shall be construed as a reference to the same as it may have been, or may from time to time be, amended, modified or re-enacted; |

| (f) | references to “this Agreement” or any other agreement or document shall be construed as a reference to such agreement or document as amended, modified or supplemented and in effect from time to time and shall include a reference to any document which amends, modifies or supplements it, or is entered into, made or given pursuant to or in accordance with its terms; |

| (g) | the headings are for convenience only and shall be ignored in construing this Agreement; |

| (h) | references to persons include their successors and any permitted transferees and assigns; |

| (i) | no rule of construction shall apply to the detriment of any party by reason of that party having control and/or was responsible for the preparation of this Agreement or any part thereof; |

| (j) | whenever this Agreement refers to a number of days, such reference shall be to calendar days unless business days are specified; |

| (k) | the recital set forth above are incorporated herein by reference and made a part of this Agreement as if fully set for the herein; |

| (l) | for the purpose of calculating any period of time stipulated herein, or when an act is required to be done within a specified period after or from a specified dated, the period is inclusive of an time beings to run from the date so specified; and |

| (m) | in carrying out their obligations and duties under this Agreement, the Parties shall have an implied obligation of good faith. |

| 2. | APPOINTMENT |

| 2.1 | During the Term of this Agreement, the Service Provider agree to provide the Services to the Company in relation to management consultancy and business strategy planning as described in Second Schedule (“the Scope of Service”). |

| 2.2 | Subject to Clause 2.1 above, the Services shall be performed on a non-exclusive service of person designated by the Service Provider, as listed in Second Schedule of this Agreement and the Company agree and acknowledge that: |

| (a) | the Service Provider provides solely the Services and is not involved whatsoever in the business or operation of the Company; |

| (b) | the Service Provider does not advise on or perform any service relating to tax audit, accounting audit, financial and legal adviser, capital raising advice, investor relation or any other matter outside the Services and the Company will seek the advise and services of relevant experts for such matters; |

| (c) | neither the Service Provider nor any Designated Person shall be liable to the Company or any of the Company’s directors for any damages, losses, costs or expenses which the Company or Company’s directors incurs in relation to any advice or service rendered by the Service Provider or any of designated person in respect of the matter outside the Services. |

| 2.3 | In addition to Clause 2.2 above, the Services shall not extend to the day-to-day business or operation of the Company and shall not include any services provided by the Designated Person in their capacity as directors, officers, managers or whatsoever of the Company. |

| 2.4 | The Service Provider agrees to devote such time and effort and make available such Designated Persons as may from time to time reasonably be required for the performance of Services hereunder and agrees to use its reasonably best effort to carry out the purposes of the Company and shall perform the Services to the best abilities in a timely manner, competent and professional manner, in compliance with the Company’s policies, procedures and controls provided by the Company to Services Provider in writing from time to time, and any laws relevant such Services. Additionally, the Designated Person shall exercise reasonable skills and diligence in performance of the Services and observe principles of professional ethics and respect the laws and customs in the country where the Services rendered. |

| 2.5 | The Scope of Service to be provided by the Service Provider under this Agreement may be subject to amendment, modification or supplemental from time to time as mutually agreed upon in writing between the Parties. |

| 3. | TERM |

| 3.1 | Notwithstanding to the Agreement Date and subject to Clause 3.2 below, this Agreement will be commence from the date as stipulated in Section 3 of the Schedule (“Commencement Date”) and remain in force for a period of twenty-four (24) months from the Commencement Date unless otherwise frustrated, rescinded and/or termination in accordance Clause 10 herein (“Term”) PROVIDED THAT the Parties shall be opened to commercial negotiation from time to time pertaining to the content of this Agreement whereby should any such negotiation materialise, the Parties shall record such mutually agreed negotiation into written instrument which shall be supplemental to this Agreement. |

| 3.2 | Unless the Agreement is otherwise frustrated, rescinded and/or termination in accordance to Clause 10, it is hereby agreed whereupon the expiration of the Term, the Parties shall have discretion to renew the Term for a subsequent fixed period of twelve (12) months (“Renewed Term”) PROVIDED THAT any such renewal under this provision (if any) shall only be effective upon the Parties agreed in writing in which all the terms and conditions of this Agreement shall, unless otherwise agreed by the Parties in writing, subsist and applicable mutatis mutandis to whole Renewed Term. |

| 4. | CONSIDERATION |

| 4.1 | Subject to Clause 2 above, in consideration of the performance of the Services by the Service Provider, the Company agree to pay the Service Provider an aggregated amount of United States Dollar One Million Five Hundred Thousand (US$1,500,000.00) (“Service Fees”). |

| 4.2 | The Service Fee shall be due and earned upon execution of this Agreement and the Company has the absolute discretion to choose to pay in cash and/or its equivalent in common stock of the Company (“TGL Shares”). |

| 4.3 | If the Company opt to be satisfied the Service Fees through the issuance and allotment of TGL Shares, the Parties agrees and acknowledge that issue price per TGL Shares shall be at United States Dollar Ninety Cent (US$0.90) per share (“Issuance Price). |

| 4.4 | The Company’s common stock shall be issued on a restricted basis for a period of six (6) months pursuant to the requirement of the Securities Act 1933, Rule 144. |

| 4.5 | True Up Share. If at any time, the closing price of the Company common stock is less than US$1.00 after the unlock period, the Company shall issue an additional common stock of the Company to the Service Provider equal to the differential sum between the Service Fees and the value of the Company Shares within fourteen (14) business days upon receiving written notice from the Service Provider. |

| 4.6 | All out-of-pocket expense relating to the Services including but not limited to transportation, postage, stationery charges and other reasonable out-of-pocket expense incurred by the Service Providers in connection with the Services, the Company shall reimburse the Service Provider on a monthly basis and within five (5) days from the date of the invoice submitted for all out-of-pocket expenses. |

| 5. | REPRESENTATION, WARRANTIES AND UNDERTAKING |

| 5.1 | Each Parties represent, warrant and undertakes to the other as follows: |

| (a) | it is a company duly incorporated under the laws of its country of incorporation and has full power and authority to own its assets and carry on its business; |

| (b) | it has full legal right, power and authority to execute, deliver and perform its obligation under this Agreement; |

| (c) | all the necessary corporate resolutions and authorisation to enter into this Agreement and to perform all obligation have been duly obtained; |

| (d) | by entering into this Agreement, it is not in breach or in contravention of any law or contract applicable to it; |

| (e) | this Agreement, when executed, constitutes legal, valid and binding obligations, enforceable against it in accordance with the terms thereof; and |

| (f) | the person signing this Agreement on behalf of it has been duly authorised to execute and deliver this Agreement. |

| 6. | CHANGE REQUEST |

| 6.1 | Subject to Clause 2 above, the Company and the Service Provider agrees that each Party may during the Term of this Agreement make a change request, addition or variation to the Services or any part thereof (“Change Request”). |

| 6.2 | A Change Request can be made to the Service Provider or the Company by providing a proposal writing setting out the details of the Change Request, the impact of such Change Request on the Parties’ respective obligation [including amendment to the Service Fee (if any)], the dates or timeframes specified under statement of work. |

| 6.3 | Any change made pursuant to a Change Request shall be subject to sign off by authorised party of both Parties and shall take effect on such date as mutually agreed in writing. Nothing herein shall derogate the Parties’ rights to effect change to the scope of Services or timelines by such other mode or method as they mutually deem suitable. |

| 7. | LIMITATION ON LIABILITY |

| 7.1 | The Service Provider shall reasonably rely on information provided to it about the Company, if any, that is provided by the Company or the Company’s subsidiaries, employees, agent, representative, officers, directors or anyone from the Company. |

| 7.2 | Notwithstanding any instruction or direction from the Company and without reference to any of them, the Service Provider or Designated Person shall be entitled but not obliged, at any time, to do or refrain from doing any act which they consider, at their sole discretion, desirable to do or refrain from doing. |

| 7.3 | Both Parties agree that the Services are provided without any representative and warranty of any kind. The Service Provider make no representation or warranties, express or implied by operation of law or otherwise, and hereby expressly disclaims all representation and warranties regarding the Services it provides. |

| 7.4 | In no event that the Service Provider shall be liable to any error or inaccuracy, indirect, special, incidental, exemplary or consequential damages, fraud, gross negligence or wilful misconduct, arising out of or in connection with this Agreement or otherwise. In no event the Service Provider’s or Designated Person’s maximum agreeable liability exceed the amount paid by the Company to the Service Provider in respect of this Agreement. |

| 8. | ACCESS TO RECORDS |

| 8.1 | The Service Provider or its officer, employees or representative, including the designated persons, in performance of the Services, shall have access to all accounting book, ledgers, receipt, business information, employee information, research, organization structure information, data, computer program, budget figure or other information of the Company related to the performance of Services by Service Provider, its officer, employees, and representative including designated person, whether or not considered material (“Information”) and the Company shall promptly make any such information available to Service Provider upon its reasonable request. |

| 8.2 | The Company undertake to Service Provider that throughout the whole Term of this Agreement, and whether or not requested by Service Provider, the Company will continuously provide and will procure the Company to provide the Service Provider and designated person with updated, complete and accurate information and materials relating to the Company or the Services in a timely manner. The Service Provider or designated person shall be entitled to rely on and assume, without independent verification, the accuracy and completeness of all information and materials that are provided by the Company or publicly available, and the Service Provider and designated person shall not be responsible or liable for any loss and damages arising from any inaccuracy or other defect in such information or materials or any omission or delay in providing such information or materials. |

| 9. | CONFIDENTIALITY |

| 9.1 | The Service Provider acknowledges that in the course of the Services, the Service Provider will have access to and be entrusted with information in respect of the business, affairs and finances of the Company, all of which information are or may be confidential. |

| 9.2 | The Parties shall use any confidential information revealed during the course of this Agreement, solely for the purpose of the Services. The Parties shall use its best effort to keep the confidential information in confidence and shall not disclose any of the confidential information to any other person, provided however, that it may make any disclosure of confidential information to its representatives who on a need to know basis of such information and who agree to keep such information in confidence. |

| 9.3 | This Confidential Information clause shall not apply to confidential information which is or become publicly available, other than as a result of a breach of this provision or becomes lawfully available to both parties from a third party free from any confidentiality restrictions. |

| 9.4 | Notwithstanding anything to the contrary herein, in the event that the Service Provider’s termination, where the Service Provider may be required by law or by regulatory authority to, amongst others, disclose to the relevant authorities and the new service provider proposed to be appointed by the Company to replace the Service Provider, if any, the termination together with the reason thereto, and the Service Provider may be required to make available all information relating to the incoming advisor, the Service Provider agrees, to the extent practicable to do so, to provide prior written notification to the Company of such disclosure. |

| 9.5 | The obligations contained in this Clause shall survive the termination of this Agreement for a period of one (1) year following the date of termination of this Agreement. |

| 10. | TERMINATION |

| 10.1 | Notwithstanding anything contained in this Agreement, this Agreement may be terminated, rescinded or frustration by either Party by serving a written notice of sixty (60) days to the other Party. Upon termination, rescinded or frustration of this Agreement, neither Party shall have no rights to claim any damages, loss, claim or liabilities whatsoever arising out of or in connection with this Agreement. |

| 11. | RELATIONSHIP OF PARTIES |

| 11.1 | At no time the Designated Persons, employees, any independent contractors engaged by the Service Provider and/or the employees of such independent contractors be considered employees of the Company. This Agreement is not one of agency between the Service Provider and the Company, but one in which the Service Provider is engaged to provide the Services as an independent contractor. For the avoidance of doubt, neither Party shall have the power to obligated or bind the other Party vis-à-vis a third party. |

| 12. | INDEMNIFICATION |

| 12.1 | The Company hereby agrees to indemnify, defend and hold harmless the Service Provider and Designated Persons from and against any all claim, losses, demands, liabilities, costs and expenses (including reasonable solicitors’ feeds and costs and expenses related thereto) suffered or incurred by the Service Provider or Designated Persons as a result of or in connection with any third party claims to the extend caused, in whole or in part, by the fraud, gross negligence or willful misconduct of the Company or any of its subsidiaries in its receipt of the Services or in its provision to the Service Provider or Designated Person of any information reasonably required for performance of the Services by the Service Provider or Designated Persons to Service Provider, for any damages concerning the Company’s or its subsidiaries receipt of the Services or any other matter arising out of, or related to, this Agreement (regardless of whether any such claim for such damages is based in contract or in tort) exceed the amounts actually paid to the Service Provider by the Company pursuant to this Agreement. |

| 12.2 | The Service Provider or Designated Persons hereby agrees to indemnify, defend and hold harmless of the Company and its subsidiaries from and against any and all claims, losses, demand, liabilities, costs and expenses (including the reasonably solicitors’ fee, cost and expenses related thereto) suffered or incurred by the Company or its subsidiaries as a result of, or in connection with, any third party claims to the extent caused, in whole or in part, by the fraud, gross negligence or willful misconduct of the Service Provider in performing the Services. In no event shall the aggregate liability of the Service Provider to the Company for any damages concerning the Service Provider’s performance or non-performance of the Services or any other matter arising out of, or related to, this Agreement (regardless of whether any such claim for such damages is based in contract or tort) exceed the amount actually paid to the Service Provider by the Company pursuant to this Agreement. |

| 13. | SUCCESSORS AND ASSIGNS |

| 13.1 | This Agreement shall be binding on and shall ensure for the benefit of each of the Parties successors and permitted assigns. Any reference in this Agreement to any Parties shall be construed accordingly. The Service Provider shall be permitted to assign any of its rights and/or obligations to his affiliated company with the same terms and conditions hereunder by providing thirty (30) days written notice to the Company. |

| 14. | FORCE MAJEURE |

| 14.1 | Neither Party shall be deemed to be in breach of this Agreement, or otherwise be liable to other, by reason of any delay in performance, or the non-performance, of any of its obligation hereunder, to the extent the delay or non-performance is due to an event of Force Majeure of which it has notified the other, and the time for performance of its obligation shall be extended accordingly. For the purpose herein, “Force Majeure” shall mean any act, event or circumstance relied on by either Party hereto over which that affected Party could not have reasonably exercised control, including but not limited to acts of God, acts of government or other authorities, fires, lockouts, riots, wars, pandemics, epidemics, inclement weather, earthquakes and other natural disasters. |

| 14.2 | Each Party shall immediately notify the other Party in writing of the occurrence of any event of Force Majeure applicable to its obligation under this Agreement, its consequences. If either Party considers the event of Force Majeure to be of such severity or to be continuing for an aggregated period of three (3) months such that the party is unable to perform any of its obligations hereunder, this Agreement may be terminated by that Party by notice in writing to the other Party, which termination may take effect immediately or on the date specified in the notice of termination at the option of the Party issuing the termination notice. Neither party shall have any liability to the other in respect of the termination of this Agreement as a result of the Event of Force Majeure save and except for any antecedent breach or liability, which has arisen prior to the Event of Force Majeure. |

| 15. | NOTICE |

| 15.1 | Any notice required or permitted to be given by either Party to the other shall be deemed sufficient if sent by registered or certified mail, postage prepaid, electronic mail, addressed by the Party giving notice to the other Party at the address as stated in Section 2 of the First Schedule and Preamble of this Agreement. |

| 15.2 | Unless expressly herein, any notice or communication to be given under this Agreement shall be in writing and be in English Language. |

| 15.3 | All notices and communications by one Party to the other shall be deemed to have been received by the other Party and be effective as follows: |

| (a) | If by hand, upon written acknowledgement of receipt by a duly authorized officer, employee, agent, or representative of the receiving Party; | |

| (b) | If by international courier (if any), five (5) days after notice is posted; and | |

| (c) | If by electronic mail, upon sending provided that there is no return email notifying failure of delivery. |

| 16. | SEVERABILITY |

| 16.1 | Any provision of this Agreement which is invalid in respect of any law, regulation or any authority shall be invalid, without invalidating or affecting the remaining provisions of this Agreement. |

| 17. | TIME OF THE ESSENCE |

| 17.1 | Time is of the essence of this Agreement. |

| 18. | NO WAIVER |

| 18.1 | Knowledge or acquiescence by any party of any breach of the terms and conditions of this Agreement shall not be deemed to be a waiver of such terms and conditions, and notwithstanding such knowledge or acquiescence, such Party shall be entitled to exercise its rights under this Agreement and to require strict performance by the other Party of the terms and conditions of this Agreement. Waiver of any breach of the terms and conditions of this Agreement or of any right, power, authority, discretion or remedy arising upon a breach of or default under this Agreement, must be in writing and signed by the Party granting the waiver. |

| 19. | COUNTERPART |

| 19.1 | This Agreement may be signed in any number of counterparts, each of which shall be deemed an original and all of which when taken together shall constitute one and the same instrument. |

| 20. | SUPPLEMENTAL AGREEMENT |

| 20.1 | This Agreement may be amended by supplemental agreements at any time during the term of this Agreement. Should either party wishes to negotiate a matter of this kind, it shall notify the other party in writing of the specific subjects it wishes to negotiate. Unless otherwise agreed to in writing by both parties, supplemental agreements shall remain in effect for the duration of this Agreement. |

| 21. | GOOD FAITH |

| 21.1 | In entering into this Agreement, the Parties recognise that it is impracticable to make provisions for every contingency that may arise in the course of the performance of this Agreement. Accordingly, the Parties hereby declare it to be their intention that this Agreement shall operate between them in accordance with the principle of good faith, with fairness and without detriment to the interests of any of them and if in the course of performance of this Agreement unfairness to any Party is disclosed or anticipated or any dispute arises then the Parties shall use their best endeavours (without prior recourse to arbitration or litigation) to agree upon such action as may be necessary and equitable to remove or resolve the cause or causes of the same. |

| 22. | ENTIRE AGREEMENT |

| 22.1 | This Agreement constitutes the entire agreement between the parties hereto with respect to the matters dealt with therein and supersedes any previous agreement or understanding between the parties hereto in relation to such matters. This Agreement shall only be novated, amended and/or supplemented in writing with agreement of both parties and not otherwise. |

| 23. | GOVERNING LAW AND JURISDICTION |

| 23.1 | This Agreement shall be governed by and construed and enforced in accordance with the laws of Malaysia. |

| 23.2 | Any dispute, controversy or claim arising out of or in relation to this Agreement including any breach of any terms of this Agreement shall be resolved, insofar as it is possible, by mutual consultation between the Parties. |

| 23.3 | In the event that no settlement is capable to be reached by the Parties, the dispute shall be resolved by the courts of Malaysia. |

[The remainder of this page is intentionally left blank]

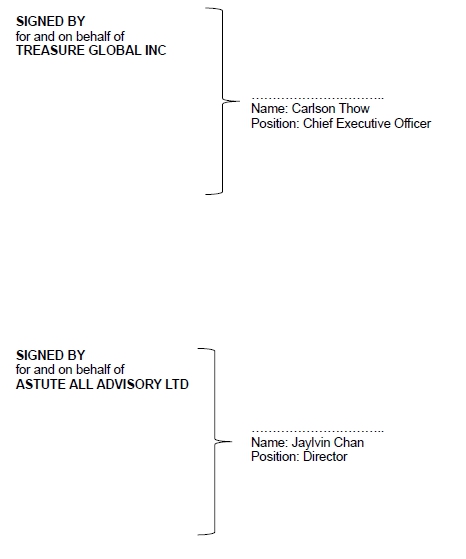

IN WITNESS WHEREOF the Parties have set their hands on the date and year first above written.

SCHEDULE

(which is to be taken read and construed as an integral part of this Agreement)

| Section | Description | Particulars | ||

| 1 | Agreement Date | October 27, 2025 | ||

| 2 | Service Provider | Company Name |

: | ASTUTE

ALL ADVISORY LTD |

| Registration No. |

: | 2162272 | ||

| Registered Office |

: | Nerine

Chambers, PO Box 905, Road Town, Tortola, British Virgin Island |

||

| Email Address |

: | jaylvin.chan@astuteall.com | ||

| 3 | Commencement Date | October 27, 2025 | ||

[The remainder of this page is intentionally left blank]

SECOND SCHEDULE

(which is to be taken read and construed as an integral part of this Agreement)

| 1. | Designated Persons |

The list of Designated Persons below may be amended, modified or supplemented by Service Provider from time to time:

| (a) | Jaylvin Chan Yee Fei |

| (b) | Chanell Chuah |

| (c) | Sue Chuah Su Huay |

| (d) | Caroll Tai |

| 2. | Scope of Services |

The Service Provider shall provide bona fide management and business strategy to the Company including the following:

| (a) | Organisation Review and Recommendation |

| (i) | review the Company’s current management and organisation structure; |

| (ii) | provide written recommendations to improve reporting lines, accountability and efficiency. |

| (b) | Operational and Corporate Governance Support |

| (i) | assess existing operational process and governance framework; |

| (ii) | recommend updates to align with recognised good practices. |

| (c) | Strategic Planning Support |

| (i) | assist management in developing a short term and medium-term business strategy roadmap. |

| (ii) | Advice on operational priorities and allocation of resource to support strategic support. |

| (d) | Policy and Procedure Enhancement |

| (i) | review key internal policies; |

| (ii) | recommend enhancements and draft updated version where appropriate. |

| (e) | Internal Control Assessment and benchmarking study |

| (i) | assess non-financial internal control; |

| (ii) | provide recommendation to strengthen accountability and transparency; |

| (iii) | conduct a peer comparison of governance, organisation practices and operational models of similar size of the listed company; |

| (iv) | recommend best practices for adoption. |

| (f) | Quarterly Monitoring Report |

| (i) | provide the Board with quarterly monitoring updates, identifying challenges and corrective measures. |

[The remainder of this page is intentionally left blank]