UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of October 2025

Commission File Number: 001-37643

PURPLE BIOTECH LTD.

(Translation of registrant’s name into English)

4 Oppenheimer Street, Science Park, Rehovot 7670104, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Purple Biotech

On October 28, 2025, Purple Biotech Ltd. (the “Company” or the “Registrant”) announced that an Extraordinary General Meeting of Shareholders of the Company will be held on Monday, December 15, 2025, at 4:30 p.m. Israel time at the Company’s executive offices at 4 Oppenheimer Street, Science Park, Rehovot, Israel. The Notice of Extraordinary General Meeting of Shareholders and the Proxy Statement in connection with the Extraordinary General Meeting of Shareholders, including the Voting Slip for holders of ordinary shares of the Company, are attached to this Form 6-K as Exhibit 99.1.

BNY Mellon, the Depositary of the Company’s American Depositary Shares (“ADSs”) program, will distribute a Voting Instruction Form for holders of the Company’s ADSs. A copy of the Voting Instruction Form is attached hereto as Exhibit 99.2.

This report on Form 6-K of the Registrant consists of the following documents, which are attached hereto and incorporated by reference herein:

Incorporation by Reference

This Report on Form 6-K, including all exhibits attached hereto, is hereby incorporated by reference into each of the Registrant’s Registration Statement on Form S-8 filed with the Securities and Exchange Commission on May 20, 2016 (Registration file number 333-211478), the Registrant’s Registration Statement on Form S-8 filed with the Securities and Exchange Commission on June 6, 2017 (Registration file number 333-218538), the Registrant’s Registration Statement on Form F-3, as amended, originally filed with the Securities and Exchange Commission on July 16, 2018 (Registration file number 333-226195), the Registrant’s Registration Statement on Form S-8 filed with the Securities and Exchange Commission on March 28, 2019 (Registration file number 333-230584), the Registrant’s Registration Statement on Form F-3 filed with the Securities and Exchange Commission on September 16, 2019 (Registration file number 333-233795), the Registrant’s Registration Statement on Form F-3 filed with the Securities and Exchange Commission on May 13, 2020 (Registration file number 333-238229), the Registrant’s Registration Statement on Form S-8 filed with the Securities and Exchange Commission on May 18, 2020 (Registration file number 333-238481), each of the Registrant’s Registration Statements on Form F-3 filed with the Securities and Exchange Commission on July 10, 2020 (Registration file numbers 333-239807 and 333-233793), the Registrant’s Registration Statement on Form S-8 filed with the Securities and Exchange Commission on April 4, 2022 (Registration file number 333-264107), the Registrant’s Registration Statement on Form F-3, originally filed with the Securities and Exchange Commission on December 7, 2022 (Registration file number 333-268710), the Registrant’s Registration Statement on Form F-3 filed with the Securities and Exchange Commission on March 23, 2023 (Registration file number 333-270769), and the Registrant’s Registration Statement on Form F-3, originally filed with the Securities and Exchange Commission on May 17, 2023 (Registration file number 333-268710), to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| October 28, 2025 | PURPLE BIOTECH LTD. | |

| By: | /s/ Gil Efron | |

| Gil Efron | ||

| Chief Executive Officer | ||

2

Exhibit 99.1

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

Notice is hereby given that an Extraordinary General Meeting of Shareholders (the “Meeting”) of Purple Biotech Ltd. (the “Company”) will be held on Monday, December 15, 2025, at 4:30 p.m. Israel time at the Company’s executive offices at 4 Oppenheimer Street, Science Park, Rehovot, Israel.

The purpose of the Meeting is to approve the grant of equity-based awards to (a) Mr. Gil Efron, our Chief Executive Officer; and (b) each of our directors.

Shareholders and holders of the Company’s American Depositary Shares (“ADSs”) of record at the close of business in New York on November 3, 2025 (the “Record Date”), are entitled to receive notice of, and vote at, the Meeting and any adjournments or postponements thereof. You are also entitled to notice of, and to vote at the Meeting, and any adjournments or postponements thereof if you are a beneficial owner who holds ordinary shares or ADSs through a broker, bank or other nominee as of the Record Date. All shareholders are cordially invited to attend the Meeting in person.

Whether or not you plan to attend the Meeting, it is important that your ordinary shares be represented. Holders of ADSs (whether registered in their name or in “street name”) will receive voting instruction forms from the Bank of New York Mellon (which acts as the Depositary for the ADSs) in order to instruct their banks, brokers or other nominees on how to vote, and they are kindly requested to complete, date, sign and mail the voting instruction form in the envelope provided at the earliest convenience so that it will be received no later than the date and time indicated on the voting instruction form.

Shareholders who hold ordinary shares through members of the Tel Aviv Stock Exchange (the “TASE”), may vote at the Meeting in person or through a voting slip, by completing, dating, signing and delivering or mailing (by registered mail) the voting slip to the Company’s offices so that it is received by the Company no later than four hours prior to the designated time of the Meeting, namely by no later than Monday, December 15, 2025, 12:30 p.m. Israel time. Shareholders who hold ordinary shares through members of the TASE (whether attending the Meeting in person or voting through a voting slip) must provide the Company with an ownership certificate confirming their ownership of our ordinary shares as of the Record Date from the applicable TASE member, as required by the Israeli Companies Regulations (Proof of Ownership of Shares for Voting at General Meeting) of 2000, as amended. Alternatively, a shareholder whose shares are registered with a TASE member may also vote electronically via the electronic voting system of the Israel Securities Authority (the “ISA”). You should receive instructions about electronic voting from the TASE member through which you hold your shares. Voting via the electronic voting system will be permitted until four hours prior to the Meeting commencement, namely by no later than Monday, December 15, 2025, 12:30 p.m. Israel time.

A holder of ordinary shares at the close of business on the Record Date shall also be entitled to participate in the Meeting by proxy, which shall be in writing and signed by the appointing party or its authorized attorney, and if the appointing party is a corporation, the appointment shall be in writing signed by authorized corporate signatories together with the company stamp or by an authorized attorney. The proxy, or a copy satisfactory to the Company Secretary, must be deposited at the Company’s offices no later than 72 hours prior to the time scheduled for the Meeting. However, the Meeting chairman is entitled to waive this requirement with respect to all participants at the Meeting, and to accept all proxies at the commencement of the Meeting, subject to the presentation of proof of share ownership. A proxy held by a participant at the Meeting that is dated more than 12 months from the date of the signature shall be considered invalid.

Our Board of Directors recommends that you vote FOR the above proposals, which are described in the proxy statement.

The quorum required for the Meeting consists of at least two shareholders who are present at the Meeting, in person, by proxy, voting instruction form or voting slip (paper or electronic) (“Valid Meeting Participants”), and who hold in the aggregate twenty-five percent (25%) or more of the voting rights of the Company. In the event that there is no quorum present thirty minutes after the scheduled time, the Meeting will be adjourned for one week, to the same time and place, i.e., on Monday, December 22, 2025, at 4:30 p.m. (Israel time) at the Company’s offices (the “Adjourned Meeting”). If there is no quorum present thirty minutes after the time set for the Adjourned Meeting, any two shareholders present as Valid Meeting Participants will then constitute a legal quorum at the Adjourned Meeting. This notice will serve as notice of the Adjourned Meeting if no quorum is present at the original date and time, and no further notice of the Adjourned Meeting will be given to shareholders.

The affirmative vote of the holders of a majority of the Company’s ordinary shares, including those represented by ADSs, participating and voting on the matter at the Meeting as Valid Meeting Participants (excluding abstentions), is required to approve the proposals.

In addition, the approval of Proposal 1(a) is also subject to the fulfillment of one of the following additional voting requirements: (i) at least a majority of the shares (including those represented by ADSs) held by shareholders (including ADS holders) who are non-controlling shareholders and shareholders (including ADS holders) who do not have a personal interest in the matter voted in favor of the proposal (excluding abstentions); or (ii) the total number of shares (including those represented by ADSs) voted against the proposal by shareholders and ADS holders (as applicable) referred to in clause (i) does not exceed two-percent (2%) of the outstanding voting power in the Company.

We are not aware of any shareholder or ADS holder that would be deemed to be a controlling shareholder of our Company as of the current time for purposes of Proposal 1(a). The Israeli Companies Law, 1999 (the “Companies Law”) requires that each shareholder and ADS holder voting on Proposal 1(a) inform the Company, prior to voting on Proposal 1(a) at the Meeting, if the shareholder or ADS holder has a personal interest in the proposal; otherwise, a shareholder or ADS holder’s vote will not be counted for the purposes of the proposal. In accordance with regulations promulgated under the Companies Law, a shareholder who votes via voting slip, and an ADS holder who signs and returns a voting instruction form, will be deemed to have confirmed that such shareholder or ADS holder (as applicable), and any related party thereof, does not have a personal interest in Proposal 1(a), unless such shareholder or ADS holder has delivered a written notice to the Company notifying of the existence of a personal interest no later than 10:00 a.m. (Israel time) on Monday, December 15, 2025. Any such written notice must be sent to the Company via registered mail at the Company’s offices; Attention: Gil Efron, Chief Executive Officer. All other shareholders voting on Proposal 1(a) are required to indicate via the ISA’s electronic voting system, or, if voting in person at the Meeting, inform us prior to voting on the matter at the Meeting, whether or not the shareholder has a personal interest in the proposal; otherwise, any such shareholder’s vote will not be counted for the purposes of such proposal.

Under the Companies Law, a “personal interest” of a shareholder (including ADS holder) in an act or transaction of a company (i) includes a personal interest of (a) any relative (i.e., spouse, sibling, parent, grandparent or descendant of the shareholder (including ADS holder), any descendant, sibling or parent of a spouse of the shareholder (including ADS holder) and the spouse of any of the foregoing); and (b) a company with respect to which the shareholder (including ADS holder) or any of the foregoing relatives of the shareholder or ADS holder) owns at least 5% of the outstanding shares or voting rights, serves as a director or chief executive officer or has the right to appoint one or more directors or the chief executive officer; and (ii) excludes a personal interest arising solely from the ownership of shares. Under the Companies Law, in the case of a person voting by proxy, “personal interest” includes the personal interest of either the proxy holder or the shareholder granting the proxy, whether or not the proxy holder has discretion how to vote.

The last date for submitting a request to include a proposal in accordance with Section 66(b) of the Companies Law and the regulations thereunder, is November 3, 2025. The full version of the proposed resolutions may be viewed in the proxy statement, which, together with the accompanying voting instruction form and voting slip (collectively, the “Proxy Materials”), will be furnished to the U.S. Securities and Exchange Commission under cover of Form 6-K and will be publicly available via its website at http://www.sec.gov. This Notice of Extraordinary General Meeting of Shareholders and the Proxy Materials will also be submitted to the ISA and TASE and will be available on their respective websites for listed company reports http://www.tase.co.il/tase/ and http://www.magna.isa.gov.il. The Proxy Materials will also be made available at the “Investor” portion of our website, which can be found at https://purple-biotech.com/investors, and may also be viewed at our offices, upon prior coordination and during regular business hours, at 4 Oppenheimer Street, Science Park, Rehovot, Israel (Tel: +972-3-9333121), until the date of the Meeting. Detailed voting instructions are provided in the proxy statement, the voting instruction form and the voting slip.

| Sincerely, | |

| /s/ Dr. Eric Rowinsky | |

| Dr. Eric Rowinsky, | |

| Chairman of the Board of Directors |

October 28, 2025

PROXY STATEMENT

EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

This Proxy Statement is being furnished to the holders of ordinary shares, no par value, and to holders of American Depositary Shares (“ADSs”), each representing 200 ordinary shares, issued by the Bank of New York Mellon (“BNY Mellon”), in connection with the solicitation of proxies on behalf of the Board of Directors of Purple Biotech Ltd. (“we,” “us,” “our,” “Purple” or the “Company”) to be voted at an Extraordinary General Meeting of Shareholders (the “Meeting”) and at any adjournment thereof, pursuant to the accompanying Notice of Extraordinary General Meeting of Shareholders. The Meeting will be held on Monday, December 15, 2025, at 4:30 p.m. Israel time at our executive offices at 4 Oppenheimer Street, Science Park, Rehovot, Israel (the “Company Offices”).

Purpose of the Meeting

At the Meeting, shareholders will be asked to consider and vote upon the approval of the grant of equity-based awards to (a) Mr. Gil Efron, our Chief Executive Officer; and (b) each of our directors.

We are currently not aware of any other matters that may be raised at the Meeting. If any other matters are properly raised at the Meeting or any adjournment or postponement thereof, the proxy and voting instruments confer discretionary authority with respect to acting thereon, and the persons named in the proxy or other voting instrument will vote on such matters in accordance with their best judgment.

Board Recommendation

The Board of Directors recommends that you vote “FOR” the proposals on the agenda.

Record Date; Shareholders and ADS Holders Entitled to Vote

Shareholders and holders of our ADSs of record at the close of business in New York on November 3, 2025 (the “Record Date”) are entitled to receive notice of, and vote at, the Meeting and any adjournments or postponements thereof. You are also entitled to notice of, and to vote at the Meeting, and any adjournments or postponements thereof if you are a beneficial owner who holds ordinary shares or ADSs through a broker, bank or other nominee as of the Record Date, and if you held your shares through the Tel Aviv Stock Exchange (“TASE”) on that date

How to Vote

| ● | Holders of ADSs. Holders of ADSs (whether registered in their name or in “street name”) will receive from BNY Mellon (which acts as the Depositary for the ADSs) a voting instruction form in order to instruct their banks, brokers or other nominees on how to vote. Under the terms of the Deposit Agreement between the Company, BNY Mellon and the holders of the Company’s ADSs, BNY Mellon shall endeavor (insofar as is practicable) to vote or cause to be voted the number of ordinary shares represented by ADSs in accordance with the instructions provided by the holders of ADSs to BNY Mellon. For ADSs that are held in “street name” through a bank, broker or other nominee, the voting process will be based on the underlying beneficial holder of the ADSs directing the bank, broker or other nominee to arrange for BNY Mellon to vote the ordinary shares represented by the ADSs in accordance with the beneficial holder’s voting instructions. If no instructions are received by the Depositary from an owner of ADSs with respect to a matter and a number of ADSs of that owner on or before the instruction cutoff date set forth on the BNY Mellon voting instruction form, the Depositary shall deem that owner to have instructed the Depositary to give a discretionary proxy to a person designated by us with respect to that matter and the number of ordinary shares represented by that number of ADSs, and the Depositary shall give a discretionary proxy to the person designated by us to vote that number of ordinary shares as to that matter, except that no instruction of that kind shall be deemed given and no discretionary proxy shall be given with respect to any matter as to which we inform the Depositary (and we agree to provide such information as promptly as practicable in writing, if applicable) that (x) we do not wish a proxy to be given, (y) substantial shareholder opposition exists, or (z) the matter materially and adversely affects the rights of holders of shares. ADS holders should return their BNY Mellon voting instruction form by no later than the date and time set forth on such voting instruction form. |

| ● | Holders of Ordinary Shares Traded on TASE. Shareholders who hold ordinary shares through a member of the TASE may vote at the Meeting (i) by attending the Meeting and voting in person. All such shareholders must present a form of government-issued photograph identification (e.g., passport or certificate of incorporation (as the case may be)) and an ownership certificate (as of the Record Date) from the applicable TASE member, as required by the Israeli Companies Regulations (Proof of Ownership of Shares for Voting at General Meeting) of 2000, as amended (an “Ownership Certificate”); (ii) by voting slip, by sending the duly executed voting slip together with an Ownership Certificate to the Company Offices no later than four hours prior to the designated time of the Meeting, namely by no later than Monday, December 15, 2025, 12:30 p.m. Israel time. A shareholder whose shares are registered with a TASE member is entitled to receive from the TASE member that holds the shares on the shareholder’s behalf by e-mail (for no charge) a link to the text of the voting slip posted on the website of the Israel Securities Authority (the “ISA”), unless the shareholder notified such TASE member that he or she or it is not interested in receiving such link, provided that such notification was provided by the shareholder with respect to a particular securities account prior to the Record Date; (iii) by voting electronically via the electronic voting system of the ISA. You should receive instructions about electronic voting from the TASE member through which you hold your shares. Voting via the ISA electronic voting system will be permitted until four hours prior to the Meeting commencement, namely by no later than Monday, December 15, 2025, 12:30 p.m. Israel time; and (iv) by proxy, by sending the duly executed proxy together with an Ownership Certificate to the Company Offices no later than 72 hours prior to the time scheduled for the Meeting. However, the Meeting chairman is entitled to waive this requirement with respect to all participants at the Meeting, and to accept all proxies (and accompanying Ownership Certificates) at the commencement of the Meeting, subject to the presentation of proof of share ownership. The proxy must be signed by the appointing party or its authorized attorney, and if the appointing party is a corporation, by authorized corporate signatories together with the Company stamp or by an authorized attorney. A proxy dated more than 12 months from the date of the signature shall be considered invalid. |

Change or Revocation of Vote

Holders of ADSs: A holder of ADS who has executed and returned a voting instruction form may revoke its voting instructions at any time before the applicable deadline by filing with BNY Mellon (in the case of holders of ADSs) a written notice of revocation or a duly executed voting instruction form bearing a later date. If your ADSs are held in “street name,” you may change your vote by submitting new voting instructions to your broker, bank, trustee, or nominee or, if you have obtained a legal proxy from your broker, bank, trustee or nominee giving you the right to vote your shares, by attending the Meeting and voting in person.

Holder of Ordinary Shares: If you are a beneficial owner of ordinary shares registered in the name of a member of the TASE, you may change your vote (i) by attending the Meeting and voting in person, by presenting a valid Ownership Certificate (as of the Record Date); (ii) by delivering a later-dated duly executed voting slip, together with a valid Ownership Certificate (as of the Record Date), to the Company Offices no later than four hours prior to the designated time of the Meeting, (iii) by following the relevant instructions for changing your vote via the ISA electronic voting system by no later than four hours before the time set for the Meeting; or (iv) by delivering a later-dated duly executed proxy, together with a valid Ownership Certificate (as of the Record Date), to the Company Offices no later than 72 hour prior to the designated time of the Meeting.

Quorum

The quorum required for the Meeting consists of at least two shareholders who are present at the Meeting, in person, by proxy, voting instruction form or voting slip, or voting via the ISA electronic system, or otherwise represented at the Meeting by their authorized persons (“Valid Meeting Participants”), and who hold in the aggregate twenty-five percent (25%) or more of the voting rights of the Company. In the event that there is no quorum present thirty minutes after the scheduled time, the Meeting will be adjourned for one week, to the same time and place, i.e., to Monday, December 22, 2025, at 4:30 p.m. (Israel time) at the Company Offices (each such adjourned meeting is referred to as an “Adjourned Meeting”). If there is no quorum present thirty minutes after the time set for the Adjourned Meeting, any two shareholders present as Valid Meeting Participants will then constitute a legal quorum at the Adjourned Meeting. This notice will serve as notice of an Adjourned Meeting if no quorum is present at the original date and time, and no further notice of the Adjourned Meeting will be given to shareholders.

Abstentions and “broker non-votes”, as well as any abstentions by ADS holders with respect to our ordinary shares held by BNY Mellon, are counted as present and entitled to vote for purposes of determining a legal quorum.

Vote Required for Approval of the Proposals

The affirmative vote of the holders of a majority of the Company’s ordinary shares, including those represented by ADSs, participating and voting on the matter at the Meeting as Valid Meeting Participants (excluding abstentions), is required to approve the proposals.

In addition, the approval of Proposal 1(a) is also subject to the fulfillment of one of the following additional voting requirements (the “Special Majority”): (i) at least a majority of the shares (including those represented by ADSs) held by shareholders (including ADS holders) who are non-controlling shareholders and shareholders (including ADS holders) who do not have a personal interest in the matter voted in favor of the proposal (excluding abstentions); or (ii) the total number of shares (including those represented by ADSs) voted against the proposal by shareholders and ADS holders (as applicable) referred to in clause (i), does not exceed two-percent (2%) of the outstanding voting power in the Company.

We are not aware of any shareholder or holder of ADSs that would be deemed to be a controlling shareholder of our Company as of the current time for purposes of Proposal 1(a). The Israeli Companies Law, 1999 (the “Companies Law”) requires that each shareholder and ADS holder voting on Proposal 1(a) inform the Company, prior to voting on the proposal at the Meeting, if the shareholder or ADS holder has a personal interest in the proposal; otherwise, a shareholder or ADS holder’s vote will not be counted for the purposes of the proposal. In accordance with regulations promulgated under the Companies Law, a shareholder who votes via voting slip or proxy, and an ADS holder who signs and returns a voting instruction form, will be deemed to have confirmed that such shareholder or ADS holder (as applicable), and any related party thereof, does not have a personal interest in Proposal 1(a), unless such shareholder or ADS holder has delivered a written notice to the Company notifying of the existence of a personal interest no later than 10:00 a.m. (Israel time) on Monday, December 15, 2025. Any such written notice must be sent to the Company via registered mail at the Company’s Offices; Attention: Gil Efron, Chief Executive Officer. All other shareholders voting on Proposal 1(a) are required to indicate via the ISA’s electronic voting system, or, if voting in person at the Meeting, inform us prior to voting on the matter at the Meeting, whether or not the shareholder has a personal interest in the proposal; otherwise, any such shareholder’s vote will not be counted for the purposes of such proposal.

Under the Companies Law, a “personal interest” of a shareholder (including ADS holder) in an act or transaction of a company (i) includes a personal interest of (a) any relative (i.e., spouse, sibling, parent, grandparent or descendant of the shareholder (including ADS holder), any descendant, sibling or parent of a spouse of the shareholder (including ADS holder) and the spouse of any of the foregoing); and (b) a company with respect to which the shareholder (including ADS holder) or any of the foregoing relatives of the shareholder or ADS holder) owns at least 5% of the outstanding shares or voting rights, serves as a director or chief executive officer or has the right to appoint one or more directors or the chief executive officer; and (ii) excludes a personal interest arising solely from the ownership of shares. Under the Companies Law, in the case of a person voting by proxy, “personal interest” includes the personal interest of either the proxy holder or the shareholder granting the proxy, whether or not the proxy holder has discretion how to vote.

Solicitation of Proxies

We may bear the reasonable and actual cost of solicitation of proxies, including preparation, assembly, printing, and mailing of the BNY Mellon voting instruction form and any additional information furnished to holders of ordinary shares or ADSs. The Notice of Extraordinary General Meeting of the Shareholders, the Proxy Statement, and the voting slip will not be mailed to holders of ordinary shares traded on the TASE. We may reimburse brokerage firms and other persons representing beneficial owners of ordinary shares or ADSs only for reasonable expenses incurred by them in forwarding proxy soliciting materials to such beneficial owners. In addition to solicitation by mail, certain of our directors, officers and employees, without additional remuneration, may solicit proxies by telephone, facsimile, email or personal contact.

Reporting Requirements

We are subject to the information reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), applicable to foreign private issuers. We fulfill these requirements by filing reports with the U.S. Securities and Exchange Commission (the “Commission”). Our filings with the Commission are available to the public on the Commission’s website at www.sec.gov. We submit copies of our filings with the Commission to the ISA and the TASE, and such filings can be reviewed on their respective websites for listed company reports at www.magna.isa.gov.il and www.maya.tase.co.il.

As a foreign private issuer, we are exempt from the rules under the Exchange Act related to the furnishing and content of proxy statements. The circulation of this proxy statement and related notice should not be taken as an admission that we are subject to those proxy rules. Furthermore, our officers, directors and principal shareholders are exempt from the reporting and “short swing” profit recovery provisions contained in Section 16 of the Exchange Act and the rules thereunder, with respect to their purchases and sales of securities. Additionally, we are not required to file periodic reports and financial statements with the Commission under the Exchange Act as frequently or as promptly as United States companies whose securities are registered under the Exchange Act.

Security Ownership of Certain Beneficial Owners and Management

As of October 20, 2025, (i) no officer or director individually beneficially owned 1% or more of our outstanding ordinary shares; and (ii) all of our current officers and directors as a group (4 persons) beneficially owned 13,470,574, or 0.7%, of our outstanding ordinary shares. Such number of ordinary shares includes 5,214,172 ordinary shares issuable under outstanding options and restricted stock units (“RSUs”) which will be exercisable or shall vest (as applicable) within 60 days of October 20, 2025.

The following table sets forth information with respect to the beneficial ownership of our ordinary shares by each person or entity known to us to beneficially own 5% or more of our outstanding ordinary shares as of October 20, 2025.

The beneficial ownership of our ordinary shares is determined in accordance with the rules of the Commission. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of the security, or investment power, which includes the power to dispose of or to direct the disposition of the security. For purposes of the table below, we deem ordinary shares issuable pursuant to options or warrants that are currently exercisable or exercisable within 60 days of October 20, 2025 and ordinary shares underlying RSUs that vest within 60 days of October 20, if any, to be outstanding and to be beneficially owned by the person holding the options, warrants or RSUs for the purposes of computing the percentage ownership of that person, but we do not treat them as outstanding for the purpose of computing the percentage ownership of any other person. The calculation of beneficial ownership is based on 1,806,089,801 ordinary shares (not including 1 share held in treasury) outstanding as of October 20, 2025. Each one (1) ADS held represents two hundred (200) ordinary shares. The information in the table below with respect to the beneficial ownership of shareholders is based on the public filings of such shareholders with the Commission through October 20, 2025.

| Name | Share Number |

Percentage | ||||||

| Intracoastal Capital LLC (1) | 139,632,475 | 7.7 | % | |||||

| Lincoln Alternative Strategies LLC(2) | 121,000,000 | 6.7 | % | |||||

| (1) | Based solely on, and qualified in its entirety with reference to, a Schedule 13G filed with the SEC by Intracoastal Capital LLC, Mitchell P. Kopin and Daniel B. Asher on September 10, 2025. According to the Schedule 13G, includes 47,632,475 ordinary shares issuable upon exercise of warrants and excludes 352,367,525 ordinary shares issuable upon exercise of warrants which contain a 9.99% blocker provision. |

| (2) | Based solely on, and qualified in its entirety with reference to, a Schedule 13G filed with the SEC by Lincoln Alternative Strategies LLC on September 9, 2025. |

PROPOSAL 1

APPROVAL OF THE GRANT OF EQUITY-BASED AWARDS TO OUR CHIEF EXECUTIVE OFFICER AND OUR DIRECTORS

Background

Under the Companies Law, the payment of compensation, including equity-based compensation, to a chief executive officer or director that is consistent with a company’s compensation policy must be approved by the compensation committee, the board of directors and shareholders, in the case of a chief executive officer, by the Special Majority (for definition, see “Vote Required for Approval of the Proposals” above), and in the case of a director, by an ordinary majority.

Our Compensation Committee and Board of Directors conducted a comprehensive review of the equity-based compensation of our directors, executive officers and employees. In conducting their review, the Compensation Committee and the Board of Directors considered the Company’s compensation philosophies and the provisions of its Compensation Policy, as well as internal consistency and prevailing market practices. While the Company’s compensation philosophy encourages the grant of equity-based compensation to directors and executive officers to align their interests with those of our shareholders and to promote long-term value creation, the Compensation Committee and the Board of Directors noted that the Company’s Chief Executive Officer and directors have not received equity-based awards since 2023.

Based on such review, our Compensation Committee and Board of Directors approved, subject to shareholder approval, the grant to our Chief Executive Officer and to each of our currently serving directors of the following equity-based awards: (i) to Mr. Gil Efron, our Chief Executive Officer, options to purchase up to 13,500,000 ordinary shares (equivalent to 67,500 ADSs) and 13,500,000 RSUs (equivalent to 67,500 ADSs); (ii) to Dr. Eric Rowinsky, the Chairman of our Board of Directors, options to purchase up to 5,300,000 ordinary shares (equivalent to 26,500 ADSs) and 5,300,000 RSUs (equivalent to 26,500 ADSs); and (iii) to each of our other directors, options to purchase up to 2,650,000 ordinary shares (equivalent to 13,250 ADSs) and 2,650,000 RSUs (equivalent to 13,250 ADSs), in each case on the terms described below, provided that non-Israeli resident directors (namely, Dr. Rowinsky and Mr. Gagnon) may elect, at their sole discretion, to receive the entire equity award in the form of stock options.

Each of the proposed option awards will have an exercise price of US$0.003, which is equal to the quotient of the average closing price of our ADSs on the Nasdaq Capital Market during the 30 days prior to the date of the approval of the grant of the equity awards by our Board of Directors (i.e., $0.583), divided by two hundred (200). Each of the proposed equity awards will vest over a period of three years, with 8.33% of each of the awards vesting at the end of each three-month period, subject to such individual’s continued engagement by the Company on each applicable vesting date. Any outstanding unexercised options shall expire five years following the date of the approval of the awards by our Board of Directors. The vesting of any of outstanding equity awards shall accelerate in full upon a “Merger/Sale,” as defined in the Company’s 2016 Equity-Based Incentive Plan (the “2016 Plan”). The equity awards, if approved at the Meeting, will be granted under, and shall be subject to, the 2016 Plan and the applicable award agreements to be entered into with each recipient. The equity awards to Mr. Efron and Israeli resident directors (namely, Isaac Israel, Ido Agmon, Simcha Rock, Suzana Nahum-Zilberberg and Yael Margolin), if approved at the Meeting, will be granted pursuant to the capital gains track under Section 102 of the Israel Income Tax Ordinance [New Version] 5721-1961. The estimated fair market value of the equity award proposed to be granted to (i) Mr. Efron is approximately US$94,500, (ii) Dr. Rowinsky is approximately US$37,000, and (iii) each of the other directors is approximately US$18,550, in each case estimated using the average closing price of the ADSs on the Nasdaq Capital Market during the 30 days prior to October 21, 2025, and calculated using the Black & Scholes valuation method.

Each of our Compensation Committee and Board of Directors determined that the grant of the equity awards and their terms are consistent with our Compensation Policy.

Proposed Resolutions

It is proposed that the following resolutions be adopted at the Meeting:

1(a). “RESOLVED, to approve the grant of equity-based awards to Gil Efron, the Chief Executive Officer of the Company, in such amounts and with such terms and conditions as described in Proposal 1 of the Proxy Statement for the Meeting.”

1(b). “RESOLVED, to approve the grant of equity-based awards to each of the members of the Company’s Board of Directors, in such amounts and with such terms and conditions as described in Proposal 1 of the Proxy Statement for the Meeting.”

Approvals Required

See “Vote Required for Approval of the Proposals” above.

Board Recommendation

Our Board of Directors recommends a vote “FOR” the approval of the grant of equity-based awards to our Chief Executive Officer and each of our directors, as described in Proposal 1.

OTHER MATTERS

The Board of Directors is not aware of any other matters to be presented at the Meeting other than those specifically set forth in this Proxy Statement. If any other matters properly come before the Meeting, it is the intention of the persons named in the accompanying proxy to vote such proxy in accordance with the judgment and recommendation of the Board of Directors.

| By Order of the Board of Directors, | |

| /s/ Dr. Eric Rowinsky | |

| Dr. Eric Rowinsky, | |

| Chairman of the Board of Directors |

October 28, 2025

VOTING SLIP FOR EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

Company name: Purple Biotech Ltd., company no. 520031238

Company address (for submission and delivery of Voting Slips): 4 Oppenheimer Street, Science Park, Rehovot 6701101, Israel, Attn.: Gil Efron, Chief Executive Officer

Meeting date: Monday, December 15, 2025, at 4:30 p.m. (Israel time).

Meeting type: Extraordinary General Meeting (the “Meeting”).

Record Date: Monday, November 3, 2025

Shareholder details:

| Shareholder name: |

| Israeli identification number: |

For shareholders who do not have an Israeli identification card:

| Passport number: |

| Country of issue: |

| Valid until: |

For shareholders that are corporations:

| Corporation number: |

| Country of incorporation: |

Is the shareholder a “Principal Shareholder1”, “Senior Officer of the Company2” or an “Institutional Investor3”? Yes/No (circle as appropriate)

| 1 | As defined in Section 1 of the Israel Securities Law, 5728-1968 (the “Securities Law”). |

| 2 | As defined in Section 37(d) of the Securities Law. |

| 3 | As defined in Regulation 1 of the Supervision of Financial Services Regulations (Provident Funds) (Participation of a Management Company at a General Meeting), 5769-2009 as well as a Manager of Mutual Funds as per the meaning in the Mutual Funds Law, 5754-1999. |

MANNER OF VOTING

(Check or mark “X” clearly in each column in accordance with your voting decision.)

| Matter | Manner of Voting | |||

| For | Against | Abstain | ||

| 1(a) | To approve the grant of equity-based awards to Gil Efron, the Chief Executive Officer of the Company, in such amounts and with such terms and conditions as described in Proposal 1 of the Proxy Statement for the Meeting. | |||

| 1(b) | To approve the grant of equity-based awards to each of the members of the Board of Directors, in such amounts and with such terms and conditions as described in Proposal 1 of the Proxy Statement for the Meeting. | |||

| Date | Signature |

For shareholders holding shares through a member of the Tel Aviv Stock Exchange, this Voting Slip is only valid when accompanied by a certification of ownership, in accordance with the Israeli Companies Regulations (Proof of Ownership of Shares for Voting at General Meeting) of 2000. For shareholders registered in the Company’s shareholder registry, this Voting Slip will only be valid when accompanied by a photocopy of a government-issued photograph identification (e.g., passport, identification card or certificate of incorporation (as the case may be)).

Each shareholder voting on Proposal 1(a) who votes via voting slip, will be deemed to have confirmed that such shareholder, and any related party thereof, does not have a personal interest in Proposal 1(a), unless such shareholder has delivered a written notice to the Company notifying of the existence of a personal interest no later than 10:00 a.m. (Israel time) on Monday, December 15, 2025. Any such written notice must be sent to the Company via registered mail at the Company’s offices; Attention: Gil Efron, Chief Executive Officer.

11

Exhibit 99.2

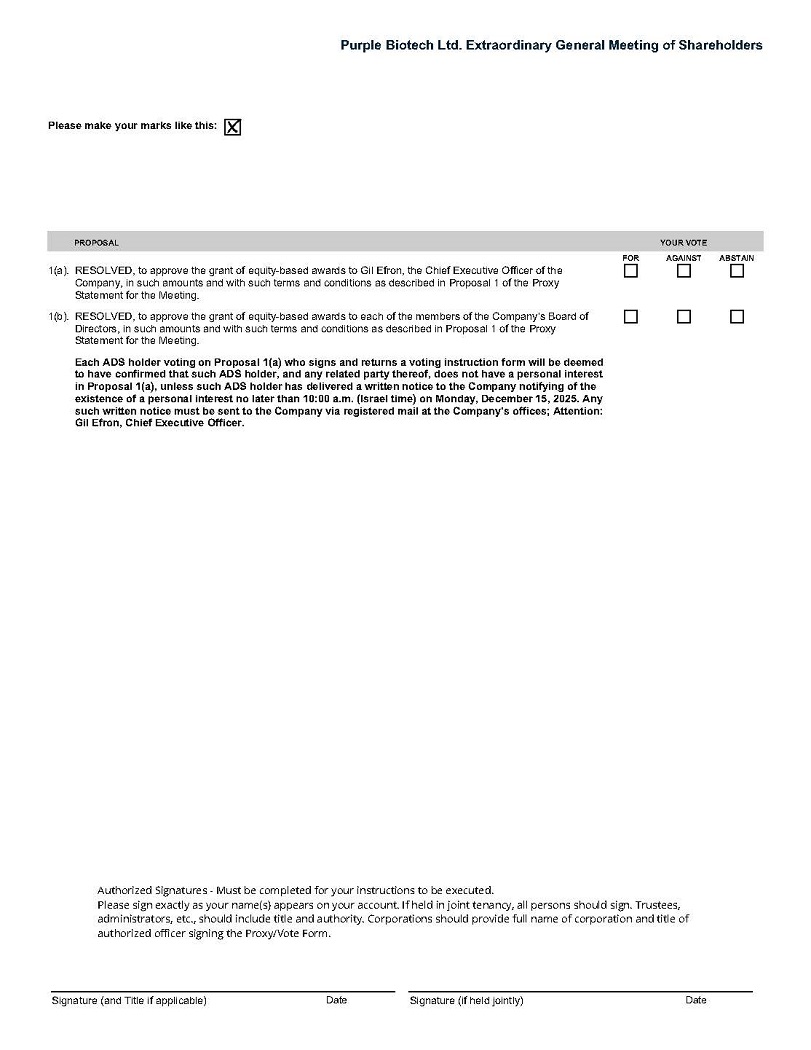

PLEASE BE SURE TO SIGN AND DATE THIS PROXY CARD AND MARK ON THE REVERSE SIDE Copyright © 2025 BetaNXT, Inc. or its affiliates. All Rights Reserved Purple Biotech Ltd. Extraordinary General Meeting of Shareholders For Shareholders of record as of November 3 , 2025 Monday, December 15 , 2025 4 : 30 PM, Israel Time 4 Oppenheimer Street, Science Park, Rehovot, Israel YOUR VOTE IS IMPORTANT! PLEASE VOTE BY: 12:00 PM E.T. December 9, 2025. Purple Biotech Ltd. Instructions to The Bank of New York Mellon, as Depositary (Must be received prior to 12:00 p.m. E.T. on December 9, 2025) The undersigned registered owner of American Depositary Shares hereby requests and instructs The Bank of New York Mellon, as Depositary, to endeavor, in so far as practicable, to vote or cause to be voted the amount of Shares or other Deposited Securities represented by such Shares of Purple Biotech Ltd. registered in the name of the undersigned on the books of the Depositary as of the close of business on November 3, 2025 at the Extraordinary General Meeting of Shareholders of Purple Biotech Ltd. to be held on December 15, 2025, or any postponement or adjournment thereof in respect of the resolutions specified on the reverse. NOTES: 1. Please direct the Depositary how it is to vote by placing an "X" in the appropriate box opposite each agenda item. It is understood that, if this form is signed and returned but no instructions are indicated in the boxes, then a discretionary proxy will be given to a person designated by the Company. 2. It is understood that, if this form is not signed and returned, the Depositary will deem such holder to have instructed the Depositary to give a discretionary proxy to a person designated by the Company. To review EGM related materials, including the full Proxy Statement, please visit: https://purple - biotech.com/Investors/#shareholderMeet BNY: PO BOX 505006, Louisville, KY 40233 - 5006 Mail: • Mark, sign and date your Proxy Card • Fold and return your Proxy Card in the postage - paid envelope provided Your vote matters! Have your ballot ready and please use one of the methods below for easy voting : Your control number Have the 12 digit control number located in the box above available when you access the website and follow the instructions.

Purple Biotech Ltd. Extraordinary General Meeting of Shareholders Please make your marks like this: PROPOSAL YOUR VOTE FOR AGAINST ABSTAIN (a) RESOLVED, to approve the grant of equity - based awards to Gil Efron, the Chief Executive Officer of the Company, in such amounts and with such terms and conditions as described in Proposal 1 of the Proxy Statement for the Meeting. (b) RESOLVED, to approve the grant of equity - based awards to each of the members of the Company's Board of Directors, in such amounts and with such terms and conditions as described in Proposal 1 of the Proxy Statement for the Meeting. Each ADS holder voting on Proposal 1(a) who signs and returns a voting instruction form will be deemed to have confirmed that such ADS holder, and any related party thereof, does not have a personal interest in Proposal 1(a), unless such ADS holder has delivered a written notice to the Company notifying of the existence of a personal interest no later than 10:00 a.m. (Israel time) on Monday, December 15, 2025. Any such written notice must be sent to the Company via registered mail at the Company's offices; Attention: Gil Efron, Chief Executive Officer. Authorized Signatures - Must be completed for your instructions to be executed. Please sign exactly as your name(s) appears on your account. If held in joint tenancy, all persons should sign. Trustees, administrators, etc., should include title and authority. Corporations should provide full name of corporation and title of authorized officer signing the Proxy/Vote Form. Signature (and Title if applicable) Date Date Signature (if held jointly)