UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2025

Commission File Number: 001-42170

Collective Mining Ltd.

(Translation of registrant’s name into English)

82 Richmond Street East, 4th Floor

Toronto, Ontario

Canada, M5C 1P1

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒ Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

EXHIBIT INDEX

| EXHIBIT NO. | DESCRIPTION | |

| 99.1 | Material change report, dated October 8, 2025. | |

| 99.2 | Report of exempt distribution (45-106F1), dated October 8, 2025. |

SIGNATURES

| Collective Mining Ltd. | ||

| Date: October 8, 2025 | By: | /s/ Paul Begin |

| Name: | Paul Begin | |

| Title: | Chief Financial Officer and Corporate Secretary | |

2

Exhibit 99.1

FORM 51-102F3

MATERIAL CHANGE REPORT

| Item 1. | Name and Address of Company |

Collective Mining Ltd. (the “Company”)

82 Richmond St. East

Toronto, Ontario M5C 1P1

| Item 2. | Dates of Material Change |

October 1, 3 and 8, 2025

| Item 3. | Press Releases |

News releases in respect of the material changes referred to in this report were disseminated through the facilities of Canada NewsWire on October 1, 3 and 8, 2025. The news releases were subsequently filed on SEDAR+.

| Item 4. | Summary of Material Change |

On October 1, 2025, as amended October 2, 2025, the Company entered into an agreement BMO Capital Markets on behalf of a syndicate of Underwriters (as defined below) pursuant to which the Underwriters agreed to purchase, on a “bought deal” basis, 6,600,000 common shares in the capital of the Company (the “Shares”) at a price of $19.00 per Share (the “Offering Price”) for aggregate gross proceeds to the Company of $124,500,000 (the “Offering”). In addition, the Company granted the Underwriters an over-allotment option (the “Over-Allotment Option”) to purchase up to an additional 990,000 Shares at the Offering Price, exercisable at any time, in whole or in part, until the date that is 30 days following the closing of the Offering. On October 3, 2025, the Company entered into an underwriting agreement (the “Underwriting Agreement”) with BMO Capital Markets and Scotia Capital, as lead underwriters and joint bookrunners, and including Clarus Securities Inc., Canaccord Genuity Corp., Roth Canada, Inc., Jett Capital Advisors, LLC, and Ventum Financial Corp. (collectively, the “Underwriters”) with respect to the Offering.

The Offering and the Concurrent Private Placement (as defined below) closed on October 8, 2025, pursuant to which the Company raised aggregate gross proceeds of approximately $140 million.

| Item 5. | Full Description of Material Change |

On October 1, 2025, as amended October 2, 2025, the Company entered into an agreement with BMO Capital Markets, and on October 3, 2025, the Company and the Underwriters entered into the Underwriting Agreement, pursuant to which the Underwriters agreed to purchase, on a “bought deal” basis, 6,600,000 Shares the Offering Price for aggregate gross proceeds to the Company of $124,500,000. In addition, the Company granted to the Underwriters the Over-Allotment Option.

On October 8, 2025, the Company completed the Offering for aggregate gross proceeds to Company of 124,500,000.

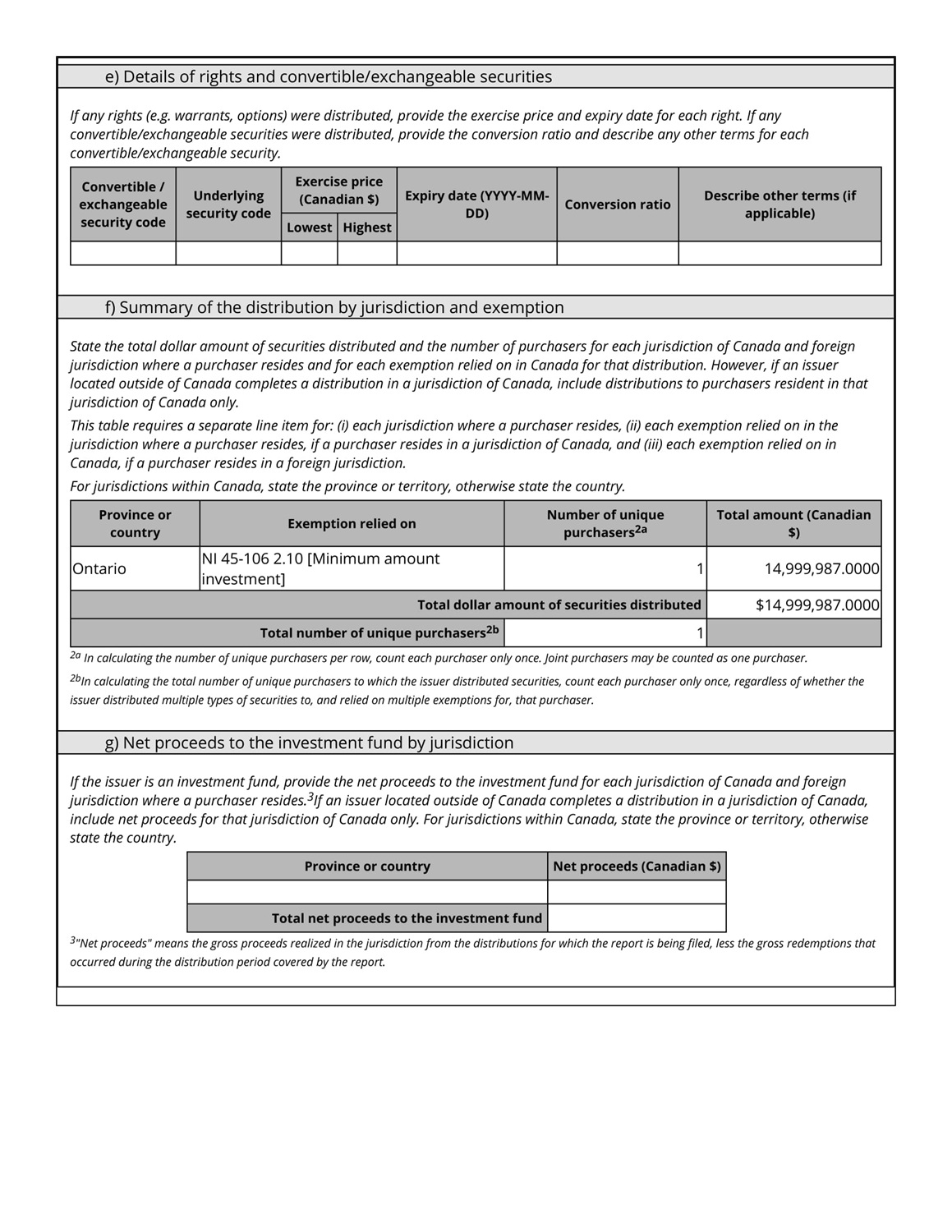

Concurrently with the closing of the Offering, the Company completed a non-brokered private placement of 789,473 Shares at the Offering Price (the “Concurrent Private Placement”) with Agnico Eagle Mines Limited for aggregate gross proceeds of $14,999,987 pursuant to Agnico’s existing participation right in equity financings of the Company.

The net proceeds from the Offering and the Concurrent Private Placement are expected to be used to fund ongoing work programs to advance the Guayabales Project, including further investment in exploration activities, technical studies and underground development on the Guayabales Project in order to expand the known gold deposits, to pursue other exploration and development opportunities, and for working capital and general corporate purposes, as more fully described in the prospectus supplement (the “Prospectus Supplement”) of the Company dated October 3, 2025.

The securities issued pursuant to the Offering were qualified for distribution in Canada pursuant to the Prospectus Supplement and a short form base shelf prospectus (the “Base Shelf Prospectus”) dated December 4, 2024. The Prospectus Supplement, Base Shelf Prospectus, and the documents incorporated by reference therein, are available on the Company’s issuer profile on SEDAR+ at www.sedarplus.cwww.sedarplus.ca.

The Concurrent Private Placement constituted a “related party transaction” under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61- 101”). Pursuant to section 5.5(a) and 5.7(1)(a) of MI 61-101, the Company was exempt from obtaining a formal valuation and minority approval of the Company’s shareholders as the fair market value of Agnico’s participation in the Concurrent Private Placement is below 25% of the Company’s market capitalization as determined in accordance with MI 61-101. The Company did not file a material change report including details with respect to the related party transaction less than 21 days prior to the closing of the Concurrent Private Placement, which the Company deemed reasonable in the circumstances so as to be able to avail itself of financing opportunities and complete the Concurrent Private Placement (and the Public Offering) in an expeditious manner.

| Item 5.2. | Disclosure for Restructuring Transactions |

Not applicable.

| Item 6. | Reliance on subsection 7.1(2) of National Instrument 51-102 |

Not applicable.

| Item 7. | Omitted Information |

No information has been omitted on the basis that it is confidential information.

| Item 8. | Executive Officer |

For further information, contact:

Paul Begin

Chief Financial Officer and Corporate Secretary

t: 416.451.2727

| Item 9. | Date of Report |

October 8, 2025.

Cautionary Note Regarding Forward Looking Information

This material change report contains “forward-looking statements” and “forward-looking information” within the meaning of applicable securities legislation (collectively, “forward-looking statements”). All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this material change report. Any statement that involves discussion with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always using phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this material change report, forward-looking statements relate, among other things, to: the anticipated use of the net proceeds from the Public Offering and the Concurrent Private Placement; receipt of all final regulatory approvals in connection with the Public Offering and the Concurrent Private Placement; the anticipated advancement of mineral properties or programs; future operations; future recovery metal recovery rates; future growth potential of Collective; and future exploration and development plans.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding future events including the direction of our business. Management believes that these assumptions are reasonable. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others: risks related to the speculative nature of the Company’s business; the Company’s formative stage of development; the Company’s financial position; possible variations in mineralization, grade or recovery rates; actual results of current exploration activities; conclusions of future economic evaluations; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, precious and base metals or certain other commodities; fluctuations in currency markets; change in national and local government, legislation, taxation, controls regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formation pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties, as well as those risk factors discussed or referred to in the annual information form of the Company dated March 24, 2025. Forward-looking statements contained herein are made as of the date of this material change report and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements and there may be other factors that cause results not to be anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements.

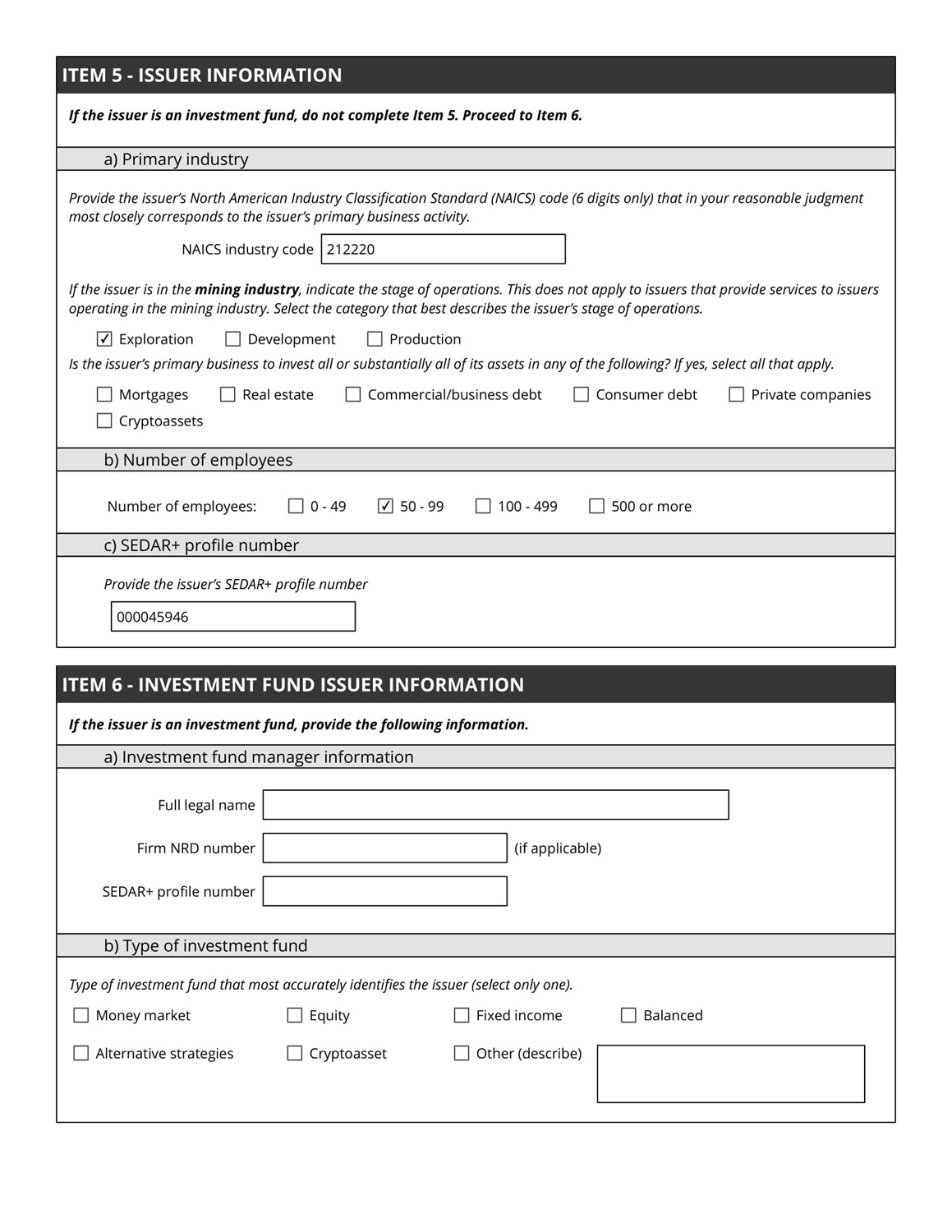

Exhibit 99.2

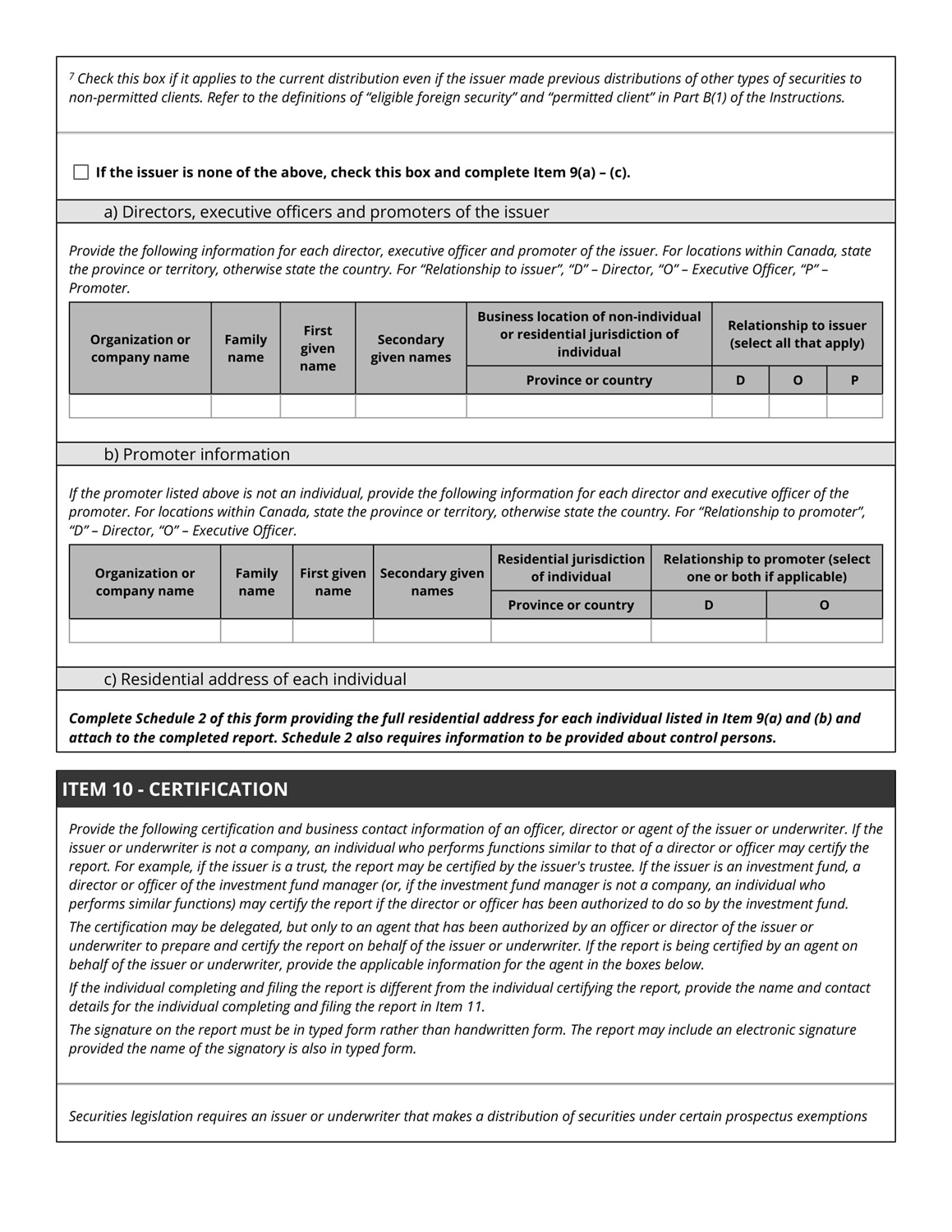

! " #! $ %& '%( )'* +, % - . %. '%( )'* / 0 1 , % - . %. 2 ( ') 34 . % 04 5 4 - 6 . 1 *% ) 0 '%( )'* *7 1 * 4 8 9 % 4 - 6 1 , % - . %. : ;<<<<=> > =? ? @ A ! B # C # D E F ! " GHIJKLMN MON PLQMR KNQMJSRJHT MON QNPUQM VWNXNKM UHXR UHNYZ [UQ T \ JILHKN QNTLQIJHT ]ONMONQ LH JWW \ NQ JW LH JH^NWM_NHM S \ HI` QNSNQ MU WNKMJUH a Z a USbLMJUHLX GHWMQ \ _NHM ca da ef GH^NWM_NHM [ \ HI gUHMJH \ U \ W hJWKXUW \ QN LHI MON KU_PLHJUH PUXJKR MU bG ca da ef VJH i \ jkNK` lNT \ XLMJUH ca da ef QNWPNKMJHT GH^NWM_NHM [ \ HI gUHMJH \ U \ W hJWKXUW \ QN LHI mUXJKR nMLMN_NHM MU lNT \ XLMJUH ca da ef QNWPNKMJHT GH^NWM_NHM [ \ HI gUHMJH \ U \ W hJWKXUW \ QNYZ / - 3% 8 *, % - * 0o - . 4 88 o %' / 88 o %' ;)*7 %' *7 1 - 1 - 4 - 3% 8 *, % - * 0o - . @ p - . %'&' 4 *%' q rrs D B BD t " F t D r mQU^JIN MON SU XXU]JHT JHSU Q_LMJUH LkU \ M MON JWW \ NQ` UQ JSMON JWW \ NQ JW LH JH^NWM_NHM S \ HI` LkU \ M MON S \ HIZ uo 5 5 5 % 61 5 - 1 , % v) 5 5 % w*4 3% > 4 - 4 - 6 x *. : y v) 5 5 % w*4 3% > 4 - 4 - 6 x *. : z '% 34 ) o 8 0o 5 5 5 % 61 5 - 1 , % z { v> x | / $ v: GSMON JWW \ NQ}W HL_N KOLHTNI JH MON XLWM a ~ _UHMOW` PQU^JIN _UWM QNKNHM PQN^JU \ W XNTLX HL_NZ % 9 8 4 *% &&&: w) 5 5 % w*4 3%, 4 - 4 - 6: w), ;4 0 1 ( ( 5 4 w 1 9 5 % @ GSMON JWW \ NQ OLW L XNTLX NHMJMR JINHMJSJNQ` PQU^JIN kNXU]Z lNSNQ MU mLQM USMON GHWMQ \ KMJUHW SU Q MON INSJHJMJU H US XNTLX NHMJMR JINHMJSJNQ Z x% 61 5 % - *4 * 4 .

% - *4 04 %' GSM]U UQ _UQN JWW \ NQW IJWMQJk \ MNI L WJHTXN WNK \ QJMR` PQU^JIN MON S \ XX XNTLX HL_NVWY USMON KUdJWW \ NQVWY UMONQ MOLH MON JWW \ NQ HL_NI LkU^NZ uo 5 5 5 % 61 5 - 1 , % ;8 @ ) 0 w) =4 88 o %';8 @ ;4 0 1 ( ( 5 4 w 1 9 5 % @ s D t D " B " D GSLH \ HINQ]QJMNQ JW KU_PXNMJHT MON QNPUQM` PQU^JIN MON \ HINQ]QJMNQ}W S \ XX XNTLX HL_N` SJQ_ blh H \ _kNQ` LHI n h l PQU SJXN H \ _kNQZ uo 5 5 5 % 61 5 - 1 , % u 4 ', $ ? - o , 9 %' ;4 0 1 ( ( 5 4 w 1 9 5 % @ ? + ( ') 04 5 % - o , 9 %' ! "# $ %# & ' ( ) * + & ), * - . / 01), 2345678 9: 8 6;;<83=; >439: ?@836ABC DC7<;93E FGB;;6H6AB964 C I9BC7B37 J>?DFIK A478 JL 76M69; 4 CGEK 9: B9 6C E4 <3 38B;4 CBNG8 O<7M@8C9 @4 ;9 AG4 ;8GE A4338;P4 C7; 94 9: 8 6;;<83=; P36@B3E N<;6C8;; BA96569EQ R ST UV * - . / 01), WX. Y Z[ ZZZ \ DH9: 8 6;;<83 6; 6C 9: 8 ] ^_ 6C76AB98 9: 8 ;9BM8 4 H4 P83B964 C;Q `: 6; 748; C49 BPPGE 94 6;;<83; 9: B9 P345678 ;8356A8; 94 6;;<83; 4 P83B96CM 6C 9: 8 @6C6CM 6C7<;93EQ I8G8A9 9: 8 AB98M43E 9: B9 N8;9 78;A36N8; 9: 8 6;;<83=; ;9BM8 4 H4 P83B964 C;Q a bc d X)& 1* X - e YfYd Xc + Y - 1 ( ) X. / W 1* X - D; 9: 8 6;;<83=; P36@B3E N<;6C8;; 94 6C58;9 BGG 43 ;<N;9BC96BGGE BGG 4 H69; B;;89; 6C BCE 4 H9: 8 H4 GG4 g6CMh DHE8;_ ;8G8A9 BGG 9: B9 BPPGEQ i X) 1j& jY 0 k Y& d Y 01& 1Y UX++ Y) W * & d lm / 0 * - Y 00 . Ym 1 UX - 0 / + Y) . Ym 1 ( ) * f& 1Y WX+ c & - * Y 0 U),c 1X& 00 Y 10 m ' R / + m Y) Xn Y+ c d X,YY 0 s \ \ X) + X) Y [ \ \ p qrr s \ p rr \ p qr R / + m Y) Xn Y+ c d X,YY 0 o W' Va e Skt c ) Xn* d Y - / + m Y) 2345678 9: 8 6;;<83=; Iuv?wx P34 H6G8 C<@N83 \ \ \ \ qsrqy z { | !! } ] # & ' T - fY 01+ Y - 1 n/ - . + & - & jY) * - nX) + & 1* X - ~/ d d d Yj& d - & + Y ~ * ) + R ke - / + m Y) * n & c c d * W& m d Y ' Va e Skt c ) Xn* d Y - / + m Y) m ' ,c Y Xn * - fY 01+ Y - 1 n/ - . `EP8 4 H6C58;9@8C9 H<C7 9: B9 @4 ;9 BAA<3B98GE 678C96H68; 9: 8 6;;<83 J;8G8A9 4 CGE 4 C8KQ i X - Y, + & ) Y 1 a / * 1, ~ * bY. * - WX+ Y & d & - WY. Sd 1Y) - & 1* fY 01)& 1Yj* Y 0 U),c 1X& 00 Y 1 1 Y) .

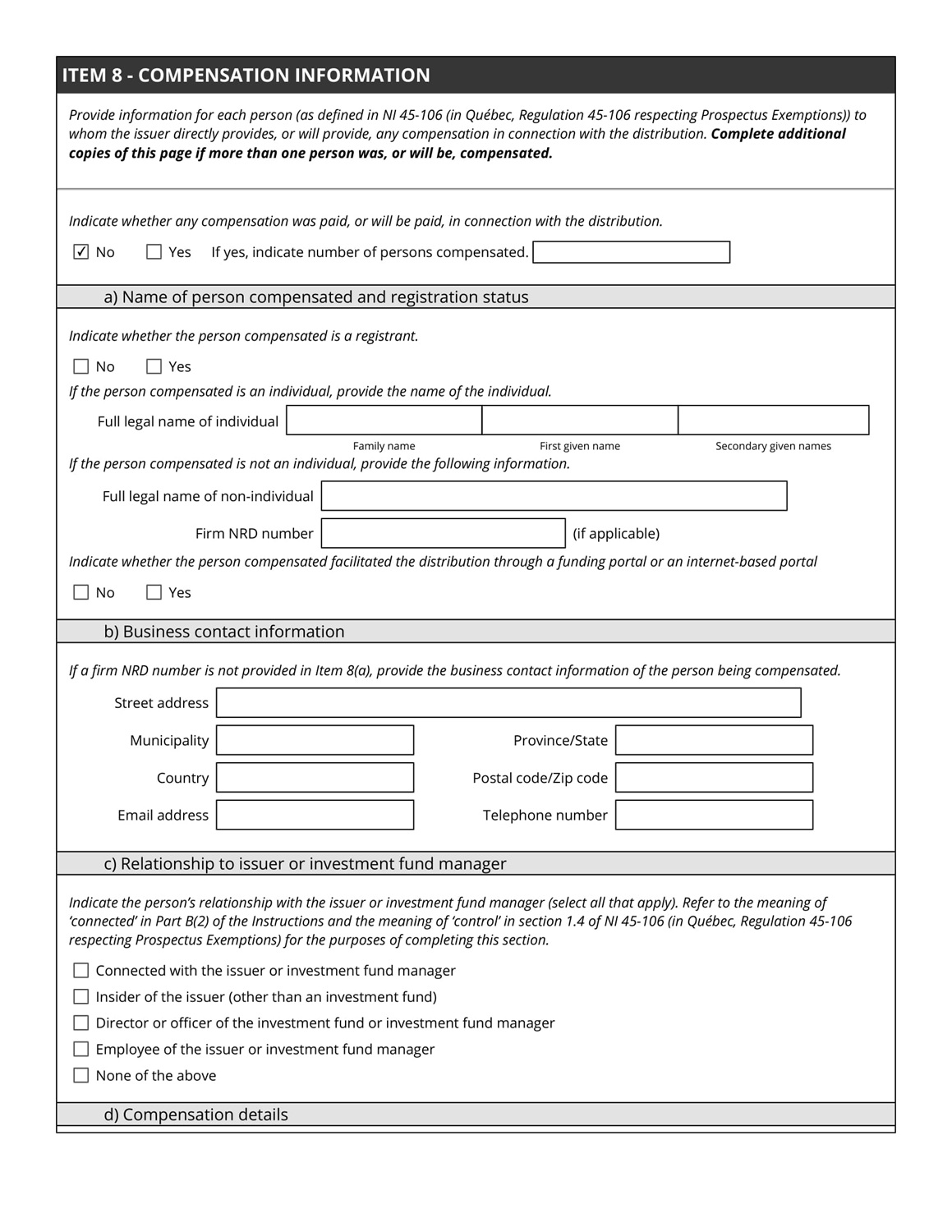

Y 0 W) * m Y ' Ih / I HIHF Ih / I HIHF ! " # ! $ % ! & ' ! " () * ! ) # + , - .) * / 0 1 2 3 4 5 613 4 7 8 9 1 6918 91 : ; < = # # $ ) >= ?@< &( ' ! " () * 5 ABC ABC 63 D8 + * E FG E FG & ) * E HFG E HFG & ) * E / IIG K # &( = ?@ ;# $ ;) $ # ! & L E / IIG & ) * E FIIG E FIIG & ) * E / J E / J & & MMMM GG K K N OP Q R S N T U VWQ XON VT XY VZ O O[ P \ N ]OWN Y Z ON VT 3 ^ 3 _ ` 5 0 ^ 3 a ` b _ _ c 4 ` 5 0 # < ,) ;% 5 B 3 ,# # * ! # * & $ $ # + d * & $ $ # e ) & f ' >* ; ! g < g < K ! ! g ) ! & * # 5 _ _ d # * # e * * # MMMM GG K K MMMM GG K K ; < K # ! $ * ) ;' # ! (& " # ! & ijklmnon pqrnstmn u jvorwx vjyk vjy nzqr ltyqrzxny z{s zoozqr orn xqrnstmn oj orn qjklmnons ynljyo| * < - % &( ;) ! ! * ! ! g ) * } ~ } B60 8 315 } _ 315 } O [ ] T \ Z ] N ] / h IIII / IIII / IIII h IIII ,G d S 59768 E 5 BDH 56 D56 T 9 ;8 U =:: F 8 7=EF 5A <B> C5698 B> 6 =D8 B 3 4: 8 6 K ? =D5 ;PPPPQRR Q S S A 3 45678 95 : 6 8 75 ;<=> =? 8 => @A L > ? 56 F K8 > I 957J 6 8 DK 7B? 5 <B> C56 D8 E F 5 G 547H => I5=EF 5 957J 6 8 DK 7B? 5 O 8 IH 59D M BN59D gBD=F =T BJ > D ;<=> =? 8 => @A d J T E 56 BU J > 8 e J 5 : J 67H = 9569 f= 3 45T : D8 B> 65F 8 5? B> c 6 BC8 > 75 B6 7BJ > D6 K n kvwwwvwxyr oooo n i j kl mn op q r n o st W W W W u h z n kvwwwvwxyr oooo gBD=F ? BF F = 6 =T BJ > D BU 957J 6 8 D8 59 ? 8 9D68 EJ D5? n gBD=F > J T E 56 BU J > 8 e J 5 : J 67H = 9569 fE d 5D : 6 B755? 9 ;<=> =? 8 => @A c 6 BC8 > 75 B6 7BJ > D6 K gBD=F > 5D : 6 B755? 9 DB DH 5 8 > C59DT 5> D UJ > ? ! "#$ $ % !& '( ' !) %# # * ! +, #*& ( ' - *# # #.# / !# ( /# * #.( * # ' # / $ /' - # +0#1#./ # +0# !#/, #! %# # * ! +, #*& ( ' - *# # /' - # ! ' ' * *#!/ +# ' # # 2! ' # / /' - # +0#1#./ # +0# !#/, $ V WW X X Y W Z [ # # ' 0 *' 00 2', ' !#/, #! * ! +, #* * # , 2+# ' (, / !# ! ' # / \ , !* / ' ' ] * * ' # \ , !* / ' % # # (, / !# #! *#! * ' # / #.#2( ' #0 #* ' ] * ' * ! +, ' $ ^'%# - # & !!,# 0'/ #* ', ! *# ' ] * /' 2(0# #! * ! +, ' \ , !* / ' ' ] * & /0,*# * ! +, ' ! ' (, / !# ! #! *# \ , !* / ' ' ] * ' 0 $ _ ! +0# #`, #! !#( # 0 # #2 ' a " ) # / \ , !* / ' % # # (, / !# #! *#!& " ) # / #.#2( ' #0 #* ' # \ , !* / ' % # # (, / !# #! *#!& (, / !# #! *#! \ , !* / ' ' ] * & * " ) # / #.#2( ' #0 #* ' ] * & (, / !# #! *#! ' # \ , !* / ' $ b' \ , !* / ' ! % ] * & ! # # ( ' - /# ' # ' & ' # % !# ! # # /', $ { / 0/, 0 # , 2+# ' , `,# (, / !# ! (# '%& /', # / (, / !# ' 0 ' /#$ |' (, / !# ! 2 +# /', #* ! ' # (, / !# $ {+ / 0/, 0 # ' 0 , 2+# ' , `,# (, / !# ! ' % / # !!,# * ! +, #* !#/, #!& /', # / (, / !# ' 0 ' /#& # *0#!! ' % # # # !!,# * ! +, #* 2, 0 (0# (#! ' !#/, #! '& * #0 #* ' 2, 0 (0# #.#2( ' ! ' & (, / !# $ i Z W X Y # !!,# ! - #! 2# , *& ( ' - *# # # ( '/##*! ' # - #! 2# , * ' # / \ , !* / ' ' ] * * ' # \ , !* / ' % # # (, / !# #! *#!$ } !!,# 0'/ #* ', ! *# ' ] * /' 2(0# #! * ! +, ' \ , !* / ' ' ] * & /0,*# # ( '/##*! ' \ , !* / ' ' ] * ' 0 $ b' \ , !* / ' ! % ] * & ! # # ( ' - /# ' # ' & ' # % !# ! # # /', $ } ~ # ( '/##*!~ 2# ! # '!! ( '/##*! # 0 #* # \ , !* / ' ' 2 # * ! +, ' ! ' % / # #(' ! +# 0#*& 0#!! # '!! #*#2( ' ! '//, #* *, # * ! +, ' (# '* /' - # #* + # #(' $ !" #$%& '( )* +, - . /* 0 #$%& '( / * 12 33 4 * 05 - 4 00 - 5 4 ,* 6 789:;<=< >??@=@8A>; B8:@<C 8D=E@C :>F< @D98G< =E>A 8A< :<GC8A H>CI 8G H@;; J<I B89:<AC>=<?K " 4 5 4 - 4 00 , - 4 ,* 6 L M NOP Q R SOPT U V W U XY ZO V [ \ ] O^ MR _ O^PMV P XM \ _ OV PY ZOW ` Y a L Y \ O MR _ O^PMV XM \ _ OV PY ZOW Y V W ^ObU PZ^Y ZU MV PZY Z[ P " 4 / 6 L M NOP " * 0 - * 06 c[ d d d ObY d V Y \ O MR U V W U eU W [ Y d c Y \ U d S V Y \ O c U ^PZ bU eOV V Y \ O f OXMV W Y ^S bU eOV V Y \ OP " * 0 - 00 4 / 6 c[ d d d ObY d V Y \ O MR V MV gU V W U eU W [ Y d c U ^ \ L hi V [ \ ] O^ jU R Y _ _ d U XY ] d O a " 4 0 ,* */ * / 0 %, 0 L M NOP ] a k [ P U V OPP XMV ZY XZ U V RM^ \ Y ZU MV " !.l * , " m 3 - ,* , / 6 f Z^OOZ Y W W ^OPP n [ V U X U _ Y d U ZS o ^MeU V XOpf ZY ZO qM[ V Z^S o MPZY d XMW OprU _ XMW O s \ Y U d Y W W ^OPP tOd O_ u MV O V [ \ ] O^ Xa h O d Y ZU MV Pu U _ ZM U PP[ O^ M^ U V eOPZ \ OV Z R[ V W \ Y V Y bO^ " v 0 4 * * / 0 00 0536 . / w v x y3 " * / w 0v & 6 # !" #$%& '( )* +, - . /* 0 #$%& '( / * 12 3 * 0 / 6 qMV V OXZOW zU Zu Zu O U PP[ O^ M^ U V eOPZ \ OV Z R[ V W \ Y V Y bO^ Q V P U W O^ MR Zu O U PP[ O^ jMZu O^ Zu Y V Y V U V eOPZ \ OV Z R[ V W a i U ^OXZM^ M^ MRRU XO^ MR Zu O U V eOPZ \ OV Z R[ V W M^ U V eOPZ \ OV Z R[ V W \ Y V Y bO^ s \ _ d MSOO MR Zu O U PP[ O^ M^ U V eOPZ \ OV Z R[ V W \ Y V Y bO^ L MV O MR Zu O Y ] MeO W a qM \ _ OV PY ZU MV W OZY U d P

:; <= > ? @A <BC; F :; <= > ? @A <BC; E :; <= > ? @A <BC; D ! " # $% &' ()** + && + ), & - % + . /% 0 1 2 ) 3 % 0 0 & 2 ( 1 4 + 5+ 2 & . + & 54 + 6 1 52 . % & ()* - 2 , &% 5+ ), 7 82 ( 1 4 + 59 (). 2 & G 2 &( 4 + 6 2 524 * & ) 3 H% 4 4 % , 5& I ) - 5+ ), & ) 4 ) 5' 24 4 + J' 5& K 5' 24 ()* - 2 , &% 5+ ), L G 2 &( 4 + 6 2 M) 5% 0 ()* - 2 , &% 5+ ), - % + . $' 2 ( N 6 ) O + 3 5' 2 - 24 &), H+ 0 0 ) 4 * % 9 42 ( 2 + P2 % , 9 . 232442 . ()* - 2 , &% 5+ ), Q. 2 &( 4 + 6 2 5' 2 524 * & 6 2 0 ) HR S T T " T " U V WX Y Z [ \ V ]X ^W_]:` X aX ^b WV cX _d d V ^X ]: ef \ g ]_Y _WX ]: _d Wh X V ::b X ] ijklm noopmq no rs nstmokumsk jpsvw vx sxk yxuz{mkm ikmu |} ~qxymmv kx ikmu } 2 - ) 4 5+ , J + && 1 24 + , % 1 4 + &. + ( 5+ ), ) 3 $% , % . % ) 42 + J, - 1 6 0 + ( + && 1 24 ' ) 0 0 9 ) H, 2 . & 1 6 & + . + % 49 ) 3 % 42 - ) 4 5+ , J + && 1 24 + , % , 9 1 4 + &. + ( 5+ ), ) 3 $% , % . % ' ) 0 0 9 ) H, 2 . & 1 6 & + . + % 49 ) 3 % 3) 42 + J, - 1 6 0 + ( + && 1 24 && 1 24 . + & 54 + 6 1 5+ , J ), 0 9 2 0 + J+ 6 0 2 3) 42 + J, & 2 ( 1 4 + 5+ 2 & % , . 5' 2 . + & 54 + 6 1 5+ ), + & 5) - 24 * + 552 . ( 0 + 2 , 5& ), 0 9 ijklm noopmq no rk {mrok xsm xjklm r xtmw vx sxk yxuz{mkm ikmu | r y } ~qxymmv kx ikmu } ! " ^): 0 '* /.

+( * 9 '/ * ++, ) - <+): ) 4' 0 : : '( 0 ' 099 : _= [ , +* . ) ++ : /40 '* /. /& . /. \ * . 7 * 2* 7 , 0 : / - - ) +* 7 ). '* 0 : ], - * +7 * 4'* /. /& * . 7 * 2* 7 , 0 : d) 4/. 70 - _ a* 2). . 08 ) + c * - +' a* 2). . 08 ) c 08 * : _ . 08 ) ` - a0 . * b0 '* /. / - 4/8 90 . _ . 08 ) e ` f e - /2* . 4) / - 4/, . ' - _ ^): 0 '* /. +( * 9 '/ 9 - /8 /') - <+): ) 4' /. ) / - 1 /'( * & 099 : * 401 : ) = ^) +* 7 ). '* 0 : ], - * +7 * 4'* /. /& * . 7 * 2* 7 , 0 : d) 4/. 70 - _ a* 2). . 08 ) + c * - +' a* 2). . 08 ) c 08 * : _ . 08 ) ` - a0 . * b0 '* /. / - 4/8 90 . _ . 08 ) ` f e - /2* . 4) / - 4/, . ' - _ !" # $ % & '( ) * ++, ) - * + . /. ) /& '( ) 01 /2) 3 4( ) 45 '( * + 1 /6 0 .

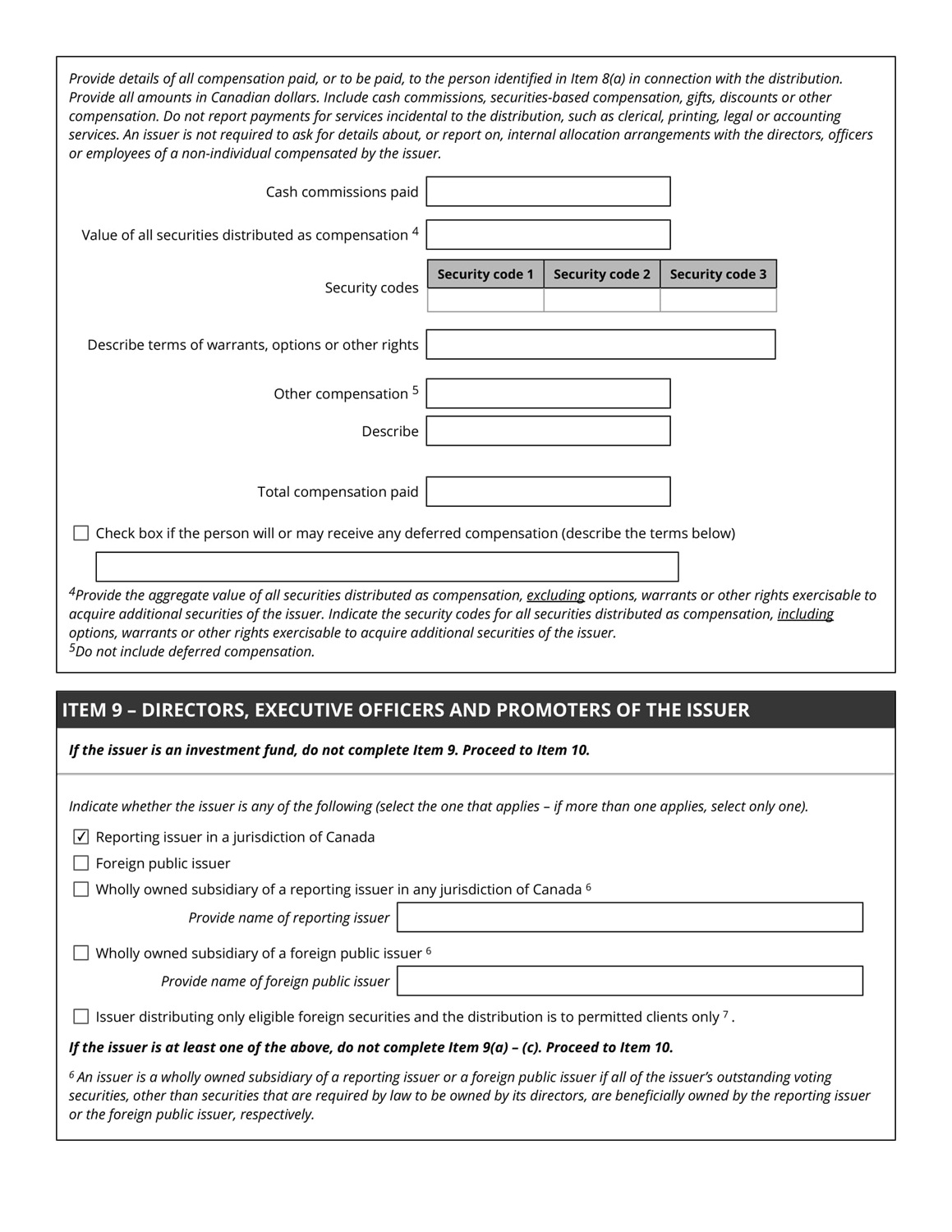

7 4/8 9 : )') % ') 8 ;<0 = > <4=? @ A B C DEFGHDIJ EKEFL GC ME HNNC FEDI @ O P Q DHR HGEDI HN GS E C IIL ED T U V T U U T V U W X W U Y X Z Y U X g A h DHR HGED C O NHDR @ GC HO $ U T V T U U T V U W X W U Y X Z Y FA i EIC P EO GC @ j @ P P DEII HN E@ FS C O P C MC P L @ j klmnopqp rstpuvop w lxqtyz xl{m n{l|yuy}~ qtp xvoo {pzyup}qy o uu{pzz xl{ p st y}uy|yuv o oyzqpu y} qpm }u }u qq st ql qtp slmnopqpu {pnl{q rstpuvop w ozl {p vy{pz y}xl{m qyl} ql p n{l|yupu lvq sl}q{lo np{zl}z % \ ^ % c % % ` T U T $ T U T V U U $ U ! U U T # U T T $ T U T $ U $ " " T T ! " # $ %& ' " ! & $ # ! ! (() "*) + "%" "* , ( !) + # # " & ( ) " ( " ) # " # ) " " " ) # " & # ( # # $ & # ' # , " , % + ( " " # + - % + & # , . " ( + " # ( # $ + & ! " # " , + + ( " " ( ") # + & . " / ) " + & 0 2 , 3 4 + 0 1 # ! ' (() "* , ( !) + # # "*# 8 # ) 6 7 ' 1 5 ) # # 5 "( , # 9 + # " , # ( 5 # # 2 ! 5 # # ;!! " : 6 # # + + " (( 0 $ F , 0 <= >?= @ A ?B= CDEDE : ) $ " G # Paul Begin 9 # ) " HHHH 33 G G 08 10 2025 I JK L M M N OPQ JROJ S K TUPQ V W X Y Z X W X X Z [ X [ Z [ Y X [ \ Z Z X X ] X X W [ Z X ^ _ ` 9 # # ( + , + ) # " ! " " G # , + 7 ab G ; 9 5 ) # # 9 + # " , # ( 5 "( , # 5 # # 8 # " " : 2# (( ( " - c # - % 448 1 # ! # + # " + ( F # (( ( 0 6 # # + + " (( <= >?= @ A d@ e CBe B = : ) $ " Q PJI OK f OPgg K OJI PQ RQ h i UK Pj S K TUPQ Rg I Q j PTL RJI PQ kX \ X X [ X Z [ X [ Z X X [ Z Z X X X Z ^ [ X W [ \ X X ] X Z [ X [ Z X l m n YX X ] X m n X X o X _ p [ W X m n kX o X _ p Y X [ Z [ X [ Z q Y W ] Z [ \ X Z [ X [ Z r X W \ s[ Z Z X ] X t Y X X W o X _ p X YX l u v

!