UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 25, 2025

SAFE & GREEN HOLDINGS CORP.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 001-38037 | 95-4463937 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) | (I.R.S. Employer Identification Number) |

990 Biscayne Blvd.

#501, Office 12

Miami, FL 33132

(Address of Principal Executive Offices, Zip Code)

(Former name or former address, if changed since last report.)

Registrant’s telephone number, including area code: 646-240-4235

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Common Stock, par value $0.01 | SGBX | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On September 25, 2025, Olenox Corp (“Olenox”), a wholly owned subsidiary of Safe & Green Holdings Corp. (the “Company”), entered into a Purchase Agreement with Charles E Webb Jr Family Partnership LTD (the “Seller”), pursuant to which Olenox will purchase certain real property located at 1207 N FM 3083 Rd, Conroe, Texas, which includes office space and warehouse space (the “Conroe Property”), for a purchase price of $3,000,000. The purchase of the Conroe Property is explicitly contingent upon Olenox obtaining a third-party loan secured by the Conroe Property in the amount of $2,400,000 for not less than 20 years with an initial interest rate not to exceed 8.000% and payments calculated on an amortization period of no less than 20 years.

Pursuant to the terms of the Purchase Agreement, Olenox will take occupancy September 26, 2025. Olenox has the option to extend the closing of the transaction for up to 24 months. Olenox has executed a commercial lease (the “Lease”) with the Seller for the interim period between the execution of the Purchase Agreement and the closing of the transaction. $4,000 of the lease payments per month will be credited to the sales price at closing.

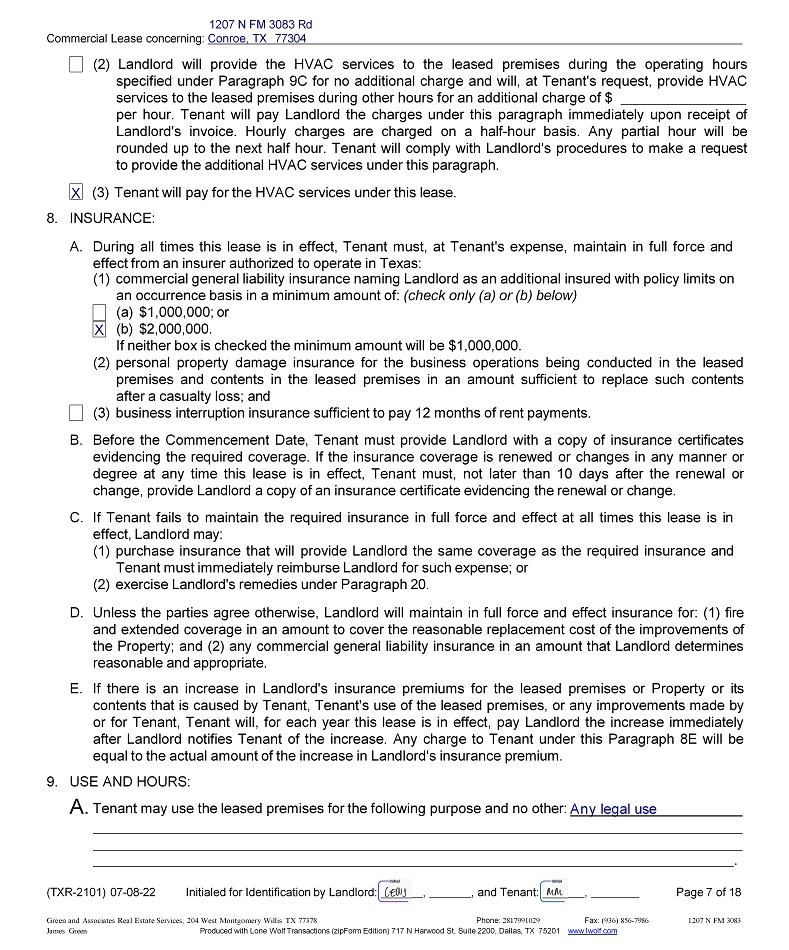

Pursuant to the terms of the Purchase Agreement, Olenox must deposit $30,000 as earnest money not later than 3 days after the effective date of the Purchase Agreement. Pursuant to the terms of the Lease, Olenox must pay a $20,000 security deposit with the Seller, which may be applied by the Seller to any amounts owed by Olenox under the Lease. Olenox shall maintain in full force and effect from an insurer authorized to operate in Texas, commercial general liability insurance naming Seller as an additional insured with policy limits on an occurrence basis with a minimum amount of $2,000,000.

The foregoing descriptions of the Purchase Agreement and the Lease are qualified in their entirety by reference to the full text of the Purchase Agreement and the Lease, copies of which are attached hereto as Exhibit 10.1 and 10.2, and are incorporated herein in their entirety by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

| Exhibit Number |

Description | |

| 10.1 | Purchase Agreement, dated September 25, 2025, by and between Olenox Corp and Charles E Webb Jr Family Partnership LTD | |

| 10.2 | Commercial Lease, dated September 25, 2025, by and between Olenox Corp and Charles E Webb Jr Family Partnership LTD | |

| 104 | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SAFE & GREEN HOLDINGS CORP. | |||

| Dated: September 30, 2025 | By: | /s/ Michael McLaren | |

| Name: | Michael McLaren | ||

| Title: | Chief Executive Officer | ||

2

Exhibit 10.1

COMMERCIAL CONTRACT - IMPROVED PROPERTY USE OF THIS FORM BY PERSONS WHO ARE NOT MEMBERS OF THE TEXAS ASSOCIATION OF REALTORS®, INC. IS NOT AUTHORIZED. ©Texas Association of REALTORS®, Inc. 2022 1. PARTIES: Seller agrees to sell and convey to Buyer the Property described in Paragraph 2. Buyer agrees to buy the Property from Seller for the sales price stated in Paragraph 3. The parties to this contract are: Seller: Charles E Webb Jr Family Partnership LTD Address : 10469 River Ridge Ln, Conroe, TX 77304 Phone : ( 936 ) 672 - 1394 E - mail : cewfpinvestments@gmail . com Mobile : ( 936 ) 672 - 1394 Fax or Other : Buyer: Olenox Corp and/or its assigns Address : 1773 Westborough Dr, Katy, TX 77449 Phone : ( 940 ) 495 - 2155 E - mail : mikem@olenox . com Mobile : ( 940 ) 205 - 1257 Fax or Other : 2. PROPERTY: A. "Property" means that real property situated in Montgomery County, Texas at 1207 N FM 3083 Rd , Conroe, TX 77304 (address) and that is legally described on the attached Exhibit or as follows: A0002 - Allen W S, Tract 1B1 - A, Acres 2.821 B. Seller will sell and convey the Property together with: (1) all buildings, improvements, and fixtures; (2) all rights, privileges, and appurtenances pertaining to the Property, including Seller's right, title, and interest in any minerals, utilities, adjacent streets, alleys, strips, gores, and rights - of - way; (3) Seller's interest in all leases, rents, and security deposits for all or part of the Property; (4) Seller's interest in all licenses and permits related to the Property; (5) Seller's interest in all third party warranties or guaranties, if transferable, relating to the Property or any fixtures; (6) Seller's interest in any trade names, if transferable, used in connection with the Property; and (7) all Seller's tangible personal property located on the Property that is used in connection with the Property's operations except: . Any personal property not included in the sale must be removed by Seller prior to closing. (Describe any exceptions, reservations, or restrictions in Paragraph 12 or an addendum.) (If mineral rights are to be reserved an appropriate addendum should be attached.) (If the Property is a condominium, attach Commercial Contract Condominium Addendum (TXR - 1930) or (TXR - 1946).) 3. SALES PRICE: At or before closing, Buyer will pay the following sales price for the Property: A. Cash portion payable by Buyer at closing . . . . . . . . . . . . . . . . . . . . . . . . . B. Sum of all financing described in Paragraph 4 . . . . . . . . . . . . . . . . . . . . . C. Sales price (sum of 3A and 3B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 600,000.00 $ 2,400,000.00 $ 3,000,000.00 (TXR - 1801) 07 - 08 - 22 Initialed for Identification by Seller , and Buyer , Page 1 of 15 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 1207 N FM 3083 Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com James Green Commercial Contract - Improved Property concerning (1) is not contingent upon Buyer obtaining third party financing.

(2) is contingent upon Buyer obtaining third party financing in accordance with the attached Commercial Contract Financing Addendum (TXR - 1931). 4. FINANCING: Buyer will finance the portion of the sales price under Paragraph 3B as follows: X A. Third Party Financing : One or more third party loans in the total amount of $ 2,400,000.00 . This contract: B . Assumption : In accordance with the attached Commercial Contract Financing Addendum (TXR - 1931 ), Buyer will assume the existing promissory note secured by the Property, which balance at closing will be $ . C . Seller Financing : Buyer will deliver a promissory note and deed of trust to Seller under the terms of the attached Commercial Contract Financing Addendum (TXR - 1931 ) in the amount of $ . 5. EARNEST MONEY: A. B. (i) days after Buyer's right to terminate under Paragraph 7B expires; or (ii) . Buyer will be in default if Buyer fails to deposit the additional amount required by this Paragraph 5B within 3 days after Seller notifies Buyer that Buyer has not timely deposited the additional amount. C. Buyer may instruct the title company to deposit the earnest money in an interest - bearing account at a federally insured financial institution and to credit any interest to Buyer. 6. TITLE POLICY, SURVEY, AND UCC SEARCH: A. Title Policy : (1) Seller, at Seller's expense, will furnish Buyer an Owner's Policy of Title Insurance (the title policy) issued by any underwriter of the title company in the amount of the sales price, dated at or after closing, insuring Buyer against loss under the title policy, subject only to : (a) those title exceptions permitted by this contract or as may be approved by Buyer in writing ; and (b) the standard printed exceptions contained in the promulgated form of title policy unless this contract provides otherwise . (2) The standard printed exception as to discrepancies, conflicts, or shortages in area and boundary lines, or any encroachments or protrusions, or any overlapping improvements : (a) will not be amended or deleted from the title policy. (b) will be amended to read "shortages in areas" at the expense of Buyer Seller. Not later than 3 days after the effective date, Buyer must deposit $ $ 30 , 000 . 00 as earnest money with Stewart Title (title company) at 604 W Worsham St Ste 500 Willis, TX 77378 (address) Marsha Stevenson (closer) . If Buyer fails to timely deposit the earnest money, Seller may terminate this contract or exercise any of Seller's other remedies under Paragraph 15 by providing written notice to Buyer before Buyer deposits the earnest money . Buyer will deposit an additional amount of $ N/A with the title company to be made part of the earnest money on or before : ( 3 ) Within 10 days after the effective date, Seller will furnish Buyer a commitment for title insurance (the commitment) including legible copies of recorded documents evidencing title exceptions . Seller authorizes the title company to deliver the commitment and related documents to Buyer at Buyer's address .

(TXR - 1801) 07 - 08 - 22 Initialed for Identification by Seller , and Buyer , Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 Page 2 of 15 1207 N FM 3083 1207 N FM 3083 Rd , Conroe, TX 77304 X X James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com Commercial Contract - Improved Property concerning B. 1207 N FM 3083 Rd , Conroe, TX 77304 Survey : Within 10 days after the effective date : (1) Buyer will obtain a survey of the Property at Buyer's expense and deliver a copy of the survey to Seller . The survey must be made in accordance with the : (i) ALTA/NSPS Land Title Survey standards, or (ii) Texas Society of Professional Surveyors' standards for a Category 1 A survey under the appropriate condition . Seller will reimburse Buyer (insert amount) of the cost of the survey at closing, if closing occurs . (2) Seller, at Seller's expense, will furnish Buyer a survey of the Property dated after the effective date . The survey must be made in accordance with the : (i) ALTA/NSPS Land Title Survey standards, or (ii) Texas Society of Professional Surveyors' standards for a Category 1 A survey under the appropriate condition . (3) Seller will deliver to Buyer and the title company a true and correct copy of Seller's most recent survey of the Property along with an affidavit required by the title company for approval of the existing survey . If the existing survey is not acceptable to the title company, Seller X Buyer (updating party), will, at the updating party's expense, obtain a new or updated survey acceptable to the title company and deliver the acceptable survey to the other party and the title company within 30 days after the title company notifies the parties that the existing survey is not acceptable to the title company . The closing date will be extended daily up to 30 days if necessary for the updating party to deliver an acceptable survey within the time required . The other party will reimburse the updating party N/A (insert amount or percentage) of the cost of the new or updated survey at closing, if closing occurs . C. UCC Search : ( 1 ) Within days after the effective date, Seller, at Seller's expense, will furnish Buyer a Uniform Commercial Code (UCC) search prepared by a reporting service and dated after the effective date . The search must identify documents that are on file with the Texas Secretary of State and the county where the Property is located that relate to all personal property on the Property and show, as debtor, Seller and all other owners of the personal property in the last 5 years . X (2) Buyer does not require Seller to furnish a UCC search. D. Buyer's Objections to the Commitment, Survey, and UCC Search : (1) Within 10 days after Buyer receives the last of the commitment, copies of the documents evidencing the title exceptions, any required survey, and any required UCC search, Buyer may object to matters disclosed in the items if : (a) the matters disclosed are a restriction upon the Property or constitute a defect or encumbrance to title to the real or personal property described in Paragraph 2 other than those permitted by this contract or liens that Seller will satisfy at closing or Buyer will assume at closing ; or (b) the items show that any part of the Property lies in a special flood hazard area (an “A” or “V” zone as defined by FEMA) . If the commitment or survey is revised or any new document evidencing a title exception is delivered, Buyer may object to any new matter revealed in such revision or new document . Buyer's objection must be made within the same number of days stated in this paragraph, beginning when the revision or new document is delivered to Buyer . If Paragraph 6 B( 1 ) applies, Buyer is deemed to receive the survey on the earlier of : (i) the date Buyer actually receives the survey ; or (ii) the deadline specified in Paragraph 6 B . (2) Seller may, but is not obligated to, cure Buyer's timely objections within 15 days after Seller receives the objections . The closing date will be extended as necessary to provide such time to cure the objections .

If Seller fails to cure the objections by the time required, Buyer may terminate X (TXR - 1801) 07 - 08 - 22 Initialed for Identification by Seller , and Buyer , Page 3 of 15 1207 N FM 3083 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com Commercial Contract - Improved Property concerning this contract by providing written notice to Seller within 5 days after the time by which Seller must cure the objections . If Buyer terminates, the earnest money, less any independent consideration under Paragraph 7 B( 1 ), will be refunded to Buyer . (3) Buyer's failure to timely object or terminate under this Paragraph 6D is a waiver of Buyer's right to object except that Buyer will not waive the requirements in Schedule C of the commitment. 7. PROPERTY CONDITION: A. Present Condition : Buyer accepts the Property in its present condition except that Seller, at Seller's expense, will complete the following before closing: . Feasibility Period : Buyer may terminate this contract for any reason within 90 days after the effective date (feasibility period) by providing Seller written notice of termination. (1) Independent Consideration . (Check only one box and insert amounts.) B. (a) If Buyer terminates under this Paragraph 7 B, the earnest money will be refunded to Buyer less $ 2 , 500 . 00 that Seller will retain as independent consideration for Buyer's unrestricted right to terminate . Buyer has tendered the independent consideration to Seller upon payment of the amount specified in Paragraph 5 A to the title company . The independent consideration is to be credited to the sales price only upon closing of the sale . If no dollar amount is stated in this Paragraph 7 B( 1 ) or if Buyer fails to deposit the earnest money, Buyer will not have the right to terminate under this Paragraph 7 B . (b) Not later than 3 days after the effective date, Buyer must pay $ as independent consideration for Buyer's right to terminate by tendering such amount to the title company . Buyer authorizes escrow agent to release and deliver the independent consideration to Seller at any time upon Seller's request without further notice to or consent from Buyer . If Buyer terminates under this Paragraph 7 B, the earnest money will be refunded to Buyer and Seller will retain the independent consideration . The independent consideration will be credited to the sales price only upon closing of the sale . If no dollar amount is stated in this Paragraph 7 B( 1 )(b) or if Buyer fails to pay the independent consideration, Buyer will not have the right to terminate under this Paragraph 7 B . (2) Feasibility Period Extension : Prior to the expiration of the initial feasibility period, Buyer may extend the feasibility period for a single additional period of days by delivering $ to the title company as additional earnest money . (a) $ of the additional earnest money will be retained by Seller as additional independent consideration for Buyer's unrestricted right to terminate, but will be credited to the sales price only upon closing of the sale . If Buyer terminates under this Paragraph 7 B, the additional earnest money will be refunded to Buyer and Seller will retain the additional independent consideration . (b) Buyer authorizes escrow agent to release and deliver to Seller the following at any time upon Seller's request without further notice to or consent from Buyer : (i) The additional independent consideration. (ii) (Check no boxes or only one box.) all or $ of the remaining portion of the additional earnest money, which will be refunded to Buyer if Buyer terminates under this Paragraph 7 B or if Seller defaults under this contract .

1207 N FM 3083 Rd , Conroe, TX 77304 X (TXR - 1801) 07 - 08 - 22 Initialed for Identification by Seller , and Buyer , Page 4 of 15 1207 N FM 3083 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com Commercial Contract - Improved Property concerning Buyer the following to the extent in Seller's possession: (Check all that apply.) (a) a current rent roll of all leases affecting the Property certified by Seller as true and correct; (b) copies of all current leases, including any mineral leases, pertaining to the Property, including any modifications, supplements, or amendments to the leases; (c) a current inventory of all personal property to be conveyed under this contract and copies of any leases for such personal property; (d) copies of all notes and deeds of trust against the Property that Buyer will assume or that Seller will not pay in full on or before closing; (e) copies of all current service, utility, maintenance, and management agreements relating to the ownership and operation of the Property; (f) copies of current utility capacity letters from the Property's water and sewer service provider; (g) copies of all current warranties and guaranties relating to all or part of the Property; (h) copies of fire, hazard, liability, and other insurance policies that currently relate to the Property; (i) copies of all leasing or commission agreements that currently relate to the tenants of all or part of the Property; (j) a copy of the “as - built” plans and specifications and plat of the Property; (k) copies of all invoices for utilities and repairs incurred by Seller for the Property in the 24 months immediately preceding the effective date; (l) a copy of Seller's income and expense statement for the Property from to ; (m) copies of all previous environmental assessments, geotechnical reports, studies, or analyses made on or relating to the Property; If no dollar amount is stated in this Paragraph 7 B( 2 ) as additional earnest money or as additional independent consideration, or if Buyer fails to timely deliver the additional earnest money, the extension of the feasibility period will not be effective . C . Inspections, Studies, or Assessments : (1) During the feasibility period, Buyer, at Buyer's expense, may complete or cause to be completed any and all inspections, studies, or assessments of the Property (including all improvements and fixtures) desired by Buyer . (2) Seller, at Seller's expense, will turn on all utilities necessary for Buyer to make inspections, studies, or assessments. (3) Buyer must: (a) employ only trained and qualified inspectors and assessors; (b) notify Seller, in advance, of when the inspectors or assessors will be on the Property; (c) abide by any reasonable entry rules or requirements of Seller; (d) not interfere with existing operations or occupants of the Property; and (e) restore the Property to its original condition if altered due to inspections, studies, or assessments that Buyer completes or causes to be completed. (4) Except for those matters that arise from the negligence of Seller or Seller's agents, Buyer is responsible for any claim, liability, encumbrance, cause of action, and expense resulting from Buyer's inspections, studies, or assessments, including any property damage or personal injury . Buyer will indemnify, hold harmless, and defend Seller and Seller's agents against any claim involving a matter for which Buyer is responsible under this paragraph . This paragraph survives termination of this contract . D .

Property Information : (1) Delivery of Property Information : Within 5 days after the effective date, Seller will deliver to 1207 N FM 3083 Rd , Conroe, TX 77304 X X X (TXR - 1801) 07 - 08 - 22 Initialed for Identification by Seller , and Buyer , Page 5 of 15 1207 N FM 3083 Phone: 2817991029 Fax: (936) 856 - 7986 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com Commercial Contract - Improved Property concerning (n) real and personal property tax statements for the Property for the previous 2 calendar years; (o) Tenant reconciliation statements including, operating expenses, insurance and taxes for the Property from to ; and (p) . (2) Return of Property Information : If this contract terminates for any reason, Buyer will, not later than 10 days after the termination date: (Check all that apply.) (a) return to Seller all those items described in Paragraph 7D(1) that Seller delivered to Buyer in other than an electronic format and all copies that Buyer made of those items; (b) delete or destroy all electronic versions of those items described in Paragraph 7D(1) that Seller delivered to Buyer or Buyer copied in any format; and (c) deliver to Seller copies of all inspection and assessment reports related to the Property that Buyer completed or caused to be completed. This Paragraph 7D(2) survives termination of this contract. E . Contracts Affecting Operations : Until closing, Seller : ( 1 ) will operate the Property in the same manner as on the effective date under reasonably prudent business standards ; and ( 2 ) will not transfer or dispose of any part of the Property, any interest or right in the Property, or any of the personal property or other items described in Paragraph 2 B or sold under this contract . After the feasibility period ends, Seller may not enter into, amend, or terminate any other contract that affects the operations of the Property without Buyer's written approval . 8. LEASES: A . Each written lease Seller is to assign to Buyer under this contract must be in full force and effect according to its terms . Seller may not enter into any new lease, fail to comply with any existing lease, or make any amendment or modification to any existing lease without Buyer's written consent . Seller must disclose, in writing, if any of the following exist at the time Seller provides the leases to the Buyer or subsequently occur before closing : (1) any failure by Seller to comply with Seller's obligations under the leases; (2) any circumstances under any lease that entitle the tenant to terminate the lease or seek any offsets or damages; (3) any non - occupancy of the leased premises by a tenant; (4) any advance sums paid by a tenant under any lease; (5) any concessions, bonuses, free rents, rebates, brokerage commissions, or other matters that affect any lease; and (6) any amounts payable under the leases that have been assigned or encumbered, except as security for loan(s) assumed or taken subject to under this contract. B. Estoppel Certificates : Within N/ A days after the effective date, Seller will deliver to Buyer estoppel certificates signed not earlier than N/A by each tenant that leases space in the Property . The estoppel certificates must include the certifications contained in the current version of TXR Form 1938 - Commercial Tenant Estoppel Certificate and any additional information requested by a third party lender providing financing under Paragraph 4 if the third party lender requests such additional information at least 10 days prior to the earliest date that Seller may deliver the signed estoppel certificates . 1207 N FM 3083 Rd , Conroe, TX 77304 X (TXR - 1801) 07 - 08 - 22 Initialed for Identification by Seller , and Buyer , Page 6 of 15 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 1207 N FM 3083 Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com James Green Commercial Contract - Improved Property concerning 9.

BROKERS: A. The brokers to this sale are: Principal Broker: Green and Associates Real Estate Services Agent: James Green Address: 204 W Montgomery Willis,TX 77378 Phone & Fax : ( 936 ) 856 - 0355 E - mail : jgreen 03 @msn . com License No .: 0516990 Phone & Fax : E - mail : License No .: Cooperating Broker: Agent: Address: Principal Broker: (Check only one box) Cooperating Broker represents Buyer. represents Seller only. represents Buyer only. is an intermediary between Seller and Buyer. B. Fees : (Check only (1) or (2) below.) (Complete the Agreement Between Brokers on page 15 only if (1) is selected.) X ( 1 ) Seller will pay Principal Broker the fee specified by separate written commission agreement between Principal Broker and Seller . Principal Broker will pay Cooperating Broker the fee specified in the Agreement Between Brokers found below the parties' signatures to this contract . (2) At the closing of this sale, Seller will pay: Principal Broker a total cash fee of: % of the sales price. . Cooperating Broker a total cash fee of: % of the sales price. . (1) (2) 7 days after objections made under Paragraph 6D have been cured or waived. B. If either party fails to close by the closing date, the non - defaulting party may exercise the remedies in Paragraph 15. (TXR - 1801) 07 - 08 - 22 Initialed for Identification by Seller , and Buyer , Page 7 of 15 The cash fees will be paid in Montgomery County, Texas. Seller authorizes the title company to pay the brokers from the Seller's proceeds at closing. NOTICE: Chapter 62, Texas Property Code, authorizes a broker to secure an earned commission with a lien against the Property. C. The parties may not amend this Paragraph 9 without the written consent of the brokers affected by the amendment. 10. CLOSING: A. The date of the closing of the sale (closing date) will be on or before the later of: X days after the expiration of the feasibility period. (specific date) . 30 days after feasability or the dates set forth in the lease. .

1207 N FM 3083 Rd , Conroe, TX 77304 X Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 1207 N FM 3083 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com Commercial Contract - Improved Property concerning C. At closing, Seller will execute and deliver to Buyer, at Seller's expense, a X general special warranty deed . The deed must include a vendor's lien if any part of the sales price is financed . The deed must convey good and indefeasible title to the Property and show no exceptions other than those permitted under Paragraph 6 or other provisions of this contract . Seller must convey the Property : (1) with no liens, assessments, or Uniform Commercial Code or other security interests against the Property which will not be satisfied out of the sales price, unless securing loans Buyer assumes ; (2) without any assumed loans in default ; and (3) with no persons in possession of any part of the Property as lessees, tenants at sufferance, or trespassers except tenants under the written leases assigned to Buyer under this contract . D. At closing, Seller, at Seller's expense, will also deliver to Buyer: (1) tax statements showing no delinquent taxes on the Property; (2) a bill of sale with warranties to title conveying title, free and clear of all liens, to any personal property defined as part of the Property in Paragraph 2 or sold under this contract; (3) an assignment of all leases to or on the Property; (4) to the extent that the following items are assignable, an assignment to Buyer of the following items as they relate to the Property or its operations: (a) licenses and permits; (b) service, utility, maintenance, management, and other contracts; and (c) warranties and guaranties; (5) a rent roll current on the day of the closing certified by Seller as true and correct; (6) evidence that the person executing this contract is legally capable and authorized to bind Seller; (7) an affidavit acceptable to the title company stating that Seller is not a foreign person or, if Seller is a foreign person, a written authorization for the title company to : (i) withhold from Seller's proceeds an amount sufficient to comply with applicable tax law ; and (ii) deliver the amount to the Internal Revenue Service together with appropriate tax forms ; and (8) any notices, statements, certificates, affidavits, releases, and other documents required by this contract, the commitment, or law necessary for the closing of the sale and the issuance of the title policy, all of which must be completed and executed by Seller as necessary . E. At closing, Buyer will: (1) pay the sales price in good funds acceptable to the title company; (2) deliver evidence that the person executing this contract is legally capable and authorized to bind Buyer; (3) sign and send to each tenant in the Property a written statement that: (a) acknowledges Buyer has received and is responsible for the tenant's security deposit; and (b) specifies the exact dollar amount of the security deposit; (4) sign an assumption of all leases then in effect; and (5) execute and deliver any notices, statements, certificates, or other documents required by this contract or law necessary to close the sale. F. Unless the parties agree otherwise, the closing documents will be as found in the basic forms in the current edition of the State Bar of Texas Real Estate Forms Manual without any additional clauses . 11 . POSSESSION : Seller will deliver possession of the Property to Buyer upon closing and funding of this sale in its present condition with any repairs Seller is obligated to complete under this contract, ordinary wear and tear excepted . Any possession by Buyer before closing or by Seller after closing that is not authorized by a separate written lease agreement is a landlord - tenant at sufferance relationship between the parties .

1207 N FM 3083 Rd , Conroe, TX 77304 (TXR - 1801) 07 - 08 - 22 Initialed for Identification by Seller , and Buyer , Page 8 of 15 Phone: 2817991029 Fax: (936) 856 - 7986 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 1207 N FM 3083 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com Commercial Contract - Improved Property concerning 12 . SPECIAL PROVISIONS : The following special provisions apply and will control in the event of a conflict with other provisions of this contract . (If special provisions are contained in an Addendum, identify the Addendum here and reference the Addendum in Paragraph 22 D . ) 13. SALES EXPENSES: A. Seller's Expenses : Seller will pay for the following at or before closing: (1) releases of existing liens, other than those liens assumed by Buyer, including prepayment penalties and recording fees; (2) release of Seller's loan liability, if applicable; (3) tax statements or certificates; (4) preparation of the deed and any bill of sale; (5) one - half of any escrow fee; (6) costs to record any documents to cure title objections that Seller must cure; and (7) other expenses that Seller will pay under other provisions of this contract. B. Buyer's Expenses : Buyer will pay for the following at or before closing: (1) all loan expenses and fees; (2) preparation fees of any deed of trust; (3) recording fees for the deed and any deed of trust; (4) premiums for flood and hazard insurance as may be required by Buyer's lender; (5) one - half of any escrow fee; and (6) other expenses that Buyer will pay under other provisions of this contract. 14. PRORATIONS: A. Prorations : (1) Interest on any assumed loan, taxes, rents, and any expense reimbursements from tenants will be prorated through the closing date . (2) If the amount of ad valorem taxes for the year in which the sale closes is not available on the closing date, taxes will be prorated on the basis of taxes assessed in the previous year . If the taxes for the year in which the sale closes vary from the amount prorated at closing, the parties will adjust the prorations when the tax statements for the year in which the sale closes become available . This Paragraph 14 A( 2 ) survives closing . (3) If Buyer assumes a loan or is taking the Property subject to an existing lien, Seller will transfer all reserve deposits held by the lender for the payment of taxes, insurance premiums, and other charges to Buyer at closing and Buyer will reimburse such amounts to Seller by an appropriate adjustment at closing . B. Rollback Taxes : If Seller's use or change in use of the Property before closing results in the assessment of additional taxes, penalties, or interest (assessments) for periods before closing, the assessments will be the obligation of Seller . If this sale or Buyer's use of the Property after closing results in additional assessments for periods before closing, the assessments will be the obligation of Buyer . This Paragraph 14 B survives closing .

1207 N FM 3083 Rd , Conroe, TX 77304 (TXR - 1801) 07 - 08 - 22 Initialed for Identification by Seller , and Buyer , Page 9 of 15 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 1207 N FM 3083 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com Commercial Contract - Improved Property concerning C . Rent and Security Deposits : At closing, Seller will tender to Buyer all security deposits and the following advance payments received by Seller for periods after closing : prepaid expenses, advance rental payments, and other advance payments paid by tenants . Rents prorated to one party but received by the other party will be remitted by the recipient to the party to whom it was prorated within 5 days after the rent is received . This Paragraph 14 C survives closing . 15. DEFAULT: A . If Buyer fails to comply with this contract, Buyer is in default and Seller, as Seller's sole remedy(ies), may terminate this contract and receive the earnest money, as liquidated damages for Buyer's failure except for any damages resulting from Buyer's inspections, studies or assessments in accordance with Paragraph 7 C( 4 ) which Seller may pursue, or (Check if applicable) enforce specific performance, or seek such other relief as may be provided by law. B. If, without fault, Seller is unable within the time allowed to deliver the estoppel certificates, survey or the commitment, Buyer may: (1) terminate this contract and receive the earnest money, less any independent consideration under Paragraph 7B(1), as liquidated damages and as Buyer's sole remedy; or (2) extend the time for performance up to 15 days and the closing will be extended as necessary. C. Except as provided in Paragraph 15B, if Seller fails to comply with this contract, Seller is in default and Buyer may: (1) terminate this contract and receive the earnest money, less any independent consideration under Paragraph 7B(1), as liquidated damages and as Buyer's sole remedy; or (2) enforce specific performance, or seek such other relief as may be provided by law, or both. 16. CASUALTY LOSS AND CONDEMNATION: A. If any part of the Property is damaged or destroyed by fire or other casualty after the effective date, Seller must restore the Property to its previous condition as soon as reasonably possible and not later than the closing date . If, without fault, Seller is unable to do so, Buyer may : (1) terminate this contract and the earnest money, less any independent consideration under Paragraph 7 B( 1 ), will be refunded to Buyer ; (2) extend the time for performance up to 15 days and closing will be extended as necessary ; or (3) accept at closing : (i) the Property in its damaged condition ; (ii) an assignment of any insurance proceeds Seller is entitled to receive along with the insurer's consent to the assignment ; and (iii) a credit to the sales price in the amount of any unpaid deductible under the policy for the loss . B. If before closing, condemnation proceedings are commenced against any part of the Property, Buyer may : (1) terminate this contract by providing written notice to Seller within 15 days after Buyer is advised of the condemnation proceedings and the earnest money, less any independent consideration under Paragraph 7B(1), will be refunded to Buyer; or (2) appear and defend the condemnation proceedings and any award will, at Buyer's election, belong to: (a) Seller and the sales price will be reduced by the same amount; or (b) Buyer and the sales price will not be reduced. 17 . ATTORNEY'S FEES : If Buyer, Seller, any broker, or the title company is a prevailing party in any legal proceeding brought under or with relation to this contract or this transaction, such party is entitled to recover from the non - prevailing parties all costs of such proceeding and reasonable attorney's fees . This Paragraph 17 survives termination of this contract . 1207 N FM 3083 Rd , Conroe, TX 77304 X (TXR - 1801) 07 - 08 - 22 Initialed for Identification by Seller , and Buyer , Page 10 of 15 1207 N FM 3083 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com Commercial Contract - Improved Property concerning 18.

ESCROW : A. At closing, the earnest money will be applied first to any cash down payment, then to Buyer's closing costs, and any excess will be refunded to Buyer . If no closing occurs, the title company may require payment of unpaid expenses incurred on behalf of the parties and a written release of liability of the title company from all parties . B. If one party makes written demand for the earnest money, the title company will give notice of the demand by providing to the other party a copy of the demand . If the title company does not receive written objection to the demand from the other party within 15 days after the date the title company sent the demand to the other party, the title company may disburse the earnest money to the party making demand, reduced by the amount of unpaid expenses incurred on behalf of the party receiving the earnest money and the title company may pay the same to the creditors . C. The title company will deduct any independent consideration under Paragraph 7 B( 1 ) before disbursing any earnest money to Buyer and will pay the independent consideration to Seller . D. If the title company complies with this Paragraph 18 , each party hereby releases the title company from all claims related to the disbursal of the earnest money . E. Notices under this Paragraph 18 must be sent by certified mail, return receipt requested . Notices to the title company are effective upon receipt by the title company . F. Any party who wrongfully fails or refuses to sign a release acceptable to the title company within 7 days after receipt of the request will be liable to the other party for : (i) damages ; (ii) the earnest money ; (iii) reasonable attorney's fees ; and (iv) all costs of suit . G. Seller Buyer intend(s) to complete this transaction as a part of an exchange of like - kind properties in accordance with Section 1031 of the Internal Revenue Code, as amended . All expenses in connection with the contemplated exchange will be paid by the exchanging party . The other party will not incur any expense or liability with respect to the exchange . The parties agree to cooperate fully and in good faith to arrange and consummate the exchange so as to comply to the maximum extent feasible with the provisions of Section 1031 of the Internal Revenue Code . The other provisions of this contract will not be affected in the event the contemplated exchange fails to occur . 19. MATERIAL FACTS : To the best of Seller's knowledge and belief : (Check only one box . ) A. Seller is not aware of any material defects to the Property except as stated in the attached Commercial Property Condition Statement (TXR - 1408). B. Except as otherwise provided in this contract, Seller is not aware of: (1) any subsurface: structures, pits, waste, springs, or improvements; (2) any pending or threatened litigation, condemnation, or assessment affecting the Property; (3) any environmental hazards or conditions that materially affect the Property; (4) whether the Property is or has been used for the storage or disposal of hazardous materials or toxic waste, a dump site or landfill, or any underground tanks or containers; (5) whether radon, asbestos containing materials, urea - formaldehyde foam insulation, lead - based paint, toxic mold (to the extent that it adversely affects the health of ordinary occupants), or other pollutants or contaminants of any nature now exist or ever existed on the Property; (6) any wetlands, as defined by federal or state law or regulation, on the Property; (7) any threatened or endangered species or their habitat on the Property; (8) any present or past infestation of wood - destroying insects in the Property's improvements; (9) any contemplated material changes to the Property or surrounding area that would materially and detrimentally affect the ordinary use of the Property; 1207 N FM 3083 Rd , Conroe, TX 77304 X (TXR - 1801) 07 - 08 - 22 Initialed for Identification by Seller , and Buyer , Page 11 of 15 1207 N FM 3083 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com Commercial Contract - Improved Property concerning (10) any material physical defects in the improvements on the Property; or (11) any condition on the Property that violates any law or ordinance.

(Describe any exceptions to (1) - (11) in Paragraph 12 or an addendum.) 20 . NOTICES : All notices between the parties under this contract must be in writing and are effective when hand - delivered, mailed by certified mail return receipt requested, sent by a national or regional overnight delivery service that provides a delivery receipt, or sent by confirmed facsimile transmission to the parties addresses or facsimile numbers stated in Paragraph 1 . The parties will send copies of any notices to the broker representing the party to whom the notices are sent . A. Seller also consents to receive any notices by e - mail at Seller's e - mail address stated in Paragraph 1. B. Buyer also consents to receive any notices by e - mail at Buyer's e - mail address stated in Paragraph 1. 21. DISPUTE RESOLUTION : The parties agree to negotiate in good faith in an effort to resolve any dispute related to this contract that may arise . If the dispute cannot be resolved by negotiation, the parties will submit the dispute to mediation before resorting to arbitration or litigation and will equally share the costs of a mutually acceptable mediator . This paragraph survives termination of this contract . This paragraph does not preclude a party from seeking equitable relief from a court of competent jurisdiction . 22. AGREEMENT OF THE PARTIES: A. This contract is binding on the parties, their heirs, executors, representatives, successors, and permitted assigns . This contract is to be construed in accordance with the laws of the State of Texas . If any term or condition of this contract shall be held to be invalid or unenforceable, the remainder of this contract shall not be affected thereby . All individuals signing represent that they have the authority to sign on behalf of and bind the party for whom they are signing . B. This contract contains the entire agreement of the parties and may not be changed except in writing. C. If this contract is executed in a number of identical counterparts, each counterpart is an original and all counterparts, collectively, constitute one agreement. D. Addenda which are part of this contract are: (Check all that apply.) (1) Property Description Exhibit identified in Paragraph 2; (2) Commercial Contract Condominium Addendum (TXR - 1930) or (TXR - 1946); (3) Commercial Contract Financing Addendum (TXR - 1931); (4) Commercial Property Condition Statement (TXR - 1408); (5) Commercial Contract Addendum for Special Provisions (TXR - 1940); (6) Addendum for Seller's Disclosure of Information on Lead - Based Paint and Lead - Based Paint Hazards (TXR - 1906); (7) Notice to Purchaser of Real Property in a Water District (MUD); (8) Addendum for Coastal Area Property (TXR - 1915); (9) Addendum for Property Located Seaward of the Gulf Intracoastal Waterway (TXR - 1916); (10) Information About Brokerage Services (TXR - 2501); (11) Information About Mineral Clauses in Contract Forms (TXR - 2509); (12) Notice of Obligation to Pay Improvement District Assessment (TXR - 1955, PID); (13) .

(Note: Counsel for Texas REALTORS® has determined that any of the foregoing addenda which are promulgated by the Texas Real Estate Commission (TREC) or published by Texas REALTORS® are appropriate for use with this form.) X 1207 N FM 3083 Rd , Conroe, TX 77304 X X (TXR - 1801) 07 - 08 - 22 Initialed for Identification by Seller , and Buyer , Page 12 of 15 1207 N FM 3083 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com Commercial Contract - Improved Property concerning E . Buyer X may may not assign this contract . If Buyer assigns this contract, Buyer will be relieved of any future liability under this contract only if the assignee assumes, in writing, all of Buyer's obligations under this contract . 23. TIME : Time is of the essence in this contract . The parties require strict compliance with the times for performance . If the last day to perform under a provision of this contract falls on a Saturday, Sunday, or Federal Reserve Bank holiday, the time for performance is extended until the end of the next day which is not a Saturday, Sunday, or Federal Reserve Bank holiday . 24. EFFECTIVE DATE : The effective date of this contract for the purpose of performance of all obligations is the date the title company receipts this contract after all parties execute this contract . 25. ADDITIONAL NOTICES: A. Buyer should have an abstract covering the Property examined by an attorney of Buyer's selection, or Buyer should be furnished with or obtain a title policy . B. If the Property is situated in a utility or other statutorily created district providing water, sewer, drainage, or flood control facilities and services, Chapter 49 , Texas Water Code, requires Seller to deliver and Buyer to sign the statutory notice relating to the tax rate, bonded indebtedness, or standby fees of the district before final execution of this contract . C. Notice Required by † 13 . 257 , Water Code : “The real property, described below, that you are about to purchase may be located in a certificated water or sewer service area, which is authorized by law to provide water or sewer service to the properties in the certificated area . If your property is located in a certificated area there may be special costs or charges that you will be required to pay before you can receive water or sewer service . There may be a period required to construct lines or other facilities necessary to provide water or sewer service to your property . You are advised to determine if the property is in a certificated area and contact the utility service provider to determine the cost that you will be required to pay and the period, if any, that is required to provide water or sewer service to your property . The undersigned purchaser hereby acknowledges receipt of the foregoing notice at or before the execution of a binding contract for the purchase of the real property described in the notice or at closing of purchase of the real property . ” The real property is described in Paragraph 2 of this contract . D. If the Property adjoins or shares a common boundary with the tidally influenced submerged lands of the state, † 33 . 135 , Texas Natural Resources Code, requires a notice regarding coastal area property to be included as part of this contract (the Addendum for Coastal Area Property (TXR - 1915 ) may be used) . E. If the Property is located seaward of the Gulf Intracoastal Waterway, † 61 . 025 , Texas Natural Resources Code, requires a notice regarding the seaward location of the Property to be included as part of this contract (the Addendum for Property Located Seaward of the Gulf Intracoastal Waterway (TXR - 1916 ) may be used) . F. If the Property is located outside the limits of a municipality, the Property may now or later be included in the extra - territorial jurisdiction (ETJ) of a municipality and may now or later be subject to annexation by the municipality . Each municipality maintains a map that depicts its boundaries and ETJ . To determine if the Property is located within a municipality's ETJ, Buyer should contact all municipalities located in the general proximity of the Property for further information . G. If apartments or other residential units are on the Property and the units were built before 1978 , federal law requires a lead - based paint and hazard disclosure statement to be made part of this contract (the Addendum for Seller's Disclosure of Information on Lead - Based Paint and Lead - Based Paint Hazards (TXR - 1906 ) may be used) .

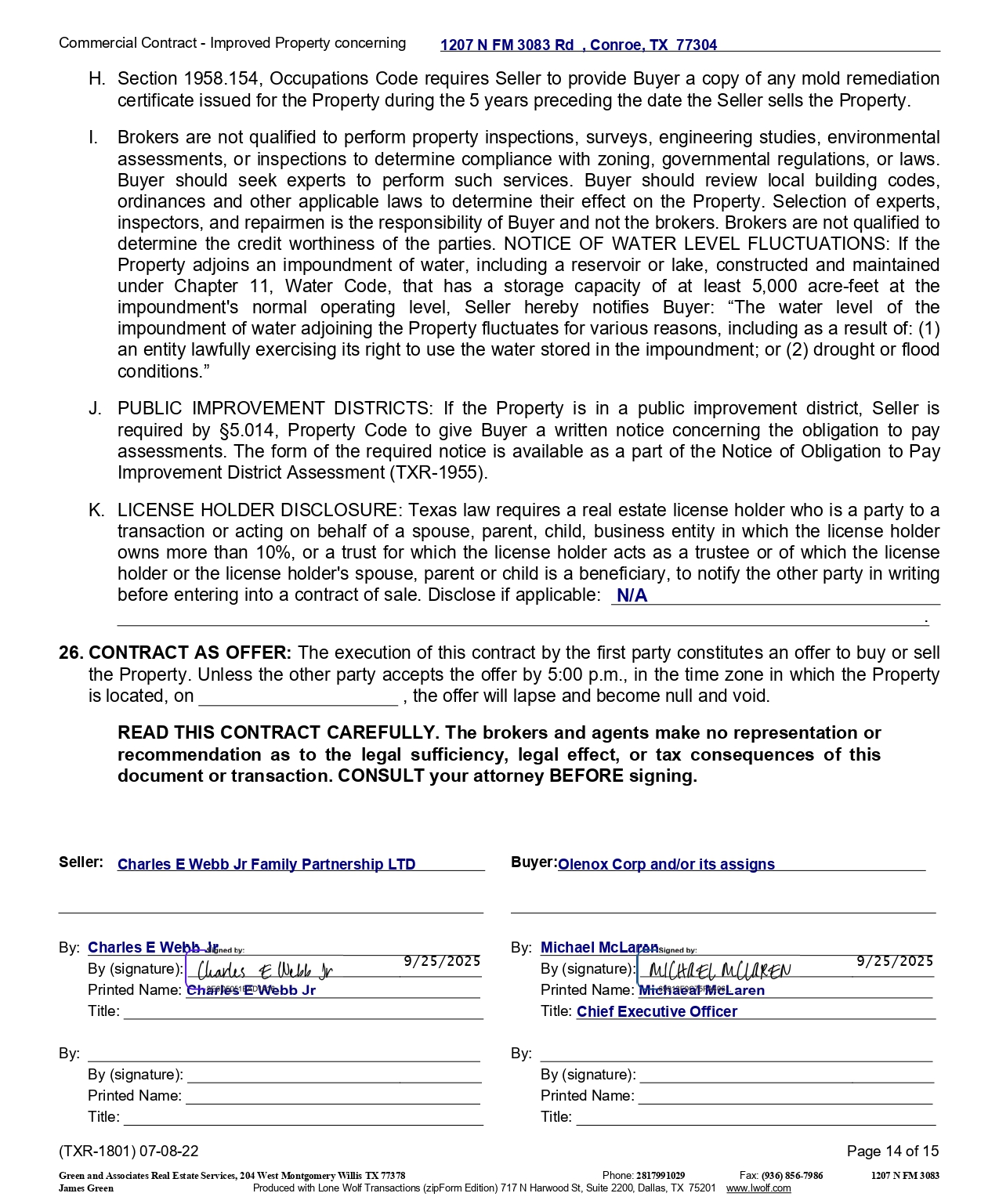

(TXR - 1801) 07 - 08 - 22 Initialed for Identification by Seller , and Buyer , Page 13 of 15 1207 N FM 3083 Rd , Conroe, TX 77304 Phone: 2817991029 Fax: (936) 856 - 7986 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 1207 N FM 3083 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com Commercial Contract - Improved Property concerning H. Section 1958 . 154 , Occupations Code requires Seller to provide Buyer a copy of any mold remediation certificate issued for the Property during the 5 years preceding the date the Seller sells the Property . I. Brokers are not qualified to perform property inspections, surveys, engineering studies, environmental assessments, or inspections to determine compliance with zoning, governmental regulations, or laws . Buyer should seek experts to perform such services . Buyer should review local building codes, ordinances and other applicable laws to determine their effect on the Property . Selection of experts, inspectors, and repairmen is the responsibility of Buyer and not the brokers . Brokers are not qualified to determine the credit worthiness of the parties . NOTICE OF WATER LEVEL FLUCTUATIONS : If the Property adjoins an impoundment of water, including a reservoir or lake, constructed and maintained under Chapter 11 , Water Code, that has a storage capacity of at least 5 , 000 acre - feet at the impoundment's normal operating level, Seller hereby notifies Buyer : “The water level of the impoundment of water adjoining the Property fluctuates for various reasons, including as a result of : ( 1 ) an entity lawfully exercising its right to use the water stored in the impoundment ; or ( 2 ) drought or flood conditions . ” J. PUBLIC IMPROVEMENT DISTRICTS : If the Property is in a public improvement district, Seller is required by † 5 . 014 , Property Code to give Buyer a written notice concerning the obligation to pay assessments . The form of the required notice is available as a part of the Notice of Obligation to Pay Improvement District Assessment (TXR - 1955 ) . K. LICENSE HOLDER DISCLOSURE : Texas law requires a real estate license holder who is a party to a transaction or acting on behalf of a spouse, parent, child, business entity in which the license holder owns more than 10 % , or a trust for which the license holder acts as a trustee or of which the license holder or the license holder's spouse, parent or child is a beneficiary, to notify the other party in writing before entering into a contract of sale . Disclose if applicable : N/A . 26 . CONTRACT AS OFFER : The execution of this contract by the first party constitutes an offer to buy or sell the Property . Unless the other party accepts the offer by 5 : 00 p . m . , in the time zone in which the Property is located, on , the offer will lapse and become null and void . READ THIS CONTRACT CAREFULLY . The brokers and agents make no representation or recommendation as to the legal sufficiency, legal effect, or tax consequences of this document or transaction . CONSULT your attorney BEFORE signing . Seller: By (signature): Printed Name: Title: By: Charles E We By : By (signature) : Printed Name : Title : Buyer: Olenox Corp and/or its assigns By (signature): By: Michael McLa By : By (signature) : Printed Name : Title : 1207 N FM 3083 Rd , Conroe, TX 77304 Charles E Webb Jr Family Partnership LTD bb Jr Charles E Webb Jr ren Michaeal McLaren Printed Name: Title: Chief Executive Officer 9/25/2025 9/25/2025 (TXR - 1801) 07 - 08 - 22 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Page 14 of 15 1207 N FM 3083 Phone: 2817991029 Fax: (936) 856 - 7986 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com ATTORNEYS Seller's attorney: Buyer's attorney: Address: Address: Phone & Fax: Phone & Fax: E - mail: E - mail: Seller's attorney requests copies of documents, Buyer's attorney requests copies of documents, notices, and other information: notices, and other information: the title company sends to Buyer.

Seller sends to Buyer. the title company sends to Seller. Buyer sends to Seller. Commercial Contract - Improved Property concerning (TXR - 1801) 07 - 08 - 22 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Page 15 of 15 1207 N FM 3083 Phone: 2817991029 Fax: (936) 856 - 7986 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com AGREEMENT BETWEEN BROKERS (use only if Paragraph 9B(1) is effective) Principal Broker agrees to pay (Cooperating Broker) a fee when the Principal Broker's fee is received. The fee to be paid to Cooperating Broker will be: $ , or % of the sales price, or % of the Principal Broker's fee. The title company is authorized and directed to pay Cooperating Broker from Principal Broker's fee at closing . This Agreement Between Brokers supersedes any prior offers and agreements for compensation between brokers . Principal Broker : Cooperating Broker : By : By : ESCROW RECEIPT The title company acknowledges receipt of: A. the contract on this day (effective date); B. earnest money in the amount of $ in the form of on .

Title company: Address: By: Phone & Fax: Assigned file number (GF#): E - mail: 1207 N FM 3083 Rd , Conroe, TX 77304 COMMERCIAL CONTRACT FINANCING ADDENDUM USE OF THIS FORM BY PERSONS WHO ARE NOT MEMBERS OF THE TEXAS ASSOCIATION OF REALTORS®, INC. IS NOT AUTHORIZED. ©Texas Association of REALTORS®, Inc. 2010 ADDENDUM TO COMMERCIAL CONTRACT BETWEEN THE UNDERSIGNED PARTIES CONCERNING THE PROPERTY AT 1207 N FM 3083 Rd , Conroe, TX 77304 The portion of the Sales Price not payable in cash will be paid as follows: (Check all that apply.) X A. THIRD PARTY FINANCING : (1) The contract is contingent upon Buyer obtaining a third party loan(s) secured by the Property in the amount of $ 2 , 400 , 000 . 00 for not less than 20 years with the initial interest rate not to exceed 8 . 000 % per annum and payments calculated on an amortization period of no less than 20 years . (2) Buyer will apply for the third party loan(s) described in Paragraph A( 1 ) promptly after the effective date . If Buyer cannot obtain the loan(s), Buyer may give Seller written notice within 30 days after the effective date and the contract will terminate and the earnest money, less any independent consideration under Paragraph 7 B( 1 ) of the contract, will be refunded to Buyer . If Buyer does not give such notice within the time required, this contract will no longer be subject to the contingency described in this Paragraph A . (3) Each note to be executed under this addendum is to be secured by vendor's and deed of trust liens. B. ASSUMPTION : (1) Buyer will assume the unpaid principal balance of the existing promissory note secured by the Property payable to dated which balance at closing will be $ . (2) Buyer's initial payment will be the first payment due after closing. Buyer's assumption of the existing note includes all obligations imposed by the deed of trust securing the note, recorded in (recording reference) in the real property records of the county where the Property is located. (3) If the unpaid principal balance of the assumed loan as of the date of closing varies from the loan balance stated in Paragraph B( 1 ), the cash payable at closing will be adjusted by the net amount of any variance ; provided, if the total principal balance of the assumed loan varies in an amount greater than $ at closing, either party may terminate this contract and the earnest money will be refunded to Buyer unless either party elects to eliminate the excess in the variance by an appropriate adjustment at closing . (4) Buyer may terminate the contract and the earnest money, less any independent consideration under Paragraph 7B(1) of the contract, will be refunded to Buyer if the note holder on assumption requires: (a) Buyer to pay an assumption fee in excess of $ and Seller declines to pay such excess; (b) an increase in the interest rate to more than %; or (c) any other modification of the loan documents. (3) Unless Seller is released of liability on any assumed note, Seller requires a vendor's lien and deed of trust to secure assumption, which will be automatically released on execution and delivery of a release by the note holder .

(TXR - 1931) 1 - 26 - 10 Initialed for Identification by Seller: , , and Buyer: , Page 1 of 4 1207 N FM 3083 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com Commercial Contract Financing Addendum concerning 1207 N FM 3083 Rd , Conroe, TX 77304 ( 6 ) If assumption approval is required by the note holder, Buyer will apply for assumption approval within days after the effective date of the contract and will make every reasonable effort to obtain assumption approval . If Buyer cannot obtain assumption approval, Buyer may give Seller written notice within days after the effective date and the contract will terminate and the earnest money, less any independent consideration under Paragraph 7 B( 1 ) of the contract, will be refunded to Buyer . If Buyer does not give such notice within the time required and Buyer does not close because Buyer is not able to assume the existing note, Buyer will be in default . C. SELLER FINANCING : (1) At closing, Buyer will execute and deliver a promissory note (the note) from Buyer to Seller in the amount of $ , bearing % interest per annum . Matured, unpaid amounts will bear interest at the maximum rate of interest allowed by law . (2) The note will be payable as follows : (a) In one payment, due after the date of the note, with interest payable : (i) monthly (ii) . (b) In installments of $ including interest plus interest beginning after the date of the note and continuing at monthly intervals thereafter for when the entire balance of the note will be due and payable . (c) Interest only in monthly installments for the first years and thereafter in installments of $ including interest plus interest beginning after the date of the note and continuing at monthly intervals thereafter for when the entire balance of the note will be due and payable . (3) The note will be secured by vendor's and deed of trust liens and an assignment of leases payable at the placed designated by Seller . (4) The note will provide that if Buyer fails to timely pay an installment within 10 days after the installment is due, Buyer will pay a late fee equal to 5 % of the installment not paid . (5) The note will will not provide for liability (personal or corporate) against the maker in the event of default . (6) The note may be prepaid in whole or in part at any time without penalty . Any prepayments are to be applied to the payment of the installments of principal last maturing and interest will immediately cease on the prepaid principal . (7) The lien securing payment of the note will be inferior to any lien securing any superior note described in this addendum . If an owner's policy of title insurance is furnished, Buyer, at Buyer's expense, will furnish Seller with a mortgagee title policy in the amount of the note at closing . (8) If all or any part of the Property is sold or conveyed without Seller's prior written consent, Seller, at Seller's option, may declare the outstanding principal balance of the note, plus accrued interest, immediately due and payable . Any of the following is not a sale or conveyance of the Property : (a) the creation of a subordinate lien; (b) a sale under a subordinate lien; (c) a deed under threat or order of condemnation; (d) a conveyance solely between the parties; or (e) the passage of title by reason of death of a maker or operation of law. (TXR - 1931) 1 - 26 - 10 Initialed for Identification by Seller: , , and Buyer: , Page 2 of 4 Phone: 2817991029 Fax: (936) 856 - 7986 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 1207 N FM 3083 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com Commercial Contract Financing Addendum concerning 1207 N FM 3083 Rd , Conroe, TX 77304 (9) Deposits for Taxes and Insurance : Together with the principal and interest installments, Buyer will will not deposit with Seller a pro rata part of the estimated annual ad valorem taxes on the Property and a pro rata part of the estimated annual insurance premiums for the improvements on the Property.

(a) If Buyer deposits taxes and insurance deposits with Seller, Buyer agrees that the taxes and insurance deposits are only estimates and may be insufficient to pay total taxes and insurance premiums . Buyer agrees to pay any deficiency within 30 days after Seller notifies Buyer of any deficiency . Buyer's failure to pay the deficiency is a default under the deed of trust . (b) If any superior lien holder on the Property collects payments for taxes and insurance, any requirement to deposit taxes and insurance deposits with Seller under this addendum is inoperative so long as payments are being made to the superior lien holder . (10) Any event that constitutes a default under any superior lien constitutes a default under the deed of trust securing the note . (11) The note will include a provision for reasonable attorney's fees for any collection action. (12) Unless the parties agree otherwise, the form of the note and loan documents will be as found in the current edition of the State Bar of Texas Real Estate Forms Manual without any additional clauses . D. CREDIT APPROVAL ON ASSUMPTION OR SELLER FINANCING : (1) To establish Buyer's creditworthiness for assumption approval or seller financing, Buyer will deliver to Seller the following information (Buyer's documentation) within days after the effective date of the contract : (a) verification of employment, including salary; (b) verification of funds on deposit in financial institutions; (c) current financial statement; (d) credit report; (e) tax returns for the following years ; (f) . (2) If Buyer does not timely deliver Buyer's documentation or Seller determines, in Seller's sole discretion, that Buyer's creditworthiness is not acceptable, Seller may terminate the contract by giving written notice to Buyer not later than days after the date Buyer must deliver Buyer's documentation under Paragraph D( 1 ) and the earnest money, less any independent consideration under Paragraph 7 B( 1 ) of the contract, will be refunded to Buyer . If Seller does not timely terminate the contract under this paragraph, Seller will be deemed to have accepted Buyer's credit . E.

SPECIAL PROVISIONS : (TXR - 1931) 1 - 26 - 10 Initialed for Identification by Seller: , , and Buyer: , Page 3 of 4 1207 N FM 3083 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com James Green Commercial Contract Financing Addendum concerning 1207 N FM 3083 Rd , Conroe, TX 77304 Seller: By: Charles E Webb Jr By (signature): Printed Name: Charles E Webb Jr Title: By : By (signature) : Printed Name : Title : Buyer: By: Michael McLaren By (signature): Printed Name: Michaeal McLaren Title: Chief Executive Officer By : By (signature) : Printed Name : Title : (TXR - 1931) 1 - 26 - 10 Page 4 of 4 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 1207 N FM 3083 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com COMMERCIAL CONTRACT SPECIAL PROVISIONS ADDENDUM USE OF THIS FORM BY PERSONS WHO ARE NOT MEMBERS OF THE TEXAS ASSOCIATION OF REALTORS®, INC. IS NOT AUTHORIZED. ©Texas Association of REALTORS®, Inc. 2018 ADDENDUM TO COMMERCIAL CONTRACT BETWEEN THE UNDERSIGNED PARTIES CONCERNING THE PROPERTY AT: 1207 N FM 3083 Rd , Conroe, TX 77304 The following special provisions apply and will control in the event of a conflict with the other provisions of the contract : Buyer will take occupancy September 26 th when lease will start on the 18 , 852 sq foot building . Deposit of $ 20 , 000 will be due once contract is signed . Monthly rent in the amount of $20,000 will be due starting October 1st and be due the first of each month until property closes. A $4,000 credit per month will be credited to the sales price at closing. Buyer has the option to extend closing up to 24 months and must give a 90 - day notice if they will be vacating and terminating the contract. Buyer/Tenant will be responsible to carry rental insurance on the building they occupy. The Seller and Buyer acknowledge and agree that they are each bound by and shall comply with all obligations, duties and responsibilities set forth in the Texas Realtors Commercial Lease Agreement. Both parties further agree to perform their respective obligations in good faith and in accordance with the terms and conditions of the lease up to the date of closing. Seller: By: Charles E Webb Jr By (signature): Printed Name: Charles E Webb Jr Title: By: By (signature) : Printed Name : Title : Buyer: By: Michael McLaren By (signature): Printed Name: Michaeal McLaren Title: Chief Executive Officer By: By (signature) : Printed Name : Title : (TXR - 1940) 4 - 1 - 18 Page 1 of 1 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 James Green Produced with Lone Wolf Transactions (zipForm Edition) 231 Shearson Cr. Cambridge, Ontario, Canada N1T 1J5 www.lwolf.com 1207 N FM 3083

Exhibit 10.2

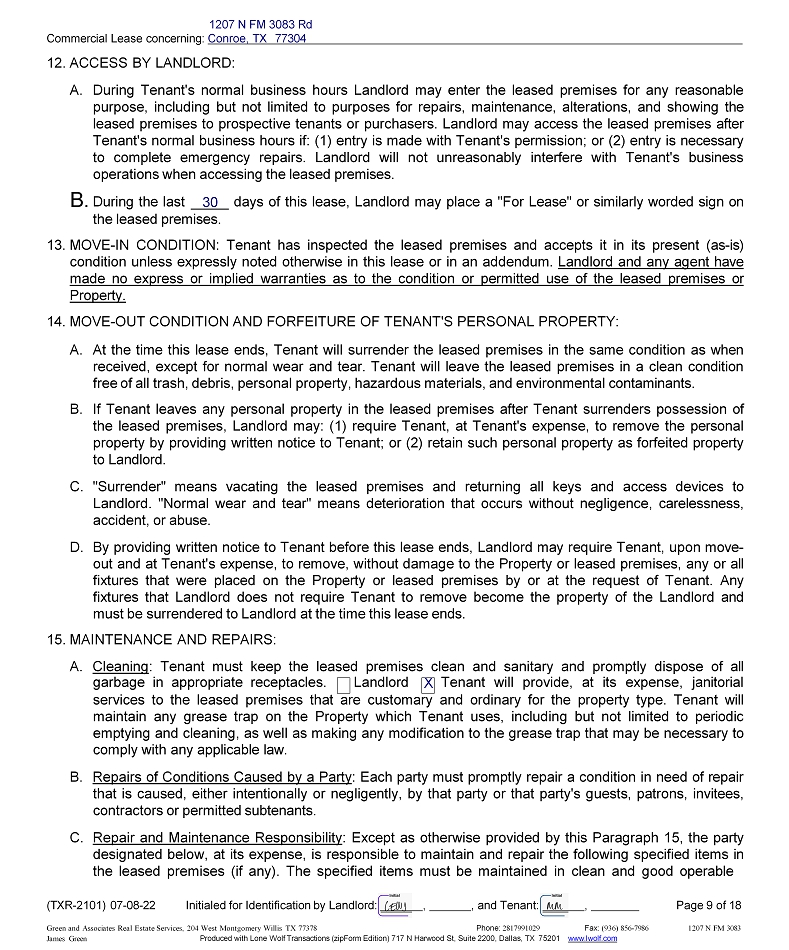

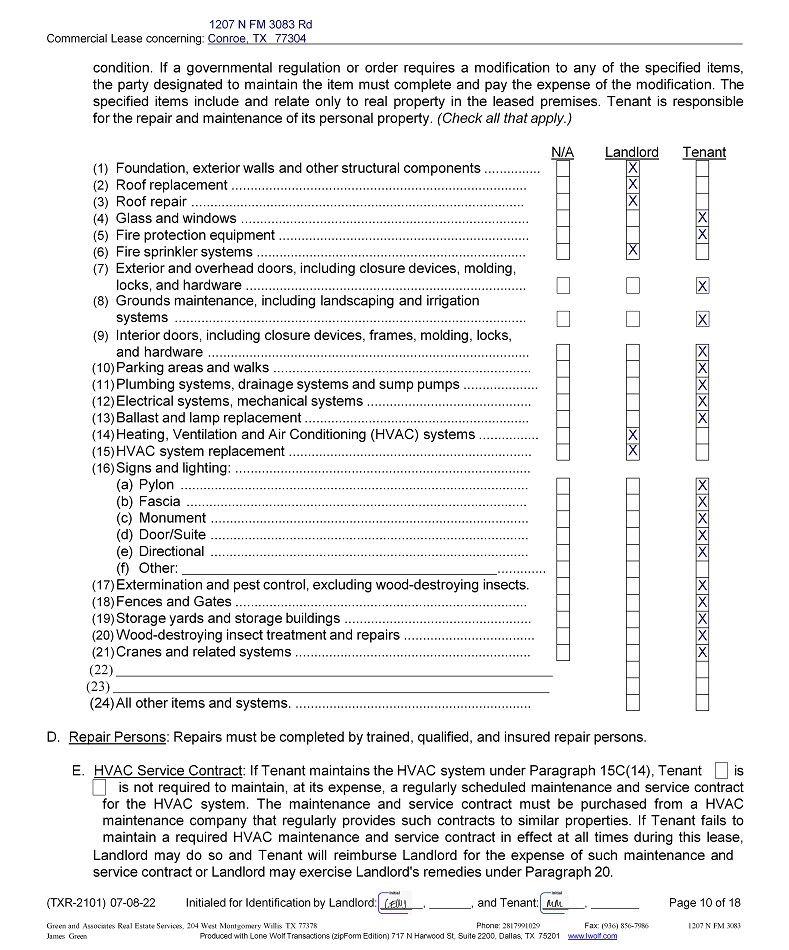

COMMERCIAL LEASE USE OF THIS FORM BY PERSONS WHO ARE NOT MEMBERS OF THE TEXAS ASSOCIATION OF REALTORS®, INC. IS NOT AUTHORIZED. ©Texas Association of REALTORS®, Inc. 2022 1207 N FM 3083 Rd CONCERNING THE LEASED PREMISES AT Conroe, TX 77304 between Charles E Webb Jr Family Partnership LTD (Landlord) and Olenox Corp. (Tenant). Table of Contents No. Paragraph Description Pg. Parties .......................................................... 2 Leased Premises ......................................... 2 Term ............................................................ 2 Rent and Expenses ..................................... 3 Security Deposit ........................................... 5 Taxes ............................................................ 6 Utilities .......................................................... 6 Insurance ...................................................... 7 Use and Hours ............................................. 7 Legal Compliance ......................................... 7 Signs ............................................................ 8 Access By Landlord ...................................... 8 Move - In Condition ........................................ 9 Move - Out Condition ..................................... 9 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. Maintenance and Repairs ........................ 9 Alterations .................................................... 11 Liens ............................................................. 11 Liability ......................................................... 11 Indemnity ...................................................... 11 Default .......................................................... 11 Abandonment, Interruption of Utilities, Removal of Property and Lockout ................ 12 Holdover ....................................................... 12 Landlord's Lien and Security Interest ........... 12 Assignment and Subletting ........................... 12 Relocation .................................................... 13 Subordination ............................................... 13 Estoppel Certificates and Financial Info . ...... 13 Casualty Loss ............................................... 13 Condemnation .............................................. 14 Attorney's Fees ............................................. 14 Representations ........................................... 14 Brokers ......................................................... 14 Addenda ....................................................... 15 Notices ......................................................... 15 Special Provisions ........................................ 16 Agreement of Parties ................................... 16 Effective Date ............................................... 16 License Holder Disclosure ............................ 17 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. ADDENDA & EXHIBITS (check all that apply) Exhibit Exhibit Exhibit Commercial Property Condition Statement (TXR - 1408) Commercial Lease Addendum for Broker's Fee (TXR - 2102) Commercial Lease Addendum for Option to Extend Term (TXR - 2104) Commercial Lease Addendum for Tenant's Right of First Refusal (TXR - 2105) Commercial Lease Addendum for Percentage Rent (TXR - 2106) Commercial Lease Addendum for Parking (TXR - 2107) Commercial Landlord's Rules and Regulations (TXR - 2108) Commercial Lease Guaranty (TXR - 2109) Commercial Lease Addendum for Tenant's Option for Additional Space (TXR - 2110) Commercial Lease Construction Addendum (TXR - 2111) or (TXR - 2112) Commercial Lease Addendum for Contingencies (TXR - 2119) Information About Brokerage Services (TXR - 2501) (TXR - 2101) 07 - 08 - 22 Initialed for Identification by Landlord: , , and Tenant: , Page 1 of 18 Green and Associates Real Estate Services, 204 West Montgomery Willis TX 77378 Phone: 2817991029 Fax: (936) 856 - 7986 1207 N FM 3083 James Green Produced with Lone Wolf Transactions (zipForm Edition) 717 N Harwood St, Suite 2200, Dallas, TX 75201 www.lwolf.com COMMERCIAL LEASE USE OF THIS FORM BY PERSONS WHO ARE NOT MEMBERS OF THE TEXAS ASSOCIATION OF REALTORS®, IS NOT AUTHORIZED.

©Texas Association of REALTORS®, Inc. 2020 1. PARTIES: The parties to this lease are: Landlord: Charles E Webb Jr Family Partnership LTD ; and Tenant: Olenox Corp. . 2. LEASED PREMISES: A. Landlord leases to Tenant the following described real property, known as the "leased premises," along with all its improvements (Check only one box) : X (1) Multiple - Tenant Property : Suite or Unit Number 1 containing approximately 18852 square feet of rentable area ("rsf") in (project name) at 1207 N FM 3083 Rd (address) in Conroe (city) , Montgomery (county) , Texas, which is legally described on attached Exhibit or as follows: A0002 - Allen W S, Tract 1B1 - A, Acres 2.821 . (2) Single - Tenant Property : The real property containing approximately square feet of rentable area ("rsf") at: (address) in (city) , (county) , Texas, which is legally described on attached Exhibit or as follows: . B. If Paragraph 2A(1) applies: (1) "Property" means the building or complex in which the leased premises are located, inclusive of any common areas, drives, parking areas, and walks; and (2) the parties agree that the rentable area of the leased premises may not equal the actual or useable area within the leased premises and may include an allocation of common areas in the Property. The rentable area will X will not be adjusted if re - measured. 3. TERM: A. Term : The term of this lease is up to 24 months and days, commencing on: (Commencement Date) and ending on the earlier of 9/30/2027 or when Tenant closes building purchase (Expiration Date). B.