UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2025

Commission File Number: 001-42370

MEGA MATRIX INC.

Level 21, 88 Market Street

CapitaSpring

Singapore 048948

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Explanatory Notes

Business Update

Mega Matrix Inc. (the “Company”) is providing a business

update regarding its Digital Asset Treasury (“DAT”) reserve strategy which has been refined to include other leading stablecoins

and their governance tokens, and to focus on a “dual-engine” approach consisting of:

(a) Stable Yield, through holding a basket of stablecoins and deploying them into low-risk decentralized finance (DeFi) strategies to generate recurring income; and

(b) Growth Potential, through allocation to governance tokens of leading stablecoin protocols, aiming to capture long-term upside in the stablecoin sector. A slide presentation entitled “Mega Matrix Inc. DAT Strategy Business Update” is filed herewith as Exhibit 99.1 and incorporated herein by reference. Exhibit 99.1 to this report on Form 6-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any filings made by the Company under the Securities Act, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Successfully implementing this strategy may present organizational and infrastructure challenges, and the Company may not be able to fully implement or realize the intended benefits of its strategy. There can be no assurance that the Company will be successful in implementing its new business strategy. In addition, moving to a new business strategy may result in a loss of established efficiency, which may have a negative impact on the Company’s business. The Company may also face an increased amount of competition as we attempt to expand and grow its business, which may negatively impact its results of operations, cash flows and financial condition. The Company intends to provide further updates as material developments occur.

Press Release

On October 1, 2025, the Company issued a press release announcing the business update. A copy of the press release is attached hereto as Exhibit 99.2. Exhibit 99.2 to this report on Form 6-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any filings made by the Company under the Securities Act, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Incorporation by Reference

The section entitled “Business Update” is incorporated by reference in the registration statements on Form S-8 (File No. 333-277227), Form F-3 (File No. 333-283739), Form S-8 (File No. 333-289715), and Form F-3 (File No. 333-290026), each as filed with the Securities and Exchange Commission, to the extent not superseded by documents or reports subsequently filed.

Forward-Looking Statements

This report contains forward-looking statements within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. All statements in this press release other than statements that are purely historical are forward looking statements. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose,” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees for future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, are the: ability to manage growth; ability to identify and integrate future acquisitions; ability to grow and expand our FlexTV business; ability to purchase leading stablecoins and their governance tokens, Bitcoin or Ethereum at the price that we want; ability to reinitiate the ETH staking business, ability to implement the strategic expansion into the stablecoin sector, ability to implement the new DAT reserve strategy, and ability to create value; the regulatory volatility on stablecoins and governance tokens, ability to obtain additional financing in the future to fund capital expenditures and our DAT treasury reserve strategy and ability to create value; ability to obtain effectiveness of the universal shelf registration and raise capital as contemplated; ; fluctuations in general economic and business conditions; costs or other factors adversely affecting the Company’s profitability; litigation involving patents, intellectual property, and other matters; potential changes in the legislative and regulatory environment; a pandemic or epidemic; the possibility that the Company may not succeed in developing its new lines of businesses due to, among other things, changes in the business environment, competition, changes in regulation, or other economic and policy factors; and the possibility that the Company’s new lines of business may be adversely affected by other economic, business, and/or competitive factors. The forward-looking statements in this press release and the Company’s future results of operations are subject to additional risks and uncertainties set forth under the heading “Risk Factors” in documents filed by the Company with the Securities and Exchange Commission (“SEC”), including the Company’s latest annual report on Form 20-F, filed with the SEC on March 28, 2025, and are based on information available to the Company on the date hereof. In addition, such risks and uncertainties include the inherent risks with investing in stablecoins, governance tokens, Bitcoin and/or Ethereum, including governance token’s, Bitcoin’s and Ethereum’s volatility; and risk of implementing a new diversified treasury strategy. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this report.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Mega Matrix Inc. | ||

| By: | /s/ Yucheng Hu | |

| Yucheng Hu | ||

| Chief Executive Officer | ||

| Dated: October 1, 2025 | ||

4

Exhibit 99.1

Mega Matrix Inc. (NYSE American: MPU) September 2025

This presentation and other written or oral statements made from time to time by representatives of Mega Matrix Inc. (sometimes referred to as “Mega Matrix”) contains forward - looking statements within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. All statements in this press release other than statements that are purely historical are forward looking statements. When used in this press release, the words "estimates," "projected," "expects," "anticipates," "forecasts," "plans," "intends," "believes," "seeks," "may," "will," "should," "future," "propose," and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward - looking statements. These forward - looking statements are not guarantees for future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company's control, that could cause actual results or outcomes to differ materially from those discussed in the forward - looking statements. Important factors, among others, are the: ability to manage growth; ability to identify and integrate future acquisitions; ability to grow and expand our FlexTV business; ability to purchase Stablecoins and their Governance Token, Bitcoin or Ethereum at the price that we want; ability to reinitiate the ETH staking business, ability to implement the strategic expansion into the stablecoin sector, ability to obtain additional financing in the future to fund capital expenditures and our digital asset treasury reserve strategy and ability to create value; fluctuations in general economic and business conditions; costs or other factors adversely affecting the Company's profitability; litigation involving patents, intellectual property, and other matters; potential changes in the legislative and regulatory environment; a pandemic or epidemic; the possibility that the Company may not succeed in developing its new lines of businesses due to, among other things, changes in the business environment, competition, changes in regulation, or other economic and policy factors; and the possibility that the Company's new lines of business may be adversely affected by other economic, business, and/or competitive factors. The forward - looking statements in this press release and the Company's future results of operations are subject to additional risks and uncertainties set forth under the heading "Risk Factors" in documents filed by the Company with the Securities and Exchange Commission ("SEC"), including the Company's latest annual report on Form 20 - F, filed with the SEC on March 28, 2025, and are based on information available to the Company on the date hereof. In addition, such risks and uncertainties include the inherent risks with investing in $ENA, Bitcoin and/or Ethereum, including Stablecoin Governance Token, Bitcoin's and Ethereum's volatility; and risk of implementing a new digital asset treasury reserve strategy. The Company undertakes no obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on forward - looking statements, which speak only as of the date of this press release.

Investor Notice Investing in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks, uncertainties and forward - looking statements described under “Risk Factors” in our most recent annual report on Form 20 - F, filed with the SEC on March 28, 2025,and other SEC filings. If any of these risks were to occur, our business, financial condition or results of operations would likely suffer. In that event, the value of our securities could decline, and you could lose part or all of your investments. The risks and uncertainties we described are not the only ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. In addition, our past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results in the future. Industry and Market Data This Presentation has been prepared by the Company and its Representatives and includes market data and other statistical information from third - party industry publications and sources as well as from research reports prepared for other purposes. Although the Company believes these third - party sources are reliable as of their respective dates, none of the Company or any of its respective Representatives has independently verified the accuracy or completeness of this information and cannot assure you of the data’s accuracy or completeness. Some data are also based on the Company’s good faith estimates, which are derived from both internal sources and the third - party sources. None of the Company or its Representatives make any representation or warranty with respect to the accuracy of such information. The Company expressly disclaims any responsibility or liability for any damages or losses in connection with the use of such information herein. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any registration statement, prospectus, proxy statement or other report or document to be filed or furnished by the Company. Trademarks and Intellectual Property All trademarks, service marks, and trade names of the Company and its respective affiliates used herein are trademarks, service marks, or registered trade names of the Company or its respective affiliate, respectively, as noted herein. Any other product, company names, or logos mentioned herein are the trademarks and/or intellectual property of their respective owners, and their use is not alone intended to, and does not alone imply, a relationship with the Company, or an endorsement or sponsorship by or of the Company. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that the Company or the applicable rights owner will not assert, to the fullest extent under applicable law, their rights or the right of the applicable owner or licensor to these trademarks, service marks and trade names.

Mega Matrix Targets to be the To Develop Digital Asset Treasury Strategy on Stablecoin and Governance Token Pairs

As Strategic Reserve Asset

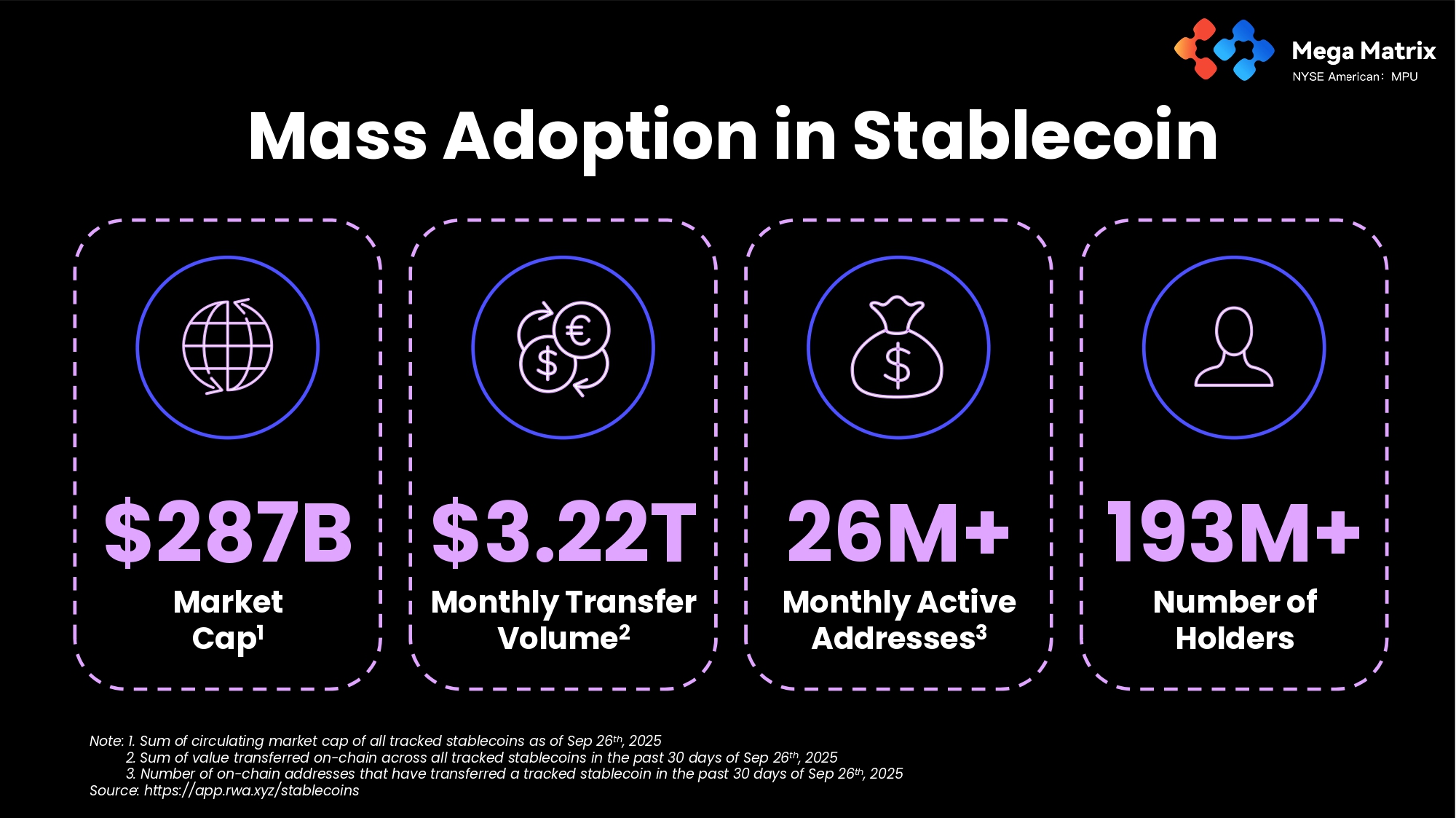

Note: 1. Standard Chartered: Stablecoin Market Could Grow to $2T by End - 2028 Source: https:// www.coindesk.com/markets/2025/04/15/stablecoin - market - could - grow - to - usd2t - by - end - 2028 - standard - chartered Stablecoin : Future of Digital Dollar $287B Market Cap 1 $3.22T Monthly Transfer Volume 2 26M+ Monthly Active Addresses 3 193M+ Number of Holders Mass Adoption in Stablecoin Note: 1.

Sum of circulating market cap of all tracked stablecoins as of Sep 26 th , 2025 2. Sum of value transferred on - chain across all tracked stablecoins in the past 30 days of Sep 26 th , 2025 3.

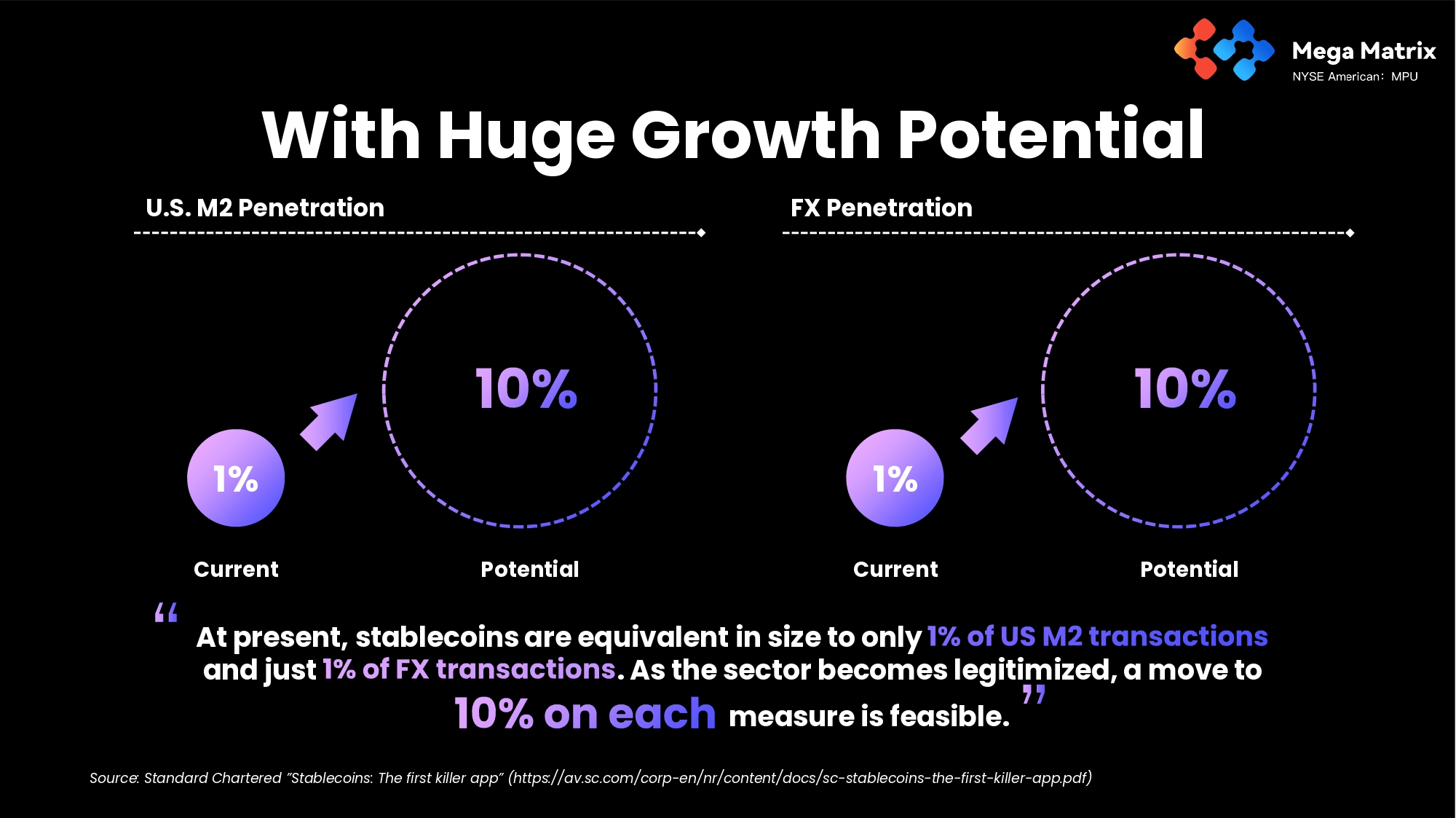

Number of on - chain addresses that have transferred a tracked stablecoin in the past 30 days of Sep 26 th , 2025 Source: https://app.rwa.xyz/stablecoins With Huge Growth Potential Source: Standard Chartered ”Stablecoins: The first killer app” (https://av.sc.com/corp - en/nr/content/docs/sc - stablecoins - the - first - killer - app.pdf) At present, stablecoins are equivalent in size to only and just . As the sector becomes legitimized, a move to measure is feasible. 1% 1% Current Potential Current Potential U.S. M2 Penetration FX Penetration Dual Engines for Stability & Growth

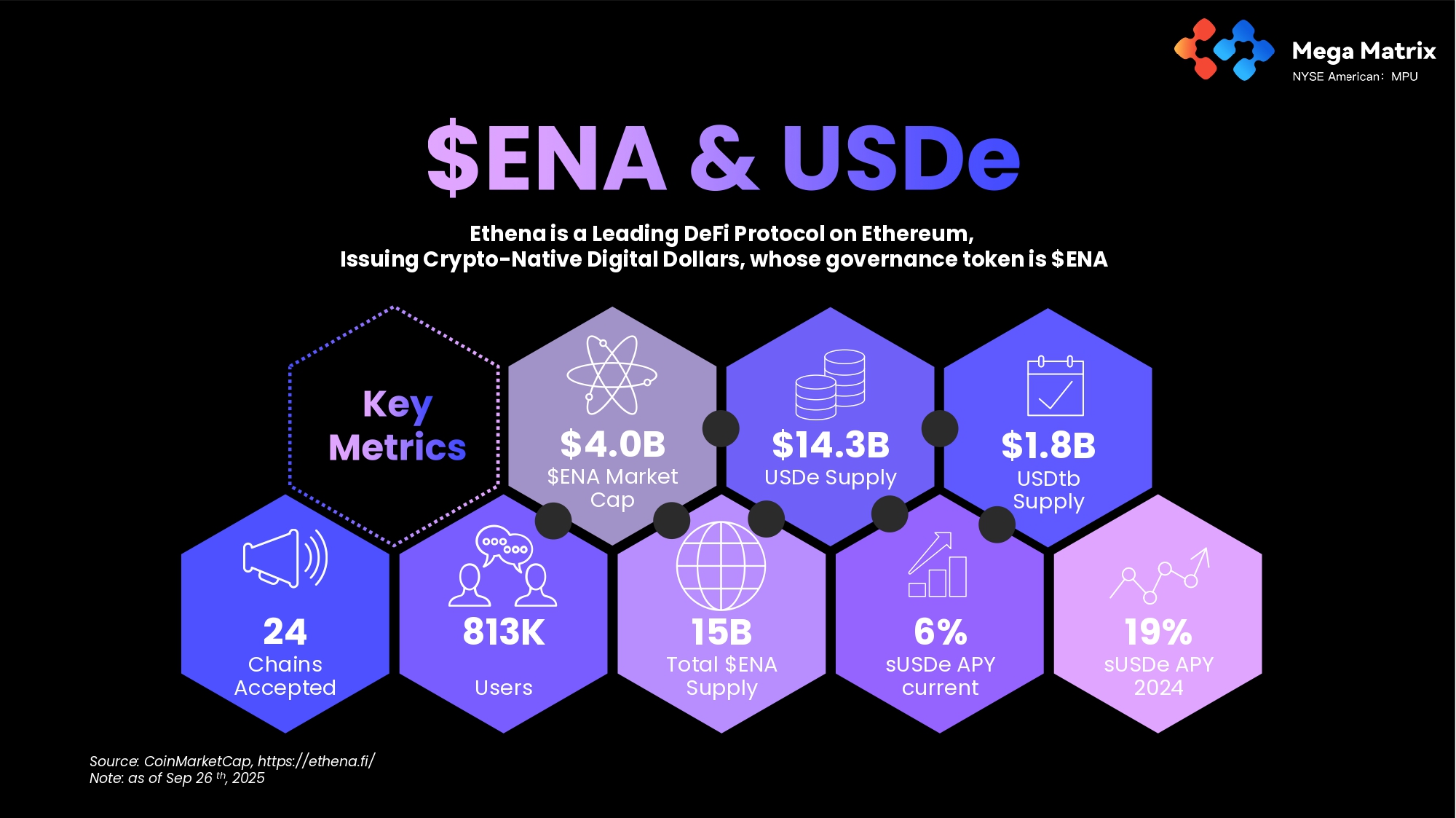

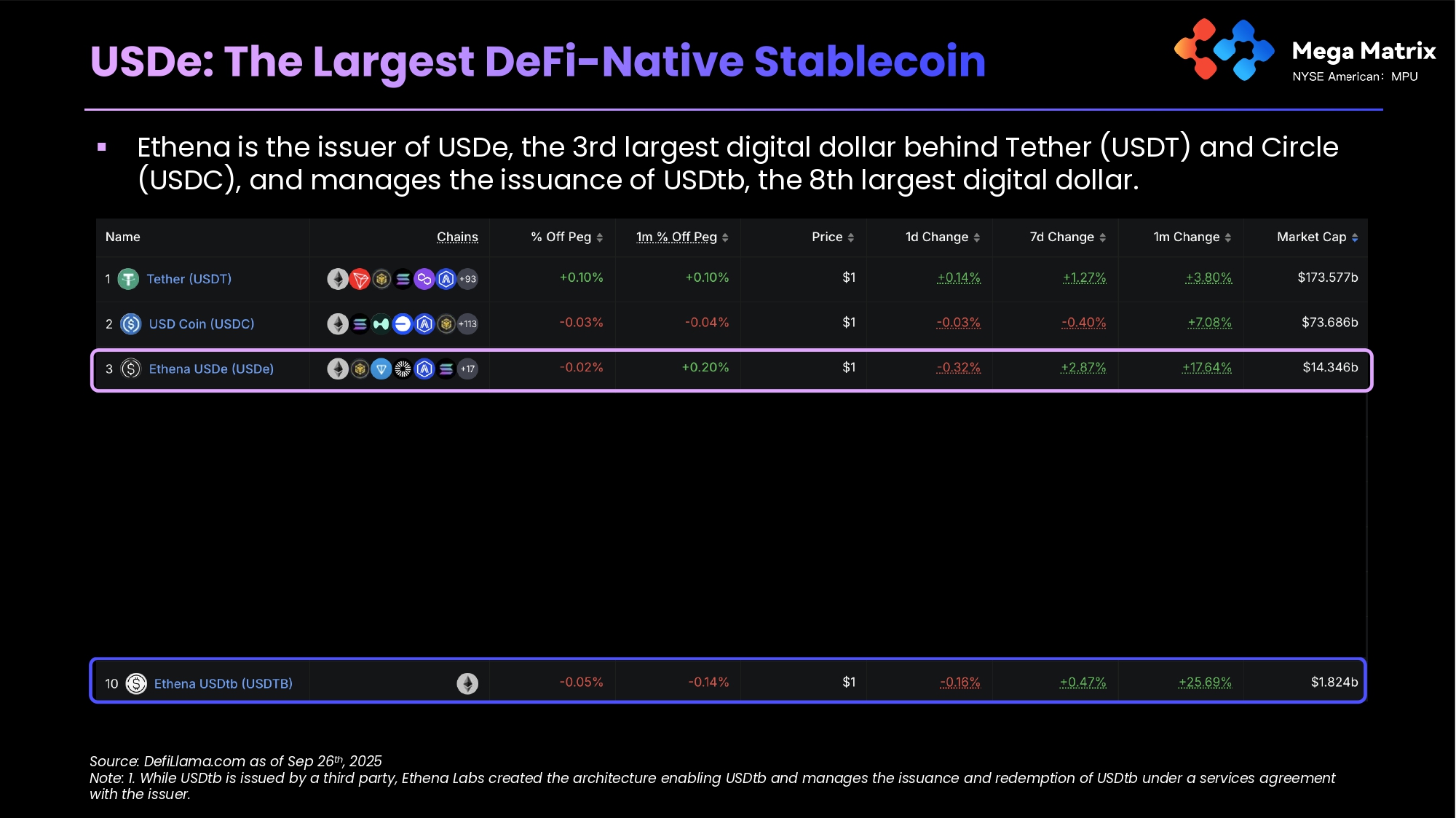

$4.0B $ENA Market Cap 15B Total $ENA Supply $14.3B USDe Supply $1.8B USDtb Supply 19% sUSDe APY 2024 24 Chains Accepted 813K Users 6% sUSDe APY current Ethena is a Leading DeFi Protocol on Ethereum, Issuing Crypto - Native Digital Dollars, whose governance token is $ENA Source: CoinMarketCap, https://ethena.fi/ Note: as of Sep 26 th , 2025 ▪ Ethena is the issuer of USDe, the 3rd largest digital dollar behind Tether (USDT) and Circle (USDC), and manages the issuance of USDtb, the 8th largest digital dollar.

Source: DefiLlama.com as of Sep 26 th , 2025 Note: 1. While USDtb is issued by a third party, Ethena Labs created the architecture enabling USDtb and manages the issuance and redemption of USDtb under a services agreement with the issuer.

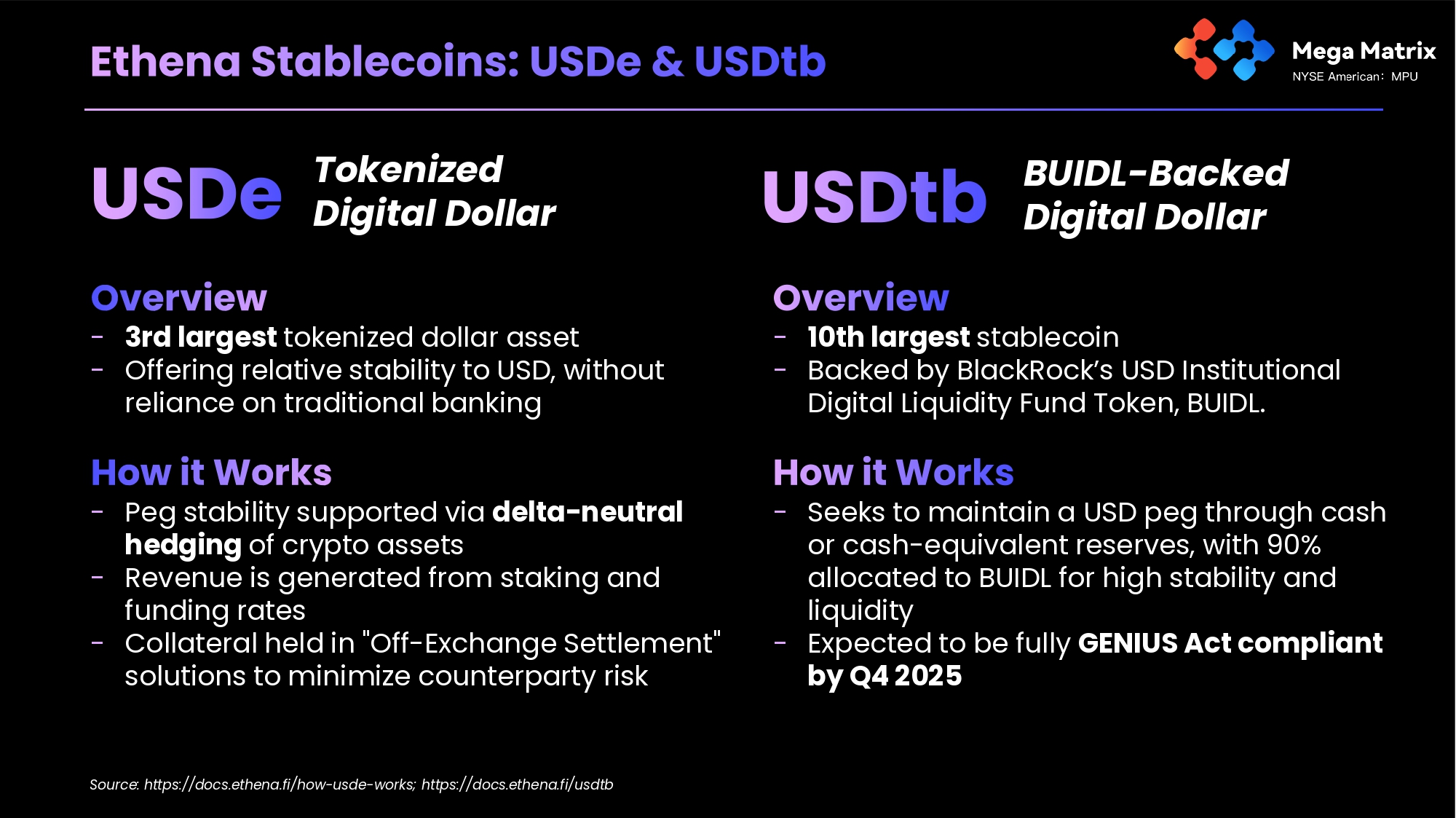

- 3rd largest tokenized dollar asset - Offering relative stability to USD, without reliance on traditional banking - Peg stability supported via delta - neutral hedging of crypto assets - Revenue is generated from staking and funding rates - Collateral held in "Off - Exchange Settlement" solutions to minimize counterparty risk - 10th largest stablecoin - Backed by BlackRock’s USD Institutional Digital Liquidity Fund Token, BUIDL. - Seeks to maintain a USD peg through cash or cash - equivalent reserves, with 90% allocated to BUIDL for high stability and liquidity - Expected to be fully GENIUS Act compliant by Q4 2025 Tokenized Digital Dollar BUIDL - Backed Digital Dollar Source: https://docs.ethena.fi/how - usde - works; https://docs.ethena.fi/usdtb Web3 Wallets ▪ Ethena’s USDe is a crypto - native synthetic dollar utilizing spot assets as backing, on - chain custody, and centralized liquidity venues Centralized Exchanges OES Providers USDe Redeem Receive USDT USDe Mint Deposit USDT Protocol Source: https://docs.ethena.fi/how - usde - works

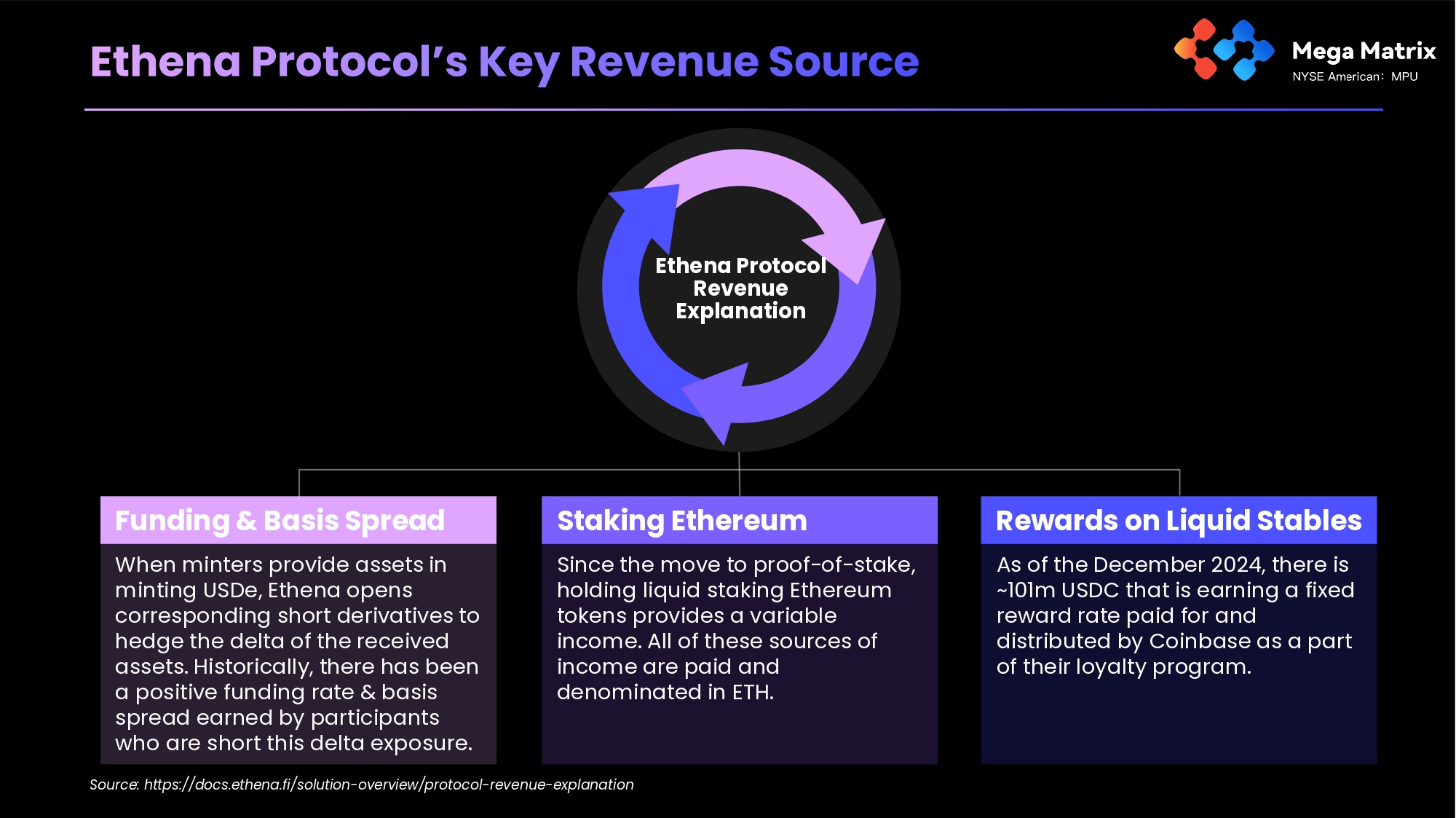

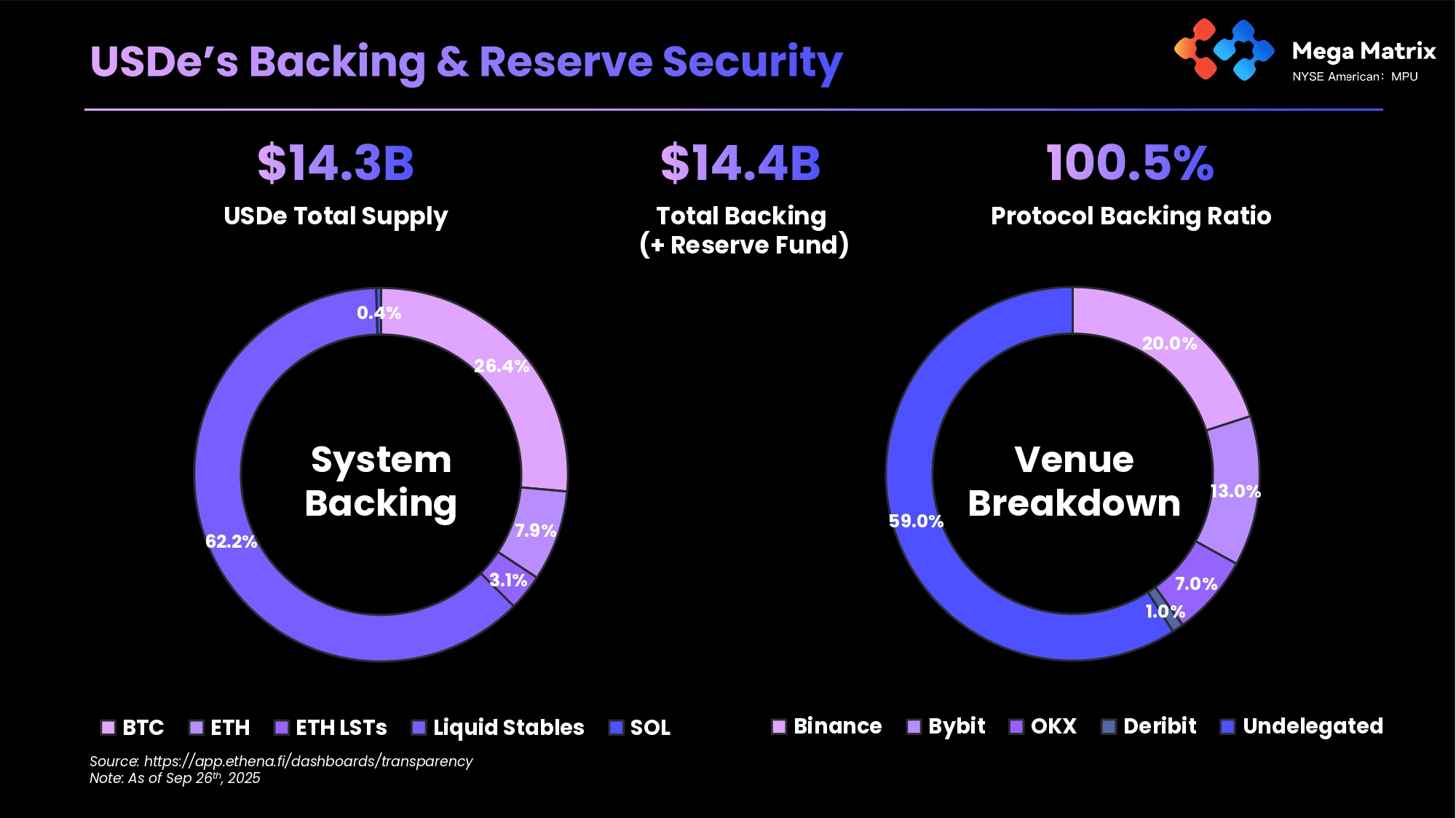

Funding & Basis Spread When minters provide assets in minting USDe, Ethena opens corresponding short derivatives to hedge the delta of the received assets. Historically, there has been a positive funding rate & basis spread earned by participants who are short this delta exposure. Staking Ethereum Since the move to proof - of - stake, holding liquid staking Ethereum tokens provides a variable income. All of these sources of income are paid and denominated in ETH. Rewards on Liquid Stables As of the December 2024, there is ~101m USDC that is earning a fixed reward rate paid for and distributed by Coinbase as a part of their loyalty program. Ethena Protocol Revenue Explanation Source: https://docs.ethena.fi/solution - overview/protocol - revenue - explanation USDe Total Supply Total Backing (+ Reserve Fund) Protocol Backing Ratio 26.4% 7.9% 3.1% 62.2% 0.4% SOL 20.0% 13.0% 7.0% 1.0% 59.0% Binance Bybit OKX Deribit Undelegated BTC ETH ETH LSTs Liquid Stables Source: https://app.ethena.fi/dashboards/transparency Note: As of Sep 26 th , 2025 System Backing Venue Breakdown

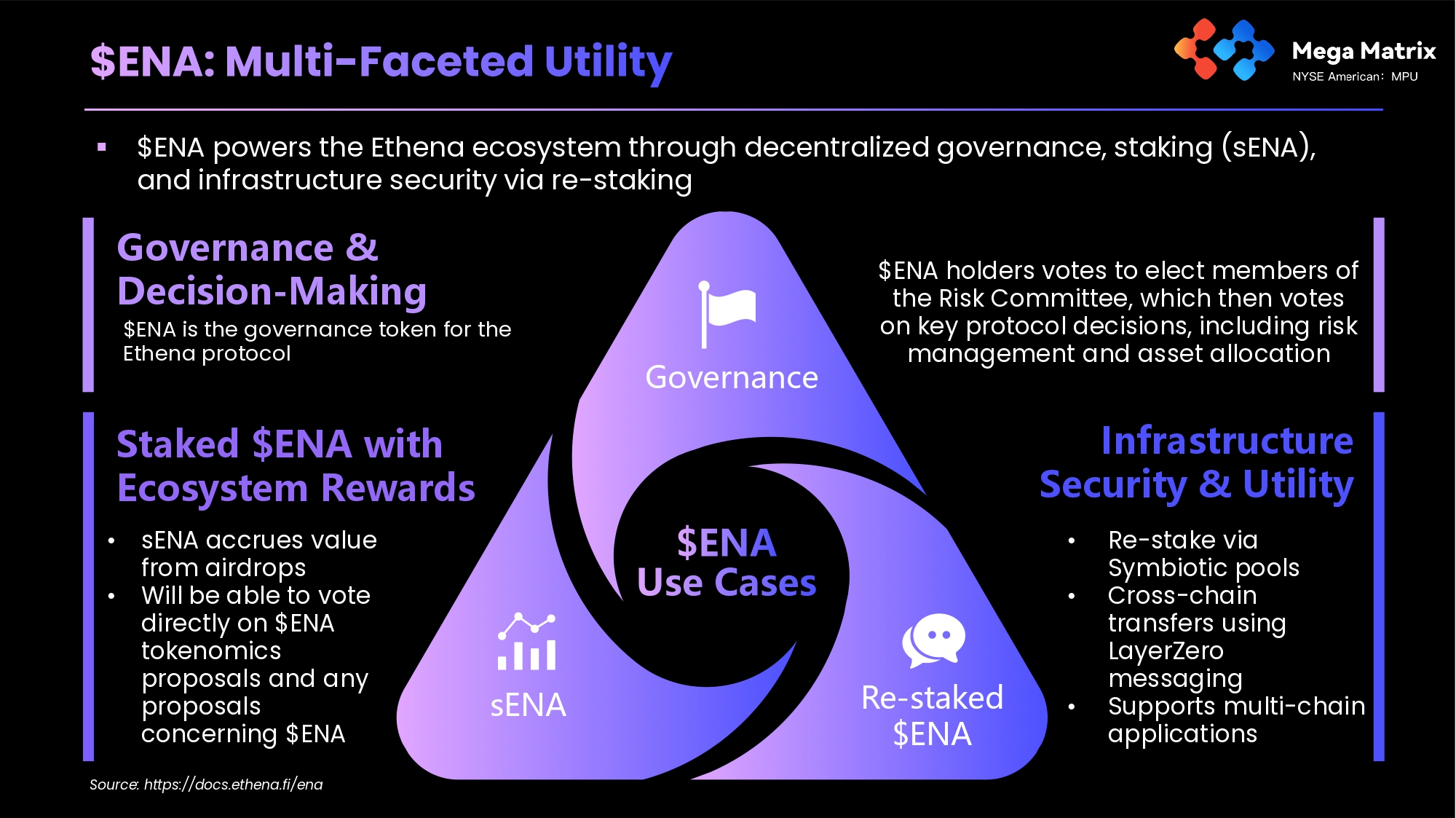

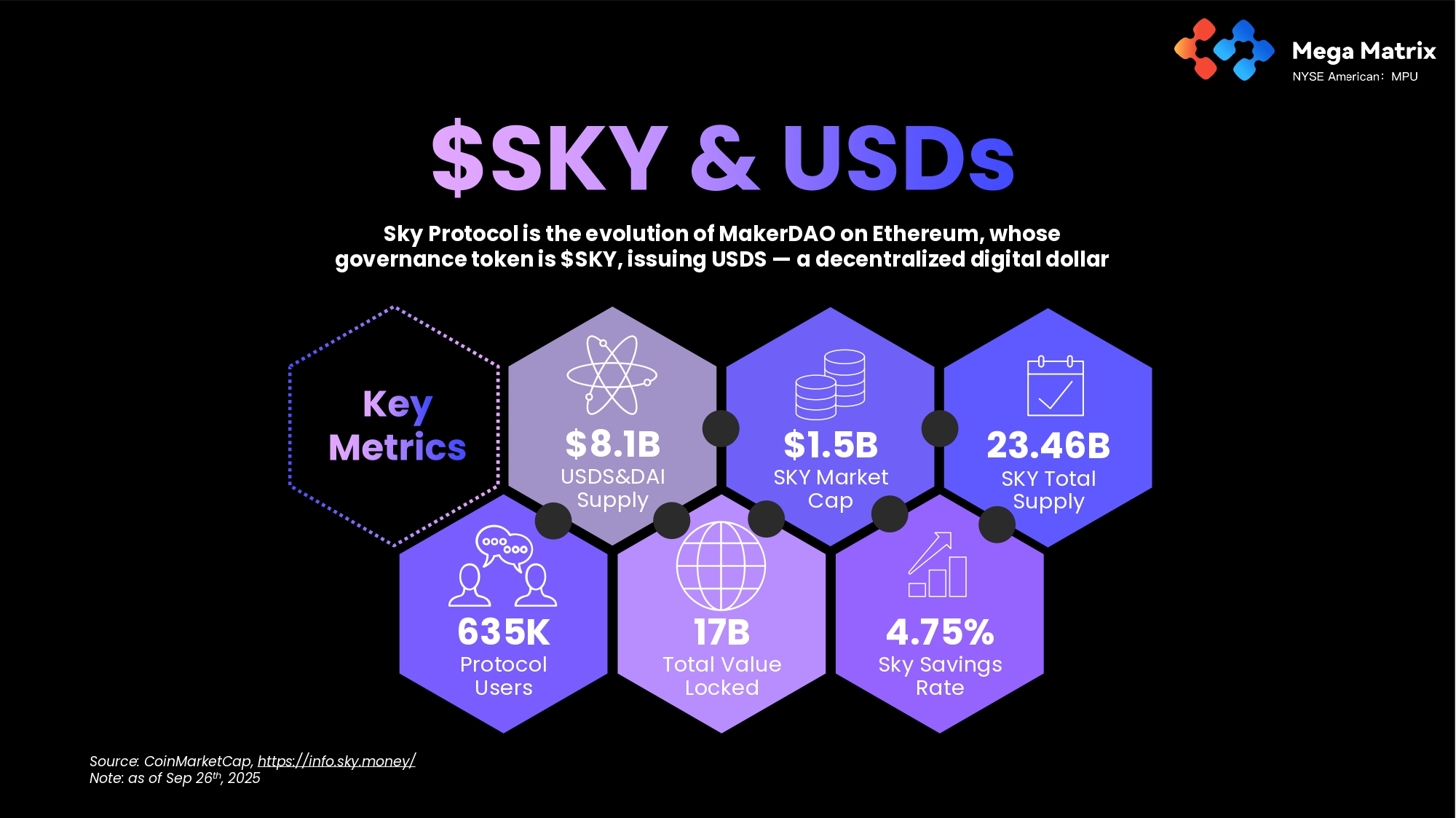

Governance Re - staked $ENA sENA $ENA holders votes to elect members of the Risk Committee, which then votes on key protocol decisions, including risk management and asset allocation Infrastructure Security & Utility • Re - stake via Symbiotic pools • Cross - chain transfers using LayerZero messaging • Supports multi - chain applications Staked $ENA with Ecosystem Rewards • sENA accrues value from airdrops • Will be able to vote directly on $ENA tokenomics proposals and any proposals concerning $ENA Governance & Decision - Making $ENA is the governance token for the Ethena protocol ▪ $ENA powers the Ethena ecosystem through decentralized governance, staking (sENA), and infrastructure security via re - staking Source: https://docs.ethena.fi/ena $8.1B USDS&DAI Supply 17B Total Value Locked $1.5B SKY Market Cap 23.46B SKY Total Supply 635K Protocol Users 4.75% Sky Savings Rate Sky Protocol is the evolution of MakerDAO on Ethereum, whose governance token is $SKY, issuing USDS — a decentralized digital dollar Source: CoinMarketCap, https://info.sky.money/ Note: as of Sep 26 th , 2025

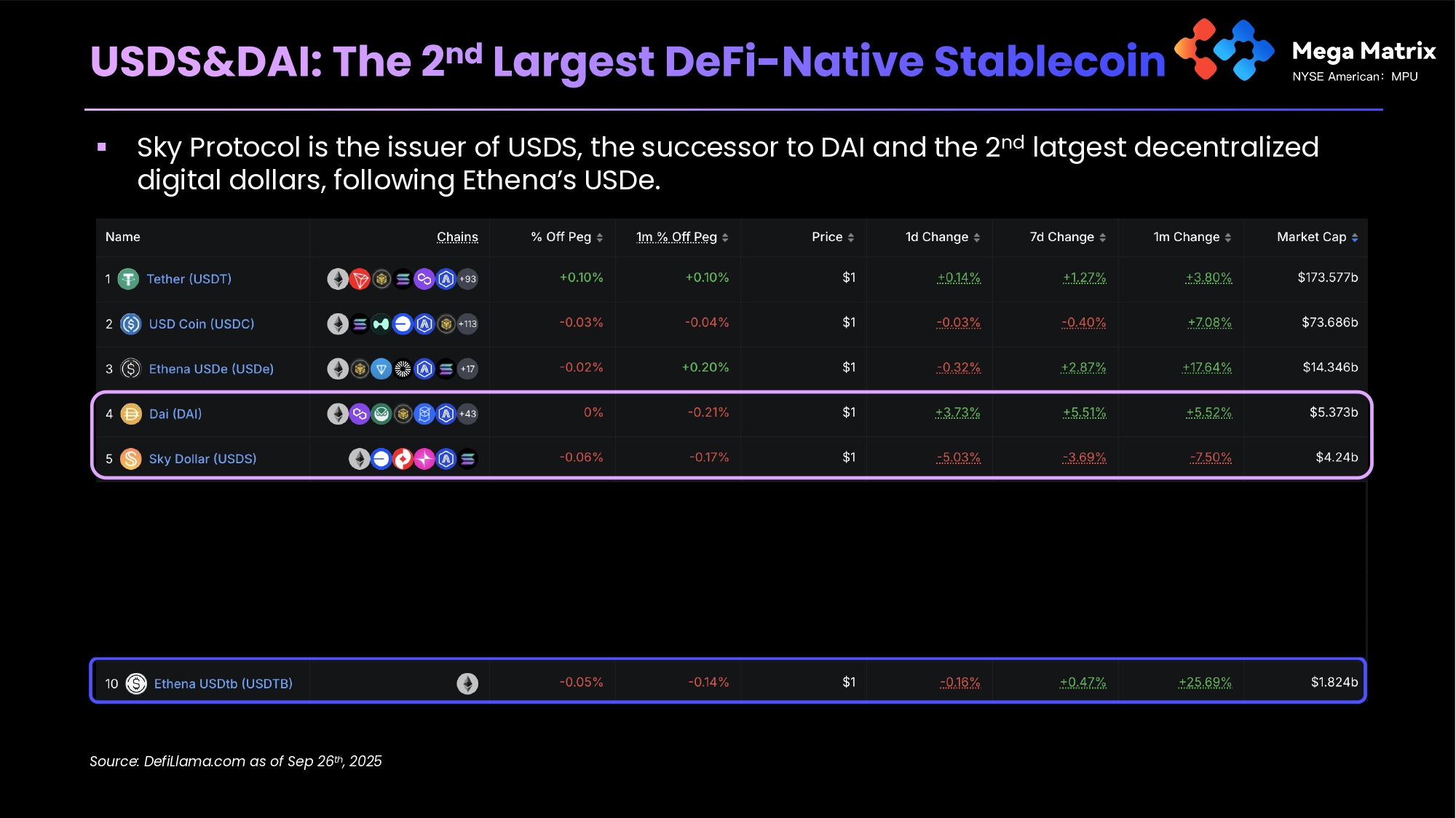

Source: DefiLlama.com as of Sep 26 th , 2025 ▪ Sky Protocol is the issuer of USDS, the successor to DAI and the 2 nd latgest decentralized digital dollars, following Ethena’s USDe.

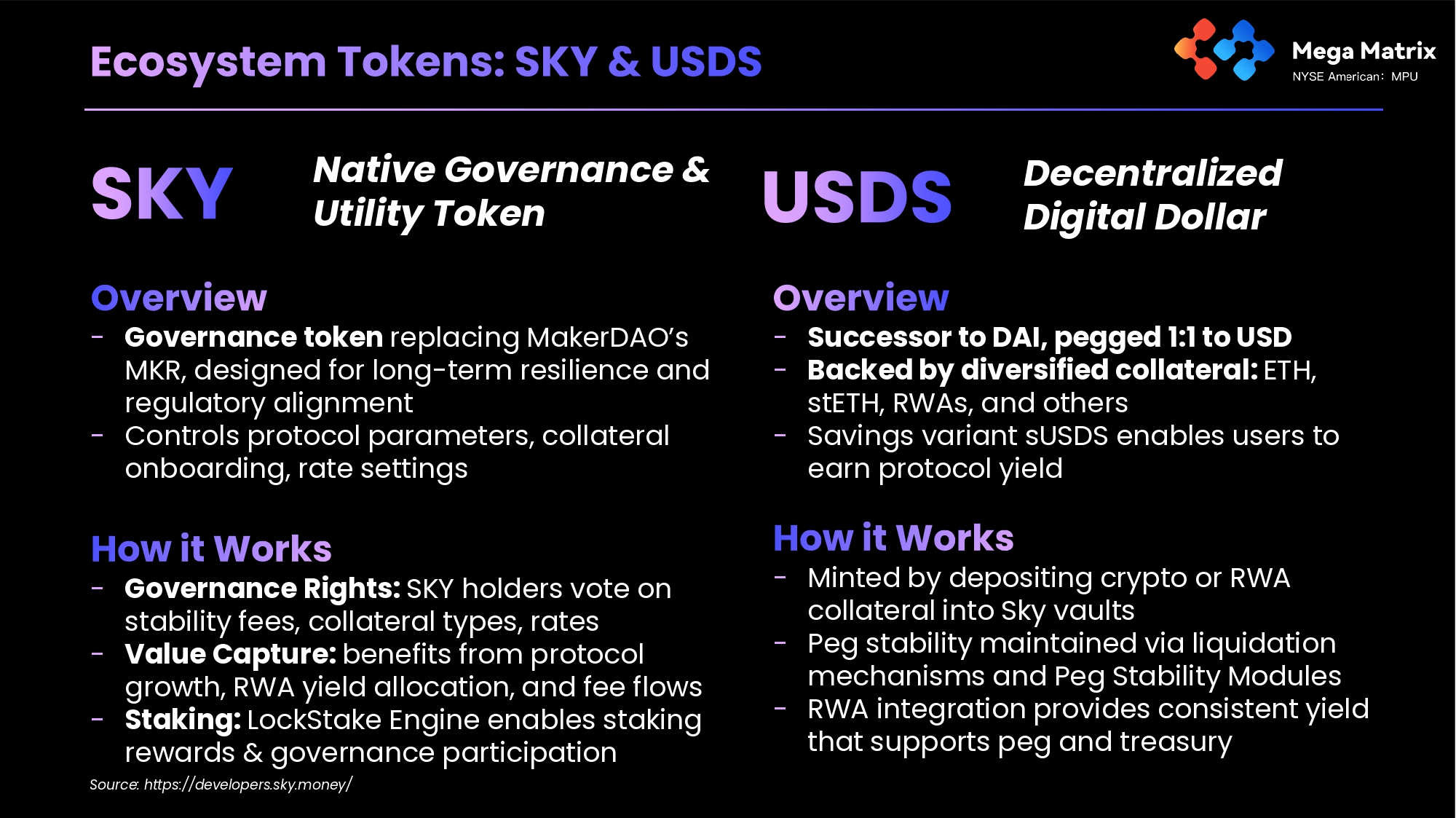

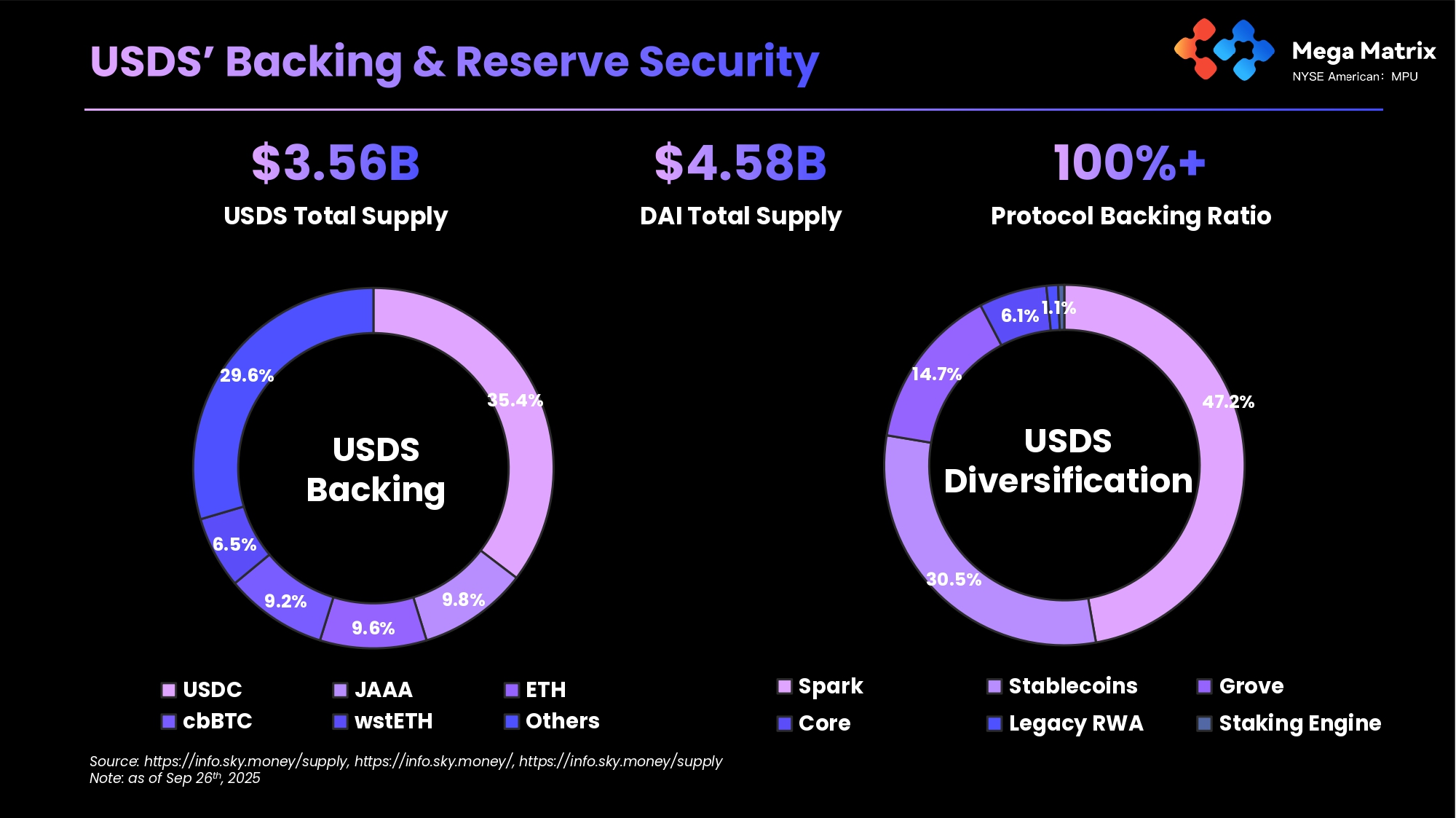

- Governance token replacing MakerDAO’s MKR, designed for long - term resilience and regulatory alignment - Controls protocol parameters, collateral onboarding, rate settings - Successor to DAI, pegged 1:1 to USD - Backed by diversified collateral: ETH, stETH, RWAs, and others - Savings variant sUSDS enables users to earn protocol yield - Minted by depositing crypto or RWA collateral into Sky vaults - Peg stability maintained via liquidation mechanisms and Peg Stability Modules - RWA integration provides consistent yield that supports peg and treasury Native Governance & Utility Token Decentralized Digital Dollar - Governance Rights: SKY holders vote on stability fees, collateral types, rates - Value Capture: benefits from protocol growth, RWA yield allocation, and fee flows - Staking: LockStake Engine enables staking rewards & governance participation Source: https://developers.sky.money/ USDS Total Supply DAI Total Supply Protocol Backing Ratio 35.4% 9.8% 9.6% 9.2% 6.5% 29.6% USDC cbBTC JAAA wstETH ETH Others 47.2% 30.5% 14.7% 6.1% 1.1% Spark Core Stablecoins Legacy RWA Grove Staking Engine Source: https://info.sky.money/supply, https://info.sky.money/, https://info.sky.money/supply Note: as of Sep 26 th , 2025 USDS Backing USDS Diversification

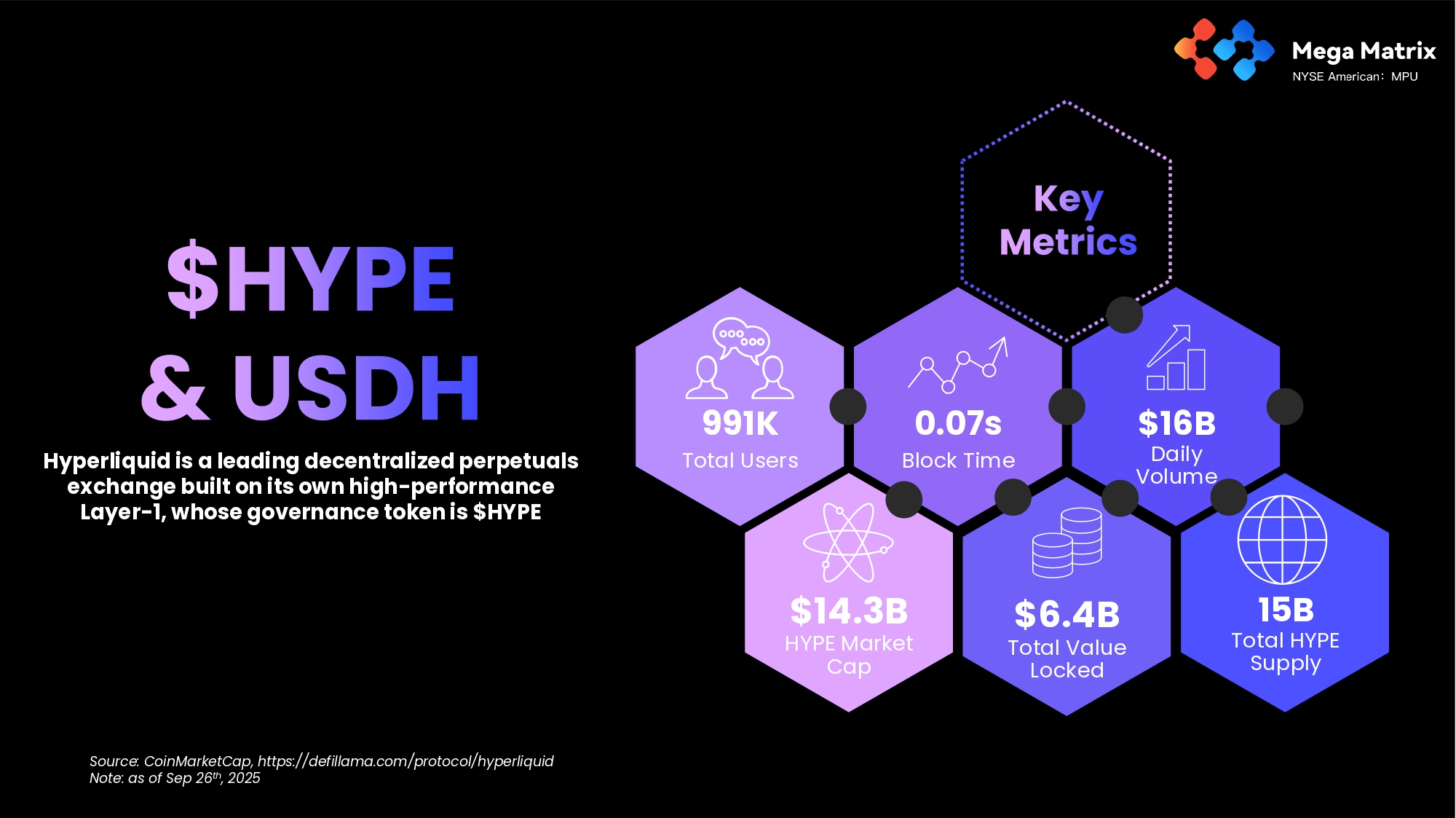

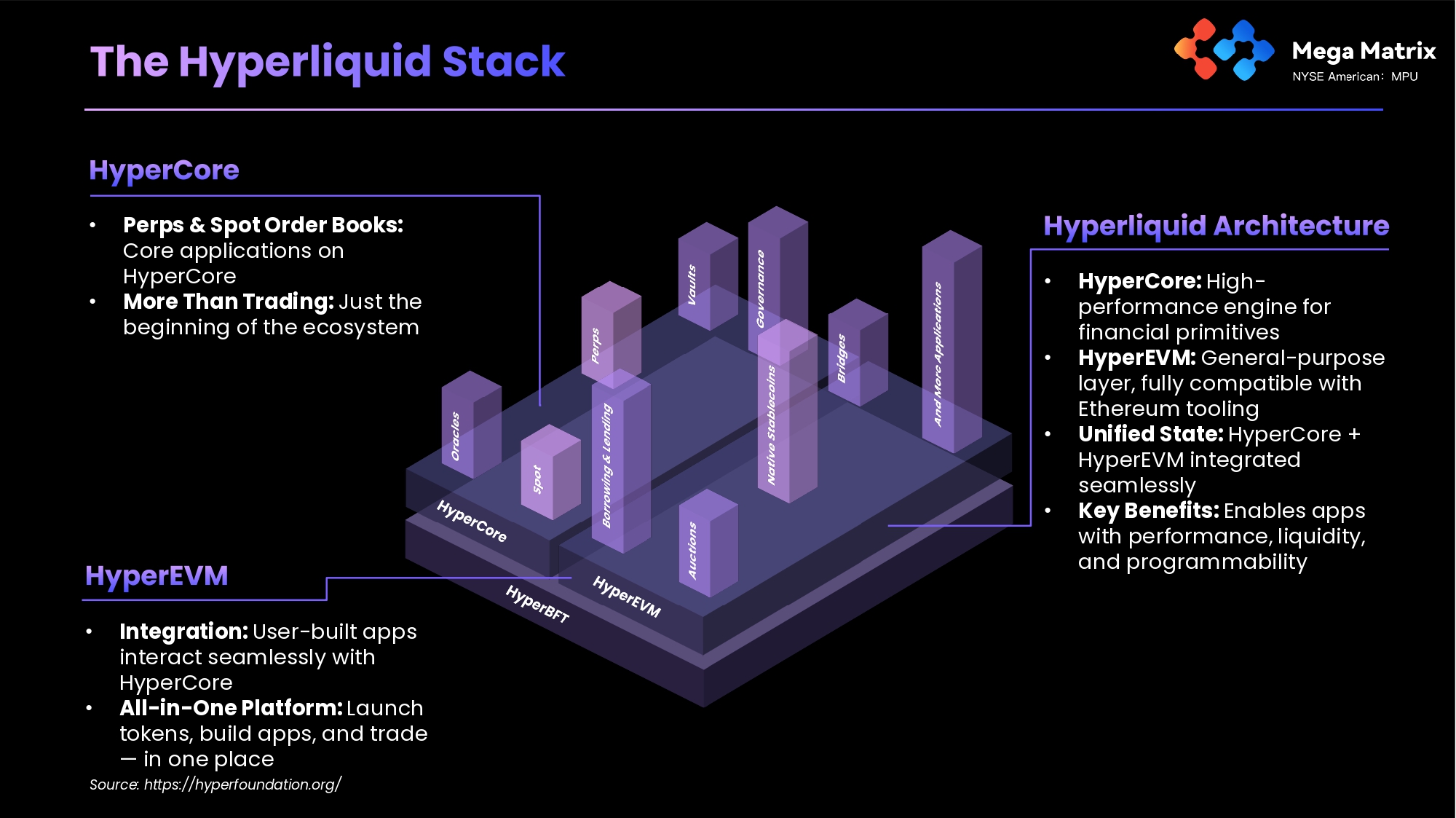

Hyperliquid is a leading decentralized perpetuals exchange built on its own high - performance Layer - 1, whose governance token is $HYPE Source: CoinMarketCap, https://defillama.com/protocol/hyperliquid Note: as of Sep 26 th , 2025 991K Total Users $14.3B HYPE Market Cap 0.07s Block Time $16B Daily Volume 15B Total HYPE Supply $6.4B Total Value Locked • Perps & Spot Order Books: Core applications on HyperCore • More Than Trading: Just the beginning of the ecosystem • HyperCore: High - performance engine for financial primitives • HyperEVM: General - purpose layer, fully compatible with Ethereum tooling • Unified State: HyperCore + HyperEVM integrated seamlessly • Key Benefits : Enables apps with performance, liquidity, and programmability • Integration: User - built apps interact seamlessly with HyperCore • All - in - One Platform: Launch tokens, build apps, and trade — in one place Source: https://hyperfoundation.org/ - Ranked 11st among on chain market cap - Native governance & utility token of the Hyperliquid Layer - 1 blockchain - Total supply: ~1 billion HYPE tokens - USD - pegged stablecoin under Hyperliquid and will be deployed natively on HyperEVM - USDH ticker awarded to and expected to be issue/manage by Native Markets . - Reduce dependence on external stablecoins which currently dominate liquidity & collateral on Hyperliquid - Cpture value that would otherwise flow outside the ecosystem. - Improve security / sovereignty Native Governance & Utility Token Stablecoin for Hyperliquid (coming soon) - Governance: HYPE holders vote on key protocol parameters - Staking / Security: users stake HYPE to support validators, help secure the chain, and earn staking rewards - Fee / Utility: used for transaction/gas fees, etc Source: https://hyperliquid.gitbook.io/hyperliquid - docs

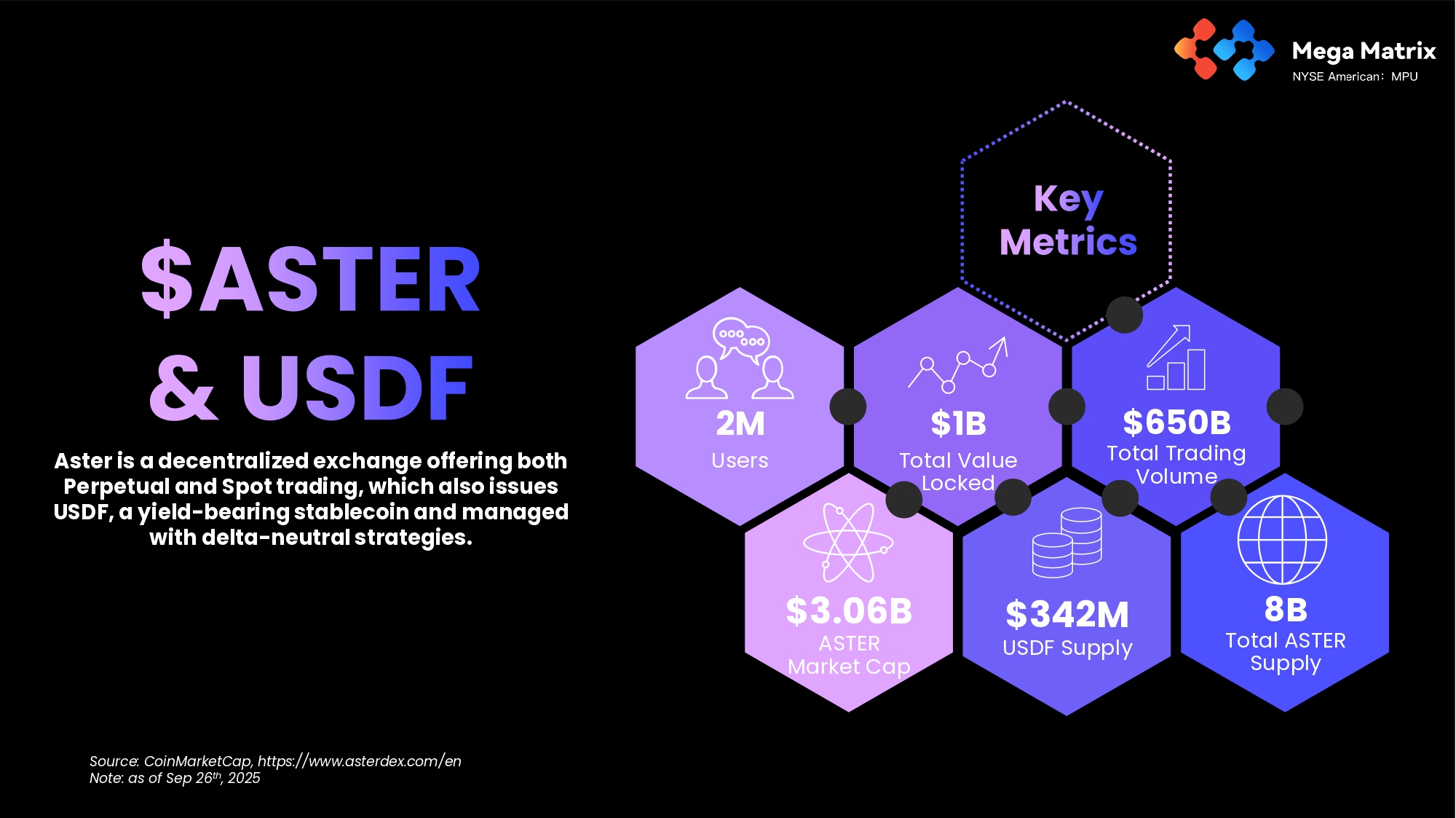

Aster is a decentralized exchange offering both Perpetual and Spot trading, which also issues USDF, a yield - bearing stablecoin and managed with delta - neutral strategies.

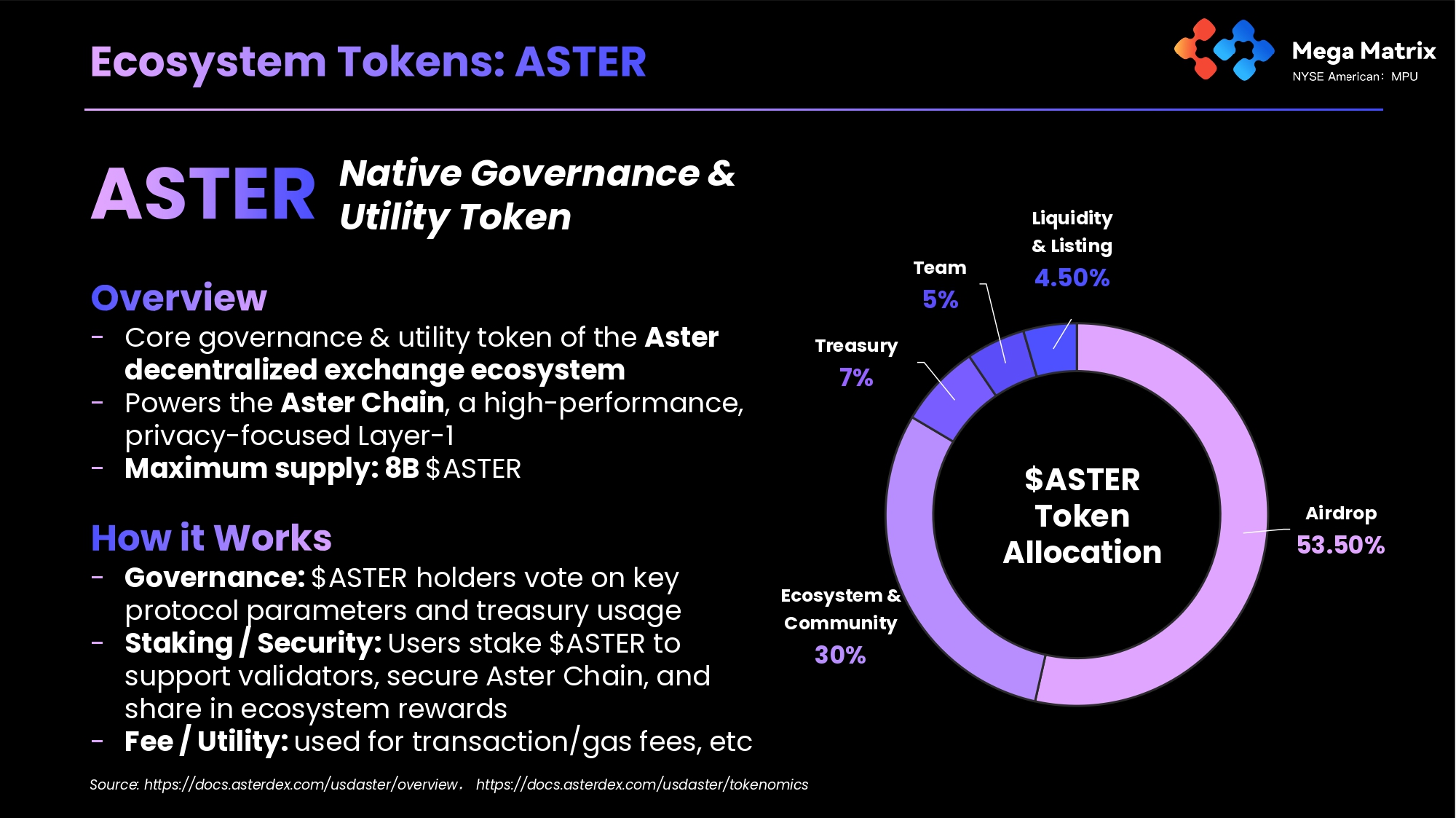

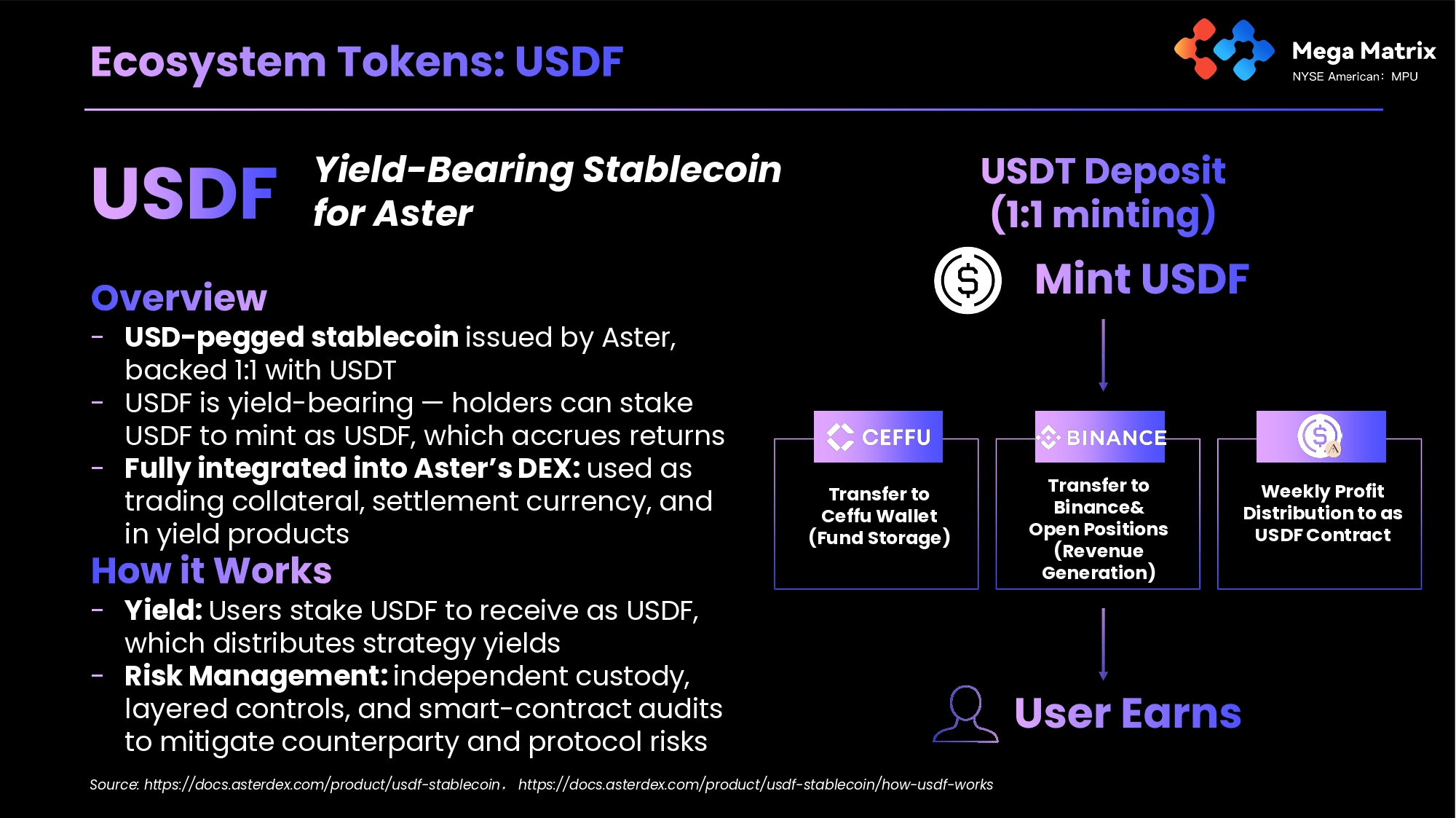

Source: CoinMarketCap, https:// www.asterdex.com/en Note: as of Sep 26 th , 2025 2M Users $3.06B ASTER Market Cap $1B Total Value Locked $650B Total Trading Volume 8B Total ASTER Supply $342M USDF Supply - Core governance & utility token of the Aster decentralized exchange ecosystem - Powers the Aster Chain , a high - performance, privacy - focused Layer - 1 - Maximum supply: 8B $ASTER - Governance: $ASTER holders vote on key protocol parameters and treasury usage - Staking / Security: Users stake $ASTER to support validators, secure Aster Chain, and share in ecosystem rewards - Fee / Utility: used for transaction/gas fees, etc Native Governance & Utility Token Source: https://docs.asterdex.com/usdaster/overview ˈ https://docs.asterdex.com/usdaster/tokenomics Airdrop 53.50% Ecosystem & Community 30% Treasury 7% Team 5% Liquidity & Listing 4.50% $ASTER Token Allocation - USD - pegged stablecoin issued by Aster, backed 1:1 with USDT - USDF is yield - bearing — holders can stake USDF to mint as USDF, which accrues returns - Fully integrated into Aster’s DEX: used as trading collateral, settlement currency, and in yield products Yield - Bearing Stablecoin for Aster - Yield: Users stake USDF to receive as USDF, which distributes strategy yields - Risk Management: independent custody, layered controls, and smart - contract audits to mitigate counterparty and protocol risks Source: https://docs.asterdex.com/product/usdf - stablecoin ˈ https://docs.asterdex.com/product/usdf - stablecoin/how - usdf - works Transfer to Ceffu Wallet (Fund Storage) Transfer to Binance& Open Positions (Revenue Generation) Weekly Profit Distribution to as USDF Contract

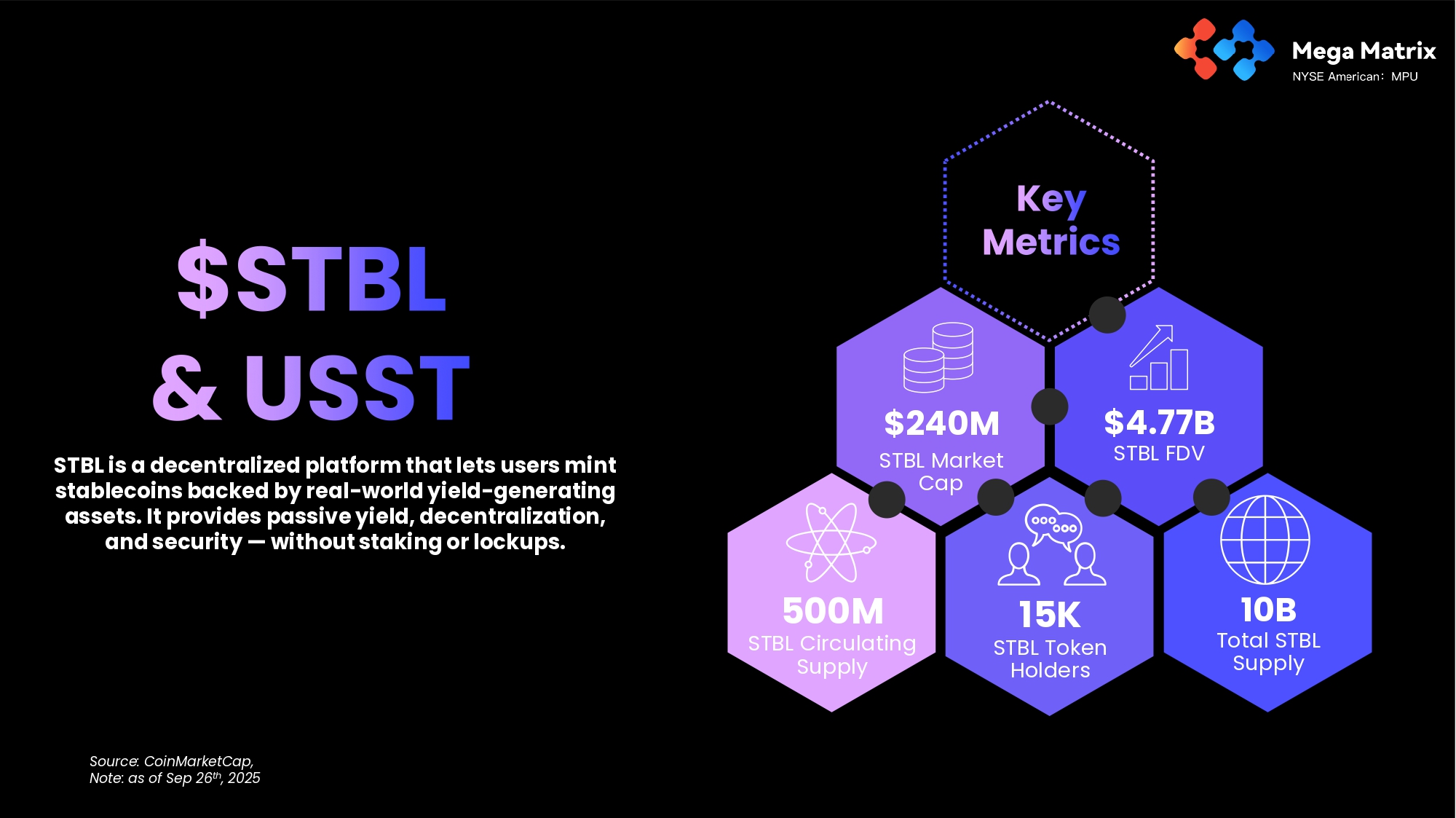

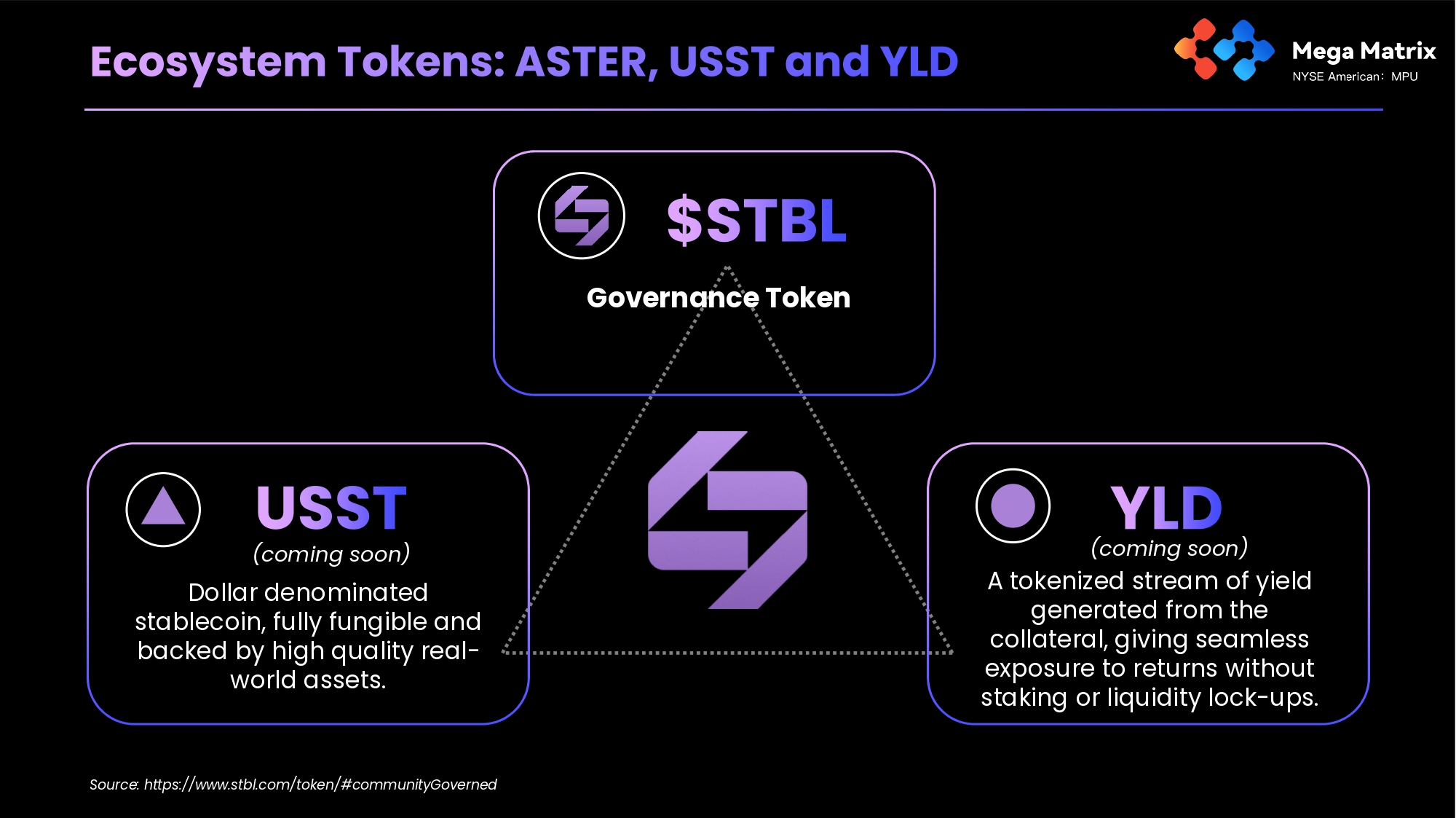

$240M STBL Market Cap STBL is a decentralized platform that lets users mint stablecoins backed by real - world yield - generating assets. It provides passive yield, decentralization, and security — without staking or lockups. Source: CoinMarketCap, Note: as of Sep 26 th , 2025 500M STBL Circulating Supply $4.77B STBL FDV 10B Total STBL Supply 15K STBL Token Holders Source: https:// www.stbl.com/token/#communityGoverned Governance Token (coming soon) Dollar denominated stablecoin, fully fungible and backed by high quality real - world assets.

(coming soon) A tokenized stream of yield generated from the collateral, giving seamless exposure to returns without staking or liquidity lock - ups.

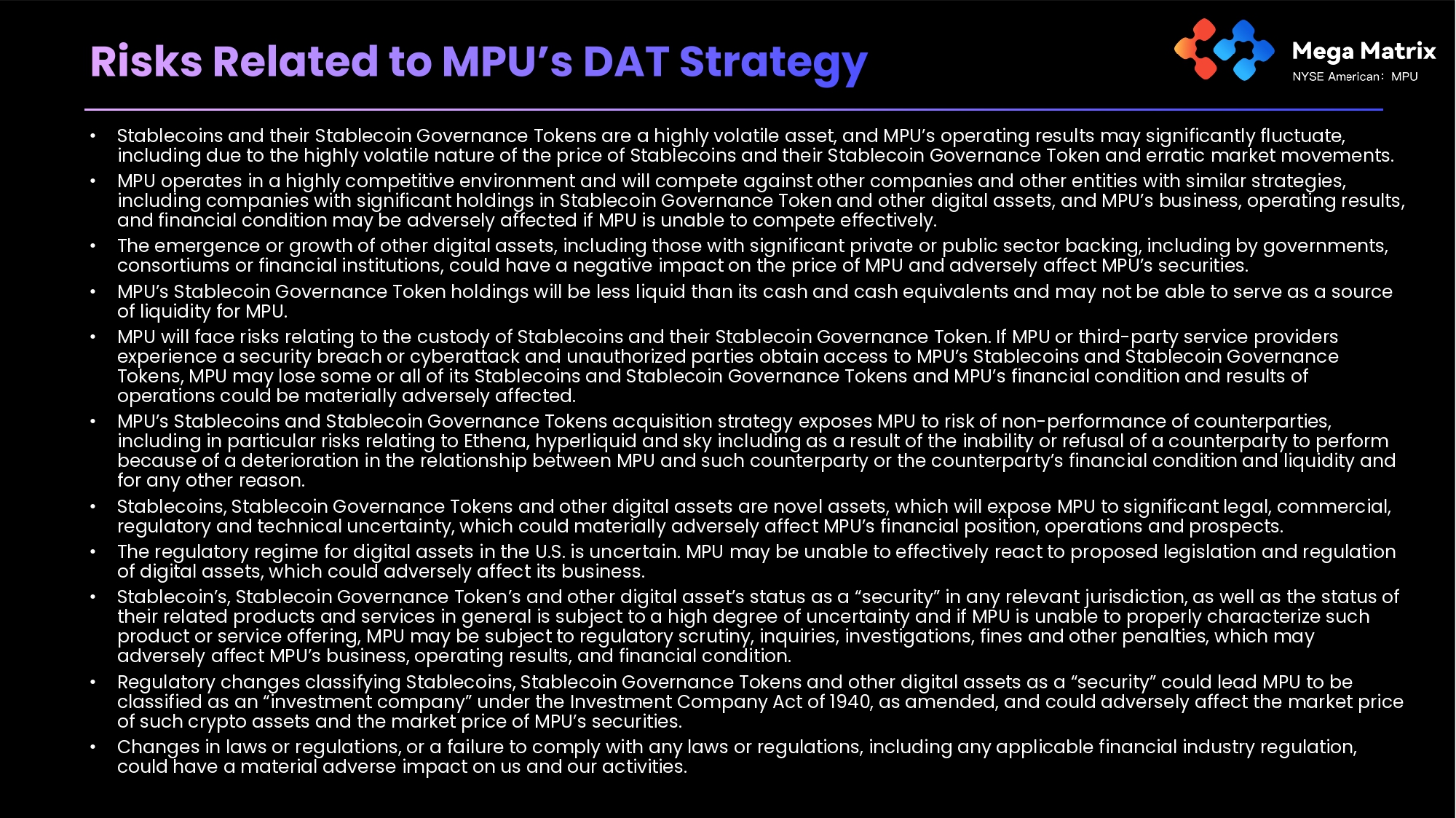

• Stablecoins and their Stablecoin Governance Tokens are a highly volatile asset, and MPU’s operating results may significantly fluctuate, including due to the highly volatile nature of the price of Stablecoins and their Stablecoin Governance Token and erratic market movements. • MPU operates in a highly competitive environment and will compete against other companies and other entities with similar strategies, including companies with significant holdings in Stablecoin Governance Token and other digital assets, and MPU’s business, operating results, and financial condition may be adversely affected if MPU is unable to compete effectively. • The emergence or growth of other digital assets, including those with significant private or public sector backing, including by governments, consortiums or financial institutions, could have a negative impact on the price of MPU and adversely affect MPU’s securities. • MPU’s Stablecoin Governance Token holdings will be less liquid than its cash and cash equivalents and may not be able to serve as a source of liquidity for MPU. • MPU will face risks relating to the custody of Stablecoins and their Stablecoin Governance Token. If MPU or third - party service providers experience a security breach or cyberattack and unauthorized parties obtain access to MPU’s Stablecoins and Stablecoin Governance Tokens, MPU may lose some or all of its Stablecoins and Stablecoin Governance Tokens and MPU’s financial condition and results of operations could be materially adversely affected. • MPU’s Stablecoins and Stablecoin Governance Tokens acquisition strategy exposes MPU to risk of non - performance of counterparties, including in particular risks relating to Ethena, hyperliquid and sky including as a result of the inability or refusal of a counterparty to perform because of a deterioration in the relationship between MPU and such counterparty or the counterparty’s financial condition and liquidity and for any other reason. • Stablecoins, Stablecoin Governance Tokens and other digital assets are novel assets, which will expose MPU to significant legal, commercial, regulatory and technical uncertainty, which could materially adversely affect MPU’s financial position, operations and prospects. • The regulatory regime for digital assets in the U.S. is uncertain. MPU may be unable to effectively react to proposed legislation and regulation of digital assets, which could adversely affect its business. • Stablecoin’s, Stablecoin Governance Token’s and other digital asset’s status as a “security” in any relevant jurisdiction, as well as the status of their related products and services in general is subject to a high degree of uncertainty and if MPU is unable to properly characterize such product or service offering, MPU may be subject to regulatory scrutiny, inquiries, investigations, fines and other penalties, which may adversely affect MPU’s business, operating results, and financial condition. • Regulatory changes classifying Stablecoins, Stablecoin Governance Tokens and other digital assets as a “security” could lead MPU to be classified as an “investment company” under the Investment Company Act of 1940, as amended, and could adversely affect the market price of such crypto assets and the market price of MPU’s securities. • Changes in laws or regulations, or a failure to comply with any laws or regulations, including any applicable financial industry regulation, could have a material adverse impact on us and our activities.

Mega Matrix Inc. (NYSE American: MPU)

Exhibit 99.2

MPU to Diversify DAT Strategy with Basket of Leading Stablecoins and Governance Tokens

Singapore – October 1, 2025— Mega Matrix Inc. (“MPU” or the “Company”) today announced a strategic update to its Digital Asset Treasury (“DAT”) strategy. The Company will transition from a single-asset approach focused on Ethena’s governance token (ENA) to a diversified basket of leading stablecoins and their governance tokens.

The enhanced DAT framework is designed around a “dual-engine” model:

| ● | Stable Yield — Holding a basket of stablecoins and deploying them in low-risk decentralized finance (DeFi) strategies to generate recurring income. |

| ● | Growth Potential — Allocating to governance tokens of leading stablecoin protocols, capturing the long-term appreciation of the stablecoin sector. |

“Stablecoins have become a core asset class in global digital finance, with U.S. Treasury officials projecting the market could reach $2 trillion by 2028,” said Songtao Jia, Chief Strategy Officer of MPU. “By refining our DAT strategy, MPU is moving beyond a single-token approach to embrace multiple leading ecosystems — USDe/USDtb: ENA, USDS/DAI: SKY, USDH: HYPE, USDF: Aster, and USST: STBL. This positions MPU to capture both stable yield and the governance upside that will define the next chapter of digital assets.”

This evolution provides MPU shareholders with balanced and resilient exposure, combining yield stability with long-term growth participation. It also positions the Company as one of the first U.S.-listed firms to anchor its treasury on a diversified stablecoin ecosystem, executed within a transparent and compliant framework.

About Mega Matrix Inc.: Mega Matrix Inc. (NYSE American: MPU), a holding company headquartered in Singapore is executing its strategic digital asset treasury (“DAT”) strategy by looking to diversifying its basket of leading stablecoins and their governance tokens, and operates FlexTV, a short-video streaming platform and producer of short dramas, through Yuder Pte, Ltd., an indirect wholly owned subsidiary of the Company. For more information, please contact info@megamatrix.io or visit http://www.megamatrix.io.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. All statements in this press release other than statements that are purely historical are forward looking statements. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose,” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees for future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, are the: ability to manage growth; ability to identify and integrate future acquisitions; ability to grow and expand our FlexTV business; ability to purchase stablecoin governance tokens, Bitcoin or Ethereum at the price that we want; ability to reinitiate the ETH staking business, ability to implement the strategic expansion into the stablecoin sector, ability to implement the new business strategy with a focus on stablecoin governance token and ability to create value; the regulatory volatility on stablecoins and governance tokens; ability to obtain additional financing in the future to fund capital expenditures and our digital asset treasury (“DAT”) reserve strategy and ability to create value; fluctuations in general economic and business conditions; costs or other factors adversely affecting the Company’s profitability; litigation involving patents, intellectual property, and other matters; potential changes in the legislative and regulatory environment; a pandemic or epidemic; the possibility that the Company may not succeed in developing its new lines of businesses due to, among other things, changes in the business environment, competition, changes in regulation, or other economic and policy factors; and the possibility that the Company’s new lines of business may be adversely affected by other economic, business, and/or competitive factors. The forward-looking statements in this press release and the Company’s future results of operations are subject to additional risks and uncertainties set forth under the heading “Risk Factors” in documents filed by the Company with the Securities and Exchange Commission (“SEC”), including the Company’s latest annual report on Form 20-F, filed with the SEC on March 28, 2025, and are based on information available to the Company on the date hereof. In addition, such risks and uncertainties include the inherent risks with investing in digital assets such as stablecoins, governance tokens, Bitcoin and/or Ethereum, Digital asset’s volatility; and risk of implementing a new DAT strategy focusing on digital assets. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this press release.

Disclosure Channels

We announce material information about the Company and its services and for complying with our disclosure obligation under Regulation FD via the following social media channels:

| X (f/k/a Twitter): | twitter.com/MegaMatrixMPU |

| Facebook: | facebook.com/megamatrixmpu |

| LinkedIn: | linkedin.com/company/megamatrixmpu |

The Company will also use its landing page on its corporate website (www.megamatrix.io) to host social media disclosures and/or links to/from such disclosures. The information we post through these social media channels may be deemed material. Accordingly, investors should monitor these social media channels in addition to following our website, press releases, SEC filings and public conference calls and webcasts. The social media channels that we intend to use as a means of disclosing the information described above may be updated from time to time as listed on our website.

For inquiries, please contact: Info@megamatrix.io

SOURCE Mega Matrix Inc.