UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

September 24, 2025

Date of Report (Date of earliest event reported)

SUI GROUP HOLDINGS LIMITED

(Exact Name of Registrant as Specified in its Charter)

| Minnesota | 001-41472 | 90-0316651 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

| 1907 Wayzata Boulevard, Suite 205 Wayzata, MN |

55391 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (952) 479-1923

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.001 per share | SUIG | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On September 24, 2025, Sui Group Holdings Limited (the “Company”) issued a press release announcing that it had repurchased 276,296 shares of its common stock under its $50 million stock repurchase program and providing an update on its SUI treasury holdings. The press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated into this Item 7.01 by reference. The information in Item 7.01 (including Exhibit 99.1) are “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of such section nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits

(a) Exhibits

| Number | Description | |

| 99.1 | Press Release, dated September 24, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated September 25, 2025

| Sui Group Holdings Limited | ||

| By: | /s/ Douglas M. Polinsky | |

| Name: | Douglas M. Polinsky | |

| Title: | Chief Executive Officer | |

Exhibit 99.1

SUI Group Repurchases 276,296 Shares Under Newly Authorized $50 Million Stock Repurchase Program

The Company also Provides an Update on its Treasury Holdings and Related Metrics

WAYZATA, MN, September 24, 2025 – SUI Group Holdings Limited (“SUI Group,” “SUIG” or the “Company”) (NASDAQ: SUIG), the only publicly traded company with an official relationship with the Sui Foundation, today announced it has repurchased approximately 276,296 shares of its common stock under its new $50 million stock repurchase program. The Company is also providing an update on its treasury holdings and related metrics.

Following the authorization of SUI Group’s new $50 million stock repurchase program, the Company repurchased approximately 276,296 shares of its common stock at an average price of $4.37 per share between September 15, 2025 and September 18, 2025. Sui Group continues to believe share repurchases at these levels are immediately accretive to existing stockholders and underscore its belief in its underlying fundamentals and long-term value proposition.

“We are taking deliberate steps to enhance shareholder value while building a premier treasury platform designed for scale, transparency, and sustained value creation,” said Stephen Mackintosh, Chief Investment Officer of SUI Group. “Our ongoing share repurchases are high-conviction investments that demonstrate our confidence in SUI Group’s long-term growth trajectory and the foundational strength of our platform. We remain committed to disciplined capital allocation and will continue to evaluate opportunities that we believe can bolster shareholder returns in a dynamic market environment.”

Share repurchases may be made through a combination of open market repurchases, privately negotiated transactions, or other means, in accordance with applicable securities laws and subject to market conditions and other factors.

SUI Group Treasury Update

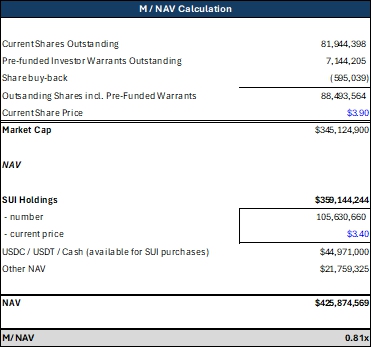

| ● | Treasury: SUI Group held 105,630,660 SUI as of September 23, 2025. |

| ● | Net Asset Value: Using the September 23, 2025 price of $3.40 per SUI, 105.6 million SUI are valued at approximately $359 million. |

| ● | SUI per Share: Using fully adjusted shares issued and outstanding as of September 23, 2025 of 88.5 million, SUI Group has grown to approximately 1.19 SUI per share of common stock (vs 0.92 on August 11, 2025), or $4.06 per share of common stock (vs $3.54 on August 11, 2025). |

| ● | Staking: Substantially all of the Company’s SUI is being staked, earning an approximate 2.2% yield. The current estimated daily yield is approximately $21,600. |

| ● | Valuation: Using the closing price of SUIG common stock and SUI token price on September 23, 2025, SUIG is trading at an approximate mNAV of 0.81x with calculation details below. |

About SUI Group Holdings Limited

SUI Group is the only publicly traded company with an official Sui Foundation relationship, providing institutional-grade exposure to the SUI blockchain. Through its industry-first SUI treasury strategy, SUI Group is building a premier, foundation-backed digital asset treasury platform designed for scale, transparency and long-term value creation. SUI’s high-speed, horizontally scalable architecture positions it as one of the leading blockchains designed for mass adoption, powering next-generation applications in finance, gaming, AI and beyond. The Company plans to continue its specialty finance operations while executing its SUI treasury strategy. For more information, please visit www.SUIG.io.

Forward Looking Statements

This press release contains “forward looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the expected benefits of the Company’s rebranding, expectations with respect to future performance and growth of the Company; the ability of the Company to execute its plans, the Company’s digital asset treasury strategy, the digital assets to be held by the Company and future performance. Forward looking statements are subject to numerous risks and uncertainties, many of which are beyond the Company’s control, and actual results may differ materially. Applicable risks and uncertainties include, among others, the risk that the transactions described herein may not be completed in a timely manner or at all; the Company’s ability to achieve profitable operations; fluctuations in the market price of SUIG that will impact the Company’s accounting and financial reporting; government regulation of cryptocurrencies; changes in securities laws or regulations; changes in business, market, financial, political and regulatory conditions; risks relating to the Company’s operations and business, including the highly volatile nature of the price of cryptocurrencies; the risk that the Company’s stock price may be highly correlated to the price of the digital assets that it holds; risks related to increased competition in the industries in which the Company does and will operate; risks relating to significant legal, commercial, regulatory and technical uncertainty regarding digital assets generally; risks relating to the treatment of crypto assets for U.S. and foreign tax purpose; expectations with respect to future performance, growth and anticipated acquisitions; potential litigation involving the Company or the validity or enforceability of the intellectual property of the Company; global economic conditions; geopolitical events and regulatory changes; access to additional financing, and the potential lack of such financing; and the Company’s ability to raise funding in the future and the terms of such funding, including dilution caused thereby, as well as those risks and uncertainties identified and those identified under the heading “Risk Factors” in the Company’s Registration Statement on Form S-1 dated September 8, 2025, as well as the supplemental risk factors and other information the Company has or may file with the SEC. Readers are cautioned not to place undue reliance on these statements. Investors should also be aware that under U.S. generally accepted accounting principles (GAAP), certain crypto assets must be measured at fair value, with changes recognized in net income for each reporting period. These fair value adjustments may cause significant fluctuations in the Company’s balance sheet and income statement from period-to-period. In addition, for certain crypto assets, impairment charges may be required to be reported in net income if the market price of such assets falls below the cost basis at which those assets are carried on the balance sheet. Readers are encouraged to read the Company’s filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this press release speak only as of the date of this document, and the Company undertakes no obligation to update any forward-looking statements except as required by law. The Company’s business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

Media Contact

Gasthalter & Co.

SUIG@gasthalter.com

Investor Relations Contact

Sean Mansouri, CFA or Aaron D’Souza

Elevate IR

(720) 330-2829

SUIG@elevate-ir.com