UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 8, 2025

Maison Solutions Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-41720 | 84-2498787 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 127 N Garfield Ave, Monterey Park, CA 91754 | 91754 | |

| (Address of principal executive offices) | (Zip Code) |

(626) 737-5888

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of exchange on which registered | ||

| Class A Common Stock, par value $0.0001 per share | MSS | The Nasdaq Capital Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

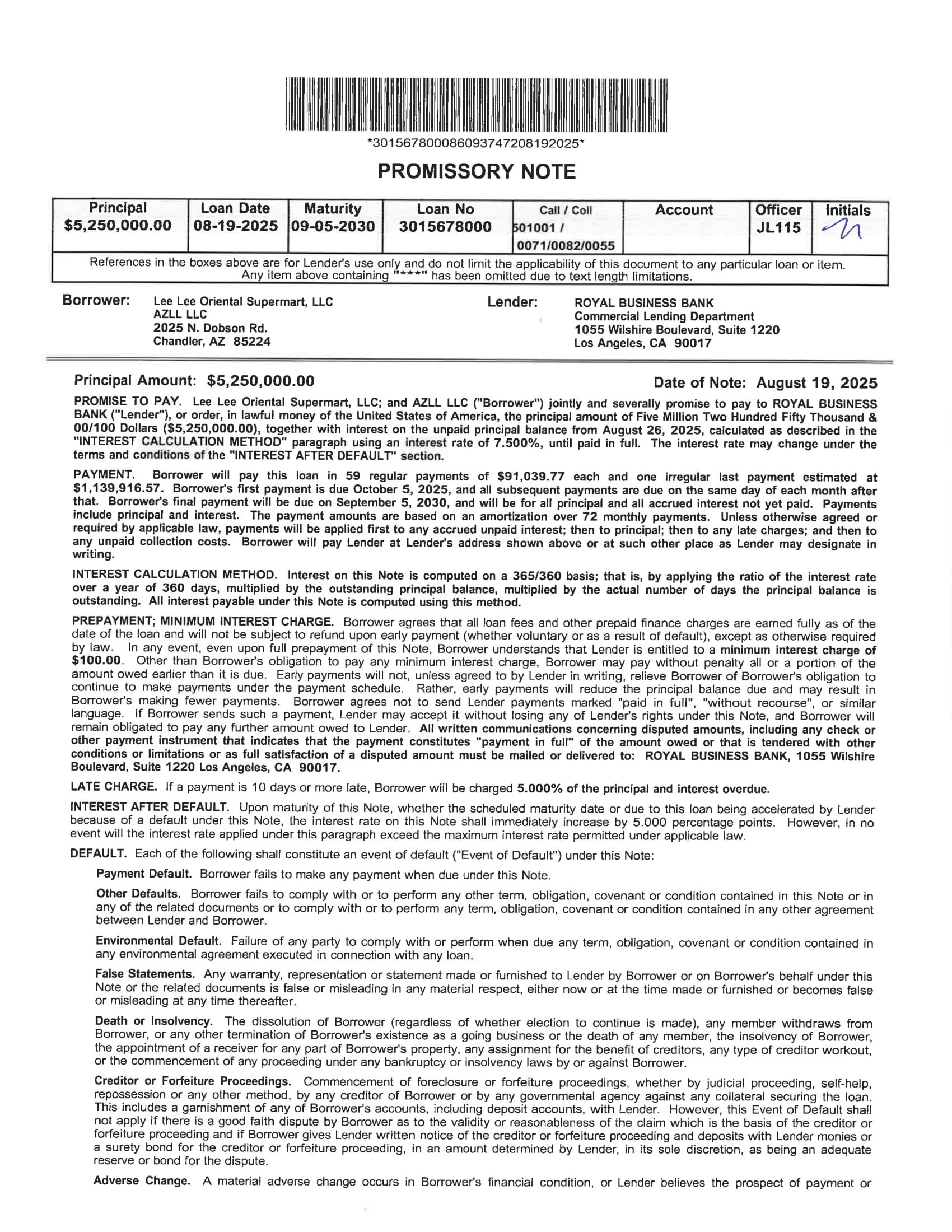

On September 8, 2025, our subsidiaries Lee Lee Oriental Supermart, LLC (“Lee Lee”) and AZLL LLC (“AZLL”) closed a Business Loan Agreement (the “Agreement”) with Royal Business Bank (“RBB”) which provided secured financing in the principal amount of $5,250,000. The loan from RBB is further documented by a Promissory Note (the “Note”). The Note bears interest at a rate of 7.5% per year and requires monthly payments of principal and interest in the amount of $91,039.77, with a final ballon payment in the amount of $1,139,916.57 due at maturity on September 5, 2030. The Note is secured by a substantially all assets of Lee Lee under the terms of a Commercial Security Agreement (the “Security Agreement”) and is personally guaranteed by our CEO, John Xu, and his spouse, Grace Xu. In addition, Mr. Xu has pledged certain real property as collateral security for his guaranty of the loan.

AZLL, our wholly owned subsidiary, owns 100% of the equity interests in Lee Lee, which owns and operates a three-store supermarket chain operating under the name Lee Lee International Supermarkets in the greater Phoenix and Tucson, Arizona metro areas. AZLL acquired 100% of the equity interests in Lee Lee on April 8, 2024 for an aggregate purchase price of approximately $22.2 million, consisting of $7.0 million in cash paid at closing and a Secured Note with an original principal amount of approximately $15.2 million pursuant to a Senior Secured Note Agreement. The Senior Secured Note Agreement was amended on October 21, 2024 and further modified on March 12, 2025. The proceeds of loan from RBB were used to retire the remaining secured debt owing under the original Senior Secured Note Agreement.

The Agreement, the Note, and Security Agreement, which are filed herewith as Exhibits 10.1, 10.2, and 10.3, respectively, and incorporated herein by reference, should be reviewed for additional information.

Item 9.01 Financial Statements and Exhibits.

| Exhibit No. | Description | |

| 10.1 | Business Loan Agreement | |

| 10.2 | Promissory Note | |

| 10.3 | Commercial Security Agreement | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Maison Solutions Inc. | ||

| Date: September 10, 2025 | By: | /s/ John Xu |

| Name: | John Xu | |

| Title: | Chief Executive Officer | |

2

Exhibit 10.1

ROYAL BUSINESS BANK Lender: Borrower: Lee Lee Oriental Supermart, LLc Commercial Lending Department AZLL LLC 1055 Wilshire Boulevard, Suite 1220 2025 N. Dobson Rd. Los Angeles, CA 90017 Chandler, AZ 85224 Initials Officer JL115 Account caM / caii 501001 / 0071/0082/0055 Loan No 3015678000 Maturtty 09 - 05 - 2030 Loan Date 08 - 19 - 2025 Principal $S,250,OOO.00 References in the boxes above are for Lender's use only and do not limit the applicability of this document to any particular loan or item. Any item above containing "”””" has been omitted due to text length limitations. *301567800086093747208192025* BUSINESS LOAN AGREEMENT THIS BUSINESS LOAN AGREEMENT dated August 19 , 2025 , is made and executed between Lee Lee Oriental Supermart, LLC ; and AZLL LLC ("Borrower") and ROYAL BUSINESS BANK ("Lender") on the following terms and conditions . Borrower has received prior commercial loans from Lender or has applied to Lender for a commercial loan or loans or other financial accommodations, including those which may be described on any exhibit or schedule attached to this Agreement . Borrower understands and agrees that : (A) in granting, renewing, or extending any Loan, Lender is relying upon Borrower's representations, warranties, and agreements as set forth in this Agreement ; (B) the granting, renewing, or extending of any Loan by Lender at all times shall be subject to Lender's sole judgment and discretion ; and (C) all such Loans shall be and remain subject to the terms and conditions of this Agreement . TERM . This Agreement shall be effective as of August 19 , 2025 , and shall continue in full force and effect until such time as all of Borrower's Loans in favor of Lender have been paid in full, including principal, interest, costs, expenses, attorneys' fees, and other fees and charges, or until such time as the parties may agree in writing to terminate this Agreement . CONDITIONS PRECEDENT TO EACH ADVANCE . Lender's obligation to make the initial Advance and each subsequent Advance under this Agreement shall be subject to the fulfillment to Lender's satisfaction of all of the conditions set forth in this Agreement and in the Related Documents . Loan Documents . Borrower shall provide to Lender the following documents for the Loan : ( 1 ) the Note ; ( 2 ) Security Agreements granting to Lender security interests in the Collateral ; ( 3 ) financing statements and all other documents perfecting Lender's Security Interests ; ( 4 ) evidence of insurance as required below ; ( 5 ) guaranties ; ( 6 ) together with all such Related Documents as Lender may require for the Loan ; all in form and substance satisfactory to Lender and Lender's counsel . Borrower's Authorization . Borrower shall have provided in form and substance satisfactory to Lender properly certified resolutions, duly authorizing the execution and delivery of this Agreement, the Note and the Related Documents . In addition, Borrower shall have provided such other resolutions, authorizations, documents and instruments as Lender or its counsel, may require . Payment of Fees and Expenses . Borrower shall have paid to Lender all fees, charges, and other expenses which are then due and payable as specified in this Agreement or any Related Document . Representations and Warranties . The representations and warranties set forth in this Agreement, in the Related Documents, and in any document or certificate delivered to Lender under this Agreement are true and correct . No Event of Default . There shall not exist at the time of any Advance a condition which would constitute an Event of Default under this Agreement or under any Related Document . MULTIPLE BORROWERS . This Agreement has been executed by multiple obligors who are referred to in this Agreement individually, collectively and interchangeably as "Borrower . " Unless specifically stated to the contrary, the word "Borrower" as used in this Agreement, including without limitation all representations, warranties and covenants, shall include all Borrowers . Borrower understands and agrees that, with or without notice to any one Borrower, Lender may (A) make one or more additional secured or unsecured loans or otherwise extend additional credit with respect to any other Borrower ; (B) with respect to any other Borrower alter, compromise, renew, extend, accelerate, or otherwise change one or more times the time for payment or other terms of any indebtedness, including increases and decreases of the rate of interest on the indebtedness ; (C) exchange, enforce, waive, subordinate, fail or decide not to perfect, and release any security, with or without the substitution of new collateral ; (D) release, substitute, agree not to sue, or deal with any one or more of Borrower's or any other Borrower's sureties, endorsers, or other guarantors on any terms or in any manner Lender may choose ; (E) determine how, when and what application of payments and credits shall be made on any indebtedness ; (F) apply such security and direct the order or manner of sale of any Collateral, including without limitation, any non - judicial sale permitted by the terms of the controlling security agreement or deed of trust, as Lender in its discretion may determine ; (G) sell, transfer, assign or grant participations in all or any part of the Loan ; (H) exercise or refrain from exercising any rights against Borrower or others, or otherwise act or refrain from ac : ting ; (I) settle or compromise any indebtedness ; and (J) subordinate the payment of all or any part of any of Borrower's indebtedness to Lender to the payment of any liabilities which may be due Lender or others . REPRESENTATIONS AND WARRANTIES . Borrower represents and warrants to Lender, as of the date of this Agreement, as of the date of each disbursement of loan proceeds, as of the date of any renewal, extension or modification of any Loan, and at all times any Indebtedness exists : Organization . Lee Lee Oriental Supermart, LLC is a limited liability company which is, and at all times shall be, duly organized, validly existing, and in good standing under and by virtue of the laws of the State of Arizona . Lee Lee Oriental Supermart, LLC is duly authorized to transact business in all other states in which Lee Lee Oriental Supermart, LLC is doing business, having obtained all necessary filings, governmental licenses and approvals for each state in which Lee Lee Oriental Supermart, LLC is doing business . Specifically, Lee Lee Oriental Supermart, LLC is, and at all times shall be, duly qualified as a foreign limited liability company in all states in which the failure to so qualify would have a material adverse effect on its business or financial condition . Lee Lee Oriental Supermart, LLC has the full power and authority to own its properties and to transact the business in which it is presently engaged or presently proposes to engage . Lee Lee Oriental Supermart, LLC maintains an office at 2025 N . Dobson Rd . , Chandler, AZ 85224 . Unless Lee Lee Oriental Supermart, LLC has designated otherwise in writing, the principal office is the office at which Lee Lee Oriental Supermart, LLC keeps its books and records including its records concerning the Collateral . Lee Lee Oriental Supermart, LLC will notify Lender prior to any change in the location of Lee Lee Oriental Supermart, LLC's state of organization or any change in Lee Lee Oriental Supermart, LLC's name .

Lee Lee Oriental Supermart, LLC shall do all things necessary to preserve and to keep in full force and effect its existence, rights and privileges, and shall comply with all regulations, rules, ordinances, statutes, orders and decrees of any governmental or quasi - governmental authority or court applicable to Loan No: 3015678000 BUSINESS LOAN AGREEMENT (Continued) Lee Lee Oriental Supermart, LLC and Lee Lee Oriental Supermart, LLC's business activities . AZLL LLC ìS a limited liability company which is, and at all times shall be, duly organized, validly existing, and in good standing under and by virtue of the laws of the State of Arizona . AZLL LLC is duly authorized IO transact business in all other slates in which AZLL LLC is doing business, having oblafned all necessary filings, governmental flcan 6 e 6 and approvaTs far each state in which AZLL LLC Ts doing busìneaa Specifîœlly, AZLL LLC is, and at all times shall be, duly quallfied as ą foraign Ilm)ted liability œmpany in all ststes Tn which the failure to so qualify would have a matariaJ adverse effect on its business or financial œnditton . AZLL UC has fhe fu)ł power and authońty to own its properties and to transact the businœs in which it is prc›æntIy engaged ar presenüy proposes to engage . AZLL LLC maintains an offiœ at 8 W . Grant Rd . , Tucson, AZ 85705 . Unless AZLL LLC has designated otherwise in writing, the principal office is the office at which AZLL LLC keeps its ôooks and records including its mœrds œnœming the Collateral . AZLL LLC will notify Lender priœ to any change In the location of AZLL LLC's state of organization or any change in AZLL LLC's name . AZLL LLC shall do all fhings necessary to presarve and to keep In fuìì force and affect its existence, rights and pñvTleges, and shall comply with all ægulatlons . rutes, ordinances . statutes, orders and decrees of any governmental or quasl - governmental authority or court applicable to AZLL LLC and AZLL LLC's business activities . Assumed Business Names . Borrower has filed or recorded all documents or filings required by law relating to all assumed business names used by BOrrower . Excluding the name of Borrower, the following is a complete list of all assumed business names under which Borrower does busirłøss : None . Authorization . Borrower's execution, delivery, and performance of this Agæement and all the Related Documents have been duly authorized by all necessary action by Borrower and do not conflict with, result in a violation of, or constitute a default under ( 1 ) any provision of (a) Borrower's articles of organization or membership agreements, or (b) any agreement or other instrument binding upon Borrower or ( 2 ) any law, governmental regulation, court decree, or order applicable to Borrower or to Borrower's properties . Financial Information . Each of Borrower's financial statements supplied to Lender truly and completely disclosed Borrower's financial condition as of the date of the statement, and there has been no material adverse change in Borrower's financial condition subsequent to the date of the most recent financial statement supplied to Lender . Borrower has no material contingent obligations except as disclosed in such financial statements . Legal Effect . This Agreement constitutes, and any instrument or agreement Borrower is required to give under this Agreement when delivered will constitute legal, valid, and binding obligations of Borrower enforceable against Borrower in accordance with their respective terms . Properties . Except as contemplated by this Agreement or as previously disclosed in Borrower's financial statements or in writing to Lender and as accepted by Lender, and except for ğropølty tax liens for taxes not presently due and payable, Borrower owns and has good title to all of BorfoWer's properties free and ctear of all Security Interests, and has not executed any sacUrity documents or finanÒng statements relating to such properties . All of Borrower's properties are titled in Borrower's legal name, and Borrower has not used or filed a financing statement under any other name for at least the last five ( 5 ) years . Hazardous Substances . Excapt as disclosed to and acknowledged by Lender in writing, Borrower represents and warrants that : ( 1 ) During the period of BołYower's ownership of (he Collatœel, there has been no use, generation, manufacture, storage, treatment, disposal, release or threatened release of any Hazardous Substance by any person on, under, about or from any of the Collateral . ( 2 ) Borrower has no knowledge of , or reason to believe that theæ has been (a) any breach or violation of any Enviænmentał Laws ; (b) any use, generation, manufacture, storage, treatment, disposal, release or threatened release of any Hazardous Substance on, under, about or from the Collateral by any prior owners or occupants of any of the Collateral ; or (c) any actual or threatened litigation or claims of any kind by any person relating to such matters . ( 3 ) Neither Borrower nor any tenant, contfaØor, agent Œ Other authorİzed usar of any of the Collateral 8 ha \ I use, generate, manufacture, store, treat, dispose of or release any Hazardous Substance on, undar, about or from any of the Collateral ; and any such activity Ghal) be œnduCłed in compliance with all applicable federal, state, and local laws, regulations, and ordinances, including without limitation all Envirorimantal Laws . Borrower authorizes Lender and its agents to enter upon the Collateral to make such inspections and tests as Lender may deem appropriate to determine compliance of the Collateral with this section of the Agæement . Any inspections or tests made by Lender shal) be at Borrower's expense and for Lender's purposes only and shall not be œnatrued to craate any rasponsibilTty or liability on the part of Lender Ø Borrower or to any other person . The rapæsantations and waræntlea contained heæin are Dasad on Borrower's due diligence In investİgatlng the Cołlateæl far hazardous wa 6 ta 8 nd Hazardous Substances . Borrower hereby ( 1 ) æleases and waives any futuæ daims against Lender for lndemnil : y or confrfbutłon In the gvsnt Borrower bBoomes liable for cleanup or other cosle under any such laws, and ( 2 ) agrœs to indemnify, defend, and hold harmless Lender against any and all daim 9 , losses, liabilities, damages, penalties, and expenses which Lender may directly or İndfæctly sustain or suffer resulting from a breach of this section of the Agraement or as a consequence of any use, generation, manufaduæ, storage, disposal, release or threatened release of a hazardous waste or substance on the Collateral . The provisions of this section of the Agreement, including the obligation to indemnify and defend, shall survive the payment of the Indebtedness and the termination . expiration or satisfaction of thła Agreement and shall not be affected by Lender's acquisition of any interest in any of the Collateral, whether by forec 1 osure or otherwise . Litigation and Claims . No litigation, claim, investigation, administrative proceeding or similar action (including those for unpaid taxes) against Borrower is pending or threatened, and no other event has occurred which may materially adversely affect Borrower's financial condition or properties, other than litigation, claims, or other events, if any, that have been dìsclosed to and acknowledged by Lender in writing . Taxes . To the best of Borrower's knowledge, all of Borrower's tax returns and reports that are or were required to be filed, have been filed, and all taxes, assessments and other governmental charges have been paid in full, except thoœ pæsøntly being or to be contested by Bonower in good faith in the ordinary course of business and fOr which adequate reserves have been provlded . Lien Priority . Unless otherwise previously disclosed to Lender in writing, Borrower has not entered into or granted any Security Agreements, or permitted the filing or attachment of any Security Interests on or affecting any of the Collateral directly or indirectly secunng repayment of Borrower's Loan and Note, that would be prior or that may in any way be superior to Lender's Security Interests and nghts in and to 6 uch Collalefal . Binding Effect . This Agreement, the Note, all Security Agreements (if any), and all Related Documents are binding upon the signers thereof, as well as upon their successors, representatives and assigns, and are legally enforceable in accordance with their respective terms . AFFIRMATIVE COVENANTS . Borrower covenants and agrees with Lender that, so long as this Agreement remains in effect, Borrower will : Notices of Claims and Litigation . Promptly inform Lender in writing of ( 1 ) all materìal adverse changes in BOrrower's ńnancial condition, and ( 2 ) all existing and all threatened litigation, claims . investigations, administratlve proceedings or similar acôons affecting Borrower or any Guarantor which could materially affect the financial condition of Borrower or the financial condition of any Guarantor . Page 2 Loan No: 3015678000 BUSINESS LOAN AGREEMENT (Continued) Page 3 Financial Records.

Maintain its books and records in accordance with GAAP, or an OCBOA acceptable to Lender, applied on a consistent basis, and permit Lender to examine and audit Borrower's books and records at all reasonable times. Financial Statements. Furnish Lender with the following: Tax Returns. As soon as available, but in no event later than thirty (30) days after the applicable filing date for the tax reporting period ended, Borrower's Federal and other governmental tax returns, prepared by Borrower. Additional Requirements. 1. Annual CPA Audited Financial Statements to be submitted within 120 days after period ends. 2. Company Prepared Financial Statements to be submitted 30 days after each month - end. Authorized corporate officer to submit a compliance certificate certifying that the interim financials are true and accurate. 3. Sales Report, Accounts Payable (A/P) Aging Reports, Accounts Receivable (A/R) Aging Reports, and Inventory listing Reports to be submitted 30 days after each month - end. 4. Collateral Audit to be performed within 30 days before loan maturity. Requirements for Guarantors: 1. Guarantor's Tax Returns. As soon as available, but in no event later than 30 days after the applicable filing date for the tax reporting period ended, Federal and other government tax returns, prepared by Guarantor. 2. Guarantors Financial Statement signed by Guarantor, to be submitted annually. All financial reports required to be provided under this Agreement shall be prepared in accordance with GAAP, or an OCBOA acceptable to Lender, applied on a consistent basis, and certified by Borrower as being true and correct . Additional Information . Furnish such additional information and statements, as Lender may request from time to time . Insurance . Maintain fire and other risk insurance, public liability insurance, and such other insurance as Lender may require with respect to Borrower's properties and operations, in form, amounts, coverages and with insurance companies acceptable to Lender . Borrower, upon request of Lender, will deliver to Lender from time to time the policies or certificates of insurance in form satisfactory to Lender, including stipulations that coverages will not be cancelled or diminished without at least ten ( 10 ) days prior written notice to Lender . Each insurance policy also shall include an endorsement providing that coverage in favor of Lender will not be impaired in any way by any act, omission or default of Borrower or any other person . In connection with all policies covering assets in which Lender holds or is offered a security interest for the Loans, Borrower will provide Lender with such lender's loss payable or other endorsements as Lender may require . Insurance Reports . Furnish to Lender, upon request of Lender, reports on each existing insurance policy showing such information as Lender may reasonably request, including without limitation the following : ( 1 ) the name of the insurer ; ( 2 ) the risks insured ; ( 3 ) the amount of the policy ; ( 4 ) the properties insured ; ( 5 ) the then current property values on the basis of which insurance has been obtained, and the manner of determining those values ; and ( 6 ) the expiration date of the policy . In addition, upon request of Lender (however not more often than annually), Borrower will have an independent appraiser satisfactory to Lender determine, as applicable, the actual cash value or replacement cost of any Collateral . The cost of such appraisal shall be paid by Borrower . Guaranties . Prior to disbursement of any Loan proceeds, furnish executed guaranties of the Loans in favor of Lender, executed by the guarantors named below, on Lender's forms, and in the amounts and under the conditions set forth in those guaranties . Names of Guarantors Grace Xu John Xu Amounts Unlimited Unlimited Other Agreements . Comply with all terms and conditions of all other agreements, whether now or hereafter existing, between Borrower and any other party and notify Lender immediately in writing of any default in connection with any other such agreements . Loan Proceeds . Use all Loan proceeds solely for the following specific purposes : To pay off the seller - carry note and finance the closing costs of the subject facility . Taxes, Charges and Liens . Pay and discharge when due all of its indebtedness and obligations, including without limitation all assessments, taxes, governmental charges, levies and liens, of every kind and nature, imposed upon Borrower or its properties, income, or profits, prior to the date on which penalties would attach, and all lawful claims that, if unpaid, might become a lien or charge upon any of Borrower's properties, income, or profits . Provided however, Borrower will not be required to pay and discharge any such assessment, tax, charge, levy, lien or claim so long as ( 1 ) the legality of the same shall be contested in good faith by appropriate proceedings, and ( 2 ) Borrower shall have established on Borrower's books adequate reserves with respect to such contested assessment, tax, charge, levy, lien, or claim in accordance with GAAP or an OCBOA acceptable to Lender . Performance . Perform and comply, in a timely manner, with all terms, conditions, and provisions set forth in this Agreement, in the Related Documents, and in all other instruments and agreements between Borrower and Lender . Borrower shall notify Lender immediately in writing of any default in connection with any agreement . Operations . Maintain executive and management personnel with substantially the same qualifications and experience as the present executive and management personnel ; provide written notice to Lender of any change in executive and management personnel ; conduct its business affairs in a reasonable and prudent manner . Environmental Studies . Promptly conduct and complete, at Borrower's expense, all such investigations, studies, samplings and testings as may be requested by Lender or any governmental authority relative to any substance, or any waste or by - product of any substance defined as toxic or a hazardous substance under applicable federal, state, or local law, rule, regulation, order or directive, at or affecting any property or any facility owned, leased or used by Borrower . Compliance with Governmental Requirements . Comply with all laws, ordinances, and regulations, now or hereafter in effect, of all governmental authorities applicable to the conduct of Borrower's properties, businesses and operations, and to the use or occupancy of the Collateral, including without limitation, the Americans With Disabilities Act . Borrower may contest in good faith any such law, ordinance, or regulation and withhold compliance during any proceeding, including appropriate appeals, so long as Borrower has notified Lender in writing prior to doing so and so long as, in Lender's sole opinion, Lender's interests in the Collateral are not jeopardized . Lender may require Borrower to post adequate security or a surety bond, reasonably satisfactory to Lender, to protect Lender's interest . Beneficial Ownership Information . Comply with all beneficial ownership information reporting requirements of the Corporate Transparency Act and its implementing regulations (collectively the CTA), if applicable to any Borrower .

Any Borrower that is or becomes a reporting company as defined in the CTA : ( 1 ) has filed, or will file within required timeframes a complete and accurate report of its beneficial ownership information with the Financial Crimes Enforcement Network (FinCEN) as required by the CTA ; ( 2 ) will update or correct its beneficial ownership information with FinCEN within required timeframes upon any change in its beneficial ownership information ; ( 3 ) will Loan No: 3015678000 BUSINESS LOAN AGREEMENT (Continued) Page 4 provide Lender vvilh a copy of its beneficial ownership information report filed with FinCEN upon request, ( 4 ) consents to allow Lender to obtain from FinGEN beneficial ownership information filed by Borrower ; and ( 5 ) will notify Lender in writing of any change in its beneficial ownership information witnin 30 days of such change . lnapection . Permit employees or agents of Lender at any raasonabte time to inspect any and all Collateral for the Loan or LOans and Borrower's other properties and to examine or audit Borrower's books, accounts, and records and to make copies and memoranda of Borrower's books, accounts, and records . If Borrower now or at any time hereafter maintains any records (including without limitation computer generated records and computer software programs for the generation of such records) in the possession of a third party, Borrower, upon request of Lender, shall notify such party to permit Lender free access to such records at all reasonable times and to provide Lender with copies of any records it may request, all at Borrower's expense . Compliance Certificates . Unless waived in writing by Lendar, provide Lender al least annually, with a certificate executed by Borrower's chief financial officer, or other oPicer or person acceptable to Lender, certifying that the representations and warranties set forth in lhis Agreement are true and correct as of the date of the certificate and further certifying that, as of lhe dale of lhe certificate, no Evenl of Default exists under this Agreement . Environmental Compliance and Reports . Borro ver shall comply in all respects with any and all Environmental Laws ; not cause or permit to exisl, as a result of an intentional or unintentional action or omi •: sio n on Borrower's part or on the part of any third party, on property owned and/or occupied by Borrower, any environmental activity where damage may result to the environment, unless such environmental activity is pursuant to and in compliance with the conditions of a permit issued by the appropriate federal, state or local governmental authorities, shall furnish to Lander promptly and in any event within thirty ( 30 ) days aher re ¢ ›aipt thereof a copy of any notice, summons, lien, citation, directive, letter or other communication from any governmental agency or instrumentality concerning any intentional or unintentional action or omission on Borrower's part in connection with any environmental activity whether or not lhere is damage to the environment and/or other natural resources . Additional Assurances . Make, execute and deliver to Lender such promissory notes, mortgages, deeds of trust, security agreements, assignments, financing statements, instruments, documents and other agreements as Lender or ils attorneys may reasonably request to evidence and secure the Loans and to perfect all Security Interests . LENDER'S EXPENDITUREs . ir any action or proceeding is commenced that would materially affect Lender's interest in the Collateral or if Borrower fails fo compiy with any provision of this Agreement or any Related Documents, including but not limited to Borrowers failure to discharge or pay when due any amounts Borrower is required to discharge or pay under this Agreement or any Related Dcicuments, Lender on Borrower's behalf may (but shall not De obligated to) take any action that Lencler deems appropriate, including but not limited to discharging or paying all taxes, liens, security interests, encumbrances and other claims, at any time levied or placed on any Collateral and paying all costs for insuring, maintaining and preserving any Collateral . All such expenditures incurred or paid by Lender for such purposes will than bear inleresl at the rate charged under Iha No(a from the date incurred or paid by Lender to the date of repayment by Borrower . All such expenses will become a part of )he indebtedness and, a \ Lender's option, will (A) be payable on demand : ( 8 ) be added to the balance of the Note and be apportioned among and be payable with any installment payments to become due during eilher ( 1 ) the term of any applicable insurance policy ; or ( 2 ) the remaining term of the Noie : or (C) be treated as a balloon payment which will be due and payable at the Note's maturi \ y . NEGATIVE COVENANTS . Borrower covenants and agrees with Lender that while this Agreement is in effect, Borrower shall not, without the grior written consent of Lender : Indebtedness and Liens . { 1 ) Ercept for trade debl incurred in lhe normal course of business and indebtedness to Lender contemplated by this Agreement, create, incur or assume indebtedness for borrowed money, including finance leases . ( 2 ) sell, transfer, mortgage, assign, pledge, lease, grant a security interest in, or encumber any of Borrower's assets (except as allowed as Permitted Liens), or ( 3 ) sell with recourse any of Borrower's accciunts receivable, except to Lender . Continuity of Operations . ( 1 ) Engage in any business activities su bslantially different than those in which Borrower is presently engaged . { 2 ) cease operations, liquidate, merge or restructure as a legal entity (whether by division or otherwise), consolidate with or acquire any other e ntiry, change its name, convert to another type of enti \ y or redomeslicate . dissolve or transfer or sell Collateral out of the ordinary course of business . or ( 3 ) make any distribution with respect to any capital account, whether by reduction of capital or otherwise . Loans, Acquisitions and Guaranties . ( 1 ) Loan, invest in or advance money or assels to any other person, enterprise or entity, ( 2 ) purchase, create or acquire any interest in any other enterprise or entity, or ( 3 ) incur any obligation as surety or guarantor other than in the ordinary course of business . Agreements . Enter into any agree uunt containing any provisions which would be violated or breached by the performance of Borrower's obligations under this Agreement or In connection herewith . CESSATION OF ADVANCES . If Lender has made any commitment to make any Loan to Borrower, whether under this Agreement or under any other agreement, Lender shall have no obligation to make Loan Advances or to disburse Loan proceeds if : (A) Borrower or any Guarantor is in default under the terms of this Agreement or any of the Related Documents or any other agreement that Borrower or any Guarantor has with Lender : (B) Borrower or any Guarantor dies, becomes incompetent or becomes insolvent, files a petition in bankruptcy or similar proceedings, or is adjudged a bankrupt : (C) there occurs a material adverse change in Borrower's financial condition, in the financial condition of any Guarantor, or in the value of any Collateral securing any Loan ; or (D) any Guarantor seeks . claims or otherwise allempts to limit, modify or revoke such Guarantor's guaranty of lhe Loan or any other loan wilh Lender ; or (E) Lender In good faith deems ilself insecure, even though no Evenl of Default shall have occurred . RIGHT OF SETOFF . To the extent permitted by applicable law . Lender reserves a right of setoff in all Borrower's accounts with Lender (whether checking, savings, or some other account) . This includes all accounts Borrower hotds jointly with someone else and all accounts Borrower may open in the future . However, this does not include any IRA or Keogh accounts, or any trust accounts for which setoff would be prohibited by law . Borrower authorizes Lender, to the extent permitted by appiicable law, to charge or setoff all sums owing on the Indebtedness against any and all such accounts . DEFAULT . Each of the following shall constitute an Event of Default under this Agreement : Payment Default . Borrower fails to make any payment when due under the Loan . Other defaults . Borrower fails to comply with or to perform any other torm, obligation, covenant or condition contained in this Agreement or in any of the Related Documents or to comply with or to perform any term, obligation, covenant or condition contained in any other agreement between Lender and Borrower . Environmental Default . Failure of any party to comply with or perform when due any term, obligation, covenant or condition contained in any environmental agreement executed in connection with any Loan . False Statements .

Any warranty, representation or statement made or furnished to Lender by Borrower or on Borrower's behalf under this Loan No: 3015678000 BUSINESS LOAN AGREEMENT (Continued) Page 5 Agreement or the Related Documents is false or misleading in any material respect, either now or at the time made or furnished or becomes false or misleading at any time thereafter . Death or Insolvency . The dissolution of Borrower (regardless of whether election to continue is made), any member withdraws from Borrower, or any other termination of Borrower's existence as a going business or The dealh of any member, the insolvency of Borrower, the appointment of a receiver for any part of Borrower's property, any assignment for the benefit of creditors, any type of creditor workout, or the commencement of any proceeding under any bankruptcy or insolvency laws by or against Borrower . Defective Collateralization . This Agreement or any of the Related Documents ceases to be in full force and effect (including failure of any collateral document to create a valid and perfected security interest or lien) at any time and for any reason . Creditor or Forfeiture Proceedings . Commencement of foreclosure or forfeiture proceedings, whether by judicial proceeding, sel I - help, repossession or any other method, by any creditor of Borrower or by any governmental agency against any collateral securing the Loan . This includes a B amishment of any of Borrowers accounts, including deposit accounts, with Lender . However, this Event of Default shall not apply if there is a good faith dispute by Borrower as to the validity or reasonableness of the claim which is the basis of the creditor or forfeiture proceeding and if Borrower gives Lender written notice of the creditor or forfeiture proceeding and deposits with Lender monies or a surety bond for the creditor or forfeiture proceeding, in an amount determined by Lender, in its sole discretion, as being an adequate reserve or bond for the dispute . Adverse Change. A material adverse change occurs in Borrower's financial condition, or Lender believes the prospect of payment or performance of the Loan is impaired. Insecurity. Lender in good faith believes itself insecure. Events Affecting Guarantor. Any of the preceding events occurs with respect to any Guarantor of any of the Indebtedness or any Guarantor dies or becomes incompetent, or revokes or disputes the validity of, or liability under, any Guaranty of the Indebtedness. EFFECT OF AN EVENT OF DEFAULT . If any Event of Default shall occur, except where otherwise provided in this Agreement or the Related Documents, all commitments and obligations of Lender under this Agreement or the Related Documents or any other agreement immediately will terminate (including any obligation to make further Loan Advances or disbursements), and, at Lender's option, all Indebtedness immediately will become due and payable, all without . notice of any kind to Borrower, except that in the case of an Event of Default of the type described in the "Insolvency" subsection above, such acceleration shall be automatic and not optional . In addition, Lender shall have all the rights and remedies provided in the Related Documents or available at law, in equity, or otherwise . Except as may be prohibited by applicable law, all of Lender's rights and remedies shall be cumulative and may be exercised singularly or concurrently . Election by Lender to pursue any remedy shall not exclude pursuit of any other remedy, and an election to make expenditures or to take action to perform an obligation of Borrower or of any Grantor shall not affect Lender's right to declare a default and to exercise its rights and remedies . RIGHT TO OBTAIN AN APPRAISAL . The Bank reserves the right to obtain an appraisal on any real property collateral at any time and at the expense of the borrower to confirm the value and validity of its security interest in subject collateral . MISCELLANEOUS PROVISIONS . The following miscellaneous provisions are a part of this Agreement : Amendments . This Agreement, together with any Related Documents, constitutes the entire understanding and agreement of the parties as to the matters set forth in this Agreement . No alteration of or amendment to this Agreement shall be effective unless given in writing and signed by the party or parties sought to be charged or bound by the alteration or amendment . Arbitration . Borrower and Lender agree that all disputes, claims and controversies between them whether individual, joint, or class in nature, arising from this Agreement or otherwise, including without limitation contract and tort disputes, shall be arbitrated pursuant to the Commercial Arbitration Rules of the American Arbitration Association in effect at the time the claim is filed, upon request of either party . No act to take or dispose of any Collateral shall constitute a waiver of this arbitration agreement or be prohibited by this arbitration agreement . This includes, without limitation, obtaining injunctive relief or a temporary restraining order ; invoking a power of sale under any deed of trust or mortgage ; obtaining a writ of attachment or imposition of a receiver ; or exercising any rights relating to personal property, including taking or disposing of such property with or without judicial process pursuant to Article 9 of the Uniform Commercial Code . Any disputes, claims, or controversies concerning the lawfulness or reasonableness of any act, or exercise of any right, concerning any Collateral, including any claim to rescind, reform, or otherwise modify any agreement relating to the Collateral, shall also be arbitrated, provided however that no arbitrator shall have the right or the power to enjoin or restrain any act of any party . Borrower and Lender agree that in the event of an action for judicial foreclosure pursuant to California Code of Civil Procedure Section 726 , or any similar provision in any other state, the commencement of such an action will not constitute a waiver of the right to arbitrate and the court shall refer to arbitration as much of such action, including counterclaims, as lawfully may be referred to arbitration . Judgment upon any award rendered by any arbitrator may be entered in any court having jurisdiction . Nothing in this Agreement shall preclude any party from seeking equitable relief from a court of competent jurisdiction . The statute of limitations, estoppel, waiver, laches, and similar doctrines which would otherwise be applicable in an action brought by a party shall be applicable in any arbitration proceeding, and the commencement of an arbitration proceeding shall be deemed the commencement of an action for these purposes . The Federal Arbitration Act shall apply to the construction, interpretation, and enforcement of this arbitration provision . Attorneys' Fees ; Expenses . Borrower agrees to pay upon demand all of Lender's costs and expenses, including Lender's attorneys' fees and Lender's legal expenses, incurred in connection with the enforcement of this Agreement . Lender may hire or pay someone else to help enforce this Agreement, and Borrower shall pay the costs and expenses of such enforcement . Costs and expenses include Lender's attorneys' fees and legal expenses whether or not there is a lawsuit, including attorneys' fees and legal expenses for bankruptcy proceedings (including efforts to modify or vacate any automatic stay or injunction), appeals, and any anticipated post - judgment collection services . Borrower also shall pay all court costs and such additional fees as may be directed by the court . Caption Headings. Caption headings in this Agreement are for convenience purposes only and are not to be used to interpret or define the provisions of this Agreement. Consent to Loan Participation . Borrower agrees and consents to Lender's sale or transfer, whether now or later, of one or more participation interests in the Loan to one or more purchasers, whether related or unrelated to Lender . Lender may provide, without any limitation whatsoever, to any one or more purchasers, or potential purchasers, any information or knowledge Lender may have about Borrower or about any other matter relating to the Loan, and Borrower hereby waives any rights to privacy Borrower may have with respect to such matters . Borrower additionally waives any and all notices of sale of participation interests, as well as all notices of any repurchase of such participation interests . Borrower also agrees that the purchasers of any such participation interests will be considered as the absolute owners of such interests in the Loan and will have all the rights granted under the participation agreement or agreements governing the sale of such participation interests . Borrower further waives all rights of offset or counterclaim that it may have now or later against Lender or against any purchaser of such a participation interest and unconditionally agrees that either Lender or such purchaser may enforce Borrower's obligation under the Loan irrespective of the failure or insolvency of any holder of any interest in the Loan .

Borrower Loan No: 3015678000 BUSINESS LOAN AGREEMENT (Continued) Page 6 further agrees that the purchaser of any such participation interests may enforce its interests irrespective of any personal claims or defenses that Borrower may have against Lender . Governing Law . This Agreement will be governed by federal law applicable to Lender and, to the extent not preempted by federal law, the laws of the State of California without regard to its conflicts of law provisions . This Agreement has been accepted by Lender in the State of California . Choice of Venue . If there is a lawsuit, Borrower agrees upon Lender's request to submit to the jurisdiction of the courts of Los Angeles County, State of California . Joint and Several Liability . All obligations of Borrower under this Agreement shall be joint and several, and all references to Borrower shall mean each and every Borrower . This means that each Borrower signing below is responsible for all obligations in this Agreement . Where any one or more of the parties is a corporation, partnership, limited liability company or similar entity, it is not necessary for Lender to inquire into the powers of any of the officers, directors, partners, members, or other agents acting or purporting to act on the entity's behalf, and any obligations made or created in reliance upon the professed exercise of such powers shall be guaranteed under this Agreement . No Waiver by Lender . Lender shall not be deemed to have wa’i’vea any rights under this Agreement unless such waiver is given in writing and signed by Lender . No delay or omission on the part of Lender in exercising any right shall operate as a waiver of such right or any other right . A waiver by Lender of a provision of this Agreement shall not prejudice or constitute a waiver of Lender's right otherwise to demand strict compliance with that provision or any other provision of this Agreement . No prior waiver by Lender, nor any course of dealing between Lender and Borrower, or between Lender and any Grantor, shall constitute a waiver of any of Lender's rights or of any of Borrower's or any Grantor's obligations as to any future transactions . Whenever the consent of Lender is required under this Agreement, the granting of such consent by Lender in any instance shall not constitute continuing consent to subsequent instances where such consent is required and in all cases such consent may be granted or withheld in the sole discretion of Lender . Notices . Any notice required to be given under this Agreement shall be given in writing, and shall be effective when actually delivered, when actually received by telefacsimile (unless otherwise required by law), when deposited with a nationally recognized overnight courier, or, if mailed, when deposited in the United States mail, as first class, certified or registered mail postage prepaid, directed to the addresses shown near the beginning of this Agreement . Any party may change its address for notices under this Agreement by giving formal written notice to the other parties, specifying that the purpose of the notice is to change the party's address . For notice purposes, Borrower agrees to keep Lender informed at all times of Borrower's current address . Unless otherwise provided or required by law, if there is more than one Borrower, any notice given by Lender to any Borrower is deemed to be notice given to all Borrowers . Severability . If a court of competent jurisdiction finds any provision of this Agreement to be illegal, invalid, or unenforceable as to any person or circumstance, that finding shall not make the offendin‹j provision illegal, invalid, or unenforceable as to any other person or circumstance . If feasible, the offending provision shall be considered modified so that it becomes legal, valid and enforceable . If the offending provision cannot be so modified, it shall be considered deleted from this Agreement . Unless otherwise required by law, the illegality, invalidity, or unenforceability of any provision of this Agreement shall not affect the legality, validity or enforceability of any other provision of this Agreement . Subsidiaries and Affiliates of Borrower . To the extent the context of any provisions of this Agreement makes it appropriate, including without limitation any representation, warranty or Covenant . the word "Borrower" as used in this Agreement shall include all of Borrower's subsidiaries and affiliates . Notwithstanding the foregoing howevE!r, under no circumstances shall this Agreement be construed to require Lender to make any Loan or other financial accommodation to any of Borrower's subsidiaries or affiliates . Successors and Assigns . All covenants and agreements by or on behalf of Borrower contained in this Agreement or any Related Documents shall bind Borrower's successors and assigns and shall inure to the benefit of Lender and its successors and assigns . Borrower shall not, however, have the right to assign Borrower's rights under this Agreement or any interest therein, without the prior written consent of Lender . Survival of Representations and Warranties . Borrower understands and agrees that in making the Loan, Lender is relying on all representations, warranties, and covenants made by Borrower in this Agreement or in any certificate or other instrument delivered by Borrower to Lender under this Agreement or the Related Documents . Borrower further agrees that regardless of any investigation made by Lender, all such representations, warranties and covenants will survive the making of the Loan and delivery to Lender of the Related Documents, shall be continuing in nature, and shall remain in full force and effect until such time as Borrower's Indebtedness shall be paid in full, or until this Agreement shall be terminated in the manner provided above, whichever is the last to occur . Time is of the Essence . Time is of the essence in the performance of this Agreement . Waive Jury, To the extent permitted by applicable taw, all parties to this Agreement herb waive the right to any jury triai in any action, proceeding, or counterclaim brought by any party against any other party . (Initial Here DEFINITIONS . The following capitalized words and terms shall have the ro 1 lowing meanings when used in this Agreement . Unless specifically stated to the contrary, all references to dollar amounts shall mean amounts in lawful money of the United States of America . Words and terms used in the singular shall include the plural, and the plural shall include the singular, as the context may require . Words and terms not otherwise defined in this Agreement shall have the meanings attributed to such terms in the Uniform Commercial Code . Accounting words and terms not otherwise defined in this Agreement shall have the meanings assigned to them in accordance with generally accepted accounting principles as in effect on the date of this Agreement : Advance. The word "Advance" means a disbursement of Loan funds made, or to be made, to Borrower or on Borrower's behalf on a line of credit or multiple advance basis under the terms and conditions of this Agreement. Agreement. The word "Agreement" means this Business Loan Agreement, as this Business Loan Agreement may be amended or modified from time to time, together with all exhibits and schedules attached to this Business Loan Agreement from time to time. Borrower. The word "Borrower" means Lee Lee Oriental Supermart, LLC; and AZLL LLC and includes all co - signers and co - makers signing the Note and all their successors and assigns. Collateral . The word "Collateral" means all property and assets granted as collateral security for a Loan, whether real or personal property, whether granted directly or indirectly, whether granted now or in the future, and whether granted in the form of a security interest, mortgage, collateral mortgage, deed of trust, assignment, pledge, crop pledge, chattel mortgage, collateral chattel mortgage . chattel trust, factor's lien, equipment trust, conditional sale, trust receipt, lien, charge, lien or title retention contract, lease or consignment intended as a security device, or any other security or lien interest whatsoever, whether created by law, contract, or otherwise . Environmental Laws .

The words "Environmental Laws" mean any and all state, federal and local statutes, regulations and ordinances relating to the protection of human health or the environment, including without limitation the Comprehensive Environmental Response, Loan No: 3015678000 BUSINESS LOAN AGREEMENT (Continued) Page 7 Compensation, and Liability Act of 1980 , as amended, 42 U . S . C . Section 9601 , et seq . ("CERCLA"), the Superfund Amendments and Reauthorlzaton Act of 1986 , Pub . L . No . 99 - 499 ("SARA"), the Hazardous Materials Transportation Act, 49 U . S . C . Section 1801 , et seq . , the ResourCa ConserVation and Recovery Act, 42 U . S . C . Section 6901 , et seq . , Chapters 6 . 5 through 7 . 7 of Division 20 of the California Health and Safety Code, Section 25100 , et seq . , or other applicable state or federal laws, rules, or regulations adopted pursuant thereto . Event of Default . The words "Event of Default" mean any of the events of default set forth in this Agreement in the default section of this Agreement . GAAP . The word "GAAP" means generally accepted accounting principles . Grantor . The word "Grantor" means each and all of the persons or entities granting a Security Interest in any Collateral for the Loan, including without limitation all Borrowers granting such a Security Interest . Guarantor . The word "Guarantor" means any guarantor, surety, or accommodation party of any or all of the Loan . Guaranty . The word "Guaranty" means the guaranty from Guarantor to Lender, including without limitation a guaranty of all or part of the Note . Hazardous Substances . The words "Hazardous Substances" mean materials that, because of their quantity, concentration or physical, chemical or infectious characteristics, may cause or pose a present or potential hazard to human health or the environment when improperly used, treated, stored, disposed of, generated, manufactured, transported or otherwise handled . The words "Hazardous Substances" are used in their very broadest sense and include without limitation any and all hazardous or toxic substances, materials or waste as defined by or listed under the Environmental Laws . The term "Hazardous Substances" also includes, without limitation, petroleum and petroleum by - products or any fraction thereof and asbestos . Indebtedness . The word "Indebtedness" means the indebtedness evidenced by the Note or Related Documents, including all principal and interest together with all other indebtedness and costs and expenses for which Borrower is responsible under this Agreement or under any of the Related Documents . Lender . The word "Lender" means ROYAL BUSINESS BANK, its successors and assigns . Loan . The word "Loan" means any and all loans and financial accommodations from Lender to Borrower whether now or hereafter existing, and however evidenced, including without limitation those loans and financial accommodations described herein or described on any exhibit or schedule attached to this Agreement from time to time . Note . The word "Note" means the Note dated August 19 , 2025 and executed by Lee Lee Oriental Supermart, LLC ; and AZLL LLC in the principal amount of $ 5 , 250 , 000 . 00 , together with all renewals of, extensions of, modifications of, refinancings of, consolidations of, and substitutions for the note or credit agreement . OCBOA . The term "OCBOA" means Other Comprehensive Basis of Accounting, as designated by Lender in writing as an acceptable alternative to GAAP . Permitted Liens . The words "Permitted Liens" mean ( 1 ) liens and security interests securing Indebtedness owed by Borrower to Lender ; ( 2 ) liens for taxes, assessments, or similar charges either not yet due or being contested in good faith ; ( 3 ) liens of materialmen, mechanics, warehousemen, or carriers, or other like liens arising in the ordinary course of business and securing obligations which are not yet delinquent ; ( 4 ) purchase money liens or purchase money security interests upon or in any property acquired or held by Borrower in the ordinary course of business to secure indebtedness outstanding on the date of this Agreement or permitted to be incurred under the paragraph of this Agreement titled "Indebtedness and Liens" ; ( 5 ) liens and security interests which, as of the date of this Agreement, have been disclosed to and approved by the Lender in writing ; and ( 6 ) those liens and security interests which in the aggregate constitute an immaterial and insignificant monetary amount with respect to the net value of Borrower's assets . Related Documents . The words "Related Documents" mean all promissory notes, credit agreements, loan agreements, environmental agreements, guaranties, security agreements, mortgages, deeds of trust, security deeds, collateral mortgages, and all other instruments, agreements and documents, whether now or hereafter existing, executed in connection with the Loan . Security Agreement . The words "Security Agreement" mean and include without limitation any agreements, promises, covenants, arrangements, understandings or other agreements, whether created by law, contract, or otherwise, evidencing, governing, representing, or creating a Security Interest . Security Interest . The words "Security Interest" mean, without limitation, any and all types of collateral security, present and future, whether in the form of a lien, charge, encumbrance, mortgage, deed of trust, security deed, assignment, pledge, crop pledge, chattel mortgage, collateral chattel mortgage, chattel trust, factor's lien, equipment trust, conditional sale, trust receipt, lien or title retention contract, lease or consignment intended as a security device, or any other security or lien interest whatsoever whether created by law, contract, or otherwise .

Loan No: 3015678000 BUSINESS LOAN AGREEMENT (Continued) Page 8 BORROWER ACKNOWLEDGES HAVING READ ALL THE PROVISIONS OF THIS BUSINESS LOAN AGREEMENT AND BORROWER AGREES TO ITS TERMS. THIS BUSINESS LOAN AGREEMENT IS DATED AUGUST 19, 2025. BORROWER: LEE LEE ORIENTAL SUPERMART, LLC AZLL LLC, Managing Member of Lee Lee Oriental Supermart, LLC MAISON SOL ONS INC., Managing Member of AZLL LLC By: John u, of Maison Solutions Inc. AZLL LLC MAISON SOL f NS INC., Managing Member of AZLL LLC By: John Xu, t o olulions lnC. LENDER: ROYAL BUSINESS BA By: Jack Leung,‘FVP/FfelationWip Manager Laserfl'ro Ver 25 J 20 003 Copr Finasva USA Corporafion 997, 20Z0 All Rignls Reserved - CA C \ APPOSHABLAND TCFIK PLtCéO GC OR - 39•t6 PR•6 Initials Officer JL115 Account caii / Coll 501001 / 0071/0082/0055 Loan No 3015678000 Maturtty 09 - 05 - 2030 Loan Date 08 - 19 - 2025 Principal 55,250,000.00 References in the boxes above are for Lender's use only and do not limit the applicability of this document to any particular loan or item.

Exhibit 10.2

Exhibit 10.3

Any item above containing "”””" has been omitted due to text length limitations. *30156780008609374T208192025* COMMERCIAL SECURITY AGREEMENT Borrower: Grantor: Lee Lee Oriental Supermart, LLC AZLL LLC 2025 N. Dobson Rd. Chandler, AZ 85224 Lee Lee Oriental Supermart, LLC 2025 N. Dobson Rd. Chandler, AZ 85224 Lender: ROYAL BUSINESS BANK Commercial Lending Department 1055 Wilshire Boulevard, Suite 1220 Los Angeles, CA 90017 THIS COMMERCIAL SECURITY AGREEMENT dated August 19, 2025, is made and executed among Lee Lee Oriental Supermart, LLC ("Grantor") ; Lee Lee Oriental Supermart, LLC ; and AZLL LLC ("Borrower") ; and ROYAL BUSINESS BANK ("Lender") . GRANT OF SECURITY INTEREST . For valuable consideration, Grantor grants to Lender a security interest in the Collateral to secure the Indebtedness and agrees that Lender shall have the rights stated in this Agreement with respect to the Collateral, in addition to all other rights which Lender may have by law . COLLATERAL DESCRlPTiON . The word "Collateral" as used in this Agreement means ihe following described property, whether now owned or hereafter acquired, yvhelher now existing or hereaRer arising, and wherever located, in which Grantor is giving to Lender a security interest for the payment of the Indebtedness and performance of all other obligations under the Note and this Agreement : All inventory, equipment, accounts (including but not limited to all health - care - insurance receivables), chattel paper, instruments (including but not limited to all promissory notes), letter - of - credit rights, letters of credit, documents, deposit accounts, investment property, money, other rights to payment and performance, and general intangibles (including but not limited to all software and all payment intangibles) ; all oil, gas and other minerals before extraction ; all oil, gas, other minerals and accounts constituting as - extracted collateral ; all fixtures ; all timber to be cut ; all attachments, accessions, accessories, fittings, increases, tools, parts, repairs, supplies, and commingled goods relating to the foregoing property, and all additions, replacements of and • iubstitutions for all or any part of the foregoing property ; all insurance refunds relating to the foregoing property ; all good will relating to tha foregoing property ; all records and data and embedded software relating to the foregoing property, and all equipment, inventory and software to utilize, create, maintain and process any such records and data on electronic media ; and all supporting obligations relating to the foregoing property ; all whether now exlstfng or hereafter arising, whether now owned or hereafter acquired or whether now or hereafter subject to any rights in the foregoing property : and all products and proceeds (including but not limited to all insurance payments) of or relating to the foregoing property . INCLUDING ASSETS RELATED TO 2025 N. Dobson Rd., Chandler, AZ 85224, 7575 W. Cactus Rd., Peoria, AZ 85381, and 1990 W. Orange Grove Rd . , Tucson, AZ 85704 . In addition, the word "Collateral" also includes all the following, whether now owned or hereafter acquired, whether now existing or hereafter arising, and wherever located : (A) All accessions, attachments, accessories, tools, parts, supplies, replacements of and additions to any of the collateral described herein, whether added now or later. (B) All products and produce of any of the property described in this Collateral section. (C) All accounts, general intangibles, instruments, rents, monies, payments, and all other rights, arising out of a sale, lease, consignment or other disposition of any of the property described in this Collateral section. (D) All proceeds (including insurance proceeds) from the sale, destruction, loss, or other disposition of any of the property described in this Collateral section, and sums due from a third party who has damaged or destroyed the Collateral or from that party's insurer, whether due to judgment, settlement or other process . (E) All records and data relating to any of the property described in this Collateral section, whether in the form of a writing, photograph, microfilm, microfiche, or electronic media, together with all of Grantor's right, title, and interest in and to all computer software required to utilize, create, maintain, and process any such records or data on electronic media . FUTURE ADVANCES . In addition to the Note, this Agreement secures all future advances made by Lender to Borrower regardless of whether the advances are made a) pursuant to a commitment or b) for the same purposes . BORROWER'S WAIVERS AND RESPONSIBILITIES . Except as otherwise required under this Agreement or by applicable law, (A) Borrower agrees that Lender need not tell Borrower about any action or inaction Lender takes in connection with this Agreement ; (B) Borrower assumes the responsibility for being and keeping informed about the Collateral ; and (C) Borrower waives any defenses that may arise because of any action or inaction of Lender, including withou! limitation any failure of Lender to realize upon the Collateral or any delay by Lender in realizing upon the Collateral ; and Borrower agrees to remain liable under the Note no matter what action Lender takes or fails to take under this Agreement . GRANTOR'S REPRESENTATIONS AND WARRANTIES . Grantor warrants that : (A) this Agreement is executed at Borrower's request and not at the request of Lender ; (B) Grantor has the full right, power and authority to enter into this Agreement and to pledge the Collateral to Lender ; (C) Grantor has established adequate means of obtaining from Borrower on a continuing basis information about Borrower's financial condition; and (D) Lender has made no representation to Grantor about Borrower or Borrower's creditworthiness. GRANTOR'S WAIVERS .

Except as prohibited by applicable law, Grantor waives any right to require Lender to (A) make any presentment, protest, demand, or notice of any kind, including notice of change of any terms of repayment of the Indebtedness, default by Borrower or any Loan No: 3015678000 COMMERCIAL SECURITY AGREEMENT (Continued) Page 2 other guarantor or surety, any action or nonaction taken by Borrower, Lender, or any other guarantor or surety of Borrower, or the creation of new or additional Indebtedness ; (B) proceed against any person, including Borrower . bafore proceeding against Grantor ; (C) proceed against any collateral for the Indebtedness, including Borrower's collateral, before proceeding against Grantor ; (D) apply any payments or proceeds received against the indebtedness in any order ; (E) give notice of the terms, time, and place of any sale of any collateral pursuant to the Uniform Commercial Code or any other law governing such sale ; (F) disclose any information about the Indebtedness, the Borrower, any collateral, or any other guarantor or surety, or about any action or nc›naction of Lender ; or (G) pursue any remedy or course of action in Lender's power whatsoever . Grantor also waives any and all rights or defenses arising by reason of (A) any disability or other defense of Borrower, any other guarantor or surety or any other person ; (B) the cessation from any cause whatsoever, other than payment in full, of the Indebtedness ; (C) the application of proceeds of the Indebtedness by Borrower for purposes other than the purposes understood and intended by Grantor and Lender ; (D) any act of omission or commission by Lender which directly or indirectly results in or contributes to the discharge of Borrower or any Other guarantor or surety, or the Indebtedness, or the loss or release of any collateral by operation of law or otherwise ; (E) any statute of limitations in any action under this Agreement or on the Indebtedness ; or (F) any modification or change in terms of the Indebtedness, whatsoever, including without limitation, the renewal, extension, acceleration, or other change in the time payment of the Indebtedness is due and any change in the interest ra \ e . Grantor waives all rights and defenses arising out of an election of remedies by Lender even though that election of remedies, such as a non - judicial foreclosure with respect to security for a guaranteed obligation, has destroyed Grantor's rights of subrogation and reimbursement against Borrower by operation of Section 5 B 0 d of the California Code of Civil Procedure or otherwise . Grantor waives all rights and defenses that Grantor may have because Borrower's obligation is secured by real property . This means among other things : ( 1 ) Lender may collect from Grantor without first foreclosing on any real property collateral pledged by Borrower ; and ( 2 ) If Lender forecloses on any real property collateral pledged by the Bonower : (A) The amount of the Borrower's obligation may be reduced only by the price for which the collateral is sold at the foreclosure sale, even if the ‹bilateral is worth more than the sale price ; (B) The Lender may collect from the Grantor even if the Lender, by foreclosing on the real property collateral, has destroyed any right the Grantor may have to collect from lhe borrower . This is an unconditional and irrevocable waiver of an'y rights and defenses the Grantor may have because the Borrower's obligation is secured by real property . These rights and defenses include, but are not limited to, any rights and defenses based upon Sections 580 a, 580 b, 580 d, or T 26 of the Code of Civil Procedure . Grantor understands and agrees that the foregoing waivers are unconditional and irrevocable waivers of substantive rights and defenses to which Grantor might otherwise be entitled under state and federal law . The rights and defenses waived include, without limitation, those provided by California laws of suretyship and guaranty, anti - deficiency laws, and the Uniform Commercial Code . Grantor further understands and agrees that this Agreement is a separate and independent contract between Grantor and Lender, given for full and amplo considera \ Ion, and is enforceable on its own terms . Grantor acknowledges that Grantor has provided (hese waivers of rights and defenses with lhe intention that they be fully relied upon by Lender . Until all Indebtedness is paid in full, Grantor waives any right to enforce any remedy Grantor may have against Borrower or any other guarantor, surety, or other person, and further, Grantor waives any right to participate in any collateral for the Indebtedness now or hereafter held by Lender . RIGHT OF SETOFF . To the extent permitted by applicable law, Lender reserves a right of setoff in all Grantor's accounts with Lender (whether checking, savings, or some other account) . This includes all accounts Grantor holds jointly with someone else and all accounts Grantor may open in the future . However, this does not include any IRA or Keogh accounts, or any trust accounts for which setoff would be prohibited by law . Grantor authorizes Lender, to the extent permitted by applicable law, to charge or setoff all sums owing on the Indebtedness against any and all such accounts . GRANTOR'S REPRESENTATIONS AND WARRANTIES WITH RESPECT TO THE COLLATERAL . With respect to the Collateral, Grantor represents and promises to Lender that : Perfection of Security Interest . Grantor agrees to take whatever actions are requested by Lender to perfect and continue Lender's security interest in the Collateral . Upon request of Lender, Grantor will deliver to Lender any and all of the documents evidencing or constituting the Collateral, and Grantor will note Lender's interest upon any and all chattel paper and instruments if not delivered to Lender for possession by Lender . This is a continuing Security Agreement and will continue in effect even though all or any part of the Indebtedness is paid in full and even though for a period of time Borrower may not be indebted to Lender . Notices to Lender . Grantor will promptly notify Lender in writing at Lender's address shown above (or such other addresses as Lender may designate from time to time) prior to any ( 1 ) change in Grantor's name ; ( 2 ) change in Grantor's assumed business name(s) ; ( 3 ) change in the management or in the members or managers of the limited liability company Grantor ; ( 4 ) change in the authorized signer(s) ; ( 5 ) change in Grantor's principal office address ; ( 6 ) change in Grantor's state of organization ; ( 7 ) conversion of Grantor to a new or different type of business entity ; or ( 8 ) change in any other aspect of Grantor that directly or indirectly relates to any agreements between Grantor and Lender . No change in Grantor's name or state of organization will take effect until after Lender has received notice . No Violation . The execution and delivery of this Agreement will not violate any law or agreement governing Grantor or to which Grantor is a party, and its membership agreement does not prohibit any term or condition of this Agreement . Enforceability of Collateral . To the extent the Collateral consists of accounts, chattel paper, or general intangibles, as defined by the Uniform Commercial Code, the Collateral is enforceable in accordance with its terms, is genuine, and fully complies with all applicable laws and regulations cenceming form, content and manner of preparation and e • = : mition, and all persons appearing to be obligated on the Collateral have authority and capacity to contract and are in fact obligated as they appear to be on the Collateral . At the lime any account becomes subject to a security interest in favor of Lender, the account shall be a good and valid account representing an undisputed, bona fide indebtedness incurred by the account debtor, for merchandise held subject to delivery instructions or previously shipped or delivered pursuant to a contract of sale, or for services previously performed by Grantor with or for the account debtor . So long as this Agreement remains in effect, Grantor shall not, without Lender's prior written consent, compromise, settle, adjust, or extend payment under or witLi regard to any such Accounts . There shall be no setoffs or counterclaims against any of the Collateral, and no agreement shall have been made under which any deductions or discounts may be claimed concerning the Collateral except those disclosed to Lender in writing . Location of the Collateral . Except in the ordinary course of Grantor's business, Grantor agrees to keep the Collateral (or to the extent the Collateral consists of intangible property such as accounts or general intangibles, the records concerning the Collateral) at Grantor's address shown above or at such other looations as are acceptable to Lender . Upon Lender's request, Grantor will deliver to Lender in form satisfactory to Lender a schedule of real properties and Collateral locations relating to Grantor's operations, including without limitation the following : ( 1 ) all real property Grantor owns or is purchasing ; ( 2 ) all real property Grantor is renting or leasing ; ( 3 ) all storage facilities Grantor owns, rents, leases . or uses, and ( 4 ) all other properties where Collateral is or may be located . Removal of the Collateral . Except in the ordinary course of Grantor's business, including the sales of inventory, Grantor shall not remove the Collateral from its existing location without Lender's prior written consent .