UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the Month of September 2025

Commission File Number: 001-38104

IMMURON LIMITED

(Name of Registrant)

Level 3, 62 Lygon Street, Carlton South, Victoria, 3053, Australia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-Immuron Limited (the “Company”) published two announcements (the “Public Notices”) to the Australian Securities Exchange on September 2, 2025 titled:

IMMURON LIMITED

EXPLANATORY NOTE

| - | Appendix 4E Preliminary Final Report | |

| - | FY25 Results Presentation |

A copy of the Public Notice is attached as an exhibit to this report on Form 6-K.

This report on Form 6-K (including the exhibit hereto) shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

EXHIBITS

| Exhibit Number |

Description | |

| 99.1 | Appendix 4E Preliminary Final Report | |

| 99.2 | FY25 Results Presentation |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| IMMURON LIMITED | ||

| Date: September 2, 2025 | By: | /s/ Phillip Hains |

| Phillip Hains | ||

| Company Secretary | ||

Exhibit 99.1

Immuron Limited

Appendix 4E

Preliminary final report

1. Company details

| Name of entity: | Immuron Limited |

| ABN: | 80 063 114 045 |

| Reporting period: | For the year ended 30 June 2025 |

| Previous period: | For the year ended 30 June 2024 |

| 2. Results for announcement to the market | $ | |||||||||

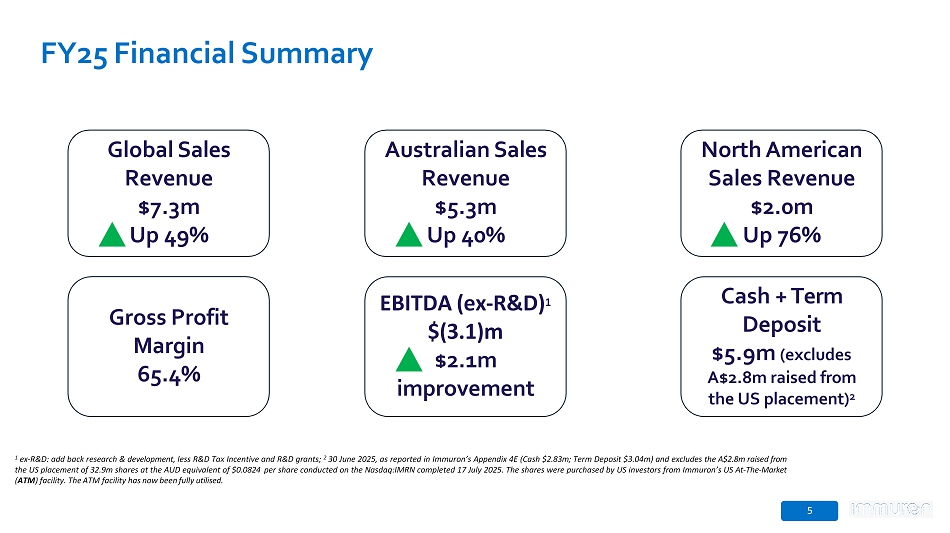

| Revenue from ordinary activities | up | 48.6% to | 7,287,002 | |||||||

| Loss from ordinary activities after tax attributable to the members of Immuron Limited | down | 24.3% to | (5,253,209 | ) | ||||||

| Loss for the year attributable to the members of Immuron Limited | down | 24.3% to | (5,253,209 | ) | ||||||

| 3. Net tangible assets | ||||||||

| Consolidated | ||||||||

| 2025 | 2024 | |||||||

| Cents | Cents | |||||||

| Net tangible asset backing (per security) | 3.39 | 5.51 | ||||||

The calculation of net tangible assets excludes right-of-use assets arising from AASB 16 Leases.

4. Explanation of results

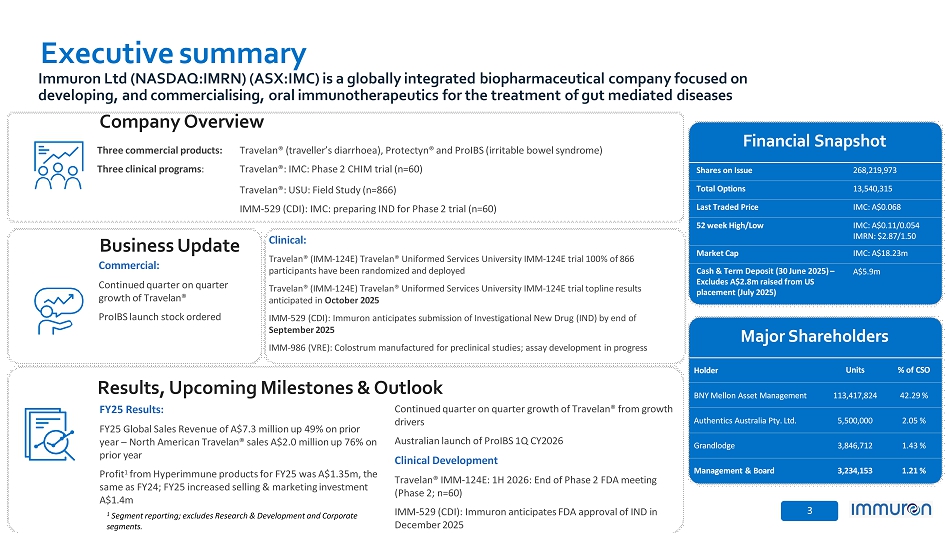

The reported loss after tax of the current financial year of $5,253,209 (2024: $6,936,957) is after fully expensing the company’s research and development expenditure of $3,597,296 incurred during the year (2024: $5,375,461). Of which, $146,252 (2024: $2,599,458) was funded by the R&D grant from Medical Technology Enterprise Consortium (MTEC).

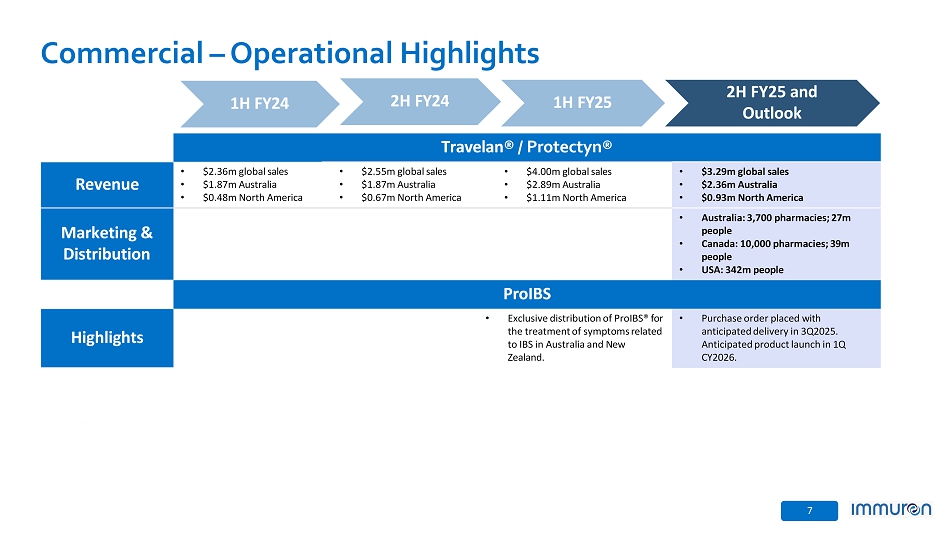

The revenue from contracts with customers for the year was $7,287,002, which is an increase of 48.6% from the prior financial year (2024: $4,902,865), primarily due to the sales increase in the Australian and North American markets for Travelan®. We anticipate that revenues from sales of our Travelan® product will continue to increase in the future.

As at 30 June 2025, the company’s cash position was $2,830,526 (30 June 2024: $11,657,315). The company had trade and other receivables of $1,888,370 (30 June 2024: $1,387,573). This receivables amount includes future receivables from the Australian Government under the R&D Tax Incentive program. The company had other current assets of $3,486,744 (30 June 2024: $96,841). This other current assets amount includes a 90-day fixed term deposit of $3,036,278 (30 June 2024: Nil), which matured on 27 July 2025.

The preliminary final report follows, with the further details to be included in the audited financial statements to be released by 30 September 2025.

Immuron Limited

Appendix 4E

Preliminary final report

5. Distributions

No dividends have been paid or declared by the company for the current financial year. No dividends were paid for the previous financial year.

6. Changes in controlled entities

There have been no changes in controlled entities during the year ended 30 June 2025.

7. Details of associates and joint venture entities

| Ownership interest held by | ||||||||||

| Place of | the Group | |||||||||

| business/country | 2025 | 2024 | ||||||||

| Name of entity | of incorporation | % | % | |||||||

| Ateria Health Limited | United Kingdom | 23.6 | % | s | 23.6 | % | ||||

As at 30 June 2025, Immuron has a 23.61% interest in Ateria. Immuron is deemed to have significant influence over Ateria.

8. Audit

The financial statements of Immuron Limited (the ‘Group’) are currently in the process of being audited. The audited financial statements along with the independent auditor report for the year end 30 June 2025 will be provided in the due course.

Immuron Limited

Consolidated statement of profit or loss and other comprehensive income

For the year ended 30 June 2025

| Consolidated | ||||||||||||

| Note | 2025 | 2024 | ||||||||||

| $ | $ | |||||||||||

| Revenue from contracts with customers | 1 | 7,287,002 | 4,902,865 | |||||||||

| Cost of goods sold | (2,521,903 | ) | (1,566,068 | ) | ||||||||

| Gross profit | 4,765,099 | 3,336,797 | ||||||||||

| Other income | 2 | 1,374,283 | 3,408,199 | |||||||||

| Net foreign exchange gains/(losses) | 12,183 | (27,603 | ) | |||||||||

| Fair value losses to financial assets | - | (557,676 | ) | |||||||||

| Total other income including gains/(losses) | 1,386,466 | 2,822,920 | ||||||||||

| Expenses | ||||||||||||

| General and administrative expenses | (4,483,623 | ) | (4,555,726 | ) | ||||||||

| Research and development expenses | (3,597,296 | ) | (5,375,461 | ) | ||||||||

| Selling and marketing expenses | (3,452,416 | ) | (2,029,648 | ) | ||||||||

| Operating loss | (5,381,770 | ) | (5,801,118 | ) | ||||||||

| Finance income | 135,866 | 327,756 | ||||||||||

| Finance expenses | (7,305 | ) | (7,576 | ) | ||||||||

| Share of loss from equity accounted associate | 10 | - | (1,456,019 | ) | ||||||||

| Loss before income tax expense | (5,253,209 | ) | (6,936,957 | ) | ||||||||

| Income tax expense | - | - | ||||||||||

| Loss after income tax expense for the year attributable to the members of Immuron Limited | (5,253,209 | ) | (6,936,957 | ) | ||||||||

| Other comprehensive (loss)/income | ||||||||||||

| Items that may be reclassified subsequently to profit or loss | ||||||||||||

| Exchange differences on translation of foreign operations (expense)/income | (1,358 | ) | 2,266 | |||||||||

| Other comprehensive (loss)/income for the year | (1,358 | ) | 2,266 | |||||||||

| Total comprehensive loss for the year | (5,254,567 | ) | (6,934,691 | ) | ||||||||

Loss per share for profit attributable to the ordinary equity holders of the company: |

Cents | Cents | ||||||

| Basic and diluted loss per share | (2.27 | ) | (3.04 | ) | ||||

The above consolidated statement of profit or loss and other comprehensive income should be read in conjunction with the accompanying notes

Immuron Limited

Consolidated statement of financial position

As at 30 June 2025

| Consolidated | ||||||||||||

| Note | 2025 | 2024 | ||||||||||

| $ | $ | |||||||||||

| Assets | ||||||||||||

| Current assets | ||||||||||||

| Cash and cash equivalents | 2,830,526 | 11,657,315 | ||||||||||

| Trade and other receivables | 3 | 1,888,370 | 1,387,573 | |||||||||

| Inventories | 1,772,363 | 1,584,608 | ||||||||||

| Other current assets | 4 | 3,486,744 | 96,841 | |||||||||

| Total current assets | 9,978,003 | 14,726,337 | ||||||||||

| Non-current assets | ||||||||||||

| Property, plant and equipment | 113,950 | 154,347 | ||||||||||

| Inventories | 666 | 669,285 | ||||||||||

| Total non-current assets | 114,616 | 823,632 | ||||||||||

| Total assets | 10,092,619 | 15,549,969 | ||||||||||

| Liabilities | ||||||||||||

| Current liabilities | ||||||||||||

| Trade and other payables | 1,529,434 | 2,135,852 | ||||||||||

| Employee benefits | 391,503 | 522,571 | ||||||||||

| Other current liabilities | 45,272 | 40,556 | ||||||||||

| Total current liabilities | 1,966,209 | 2,698,979 | ||||||||||

| Non-current liabilities | ||||||||||||

| Employee benefits | 22,722 | 8,605 | ||||||||||

| Other non-current liabilities | 71,855 | 132,941 | ||||||||||

| Total non-current liabilities | 94,577 | 141,546 | ||||||||||

| Total liabilities | 2,060,786 | 2,840,525 | ||||||||||

| Net assets | 8,031,833 | 12,709,444 | ||||||||||

| Equity | ||||||||||||

| Share capital | 5 | 88,872,756 | 88,504,043 | |||||||||

| Other reserves | 6 | 1,639,504 | 3,173,797 | |||||||||

| Accumulated losses | (82,480,427 | ) | (78,968,396 | ) | ||||||||

| Total equity | 8,031,833 | 12,709,444 | ||||||||||

The above consolidated statement of financial position should be read in conjunction with the accompanying notes

Immuron Limited

Consolidated statement of changes in equity

For the year ended 30 June 2025

| Issued capital |

Reserves | Accumulated losses | Total equity | |||||||||||||

| Consolidated | $ | $ | $ | $ | ||||||||||||

| Balance at 1 July 2023 | 88,436,263 | 3,235,969 | (72,055,396 | ) | 19,616,836 | |||||||||||

| Loss after income tax expense for the year | - | - | (6,936,957 | ) | (6,936,957 | ) | ||||||||||

| Other comprehensive income for the year | - | 2,266 | - | 2,266 | ||||||||||||

| Total comprehensive income/(loss) for the year | - | 2,266 | (6,936,957 | ) | (6,934,691 | ) | ||||||||||

| Transactions with members in their capacity as members: | ||||||||||||||||

| Options and warrants vested in the year | - | 15,231 | - | 15,231 | ||||||||||||

| Options and warrants issued/expensed (net of adjustments) | - | (11,932 | ) | - | (11,932 | ) | ||||||||||

| Options and warrants exercised | 67,780 | (43,780 | ) | - | 24,000 | |||||||||||

| Options and warrants forfeited | - | (23,957 | ) | 23,957 | - | |||||||||||

| Balance at 30 June 2024 | 88,504,043 | 3,173,797 | (78,968,396 | ) | 12,709,444 | |||||||||||

| Issued capital |

Reserves | Accumulated losses | Total equity | |||||||||||||

| Consolidated | $ | $ | $ | $ | ||||||||||||

| Balance at 1 July 2024 | 88,504,043 | 3,173,797 | (78,968,396 | ) | 12,709,444 | |||||||||||

| Loss after income tax expense for the year | - | - | (5,253,209 | ) | (5,253,209 | ) | ||||||||||

| Other comprehensive loss for the year | - | (1,358 | ) | - | (1,358 | ) | ||||||||||

| Total comprehensive loss for the year | - | (1,358 | ) | (5,253,209 | ) | (5,254,567 | ) | |||||||||

| Transactions with members in their capacity as members: | ||||||||||||||||

| Shares issued, net of transaction costs (note 5) | 272,713 | - | - | 272,713 | ||||||||||||

| Options and warrants issued/expensed (net of adjustments) (note 6) | - | 64,755 | - | 64,755 | ||||||||||||

| Options and warrants lapsed/expired (note 6) | - | (1,741,178 | ) | 1,741,178 | - | |||||||||||

| Performance rights issued/expensed (note 6) | - | 239,488 | - | 239,488 | ||||||||||||

| Performance rights exercised (note 6) | 96,000 | (96,000 | ) | - | - | |||||||||||

| Balance at 30 June 2025 | 88,872,756 | 1,639,504 | (82,480,427 | ) | 8,031,833 | |||||||||||

The above consolidated statement of changes in equity should be read in conjunction with the accompanying notes

Immuron Limited

Consolidated statement of cash flows

For the year ended 30 June 2025

| Consolidated | ||||||||

| 2025 | 2024 | |||||||

| $ | $ | |||||||

| Cash flows from operating activities | ||||||||

| Receipts from customers (inclusive of GST) | 7,592,577 | 4,734,350 | ||||||

| Payments to suppliers (inclusive of GST) | (14,772,687 | ) | (12,910,753 | ) | ||||

| Australian R&D tax incentive refund | 768,433 | 395,001 | ||||||

| Grants received from government and non-government sources | 274,728 | 1,901,263 | ||||||

| Net cash used in operating activities | (6,136,949 | ) | (5,880,139 | ) | ||||

| Cash flows from investing activities | ||||||||

| Payment for property, plant and equipment | - | (195 | ) | |||||

| Payments for term deposit | (3,036,278 | ) | - | |||||

| Interest received | 135,866 | 327,756 | ||||||

| Net cash (used in)/from investing activities | (2,900,412 | ) | 327,561 | |||||

| Cash flows from financing activities | ||||||||

| Proceeds from issues of shares | 396,827 | 24,000 | ||||||

| Share issue transaction costs | (124,114 | ) | - | |||||

| Principal elements of lease payments | (65,661 | ) | (15,595 | ) | ||||

| Interest and other costs of finance paid | (7,305 | ) | (7,576 | ) | ||||

| Net cash from financing activities | 199,747 | 829 | ||||||

| Net decrease in cash and cash equivalents | (8,837,614 | ) | (5,551,749 | ) | ||||

| Cash and cash equivalents at the beginning of the financial year | 11,657,315 | 17,159,764 | ||||||

| Effects of exchange rate changes on cash and cash equivalents | 10,825 | 49,300 | ||||||

| Cash and cash equivalents at the end of the financial year | 2,830,526 | 11,657,315 | ||||||

The above consolidated statement of cash flows should be read in conjunction with the accompanying notes

Immuron Limited

Notes to the consolidated financial statements

30 June 2025

1. Revenue from contract with customers

The Group derives revenue from the transfer of hyperimmune products at a point in time in the following major product lines and geographical regions:

| Consolidated | ||||||||

| 2025 | 2024 | |||||||

| $ | $ | |||||||

| Hyperimmune products revenue | ||||||||

| Travelan - Australia | 5,201,385 | 3,702,876 | ||||||

| Travelan - United States | 1,658,336 | 1,075,614 | ||||||

| Travelan - Canada | 378,706 | 80,888 | ||||||

| Protectyn - Australia | 48,575 | 43,487 | ||||||

| Revenue from external customers | 7,287,002 | 4,902,865 | ||||||

2. Other income

| Consolidated | ||||||||

| 2025 | 2024 | |||||||

| $ | $ | |||||||

| Australian R&D tax incentive refund | 1,073,355 | 764,981 | ||||||

| MTEC R&D grant | 146,252 | 2,599,458 | ||||||

| HJF R&D grant | 124,164 | - | ||||||

| EMDG grant | - | 28,000 | ||||||

| Other income | 30,512 | 15,760 | ||||||

| 1,374,283 | 3,408,199 | |||||||

(i) Fair value of R&D tax incentive

The Group’s research and development (R&D) activities are eligible under an Australian government tax incentive for eligible expenditure. Management has assessed these activities and expenditure to determine which are likely to be eligible under the incentive scheme. Amounts are recognised when it has been established that the conditions of the tax incentive have been met and that the expected amount can be reliably measured. For the year ended 30 June 2025, the Group has included an item in other income of $1,073,355 (2024: $764,981).

3. Trade and other receivables

| Consolidated | ||||||||

| 2025 | 2024 | |||||||

| $ | $ | |||||||

| Current assets | ||||||||

| Trade receivables | 826,857 | 607,436 | ||||||

| Less: Allowance for expected credit losses | (35,466 | ) | (16,233 | ) | ||||

| 791,391 | 591,203 | |||||||

| Accrued income - Australian R&D tax incentive refund | 1,073,291 | 768,370 | ||||||

| Other income receivables - other grants | - | 28,000 | ||||||

| Other receivables | 23,688 | - | ||||||

| Total trade and other receivables | 1,888,370 | 1,387,573 | ||||||

Classification as trade receivables

Trade receivables are amounts due from customers for goods sold or services performed in the ordinary course of business. They are generally due for settlement within 30 days and therefore are all classified as current. Trade receivables are recognised initially at the amount of consideration that is unconditional unless they contain significant financing components, when they are recognised at fair value. The Group holds the trade receivables with the objective to collect the contractual cash flows and therefore measures them subsequently at amortised cost using the effective interest method.

Immuron Limited

Notes to the consolidated financial statements

30 June 2025

3. Trade and other receivables (continued)

Accrued receivables

These amounts primarily comprise receivables from the Australian Taxation Office in relation to the R&D tax incentive.

Fair value of trade and other receivables

Due to the short-term nature of the current receivables, their carrying amount is considered to be the same as their fair value.

4. Other current assets

| Consolidated | ||||||||

| 2025 | 2024 | |||||||

| $ | $ | |||||||

| Prepayments | 442,800 | 86,798 | ||||||

| Term deposits | 3,036,278 | - | ||||||

| Other current assets | 7,666 | 10,043 | ||||||

| 3,486,744 | 96,841 | |||||||

The Group entered into a 90-day fixed term deposit, which matured on 27 July 2025. Term deposits are presented as Other Current Assets as they are not considered highly liquid instruments readily convertible to cash and cash equivalents. The deposit was held to maturity in accordance with the Group’s investment policy.

5. Share capital

| Consolidated | ||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Shares | Shares | $ | $ | |||||||||||||

| Ordinary shares - fully paid | 233,959,013 | 227,998,346 | 98,581,947 | 98,089,120 | ||||||||||||

| Transaction costs arising on ordinary share issues | - | - | (9,709,191 | ) | (9,585,077 | ) | ||||||||||

| 233,959,013 | 227,998,346 | 88,872,756 | 88,504,043 | |||||||||||||

Movements in ordinary shares:

| Details | Date | Shares | $ | |||||||

| Balance | 1 July 2023 | 227,798,346 | 88,436,263 | |||||||

| Issue at $0.12 on exercise of unlisted options (2024-03-12) | 200,000 | 67,780 | ||||||||

| Less: Transaction costs arising on share issues | - | - | ||||||||

| Balance | 30 June 2024 | 227,998,346 | 88,504,043 | |||||||

| Issue of shares on the exercise of performance rights at $0.0 per share (2024-10-07) | 1,147,083 | 83,000 | ||||||||

| Issue at US$2.1784 pursuant to At The Market facility (2025-01-08) | 2,579,760 | 226,567 | ||||||||

| Issue at US$2.0971 pursuant to At The Market facility (2025-01-15) | 1,801,680 | 152,300 | ||||||||

| Issue of shares on the exercise of performance rights at $0.0 per share (2025-04-10) | 179,664 | 13,000 | ||||||||

| Issue at US$1.8435 pursuant to At The Market facility (2025-05-29) | 135,800 | 9,744 | ||||||||

| Issue at US$1.8286 pursuant to At The Market facility (2025-06-03) | 116,680 | 8,216 | ||||||||

| Less: Transaction costs arising on share issues | - | (124,114 | ) | |||||||

| Balance | 30 June 2025 | 233,959,013 | 88,872,756 | |||||||

Rights of each type of share

Ordinary shares entitle the holder to participate in dividends and the proceeds on winding up of the company in proportion to the number of shares held. On a show of hands every holder of ordinary shares present at a meeting or by proxy, is entitled to one vote upon a poll every holder is entitled to one vote per share held. The ordinary shares have no par value.

Immuron Limited

Notes to the consolidated financial statements

30 June 2025

6. Other reserves

| Share-based | Foreign currency | |||||||||||

| payments | translation | Total | ||||||||||

| Consolidated | $ | $ | $ | |||||||||

| Balance at 1 July 2023 | 3,123,759 | 112,210 | 3,235,969 | |||||||||

| Currency translation differences | - | 2,266 | 2,266 | |||||||||

| Transactions with owners in their capacity as owners: | ||||||||||||

| Options and warrants vested in the year | 15,231 | - | 15,231 | |||||||||

| Options and warrants issued/expensed (net of adjustments) | (11,932 | ) | - | (11,932 | ) | |||||||

| Options and warrants exercised | (43,780 | ) | - | (43,780 | ) | |||||||

| Options and warrants lapsed/expired | (23,957 | ) | - | (23,957 | ) | |||||||

| Balance at 30 June 2024 | 3,059,321 | 114,476 | 3,173,797 | |||||||||

| Currency translation differences | - | (1,358 | ) | (1,358 | ) | |||||||

| Transactions with owners in their capacity as owners: | ||||||||||||

| Options and warrants issued/expensed (net of adjustments) (note 6(ii)) | 64,755 | - | 64,755 | |||||||||

| Options and warrants lapsed/expired (note 6(ii)) | (1,741,178 | ) | - | (1,741,178 | ) | |||||||

| Performance rights issued/expensed (note 6(ii)) | 239,488 | - | 239,488 | |||||||||

| Performance rights exercised (note 6(ii)) | (96,000 | ) | - | (96,000 | ) | |||||||

| Balance at 30 June 2025 | 1,526,386 | 113,118 | 1,639,504 | |||||||||

| (i) | Nature and purpose of other reserves: |

Share-based payments

The share-based payment reserve records items recognised as expenses on valuation of share options and warrants issued to key management personnel, other employees and eligible contractors.

Foreign currency translation

Exchange differences arising on translation of foreign controlled entities are recognised in other comprehensive income as described in note and accumulated in a separate reserve within equity.

| (ii) | Movements in options, warrants and performance rights: |

| Details | Number

of options or performance rights |

$ | ||||||

| Balance as at 1 July 2023 | 12,879,720 | 3,123,759 | ||||||

| Options issued in the year (net of adjustments) | 1,000,000 | (11,932 | ) | |||||

| Exercise of unlisted options at $0.12 (2024-03-12) | (200,000 | ) | (43,780 | ) | ||||

| Lapse of unexercised options | (173,600 | ) | (23,957 | ) | ||||

| Share-based payments expense for options previously issued | - | 15,231 | ||||||

| Performance rights issued in the year | 1,688,839 | - | ||||||

| Balance as at 30 June 2024 | 15,194,959 | 3,059,321 | ||||||

| Options issued in the year (net of adjustments) | 3,000,000 | 55,584 | ||||||

| Lapse of unexercised options | (8,016,120 | ) | (1,741,178 | ) | ||||

| Share-based payments expense for options previously issued | - | 9,171 | ||||||

| Exercise of performance rights | (1,326,747 | ) | (96,000 | ) | ||||

| Performance rights issued in the year | 5,386,810 | 239,488 | ||||||

| Lapse of performance rights issued in the year | (285,741 | ) | - | |||||

| Balance as at 30 June 2025 | 13,953,161 | 1,526,386 | ||||||

Immuron Limited

Notes to the consolidated financial statements

30 June 2025

7. Share-based payments

Performance rights

Performance rights which can be settled in shares, were granted to key management personnel and employees during the year. The expense for the year ended 30 June 2025 was $239,488. The performance rights are based on non-market weighted key performance indicators (KPIs) and have been expensed over the service period, based on the probability the KPIs being achieved. The performance rights are expected to vest between one and five years.

Options

Options were approved at the Annual General Meeting, held on 18 November 2024 for Prof. Ravi Savarirayan and Mr. Daniel Pollock of 1,000,000 each. The option exercise price is $0.145 and they have an expiry date of 20 August 2028. The expense for the year was $34,952.

Options were granted to Dr. Jeanette Joughin on 19 June 2024 but were subject to shareholder approval obtained on 18 November 2024. The expense of $20,632 recorded in the year includes an adjustment for the revised estimate of fair value on the grant date of 18 November 2024.

Fair value is determined using the Black-Scholes option pricing model that takes into account the exercise price, term of the award, security price at grant date, expected volatility, expected dividend yield and the risk-free interest rate.

The model inputs for the options granted during the year:

| Grant date | Expiry date | Exercise price ($A) | No. of options | Share price at grant date | Expected volatility | Dividend yield | Risk-free interest rate | Fair value at grant date per option | ||||||||||||||||||||||

| 18-NOV-24 | 20-AUG-28 | $ | 0.145 | 2,000,000 | $ | 0.079 | 74.51 | % | 0.00 | % | 4.15 | % | $ | 0.033 | ||||||||||||||||

| 18-NOV-24 | 19-JUN-28 | $ | 0.130 | 1,000,000 | $ | 0.079 | 75.72 | % | 0.00 | % | 4.15 | % | $ | 0.035 | ||||||||||||||||

8. Events after the reporting period

At The Market Capital Raising

In July 2025, Immuron Limited (ASX: IMC), raised gross proceeds of USD$1,822,322 (AUD$2,809,177) through an At The Market Facility comprising 34,260,960 shares at an average issue price of of USD$0.053 (AUD$0.082) per share.

This capital raising initiative does not provide evidence of conditions that existed at 30 June 2025 and is therefore classified as a non-adjusting event in accordance with AASB 110 Events after the Reporting Period. No adjustments have been made to the financial statements as a result of this transaction.

No other matter or circumstance has arisen since 30 June 2025 that has significantly affected, or may significantly affect the Group’s operations, the results of those operations, or the Group’s state of affairs in future financial years.

Immuron Limited

Notes to the consolidated financial statements

30 June 2025

9. Principal subsidiaries

The Group’s principal subsidiaries at 30 June 2025 are set out below. Unless otherwise stated, they have share capital consisting solely of ordinary shares that are held directly by the Group, and the proportion of ownership interests held equals the voting rights held by the Group. The country of incorporation or registration is also their principal place of business.

| Ownership interest by the Group | ||||||||||

| Name of entity | Principal place of business / Country of incorporation | 2025 % |

2024 % |

|||||||

| Immuron Inc. | United States | 100 | % | 100 | % | |||||

| Immuron Canada Limited | Canada | 100 | % | 100 | % | |||||

| Anadis ESP Pty Ltd | Australia | 100 | % | 100 | % | |||||

10. Interests in associates

Immuron Limited has a 23.6% interest in Ateria Health Limited (Ateria). The investment was impaired to NIL during the 2024 financial year and there has been no changes to this in the year ended 30 June 2025.

| Ownership interest held by the Group | ||||||||||

| Name of entity | Principal place of business / Country of incorporation | 2025 % |

2024 % |

|||||||

| Ateria Health Limited | United Kingdom | 23.6 | % | 23.6 | % | |||||

| Summarised financial information for associates | ||||||||||

| Consolidated | ||||||||

| 2025 | 2024 | |||||||

| $ | $ | |||||||

| Share of loss for the year | - | (1,456,019 | ) | |||||

| Consolidated | ||||||||

| 2025 | 2024 | |||||||

| Recognised in: | $ | $ | ||||||

| Share of loss for the year - 23.6% (2024: 23.6%) | - | (291,711 | ) | |||||

| Impairment of investment in associate | - | (1,164,308 | ) | |||||

| - | (1,456,019 | ) | ||||||

The carrying amount of investment in associate is NIL, therefore no share of the loss has been recognised for the year ended 30 June 2025.

11

Exhibit 99.2