UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: June 30, 2025

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to _____________

Commission File No. 001-42033

| CleanCore Solutions, Inc. |

| (Exact name of registrant as specified in its charter) |

| Nevada | 88-4042082 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

| 5920 S 118th Circle, Omaha, NE | 68137 | |

| (Address of principal executive offices) | (Zip Code) |

| (877) 860-3030 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Class B Common Stock, par value $0.0001 per share | ZONE | NYSE American LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of December 31, 2024 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the registrant’s class B common stock held by non-affiliates (based upon the closing price as reported on NYSE American) was approximately $6.6 million. Shares held by each executive officer and director and by each person who owns 10% or more of the outstanding shares of class B common stock have been excluded from the calculation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of August 21, 2025, there were a total of 11,175,846 shares of the registrant’s class B common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its 2025 annual meeting of stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The registrant’s definitive proxy statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

CleanCore Solutions, Inc.

Annual Report on Form 10-K

Year Ended June 30, 2025

TABLE OF CONTENTS

INTRODUCTORY NOTES

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to “we,” “us,” “our” and “our company” refer to CleanCore Solutions, Inc., a Nevada corporation, and its wholly owned subsidiary CleanCore Global Limited, an Irish company, or CleanCore Global.

Special Note Regarding Forward-Looking Statements

This report contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to us. All statements other than statements of historical facts are forward-looking statements. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| ● | our goals and strategies; |

| ● | our future business development, financial condition and results of operations; |

| ● | expected changes in our revenue, costs or expenditures; |

| ● | growth of and competition trends in our industry; |

| ● | our expectations regarding demand for, and market acceptance of, our products and services; |

| ● | our expectations regarding our relationships with investors, institutional funding partners and other parties we collaborate with; |

| ● | fluctuations in general economic and business conditions in the market in which we operate; and |

| ● | relevant government policies and regulations relating to our industry. |

In some cases, you can identify forward-looking statements by terms such as “may,” “could,” “will,” “should,” “would,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “project” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under Item 1A “Risk Factors” and elsewhere in this report. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements.

The forward-looking statements made in this report relate only to events or information as of the date on which the statements are made in this report. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

PART I

ITEM 1. BUSINESS.

Overview

We specialize in the development and production of cleaning products that produce pure aqueous ozone for professional, industrial, or home use. We have a patented nanobubble technology using aqueous ozone that we believe is highly effective in cleaning, sanitizing, and deodorizing surfaces and high-touch areas.

Our mission is to become a leader in creating safe, clean spaces that are free from any chemical residue or skin irritants. We are currently expanding our distributor network, improving our production processes, and proving the effectiveness of our products in restaurants, airports, and hotels.

As noted by the U.S. Environmental Protection Agency, or the EPA (“Wastewater Technology Fact Sheet: Ozone Disinfection,” September 1999), ozone has been used in water treatment facilities to remove pathogens from water for decades. However, ozone was not safe for traditional cleaning because the gas alone can be harmful when inhaled. In recent years, ozone has been found to become a powerful cleaning solution if infused into tap water, which then creates a solution called aqueous ozone. Once the ozone is added into the water, the resulting solution is safe to handle, yet continues to hold the effective cleaning and oxidizing components of ozone.

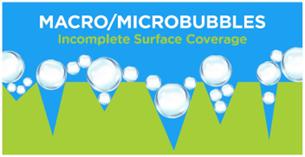

Our product offerings utilize a patented technology that we believe produces an enhanced aqueous ozone solution that requires no additives, filters, or advanced chemicals. We believe that we are the only company that has an aqueous ozone solution that is produced in the form of nanobubbles. In a critical review from Environmental Science Nano (“Disinfection applications of ozone micro- and nanobubbles,” November 2, 2021) authors Petroula Seridou and Nicolas Kalogerakis explain that since its discovery in the 1990’s, nanobubbles have been used to remove pollutants in many industries, including biopharma and food processing. Nanobubbles are nanometer-sized (one billionth of a meter) gaseous cavities in a liquid solution. The common micro sized bubbles have larger diameters which causes them to rise quickly to the surface of an aqueous solution as compared to the smaller bubbles.

|

|

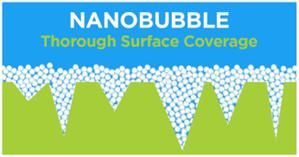

Since nanobubbles have no natural buoyancy, they remain underwater, where each tiny, negatively charged bubble is attracted to positively charged pollutants and harmful toxins. In the article, Seridou and Kalogerakis write about how this union causes the nanobubbles to release ozone which extinguishes pathogens and slowly breaks down the cell walls of mold, germs, and other residues. Further, a smaller size of nanobubbles is also more effective as they have a higher density of ozone and are able to provide a more thorough surface coverage, which destroys a higher number of contaminants.

Our pure aqueous ozone product is a natural cleaner, sanitizer, and deodorizer produced through the infusion of ozone into water using electricity. The use of this ozone solution has been proven effective in eliminating germs, viruses, bacteria, allergens, and molds; and it performs better than bleach according to a research report published by PLoS One (“The microbial killing capacity of aqueous and gaseous ozone on different surfaces contaminated with dairy cattle manure,” May 14, 2018). Aqueous ozone technology has been tested and previously destroyed pathogens including E. Coli, Staphylococcus, Listeria, and Salmonella as described in Catalyst journal (“Ozone and Photocatalytic Processes for Pathogens Removal from Water: A Review,” January 5, 2019). The solution cleans hard surfaces, floors, carpets, upholstery, and food contact surfaces.

In addition, in an independent case study at Cape Coral Hospital in Florida, the aqueous ozone solution worked to significantly deodorize smells. The same internal case study notes that the aqueous ozone does not mask smells, but instead destroys the bacterium causing the smell.

Our aqueous ozone solution is referred to as “pure” because of its ability to keep high concentration of ozone in the solution without needing to use a stabilizer or additive. Depending on the product, the pure aqueous ozone solution contains between 0.5 to 1.5 parts per million, or ppm, of ozone for professional cleaning and up to 20 ppm of ozone for industrial cleaning. At these levels, we believe the concentration of ozone within the solution is strong enough to effectively clean and deodorize better than bleach.

Corporate History and Structure

We were incorporated in the State of Nevada on August 23, 2022 under the name CC Acquisition Corp. for the sole purpose of acquiring substantially all of the assets of CleanCore Solutions, LLC, a Delaware limited liability company, or CleanCore LLC, TetraClean Systems, LLC, a Delaware limited liability company, or TetraClean, and Food Safety Technology L.L.C., a Delaware limited liability company, or Food Safety. On November 21, 2022, we changed our name from CC Acquisition Corp. to CleanCore Solutions, Inc.

On October 17, 2022, we entered into an asset purchase agreement with CleanCore LLC, TetraClean, Food Safety and Burlington Capital, LLC, or Burlington, the majority owner of these entities, pursuant to which we acquired substantially all of the assets of CleanCore LLC, TetraClean and Food Safety for a total purchase price of $5,000,000, consisting of $2,000,000 in cash and the issuance of a promissory note in the principal amount of $3,000,000.

The predecessor of CleanCore LLC was CleanCore Technologies, LLC, which was formed in 2014 and was wholly owned by Center Ridge Holdings, LLC. CleanCore LLC was formed in 2019 by Burlington and Walker Water, LLC d/b/a O-Z Tech. In 2019, prior to the formation of CleanCore LLC, Center Ridge Holdings, LLC transferred substantially all of the assets of CleanCore Technologies, LLC to Burlington, which then transferred such assets to CleanCore LLC. TetraClean and Food Safety were created to focus on industrial and food safety, respectively. CleanCore LLC, TetraClean, and Food Safety were all under majority control by Burlington prior to the acquisition by CC Acquisition Corp. All discussions in this report regarding our business prior to the acquisition reflect the combined business of CleanCore LLC, TetraClean, and Food Safety, our predecessor companies. Prior to the acquisition, we had no operations other than operations relating to our incorporation and organization.

On January 29, 2025, we established CleanCore Global as a wholly owned subsidiary in Ireland in anticipation of the acquisition described below.

On February 21, 2025, CleanCore Global entered into an asset purchase agreement, which was amended on April 15, 2025, with Sanzonate Europe Ltd., an Irish incorporated company, or Sanzonate, and Sanzonate Global Inc., the majority stockholder of Sanzonate, pursuant to which on April 15, 2025 CleanCore Global acquired substantially all of the assets of Sanzonate used in the manufacturer and distribution of aqueous ozone products for an aggregate purchase price of $2,475,000, consisting of: (i) $425,000 in cash; (ii) the issuance of a promissory note in the principal amount of $800,000; and (iii) up to $1,250,000 in Earn-Out Payments (as defined below). As additional consideration, we issued to Sanzonate Global Inc. a five-year warrant to purchase 425,000 shares of our class B common stock at an exercise price of $1.25 per share.

Sanzonate is also entitled to receive the following payments (which we refer to as the Earn-Out Payments) to the extent that Net Sales (as defined in the asset purchase agreement) achieve the following milestones during the five-year period beginning on the closing date and ending on the fifth anniversary of the closing date. If Net Sales are at least (i) €2,000,000, CleanCore Global shall pay $200,000 to Sanzonate; (ii) €4,000,000, CleanCore Global shall pay an additional $200,000 to Sanzonate; (iii) €6,000,000, CleanCore Global shall pay an additional $200,000 to Sanzonate; (iv) €8,000,000, CleanCore Global shall pay an additional $200,000 to Sanzonate; (v) €10,000,000, CleanCore Global shall pay an additional $200,000 to Sanzonate; and (vi) €12,000,000, CleanCore Global shall pay an additional $250,000 to Sanzonate.

As of the date of this report, CleanCore Global is our only subsidiary.

Products

We offer products and solutions that are marketed for janitorial and sanitation, ice machine cleaning, laundry, and industrial industries. Our products are used in many types of environments including retail establishments, distribution centers, factories, warehouses, restaurants, schools and universities, airports, healthcare, food service, and commercial buildings such as offices, malls, and stores.

Janitorial and Sanitation

Within the janitorial and sanitation sector, we currently manufacture the following products:

| ● | Fill Stations: Wall-mounted units that produce on demand aqueous ozone and can fill up spray bottles or buckets for general cleaning, including our 1.0 Fill Station, which can produce one gallon per minute of aqueous ozone for users with smaller cleaning needs, and our 3.0 Fill Station, which can produce three gallons per minute and is designed for commercial and industrial cleaning requirements. |

| ● | POWER CADDY: A 12-gallon tank that generates aqueous ozone within it, so users are able to generate on-site, on-demand aqueous ozone as they clean. These units come equipped with a spray gun and vacuum hose to properly clean all locations. The POWER CADDY includes a high-pressure spray gun with a pressure per inch boost over 100 for more intense cleaning. |

| ● | POWER MINI CADDY. A six-gallon tank that generates aqueous ozone within it, so users are able to generate on-site, on-demand aqueous ozone as they clean. This product comes equipped with a spray gun and vacuum hose to properly clean all locations. The MINI CADDY is a smaller version of the POWER CADDY that is popular in smaller areas such as restaurants. |

Ice System

The Ice Treatment System establishes a proactive ice machine cleaning program. Cleaning ice machines is a labor intensive and slow process that needs to happen often to stop the buildup of bacteria and mold in the ice machine, the buildup of which could contaminate the ice supply. Ice machines, like other water systems used within indoor environments, create ideal conditions for fostering the growth of bacteria and mold. Pure aqueous ozone is highly effective in cleaning the inside of ice machines. Our Ice System destroys bacteria by sending 0.50 ppm of aqueous ozone through the ice machine each time it makes more ice. Aqueous ozone proactively prevents the growth of Listeria, Salmonella, E. Coli, Norwalk Virus, and Shigella in the ice and keeps the ice pure while preventing respiratory and gastrointestinal illnesses.

|

|

Commercial and Residential Laundry

We believe that the laundry unit effectively oxidizes and deodorizes to extend the life of your laundry. When the laundry ozone unit is connected to a washing machine, the aqueous ozone is used to clean towels and linens. As a result, by avoiding harsh chemicals, the aqueous ozone may expand the life of the linens, reduce dry time, and eliminate skin irritation. The flow rate of the commercial product is five GPM on each line.

Industrial Cleaning Products

We also plan to make aqueous ozone available for industrial applications, primarily for the purpose of keeping industrial plants and production lines clean. We believe this industrial product is safe to be used on food-contact surfaces and has been used in meat packing plants to eliminate the need to stop the packaging line for cleaning. Additional applications for this product may include pet food packaging and manufacturing, canning operations, breweries, wineries, distilleries, and consumer health manufacturers.

We build customized cleaning systems to meet the required needs of our clients. Our system’s volume output ranges from 10-250 GPM of our patented solution. The concentration levels of our aqueous ozone solutions can be adjusted to suit our client’s distinctive needs. Multiple units can be placed in tandem for large volume projects. Concentration levels of ozone can be established at up to 20 ppm of ozone.

Sanitizing and Disinfectant Tablets

Branded “GreenKlean,” these chlorinated tablets kill 99.9% of viruses and bacteria on a surface. These tablets eliminate odors while disinfecting and can be used on a variety of hard non-porous surfaces. We believe each tablet is easy to use, fast dissolving in water, and each tablet provides a single, standardized cleaning dose. The solution created from the tablet when mixed with water may be applied with a spray device, cloth, wipe, sponge, brush, or mop. Each tablet is effective for up to three days in a closed container and should be prepared daily when used in open containers. Generally, there is no need to rinse off the product after cleaning, the surface just needs to fully air dry, with no remaining residue left nor harm to the surfaces’ finish. The tablets are made according to standards of the National Science Foundation, an independent agency of the United States government that supports fundamental research and education in all the non-medical fields of science and engineering, under the “D2” classification, which means these tablets may be used as an antimicrobial agent that would not need to be rinsed or qualified as a “no rinse sanitizer.”

Manufacturing

We currently source components and raw materials both domestically and overseas from vendors. The components and raw materials are shipped to our facility in Omaha, NE and assembled. We have implemented a strict quality control program which is run by our Director of Operations along with our Lead Production Supervisor. We have inventory control systems at our facilities that track each manufacturing and packaging component as we receive it from our supply sources through manufacturing and shipment of each product to customers. To facilitate this tracking, most products we sell are bar coded. We believe our distribution capabilities increase our flexibility in responding to our customers’ delivery requirements.

Our manufacturing operations are designed to allow low-cost production of a wide variety of products of different quantities, physical sizes and packaging formats, while maintaining a high level of customer service and quality. Flexible production line changeover capabilities and reduced cycle times allow us to respond quickly to changes in manufacturing schedules and customer demands.

We believe that our manufacturing facilities generally have sufficient capacity to meet our current business requirements and our currently anticipated sales.

Raw Materials and Suppliers

The primary raw materials used in the manufacture of our products are chassis, generators, various sockets, degas cylinders, and a variety of other components. The cost of these raw materials is a key factor in pricing our products.

We source raw materials from multiple regional, national and foreign suppliers; however, we have a single vendor for a major component of two of our main products. For the years ended June 30, 2025 and 2024, this vendor accounted for approximately 11% and 30%, respectively, of our total purchases. Certain of our materials come from Asian-based suppliers. Raw materials from Asian-based suppliers may be subjected to import duties, depending on various foreign policies of the US government. As such, we continue to explore partnership or supplier opportunities to optimize our costs.

As noted above, we have historically purchased certain key raw materials from a limited number of suppliers. We purchase raw materials on the basis of purchase orders. While we believe that there is an ample supply of most of the raw materials that we need, in the absence of firm and long-term contracts, we may not be able to obtain a sufficient supply of these raw materials from our existing suppliers or alternates in a timely fashion or at a reasonable cost. If we fail to secure a sufficient supply of key raw materials in a timely fashion, it will result in a significant delay in delivering our products. Furthermore, failure to obtain a sufficient supply of these raw materials at a reasonable cost could also harm our revenue and gross profit margins. Please see Item 1A “Risk Factors—Risks Related to Our Business and Industry—We have historically depended on a limited number of third parties to supply key raw materials to us and the failure to obtain a sufficient supply of these raw materials in a timely fashion and at reasonable costs could significantly delay our delivery of products” for a description of the risks related to our supplier relationships.

Sales and Marketing

We will utilize media, websites, email lists, social media to reach industries and new potential clients. We actively participate in a variety of trade shows in health care, food service, commercial real estate, and schools and universities where we demonstrate and market our products to thousands of potential and existing customers. We will also use these marketing tactics to grow awareness for our products that we deploy in various cleaning applications. Finally, we will distribute press releases, attend industry conferences, and leverage our relationships with existing customers to grow our client base.

During the fourth quarter of fiscal 2025, we acquired the assets of Sanzonate and formed CleanCore Global in Ireland. We will work to expand the distribution base the former Sanzonate operation had by selling units in Europe through CleanCore Global.

We believe the work we are doing with KBS (as described below) will allow us to expand sales opportunities with other building service management companies located in North America and the European Union through CleanCore Global.

Customers

Historically, we previously sold most of our products through distributors. Over the past two years, we have started to sell an increasing number of products directly to end customers.

On January 10, 2025, we signed a three-year memorandum of understanding with Kellermeyer Bergensons Services, LLC, or KBS. KBS is a national building service management company that provides janitorial services to over 100,000 buildings in the United States. The memorandum of understanding covers pricing, accounts payable terms, and other key items to establish an opportunity for both companies to grow together. KBS issued its first purchase order on May 28, 2025 for $1.369 million, of which $863,000 was invoiced in June 2025 and the remaining balance is scheduled to be shipped and invoiced between July and September of 2025. A second purchase order from KBS was received on June 4, 2025 for $261,000 with shipment scheduled between July and September of 2025.

For the year ended June 30, 2025, two customers, KBS and Prolink, Inc., accounted for 42% and 17% of revenue, respectively, and one customer, KBS, accounted for 47% of all accounts receivable as of June 30, 2025. For the year ended June 30, 2024, one customer, Pro-Link, Inc., accounted for 14% of revenue, and two customers, Consensus Group and Tharaldson Hospitality, each accounted for 28% of all accounts receivable as of June 30, 2024. We do not have a long-term contract with any of these customers mentioned (the memorandum of understanding with KBS is not binding and does not require the purchase of specific quantities of products). We primarily sell products to customers under individual purchase orders placed by them under their standard terms and conditions of sale. These terms and conditions generally include insurance requirements, representations by us with respect to the quality of our products and our production process, our obligations to comply with law, and indemnifications by us if we breach our representations or obligations. There is no commitment from any of these customers to purchase from us, or from us to sell to them, any minimum number of products.

The loss of any major customer could have a material adverse effect on our results of operations. See Item 1A “Risk Factors—Risks Related to Our Business and Industry—Our major customers account for a significant portion of our revenue and the loss of any major customer could have a material adverse effect on our results of operations.”

Competition

The janitorial services industry is highly competitive and has many established, large and small global competitors. We compete against a wide range of cleaning-focused businesses. Some of our current competitors may be larger than we are, have larger customer bases, greater brand recognition and operating histories, a dominant or more secure position, broader geographic scope, volume, scale, resources, and more market share than we do, or offer products and services we do not offer. Other competitors are smaller, younger, companies that may be more agile in responding quickly to new products or changes in the market.

Our major competitors for our products are traditional cleaning companies such as Proctor and Gamble and Unilever, which are companies that develop and manufacture traditional chemical cleaning products. However, to the best of our knowledge, none of them have an aqueous ozone technology. We also compete with companies in the aqueous ozone cleaning market such as Tennant Company, Tersano Inc., and Enozo Technologies Inc and O3 Waterworks. Each of these companies also produces devices to make aqueous ozone, and Tersano Inc. and Enozo Technologies Inc. produce aqueous ozone products for both personal and professional use.

We also compete with a multitude of foreign, regional, and local competitors that vary by market. If our existing or future competitors seek to gain or retain market share by reducing prices, we may be required to lower our prices, which would adversely affect our operating results. Similarly, if customers or potential customers perceive the products or services offered by our existing or future competitors to be of higher quality than ours or part of a broader product mix, our revenues may decline, which would adversely affect our operating results.

Competitive Strengths

We believe that the following competitive strengths contribute to our success and differentiate us from our competitors:

| ● | We have numerous patents for our technology. We currently have 15 patents for our technology. These patents cover the functions of our products that allow our machines to produce ozone in the form of nanobubbles. |

| ● | We have experience in the cleaning industry. Our acquisition and subsequent business with aqueous ozone products have led us to maintain and uphold significant and meaningful relationships throughout the service cleaning industry with various providers of cleaning services. |

| ● | We believe that our products eliminate the need for harsh chemicals and reduce costs of labor in janitorial services. Various chemical solutions for cleaning are costly, but with the aqueous ozone solution, we believe hospitals may reduce expenditures by switching to the aqueous ozone technology. Our customers in janitorial services have reported a reduced time in cleaning and sanitizing, which saves our customers on labor costs. |

| ● | There is no chemical residue left after using our solution, and we believe it causes less irritation compared to typical cleaning agents. When cleaning with the aqueous ozone solution, it may remove and deodorize surfaces without using harsh caustic chemicals, and only water remains on the surface after cleaning, not any chemical residue that may require additional rinsing. As a result, our clients may report less eye, skin, and respiratory irritation after switching to our cleaning products. |

| ● | Our product is environmentally conscious. Our goal is to reduce packaging waste when replacing traditional cleaners and their packaging with aqueous ozone dispensers. We believe our product also reduces water consumption while cleaning. A two-year study at a major Vancouver hospital found that clients use 90% less water since the aqueous ozone technology removes the need to flush the cleaning dispensing system between various chemical cleaning agents. Overall, our products may reduce the carbon footprint of a janitorial service business when used in lieu of traditional cleaning methods. |

Growth Strategies

The key elements of our strategy to grow our business include:

| ● | Targeting key industries. Historically, we sold our products primarily through geographic and strategic distributors across the United States and Europe in the janitorial services sector. In the past twelve months, we have shifted our focus to selling direct to end users. Our focus target groups include building service management companies, hospitality, education, venue, and education. |

| ● | Deploy marketing strategies that raise awareness for our cleaning products. We plan to expand our marketing efforts to increase awareness of our products. Our strategy includes attending industry conferences and working with salespeople to start the use of our product in new areas. |

| ● | Create partnerships through exclusive licensing for distributors and a direct sales model. We anticipate evolving the business model into a hybrid of both traditional distributors and a direct sales model with key salespeople penetrating the health care, education, food service, and commercial buildings industries. Our goal is also to create partnerships with some of the largest sports and entertainment arenas in the world, providing end-to-end sales and service. |

| ● | Expand distribution to the European Union. With the acquisition of the assets of Sanzonate and the formation of CleanCore Global, we anticipate expanding the distribution network that Sanzonate had to cover the entire European Union. We believe that Sanzonate was a market leader in providing Aqueous Ozone cleaning devises in the European Union and we plan to capitalize on this opportunity. |

Research and Development

We are continuing our research and development into specific product applications across our core janitorial and sanitation product line, specifically aligning our new direct sales and support strategy by evolving the existing product lines to capture new “real time” testing evaluations.

Previously, we had conducted an adenosine triphosphate study on the Clemson University Core buildings to determine the cleaning effect of aqueous ozone and our products.

We are also active in developing consumer-focused products that can be sold and marketed online and in large box retail stores across the country. We are exploring the development of our products for expanded usage in key market segments such as health care, food service, and commercial cleaning industries.

Intellectual Property

Currently, we hold 15 patents, including 10 in the United States, 1 in Mexico and 4 in Canada. These patents cover the functions of our products that allow our machines to produce the ozone in the form of nanobubbles. Each of our United States patents are utility patents, and are owned by us. We currently do not license any patents.

| Patent Title | Patent Number | Jurisdiction | Expiration Year | |||

| Ozone Cleaning System | 2680331 | Canada | 2028 | |||

| Ozone Cleaning System | 320909 | Mexico | 2028 | |||

| Ozonated Liquid Dispensing Unit | 10479683 | United States | 2028 | |||

| Reaction Vessel for an Ozone Cleaning System | 8075705 | United States | 2029 | |||

| Aqueous Ozone Solution for Ozone Cleaning System | 8071526 | United States | 2029 | |||

| Aqueous Ozone Solution for Ozone Cleaning System | 8735337 | United States | 2029 | |||

| Ozonated Liquid Dispensing Unit | 9174845 | United States | 2029 | |||

| Ozone Cleaning System | 9068149 | United States | 2030 | |||

| Ozonated Liquid Dispensing Unit | 9522348 | United States | 2030 | |||

| System for Producing and Distributing an Ozonated Fluid | 2802307 | Canada | 2031 | |||

| Ozonated Liquid Dispensing Unit | 2802311 | Canada | 2031 | |||

| Ozonated Liquid Dispensing Unit | 2896332 | Canada | 2034 | |||

| Method and Systems for Controlling Microorganisms | 9670081 | United States | 2035 | |||

| Apparatus for Generating Aqueous Ozone | 11033647 | United States | 2039 | |||

| Apparatus for Generating Aqueous Ozone | 11660364 | United States | 2039 |

To protect our intellectual property, we rely on a combination of laws and regulations, as well as contractual restrictions. We rely on Federal patent laws to protect our intellectual property, including our patented technology. We also rely on the protection of laws regarding unregistered copyrights for certain content we create and trade secret laws to protect our proprietary technology. To further protect our intellectual property, we enter into confidentiality agreements with our executive officers and directors.

Employees

We seek to attract and retain quality employees in the areas of sales, marketing, and internal operations. Our salespeople will be selected to continue to identify and develop our client relationships. Our marketing staff will develop brand awareness of our products within the janitorial services market.

As of June 30, 2025, we had 15 full time employees, 13 of whom were in the United States and 2 of whom were in Ireland. None of our employees are represented by labor unions, and we believe that we have an excellent relationship with our employees.

Government Regulation

As a manufacturer of ozone devices, we are subject to regulation by multiple U.S. government agencies, including the EPA. We must also comply with the Federal Insecticide, Fungicide, and Rodenticide Act, or FIFRA, which establishes procedures for registering pesticides and pesticide generating devices with the U.S. Department of Agriculture and following established labeling provisions. FIFRA mandates that the EPA regulates the use and sale of pesticides and pesticide generating devices to protect human health and preserve the environment. Under FIFRA’s definition, ozone is considered a pesticide and manufacturers of ozone generating devices are required to register with the EPA. Our EPA registration establishment number is 090379-NE-001.

We are also subject to regulation by the U.S. Food and Drug Administration, or the FDA, for the use of ozone for water treatment as well as its use as an antimicrobial agent for the treatment, storage, and processing of foods. In 1982, the FDA granted “GRAS” approval, meaning it is “generally recognized as safe” status for ozone treatment of bottled water. The FDA and the Center for Food Safety and Applied Nutrition announced on June 26, 2001 that ozone may be safely used in the treatment, storage, and processing of foods, including meat and poultry, when used in accordance with the specified conditions; and that ozone is approved as a secondary food additive permitted for human consumption.

Additionally, the U.S. Department of Agriculture and Food Safety and Inspection Service declared in December 2001 that ozone may be used on food labeled as “organic,” and that there are no special labeling requirements for treated raw and ready-to-eat meat and poultry products if treated with ozone just prior to packaging.

The Occupational Safety and Health Administration, or OSHA, and the American Conference of Governmental Industrial Hygienists, or ACGIH, have also issued guidelines and regulations for ozone gas exposure. OSHA regulates ozone gas exposure based on time-weighted averages, and states that ozone levels in ambient air should not exceed 0.10 ppm for an eight-hour exposure period. Similarly, ACGIH guidelines state provide for similar time weighted averages, distinguishing based on the level of exertion starting from 0.10 ppm of ozone exposure for eight hours of light work to 0.05 ppm of ozone exposure for eight hours of during heavy work.

The Hazard Communication Standard provides workers who are exposed to hazardous chemicals or alike with “the right to know” the identities and protective measures to be taken to protect themselves from adverse effect of air contaminants. Government recommendations include guidelines that if an employee is exposed to ambient ozone levels higher than permitted, to wear a respirator or other personal protective equipment until such a time when air contaminate levels are in within compliance according to the OSHA standards.

In Canada, Health Canada has issued our company a letter of no-objection to the use of our solution as a sanitizer in Canada for use as a general use sanitizer, hand disinfectant, personal hygiene cleaner, as a drain cleaner, for food packaging materials, and in use with food contacting hard surfaces. Our Health Canada reference numbers are: IS13041201/02, IS13041209 to IS13041216, and IP13101701.

The application, interpretation, and enforcement of these U.S. and foreign laws and regulations are often uncertain, particularly in the rapidly evolving industry in which we operate and may be interpreted and applied inconsistently from country to country and inconsistently with our current policies and practices. Any existing or new legislation applicable to our operations could expose us to substantial liability, including significant expenses necessary to comply with such laws and regulations, to respond to regulatory inquiries or investigations, and to defend individual or class litigation. These events could dampen growth in the use of the internet in general and cause us to divert significant resources and funds to addressing these issues, and possibly require us to change our business practices.

ITEM 1A. RISK FACTORS.

An investment in our securities involves a high degree of risk. You should carefully read and consider all of the risks described below, together with all of the other information contained or referred to in this report, before making an investment decision with respect to our securities. If any of the following events occur, our financial condition, business and results of operations (including cash flows) may be materially adversely affected. In that event, the market price of our stock could decline, and you could lose all or part of your investment.

Risks Related to Our Business and Industry

We are an early-stage company with a limited operating history.

We are an early, startup stage company with a limited history upon which you can evaluate our business and prospects. Our prospects must be considered in light of the risks encountered by companies in the early stages of development in highly competitive markets. You should consider the frequency with which early-stage businesses encounter unforeseen expenses, difficulties, complications, delays and other adverse factors. These risks are described in more detail below.

We have incurred losses since our inception, and we may not be able to manage our business on a profitable basis.

We have generated losses since inception and have relied on cash on-hand, sales of securities, proceeds from our initial public offering, external bank lines of credit, and issuance of third-party and related party debt to support our operations. For the year ended June 30, 2025, we generated an operating loss of $6,386,341 and a net loss of $6,742,275. The revenue and income potential of our business and market are unproven. This makes an evaluation of our company and its prospects difficult and highly speculative. There can be no assurances that we will be able to develop products or services on a timely and cost effective basis, that will be able to generate any increase in revenues, that we will have adequate financing or resources to continue operating our business and to provide products to customers, that we will earn a profit, that we can raise sufficient capital to support operations by attaining profitability, or that we can satisfy future liabilities.

Our auditors have issued a going concern opinion on our audited consolidated financial statements.

The report of our independent registered public accounting firm that accompanies our consolidated financial statements for the year ended June 30, 2025 contains a going concern qualification in which such firm expressed substantial doubt about our ability to continue as a going concern, based on the financial statements at that time. We have generated losses since inception and have relied on cash on-hand, sales of securities, proceeds from our initial public offering, external bank lines of credit, and issuance of third-party and related party debt to support cashflow from operations. As of June 30, 2025, we had cash of $1,460,997, a net loss of $6,742,275, working capital of $970,461, and cash used in operating activities of $2,337,659. Management believes that currently available resources may not be sufficient to fund our planned expenditures over the next 12 months. These factors, individually and collectively, indicate that a material uncertainty exists that raises substantial doubt about our company’s ability to continue as a going concern for 12 months from the balance sheet date as of June 30, 2025.

We will be dependent upon the raising of additional capital through equity and/or debt financing in order to implement our business plan and generate sufficient revenue in excess of costs. If we raise additional capital through the issuance of equity securities or securities convertible into equity, stockholders will experience dilution, and such securities may have rights, preferences or privileges senior to those of the holders of common stock. If we raise additional funds by issuing debt, we may be subject to limitations on its operations, through debt covenants or other restrictions. There is no assurance that we will be successful with future financing ventures, and the inability to secure such financing may have a material adverse effect on our financial condition. The accompanying consolidated financial statements have been prepared on a going concern basis under which our company is expected to be able to realize its assets and satisfy its liabilities in the normal course of business and do not include any adjustments to the amounts and classifications of assets and liabilities that might be necessary should we be unable to continue as a going concern. If we are unable to continue as a going concern, our stockholders could potentially lose most or all of their investment in our company.

We will require additional financing to accomplish our business strategy.

We require substantial working capital to fund our business development plans, and we expect to experience significant negative cash flow from operations. Depending upon the sales volume generated by our business during that time, we also anticipate the possibility of having to raise additional funds in order to achieve our plans and accomplish our immediate and longer-term business strategy. These additional funds likely will be raised through the issuance of our securities in debt and/or equity financings. If we are unable to raise these additional funds on terms acceptable to us, we will be required to limit our expenditures for continuing our product development activities and expanding our sales and marketing operations, reduce our work force, or find alternatives to fund our business on terms that are not as favorable to us. Any such actions would impair our product development and expansion plans, reduce potential revenues, increase operating losses, and adversely affect the value of our company.

We cannot accurately predict future revenues or profitability in the emerging market for aqueous ozone technology.

The market for alternative green cleaning supplies is rapidly evolving. As is typical of a rapidly evolving industry, demand, and market acceptance for recently introduced products are subject to a high level of uncertainty. Moreover, since the market for our products is evolving, it is difficult to predict the future growth rate, if any, and size of this market. Because of our limited operating history and the emerging nature of the markets in which we compete, we are unable to accurately forecast our revenues or our profitability. The market for our products and the long-term acceptance of our products are uncertain, and our ability to attract and retain qualified personnel with industry expertise, particularly sales and marketing personnel, is uncertain. To the extent we are unsuccessful in increasing revenues, we may be required to appropriately adjust spending to compensate for any unexpected revenue shortfall, or to reduce our operating expenses, causing us to forego potential revenue generating activities, either of which could have a material adverse effect on our business, results of operations and financial condition.

We may face significant challenges in obtaining market acceptance of our products, which could adversely affect our potential sales and revenues.

We do not yet have an established market or customer base for our products. Acceptance of our products in the marketplace by both potential users and potential purchasers, including hospitals, schools, universities, commercial facilities, transportation systems and other healthcare and non-healthcare providers, is uncertain, and failure to achieve sufficient market acceptance will significantly limit our ability to generate revenue and be profitable. Market acceptance will require substantial marketing efforts and the expenditure of significant funds by us to inform hospitals, schools, universities, commercial facilities, transportation systems, residential spaces and other health care and non-healthcare providers of the benefits of using our products. We may encounter significant clinical and market resistance to our products, and our products may never achieve market acceptance. We may not be able to build key relationships with physicians, education administrators, and government agencies. Product orders may be cancelled or customers that are beginning to use our products may cease their use of our products and customers expected to begin using our products may not do so.

Factors that may affect our ability to achieve acceptance of our products in the marketplace include, but are not limited, to whether:

| ● | such products will work effectively; |

| ● | the products are cost-effective for our customers; |

| ● | we are able to demonstrate product safety, efficacy, and cost-effectiveness of the products; and |

| ● | we are able to maintain customer relationships and acceptance. |

Acceptance of our products in the marketplace is also uncertain, and our failure to achieve sufficient market acceptance and any inability to sell such products at competitive prices will limit our ability to generate revenue and be profitable. Our products and technologies may not achieve expected reliability, performance, and endurance standards. Our products and technologies may also not achieve market acceptance, including among hospitals, or may not be deemed suitable for other commercial applications.

If we do not build brand awareness and brand loyalty, our business may suffer.

Due in part to the substantial resources available to many of our competitors providing aqueous ozone technology, our opportunity to achieve and maintain a significant market share may be limited. The importance of brand recognition will increase as competition in our market increases. Successfully promoting and positioning of our brand will depend largely on the effectiveness of our marketing efforts, our ability to offer reliable and desirable products at competitive rates, and customer perceptions of the value of our products. If our planned marketing efforts are ineffective or if customer perceptions change regarding the effectiveness of our cleaning machines and products, we may need to increase our financial commitment to creating and maintaining brand awareness and loyalty among customers, which could divert financial and management resources from other aspects of our business or cause our operating expenses to increase disproportionately to our revenues. This would cause our business and operating results to suffer.

If we fail to properly manage our anticipated growth, our business could suffer.

The planned growth of our commercial operations may place a significant strain on our management and on our operational and financial resources and systems. To manage growth effectively, we will need to maintain a system of management controls, and attract and retain qualified personnel, as well as develop, train and manage management-level and other employees. Failure to manage our growth effectively could cause us to over-invest or under-invest in infrastructure, and result in losses or weaknesses in our infrastructure, which could have a material adverse effect on our business, results of operations, financial condition and cash flow. Any failure by us to manage our growth effectively could have a negative effect on our ability to achieve our development and commercialization goals and strategies.

If we are unable to maintain, train and build an effective international sales and marketing infrastructure, we will not be able to commercialize and grow our brand successfully.

As we grow, we may not be able to secure sales personnel or organizations that are adequate in number or expertise to successfully market and sell our brand and products on a global scale. We presently rely on individual independent sales representatives and an in-house sales team to market and sell our products. If we are unable to expand our sales and marketing capability, train our sales force effectively or provide any other capabilities necessary to commercialize our brand internationally, we will need to contract with third parties to market and sell our brand, which will be an additional expense. If we are unable to establish and maintain compliant and adequate sales and marketing capabilities, we may not be able to increase our revenue, may generate increased expenses, and may not continue to be profitable.

We operate in new and rapidly changing markets, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

The market for cleaning products is a rapidly changing market, characterized by changing technologies, intense price competition, the introduction of new competitors and brand name cleaning products, evolving industry standards, changing and diverse regulatory environments, frequent new service announcements, and changing user demands and behaviors. Our inability to anticipate these changes and adapt our business, platform, and offerings could undermine our business strategy. Our business strategy and projections, including those related to our revenue growth and profitability, rely on a number of assumptions about the market for cleaning products, including the size and projected growth of the cleaning product markets over the next several years. Some or all of these assumptions may be incorrect. Our growth strategy is dependent, in part, on our ability to timely and effectively launch new products and services, the development of which is uncertain, complex, and costly. In addition, we may be unable successfully and efficiently to address advancements in distribution technology, marketing and pricing strategies and content breadth and availability in certain or all of these markets, which could materially and adversely affect our growth prospects and results of operations.

The limited history of some of the markets in which we operate makes it difficult to effectively assess our future prospects, and our business and prospects should be considered in light of the risks and difficulties we may encounter in these evolving markets. We cannot accurately predict whether our products and services will achieve significant acceptance by potential users in significantly larger numbers or at the same or higher price points than at present. Our historic growth rates should therefore not be relied upon as an indication of future growth, financial condition, or results of operations.

Our major customers account for a significant portion of our revenue and the loss of any major customer could have a material adverse effect on our results of operations.

For the year ended June 30, 2025, two customers, KBS and Prolink, Inc., accounted for 42% and 17% of revenue, respectively, and one customer, KBS, accounted for 47% of all accounts receivable as of June 30, 2025. For the year ended June 30, 2024, one customer, Pro-Link, Inc., accounted for 14% of revenue, and two customers, Consensus Group and Tharaldson Hospitality, each accounted for 28% of all accounts receivable as of June 30, 2024. We do not have a long-term contract with any of these customers mentioned (the memorandum of understanding with KBS is not binding and does not require the purchase of specific quantities of products) and primarily sell products to customers under individual purchase orders placed by them under their standard terms and conditions of sale. Our results of operations and ability to service our debt obligations would also be impacted negatively to the extent that any major customer is unable to make payments to us or does not make timely payments on outstanding accounts receivable.

We have historically depended on a limited number of third parties to supply key raw materials to us and the failure to obtain a sufficient supply of these raw materials in a timely fashion and at reasonable costs could significantly delay our delivery of products.

Since our company’s inception, we have historically purchased certain key raw materials and components, such as chassis, generators, vacuum switches, and head sockets and other components from a limited number of suppliers, and we have a single vendor for a major component of two of our main products. For the years ended June 30, 2025 and 2024, this vendor accounted for approximately 11% and 30%, respectively, of our total purchases. We purchased raw materials on the basis of purchase orders. In the absence of firm and long-term contracts, we may not be able to obtain a sufficient supply of these raw materials from our existing suppliers or alternates in a timely fashion or at a reasonable cost. Although we have not experienced any supply chain disruptions in the past, we cannot guarantee that we will not experience any disruptions in the future. If we fail to secure a sufficient supply of key raw materials in a timely fashion, it will result in a significant delay in our delivery of products. Furthermore, failure to obtain a sufficient supply of these raw materials at a reasonable cost could also harm our revenue and gross profit margins.

Increased prices for raw materials could increase our cost of sales and decrease demand for our products, which could adversely affect our revenue or profitability.

Our profitability is affected by the prices of the raw materials used in the manufacturing and sale of our products. These prices may fluctuate based on a number of factors beyond our control, including, among others, changes in supply and demand, general economic conditions, labor costs, competition, import duties, currency exchange rates and, in some cases, government regulation. Increased prices could adversely affect our profitability or revenues. We do not have long-term supply contracts for raw materials. Significant increases in the prices of raw materials could adversely affect our profit margins, especially if we are not able to recover these costs by increasing the prices we charge our customers for our products.

Changes to U.S. trade policy, tariff and import/export regulations may adversely affect our operating results.

The United States has recently enacted and/or proposed to enact significant new tariffs on goods imported from numerous countries. Additionally, President Trump has directed various federal agencies to further evaluate key aspects of U.S. trade policy and there has been ongoing discussion and commentary regarding potential significant changes to U.S. trade policies, treaties and tariffs. There continues to exist significant uncertainty about the future relationship between the U.S. and other countries with respect to such trade policies, treaties and tariffs.

The majority of the components used to assemble our units are sourced from domestic suppliers, who may, in turn, obtain raw materials from overseas vendors. We also purchase a small number of components from China. In the event we determine to pass on increased costs to our customers, our customers may reduce their orders from us, which could negatively affect our business, profitability and operating results. We are closely monitoring these developments and evaluating strategies to mitigate potential impacts.

Furthermore, as a result of policy changes and government proposals, there may be greater restrictions and economic disincentives on international trade in general. The new tariffs and other changes in U.S. trade policy have triggered retaliatory actions by affected countries, and foreign governments have instituted or are considering imposing trade sanctions on U.S. goods. Such changes have the potential to adversely impact the U.S. economy or sectors thereof, our industry and the demand for our products, and as a result, could have a negative impact on our business, financial condition and results of operations.

Interruptions in deliveries of raw materials could adversely affect our revenue or profitability.

Our dependency upon regular deliveries from particular suppliers means that interruptions or stoppages in such deliveries could adversely affect our operations until arrangements with alternate suppliers could be made. If any of our suppliers were unable to deliver raw materials to us for an extended period of time, as the result of financial difficulties, catastrophic events affecting their facilities or other factors beyond our control, or if we were unable to negotiate acceptable terms for the supply of raw materials with these or alternative suppliers, our business could suffer. We may not be able to find acceptable alternatives, and any such alternatives could result in increased costs for us. Even if acceptable alternatives are found, the process of locating and securing such alternatives might be disruptive to our business. Extended unavailability of necessary raw materials could cause us to cease producing or selling one or more of our products for a period of time.

We depend on third-party delivery services, for both inbound and outbound shipping, to deliver our products to our distribution centers and subsequently to our customers on a timely and consistent basis, and any deterioration in our relationship with any one of these third parties or increases in the fees that they charge could harm our reputation and adversely affect our business and financial condition.

We rely on third parties for the shipment of our products, both inbound and outbound shipping logistics, and we cannot be sure that these relationships will continue on terms favorable to us, or at all. Shipping costs have increased from time to time, and may continue to increase, and we may not be able to pass these costs directly to our customers.

Any increased shipping costs could harm our business, prospects, financial condition and results of operations by increasing our costs of doing business and reducing gross margins which could negatively affect our operating results. In addition, we utilize a variety of shipping methods for both inbound and outbound logistics. For inbound logistics, we rely on trucking and ocean carriers and any increases in fees that they charge could adversely affect our business and financial condition. For outbound logistics, we rely on “Less-than-Truckload” and parcel freight based upon the product and quantities being shipped and customer delivery requirements. These outbound freight costs have increased on a year-over-year basis and may continue to increase in the future. We also ship a number of oversized products which may trigger additional shipping costs by third-party delivery services. Any increases in fees or any increased use of “Less-than-Truckload” shipping would increase our shipping costs which could negatively affect our operating results.

In addition, if our relationships with these third parties are terminated or impaired, or if these third parties are unable to deliver products for us, whether due to labor shortage, slow down or stoppage, deteriorating financial or business condition, responses to terrorist attacks or for any other reason, we would be required to use alternative carriers for the shipment of products to our customers. Changing carriers could have a negative effect on our business and operating results due to reduced visibility of order status and package tracking and delays in order processing and product delivery, and we may be unable to engage alternative carriers on a timely basis, upon terms favorable to us, or at all.

If our fulfillment operations are interrupted for any significant period of time or are not sufficient to accommodate increased demand, our sales could decline, and our reputation could be harmed.

Our success depends on our ability to successfully receive and fulfill orders and to promptly deliver our products to our customers. Most of the orders for our products are filled from our inventory in our distribution centers, where all our inventory management, packaging, labeling and product return processes are performed. Increased demand and other considerations may require us to expand our distribution centers or transfer our fulfillment operations to larger or other facilities in the future. If we do not successfully expand our fulfillment capabilities in response to increases in demand, our sales could decline.

In addition, our distribution centers are susceptible to damage or interruption from human error, pandemics, fire, flood, power loss, telecommunications failures, terrorist attacks, acts of war, break-ins, earthquakes and similar events. We do not currently maintain back-up power systems at our fulfillment centers. We do not presently have a formal disaster recovery plan and our business interruption insurance may be insufficient to compensate us for losses that may occur in the event operations at our fulfillment center are interrupted. In addition, alternative arrangements may not be available, or if they are available, may increase the cost of fulfillment. Any interruptions in our fulfillment operations for any significant period of time, including interruptions resulting from the expansion of our existing facilities or the transfer of operations to a new facility, could damage our reputation and brand and substantially harm our business and results of operations.

If commodity prices such as fuel, plastic and steel increase, our margins may be negatively impacted.

Our third-party delivery services have increased fuel surcharges from time to time, and such increases negatively impact our margins, as we are generally unable to pass all of these costs directly to consumers. Increasing prices of the raw materials for the products we sell may impact the availability, the quality and the price of our products, as suppliers search for alternatives to existing materials and increase the prices they charge. We cannot ensure that we can recover all the increased costs through price increases, and our suppliers may not continue to provide the consistent quality of raw materials as they may substitute lower cost materials to maintain pricing levels, all of which may have a negative impact on our business and results of operations.

Business interruptions in our facilities may affect the distribution of our products and/or the stability of our computer systems, which may affect our business.

Weather, terrorist activities, war or other disasters, or the threat of them, may result in the closure of one or more of our facilities, or may adversely affect our ability to timely provide products to our customers, resulting in lost sales or a potential loss of customer loyalty. Most of our raw materials are imported from other countries and these goods could become difficult or impossible to bring into the United States, and we may not be able to obtain such raw materials from other sources at similar prices. Such a disruption in revenue could potentially have a negative impact on our results of operations, financial condition and cash flows.

We rely extensively on our computer systems to manage inventory, process transactions and timely provide products to our customers. Our systems are subject to damage or interruption from power outages, telecommunications failures, computer viruses, security breaches or other catastrophic events. If our systems are damaged or fail to function properly, we may experience loss of critical data and interruptions or delays in our ability to manage inventories or process customer transactions. Such a disruption of our systems could negatively impact revenue and potentially have a negative impact on our results of operations, financial condition and cash flows.

Security threats, such as ransomware attacks, to our IT infrastructure could expose us to liability, and damage our reputation and business.

It is essential to our business strategy that our technology and network infrastructure remain secure and is perceived by our customers to be secure. Despite security measures, however, any network infrastructure may be vulnerable to cyber-attacks. Information security risks have significantly increased in recent years in part due to the proliferation of new technologies and the increased sophistication and activities of organized crime, hackers, terrorists and other external parties, including foreign private parties and state actors. We may face cyber-attacks that attempt to penetrate our network security, including our data centers, to sabotage or otherwise disable our website, misappropriate our or our customers’ proprietary information, which may include personally identifiable information, or cause interruptions of our internal systems and services. If successful, any of these attacks could negatively affect our reputation, damage our network infrastructure and our ability to sell our products, harm our relationship with customers that are affected and expose us to financial liability.

We maintain a comprehensive system of preventive and detective controls through our security programs; however, given the rapidly evolving nature and proliferation of cyber threats, our controls may not prevent or identify all such attacks in a timely manner or otherwise prevent unauthorized access to, damage to, or interruption of our systems and operations, and we cannot eliminate the risk of human error or employee or vendor malfeasance.

In addition, any failure by us to comply with applicable privacy and information security laws and regulations could cause us to incur significant costs to protect any customers whose personal data was compromised and to restore customer confidence in us and to make changes to our information systems and administrative processes to address security issues and compliance with applicable laws and regulations. In addition, our customers could lose confidence in our ability to protect their personal information, which could cause them to stop shopping on our sites altogether. Such events could lead to lost sales and adversely affect our results of operations. We also could be exposed to government enforcement actions and private litigation.

We face significant competition.

We believe that our success will depend heavily upon achieving market acceptance of our products before our competitors introduce more advanced competing products. Current and new competitors, however, may be able to develop and introduce better or more desirable products in advance of us or at a lower cost. In addition, some of our current and potential competitors have longer and/or more established operating histories, greater industry experience, greater name recognition, established customer bases, and significantly greater financial, technical, marketing, and other resources than we do. To be competitive, we must respond promptly and effectively to the challenges of technological change, evolving standards and regulations, and our competitors’ innovations by continually working to improve the design of our products, enhancing our products, as well as improving and increasing our marketing and distribution channels. Increased competition could result in a decrease in the desirability of our products, a decrease in the use of our products by customers, loss of market share and brand recognition, and a reduction in the projected revenues from our products. We cannot assure you that we will be able to compete successfully against current and future competitors. Competitive pressures faced by us could have a material adverse effect on our business, operating results and financial condition.

Quality problems with, and product liability claims in connection with, our aqueous ozone machines could lead to recalls or safety alerts, harm to our reputation, or adverse verdicts or costly settlements, and could have a material adverse effect on our business, financial condition, and results of operations.

Quality is extremely important to us and our customers due to the serious and costly consequences of product failure, and our business exposes us to potential product liability risks that are inherent in the design, manufacture and marketing of cleaning devices and services. In addition, our products may be used in intensive care settings with immunocompromised and seriously ill patients. Component failures, manufacturing defects or design flaws could result in an unsafe condition or injury to, or death of, a patient or other user of our products. These problems could lead to the recall of, or issuance of a safety alert relating to, our products and could result in unfavorable judicial decisions or settlements arising out of product liability claims and lawsuits, including class actions, which could negatively affect our business, financial condition and results of operations. In particular, a material adverse event involving one of our products could result in reduced market acceptance and demand for all products offered under our brand and could harm our reputation and ability to market products in the future.

High quality products are critical to the success of our business. If we fail to meet the high standards that we set for ourselves and that our customers expect, and if our products are the subject of recalls, safety alerts or other material adverse events, our reputation could be damaged, we could lose customers and our revenue could decline.

Any product liability claim brought against us, with or without merit, could be costly to defend and resolve. Any of the foregoing problems, including product liability claims or product recalls in the future, regardless of their ultimate outcome, could harm our reputation and have a material adverse effect on our business, financial condition, and results of operations.

We may receive a significant number of warranty claims or our aqueous ozone products may require significant amounts of service after sale.

Sales of our aqueous ozone products include a product limited two-year warranty that covers any issues related to manufacturing defects, specifically relating to the CCS Caddy, POWER CADDY, MINI CADDY, CCS 3.0 Fill Station, CCS 1.0 Fill Station, CCS 1000, CCS 2000L, CCS 5000 and the NuClean Pro Residential Fill Station. If a product is provided that has a manufacturing defect, we or an authorized distributor will replace or repair the defective product as long as a claim is submitted to us within the warranty period in writing within 30 days of the failure. This warranty does not cover abuse, misuse of the products, service or unit modifications not authorized by us, or environmental hazards. As the possible number and complexity of the features and functionalities of our products increase, we may experience a higher level of warranty claims. If product returns or warranty claims are significant or exceed our expectations, we could incur unanticipated expenditures on parts and services, which could have a material adverse effect on our operating results.

We could be subject to litigation.

Product liability claims are common. Even though we have not been subject to such claims in the past, we could be a named defendant in a lawsuit alleging product liability claims including, but not limited to, defects in the design, manufacture or labeling of our aqueous ozone products and machines. Any litigation, regardless of its merit or eventual outcome, could result in significant legal costs and high damage awards or settlements. Although we currently maintain product liability insurance, the coverage is subject to deductibles and limitations, and may not be adequate to cover future claims. Additionally, we may be unable to maintain our existing product liability insurance in the future at satisfactory rates or at adequate amounts.

If we are unable to protect our intellectual property rights, our reputation and brand could be impaired, and we could lose customers.