UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of August 2025

Commission File Number: 001-42484

ASCENTAGE PHARMA GROUP INTERNATIONAL

(Translation of Registrant’s name into English)

68 Xinqing Road

Suzhou Industrial Park

Suzhou, Jiangsu

China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Explanatory Note

On August 20, 2025, Ascentage Pharma Group International (“Ascentage Pharma” or the “Company”) issued a press release entitled, “Ascentage Pharma Reports 2025 Interim Unaudited Six Months Financial Results and Business Updates”. A copy of the press release is furnished as Exhibit 99.1 to this Report. On August 21, 2025, Ascentage Pharma Group International posted an announcement on the Hong Kong Stock Exchange entitled, “Announcement of Unaudited Interim Results for the Six Months Ended June 30, 2025”. A copy of the announcement is furnished as Exhibit 99.2 to this Report.

Approval of New Form of Indemnification Agreement and Interest Payments

As previously disclosed, on July 17, 2025, the Company closed an offshore placement and top-up subscription of new shares pursuant to which Dajun Yang Dynasty Trust, an affiliate of the Company’s Chief Executive Officer, Dajun Yang, M.D., Ph.D. (the “Vendor”), offered and sold 22 million ordinary shares, par value US$0.0001 per share, of the Company at a price of HKD68.60 per share and 22 million new ordinary shares were issued to the Vendor at a price of HKD68.60, resulting in net proceeds to the Company of approximately HKD1,492 million (approximately US$190.1 million based on an exchange rate of 1 USD to 7.85 HKD).

Given the advantages realized by the Company through the use of the above top-up placement, and the Company’s January 2023 top-up placement, the Company’s Board considered and approved certain amendments to the indemnification agreement for its directors and officers (“Indemnification Agreement”). The Indemnification Agreement amends the existing form of indemnification agreement, filed as Exhibit 4.1 to the Company’s most recent annual report on Form 20-F, to provide for indemnification of affiliates of an indemnitee for any action or inaction taken by the indemnitee in the role of an officer or director of the Company, or by such affiliates in their capacity of a shareholder of the Company, for actions taken at the request of the Company (each such affiliate and indemnitee, an “Indemnified Person”) and approved, as necessary, by the Company’s Board. There were no other substantive changes made to the existing form of indemnification agreement. In addition, considering that the underlying structure of these top-up placements represents a de-facto share-loan arrangement, whereby Indemnified Persons loaned ordinary shares for specific period of days, respectively, the Board considered and approved the payment of up to $600,000 in interest payments to those Indemnified Persons that enabled the successful completion of those top-up placements.

The foregoing description of the Indemnification Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the form of indemnification agreement, which is filed as Exhibit 99.3 to this report on Form 6-K and is incorporated herein by reference.

INDEX TO EXHIBITS

| Exhibit Number |

Exhibit Title | |

| 99.1 | Press release dated August 20, 2025 | |

| 99.2 | Announcement dated August 21, 2025 | |

| 99.3 | Indemnification Agreement |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| ASCENTAGE PHARMA GROUP INTERNATIONAL | ||

| Date: August 21, 2025 | /s/ Dajun Yang | |

| Name: | Dajun Yang | |

| Title: | Chief Executive Officer | |

Exhibit 99.1

ASCENTAGE PHARMA REPORTS 2025 INTERIM UNAUDITED SIX MONTHS FINANCIAL RESULTS AND BUSINESS UPDATES

| ● | Product sales from Olverembatinib in the first half of 2025 increased 93% year-over-year to US$30.3 million (RMB217.4 million), primarily attributable to the expansion of NRDL coverage |

| ● | Commenced commercial sales of Lisaftoclax in China, following approval on July 10, 2025 by China’s NMPA for the treatment of adult patients with CLL/SLL who have previously received at least one systemic therapy including BTK inhibitors |

| ● | Registrational Phase III trial for 1L HR MDS (GLORA-4) cleared by FDA and EMA, and first patients enrolled in Europe and China |

| ● | Completed a top-up placement in July 2025, resulting in US$190.1 million in net proceeds |

| ● | Nine registrational clinical trials are in progress, including three cleared by FDA |

| ● | Chinese (Mandarin) language investor webcast at 9:00 pm EDT on August 20, 2025 / 9:00 am HKT on August 21, 2025, and English language investor webcast at 8:00 am EDT / 8:00 pm HKT on August 21, 2025 |

ROCKVILLE, MD and SUZHOU, China, August 20, 2025 – Ascentage Pharma Group International (Ascentage Pharma) (NASDAQ: AAPG; HKEX: 6855) (referred hereinto as “Ascentage Pharma,” the “Company,” “we,” “us” or “our”), a global, commercial stage, integrated biopharmaceutical company engaged in the discovery, development and commercialization of novel, differentiated therapies to address unmet medical needs in cancer, today reported its unaudited financial results for the six months ended June 30, 2025, and provided updates on key ongoing clinical programs and commercial activities.

Dr. Dajun Yang, Chairman and Chief Executive Officer of Ascentage Pharma, said, “We reported strong momentum across our business in the first half of 2025, highlighted by the remarkable 93% year-over-year growth in Olverembatinib sales of $30.3 million, driven by expanded National Reimbursement Drug List (NRDL) coverage that has significantly improved patient access in China. In addition, the historic approval of Lisaftoclax in July marks a pivotal milestone as the first Bcl-2 inhibitor to receive conditional approval for chronic lymphocytic leukemia (CLL) / small lymphocytic leukemia (SLL) treatment in China. Our robust pipeline continues to advance with nine registrational clinical trials, all of which are actively ongoing, including three cleared by the FDA, demonstrating our commitment to bringing innovative cancer therapies to patients globally. The successful completion of our financing in July, raising US$190.1 million in net proceeds, strengthens our balance sheet and provides additional resources needed to execute our commercialization strategy and development programs. These achievements highlight our capability to execute globally and our commitment to delivering novel therapies to patients worldwide.”

Key Commercial Product and Pipeline Updates

Olverembatinib (HQP1351) is a novel, next-generation TKI and the first third-generation BCR-ABL1 TKI approved in China for treatment of patients with chronic myeloid leukemia (CML) in chronic-phase (-CP) or CML in accelerated phase (-AP) with T315I mutations, and in CML-CP that is resistant and/or intolerant to first and second-generation TKIs. Since 2021, commercialization of Olverembatinib in China continues to perform well. Additional potential indications for Olverembatinib are being evaluated in ongoing clinical trials.

Commercial progress

| ● | Revenue from sales of Olverembatinib in China increased 93% to US$30.3 million for the six months ended June 30, 2025, compared to US$15.5 million for the six months ended June 30, 2024. |

| ● | All approved indications for Olverembatinib have been covered since January 2025 by the China’s NRDL, which has bolstered the affordability and accessibility of Olverembatinib. |

| ● | The number of direct-to-patient (DTP) pharmacies and hospitals where Olverembatinib is on formulary reached 782 as of June 30, 2025, a 17% increase compared to June 30, 2024. In particular, the number of hospitals where Olverembatinib is on formulary increased 47% over the same period to 295 hospitals as of June 30, 2025 from 201 hospitals as of June 30, 2024. |

Clinical progress

| ● | Enrollment continues in a registrational Phase III clinical trial of Olverembatinib for the treatment of patients with succinate dehydrogenase (SDH)-deficient gastrointestinal stromal tumor (GIST) who have not responded to prior systemic treatment (POLARIS-3). |

| ● | Enrollment continues in an FDA-cleared registrational Phase III clinical trial of Olverembatinib for previously treated CML-CP patients, both with and without T315I mutation (POLARIS-2). |

| ● | Enrollment continues in a registrational Phase III clinical trial of Olverembatinib in combination with chemotherapy versus imatinib in combination with chemotherapy in patients with newly diagnosed Philadelphia chromosome-positive ALL (Ph+ ALL) (POLARIS-1). |

Anticipated progress

| ● | Plan to seek clearance from the FDA to initiate a registrational Phase III clinical trial of Olverembatinib in newly diagnosed Ph+ ALL patients. |

Lisaftoclax (APG-2575) is a novel, oral B-cell lymphoma 2 (Bcl-2) inhibitor developed to treat a variety of hematologic malignancies and solid tumors by selectively blocking Bcl-2 to restore the normal apoptosis process in cancer cells. Lisaftoclax is approved in China for the treatment of adult patients with CLL/SLL who have previously received at least one systemic therapy including Bruton’s tyrosine kinase (BTK) inhibitors and is being evaluated for additional potential indications in ongoing clinical trials.

Commercial progress

| ● | Lisaftoclax was approved on July 10, 2025, by China’s National Medical Products Administration (NMPA) for the treatment of adult patients with CLL/SLL who have previously received at least one systemic therapy including BTK inhibitors, which makes Lisaftoclax the first Bcl-2 inhibitor to receive conditional approval and marketing authorization for the treatment of patients with CLL/SLL in China, and the second Bcl-2 inhibitor approved globally. Shortly after the approval, commercial sales of Lisaftoclax commenced in China. |

| ● | Lisaftoclax received its first recommendation in April 2025 in the Chinese Society of Clinical Oncology (CSCO) Guidelines for the Diagnosis and Treatment of Lymphoid Malignancies as a monotherapy for the treatment of patients with relapsed/refractory (R/R) CLL/SLL. |

Clinical progress

| ● | Enrollment continues in a multicenter, registrational Phase III clinical trial of Lisaftoclax in combination with azacitidine for the treatment of patients who are newly diagnosed with higher-risk (HR) myelodysplastic syndrome (MDS) (GLORA-4). GLORA-4 has been cleared by the FDA and EMA and was originally approved by the China CDE in 2024. Currently, the study is enrolling patients globally, with the first patients dosed in Europe and China. |

| ● | Enrollment continues in a registrational Phase III clinical trial of Lisaftoclax for the treatment of newly diagnosed old or unfit patients with acute myeloid leukemia (AML) (GLORA-3). |

| ● | Enrollment continues in a registrational Phase III clinical trial to evaluate Lisaftoclax in combination with the BTK inhibitor acalabrutinib, versus immunochemotherapy in treatment-naïve patients with CLL/SLL (GLORA-2) to validate a fixed duration combination regimen as a first-line treatment. |

| ● | Enrollment continues in an FDA-cleared registrational Phase III clinical trial of Lisaftoclax in combination with BTK inhibitors in patients with CLL/SLL previously treated with BTK inhibitors (GLORA). |

| ● | Enrollment advancing in the Phase 1b/II clinical trials of Lisaftoclax in combination therapies for the treatment of patients with multiple myeloma (MM) in the United States. |

Recent Developments

| ● | Completed a top-up placement of ordinary shares in July 2025, resulting in US$190.1 million in net proceeds. |

| ● | Appointed Dr. Veet Misra as Chief Financial Officer and Eric Huang as Senior Vice President of Global Corporate Development and Finance. |

Half Year 2025 Unaudited Financial Results

Revenue for the six months ended June 30, 2025 was US$32.6 million, compared to US$113.4 million for the six months ended June 30, 2024, which represented a decrease of US$80.7 million, or 71.6% on a constant currency basis. The decrease in revenue was primarily due to intellectual property revenue of US$93.4 million recorded during the six months ended June 30, 2024. Product sales of Olverembatinib in China increased by US$14.8 million, or 92.5% on a constant currency basis, to US$30.3 million for the first half of 2025 from US$15.5 million for the six months ended June 30, 2024.

Selling and distribution expenses for the six months ended June 30, 2025 were US$19.2 million, compared to US$12.3 million for the six months ended June 30, 2024, which represented an increase of US$6.9 million, or 53.7% on a constant currency basis. The increase was attributable to expansions in commercialization efforts of Olverembatinib and preparation for anticipated launch of Lisaftoclax.

Research and development expenses for the six months ended June 30, 2025 were US$73.8 million, compared to US$61.1 million for the six months ended June 30, 2024, which represented an increase of US$12.7 million, or 19.0% on a constant currency basis. The increase was attributable to increased external research and development expenses related to our ongoing global clinical trials.

Administrative expenses for the six months ended June 30, 2025 were US$13.9 million, compared to US$12.0 million for the six months ended June 30, 2024, which represented an increase of US$1.9 million, or 14.6% on a constant currency basis. The increase was due to the increase in the consulting fees and agency fees.

Financing costs for the six months ended June 30, 2025 were US$3.9 million, compared to US$4.7 million for the six months ended June 30, 2024, which represented a decrease of US$0.8 million, or 18.4% on a constant currency basis. The decrease was due to lower effective interest rates in relation to bank borrowings.

Other expenses for the six months ended June 30, 2025 were US$5.6 million, compared to US$1.0 million for the six months ended June 30, 2024, which represented an increase of US$4.6 million, or 465.6% on a constant currency basis. The increase was primarily attributable to the increase in fair value loss of contingent consideration related to acquisition of Guangzhou Healthquest Pharma Co., Ltd.

Loss for the six months ended June 30, 2025 was US$82.5 million, compared to the profit of US$22.4 million for the six months ended June 30, 2024. The loss per share attributable to ordinary equity holders was $0.24 per ordinary share for the six months ended June 30, 2025, compared to the earnings per share of $0.08 per ordinary share for the six months ended June 30, 2024.

Cash and bank balances as of June 30, 2025, were US$231.9 million, compared to US$172.8 million as of December 31, 2024, which represented an increase of US$59.1 million, or 31.7% on a constant currency basis. The increase was primarily due to the net proceeds of US$132.5 million from the U.S. initial public offering in January 2025.

Following the top-up placement in July 2025, which resulted in US$190.1 million in net proceeds, these net proceeds together with existing cash and cash equivalents, loan facilities and future sales will enable the Company to fund operating expenses and capital expenditure requirements.

Investor Conference Call and Webcast

Ascentage Pharma will be holding investor webcasts to discuss its six months 2025 unaudited interim results.

Ascentage Pharma will host a Chinese (Mandarin) language investor webcast at 9:00 pm EDT on August 20, 2025 / 9:00 am HKT on August 21, 2025. To access the Chinese language investor event or conference call, please register in advance here.

The English language investor conference call and webcast will be held at 8:00 am EDT / 8:00 pm HKT on August 21, 2025. To access the English language webcast, please register in advance here. The webcast replay for English language conference call and presentation will also be available on the News & Events page of the Ascentage Pharma website.

Statement Regarding Unaudited Financial Information

This press release includes unaudited condensed consolidated financial information as of and for the six months ended June 30, 2025, which has not been audited by the Company’s auditors. The unaudited information for the six months ended June 30, 2025, is preliminary, based on the information available at this time and subject to changes in connection with the completion of the review of the Company’s financial statements. As such, the Company’s actual results and financial condition as reflected in the financial statements that will be included in the Company’s Annual Report on Form 6-K, may be adjusted or presented differently from the financial information herein and the variations could be material. The unaudited condensed consolidated financial statements include the accounts of the Company and its subsidiaries. All periods presented have been accounted for in conformity with IFRS accounting standard as issued by the International Accounting Standards Board and pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”).

Currency and Exchange Rate Information

Unless otherwise indicated, translations from RMB to U.S. dollars for the six months ended June 30, 2025 and 2024 and as at December 31, 2024 are made at RMB7.1636 to US$1.00, RMB 7.2672 to US$1.00 and RMB 7.2993 to US$1.00, representing the noon buying rate in the City of New York, as certified by the Federal Reserve Bank of New York, on June 30, 2025, June 28, 2024 and December 31, 2024, respectively. Ascentage Pharma makes no representation that the RMB or U.S. dollar amounts referred to in this press release could have been or could be converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all.

About Ascentage Pharma

Ascentage Pharma Group International (NASDAQ: AAPG; HKEX: 6855) (“Ascentage Pharma” or the “Company”) is a global, commercial stage, integrated biopharmaceutical company engaged in the discovery, development and commercialization of novel, differentiated therapies to address unmet medical needs in cancer. The company has built a rich pipeline of innovative drug products and candidates that include inhibitors targeting key proteins in the apoptotic pathway, such as Bcl-2 and MDM2-p53 and next-generation kinase inhibitors.

The Company’s first approved product, Olverembatinib, is the first novel third-generation BCR-ABL1 inhibitor approved in China for the treatment of patients with CML in chronic phase (CML-CP) with T315I mutations, CML in accelerated phase (CML-AP) with T315I mutations, and CML-CP that is resistant or intolerant to first and second-generation TKIs. It is covered by the China National Reimbursement Drug List (NRDL). Ascentage Pharma is currently conducting an FDA-cleared registrational Phase III trial, called POLARIS-2, of Olverembatinib for CML, as well as registrational Phase III trials for patients with newly diagnosed Ph+ ALL, called POLARIS-1, and SDH-deficient GIST patients, called POLARIS-3.

The Company’s second approved product, Lisaftoclax, is a novel Bcl-2 inhibitor for the treatment of various hematologic malignancies. Lisaftoclax has been approved by China’s National Medical Products Administration (NMPA) for the treatment of adult patients with chronic lymphocytic leukemia/small lymphocytic lymphoma (CLL/SLL) who have previously received at least one systemic therapy including Bruton’s tyrosine kinase (BTK) inhibitors. The Company is currently conducting four global registrational Phase III trials: the FDA-cleared GLORA study of Lisaftoclax in combination with BTK inhibitors in patients with CLL/SLL previously treated with BTK inhibitors for more than 12 months with suboptimal response; the GLORA-2 study in patients with newly diagnosed CLL/SLL; the GLORA-3 study in newly diagnosed, elderly and unfit patients with AML; and the FDA-cleared GLORA-4 study in patients with newly diagnosed HR MDS.

Leveraging its robust R&D capabilities, Ascentage Pharma has built a portfolio of global intellectual property rights and entered into global partnerships and other relationships with numerous leading biotechnology and pharmaceutical companies, such as Takeda, AstraZeneca, Merck, Pfizer, and Innovent, in addition to research and development relationships with leading research institutions, such as Dana-Farber Cancer Institute, Mayo Clinic, National Cancer Institute and the University of Michigan.

Cautionary Note Regarding Forward-Looking Statements

For more information, visit https://ascentage.com/ This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, contained in this press release may be forward-looking statements, including statements that express Ascentage Pharma’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results of operations or financial condition. These forward-looking statements are subject to a number of risks and uncertainties as discussed in Ascentage Pharma’s filings with the SEC, including those set forth in the sections titled “Risk factors” and “Cautionary note regarding forward-looking statements” in its Annual Report on Form 20-F for the year ended December 31, 2024, filed with the SEC on April 16, 2025, the sections headed “Forward-looking Statements” and “Risk Factors” in the prospectus of the Company for its Hong Kong initial public offering dated October 16, 2019, and other filings with the SEC and/or The Stock Exchange of Hong Kong Limited it has made or it makes from time to time that may cause actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. The forward-looking statements contained in this press release do not constitute profit forecast by the Company’s management.

As a result of these factors, you should not rely on these forward-looking statements as predictions of future events. The forward-looking statements contained in this press release are based on Ascentage Pharma’s current expectations and beliefs concerning future developments and their potential effects and speak only as of the date of such statements. Ascentage Pharma does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact Information

Investor Relations:

Hogan Wan, Head of IR and Strategy

Ascentage Pharma

Hogan.Wan@ascentage.com

+86 512 85557777

Stephanie Carrington

ICR Healthcare

AscentageIR@icrhealthcare.com

+1 (646) 277-1282

Media Relations:

Jon Yu

ICR Healthcare

AscentagePR@icrhealthcare.com

+1 (646) 677-1855

Ascentage Pharma Group International

Condensed consolidated statements of profit or loss

(Amounts in thousands of Renminbi (“RMB”) and U.S. dollar (“US$”), except for number of shares and per share data)

| For the Six Months Ended June 30, | ||||||||||||||||

| 2023 | 2024 | 2025 | 2025 | |||||||||||||

| RMB | RMB | RMB | US$ | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| REVENUE | ||||||||||||||||

| Intellectual property | - | 678,416 | - | - | ||||||||||||

| Products | 129,533 | 124,823 | 212,874 | 29,716 | ||||||||||||

| Others | 13,168 | 20,507 | 20,825 | 2,907 | ||||||||||||

| Total revenue | 142,701 | 823,746 | 233,699 | 32,623 | ||||||||||||

| Cost of sales | ||||||||||||||||

| Products | (18,154 | ) | (14,158 | ) | (20,659 | ) | (2,884 | ) | ||||||||

| Others | - | (901 | ) | (991 | ) | (138 | ) | |||||||||

| Total cost of sales | (18,154 | ) | (15,059 | ) | (21,650 | ) | (3,022 | ) | ||||||||

| Gross profit | 124,547 | 808,687 | 212,049 | 29,601 | ||||||||||||

| Other income and gains | 17,021 | 17,346 | 36,661 | 5,118 | ||||||||||||

| Selling and distribution expenses | (83,319 | ) | (89,637 | ) | (137,787 | ) | (19,234 | ) | ||||||||

| Administrative expenses | (91,340 | ) | (86,988 | ) | (99,685 | ) | (13,915 | ) | ||||||||

| Research and development expenses | (309,814 | ) | (444,079 | ) | (528,561 | ) | (73,784 | ) | ||||||||

| Other expenses | (4,175 | ) | (7,106 | ) | (40,192 | ) | (5,612 | ) | ||||||||

| Finance costs | (52,719 | ) | (34,076 | ) | (27,798 | ) | (3,880 | ) | ||||||||

| Share of profit/(loss) of a joint venture | 196 | (1,252 | ) | 1 | - | |||||||||||

| (LOSS)/PROFIT BEFORE TAX | (399,603 | ) | 162,895 | (585,312 | ) | (81,706 | ) | |||||||||

| Income tax expense | (2,746 | ) | (69 | ) | (5,512 | ) | (770 | ) | ||||||||

| (LOSS)/PROFIT FOR THE PERIOD | (402,349 | ) | 162,826 | (590,824 | ) | (82,476 | ) | |||||||||

| Attributable to: | ||||||||||||||||

| Ordinary equity holders of the Company | (402,351 | ) | 163,001 | (590,768 | ) | (82,468 | ) | |||||||||

| Non-controlling interests | 2 | (175 | ) | (56 | ) | (8 | ) | |||||||||

| (402,349 | ) | 162,826 | (590,824 | ) | (82,476 | ) | ||||||||||

| (LOSS)/EARNINGS PER SHARE ATTRIBUTABLE TO ORDINARY EQUITY HOLDERS OF THE COMPANY | ||||||||||||||||

| Basic | (1.47 | ) | 0.56 | (1.73 | ) | (0.22 | ) | |||||||||

| Diluted | (1.47 | ) | 0.55 | (1.73 | ) | (0.22 | ) | |||||||||

Ascentage Pharma Group International

Condensed consolidated statements of comprehensive loss

(Amounts in thousands of Renminbi and U.S. dollar, except for number of shares and per share data)

| For the Six Months Ended June 30, | ||||||||||||||||

| 2023 | 2024 | 2025 | 2025 | |||||||||||||

| RMB | RMB | RMB | US$ | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| (LOSS)/PROFIT FOR THE PERIOD | (402,349 | ) | 162,826 | (590,824 | ) | (82,476 | ) | |||||||||

| OTHER COMPREHENSIVE INCOME/(LOSS) | ||||||||||||||||

| Other comprehensive income that may be reclassified to profit or loss in subsequent periods: | ||||||||||||||||

| Exchange differences on translation of foreign operations | (699 | ) | 40 | 1,095 | 153 | |||||||||||

| Other comprehensive income that will not be reclassified to profit or loss in subsequent periods: | ||||||||||||||||

| Exchange differences on translation of the Company | 40,479 | 2,229 | (2,035 | ) | (284 | ) | ||||||||||

| OTHER COMPREHENSIVE INCOME/(LOSS) FOR THE PERIOD, NET OF TAX | 39,780 | 2,269 | (940 | ) | (131 | ) | ||||||||||

| TOTAL COMPREHENSIVE (LOSS)/INCOME FOR THE PERIOD | (362,569 | ) | 165,095 | (591,764 | ) | (82,607 | ) | |||||||||

| Attributable to: | ||||||||||||||||

| Ordinary equity holders of the Company | (362,571 | ) | 165,270 | (591,708 | ) | (82,599 | ) | |||||||||

| Non-controlling interests | 2 | (175 | ) | (56 | ) | (8 | ) | |||||||||

| (362,569 | ) | 165,095 | (591,764 | ) | (82,607 | ) | ||||||||||

Ascentage Pharma Group International

Condensed consolidated statements of financial position

(Amounts in thousands of Renminbi and U.S. dollar, except for number of shares and per share data)

| As at | ||||||||||||

| December 31, 2024 |

June 30, 2025 |

June 30, 2025 |

||||||||||

| RMB | RMB | US$ | ||||||||||

| (Audited) | (Unaudited) | (Unaudited) | ||||||||||

| NON-CURRENT ASSETS | ||||||||||||

| Property, plant and equipment | 849,450 | 821,201 | 114,635 | |||||||||

| Right-of-use assets | 56,109 | 50,760 | 7,086 | |||||||||

| Goodwill | 24,694 | 24,694 | 3,447 | |||||||||

| Other intangible assets | 75,998 | 70,994 | 9,910 | |||||||||

| Investment in a joint venture | 32,717 | 32,718 | 4,567 | |||||||||

| Financial assets at fair value through profit or loss (“FVTPL”) | 1,141 | 4,617 | 645 | |||||||||

| Deferred tax assets | 44,236 | 33,385 | 4,660 | |||||||||

| Other non-current assets | 59,303 | 99,055 | 13,828 | |||||||||

| Total non-current assets | 1,143,648 | 1,137,424 | 158,778 | |||||||||

| CURRENT ASSETS | ||||||||||||

| Inventories | 6,597 | 8,591 | 1,199 | |||||||||

| Trade receivables, net | 83,143 | 78,362 | 10,939 | |||||||||

| Prepayments, other receivables and other assets | 123,211 | 160,313 | 22,379 | |||||||||

| Cash and bank balances | 1,261,211 | 1,661,454 | 231,930 | |||||||||

| Total current assets | 1,474,162 | 1,908,720 | 266,447 | |||||||||

| CURRENT LIABILITIES | ||||||||||||

| Trade payables | 91,966 | 118,676 | 16,567 | |||||||||

| Other payables and accruals | 258,098 | 249,358 | 34,808 | |||||||||

| Contract liabilities | 37,485 | 37,485 | 5,233 | |||||||||

| Interest-bearing bank and other borrowings | 779,062 | 833,783 | 116,392 | |||||||||

| Total current liabilities | 1,166,611 | 1,239,302 | 173,000 | |||||||||

| NET CURRENT ASSETS | 307,551 | 669,418 | 93,447 | |||||||||

| TOTAL ASSETS LESS CURRENT LIABILITIES | 1,451,199 | 1,806,842 | 252,225 | |||||||||

Ascentage Pharma Group International

Condensed consolidated statements of financial position

(Amounts in thousands of Renminbi and U.S. dollar, except for number of shares and per share data)

| As at | ||||||||||||

| December 31, 2024 |

June 30, 2025 |

June 30, 2025 |

||||||||||

| RMB | RMB | US$ | ||||||||||

| (Audited) | (Unaudited) | (Unaudited) | ||||||||||

| NON-CURRENT LIABILITIES | ||||||||||||

| Contract liabilities | 248,460 | 229,628 | 32,055 | |||||||||

| Interest-bearing bank and other borrowings | 889,4351 | 882,382 | 123,176 | |||||||||

| Deferred tax liabilities | 5,368 | - | - | |||||||||

| Deferred income | 27,500 | 6,500 | 907 | |||||||||

| Other non-current liabilities | 6,274 | 12,423 | 1,734 | |||||||||

| Total non-current liabilities | 1,177,037 | 1,130,933 | 157,872 | |||||||||

| TOTAL LIABILITIES | 2,343,648 | 2,370,235 | 330,872 | |||||||||

| EQUITY | ||||||||||||

| Equity attributable to ordinary equity holders of the Company | ||||||||||||

| Ordinary shares (par value of US$0.0001 per share as of December 31, 2024 and June 30, 2025; 315,224,993 and 348,999,320 shares authorized, issued and outstanding as of December 31, 2024 and June 30, 2025, respectively) | 214 | 239 | 33 | |||||||||

| Treasury shares | (8 | ) | (2,960 | ) | (413 | ) | ||||||

| Share premium | 6,545,129 | 7,546,108 | 1,053,396 | |||||||||

| Capital and reserves | (384,515 | ) | (389,056 | ) | (54,310 | ) | ||||||

| Exchange fluctuation reserve | (126,071 | ) | (127,011 | ) | (17,730 | ) | ||||||

| Accumulated losses | (5,770,555 | ) | (6,361,323 | ) | (888,006 | ) | ||||||

| 264,194 | 665,997 | 92,970 | ||||||||||

| Non-controlling interests | 9,968 | 9,912 | 1,383 | |||||||||

| Total equity | 274,162 | 675,909 | 94,353 | |||||||||

Exhibit 99.2

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

ASCENTAGE PHARMA GROUP INTERNATIONAL

亞盛醫藥集團

(Incorporated in the Cayman Islands with limited liability)

(Stock Code: 6855)

ANNOUNCEMENT OF UNAUDITED INTERIM

RESULTS

FOR THE SIX MONTHS ENDED JUNE 30, 2025

The Board is pleased to announce the unaudited consolidated results of Ascentage Pharma Group International for the six months ended June 30, 2025, together with the comparative figures for the six months ended June 30, 2024.

FINANCIAL HIGHLIGHTS

Revenue for the six months ended June 30, 2025 was RMB233.7 million (US$32.6 million) which represents a decrease of RMB590.0 million (US$80.7 million), or 71.6%, as compared to the six months ended June 30, 2024, primarily because of intellectual property revenue of RMB678.4 million (US$95.3 million) during the six months ended June 30, 2024. Product sales from Olverembatinib in China increased by RMB104.5 million (US$14.9 million), or 93%, to RMB217.4 million (US$30.3 million) for the first half of 2025 compared to RMB112.9 million (US$15.5 million) for the six months ended June 30, 2024.

Total operating expenses for the six months ended June 30, 2025 increased by RMB145.3 million (US$21.5 million), or 23.4% to RMB766.0 million (US$106.9 million), as compared to the same period of 2024. Research and development expenses increased by RMB84.5 million (US$12.7 million), or 19.0%, to RMB528.6 million (US$73.8 million) for the six months ended June 30, 2025 primarily attributable to increased external research and development expenses related to our ongoing global clinical trials. Selling and distribution expenses increased by RMB48.2 million (US$6.9 million), or 53.7%, to RMB137.8 million (US$19.2 million) for the six months ended June 30, 2025, primarily attributable to expansion in commercialization of Olverembatinib and preparation for the launch of Lisaftoclax.

Net loss was RMB590.8 million (US$82.5 million) for the six months ended June 30, 2025, compared to profit of RMB162.8 million (US$22.4 million) for the six months ended June 30, 2024, which was primarily attributable to the decrease in intellectual property revenue as explained above.

As at June 30, 2025, the Group’s cash and bank balances were RMB1,661.5 million (US$231.9 million), or an increase of RMB400.2 million (US$59.1 million), or 31.7% compared with RMB1,261.2 million (US$172.8 million) as at December 31, 2024, which was primarily attributable to the net proceeds of US$132.5 million from its U.S. initial public offering in January 2025. In addition, after the Reporting Period, in July 2025, we have received net proceeds of HK$1,492.5 million (US$190.1 million) arising from the 2025 Placing.

BUSINESS HIGHLIGHTS

Lisaftoclax has been approved in China for CLL/SLL

| 1. | On July 10, 2025, Lisaftoclax was approved by China’s National Medical Products Administration (NMPA) for the treatment of adult patients with chronic lymphocytic leukemia/small lymphocytic lymphoma (CLL/SLL) who have previously received at least one systemic therapy, including Bruton’s tyrosine kinase, or BTK, inhibitors. |

| 2. | This approval for Lisaftoclax demonstrates Ascentage Pharma’s exceptional ability to execute its overall strategy in translating clinical development to approved products. Lisaftoclax is the first Bcl-2 inhibitor to receive conditional approval and marketing authorization for the treatment of patients with CLL/SLL in China, and the second Bcl-2 inhibitor approved globally. |

Olverembatinib revenue grew significantly after NRDL coverage expansion

| 1. | Revenue from sales of Olverembatinib in China increased 93% to RMB217.4 million (US$30.3 million) for the six months ended June 30, 2025, compared to RMB112.9 million (US$15.5 million) for the six months ended June 30, 2024. |

| 2. | All approved indications of Olverembatinib are covered since January 2025 by the China’s National Reimbursement Drug List, or NRDL, which bolstered the affordability and accessibility of the drug in China. |

| 3. | The number of hospitals where Olverembatinib are on formulary and Direct-to-Patient, or DTP, pharmacies reached 782 as of June 30, 2025, a 17% increase compared to June 30, 2024. In particular, the number of hospitals where Olverembatinib is on formulary increased approximately 47% over the same period to 295 hospitals as of June 30, 2025 from 201 hospitals as of June 30, 2024. |

MANAGEMENT DISCUSSION & ANALYSIS

OVERVIEW

We are a global, commercial stage, integrated biopharmaceutical company engaged in the discovery, development and commercialization of novel, differentiated therapies to address unmet medical needs in cancer.

Our lead drug products, Olverembatinib and Lisaftoclax, were developed by us to treat multiple major hematological malignancies as well as solid tumors that occur globally. Currently, for hematological malignancies, Olverembatinib is directed towards or intended to address chronic myeloid leukemia, or CML, and acute lymphocytic leukemia, or ALL, and Lisaftoclax is directed towards or intended to address chronic lymphocytic leukemia, or CLL, small lymphocytic leukemia, or SLL, acute myeloid leukemia, or AML, myelodysplastic syndrome, or MDS, and multiple myeloma, or MM. These particular hematological diseases alone are expected to exceed US$160 billion in aggregate market size by 2035, according to an industry report commissioned by us and independently prepared by Frost & Sullivan, or the F&S Report.

Our first product, Olverembatinib, is a novel, next-generation tyrosine kinase inhibitor, or TKI, that was the first BCR-ABL1 TKI approved in China for treatment of patients with CML in chronic phase, or CML-CP, with T315I mutations, CML in accelerated phase, or CML-AP, with T315I mutations, and CML-CP that is resistant and/or intolerant to first and second-generation TKIs. We are currently commercializing Olverembatinib in China. Since January 2025, all commercialized indications of Olverembatinib have been included in the NRDL, which bolstered the affordability and accessibility of the drug in China. We are currently conducting an FDA-cleared, registrational Phase III trial, called POLARIS-2, of Olverembatinib for CML. In addition, we are conducting registrational Phase III trials for patients with newly diagnosed Ph+ ALL and SDH-deficient GIST patients. In June 2024, we entered into an Exclusive Option Agreement with Takeda Pharmaceuticals International AG, or Takeda, pursuant to which we granted Takeda an exclusive option to enter into an exclusive license agreement for Olverembatinib. If exercised, the Option would allow Takeda to license global rights to develop and commercialize Olverembatinib in all territories outside of the PRC, Hong Kong, Macau, Taiwan and Russia.

Our second product, Lisaftoclax, is a novel Bcl-2 inhibitor that, on July 10, 2025, was approved by China’s NMPA for the treatment of adult patients with CLL/SLL, who have previously received at least one systemic therapy including BTK inhibitors. This milestone makes Lisaftoclax the first Bcl-2 inhibitor receiving conditional approval and marketing authorization for the treatment of patients with CLL/SLL in China, and the second Bcl-2 inhibitor approved globally. We are also currently conducting four registrational Phase III trials of Lisaftoclax: (1) the GLORA study of Lisaftoclax in combination with BTK inhibitors in patients with CLL/SLL previously treated with BTK inhibitors for more than 12 months with suboptimal response, (2) the GLORA-2 study in combination with acalabrutinib in patients with newly diagnosed CLL/SLL, (3) the GLORA-3 study in combination with azacitidine, or AZA, in newly diagnosed, elderly and unfit patients with AML; and (4) the GLORA-4 study in combination with AZA in patients with newly diagnosed higher risk, or HR, MDS.

Our central strategy has been to leverage our expertise in chemistry to synthesize inhibitors targeting proteins and pathways that drive the key hallmarks of cancer. Beyond our two products, we have several other clinical-stage assets in U.S., China or international clinical trials. To date, we have utilized our knowledge of small molecule discovery together with our ability to execute clinical trials globally to develop novel treatments to address unmet medical needs in cancer. Backed by our strong scientific foundation, we use state-of-the-art technologies to discover and develop innovative therapeutic agents directed towards our target patient populations.

We are empowered by our technical expertise in structure-based drug design and our innovative drug discovery engine, which allows us to address unmet medical needs by targeting key apoptotic pathways and tyrosine kinases that have been well-known and validated in the field. These core competencies have allowed us to develop small molecule and degrader candidate therapeutics against a range of well-characterized apoptotic targets including Bcl-2, Bcl-2/Bcl-xL, IAP, and MDM2-p53. In addition, we are building next-generation cell signaling inhibitor candidates (i.e., BCR-ABL1, ALK, FAK inhibitors) as well as epigenome-modifying agents (i.e., EED inhibitor). Earlier stage in our pipeline, we are harnessing our deep understanding of protein degraders to develop a wide range of therapeutic candidates, such as proteolysis targeting chimera molecules, or PROTACs, that target traditionally undruggable proteins that are implicated in oncogenesis. We are the only company in the world with active clinical programs targeting all three known classes of key apoptosis regulators, according to the F&S Report.

Leveraging our robust internal research and development capabilities, we have built an intellectual property portfolio with rights that span globally. As of June 30, 2025, we cumulatively have 478 issued patents globally, which includes over 20 new patents issued during the reporting period, while excluding the expiration and abandonment of certain patents unrelated to our core product portfolio. 342 issued patents are issued outside of China as of the end of the Reporting Period.

We have also established collaborations and other relationships with leading biotechnology and pharmaceutical companies around the world, including a collaboration and license agreement with Innovent as well as clinical collaboration agreements with AstraZeneca, Merck & Co., and Pfizer Inc. We also have research and development collaborations with leading research institutions, including, but not limited to, Dana-Farber Cancer Institute, Mayo Clinic, MD Anderson Cancer Center, National Cancer Institute, and the University of Michigan.

BUSINESS OVERVIEW

Product Pipeline

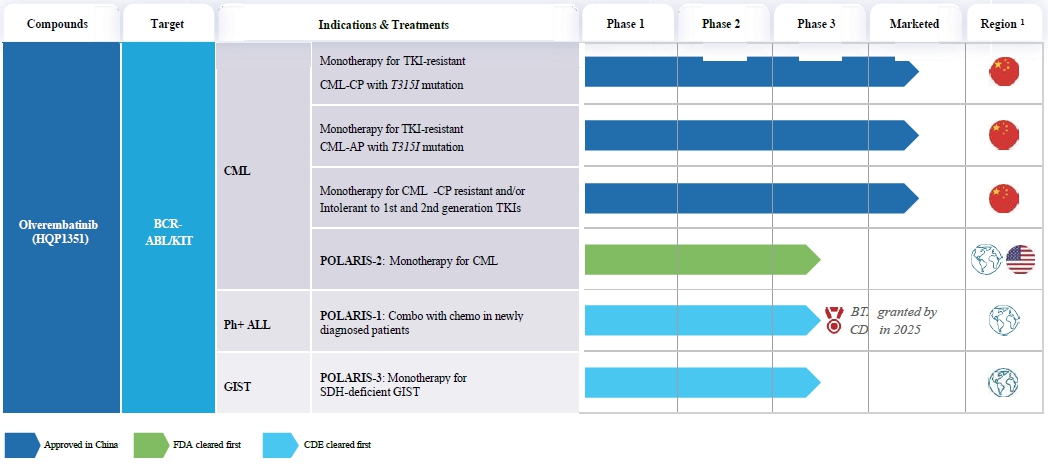

The following table summarizes our clinical-stage pipeline consisting of six small molecule drug candidates, including ongoing trials for Olverembatinib and Lisaftoclax for oncology indications beyond those currently approved in China, along with the development status of each candidate, as of July 31, 2025:

| 1. | The globe icon refers to trials that have received clearance, or for which we expect to obtain clearance, in two or more countries or regions. The U.S. flag refers to trials for which we have received clearance from the FDA to conduct trials in the United States. The China flag refers to trials for which we have conducted, are currently conducting, or plan to conduct only in China. |

| 2. | The globe icon also indicates having global development and commercialization rights. |

| 3. | CLL/SLL patients who have previously received at least one systemic therapy, including BTK inhibitors. |

| 4. | Registrational trials for ongoing CLL/SLL, AML and MDS. Phase 2 trials ongoing for MM. |

| 5. | Two registrational trials ongoing for NSCLC. Phase 2 trials ongoing for ovarian cancer. |

Current Core Products

Olverembatinib (HQP1351)

Our first product, Olverembatinib, is a novel, next-generation TKI. Olverembatinib is the first third generation BCR-ABL1 TKI approved in China for treatment of patients with CML-CP with T315I mutations, CML-AP with T315I mutations and CML-CP that is resistant and/or intolerant to first and second-generation TKIs. Olverembatinib received support from China’s National Major New Drug Discovery and Manufacturing Program. Since January 2025, all approved indications of Olverembatinib are covered by the China’s NRDL, which bolstered the affordability and accessibility of the drug in China.

Olverembatinib was included as an Emerging Treatment Option in the 2024 National Comprehensive Cancer Network USA, or NCCN, guidelines for the management of CML and received recommendation from the Chinese Society of Clinical Oncology, or CSCO, guidelines for the treatment of CML and Ph+ ALL. As of the date of this report, the FDA has granted four Orphan Drug Designations (ODDs) to Olverembatinib, including for CML, ALL, AML and GIST, as well as Fast-Track Designation for treatment of CML in patients with certain genetic markers who have failed to respond to treatments with existing TKIs. Olverembatinib was also granted an Orphan Designation by the European Medicines Agency, or EMA, for the treatment of CML.

The following table summarizes registrational trials that were completed or ongoing worldwide for Olverembatinib:

| 1. | The globe icon as used in this table refers to trials that are currently taking place in at least two countries. The US flag refers to trials for which we have received clearance from the FDA to conduct trials in the United States. The China flag refers to trials for which we have conducted only in China. |

The recent progress of Olverembatinib is as follows:

Commercial progress

| 1. | Revenue from sales of Olverembatinib in China increased 93% to RMB217.4 million (US$30.3 million) for the six months ended June 30, 2025, compared to RMB112.9million (US$15.5 million) for the six months ended June 30, 2024. |

| 2. | All approved indications of Olverembatinib are covered since January 2025 by China’s NRDL, which bolstered the affordability and accessibility of the drug in China. |

| 3. | The number of DTP pharmacies and hospitals where Olverembatinib is on formulary reached 782 as of June 30, 2025, a 17% increase compared to June 30, 2024. In particular, the number of hospitals where Olverembatinib is on formulary increased 47% compared to June 30, 2024. |

| 4. | In April 2025, Olverembatinib received an upgraded recommendation in the CSCO Guidelines for the Diagnosis and Treatment of Leukemias in Children and Adolescent and retained its recommendations in the CSCO Guidelines for the Diagnosis and Treatment of Hematological Malignancies. |

Clinical progress

| 1. | We continue enrollment in a registrational Phase III clinical trial of Olverembatinib in combination with chemotherapy versus imatinib in combination with chemotherapy in patients with newly diagnosed Ph+ ALL (POLARIS-1). |

| 2. | We continue enrollment in a FDA-cleared registrational Phase III clinical trial of Olverembatinib for previously treated CML-CP patients, both with and without T315I mutation (POLARIS-2). |

| 3. | We continue enrollment in a registrational Phase III clinical trial of Olverembatinib for the treatment of patients with SDH-deficient GIST who have failed prior systemic treatment (POLARIS-3). |

| 4. | We obtained Breakthrough Therapy Designation (BTD) for Olverembatinib in March 2025 from the CDE of China’s NMPA for combination with low-intensity chemotherapy for the first-line treatment of newly-diagnosed patients with Ph+ ALL. |

Data publications

| 1. | In June 2025, the updated results from multiple studies of Olverembatinib were presented as posters at the 2025 European Hematology Association Hybrid Congress (EHA 2025). The results showed broad therapeutic potential and demonstrated clinical benefit in the treatment of Ph+ ALL. According to the results, Olverembatinib demonstrated high CR and CMR rates, as well as favorable tolerability in first-line treatment of newly diagnosed and relapsed/refractory Ph+ ALL as well as specific subtypes of some hematologic malignancies (e.g., myeloid/lymphoid neoplasm with FGFR1 rearrangement). Furthermore, studies on various combinations of Olverembatinib (with venetoclax plus azacitidine, the VP regimen, blinatumomab, or inotuzumab ozogamicin) have shown encouraging results that revealed Olverembatinib’s potential to offer additional treatment options and improve long-term prognoses for patients with Ph+ ALL. |

| 2. | In April 2025, we released data of Olverembatinib in combination with Lisaftoclax overcoming venetoclax resistance in preclinical models of AML as well as preclinical data of Olverembatinib in combination with Lisaftoclax in T-ALL at the 2025 American Association for Cancer Research (AACR 2025). |

Expected Progress of Olverembatinib

| 1. | We plan to seek clearance from the FDA to initiate a registrational Phase III clinical trial in newly diagnosed Ph+ ALL patients. |

Key Products and Pipeline Candidates

Lisaftoclax (APG-2575)

Lisaftoclax is a novel, oral Bcl-2 inhibitor developed to treat a variety of hematologic malignancies and solid tumors by selectively blocking Bcl-2 to restore the normal apoptosis process in cancer cells. In July 2025, Lisaftoclax was approved by China’s NMPA for the treatment of adult patients with CLL/SLL who have previously received at least one systemic therapy, including BTK inhibitors, which makes Lisaftoclax the first Bcl-2 inhibitor receiving conditional approval and marketing authorization for the treatment of patients with CLL/SLL in China as well as the second Bcl-2 inhibitor approved globally. Currently, Lisaftoclax has received clearances and approvals for clinical studies in China, the United States, Australia, and Europe, with indications including CLL/ SLL, non-Hodgkin’s lymphoma, or NHL, AML, MM, MDS, Waldenström’s macroglobulinemia, or WM, and certain solid tumors. Furthermore, the FDA has granted five ODDs to Lisaftoclax, specifically for the treatment of patients with follicular lymphoma, or FL, WM, CLL, MM, and AML.

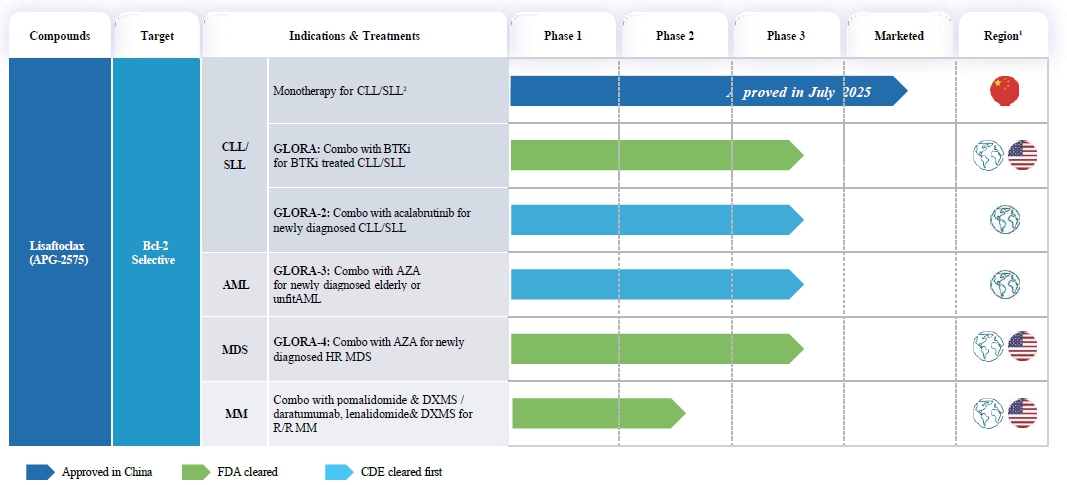

The following table summarizes the registrational trials completed or ongoing for Lisaftoclax:

| 1. | The globe icon as used in this table refers to trials that are currently taking place in at least two countries. The U.S. flag refers to trials for which we have received clearance from the FDA to conduct trials in the United States. The China flag refers to trials for which we have conducted or currently conduct only in China. |

| 2. | CLL/SLL patients who have previously received at least one systemic therapy including BTK inhibitors. |

A summary of recent progress of Lisaftoclax is as follows:

Commercial progress

| 1. | On July 10, 2025, Lisaftoclax was approved by China’s NMPA for the treatment of adult patients with CLL/SLL who have previously received at least one systemic therapy including BTK inhibitors, which makes Lisaftoclax the first Bcl-2 inhibitor receiving conditional approval and marketing authorization for the treatment of patients with CLL/SLL in China, and the second Bcl-2 inhibitor approved globally. Shortly after the approval, we have commenced the commercial sales of Lisaftoclax in China. |

| 2. | In April 2025, Lisaftoclax received its first recommendation in the CSCO Guidelines for the Diagnosis and Treatment of Lymphoid Malignancies, as a monotherapy for the treatment of patients with relapsed/refractory (R/R) CLL/SLL. |

Clinical progress

| 1. | We continue enrollment in a global, multi-center, registrational Phase III clinical trial, called GLORA-4, of Lisaftoclax in combination with AZA for the treatment of patients who are newly diagnosed with HR MDS. GLORA-4 trial has been cleared by the FDA and EMA. |

| 2. | We continue enrollment in a registrational Phase III clinical trial, called GLORA-3, of Lisaftoclax in combination with AZA for the treatment of newly diagnosed old or unfit patients with AML. |

| 3. | We continue enrollment in a registrational Phase III clinical trial, called GLORA-2, to evaluate Lisaftoclax in combination with the BTK inhibitor acalabrutinib, versus immunochemotherapy in treatment-naïve patients with CLL/SLL, to validate a fixed duration of combination regimen as a first-line treatment. |

| 4. | We continue enrollment in an FDA-cleared registrational Phase III clinical trial, called GLORA, of Lisaftoclax in combination with BTK inhibitors in patients with CLL/SLL previously treated with BTK inhibitors. |

| 5. | We continue enrollment in the Phase Ib/II clinical trials of Lisaftoclax in combination with other therapies for the treatment of patients with MM in the United States. |

| 6. | Phase Ib/II studies of Lisaftoclax as a single agent or in combination with other therapies for the treatment of patients with AML/MDS are ongoing in China. |

| 7. | Phase Ib/II studies of Lisaftoclax in combination with other therapies for the treatment of patients with AML/MDS are also ongoing in the United States. |

| 8. | A Phase Ib/II study of Lisaftoclax, both as a single agent and in combination with the BTK inhibitor ibrutinib or combination with rituximab for the treatment of patients with WM, is ongoing in the United States, Australia, and China. |

Data publications

| 1. | In June 2025, we presented updated results of Lisaftoclax combined with AZA in patients with myeloid malignancies that are treatment-naïve (TN) or that have had prior venetoclax exposure. We presented this data in an oral presentation at the 61st ASCO Annual Meeting. This is an ongoing multi-country, multi-center Phase Ib/II study of Lisaftoclax, which as of data cutoff in April 2025, had enrolled a total of 103 patients, including patients with TN or R/R AML or MDS. The data of this study once again underscored the promising antitumor activity and manageable tolerability of Lisaftoclax in myeloid malignancies. This study reported that Lisaftoclax was able to achieve tumor responses in patients for the first time that are refractory to venetoclax. Specifically, in efficacy-evaluable venetoclax-refractory patients with R/R AML/Mixed Phenotype Acute Leukemia, or MPAL, the overall response rate (ORR) was 31.8%, suggesting that Lisaftoclax has a favorable antitumor profile and is differentiated from other drugs within the same class. This is also the third consecutive year in which this study of Lisaftoclax was selected for presentations at the ASCO Annual Meeting. |

Expected progress of Lisaftoclax

| 1. | We plan to initiate clinical studies to confirm Lisaftoclax’s potential to overcome venetoclax resistance in patients who have failed venetoclax treatment. |

APG-2449

APG-2449 is a novel, orally active, small-molecule inhibitor of focal adhesion kinase, or FAK, a third generation inhibitor of anaplastic lymphoma kinase, or ALK, and an inhibitor of receptor tyrosine kinase C-ros oncogene 1, or ROS1. It is a triple ligase kinase inhibitor designed and developed by Ascentage Pharma. It is the first FAK inhibitor approved by CDE for clinical studies in China. A first-in-human trial, cerebrospinal fluid pharmacokinetics or PK analyses showed that APG-2449 was brain-penetrant. An updated study of APG-2449 demonstrated preliminary clinical benefit in patients with NSCLC whose disease was TKI naïve and resistant to second-generation ALK inhibitors, especially in those with brain metastases. In addition, high phosphorylated FAK, or pFAK, expression levels in baseline tumor tissue correlated with improved APG-2449 treatment responses in patients with NSCLC resistant to second-generation ALK inhibitors, suggesting that the increase in pFAK levels may be associated with second-generation ALK TKI resistance.

Recent progress of APG-2449 is as follows:

Clinical progress

| 1. | Two CDE-cleared registrational Phase III clinical trials are ongoing that are separately evaluating APG-2449 in patients with NSCLC who are resistant to or intolerant of second- generation ALK TKIs and treatment-naïve patients with ALK-positive advanced or locally advanced NSCLC. |

| 2. | A Phase 1b/2 study of APG-2449 in combination with liposomal doxorubicin hydrochloride in platinum-resistant ovarian cancer is ongoing. |

Data publications

| 1. | In April 2025, we released updated preclinical data of APG-2449 at AACR 2025, demonstrating enhanced antitumor activity with chemotherapy in preclinical models of small- cell lung cancer, or SCLC, with activated FAK. |

Cautionary Statement required by Rule 18A.05 of the Listing Rules: WE MAY NOT BE ABLE TO ULTIMATELY DEVELOP AND MARKET APG-2449 SUCCESSFULLY.

Alrizomadlin (APG-115)

Alrizomadlin (APG-115) is a novel, orally bioavailable, small-molecule inhibitor of mouse double minute 2-p53 homolog, or MDM2-p53, designed to be highly specific for disruption of the protein- protein interaction of MDM2 and p53 in order to restore activation of p53 tumor suppressor activity. It is undergoing multiple clinical studies in China, the United States, and Australia as a single agent or in combination with immunotherapy or chemotherapy for treating solid tumors and hematologic malignancies.

The FDA has granted six ODDs for alrizomadlin for the treatment of soft-tissue sarcoma, gastric cancer, AML, retinoblastoma, stage IIB-IV melanoma, and neuroblastoma. In addition, alrizomadlin has been granted two Rare Pediatric Disease Designations, or RPDD designations by the FDA for the treatment of neuroblastoma and retinoblastoma.

Recent progress of alrizomadlin is as follows:

Clinical progress

We are currently advancing the following clinical studies of alrizomadlin in the United States and/ or Australia:

| 1. | A Phase Ib/II study of alrizomadlin monotherapy or in combination with pembrolizumab in patients with unresectable or metastatic melanoma (in collaboration with Merck & Co.) or other advanced solid tumors. |

| 2. | A Phase IIa study evaluating the pharmacokinetics, safety and efficacy of alrizomadlin as a single agent or in combination with Lisaftoclax in subjects with relapsed/refractory T-cell Prolymphocytic Leukemia, or R/R T-PLL, or NHL. |

| 3. | A collaborative research study of alrizomadlin monotherapy or in combination with chemotherapy in a Phase II study for the treatment of salivary gland cancer. |

In addition, the CDE has granted approval for the following clinical trials of alrizomadlin in China:

| 1. | A Phase Ib/II clinical study of alrizomadlin in combination with anti-PD-1 antibody (JS001) toripalimab, for the treatment of patients with advanced liposarcoma (LPS) or other advanced solid tumors. |

| 2. | A Phase Ib study of alrizomadlin as a single agent or in combination with azacitidine or cytarabine in patients with R/R AML and relapsed/progressed high-/very high-risk MDS. |

| 3. | A Phase I clinical study of alrizomadlin alone or in combination with Lisaftoclax in children with recurrent or refractory neuroblastoma or other solid tumors. |

Data publications

| 1. | In June 2025, we released clinical data from our Phase II study of alrizomadlin as a single agent or in combination with PD-1 inhibitor toripalimab in patients with advanced adenoid cystic carcinoma, or ACC, or other solid tumors in a poster presentation at the 61st ASCO Annual Meeting. |

Cautionary Statement required by Rule 18A.05 of the Listing Rules: WE MAY NOT BE ABLE TO ULTIMATELY DEVELOP AND MARKET ALRIZOMADLIN (APG-115) SUCCESSFULLY.

Pelcitoclax (APG-1252)

Pelcitoclax is a novel, highly potent, small-molecule drug candidate designed to restore apoptosis through dual inhibition of the Bcl-2/Bcl-xL proteins for the treatment of SCLC, NSCLC, neuroendocrine tumor and NHL. It was granted an ODD by the FDA for the treatment of SCLC.

In various clinical trials conducted in the United States, Australia and China, patients have been treated with pelcitoclax as a monotherapy or in combination with other antitumor agents. Pelcitoclax has been well tolerated in patients to date using either weekly or biweekly intermittent dosing schedules. Preliminary antitumor activity was observed as a single agent in heavily pretreated patients.

Recent progress of pelcitoclax is as follows:

Clinical progress

Pelcitoclax is currently under investigation in a variety of combination trials, including:

| 1. | A Phase Ib study of pelcitoclax plus osimertinib in patients with epidermal growth factor receptor, or EGFR, mutant NSCLC in China; |

| 2. | A Phase Ib/II study of pelcitoclax as a single agent or in combination with other therapeutic agents in patients with R/R NHL in China. |

| 3. | A Phase I study of pelcitolclax in combination with cobimetinib in recurrent ovarian and endometrial cancers. |

Cautionary Statement required by Rule 18A.05 of the Listing Rules: WE MAY NOT BE ABLE TO ULTIMATELY DEVELOP AND MARKET PELCITOCLAX (APG-1252) SUCCESSFULLY.

APG-5918

APG-5918 is a potent, orally bioavailable, and highly selective embryonic ectoderm development, or EED, inhibitor. EED is a core subunit of the Polycomb Repressive Complex 2, or PRC2. Preliminary study results from our preclinical models of anemia demonstrated that APG-5918 has the potential to improve hemoglobin or Hb insufficiency induced by chronic kidney disease, or CKD.

We have initiated an FDA-regulated, multi-center, open-label Phase I clinical trial to evaluate the safety, pharmacokinetics, and efficacy of APG-5918 in patients with advanced solid tumors or lymphomas, including NHL, who have progressed while on or are intolerant to approved therapies, or for whom no standard treatments are available.

Recent progress of APG-5918 is as follows:

Clinical progress

| 1. | We continue the ongoing Phase I clinical trial of APG-5918 for the treatment of patients with advanced solid tumors and hematologic malignancies in China and the U.S. |

| 2. | We continue the Phase I clinical trial of APG-5918 for the treatment of patients with anemia- related indications in China. The first part of the single ascending dose, or SAD, study in healthy subjects has been completed, and the second part of multiple ascending dose, or MAD, phase in anemic subjects is ongoing. |

Data publications

| 1. | In June 2025, we released the preclinical results of APG-5918 at EHA 2025, demonstrating that APG-5918 exhibits potent antitumor activity and synergizes with histone deacetylase inhibitor tucidinostat in preclinical T-cell lymphoma, or TCL, models. |

| 2. | In April 2025, we released preclinical data of APG-5918 at AACR 2025, demonstrating that APG-5918 alone or in combination with enzalutamide is a promising therapeutic strategy for the treatment of patients with prostate cancer. |

Cautionary Statement required by Rule 18A.05 of the Listing Rules: WE MAY NOT BE ABLE TO ULTIMATELY DEVELOP AND MARKET APG-5918 SUCCESSFULLY.

Discovery programs

Protein degraders

Our deep understanding of heterobifunctional molecules and ligase biology has allowed us to develop protein degraders targeting traditionally undruggable proteins of interest implicated in key oncologic pathways. We believe we have the ability to develop differentiated degraders with superior pharmacokinetic-pharmacodynamic, or PK/PD, profiles resulting in less off-target effects than other degraders in clinical development. Through our degrader platform, we also believe we can develop cancer therapeutics targeted at resistance mechanisms that have traditionally plagued small molecule inhibitors.

We have identified and nominated our first targeted protein degrader, or TPD, candidate for pre-clinical development. This orally bioavailable degrader is targeting the p53-MDM2 pathway. In the last twenty years, many highly potent and orally active MDM2 inhibitors have been developed as a way to activate the p53 tumor suppressor gene, and several are currently in clinical development, including alrizomadlin. However, inhibition of p53 often leads to upregulation of MDM2, which, in turn, has limited the efficacy of MDM2 inhibitors evaluated by others to date. Therefore, we believe that a degrader approach has the potential to be a transformative new strategy against these key oncology targets.

We have also identified several compounds that are capable of rapidly reducing the levels of the Bcl-xL protein in human cancer cell lines and thereby inhibiting cancer cell growth that is dependent on Bcl-xL. Based on our initial studies, we believe our Bcl-xL protein degrader approach has the potential to demonstrate strong antitumor activity along with low levels of platelet toxicity. We are in the process of selecting and nominating our first Bcl-xL degrader as a candidate for pre-clinical development. The potential candidates exhibit high selectivity for the Bcl-xL target, demonstrating potent cellular and degradation activity, and showing remarkable in vivo efficacy in xenograft mice models.

RESEARCH AND DEVELOPMENT

We have a proven track record of accomplishment in research discovery, global clinical development, and commercialization of novel biopharmaceuticals directed towards cancer. We plan to continue to diversify and expand our product pipeline through both in-house research and development and collaboration with biotechnology and pharmaceutical companies, as well as academic institutions. We have an experienced scientific advisory board, or SAB, chaired by Dr. Shaomeng Wang, our co-founder and non-executive Director. Members of our SAB are physician scientists with expertise in cancer research and drug development. They are not our employees but periodically provide us with assistance and guide our clinical development programs through regularly scheduled SAB meetings.

For the six months ended June 30, 2024 and 2025, our research and development expenses were RMB444.1 million and RMB528.6 million, respectively.

INTELLECTUAL PROPERTY RIGHTS

Intellectual property rights are fundamental to our business. Through our robust research and development, we have strategically developed a global intellectual property portfolio with exclusive rights to issue patents or patent applications worldwide with respect to our products and product candidates. As of June 30, 2025, we cumulatively had 478 issued patents globally, this total includes over 20 new patents issued during the reporting period, while excluding the expiration and abandonment of certain patents unrelated to our core product portfolio. 342 issued patents were issued outside of China as of June 30, 2025.

COMMERCIALIZATION

Ascentage Pharma is executing its dual-engine commercialization strategy.

We achieved robust revenue growth in the first half of 2025, and we are confident of extending the growth in the second half, driven by the expanded coverage of Olverembatinib in the NRDL since the beginning of 2025 and commercial launch of Lisaftoclax in July 2025. As of July 31, 2025, we have a fully operational commercialization team in China consisting of more than 140 staff members and our commercialization effort in China covers over 1,000 hospitals across the country. With Lisaftoclax’s differentiated clinical profile, our established commercial capabilities and market leading pipeline in hematological oncology, we plan to accelerate market penetration for Lisaftoclax, which is the first Bcl-2 inhibitor receiving conditional approval and marketing authorization for the treatment of patients with CLL/SLL in China.

Revenue from sales of Olverembatinib in China was RMB217.4 million for the six months ended June 30, 2025, compared to RMB112.9 million for the six months ended June 30, 2024, which represented an increase of RMB104.5 million, or 93%. The strong revenue growth was primarily driven by the expanded coverage in NRDL, which has begun to cover CML-CP patients who are resistant and/or intolerant to first and second-generation TKIs since the beginning of 2025. Continued acceleration of new patient prescriptions and extension of the duration of treatment will support sustained growth of Olverembatinib in the future.

Our team, together with Innovent Biologics, Inc. (1801.HK), currently cover approximately 867 hospitals and 290 distributors in China. During the six months ended of June 30, 2025, we have entered 782 DTP pharmacies and hospitals, increased approximately 17% at this point compared to June 30, 2024. In particular, the number of hospitals where Olverembatinib is on formulary increased approximately 47% to 295 hospitals as of June 30, 2025 from 201 hospitals as of June 30, 2024. We will continue to collaborate with Innovent to accelerate market penetration, laying a solid foundation for accessibility for newly approved and pipeline products and indications.

Olverembatinib was included in 2025 version of the China Anti-Cancer Association (CACA) guidelines and 2025 version of CSCO guidelines for the treatment of CML and Ph+ ALL. In April 2025, Olverembatinib received an upgraded recommendation in the 2025 version of “CSCO Guidelines for the Diagnosis and Treatment of Leukemias in Children and Adolescent” for children with Ph+ ALL who harbor the T315I BCR-ABL1 kinase domain mutation. Olverembatinib was included as an Emerging Treatment Option in the 2024 NCCN guidelines for the management of CML and included in the updated 2025 European LeukemiaNet Recommendations. Ascentage Pharma is committed to the expansion of commercialization and accessibility of Olverembatinib in the China market and abroad.

Lisaftoclax, our second product, was approved by China NMPA on July 10, 2025. We have commenced commercialization of Lisaftoclax in China with our fully in-house commercialization team. The first prescription in China of Lisaftoclax was issued just 15 days after CDE approval, demonstrating Ascentage Pharma’s speed and efficiency to market. We are committed to accelerating Lisaftoclax’s market entry to obtain a competitive edge and secure market leading advantage for its approved indication.

Lisaftoclax has been recommended in the 2025 CSCO Guidelines for the Diagnosis and Treatment of Lymphoma for the monotherapy of patients with relapsed/refractory CLL/SLL, based on its outstanding clinical data. This marks the first inclusion of Lisaftoclax in the CSCO Guidelines and makes it the only originally developed in China Bcl-2 inhibitor to receive CSCO guidelines recommendation. It represents a landmark step for Ascentage Pharma in advancing this innovative drug to truly benefit patients and a major breakthrough for China drug development innovation in the field of hematological oncology.

CHEMISTRY, MANUFACTURING AND CONTROLS

We have established our own Suzhou facility as our global R&D center and manufacturing facility. The R&D center and the manufacturing center was commissioned into use in the second half of 2021 and the fourth quarter of 2022, respectively.

The Suzhou manufacturing center has more than 200,000 square feet of space, and the manufacturing capacity for both oral solid tablet and capsule formulations is up to 250 million dosage units per year. We also maintain manufacturing capability at the Suzhou center for injectable drug products, including lyophilized formulations. In the fourth quarter of 2022, we obtained a Drug Manufacturing License (Certificate A). In 2024, the Suzhou manufacturing center completed the technical transfer and process validation campaign of Olverembatinib tablets. At the same time, we obtained the updated version of the Drug Manufacturing Licenses (including certificates A, B and C) and passed GMP compliance inspection conducted by Jiangsu Medical Products Administration which allows our facility to manufacture and supply Olverembatinib oral solid tablets for supply for global clinical trials as well as for commercial sales in the China market.

In April 2023, we received a zero-deficiency report from the Good Manufacturing Practices (GMP) compliance audit of Ascentage Pharma’s global manufacturing center by a Qualified Person (QP) of the European Union (EU). We believe this report indicates that our Global Manufacturing Center and quality management system implemented at the site are compliant with the standards of the EU GMP, marking the achievement of a major milestone that will pave the way for our continued global expansion.

In 2023, we completed the technical transfer of the Lisaftoclax tablets, which allows for the in-house production and supply of the drug for our global clinical trials. We completed the drug tablet coating, debossing development, and the GMP production of Olverembatinib tablets, thereby preparing for future applications to the global regulatory authorities including the FDA.

In the first half of 2025, Lisaftoclax pre-approval inspections for both drug substance and drug product were successfully completed through collaboration of Ascentage Pharma and Contract Development and Manufacturing Organizations, or CDMOs, which facilitated Lisaftoclax NDA approval in China.

In addition, we leased a facility with a size of approximately 50,000 square feet for R&D and manufacturing in China Medical City, Taizhou, Jiangsu Province, China, where we produce and supply preclinical test articles and clinical trial materials for some of our drug candidates. We believe that the existing facilities are adequate for our current needs.

BUSINESS DEVELOPMENT

In addition to our strong in-house research and development team, we have established global collaboration and other relationships with leading biotechnology and pharmaceutical companies as well as academic institutions. We will continue to seek partnerships to maximize the value of our pipeline products.

On June 14, 2024, Ascentage Pharma, Ascentage HK, Ascentage GZ, Ascentage SZ and Takeda entered into an Exclusive Option Agreement, pursuant to which we granted Takeda an exclusive option to enter into an exclusive license agreement for Olverembatinib. If exercised, the Option would allow Takeda to license global rights to develop and commercialize Olverembatinib in all territories outside of the PRC, Hong Kong, Macau, Taiwan and Russia. Pursuant to the Exclusive Option Agreement, Ascentage Pharma shall be solely responsible for all clinical development of Olverembatinib before the potential exercise of the Option. The Exclusive Option Agreement calls for Ascentage to receive an option payment of US$100 million related to intellectual property income and option payment under the Exclusive Option Agreement. Additionally, Ascentage Pharma is eligible for an option exercise fee as additional potential milestone payments of up to approximately US$1.2 billion plus a 12%-19% royalty rate based on annual net sales. On July 2, 2024, Ascentage Pharma received the option payment related to intellectual property income and option payment under the Exclusive Option Agreement.

The Exclusive Option Agreement would allow Ascentage Pharma to leverage the global commercial expertise of Takeda with a proven record of accomplishment and global oncology footprint to potentially broaden the impact that Olverembatinib could have on patients worldwide.

Additionally, on June 20, 2024, pursuant to the securities purchase agreement dated June 14, 2024 between us and Takeda, Ascentage Pharma issued and allotted to Takeda 24,307,322 Shares (Takeda Shares) at a price per share equal to HK$24.09850 per Share (equivalent to approximately US$3.08549), and with the aggregate purchase price of US$75 million (equivalent to approximately HK$585.77 million). The Share Purchase Price represents a 25.12% premium to the 20-day average closing price of the Shares prior to the date of the Securities Purchase Agreement (being HK$19.26 per Share). Pursuant to the Securities Purchase Agreement, Takeda agreed to certain lock-up arrangements in connection with the Shares until June 20, 2025. Specifically, under the lock-up arrangement, Takeda agreed that, subject to certain exceptions, for a period of 180 days after January 23, 2025, they will not, sell or otherwise transfer or dispose of any Takeda Shares or any securities convertible into or exchangeable for our ordinary shares.

For further details on the Exclusive Option Agreement, the Securities Purchase Agreement and the transactions contemplated thereunder, please refer to our relevant announcements dated June 14, 2024, June 21, 2024 and July 4, 2024.

FINANCING ACTIVITIES

Completion of the U.S. Initial Public Offering

On January 28, 2025, we completed our U.S. initial public offering in which we offered and sold an aggregate 7,325,000 ADSs at an offer price of US$17.25 per ADS, representing 29,300,000 ordinary shares of the Company for gross proceeds of approximately US$126.4 million (equivalent to approximately HK$983.8 million). On February 13, 2025, in connection with the underwriters’ exercise of their over-allotment option, we issued an additional 935,144 ADSs at an offer price of US$17.25 per ADS, representing 3,740,576 ordinary shares of the Company for gross proceeds of approximately US$16.13 million (equivalent to approximately HK$125.6 million). Each ADS represents 4 ordinary shares. Our ADSs are listed on the Nasdaq Global Market, or the Nasdaq, under the symbol “AAPG.”

Therefore, we issued a total of 8,260,144 ADSs (representing 33,040,576 ordinary shares). After the issuance, the total number of our issued and outstanding ordinary shares increased from 315,226,005 shares to 348,266,581 shares. The aggregate gross proceeds raised under the offering were approximately US$142.5 million (equivalent to approximately HK$1,109.4 million). The net proceeds under the offering were approximately US$132.5 million (equivalent to approximately HK$1,031.8 million) after deduction of the underwriting discounts and commissions of approximately US$10.0 million (equivalent to approximately HK$77.7 million).

For details, please refer to the announcements issued by the Company on December 29, 2024, January 21, 2025, January 24, 2025, February 2, 2025, and February 13, 2025.

The 2025 Placing

On July 25, 2025, we issued and sold 22,000,000 subscription Shares (being the same number as the sale Shares) to the Vendor at HK$68.60 per subscription Share (being the same as the placing price). The net proceeds from the subscription amount were approximately HK$1,492.5 million (approximately US$190.1 million based on an exchange rate of 1 USD to 7.85 HKD).

We expect to use the net proceeds from the 2025 Placing in the following manner: