UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2025

Or.

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-41497

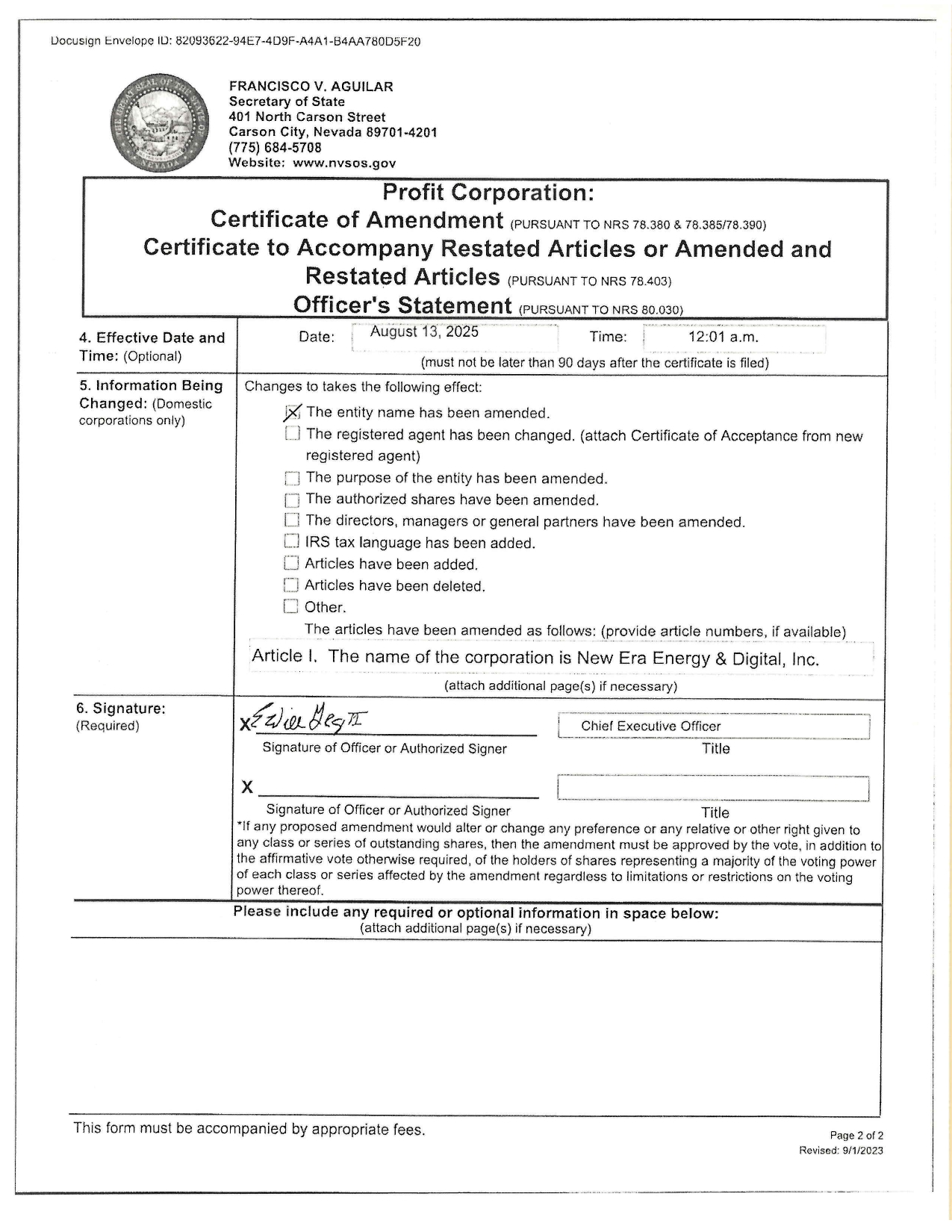

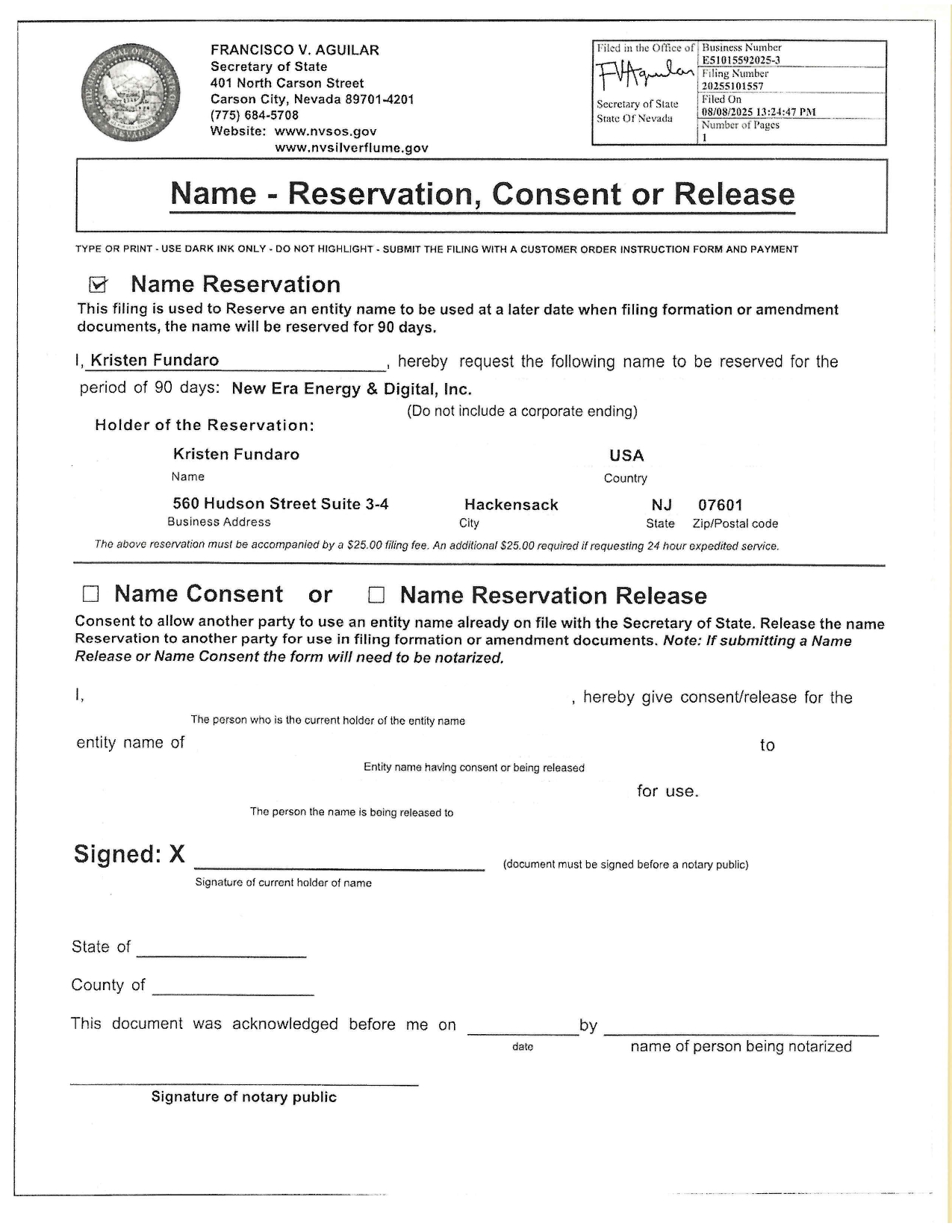

NEW ERA ENERGY & DIGITAL, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 99-3749880 | |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| 4501 Santa Rosa Dr. Midland, TX 79707 |

| (Address of principal executive offices and Zip Code) |

| (432) 695-6997 |

| (Registrant’s telephone number, including area code) |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock | NUAI | The Nasdaq Stock Market LLC | ||

| Warrants | NUAIW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

As of August 11, 2025, the registrant had 26,153,893 shares of common stock issued and 25,979,535 shares of common stock outstanding.

NEW ERA ENERGY & DIGITAL, INC.

INDEX TO FINANCIAL STATEMENTS

NEW ERA ENERGY & DIGITAL, INC.

CONSOLIDATED BALANCE SHEETS

| June 30, 2025 | December 31, 2024 |

|||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 5,199,825 | $ | 1,053,744 | ||||

| Accounts receivable, net | 969,458 | 851,304 | ||||||

| Prepaid expenses and other current assets | 730,086 | 967,176 | ||||||

| Restricted investments | 1,360,117 | 1,333,789 | ||||||

| Total current assets | 8,259,486 | 4,206,013 | ||||||

| Oil and natural gas properties, net (full cost) | 482,909 | 790,093 | ||||||

| Property, plant and equipment, net | 4,598,909 | 3,809,742 | ||||||

| Equity facility derivative asset | 158,255 | 16,999 | ||||||

| Investment in joint venture | 75,000 | |||||||

| Prepaid expenses – non-current | 240,000 | 360,000 | ||||||

| TOTAL ASSETS | $ | 13,814,559 | $ | 9,182,847 | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 942,214 | $ | 1,730,610 | ||||

| Accrued liabilities | 486,590 | 319,327 | ||||||

| Excise taxes payable | 1,351,061 | 1,155,726 | ||||||

| Withholding taxes payable | 770,046 | 594,561 | ||||||

| Share issuance liability | 423,750 | |||||||

| Notes payable – current | 2,304,153 | |||||||

| Convertible note, net of discount | 5,256,904 | 2,233,712 | ||||||

| Embedded derivative liability | 480,490 | |||||||

| Due to related parties | 1,354 | |||||||

| Other current liabilities | 52,557 | 47,577 | ||||||

| Total current liabilities | 11,644,015 | 6,506,617 | ||||||

| Embedded derivative liability | 309,181 | |||||||

| Asset retirement obligation | 2,307,928 | 2,198,064 | ||||||

| Notes payable – noncurrent | 2,217,823 | |||||||

| Total liabilities | 13,951,943 | 11,231,685 | ||||||

| Commitments and Contingencies (Note 15) | ||||||||

| Stockholders’ Deficit | ||||||||

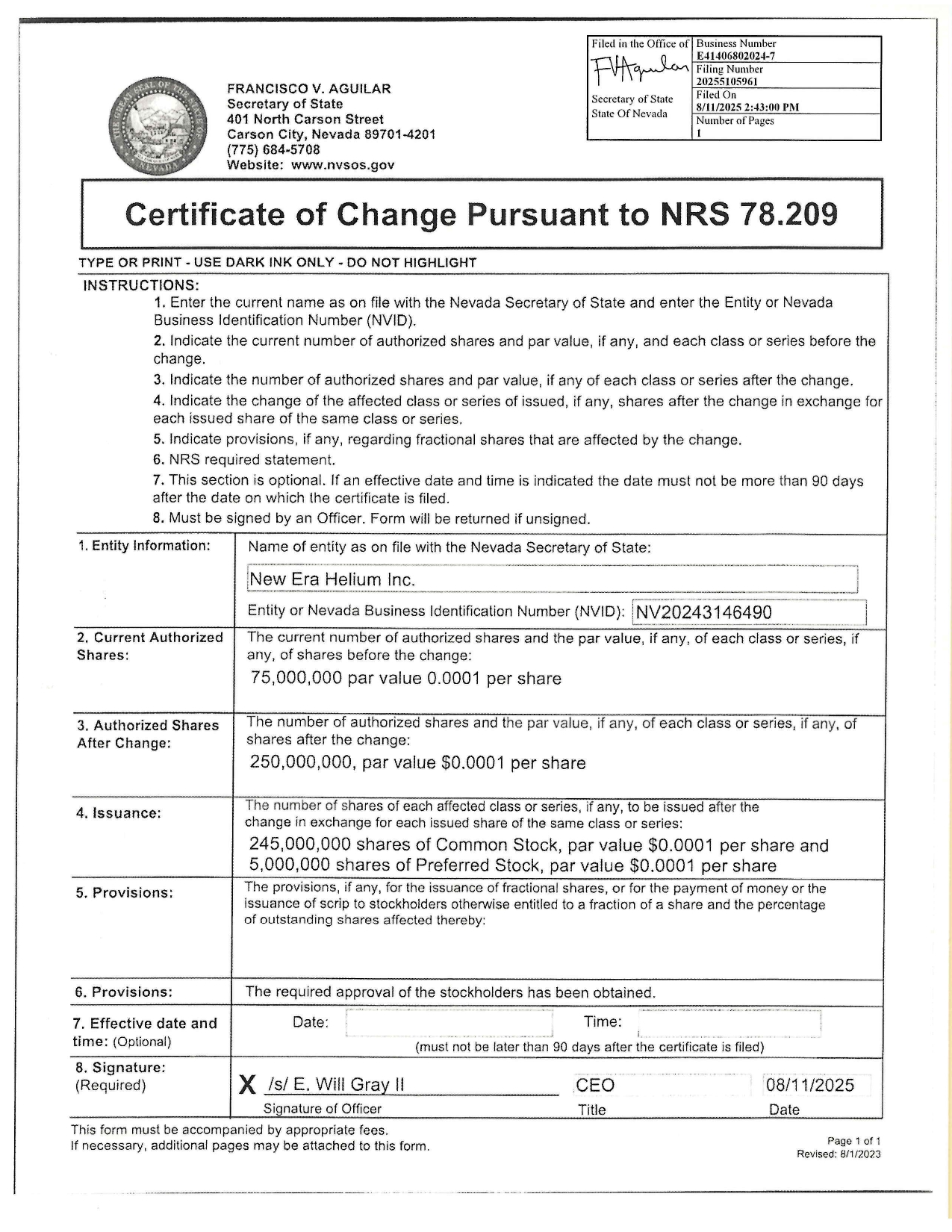

| Preferred stock, $0.0001 par value, 5,000,000 shares authorized; none issued or outstanding as of June 30, 2025, and December 31,2024 | ||||||||

| Common stock, $0.0001 par value, 245,000,000 shares authorized, 25,656,628 issued and 25,482,270 outstanding at June 30, 2025; 70,000,000 shares authorized, 13,165,152 issued and 12,990,794 shares outstanding at December 31, 2024 | 2,567 | 1,318 | ||||||

| Treasury stock, 174,358 shares at June 30, 2025 and December 31, 2024 | (17 | ) | (17 | ) | ||||

| Additional paid-in capital | 20,558,565 | 11,722,100 | ||||||

| Accumulated deficit | (20,698,499 | ) | (13,772,239 | ) | ||||

| Total Stockholders’ Deficit | (137,384 | ) | (2,048,838 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | $ | 13,814,559 | $ | 9,182,847 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

NEW ERA ENERGY & DIGITAL, INC.

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Revenues, net | ||||||||||||||||

| Oil, natural gas, and product sales, net | $ | 209,114 | $ | 20,377 | $ | 535,569 | $ | 349,588 | ||||||||

| Total Revenues, net | 209,114 | 20,377 | 535,569 | 349,588 | ||||||||||||

| Costs and expenses | ||||||||||||||||

| Lease operating expenses | 308,385 | 225,368 | 568,865 | 728,927 | ||||||||||||

| Depletion, depreciation, amortization, and accretion | 232,018 | 255,149 | 430,427 | 499,193 | ||||||||||||

| General and administrative expenses | 1,532,520 | 1,043,122 | 3,469,174 | 1,788,186 | ||||||||||||

| Total Costs and expenses | 2,072,923 | 1,523,639 | 4,468,466 | 3,016,306 | ||||||||||||

| Loss from operations | (1,863,809 | ) | (1,503,262 | ) | (3,932,897 | ) | (2,666,718 | ) | ||||||||

| Other income (expense) | ||||||||||||||||

| Interest income | 10,948 | 8,074 | 26,328 | 24,668 | ||||||||||||

| Interest expense | (1,515,986 | ) | (79,484 | ) | (2,958,108 | ) | (139,822 | ) | ||||||||

| Change in fair value of derivative asset | 156,659 | 141,256 | ||||||||||||||

| Change in fair value of derivative liability | (99,274 | ) | 91,703 | |||||||||||||

| Other, net | (294,542 | ) | 66,799 | (294,542 | ) | 133,597 | ||||||||||

| Total other (expense) income, net | (1,742,195 | ) | (4,611 | ) | (2,993,363 | ) | 18,443 | |||||||||

| Loss before income taxes | (3,606,004 | ) | (1,507,873 | ) | (6,926,260 | ) | (2,648,275 | ) | ||||||||

| Income tax expense | 418,114 | 699,484 | ||||||||||||||

| Net loss | $ | (3,606,004 | ) | $ | (1,089,759 | ) | $ | (6,926,260 | ) | $ | (1,948,791 | ) | ||||

| Net loss per common share, basic and diluted | $ | (0.21 | ) | $ | (0.17 | ) | $ | (0.45 | ) | $ | (0.30 | ) | ||||

| Weighted average number of common shares outstanding, basic and diluted | 16,904,066 | 6,425,375 | 15,390,821 | 6,425,375 | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

NEW ERA ENERGY & DIGITAL, INC.

UNAUDITED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025 AND 2024

| Total | ||||||||||||||||||||||||||||

| Common Stock | Treasury Stock | Paid-in | Accumulated | Stockholders’ | ||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | Deficit | ||||||||||||||||||||||

| Balance, January 1, 2025 | 13,165,152 | $ | 1,318 | (174,358 | ) | $ | (17 | ) | $ | 11,722,100 | $ | (13,772,239 | ) | $ | (2,048,838 | ) | ||||||||||||

| Sale of common stock | 835,000 | 84 | — | 2,198,359 | 2,198,443 | |||||||||||||||||||||||

| Common shares issued for services | 125,000 | 12 | — | 423,738 | 423,750 | |||||||||||||||||||||||

| Net loss | — | — | (3,320,256 | ) | (3,320,256 | ) | ||||||||||||||||||||||

| Balance, March 31, 2025 | 14,125,152 | $ | 1,414 | (174,358 | ) | $ | (17 | ) | $ | 14,344,197 | $ | (17,092,495 | ) | $ | (2,746,901 | ) | ||||||||||||

| Sale of common stock | 11,531,476 | 1,153 | — | 6,214,368 | 6,215,521 | |||||||||||||||||||||||

| Net loss | — | — | (3,606,004 | ) | (3,606,004 | ) | ||||||||||||||||||||||

| Balance, June 30, 2025 | 25,656,628 | $ | 2,567 | (174,358 | ) | $ | (17 | ) | $ | 20,558,565 | $ | (20,698,499 | ) | $ | (137,384 | ) | ||||||||||||

| Retained | Total | |||||||||||||||||||

| Common Stock | Paid-in | Earnings (Accumulated |

Stockholders’ Equity |

|||||||||||||||||

| Shares | Amount | Capital | Deficit) | (Deficit) | ||||||||||||||||

| Balance, January 1, 2024 | 6,421,829 | $ | 643 | $ | 517,843 | $ | 10,145 | $ | 528,631 | |||||||||||

| Sale of common stock | 3,546 | 1 | 11,999 | 12,000 | ||||||||||||||||

| Net loss | — | (859,032 | ) | (859,032 | ) | |||||||||||||||

| Balance, March 31, 2024 | 6,425,375 | $ | 644 | $ | 529,842 | $ | (848,887 | ) | $ | (318,401 | ) | |||||||||

| Net loss | — | (1,089,759 | ) | (1,089,759 | ) | |||||||||||||||

| Balance, June 30, 2024 | 6,425,375 | $ | 644 | $ | 529,842 | (1,938,646 | ) | (1,408,160 | ) | |||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

NEW ERA ENERGY & DIGITAL, INC.

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

| For the Six Months Ended June 30, |

||||||||

| 2025 | 2024 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net loss | $ | (6,926,260 | ) | $ | (1,948,791) | |||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depletion, depreciation, amortization, and accretion | 430,427 | 499,194 | ||||||

| Change in fair value of derivative asset | (141,256 | ) | — | |||||

| Change in fair value of derivative liability | (91,703 | ) | — | |||||

| Deferred income tax benefit | (699,484) | |||||||

| Amortization of debt discount and debt issuance costs | 2,344,697 | |||||||

| Accrued interest expense on note payable and other current liabilities | 86,330 | 101,953 | ||||||

| Interest income on restricted investments and notes receivable | (26,328 | ) | (24,669) | |||||

| Compensation – assignment of property | 166,449 | |||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivables | (118,154 | ) | (34,603) | |||||

| Prepaid expenses and other assets | 357,090 | 23,315 | ||||||

| Accounts payable | (788,397 | ) | 543,963 | |||||

| Accrued liabilities | (180,379 | ) | 176,777 | |||||

| Excise tax payable | 195,335 | |||||||

| Withholding tax payable | 175,485 | |||||||

| Due to related parties | (1,354 | ) | 170,603 | |||||

| Other liabilities – current | 4,980 | (44,890) | ||||||

| Net cash used in operating activities | (4,679,487 | ) | (1,070,183) | |||||

| Cash Flows from Investing Activities: | ||||||||

| Investment in property, plant and equipment, net | (802,546 | ) | (200,000) | |||||

| Investment in joint venture | (75,000 | ) | — | |||||

| Net cash used in investing activities | (877,546 | ) | (200,000) | |||||

| Cash Flows from Financing Activities: | ||||||||

| Issuance of common stock | 8,413,964 | 12,000 | ||||||

| Proceeds from note payable | 1,089,528 | |||||||

| Proceeds from convertible note, net of transaction costs | 2,790,000 | — | ||||||

| Repayment on convertible notes | (1,416,667 | ) | — | |||||

| Debt issuance costs | (84,183 | ) | — | |||||

| Proceeds from related party | 77,500 | |||||||

| Net cash provided by financing activities | 9,703,114 | 1,179,028 | ||||||

| Net Change in Cash and cash equivalents | 4,146,081 | (91,155) | ||||||

| Cash and cash equivalents – Beginning of period | 1,053,744 | 120,010 | ||||||

| Cash and cash equivalents – End of period | $ | 5,199,825 | $ 28,855 | |||||

| Supplemental cash flow information: | ||||||||

| Cash interest payments | $ | 462,331 | $ 34,264 | |||||

| Supplemental non-cash investing and financing activities: | ||||||||

| Capital expenditures accrued in accounts payable and accrued liabilities | $ | $ | (152,894 | ) | ||||

The accompanying notes are an integral part of these consolidated financial statements.

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

NOTE 1. ORGANIZATION AND BASIS OF PRESENTATION

Organization and Nature of Operations

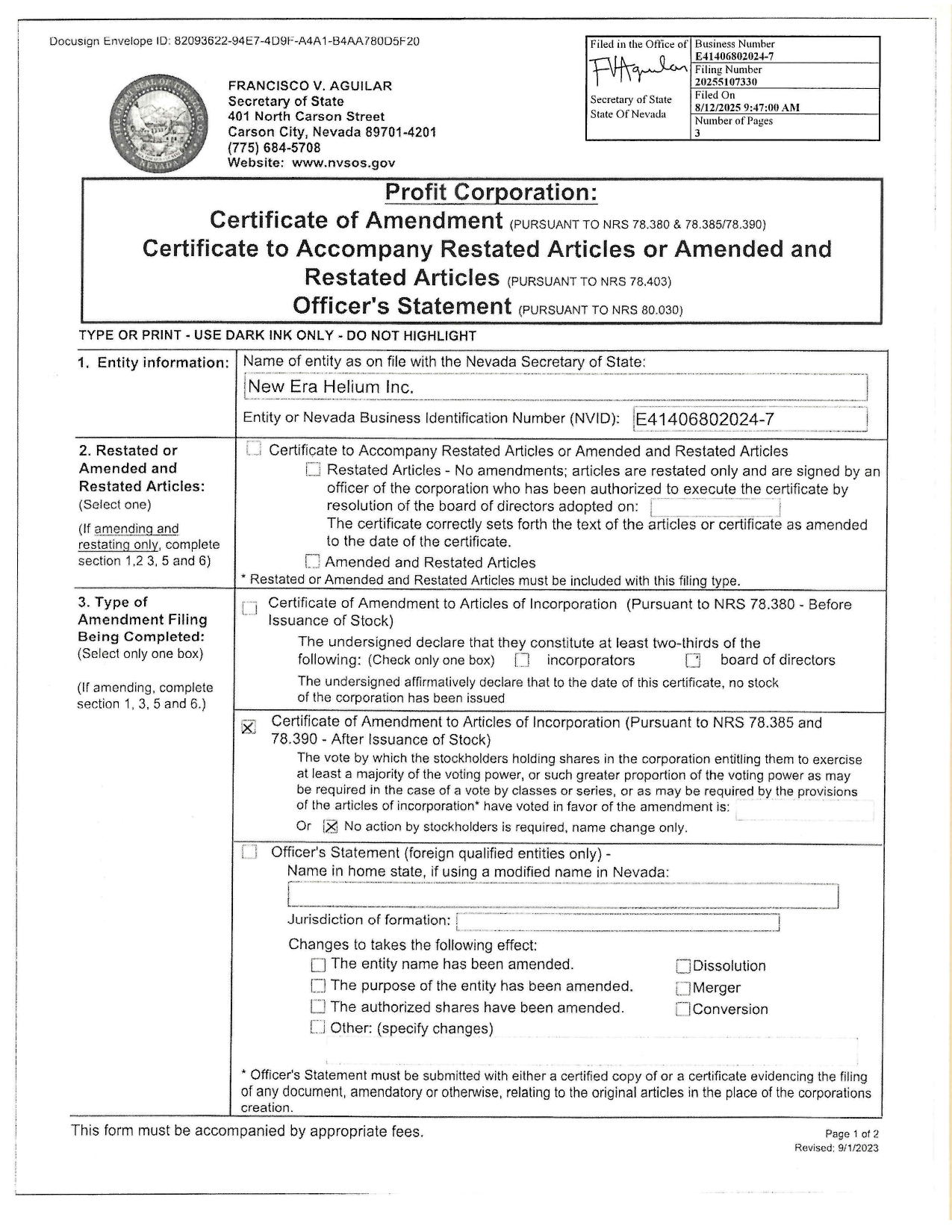

New Era Helium, Inc.(the “Company”, “NEW ERA”, “we,”, “us,” or “our”), formerly known as Roth CH Holdings, Inc. (“Roth V”), is a Nevada corporation. On August 13, 2025, the Company changed its name from New Era Helium, Inc. to New Era Energy & Digital, Inc. The Company was formed on February 6, 2023, through a Reorganization Agreement and Plan Share Exchange (the “Agreement”) with Solis Partners, LLC (“Solis Partners”) as described further in the paragraph below. The Company’s primary operations include the exploration, development, and production of helium, natural gas, oil, and natural gas liquids (“NGLs”). The Company’s producing oil and gas assets and non-producing acreage are primarily located in Chaves County, New Mexico. The Company also owns overriding royalty interests located in Howard County, Texas.

On February 6, 2023, the Company entered into the Agreement with Solis Partners. Immediately prior to February 6, 2023, the Company was authorized to issue 190 million shares of common stock with a par value of $0.001 per share and 10 million shares of preferred stock with a par value of $0.001 per share. Subject to the terms of the Agreement, all issued and outstanding member interests in Solis Partners was automatically converted and exchanged for 5 million shares of the Company’s common stock.

The Company’s wholly owned subsidiary Solis Partners is a Texas limited liability company. Solis Partners owns and operates the Company’s producing oil and gas assets and non-producing acreage. The Company’s wholly owned subsidiary NEH Midstream LLC (“NEH Midstream”) is a Texas limited liability company, formed August 4, 2023. NEH Midstream is the owner of the helium offtake and tolling agreements. NEH Midstream is in the process of constructing a natural gas processing facility in which NEH Midstream will be the owner and operator.

On December 6, 2024, the Company completed the business combination (the “Business Combination) contemplated by the Business Combination and Plan of Organization dated January 3, 2024 (the “Business Combination Agreement”) (as amended on June 5, 2024, August 8, 2024, September 11, 2024 and September 30, 2024, the “BCA”), by and among Roth CH Acquisition V Co. (“ROCL”), Roth CH V Merger Sub Corp., a Delaware corporation and a wholly-owned subsidiary of ROCL (“Merger Sub”), and NEW ERA.

The Business Combination was accounted for as a reverse recapitalization in accordance with Generally Accepted Accounting Principles in the United States of America (“GAAP”). Under this method of accounting, although ROCL acquired the outstanding equity in NEW ERA in the Business Combination, ROCL is treated as the “acquired company” and NEW ERA was treated as the accounting acquirer for financial statement purposes. Accordingly, the Business Combination was treated as the equivalent of NEW ERA issuing stock for the net assets of ROCL, accompanied by a recapitalization. The net assets of ROCL are stated at historical cost, with no goodwill or other intangible assets recorded.

Furthermore, the historical financial statements of NEW ERA became the historical financial statements of the Company upon the consummation of the merger. As a result, the financial statements included in this Quarterly Report reflect (i) the historical operating results of NEW ERA prior to the merger; (ii) the combined results of ROCL and NEW ERA following the close of the merger; (iii) the assets and liabilities of NEW ERA at their historical cost and (iv) NEW ERA’s equity structure for all periods presented, as affected by the recapitalization presentation after completion of the merger. See Note 3 - Reverse Capitalization for further details of the merger.

Basis of Presentation

The accompanying consolidated financial statements of the Company as of June 30, 2025 and December 31, 2024, have been prepared in accordance with GAAP issued by the Financial Accounting Standards Board (“FASB”). The accompanying consolidated financial statements reflect all adjustments including normal recurring adjustments, which, in the opinion of management, are necessary to present fairly the financial position, results of operations, and cash flows for the years presented. References to GAAP issued by the FASB in these accompanying notes to the consolidated financial statements are to the FASB Accounting Standards Codification (“ASC”).

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

Emerging Growth Company Status

The Company is an emerging growth company, as defined in the JOBS Act. Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards issued subsequent to the enactment of the JOBS Act, until such time as those standards apply to private companies. The Company has elected to use this extended transition period for complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier of the date that it (i) is no longer an emerging growth company or (ii) affirmatively and irrevocably opts out of the extended transition period provided in the JOBS Act. As a result, these financial statements may not be comparable to companies that comply with the new or revised accounting pronouncements as of public company effective dates.

Risks and Uncertainties

As a producer of natural gas, NGLs and oil, and an anticipated future producer of helium, the Company’s revenue, profitability, and future growth are substantially dependent upon the prevailing and future prices for helium, natural gas, NGLs and oil, which are dependent upon numerous factors beyond its control such as economic, political, and regulatory developments and competition from other energy sources. The energy markets have historically been very volatile, and there can be no assurance that the prices for helium, natural gas, NGLs or oil will not be subject to wide fluctuations in the future. A substantial or extended decline in prices for helium, natural gas, NGLs and oil could have a material adverse effect on the Company’s financial position, results of operations, cash flows, the quantities of natural gas, helium, NGL and oil reserves that may be economically produced and the Company’s access to capital.

Inflation Reduction Act of 2022

On August 16, 2022, the Inflation Reduction Act of 2022 (the “IR Act”) was signed into federal law. The IR Act provides for, among other things, a new U.S. federal 1% excise tax on certain repurchases of stock by publicly traded U.S. domestic corporations and certain U.S. domestic subsidiaries of publicly traded foreign corporations occurring on or after January 1, 2023. The excise tax is imposed on the repurchasing corporation itself, not its shareholders from which shares are repurchased. The amount of the excise tax is generally 1% of the fair market value of the shares repurchased at the time of the repurchase. However, for purposes of calculating the excise tax, repurchasing corporations are permitted to net the fair market value of certain new stock issuances against the fair market value of stock repurchases during the same taxable year. In addition, certain exceptions apply to the excise tax. The U.S. Department of the Treasury (the “Treasury”) has been given authority to provide regulations and other guidance to carry out and prevent the abuse or avoidance of the excise tax.

Any redemption or other repurchase that occurs after December 31, 2022, in connection with a Business Combination, extension vote or otherwise, may be subject to the excise tax. Whether and to what extent the Company would be subject to the excise tax in connection with a Business Combination, extension vote or otherwise would depend on a number of factors, including (i) the fair market value of the redemptions and repurchases in connection with the Business Combination, extension or otherwise, (ii) the structure of a Business Combination, (iii) the nature and amount of any “PIPE” or other equity issuances in connection with a Business Combination (or otherwise issued not in connection with a Business Combination but issued within the same taxable year of a Business Combination) and (iv) the content of regulations and other guidance from the Treasury. In addition, because the excise tax would be payable by the Company and not by the redeeming holder, the mechanics of any required payment of the excise tax have not been determined. The foregoing could cause a reduction in the cash available on hand to complete a Business Combination and in the Company’s ability to complete a Business Combination.

In connection with the ROCL stockholders’ vote at the May 2023 Special Meeting, ROCL public stockholders exercised their right to redeem 8,989,488 shares of ROCL common stock for a total of $93,010,772 as of May 31, 2023. In connection with the ROCL stockholders’ vote at the December 2023 Special Meeting, 927,715 shares of ROCL common stock were tendered for redemption as of December 1, 2023. Excise tax should be recognized in the period incurred, that is when the repurchase occurs. Any reduction in the tax liability due to a subsequent stock issuance, or an event giving rise to an exception, which occurs within a tax year, should be recorded in the period of such stock issuance or event giving rise to an exception. As of June 30, 2025 and December 31, 2024, the Company recorded $1,029,003 of excise tax liability calculated as 1% of the value of shares redeemed on May 31, 2023 and December 1, 2023.

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

During the second quarter of 2023, the IRS issued final regulations with respect to the timing and payment of the excise tax. Pursuant to those regulations, the Company would need to file a return and remit payment for any liability incurred during the period from January 1, 2023 to December 31, 2023 on or before October 31, 2024.

The Company is currently evaluating its options with respect to payment of this obligation. If the Company is unable to pay its obligation in full, it will be subject to additional interest and penalties which are currently estimated at 10% interest per annum and a 5% underpayment penalty per month or portion of a month up to 25% of the total liability for any amount that is unpaid from November 1, 2024, until paid in full. The Company has $322,058 and $126,722 of accrued interest and penalty in the consolidated balance sheet at June 30, 2025 and December 31, 2024, respectively.

Notice of Delisting

On March 4, 2025, the Company received a letter from Nasdaq (the “Notice”) which notified the Company that, for 30 consecutive business days, the Company’s market value of listed securities (“MVLS”) closed below the $50,000,000 MVLS threshold required for continued listing on the Nasdaq Global Market under Nasdaq Listing Rule 5450(b)(2)(A) (the “MVLS Rule”).

In accordance with Nasdaq Listing Rule 5810(c)(3)(C), the Company has 180 calendar days, or until September 2, 2025 (the “MVLS Compliance Period”), to regain compliance with the MVLS Rule. The Notice notes that, to regain compliance, the Company’s MVLS must close at or above $50,000,000 for a minimum of ten consecutive business days during the MVLS Compliance Period. The Notice further notes that if the Company is unable to satisfy the MVLS requirement prior to such date, the Company may be eligible to transfer the listing of its securities to The Nasdaq Capital Market (provided that the Company then satisfies the requirements for continued listing on that market). If the Company does not regain compliance by the end of the MVLS Compliance Period, Nasdaq staff will provide written notice to the Company that its securities are subject to delisting. At that time, the Company may appeal any such delisting determination to a hearings panel. The Notice has no immediate effect on the listing or trading of the Company’s common stock on the Nasdaq Global Market.

The Company is actively monitoring the Company’s MVLS between now and September 2, 2025, and may, if appropriate, evaluate available options to resolve the deficiencies and regain compliance with the MVLS Rule. While the Company is exercising diligent efforts to maintain the listing of its securities on Nasdaq, there can be no assurance that the Company will be able to regain or maintain compliance with Nasdaq listing standards.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries after elimination of all significant intercompany transactions and balances.

Segments

ASC Topic 280, “Segment Reporting,” establishes standards for companies to report in their financial statement information about operating segments, products, services, geographic areas, and major customers. Operating segments are defined as components of an enterprise that engage in business activities from which it may recognize revenues and incur expenses, and for which separate financial information is available that is regularly evaluated by the Company’s chief operating decision maker, or group, in deciding how to allocate resources and assess performance.

The Company’s chief operating decision maker (“CODM”) has been identified as the Chief Executive Officer, who reviews total assets and income (loss) from operation of the single reportable segment of the Company as a whole to make decisions about allocating resources and assessing financial performance. Accordingly, management has determined that there is only one reportable segment which is the development, exploration and production of natural gas, helium, NGLs and oil. In addition, the Company has a single company-wide management team that allocates capital resources to maximize profitability and measures financial performance as a single enterprise.

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

Functional and reporting currency

The functional and reporting currency of the Company is the United States dollar.

Liquidity and Going Concern

The Company recorded a net loss of $6,926,260 for the six months ended June 30, 2025, and net loss of $1,948,791 for the six months ended June 30, 2024. As of June 30, 2025, the Company had a working capital deficit of $3,384,529 and a cash balance of $5,199,825.

Historically, the Company’s primary sources of liquidity have been cash received from oil, natural gas, and product sales, contributions from members, and borrowings.

Management’s assessment of the entity’s ability to continue as a going concern involves making a judgement, at a particular point in time, about inherently uncertain future outcomes of events or conditions.

Any judgment about the future is based on information available at the time at which the judgment is made. Subsequent events may result in outcomes that are inconsistent with judgments that were reasonable at the time they were made. Management has taken into account the following:

| a. | The Company’s financial position; and |

| b. | The risks facing the Company that could impact liquidity and capital adequacy. |

The Company’s future capital requirements will depend on many factors, including the Company’s revenue growth rate, and the timing and extent of spending to support further sales and marketing efforts. In connection with the closing of the Business Combination on December 6, 2024, the Company and an institutional investor (the EPFA Investor”) entered into an Equity Purchase Agreement, as further amended as of February 21, 2025, May 5, 2025, and July 10, 2025 (the “EPFA”). Pursuant to the EPFA, the Company has the right to issue and sell to the EPFA Investor, and the EPFA Investor must purchase from the Company, up to an aggregate of $75 million (the “Commitment Amount”) in newly issued shares (the “Advance Shares”) of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), subject to the satisfaction or waiver of certain conditions. The EFPA also provides for the issuance of two pre-paid advances in the aggregate amount of $10 million, the first pre-paid advance in the amount of $7 million, which was drawn by the Company on December 6, 2024, and the second pre-paid advance in the amount of $3 million, which was drawn by the Company on January 16, 2025, each of which is evidenced by a senior secured convertible promissory note (each, a “Convertible Note”), which is convertible into shares of common stock.

The Company is making payments of principal and interest on the Convertible Notes and the Company’s general and administrative expenses through funds received from shares sold under the EFPA. The Company’s share price has significantly declined and as a result, management has concern about the Company’s ability to sell sufficient shares under the EFPA at high enough prices to produce cash flow to meet its obligations within the assessment period as necessary. The Company may need to raise additional financing through loans. The Company cannot provide any assurance that the new financing will be available to it on commercially acceptable terms, if at all. If the Company is unable to raise additional capital, The Company’s business, results of operations and financial condition would be materially and adversely affected. As a result, in connection with the Company’s assessment of going concern considerations in accordance with FASB Accounting Standards Update (“ASU”) 2014-15, “Disclosures of Uncertainties about an Entity’s Ability to Continue as a Going Concern”, Management has determined that the Company’s liquidity condition raises substantial doubt about the Company’s ability to continue as a going concern through the twelve months following the issuance date of the June 30, 2025, consolidated financial statements. These consolidated financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates, judgements and assumptions that affect the reported amounts of assets and liabilities, certain disclosures at the date of the consolidated financial statements, as well as the reported amounts of expenses during the reporting period. Significant estimates affecting the consolidated financial statements have been prepared on the basis of the most current and best available information. The estimates and assumptions include but are not limited to inputs used to calculate asset retirement obligations (“AROs”) (Note 11), the estimate of proved natural gas, oil, and natural gas liquids reserves and related present value estimates of future net cash flows therefrom (Note 6) and inputs used to calculate the value of the derivative asset and derivative liabilities (Note 16). These estimates and assumptions are based on management’s best estimates and judgements. However, actual results from the resolution of such estimates and assumptions may vary from those used in the preparation of the financial statements.

Cash and Cash Equivalents

The Company considers all highly liquid instruments purchased with an original maturity date of six months or less to be cash equivalents. As of June 30, 2025 and December 31, 2024, the Company did not hold any cash equivalents other than cash on deposit.

Restricted Investments

Restricted investments relates to Certificates of Deposit (“CDs”) held at West Texas National Bank. These CDs are used as collateral for operating and plugging bonds for the New Mexico Oil Conservation Division, New Mexico State Land Office, and the Bureau of Land Management.

Receivables and Allowance for Expected Losses

The Company’s receivables result primarily from the sale of oil, natural gas and NGLs as well as billings to joint interest owners for properties in which the Company serves as the operator. Receivables from product sales are generally due within 30 to 60 days after the last day of each production month and do not bear any interest. Receivables associated with joint interest billings are regularly reviewed by Management for collectability, and they establish or adjust an allowance for expected losses as necessary. The Company determines its allowance for each type of receivable by considering a number of factors, including the length of time accounts receivable are past due, the Company’s previous loss history, the debtor’s current ability to pay its obligation to the Company, the condition of the general economy and the industry as a whole. Management has determined that an allowance for expected losses was not required for the six months ended June 30, 2025, and the year ended December 31, 2024.

| June 30, | December 31, | |||||||

| 2025 | 2024 | |||||||

| Oil, natural gas and NGL sales | $ | 97,860 | $ | 108,091 | ||||

| Joint interest accounts receivable | 749,287 | 624,577 | ||||||

| Other accounts receivable | 122,311 | 118,636 | ||||||

| Total Accounts receivable, net | $ | 969,458 | $ | 851,304 | ||||

The beginning accounts receivable balance at January 1, 2024 was $692,351.

The Company did not write off any accounts receivable during the six months ended June 30, 2025 and the year ended December 31, 2024.

Prepaid Expenses

The Company includes in prepaid expenses payments made in advance for goods or services for which the Company will receive a future benefit. Prepaid expenses are recorded at cost and are expensed over the period in which the benefit is realized.

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

Property, Plant and Equipment

Property, plant and equipment is stated at cost, less accumulated depreciation. Betterments, renewals, and extraordinary repairs that materially extend the useful life of the asset are capitalized; other repairs and maintenance charges are expensed as incurred. The Company includes in property, plant and equipment the processing plant under construction, computer equipment, furniture and fixtures, and leasehold improvements.

Depreciation and amortization expense is calculated using the straight-line method over the estimated useful lives of the related assets, which results in depreciation and amortization being incurred evenly over the life of an asset. Fully depreciated assets are retained in property and accumulated depreciation accounts until they are removed from service.

Management performs ongoing evaluations of the estimated useful lives of the property and equipment for depreciation purposes. Management periodically reviews long-lived assets, other than oil and gas property, for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable.

The Company recognizes an impairment loss when the sum of expected undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured as the difference between the asset’s estimated fair value and its carrying amount. The Company recorded no impairment charges during the six months ended June 30, 2025 and 2024.

Oil and Gas Properties

The Company follows the full cost accounting method to account for oil and natural gas properties, whereby costs incurred in the acquisition, exploration and development of oil and gas reserves are capitalized. Such costs include lease acquisition, geological and geophysical activities, rentals on nonproducing leases, drilling, completing and equipping of oil and gas wells, administrative costs directly attributable to those activities and asset retirement costs. Disposition of oil and gas properties are accounted for as a reduction of capitalized costs, with no gain or loss recognized unless such adjustment would significantly alter the relationship between capital costs and proved reserves of oil and gas, in which case the gain or loss is recognized to operations.

The capitalized costs of oil and gas properties, plus estimated future development costs relating to proved reserves and excluding unevaluated and unproved properties, are amortized as depletion expense using the units-of-production method based on estimated proved recoverable oil and gas reserves.

The costs associated with unevaluated and unproved properties, initially excluded from the amortization base, relate to unproved leasehold acreage, wells and production facilities in progress and wells pending determination of the existence of proved reserves, together with capitalized interest costs for these projects. Unproved leasehold costs are transferred to the amortization base with the costs of drilling the related well once a determination of the existence of proved reserves has been made or upon impairment of a lease. Costs associated with wells in progress and completed wells that have yet to be evaluated are transferred to the amortization base once a determination is made whether or not proved reserves can be assigned to the property. Costs of dry wells are transferred to the amortization base immediately upon determination that the well is unsuccessful.

Under full cost accounting rules for each cost center, capitalized costs of evaluated oil and gas properties, including asset retirement costs, less accumulated amortization and related deferred income taxes, may not exceed an amount (the “cost ceiling”) equal to the sum of (a) the present value of future net cash flows from estimated production of proved oil and gas reserves, based on current prices and operating conditions, discounted at ten percent (10%), plus (b) the cost of properties not being amortized, plus (c) the lower of cost or estimated fair value of any unproved properties included in the costs being amortized, less (d) any income tax effects related to differences between the book and tax basis of the properties involved. If capitalized costs exceed this limit, the excess is charged to operations. For purposes of the ceiling test calculation, current prices are defined as the un-weighted arithmetic average of the first day of the month price for each month within the 12-month period prior to the end of the reporting period. Prices are adjusted for basis or location differentials. Unless sales contracts specify otherwise, prices are held constant for the productive life of each well. Similarly, current costs are assumed to remain constant over the entire calculation period.

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

Given the volatility of oil and gas prices, it is reasonably possible that the estimate of discounted future net cash flows from proved oil and gas reserves could change in the near term. If oil and gas prices decline in the future, even if only for a short period of time, it is possible that impairments of oil and gas properties could occur. In addition, it is reasonably possible that impairments could occur if costs are incurred in excess of any increases in the present value of future net cash flows from proved oil and gas reserves, or if properties are sold for proceeds less than the discounted present value of the related proved oil and gas reserves. The Company recorded no ceiling test impairment charges for the six months ended June 30, 2025 and June 30, 2024.

Accounts Payable and Accrued Liabilities

The Company’s payables and accrued liabilities result primarily from the operation of its oil and natural gas properties as well as the administration of the Company. For properties in which the Company is operator, the Company pays 100% of most operating costs, then bills the non-operating partners for their share of the costs. The Company records the Company’s share of these costs in its consolidated statements of operations. Accounts payable are generally due within 30 days of receipt of the invoices by the Company and do not bear any interest. The table below represents the accounts payable and accrued liabilities recorded in the Company’s consolidated balance sheets.

| June 30, 2025 |

December 31, 2024 |

|||||||

| Trade payable | $ | 216,487 | $ | 1,003,380 | ||||

| Suspense payable | 725,727 | 727,230 | ||||||

| Total accounts payable | $ | 942,214 | $ | 1,730,610 | ||||

| Total accrued liabilities | $ | 486,590 | $ | 319,327 | ||||

Leases

The Company determines if an arrangement is a lease at inception. Operating leases are recorded in operating lease right-of-use asset, operating lease liability, current, and operating lease liability, long-term on the consolidated balance sheets.

Operating lease right-of-use assets represent the Company’s right to use an underlying asset for the lease term and lease liabilities represent its obligation to make lease payments arising from the lease. Operating lease assets and liabilities are recognized at the commencement date based on the present value of lease payments over the lease term. As the Company’s lease does not provide an implicit rate, the Company uses the incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. The incremental borrowing rate used at adoption was 2.37%. Significant judgement is required when determining the incremental borrowing rate. Rent expense for lease payments is recognized on a straight-line basis over the lease term.

Asset retirement obligations

The Company records a liability for asset retirement obligations (“ARO”) associated with its oil and gas wells when the well has been completed. The ARO is recorded at its estimated fair value, measured by the expected future cash outflows required to satisfy the abandonment and restoration discounted at our credit-adjusted risk-free interest rate. The corresponding cost is capitalized as an asset and included in the carrying amount of oil and gas properties and is depleted over the useful life of the properties. Subsequently, the ARO liability is accreted to its then-present value.

Inherent in the fair value calculation of an ARO are numerous assumptions and judgments including the ultimate settlement amounts, inflation factors, credit adjusted discount rates, timing of settlement, and changes in the legal, regulatory, environmental, and political environments. To the extent future revisions to these assumptions impact the fair value of the existing ARO liability, a corresponding adjustment is made to the oil and gas property balance. Settlements greater than or less than amounts accrued as ARO are recorded as a gain or loss upon settlement. This gain or loss is recorded to the oil and gas property balance.

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

Financial Instruments and Concentrations of Risk

Financial instruments that potentially subject the Company to a concentration of credit risk consist of cash and cash equivalents and accounts receivable. The Company maintains its cash in accounts with major financial institutions within the United States. The Company’s cash balances can, at times, exceed amounts insured by the Federal Deposit Insurance Corporation. The Company places its cash with high credit quality financial institutions. The Company has not experienced any losses in these accounts and believes it is not exposed to any significant credit risk.

The Company is subject to credit risk resulting from the concentration of its oil, natural gas and NGL receivables with significant purchasers. For the six months ending June 30, 2025, the Company had no oil sales. A separate purchaser accounted for all of the Company’s natural gas and NGL revenues for the six months ending June 30, 2025, and 2024. For the six months ending June 30, 2024, one purchaser accounted for all of the Company’s oil sales revenues. The Company does not require collateral. While the Company believes its recorded receivables will be collected, in the event of default the Company will follow normal collection procedures. The Company does not believe the loss of either purchaser would materially impact its operating results as oil, natural gas and NGLs are fungible products with a well-established market and numerous purchasers.

Revenue recognition

The Company records revenue in accordance with FASB ASC 606, Revenue from Contracts with Customers (“ASC 606”) which uses a five-step model that requires entities to exercise judgment when considering the terms of the contract(s) which includes (i) identifying the contract(s) with the customer, (ii) identifying the separate performance obligations in the contract, (iii) determining the transaction price, (iv) allocating the transaction price to the separate performance obligations, and (v) recognizing revenue as each performance obligation is satisfied.

Revenue from contracts with customers

The Company recognizes revenue when it satisfies a performance obligation by transferring control over a product to a customer or the processor of the product. Revenue is measured based on the consideration the Company expects to receive in exchange for those products.

Performance obligations and significant judgments

The Company sells oil and natural gas products in the United States through a single reportable segment. The Company enters into contracts that generally include oil, natural gas, helium, and associated liquids in variable quantities and priced based on a specific index related to the type of product.

The oil and natural gas are typically sold in an unprocessed state to processors and other third parties for processing and sale to customers. The Company recognizes revenue at a point in time when control of the oil or natural gas passes to the customer or processor, as applicable, discussed below.

The Company sells its oil to a single purchaser under a month-to-month purchase agreement at a price based on an index price from the purchaser. This agreement will continue on a month-to-month basis thereafter unless and until terminated by the Company or the purchaser with a 30-day advance notice. Oil that is produced from the Company’s wells is stored in tank batteries located on the Company’s lease. When the purchaser’s truck connects to the storage tank and oil enters the truck, control of the oil is transferred to the purchaser, the Company’s obligations are satisfied, and revenue is recognized.

The Company sells its natural gas and NGLs to a single purchaser, who is also the processor, under a purchase agreement at a price based on an index price from the purchaser which expired on May 31, 2024. This agreement currently continues on a month-to-month basis unless and until terminated by the Company or the purchaser with a 30-day advance notice. Under our natural gas and NGL contracts with processors, when the unprocessed natural gas is delivered at the sales meter, control of the gas is transferred to the purchaser, the Company’s obligations are satisfied, and revenue is recognized. In the cases where the Company sells to a processor, management has determined that the processors are customers. The Company recognizes the revenue in these contracts based on the net proceeds received from the processor.

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

The Company will sell its helium to two purchasers, each purchasing 50% of the helium production under 10-year contracts. One of the contracts will commence upon delivery of gaseous helium production at the tailgate of the processing plant. The other contract will commence upon delivery of liquid helium from the Keyes Helium Company (“Keyes Helium”) liquefaction plant located in Keyes, Oklahoma. When the gaseous helium is loaded into the gaseous helium trailer, control of the helium is transferred to the purchaser, the Company’s obligations will be satisfied, and revenue will be recognized. With regards to liquid helium, the Company will transport the gaseous helium to the Keyes Helium liquefaction plant. Once the helium has been liquified and loaded into the liquid helium trailer, control of the helium is transferred to the purchaser, the Company’s obligations are satisfied, and revenue is recognized.

The Company has no unsatisfied performance obligations at the end of each reporting period.

Management does not believe that significant judgments are required with respect to the determination of the transaction price, including any variable consideration identified. There is a low level of uncertainty due to the precision of measurement and use of index-based pricing adjusted for transportation and other related deductions, which are based on contractual or historical data. Additionally, any variable consideration identified is not constrained.

Fair Value of Financial Instruments

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants at the measurement date. The hierarchy is broken down into three levels based on the observability of inputs as follows:

| ● | Level 1 — Valuations based on quoted prices in active markets for identical assets or liabilities that the Company has the ability to access. Valuation adjustments and block discounts are not applied to Level 1 instruments. Since valuations are based on quoted prices that are readily and regularly available in an active market, valuation of these products does not entail a significant degree of judgment; | |

| ● | Level 2 — Valuations based on one or more quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly; and | |

| ● | Level 3 — Valuations based on inputs that are unobservable and significant to the overall fair value measurement. |

Convertible Note Payable

When the Company issues convertible debt, it first evaluates the balance sheet classification of the convertible instrument in its entirety to determine (1) whether the instrument should be classified as a liability under ASC 480, Distinguishing Liabilities from Equity, and (2) whether the conversion feature should be accounted for separately from the host instrument. A conversion feature of a convertible debt instrument would be separated from the convertible instrument and classified as a derivative liability if the conversion feature, were it a standalone instrument, meets the definition of a “derivative” in ASC 815, Derivatives and Hedging. When a conversion feature meets the definition of an embedded derivative, it would be separated from the host instrument and classified as a derivative liability carried on the consolidated balance sheet at fair value, with any changes in its fair value recognized currently in the consolidated statements of operations. See Note 7 “Notes Payable” for further information.

Warrants

The Company determines the accounting classification of warrants it issues as either liability or equity classified by first assessing whether the warrants meet liability classification in accordance with ASC 480-10, Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity (“ASC 480”), then in accordance with ASC 815-40 (“ASC 815”), Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company’s Own Stock. Under ASC 480, warrants are considered liability classified if the warrants are mandatorily redeemable, obligate the Company to settle the warrants or the underlying shares by paying cash or other assets, or warrants that must or may require settlement by issuing a variable number of shares. If warrants do not meet liability classification under ASC 480, the Company assesses the requirements under ASC 815, which states that contracts that require or may require the issuer to settle the contract for cash are liabilities recorded at fair value, irrespective of the likelihood of the transaction occurring that triggers the net cash settlement feature. If the warrants do not require liability classification under ASC 815, and in order to conclude equity classification, the Company also assesses whether the warrants are indexed to its Common Stock and whether the warrants are classified as equity under ASC 815 or other applicable GAAP. After all relevant assessments, the Company concludes whether the warrants are classified as liability or equity. Liability classified warrants require fair value accounting at issuance and subsequent to initial issuance with all changes in fair value after the issuance date recorded in the statements of operations. Equity classified warrants only require fair value accounting at issuance with no changes recognized subsequent to the issuance date.

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

Related parties

All material related-party transactions are approved by members of the Board of Directors not affiliated with the transactions. These Board members consider the details of each new, existing or proposed related party transaction, including the terms of the transaction, the business purpose of the transaction, and the benefits to the Company and the relevant related party. In determining whether to approve a related party transaction, the following factors are considered: (1) if the terms are fair to the Company, (2) if there are business reasons to enter into the transaction, or (3) if the transaction would present an improper conflict of interest for any officer.

Income taxes

The provision for income taxes is determined using the asset and liability approach of accounting for income taxes. Under this approach, deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the carrying amounts for income tax purposes and net operating loss and tax credit carryforwards. The amount of deferred taxes on these temporary differences is determined using the tax rates that are expected to apply to the period when the asset is realized or the liability is settled, as applicable, based on tax rates and laws in the respective tax jurisdiction enacted as of the balance sheet date.

The Company reviews its deferred tax assets for recoverability and establishes a valuation allowance based on projected future taxable income, applicable tax strategies and the expected timing of the reversals of existing temporary differences. A valuation allowance is provided when it is more likely than not (likelihood of greater than 50 percent) that some portion or all the deferred tax assets will not be realized. The Company recorded a valuation allowance of $4,248,911 as of June 30, 2025, and $2,487,466 as of December 31, 2024.

The Company recognizes the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained upon examination by the taxing authorities, based upon the technical merits of the position. If all or a portion of the unrecognized tax benefit is sustained upon examination by the taxing authorities, the tax benefit will be recognized as a reduction to the Company’s deferred tax liability and will affect the Company’s effective tax rate in the period it is recognized.

The Company records any tax-related interest charges as interest expense and any tax-related penalties as other expenses in the consolidated statements of operations of which there have been none to date.

The Company is also subject to the Texas Margin Tax. The Company realized no Texas Margin Tax in the accompanying consolidated financial statements as we do not anticipate owing any Texas Margin Tax for the periods presented.

Stock-based compensation

The Company accounts for its stock-based compensation awards in accordance with Accounting Standards Codification (“ASC”) Topic 718, Compensation-Stock Compensation (“ASC 718”). ASC 718 requires all stock-based payments to employees and non-employees, including grants of stock options, to be recognized as expense in the consolidated statements of operations based on their grant date fair values.

The Company periodically issues common stock and common stock options to consultants for various services. Costs of these transactions are measured at the fair value of the service received or the fair value of the equity instruments issued, whichever is more reliably measurable. The value of the common stock is measured at the earlier of (i) the date at which a firm commitment for performance by the counterparty to earn the equity instruments is reached or (ii) the date at which the counterparty’s performance is complete.

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

Loss Per Share

The Company accounts for net loss per share in accordance with Accounting Standards Codification subtopic 260 - 10, Earnings Per Share (“ASC 260 - 10”), which requires presentation of basic and diluted earnings per share (“EPS”) on the face of the consolidated statement of operations for all entities with complex capital structures and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS. Basic net loss per share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during each period. It excludes the dilutive effects of any potentially issuable common shares. Diluted net loss per share is calculated by including any potentially dilutive share issuances in the denominator. For the six months ended June 30, 2025 and 2024, all potentially dilutive securities were not included in the calculation of diluted net loss per share as their effect would be anti - dilutive.

Recent accounting pronouncements

In December 2023, the FASB issued ASU 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures,” which enhances the transparency and decision usefulness of income tax disclosures. The amendments address more transparency about income tax information through improvements to income tax disclosures primarily related to the rate reconciliation and income taxes paid information. The ASU also includes certain other amendments to improve the effectiveness of income tax disclosures. The amendments in the ASU are effective for public business entities for annual periods beginning after December 31, 2024 on a prospective basis. Early adoption is permitted. The Company is currently evaluating the impact of the adoption of this guidance.

In November 2023, the FASB issued ASU 2023-07, “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures.” This ASU updates reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expense and information used to assess segment performance. The amendments in the ASU are effective for public entities for fiscal years beginning after December 15, 2023 and interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted. Retrospective application to all prior periods presented in the financial statements is required for public entities. The Company adopted ASU 2023-07 as of January 1, 2024. Adoption of the ASU did not impact the Company’s financial position, results of operations or cash flows.

In November 2024, the FASB issued ASU 2024-03, “Income Statement – Reporting Comprehensive Income – Expense Disaggregation Disclosure (Subtopic 220-40): Disaggregation of Income Statement Expenses. This ASU requires public business entities to disclose, in interim and annual reporting periods, additional information about certain expenses in the notes to the financial statements. The amendments in the ASU are effective for public entities for fiscal years beginning after December 15, 2026 and interim periods within fiscal years beginning after December 15, 2027, with early adoption permitted. The Company is still evaluating the effect of the adoption of this guidance.

NOTE 3: RECAPITALIZATION

As discussed in Note 1, “Organization and Basis of Presentation,” on December 6, 2024, the Company completed the Business Combination contemplated by the Business Combination Agreement dated January 3, 2024, by and among ROCL, the Merger Sub, and NEW ERA.

At the Closing, pursuant to the Business Combination Agreement and after giving effect to the redemption of shares of ROCL common stock:

| 1. | The total consideration paid at the Closing (the “Merger Consideration”) by ROCL to New Era Helium Corp. security holders was 8,916,625 shares of common stock of Holdings. |

| 2. | Each share of Merger Sub common stock, par value $0.0001 per share (“Merger Sub Common Stock”), issued and outstanding immediately prior to the Effective Time (as defined in the Business Combination Agreement) was converted into one newly issued share of the Company’s common stock. |

Following the filing of the Articles of Merger with the Secretary of State of the State of Nevada, ROCL merged with and into Holdings, with Holdings as the surviving company of the Initial Merger. Following the filing of the Articles of Merger with the Secretary of State of the State of Nevada, Merger Sub merged with and into with New Era Helium Corp. as the surviving corporation of the Business Combination, effective December 6, 2024. Thus, New Era Helium Corp. became a wholly owned subsidiary of ROCL. In connection with the Business Combination, Holdings changed its name to “New Era Helium, Inc.”

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

Although ROCL was the legal acquirer of NEW ERA in the merger, NEW ERA is deemed to be the accounting acquirer, and the historical financial statements of NEW ERA became the basis for the historical financial statements of the Company upon the closing of the merger. NEW ERA was determined to be the accounting acquirer based on an evaluation of the following facts and circumstances:

| ● | NEW ERA’s current shareholders have a majority of the voting power in the combined company; |

| ● | NEW ERA’s existing stockholders have the ability to control decisions regarding election and removal of directors and officers of the combined company; |

| ● | NEW ERA is the larger entity in terms of substantive operations and employee base; |

| ● | NEW ERA comprises the ongoing operations of the combined company; |

| ● | NEW ERA’s existing senior management is the senior management of the combined company. |

In accordance with the guidance applicable to these circumstances, the equity structure has been restated in all comparable periods up to December 6, 2024, to reflect the number of shares of the Company’s common stock, $0.0001 par value per share, issued to NEW ERA’s stockholders in connection with the merger. As such, the shares and corresponding capital amounts and earnings per share related to NEW ERA’s common stock prior to the merger have been retroactively restated as shares reflecting the exchange ratio established in the merger.

The number of shares of Common Stock issued immediately following the consummation of the Business Combination were:

| ROCL common stock outstanding prior to the Business Combination | 11,500,000 | |||

| Less: Redemption of ROCL common stock | (11,162,973 | ) | ||

| ROCL common stock | 337,027 | |||

| ROCL founder shares outstanding | 2,325,000 | |||

| ROCL private shares outstanding | 461,500 | |||

| Shares issued to advisors | 1,125,000 | |||

| Business combination shares | 4,248,527 | |||

| NEW ERA shares | 8,916,625 | |||

| Common stock immediately after the Business Combination | 13,165,152 |

The number of NEW ERA shares was determined as follows:

| NEW ERA Shares | ||||||||

| after | ||||||||

| NEW ERA Shares | Conversion Ratio |

|||||||

| Common stock | 8,623,205 | 8,916,625 | ||||||

Public and private placement warrants

The 5,750,000 Public Warrants issued at the time of ROCL’s initial public offering and the 230,750 warrants issued in connection with the private placement at the time of ROCL’s initial public offering (the “Private Placement Warrants”) remained outstanding and became warrants for the Company (See Note 12 EQUITY).

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

Redemption

Prior to the closing of the Business Combination, certain ROCL public stockholders exercised their right to redeem certain of their outstanding shares for cash, resulting in the redemption of 11,162,973 shares of ROCL common stock for an aggregate payment of $117,044,333.

NOTE 4: PREPAID EXPENSES AND OTHER CURRENT ASSETS

The following table presents the components of prepaid expenses and other current assets as of the dates indicated:

| June 30, | December 31, | |||||||

| 2025 | 2024 | |||||||

| Retainer for workover rigs | $ | 240,000 | $ | 240,000 | ||||

| Prepaid insurance | 260,849 | 575,498 | ||||||

| Prepaid expense | 81,003 | 3,444 | ||||||

| Prepaid taxes | 133,198 | 133,198 | ||||||

| Security deposit | 5,050 | 5,050 | ||||||

| Other | 9,986 | 9,986 | ||||||

| Total prepaid expenses and other current assets- current | $ | 730,086 | $ | 967,176 | ||||

| Retainer for workover rigs | 240,000 | 360,000 | ||||||

| Total prepaid expenses-noncurrent | $ | 240,000 | $ | 360,000 | ||||

NOTE 5. PROPERTY, PLANT AND EQUIPMENT

The Company will record depreciation expense for the processing plant over its estimated useful life.

Depreciation for the processing plant will commence once the processing plant is placed into service. The Company records depreciation expense for computer equipment and furniture and fixtures over a useful life of five years. The Company records depreciation expense for leasehold improvement over the lesser of their estimated useful lives or the underlying terms of the associated leases.

| June 30, | December 31, | |||||||

| 2025 | 2024 | |||||||

| Processing plant under construction – cost | $ | 4,466,736 | $ | 3,791,736 | ||||

| Computer equipment – cost | 30,020 | 9,820 | ||||||

| Field equipment – cost | 107,347 | |||||||

| Furniture and fixtures – cost | 22,101 | 22,101 | ||||||

| Leasehold improvements – cost | 23,005 | 23,006 | ||||||

| Total – cost | 4,649,209 | 3,846,663 | ||||||

| Processing plant under construction – accumulated depreciation | ||||||||

| Computer equipment – accumulated depreciation | (9,876 | ) | (6,874 | ) | ||||

| Field equipment – accumulated depreciation | ||||||||

| Furniture and fixtures – accumulated depreciation | (18,481 | ) | (16,271 | ) | ||||

| Leasehold improvements – accumulated depreciation | (21,943 | ) | (13,776 | ) | ||||

| Total – accumulated depreciation | (50,300 | ) | (36,921 | ) | ||||

| Processing plant under construction – net | 4,466,736 | 3,791,736 | ||||||

| Computer equipment – net | 20,144 | 2,946 | ||||||

| Field equipment – net | 107,347 | |||||||

| Furniture and fixtures – net | 3,620 | 5,830 | ||||||

| Leasehold improvements – net | 1,062 | 9,230 | ||||||

| Total Property, plant and equipment, net | $ | 4,598,909 | $ | 3,809,742 | ||||

The Company recorded depreciation expense in the amounts of $13,379 and $5,493 during the six months ended June 30, 2025, and 2024, respectively.

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

NOTE 6. OIL AND NATURAL GAS PROPERTIES

| June 30, | December 31, | |||||||

| 2025 | 2024 | |||||||

| Evaluated oil and natural gas properties – cost | $ | 6,933,071 | $ | 6,933,071 | ||||

| Accumulated depletion and impairment | (6,450,162 | ) | (6,142,978 | ) | ||||

| Oil and natural gas properties, net | $ | 482,909 | $ | 790,093 | ||||

The Company had no unevaluated properties at June 30, 2025 and December 31, 2024.

The Company recorded depletion expense in the amounts of $307,184 and $403,183 for the six months ended June 30, 2025 and 2024, respectively. There were no ceiling test impairments recorded during the six months ended June 30, 2025 and the year ended December 31, 2024.

NOTE 7. NOTES PAYABLE

AirLife Note Payable

On August 25, 2023, the Company, through its wholly owned subsidiary NEH Midstream, LLC., entered into a Promissory Note (“AirLife Note”) with AirLife Gases USA Inc. (“AirLife”). Under the AirLife Note, NEH Midstream agreed to pay AirLife the principal sum of $2,000,000 or such lesser amount as shall equal the outstanding principal amount of the Advance made to NEH Midstream by AirLife. The entire balance will be due on the earlier of (i) the date that is 18 months after the commencement date as defined the Purchase and Sale Agreement between NEH Midstream and AirLife dated August 25, 2023, or (ii) May 30, 2027. Interest shall accrue at 0.0211%, compounded daily, equivalent to an annual interest rate of 8%, commencing on the date the advance was made and continuing until repaid. The Company’s interest in certain oil and natural gas properties, included within the Oil and natural gas properties, net (full cost) balance on the Company’s consolidated balance sheets are pledged as collateral for the AirLife Note. As of June 30, 2025 and December 31, 2024, the amount outstanding under the AirLife Note, including accrued interest of $304,153 and $217,823, respectively, and were $2,304,153 and $2,217,823, respectively, and the June 30, 2025 balance was recorded as Notes payable – current and the December 31, 2024 balance was recorded as Notes payable – noncurrent on the Company’s consolidated balance sheets.

Pursuant to the terms of the Purchase Agreement, if the Purchase Agreement is terminated due to delay of the November 30, 2025 Commencement Date, succession of plant operations or early termination of the Purchase Agreement, the Company will be required to pay the total amount of remaining monthly installments of the AirLife Note within five (5) days of the date of such termination. (See Note 14)

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

Equity Purchase Facility Agreement (“EPFA”) and Convertible Notes

On December 6, 2024, following the closing of the Business Combination, the Company and an institutional investor (the “EPFA Investor”) entered into an Equity Purchase Facility Agreement (the “EPFA”). Pursuant to the EPFA, the Company has the right to issue and sell to the EPFA Investor, and the EPFA Investor must purchase from the Company, up to an aggregate of $75 million (the “Commitment Amount”) in newly issued shares (the “Advance Shares”) of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), subject to the satisfaction or waiver of certain conditions. The Company may issue up to 866,873 Advance Shares assuming a purchase price of $8.075 per Advance Share.

The EFPA provides for the issuance of two pre-paid advances in the aggregate amount of $10 million, the first pre-paid advance in the amount of $7 million and the second pre-paid advance in the amount of $3 million, each of which to be evidenced by a senior secured convertible promissory note (“the Notes”), which is convertible into shares of Common Stock. The Notes are secured by all assets of the Company. The Note for the First Pre-Paid Advance is initially convertible into 770,000 shares of Common Stock, assuming a conversion price of $10 and no accrued and unpaid interest. The Second Pre-Paid Advance Note will be initially convertible into 330,000 shares of Common Stock, assuming a conversion price of $10 and no accrued and unpaid interest.

The proceeds from the Second Pre-Paid Advance Note and sale of Advance Shares are expected to be used by the Company first to pay the then monthly payment on any outstanding Notes and then the remainder would be utilized for working capital. Pursuant to the terms of the EPFA, the Company is required to hold a special meeting of stockholders no later than ninety (90) calendar days following December 6, 2024 to seek approval of (i) the issuance of all of the shares of Common Stock that may be issuable pursuant to the Notes and the EPFA in compliance with the rules and regulations of Nasdaq and (ii) an amendment to the Company’s articles of incorporation to increase the number of authorized shares of capital stock of the Company to 250,000,000. At any time until the EPFA is terminated, the Company, in its sole discretion, has the right, but not the obligation, to issue and sell to the EPFA Investor, and the EPFA Investor must subscribe for and purchase from the Company, Advance Shares.

The price per Advance Share will be determined by multiplying the market price by 95% in respect of an Advance Notice, which shall be reduced by one-third (1/3rd) for each Excluded Day Purchase Price (as defined in the EPFA), which is not known at the time an Advance Notice is delivered but shall be determined on each closing based on the daily prices of the Advance Shares that are the inputs to the determination of the purchase price.

While the Convertible Notes are outstanding, the Company cannot issue, sell, grant, or otherwise dispose of any securities, or enter into any agreement or arrangement to do so, at a price per security less than 120% of $2.00 per share of Common Stock (the “EPFA Floor Price”) on such date, or otherwise provide rights to acquire securities at an effective price per security below 120% of the EPFA Floor Price unless the Company uses the proceeds of such transaction to fully redeem such outstanding Notes.

Until the termination of the EPFA, the Company must maintain a minimum cash balance of $500,000.

The Company reviewed the EFPA and determined that it should be recognized at fair value with changes in fair value recorded in the consolidated statement of operations (See Note 16).

As an inducement to entering into the EPFA, a designee of the EPFA Investor received 550,000 shares of ROCL and such shares were converted into 550,000 shares of Common Stock in connection with Business Combination.

New Era Energy & Digital, Inc.

Notes to Unaudited Consolidated Financial Statements

Senior Secured Convertible Promissory Note

Each Convertible Note provides for a 7% original issue discount and is for a term of 15 months. Commencing on the ninetieth (90th) day following the applicable Issuance Date and continuing on the same day of each successive calendar month until the entire outstanding principal amount has been repaid, the Company is required to make monthly payments to the holder of the Note (the “Holder”). Each monthly payment will be in an amount equal to the sum of (i) one twelfth (1/12) of the initial aggregate principal of the Note and all other notes issued pursuant to the EPFA, plus (ii) accrued and unpaid under the Note as of each payment date. Interest accrues on the outstanding principal balance at an initial annual rate equal to 10% (“Interest Rate”), which Interest Rate will increase to an annual rate of 18% upon the occurrence of an Event of Default (as defined in the Note).

On December 6, 2024, the Company drew the first prepaid advance of $7,000,000, net of an original issue discount of $490,000 and debt issuance costs of $5,048,574.

On January 16, 2025, following the effectiveness of the Company’s Registration Statement on Form S-1, on December 30, 2024, the Company issued another Senior Secured Convertible Promissory Note (the “Subsequent Note”) to the Investor in an aggregate principal amount of $3.0 million for an aggregate purchase price of $2.79 million after giving effect to a 7% original issue discount of $210,000 and debt issuance costs of $347,195. The Subsequent Note is for a term of 15 months from the Issuance Date.

The outstanding balance on the Convertible Note and the Subsequent Note, net of debt discount, as of December 31, 2024 was $2,233,712.

Amendment to Senior Secured Convertible Promissory Note