SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): August 14, 2025

AIR INDUSTRIES GROUP

(Exact Name of Registrant as Specified in its Charter)

| Nevada | 001-35927 | 80-0948413 | ||

| State of Incorporation | Commission File Number | IRS Employer I.D. Number |

1460 Fifth Avenue, Bay Shore, New York 11706

(Address of Principal Executive Offices)

Registrant’s telephone number: (631) 968-5000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.001 | AIRI | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operation and Financial Condition.

On August 14, 2025, Air Industries Group (the “Company”) issued a press release reporting its financial results for the three and six months ended June 30, 2025. The Company also confirmed that it will host a conference call to discuss its financial results. The call is scheduled for August 14, 2025, at 4:30 PM Eastern Time. The conference call number is 877-524-8416 and the call will be made available for replay at www.airindustriesgroup.com.

The information furnished in this Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed as “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liability of such Section, nor shall it be deemed incorporated by reference in any filing by Air Industries under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Text of press release issued August 14, 2025, by Air Industries Group. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 14, 2025

| AIR INDUSTRIES GROUP | ||

| By: | /s/ Scott Glassman | |

| Scott Glassman Chief Financial Officer |

||

Exhibit 99.1

August 14, 2025 07:00 AM Eastern Daylight Time

Air Industries Group Announces Financial Results for the Three and Six Months Ended June 30, 2025

BAY SHORE, N.Y.--(BUSINESS WIRE)-- Air Industries Group (“Air Industries”) (NYSE American: AIRI), a leading manufacturer of precision components and assemblies for large aerospace and defense prime contractors, today announced Financial Results for the Three and Six months ended June 30, 2025.

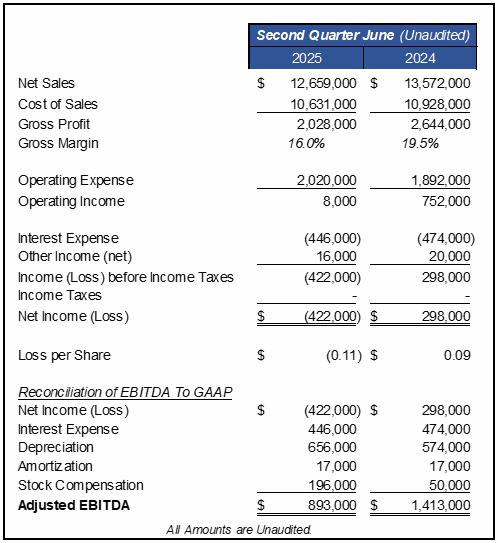

Second Quarter 2025 Financial Highlights

| ● | Net sales: $12.7 million, a decrease of $0.9 million or 6.7% decrease from $13.6 million in Q2 2024. |

| ● | Gross Profit: $2.0 million, down $0.6 million or 23.3% from $2.6 million in Q2 2024. Gross margin decreased to 16.0%, a decrease of 350 basis points from 19.5% in Q2 2024. |

| ● | Operating Expenses: $2.0 million, up $0.1 million or 6.8% from $1.9 million in Q2 2024. |

| ● | Operating income: $8,000, compared to $752,000 in Q2 2024. |

| ● | Net loss: $422,000, compared to net income of $298,000 in Q2 2024. |

| ● | Adjusted EBITDA: $893,000, a decrease from $1,413,000 in Q2 2024 |

Second Quarter Summary Income Statement

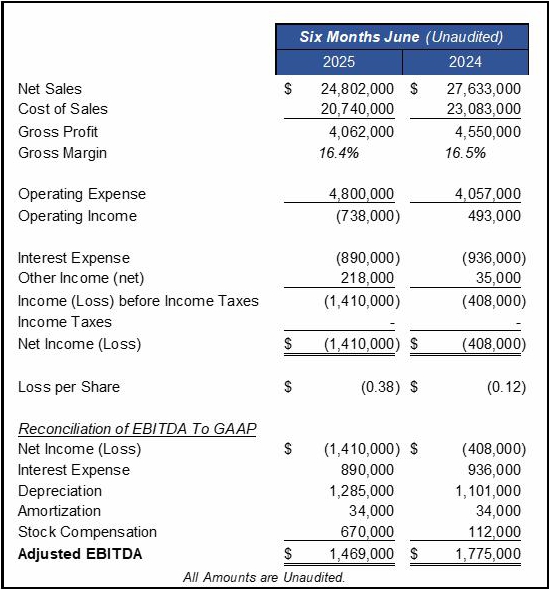

First Half 2025 Results:

| ● | Net sales: $24.8 million, down $2.8 million or 10.2% decrease from $27.6 million in the first half of 2024. |

| ● | Gross Profit: $4.1 million a decrease of $0.5 million or 10.7% from $4.6 million in the first half of 2024. Gross margin was 16.4%, compared to 16.5% in 2024. |

| ● | Operating Expenses: $4.8 million, up $0.7 million or 18.3% from $4.1 million in the first half of 2024, with $0.6 million of the increase driven by non-cash stock compensation expense. |

| ● | Operating loss: $0.7 million, compared to operating income of $0.5 million in the first half of 2024. |

| ● | Net loss: $1.4 million, compared to a net loss of $0.4 million in the first half of 2024. |

| ● | Adjusted EBITDA: $1.5 million a decrease from $1.8 million in the first half of 2024. |

First Half 2025 Summary Income Statement

Lou Melluzzo, Chief Executive Officer of Air Industries Group, commented: “The second quarter of 2025 presented challenges, primarily delays in customer orders and extended lead times from subcontractors, which impacted our results. These issues, combined with higher non-cash stock compensation expenses, contributed to a net loss for the quarter. However, Adjusted EBITDA for the first half remained positive, reflecting our ability to manage costs. Looking to the second half, we are adjusting our outlook to reflect the impact of these issues and now expect overall second-half results in 2025 to be lower than the first half, with our fourth quarter expected to be the strongest by far. At the same time, we have implemented cost-saving initiatives, including a workforce reduction that should reduce annual payroll by approximately $1.0 million.”

Mr. Melluzzo further commented: “Despite recent headwinds, I believe our long-term business outlook remains strong. In early July 2025, we successfully completed an at-the-market (“ATM”) offering, raising nearly $4.0 million in gross proceeds through the sale of 1,003,653 common shares—further strengthening our balance sheet. Our backlog remains at record levels, reflecting sustained demand for our products, the benefits of which will be realized in fiscal 2026 and beyond. I remain confident that the underlying strength of our business will drive continued progress and deliver lasting value to our shareholders.”

Conference Call Information

Air Industries Group will host a conference call to discuss Financial Results for the Second Quarter and Six Months of 2025 on Thursday August 14th at 4:30 pm Eastern.

The conference call-in number is 877–524–8416

ABOUT AIR INDUSTRIES GROUP

Air Industries Group is a leading manufacturer of precision components and assemblies for large aerospace and defense prime contractors. Its products include landing gears, flight controls, engine mounts and components for aircraft jet engines, ground turbines and other complex machines. Whether it is a small individual component or complete assembly, its high quality and extremely reliable products are used in mission critical operations that are essential for the safety of military personnel and civilians.

FORWARD LOOKING STATEMENTS

Certain matters discussed in this press release are ‘forward-looking statements’ intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. In particular, the Company’s statements regarding trends in the marketplace, future revenues, earnings and Adjusted EBITDA, the ability to realize firm backlog and projected backlog, cost cutting measures, potential future results and acquisitions, are examples of such forward-looking statements. The forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, the timing of projects due to variability in size, scope and duration, the inherent discrepancy in actual results from estimates, projections and forecasts made by management, regulatory delays, changes in government funding and budgets, and other factors, including general economic conditions, not within the Company’s control. The factors discussed herein and expressed from time to time in the Company’s filings with the Securities and Exchange Commission could cause actual results and developments to be materially different from those expressed in or implied by such statements. The forward-looking statements are made only as of the date of this press release and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

NON-GAAP FINANCIAL MEASURES

The Company uses Adjusted EBITDA, a Non-GAAP financial measure as defined by the SEC, as a supplemental profitability measure because management finds it useful to understand and evaluate results, excluding the impact of non-cash depreciation and amortization charges, stock based compensation expenses, and nonrecurring expenses and outlays, prior to consideration of the impact of other potential sources and uses of cash, such as working capital items. This calculation may differ in method of calculation from similarly titled measures used by other companies and may be different than the EBITDA calculation used by our lenders for purposes of determining compliance with our financial covenants. This Non-GAAP measure may have limitations when understanding performance as it excludes the financial impact of transactions such as interest expense necessary to conduct the Company’s business and therefore are not intended to be an alternative to financial measure prepared in accordance with GAAP. The Company has not quantitatively reconciled its forward looking Adjusted EBITDA target to the most directly comparable GAAP measure because items such as amortization of stock-based compensation and interest expense, which are specific items that impact these measures, have not yet occurred, are out of the Company’s control, or cannot be predicted. For example, quantification of stock-based compensation is not possible as it requires inputs such as future grants and stock prices which are not currently ascertainable.

Anyone wishing to contact us or send a message can also do so by visiting: www.airindustriesgroup.com/contact-us/

Contact

Air Industries Group

Chief Financial Officer

631-328-7039