UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 12, 2025

Ondas Holdings Inc.

(Exact name of registrant as specified in its charter)

Nevada |

001-39761 | 47-2615102 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

One Marina Park Drive, Suite 1410, Boston, MA 02210

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (888) 350-9994

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| Common Stock par value $0.0001 | ONDS |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 12, 2025, Ondas Holdings Inc. (the “Company”), issued a press release announcing its financial and operating results for the second quarter ended June 30, 2025. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. A slide presentation, which includes supplemental information relating to the Company’s financial results for the second quarter ended June 30, 2025, is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information in Item 2.02 of this Current Report on Form 8-K (including Exhibit 99.1 and Exhibit 99.2) is furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information in Item 2.02 of this Current Report on Form 8-K (including Exhibit 99.1 and Exhibit 99.2) shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date of this Current Report on Form 8-K, regardless of any general incorporation language in the filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Press Release, dated August 12, 2025. | |

| 99.2 | Presentation, dated August 12, 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: August 12, 2025 | ONDAS HOLDINGS INC. | |

| By: | /s/ Eric A. Brock | |

| Eric A. Brock | ||

| Chief Executive Officer | ||

Exhibit 99.1

Ondas Holdings Reports Second Quarter 2025 Financial Results—Remains on Track for Record Year Driven by Execution at OAS, Global Demand for Autonomous Drone Systems

Record Quarterly Revenue of $6.3 Million in Q2; a 6-fold Increase YoY and 50% Growth QoQ

Ended Second Quarter with $68.6 Million of Cash to Support Growth Plan

$22.0 million backlog at end of Q2 2025

Expected New Orders Across Europe, the Middle East and the United States in 2H 2025 Position OAS for Accelerated Global Expansion into 2026

Conference Call Scheduled for Today at 8:30 a.m. ET

BOSTON, MA / AUGUST 12, 2025 / Ondas Holdings Inc. (Nasdaq: ONDS) (“Ondas” or the “Company”), a leading provider of private industrial wireless networks and commercial drone and automated data solutions through its Ondas Networks and Ondas Autonomous Systems (OAS) business units, reported financial and operating results for the second quarter ended June 30, 2025.

“Ondas delivered a record quarter with $6.3 million in revenue, reflecting accelerating execution and global market adoption at Ondas Autonomous Systems (OAS),” said Eric Brock, Chairman and CEO of Ondas Holdings. “OAS is executing with discipline and scale as we continue to see robust international demand for our autonomous drone technologies across defense and homeland security markets. In the first half of 2025, we secured record orders and continued to convert our growing backlog into revenue, supported by urgent deployments and new contracts. In Q2, our team delivered key program milestones in Israel and the UAE and advanced new customer engagements across Europe, Asia, and the United States. In addition, we are making substantial progress on our strategic growth plan, as evidenced by our partnership and strategic investment in Rift Dynamics, which will broaden Ondas’ relationships in Europe, and provide American Robotics with a built-for-purpose attritable drone capability meeting “mass lethality” requirements for the U.S. defense market.”

“National policy in the United States continues to evolve in favor of strengthening the domestic drone industry. During Q2, we saw a series of significant developments, from the Trump Administration’s executive orders, including the ‘Ensuring American Drone Dominance’ directive, to the bipartisan passage of the One Big Beautiful Act (OBBA), which outlines major increases in federal funding for drone procurement and R&D. And just last week, the FAA issued a Notice of Proposed Rulemaking (NPRM) to advance regulations enabling beyond visual line of sight (BVLOS) drone operations. These policy milestones reflect growing national urgency to build sovereign capabilities in autonomous aerial systems and reinforce the long-term demand drivers that support our strategic growth plan at OAS.”

“At Ondas Networks, we continued to build commercial traction around our IEEE 802.16 (“dot16”) standard as the foundation for next-generation rail communications in North America. In Q2, the Association of American Railroads (AAR) formally selected our dot16 technology for the Next-Generation Head-of-Train/End-of-Train (NGHE) system, validating our long-term strategy. We are now working with multiple Class 1 railroads on field trials to expand dot16 applications beyond NGHE and into broader operational domains. With the successful A Block migration in Chicago, delivery of our new 220 MHz ACSES radios to Amtrak, and near-complete Metra system upgrades, momentum is building. The recent Cybersecurity and Infrastructure Security Agency (“CISA”) advisory further underscores the urgent cybersecurity need to replace vulnerable legacy protocols, an area where dot16 is uniquely positioned to lead. Our priority is to translate this industry validation into commercial adoption and scale.”

“Financially, we made significant progress. We ended Q2 with over $68 million in cash and, in July, retired the remaining balance of Ondas Holdings’ convertible notes, putting us on strong financial footing. With record customer activity, a growing backlog, and deepening visibility, we are building a highly scalable platform. We expect to exit 2025 with a record backlog and clear revenue visibility into 2026,” Brock concluded.

Second Quarter 2025 and Recent Highlights – Ondas Autonomous Systems (OAS)

| ● | Generated approximately $6.1 million in revenue during the second quarter of 2025, representing a more than 6-fold increase from the same period in 2024. |

| ● | OAS backlog reached $20.7 million as of June 30, 2025, up from $9.4 million at the end of Q1, reflecting continued global demand for the Optimus and Iron Drone platforms. |

| ● | Secured a $14.3 million order from a major defense customer for the Optimus drone system—the largest single Optimus order in the Company’s history—significantly expanding the Company’s presence in the global defense sector. |

| ● | Announced follow on orders of $3.8 million from the Government of Dubai to expand and support the Optimus drone network supporting public safety operations and the city’s “Drone Box” program. |

| ● | Expanded Iron Drone Raider’s global footprint with a $3.4 million contract from a European governmental defense agency, meeting an urgent demand to secure an international airport and marking the system’s first operational deployment in Europe. |

| ● | Delivered a $1.7 million initial Iron Drone Raider order from a governmental agency in Asia for homeland security operations with future expansion potential. |

| ● | American Robotics secured a purchase order from a major U.S. urban public safety agency for the Kestrel System, an advanced drone detection and counter-UAS platform designed to enhance airspace awareness and provide layered security at high-visibility public events. |

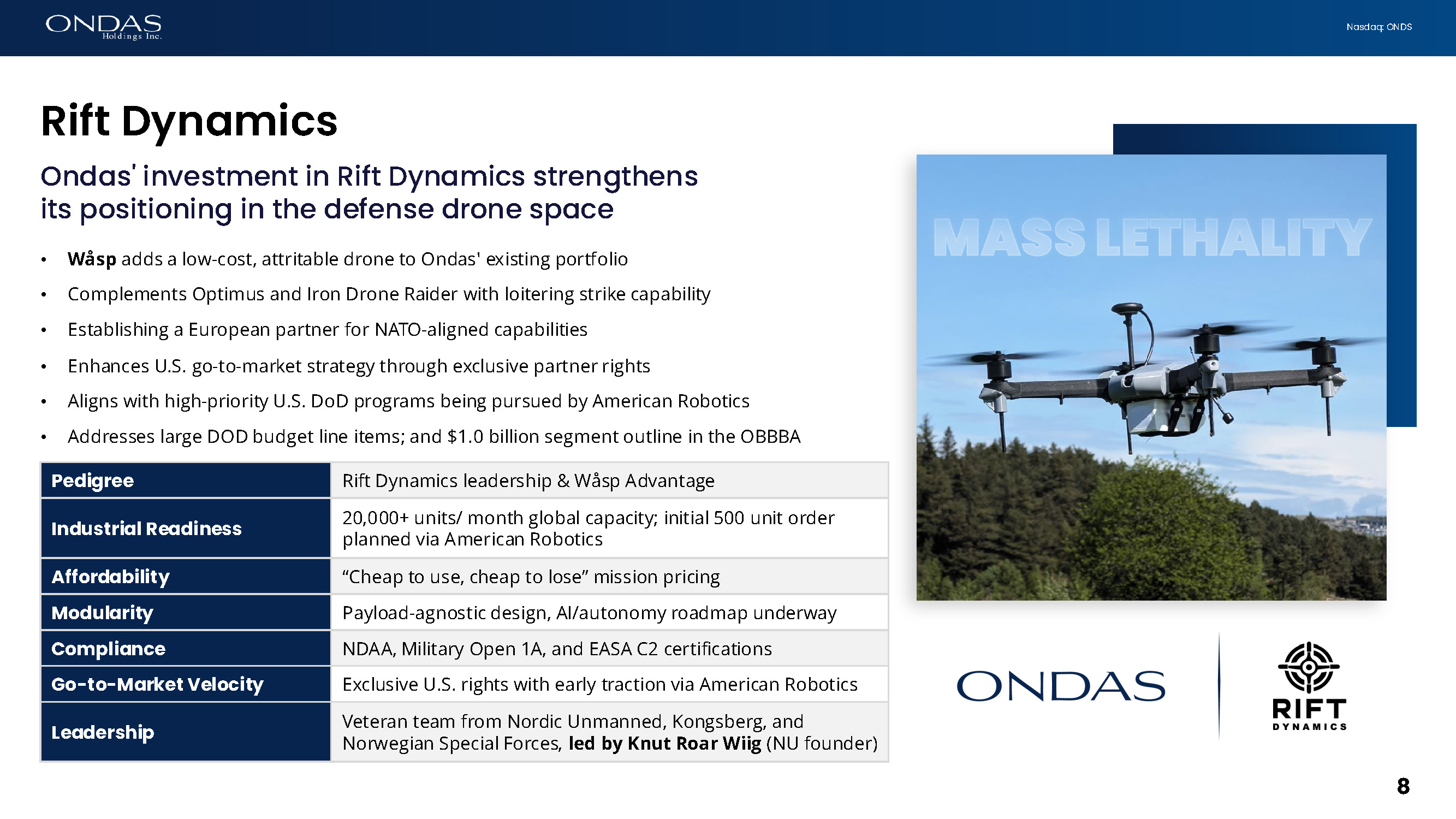

| ● | Entered into a partnership with Norway-based Rift Dynamics to support the launch of their Wåsp platform, an attritable drone designed to meet the requirements of allied militaries. The partnership with Rift includes an investment from Ondas and provides American Robotics with exclusive marketing rights for the Wåsp in the U.S. defense markets. |

| ● | NY Post highlighted that NYPD was looking for expanded authority to utilize CUAS tools and specifically highlighted their interest in deploying American Robotics’ Iron Drone platform. |

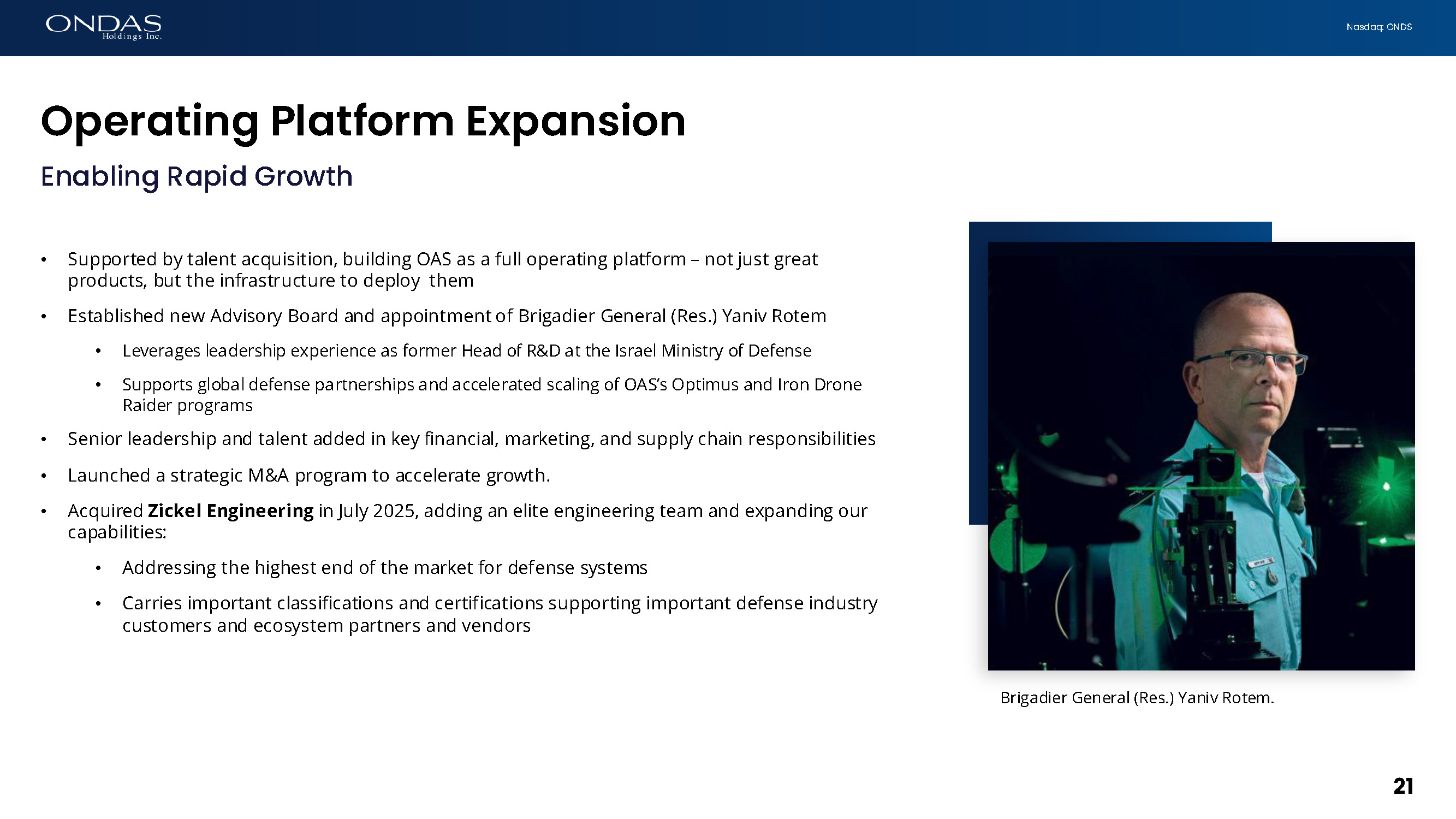

| ● | Appointed Brigadier General (Res.) Yaniv Rotem to the newly formed OAS Advisory Board, leveraging his deep leadership experience as former Head of R&D at the Israel Ministry of Defense to guide strategy on autonomous, AI-enabled ISR and counter-UAS platforms, support global defense partnerships, and accelerate scaling of OAS’s Optimus and Iron Drone Raider programs. |

| ● | Entered a strategic partnership with Mistral Inc., a leading U.S. defense business development firm, to accelerate sales and deployment of the Optimus and Iron Drone Raider platforms across the U.S. Department of Defense and Homeland Security markets. The Mistral partnership leverages decades of experience in U.S. federal procurement and is aligned with Ondas’ broader roadmap to become a next-generation defense prime contractor. |

| ● | Established a manufacturing partnership with Detroit Manufacturing Systems (DMS) to support U.S.-based production and supply chain scalability for our autonomous drone platforms. |

| ● | OAS continued to advance global partnerships and customer evaluations for both Optimus and Iron Drone Raider, driving interest in key new markets including Japan, Latin America, and additional NATO-aligned countries. |

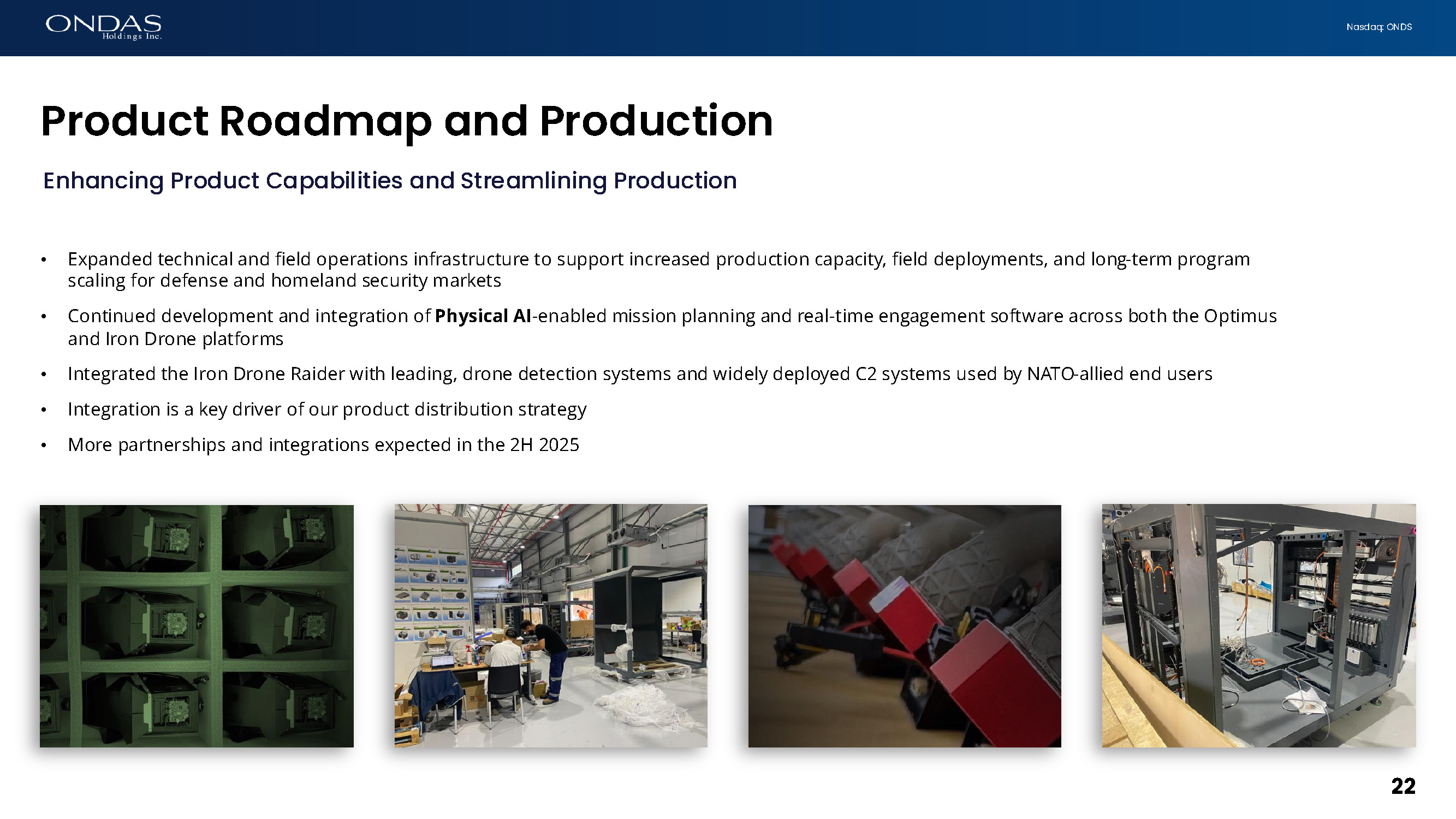

| ● | Expanded technical and field operations infrastructure to support increased production capacity, field deployments, and long-term program scaling for defense and homeland security markets. |

| ● | Continued development and integration of AI-enabled mission planning and real-time engagement software across both the Optimus and Iron Drone platforms. |

| ● | Hosted a dedicated OAS Investor Day in July 2025, presenting our long-term strategy, technology roadmap, global expansion plans and our strategic growth initiatives to the investor community. |

“We continue to build strong momentum across our OAS platforms, securing major multi-million-dollar contracts while proving operational maturity in critical defense and homeland security missions,” said Oshri Lugassy, Co-CEO of Ondas Autonomous Systems. “The combination of Optimus and Iron Drone Raider is now delivering measurable impact in the field, and our pipeline continues to grow with high-value opportunities globally. Specific to Iron Drone, our work with customers across multiple geographies continues to validate the platform’s effectiveness in complex, live security environments, helping to establish the system as a category leader in low-kinetic counter-UAS solutions. We remain focused on scaling our capabilities to meet demand from security forces, defense integrators, and government agencies worldwide.”

“OAS is executing a focused growth strategy—expanding deployments, increasing manufacturing capacity, and deepening strategic engagements in key regions,” Lugassy added. “With our leading technology, validated systems, and growing customer base, we are on track for a record year and well-positioned to lead the global adoption of autonomous aerial systems for national security and critical infrastructure protection.”

Second Quarter 2025 and Recent Highlights – Ondas Networks

| ● | The value of Ondas Networks’ dot16 wireless industrial networking technology continues to be validated by the rail industry as evidenced by the selection of 802.16t Direct-Peer-to-Peer protocol for the NGHE technology. The decision by the AAR’s Wireless Communications Committee in April 2025 has paved the way for broad-ranged discussions with Class 1s on dot16 applications in other railroad communication domains. These applications address long-standing issues in railroad operations. Ondas Networks is participating in several distinct field trials to approve each application for operating use. |

| ● | A Class 1 that installed Ondas Networks equipment in the Chicago area, one of the most challenging locations for railroad communications, recently completed its migration to the new 900 MHz A Block. Based on the successful migration to the A Block, the Class 1 railroad is now preparing to move to 802.16 in the same area. |

| ● | Metra, the primary commuter rail system serving the Chicago metropolitan area, has almost completed the systemwide installation of Ondas Networks’ 900 MHz equipment. Metra is expected to complete the transition to the A Block in advance of the September Federal Communications Commission deadline. |

| ● | Ondas Networks has delivered the initial units of the 220 MHz Advanced Civil Speed Enforcement System (“ACSES”) radios to Amtrak. The new radios will power Amtrak’s upgrade to ACSES, a Positive Train Control (PTC) system utilized by passenger and transit, as well as certain freight rail operators in the Northeast Corridor (NEC). Commercial deliveries will continue through the end of the year. Ondas Networks expects other NEC operators to upgrade to the new radios starting in 2026. |

| ● | A recent ICS Advisory issued by CISA highlighted the vulnerabilities of the legacy NGHE Remote Linking Protocol. Ondas Networks’ IEEE 802.16t Direct-Peer-to-Peer protocol eliminates the security risks highlighted by CISA. Ondas Networks continues to work with industry partners to bring NGHE products to market that increase the security and resilience of the North American rail network. |

Markus Nottelmann, Ondas Networks’ Chief Executive Officer, commented, “We are pleased that the North American rail industry is engaging directly with Ondas Networks to address long-standing opportunities for improvement in rail communications. Dot16 is increasingly seen as presenting opportunities to upgrade all existing railroad-specific networks to open the door to new applications, and to improve the overall security of the networks, and by extension the resilience of supply chains.”

“We are proactively pursuing live trials and deployments on a variety of applications that hold the potential for significant operations improvements with several Class 1s. We expect these trials to result in formal adoption and broad rollout of our products as they are validated in the field. With our partners we continue to build an eco-system of applications that will lead to faster adoption of dot16-enabled general-purpose networks,” Nottelmann concluded.

Second Quarter 2025 Financial Summary

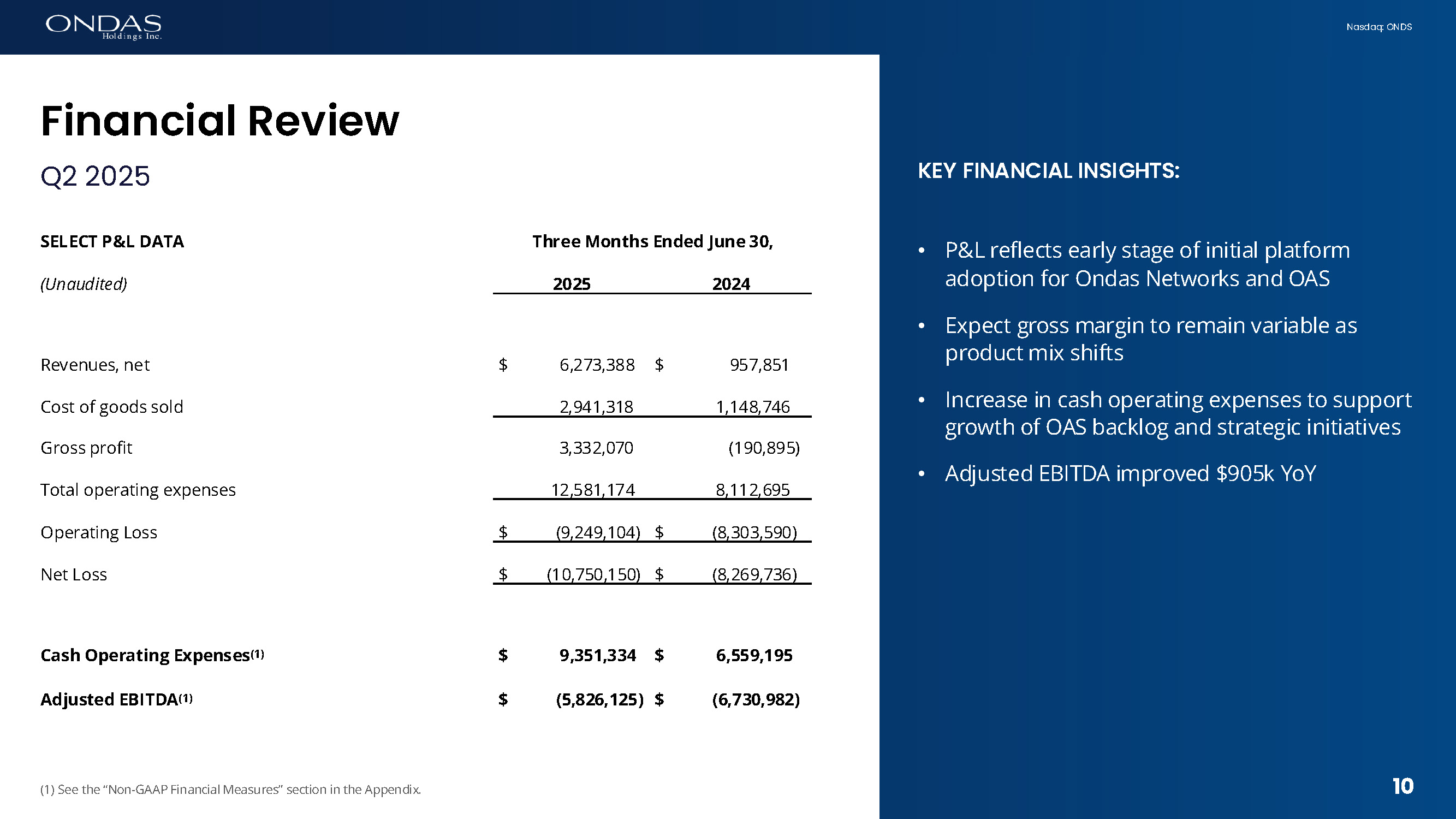

Ondas reported revenues of $6.3 million for the second quarter of 2025, a 555% increase from $1.0 million in the second quarter of 2024 and a 48% increase from $4.2 million in the first quarter of 2025. This significant increase was primarily driven by ongoing deliveries of Iron Drone and Optimus systems under previously announced contracts with military and public safety customers.

Gross profit rose to $3.3 million compared to a loss of $0.2 million in the second quarter of 2024. This resulted in a gross margin of 53% in the second quarter of 2025 versus a loss of 20% in the second quarter of 2024. This improvement reflects the shipment of higher margin products, in particular, Iron Drone, compared to lower margin service and maintenance. Gross margins are expected to fluctuate on a quarter-to-quarter basis depending on the mix of revenue.

Operating expenses increased by $4.5 million to $12.6 million, up from $8.1 million in the second quarter of 2024. Approximately $3.6 million of the increase is related to human resource costs, including stock-based compensation, to support business growth and strategic initiatives. The remaining increase includes additional operating costs related to the Palantir partnership and for other R&D expenses.

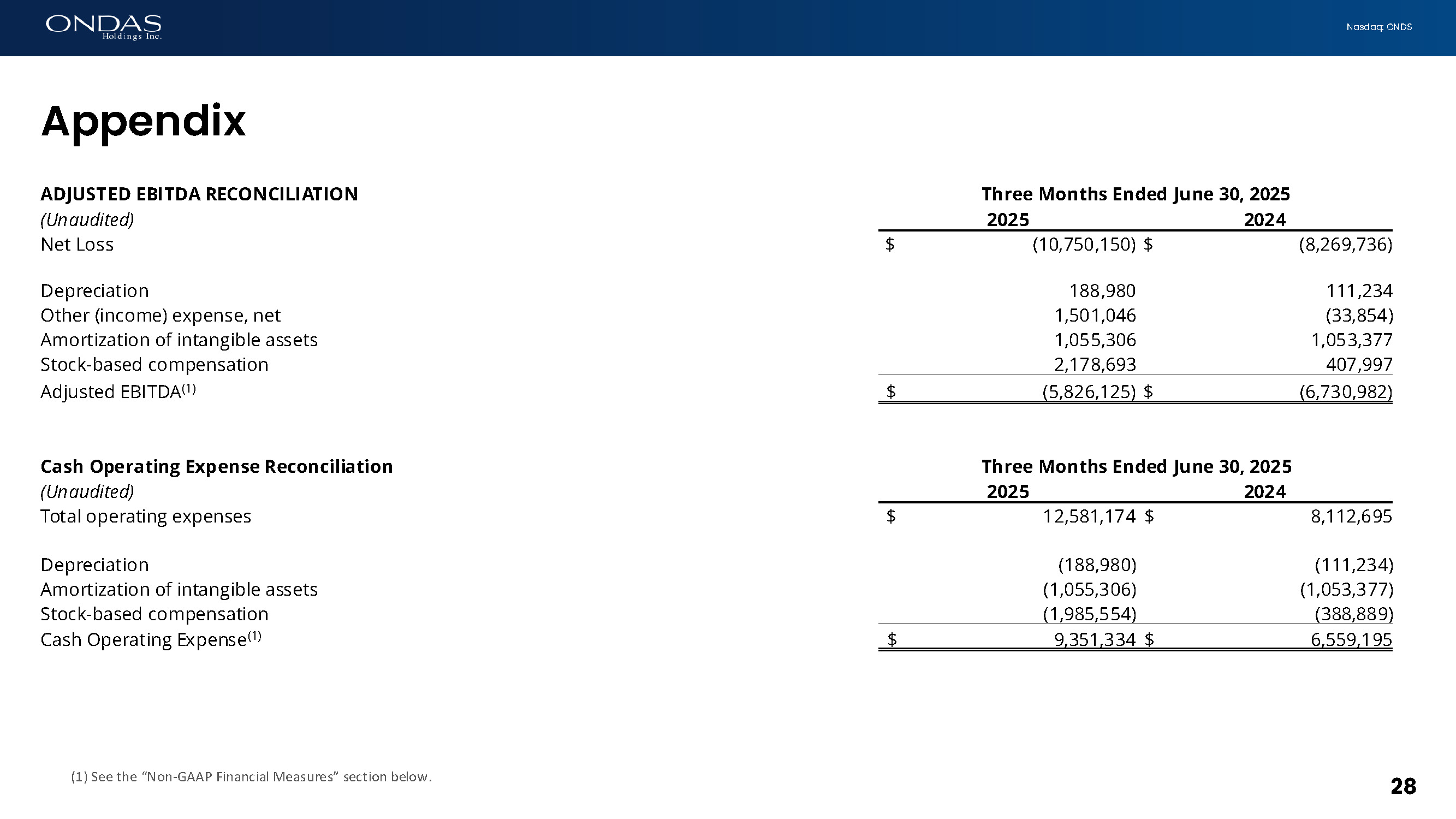

Cash operating expenses were $9.4 million in the second quarter of 2025, as compared to $6.6 million in the second quarter of 2024. As indicated above, the majority of the increase in cash operating expenses was attributed to higher human resource costs to support the expected business growth in the coming quarters. A reconciliation of cash operating expenses, a non-GAAP measure, is provided in the attached financial tables.

Operating loss was $9.2 million, compared to $8.3 million in the second quarter of 2024, primarily due to investments in headcount to build capacity to support expected revenue growth in the next twelve months.

Net loss was $10.8 million, compared to $8.3 million in the second quarter of 2024, which included an increase of $0.9 million in interest expense which included the faster amortization of debt issuance costs because of the accelerated conversion of debt.

Adjusted EBITDA improved to a loss of $5.8 million, compared to $6.7 million in the second quarter of 2024. A reconciliation of Adjusted EBITDA, a non-GAAP measure, is provided in the attached financial tables.

Balance Sheet and Cash Flow

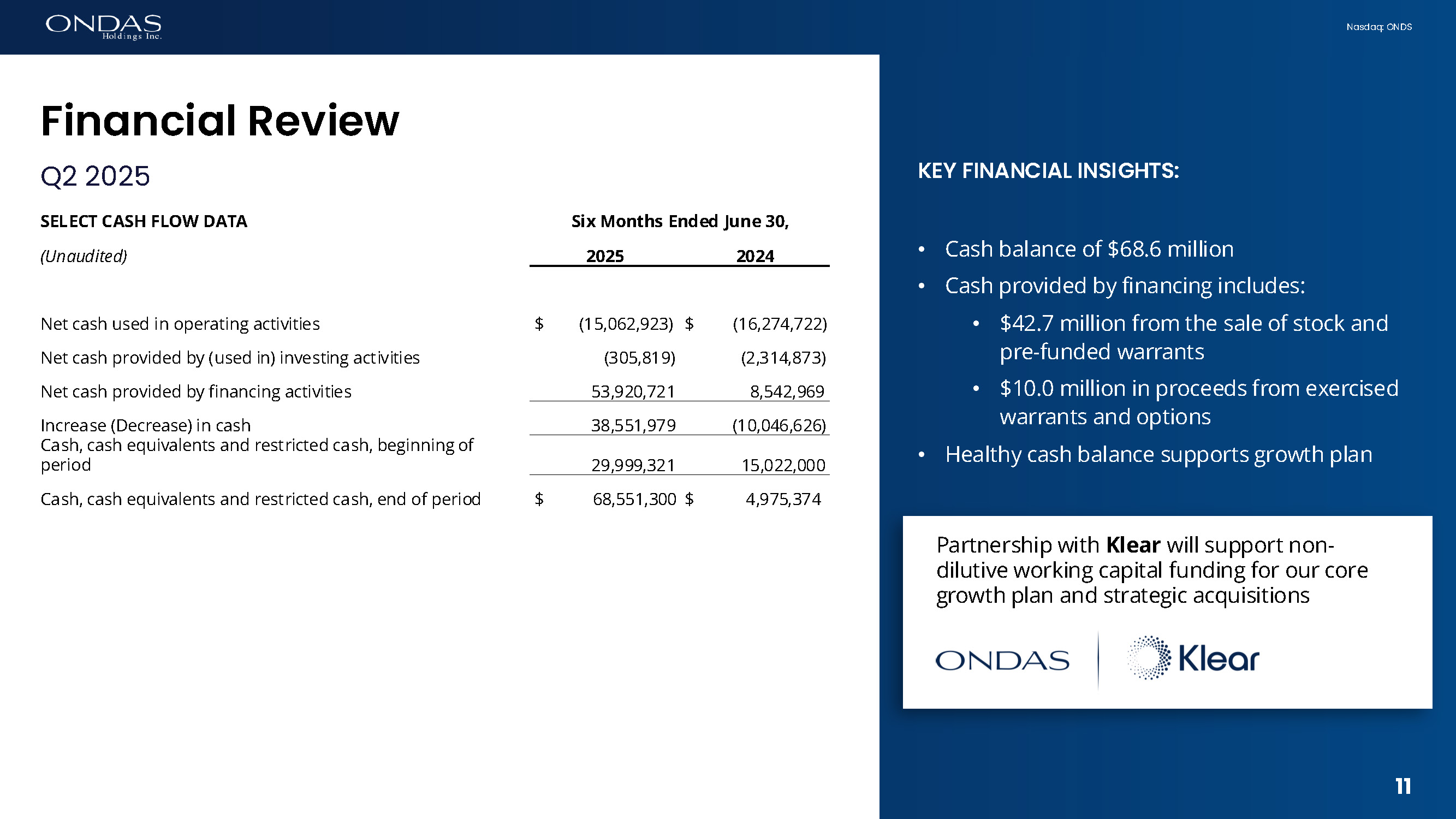

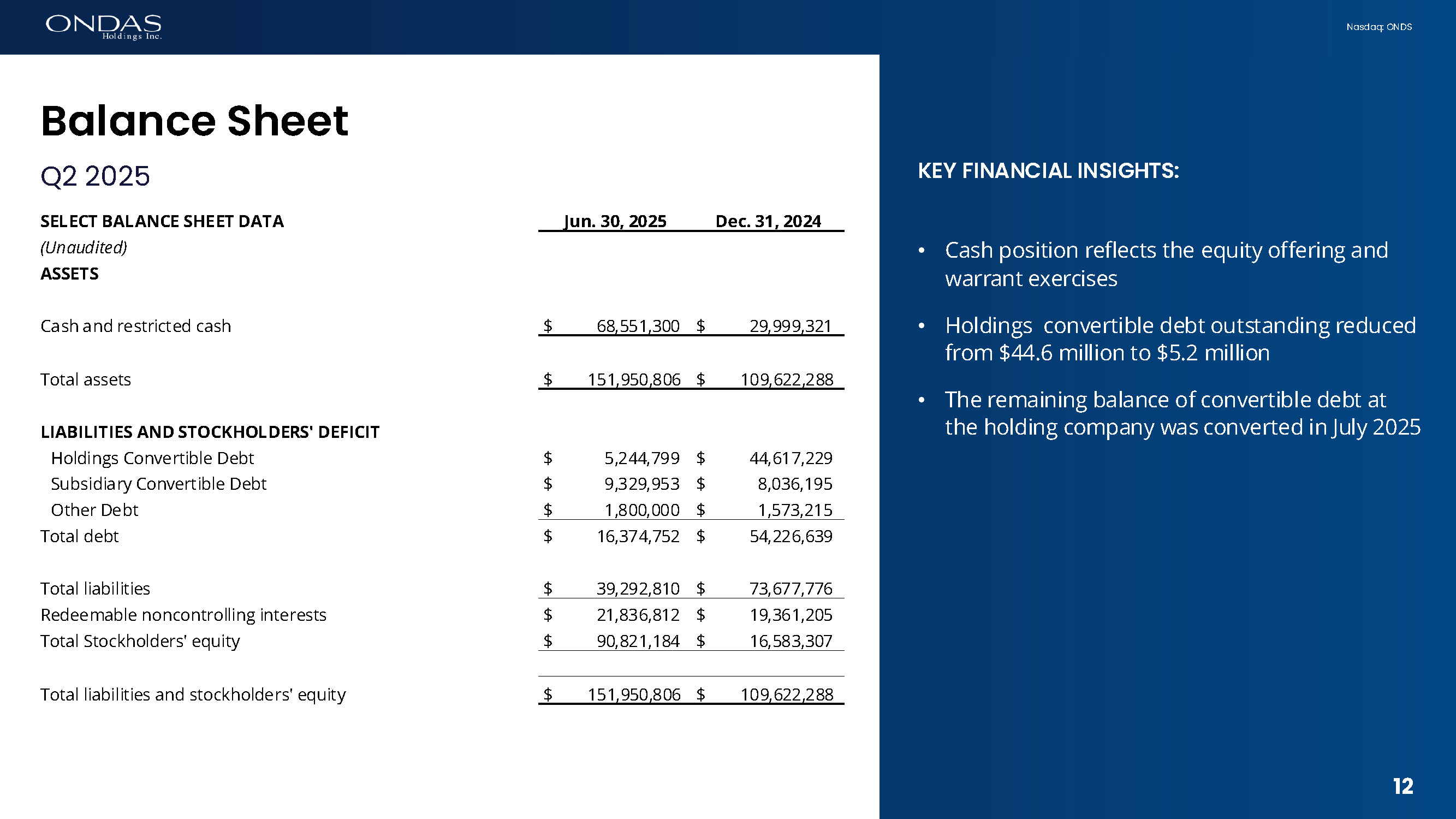

Ondas ended the quarter with $68.6 million in cash and restricted cash, compared to $30.0 million as of December 31, 2024. Cash flows from financing activities in the six-month period were $53.9 million including $42.7 million from the sale of stock and pre-funded warrants (net of expenses) and $10.0 million from the exercise of warrants and options. Cash used in operating activities improved to $15.1 million in the current period from $16.3 million in the first half of 2024.

Convertible debt outstanding, net of issuance costs, was $14.6 million as of June 30, 2025, a significant decrease from $52.7 million as of December 31, 2024. The decrease was driven by the partial conversion of the holding company debt into equity. The balance of the holding company convertible debt was converted into equity in July 2025.

As a result of the financing activities and the debt conversions, total shareholders’ equity increased to $90.8 million as of June 30, 2025, an increase of $74.2 million from $16.6 million as of December 31, 2024.

Operational and Financial Outlook

The Company expects to generate strong growth and maintains a revenue target of at least $25 million for 2025. This would be a record year and represent nearly 250% growth year-over-year from 2024. Growth will be led by our OAS business unit which we expect to generate over $20 million in revenue. This outlook is supported by results to date and $22.0 million in backlog at the end of Q2 2025, as well as our visibility on expected production and delivery schedules with customers. Revenue expectations for Ondas Networks currently are primarily related to existing and expected development programs and modest system sales due to the current lack of firm commitments on rail network buildout timelines.

Bookings and revenue growth are expected to fluctuate from quarter-to-quarter given the variability around both expected orders associated with program expansion with existing customers, as well as the timing of the addition of new customers at OAS, and the timing of rail network buildouts for Ondas Networks.

Earnings Conference Call & Audio Webcast Details

An earnings conference call is scheduled for today, August 12, 2025, at 8:30 a.m. Eastern Time (5:30 a.m. Pacific Time). The conference call will also be broadcast live and available for replay here and via the investor relations section of the Company’s website at ir.ondas.com. A replay will be accessible from the investor relations website after completion of the event.

Date: Tuesday, August 12, 2025

Time: 8:30 a.m. Eastern time

Toll-free dial-in number: 844-883-3907

International dial-in number: 412-317-5798

Call participant pre-registration link: here The Company encourages listeners to pre-register, which allows callers to gain immediate access and bypass the live operator.

Please note that you can register at any time during the call. For those who choose not to pre-register, please call the conference telephone number 10-15 minutes prior to the start time, at which time an operator will register your name and organization.

About Ondas Holdings Inc.

Ondas Holdings Inc. (Nasdaq: ONDS) is a leading provider of autonomous drone and private wireless solutions through its business units Ondas Autonomous Systems (OAS) and Ondas Networks. Ondas’ technologies offer a powerful combination of aerial intelligence and next-generation connectivity to enhance security, operational efficiency, and data-driven decision-making across essential industries.

OAS offers a portfolio of best-in-class AI-driven defense and security drone platforms that are currently deployed globally to protect and secure sensitive locations, populations, and critical infrastructure. Operating via its wholly owned subsidiaries, American Robotics and Airobotics, OAS offers the Optimus System—the first U.S. FAA-certified sUAS for automated aerial security and data capture—and the Iron Drone Raider—an autonomous counter-UAS system designed to neutralize hostile drones.

Ondas Networks provides software-defined wireless broadband technology through its FullMAX platform, based on the IEEE 802.16t standard. This standards-based system delivers high-performance connectivity for mission-critical IoT applications in markets such as rail, utilities, oil and gas, transportation, and government.

For additional information on Ondas Holdings: www.ondas.com, X and LinkedIn

For Ondas Autonomous Systems: LinkedIn

For Airobotics: www.airoboticsdrones.com, X and LinkedIn

For American Robotics: www.american-robotics.com, X and LinkedIn

For Ondas Networks: www.ondasnetworks.com, X and LinkedIn

Non-GAAP Financial Measure

As required by the rules of the Securities and Exchange Commission (“SEC”), we provide a reconciliation of Adjusted EBITDA and cash operating expenses, the non-GAAP financial measures, contained in this press release to the most directly comparable measures under GAAP, which reconciliations are set forth in the tables below.

We believe that Adjusted EBITDA and cash operating expenses facilitate analysis of our ongoing business operations because such measures exclude items that may not be reflective of, or are unrelated to, the Company’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate Adjusted EBITDA and cash operating expenses differently, and therefore our measures may not be comparable to similarly titled measures used by other companies. Adjusted EBITDA and cash operating expenses should only be used as supplemental measures of our operating performance.

We believe that Adjusted EBITDA improves comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the table below, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses.

We believe that cash operating expenses improve comparability from period to period by removing the impact of depreciation, amortization and stock-based compensation as set out in the tables below, which management has determined are not reflective of core operating expenses and thereby assist investor with assessing trend in our underlying business.

Management uses Adjusted EBITDA and cash operating expenses in making financial, operating, and planning decisions and evaluating the Company’s ongoing performance.

Forward-Looking Statements

Statements made in this release that are not statements of historical or current facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We caution readers that forward-looking statements are predictions based on our current expectations about future events. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Our actual results, performance, or achievements could differ materially from those expressed or implied by the forward-looking statements as a result of a number of factors, including the risks discussed under the heading “Risk Factors” discussed under the caption “Item 1A. Risk Factors” in Part I of our most recent Annual Report on Form 10-K or any updates discussed under the caption “Item 1A. Risk Factors” in Part II of our Quarterly Reports on Form 10-Q and in our other filings with the SEC. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law.

Contacts

IR Contact for Ondas Holdings Inc.

888.350.9994

ir@ondas.com

Media Contact for Ondas

Escalate PR

ondas@escalatepr.com

Preston Grimes

Marketing Manager, Ondas Holdings Inc.

Preston.grimes@ondas.com

ONDAS HOLDINGS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| June 30, | December 31, | |||||||

| 2025 | 2024 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | 67,567,978 | $ | 29,958,106 | ||||

| Restricted cash | 983,322 | 41,215 | ||||||

| Accounts receivable, net | 5,382,704 | 5,223,182 | ||||||

| Inventory, net | 11,190,963 | 9,821,692 | ||||||

| Other current assets | 6,084,586 | 2,476,356 | ||||||

| Total current assets | 91,209,553 | 47,520,551 | ||||||

| Property and equipment, net | 2,483,708 | 2,586,691 | ||||||

| Other Assets: | ||||||||

| Goodwill, net of accumulated impairment charges | 27,751,921 | 27,751,921 | ||||||

| Intangible assets, net | 25,084,291 | 27,178,057 | ||||||

| Deposits and other assets | 706,023 | 663,073 | ||||||

| Operating lease right of use assets | 4,715,310 | 3,921,995 | ||||||

| Total other assets | 58,257,545 | 59,515,046 | ||||||

| Total assets | $ | 151,950,806 | $ | 109,622,288 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | 4,766,014 | $ | 5,659,643 | ||||

| Operating lease liabilities | 1,522,279 | 1,121,565 | ||||||

| Accrued expenses and other current liabilities | 4,822,251 | 4,719,214 | ||||||

| Notes payable, net of unamortized debt discount and issuance costs of $0 and $226,785, respectively, related party | 1,500,000 | 1,273,215 | ||||||

| Convertible notes payable, net of unamortized debt discount and issuance cost of $119,570 and $362,237, respectively, related party | 5,350,430 | 5,137,763 | ||||||

| Convertible notes payable, net of unamortized debt discount and issuance cost of $1,005,678 and $5,236,362, respectively | 9,224,322 | 31,947,445 | ||||||

| Deferred revenue | 3,364,533 | 329,025 | ||||||

| Government grant liability | 939,686 | 388,752 | ||||||

| Total current liabilities | 31,489,515 | 50,576,622 | ||||||

| Long-Term Liabilities: | ||||||||

| Notes payable | 300,000 | 300,000 | ||||||

| Convertible notes payable, net of current, net of unamortized debt discount and issuance cost of $0 and $1,681,784, respectively | - | 15,568,216 | ||||||

| Accrued interest | 19,848 | 20,041 | ||||||

| Government grant liability, net of current | 2,086,253 | 2,168,430 | ||||||

| Operating lease liabilities, net of current | 5,314,694 | 4,961,967 | ||||||

| Other liabilities | 82,500 | 82,500 | ||||||

| Total long-term liabilities | 7,803,295 | 23,101,154 | ||||||

| Total liabilities | 39,292,810 | 73,677,776 | ||||||

| Commitments and Contingencies | ||||||||

| Temporary Equity | ||||||||

| Redeemable noncontrolling interest | 21,836,812 | 19,361,205 | ||||||

| Stockholders’ Equity | ||||||||

| Preferred stock - par value $0.0001; 5,000,000 shares authorized and none issued or outstanding at June 30, 2025 and December 31, 2024 | - | - | ||||||

| Preferred stock, Series A - par value $0.0001; 5,000,000 shares authorized and none issued or outstanding at June 30, 2025 and December 31, 2024 | - | - | ||||||

| Common Stock - par value $0.0001; 400,000,000 and 300,000,000 shares authorized at June 30, 2025 and December 31, 2024, respectively; 206,732,666 and 93,173,191 issued and outstanding, respectively June 30, 2025 and December 31, 2024, respectively | 20,673 | 9,317 | ||||||

| Additional paid in capital | 352,054,834 | 252,941,813 | ||||||

| Accumulated deficit | (261,254,323 | ) | (236,367,823 | ) | ||||

| Total stockholders’ equity | 90,821,184 | 16,583,307 | ||||||

| Total liabilities and stockholders’ equity | $ | 151,950,806 | $ | 109,622,288 | ||||

ONDAS HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Revenues, net | $ | 6,273,388 | $ | 957,851 | $ | 10,521,570 | $ | 1,582,860 | ||||||||

| Cost of goods sold | 2,941,318 | 1,148,746 | 5,700,950 | 2,168,737 | ||||||||||||

| Gross profit | 3,332,070 | (190,895 | ) | 4,820,620 | (585,877 | ) | ||||||||||

| Operating expenses: | ||||||||||||||||

| General and administration | 6,078,531 | 4,163,987 | 11,987,929 | 8,062,076 | ||||||||||||

| Sales and marketing | 2,265,715 | 1,308,705 | 4,695,825 | 2,629,854 | ||||||||||||

| Research and development | 4,236,928 | 2,640,003 | 7,696,408 | 6,152,978 | ||||||||||||

| Total operating expenses | 12,581,174 | 8,112,695 | 24,380,162 | 16,844,908 | ||||||||||||

| Operating loss | (9,249,104 | ) | (8,303,590 | ) | (19,559,542 | ) | (17,430,785 | ) | ||||||||

| Other income (expense), net | ||||||||||||||||

| Other income (expense), net | (17,204 | ) | 257 | (18,366 | ) | (2,067 | ) | |||||||||

| Change in fair value of government grant liability | (143,349 | ) | 623,409 | (267,374 | ) | 549,017 | ||||||||||

| Interest income | 250,340 | 87,276 | 451,146 | 184,777 | ||||||||||||

| Interest expense | (1,560,512 | ) | (703,551 | ) | (5,428,369 | ) | (1,486,162 | ) | ||||||||

| Foreign exchange gain (loss), net | (30,321 | ) | 26,463 | (63,995 | ) | 39,400 | ||||||||||

| Total other income (expense), net | (1,501,046 | ) | 33,854 | (5,326,958 | ) | (715,035 | ) | |||||||||

| Loss before income taxes | (10,750,150 | ) | (8,269,736 | ) | (24,886,500 | ) | (18,145,820 | ) | ||||||||

| Provision for income taxes | - | - | - | - | ||||||||||||

| Net loss | (10,750,150 | ) | (8,269,736 | ) | (24,886,500 | ) | (18,145,820 | ) | ||||||||

| Less preferred dividends attributable to noncontrolling interest | 390,000 | 390,000 | 780,000 | 724,138 | ||||||||||||

| Less deemed dividends attributable to accretion of redemption value | 878,480 | 718,494 | 1,695,607 | 1,357,140 | ||||||||||||

| Net loss attributable to common stockholders | $ | (12,018,630 | ) | $ | (9,378,230 | ) | $ | (27,362,107 | ) | $ | (20,227,098 | ) | ||||

| Net loss per share - basic and diluted | $ | (0.08 | ) | $ | (0.14 | ) | $ | (0.21 | ) | $ | (0.31 | ) | ||||

| Weighted average number of common shares outstanding, basic and diluted | 150,652,998 | 66,377,505 | 127,955,008 | 64,706,314 | ||||||||||||

ONDAS HOLDINGS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Six Months Ended | ||||||||

| June 30, | ||||||||

| 2025 | 2024 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (24,886,500 | ) | $ | (18,145,820 | ) | ||

| Adjustments to reconcile net loss to net cash flows used in operating activities: | ||||||||

| Depreciation | 369,689 | 234,305 | ||||||

| Amortization of debt discount and issuance costs | 4,496,595 | 994,705 | ||||||

| Amortization of intangible assets | 2,117,175 | 2,105,588 | ||||||

| Amortization of right of use asset | 559,570 | 466,156 | ||||||

| Retirement of assets | - | 1,578 | ||||||

| Loss on intellectual property | 15,704 | - | ||||||

| Change in fair value of government grant liability | 111,074 | (692,196 | ) | |||||

| Stock-based compensation | 3,751,338 | 677,550 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (159,522 | ) | 1,138,730 | |||||

| Inventory | (1,369,271 | ) | (2,371,081 | ) | ||||

| Other current assets | (3,608,230 | ) | 115,866 | |||||

| Deposits and other assets | (42,950 | ) | (109,690 | ) | ||||

| Accounts payable | (893,629 | ) | (232,044 | ) | ||||

| Accrued expenses and other current liabilities | 2,039,970 | (388,363 | ) | |||||

| Deferred revenue | 3,035,508 | 8,335 | ||||||

| Operating lease liability | (599,444 | ) | (160,841 | ) | ||||

| Other liabilities | - | 82,500 | ||||||

| Net cash flows used in operating activities | (15,062,923 | ) | (16,274,722 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Patent costs | (27,748 | ) | (18,698 | ) | ||||

| Purchase of equipment | (266,706 | ) | (2,282,237 | ) | ||||

| Proceeds from sale of equipment | - | 1,700 | ||||||

| Purchase of software intangible | (11,365 | ) | (15,638 | ) | ||||

| Net cash flows used in investing activities | (305,819 | ) | (2,314,873 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Proceeds from sale of noncontrolling interest in Ondas Networks, net of issuance costs | - | 4,375,035 | ||||||

| Proceeds from sale of common stock and Pre-Funded Warrants, net of issuance costs | 42,677,083 | 3,859,394 | ||||||

| Proceeds from exercise of options and warrants | 9,962,597 | 8,702 | ||||||

| Proceeds from convertible notes payable, net of issuance costs | 923,358 | - | ||||||

| Proceeds from government grant | 364,683 | 299,838 | ||||||

| Payments on government grant liability | (7,000 | ) | - | |||||

| Net cash flows provided by financing activities | 53,920,721 | 8,542,969 | ||||||

| Increase (decrease) in cash, cash equivalents, and restricted cash | 38,551,979 | (10,046,626 | ) | |||||

| Cash, cash equivalents, and restricted cash, beginning of period | 29,999,321 | 15,022,000 | ||||||

| Cash, cash equivalents, and restricted cash, end of period | $ | 68,551,300 | $ | 4,975,374 | ||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | ||||||||

| Cash paid for interest | $ | 7,693 | $ | 11,923 | ||||

| Cash paid for income taxes | $ | - | $ | - | ||||

| SUPPLEMENTAL SCHEDULE OF NON-CASH FINANCING ACTIVITIES: | ||||||||

| Preferred dividends attributable to redeemable noncontrolling interest | $ | 780,000 | $ | 724,138 | ||||

| Accretion of redeemable preferred stock in Ondas Networks | $ | 1,695,607 | $ | 1,357,140 | ||||

| Common stock issued in exchange for debt repayment | $ | 47,101,915 | $ | 250,187 | ||||

| Noncash consideration for settlement of development agreement payable | $ | - | $ | 342,428 | ||||

| Warrants in Ondas Autonomous Systems, in relation to sale of common stock | $ | - | $ | 954,737 | ||||

| Warrants in relation to sale of redeemable preferred stock in Ondas Networks | $ | - | $ | 1,471,194 | ||||

| Warrants in Ondas Networks, in relation to notes payable and convertible notes payable | $ | 345,403 | $ | - | ||||

| Transfer of equipment into inventory | $ | - | $ | 398,046 | ||||

| Operating leases right-of-use assets obtained in exchange of lease liabilities | $ | 1,352,885 | $ | - | ||||

ONDAS HOLDINGS INC.

RECONCILIATIONS OF ADJUSTED EBITDA

(Unaudited)

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Net Loss | $ | (10,750,150 | ) | $ | (8,269,736 | ) | $ | (24,886,500 | ) | $ | (18,145,820 | ) | ||||

| Depreciation | 188,980 | 111,234 | 369,689 | 234,305 | ||||||||||||

| Amortization of intangible assets | 1,055,306 | 1,053,377 | 2,117,175 | 2,105,588 | ||||||||||||

| Other (income) expense, net(1) | 1,501,046 | (33,854 | ) | 5,326,958 | 715,035 | |||||||||||

| Stock-based compensation | 2,178,693 | 407,997 | 3,751,338 | 677,550 | ||||||||||||

| Adjusted EBITDA | $ | (5,826,125 | ) | $ | (6,730,982 | ) | $ | (13,321,340 | ) | $ | (14,413,342 | ) | ||||

| (1) | Other (income) expense, net includes interest income, interest expense, foreign exchange gain (loss), net, change in fair value of government grant liability, and other income (expense), net included on the Company’s Condensed Consolidated Statements of Operations. |

ONDAS HOLDINGS INC.

RECONCILIATIONS OF CASH OPERATING EXPENSES

(Unaudited)

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Total operating expenses | $ | 12,581,174 | $ | 8,112,695 | $ | 24,380,162 | $ | 16,844,908 | ||||||||

| Depreciation | (188,980 | ) | (111,234 | ) | (369,689 | ) | (234,305 | ) | ||||||||

| Amortization of intangible assets | (1,055,306 | ) | (1,053,377 | ) | (2,117,175 | ) | (2,105,588 | ) | ||||||||

| Stock-based compensation | (1,985,554 | ) | (388,889 | ) | (3,424,196 | ) | (640,502 | ) | ||||||||

| Cash operating expenses | $ | 9,351,334 | $ | 6,559,195 | $ | 18,469,102 | $ | 13,864,513 | ||||||||

Exhibit 99.2

Nasdaq: ONDS 1 Secofid Qu6rter 2025 E6rfiifigs Rele6se Copyright 2025. All rights reserved.

NASDAQ: ONDS | August 12, 2025 Nasdaq: ONDS This presentation may contain "forward - looking statements" as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning . Ondas Holdings Inc . (“Ondas” or the “Company”) cautions readers that forward - looking statements are predictions based on its current expectations about future events . These forward - looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict . The Company’s actual results, performance, or achievements could differ materially from those expressed or implied by the forward - looking statements as a result of a number of factors, including, the risks discussed under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10 - K filed with the U . S . Securities and Exchange Commission (“SEC”), in the Company’s Quarterly Reports on Form 10 - Q filed with the SEC, and in the Company’s other filings with the SEC . The Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law . Also, this presentation contains certain non - GAAP financial measures . For a description of these non - GAAP financial measures, including reconciliations to the most comparable measure under GAAP, see the Appendix to this presentation . Information in this presentation is not an offer to sell securities or the solicitation of an offer to buy securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction . 2 Discl6imer Nasdaq: ONDS Eric Brock CHAIRMAN & CEO Eric is an entrepreneur with over 25 years of management and investing experience.

Neil L6ird CFO Neil is an experienced financial executive with over 25 years in the technology sector. Meir Klifier PRESIDENT Meir is an entrepreneur with over 20 years of proven track record in aerospace development and manufacturing. M6rkus Nottelm6fifi CEO Markus has extensive experience introducing new technologies into railroad markets, holding leadership roles in finance and operations across multiple companies. Oshri Lug6ssy Co - CEO Oshri is a defense and technology leader with decades of experience in autonomous systems, global business development, and military command. Le6dership Te6m 3 4 Nasdaq: ONDS Agefid6 • Introduction • Financial Review • Business Update • Ondas Networks • Ondas Autonomous Systems (OAS) • Closing Remarks • Q&A

Nasdaq: ONDS Overview 5 Momentum continues in Q2 — Record year expected • Advancing multi - year growth plan ; reiterate target for at least $25 million in revenue for 2025 • Generated $6.3 million in revenue in Q2 2025, a 555% increase from Q2 2024 • OAS delivering on and expanding existing customer programs • Iron Drone operational, expanding with initial military customer in Middle East • Optimus drone network fleet expansion continues for UAE public safety customer • OAS is capturing new programs ; pipeline is growing and maturing • Iron Drone order with NATO governmental entity operational at international airport • Successful Iron Drone pilot with major Asian homeland security organization • Additional military / HLS customers expected in 2025 • Ondas Networks targeting dot16 with multiple Railroad networks and applications • IEEE announced the ratification of the IEEE 802.16t ( dot16 ) wireless standard • dot16 selected as NGHE communications platform by the AAR Nasdaq: ONDS Executifig our Pl6fi 6 Demonstrating traction with our financial model • Executing multiple programs for Optimus and Iron Drone with military and public safety • OAS has secured $39 million of orders in last 12 months • Consolidated backlog has grown to $22 million from $10 million at Q4 2024 • Growing operational footprint in U.S. and Europe to support scaled platform adoption • American Robotics U.S. footprint to deploy OAS’ platform technologies and value - added services • Important ecosystem partnerships to support S&M, production and field support • Launched strategic M&A program with strong and mature target pipeline, supported by strong growth of core business and strong balance sheet • Announced Rift Dynamics partnership agreement for Wåsp , a low - cost attritable drone • Strong balance sheet and liquidity position • Convertible notes at Ondas Holdings have been fully retired via equity conversion • Strong capital base with $68.6 million of cash as of Q2 2025 • Expanded KLEAR partnership supporting M&A program and working capital

Nasdaq: ONDS F6vor6ble Policy Rem6ifis 6 T6ilwifid 7 FAA ushers in BVLOS rulemaking intended to open the skies • BVLOS (Beyond Visual Line if Sight) Enablement – FAA rulemaking supports nationwide deployment of autonomous drones like Optimus and Iron Drone Raider • Infrastructure Airspace Access – Section 2209 grants operators exclusive flight rights over critical infrastructure, benefiting secure drone operations • Federal CUAS Investment – New funding and training initiatives fuel demand for counter - drone technologies like Iron Drone Raider • Buy American Advantage – Executive Orders prioritize U.S.

- built drones, boosting demand for NDAA - compliant platforms • FAA Part 108 Regulation – New framework transitions industry to certified operations, accelerating adoption in public safety and defense sectors • OBBBA Policy Acceleration – Expands federal funding for autonomous drone adoption across defense, HLS, and infrastructure markets We believe Ondas is a significant beneficiary in the advancement of BVLOS regulations Nasdaq: ONDS Rift Dyfi6mics Ondas' investment in Rift Dynamics strengthens its positioning in the defense drone space • Wåsp adds a low - cost, attritable drone to Ondas' existing portfolio • Complements Optimus and Iron Drone Raider with loitering strike capability • Establishing a European partner for NATO - aligned capabilities • Enhances U.S. go - to - market strategy through exclusive partner rights • Aligns with high - priority U.S. DoD programs being pursued by American Robotics • Addresses large DOD budget line items; and $1.0 billion segment outline in the OBBBA Rift Dynamics leadership & Wåsp Advantage Pedigree 20,000+ units/ month global capacity; initial 500 unit order planned via American Robotics Industrial Readiness “Cheap to use, cheap to lose” mission pricing Affordability Payload - agnostic design, AI/autonomy roadmap underway Modularity NDAA, Military Open 1A, and EASA C2 certifications Compliance Exclusive U.S. rights with early traction via American Robotics Go - to - Market Velocity Veteran team from Nordic Unmanned, Kongsberg, and Norwegian Special Forces, led by Knut Roar Wiig (NU founder) Leadership 8 FINANCIAL REVIEW Nasdaq: ONDS 9 First Quarter 2025 Earnings Release Copyright 2025.

All rights reserved. NASDAQ: ONDS | August 13, 2025

Nasdaq: ONDS KEY FINANCIAL INSIGHTS: 10 10 (1) See the “Non - GAAP Financial Measures” section in the Appendix. • P&L reflects early stage of initial platform adoption for Ondas Networks and OAS • Expect gross margin to remain variable as product mix shifts • Increase in cash operating expenses to support growth of OAS backlog and strategic initiatives • Adjusted EBITDA improved $905k YoY Fifi6fici6l Review Q2 2025 Three Months Ended June 30, SELECT P&L DATA 2024 2025 (Unaudited) $ 957,851 $ 6,273,388 Revenues, net 1,148,746 2,941,318 Cost of goods sold (190,895) 3,332,070 Gross profit 8,112,695 12,581,174 Total operating expenses $ (8,303,590) $ (9,249,104) Operating Loss $ (8,269,736) $ (10,750,150) Net Loss $ 6,559,195 $ 9,351,334 Cash Operating Expenses (1) $ (6,730,982) $ (5,826,125) Adjusted EBITDA (1)

Nasdaq: ONDS KEY FINANCIAL INSIGHTS: • Cash balance of $68.6 million • Cash provided by financing includes: • $42.7 million from the sale of stock and pre - funded warrants • $10.0 million in proceeds from exercised warrants and options • Healthy cash balance supports growth plan Fifi6fici6l Review Q2 2025 Six Months Ended June 30, SELECT CASH FLOW DATA 2024 2025 (Unaudited) $ (16,274,722) $ (15,062,923) Net cash used in operating activities (2,314,873) (305,819) Net cash provided by (used in) investing activities 8,542,969 53,920,721 Net cash provided by financing activities (10,046,626) 38,551,979 Increase (Decrease) in cash 15,022,000 29,999,321 Cash, cash equivalents and restricted cash, beginning of period $ 4,975,374 $ 68,551,300 Cash, cash equivalents and restricted cash, end of period Partnership with Klear will support non - dilutive working capital funding for our core growth plan and strategic acquisitions 11 11 Nasdaq: ONDS KEY FINANCIAL INSIGHTS: 11 12 • Cash position reflects the equity offering and warrant exercises • Holdings convertible debt outstanding reduced from $44.6 million to $5.2 million • The remaining balance of convertible debt at the holding company was converted in July 2025 B6l6fice Sheet Q2 2025 Dec. 31, 2024 Jun. 30, 2025 SELECT BALANCE SHEET DATA (Unaudited) ASSETS $ 29,999,321 $ 68,551,300 Cash and restricted cash $ 109,622,288 $ 151,950,806 Total assets LIABILITIES AND STOCKHOLDERS' DEFICIT $ 44,617,229 $ 5,244,799 Holdings Convertible Debt $ 8,036,195 $ 9,329,953 Subsidiary Convertible Debt $ 1,573,215 $ 1,800,000 Other Debt $ 54,226,639 $ 16,374,752 Total debt $ 73,677,776 $ 39,292,810 Total liabilities $ 19,361,205 $ 21,836,812 Redeemable noncontrolling interests $ 16,583,307 $ 90,821,184 Total Stockholders' equity $ 109,622,288 $ 151,950,806 Total liabilities and stockholders' equity

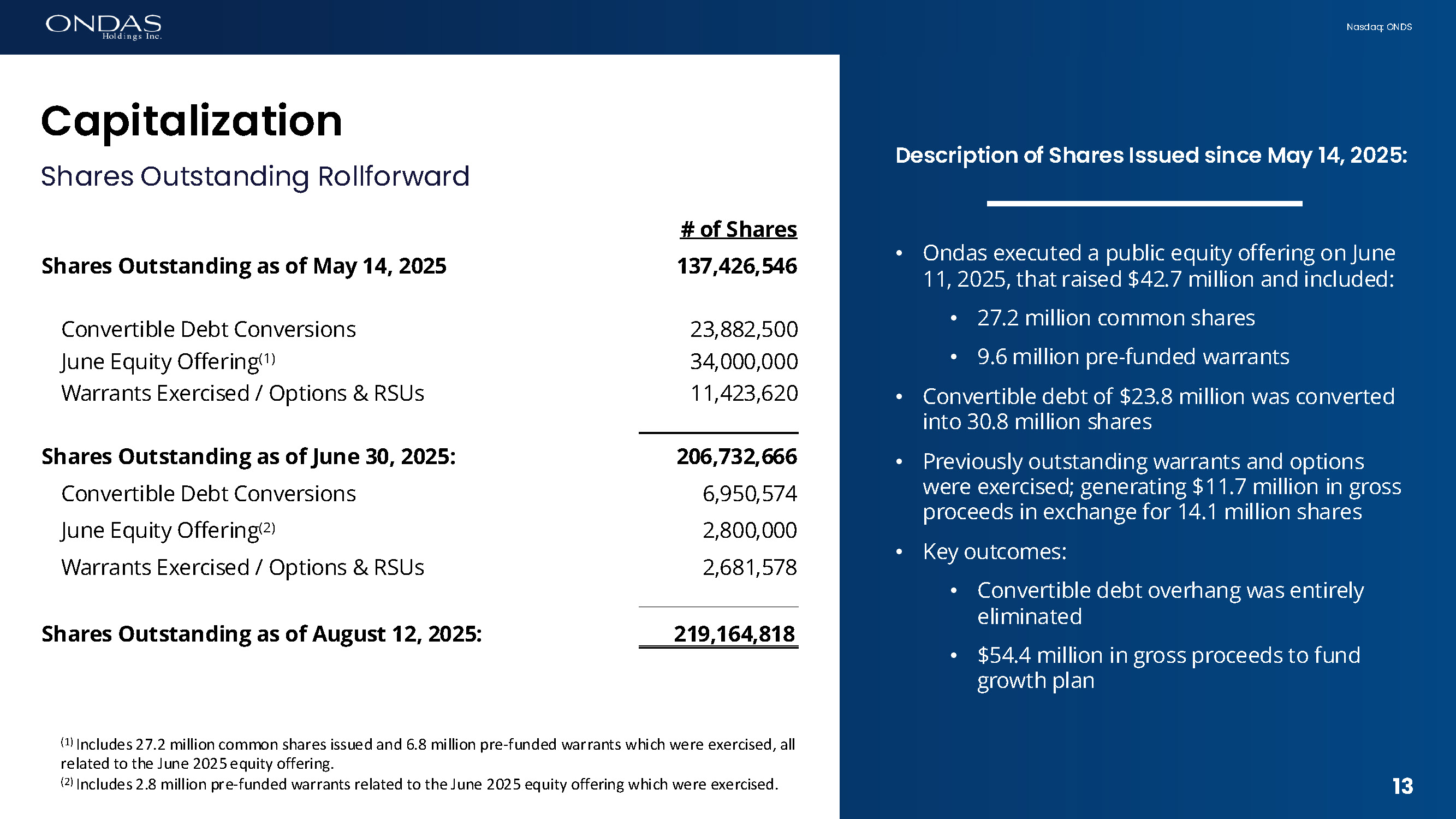

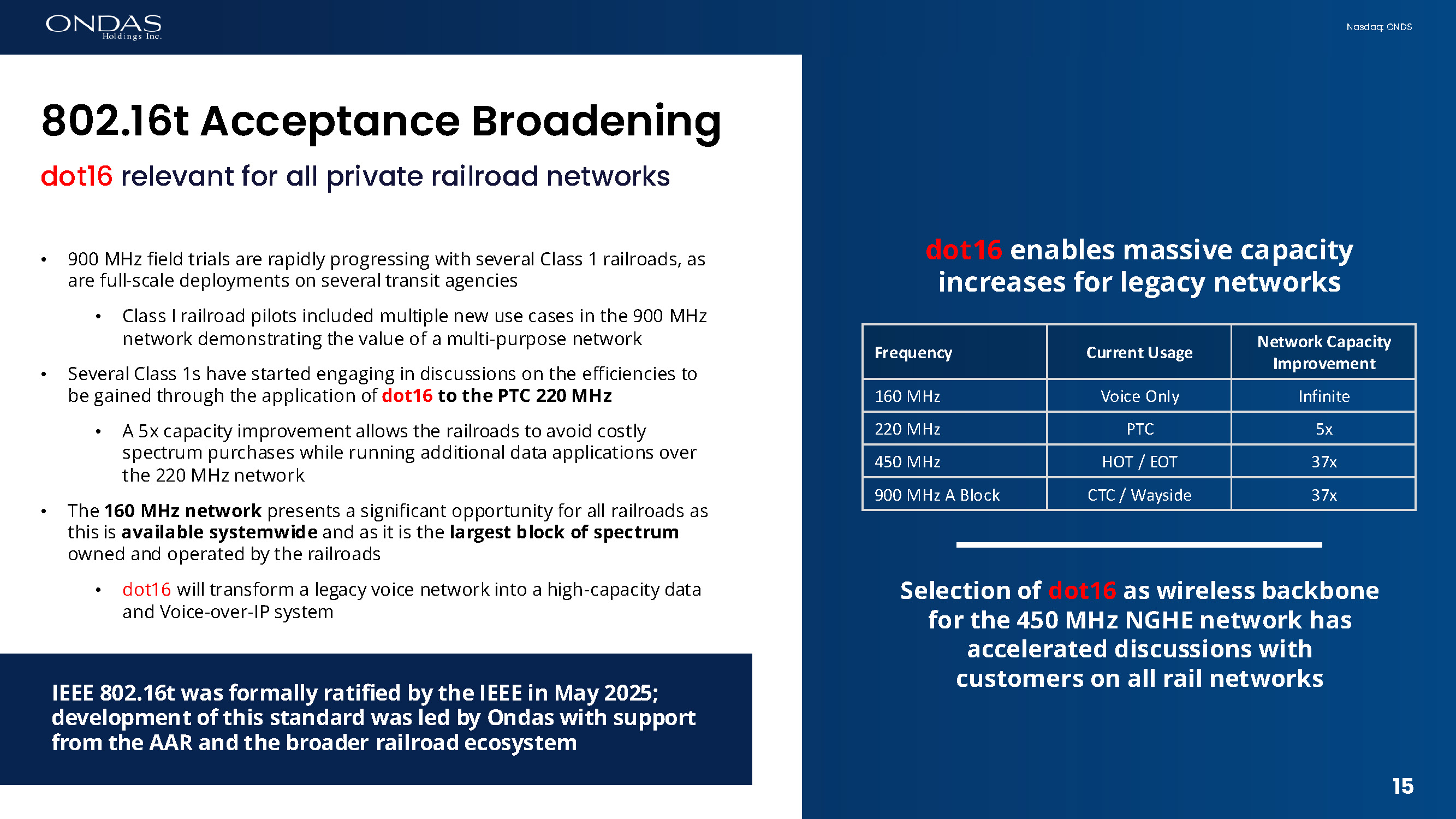

13 Nasdaq: ONDS 13 C6pit6liz6tiofi Shares Outstanding Rollforward # of Shares 137,426,546 Shares Outstanding as of May 14, 2025 23,882,500 Convertible Debt Conversions 34,000,000 June Equity Offering(1) 11,423,620 Warrants Exercised / Options & RSUs 206,732,666 Shares Outstanding as of June 30, 2025: 6,950,574 Convertible Debt Conversions 2,800,000 June Equity Offering (2) 2,681,578 Warrants Exercised / Options & RSUs 219,164,818 Shares Outstanding as of August 12, 2025: (1) Includes 27.2 million common shares issues and 6.8 million pre - funded warrants which were exercised, all related to the June X, 2025 equity offering. (2) Includes 2.8 million pre - funded warrants related to the June 11, 2025 offering. Descriptiofi of Sh6res Issued sifice M6y 14, 2025: • Ondas executed a public equity offering on June 11, 2025, that raised $42.7 million and included: • 27.2 million common shares • 9.6 million pre - funded warrants • Convertible debt of $23.8 million was converted into 30.8 million shares • Previously outstanding warrants and options were exercised; generating $11.7 million in gross proceeds in exchange for 14.1 million shares • Key outcomes: • Convertible debt overhang was entirely eliminated • $54.4 million in gross proceeds to fund growth plan Nasdaq: ONDS 802.16t Accept6fice Bro6defiifig dot16 relevant for all private railroad networks • 900 MHz field trials are rapidly progressing with several Class 1 railroads, as are full - scale deployments on several transit agencies.

• Class I railroad pilots included multiple new use cases in the 900 MHz network demonstrating the value of a multi - purpose network • Several Class 1s have started engaging in discussions on the efficiencies to be gained through the application of dot16 to the PTC 220 MHz • A 5x capacity improvement allows the railroads to avoid costly spectrum purchases while running additional data applications over the 220 MHz network • The 160 MHz network presents a significant opportunity for all railroads as this is available systemwide and as it is the largest block of spectrum owned and operated by the railroads.

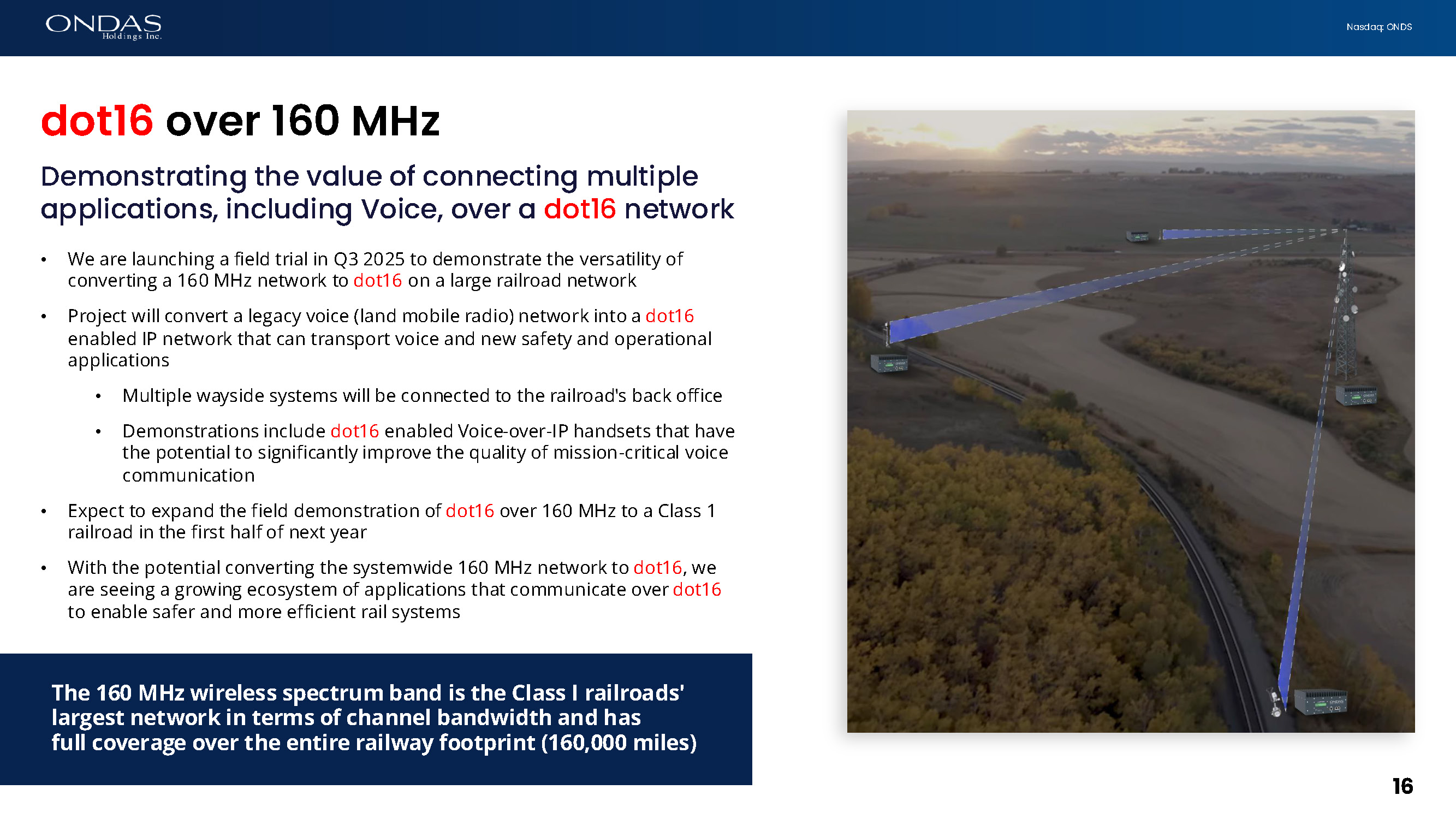

• dot16 will transform a legacy voice network into a high - capacity data and Voice - over - IP system dot16 enables massive capacity increases for legacy networks Selection of dot16 as wireless backbone for the 450 MHz NGHE network has accelerated discussions with customers on all rail networks Network Capacity Improvement Current Usage Frequency Infinite Voice Only 160 MHz 5x PTC 220 MHz 37x HOT / EOT 450 MHz 37x CTC / Wayside 900 MHz A Block 15 15 IEEE 802.16t was formally ratified by the IEEE in May 2025; development of this standard was led by Ondas with support from the AAR and the broader railroad ecosystem Nasdaq: ONDS dot16 over 160 MHz Demonstrating the value of connecting multiple applications, including Voice, over a dot16 network • We are launching a field trial in Q3 2025 to demonstrate the versatility of converting a 160 MHz network to dot16 on a large railroad network • Project will convert a legacy voice (land mobile radio) network into a dot16 enabled IP network that can transport voice and new safety and operational applications • Multiple wayside systems will be connected to the railroad's back office • Demonstrations include dot16 enabled Voice - over - IP handsets that have the potential to significantly improve the quality of mission - critical voice communication • Expect to expand the field demonstration of dot16 over 160 MHz to a Class 1 railroad in the first half of next year • With the potential converting the systemwide 160 MHz network to dot 16 , we are seeing a growing ecosystem of applications that communicate over dot 16 to enable safer and more efficient rail systems The 160 MHz wireless spectrum band is the Class I railroads' largest network in terms of channel bandwidth and has full coverage over the entire railway footprint (160,000 miles) 16 Nasdaq: ONDS G6ifiifig Momefitum 17 Progress on ongoing projects and responding to new customer opportunities • Continuing support for 900 MHz system deployments • Migration to new 900 MHz A - Block for primary use progressing • 900 MHz as an alternative path for 220 MHz applications • Field testing 900 MHz equipment to provide a general - purpose network in dark territory for a Class 1 rail operator • Amtrak 220 MHz PTC data radio program on track • Expect delivery of PTC data radios to start this quarter • Engaging with NEC operators on additional opportunities • NGHE Applications • MxV is driving finalization of the NGHE 4.0 standard by end of year • Engaging with HOT / EOT vendors to commercialize next gen products • Delivering solutions for big data challenges related to mission - critical inspections and field work

Nasdaq: ONDS • Generated $6.1 million in revenues for Q2 2025; captured $23.3 million in orders YTD • More than 6 - fold increase from the same period in 2024 • OAS backlog growth continued; supported by growing global demand for the Optimus and Iron Drone platforms • Secured $3.8 million orders for expansion and support of the Optimus Drone Network in UAE • Secured $14.3 million Optimus System order from a major defense customer • Secured and executed orders for two new defense/ HLS customers for Iron Drone • $3.4 million order securing critical locations for NATO member country • $1.7 million order for border security for major governmental customer in Asia • Expect both pilots to become infrastructure deployment programs • Secured a purchase order from a major U.S.

urban public safety agency for the Kestrel System 19 19 OAS Highlights Defense and Homeland Security Expansion Continues Nasdaq: ONDS Exp6fisiofi Highlights 19 20 World Tour Continues • Iron Drone’s demonstration tour continued opening many new opportunities in global markets • Engaged directly with top - tier defense and public safety stakeholders • Completed two strategic programs in Europe and Asia; continuing with more relevant projects to accelerate our global expansion • Participating in Project Vanaheim – a joint collaborative project of the United States and United Kingdom initiated to “shape the future” of C - UAS capabilities • World tour is unlocking new integrations to other C2 and detections systems • Creates new partnerships to accelerate larger market opportunities • Integrations validate the flexibility, modularity and robustness of the Iron Drone Raider Plans for new demos with key US entities such as USAF, NYPD and others...

participating in Interpol San Diego / US Southern Border CUAS Expo in September Nasdaq: ONDS Oper6tifig Pl6tform Exp6fisiofi 21 Enabling Rapid Growth • Supported by talent acquisition, building OAS as a full operating platform – not just great products, but the infrastructure to deploy them • Established new Advisory Board and appointment of Brigadier General (Res.) Yaniv Rotem • Leverages leadership experience as former Head of R&D at the Israel Ministry of Defense • Supports global defense partnerships and accelerated scaling of OAS’s Optimus and Iron Drone Raider programs • Senior leadership and talent added in key financial, marketing, and supply chain responsibilities • Launched a strategic M&A program to accelerate growth. • Acquired Zickel Engineering in July 2025, adding an elite engineering team and expanding our capabilities: • Addressing the highest end of the market for defense systems • Carries important classifications and certifications supporting important defense industry customers and ecosystem partners and vendors Brigadier General (Res.) Yaniv Rotem.

Nasdaq: ONDS Product Ro6dm6p 6fid Productiofi Enhancing Product Capabilities and Streamlining Production • Expanded technical and field operations infrastructure to support increased production capacity, field deployments, and long - term program scaling for defense and homeland security markets • Continued development and integration of Physical AI - enabled mission planning and real - time engagement software across both the Optimus and Iron Drone platforms • Integrated the Iron Drone Raider with leading, drone detection systems and widely deployed C2 systems used by NATO - allied end users • Integration is a key driver of our product distribution strategy • More partnerships and integrations expected in the 2H 2025 22 Nasdaq: ONDS Update on GreenUAS Optimus is making substantial progress – stay tuned Iron Drone will be submitted in Q3 Effective July 2025, GreenUAS are automatically added to the BlueUAS cleared list Acceler6tifig U.S. Exp6fisiofi Establishing scalable operating platform • Mistral provides strategic access to Federal procurement channels • 30+ years of deep contracting expertise and agency relationships in U.S. defense and homeland security • Driving business development for Iron Drone Raider and Optimus platform • Mistral focused on U.S. DoD, DHS, public safety & other governmental markets • Goal is to capture at least one DoD order by the end of 2025 • Expansive Replicator 2 DoD initiatives pursued on multiple fronts • Pipeline maturing across non - military end markets • Selected opportunities in U.S. pipeline • Major urban critical infrastructure / DFR program in the Northeast (> $10 million) • Fleet expansion with existing utility customer • Initial Optimus deployment planned with commercial operator at U.S. military base in 2H 2025 • Fortune 100 customer to secure campus operations • Detroit Manufacturing Systems (DMS) to support domestic production • Manufacturing at Kinetyc facility in Michigan — NDAA - compliant, Made in USA • Strengthens supply chain resilience with reduced costs and faster delivery • Improves gross margin profile through design - for - manufacture (DFM) at scale 23 23 Nasdaq: ONDS 24 First Quarter 2025 Earnings Release OUTLOOK Copyright 2025.

All rights reserved. NASDAQ: ONDS | August 13, 2025

Nasdaq: ONDS Str6tegic Growth Pl6fi Upd6te Acquisitions provide fuel for operational flywheel to drive capital efficient growth plan Organic + Strategic Growth • Lead with high value, proven reliable autonomous platforms • Advance service delivery and scalable operating capabilities to drive organic growth • Pursue strategic acquisitions to leverage global operations: • Broaden and deepen our solutions portfolio • Capture additional customers • Expand supply chain and production • Drive field support and sustainment capabilities MARKETS | CUSTOMERS Defense, homeland security, public safety, critical infrastructure and industrial TECHNOLOGY CAPABILITIES Optimus , Iron Drone , Insightful + AI and Strategic Roadmap OPERATING PLATFORM Sales and Marketing, Supply Chain, Production, Regulations, Field Services & Sustainment, Finance & Administration, Legal, & Gov’t FINANCIAL PLATFORM Access to Capital, FCF Reinvestment, Capital Allocation Transaction pipeline is robust; several deals in advanced diligence stage with attractive strategic and financial characteristics 25 25 Nasdaq: ONDS Outlook for 2025 25 26 Positioned for a record year in 2025; strong progress on all KPIs Revenue Target $fi5 Million Exp6fided Progr6ms Exp6fided Customer B6se Exp6fided P6rtfier Ecosystem Growifig Oper6tiofi6l Sc6le Growifig Str6tegic Footprifit New Military / HLS Customers 4 New Industry Partnerships 4 Control Acquisitions fi Deliver Current Backlog $fifi.0 Million 2H 2025 Bookings Target $fi3 Million +

Q&A First Quarter 2025 Earnings Release Copyright 2025. All rights reserved. NASDAQ: ONDS | August 13, 2025 28 Nasdaq: ONDS (1) See the “Non - GAAP Financial Measures” section below.

Appefidix Three Months Ended June 30, 2025 ADJUSTED EBITDA RECONCILIATION 2024 2025 (Unaudited) $ (8,269,736) $ (10,750,150) Net Loss 111,234 188,980 Depreciation (33,854) 1,501,046 Other (income) expense, net 1,053,377 1,055,306 Amortization of intangible assets 407,997 2,178,693 Stock - based compensation $ (6,730,982) $ (5,826,125) Adjusted EBITDA (1) Three Months Ended June 30, 2025 Cash Operating Expense Reconciliation 2024 2025 (Unaudited) $ 8,112,695 $ 12,581,174 Total operating expenses (111,234) (188,980) Depreciation (1,053,377) (1,055,306) Amortization of intangible assets (388,889) (1,985,554) Stock - based compensation $ 6,559,195 $ 9,351,334 Total Cash Operating Expense 29 Nasdaq: ONDS As required by the rules of the Securities and Exchange Commission ("SEC"), we provide a reconciliation of Adjusted EBITDA and cash operating expenses, the non - GAAP financial measures, contained in this press release to the most directly comparable measures under GAAP, which reconciliations are set forth in the tables below . We believe that Adjusted EBITDA and cash operating expenses facilitate analysis of our ongoing business operations because such measures exclude items that may not be reflective of, or are unrelated to, the Company's core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses . Other companies may calculate Adjusted EBITDA and cash operating expenses differently, and therefore our measures may not be comparable to similarly titled measures used by other companies . Adjusted EBITDA and cash operating expenses should only be used as supplemental measures of our operating performance . We believe that Adjusted EBITDA improves comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the table below, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses . We believe that cash operating expenses improve comparability from period to period by removing the impact of depreciation, amortization and stock - based compensation as set out in the tables below, which management has determined are not reflective of core operating expenses and thereby assist investor with assessing trend in our underlying business . Management uses Adjusted EBITDA and cash operating expenses in making financial, operating, and planning decisions and evaluating the Company's ongoing performance . Nofi - GAAP Fifi6fici6l Me6sures Copyright 2025.

All rights reserved. THANK YOU NASDAQ: ONDS | August 12, 2025