UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2025

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 001-38793

| INMUNE BIO INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada | 47-5205835 | |

| (State of incorporation) | (I.R.S. Employer Identification No.) |

225 NE Mizner Blvd., Suite 640

Boca Raton, FL 33432

(Address of principal executive office) (Zip code)

(561) 710-0512

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.001 per share | INMB | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period than the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 7, 2025, there were 26,585,258 shares of our common stock, par value $0.001 per share, outstanding.

INMUNE BIO INC.

FORM 10-Q

FOR THE SIX MONTHS ENDED JUNE 30, 2025

INDEX

| PART I – FINANCIAL INFORMATION | 1 | |

| Item 1. | Financial Statements | 1 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 18 |

| Item 3. | Quantitative and Qualitative Disclosure About Market Risk | 35 |

| Item 4. | Controls and Procedures | 35 |

| PART II – OTHER INFORMATION | 36 | |

| Item 1. | Legal Proceedings | 36 |

| Item 1A. | Risk Factors | 36 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 36 |

| Item 3. | Defaults Upon Senior Securities | 36 |

| Item 4. | Mine Safety Disclosures | 36 |

| Item 5. | Other Information | 36 |

| Item 6. | Exhibits | 39 |

| Signatures | 40 | |

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

INMUNE BIO INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share amounts)

(Unaudited)

| June 30, 2025 |

December 31, 2024 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | 33,374 | $ | 20,922 | ||||

| Research and development tax credit receivable | 1,605 | 1,181 | ||||||

| Other tax receivable | 550 | 228 | ||||||

| Prepaid expenses and other current assets | 505 | 331 | ||||||

| TOTAL CURRENT ASSETS | 36,034 | 22,662 | ||||||

| Equipment | 706 | |||||||

| Operating lease – right of use asset | 374 | 307 | ||||||

| Other assets | 570 | 79 | ||||||

| Acquired in-process research and development intangible assets | 16,514 | |||||||

| TOTAL ASSETS | $ | 37,684 | $ | 39,562 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable and accrued liabilities | $ | 7,671 | $ | 6,539 | ||||

| Accounts payable and accrued liabilities – related parties | 184 | 25 | ||||||

| Deferred liabilities | 511 | 517 | ||||||

| Operating lease, current liabilities | 220 | 140 | ||||||

| TOTAL CURRENT LIABILITIES | 8,586 | 7,221 | ||||||

| Long-term operating lease liabilities | 231 | 244 | ||||||

| TOTAL LIABILITIES | 8,817 | 7,465 | ||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Preferred stock, $0.001 par value, 10,000,000 shares authorized, 0 shares issued and outstanding | ||||||||

| Common stock, $0.001 par value, 200,000,000 shares authorized, 26,585,258 and 22,280,451 shares issued and outstanding, respectively | 27 | 22 | ||||||

| Additional paid-in capital | 226,904 | 195,754 | ||||||

| Accumulated other comprehensive loss | (763 | ) | (575 | ) | ||||

| Accumulated deficit | (197,301 | ) | (163,104 | ) | ||||

| TOTAL STOCKHOLDERS’ EQUITY | 28,867 | 32,097 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 37,684 | $ | 39,562 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

INMUNE BIO INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands, except share and per share amounts)

(Unaudited)

| For the Three Months Ended June 30, |

For the Six Months Ended June 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| REVENUE | $ | $ | $ | 50 | $ | 14 | ||||||||||

| OPERATING EXPENSES | ||||||||||||||||

| General and administrative | 2,253 | 2,812 | 4,569 | 5,150 | ||||||||||||

| Research and development | 5,804 | 7,053 | 13,443 | 15,746 | ||||||||||||

| Impairment of acquired in-process research and development intangible assets | 16,514 | 16,514 | ||||||||||||||

| Total operating expenses | 24,571 | 9,865 | 34,526 | 20,896 | ||||||||||||

| LOSS FROM OPERATIONS | (24,571 | ) | (9,865 | ) | (34,476 | ) | (20,882 | ) | ||||||||

| OTHER INCOME, NET | 113 | 119 | 279 | 111 | ||||||||||||

| NET LOSS | $ | (24,458 | ) | $ | (9,746 | ) | $ | (34,197 | ) | $ | (20,771 | ) | ||||

| Net loss per common share – basic and diluted | $ | (1.05 | ) | $ | (0.50 | ) | $ | (1.49 | ) | $ | (1.11 | ) | ||||

| Weighted average common shares outstanding – basic and diluted | 23,298,455 | 19,307,323 | 22,899,539 | 18,666,898 | ||||||||||||

| COMPREHENSIVE LOSS | ||||||||||||||||

| Net loss | $ | (24,458 | ) | $ | (9,746 | ) | $ | (34,197 | ) | $ | (20,771 | ) | ||||

| Other comprehensive income (loss) – foreign currency translation | (153 | ) | (44 | ) | (188 | ) | 86 | |||||||||

| Total comprehensive loss | $ | (24,611 | ) | $ | (9,790 | ) | $ | (34,385 | ) | $ | (20,685 | ) | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

INMUNE BIO INC.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025

(In thousands, except share amounts)

(Unaudited)

| Accumulated | ||||||||||||||||||||||||

| Additional | Other | Total | ||||||||||||||||||||||

| Common Stock | Paid-In | Comprehensive | Accumulated | Stockholders’ | ||||||||||||||||||||

| Shares | Amount | Capital | Loss | Deficit | Equity | |||||||||||||||||||

| Balance as of December 31, 2024 | 22,280,451 | $ | 22 | $ | 195,754 | $ | (575 | ) | $ | (163,104 | ) | $ | 32,097 | |||||||||||

| Stock-based compensation | - | 2,076 | 2,076 | |||||||||||||||||||||

| Sale of common stock for cash | 649,860 | 1 | 5,272 | 5,273 | ||||||||||||||||||||

| Exercise of warrants for cash | 100 | 1 | 1 | |||||||||||||||||||||

| Loss on foreign currency translation | - | (35 | ) | (35 | ) | |||||||||||||||||||

| Net loss | - | (9,739 | ) | (9,739 | ) | |||||||||||||||||||

| Balance as of March 31, 2025 | 22,930,411 | 23 | 203,103 | (610 | ) | (172,843 | ) | 29,673 | ||||||||||||||||

| Stock-based compensation | - | 1,534 | 1,534 | |||||||||||||||||||||

| Sale of common stock for cash | 3,654,847 | 4 | 22,267 | 22,271 | ||||||||||||||||||||

| Loss on foreign currency translation | - | (153 | ) | (153 | ) | |||||||||||||||||||

| Net loss | - | (24,458 | ) | (24,458 | ) | |||||||||||||||||||

| Balance as of June 30, 2025 | 26,585,258 | $ | 27 | $ | 226,904 | $ | (763 | ) | $ | (197,301 | ) | $ | 28,867 | |||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

INMUNE BIO INC.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2024

(In thousands, except share amounts)

(Unaudited)

| Accumulated | ||||||||||||||||||||||||

| Additional | Other | Total | ||||||||||||||||||||||

| Common Stock | Paid-In | Comprehensive | Accumulated | Stockholders’ | ||||||||||||||||||||

| Shares | Amount | Capital | Income (Loss) | Deficit | Equity | |||||||||||||||||||

| Balance as of December 31, 2023 | 17,950,776 | $ | 18 | $ | 159,143 | $ | (799 | ) | $ | (121,022 | ) | $ | 37,340 | |||||||||||

| Stock-based compensation | - | 1,779 | 1,779 | |||||||||||||||||||||

| Gain on foreign currency translation | - | 130 | 130 | |||||||||||||||||||||

| Net loss | - | (11,025 | ) | (11,025 | ) | |||||||||||||||||||

| Balance as of March 31, 2024 | 17,950,776 | 18 | 160,922 | (669 | ) | (132,047 | ) | 28,224 | ||||||||||||||||

| Stock-based compensation | - | 2,350 | 2,350 | |||||||||||||||||||||

| Common stock issued for cash | 198,364 | 2,032 | 2,032 | |||||||||||||||||||||

| Common stock and warrants issued for cash | 1,557,592 | 2 | 13,463 | 13,465 | ||||||||||||||||||||

| Loss on foreign currency translation | - | (44 | ) | (44 | ) | |||||||||||||||||||

| Net loss | - | (9,746 | ) | (9,746 | ) | |||||||||||||||||||

| Balance as of June 30, 2024 | 19,706,732 | $ | 20 | $ | 178,767 | $ | (713 | ) | $ | (141,793 | ) | $ | 36,281 | |||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

INMUNE BIO INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| For the Six Months Ended June 30, |

||||||||

| 2025 | 2024 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (34,197 | ) | $ | (20,771 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Stock-based compensation | 3,610 | 4,129 | ||||||

| Accretion of debt discount | 58 | |||||||

| Impairment of acquired in-process research and development intangible assets | 16,514 | |||||||

| Changes in operating assets and liabilities: | ||||||||

| Research and development tax credit receivable | (424 | ) | (1,238 | ) | ||||

| Other tax receivable | (322 | ) | 267 | |||||

| Prepaid expenses | (174 | ) | 497 | |||||

| Prepaid expenses – related party | 142 | |||||||

| Other assets | (491 | ) | 50 | |||||

| Accounts payable and accrued liabilities | 1,132 | 1,381 | ||||||

| Accounts payable and accrued liabilities – related parties | 159 | 104 | ||||||

| Deferred liabilities | (6 | ) | 32 | |||||

| Operating lease liabilities | - | (13 | ) | |||||

| Net cash used in operating activities | (14,199 | ) | (15,362 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Purchase of equipment | (706 | ) | ||||||

| Net cash used in investing activities | (706 | ) | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Net proceeds from sale of common stock and warrants | 27,544 | 15,497 | ||||||

| Exercise of warrants for cash | 1 | |||||||

| Repayments of debt | (5,000 | ) | ||||||

| Net cash provided by financing activities | 27,545 | 10,497 | ||||||

| Impact on cash from foreign currency translation | (188 | ) | 86 | |||||

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | 12,452 | (4,779 | ) | |||||

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 20,922 | 35,848 | ||||||

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 33,374 | $ | 31,069 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOWS INFORMATION: | ||||||||

| Cash paid for income taxes | $ | $ | ||||||

| Cash paid for interest expense | $ | $ | 523 | |||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

INMUNE BIO INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – ORGANIZATION AND DESCRIPTION OF BUSINESS

INmune Bio Inc. (the “Company” or “INmune Bio”) was organized in the State of Nevada on September 25, 2015 and is a clinical stage biotechnology pharmaceutical company focused on developing and commercializing its product candidates to treat diseases where the innate immune system is not functioning normally and contributing to the patient’s disease. INmune Bio has three product platforms. The DN-TNF product platform utilizes dominant-negative technology to selectively neutralize soluble TNF, a key driver of innate immune dysfunction and mechanistic target of many diseases and was used for its Alzheimer’s clinical trial (“XPro”). The CORDStrom product platform is a pooled, human umbilical cord mesenchymal stem cell product currently being developed to treat recessive dystrophic epidermolysis bullosa (“RDEB”). The Natural Killer Cell Priming Platform includes INKmune aimed at priming the patient’s NK cells to eliminate minimal residual disease in patients with cancer. INmune Bio’s product platforms utilize a precision medicine approach for the treatment of a wide variety of hematologic malignancies, solid tumors and chronic inflammation.

NOTE 2 – GOING CONCERN

These unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

The Company has incurred significant losses and negative cash flows from operations since inception and expects to incur additional losses until such time that it can generate significant revenue from the commercialization of its product candidates. During the six months ended June 30, 2025, the Company incurred a net loss of $34.2 million and had net cash flows used in operating activities of $14.2 million. Given the Company’s projected operating requirements and its existing cash and cash equivalents, the Company is projecting insufficient liquidity to sustain its operations through one year following the date that the financial statements are issued. These conditions and events raise substantial doubt about the Company’s ability to continue as a going concern.

In response to these conditions, management is currently evaluating different strategies to obtain the required funding of future operations. Financing strategies may include, but are not limited to, the public or private sale of equity, debt financings or funds from other capital sources, such as government funding, collaborations, strategic alliances, divestment of non-core assets, or licensing arrangements with third parties. There can be no assurances that the Company will be able to secure additional financing, or if available, that it will be sufficient to meet its needs or on favorable terms. Because management’s plans have not yet been finalized and are not within the Company’s control, the implementation of such plans cannot be considered probable. As a result, the Company has concluded that management’s plans do not alleviate substantial doubt about the Company’s ability to continue as a going concern.

The unaudited condensed consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of this uncertainty.

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying financial statements are presented in U.S. dollars and have been prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”), and pursuant to the accounting and disclosure rules and regulations of the U.S. Securities and Exchange Commission (“SEC”). The unaudited condensed consolidated financial statements include the accounts of INmune Bio Inc. and its subsidiaries. Intercompany transactions and balances have been eliminated.

In the opinion of management, the interim financial information includes all normal recurring adjustments necessary for a fair statement of the results for the interim periods. These unaudited condensed consolidated interim financial statements should be read in conjunction with the audited financial statements and notes thereto for the year ended December 31, 2024, included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on March 27, 2025.

Risks and Uncertainties

The Company is subject to risks and uncertainties common to early-stage companies in the biotechnology industry, including, but not limited to, development by competitors of new technological innovations, protection of proprietary technology, dependence on key personnel, compliance with government regulations and the need to obtain additional financing to fund operations. Product candidates currently under development will require significant additional research and development efforts, including extensive preclinical studies, clinical trials and regulatory approval prior to commercialization. These efforts require significant amounts of additional resources, adequate personnel, infrastructure and extensive compliance and reporting.

The Company’s product candidates are still in development and, to date, none of the Company’s product candidates have been approved for sale.

There can be no assurance that the Company’s research and development will be successfully completed, that adequate protection for the Company’s intellectual property will be obtained or maintained, that any products developed will obtain necessary government regulatory approval or that any approved products will be commercially viable. Even if the Company’s product development efforts are successful, it is uncertain when, if ever, the Company will generate any revenue from any of its products. The Company operates in an environment of rapid change in technology and substantial competition from other pharmaceutical and biotechnology companies.

The Company relies and expects to continue to rely on a small number of vendors to manufacture supplies and materials for its use in the clinical trial programs. These programs could be adversely affected by a significant interruption in these manufacturing services.

Use of Estimates

Preparing financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. Actual results and outcomes may differ from management’s estimates and assumptions.

Fair Value of Financial Instruments

The Company measures certain assets and liabilities in accordance with authoritative guidance which requires fair value measurements to be classified and disclosed in one of the following three categories:

Level 1: Quoted prices (unadjusted) in active markets that are accessible at the measurement date for assets or liabilities.

Level 2: Observable prices that are based on inputs not quoted on active markets but corroborated by market data.

Level 3: Unobservable inputs are used when little or no market data is available.

Assets and liabilities are classified based on the lowest level of input that is significant to the fair value measurements. The Company reviews the fair value hierarchy classification on a quarterly basis. Changes in the ability to observe valuation inputs may result in a reclassification of levels for certain assets or liabilities within the fair value hierarchy. The Company did not have any transfers of assets and liabilities between the levels of the fair value measurement hierarchy during the years presented.

The carrying amounts of financial instruments such as cash and cash equivalents, research and development tax credit receivable, other tax receivable, prepaid expenses, and accounts payable and accrued liabilities approximate the related fair values due to the short-term maturities of these instruments.

Cash and Cash Equivalents

The Company considers all short-term, highly liquid investments with an original maturity at the date of purchase of three months or less to be cash equivalents. The Company maintains cash balances that may be uninsured or in deposit accounts that exceed Federal Deposit Insurance Corporation limits. The Company maintains its cash deposits with major financial institutions.

Research and Development Tax Incentive Receivable

The Company, through its wholly owned subsidiary in Australia (“AUS”), participates in the Australian research and development tax incentive program, such that a percentage of our qualifying research and development expenditures are reimbursed by the Australian government, and such incentives are reflected as a reduction of research and development expense. The Australian research and development tax incentive is recognized when there is reasonable assurance that the incentive will be received, the relevant expenditure has been incurred and the amount of the consideration can be reliably measured. At each period end, management estimates the reimbursement available to the Company based on available information at the time.

The Company, through its wholly owned subsidiary in the United Kingdom (“UK”), participates in the research and development program provided by the United Kingdom tax relief program, such that a percentage of our qualifying research and development expenditures are reimbursed by the United Kingdom government, and such incentives are reflected as a reduction of research and development expense. The United Kingdom research and development tax incentive is recognized when there is reasonable assurance that the incentive will be received, the relevant expenditure has been incurred and the amount of the consideration can be reliably measured. At each period end, management estimates the reimbursement available to the Company based on available information at the time.

Equipment

Equipment is recorded at cost and depreciated using the straight-line method over the estimated useful lives of the assets and consist of scientific equipment with a 5 year life. Repairs and maintenance costs are charged to expense as incurred. At June 30, 2025, the Company’s equipment was not yet placed into service.

Intangible Assets

The Company capitalizes costs incurred in connection with in-process research and development purchased from others if the asset has alternative uses and such uses are not restricted under applicable license agreements; patent applications (principally legal fees), patent purchases, and trademarks related to its cell line as intangible assets. Acquired in-process research and development costs that do not have alternative uses are expensed as incurred. When the assets are determined to have a finite life (upon completion of the development of the in-process research and development for its DN-TNF platform), the useful life will be determined and the in-process research and development intangible assets will be amortized.

During the fourth quarter and if business factors indicate more frequently, the Company performs an assessment of the qualitative factors affecting the fair value of our in-process research and development. If the qualitative assessment suggests that impairment is more likely than not, a quantitative analysis is performed. The quantitative analysis involves a comparison of the fair value of the in-process research and development with the carrying amount. If the carrying amount of the in-process research and development exceeds its fair value, an impairment loss is recognized in an amount equal to that excess.

During the six months ended June 30, 2025, the Company released the Phase 2 clinical trial results for our Alzheimer’s drug candidate, XPro, which failed to meet the primary endpoint, though a subgroup showed potential benefits. Due to insufficient resources to fund further trials, the Company has halted immediate plans to develop XPro for Alzheimer’s or other indications and are instead seeking a partner to continue these studies. As part of preparing its interim unaudited condensed consolidated financial statements, the Company determined that the intangible asset’s fair value was likely below its carrying value. Following a quantitative impairment assessment, the Company estimated the asset’s fair value at $0 as of June 30, 2025, resulting in a recorded impairment of $16,514,000.

Basic and Diluted Loss per Share

Basic loss per share is computed by dividing net loss available to common shareholders by the weighted average number of outstanding common shares during the period. Diluted loss per share gives effect to all dilutive potential common shares outstanding during the period. Dilutive loss per share excludes all potential common shares if their effect is anti-dilutive. For all periods presented, there is no difference in the number of shares used to calculate basic and diluted shares outstanding due to the Company’s net loss position.

At June 30, 2025 and 2024, the Company had potentially issuable shares as follows:

| June 30, | ||||||||

| 2025 | 2024 | |||||||

| Stock options | 7,281,307 | 6,291,807 | ||||||

| Warrants | 3,944,138 | 1,602,978 | ||||||

| Total | 11,225,445 | 7,894,785 | ||||||

Revenue Recognition

The Company recognizes revenue when the customer obtains control of promised goods or services, in an amount that reflects the consideration the Company expects to receive in exchange for those goods or services. The Company recognizes revenue following the five-step model prescribed under ASC Topic 606: (1) identify contract(s) with a customer; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to the performance obligations in the contract; and (5) recognize revenues when (or as) the Company satisfies the performance obligations. The Company records the expenses related to revenue in research and development expense, in the periods such expenses were incurred.

The Company records deferred revenues when cash payments are received or due in advance of performance, including amounts which are refundable.

Stock-Based Compensation

The Company utilizes the Black-Scholes option pricing model to estimate the fair value of stock option awards at the date of grant, which requires the input of highly subjective assumptions, including expected volatility and expected life. Changes in these inputs and assumptions can materially affect the measure of estimated fair value of our share-based compensation. These assumptions are subjective and generally require significant analysis and judgment to develop. When estimating fair value, some of the assumptions will be based on, or determined from, external data and other assumptions may be derived from our historical experience with stock-based payment arrangements. The appropriate weight to place on historical experience is a matter of judgment, based on relevant facts and circumstances. The Company accounts for forfeitures of stock options as they occur.

Research and Development

Research and development (“R&D”) costs are expensed as incurred. Research and development credits are recorded by the Company as a reduction of research and development costs. Major components of research and development costs include cash compensation, stock-based compensation, costs of preclinical studies, clinical trials and related clinical manufacturing, costs of drug development, costs of materials and supplies, facilities cost, overhead costs, regulatory and compliance costs, and fees paid to consultants and other entities that conduct certain research and development activities on the Company’s behalf.

The Company recognizes grants as contra research and development expense in the consolidated statement of operations on a systematic basis over the periods in which the entity recognizes as expenses the related costs for which the grants are intended to compensate.

Income Taxes

The Company follows the liability method of accounting for income taxes. Under this method, deferred income tax assets and liabilities are recognized for the estimated tax consequences attributable to differences between the financial statement carrying values and their respective income tax basis (temporary differences). The effect on deferred income tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

Foreign Currency Translation

The Company’s financial statements are presented in the U.S. dollar (“$”), which is the Company’s reporting currency, while its functional currencies are the U.S. Dollar for its U.S. based operations, British Pound (“GBP”) for its United Kingdom-based operations and Australian Dollars (“AUD”) for its Australian-based operations. All assets and liabilities are translated at the exchange rate on the balance sheet date, stockholders’ equity is translated at historical rates and statement of operations items are translated at the weighted average exchange rate for the period. The resulting translation adjustments are reported under other comprehensive income. Gains and losses resulting from the translations of foreign currency transactions and balances are reflected in the statement of operations and comprehensive income (loss).

Segment Information

The Company has one primary business activity and operates in one reportable segment.

The Company’s chief operating decision maker (“CODM”) is its Chief Financial Officer who evaluates performance and makes operating decisions about allocating resources based on financial data presented on a consolidated basis. The measures of profitability and the significant segment expenses reviewed by the CODM are consistent with these financial statements and footnotes.

Recent Accounting Pronouncements

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (“ASU 2023-09”). The guidance in ASU 2023-09 improves the transparency of income tax disclosures by greater disaggregation of information in the rate reconciliation and income taxes paid disaggregated by jurisdiction. The standard is effective for public companies for fiscal years beginning after December 15, 2024 and for interim periods for fiscal years beginning after December 15, 2025, with early adoption permitted. The Company is currently evaluating the impact that the adoption of ASU 2023-09 may have on its consolidated financial statements.

In November 2024, the FASB issued ASU 2024-03, Income Statement-Reporting Comprehensive Income-Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses (“ASU 2024-03”). ASU 2024-03 requires additional disclosure of specific types of expenses included in the expense captions presented on the face of the income statement as well as disclosures about selling expenses. ASU 2024-03 is effective for fiscal years beginning after December 15, 2026, and interim periods beginning after December 15, 2027, with early adoption permitted. ASU 2024-03 may be applied prospectively with the option for retrospective application for all prior periods presented. The Company is currently evaluating the impact of adopting this guidance on the Company’s current financial position, results of operations or financial statement disclosures.

Subsequent Events

The Company evaluates events that have occurred after the balance sheet date of June 30, 2025, through the date which the financial statements are issued.

NOTE 4 – RESEARCH AND DEVELOPMENT ACTIVITY

According to AUS tax law, the Company is allowed an R&D tax credit that reduces a company’s tax bill in AUS for expenses incurred in R&D subject to certain requirements. The Company’s Australian subsidiary submits R&D tax credit requests annually for research and development expenses incurred. At June 30, 2025 and December 31, 2024, the Company recorded a research and development tax credit receivable of $1,605,000 and $1,181,000, respectively, for R&D expenses incurred in Australia.

Xencor, Inc. License Agreement

On October 3, 2017, the Company entered into a license agreement (“Xencor License Agreement”) with Xencor, Inc. (“Xencor”), which discovered and developed a proprietary biological molecule that inhibits soluble tumor necrosis factor. On June 10, 2021, the Company and Xencor entered into a First Amendment to License Agreement pursuant to which, among other things, Section 3.2 of the Xencor License Agreement was amended to change the due diligence milestones. Pursuant to the Xencor License Agreement, Xencor granted the Company an exclusive worldwide, royalty-bearing license in licensed patent rights, licensed know-how and licensed materials (as defined in the license agreement) to make, develop, use, sell and import any pharmaceutical product that comprises, contains, or incorporates Xencor’s proprietary protein known as “XPro” that inhibits soluble tumor necrosis factor (or all modifications, formulations and variants of the licensed protein that specifically bind soluble tumor necrosis factor) alone or in combination with one or more active ingredients, in any dosage or formulation (“Licensed Products”). The Company believes the protein has numerous medical applications. Such additional alternative applications of the technology are available under the Xencor License Agreement.

The Company also agreed to pay Xencor a 5% royalty on Net Sales of all Licensed Products in a given calendar year, which are payable on a country-by- country and licensed product by licensed product basis until the date that is the later of (a) the expiration of the last to expire valid claim covering such Licensed Product in such country or (b) ten years following the first sale to a third party of the licensed product in such country.

During the six months ended June 30, 2025, the Company released the Phase 2 clinical trial results for our Alzheimer’s drug candidate, XPro, which failed to meet the primary endpoint, though a subgroup showed potential benefits. Due to insufficient resources to fund further trials, the Company has halted immediate plans to develop XPro for Alzheimer’s or other indications and are instead seeking a partner to continue these studies. As part of preparing its interim unaudited condensed consolidated financial statements, the Company determined that the intangible asset’s fair value was likely below its carrying value. Following a quantitative impairment assessment, the Company estimated the asset’s fair value at $0 as of June 30, 2025, resulting in a recorded impairment of $16,514,000.

Cordstrom License Agreement

On February 6, 2025, the Company and Great Ormond Street Hospital for Children NHS Foundation Trust (“GOSH”) entered into a license agreement for the exclusive commercial use to clinical trial data associated with a GOSH study investigating the potential of CORDStrom to treat RDEB in pediatric patients (the “MissionEB study”). The Company owns the intellectual property covering CORDStrom, the investigational medicinal product used in the Mission EB study. In addition, the Company owns intellectual property and maintains trade secret protections covering the manufacturing of CORDStrom. With this license to the clinical trial data, the Company intends to prepare applications seeking marketing authorization of CORDStrom for treatment of pediatric RDEB in each of the FDA, EMA, and MHRA. Terms of the license agreement include an upfront payment of £250,000 (approximately $0.3 million at June 30, 2025) and a single milestone payment of up to £6,000,000 (approximately $8.2 million as of June 30, 2025) due on the first to occur marketing authorization to be granted by the FDA, EMA or MHRA, which had not occurred as of June 30, 2025. At June 30, 2025 and December 31, 2024, the Company recorded $0.3 million and $0, respectively, payable to GOSH within accounts payable and accrued liabilities in the consolidated balance sheets.

Pursuant to the GOSH license agreement, the Company has an obligation to provide CORDStrom to the MissionEB study at no cost. While Part 1 of the study is completed, Part 2 of the MissionEB study is currently uninitiated due to a lack of funding by the National Health Services England (“NHSE”). It is unknown whether funding for the study will be allocated by NHSE or its successor agency in the United Kingdom. The Company has not recorded an estimated obligation for the supply of the MissionEB trial with CORDStrom as it is unknown if the MissionEB trial will resume.

INKmune License Agreement

On October 29, 2015, the Company entered into an exclusive license agreement (the “INKmune License Agreement”) with Immune Ventures, LLC (“Immune Ventures”). Pursuant to the INKmune License Agreement, the Company was granted exclusive worldwide rights to the patents, including rights to incorporate any improvements or additions to the patents that may be developed in the future. In consideration for the patent rights, the Company agreed to the following milestone payments:

| (in thousands) | ||||

| Each Phase I initiation | $ | 25 | ||

| Each Phase II initiation | $ | 250 | ||

| Each Phase III initiation | $ | 350 | ||

| Each NDA/EMA filing | $ | 1,000 | ||

| Each NDA/EMA awarded | $ | 9,000 | ||

In addition, the Company agreed to pay the licensor a royalty of 1% of net sales during the life of each patent granted to the Company. The License is owned by Immune Ventures. RJ Tesi, the Company’s President and a member of our Board of Directors, David Moss, its Chief Financial Officer and Treasurer and Mark Lowdell, its Chief Scientific Officer, are the owners of Immune Ventures. No sales have occurred under this license. During December 2023, the Company initiated a Phase I trial with INKmune in patients with metastatic castration-resistant prostate cancer. At December 31, 2024 and June 30, 2025, the Company recorded $25,000 payable to Immune Ventures within accounts payable and accrued liabilities – related parties in the consolidated balance sheet.

The term of the agreement began on October 29, 2015 and ends on a country-by-country basis on the date of the expiration of the last to expire patent rights where patent rights exists, unless terminated earlier in accordance with the agreement. Upon the termination of the agreement, we shall have a fully paid up, perpetual, royalty-free license without further obligation to Immune Ventures. The agreement can be terminated by Immune Ventures if, after 60 days from the Company’s receipt of notice that the Company has not made a payment under the agreement, and the Company still does not make this payment. On July 20, 2018 and October 30, 2020, the parties amended the agreement under which the Company was required achieve milestones pursuant to the agreement.

On April 17, 2023, the parties executed an additional amendment to the agreement under which the Company removed the due diligence requirements to achieve reasonable commercial efforts to bring INKmune to market. This removed all requirements of clinical trial timelines and the filing timelines of an NDA or equivalent. All other provisions in the INKmune License Agreement shall continue in full force and effect.

University of Pittsburg License Agreement

On October 3, 2017, the Company entered into an Assignment and Assumption Agreement with Immune Ventures related to intellectual property licensed from the University of Pittsburgh. Pursuant to the Assignment and Assumption Agreement (“Assignment Agreement”), Immune Ventures assigned all of its rights, obligations and liabilities under an Exclusive License Agreement between the University of Pittsburgh – Of the Commonwealth System of Higher Education (“Licensor”) and Immune Ventures to INmune Bio (“Licensee”), (the “PITT Agreement”).

Consideration under the PITT Agreement includes: (i) annual maintenance fees, (ii) royalty payments based on the sale of products making use of the licensed technology, and (iii) milestone payments.

The Company owes annual maintenance fees under the PITT Agreement in the amount of $25,000 payable on June 26 of each year until the first commercial sale. At June 30, 2025, the Company owed the University of Pittsburgh $25,000 for annual maintenance fees.

Upon first commercial sale of a product making use of the licensed technology under the PITT Agreement, the Licensee is required to pay royalties equal to 2.5% of Net Sales each calendar quarter.

Moreover, under the PITT Agreement the Licensee is required to make milestone payments as follows:

| (in thousands) | ||||

| Each Phase I initiation | $ | 50 | ||

| Each Phase III initiation | $ | 500 | ||

| First commercial sale of product making use of licensed technology | $ | 1,250 | ||

The PITT Agreement expires upon the earlier of: (i) expiration of the last claim of the Patent Rights (as defined in the PITT Agreement) forming the subject matter of the PITT Agreement; or (ii) the date that is 20 years from the effective date of the agreement (June 26, 2037).

The Licensee may terminate the PITT Agreement upon 3 months prior written notice provided all payments under the license are current. The Licensor may terminate the PITT Agreement upon written notice if: (i) Licensee defaults as to performance of material obligations which have not been cured within 60 days after receiving written notice; or (ii) Licensee ceases to carry out its business, becomes bankrupt or insolvent, applies for or consents to the appointment of a trustee, receiver or liquidator of its assets or seeks relief under any law for the aid of debtors.

NOTE 5 – FAIR VALUE MEASUREMENTS

The following table presents the hierarchy for assets and liabilities measured at fair value on a recurring basis:

| (in thousands) | Total | Quoted Price in Active Market (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

||||||||||||

| June 30, 2025: | ||||||||||||||||

| Cash equivalents | ||||||||||||||||

| Money market funds | $ | 32,919 | $ | 32,919 | $ | $ | ||||||||||

| Total cash equivalents | $ | 32,919 | $ | 32,919 | $ | $ | ||||||||||

| (in thousands) | Total | Quoted Price in Active Market (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

||||||||||||

| December 31, 2024: | ||||||||||||||||

| Cash equivalents | ||||||||||||||||

| Treasury Bills | $ | 10,260 | $ | 10,260 | $ | $ | ||||||||||

| Money market fund | 10,328 | 10,328 | ||||||||||||||

| Total cash equivalents | $ | 20,588 | $ | 20,588 | $ | $ | ||||||||||

NOTE 6 – COMMITMENTS

In April 2025, the Company wholly owned subsidiary, INmune Bio International Ltd., entered into an agreement whereby the Company leases manufacturing space from a third party in the United Kingdom for 2 years. The lease requires payments of approximately $77,000 each quarter during the first year and $154,000 each quarter during the second year. The lease commencement date is August 2025.

As of June 30, 2025, the maturities of our lease liabilities are as follows:

| (in thousands, except years) | ||||

| 2025 | $ | 136 | ||

| 2026 | 278 | |||

| 2027 | 91 | |||

| Total lease payments | 505 | |||

| Less: imputed interest | (54 | ) | ||

| Present value of future lease payments | 451 | |||

| Less: operating lease, current liabilities | (220 | ) | ||

| Long-term operating lease liabilities | $ | 231 | ||

| Weighted-average remaining lease term | 1.8 years | |||

| Weighted-average discount rate | 12.0 | % |

During the three and six months ended June 30, 2025 the Company recognized $55,000 and $95,000, respectively, in operating lease expense, which is included in general and administrative expenses in the Company’s consolidated statement of operations.

During the three and six months ended June 30, 2024, the Company recognized $41,000 and $80,000, respectively, in operating lease expense, which is included in general and administrative expenses in the Company’s consolidated statement of operations

During April 2025, the Company’s wholly-owned subsidiary, INmune Bio International. Ltd., entered into a 2-year collaboration agreement with a vendor whereby it shall make fixed payments to the vendor in exchange for services pursuant to manufacturing CORDStrom in the United Kingdom. A summary of the commitments payable for these services pursuant to the agreement is as follows as of June 30, 2025:

| (in thousands, except years) | ||||

| 2025 | $ | 532 | ||

| 2026 | 1,285 | |||

| 2027 | 1,152 | |||

| Total | $ | 2,969 | ||

NOTE 7 – RELATED PARTY TRANSACTIONS

UCL

At June 30, 2025 and December 31, 2024, the Company recorded a payable to UCL of $133,000 and $0, respectively, for medical research performed on behalf of the Company. During the six months ended June 30, 2025 and 2024, the Company made no payments to UCL. UCL is a wholly owned subsidiary of the University of London. The Company’s Chief Scientific and Manufacturing Officer is a professor at the University of London.

AmplifyBio

At June 30, 2025 and December 31, 2024, the Company recorded a payable to AmplifyBio of $26,000 and $0, respectively, for medical research performed on behalf of the Company. During the six months ended June 30, 2025 and 2024, the Company paid AmplifyBio $41,000 and $233,000, respectively. During 2025, AmplifyBio ceased operations. Amplify Bio’s former CEO is on the board of directors of the Company.

NOTE 8 – DEBT

During 2021, the Company entered into a Loan and Security Agreement (the “Term Loan”) with Silicon Valley Bank and SVB Innovation Credit Fund VIII, L.P., together (the “Lenders”) in which the Company borrowed $15 million. The Term Loan was secured by the Company’s assets. During December 2024, the Company paid off the Term Loan in full. During February 2025, the Company entered into a letter agreement with the Lenders whereby the Term Loan was terminated.

For the three and six months ended June 30, 2024, the Company recognized interest expense of $250,000 and $607,000, respectively, related to the Term Loan

NOTE 9 – STOCKHOLDERS’ EQUITY

Registered Direct Offerings

During June 2025, the Company entered into securities purchase agreements with investors whereby the Company sold 3,000,000 shares of the common stock in a registered direct offering in exchange for gross proceeds of $18.9 million (net proceeds of approximately $17.4 million).

During April 2024, the Company entered into a securities purchase agreement with an investor whereby the Company sold 986,000 shares of the Company’s common stock and warrants to purchase an additional 986,000 shares of the Company’s common stock in a registered direct offering in exchange for gross proceeds of approximately $9.7 million (net proceeds of approximately $8.9 million). The exercise price of the warrants is $9.84 and the warrants are exercisable until April 29, 2026. The Company determined that the warrants were equity classified. The fair value of the warrants was approximately $5.8 million and was calculated using the Black-Scholes option-pricing model. Variables used in the Black-Scholes option-pricing model include: (1) discount rate of 4.97% based on the applicable US Treasury bill rate (2) expected life of 2.0 years, (3) expected volatility of approximately 77% based on the trading history of the Company, and (4) zero expected dividends.

During April 2024, the Company entered into securities purchase agreements with investors whereby the Company sold 571,592 shares of the Company’s common stock and warrants to purchase an additional 571,592 shares of the Company’s common stock in a registered direct offering in exchange for gross proceeds of approximately $4.8 million (net proceeds of approximately $4.5 million). Directors and officers that participated in the offering paid a combined offering price of $8.445 per share and warrant, and other investors paid $8.32 per share and warrant. The exercise price of the warrants is $9.152, and the warrants are exercisable for two years from the issuance dates. The Company determined the warrants were equity classified. The fair value of the warrants was approximately $3.0 million and was calculated using the Black-Scholes option-pricing model. Variables used in the Black-Scholes option-pricing model include: (1) discount rate of 4.89% based on the applicable US Treasury bill rate (2) expected life of 2.0 years, (3) expected volatility of approximately 78% based on the trading history of the Company, and (4) zero expected dividends.

Common Stock – At the Market Offering

During March 2021, the Company entered into a sales agreement (“Sales Agreement”) with BTIG, LLC (“BTIG”), as sales agent, to establish an At-The-Market (“ATM”) offering program of up to $45 million of common stock, subject to certain limitations on the amount of common stock that may be offered and sold by the Company set forth in the sales agreement. During August 2023, the Company and BTIG entered into Amendment No. 1 to the Sales Agreement. The Company is required to pay BTIG a commission of 3% of the gross proceeds from the sale of shares. During the six months ended June 30, 2024, the Company issued and sold 198,364 shares of common stock at an average price of $10.56 per share under the ATM program. The aggregate net proceeds were approximately $2.0 million after commission expenses.

During August 2024, the Company entered into an amended and restated at-the-market sales agreement with RBC Capital Markets LLC and BTIG (together, the “Sales Agents”) relating to the offer and sale of shares of our common stock with an aggregate offering price of up to $75.0 million. The Company is required to pay the Sales Agents a commission of 3% of the gross proceeds from the sale of shares. During the six months ended June 30, 2025, the Company issued and sold 1,304,707 shares of common stock at an average price of $8.01 per share under the ATM program. The aggregate net proceeds were approximately $10.1 million after commission expenses. At June 30, 2025, the Company had $64.5 million of common stock available under the amended and restated at-the-market agreement.

Stock options

The following table summarizes stock option activity during the six months ended June 30, 2025:

| (in thousands, except share and per share amounts) | Number of Shares |

Weighted- average Exercise Price |

Weighted- average Remaining Contractual Term (years) |

Aggregate Intrinsic Value |

||||||||||||

| Outstanding at January 1, 2025 | 7,203,307 | $ | 8.29 | 6.49 | $ | 1,218 | ||||||||||

| Options granted | 100,000 | $ | 7.88 | 10.0 | ||||||||||||

| Options exercised | $ | - | ||||||||||||||

| Options cancelled | (22,000 | ) | $ | 5.05 | - | |||||||||||

| Outstanding at June 30, 2025 | 7,281,307 | $ | 8.29 | 6.03 | $ | |||||||||||

| Exercisable at June 30, 2025 | 5,379,014 | $ | 8.78 | 4.94 | $ | |||||||||||

During the three and six months ended June 30, 2025, the Company recognized stock-based compensation expense of approximately $1.5 million and $3.6 million, respectively, related to the vesting of stock options. During the three and six months ended June 30, 2024, the Company recognized stock-based compensation expense of approximately $2.3 million and $4.1 million, respectively, related to the vesting of stock options. As of June 30, 2025, there was approximately $9.2 million of total unrecognized compensation cost related to non-vested stock options which is expected to be recognized over a weighted-average period of 2.67 years.

Warrants

The Company issued warrants to the Company’s lenders upon obtaining a loan in June 2021. The warrants have a 10-year term and an exercise price of $14.05. At June 30, 2025, respectively, 45,386 of these warrants are outstanding and the intrinsic value of these warrants is $0.

During April 2024, the Company issued 1,557,592 warrants to investors in connection with the sale of common stock. At June 30, 2025, 1,557,592 of these warrants are outstanding and are exercisable for cash at a weighted average price of $9.59 per share. The intrinsic value of these warrants was $0 as of June 30, 2025.

During September 2024, the Company issued 2,341,260 warrants to investors in connection with the sale of common stock. At June 30, 2025, 2,341,160 of these warrants are outstanding and are exercisable for cash at a weighted average price of $6.40 per share. The intrinsic value of these warrants was $0 as of June 30, 2025.

Stock-based Compensation by Class of Expense

The following summarizes the components of stock-based compensation expense in the consolidated statements of operations for the six months ended June 30, 2025 and 2024 respectively:

| (in thousands) | Three Months Ended June 30, 2025 |

Three Months Ended June 30, 2024 |

Six Months Ended June 30, 2025 |

Six Months Ended June 30, 2024 |

||||||||||||

| Research and development | $ | 627 | $ | 996 | $ | 1,457 | $ | 1,698 | ||||||||

| General and administrative | 907 | 1,354 | 2,153 | 2,431 | ||||||||||||

| Total | $ | 1,534 | $ | 2,350 | $ | 3,610 | $ | 4,129 | ||||||||

Shareholder Rights Agreement

On December 30, 2020, the Board of Directors (the “Board”) of the Company approved and adopted a Rights Agreement, dated as of December 30, 2020, by and between the Company and VStock Transfer, LLC, as rights agent, pursuant to which the Board declared a dividend of one preferred share purchase right (each, a “Right”) for each outstanding share of the Company’s common stock held by stockholders as of the close of business on January 11, 2021. When exercisable, each right initially would represent the right to purchase from the Company one one-thousandth of a share of a newly designated series of preferred stock, Series A Junior Participating Preferred Stock, par value $0.001 per share, of the Company, at an exercise price of $300.00 per one one-thousandth of a Series A Junior Participating Preferred Share, subject to adjustment. Subject to various exceptions, the Rights become exercisable in the event any person (excluding certain exempted or grandfathered persons) becomes the beneficial owner of twenty percent or more of the Company’s common stock without the approval of the Board. The Rights Agreement was amended in 2021, 2022, 2023 and 2024 to extend the expiration date and shall expire on December 30, 2025.

NOTE 10 – GOVERNMENT GRANT

The Company has a grant awarded by the National Institutes of Health for approximately $2.0 million to support a Phase 2 study of XPro in patients with treatment resistant depression. The Company has decided it will not initiate a treatment resistant depression study using XPro. As of June 30, 2025, the Company has not received any proceeds pursuant to this grant.

NOTE 11 – LEGAL

Dispute

The Company has an ongoing dispute with a vendor in which the Company believes that the vendor did not properly provide services for which they have invoiced the Company. As of June 30, 2025, the Company has outstanding invoices with the vendor which aggregate approximately $1.6 million, of which the Company has recorded approximately $0.2 million, which is the Company’s estimate of the obligation incurred, and the remaining $1.4 million has not been recorded by the Company as the Company believes the invoices were sent erroneously. The Company and the vendor are still attempting to resolve the dispute and legal proceedings have not been threatened.

Litigation

The Company is subject to claims and suits that arise from time to time in the ordinary course of our business. Although management currently believes that resolving claims against the Company, individually or in aggregate, will not have a material adverse impact in the Company’s consolidated financial statements, these matters are subject to inherent uncertainties and management’s view of these matters may change in the future.

NOTE 12 – SUBSEQUENT EVENTS

On August 4, 2025, Dr. Raymond J. Tesi informed the Company of his intention to retire and resign from his roles as President, Chief Executive Officer, Chief Medical Officer, Chairman of the Board of Directors (the “Board”) and all positions from the Company and its subsidiaries, effective on the Effective Date (as defined below). Dr. Tesi’s resignation is not the result of any dispute or disagreement with the Company or the Board on any matter relating to the Company’s operations, policies or practices.

In connection with Dr. Tesi’s retirement, Dr. Tesi and the Company entered into a Separation Agreement and Mutual Release, dated August 4, 2025 (the “Severance Agreement”), pursuant to which, the Company agreed to pay Dr. Tesi $166,000 of severance within thirty days, pay Dr. Tesi for accrued but unused vacation days, and pay the cost of health insurance coverage for Dr. Tesi and his spouse through December 31, 2025. The Severance Agreement is subject to a seven-day revocation period following execution and shall become effective on August 12, 2025, if not revoked before (the “Effective Date”).

Under the terms of the Severance Agreement, all unvested stock options held by Dr. Tesi will remain outstanding and continue to vest in accordance with their original terms, provided that Dr. Tesi remains in compliance with the Severance Agreement. All vested stock options will remain exercisable for the later of five years following the Effective Date or their original expiration date. The agreement also imposes resale limitations on Dr. Tesi’s beneficial ownership of Company securities, restricting him from selling more than 25% of his beneficially owned shares of common stock in any calendar month during the 18-month period following the Effective Date.

The Company further agreed to maintain directors’ and officers’ liability insurance for Dr. Tesi for a period of at least three years following the Effective Date on terms no less favorable than those applicable to its then-serving officers and directors. The Severance Agreement also reaffirms Dr. Tesi’s right to indemnification under Nevada law, the Company’s articles of incorporation and bylaws, as amended and in effect as of the date hereof, and provides for contribution rights in the event indemnification is unavailable.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

This Form 10-Q contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For this purpose, any statements contained in this Form 10-Q that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate” or “continue” or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, and actual results may differ materially depending on a variety of factors, many of which are not within our control. These factors include but are not limited to economic conditions generally and in the industries in which we may participate; competition within our chosen industry, including competition from much larger competitors; technological advances and failure to successfully develop business relationships.

Description of Business

Overview

Our objective is to develop and commercialize our product candidates to treat diseases where the innate immune system is dysfunctional causing or contributing to the patient’s disease. Innate immune dysfunction can occur for a variety of reasons including genetics, lifestyle, and other factors. However, age plays a significant role in the development of immune dysfunction. Innate immune dysfunction can be seen in cancer where Natural Killer (“NK”) cells are impaired and facilitate a tumor’s evasion of the immune system and subsequent disease progression. Chronic inflammation is implicated in various diseases, where it impairs the innate immune system. Our primary focus continues to be treatment of cancer with INKmune, treatment of Alzheimer’s Disease (“AD”) with XPro1595 and treatment of receswsive dystrophic epidermolysis bullosa (RDEB) with CORDStrom, a proprietary, pooled, human umbilical cord mesenchymal stromal cell platform. RDEB is a pediatric orphan disease caused by mutations in the COL7A1 gene which results in highly debilitating skin blistering, dysphagia and failure to thrive with chronic wound problems that often result in fatal squamous cell carcinoma.

XPro for AD has completed Phase I and Phase II trials with enrollment of patients at clinical sites in the United Kingdom, EU, Australia and Canada. In light of the recent Phase 2 results of XPro in AD along with company resources, the treatment resistant depression trial will not be pursued. The INKmune program is in an open label Phase II trial in metastatic castrate resistant prostate cancer (“mCRPC”). CORDStrom for the treatment of children with RDEB has completed a pivotal blinded randomized cross-over trial. The data will be submitted for marketing authorization by filing a Marketing Authorization Application (MAA) in the United Kingdom followed by a Biologics License Application (“BLA”) with the FDA in the US which is anticipated in the first half of 2026.

We believe our DN-TNF platform can be used as a CNS (“central nervous system”) therapy to target glial activation to prevent progression of AD along with other inflammatory diseases. The primary focus of the Company’s development efforts for XPro is AD. In each case, we believe neutralizing sTNF is a cornerstone to the treatment of these diseases.

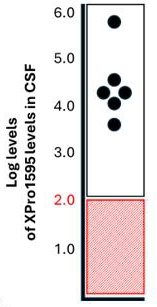

We believe the DN-TNF platform can be used to treat selected neurodegenerative diseases by reducing neuroinflammation without immunosuppression. The Company believes the core pathology of cognitive decline is a combination of neurodegeneration and synaptic dysfunction. Neurodegeneration is nerve cell death that may include demyelination. Synaptic dysfunction means the connections between nerve cells stop working efficiently and may decrease in number. The combination of neurodegeneration and synaptic dysfunction causes cognitive decline and behavioral changes associated with AD. XPro completed a Phase I trial treating patients with Alzheimer’s disease that was partially funded by a Part-the-Clouds Award from the Alzheimer’s Association. We believe XPro targets activated microglia and astrocytes of the brain that produce sTNF that promotes nerve cell loss, synaptic dysfunction and prevents myelin repair - key elements in the development of dementia. In animal models, elimination of sTNF prevents nerve cell dysfunction, reverses synaptic pruning and promotes myelin repair. The Phase I trial in patients with biomarkers of inflammation with AD has been completed. The open label, dose escalation trial was designed to demonstrate that XPro can safely decrease neuroinflammation in patients with AD and biomarkers of inflammation (ADi). The goal of the Phase 1 trial was to demonstrate safety in the target population (patients with AD), demonstrate target engagement by showing XPro got into the brain in therapeutically relevant concentrations and reduced neuroinflammation) and identify the best dose for phase 2. XPro got into the brain (Figure 1a) and dose dependently decreased biomarker of neuroinflammation in the CSF (Figure 1b) with patients treated with the highest dose (1mg/kg/week dose) having the greatest reduction in neuroinflammation. A broad analysis of proteomic changes following treatment of XPro revealed significant changes in CSF proteins related to CNS neuronal function, immune/inflammatory response, Cytoskeletal, metabolic processes, and dendritic spine morphogenesis and synaptic plasticity. Of note, XPro reduced neuronal injury markers Visinin-like protein-1 (91%) and Neurofilament light (84%), improved measures of synaptic function as evinced by a 222% increase in Contactin 2 and a 56% decrease neurogranin. Finally, XPro significantly reduced CSL levels of p-Tau217 (43%) and pTau181 (2%) after 3 months of therapy (Figure 1c).

| A | B | C |

|

|

|

Figure 1: (A) XPro gets into the brain at therapeutically relevant concentrations. XPro neutralizes 99.9% of soluble TNF when drug levels exceed two logs. (B) XPro dose dependently reduces CSF inflammation in the brain. CSF composite – a composite score of change of all cytokines measured in the OLINK Target 48 Cytokine panel. (C) XPro (at 1 mg/kg dose) reduces CSF pTau217 and pTau181 as measure by proteomics.

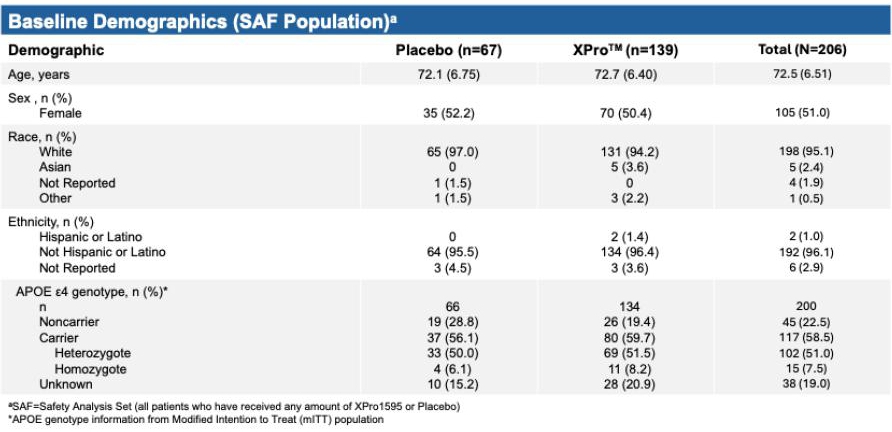

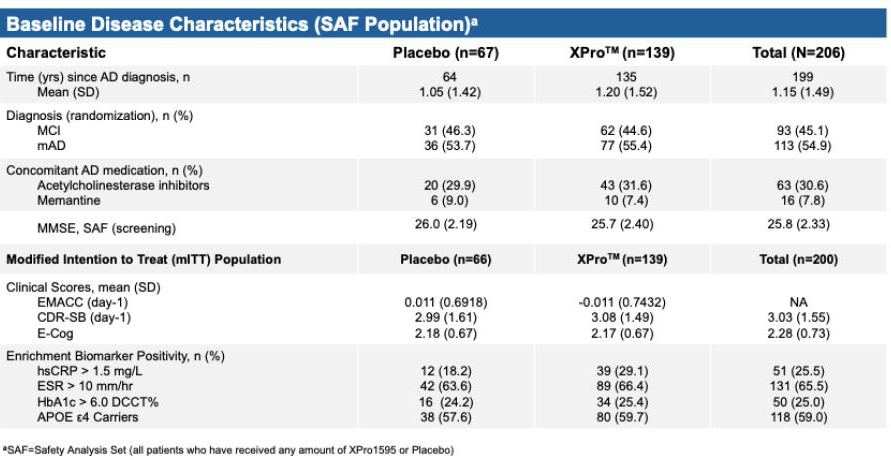

The Phase II study, also known as AD-02 and MINDFuL, was a multicenter, randomized, double-blind, placebo-controlled clinical trial evaluating the safety, tolerability, and efficacy of XPro1595 in individuals with early Alzheimer’s disease with biomarkers of inflammation (ADi). The primary goal of AD02 was to determine if XPro could affect cognition following 6 months of treatment. Participants with a diagnosis of early AD (mild cognitive impairment or mild AD) were randomized in a 2:1 (XPro:Placebo) ratio to receive either 1.0 mg/kg of XPro1595 or placebo via weekly subcutaneous injections for 6 months. An enrichment strategy mirroring to the successful strategy used in the Phase I trial was used to align the mechanism of the drug with the patients AD pathology. Eligibility required the presence of at least one inflammatory biomarker—either high-sensitivity C-reactive protein (hsCRP > 1.5 mg/L), erythrocyte sedimentation rate (ESR > 10 mm/h), hemoglobin A1c (HbA1c > 6.0% DCCT), or at least one APOE4 allele. The primary endpoint was the Early and Mild Alzheimer’s Cognitive Composite (EMACC), with secondary endpoints of Clinical Dementia Rating Scale – Sum of Boxes (CDR-SB), Everyday Cognition Scale (E-Cog), Neuropsychiatric Inventory (NPI-12), ADCS-ADL, and biomarkers such as pTau-217 and GFAP. MRI-based neuroinflammation and brain volumetrics are also evaluated. The AD program had sites in Australia, Canada, the United Kingdom, France, Germany, Spain, Czech Republic and Slovakia.

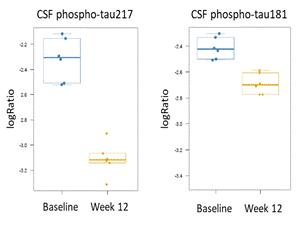

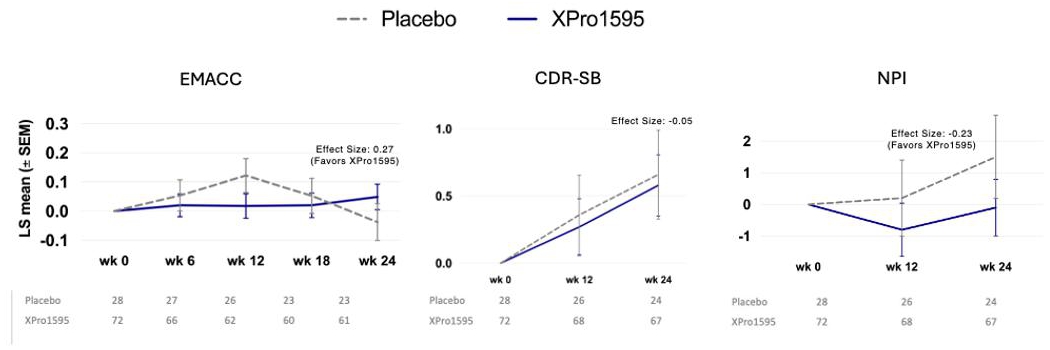

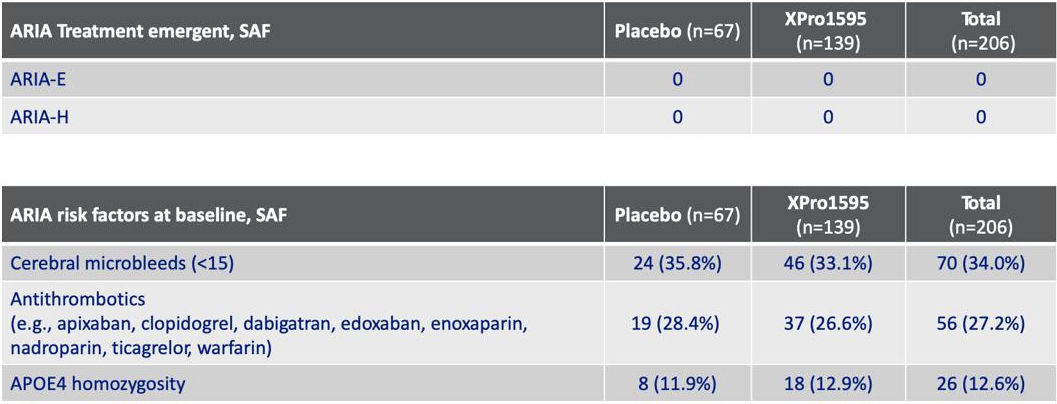

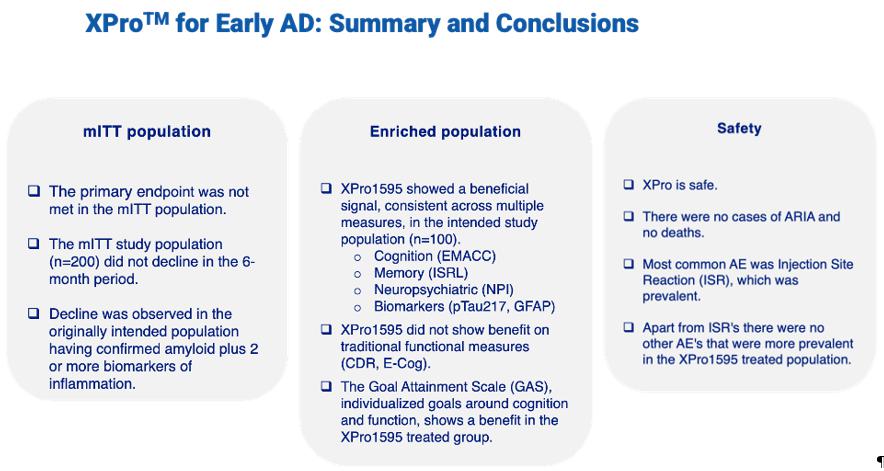

Full enrollment in the Phase II AD trial occurred in late 2024 with 208 patients enrolled and top-line data was received during June 2025. In the Phase 2 MINDFuL trial of XPro™ in patients with early Alzheimer’s Disease (AD) with biomarkers of inflammation, the modified intent-to-treat (mITT) population (n=200) did not meet the primary and key secondary endpoints (figure 1). Efficacy, Demographics and Safety data are shown below.

Figure 1: Phase 2 Study Results – mITT population Primary and Key Secondary Endpoints, Change From Baseline

Figure 1: As these graphs depict, the primary and secondary endpoints in this trial were not met as no decline in the placebo groups were observed. A trend was observed in NPI that favored XPro1595 over placebo. For reference, A higher EMACC score =better, A lower CDR and NPI score is better. EMACC: LS Mean Diff (SE): -0.018 (0.0414), 90% CI: -0.0860, 0.0509, p-value: 0.672. CDR-SB: LS Mean Diff (SE): -0.11 (0.185), 90% CI: -0.417, 0.195, p-value: 0.5491. NPI: LS Mean Diff (SE): -0.9 (0.78), 90% CI: -2.18, 0.39, p-value: 0.2499

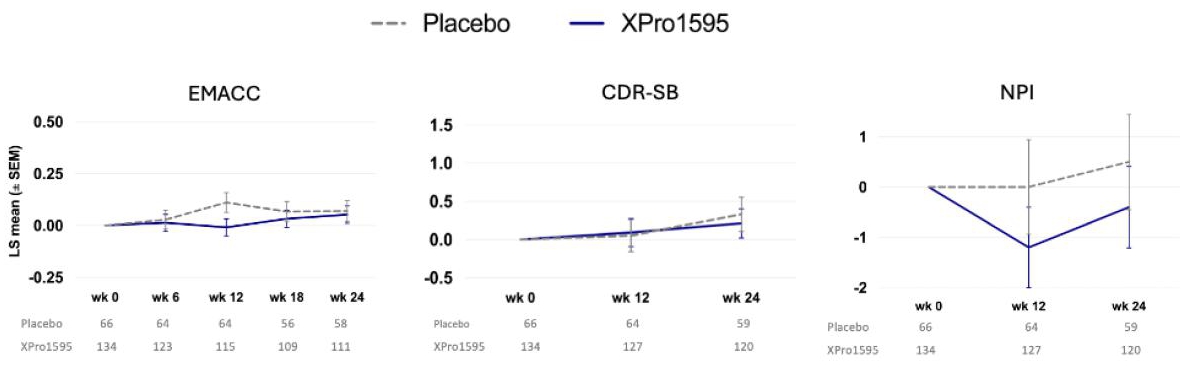

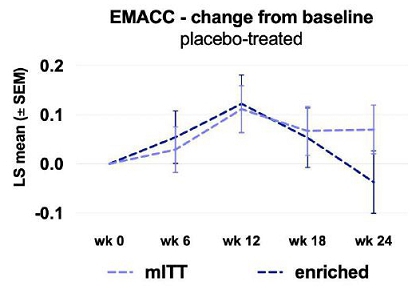

Prespecified subgroups analyses suggested a signal that favored XPro in a predetermined population of patients that were both amyloid positive and had a higher burden of inflammation defined by 2 or more biomarkers of inflammation (from hereon referred to as enriched group). As shown in figure 2, the mITT placebo group did not decline whereas patients in the enriched group did decline. Decline in the placebo group is required to test the ability of a treatment to prevent or slow decline.

Figure 2: Phase 2 Study Results – Placebo group decline in the mITT and enriched population

Figure 2: Placebo patients in the mITT did not show decline on the EMACC over the 24 week study. In the enriched group, placebo patients did decline over 24 weeks.

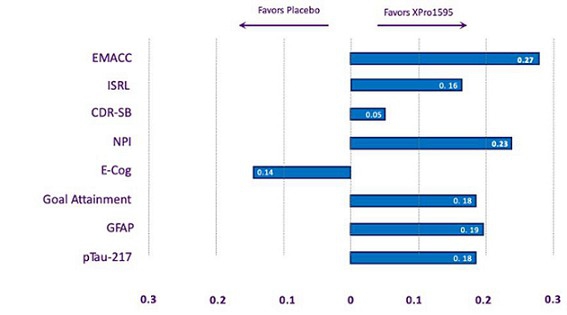

To evaluate a subgroup after missing the primary endpoint, we used effect size as the primary metric due to the smaller sample size (n=100). Effect size, measured by Cohen’s D, is well-suited for small samples and allows comparisons across different measures (e.g., cognitive tests and biomarkers). Unlike p-values, which indicate the likelihood of results being due to chance, effect size reflects clinical relevance and is commonly used for signal detection in Phase 2 studies.

We defined a promising signal as a minimum effect size of 0.2, where XPro outperformed placebo on multiple endpoints aligned with our hypothesis and the drug’s mechanism of action. Results must also be appropriate for the trial’s parameters, meaning the observed effects should align with the trial’s duration and endpoints. For example, if a clinical measure typically requires a longer time to show meaningful change than the trial’s 6-month timeframe, an observed effect on that endpoint would not be considered supportive. Signal detection was based on the effect size difference in LS mean change from baseline (MMRM model) between XPro and placebo at 6 months, ensuring results were meaningful, relevant, and appropriate for the trial’s design and objectives.

Using this method, the enriched population (50% of the total sample, n=100) showed trends toward improvement with XPro on the primary endpoint (EMACC) and a key secondary endpoint (NPI) (Figure 3). With the placebo group showing the expected decline on EMACC over six months, a beneficial effect of XPro became evident. EMACC, which measures cognition (higher scores are better), showed an effect size of 0.27, exceeding the company’s threshold of 0.2, though the p-value of 0.16 fell short of the <0.1 target. For neuropsychiatric symptoms (NPI), the enriched population showed a stronger beneficial effect compared to the overall population, with an effect size of -0.23 and a p-value of 0.2. There was no effect on CDR-SB, which measures cognition and function (lower scores are better). We also evaluated the effect size of additional endpoints (Figure 4). Across most endpoints, XPro showed favorable trends, with effect sizes approaching the 0.2 threshold for clinical relevance.

Figure 3: Phase 2 Study Results – Enriched population primary and key secondary endpoints, change from baseline

Figure 3: The enriched population show effect size >0.2 favoring XPro1595 on the EMACC and NPI. , A higher EMACC score =better, A lower CDR and NPI score is better. EMACC: LS Mean Diff (SE): 0.086 (0.0603), 90% CI: -0.0146, 0.1857, p-value: 0.1594. CDR-SB: LS Mean Diff (SE): -0.08 (0.307), 90% CI: -0.593, 0.426, p-value: 0.7859. NPI: LS Mean Diff (SE): -1.6 (1.25), 90% CI: -3.71, 0.47, p-value: 0.2003

Figure 4: Phase 2 Study Results – Most endpoints favor treatment with XPro1595.

Figure 4: Effect size of XPro across multiple endpoints described as absolute effect sizes (cohen’s D).

Demographics

Safety

| Safety: Treatment Emergent Adverse Events (TEAEs): Safety Analyses Set | |||

| Event, n (%) | Placebo (n=67) | XPro1595 (n=139) | Total (n=206) |

| Any TEAE | 59 (88.1%) | 131 (94.2%) | 190 (92.2%) |

|

Any TEAE by Maximum Severity Mild Moderate Severe |

34 (50.7%) 22 (32.8%) 3 (4.5%) |

73 (52.5%) 56 (40.3%) 2 (1.4%) |

107 (51.9%) 78 (37.9%) 5 (2.4%) |

| Any Serious TEAE | 5 (7.5%) | 8 (5.8%) | 13 (6.3%) |

| Any Treatment-Related Serious TEAE | 0 | 2 (1.4%) | 2 (1.0%) |

| Any TEAE Leading to Treatment Discontinuation | 2 (3.0%) | 12 (8.6%) | 14 (6.8%) |

| Any TEAE Leading to Study Withdrawal | 2 (3.0%) | 12 (8.6%) | 14 (6.8%) |

| Any TEAE with Fatal Outcome | 0 | 0 | 0 |

| System Organ Class & Preferred Term | Placebo (n=67) | XPro1595 (n=139) | Total (n=206) |

| General disorders and administration site conditions | |||

| Injection site reaction | 2 (3.0%) | 73 (52.5%) | 75 (36.4%) |

| Injection site erythema | 0 | 49 (35.3%) | 49 (23.8%) |

| Fatigue | 9 (13.4%) | 17 (12.2%) | 26 (12.6%) |

| Injection site hypersensitivity | 0 | 14 (10.1%) | 14 (6.8%) |

| Injection site pruritus | 0 | 12 (8.6%) | 12 (5.8%) |

| Infections and infestations | |||

| Upper respiratory tract infection | 11 (16.4%) | 9 (6.5%) | 20 (9.7%) |

| Musculoskeletal and connective tissue disorders | |||

| Arthralgia | 4 (6.0%) | 16 (11.5%) | 20 (9.7%) |

| Nervous system disorders | |||

| Headache | 7 (10.4%) | 14 (10.1%) | 21 (10.2%) |

The Company believes these findings from the Phase 2 results indicate that XPro may offer benefits to a readily identified subgroup of Alzheimer’s patients across all ages with biomarker-defined neuroinflammation, regardless of comorbidities or ApoE4 status and potentially lays the foundation for advancing XPro as a promising treatment for AD. The Company is planning an end-of-phase 2 meeting with the FDA, which is expected to occur towards the end of 2025, to determine next steps and expects to be eligible for Break Through status.

CORDStrom, developed by INmune Bio circa 2020, represents a breakthrough in mesenchymal stromal cell technology. The CORDStrom platform leverages, among other things, proprietary screening, pooling and expansion techniques to create off-the-shelf, allogeneic, pooled human umbilical cord -derived mesenchymal stromal cells (HucMSCs) as medicines to treat complex inflammatory diseases. CORDStrom products are designed to provide high-quality, off-the-shelf, batch-to-batch consistent, scalable, cGMP manufactured, potent cellular medicines that can be produced at low cost and with repeatable specification. Initially developed at the INKmune manufacturing facilities utilizing United Kingdom academic grant funding, CORDStrom is a product platform that shows promise as a therapy for RDEB and many other debilitating conditions. While the first generation CORDStrom product is agnostic to indication, the platform enables creation of indication-specific products, which can be tuned for optimization of anti-inflammatory, immunomodulatory, wound healing, and other characteristics.

The CORDStrom product platform shares many similarities, including raw materials, equipment, and procedures, with the Company’s INKmune oncology product, enabling the Company to leverage economies of scale, experienced staff, and other resources to strategically manufacture both products in a rotational campaign with resource and environmental efficiencies.

Children with RDEB have skin that is damaged by even the smallest amount of friction which causes severe blistering, deep wounds, and scars. It is caused by a fault in a gene that makes collagen, a protein that holds the skin layers together. There are limited options available for treatment, none that adequately meet the needs of patients, and the condition gets worse over time with most children reliant on a wheelchair as they move into their teenage years. Many of those with an RDEB diagnosis will also go on to develop aggressive life-threatening skin cancer in adulthood caused by the accumulated damage to their skin. The Company estimates roughly 2,000 people suffer from RDEB in the US, United Kingdom and EU representing a large unmet opportunity to potentially provide routine clinical care to these children.

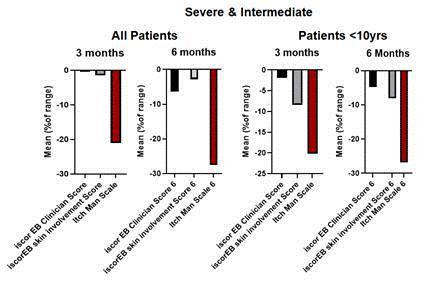

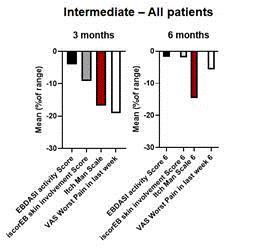

Since 2020, the Company has supplied CORDStrom HucMSCs as an investigational medical product to the Great Ormond Street Hospital (“GOSH”), London, in connection with the MissionEB study, which was primarily funded by a grant from the National Institute for Health and Care Research (“NIHR”) in the United Kingdom. INmune Bio was compensated for CORDStrom used in the trial and was not a sponsor of the Mission EB study. Investigators recently concluded a double blinded, placebo-controlled arm of the study, which evaluated the safety and efficacy of CORDStrom in 30 pediatric patients (less than 16 years old) in the United Kingdom with intermediate and severe RDEB using a novel cross-over clinical trial design. Patients were randomized to CORDStrom or placebo arms and received 2, intravenous infusions two weeks apart and then followed for 9 months. Each child then crossed over to the other arm and received two doses of placebo or CORDStrom two weeks apart with a further 9-month follow-up.