UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 9, 2025

DEFI DEVELOPMENT CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 001-41748 | 83-2676794 | ||

| (State or other jurisdiction of Incorporation) |

(Commission File Number) | (IRS Employer Identification Number) |

|

6401 Congress Avenue, Suite 250 Boca Raton, Florida |

33487 | |

| (Address of registrant’s principal executive office) | (Zip code) |

(561) 559-4111

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.00001 per share | DFDV | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 3.02. | Unregistered Sales of Equity Securities. |

On July 9, 2025, DeFi Development Corp. (the “Company”) completed its private offering of an additional $10.0 million in aggregate principal amount of its 5.50% Convertible Senior Notes due 2030 (the “notes”) pursuant to the option granted to the initial purchasers under that certain purchase agreement, dated as of July 1, 2025, entered into by and among the Company and Cantor Fitzgerald & Co., as representative of the several initial purchasers named therein (“Initial Purchasers”). As previously announced, the company previously completed its private offering of $112.5 million aggregate principal amount of notes on July 7, 2025.

The Company offered and sold the additional $10.0 million in notes to the Initial Purchasers in reliance on the exemption from the registration requirements provided by Section 4(a)(2) of the Securities Act, and the notes were resold only to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act. Any shares of common stock that may be issued upon conversion of the notes will be issued in reliance upon Section 3(a)(9) of the Securities Act as involving an exchange by the Company exclusively with its security holders. Initially, a maximum of 475,963 shares of common stock may be issued upon conversion of the notes, based on the initial maximum conversion rate of 47.5963 shares of common stock per $1,000 principal amount of notes, which is subject to customary anti-dilution adjustment provisions. Neither the notes nor the underlying shares of common stock have been registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. The Company does not intend to file a shelf registration statement for the resale of the notes or any common stock issuable upon conversion of the notes.

| Item 7.01. | Regulation FD Disclosure. |

Guidance and Updated Investor Presentation

On July 14, 2025, the Company posted an investor presentation to its website at https://defidevcorp.com/investor (the “Investor Presentation”). The Company expects to use the investor presentation, in whole or in part, and possibly with modifications, in connection with presentations to investors, analysts, and others. A copy of the investor presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

On the same day, the Company issued a press release announcing forward looking guidance on SOL per Share (“SPS”). A copy of the press release is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

Total Shares Outstanding

The Company disclosed on its website that, as of the date hereof, the Company has 18,777,884 total shares outstanding.

The information furnished under this Item 7.01, including Exhibits 99.1 and 99.2, will not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Investor Presentation | |

| 99.2 | Press Release, dated as of July 14, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: July 14, 2025 | DEFI DEVELOPMENT CORP. | |

| By: | /s/ Joseph Onorati | |

| Name: | Joseph Onorati | |

| Title: | Chairman & CEO | |

Exhibit 99.1

Forward - Looking Statements 2 This presentation has been prepared by DeFi Development Corp. (“DeFi”) (NASDAQ:DFDV) for informational purposes only and not for any other purpose. We have prepared this presentation solely to illustrate the businesses of DeFi, and it does not constitute an offer to sell, or a solicitation of an offer to buy, any securities of DeFi. Nothing contained in this presentation is, or should be construed as, a recommendation, promise or representation by the presenter or DeFi or any director, employee, agent, or adviser of DeFi. Information provided in this presentation speaks only as of the date hereof. DeFi assumes no obligation to update any statement after the date of this presentation as a result of new information, subsequent events or any other circumstances unless required by applicable law. Certain information contained in this presentation and statements made orally during this presentation relate to or are based on studies, publications, surveys and other data obtained from third - party sources and DeFi’s own internal estimates and research. While DeFi believes these third - party studies, publications, surveys and other data to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third - party sources. In addition, no independent source has evaluated the reasonableness or accuracy of DeFi’s internal estimates or research and no reliance should be made on any information or statements made in this presentation relating to or based on such internal estimates and research. You should conduct your own investigation and analysis of DeFi, its business, prospects, results of operations and financial condition. In furnishing this information, DeFi does not undertake any obligation to provide you with access to any additional information (including forward - looking information and any projections contained herein) or to update or correct the information. Certain information and conclusions set forth in this presentation are based on projections. Actual results may differ materially from those indicated in the forward - looking statements because the realization of those results is subject to many uncertainties, including economic conditions, fluctuations in the market price of SOL, the impact on our business of the regulatory environment and other factors, some of which are described more fully in the Company's most recent Annual Report on Form 10 - K and the Current Report on Form 10 - Q filed with the SEC on May 14, 2025. Forward - looking statements contained in this presentation are made as of the date of this presentation, and we undertake no duty to update such information except as required under applicable law. Investors should be aware that projections are subject to many risks and uncertainties and may be materially different from actual results. Each investor must conduct and rely on its own evaluation, including of the associated risks, in making an investment decision. This presentation also includes express and implied forward - looking statements regarding the current expectations, estimates, opinions and beliefs of DeFi that are not historical facts. Such forward - looking statements may be identified by words such as “believes,” “expects,” “endeavors,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “should” and “objective” and the negative and variations of such words and similar words. These statements are made on the basis of current knowledge and, by their nature, involve numerous assumptions and uncertainties. Nothing set forth herein should be regarded as a representation, warranty or prediction that DeFi will achieve or is likely to achieve any particular future result.

DeFi Development Corp. is the most efficient way to accumulate SOL 3 Chapter 1: The Rise of Crypto Treasury Vehicles Chapter 2: Legacy Structures Can’t Accumulate Crypto Fast Enough. We Can. Chapter 3: Solana Is the Right Asset. Now Is the Right Time. Chapter 4: DFDV Is Built to Compound – By Design and By Team Chapter 1: The Rise of Crypto Treasury Vehicles

Public - market treasury strategies are reshaping how crypto gets accumulated 5

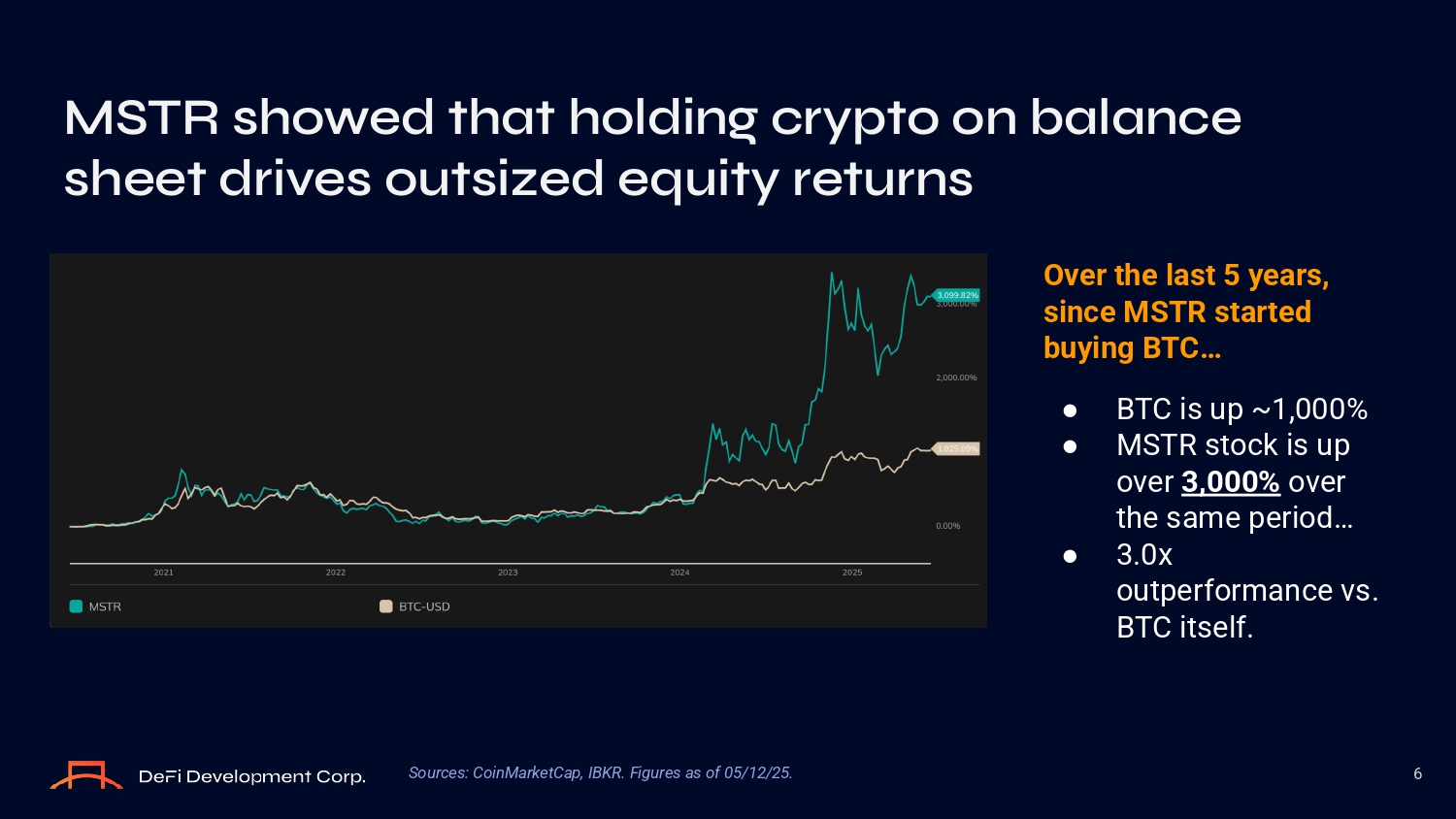

Over the last 5 years, since MSTR started buying BTC… ● BTC is up ~ 1 , 000 % ● MSTR stock is up over 3 , 000 % over the same period … ● 3.0x outperformance vs. BTC itself. MSTR showed that holding crypto on balance sheet drives outsized equity returns 6 Sources: CoinMarketCap, IBKR. Figures as of 05/12/25.

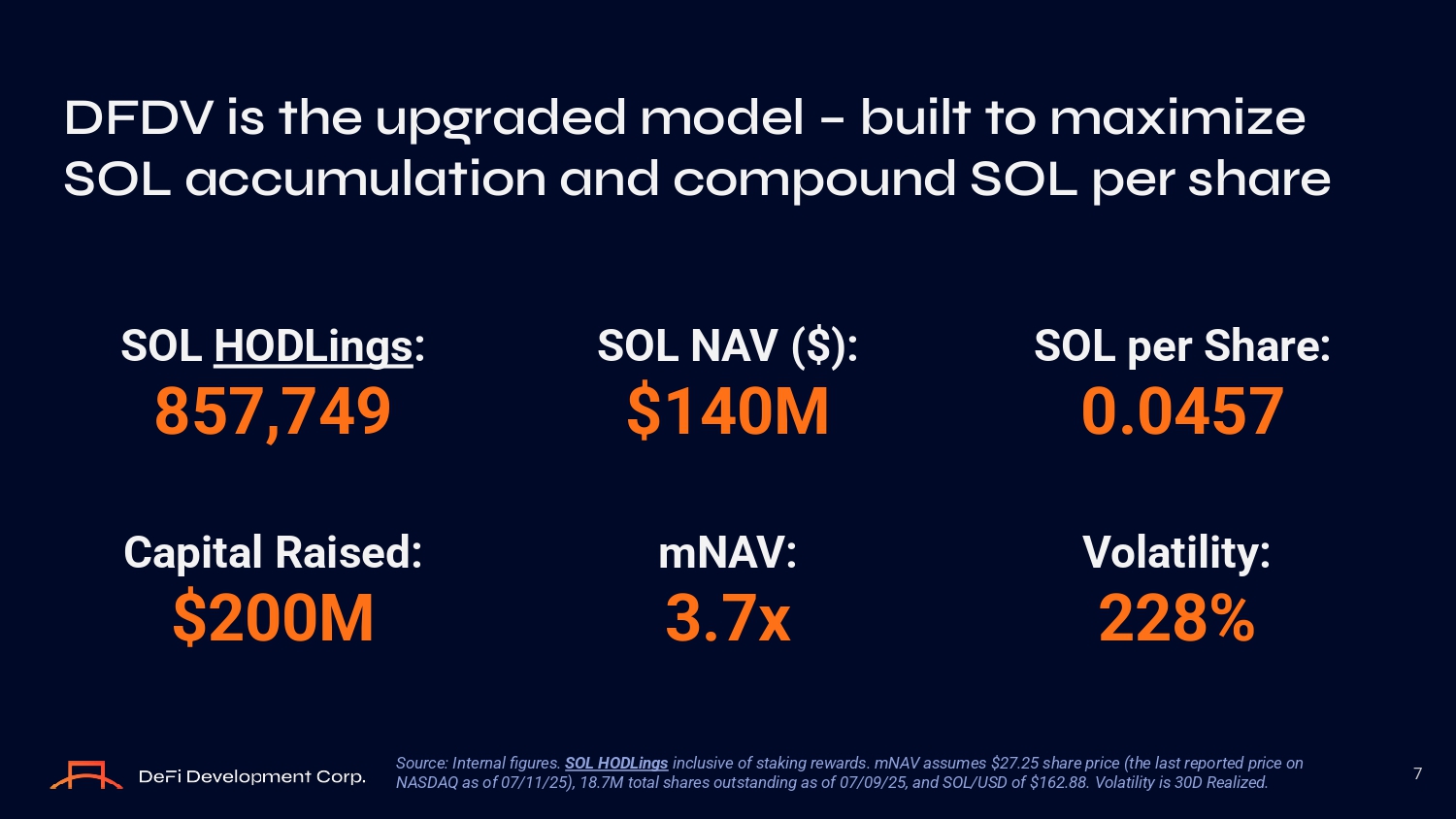

DFDV is the upgraded model – built to maximize SOL accumulation and compound SOL per share 7 Source: Internal figures. SOL HODLings inclusive of staking rewards. mNAV assumes $27.25 share price (the last reported price on NASDAQ as of 07/11/25), 18.7M total shares outstanding as of 07/09/25, and SOL/USD of $162.88. Volatility is 30D Realized. SOL per Share: SOL NAV ($): SOL HODLings : 0.0457 $140M 857,749 Volatility: mNAV: Capital Raised: 228% 3.7x $200M Our mNAV calculation normalizes for debt and fully diluted share count 8 Source: NAV in (2) is SOL NAV less net debt ($140.6M convertible debt as of 07/14/25, less $1.8M of cash as of 03/31/25 ).

mNAV assumes $27.25 share price (the last reported price on NASDAQ on 07/11/25), and SOL/USD of $162.88. See Additional Information at the end of this presentation for discussion on prepaid forward treatment in NAV. Notes mNAV NAV/shr Share Count NAV Scenario Market Cap divided by SOL 3.7x $7.44 18.7M $139.7M 1. Headline mNAV Market Cap divided by: SOL less total convertible debt outstanding 6.7x $4.07 18.7M $76.4M 2. Adjust for Debt Apr 2025 Convert strike of $9.74 Jul 2025 Convert strike of $23.11 4.4x $6.24 22.7M $141.5M 3. Debt Converts Converts and warrants all exercised ; + $ 84 M of cash proceeds from warrants 3.3x $8.21 27.5M $225.4M 4. Fully Diluted mNAV Chapter 2: Legacy Structures Can’t Accumulate Crypto Fast Enough.

We Can.

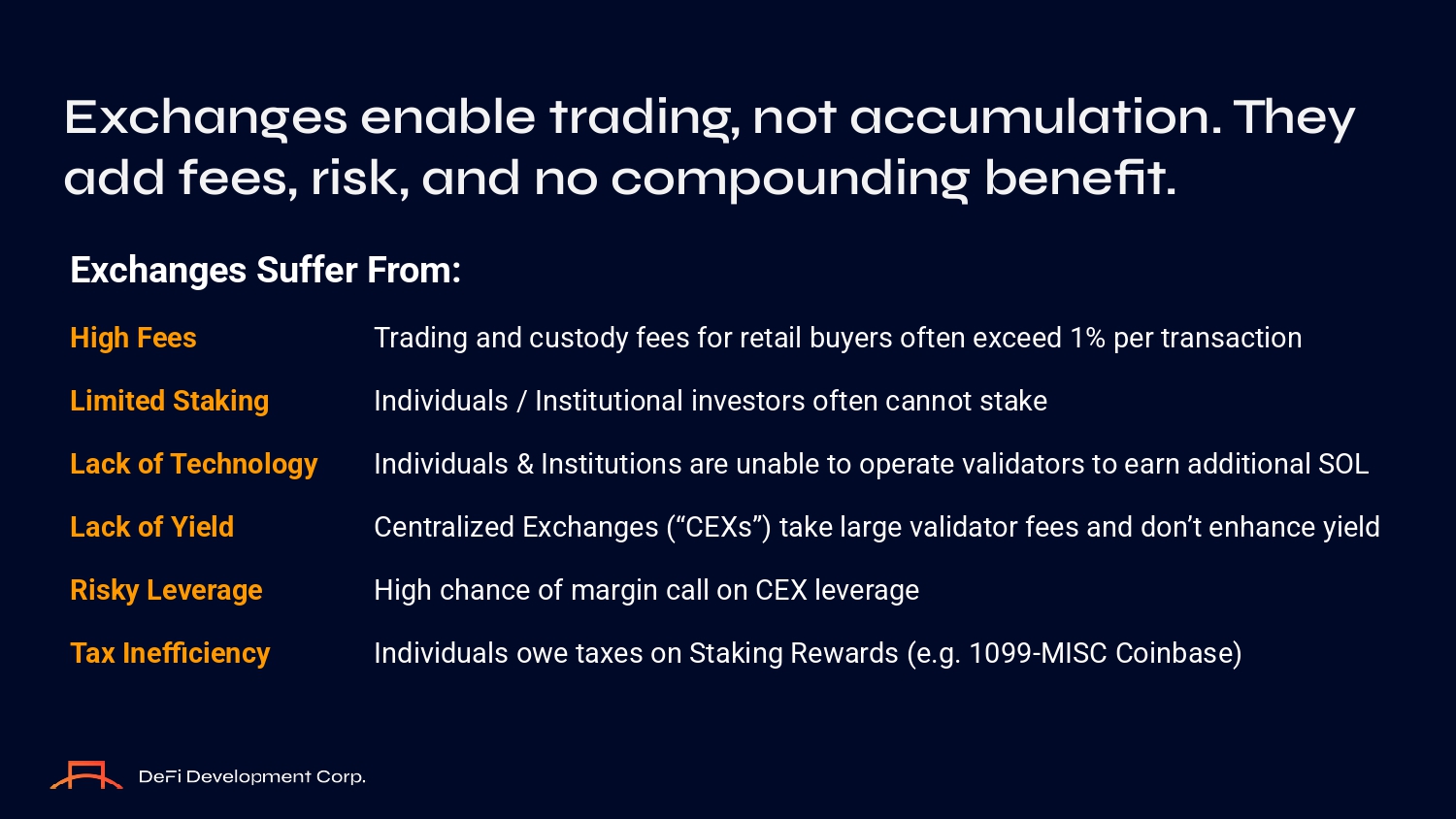

Exchanges Suffer From: High Fees Trading and custody fees for retail buyers often exceed 1% per transaction Limited Staking Individuals / Institutional investors often cannot stake Lack of Technology Individuals & Institutions are unable to operate validators to earn additional SOL Lack of Yield Centralized Exchanges (“CEXs”) take large validator fees and don’t enhance yield Risky Leverage High chance of margin call on CEX leverage Tax Inefficiency Individuals owe taxes on Staking Rewards (e.g. 1099 - MISC Coinbase) Exchanges enable trading, not accumulation. They add fees, risk, and no compounding benefit.

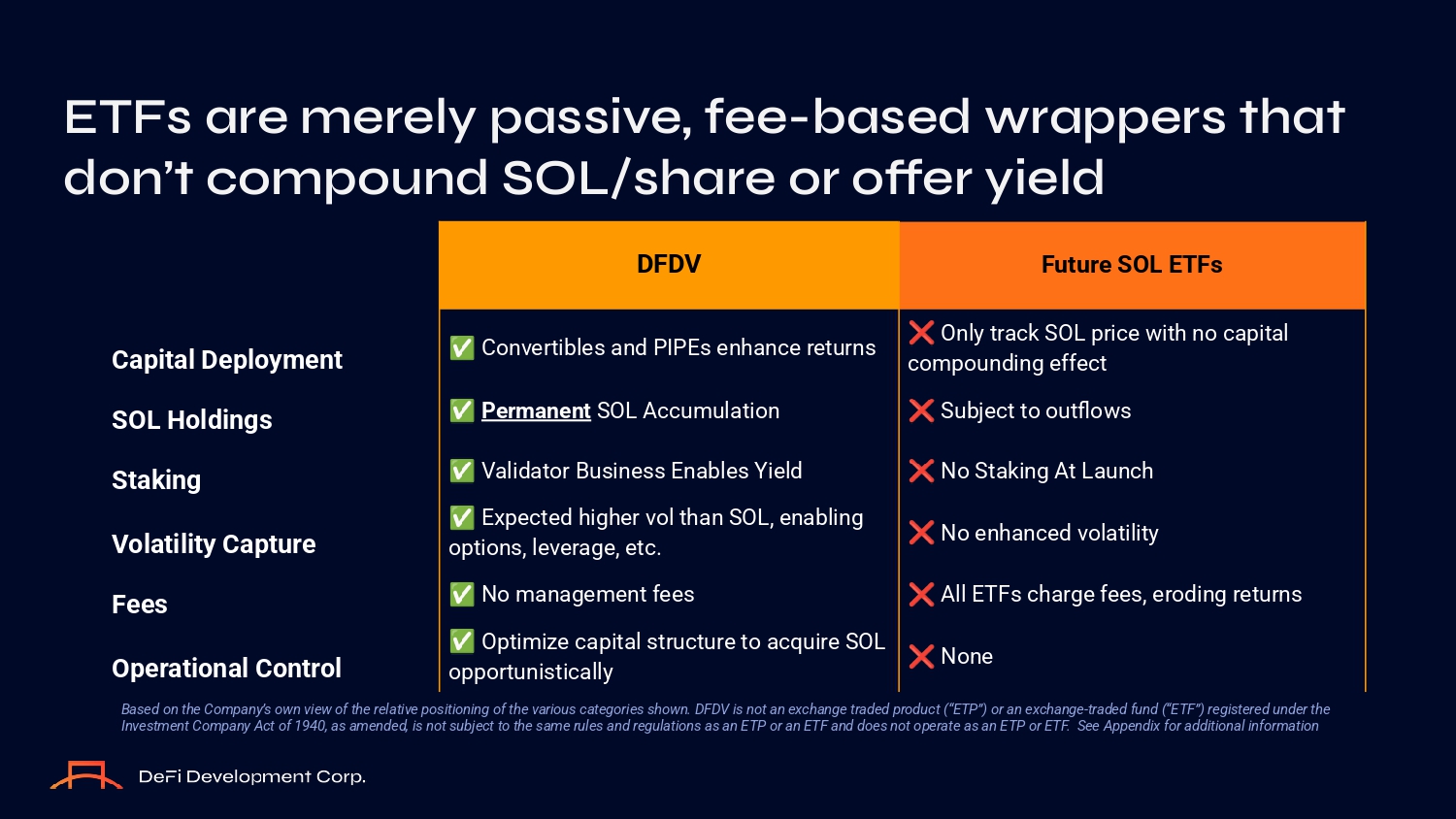

ETFs are merely passive, fee - based wrappers that don’t compound SOL/share or offer yield Capital Deployment SOL Holdings Staking Volatility Capture Fees Operational Control Future SOL ETFs DFDV Only track SOL price with no capital compounding effect Subject to outflows No Staking At Launch No enhanced volatility All ETFs charge fees, eroding returns None Convertibles and PIPEs enhance returns Permanent SOL Accumulation Validator Business Enables Yield Expected higher vol than SOL, enabling options, leverage, etc. No management fees Optimize capital structure to acquire SOL opportunistically Based on the Company’s own view of the relative positioning of the various categories shown. DFDV is not an exchange traded product (“ETP”) or an exchange - traded fund (“ETF”) registered under the Investment Company Act of 1940, as amended, is not subject to the same rules and regulations as an ETP or an ETF and does not operate as an ETP or ETF.

See Appendix for additional information Valuation Support Technology & Crypto Expertise ● Discounted locked SOL access delivers instant unrealized gains ● Owning validators increases control and improves staking economics ● Stake delegated to our validators from third parties earns more SOL ○ DFDV offers 8% stake yield vs. Coinbase at 5.1% stake yield DFDV solves this: we buy fast, generate onchain yield, and provide enhanced exposure Financial Strategies ● We expect to engage in convertible bond offerings to fund SOL purchases ● Risk - managed DeFi strategies expected to earn more SOL ● Expected minimal tax bill enables us to grow SOL stockpile faster 12 SOL SOL More SOL Less Risk Cash Flow ● Stablecoin strategy offers uncorrelated yield through the cycle ● No risk of “margin call” Source: Coinbase est. reward rate as of 07/11/25 We HODL over $130M of SOL, and this is just the beginning 13

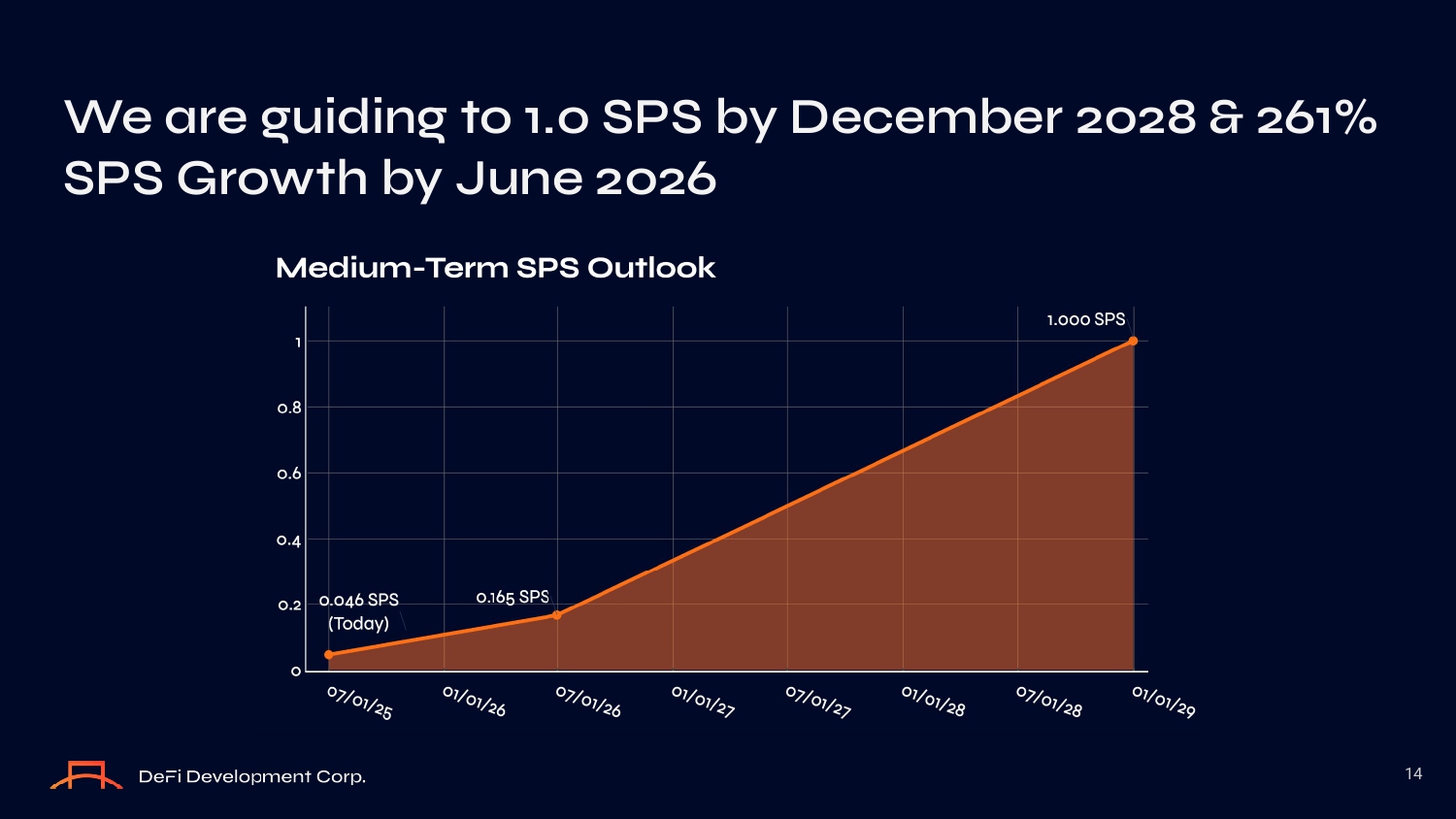

We are guiding to 1.0 SPS by December 2028 & 261% SPS Growth by June 2026 14

Chapter 3: Solana Is the Right Asset. Now Is The Right Time.

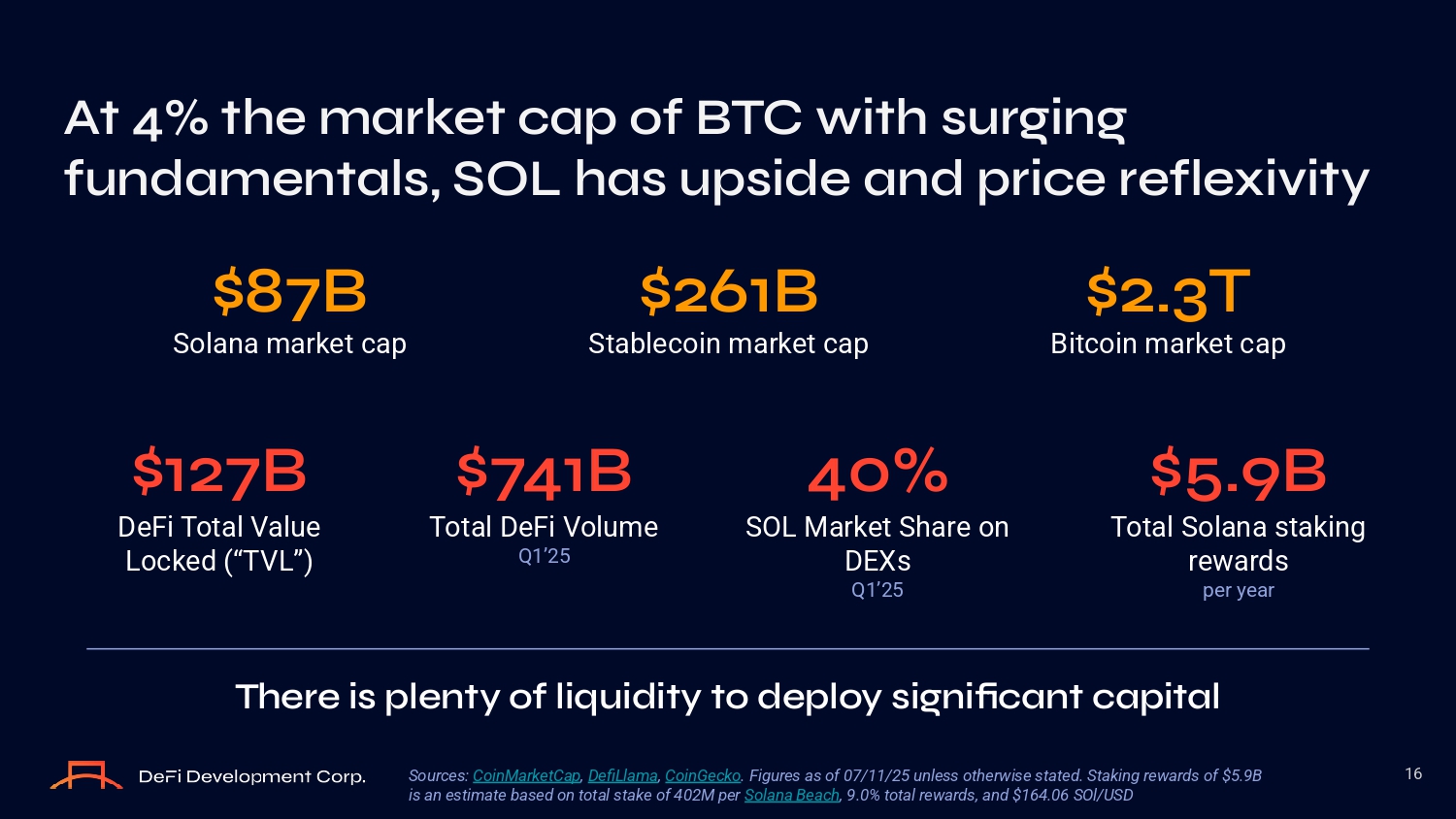

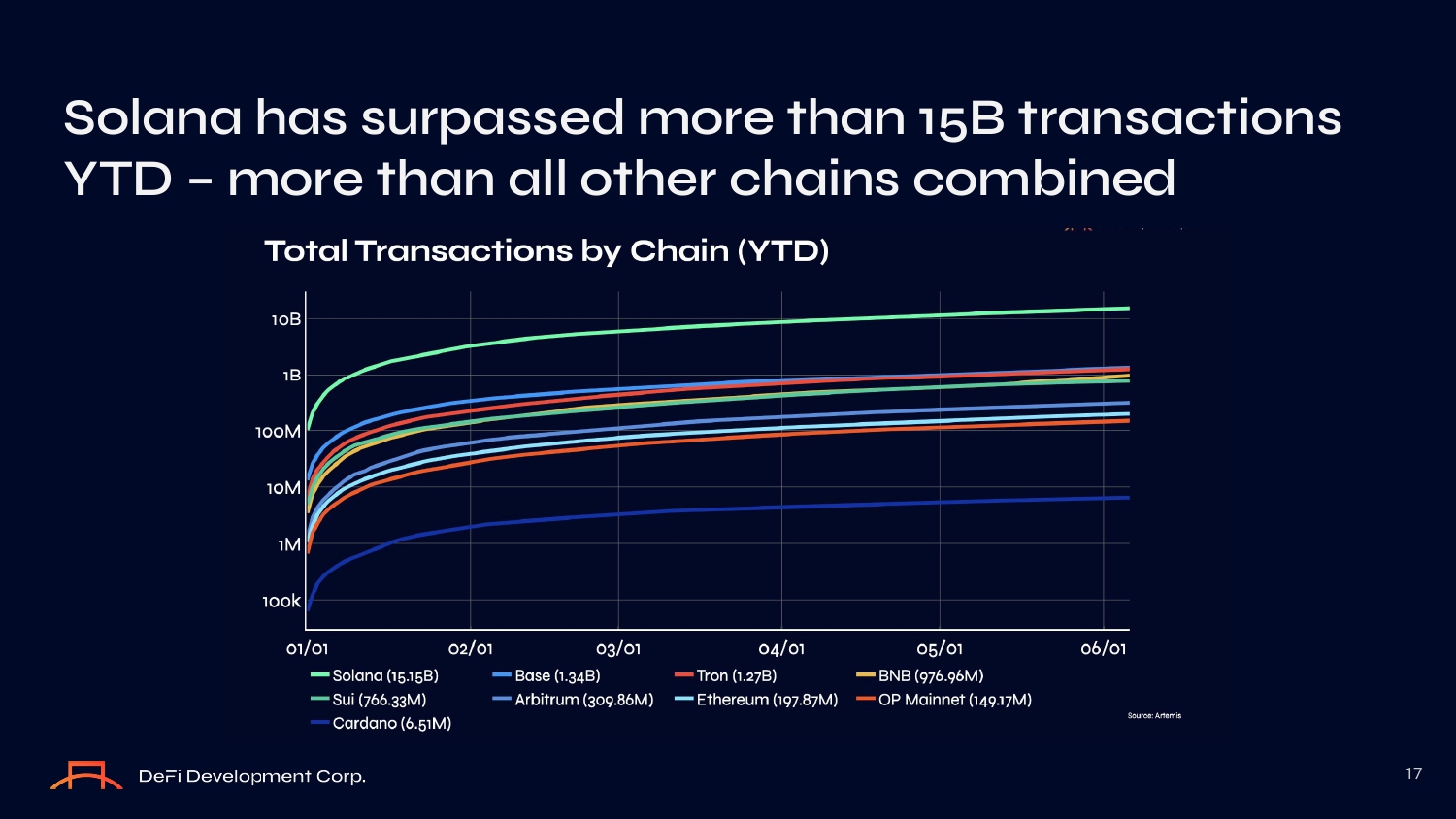

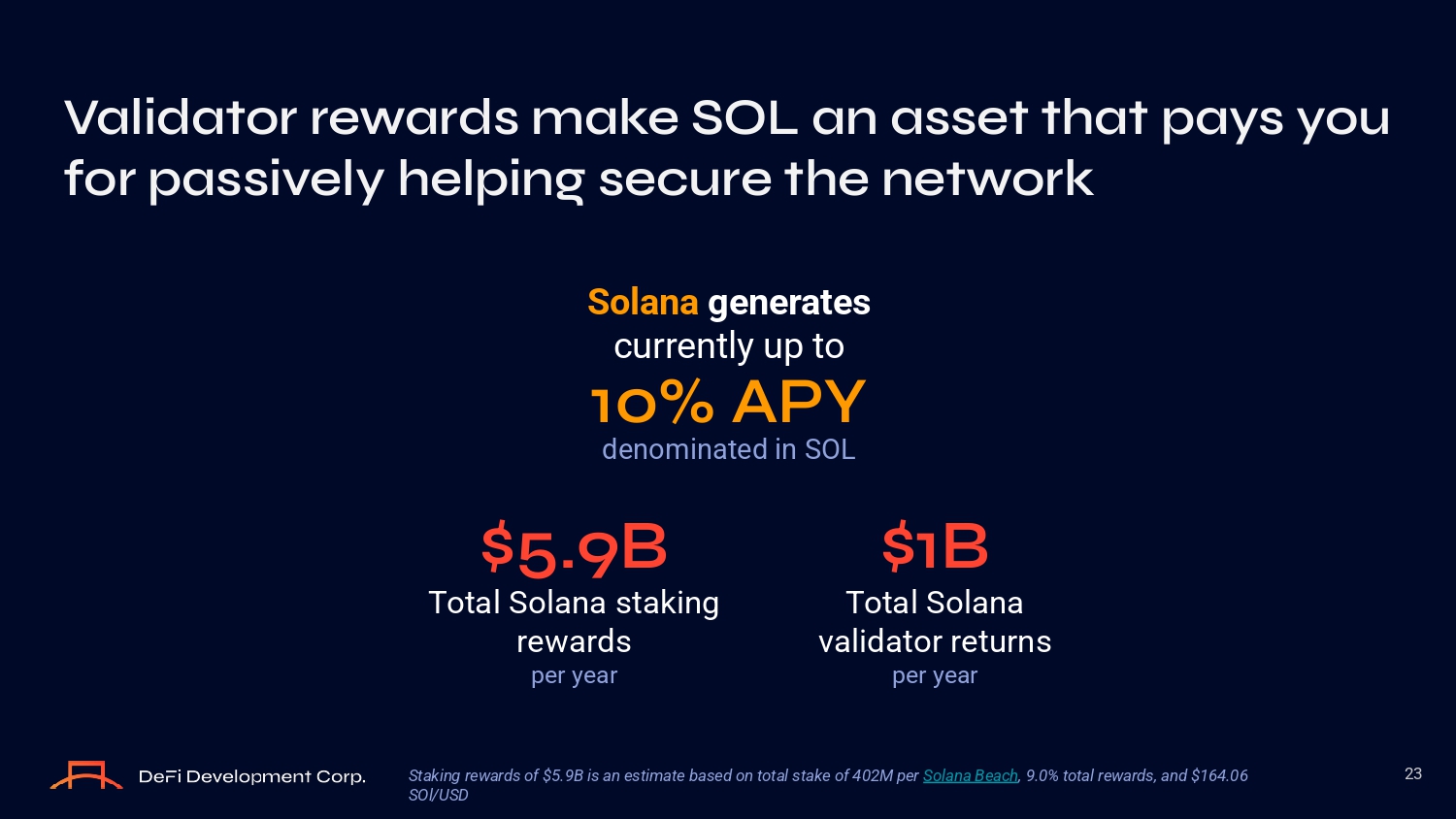

At 4% the market cap of BTC with surging fundamentals, SOL has upside and price reflexivity 16 $87B Solana market cap $261B Stablecoin market cap $2.3T Bitcoin market cap $127B DeFi Total Value Locked (“TVL”) $741B Total DeFi Volume Q1’25 40% SOL Market Share on DEXs Q1’25 There is plenty of liquidity to deploy significant capital $5.9B Total Solana staking rewards per year Sources: CoinMarketCap , DefiLlama , CoinGecko . Figures as of 07/11/25 unless otherwise stated. Staking rewards of $5.9B is an estimate based on total stake of 402M per Solana Beach , 9.0% total rewards, and $164.06 SOl/USD Solana has surpassed more than 15B transactions YTD – more than all other chains combined 17

Solana leads the pack with >60oM new wallets created YTD, nearly 2x all other chains combined 18 New Wallets by Chain (YTD)

DFDV is an onchain company, deeply integrated across the Solana ecosystem 19

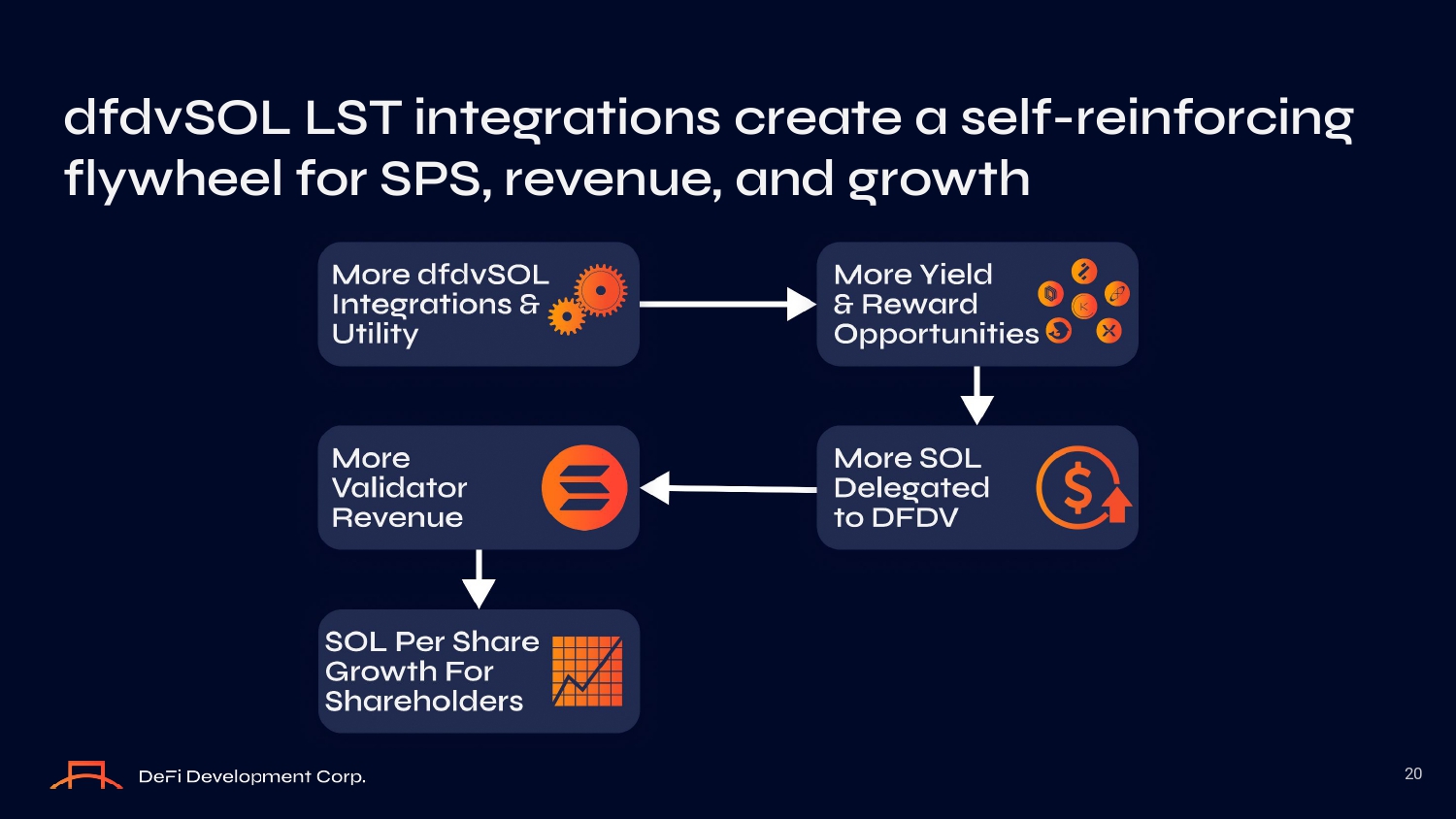

dfdvSOL LST integrations create a self - reinforcing flywheel for SPS, revenue, and growth 20

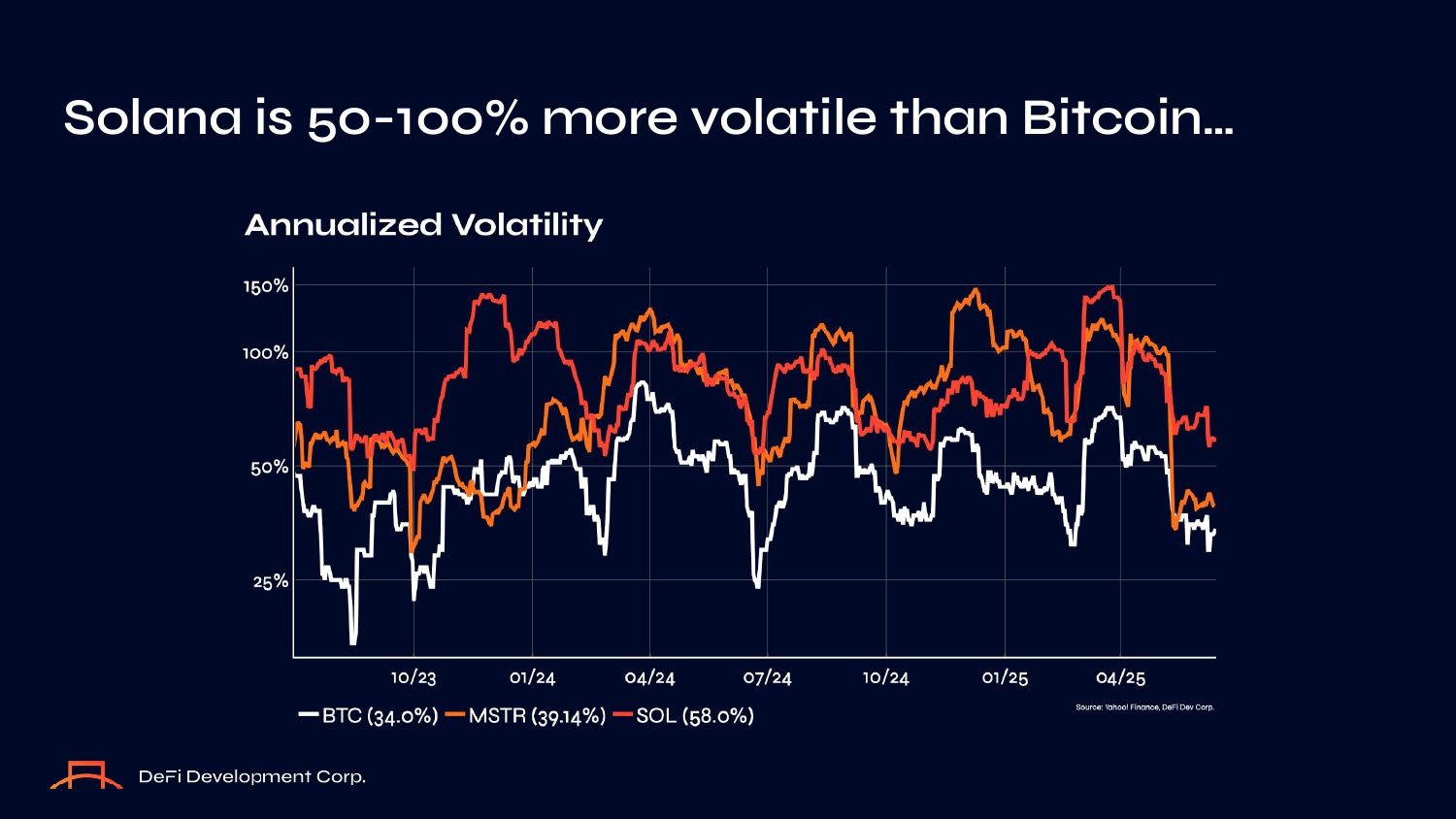

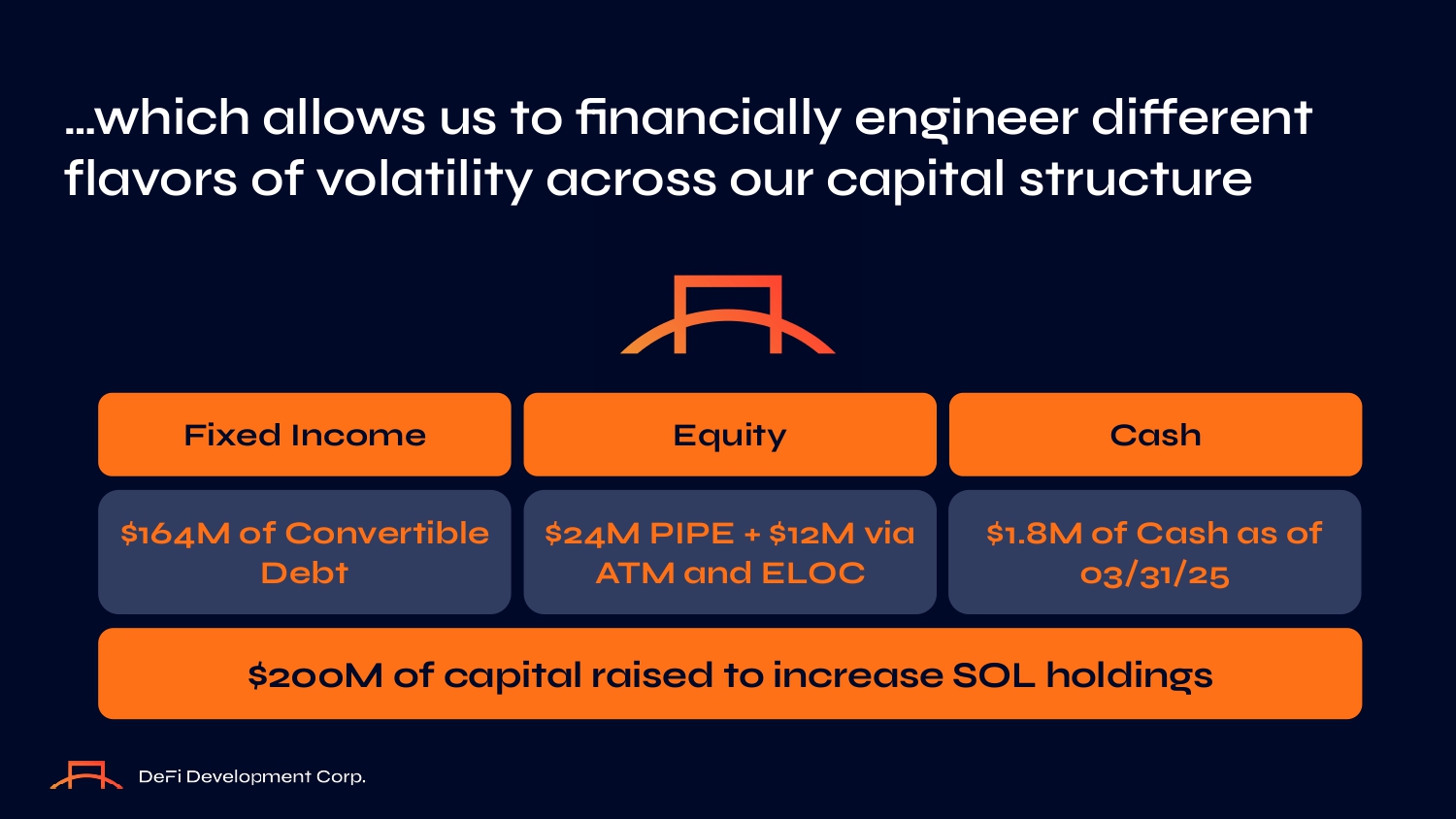

Solana is 50 - 100% more volatile than Bitcoin… Fixed Income Equity Cash $164M of Convertible Debt $24M PIPE + $12M via ATM and ELOC $1.8M of Cash as of 03/31/25 $200M of capital raised to increase SOL holdings …which allows us to financially engineer different flavors of volatility across our capital structure 23 Validator rewards make SOL an asset that pays you for passively helping secure the network Solana generates currently up to 10% APY denominated in SOL $5.9B Total Solana staking rewards per year $1B Total Solana validator returns per year Staking rewards of $5.9B is an estimate based on total stake of 402M per Solana Beach , 9.0% total rewards, and $164.06 SOl/USD

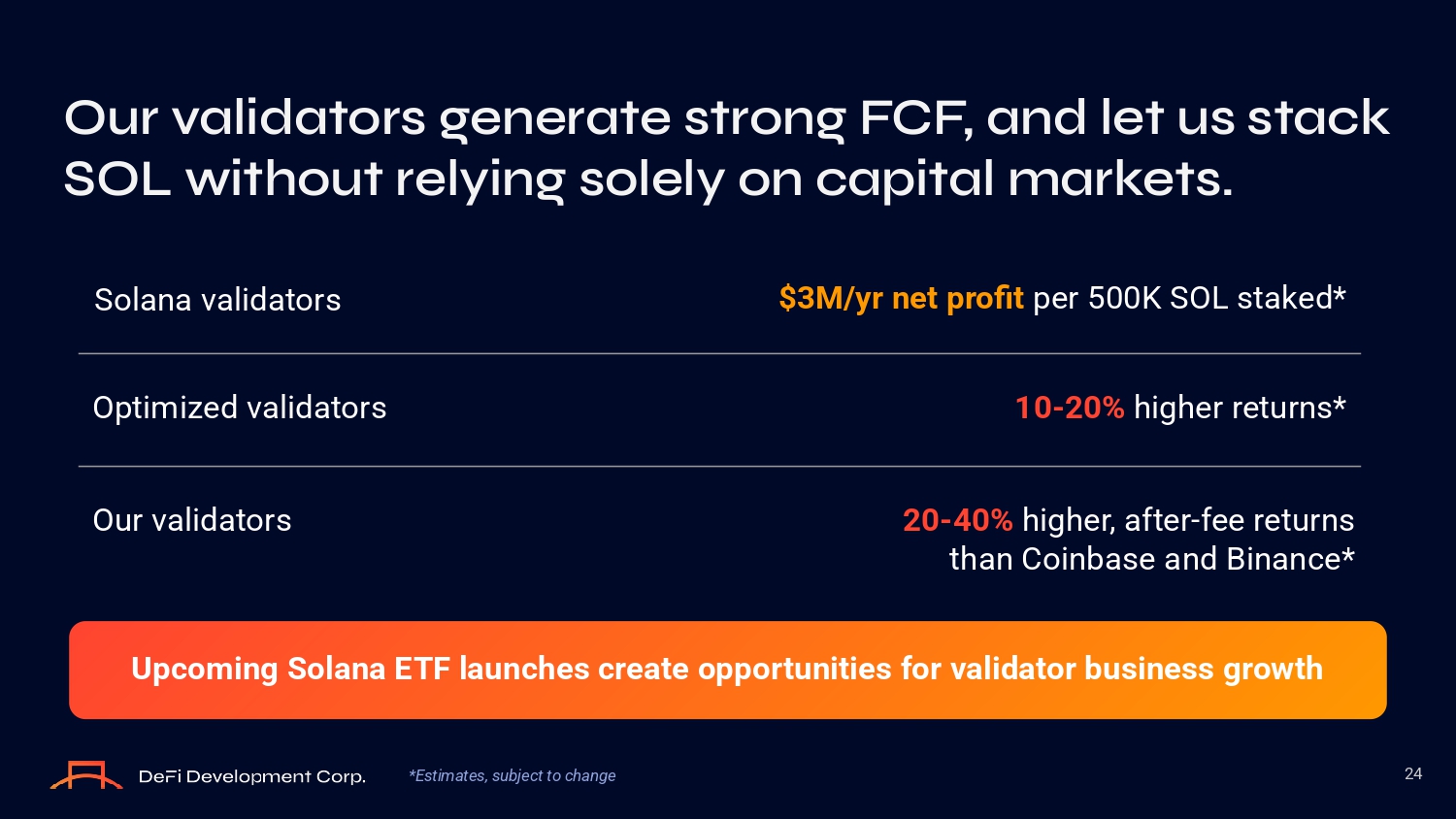

Our validators generate strong FCF, and let us stack SOL without relying solely on capital markets. 24 Solana validators $3M/yr net profit per 500K SOL staked* Optimized validators 10 - 20% higher returns* Our validators 20 - 40% higher, after - fee returns than Coinbase and Binance* Upcoming Solana ETF launches create opportunities for validator business growth *Estimates, subject to change Chapter 4: DFDV Is Built To Compound – By Design and By Team

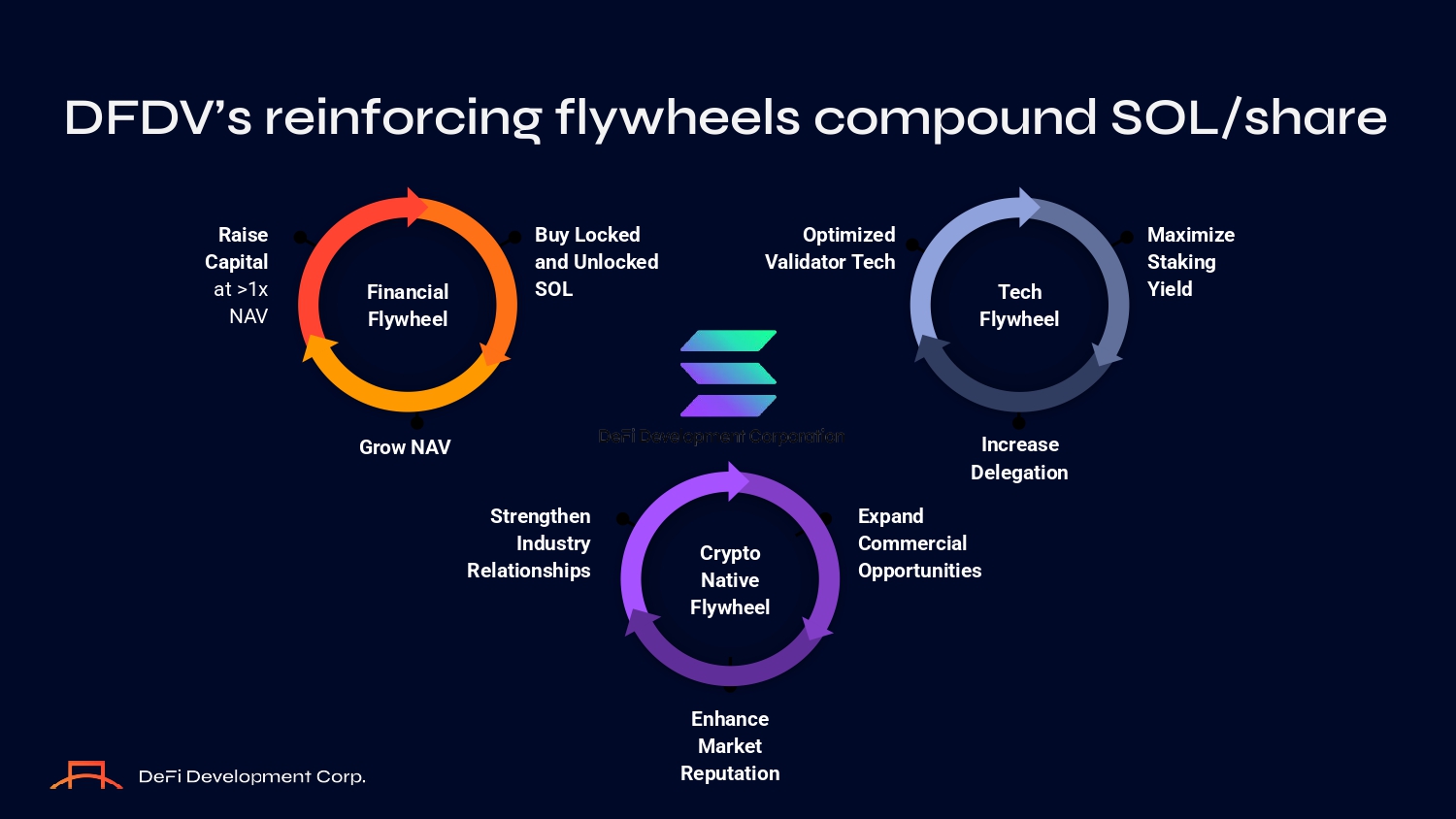

Our team has built and scaled crypto businesses across every market cycle 26 Parker White, CFA COO & CIO Joseph Onorati Chairman & CEO Dan Kang (DK) Head of IR Danial Saef, PhD Head Engineer Pete Humiston Head of Research John Han, CFA CFO Backed by a board that blends crypto - native operators with public company veterans 27 ● General Partner - Pantera Capital ● Chief Legal Officer - Kraken ● Chief Legal Officer - Blockchain.com ● Board - WalletConnect Foundation ● Partner - Cooley Marco Santori Board Blake Janover Board William Caragol Board Zach Tai Board ● Founder & CEO - Janover ● Board - Soulpower Acquisition Corp ● Founder & CEO - B. Elliot Companies ● Managing Director - Quidem LLC ● CFO, COO - Iron Horse ● CEO - PositiveID Corporation ● Board - Worksport ● VP Strategy & Operations - Everclear ● Director of Strategy - Kraken ● Vice President - Cerberus Capital ● Co - Founder - Nimbl DFDV’s reinforcing flywheels compound SOL/share Raise Capital at >1x NAV Buy Locked and Unlocked SOL Grow NAV Financial Flywheel Optimized Validator Tech Maximize Staking Yield Increase Delegation Tech Flywheel Strengthen Industry Relationships Expand Commercial Opportunities Enhance Market Reputation Crypto Native Flywheel

DeFi Development Corp. (NASDAQ: DFDV) Crypto Born. TradFi Fueled. Built to Stack Solana.

Additional Information 30 DeFi Development Corp. is not an exchange traded product (“ETP”) or an exchange - traded fund (“ETF”) registered under the Investment Company Act of 1940, as amended, is not subject to the same rules and regulations as an ETP or an ETF, and does not operate as an ETP or ETF. In particular, unlike spot Solana ETPs, we (i) do not seek for shares of our common stock to track the value of the underlying Solana we hold before payment of expenses and liabilities, (ii) do not benefit from various exemptions and relief under the Securities Exchange Act of 1934, as amended, including Regulation M, and other securities laws, which enable spot Solana ETPs to continuously align the value of their shares to the price of the underlying Solana they hold through share creation and redemption, (iii) are a Delaware corporation rather than a statutory trust, and do not operate pursuant to a trust agreement that would require us to pursue one or more stated investment objectives, (iv) are subject to federal income tax at the entity level and the other risk factors applicable to an operating business, such as ours, and (v) are not required to provide daily transparency as to our Solana holdings or our daily NAV. On July 1, 2025, we entered into a prepaid forward stock purchase transaction in connection with our issuance of 5.50% Senior Convertible Notes due 2030 (“Convertible Notes”). Given the prepaid forward represents the cash amount reserved for future share settlement, NAV as presented assumes that the approximately $75.6 million paid to the forward counterparty will be treated as an asset, offsetting a portion of the associated debt from the Convertible Notes. A determination of the accounting treatment relating to the forward stock purchase transaction for purposes of GAAP is incomplete and remains subject to review, and the final accounting treatment may cause this presentation to differ materially.

Exhibit 99.2

DeFi Development Corp. Sets 1.0 SPS Target by December 2028,

Issues First Forward-Looking Guidance

BOCA RATON, FL — July 14, 2025 — DeFi Development Corp. (Nasdaq: DFDV) (the “Company”), the first US public company with a treasury strategy built to accumulate and compound Solana (“SOL”), today issued its first forward-looking guidance on SOL per Share (“SPS”), the Company’s primary performance metric.

DFDV outlined a medium-term objective of reaching 1.0 SPS by December 2028, and near-term guidance of 0.1650 SPS by June 2026, representing approximately 261% growth from today’s level of 0.0457.

As part of its ongoing accumulation strategy, the Company also announced it had purchased an additional 10,758 SOL at an average price of $161.30.

To read the full guidance release, visit our blog.

About DeFi Development Corp.

DeFi Development Corp. (Nasdaq: DFDV) has adopted a treasury policy under which the principal holding in its treasury reserve is allocated to SOL. Through this strategy, the Company provides investors with direct economic exposure to SOL, while also actively participating in the growth of the Solana ecosystem. In addition to holding and staking SOL, DeFi Development Corp. operates its own validator infrastructure, generating staking rewards and fees from delegated stake. The Company is also engaged across decentralized finance (DeFi) opportunities and continues to explore innovative ways to support and benefit from Solana’s expanding application layer.

The Company is an AI-powered online platform that connects the commercial real estate industry by providing data and software subscriptions, as well as value-add services, to multifamily and commercial property professionals, as the Company connects the increasingly complex ecosystem that stakeholders have to manage.

The Company currently serves more than one million web users annually, including multifamily and commercial property owners and developers applying for billions of dollars of debt financing per year, professional service providers, and thousands of multifamily and commercial property lenders, including more than 10% of the banks in America, credit unions, real estate investment trusts (“REITs”), debt funds, Fannie Mae® and Freddie Mac® multifamily lenders, FHA multifamily lenders, commercial mortgage-backed securities (“CMBS”) lenders, Small Business Administration (“SBA”) lenders, and more. The Company’s data and software offerings are generally offered on a subscription basis as software as a service (“SaaS”).

Forward-Looking Statements

This release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements in this release include statements regarding the Company’s SPS objectives and can be identified by words such as: “anticipate,” “intend,” “plan,” “believe,” “project,” “estimate,” “expect,” strategy,” “future,” “likely,” “may,”, “should,” “will” and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the Company’s current beliefs, expectations, and assumptions regarding the future of its business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict and many of which are outside of the Company’s control. The Company’s actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: (i) fluctuations in the market price of SOL and any associated losses that the Company may incur as a result of a decrease in the market price of SOL; (ii) the Company’s ability to earn SOL staking rewards; (iii) our ability to access sources of capital, including debt financing and other sources of capital to finance SOL acquisitions, operations and growth; (iv) volatility in our stock price, including due to future issuances of common stock and securities convertible into common stock; (v) the effect of and uncertainties related the ongoing volatility in interest rates; (vi) our ability to achieve and maintain profitability in the future; (vii) the impact on our business of the regulatory environment and complexities with compliance related to such environment including changes in securities laws or other laws or regulations; (viii) changes in the accounting treatment relating to the Company’s SOL holdings; (ix) our ability to respond to general economic conditions; (x) our ability to manage our growth effectively and our expectations regarding the development and expansion of our business; and (xi) other risks and uncertainties more fully in the section captioned “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and other reports we file with the Securities and Exchange Commission. As a result of these matters, changes in facts, assumptions not being realized, or other circumstances, the Company’s actual results may differ materially from the expected results discussed in the forward-looking statements contained in this press release. Forward-looking statements contained in this announcement are made as of this date, and the Company undertakes no duty to update such information except as required under applicable law.

Investor Contact:

ir@defidevcorp.com

Media Contact:

Prosek Partners

pro-ddc@prosek.com