UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

June 3, 2025

Date of Report (date of earliest event reported)

Acuren Corporation

(Exact name of registrant as specified in its charter)

|

Delaware |

001-42524 | 66-1076867 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) | (I.R.S. Employer Identification Number) |

14434 Medical Complex Drive, Suite 100 Tomball, Texas 77377

(Address of principal executive offices and zip code)

(800) 218-7450

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒ Item 7.01 Regulation FD Disclosure.

On June 3, 2025, Acuren Corporation (the “Company”) held investor presentations with several of its investors. In addition, on June 4, 2025 the Company plans to present at the Baird 2025 Global Consumer, Technology & Services Conference. A copy of the investor presentation is furnished as Exhibit 99.1.

The information furnished under this 7.01 of this Current Report on Form 8-K, including Exhibits 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in any such filing, unless the Company expressly sets forth in such filing that such information is to be considered “filed” or incorporated by reference therein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Investor Presentation, dated June 3, 2025. | |

| 104 | Cover Page Interactive File (the cover page tags are embedded within the Inline XBRL document). | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Acuren Corporation | ||

| Date: June 3, 2025 | By: | /s/ Kristin Schultes |

| Name: | Kristin Schultes | |

| Title: | Chief Financial Officer | |

Exhibit 99.1

Investor Presentation June 2025

Disclaimer 2 FORWARD - LOOKING STATEMENTS Please note that in this presentation Acuren Corporation (the “Company”) may discuss events or results that have not yet occurred or been realized, commonly referred to as forward - looking statements. Such discussion and statements may contain words such as “expect,” “anticipate,” “will,” “should,” “believe,” “intend,” “plan,” “estimate,” “predict,” “seek,” “continue,” “outlook,” “may,” “might,” “should,” “can have,” “have,” “likely,” “potential,” “target,” “indicative,” “illustrative,” and variations of such words and similar expressions, and relate in this presentation, without limitation, to statements, beliefs, projections and expectations about future events. Such statements are based on the Company’s expectations, intentions and projections regarding the Company’s future performance, anticipated events or trends and other matters that are not historical facts. Such forward - looking statements include statements relating to, among other things, the Company’s expectations with respect to the (i) the transaction highlights of the business combination with NV5, (ii) results, benefits and synergies of the business combination with NV5, (iii) future financial performance and condition, including the combined free cash flow, revenue, and adjusted EBITDA (iv) ability of the Company to become an industry leader and accelerate growth, (v) the value the business combination with NV5 may bring to the Company’s stockholders, (vi) the Company’s M&A pipeline, (vii) the Company’s total addressable market, including post - business combination with NV5 and (viii) the Company’s strategic advantages. These statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward - looking statements, including: (i) economic conditions, competition, political risks, and other risks that may affect the Company’s future performance, including the impacts of inflationary pressures and other macroeconomic factors on the Company’s business, markets, supply chain, customers and workforce, on the credit and financial markets, on the alignment of expenses and revenues and on the global economy generally; (ii) material weaknesses in the Company’s internal control over financial reporting, and the Company’s ability to accurately or timely report its financial condition or results of operations; (iii) risks associated with the Company’s international operations; (iv) failure to realize the anticipated benefits of the Company’s acquisitions and acquisition strategy; (v) workplace safety incidents and the Company’s failure to comply with regulatory requirements; (vi) failure to realize expected benefits from the Company’s other business strategies; (vii) the possibility that stockholders of NV5 may not approve the Merger Agreement or stockholders of the Company may not approve the issuance of new shares of the Company’s common stock; (viii) the risk that a condition to closing may not be satisfied, that either party may terminate the Merger Agreement or that the closing might be delayed or not occur at all; (ix) potential adverse reactions or changes to business or employee relationships (x) adverse developments in the credit markets which could impact the Company’s ability to secure financing in the future; (xi) the Company’s substantial level of indebtedness; (xii) risks associated with the Company’s contract portfolio; (xiii) changes in applicable laws or regulations, including environmental, health and safety regulations; (xiv) the possibility that the Company may be adversely affected by other economic, business, and/or competitive factors; (xv) market and economic conditions, or the Company’s financial performance or determinations following the date of this presentation to use the Company’s funds for other purposes; (xvi) geopolitical risks; and (xvii) other risks and uncertainties, including those discussed in the Company’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2024 filed with the SEC on March 27, 2025 under the heading “Risk Factors.” Given these risks and uncertainties, you are cautioned not to place undue reliance on forward - looking statements. Additional information concerning these risks, uncertainties and other factors that could cause actual results to vary is, or will be, included in the reports filed by the Company with the Securities and Exchange Commission. Forward - looking statements included in this presentation speak only as of the date hereof and, except as required by applicable law, the Company does not undertake any obligation to update or revise publicly any forward - looking statements, whether as a result of new information, future events or circumstances, after the date of this presentation. NON - GAAP FINANCIAL MEASURES This presentation contains Combined revenue, Organic Change in Service Revenues, Combined Adjusted EBITDA, EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted Gross Profit, which are non - U.S. GAAP financial measures within the meaning of Regulation G promulgated by the Securities and Exchange Commission. The presentation of the combined financial information of the Company and NV5, is not in accordance with GAAP and is presented for illustrative purposes only and does not indicate the financial results of the combined company had the companies actually been combined at the beginning of the periods presented, nor the impact of possible business model changes. Combined financial information consists of the mathematical addition of selected financial data of the Company and NV5. Such presentation is not in accordance with Article 11 of Regulation S - X and may differ from the pro forma presentation to be included in the registration statement and other materials when they are filed with the SEC in connection with the transactions. No other adjustments are made to the combined presentation unless otherwise noted. However, we believe that for purposes of discussion and analysis, the combined financial information is useful for management and investors to assess the combined financial and operational performance. As used in this presentation, EBITDA is defined as earnings before interest, taxes, depreciation and amortization and Adjusted EBITDA is defined as EBITDA excluding the impact of certain non - cash and other specifically identified items. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by Revenue. Combined Adjusted EBITDA is defined as Adjusted EBITDA for NV5 and the Company for the periods presented. Organic Change in Service Revenues is revenue growth excluding the impact of foreign currency translations and acquisitions. Adjusted Gross Profit is defined as Gross Profit less depreciation expense included in cost of revenue for the periods presented. Adjusted Gross Profit Margin is defined as Gross Profit divided by Revenue. While the Company believes these non - U.S. GAAP measures are useful in evaluating the Company’s performance, this information should be considered as supplemental in nature and not as a substitute for or superior to the related financial information prepared in accordance with U.S. GAAP. Additionally, these non - U.S. GAAP financial measures may differ from similar measures presented by other companies. A reconciliation of these non - U.S. GAAP financial measures is included later in this presentation.

Disclaimer (cont.) 3 NO OFFER OR SOLICITATION This presentation does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval with respect to the Merger with NV5 and the transactions contemplated thereby (the “Transactions”) or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. IMPORTANT ADDITIONAL INFORMATION In connection with the Transactions, NV5 and the Company intend to file materials with the SEC, including the Registration Statement that will include a joint proxy statement/prospectus of NV5 and the Company. After the Registration Statement is declared effective by the SEC, NV5 and the Company intend to mail a definitive proxy statement/prospectus to the stockholders of NV5 and the stockholders of the Company. This communication is not a substitute for the joint proxy statement/prospectus or the Registration Statement or for any other document that NV5 or the Company may file with the SEC and send to NV5’s stockholders and/or the Company’s stockholders in connection with the Transactions. INVESTORS AND SECURITY HOLDERS OF NV5 AND ACUREN ARE URGED TO CAREFULLY AND THOROUGHLY READ THE JOINT PROXY STATEMENT/PROSPECTUS AND THE REGISTRATION STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND OTHER RELEVANT DOCUMENTS FILED BY NV5 AND ACUREN WITH THE SEC, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT NV5, ACUREN, THE TRANSACTIONS, THE RISKS RELATED THERETO AND RELATED MATTERS. Investors will be able to obtain free copies of the Registration Statement and the joint proxy statement/prospectus, as each may be amended from time to time, and other relevant documents filed by NV5 and the Company with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by NV5 will be available free of charge from NV5’s website at www.nv5.com under the “Investor Relations” tab or by contacting NV5’s Investor Relations Department ir@NV5.com, or by calling (954) 637 - 8048. Copies of documents filed with the SEC by the Company will be available free of charge from the Company’s website at www.acuren.com under the “Investor Relations” tab or by contacting the Company’s Investor Relations Department at IR@acuren.com. PARTICIPANTS IN THE SOLICITATION NV5, the Company and their respective directors and certain of their executive officers and other members of management and employees may be deemed, under SEC rules, to be participants in the solicitation of proxies from NV5’s stockholders and the Company’s stockholders in connection with the Transactions. Information regarding the executive officers and directors of the Company is included in its Annual Report on Form 10 - K filed with the SEC on March 27, 2025. Information regarding the executive officers and directors of NV5 is included in its amendment to its Annual Report on Form 10 - K/A filed with the SEC on April 28, 2025 and May 30, 2025. Additional information regarding the persons who may be deemed participants and their direct and indirect interests, by security holdings or otherwise, will be set forth in the Registration Statement and other materials when they are filed with the SEC in connection with the Transactions. Free copies of these documents may be obtained as described in the paragraphs above.

Today’s Presenters Kristin Schultes Chief Financial Officer Talman Pizzey Chief Executive Officer Robert A.E.

Franklin Co - Chairman Leading Mission Critical Asset Integrity Services Provider Industrial Energy Processing Facilities Power, Renewables & Transition Acuren Protects Critical Assets & Infrastructure Acuren’s Key Service Offerings Power Generation Alternative Energy Wind Turbine Pipelines Refineries and Oil Sands Facilities Manufacturing Aerospace & Defense Mining Chemical Infrastructure Midstream Energy Asset Integrity Services Are Required to Operate Safely & Extend Life ; Inspects and evaluates industrial equipment through various methods to ensure asset integrity, avoid costly accidents and downtime, and comply with regulatory requirements without destroying the asset Non - Destructive Testing (“NDT”) ; Testing, inspection and specialty services performed by employees rappelling from ropes (in lieu of higher cost scaffolding) ; Specialty craft services include coating & blasting, welding & pipefitting, hoisting & rigging and more Rope Access Technician Solutions (“RAT”) ; Comprehensive offering of materials engineering and lab testing services, including failure analysis, development of inspection programs, diagnostic analysis, chemical analysis and destructive / mechanical testing Engineering and Lab Testing Time Asset Integrity Services Needed Throughout Integrity Lifecycle 5 Critical & Resilient Nature of Work Mix Recurring / re - occurring OpEx & Highly maintenance - linked work mix Attractive Service Type Mix Customers with multiple Acuren ~2,500 services across NDT, RAT Solutions and Engineering & Lab Testing Run & Maintain ~40 - 45% Call - Out ~40 - 45% Outage / Turnaround ~8 - 12% Capital Projects ~5% Revenue by Nature of Work (1) Rope Access Technician Solutions ~20% Engineering & Lab Testing ~10% Revenue by Service Type (1) NDT ~70% Strong Geographic Mix Strategic regions covering ~8,600 customer sites 10 Diversified End Market Mix Diverse sub - sectors served across Acuren’s end markets 20+ U.S. (2) 57% Canada Revenue by 43% Geography Industrial ~40% Energy Processing ~35% Revenue by End Market (1) Diverse and Resilient Business Across All Key Dimensions (1) Based on management estimates. (2) 2024 U.S. revenue Includes United Kingdom revenue. 6 Other ~5% Midstream ~10% Power & Renewables ~10%

; 1991 – US Business established with Longview Inspection ; 1991 – Canspec Acquires Hanson Materials Engineering ; 1997 – Canspec & Longview Merger with ~$60M combined revenue ; Culture of organic and acquisitive growth ; Decentralized business, completed 38 acquisitions ; 1998 – Acquired training organization Hellier ; 2005 – New branding with Acuren across the platform; Tal Pizzey named COO ; 2006 – Expansion into Midwest – acquisition of U.S. Inspection ; 2010 – Expansion into Rope Access – acquisition of Remote Access Technologies ; 2019 – Sold to American Securities; Tal Pizzey named CEO ; Completed 13 Acquisitions, including Premium and Versa with >$75M revenue each ; Expansion of US Engineering and entry into renewable energy end markets ; Diversification of end markets, enhanced focus on recurring revenue ; Completed Admiral transaction; publicly listed ; Sir Martin E. Franklin and Robert A.E. Franklin named co - chairmen ; Kristin Schultes named CFO ; Listed on NYSE ; Announced transformative combination with NV5 – path to create a leading global TICC and engineering service firm Evolution of Acuren 7 1981 – 1997 1998 – 2019 2020 – 2023 2024+ (1) $1,097 8 Energy Downturn COVID - 19 Pandemic Global Financial Crisis 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Acuren Revenue ($M) Resilient Financial Performance Across Economic Cycles Continuous Long - Term Revenue Growth Note: Historical financials from 2019 - 2023 are presented on basis of private company audited financials.

Prior years are based on management estimates. (1) The combined financial information for the twelve months ended December 31, 2024 includes the results of operations of ASP Acuren (Predecessor) for the period from January 1, 2024 to July 29, 2024 and Acuren Corporation (Successor) for the period from July 30, 2024 to December 31, 2024.

Expansive Platform with Strong Presence & Leadership Advantages U.K. Corporate Headquarters Field Service Center Engineering & Lab Services ~130 Total Field Service Centers 9 22 Engineering & Lab Services Locations ~8,600 Customer Sites ~6,000 Total Employees ~5,500 Technicians / Direct Labor 10 Strategic Regions Expansive Footprint of Strategically Located Facilities Investment Highlights Leader in Highly Fragmented Industrial Testing, Inspection, Certification and Compliance (“TICC”) Market Mission Critical, Non - Discretionary Recurring Asset Integrity Services Provider Asset - Light, Low Capital Expenditures, High Free Cash Flow, and Disciplined Overhead Structure Track Record of Above - Market Organic Growth Supplemented With Accretive M&A Best in Class Safety Culture with Robust Technician Training and Development 1 2 3 4 5 10

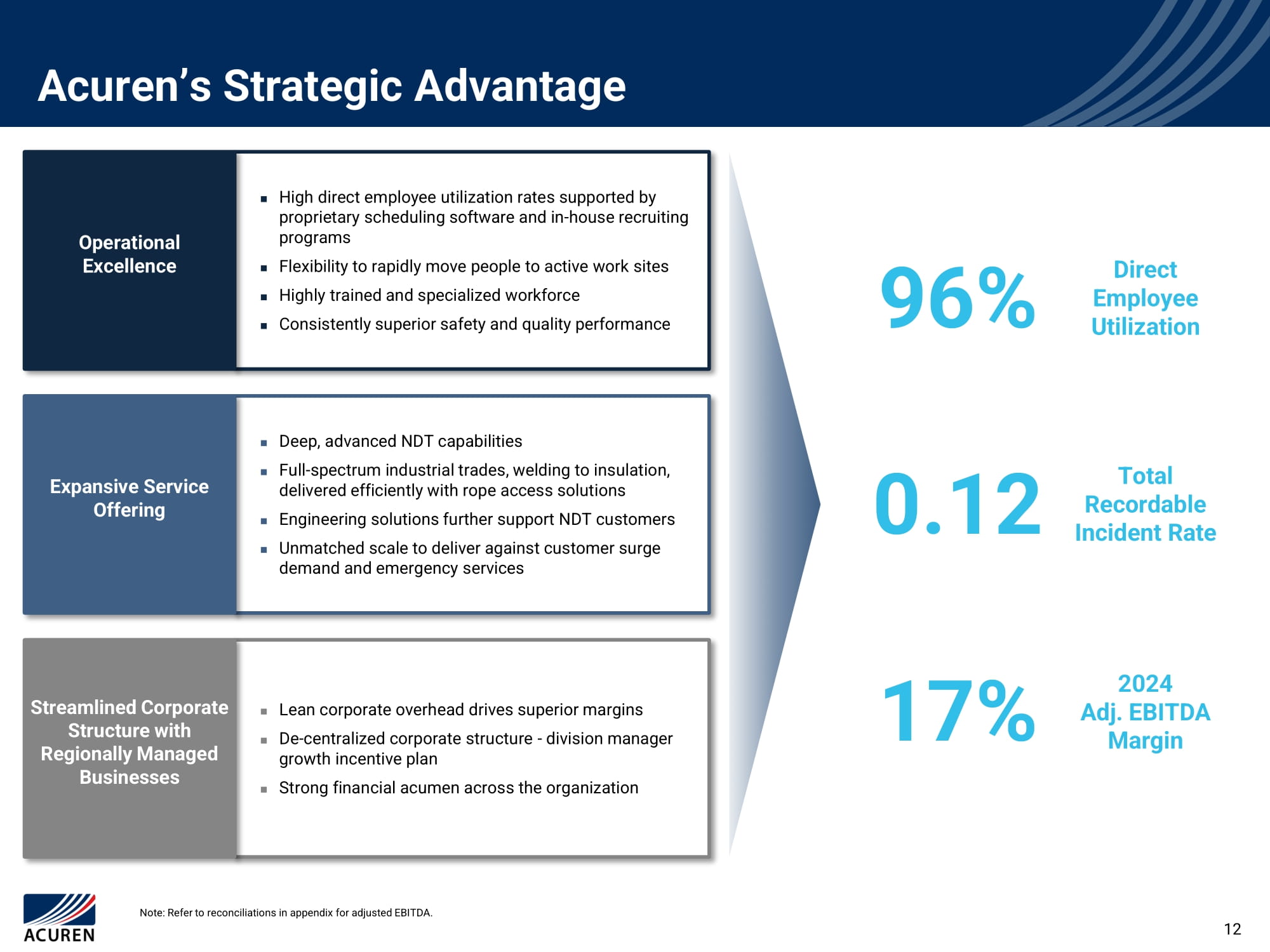

Illustrative Customer Site OpEx Acuren’s services are non - discretionary in nature and fueled by a heightened safety and regulatory environment Legislative / Regulatory Drivers Other Stakeholder Drivers Non - discretionary, Mandated quantity Specific testing compliance - driven and frequency modalities Risk mitigation for high - stakes environments Professional and industry codes Insurance coverage denial risk Owner Risk Management Drivers Protection of company reputation Prevention against costly failures Acuren’s Services Are a Small but Impactful Spend… …Driven by a Heightened Safety and Regulatory Environment… …Resulting in Recurring / Re - Occurring OpEx & Maintenance - Linked Demand Small, but Critical Spend on Asset Integrity Management (1 - 2% of Customer Site OpEx Budget (1) ) Revenue by Nature of Work ( 2 ) Run & Maintain Nested technicians providing daily recurring solutions Call - Out Service area technicians providing re - occurring solutions Outage / Turnaround Technicians and engineers inspecting equipment while the facility is not operating which allows access the inside of vessels, tanks, and furnaces; outage frequencies vary but are most typically annual Capital Projects Inspection of newly manufactured or fabricated equipment Run & Maintain ~40 - 45% Call - Out ~40 - 45% Outage / Turnaround ~8 - 12% Capital Projects ~5% Highly Recurring / Re - Occurring Asset Integrity Management Solutions Non - Discretionary Recurring Services Underpinned by Attractive Fundamentals (1) Based on 2023 third - party market study. (2) Based on management estimates. 11 Acuren’s Strategic Advantage Direct Employee Utilization Total Recordable Incident Rate 2024 Adj.

EBITDA Margin 96% 17% 0.12 ; Lean corporate overhead drives superior margins ; De - centralized corporate structure - division manager growth incentive plan ; Strong financial acumen across the organization Streamlined Corporate Structure with Regionally Managed Businesses ; Deep, advanced NDT capabilities ; Full - spectrum industrial trades, welding to insulation, delivered efficiently with rope access solutions ; Engineering solutions further support NDT customers ; Unmatched scale to deliver against customer surge demand and emergency services Expansive Service Offering ; High direct employee utilization rates supported by proprietary scheduling software and in - house recruiting programs ; Flexibility to rapidly move people to active work sites ; Highly trained and specialized workforce ; Consistently superior safety and quality performance Operational Excellence 12 Note: Refer to reconciliations in appendix for adjusted EBITDA.

Significant Expansion Opportunities in TICC & Engineering Core Served Addressable Market (SAM) Total Addressable Market (TAM) Expanded and Adjacent TICC Market (TAM+) Nondestructive Testing Rope Access Core Markets Engineering & Lab Drones / Robotics Renewable Energy Heat Treatment Rope Access Adjacent Markets Cathodic Protection Infrastructure Electrical Testing Environmental Testing Utility Services Construction Testing Rail Testing Geospatial 13 Conventional NDT Advanced NDT Tech - Enabled NDT Original method of nondestructive testing using inspectors to reliably and efficiently assess components and equipment for surface defects Radiographic Testing Magnetic Testing Ground Penetrating Radar Penetrant Testing Visual Inspection Nondestructive testing technique that uses X - ray to uncover any signs of imperfections or degradation Effective method for revealing surface and near - surface cracks or defects Safe, efficient method using ground penetrating radar to locate underground infrastructure Sensitive nondestructive testing method used for detecting surface flaws Advanced ultrasonic techniques that permits the shaping and steering of the ultrasonic beam angles to detect defects Guided Wave Services Laser Scanning Moisture Detection Imaging Infrared Thermography Advanced Ultrasonics Advanced technique that provides rapid screening of in - service pipelines to detect internal or external defects Evaluation method for assessing factors required for internal or external inspections of above ground storage tanks Identify the presence of moisture within or under insulation without the use of any other testing or removal of insulation Specialized equipment used to capture infrared energy emitted from the surface of an object and converts it to a temperature Unmanned Services Cathodic Protection Building & Infrastructure Electric Transmission Lines Metals & Mining Tanks 20% – 40% Management estimate of cost savings range with HawkEye compared to conventional indirect inspection methods Engineering & Monitoring & Indirect / Over - Construction Maintenance the - Line Inspection Select Applications NDT ~70% Nondestructive Testing (“NDT”) Overview Nondestructive Testing At - A - Glance x North American leader in nondestructive testing services, with a breadth of conventional, advanced / tech - enabled NDT solutions Note: NDT revenue by service type figure represent management estimates.

x Largest labor capacity with leading workforce of certified technicians and best - in - class training facilities ensures unmatched customer service 2024 Revenue 14 Testing & Inspection Specialty Craft Services V - Deck Access Platform Insulation & Asbestos Abatement Hoisting & Rigging Welding & Pipefitting Coating & Blasting Rope Access Technician Solutions At - A - Glance Nondestructive Testing Inspection services performed via ropes, including conventional NDT, advanced NDT, positive material identification and field engineering Advanced NDT Bristle blasting, sand blasting and vacuum blasting, and protective coating for internal and external surfaces of tanks, vessels and structural steel Welding on ropes for various applications, including steam trace, vessels and tanks, valve install & replacement and repairs Custom engineered hoisting systems allowing lifts to be executed into very high and tight places without the need for cranes Full range of industrial insulation capabilities, including piping, vessels, columns and tank insulation and cladding, asbestos abatement and various others Modular access platforms allowing work to be performed safely and efficiently without the need of large scaffold builds, which Acuren has exclusive rights to in Canada Sand Blasting Heavy Lifting & Hoisting Asbestos Abatement V - Deck Access Platform Valve Replacement Rope Access Technician Solutions ~20% Rope Access Technician (“RAT”) Solutions Overview 15 2024 Revenue Note: RAT solution revenue by service type figure represent management estimates. (1) Based on management estimates. x Leading team of rope access technicians providing an integrated offering, including inspection, repair and specialty craft services x Acuren’s rope access planners and solutions have successfully helped customers reduce scheduled scope time by 30% – 80% and costs by 30% – 60% (1)

Engineering Solutions Engineering & Lab Testing At - A - Glance Lab Testing Solutions Field Engineering Provides portable testing and analysis techniques providing engineering services to remote locations Reliability Engineering Materials Engineering On - Site Engineering Material Failure Analysis Failure Probability Data Analysis Mechanical Testing Coatings and Polymers Testing Chemical Analysis Microstructure and Failure Analysis Stress Rupture Testing Coating Weight Analysis Provides failure analysis, corrosion and welding consulting, finite element analysis & fitness for service, materials recommendations and specialized testing Assesses the ability of equipment to function without failure, including diagnostics and troubleshooting, condition monitoring and consulting services Testing for various applications including aerospace & defense, which requires 100% inspection for containment Technical analysis using specialized equipment to determine unknown material composition, grade or compliance Adhesion testing, bond strength testing, coating weight and thickness testing to identify & assess fundamental structural properties across flexural strength, chemical testing and failure analysis Engineering & Lab Testing ~10% Engineering & Lab Testing Overview x Comprehensive offering of materials engineering and lab testing services supporting Acuren’s breadth of asset integrity management solutions x Leading team of engineers, scientists, technologists and technicians covering a wide spectrum of engineering disciplines 16 Note:: Engineering & lab testing revenue by service type figure represent management estimates.

2024 Revenue Full Year 2024 Performance Highlights Revenue ($ in millions) (1) $1,097 $1,050 +5% 2024 2023 $294 2023 2024 $167 $187 2023 2024 ($ in millions and % as percent of revenue) 28.0% 28.5% 15.9% 17.0% Adjusted Gross Profit ($ in millions and % as percent of revenue) (1) $313 Adjusted EBITDA Note: Refer to reconciliations in appendix for adjusted EBITDA. (1) The combined financial information for the twelve months ended December 31, 2024 includes the results of operations of ASP Acuren (Predecessor) for the period from January 1, 2024 to July 29, 2024 and Acuren Corporation (Successor) for the period from July 30, 2024 to December 31, 2024. 17 (1) +6% +12% Transformative NV5 Acquisition Announced on May 15, 2025

19 Acuren/NV5 Combination Details ; Cash consideration expected to be funded with a combination of cash on hand and newly issued debt financing ; Committed debt financing provided by Jefferies, expected to be structured as a term loan incremental to Acuren’s existing credit facility and with pricing generally in line with existing debt Debt Financing ; Subject to Acuren and NV5 shareholder votes ; 60 - day “go - shop” period ; Subject to customary closing conditions and regulatory approvals ; Expected to close in the second half of calendar year 2025 Timing / Approvals ; Combined 2024 revenue and adjusted EBITDA of ~$2 billion and ~$350 million, including $20mm of run - rate synergy credit ; Expected to be significantly accretive to Acuren shareholders and provides substantial premium to NV5 shareholders with continued upside potential ; Expected strong combined free cash flow generation to drive expeditious deleveraging to sub - 3x net leverage in - line with long - term target Financial Impact ; Acuren to acquire NV5 for a purchase price of $23 / share, consisting of $10 / share in cash and $13 / share of Acuren common stock at closing, which represents a 32% premium to NV5’s 30 - day VWAP of $17.47 as of May 14, 2025 ; Purchase price of approximately $1.7 billion (1) , reflecting a valuation of approximately 10.3x 2025E consensus adjusted EBITDA ; Upon closing of the transaction, current Acuren shareholders will own ~60%, and current NV5 shareholders will own ~40% of the combined company, subject to an adjustment based on price at close — Exchange ratio based on Acuren 5 - day VWAP, structured as a floating exchange ratio with a symmetrical collar of 10% ; Continuity of leadership and shared culture will support smooth integration Overview Source: Company filings and CapIQ. Market date as of May 14, 2025. Note: Refer to reconciliations in appendix for adjusted EBITDA. (1) Based on NV5 3/29/2025 net debt of $181mm.

Acuren/NV5 Combination Highlights Market Leader Generating ~$2bn+ in Revenue With Expanded Addressable Market 1 Transforms Acuren and Accelerates Growth Runway 2 Attractive Transaction Structure With Significant Alignment 3 • Creates leading global TICC and engineering services firm, with complementary services • Combined business expected to have strong organic growth, limited cyclicality and high free cash flow conversion • Significant synergy opportunity through cross sell and back office optimization • Large combined TAM, with attractive growth opportunities • Increases end markets with 1 / 2 positions • Strong M&A pipeline of both companies enhanced by increased scale and access to capital 20 • Significant cash generation expected to drive expeditious deleveraging to sub - 3x net leverage in - line with long - term target • NV5 Founder and Executive Chairman Dickerson Wright and CEO Ben Heraud to join Acuren Board of Directors • Expected to be significantly accretive to Acuren shareholders • Transaction delivers a substantial premium to NV5 shareholders with participation in upside potential as a combined company U.S. 91% Foreign 9% NV5 Overview Key Offerings 2024A Revenue Breakdown by Segment & Geography Source: Company filings. (1) Includes revenue generated predominantly in UAE, Singapore, Malaysia and Hong Kong. Segment Overview Infrastructure, Engineering and Support Services Environmental Health Sciences Conformity Assessment Buildings & Technology Utility Services Geospatial Technology (1) Description Segment Engineering, surveying, testing, inspection, and program management for essential utility, transportation, and water infrastructure Infrastructure Design and commissioning of building systems including MEP, technology, fire protection, clean energy conversion and intelligent building systems Building, Technology and Sciences Geospatial data analytics and subscription - based software to support utility assets, natural & water resources and defense & intelligence Geospatial Solutions NV5 delivers integrated solutions that enhance the reliability and performance of assets Infrastructure 43% Building, Technology and Sciences 27% Geospatial 30% 21

Combination Significantly Enhances Scale and Is Accretive to Financial Profile 22 Source: Company filings. Note: Refer to reconciliations in appendix for adjusted financials. (1) Includes credit for ~$20mm of run - rate synergies. (2) Includes principal payments on finance lease obligations for Acuren. (3) Includes United Kingdom revenue. Acuren and NV5 Combined ($ in millions) $2,039 $941 (46%) $1,097 (54%) 2024A Revenue (1) ~$350 $143 $187 2024A Adj. EBITDA (1) 17.2% 15.2% 17.0% 2024A Adj. EBITDA Margin $54 (2) $17 $37 (2) 2024A Capex 2.7% 1.8% 3.4% 2024A Capex (% of Sales) ~11,000 ~5,000 ~6,000 Headcount U.S. 73% Foreign 4% Canada 23% Foreign (4) 9% Canada 43% Geographic Mix U.S. 91% U.S. (3) 57% (2024A) (4) Includes revenue generated predominantly in UAE, Singapore, Malaysia and Hong Kong.

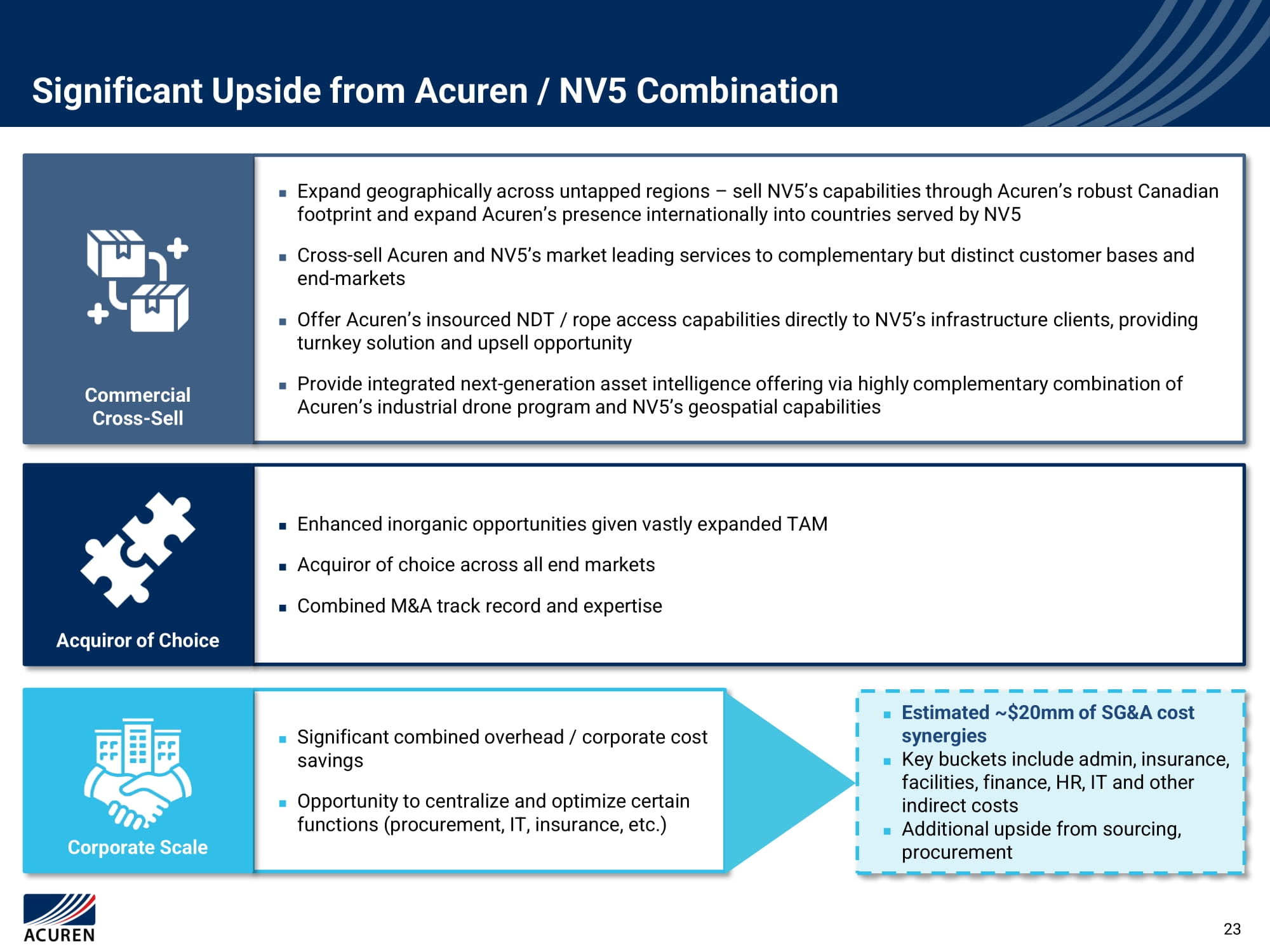

Significant Upside from Acuren / NV5 Combination ; Significant combined overhead / corporate cost savings ; Opportunity to centralize and optimize certain functions (procurement, IT, insurance, etc.) Corporate Scale ; Expand geographically across untapped regions – sell NV5’s capabilities through Acuren’s robust Canadian footprint and expand Acuren’s presence internationally into countries served by NV5 ; Cross - sell Acuren and NV5’s market leading services to complementary but distinct customer bases and end - markets ; Offer Acuren’s insourced NDT / rope access capabilities directly to NV5’s infrastructure clients, providing turnkey solution and upsell opportunity ; Provide integrated next - generation asset intelligence offering via highly complementary combination of Acuren’s industrial drone program and NV5’s geospatial capabilities Commercial Cross - Sell ; Enhanced inorganic opportunities given vastly expanded TAM ; Acquiror of choice across all end markets ; Combined M&A track record and expertise Acquiror of Choice ; Estimated ~$20mm of SG&A cost synergies ; Key buckets include admin, insurance, facilities, finance, HR, IT and other indirect costs ; Additional upside from sourcing, procurement 23 Appendix – Non - GAAP Reconciliations

Acuren Combined Revenue Reconciliation 25 Three months ended December 31, 2023 Three months ended December 31, 2024 Combined period ended December 31, 2023 Combined period ended December 31, 2024 $ 270,134 $ - $ 1,050,057 $ 633,866 Revenue from predecessor period - 262,042 - 463,527 Revenue from successor period $ 270,134 $ 262,042 $ 1,050,057 $ 1,097,393 Total combined revenue (1) (amounts in thousands) (Unaudited) (1) The combined financial information for the twelve months ended December 31, 2024 includes the results of operations of ASP Acuren (Predecessor) for the period from January 1, 2024 to July 29, 2024 and Acuren Corporation (Successor) for the period from July 30, 2024 to December 31, 2024.

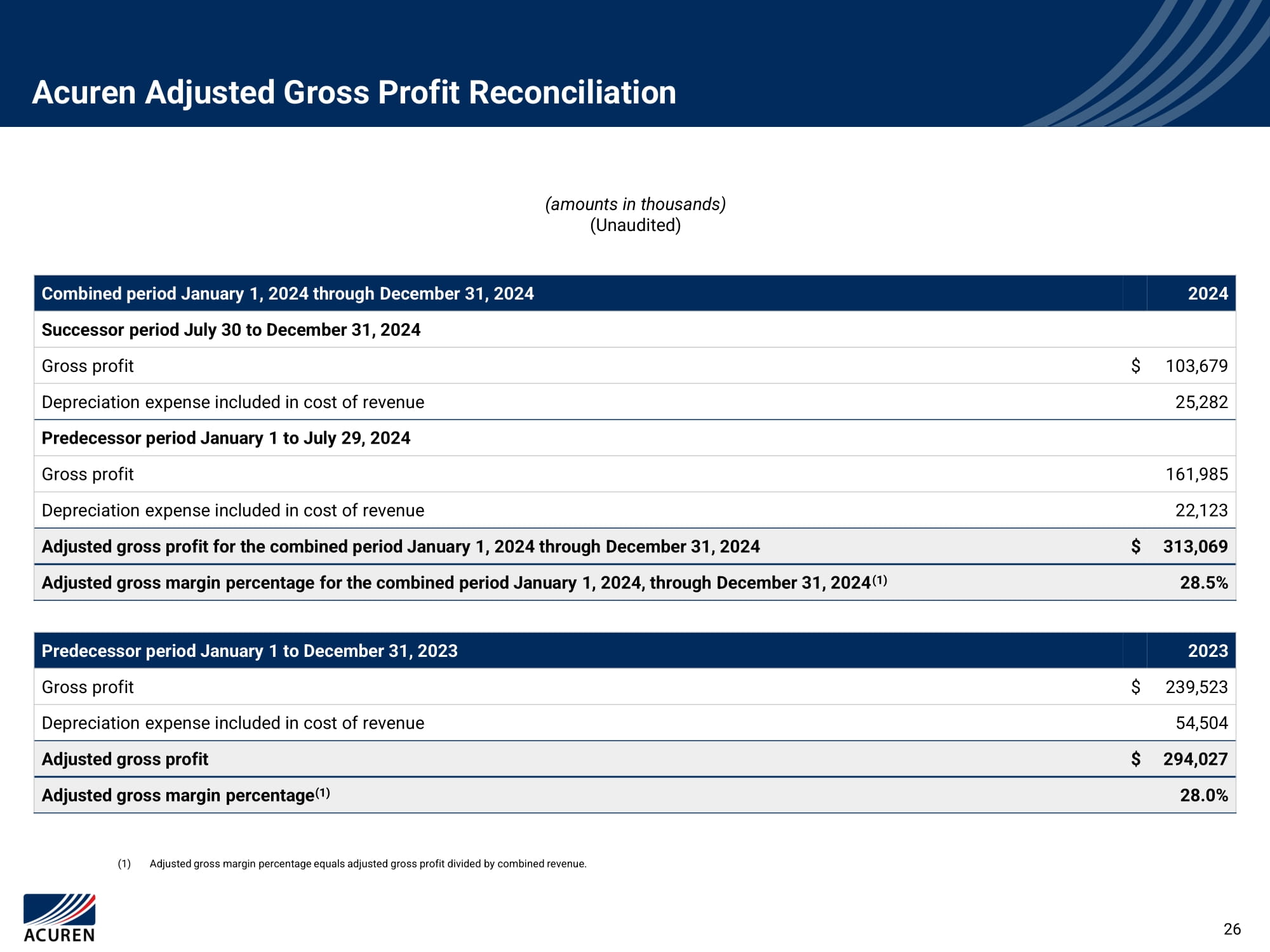

Acuren Adjusted Gross Profit Reconciliation 26 (amounts in thousands) (Unaudited) 2024 Combined period January 1, 2024 through December 31, 2024 Successor period July 30 to December 31, 2024 103,679 $ Gross profit 25,282 Depreciation expense included in cost of revenue Predecessor period January 1 to July 29, 2024 161,985 Gross profit 22,123 Depreciation expense included in cost of revenue 313,069 $ Adjusted gross profit for the combined period January 1, 2024 through December 31, 2024 28.5% Adjusted gross margin percentage for the combined period January 1, 2024, through December 31, 2024 (1) 2023 Predecessor period January 1 to December 31, 2023 239,523 $ Gross profit 54,504 Depreciation expense included in cost of revenue 294,027 $ Adjusted gross profit 28.0% Adjusted gross margin percentage (1) (1) Adjusted gross margin percentage equals adjusted gross profit divided by combined revenue.

Acuren Adj. EBITDA Reconciliation 27 (1) Adjustment to add back expenses related primarily to the previous owner’s compensation, stock incentive plans and debt extinguishment costs. (2) Adjustment to add back the one time non cash stock compensation expenses for Founder Preferred Shares and independent director stock options for which the performance target was achieved when the acquisition of ASP Acuren occurred. (3) Adjustment to add back transaction and acquisition integration related costs and similar items for acquisitions not including the acquisition of ASP Acuren. (4) Adjustment to add back the transaction related expenses for the ASP Acuren acquisition. (5) Adjustment to add back stock compensation expense. (6) Adjustment to add back other non - recurring charges including restructuring charges, IT development charges and certain gains, losses and balance adjustments. (7) The combined financial information for the year ended December 31, 2024 includes the results of operations of ASP Acuren (Predecessor) for the period from January 1, 2024 to July 29, 2024 and Acuren Corporation (Successor) for the period from July 30, 2024 to December 31, 2024. The presentation of the combined financial information of the Predecessor and Successor periods is not in accordance with GAAP. Combined financial information consists of the mathematical addition of the Predecessor and Successor revenue. No other adjustments are made to the combined presentation. (8) The Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by combined revenues for the 2024 period and divided by revenues for the 2023 period. 2024 Combined Period January 1, 2024 through December 31, 2024 Acuren Successor period July 30 to December 31, 2024 $(105,452) Net income (loss) (5,256) Benefit for income taxes 31,061 Interest expense, net 47,313 Depreciation and amortization expense Acuren Predecessor period January 1 to July 29, 2024 (15,703) Net income (loss) 3,243 Provision for income taxes 39,379 Interest expense, net 45,777 Depreciation and amortization expense Acuren Adjustments - January 1 to December 31, 2024 29,477 Pre - ASP Acuren seller - related expenses and stock compensation (1) 69,821 One time non - cash equity charges (2) 2,878 Acquisition related transaction and integration expenses (3) 41,202 ASP Acuren transaction related expenses (4) 2,152 Non cash stock compensation expense (5) 790 Other non - recurring charges (6) $186,682 Adjusted EBITDA for the Acuren combined period January 1, 2024 through December 31, 2024 (7) 17.0% Adjusted EBITDA margin for the Acuren combined period from January 1, 2024 through December 31, 2024 (8)

Acuren Adj. EBITDA Reconciliation (cont.) (7) The Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by total revenues. 2023 Predecessor period January 1 to December 31, 2023 (6,289) $ Net income (loss) 2,009 Provision for income taxes 60,022 Interest expense, net 94,818 Depreciation and amortization expense Adjustments – Twelve months ended December 31, 2023 8,492 Pre - ASP Acuren seller - related expenses and stock compensation (1) - One time non - cash equity charges (2) 5,715 Acquisition related transaction and integration expenses (3) - ASP Acuren transaction related expenses (4) - Non cash stock compensation expense (5) 2,612 Other non - recurring charges (6) 167,379 $ Adjusted EBITDA 15.9% Adjusted EBITDA margin (7) (amounts in thousands) (Unaudited) (1) Adjustment to add back expenses related primarily to the previous owner’s compensation, stock incentive plans and debt extinguishment costs. (2) Adjustment to add back the one time non cash stock compensation expenses for Founder Preferred Shares and independent director stock options for which the performance target was achieved when the acquisition of ASP Acuren occurred. (3) Adjustment to add back transaction and acquisition integration related costs and similar items for acquisitions (both completed and not completed) not including the acquisition of ASP Acuren. (4) Adjustment to add back the transaction related expenses for the ASP Acuren acquisition. (5) Adjustment to add back stock compensation expense. (6) Adjustment to add back other non - recurring charges including restructuring charges, IT development charges and certain gains, losses and balance adjustments.

Revenue Reconciliation combined presentation. 29 Year ended December 31, 2024 Combined Revenue $633,866 Acuren revenue from predecessor period $463,527 Acuren revenue from successor period $1,097,393 Total combined Acuren revenue (1) $941,265 NV5 Revenue $2,038,658 Total Acuren and NV5 combined revenue (2) (1) The Acuren combined financial information for the year ended December 31, 2024 includes the results of operations of ASP Acuren (Predecessor) for the period from January 1, 2024 to July 29, 2024 and Acuren Corporation (Successor) for the period from July 30, 2024 to December 31, 2024. The presentation of the combined financial information of the Predecessor and Successor periods is not in accordance with GAAP. Combined financial information consists of the mathematical addition of the Predecessor and Successor revenue. No other adjustments are made to the combined presentation. (2) The Acuren and NV5 combined financial information for the year ended December 31, 2024 includes the Acuren combined revenue and the NV5 reported revenue. The presentation of the combined financial information of Acuren and NV5 is not in accordance with GAAP. Combined financial information consists of the mathematical addition of the combined Acuren revenue and the NV5 revenue. No other adjustments are made to the 30 NV5 Adj.

EBITDA Reconciliation (1) Acquisition - related costs include contingent consideration fair value adjustments. Year ended December 28, 2024 NV5 EBITDA $27,979 Net income (loss) (1,726) Income tax benefit 17,181 Interest expense 66,611 Depreciation and amortization expense 25,981 Stock - based compensation 7,458 Acquisition - related costs (1) $143,484 NV5 Adjusted EBITDA 2024 31 Combined EBITDA Reconciliation (1) NV5’s fiscal year - end is December 28, 2024.

(2) The presentation of the combined financial information of Acuren and NV5 is not in accordance with GAAP. Combined financial information consists of the mathematical addition of the combined Acuren revenue and the NV5 revenue. No other adjustments are made to the combined presentation. Year ended December 31, 2024 Combined EBITDA 186,682 Acuren combined adjusted EBITDA 143,484 NV5 adjusted EBITDA (1) $330,166 Total Acuren and NV5 combined adjusted EBITDA 20,000 Estimated synergies $350,166 Total Acuren and NV5 combined adjusted EBITDA with synergies (2)