FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

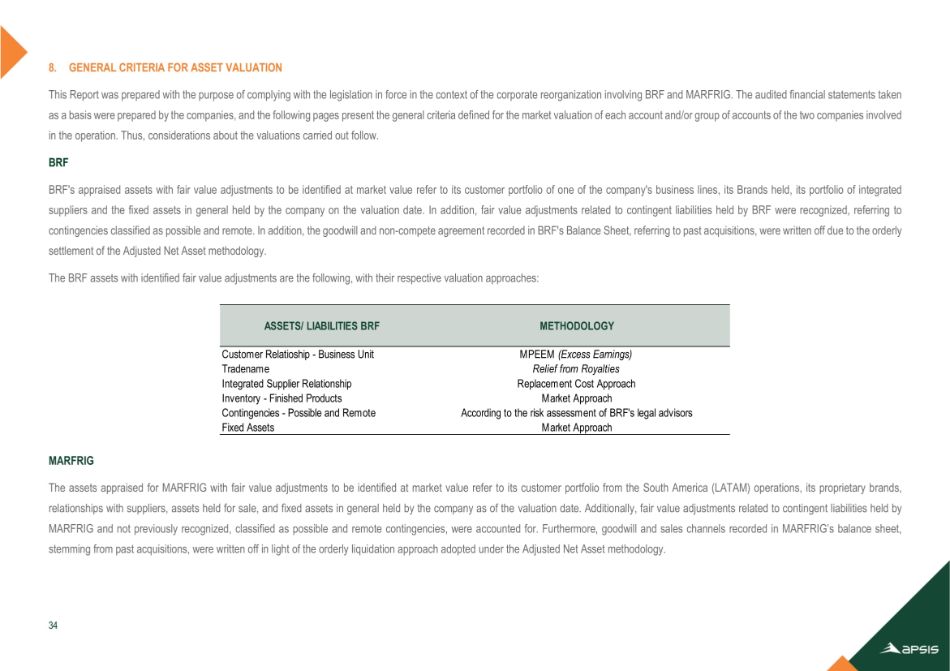

dated May 27, 2025

Commission File Number 1-15148

BRF

S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

14401

AV. DAS NACOES UNIDAS 22ND FLOOR

CHAC SANTO ANTONIO 04730 090-São Paulo – SP, Brazil

(Address of principal executive offices)

(Zip code)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

* * *

This material includes certain forward-looking statements that are based principally on current expectations and on projections of future events and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance. These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could cause actual financial condition and results of operations to differ materially from those set out in the Company’s forward-looking statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors” in the Company’s annual report on Form 20-F for the year ended December 31, 2024.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: May 27, 2025 |

|||

| BRF S.A. | |||

| By: | /s/ Fabio Luis Mendes Mariano | ||

| Name: | Fabio Luis Mendes Mariano | ||

| Title: |

Chief Financial and Investor Relations Officer |

||

EXHIBIT INDEX

Exhibit 99.1

This business combination involves the securities of a Brazilian company. The business combination is subject to disclosure requirements of Brazil that are different from those of the United States. Financial statements included in the document, if any, have been prepared in accordance with foreign accounting standards that may not be comparable to financial statements of United States companies.

It may be difficult for you to enforce your rights and any claim you may have arising under the U.S. federal securities laws, since the issuer is located in Brazil, and some or all of its officers and directors may be residents of Brazil. You may not be able to sue a Brazilian company or its officers or directors in a Brazilian court for violations of the U.S. securities laws. It may be difficult to compel a Brazilian company and its affiliates to subject themselves to a U.S. court’s judgment.

You should be aware that the issuer may purchase securities otherwise than under the exchange offer, such as in open market or privately negotiated purchases.

* * *

FIRST AMENDMENT TO THE PLAN OF MERGER FOR THE MERGER OF BRF S.A. SHARES INTO MARFRIG GLOBAL FOODS S.A.

By this private instrument, the directors of the companies identified below, as well as the companies themselves:

| (1) | MARFRIG GLOBAL FOODS S.A., a publicly held company, with its registered office in the city of São Paulo, State of São Paulo, at Avenida Queiroz Filho, No. 1,560, Block 5 (Sabiá Tower), 3rd floor, Room 301, Vila Hamburguesa, CEP 05319-000, registered in the National Registry of Legal Entities of the Ministry of Finance (“CNPJ/MF”) under No. 03.853.896/0001-40, represented herein in accordance with its bylaws (“Marfrig”); and |

| (2) | BRF S.A., a publicly held company, with its registered office in the city of Itajaí, State of Santa Catarina, at Rua Jorge Tzachel, 475, Fazenda Neighborhood, CEP 88301-600, registered in the CNPJ/MF under No. 01.838.723/0001-27, represented herein in accordance with its bylaws (“BRF” and, together with Marfrig, “Companies” or “Parties”) |

WHEREAS:

| (A) | on May 15, 2025, the Parties entered into the “Plan of Merger for the Merger of BRF S.A. Shares into Marfrig Global Foods S.A.” (“Plan of Merger”), in accordance with the provisions of articles 224, 225 and 252 of Law No. 6,404, of December 15, 1976 (“Brazilian Corporations Law ”), which regulates the terms and conditions of the merger, into Marfrig, of all shares issued by BRF not held by Marfrig (“Merger”); |

| (B) | the Parties wish to amend the Plan of Merger to include, as a condition applicable to the consummation of the Merger, the approval of the Merger by the Brazilian Administrative Council for Economic Defense – CADE; |

| (C) | at meetings held on this date, the boards of directors of the Companies approved the execution of this instrument by the Companies; |

NOW THEREFORE RESOLVE, having agreed and agreed among themselves, to enter into this “First Amendment to the Plan of Merger for the Merger of BRF S.A. Shares into Marfrig Global Foods S.A.” (“Amendment”), under the terms and conditions below.

| 1 | Definitions |

| 1.1 | Capitalized terms in this Amendment shall have the same meanings as those given to them in the Plan of Merger, unless otherwise expressly provided for in this Amendment. |

| 2 | Amendment |

| 2.1 | The Parties agree to amend Clause 8.1 of the Plan of Merger, which shall come into force under the following terms: |

“ 8.1. Conditions Precedent. The effectiveness of the Merger of Shares will be subject to the following conditions (collectively, the “Conditions Precedent”):

| (i) | from May 15, 2025 and up to and including the Closing Date, there may be no occurrence of war, armed conflicts, natural disasters and/or other events (e.g., health disasters; fires in manufacturing units) that adversely and significantly impact the production and/or marketing capacity (including export) of any of the Companies; and |

| (ii) | all acts necessary for the conclusion of the Merger and consummation of the operations contemplated in this Plan of Merger must have been approved by the Brazilian Administrative Council for Economic Defense – CADE, to the extent that such approval is necessary, in the form and terms of current legislation and regulations. |

| 8.1.1 | To the extent permitted by applicable law and regulations, the Companies may, by mutual agreement, waive the Conditions Precedent in writing.” |

| 2.2 | Due to the change in Clause 2.1 above, the Parties agree to change the references to the term “Condition Precedent” contained in the Plan of Merger to the term “Conditions Precedent”, as defined in this Amendment. |

| 3 | Restatement |

| 3.1 | As a result of the changes now agreed, the Plan of Merger, as amended and restated, shall come into force in the form of Annex (A) to this Amendment. |

| 4 | General Provisions |

| 4.1 | The provisions of Clause 9 (General Provisions) of the Plan of Merger shall apply to this Amendment, mutatis mutandis. |

| 4.2 | The Companies acknowledge and agree that (i) this Amendment is signed digitally, and such signature is accepted and acknowledged as valid by the Companies; and (ii) as provided in Provisional Measure No. 2,200-2, of August 24, 2001, this Amendment as signed electronically is acknowledged by the Companies as authentic, complete and valid, even if through an electronic signature platform not accredited by the Brazilian Public Key Infrastructure (ICP-Brasil) and without a digital signature certificate. For all purposes, the date indicated below shall be considered as the date of execution of this Amendment, even if any of the Companies signs this Amendment electronically at a later date, for any reason. In this case, such Company(ies) hereby agree(s) to the retroactive effect of this Amendment to the date indicated below. |

IN WITNESS WHEREOF, the Parties sign this Plan of Merger electronically, together with the 2 (two) witnesses below.

São Paulo, May 26, 2025.

(Signature page follows.)

(The remainder of this page is intentionally left blank.)

(Signature page of the First Amendment to the Plan of Merger for the Merger of BRF S.A. into Marfrig Global Foods S.A., executed on 26 May, 2025)

MARFRIG GLOBAL FOODS S.A.

| /s/ Rui Mendonça Junior | /s/ Tang David | |||

| Name: | Rui Mendonça Junior | Name: | Tang David | |

| Position: | CEO | Position: Administrative and Financial Director, and Director of Investor Relations | ||

BRF S.A.

| /s/ Miguel de Souza Gularte | /s/ Fabio Luis Mendes Mariano | |||

| Name: | Miguel de Souza Gularte | Name: | Fabio Luis Mendes Mariano | |

| Position: | Global CEO | Position: Vice-President Director of Finances and Investor Relations | ||

Witnesses:

| /s/ Ricardo Araujo Rocha | /s/ Mateus Boeira Garcia | |||

| Name: | Ricardo Araujo Rocha | Name: | Mateus Boeira Garcia | |

| CPF/MF: | 020.990.844-08 | CPF/MF: | 018.134.240-55 | |

Annex (A)

Amended and Restated Plan of Merger

AMENDED AND RESTATED PLAN OF MERGER FOR THE MERGER OF BRF S.A. SHARES INTO MARFRIG GLOBAL FOODS S.A.

By this private instrument, the directors of the companies identified below, as well as the companies themselves:

| (1) | MARFRIG GLOBAL FOODS S.A., a publicly held company, with its registered office in the city of São Paulo, State of São Paulo, at Avenida Queiroz Filho, No. 1,560, Block 5 (Sabiá Tower), 3rd floor, Room 301, Vila Hamburguesa, CEP 05319-000, registered in the National Registry of Legal Entities of the Ministry of Finance (“CNPJ/MF”) under No. 03.853.896/0001-40, represented herein in accordance with its bylaws (“Marfrig”); and |

| (2) | BRF S.A., a publicly held company, with its registered office in the city of Itajaí, State of Santa Catarina, at Rua Jorge Tzachel, 475, Fazenda Neighborhood, CEP 88301-600, registered in the CNPJ/MF under No. 01.838.723/0001-27, represented herein in accordance with its bylaws (“BRF” and, together with Marfrig, “Companies” or “Parties”) |

WHEREAS:

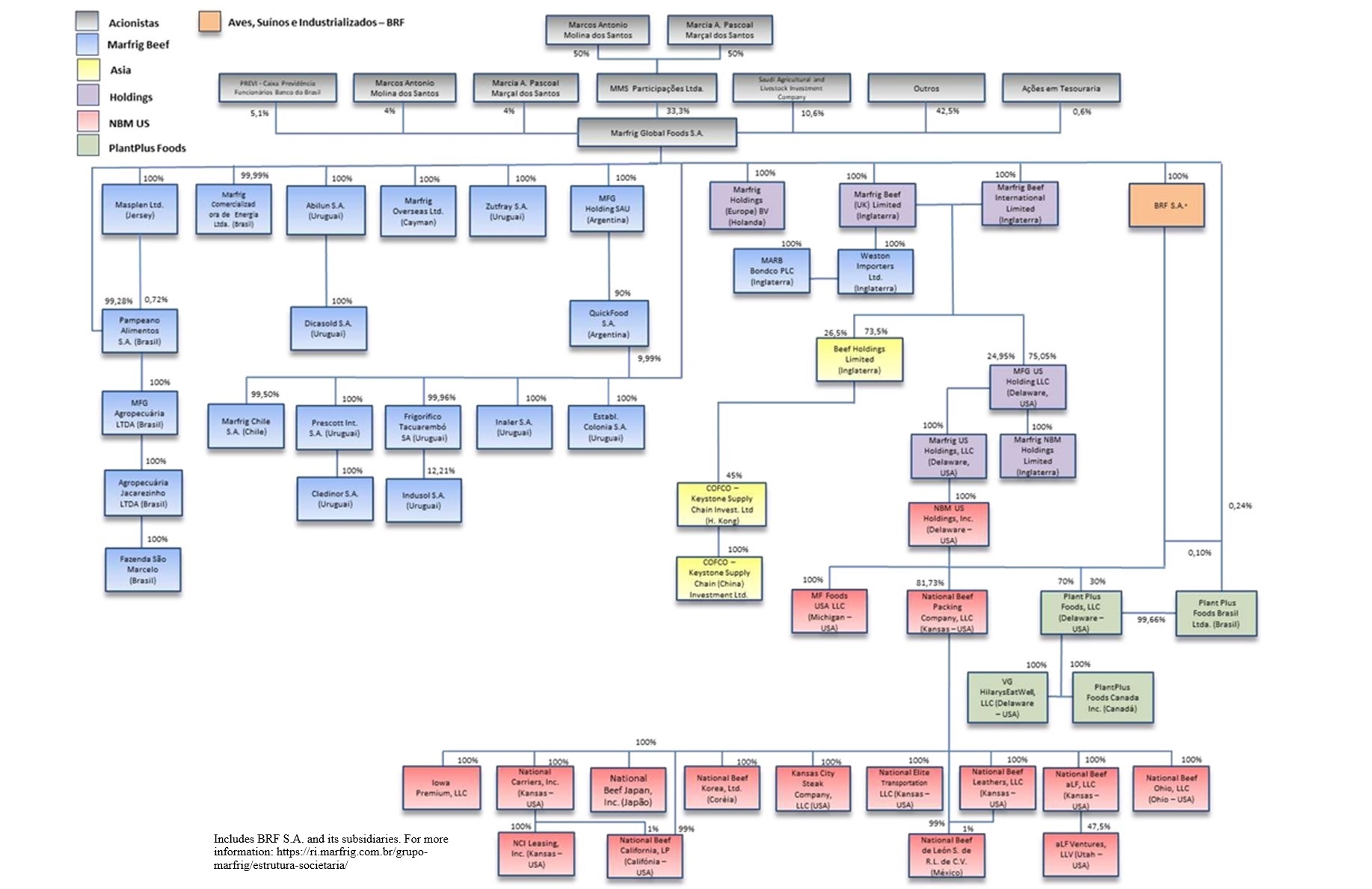

| (A) | Marfrig is a publicly held company, registered as category “A” issuer of securities with the Brazilian Securities and Exchange Commission (“CVM”) and listed on B3 S.A. – Brasil, Bolsa, Balcão (“B3”), and admitted for trading on the “Novo Mercado” B3 segment (“Novo Mercado”); |

| (B) | BRF is a publicly held company, registered as category “A” issuer of securities with the CVM, listed on B3, and admitted for trading on the Novo Mercado; |

| (C) | As of May 15, 2025, Marfrig held 849,526,130 common shares issued by BRF, representing approximately 53.09% of BRF’s voting capital (excluding BRF treasury shares); |

| (D) | on April 24, 2025, the Marfrig Board of Directors (“Marfrig Board”) approved the formation of the Marfrig Special Independent Committee and the election of its members, who qualify as independent members of the Marfrig Board (“Marfrig Independent Committee”); |

| (E) | on April 25, 2025, the BRF Board of Directors (“BRF Board” and, together with the Marfrig Board, “Boards of Directors”) approved the formation of the BRF Special Independent Committee (“BRF Independent Committee” and, together with the Marfrig Independent Committee, “Independent Committees”), and the election of its members, in accordance with CVM Guidance Opinion No. 35, dated September 1, 2008 (“CVM Guidance Opinion 35”); and |

| (F) | in meetings conducted on May 15, 2025, following the conclusion of negotiations between the Independent Committees regarding the Exchange Ratio (as defined in Clause 3.1 below), which resulted in a favorable recommendation of the terms and conditions described herein, the Boards of Directors approved the execution of this instrument by the Companies, as well as its submission to the shareholders of the Companies; |

NOW THEREFORE RESOLVE, having mutually agreed and resolved, to execute this Plan of Merger for the merger of BRF S.A. Shares into Marfrig Global Foods S.A.” (“Plan of Merger”), in accordance with the provisions of Articles 224, 225, and 252 of Law No. 6,404, dated December 15, 1976 (“Brazilian Corporations Law”), to regulate the terms and conditions applicable to the Merger (as defined in Clause 1.1 below), subject to the satisfaction (or waiver, as the case may be) of the Conditions Precedent (as defined in Clause 8.1 below) and the occurrence of the Closing Date (as defined in Clause 8.2 below).

| 1 | Purpose |

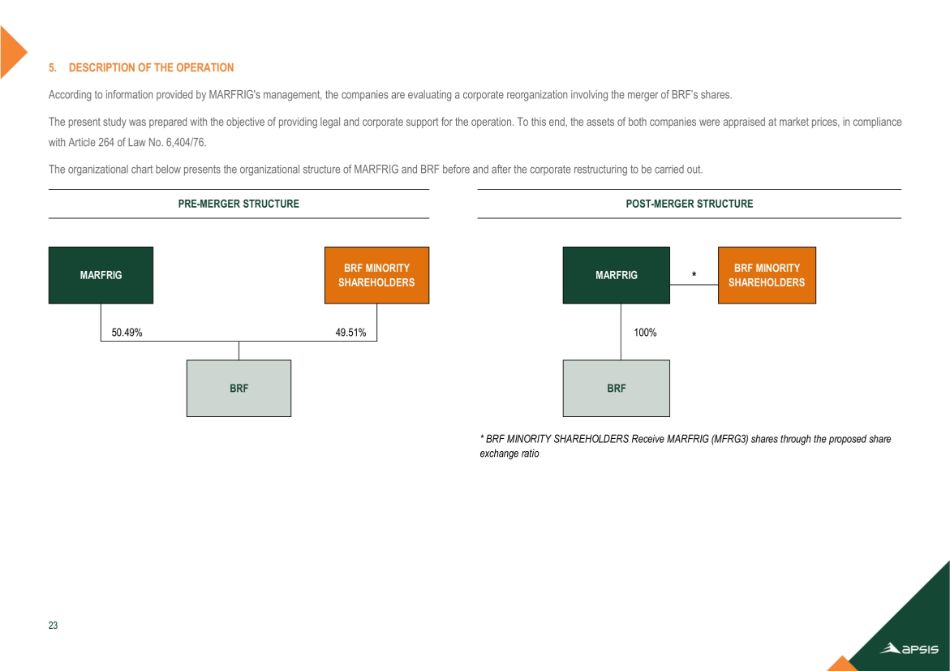

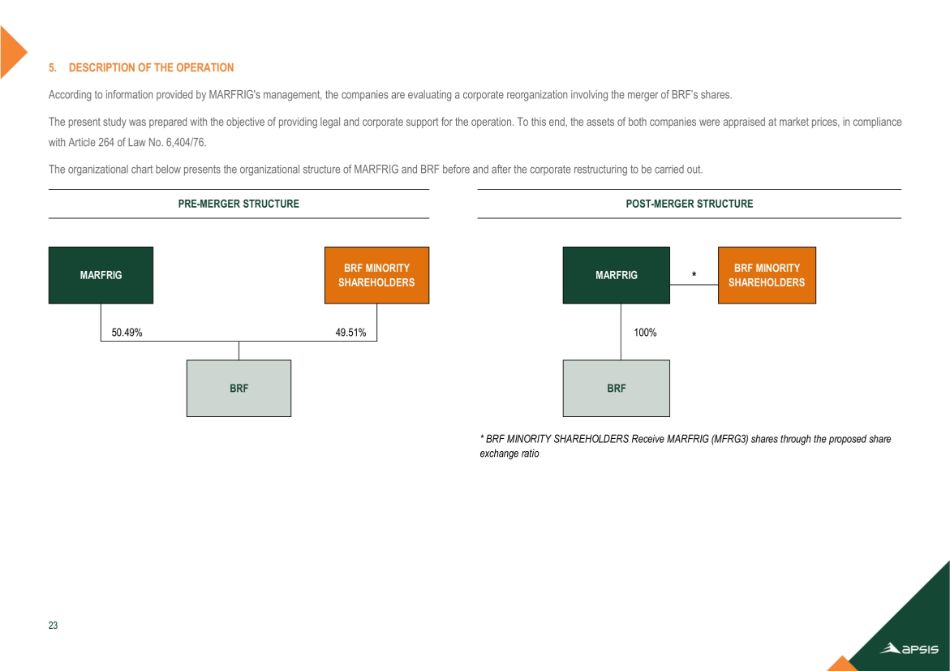

| 1.1 | Merger. Subject to the terms and conditions set forth in this Plan of Merger, the proposal for the merger into Marfrig of all BRF shares not held by Marfrig on the Closing Date is submitted to the shareholders of the Companies, with the consideration being the delivery to the BRF shareholders (except Marfrig) of common shares issued by Marfrig, in accordance with the Exchange Ratio, resulting in the transfer of BRF’s shareholder base to Marfrig (“Merger”). As a result of the Merger, BRF will become a wholly-owned subsidiary of Marfrig. |

| 2 | Justification |

| 2.1 | The Merger aims to create a global food company based on a multiprotein platform, strong presence in both domestic and international markets, portfolio diversification, scale, efficiency, and sustainability, providing significant benefits to both Companies, their shareholders, customers, suppliers, employees, and other stakeholders, generating operational, financial, and strategic synergies. |

| 2.2 | Additionally, the Companies believe that the Merger allows for the simplification and optimization of the administrative and corporate structure of the economic group to which they belong, eliminating or reducing redundant costs, and improving or facilitating access to the capital necessary for the development of their business plans. |

| 2.3 | The Companies believe that the Merger will have significant strategic value added, driving global consolidation of their businesses and strengthening their brands through a robust multi-protein platform, including, among others, (i) solidifying their position as leaders in the global food market; (ii) strategic expansion into new markets, maximizing growth opportunities and commercial synergies, including cross-selling initiatives; and (iii) increasing the scale and diversification of their operations, enhancing resilience and mitigating risks associated with sector seasonality and macroeconomic variables. |

| 3 | Terms and Conditions of the Merger |

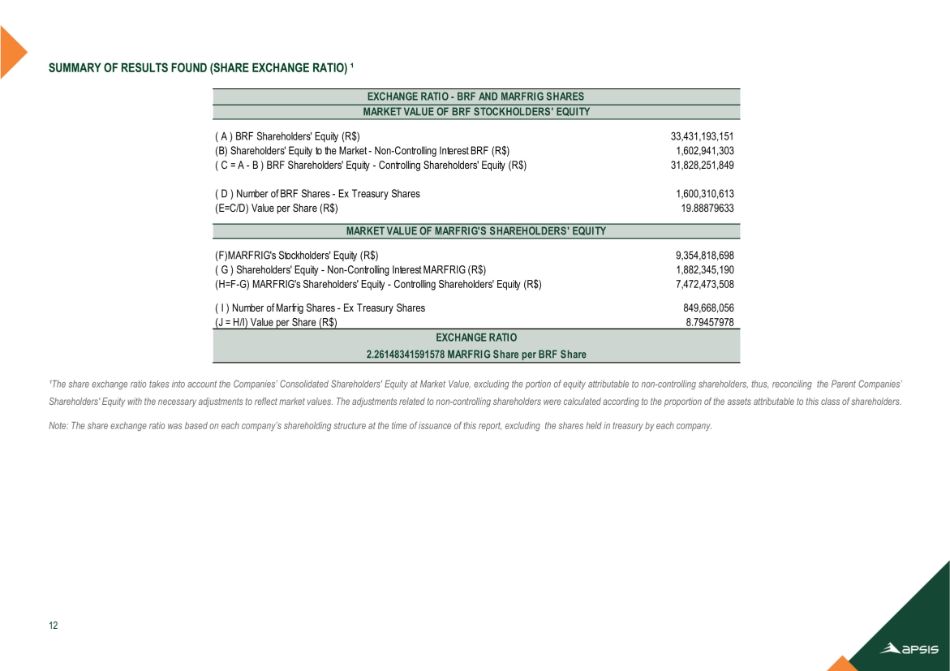

| 3.1 | Exchange Ratio. As a result of the Merger, BRF shareholders (other than Marfrig) will receive 0.8521 common shares issued by Marfrig for each 1 (one) common share of BRF held on the Closing Date (“Exchange Ratio”). |

| 3.1.1 | Independent Committees. Considering that the Merger involves a controlling company, Marfrig, and a controlled company, BRF, in compliance with CVM Guidance Opinion 35, the BRF Independent Committee was formed, and tasked with negotiating the Exchange Ratio and submit their recommendation to the BRF Board. Moreover, the Marfrig Independent Committee was responsible for the initial proposal and later negotiation of the Exchange Ratio with the BRF Independent Committee. The Exchange Ratio was exhaustively negotiated between the Independent Committees, taking into account the fair value of the Companies, and their recommendation to the respective Boards of Directors was approved by both Independent Committees at meetings held on May 15, 2025. In issuing the favorable recommendation for the transaction, the Independent Committees considered, with the collaboration of their external advisors, a variety of factors, so that the Exchange Ratio was not determined based on a single criterion, but on a variety of combined criteria. |

| 3.1.2 | Fractional Shares. Any fractional common shares of Marfrig resulting from the Merger will be aggregated into whole numbers and subsequently sold on the B3 spot market after the completion of the Merger, in accordance with a communication to be timely disclosed to the market by Marfrig. The proceeds from such sales will be made available, net of fees, to the former BRF shareholders who are entitled to the respective fractions, proportionally to their participation in each share sold. |

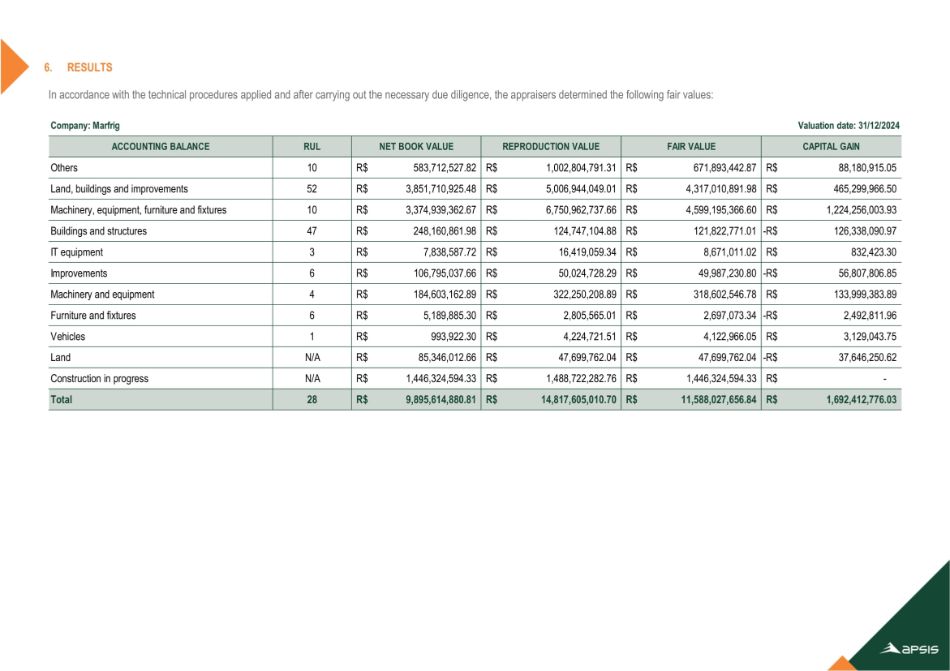

| 3.1.3 | Permitted Distributions. The negotiation and determination of the Exchange Ratio took into account the distribution of dividends and/or interest on own capital in the gross amount of (i) R$3,520,000,000.00 (three billion, five hundred and twenty million reais) by BRF; and (ii) R$2,500,000,000.00 (two billion, five hundred million reais) by Marfrig, in both cases, to be authorized after payment of the withdrawal rights of potential Dissenting Shareholders (as defined in Clause 6.1.1 below) and up to and including the Closing Date (collectively, “Permitted Distributions”), in compliance with the provisions of Clause 3.1.5 below. |

| 3.1.4 | No shares shall be issued by Marfrig as a result of the Merger corresponding to shares that may be held in treasury by BRF, which shall be canceled by BRF up to the Closing Date. |

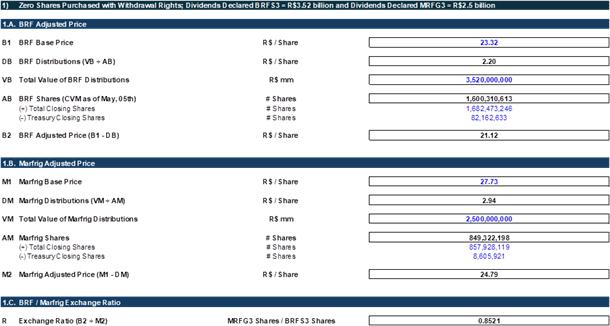

| 3.1.5 | Adjustments. The Exchange Ratio shall be adjusted exclusively (i) in the event of stock splits, consolidations, or in-kind dividend payments of either Company; and/or (ii) according to the mechanism set forth in Annex 3.1.5. of this Plan of Merger. In accordance with the mechanism described in Annex 3.1.5, any payments made incurred by the Companies upon exercising the withdrawal right will proportionally reduce the Permitted Distributions by an equivalent amount applied to both Companies. |

| 3.1.6 | The substitution of shares issued by BRF shares underlying the American Depositary Shares representing BRF common shares, in the context of the Merger, shall be carried out in accordance with the terms of the applicable deposit agreement. |

| 3.2 | BRF’s Share Capital. As of the date of this Plan of Merger, BRF’s share capital amounts to R$13,653,417,953.36 (thirteen billion, six hundred and fifty-three million, four hundred and seventeen thousand, nine hundred and fifty-three reais and thirty-six centavos), divided into 1,682,473,246 (one billion, six hundred and eighty-two million, four hundred and seventy-three thousand, two hundred and forty-six) common shares, with no-par value, all registered and held in book-entry, of which 849,526,130 (eight hundred and forty-nine million, five hundred and twenty-six thousand, one hundred and thirty) are already held by Marfrig and 82,162,633 (eighty-two million, one hundred and sixty-two thousand, six hundred and thirty-three) were BRF treasury shares on May 15, 2025 and, therefore, will not be entitled to receive common shares issued by Marfrig as a result of the Merger, in accordance with Clauses 3.1 and 3.1.4 above. |

| 3.3 | Merger at Market Value. The Merger will result in an increase in Marfrig’s shareholders’ equity in the amount of R$14,933,103,366.87 (fourteen billion, nine hundred and thirty-three million, one hundred and three thousand, three hundred and sixty-six reais and eighty-seven centavos), considering the value attributed to the shares issued by BRF to be merged into Marfrig (that is, without considering the shares issued by BRF held in treasury and the shares issued by BRF held by Marfrig), based on the Merger Appraisal Report (as defined in Clause 4.2 below) and considering the elimination of the investment held by Marfrig in BRF, provided that the amount of (i) R$4,977,203,352.18 (four billion, nine hundred and seventy-seven million, two hundred and three thousand, three hundred and fifty-two reais and eighteen centavos) will be allocated to the share capital account of Marfrig; and (ii) the remaining amount will be allocated to Marfrig’s capital reserve account. |

| 3.4 | Increase in Marfrig’s Share Capital. On the date of this Plan of Merger, Marfrig’s share capital is R$10,491,577,961.00 (ten billion, four hundred and ninety-one million, five hundred and seventy-seven thousand, nine hundred and sixty-one reais), divided into 857,928,119 (eight hundred and fifty-seven million, nine hundred and twenty-eight thousand, one hundred and nineteen) common shares, all registered, in book-entry form and with no par value. Due to the allocation to Marfrig’s share capital account provided for in Clause 3.3 above, on the Closing Date, Marfrig’s share capital will be R$15,468,781,313.18 (fifteen billion, four hundred and sixty-eight million, seven hundred and eighty-one thousand, three hundred and thirteen reais and eighteen centavos), and the number of shares to be issued by Marfrig will observe the Exchange Ratio. |

| 3.4.1 | Without prejudice to any adjustments to the Exchange Ratio to be made in accordance with Clause 3.1.5 above and in compliance with the provisions of Clause 3.4.3 below, the Merger will include the issuance by Marfrig of 639,743,458 (six hundred and thirty-nine million, seven hundred and forty-three thousand, four hundred and fifty-eight) common shares, to be subscribed by the directors of BRF on behalf of the then shareholders of BRF (other than Marfrig) on the Closing Date, in accordance with Article 252, Paragraph 2, of the Brazilian Corporations Law. |

| 3.4.2 | As a result of the increase in share capital and the issuance of shares by Marfrig in accordance with Clauses 3.4 and 3.4.1 above, Article 5, Paragraph 1, of Marfrig’s bylaws will be amended to read as follows, subject to any adjustments in accordance with Clause 3.1.5 above: |

“Article 5. The Company’s share capital, fully subscribed and paid-up, is R$15,468,781,313.18 (fifteen billion, four hundred and sixty-eight million, seven hundred and eighty-one thousand, three hundred and thirteen reais and eighteen centavos), divided into 1,497,671,577 (one billion, four hundred and ninety-seven million, six hundred and seventy-one thousand, five hundred and seventy-seven) common shares, all registered, in book-entry form and with no par value.”

| 3.4.3 | In case of adjustments to the Exchange Ratio pursuant to Clause 3.1.5 above, it will be the responsibility of the Marfrig Board to approve, subject to agreement of the first Marfrig general assembly to be held after Closing Date, a new amendment to Article 5 of the Marfrig’s bylaws, for the purpose of recording the number of shares into which Marfrig’s share capital will be divided as a result of the Merger, in accordance with powers delegated to the Marfrig Board, to be deliberated by the Marfrig EGM (as defined in 7.1(ii)). |

| 3.5 | Share Rights. The common shares to be issued by Marfrig as a result of the Merger will grant their holders the same rights and benefits currently derived from the common shares issued by BRF, and therefore, the issuance and subscription of shares to be issued by Marfrig will not result in any modification to the voting rights, dividends, or any other political or financial rights currently derived from the ownership of common shares issued by BRF, participating fully in all their benefits, including dividends and other capital remunerations that may be declared by Marfrig after the Closing Date. |

| 3.6 | Absence of Cross-Ownership. In the context of the Merger, no cross-ownership will be established between the Companies, given that (i) BRF did not hold, on May 15, 2025, and will not hold as of the Closing Date, any shares issued by Marfrig; and (ii) any BRF treasury shares will be canceled up to the Closing Date and, therefore, will not be entitled to receive shares issued by Marfrig. |

| 3.7 | Absence of Succession. The Merger will not result in the absorption by Marfrig of any assets, rights, claims, obligations, or liabilities of BRF, which will maintain its full legal personality, and therefore, there will be no succession between the Companies. |

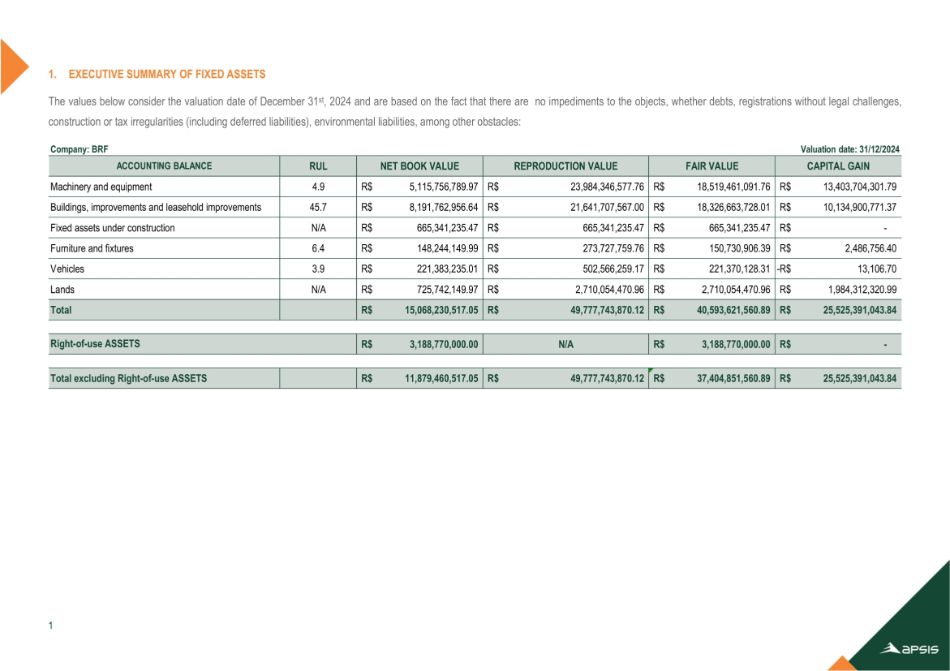

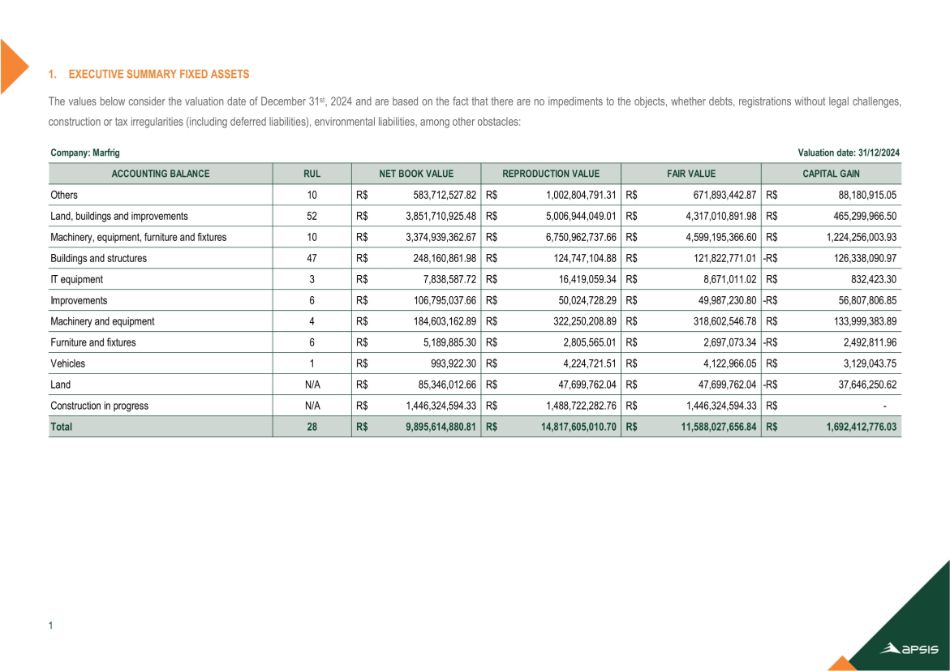

| 4 | Valuation and Net Asset Variations |

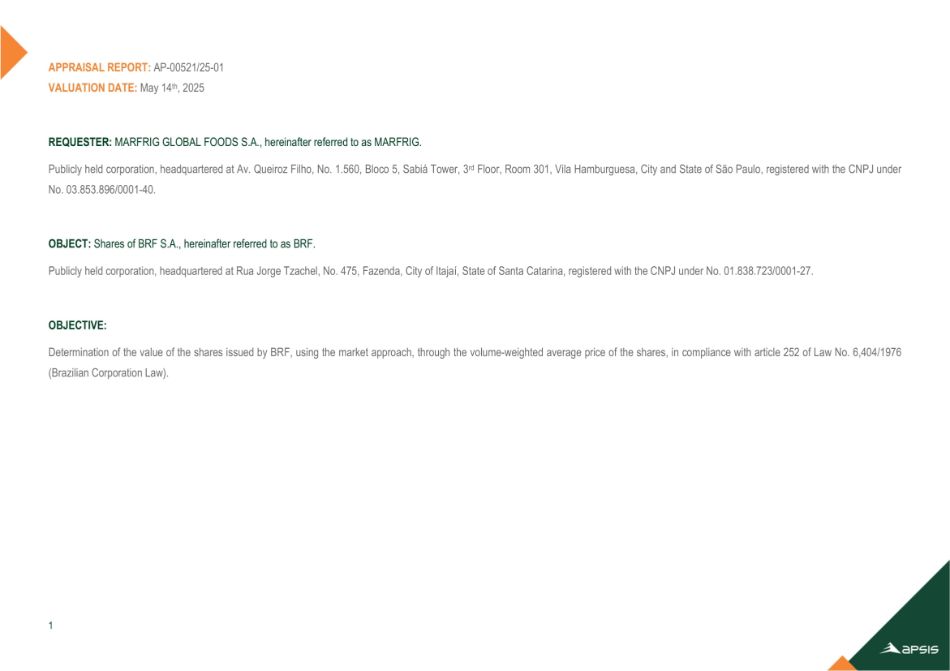

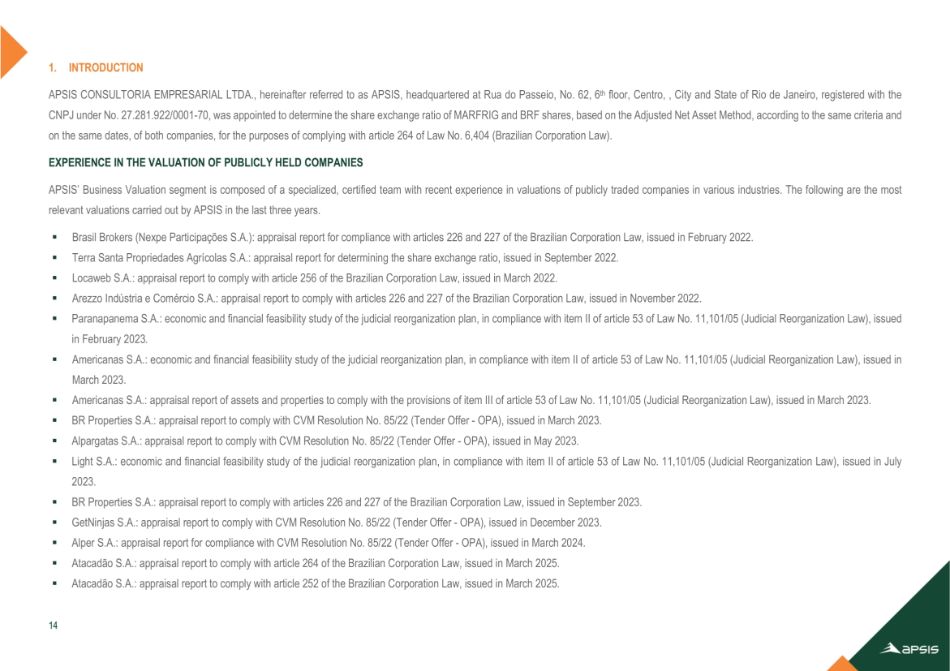

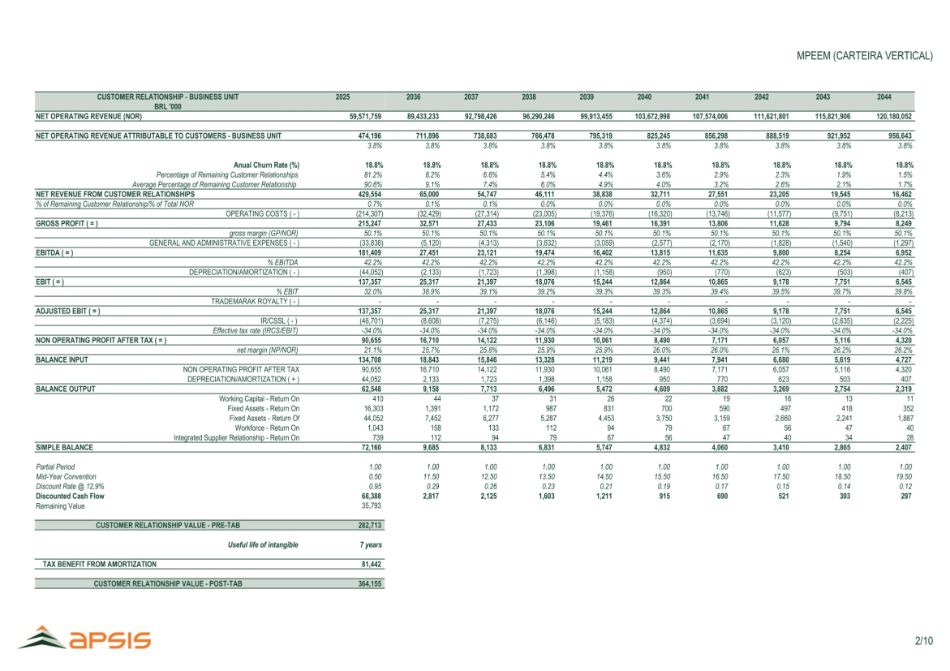

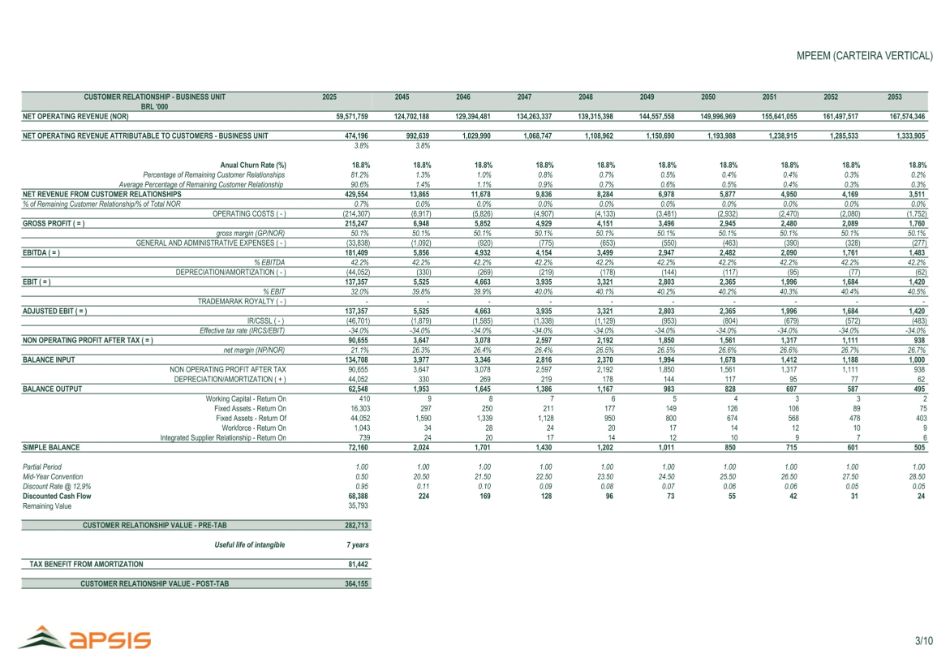

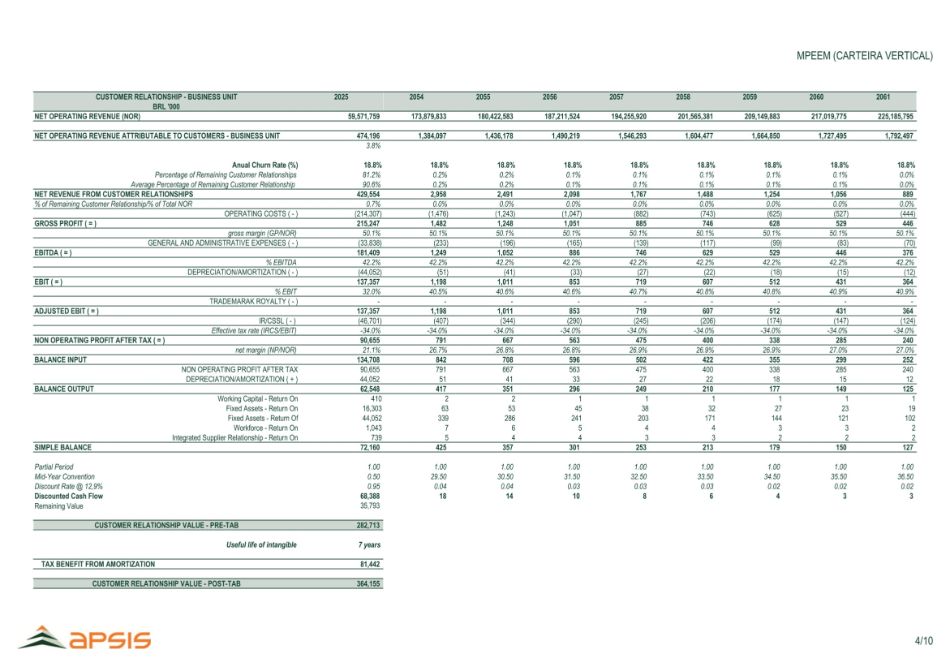

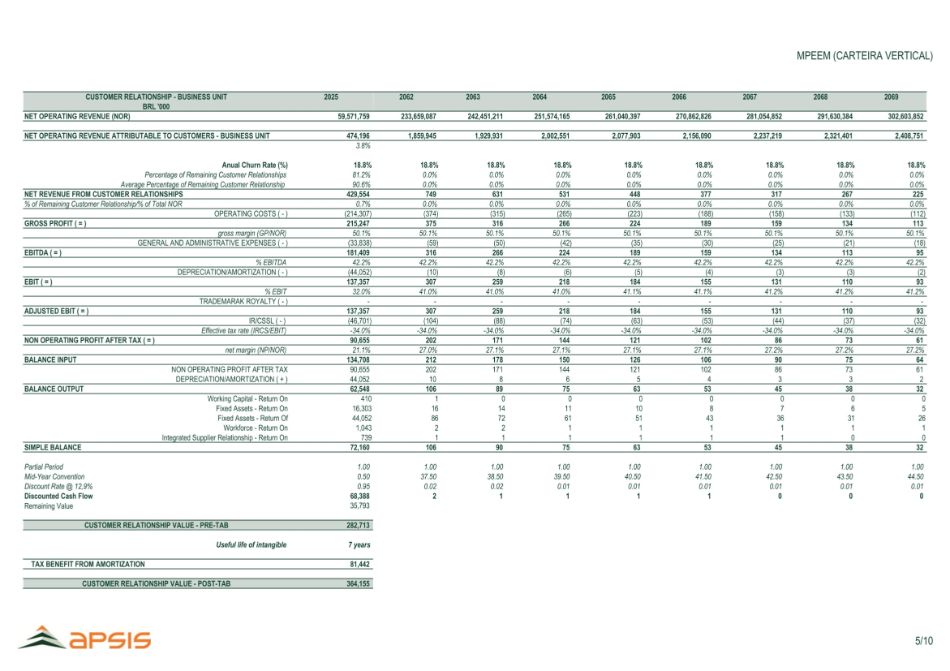

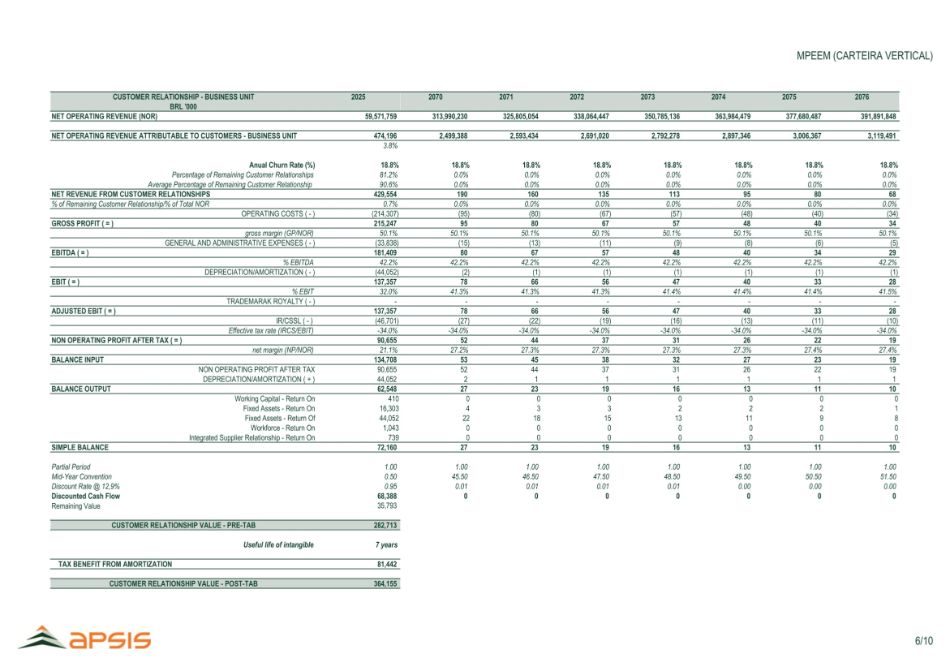

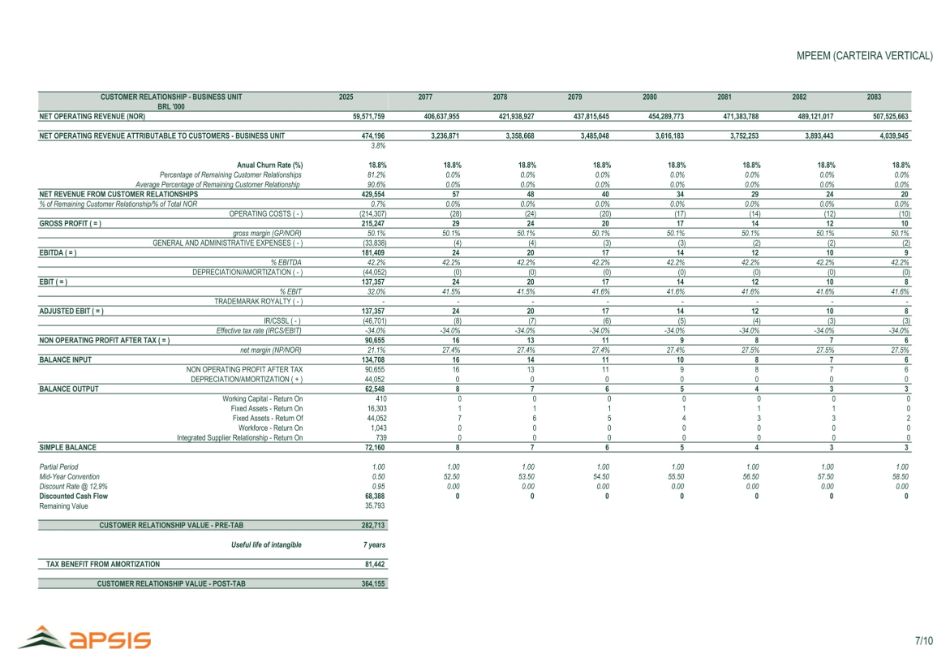

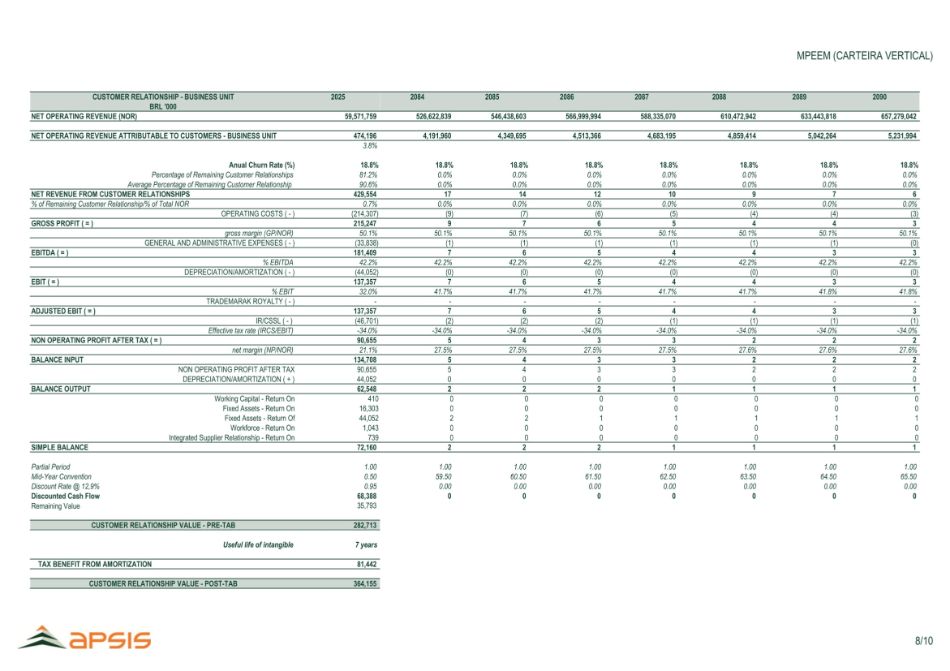

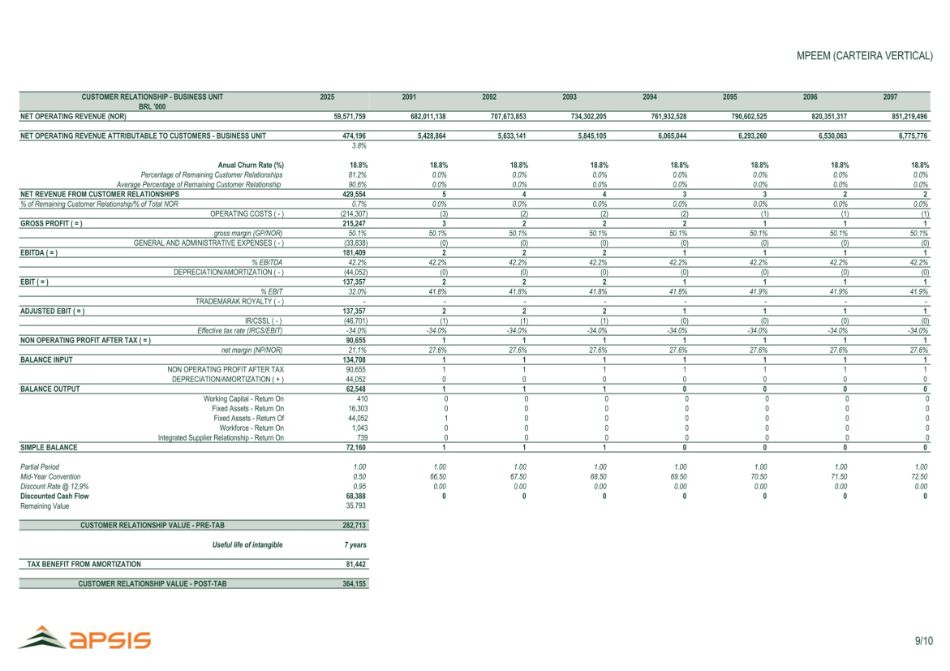

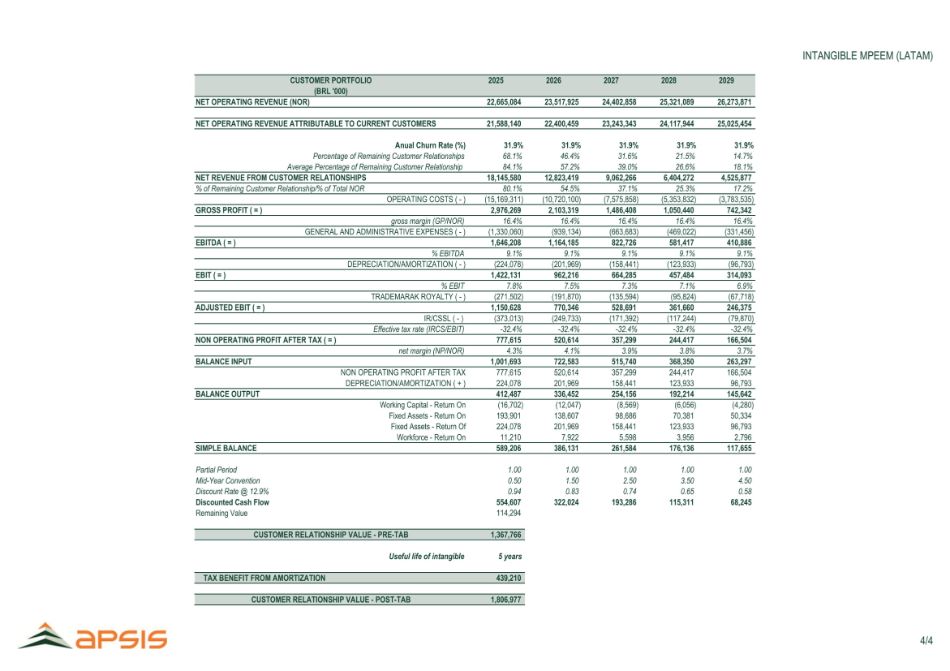

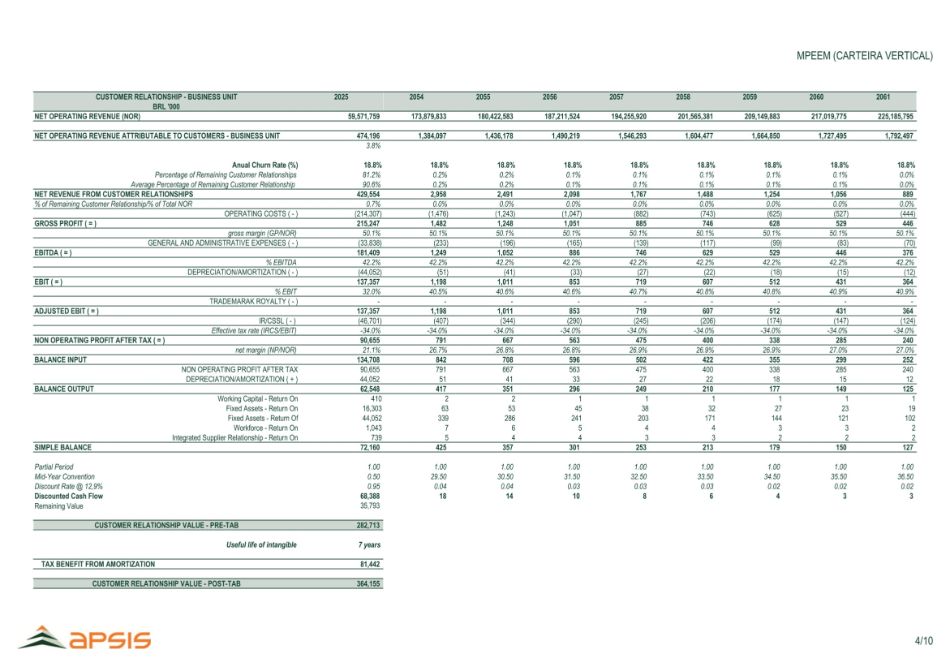

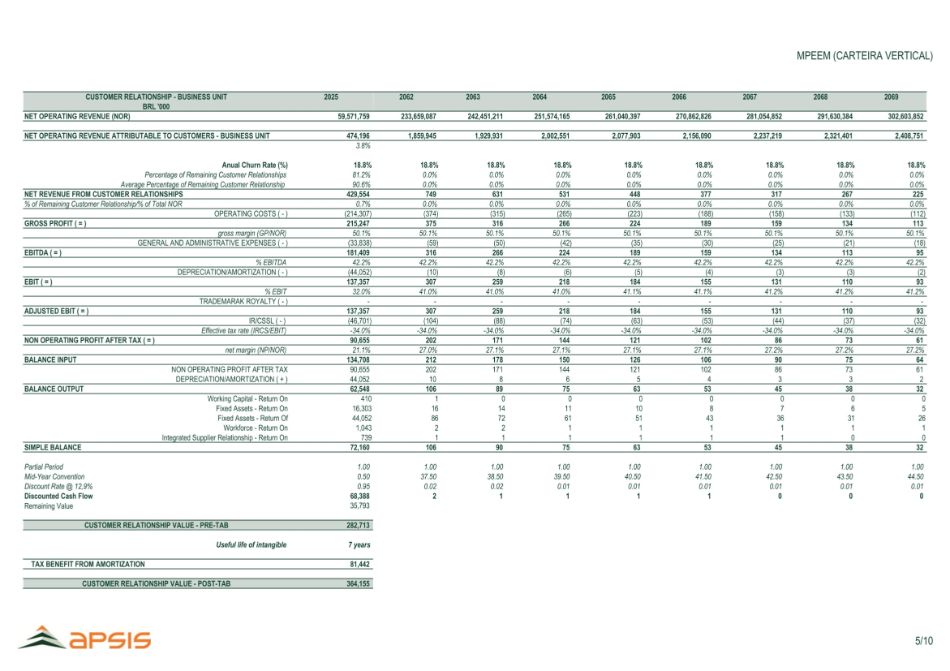

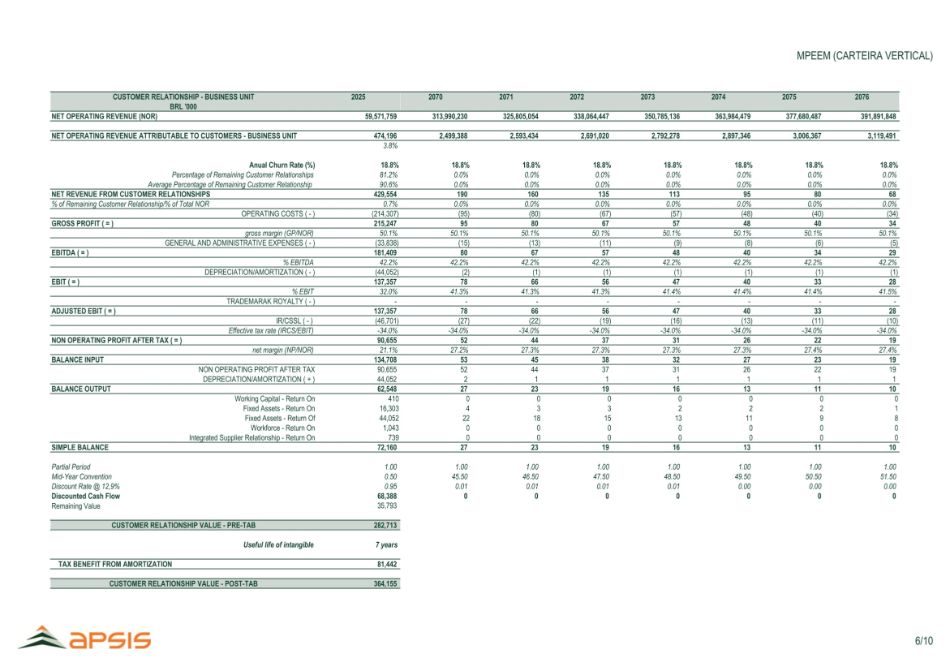

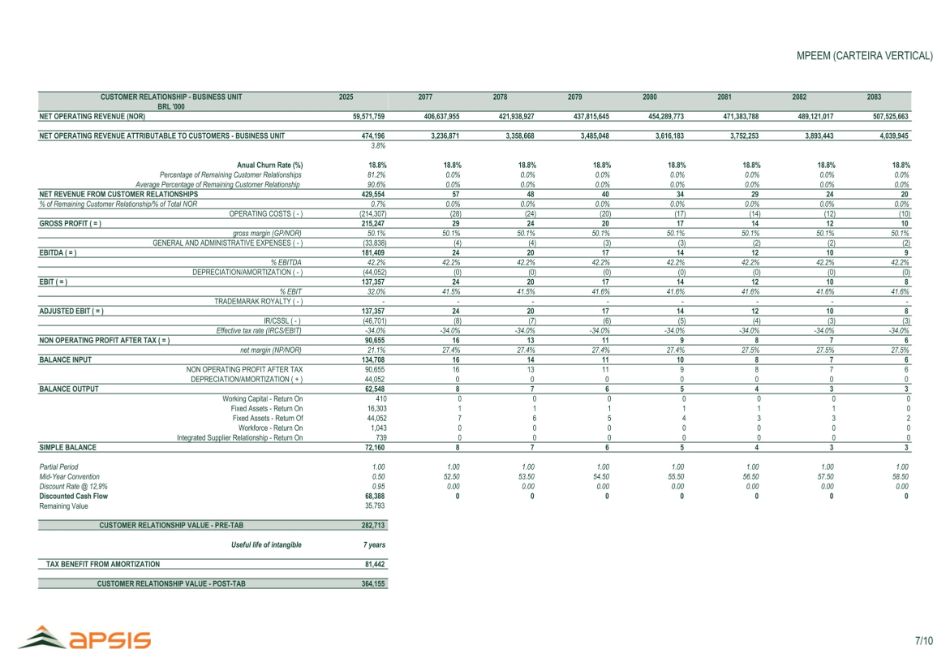

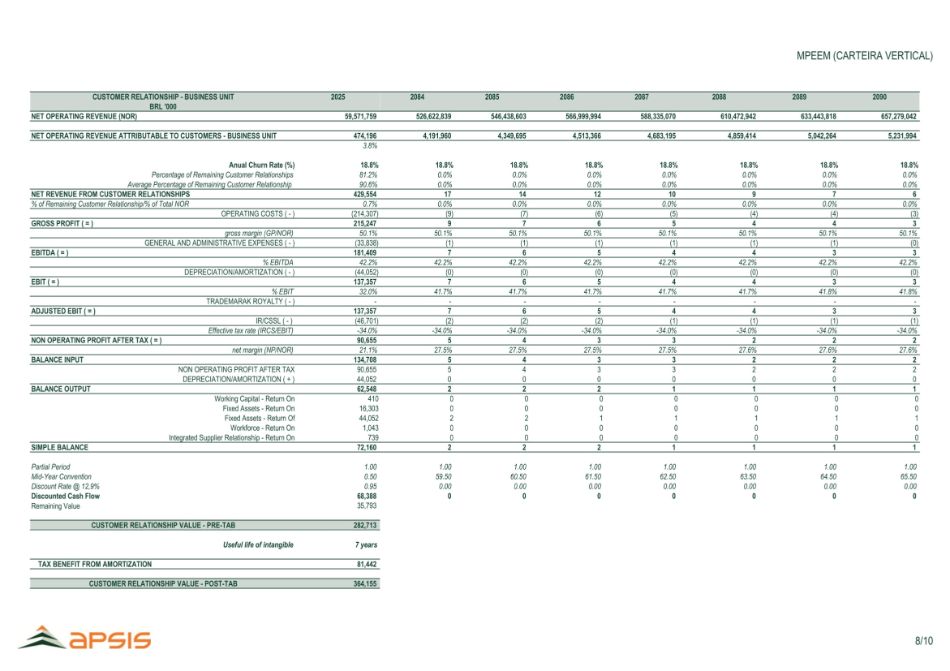

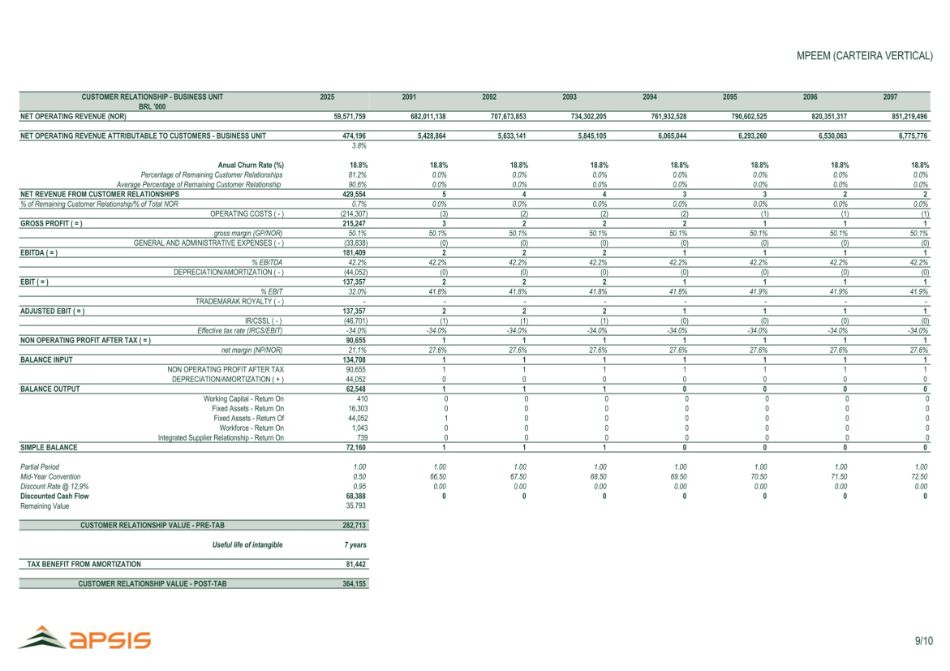

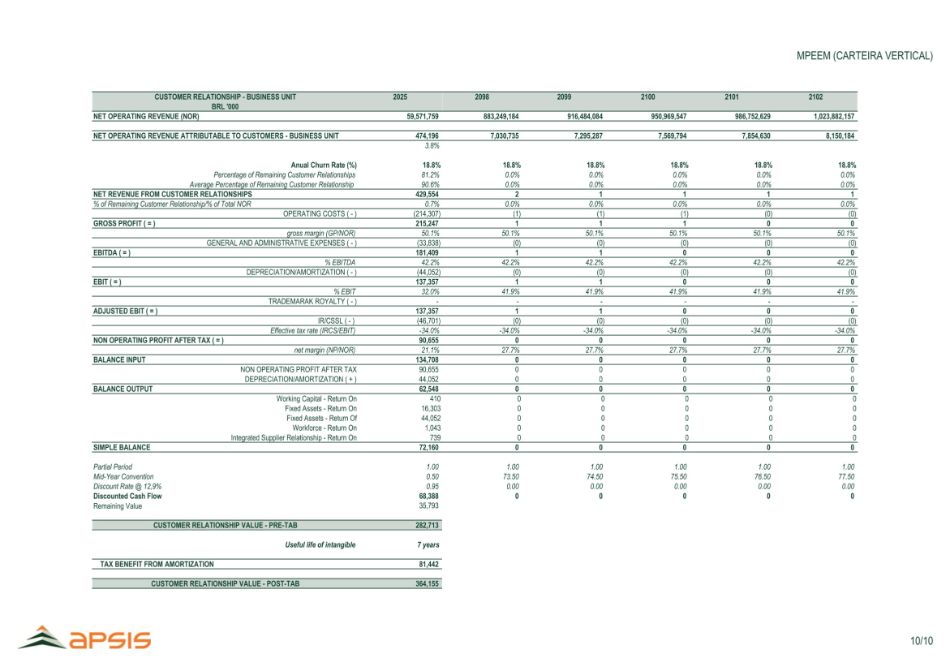

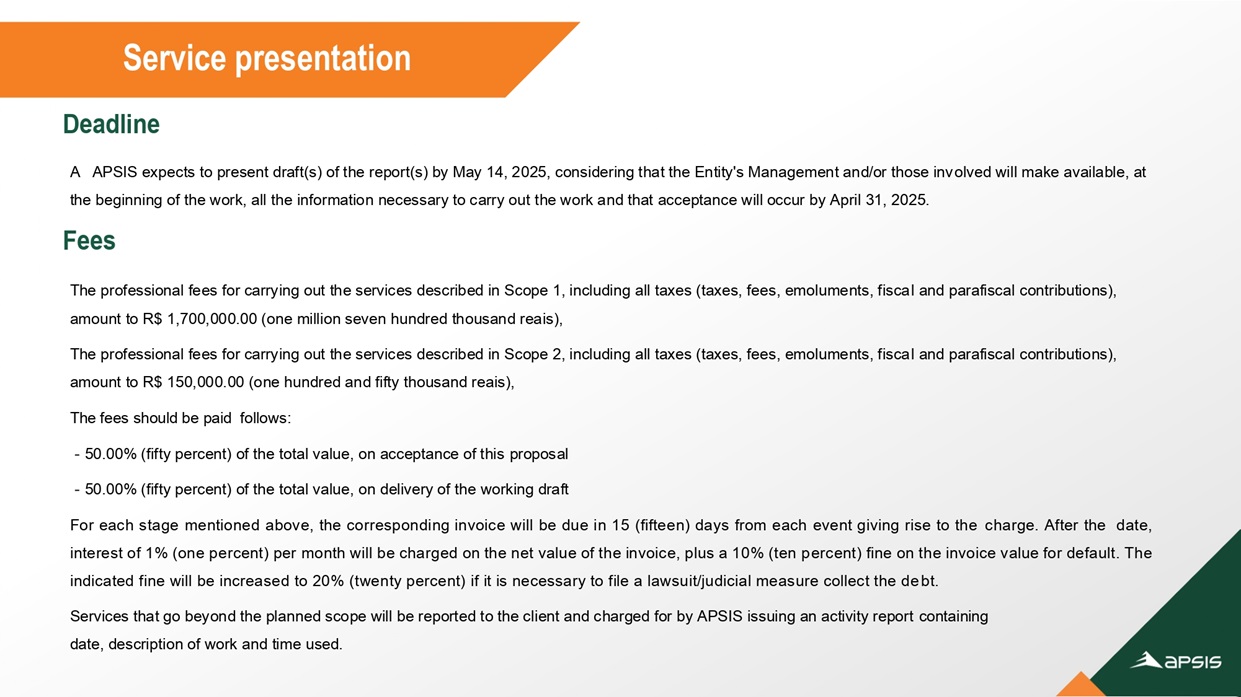

| 4.1 | Appraisal Company. The management of the Companies have engaged Apsis Consultoria Empresarial Ltda., registered with the CNPJ/MF under No. 08.681.365/0001-30 and with the Rio de Janeiro Regional Accounting Council (CRC/RJ) under No. 005112/O-9, with its registered office in the city of Rio de Janeiro, State of Rio de Janeiro, on Rua do Passeio, nº 62, 6º andar, Centro, CEP 20021-290, (“Appraisal Company”), as responsible for preparing the Appraisal Reports (as defined in Clause 4.5 below) |

| 4.1.1 | Ratification of the Appointment of the Appraisal Company. In accordance with Article 252, paragraph 1, of the Brazilian Corporations Law, the appointment of the Appraisal Company will be submitted for ratification by the BRF EGM (as defined in Clause 7.1(i)) and the Marfrig EGM. |

| 4.1.2 | Appraisal Company Declarations. The Appraisal Company has declared that (i) in accordance with the professional standards established by the Brazilian Federal Accounting Council, it has no knowledge of any direct or indirect conflict of interest, nor of any other circumstance that represents a conflict of interest in relation to the services it has provided and which are described in the Merger Appraisal Report (as defined below); and (ii) it has no knowledge of any action by the controlling shareholder or the administrators of the Companies aimed at directing, limiting, hindering, or performing any acts that could have compromised access, use, or knowledge of relevant information, assets, documents, or work methodologies for the quality of their respective conclusions. The Appraisal Company was selected for the work described in this Plan of Merger based on its extensive and well-known experience in preparing appraisals and evaluations of this nature. |

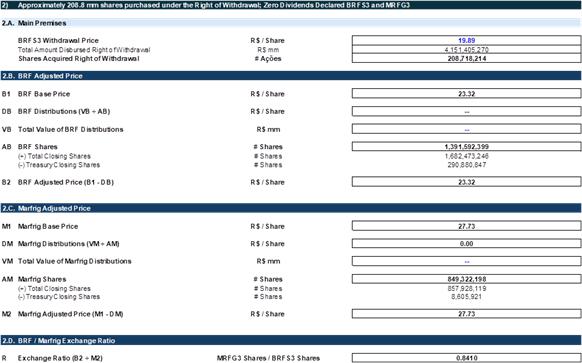

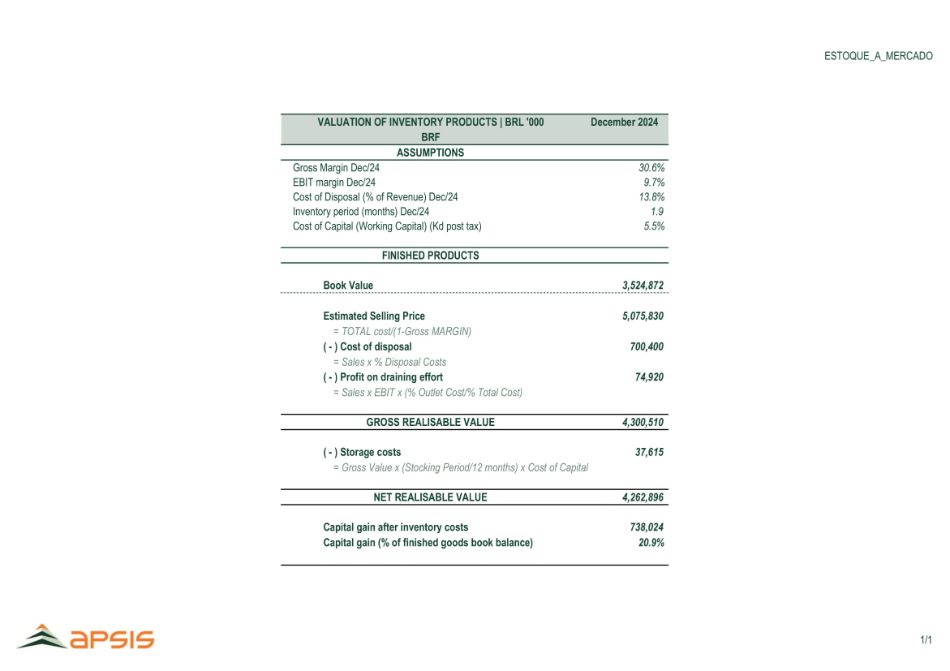

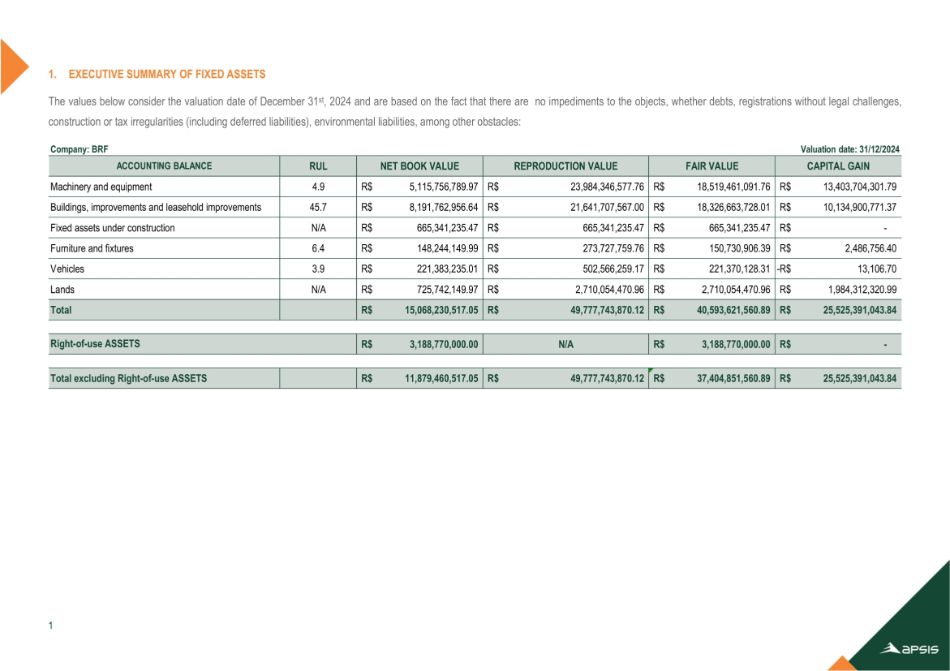

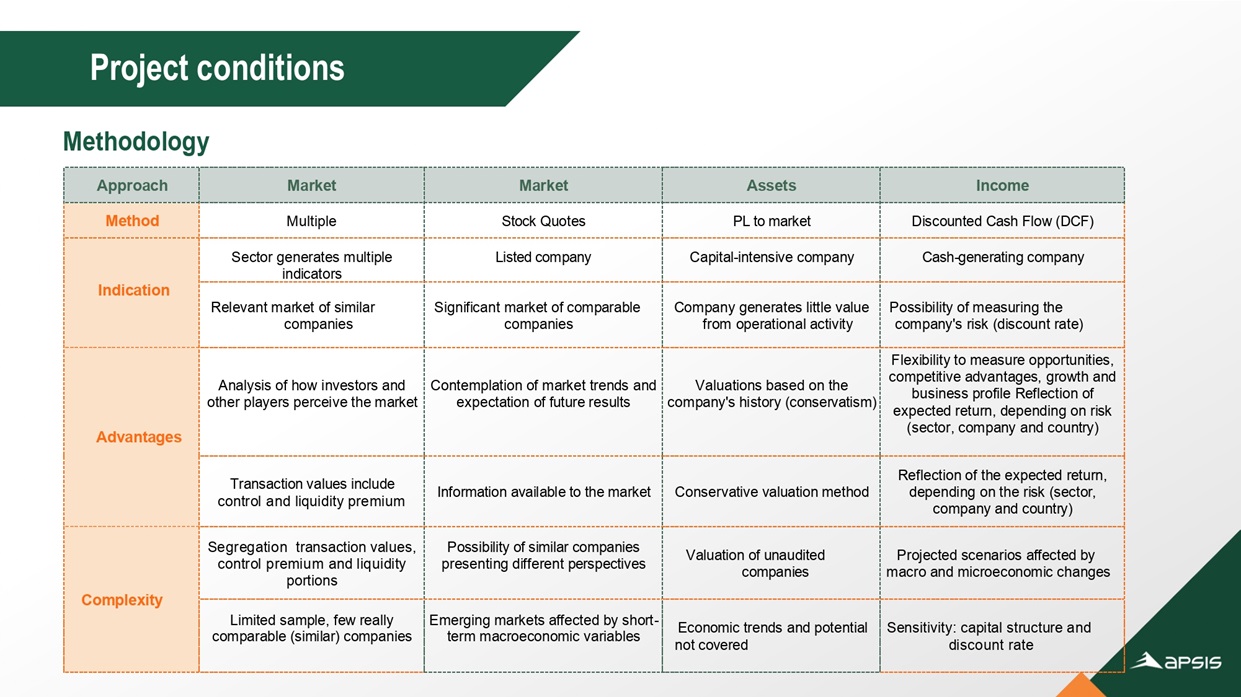

| 4.2 | Merger Appraisal Report. The Appraisal Company prepared the appraisal report of the shares issued by BRF to be merged into Marfrig at market value, in the context of the the Merger, as of the Base Date, as set forth in Annex 4.2 of this Plan of Merger (“Merger Appraisal Report”). |

| 4.2.1 | Base Date. The base date used to prepare the Merger Appraisal Report is May 14, 2025. |

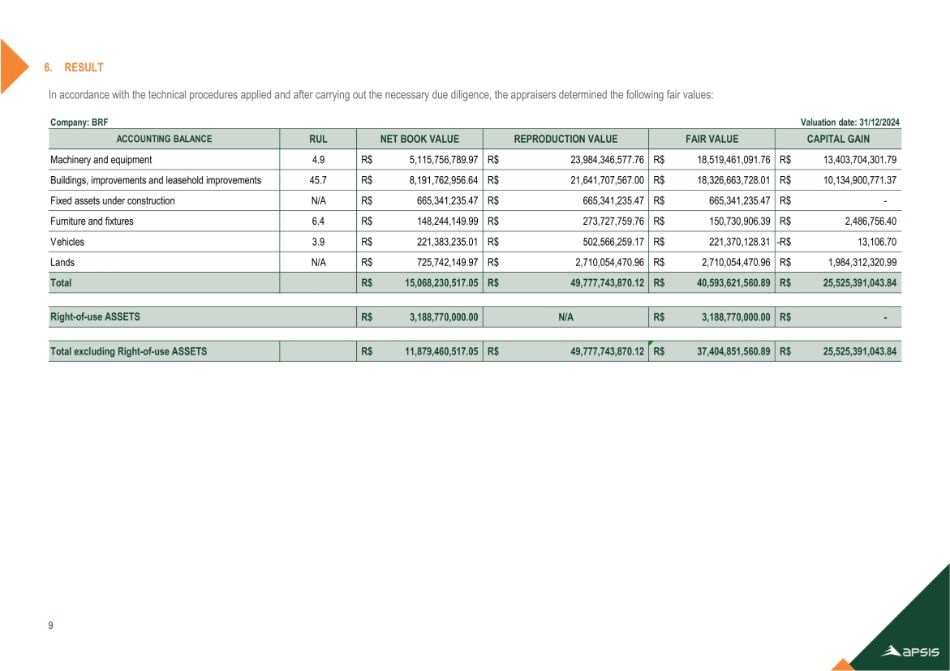

| 4.3 | Attributed Value. The market value attributed in the Merger Appraisal Report to the BRF shares to be merged into Marfrig corresponds to the total amount of R$15,406,097,591.16 (fifteen billion, four hundred and six million, ninety-seven thousand, five hundred and ninety-one reais and sixteen centavos) (already adjusted to consider the elimination of the investment held by Marfrig in BRF). |

| 4.4 | Changes in Shareholders’ Equity. Any changes in shareholders’ equity of BRF from the Base Date to the Closing Date will be borne exclusively by BRF and reflected in Marfrig as a result of the application of the equity method. |

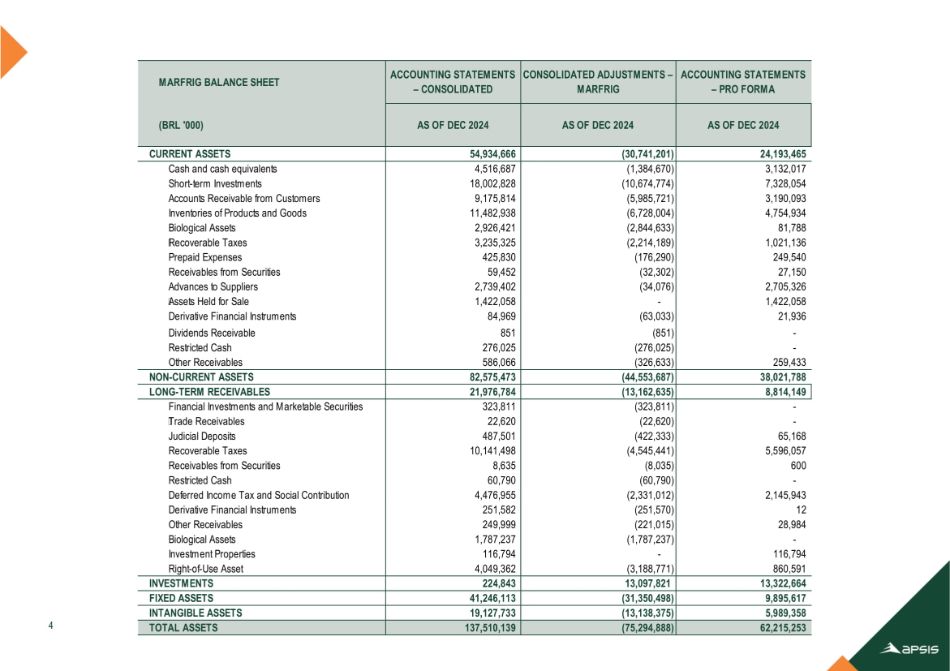

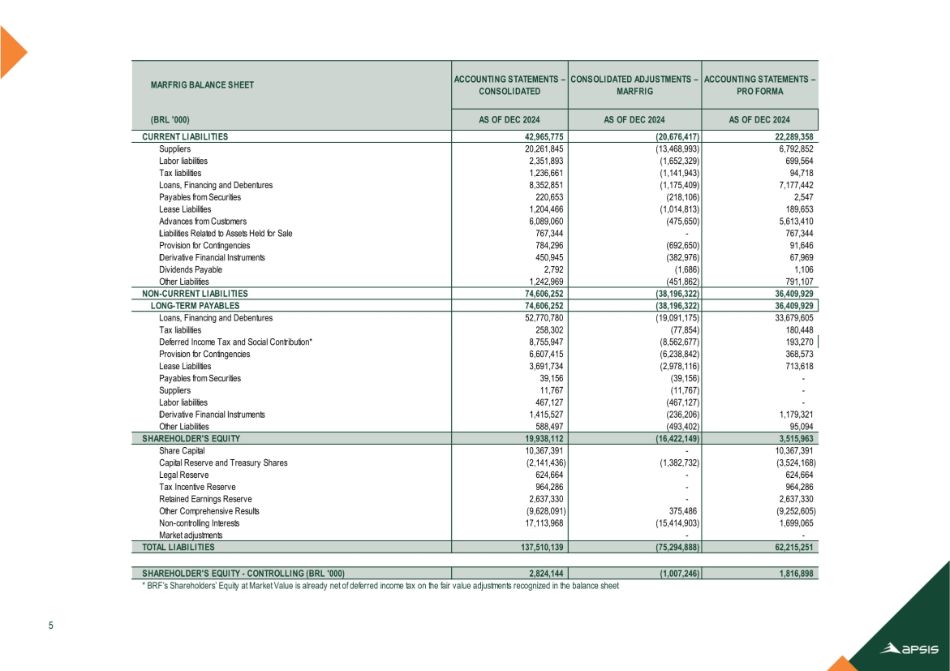

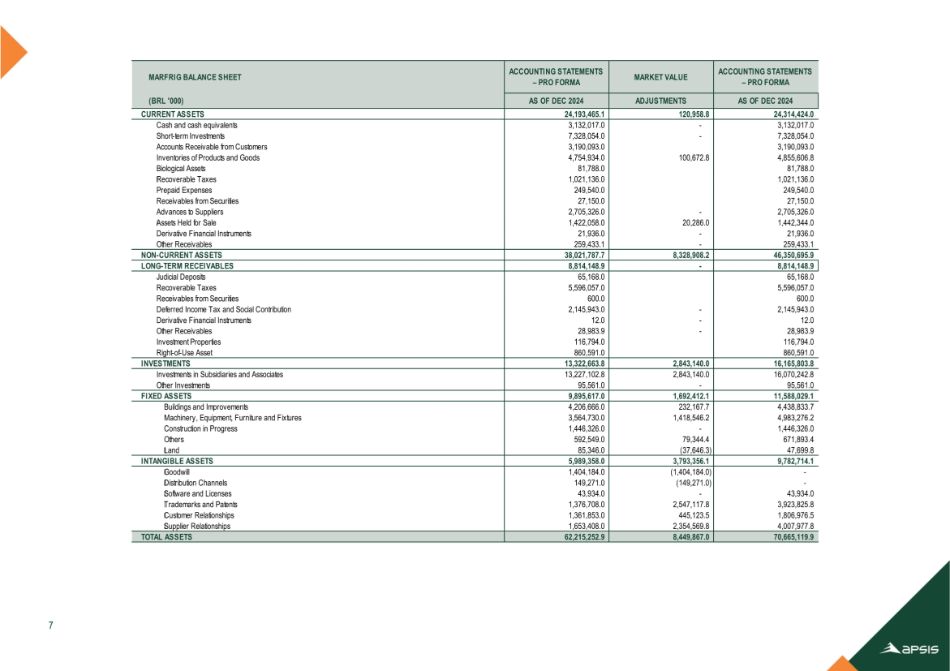

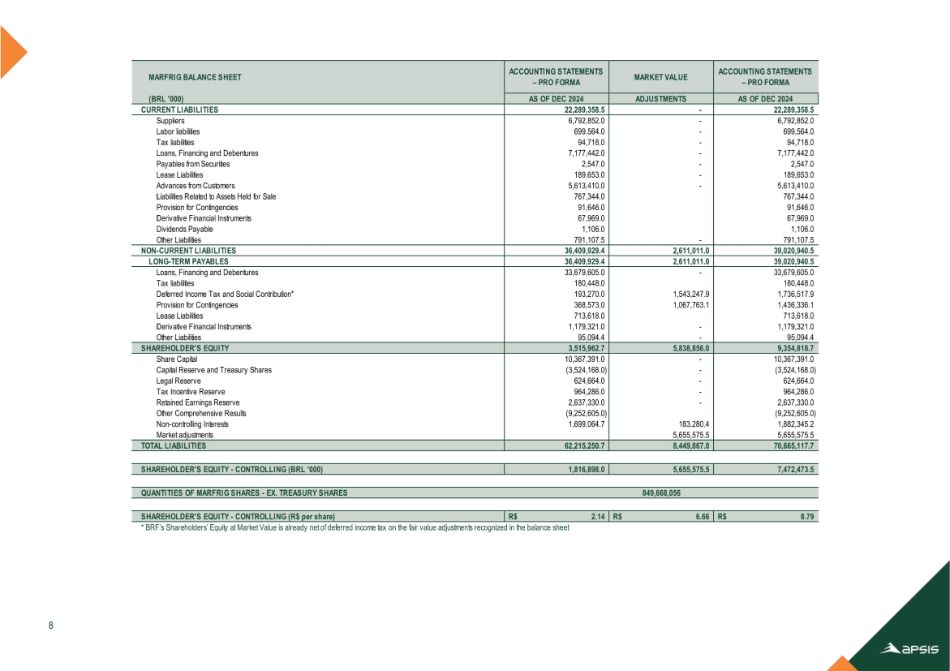

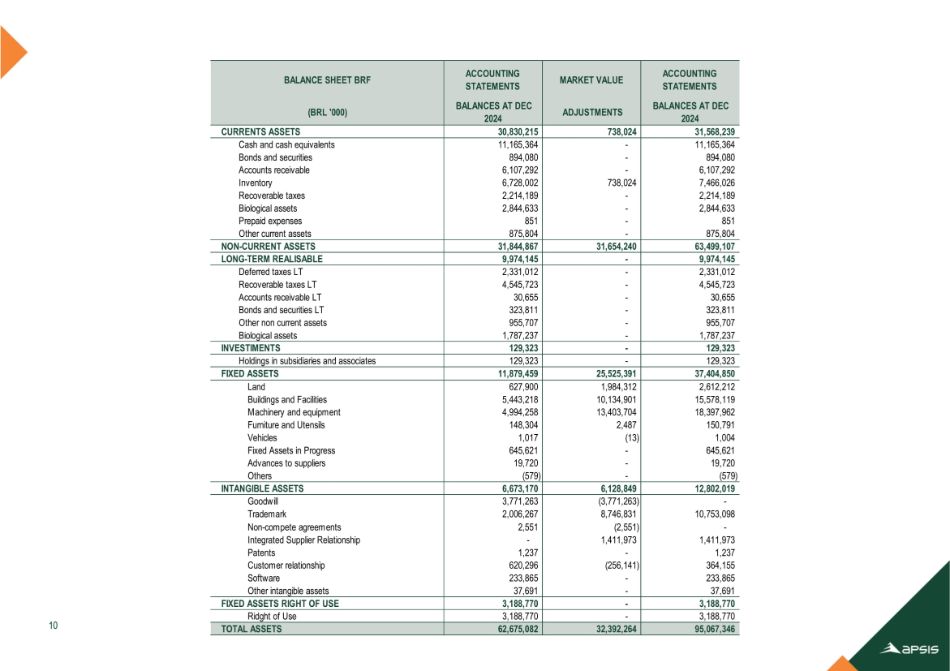

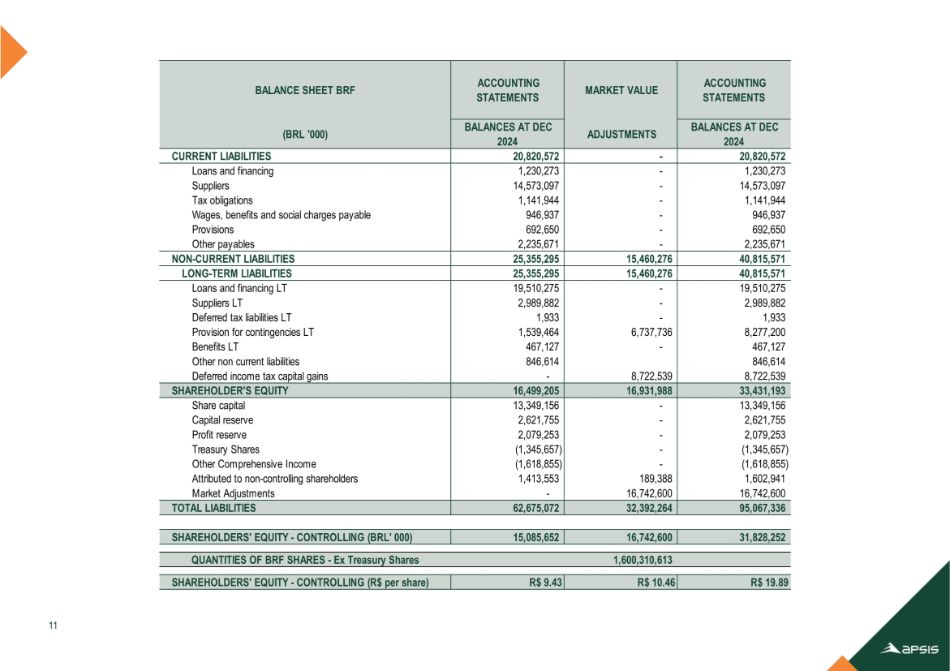

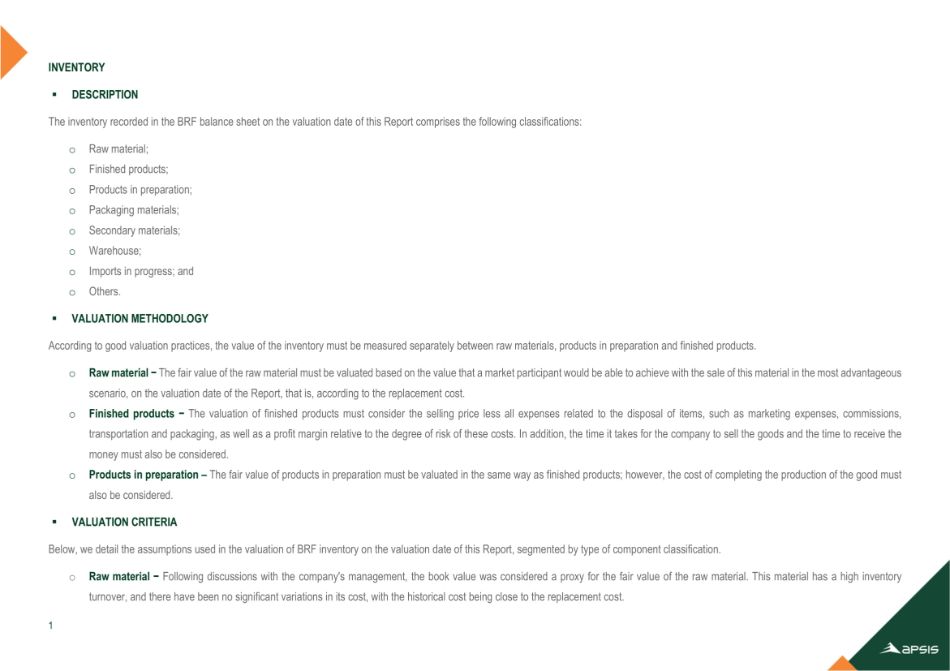

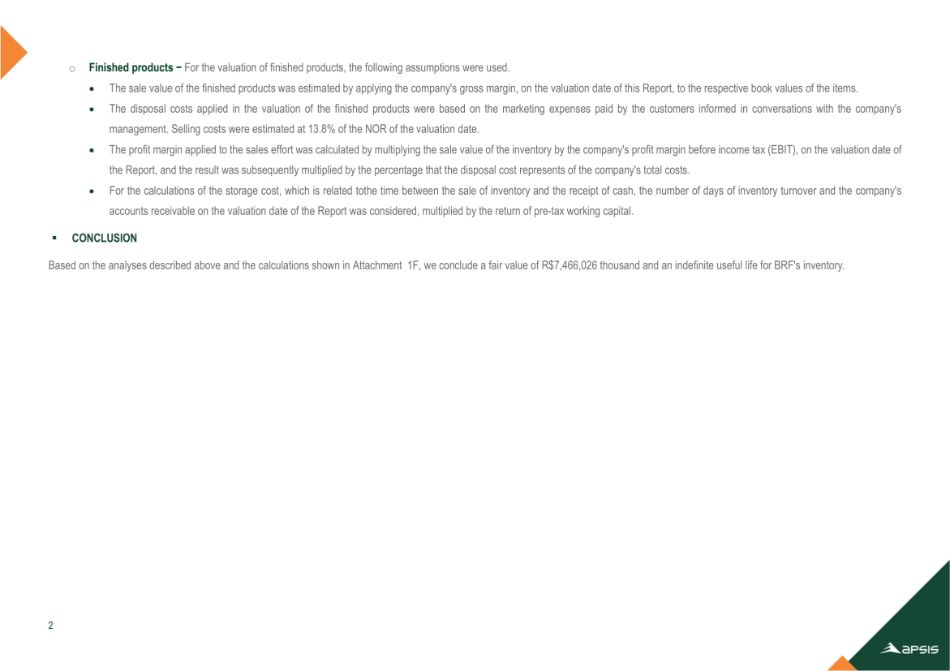

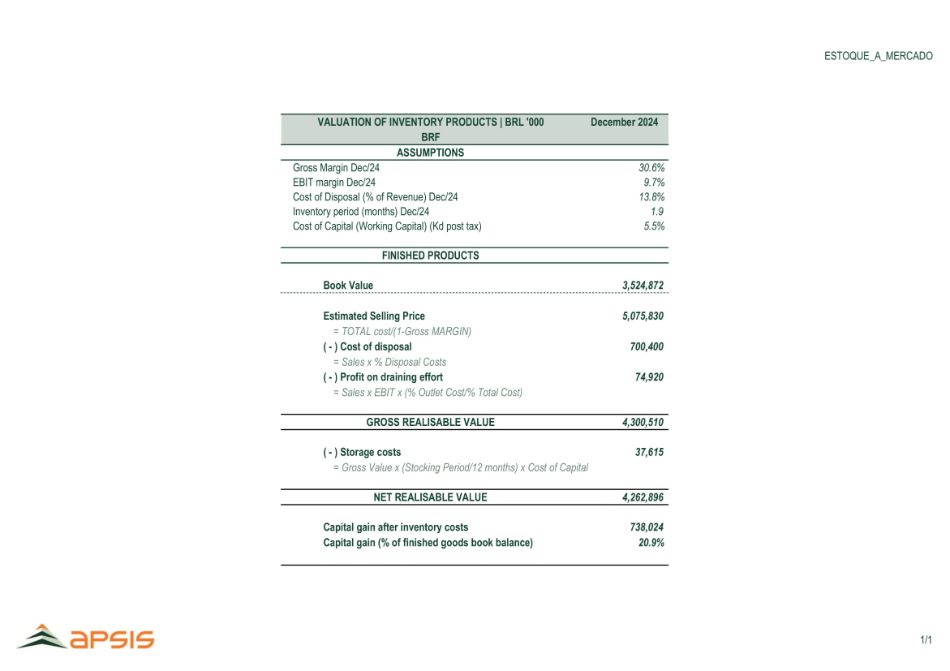

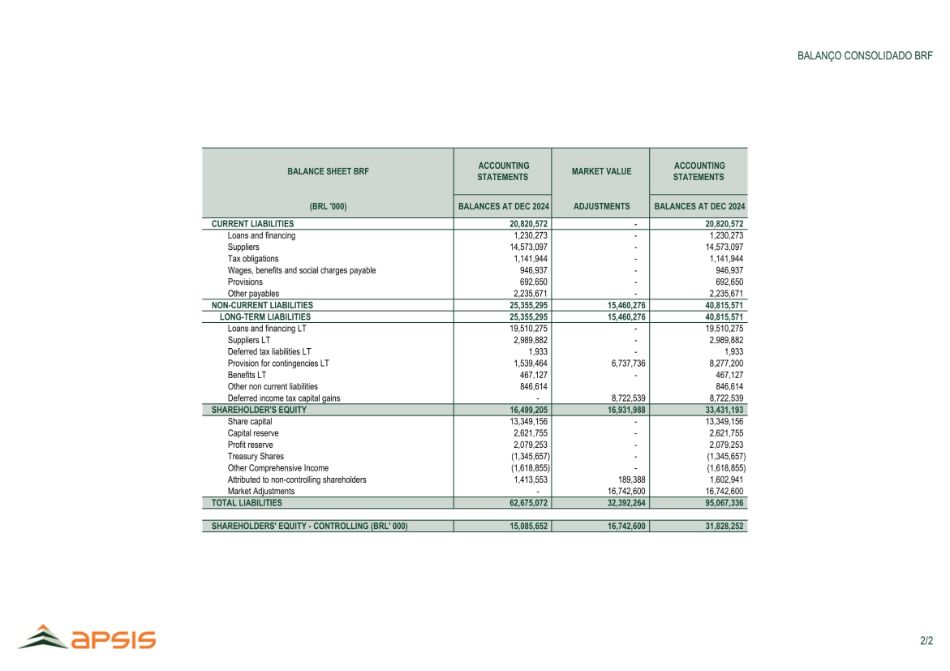

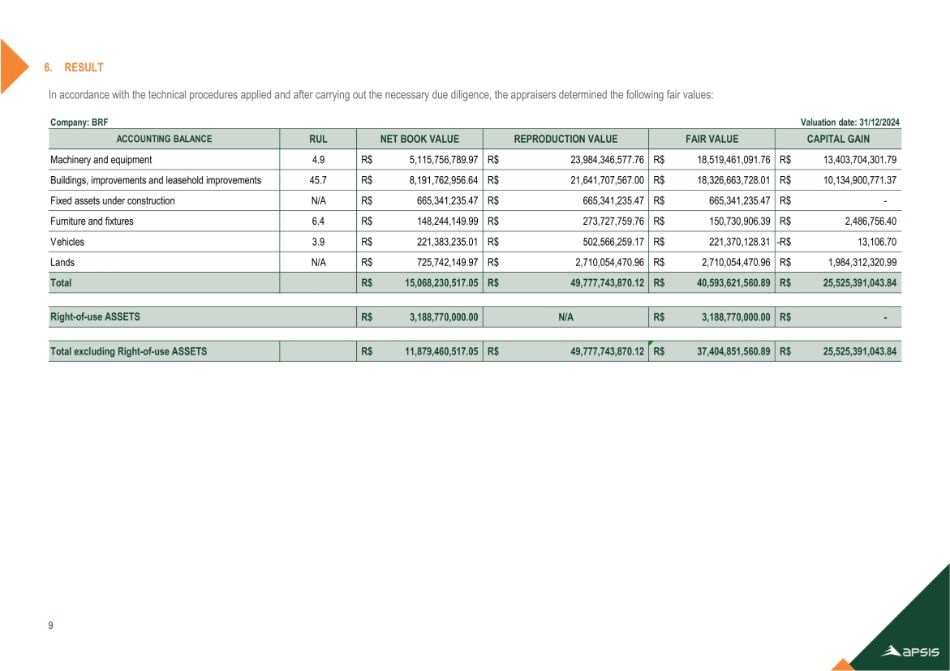

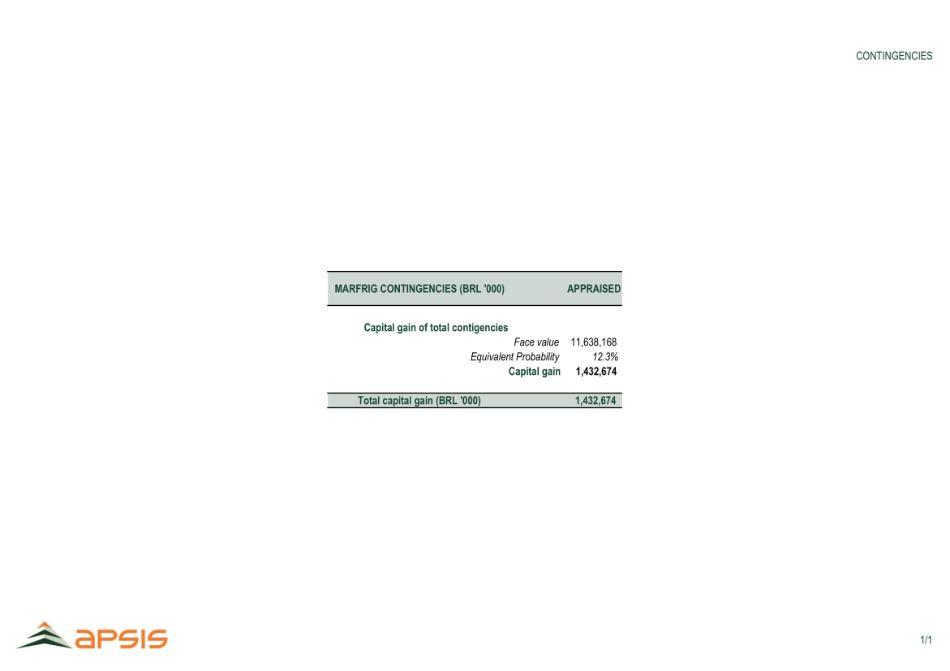

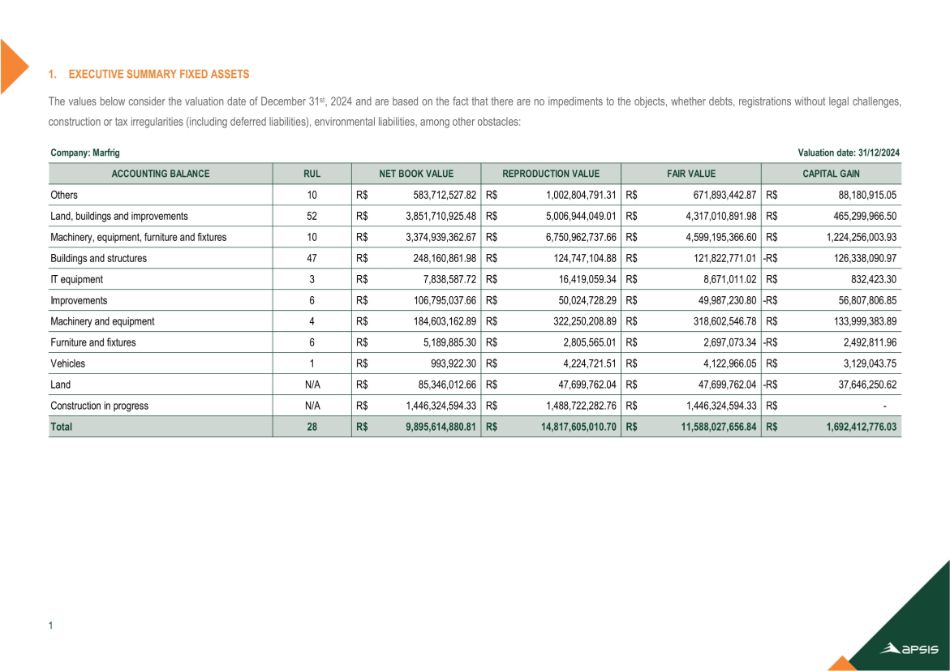

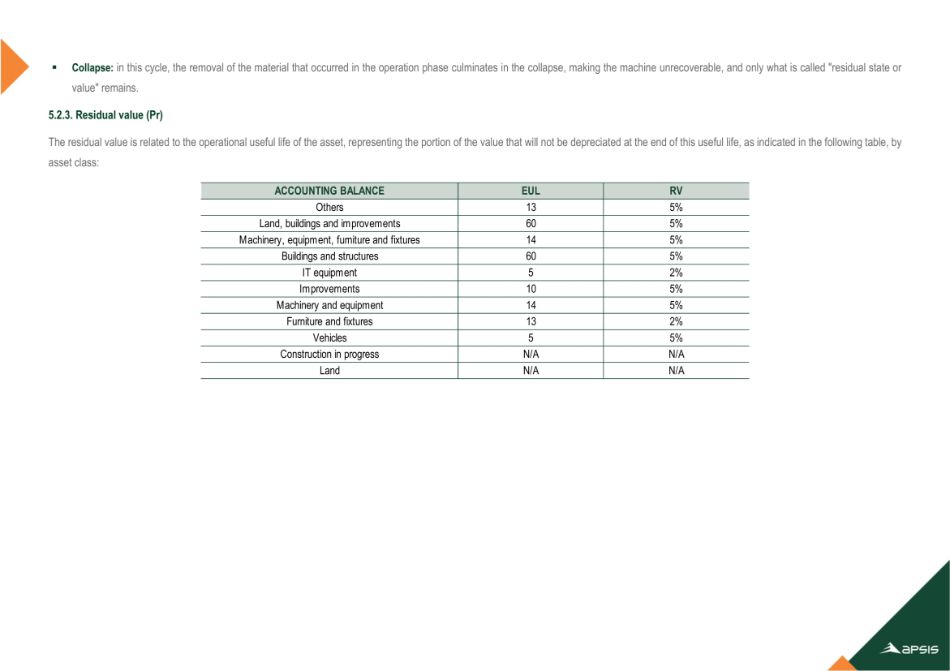

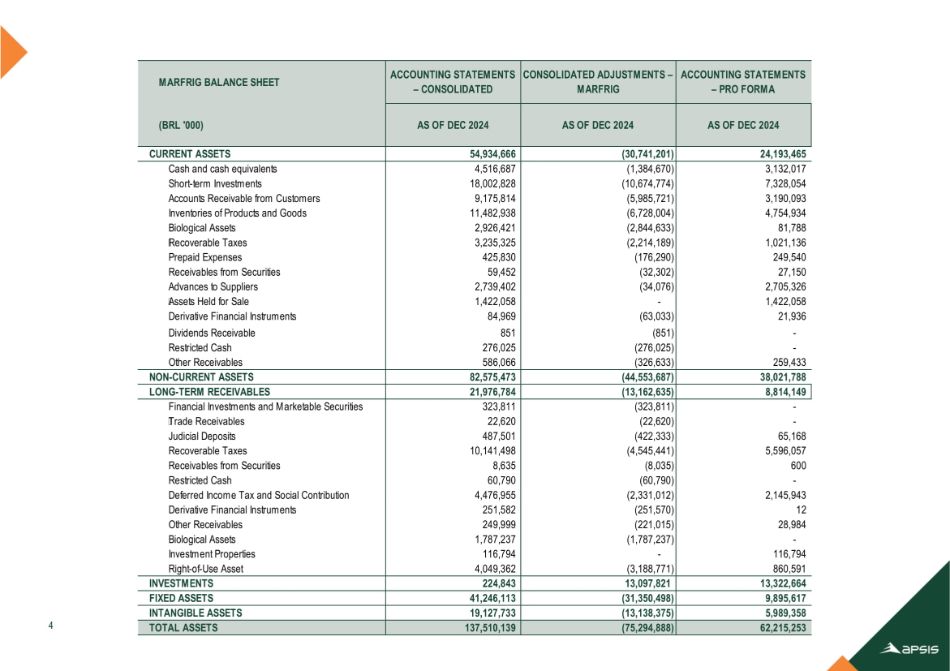

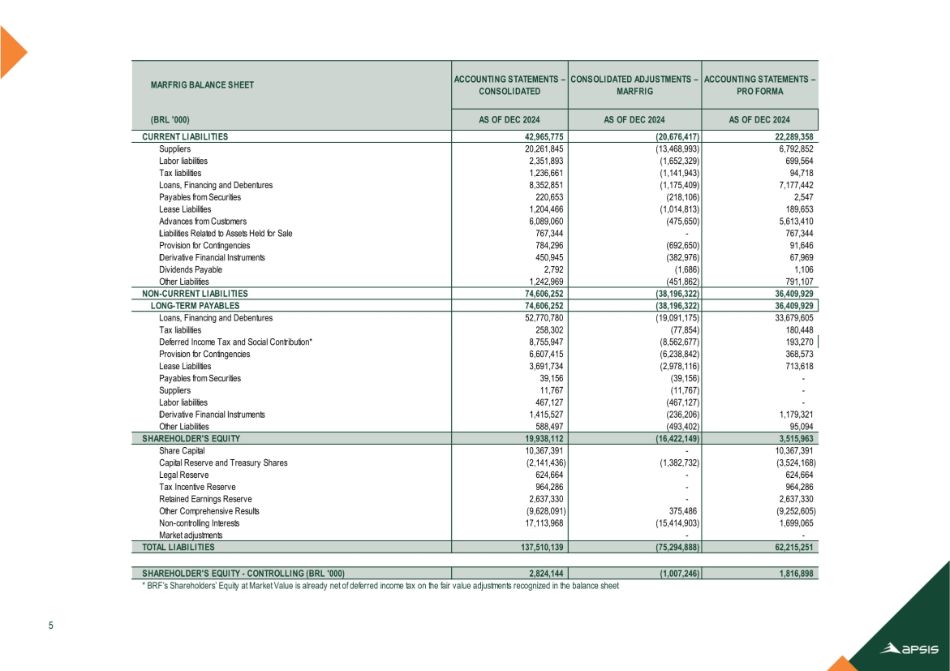

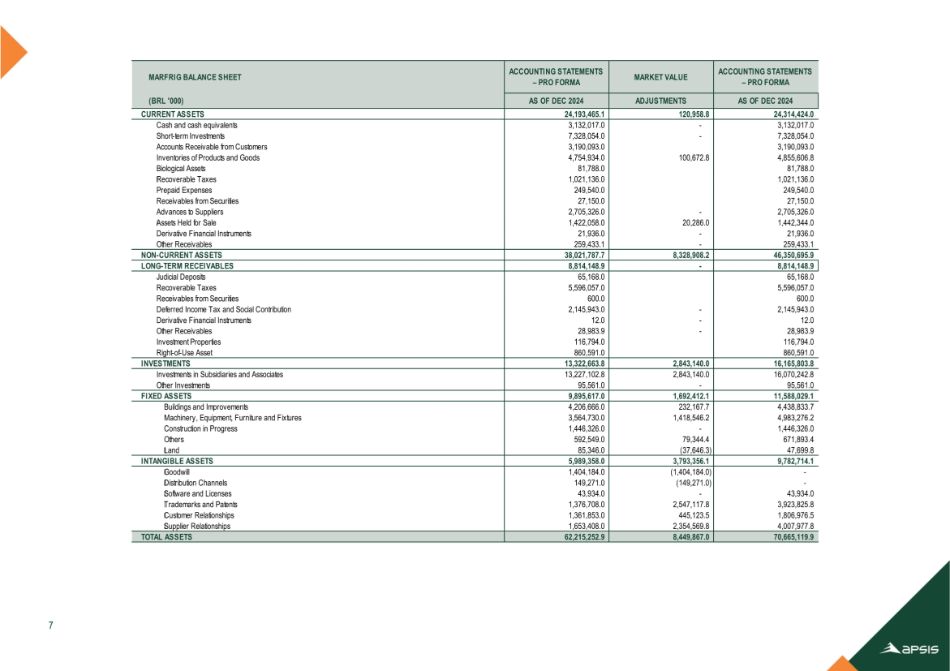

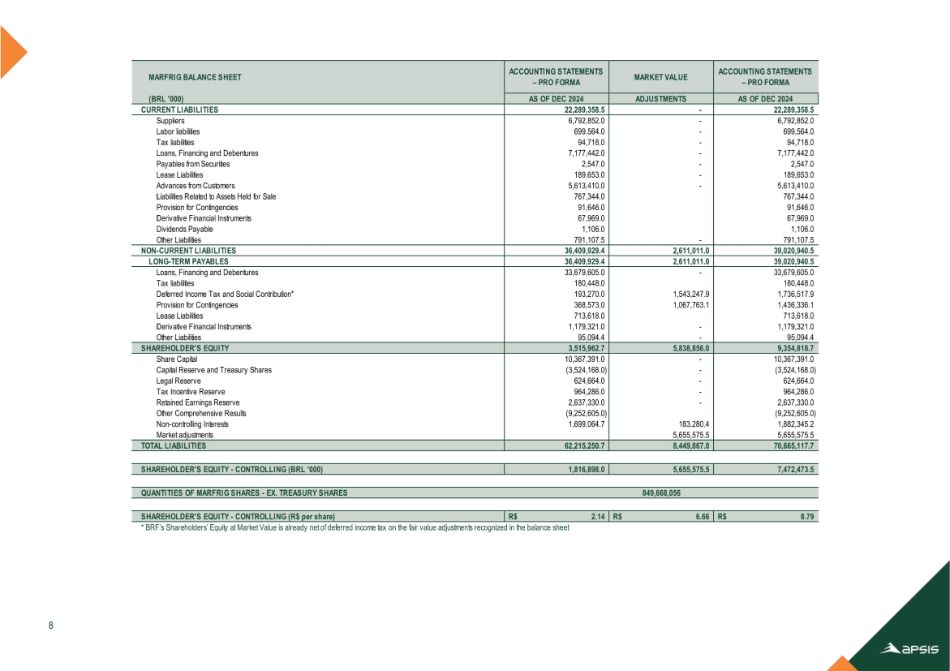

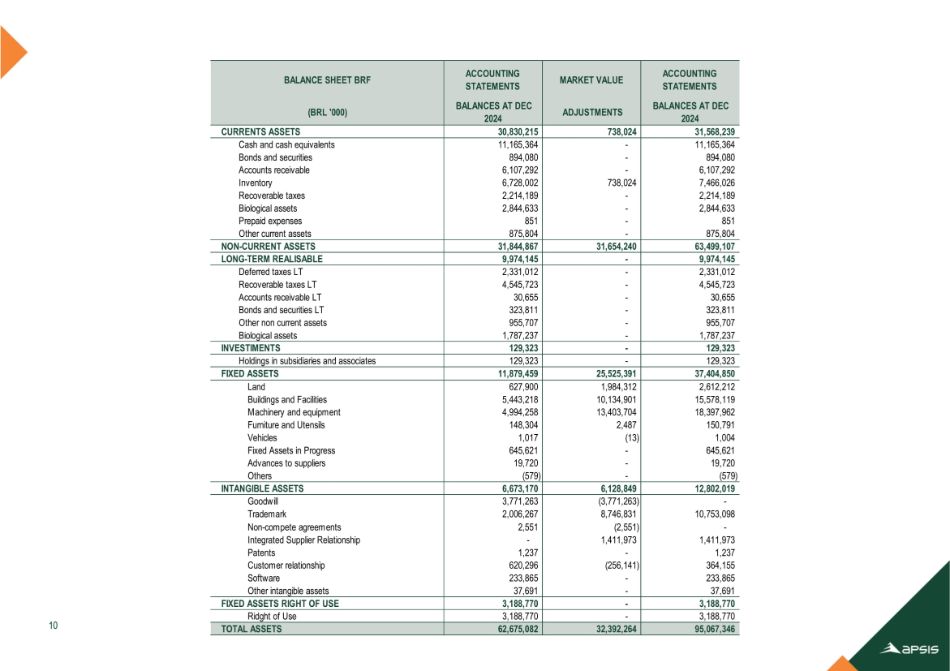

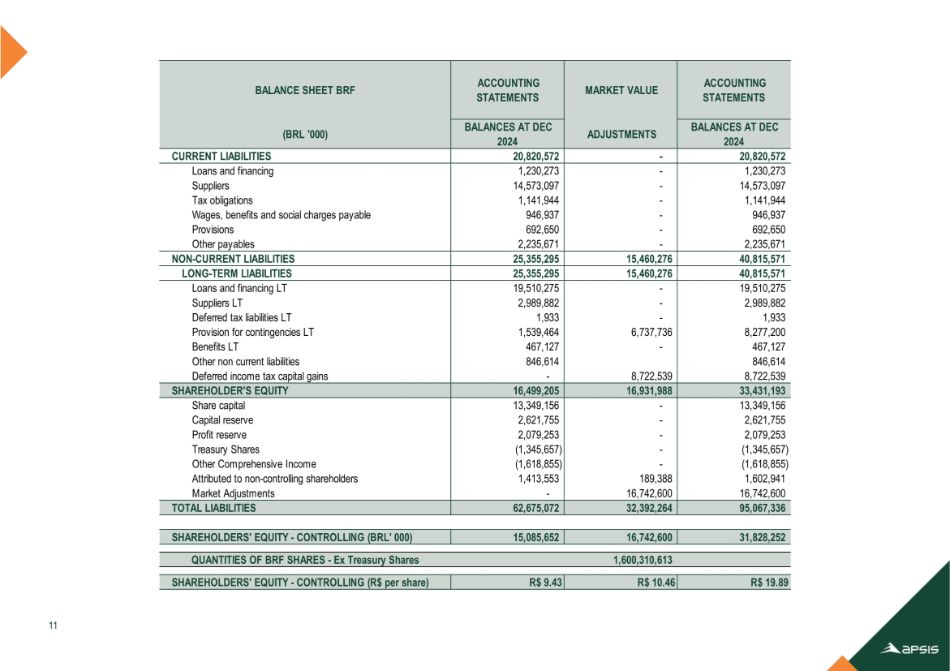

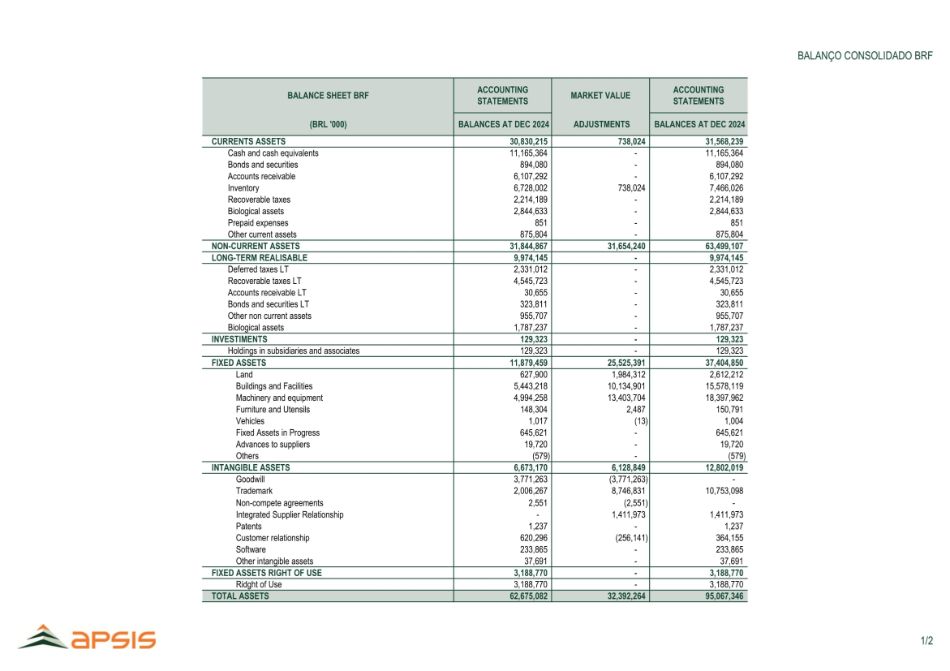

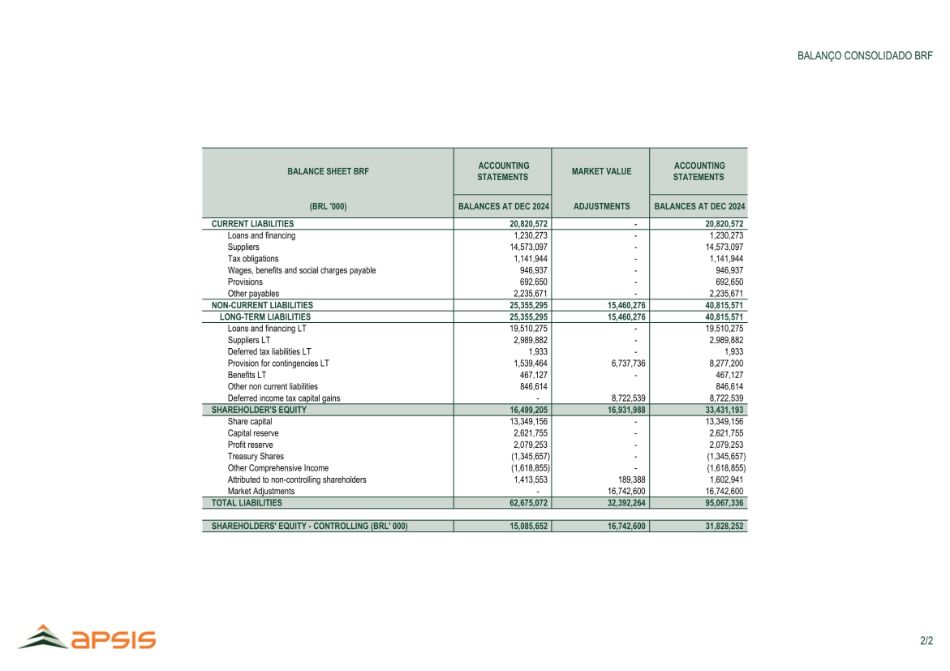

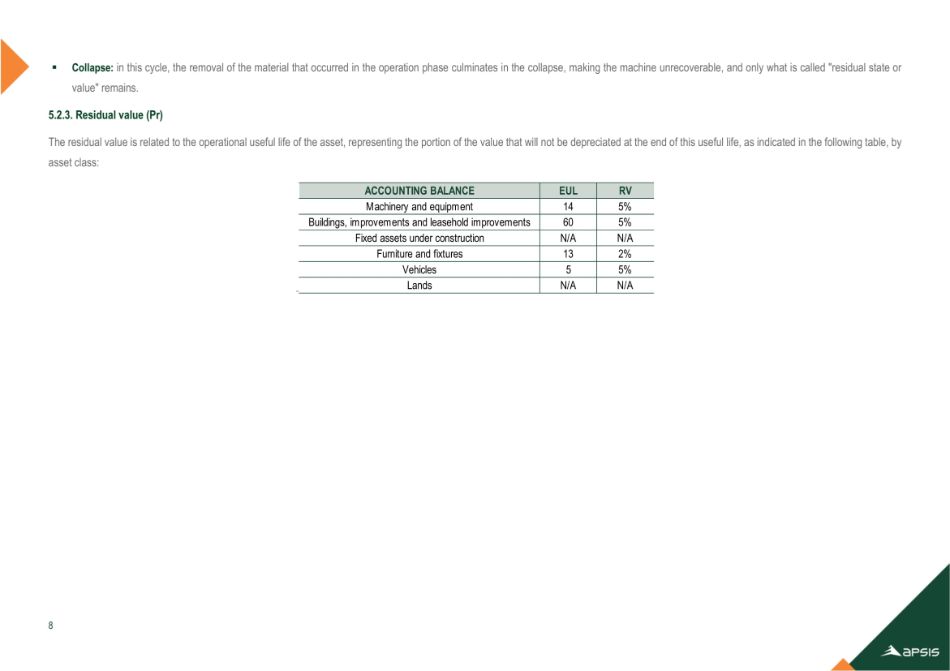

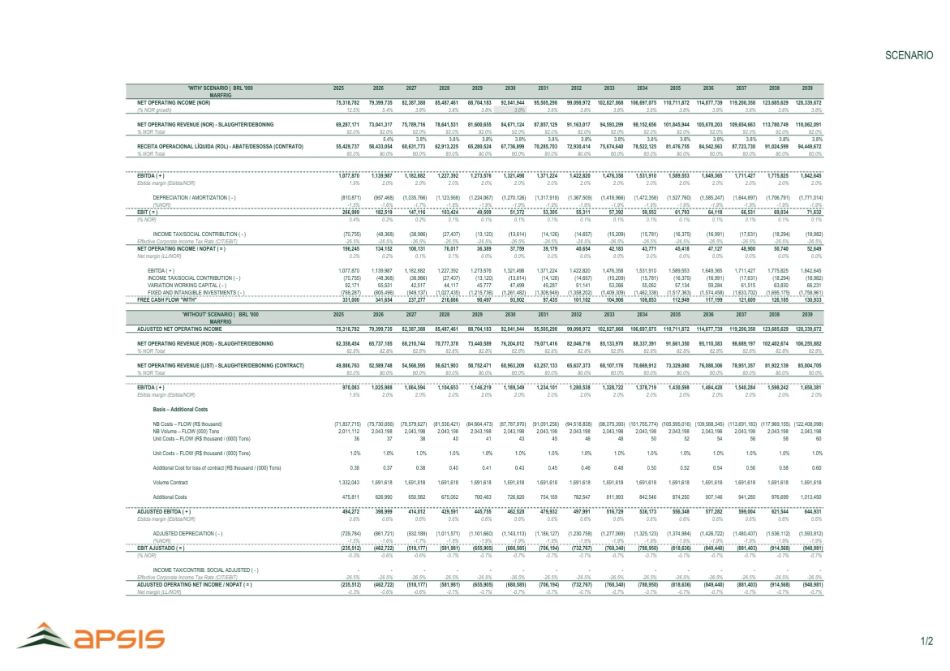

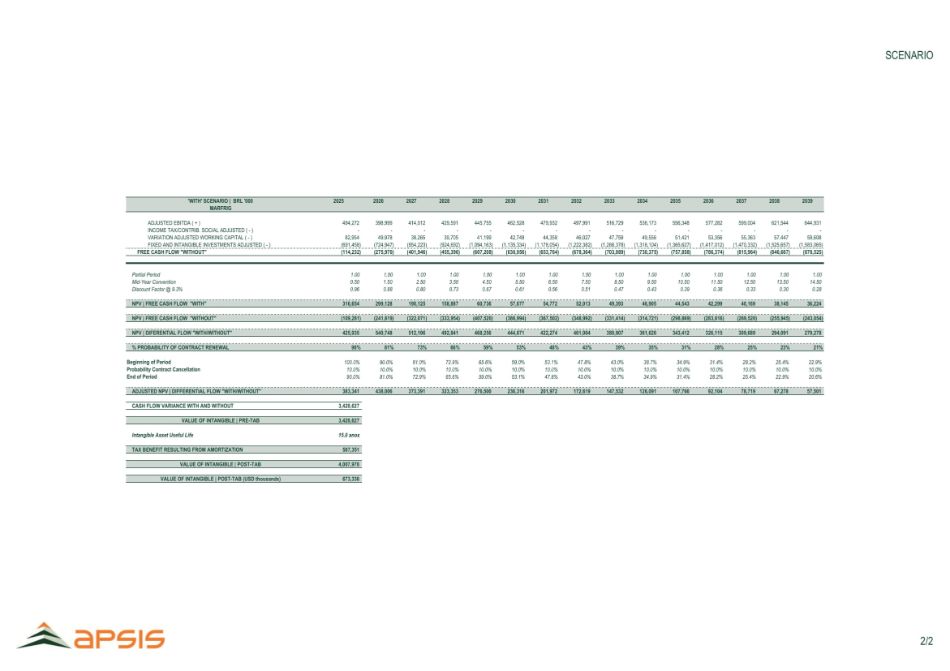

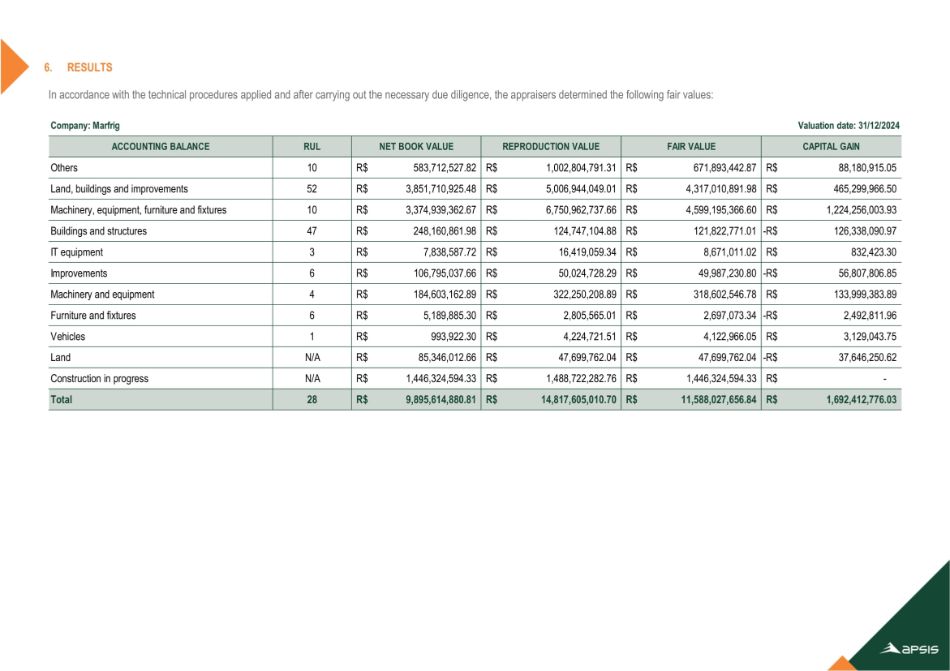

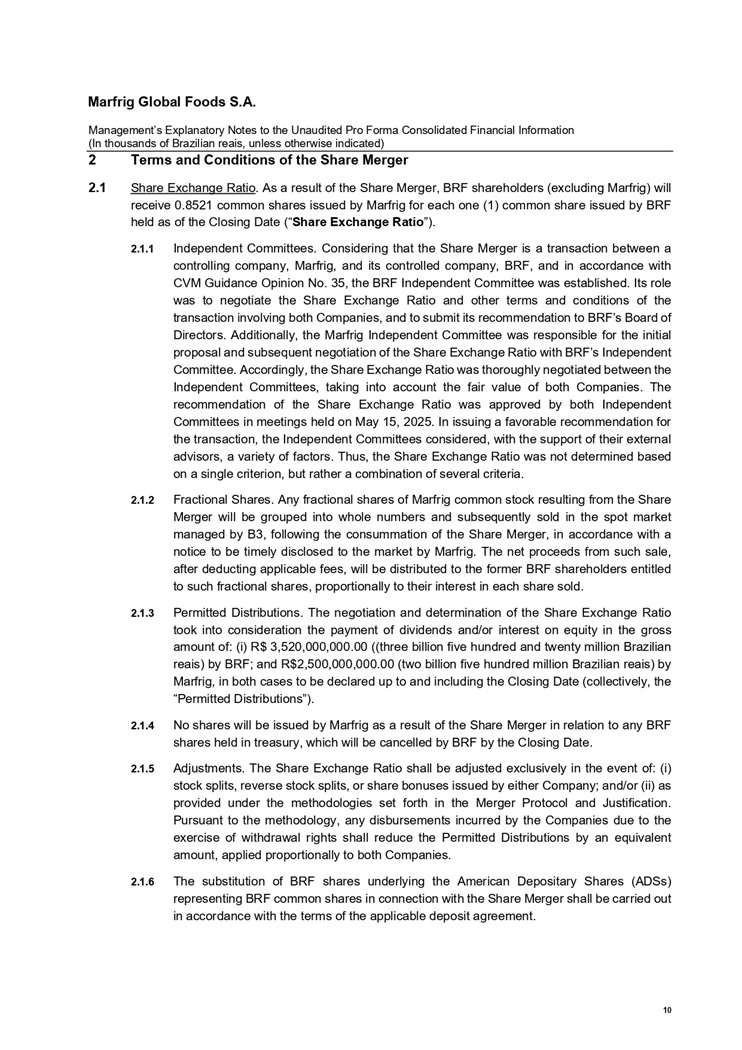

| 4.5 | Appraisal of shareholders’ equity at Market Prices. In accordance with Article 264 of the Brazilian Corporations Law, the Companies’ managements engaged the Appraisal Company to prepare an appraisal report containing the calculation of the share substitution ratio for the non-controlling shareholders of BRF, based on the market value of the shareholders’ equity of Marfrig and BRF, both evaluated according to the same criteria and as of December 31, 2024, at market price, in the form set forth in Annex 4.5 (“264 Appraisal Report”) and, together with the Merger Appraisal Report, (“Appraisal Reports”). |

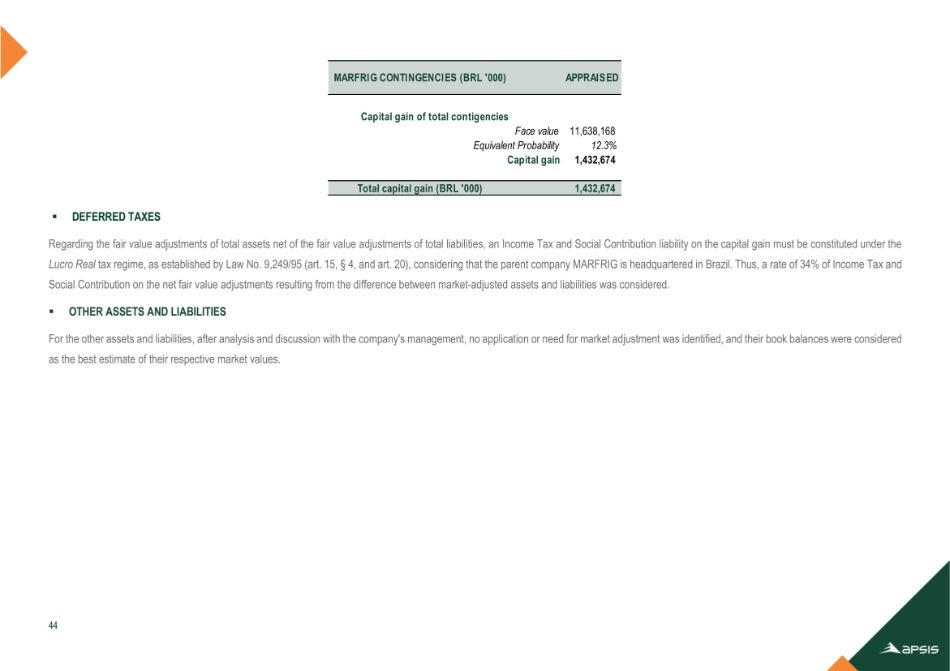

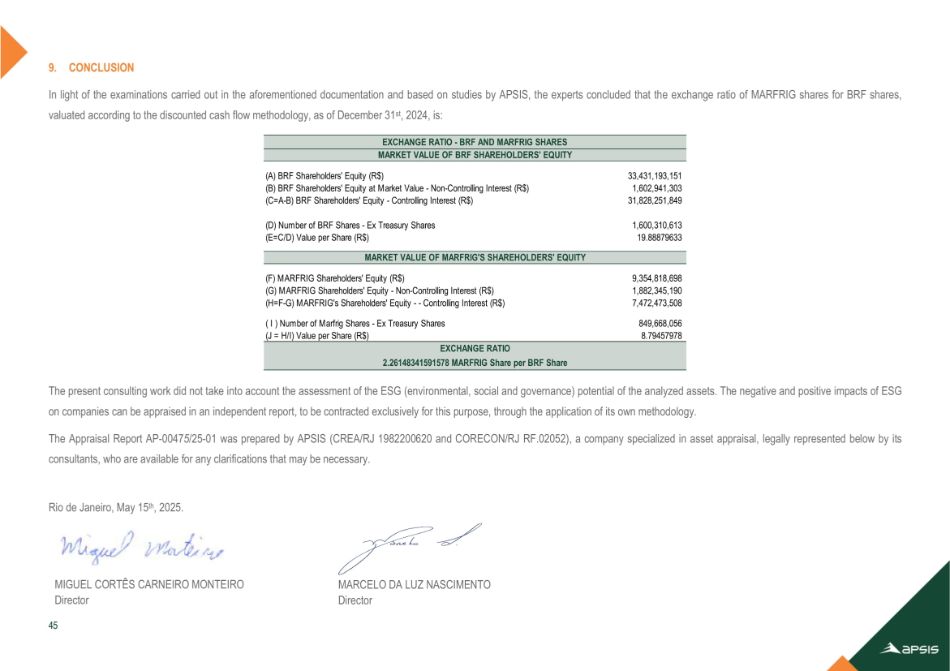

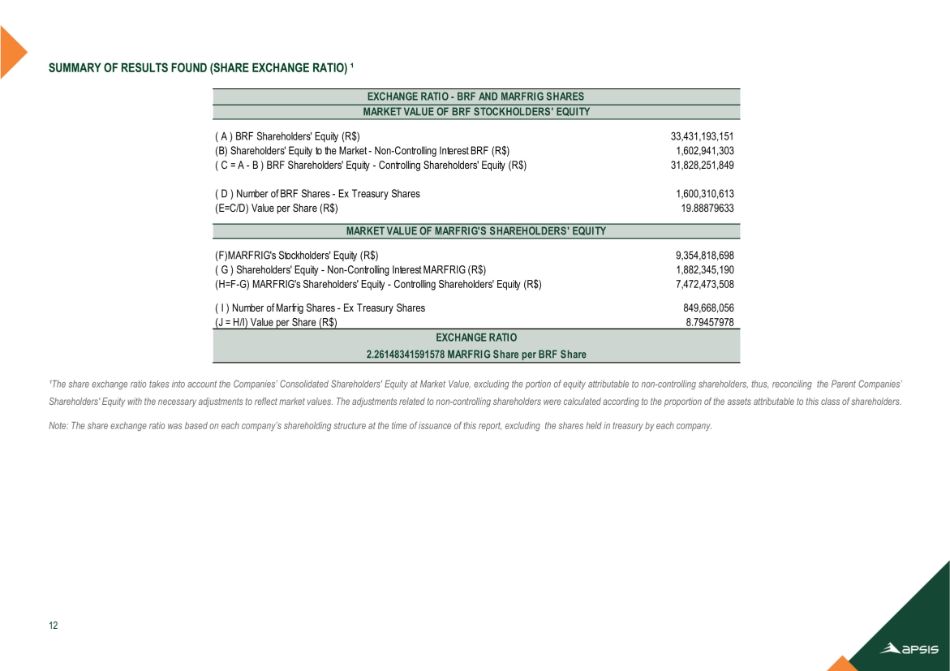

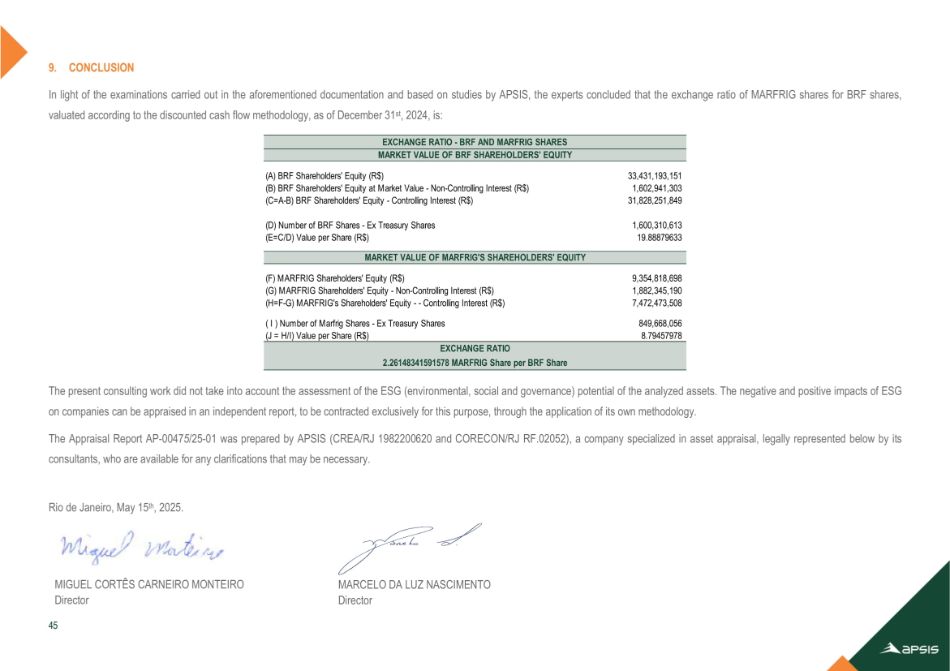

| 4.5.1 | 264 Appraisal Report Ratio. If the share exchange ratio resulting from the Merger were calculated based on the 264 Appraisal Report, 2.26148341591578 common shares of Marfrig would be attributed for each 1 (one) common share of BRF held by the shareholders of BRF (excluding Marfrig). Such exchange ratio is therefore more favorable to the BRF shareholders when compared to the Exchange Ratio. |

| 4.5.2 | Recess to Market Prices. Considering the provisions of Clause 4.5.1, the provisions of Article 264, paragraph 3, of the Brazilian Corporations Law will be applicable as provided in Clause 6.3.1 below. |

| 4.6 | Costs and Expenses. The costs and expenses related to the preparation of the Appraisal Reports, including the fees of the Appraisal Company, will be borne by Marfrig. |

| 5 | Financial Statements and Information |

| 5.1 | Financial Statements. In compliance with Article 6, paragraph 2, of CVM Resolution No. 78, dated March 29, 2022 (“CVM Resolution 78”), the Companies have disclosed their respective financial statements for the fiscal year ended December 31, 2024, prepared in accordance with the Brazilian Corporations Law and CVM regulations, accompanied by an audit report issued by Grant Thornton Auditores Independentes Ltda., a limited liability company registered with the CNPJ/MF under No. 10.830.108/0001-65 and the Regional Accounting Council of the State of São Paulo (CRC/SP) under No. 2SP-025.583/O-1, with its registered office in the city of São Paulo, State of São Paulo, at Avenida Engenheiro Luiz Carlos Berrini, No. 105, CEP 04571-900, registered as an independent auditor with the CVM (“Independent Auditor”). |

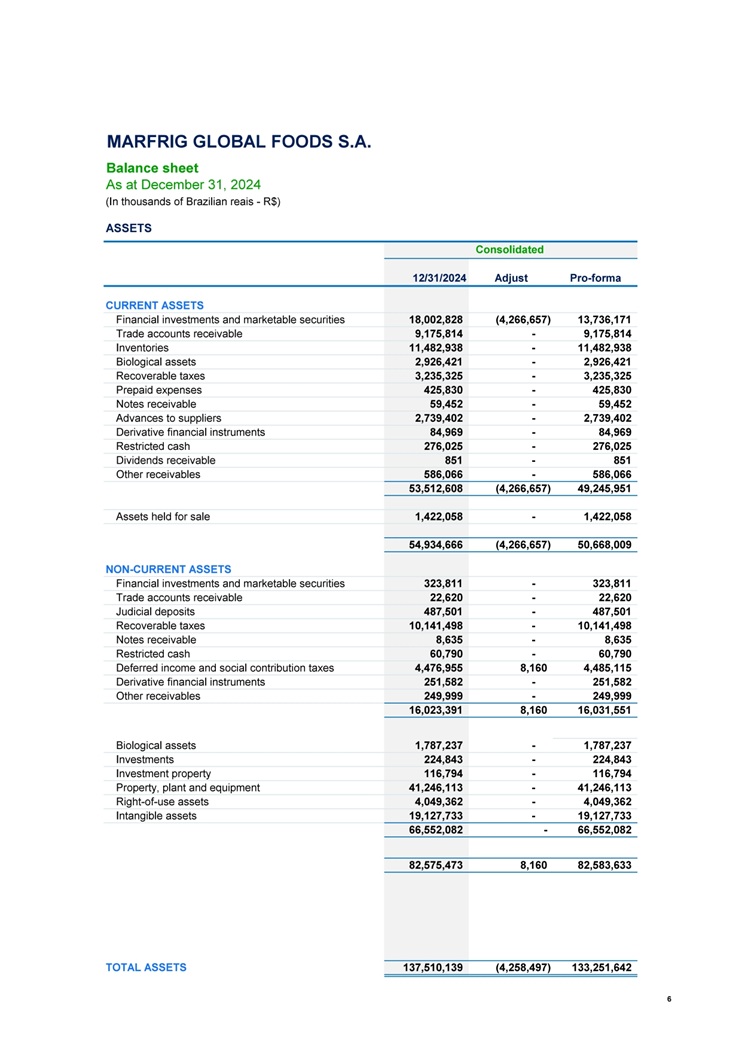

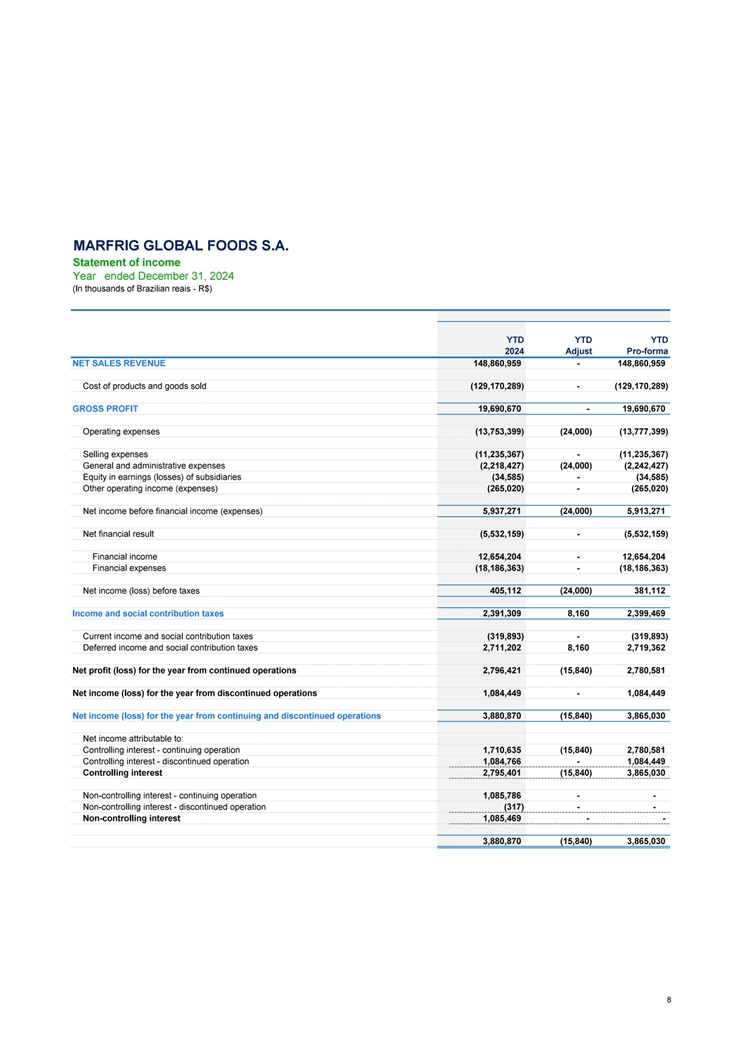

| 5.2 | Pro Forma Financial Information. In accordance with Article 7 of CVM Resolution 78, pro forma financial information of Marfrig will be disclosed, showing the effects of the Merger as if it had been completed on December 31, 2024 (“Pro Forma Information”). |

| 5.2.1 | Basis of Preparation and Reasonable Assurance. The Pro Forma Information was prepared in accordance with the Brazilian Corporations Law and CVM regulations and was subject to reasonable assurance by the Independent Auditor, in compliance with the applicable regulations. |

| 6 | Right of Withdrawal |

| 6.1 | Pursuant to Articles 137 and 252, paragraph 2, of the Brazilian Corporations Law, the Merger, if approved, will entitle the Companies’ shareholders to exercise a right of withdrawal. |

| 6.1.1 | The right of withdrawal will be granted to the shareholders of each of the Companies who (i) are holders of shares issued by Marfrig or BRF, as applicable, uninterruptedly from the date of disclosure of the first material fact regarding the Merger through the date of completion of the Merger; (ii) do not vote in favor of the Merger, abstain from voting, or do not attend the Marfrig EGM or the BRF EGM, as applicable, which will deliberate on the Merger; and (iii) expressly manifest their intention to exercise the right of withdrawal within 30 (thirty) days from the date of publication of the minutes of the Marfrig EGM or the BRF EGM, as applicable (”Dissenting Shareholders”). |

| 6.2 | Withdrawal from Marfrig. In accordance with the Brazilian Corporations Law, the Dissenting Shareholders of Marfrig will be entitled to the right of withdrawal at the value of the shareholders’ equity per common share of Marfrig as of December 31, 2024, as approved by the Marfrig ordinary general meeting held on March 31, 2025, which corresponds to R$3.32 (three reais and thirty-two centavos) per common share, without prejudice to the right to request a special balance sheet, in accordance with Article 45 of the Brazilian Corporations Law. |

| 6.3 | Withdrawal from BRF. Pursuant to the Brazilian Corporate Law, the Dissenting Shareholders of BRF shall be entitled to the right of withdrawal at the value of the shareholders’ equity per common share of BRF as of December 31, 2024, as determined by the financial statements approved at the ordinary general meeting of BRF held on March 31, 2025, which corresponds to R$ 9.43 (nine reais and forty-three centavos) per common share, without prejudice to the right to draw up a special balance sheet, in accordance with article 45 of the Corporations Law. |

| 6.3.1 | Without prejudice to the provisions of Clause 6.3 above, as provided in Article 264, paragraph 3, of the Brazilian Corporate Law, the Dissenting Shareholders of BRF may choose between (i) the reimbursement value fixed in accordance with Article 45 of the Brazilian Corporate Law, which corresponds to R$9.43 (nine reais and forty-three centavos) per common share, as set forth in Clause 6.3 above; or (ii) the shareholders’ equity per common share of BRF, determined based on the 264 Appraisal Report, which corresponds to R$19.89 (nineteen reais and eighty-nine centavos) per common share. |

| 6.4 | Reconsideration. The Companies reserve the right to convene general meetings of the Companies to ratify or reconsider the Merger, if they determine that the payments in connection with shareholder withdrawal rights to the Dissenting Shareholders who exercised such rights would jeopardize the financial stability of any of the Companies, in accordance with Article 137, paragraph 3, of the Brazilian Corporations Law. |

| 7 | Corporate Approvals |

| 7.1 | General Meetings. The completion of the Merger, which will also be subject to the satisfaction (or waiver, as the case may be) of the Conditions Precedent and to the occurrence of the Closing Date, will depend on the performance of the following acts, all of which are interdependent and shall to occur on the same date: |

| (i) | extraordinary general meeting of BRF to, in this order, (a) approve this Plan of Merger; (b) approve the Merger; (c) ratify the appointment of the Appraisal Company; (d) approve the Merger Appraisal Report; (e) approve the 264 Appraisal Report; and (f) authorize the BRF’s management to perform all acts necessary for the completion of the Merger, including, without limitation, the subscription of common shares to be issued by Marfrig on behalf of the BRF shareholders (other than Marfrig) on the Closing Date, in accordance with Article 252, paragraph 2, of the Brazilian Corporate Law (“BRF EGM”); and |

| (ii) | extraordinary general meeting of Marfrig to, in this order, (a) approve this Plan of Merger; (b) approve the Merger; (c) approve the capital increase of Marfrig, the issuance of common shares by Marfrig, as well as the consequent amendment and consolidation of Marfrig’s bylaws, with delegation to the Marfrig Board of Directors of the authority to confirm the actual number of shares to be issued by Marfrig, in case of adjustments to the Exchange Ratio; (d) ratify the appointment of the Appraisal Company; (e) approve the Merger Appraisal Report; (f) approve the 264 Appraisal Report; and (h) authorize the management to perform all acts necessary for the completion of the Merger (“Marfrig EGM”). |

| 8 | Conditions Precedent; Closing |

| 8.1 | Conditions Precedent. The effectiveness of the Merger will be conditioned to the following conditions precedent (collectively, the “Conditions Precedent”): |

| (i) | from May 15, 2025 through the Closing Date (inclusive), there shall not be an occurrence of war, armed conflicts, natural disasters and/or other unforeseen events (e.g. health emergencies, fires in manufacturing units) that adversely and materially impact the production and/or sales (including export) capacity of either Company; and |

| (ii) | all acts necessary for the conclusion of the Merger and consummation of the operations contemplated in this Plan of Merger must have been approved by the Brazilian Administrative Council for Economic Defense – CADE, to the extent that such approval is necessary, in the form and terms of current legislation and regulations. |

| 8.1.1 | To the extent permitted by applicable law and regulations, the Companies may, by mutual agreement, waive, in writing, any of the Conditions Precedent. |

| 8.2 | Closing. Once the Merger is approved by the BRF EGM and the Marfrig EGM, the Companies and their respective management must perform all acts and measures necessary for the implementation of the Merger, including, without limitation, with respect to the satisfaction or waiver of the Conditions Precedent, as applicable, it being incumbent upon the Companies to disclose to the market, in accordance with applicable legislation and regulations, the date on which the Merger will be, for all purposes and effects, deemed completed (“Closing Date”). |

| 9 | Miscellaneous Provisions |

| 9.1 | Withholding of IRRF. In the context of the Merger, the Companies reserve the right to: (i) withhold the withholding tax (“IRRF”) related to any capital gain due as a result of the Merger of the non-resident BRF shareholder (“INR”) who does not provide, directly or through their custodian agents, by the date and in accordance with the procedures set forth in a notice to shareholders to be disclosed in due course (“IRRF Base Date”), documentary evidence of the average acquisition cost of their BRF shares demonstrating the absence of taxable capital gain; and (ii) charge or offset the amount of IRRF eventually withheld by the Companies on behalf of the INR against any credits held by the Companies, as applicable, against the INR, including, without limitation, the value of any dividends and/or interest on capital (including, without limitation, Permitted Distributions) and other entitlements that may be distributed, declared and/or paid by the Companies, as applicable, at any time, even before the Closing Date. |

| 9.1.1 | Marfrig, in its capacity as acquirer of the common shares issued by BRF, will use the information provided by the INRs (directly or through their custodian agents) to calculate the capital gain, with the INR being responsible for the correctness and completeness of this information. |

| 9.1.2 | The Companies will (i) consider the acquisition cost to be zero for INRs who do not submit their acquisition cost by the IRRF Base Date; and (ii) apply a 25% (twenty-five percent) tax rate on gains of INRs who fail to inform their tax domicile by the IRRF Base Date. |

| 9.1.3 | The Companies will not be liable, under no circumstances, in face of the INRs, for any later adjustments and/or restitution or refund of potential sums paid in excess, provided that the rules set out herein are complied with. |

| 9.2 | Disclosure of Documents. This Plan of Merger and the other documents relating to the Merger are available to the respective shareholders of the Companies at the registered office of each Company and on the websites of the Companies, the CVM, and B3, in compliance with applicable regulations. |

| 9.3 | Share-Based Compensation. In the context of the Merger, the Companies will define the treatment to be given to shares and share purchase options granted and/or awarded by BRF under its share-based compensation plans. |

| 9.4 | Interdependent Transactions. The events described in this Plan of Merger, as well as other related matters submitted to the Marfrig EGM and the BRF EGM, are interdependent legal transactions, and it is the intention of the Companies that no transaction shall be effective unless all others are also effective. |

| 9.5 | Performance of Acts. On the Closing Date, the management of the Companies shall perform all acts, registrations, endorsements, and publications necessary for the proper regularization, formalization, and effectiveness of the provisions set forth in this Plan of Merger. |

| 9.6 | Amendments. No amendment to any of the terms or conditions set forth in this Plan of Merger shall have any effect unless made in writing and signed by the Parties. |

| 9.7 | Assignment. No Party shall assign or otherwise transfer, directly or indirectly, any right or obligation arising from this Plan of Merger or related to it without the prior written consent of the other Parties. Any purported or attempted assignment contrary to the terms of this instrument shall be null and void and shall have no effect. |

| 9.8 | Binding Effect. This Plan of Merger is irrevocable and irrevocable, and the obligations assumed by the Companies hereby bind their successors in title. |

| 9.9 | Exhibits. All exhibits constitute an integral part of this Plan of Merger. In the event of any discrepancy between this Plan of Merger and any exhibit, the provisions of this Plan of Merger shall prevail. |

| 9.10 | Benefit of the Parties. This Plan of Merger is intended exclusively for the benefit of the Parties, and no provision shall be construed as conferring upon any other person any claim, cause of action, remedy, or other right of any nature. |

| 9.11 | Independence of Clauses and Precedence |

| 9.11.1 | If any provision of this Plan of Merger is deemed invalid or unenforceable by a court or any other competent authority, such provision shall be deemed excluded from this Plan of Merger, and the remaining provisions shall remain in full force and effect. In such a case, the Companies shall negotiate in good faith to agree on the terms of a satisfactory provision that will replace the provision deemed invalid and/or unenforceable. |

| 9.11.2 | In negotiating, the Companies shall endeavor to reach an agreement on a provision that is as close as possible to the original intentions of the Companies. If the Companies fail to reach an agreement on this new provision, the invalidity or unenforceability of one or more provisions of this Plan of Merger shall not affect the validity or enforceability of this Plan of Merger as a whole, unless the invalid or unenforceable provision was of such essential importance to this Plan of Merger that it can be reasonably presumed that the Parties would not have entered into this Plan of Merger without such invalid or unenforceable provisions. |

| 9.12 | Waiver and Tolerance. The Companies acknowledge that, unless expressly provided otherwise in this Plan of Merger: (i) partial exercise, non-exercise, granting of a time extension, tolerance, or delay with respect to any right granted to any of them by this Plan of Merger and/or by applicable legislation or regulations shall not constitute a novation or waiver of such right, nor shall it prejudice its future exercise; (ii) waiver of any right shall be interpreted restrictively and shall not be considered a waiver of any other right granted by this Plan of Merger or by applicable legislation or regulations to any of the Companies; and (iii) any waivers shall only be granted in writing. |

| 9.13 | Executory Title. This Plan of Merger, duly signed, shall serve as an extrajudicial executory title in accordance with the civil procedural legislation, for all legal purposes, the Companies hereby acknowledging that, regardless of any other applicable measures, the obligations assumed under this Plan of Merger are subject to specific performance in accordance with the civil procedural legislation. |

| 9.14 | Specific Performance. The Companies bind themselves to comply with, formalize, and perform their obligations in strict observance of the terms and conditions established in this Plan of Merger. Accordingly, the Companies hereby acknowledge and agree that all obligations assumed or that may be imputed under this Plan of Merger are subject to specific performance in accordance with the civil procedural legislation, without prejudice to, cumulatively, the recovery of damages resulting from the non-performance of the obligations agreed upon in this Plan of Merger. The Companies expressly acknowledge and bind themselves to the specific performance of their obligations and to accept judicial, arbitral, or any other similar acts. |

| 9.15 | Costs and Expenses. Unless otherwise expressly provided in this Plan of Merger, all legal and other costs and expenses incurred in connection with this Plan of Merger and the Merger shall be borne by the Company incurring such costs and expenses. |

| 9.16 | Governing Law. This Plan of Merger shall be interpreted and governed by the laws of the Federative Republic of Brazil. |

| 9.17 | Dispute Resolution. The Companies agree that any dispute arising from or related to this Plan of Merger, including but not limited to disputes regarding its existence, validity, effectiveness, interpretation, performance, or termination, that cannot be amicably resolved within an irrevocable period of 30 (thirty) calendar days, shall be resolved by arbitration administered by the B3 Market Arbitration Chamber (Câmara de Arbitragem do Mercado da B3) (“Arbitration Chamber”), in accordance with its regulations in force on the date of the initiation of the arbitration, this section serving as an arbitration clause for the purposes of Article 4, Paragraph 1, of Law No. 9,307, dated September 23, 1996. The administration and proper conduct of the arbitration proceedings shall also be the responsibility of the Arbitration Chamber. The Companies acknowledge that the obligation to seek an amicable resolution does not prevent the immediate filing of an arbitration request if any of the Companies determines that an agreement is not possible. |

| 9.17.1 | The arbitral tribunal shall be composed of 3 (three) arbitrators (“Arbitral Tribunal”), one of whom shall be appointed by the Company(s) intending to institute, another by the other Company(s), and the third arbitrator, who shall act as the President of the Arbitral Tribunal, by the arbitrators appointed by the Companies. In the event that one of the Companies fails to appoint an arbitrator or if the appointed arbitrators fail to reach a consensus on the third arbitrator, the President of the Arbitration Chamber shall appoint the third arbitrator as soon as possible. |

| 9.17.2 | The Companies acknowledge that any arbitral order, decision, or determination shall be final and binding, constituting a judicial executory title binding on the Companies and their successors, who bind themselves to comply with the determinations in the arbitral award, regardless of judicial enforcement. |

| 9.17.3 | Notwithstanding anything to the contrary herein, each of the Companies shall retain the right petition the courts for (i) any provisional or emergency relief that may be necessary prior to the constitution of the Arbitral Tribunal, and the filing of any such request shall not be deemed a waiver by the Companies of the arbitration proceedings; (ii) the enforcement of any arbitral decision, including the final arbitral award; and (iii) the measures required to secure the constitution of the Arbitral Tribunal. For all such purposes, the Companies irrevocably submit to the jurisdiction of the courts of the Judicial District of São Paulo, State of São Paulo, and expressly waive any objection to venue or to any other forum, regardless of how privileged it may be. The seat of the arbitration shall be the city of São Paulo, State of São Paulo. |

| 9.17.4 | The seat of the arbitration shall be the city of São Paulo, State of São Paulo. |

| 9.17.5 | The arbitration shall be conducted in the Portuguese language. |

| 9.17.6 | The dispute shall be decided in accordance with Brazilian law, and judgment based on equity shall not be allowed. |

| 9.17.7 | The arbitration shall be confidential. The Companies undertake not to disclose information and documents related to the arbitration. Disclosure may be made if (i) it is required by law; (ii) it is ordered by an administrative or judicial authority; or (iii) it is necessary to defend the interests of the Company. |

| 9.18 | Electronic Signature. The Companies acknowledge and agree that (i) this Plan of Merger is signed digitally, and such signature is accepted and deemed valid by the Companies; and (ii) as provided in Provisional Measure No. 2,200-2, dated August 24, 2001, the present Plan of Merger, as electronically signed, is accepted by the Companies as authentic, complete, and valid, even if signed through an electronic signature platform not accredited by the Brazilian Public Key Infrastructure (ICP-Brasil) and without a digital signature certificate. For all purposes, the date of execution of this Plan of Merger shall be the date indicated below, even if any of the Companies signs this Plan of Merger electronically at a later date for any reason. In such a case, the Company(ies) hereby agree(s) to the retroactive effect of this Plan of Merger to the date indicated below. |

IN WITNESS WHEREOF, the Parties sign this Plan of Merger electronically, together with the 2 (two) witnesses below.

* * *

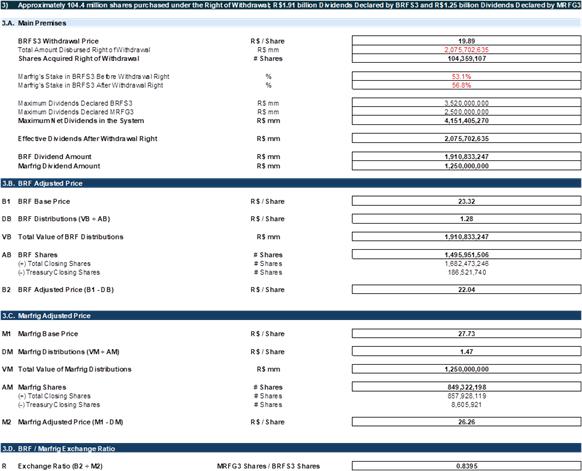

Annex 3.1.5

Exchange Ratio Adjustment Mechanism

| 1 | Formula |

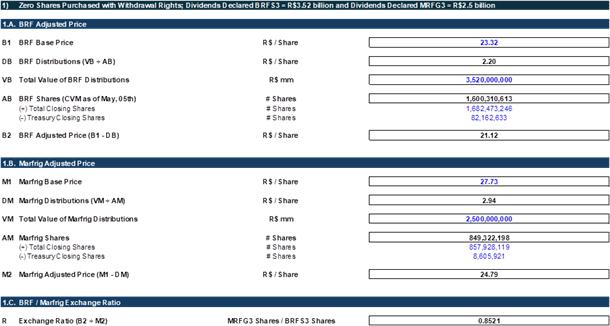

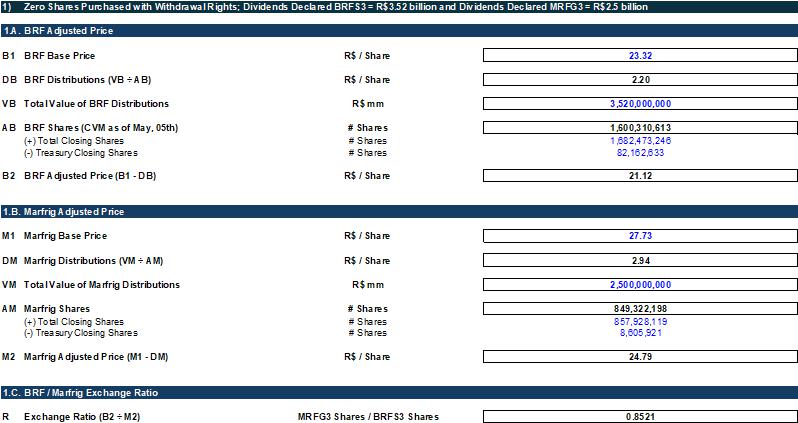

R = B2 ÷ M2, where:

| ● | “R” means the Exchange Ratio; |

| ● | “B1” means the base price per common share issued by BRF, equivalent to R$23.32 (twenty-three reais and thirty-two cents) per common share; |

| ● | “M1” means the base price per common share issued by Marfrig, equivalent to R$27.73 (twenty-seven reais and seventy-three cents) per common share; |

| ● | “B2” means the adjusted price per common share issued by BRF, calculated in accordance with the following formula: B1 – DB, where: |

| ○ | “DB” means declarations and/or distributions of dividends and/or interest on equity (in the gross amount) by BRF per common share issued by BRF which are approved between May 15, 2025 and the Closing Date, calculated in accordance with the following formula: VB ÷ AB, where: |

| § | “VB” means the gross amount in reais of distributions as dividends and/or interest on equity declared by BRF which are approved between May 15, 2025 and the Closing Date; and |

| § | “AB” means the total number of shares issued by BRF existing on the Closing Date (and, therefore, not cancelled between May 15, 2025 and the Closing Date) minus the number of shares eventually held in treasury on said date (including as a result of any exercise of the right of withdrawal by Dissenting Shareholders of BRF). |

| ● | “M2” means the adjusted price per common share issued by Marfrig, calculated in accordance with the following formula: M1 – DM, where: |

| ○ | “DM” means declarations and/or distributions of dividends and/or interest on equity (in the gross amount) by Marfrig per common share issued by Marfrig and which may be approved between May 15, 2025 and the Closing Date, calculated in accordance with the following formula: VM ÷ AM, where: |

| § | “VM” means the gross amount in reais of distributions as dividends and/or interest on equity declared by Marfrig which may be approved between May 15, 2025 and the Closing Date; an |

| § | “AM” means the total number of shares issued by Marfrig existing on the Closing Date (and, therefore, not cancelled between May 15, 2025 and the Closing Date) minus the number of shares eventually held in treasury on said date (including as a result of of possible exercise of the right of withdrawal by Dissenting Shareholders of Marfrig). |

| 2 | Examples |

| 2.1 | Example 1 |

| ● | Premises: |

| ○ | distribution and/or declaration of dividends and/or interest on equity in the gross amount equivalent to the Permitted Distributions (i.e., R$3,520,000,000.00 by BRF and R$2,500,000,000.00 by Marfrig); and |

| ○ | without any exercise of withdrawal rights |

| ● | Exchange Ratio: 0.8521x |

| ● | Demonstration: |

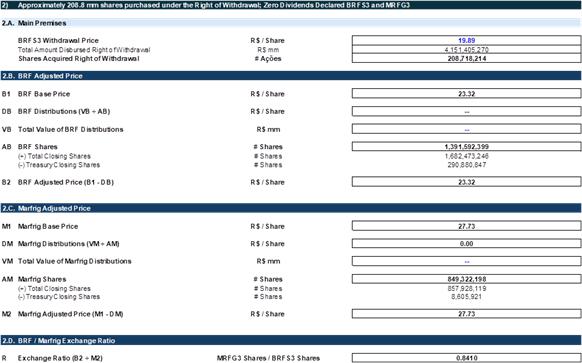

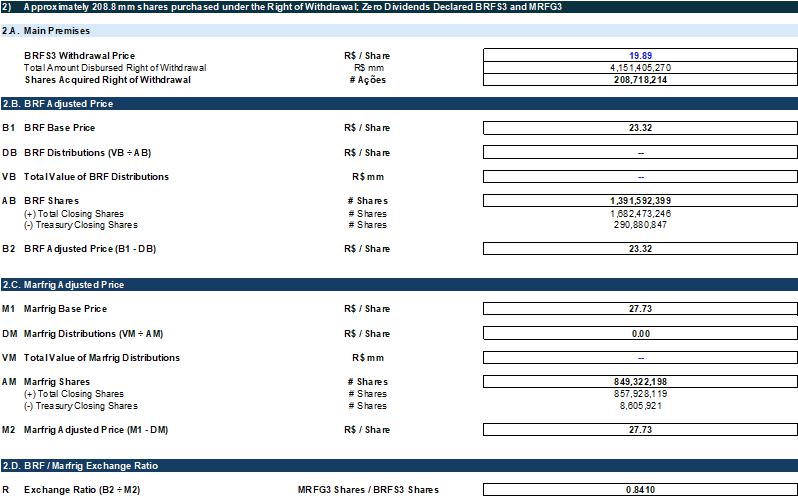

| 2.2 | Example 2 |

| ● | Premises: |

| ○ | without any distribution and/or declaration of dividends and/or interest on equity; and |

| ○ | exercise of the right of withdrawal by Dissenting Shareholders of BRF holding 208,718,214 shares, considering the reimbursement value resulting from the 264 Appraisal Report (that is, R$19.89 per common share) |

| ○ | Exchange Ratio: 0.8410x |

| ● | Demonstration: |

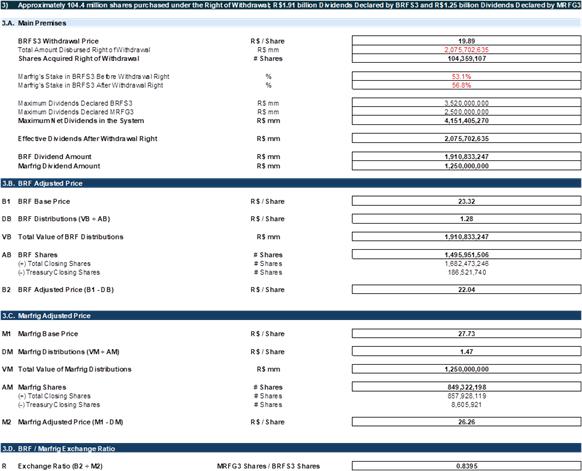

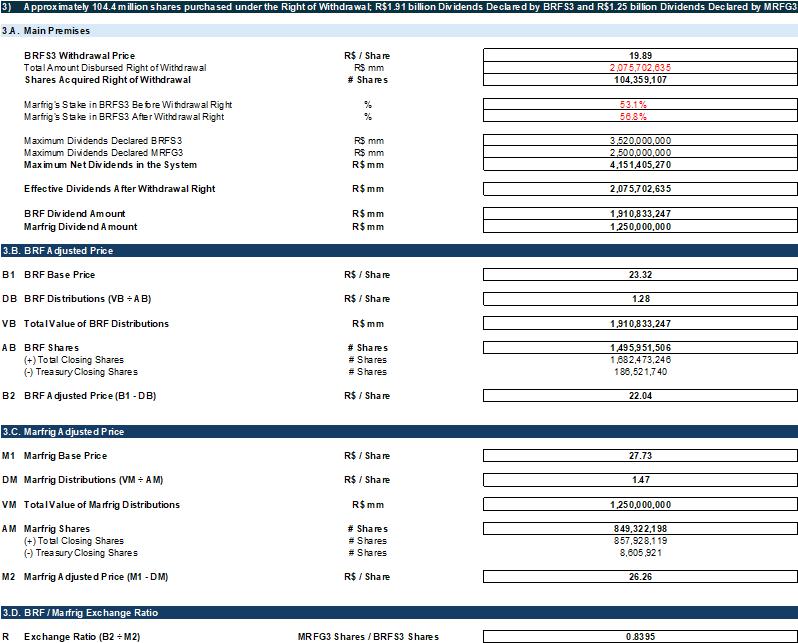

| 2.3 | Example 3 |

| ● | Premises: |

| o | distribution and/or declaration of dividends and/or interest on equity in the gross amount of R$1,910,833,247.00 by BRF and R$1,250,000,000.00 by Marfrig; and |

| o | exercise of the right of withdrawal by Dissenting Shareholders of BRF holding 104,359,107, considering the reimbursement value resulting from the 264 Appraisal Report (that is, R$19.89 per common share) |

| o | Exchange Ratio: 0.8395x |

| ● | Demonstration: |

Annex 4.2

Merger Appraisal Report

(This annex begins on the following page.)

(The remainder of this page is intentionally left blank.)

APPRAISAL REPORT AP - 00521/25 - 01 BRF S.A.

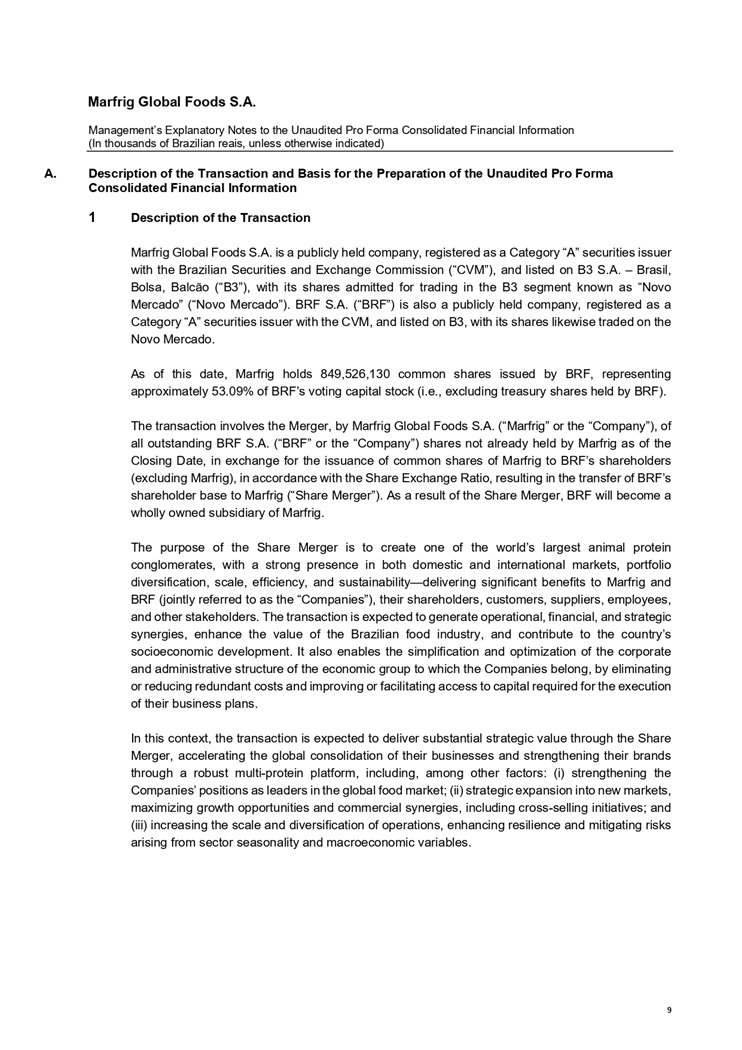

APPRAISAL REPORT: AP - 00521/25 - 01 VALUATION DATE: May 14 th , 2025 1 REQUESTER: MARFRIG GLOBAL FOODS S.A., hereinafter referred to as MARFRIG. Publicly held corporation, headquartered at Av. Queiroz Filho, No. 1.560, Bloco 5, Sabiá Tower, 3 rd Floor, Room 301, Vila Hamburguesa, City and State of São Paulo, registered with the CNPJ under No. 03.853.896/0001 - 40. OBJECT: Shares of BRF S.A., hereinafter referred to as BRF. Publicly held corporation, headquartered at Rua Jorge Tzachel, No. 475, Fazenda, City of Itajaí, State of Santa Catarina, registered with the CNPJ under No. 01.838.723/0001 - 27. OBJECTIVE: Determination of the value of the shares issued by BRF, using the market approach, through the volume - weighted average price of the shares, in compliance with article 252 of Law No. 6,404/1976 (Brazilian Corporation Law).

EXECUTIVE SUMMARY APSIS CONSULTORIA E AVALIAÇÕES LTDA . , hereinafter referred to as APSIS, headquartered at Rua do Passeio, No . 62 , 6 th floor, Centro, City and State of Rio de Janeiro, registered with the CNPJ under No . 08 . 681 . 365 / 0001 - 30 , was appointed to determine the market value of BRF shares, to be merged by MARFRIG, for the purpose of complying with the provisions of article 252 of Law No . 6 , 404 / 1976 (Brazilian Corporation Law) . In this Report, we use the market approach, through the Volume - Weighted Average Price (VWAP) 1 of the shares, to determine the equity value of BRF . The methodology aims to value a company by the sum of all its shares at market prices . Because the price of a stock is defined by the present value of the future dividend stream and a sale price at the end of the period, at a required rate of return, under the Efficient Market Hypothesis, this approach would indicate the correct value of the company to investors, when not affected by factors such as the stock's liquidity in the market . For the selection of the intervals considered in the VWAP calculation, we applied the criteria generally accepted in the market for operations of this nature, in line with the usual practices of the appraised company’s industry, and with parameters provided for in Law No . 6 , 404 / 76 (Brazilian Corporation Law) and CVM Resolution No . 85 / 22 , Annex C . The selection of these intervals was based on the representativeness and liquidity of the shares traded in the period, in order to faithfully reflect the market value of the company under normal trading conditions, mitigating any distortions . The following criteria were considered for the evaluation : ▪ The shares’ spot price on the last business day prior to the issuance of this Report. ▪ Volume - weighted average price of the shares traded on the stock exchange or in the organized over - the - counter market, during the 30 days immediately prior to the last business day before the issuance of this Report. ▪ Volume - weighted average price of shares traded on the stock exchange or in the organized over - the - counter market, during the 90 days immediately prior to the last business day before the issuance of this Report. ▪ Volume - weighted average price of shares traded on the stock exchange or in the organized over - the - counter market, during the 12 months immediately prior to the last business day before the issuance of the Report. Note : any differences between the valuation date and the analyzed dates are due to market closures on the respective dates . 1 The Volume - Weighted Average Price (VWAP) is calculated based on the average of closing prices, weighted by the volume traded. The data was extracted from the S&P Capital IQ Pro platform. 2

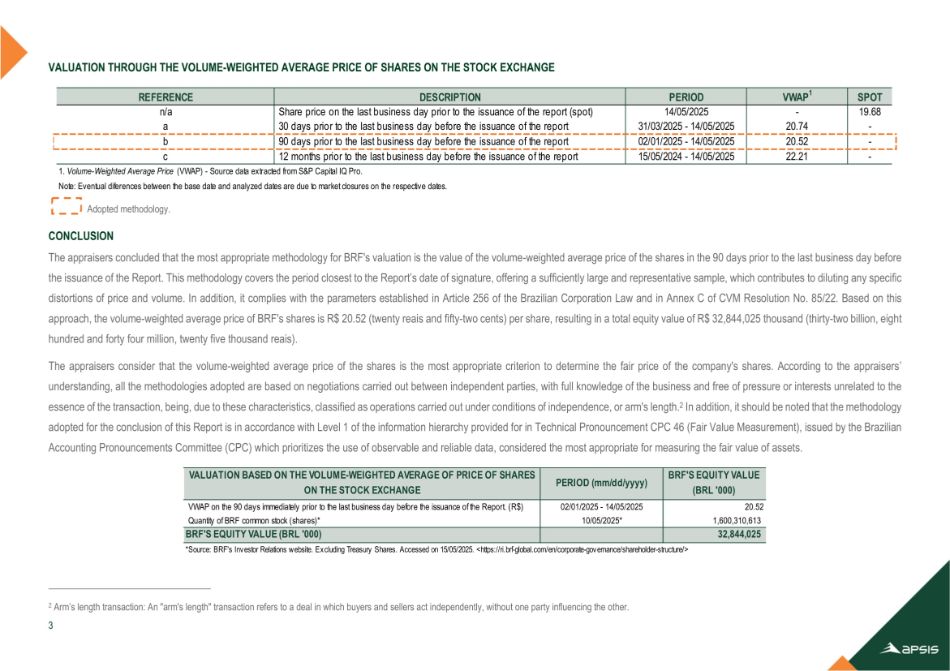

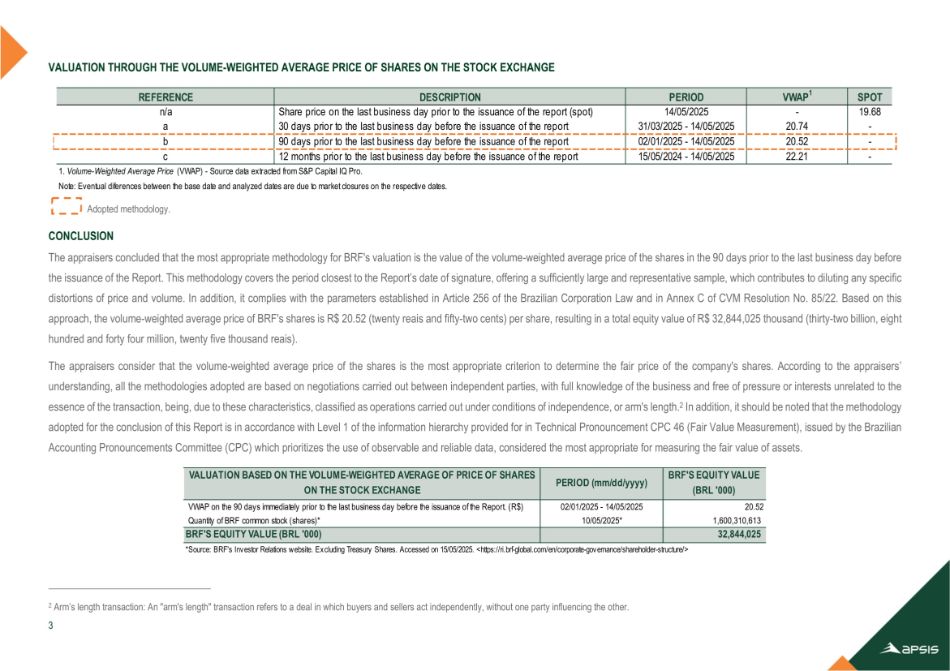

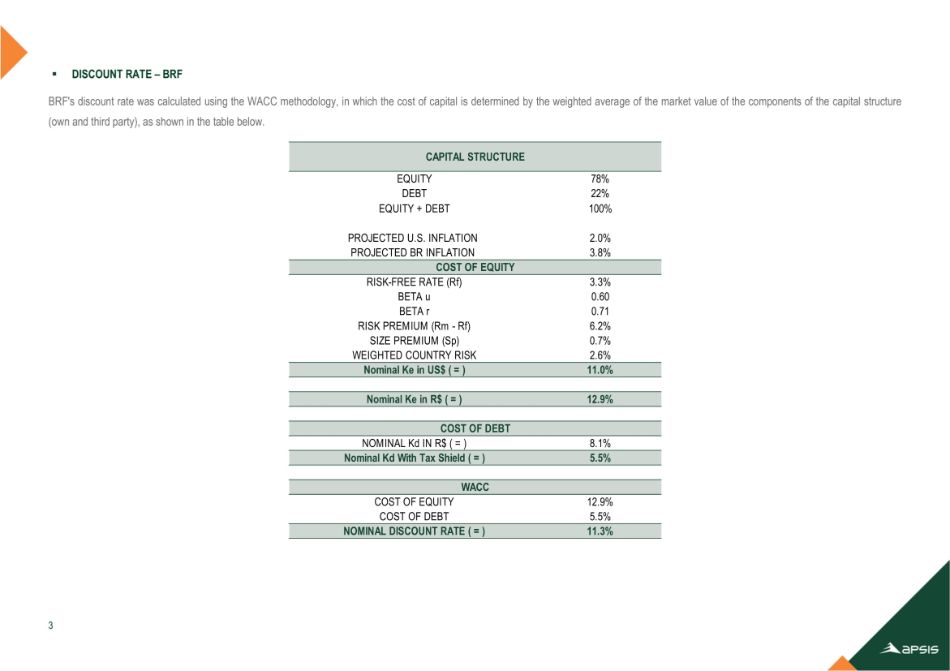

VALUATION THROUGH THE VOLUME - WEIGHTED AVERAGE PRICE OF SHARES ON THE STOCK EXCHANGE 2 Arm’s length transaction: An "arm's length" transaction refers to a deal in which buyers and sellers act independently, without one party influencing the other. SPOT VWAP 1 PERIOD DESCRIPTION REFERENCE 19.68 - - 20.74 14/05/2025 31/03/2025 - 14/05/2025 Share price on the last business day prior to the issuance of the report (spot) 30 days prior to the last business day before the issuance of the report n/a a - 20.52 02/01/2025 - 14/05/2025 90 days prior to the last business day before the issuance of the report b - 22.21 15/05/2024 - 14/05/2025 12 months prior to the last business day before the issuance of the report c BRF'S EQUITY VALUE (BRL '000) PERIOD (mm/dd/yyyy) VALUATION BASED ON THE VOLUME - WEIGHTED AVERAGE OF PRICE OF SHARES ON THE STOCK EXCHANGE 20.52 02/01/2025 - 14/05/2025 VWAP on the 90 days immediately prior to the last business day before the issuance of the Report. (R$) 1,600,310,613 10/05/2025* Quantity of BRF common stock (shares)* 32,844,025 BRF'S EQUITY VALUE (BRL '000) *Source: BRF's Investor Relations website. Excluding Treasury Shares. Accessed on 15/05/2025. <https://ri.brf - global.com/en/corporate - gov ernance/shareholder - structure/> 1. Volume - Weighted Average Price (VWAP) - Source data extracted from S&P Capital IQ Pro. Note: Eventual diferences between the base date and analyzed dates are due to market closures on the respective dates. Adopted methodology. CONCLUSION The appraisers concluded that the most appropriate methodology for BRF's valuation is the value of the volume - weighted average price of the shares in the 90 days prior to the last business day before the issuance of the Report . This methodology covers the period closest to the Report’s date of signature, offering a sufficiently large and representative sample, which contributes to diluting any specific distortions of price and volume . In addition, it complies with the parameters established in Article 256 of the Brazilian Corporation Law and in Annex C of CVM Resolution No . 85 / 22 . Based on this approach, the volume - weighted average price of BRF's shares is R $ 20 . 52 (twenty reais and fifty - two cents) per share, resulting in a total equity value of R $ 32 , 844 , 025 thousand (thirty - two billion, eight hundred and forty four million, twenty five thousand reais) . The appraisers consider that the volume - weighted average price of the shares is the most appropriate criterion to determine the fair price of the company's shares . According to the appraisers’ understanding, all the methodologies adopted are based on negotiations carried out between independent parties, with full knowledge of the business and free of pressure or interests unrelated to the essence of the transaction, being, due to these characteristics, classified as operations carried out under conditions of independence, or arm's length . 2 In addition, it should be noted that the methodology adopted for the conclusion of this Report is in accordance with Level 1 of the information hierarchy provided for in Technical Pronouncement CPC 46 (Fair Value Measurement), issued by the Brazilian Accounting Pronouncements Committee (CPC) which prioritizes the use of observable and reliable data, considered the most appropriate for measuring the fair value of assets . 3

TABLE OF CONTENTS TABLE OF CONTENTS..................................................................................................................... ... ............................................................................................................................. ... .......................... 4 1. INTRODUCTION ............................................................................................................................. ... ............................................................................................................................. ... ................... 5 2. PRINCIPLES AND CAVEATS ............................................................................................................................. ... ............................................................................................................................. .. 6 3. LIMITATIONS OF LIABILITY ............................................................................................................................. ... ............................................................................................................................. ... . 7 4. BRF CHARACTERIZATION ............................................................................................................................. ... ............................................................................................................................. ... .. 8 5. VALUATION METHODOLOGY ............................................................................................................................. ... ............................................................................................................................. 9 6. VALUATION THROUGH THE VOLUME - WEIGHTED AVERAGE PRICE OF SHARES ON THE STOCK EXCHANGE.................................................................................................................... 10 7. CONCLUSION ............................................................................................................................. ... ............................................................................................................................. ... ..................... 13 8. LIST OF ANNEXES ............................................................................................................................. ... ............................................................................................................................. ... ............. 14 4

1. INTRODUCTION APSIS CONSULTORIA E AVALIAÇÕES LTDA . , hereinafter referred to as APSIS, headquartered at Rua do Passeio, No . 62 , 6 th floor, Centro, City and State of Rio de Janeiro, registered with the CNPJ under No . 08 . 681 . 365 / 0001 - 30 , was appointed to determine the market value of BRF shares, to be merged by MARFRIG, for the purpose of complying with the provisions in article 252 of Law No . 6 , 404 / 1976 (Brazilian Corporation Law) . In the preparation of this work, data and information provided by third parties were used, in the form of documents and verbal interviews with the client . The estimates used in this process are based on : ▪ Public information collected in the S&P Capital IQ Pro platform. ▪ Audited Financial Statements of BRF as of December 31 st , 2024. ▪ Public information of BRF. ▪ Results spreadsheet extracted from the company's investor relations website. The professionals who participated in the preparation of this work are listed below : ▪ BRUNO GRAVINA BOTTINO – Director ▪ CAIO CESAR CAPELARI FAVERO – Director / Administrator and Accountant (CRA 141231 and CRC 1SP342654) ▪ DANIEL FELIX LAMONICA – Projects ▪ LEONARDO HENRIQUE CARDOSO BRAZ – Projects ▪ LUCAS ARAUJO DA SILVA CARDOZO – Projects ▪ MARCELO CAMPOS FARINHA – Projects ▪ RODRIGO MENNA BARRETO AMIL – Projects 5

2. PRINCIPLES AND CAVEATS The Report, the object of the work enumerated, calculated and particularized, carefully obeys the fundamental principles described below, which are important and should be carefully read. ▪ The consultants have no interest, direct or indirect, in the companies involved or in the transaction, and there is no other relevant circumstance that could characterize a conflict of interest. ▪ APSIS's professional fees are in no way subject to the findings of this Report. ▪ To the best knowledge and to the credit of the consultants, the analyses, opinions, and conclusions expressed in this Report are based on true and correct data, diligence, research and surveys. ▪ The information received from third parties is assumed to be correct, and their sources are contained and cited in the Report. ▪ For projection purposes, it is assumed that there are no encumbrances of any nature, judicial or extrajudicial, affecting the companies in question, other than those listed in this Report, if applicable. ▪ The Report presents all the limiting conditions imposed by the methodologies adopted, if any, that may affect the analyses, opinions and conclusions contained therein. ▪ The Report was prepared by APSIS, and no one, except its own consultants, prepared the analyses and corresponding conclusions. ▪ APSIS assumes full responsibility for the matter of Valuations, including implicit ones, for the exercise of its honorable functions, primarily established in its own laws, codes or regulations. ▪ This Report meets the recommendations and criteria established by the Brazilian Association of Technical Standards (ABNT), the Uniform Standards of Professional Appraisal Practice (USPAP) and the International Valuation Standards (IVS) . ▪ The controlling shareholder and the managers of the companies involved have not directed, limited, hindered or performed any acts that have or may have compromised the availability, use or knowledge of information, goods, documents or work methodologies relevant to the quality of the conclusions contained in this Report . ▪ The internal process of drafting and approving this document involved the following main steps : (I) analysis of the company's public documents ; (II) extraction, through the S&P Capital IQ Pro database, of quotations and historical volumes of the company's shares traded on the stock exchange or in the organized over - the - counter market ; (III) elaboration of calculations of the volume - weighted average price (VWAP) in different intervals ; (IV) preparation of the calculation of the company's equity value ; (V) submission of the report for independent internal review ; (V) implementation of any improvements and suggested changes ; (VI) issuance of a final report . 6

3. LIMITATIONS OF LIABILITY ▪ To prepare this Report, APSIS used and assumed as true and coherent information and historical data audited by third parties or not audited, provided in writing by the company's management or obtained from the aforementioned sources, and has no responsibility for their veracity . ▪ The scope of this valuation did not include an audit of the financial statements, or a review of the work carried out by its auditors . Accordingly, APSIS is not expressing an opinion on the Applicant's financial statements and measurements . ▪ APSIS is not responsible for occasional losses to the Requester and its subsidiaries, its partners, directors and creditors or other parties as a result of the use of the data and information provided by the company and contained in this Report . ▪ This Report was developed solely for the use of the Requester and its partners, aiming at the purpose already described ; therefore, it should not be published, circulated, reproduced, disseminated or used for any purpose other than the aforementioned one without the prior written approval of APSIS . ▪ The analyses and conclusions contained herein are based on several assumptions made on the present date, regarding operational projections, such as prices, volumes, market shares, revenues, taxes, investments, margins, etc . Thus, the company's future results may be different from any forecast or estimate of this work, especially if there is later knowledge of information not available at the time of the issuance of the Report . ▪ This assessment does not reflect events and impacts that occurred after the date of issuance of the Report . ▪ APSIS is not responsible for direct or indirect losses of profits that may arise from the improper use of this Report . ▪ We emphasize that understanding the conclusion of this Report will occur through the full reading of it and its annexes, and therefore no conclusions should be drawn from partial reading, which may be incorrect or mistaken . 7

4. BRF CHARACTERIZATION BRF is one of the world's largest producers of fresh and frozen animal protein, standing out for its extensive production capacity and a portfolio of more than 7 , 300 SKUs . Its products include marinated and frozen chicken, Chester® chicken, turkey meats, specialty meats, frozen processed meats, ready meals, fractionated items, as well as plant - based products . The company also sells margarine, butter, cottage cheese, special sweets, sandwiches, plant - based foods and animal feed . Owner of leading brands widely recognized by the public, such as Sadia, Perdigão and Qualy, BRF consolidated its position in the market from the merger between two traditional family businesses : Perdigão and Sadia . The union was announced in 2009 and completed in 2012 , marking the creation of one of the largest conglomerates in the food sector . Both companies already occupied prominent positions in the national and international market, with products exported to more than 120 countries . In the pet food segment, BRF has four manufacturing units, located in the states of São Paulo, Rio Grande do Sul, Paraná and also in Paraguay . Its portfolio includes brands such as Biofresh, Guabi Natural, Gran Plus, Balance, Three Dogs, Three Cats, PrimoCão, PrimoGato, Faro, Bônos, Apolo and Átila, serving different consumer profiles and their pets . BRF Operations With a 40.8% share of the Brazilian processed food market as of December 31, 2024, BRF maintains a solid structure consisting of 44 industrial units and 103 distribution centers. The company has a highly developed logistics system in the domestic market, supported by a vast distribution network that includes distribution centers and transit points. In 2024, this structure made it possible to serve approximately 415 thousand customers globally, with more than 500 thousand deliveries per month, according to MARFRIG's 2024 Reference Form. Complementing its operational efficiency, BRF invests in technology through a digital sales platform that suggests orders in a personalized way, based on the characteristics of each point of sale. Also, according to MAFRIG's Reference Form, the company demonstrated strong capillarity, with more than 300 thousand active customers in Brazil in June 2024. 8

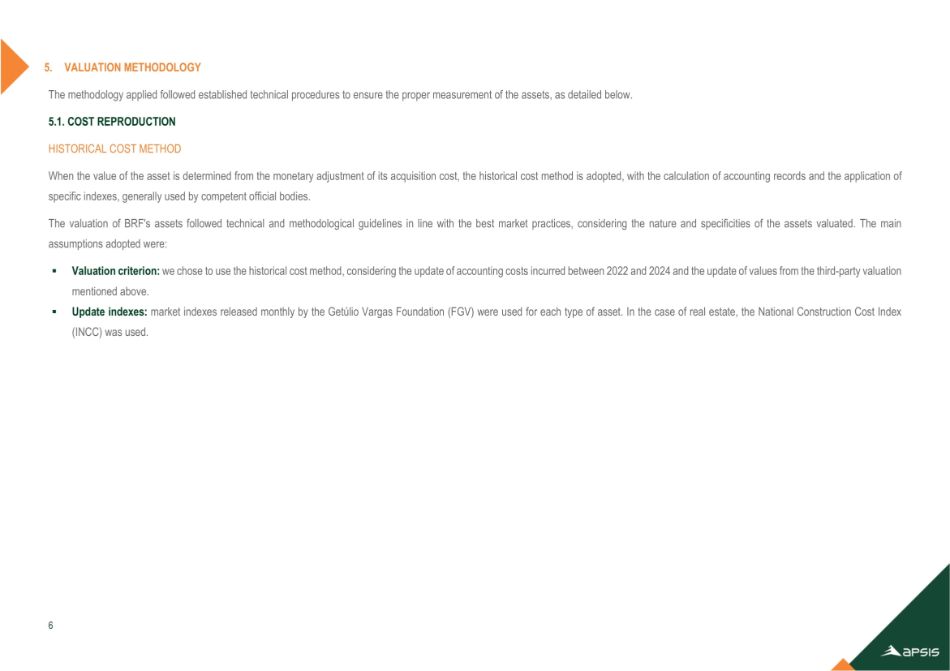

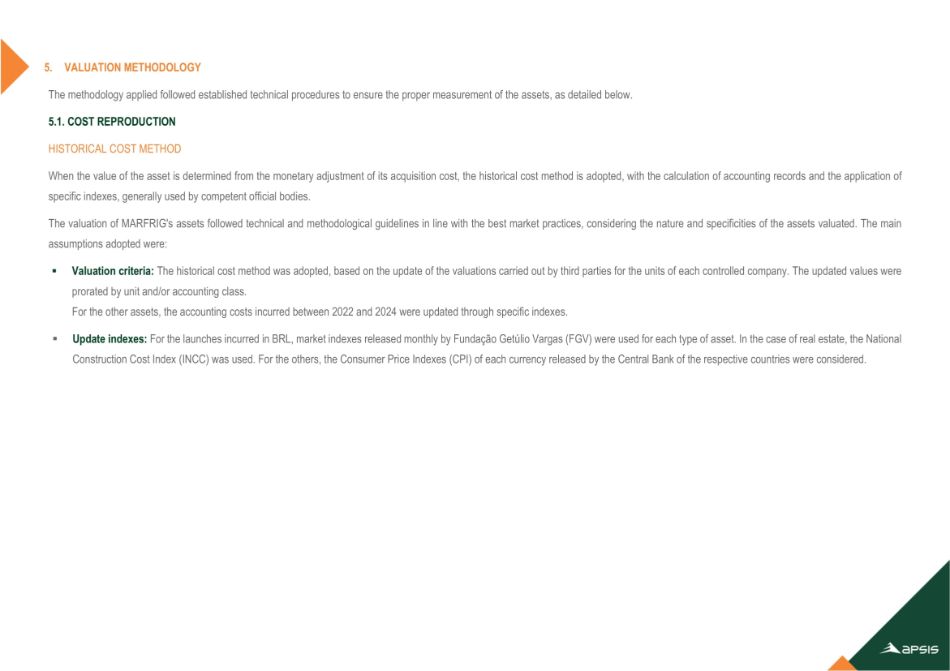

5. VALUATION METHODOLOGY 1. MARKET APPROACH – LISTING ON THE STOCK EXCHANGE In this Report, we use the market approach, through the Volume - Weighted Average Price (VWAP), to determine the equity value of BRF . The methodology aims to appraise a company by the sum of all its shares at market prices . Because the price of a stock is defined by the present value of the future dividend stream and a sale price at the end of the period, at a required rate of return, under the Efficient Market Hypothesis, this approach would indicate the correct value of the company to investors, when not affected by factors such as the stock's liquidity in the market . 9

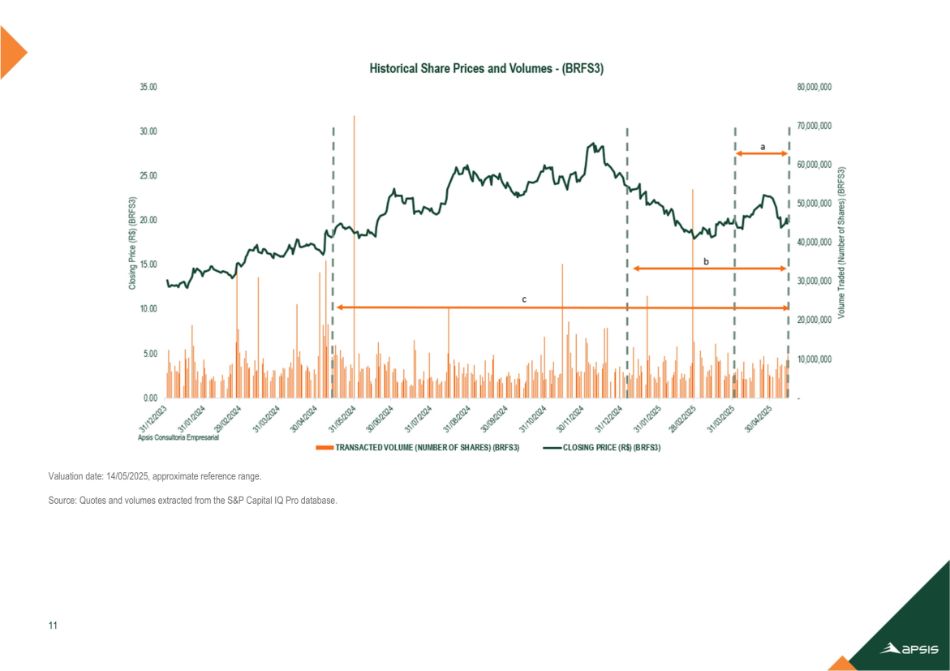

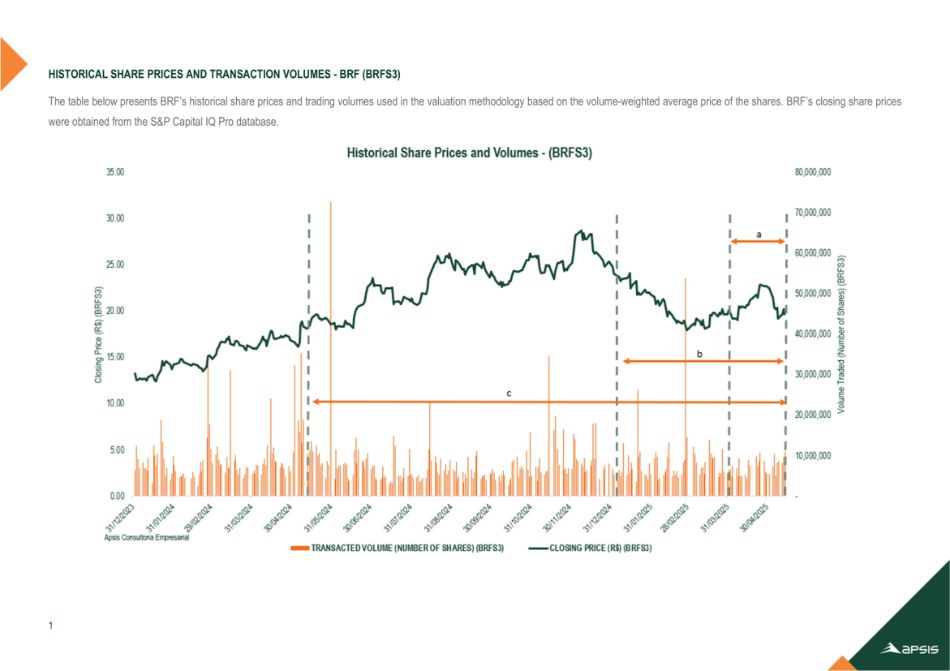

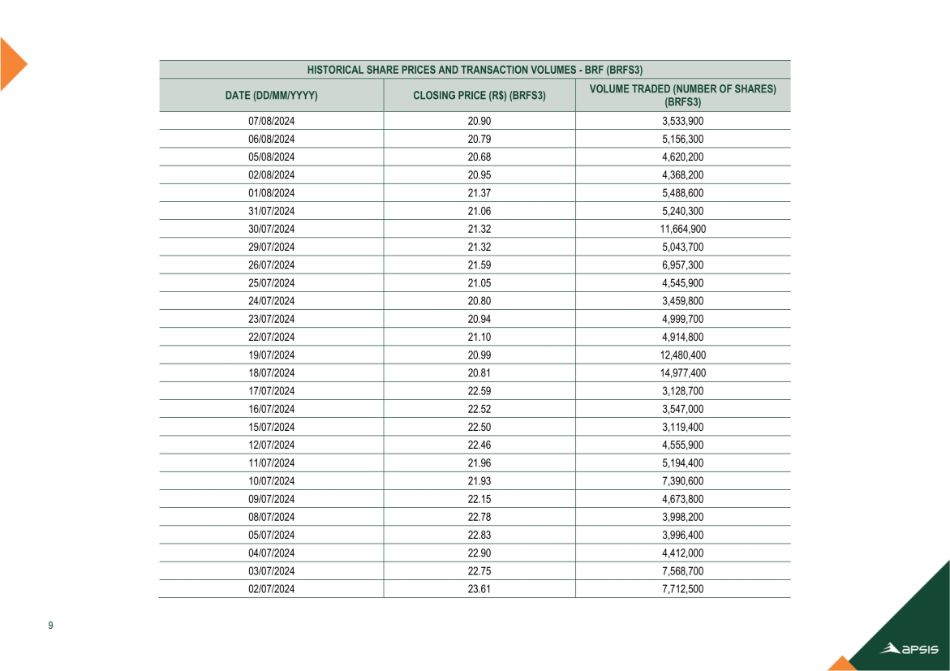

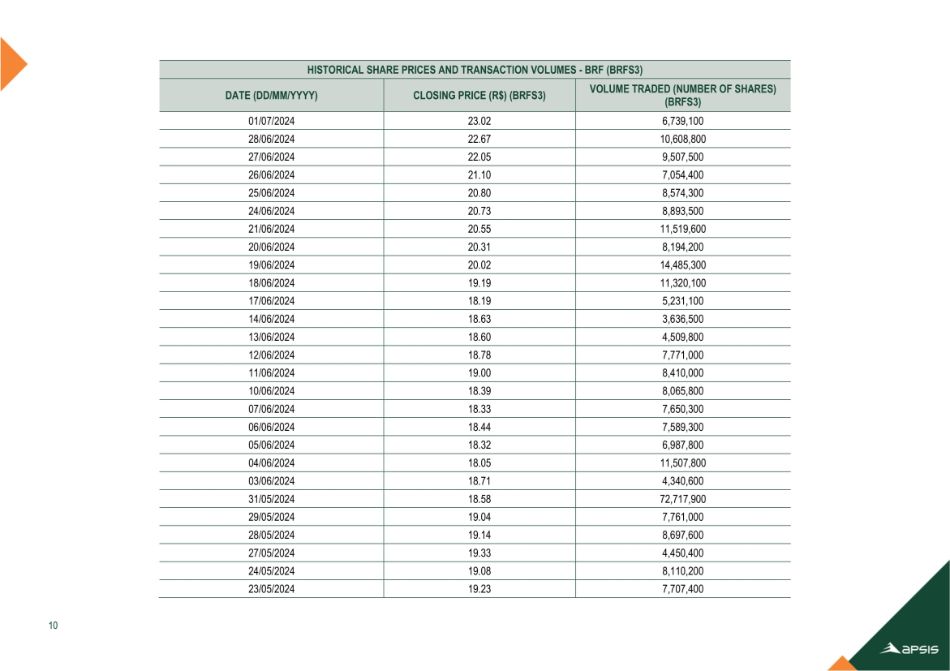

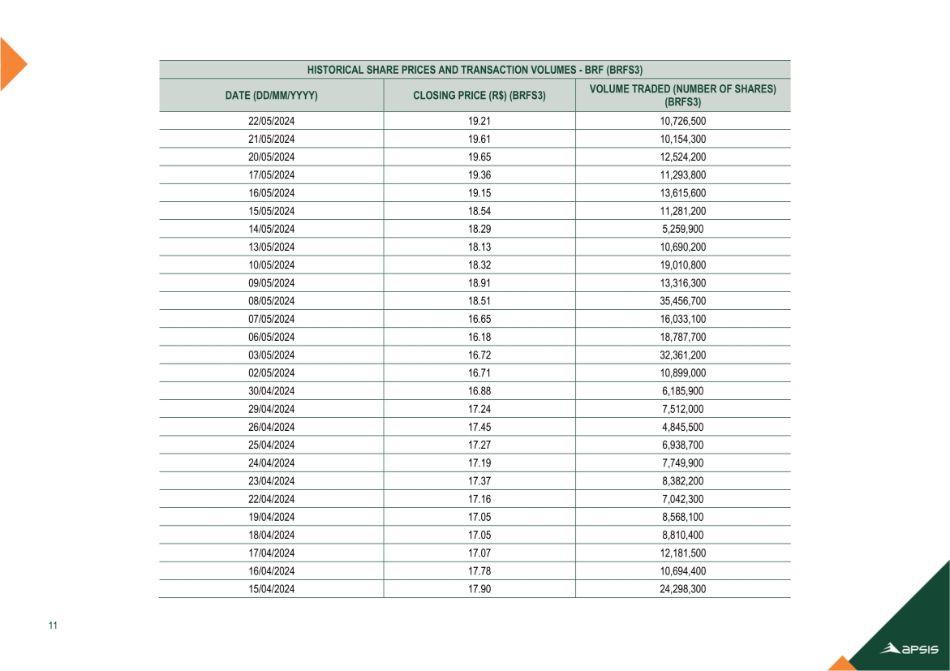

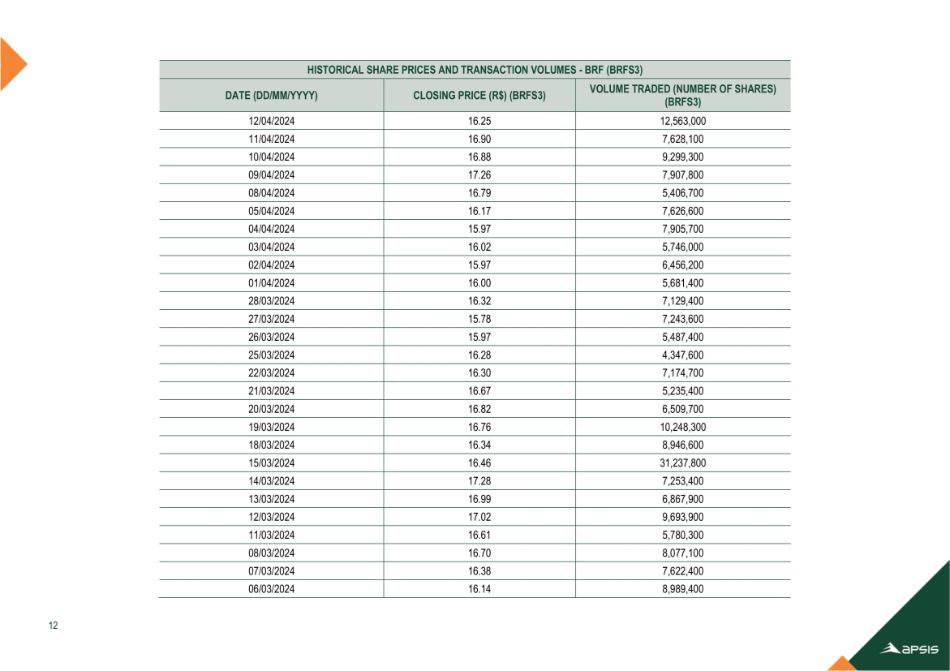

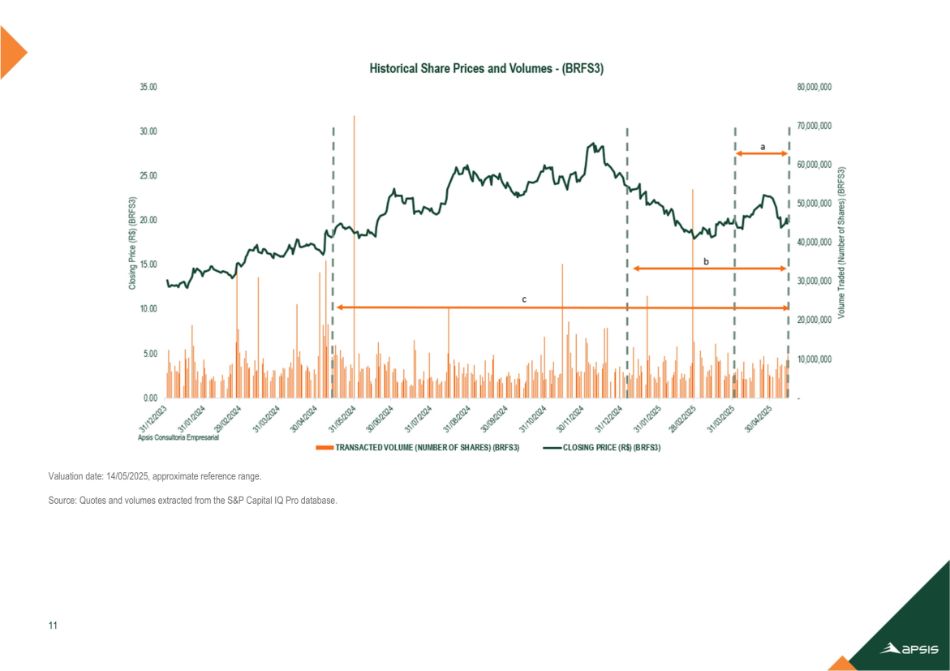

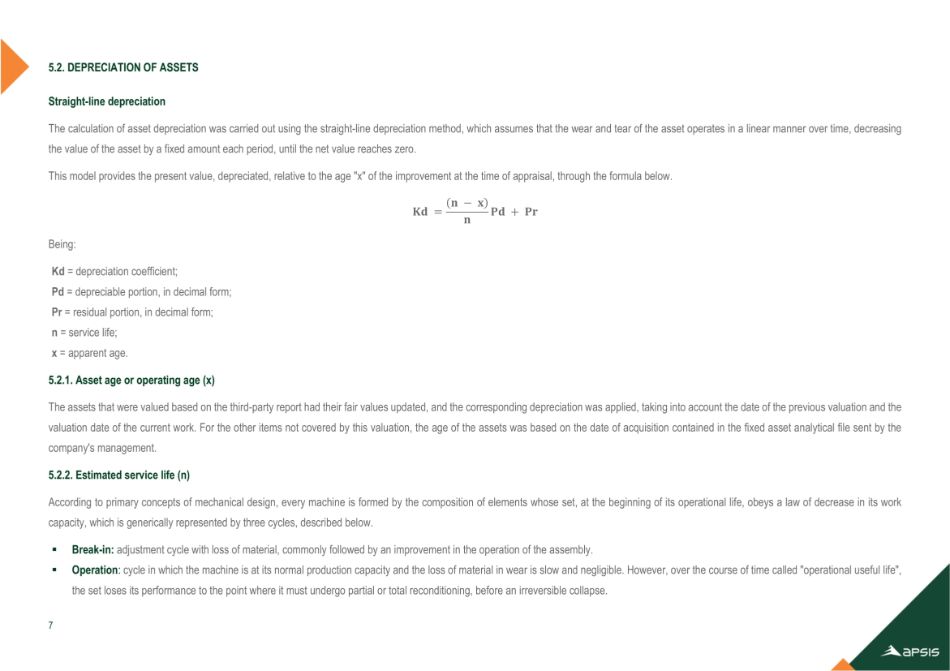

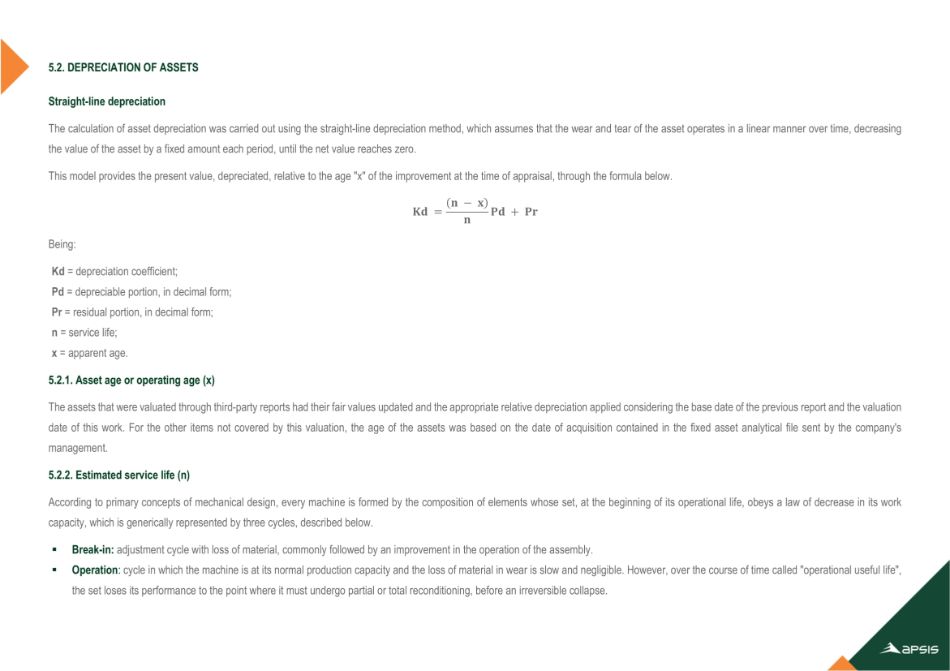

6. VALUATION THROUGH THE VOLUME - WEIGHTED AVERAGE PRICE OF SHARES ON THE STOCK EXCHANGE For the selection of the intervals considered in the VWAP calculation, we applied the criteria generally accepted in the market for operations of this nature, in line with the usual practices of the appraised company’s industry, and with parameters provided for in Article 256 of Law No . 6 , 404 / 76 (Brazilian Corporation Law) . The selection of these intervals was based on the representativeness and liquidity of the shares traded in the period, in order to faithfully reflect the market value of the company under normal trading conditions, mitigating any distortions . The following criteria were considered for the evaluation: ▪ The shares’ spot price on the last business day prior to the issuance of this Report. ▪ Volume - weighted average price of the shares traded on the stock exchange or in the organized over - the - counter market, during the 30 days immediately prior to the last business day before the issuance of this Report. ▪ Volume - weighted average price of shares traded on the stock exchange or in the organized over - the - counter market, during the 90 days immediately prior to the last business day before the issuance of this Report. ▪ Volume - weighted average price of shares traded on the stock exchange or in the organized over - the - counter market, during the 12 months immediately prior to the last business day before the issuance of the Report. Note: any differences between valuation date and analyzed dates are due to market closures on the respective dates. The quotes and historical volumes used in the valuation were extracted from the S&P Capital IQ Pro database and can be seen in Annex 1. 10

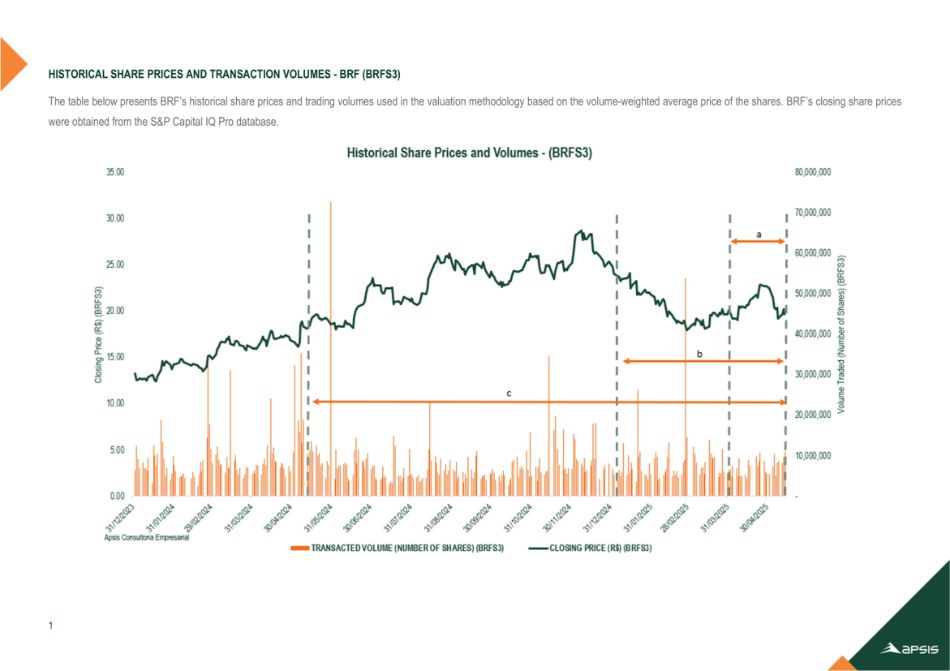

Valuation date: 14/05/2025, approximate reference range. Source: Quotes and volumes extracted from the S&P Capital IQ Pro database. 11

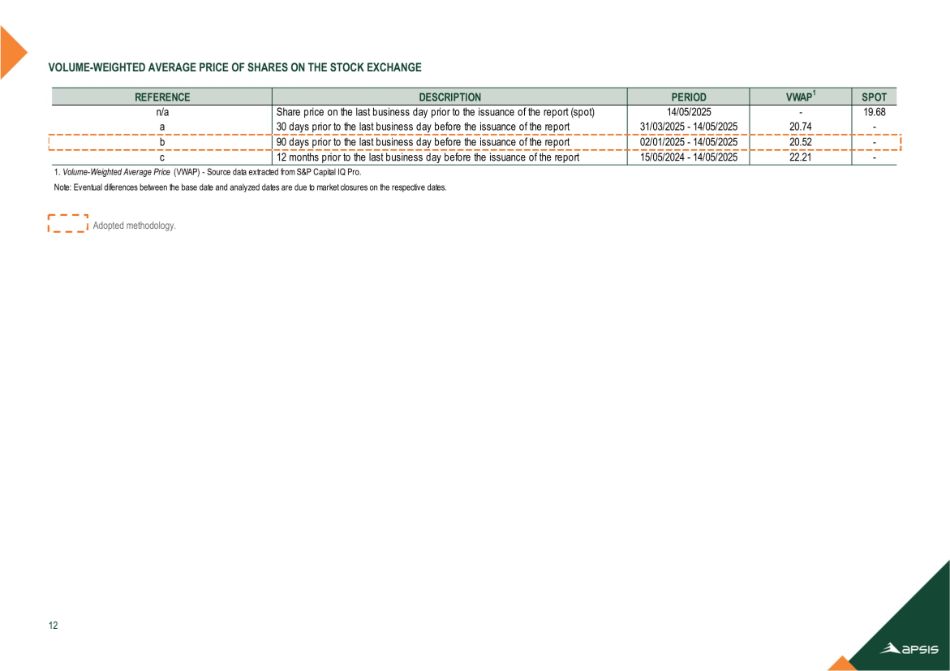

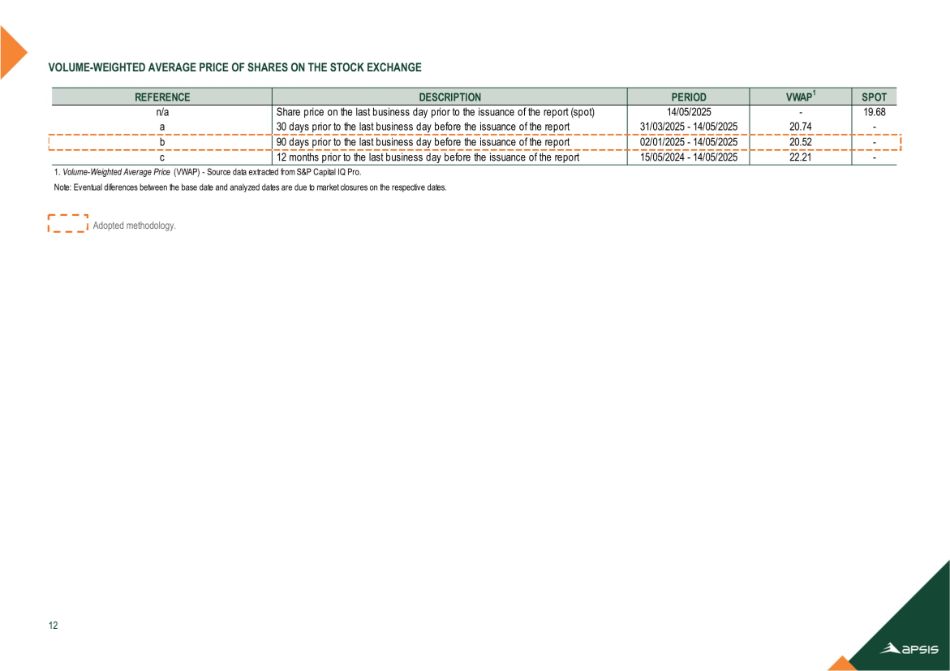

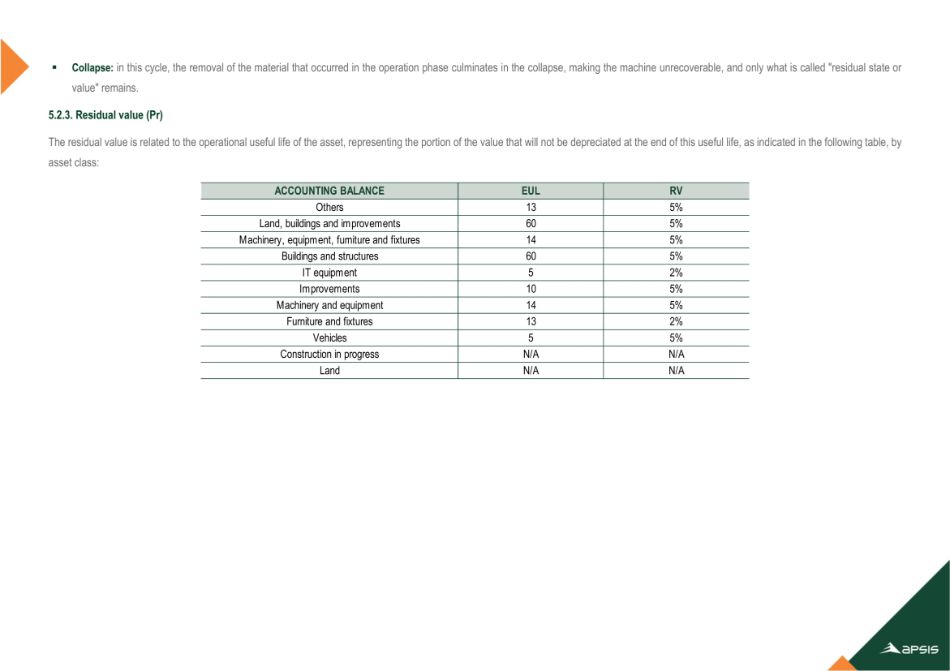

VOLUME - WEIGHTED AVERAGE PRICE OF SHARES ON THE STOCK EXCHANGE SPOT VWAP 1 PERIOD DESCRIPTION REFERENCE 19.68 - - 20.74 14/05/2025 31/03/2025 - 14/05/2025 Share price on the last business day prior to the issuance of the report (spot) 30 days prior to the last business day before the issuance of the report n/a a - 20.52 02/01/2025 - 14/05/2025 90 days prior to the last business day before the issuance of the report b - 22.21 15/05/2024 - 14/05/2025 12 months prior to the last business day before the issuance of the report c 1. Volume - Weighted Average Price (VWAP) - Source data extracted from S&P Capital IQ Pro. Note: Eventual diferences between the base date and analyzed dates are due to market closures on the respective dates. Adopted methodology. 12

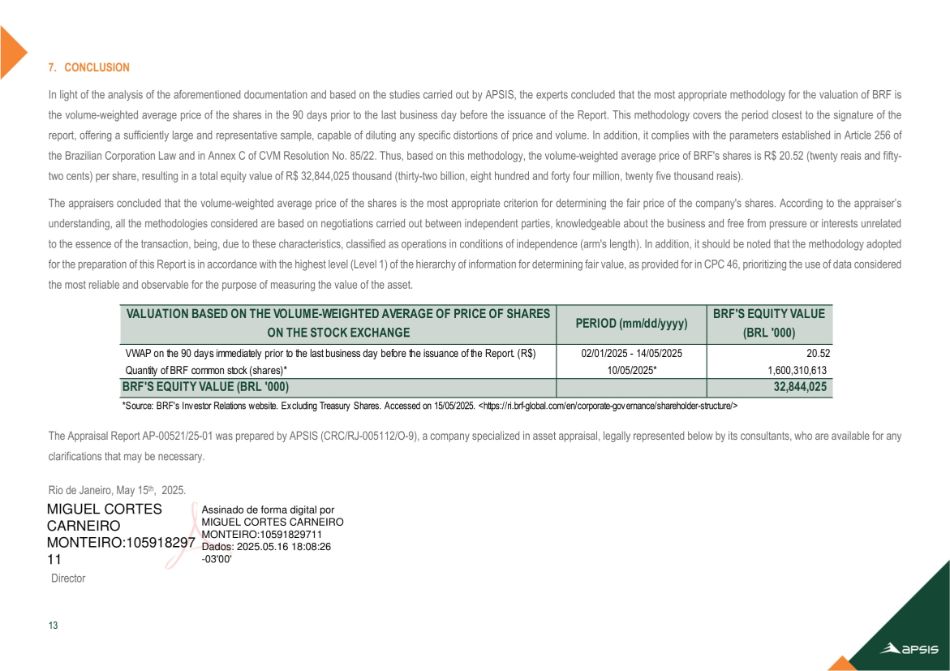

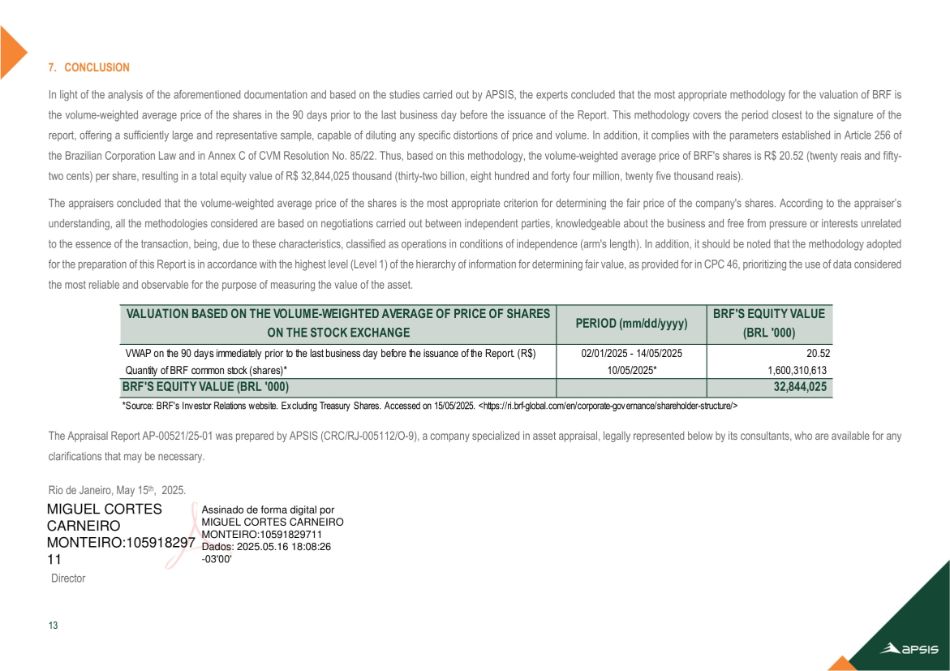

7. CONCLUSION In light of the analysis of the aforementioned documentation and based on the studies carried out by APSIS, the experts concluded that the most appropriate methodology for the valuation of BRF is the volume - weighted average price of the shares in the 90 days prior to the last business day before the issuance of the Report . This methodology covers the period closest to the signature of the report, offering a sufficiently large and representative sample, capable of diluting any specific distortions of price and volume . In addition, it complies with the parameters established in Article 256 of the Brazilian Corporation Law and in Annex C of CVM Resolution No . 85 / 22 . Thus, based on this methodology, the volume - weighted average price of BRF's shares is R $ 20 . 52 (twenty reais and fifty - two cents) per share, resulting in a total equity value of R $ 32 , 844 , 025 thousand (thirty - two billion, eight hundred and forty four million, twenty five thousand reais) . The appraisers concluded that the volume - weighted average price of the shares is the most appropriate criterion for determining the fair price of the company's shares . According to the appraiser’s understanding, all the methodologies considered are based on negotiations carried out between independent parties, knowledgeable about the business and free from pressure or interests unrelated to the essence of the transaction, being, due to these characteristics, classified as operations in conditions of independence (arm's length) . In addition, it should be noted that the methodology adopted for the preparation of this Report is in accordance with the highest level (Level 1 ) of the hierarchy of information for determining fair value, as provided for in CPC 46 , prioritizing the use of data considered the most reliable and observable for the purpose of measuring the value of the asset . 13 Director BRF'S EQUITY VALUE (BRL '000) PERIOD (mm/dd/yyyy) VALUATION BASED ON THE VOLUME - WEIGHTED AVERAGE OF PRICE OF SHARES ON THE STOCK EXCHANGE 20.52 02/01/2025 - 14/05/2025 VWAP on the 90 days immediately prior to the last business day before the issuance of the Report. (R$) 1,600,310,613 10/05/2025* Quantity of BRF common stock (shares)* 32,844,025 BRF'S EQUITY VALUE (BRL '000) *Source: BRF's Investor Relations website. Excluding Treasury Shares. Accessed on 15/05/2025. <https://ri.brf - global.com/en/corporate - gov ernance/shareholder - structure/> The Appraisal Report AP - 00521/25 - 01 was prepared by APSIS (CRC/RJ - 005112/O - 9), a company specialized in asset appraisal, legally represented below by its consultants, who are available for any clarifications that may be necessary. Rio de Janeiro, May 15 th , 2025.

8. LIST OF ANNEXES 1. Historical Quotes and Volumes 2. Glossary 14

ATTACHMENT 1

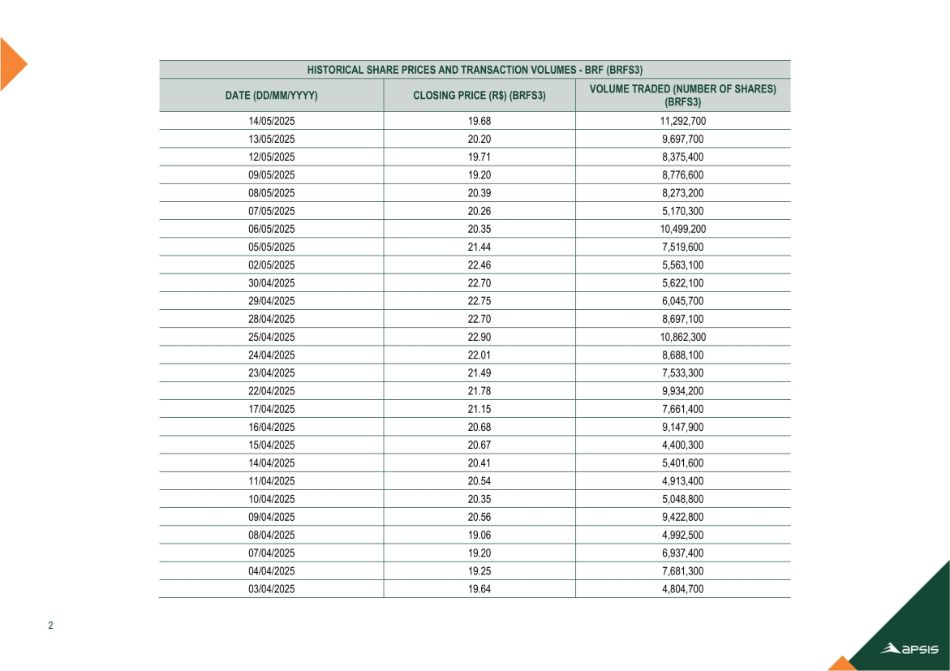

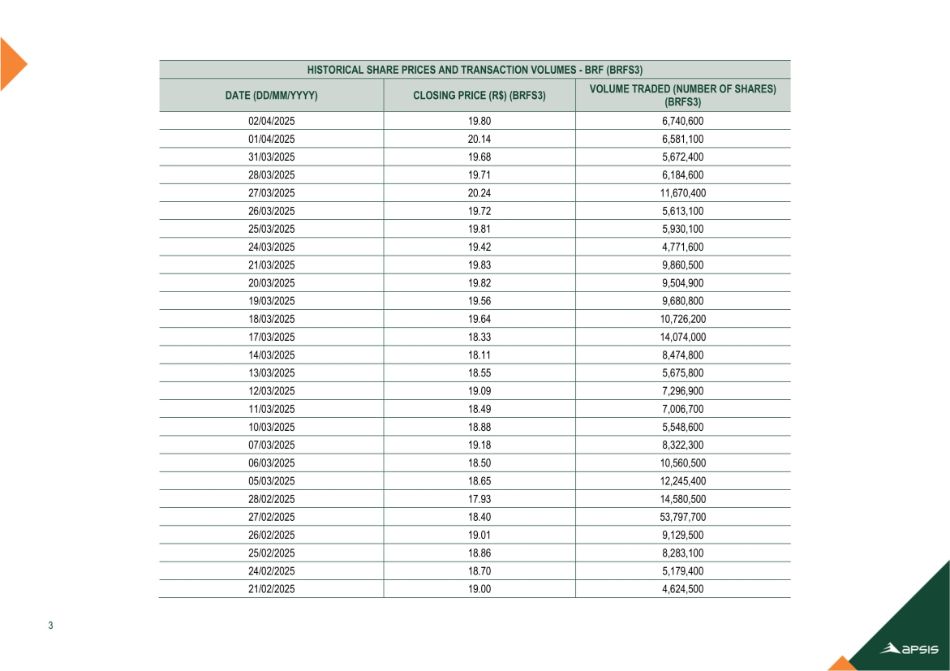

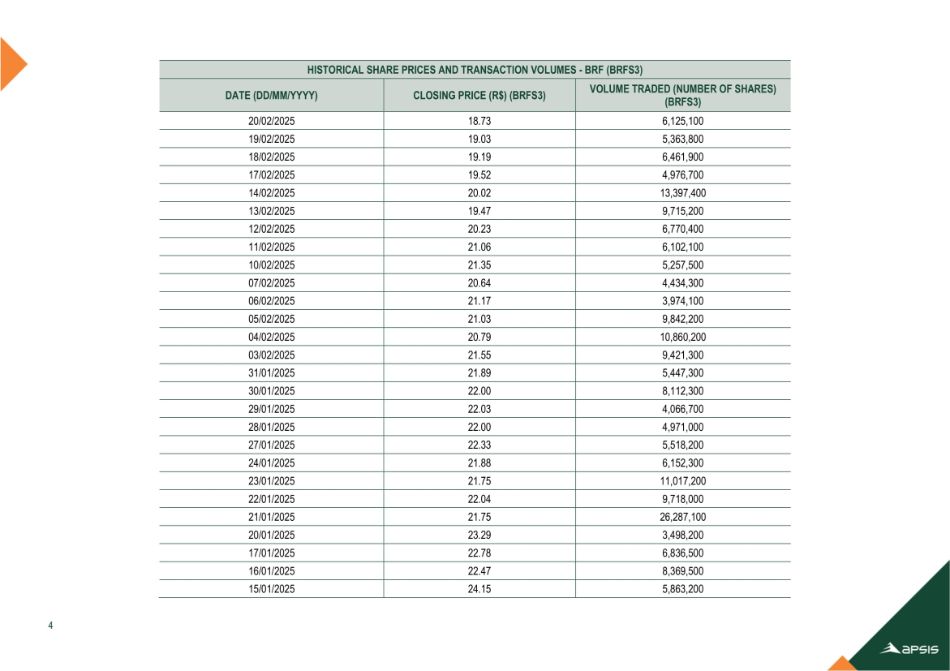

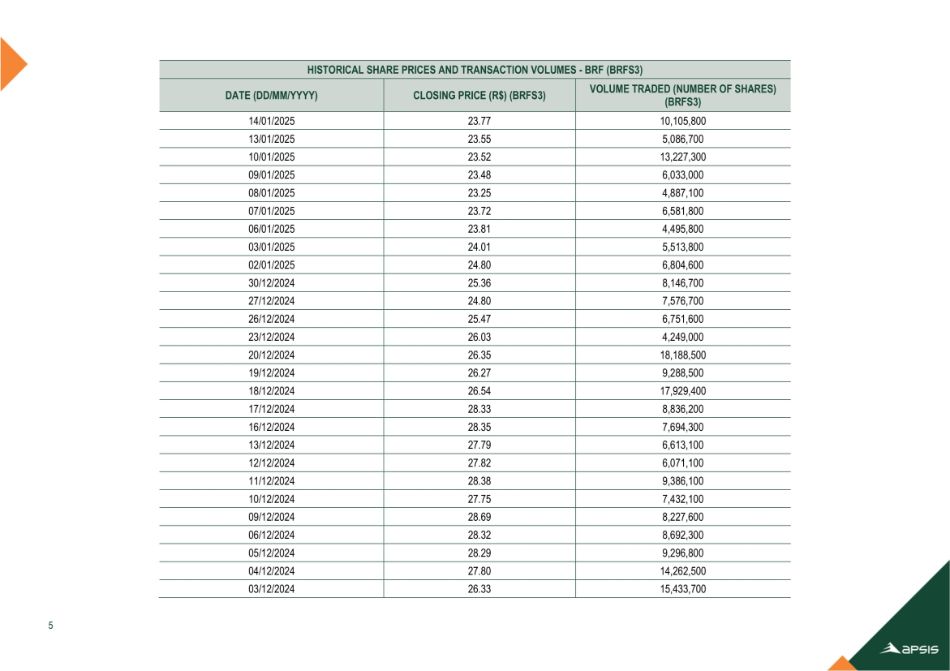

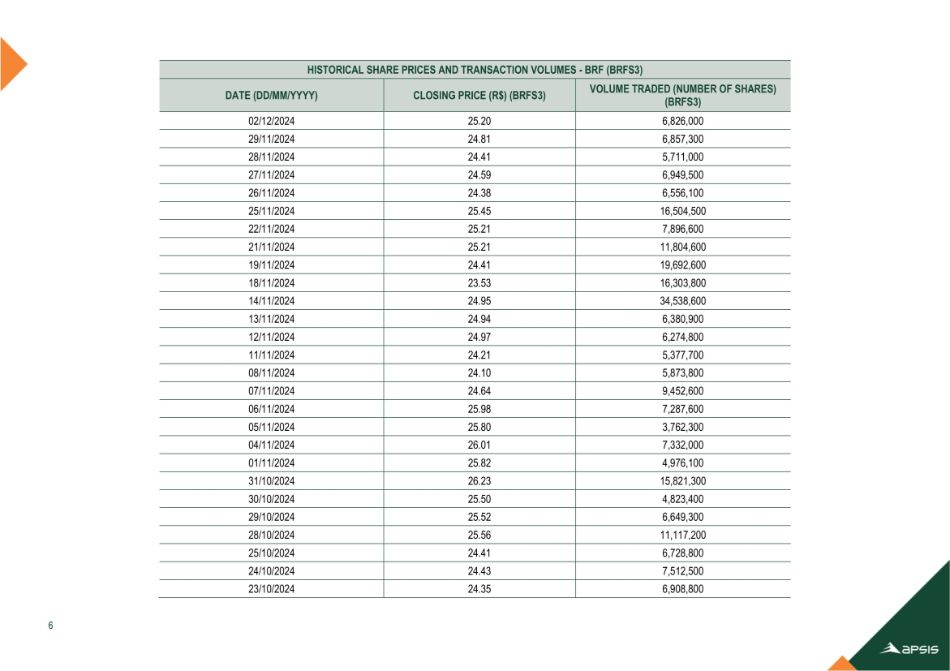

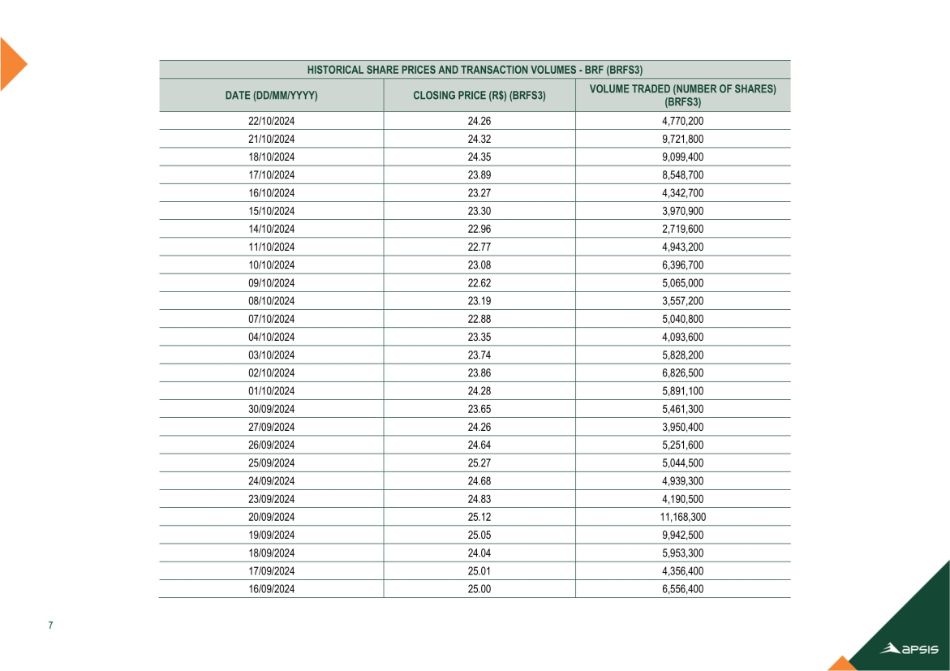

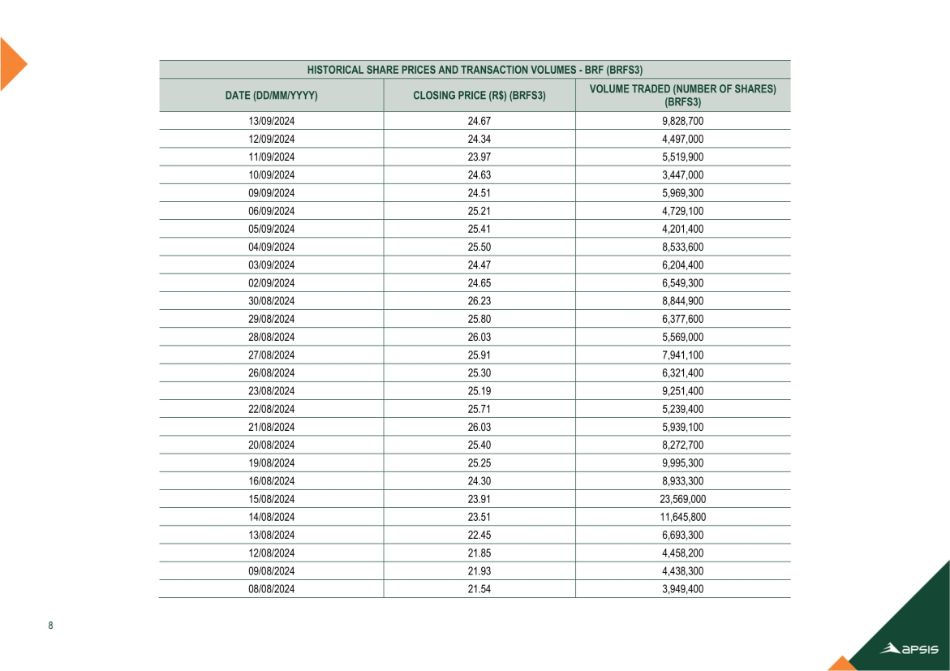

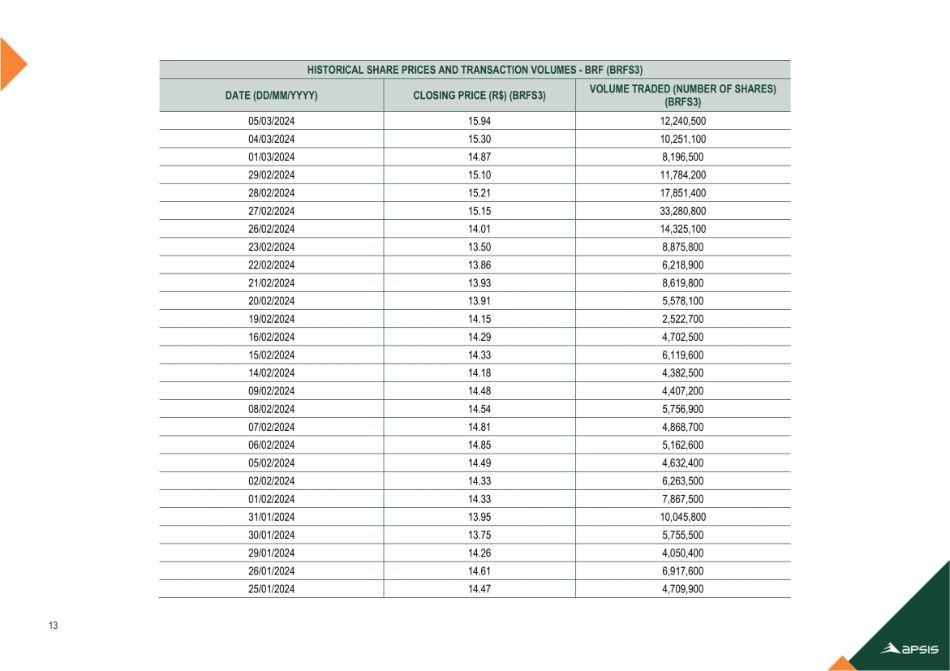

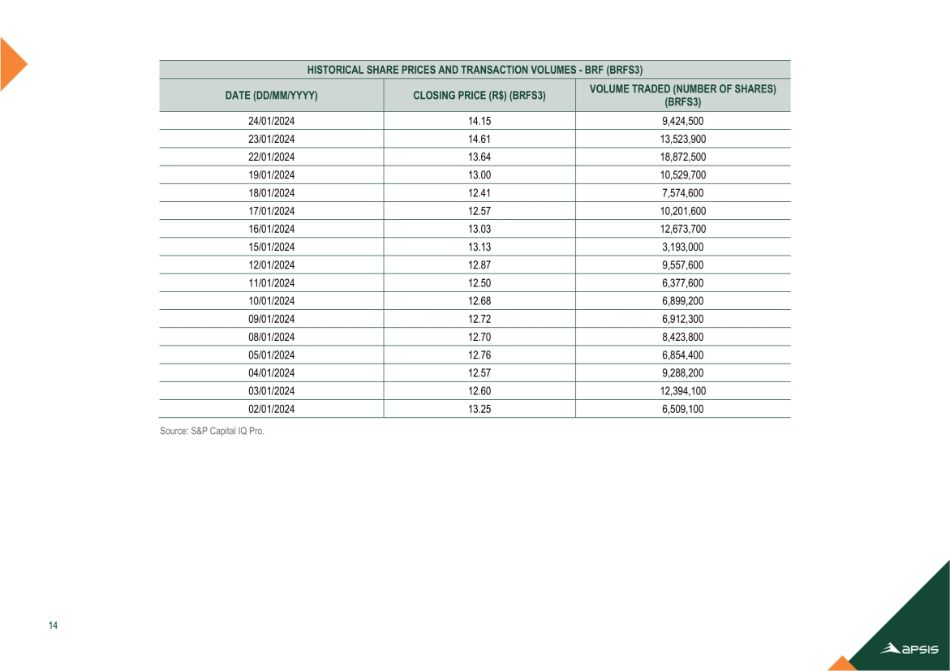

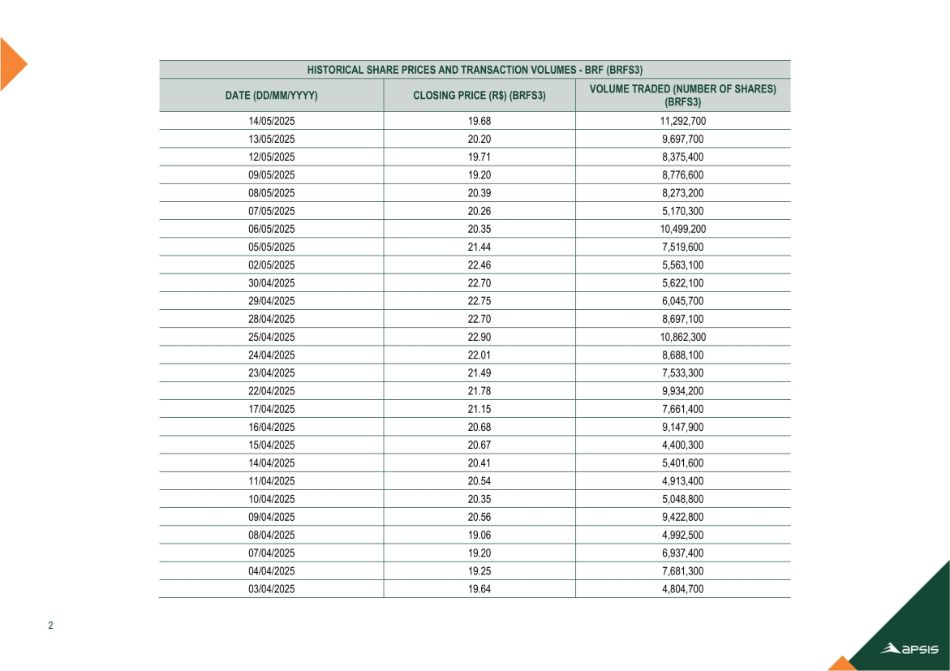

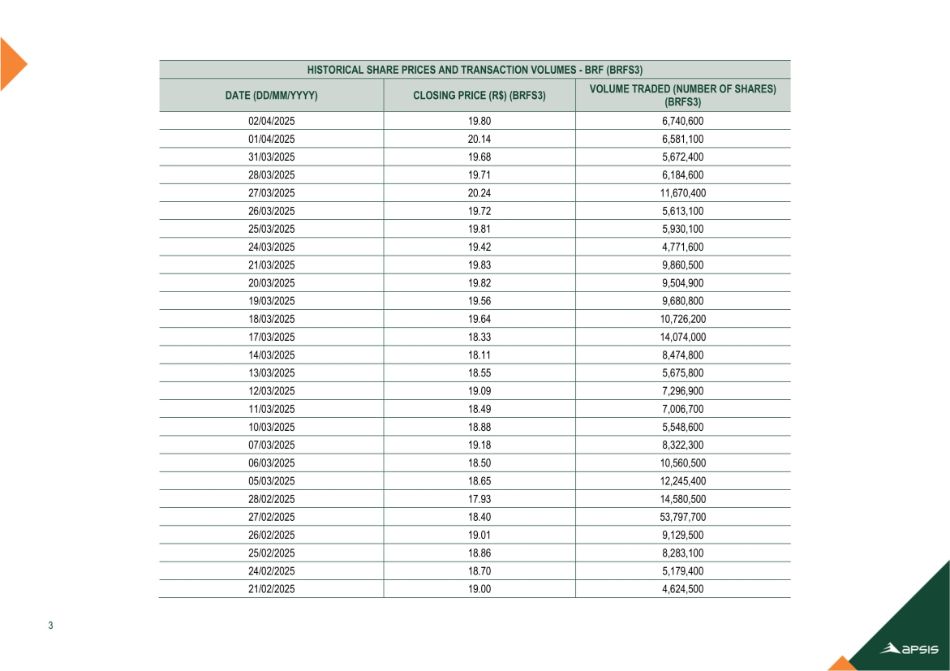

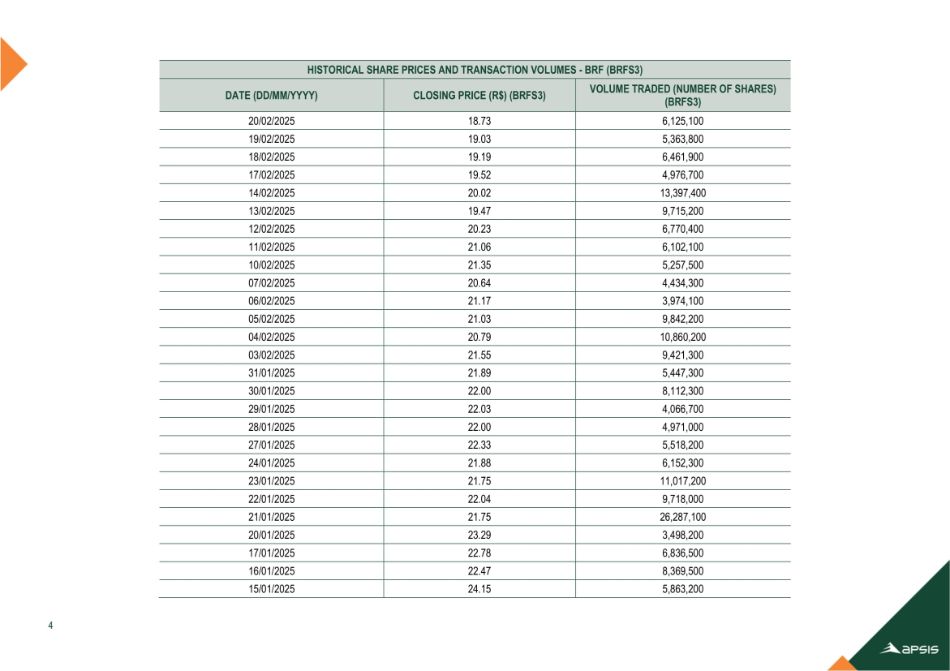

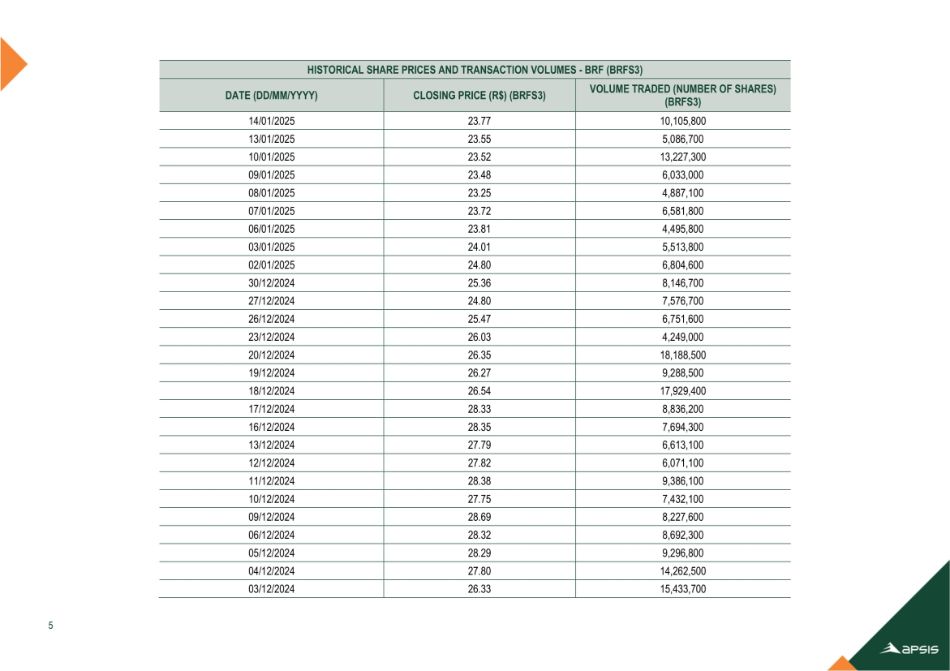

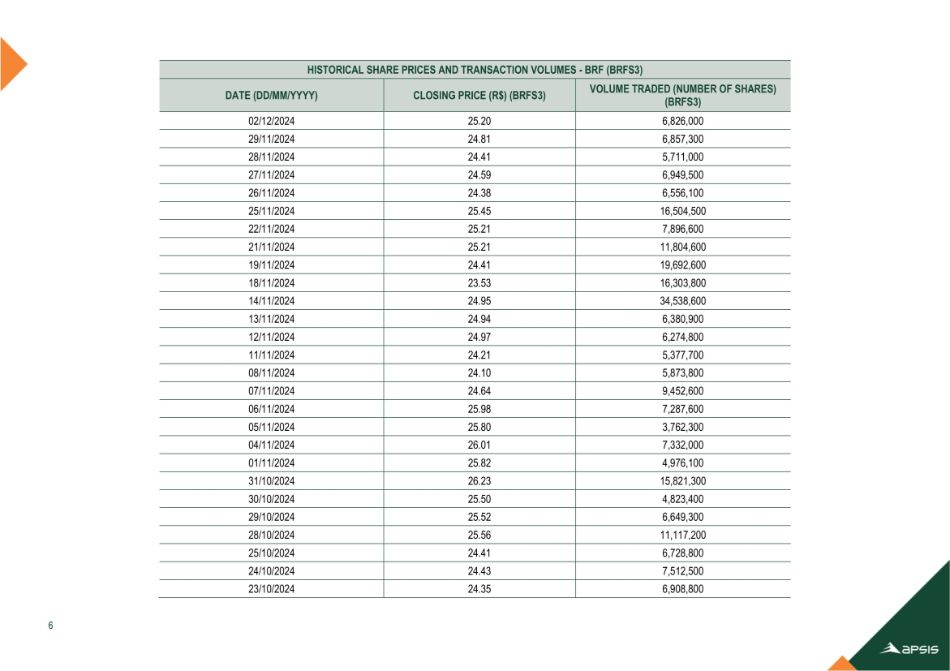

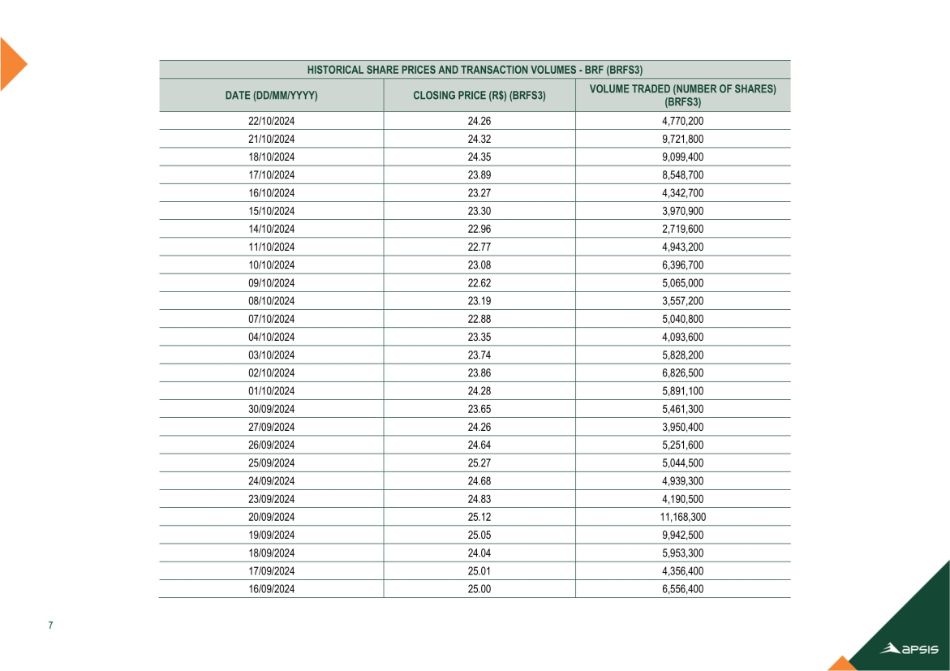

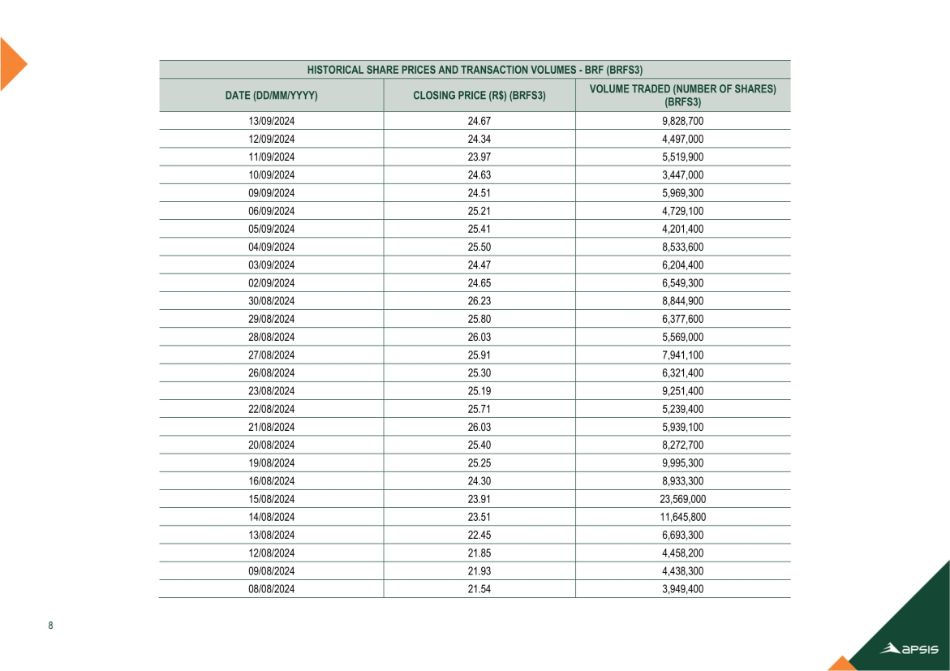

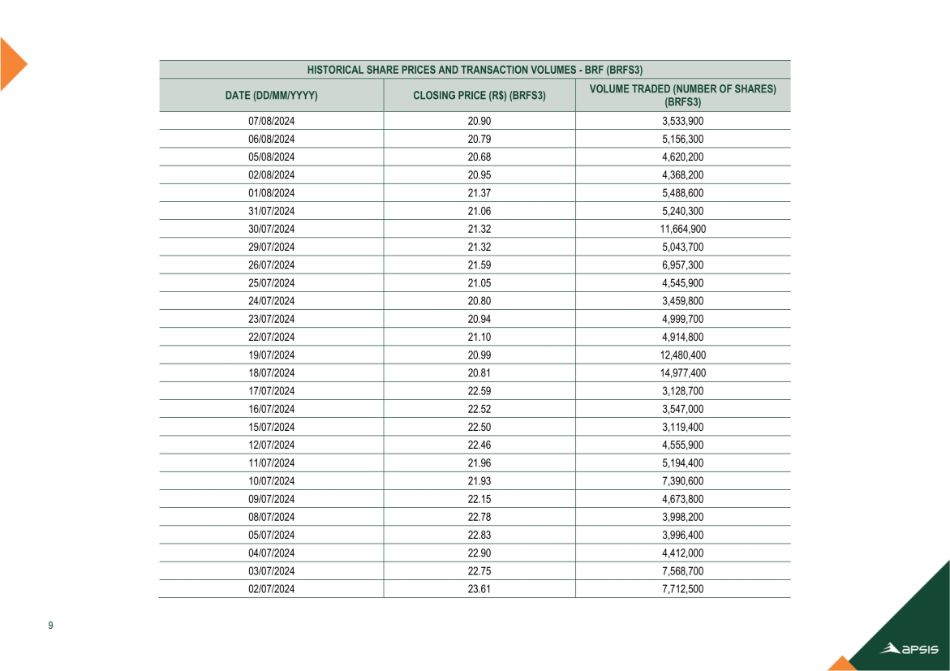

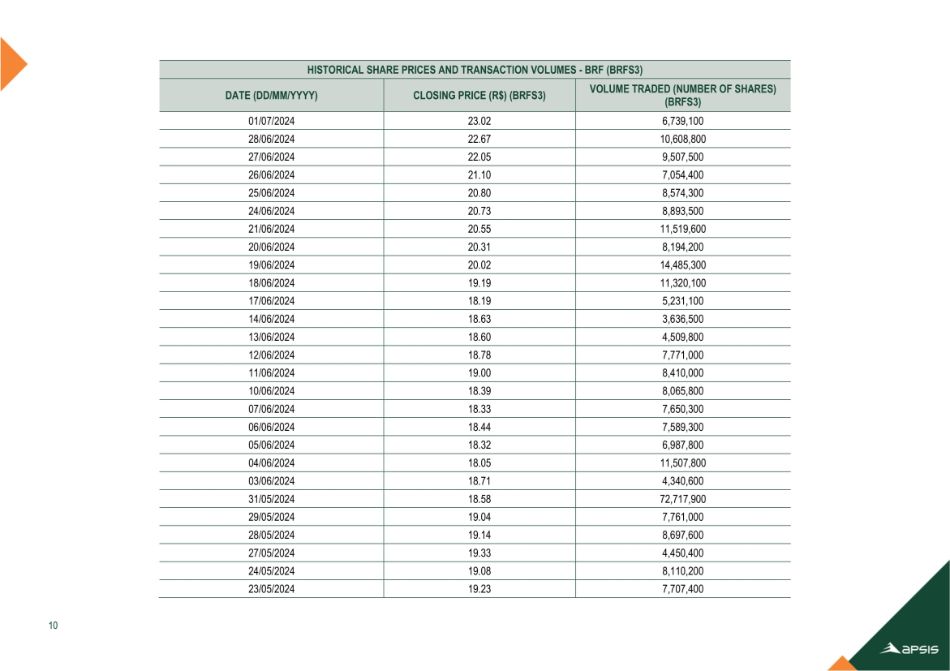

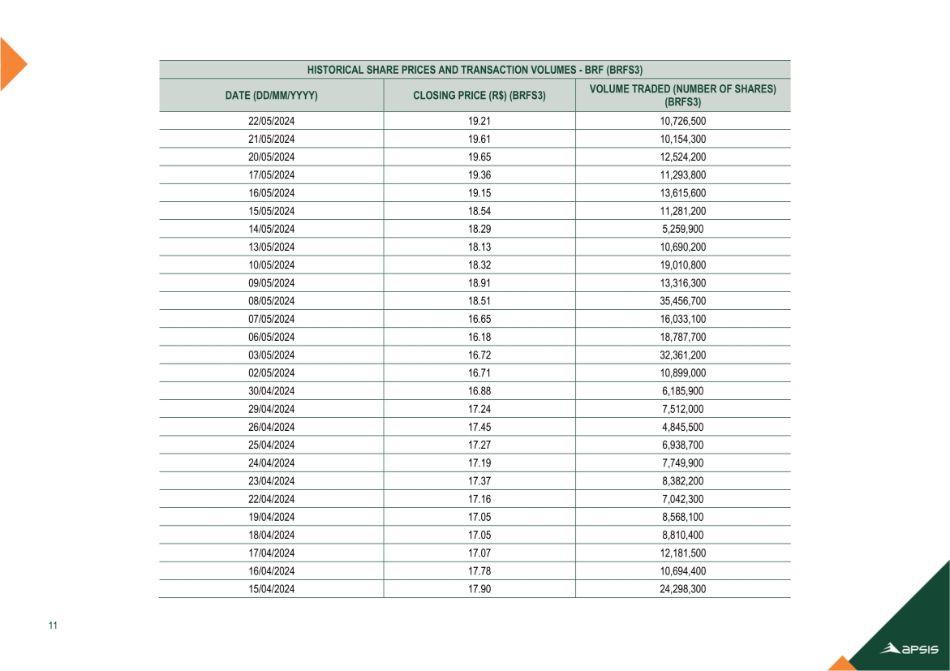

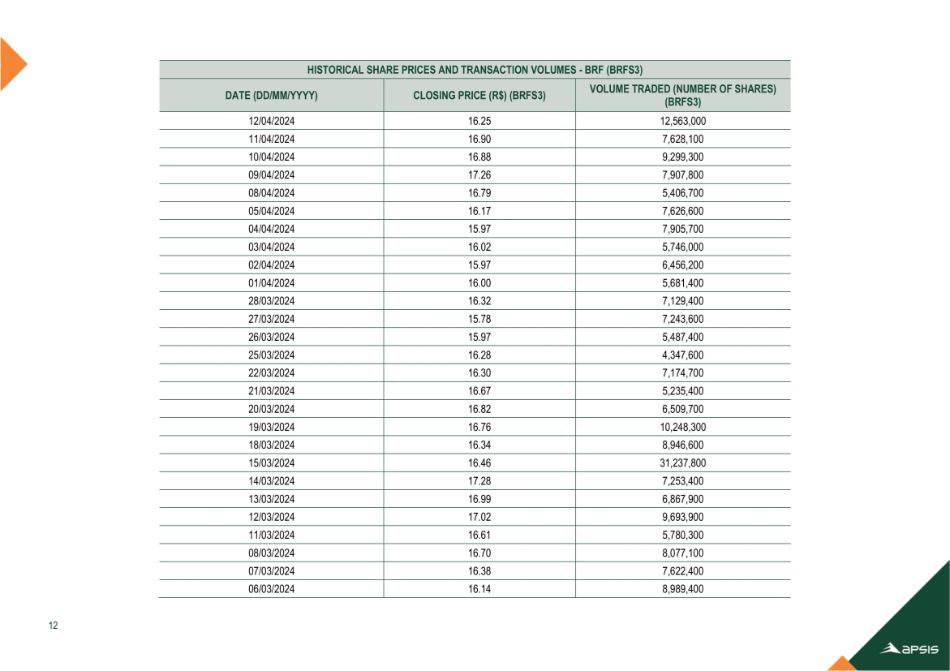

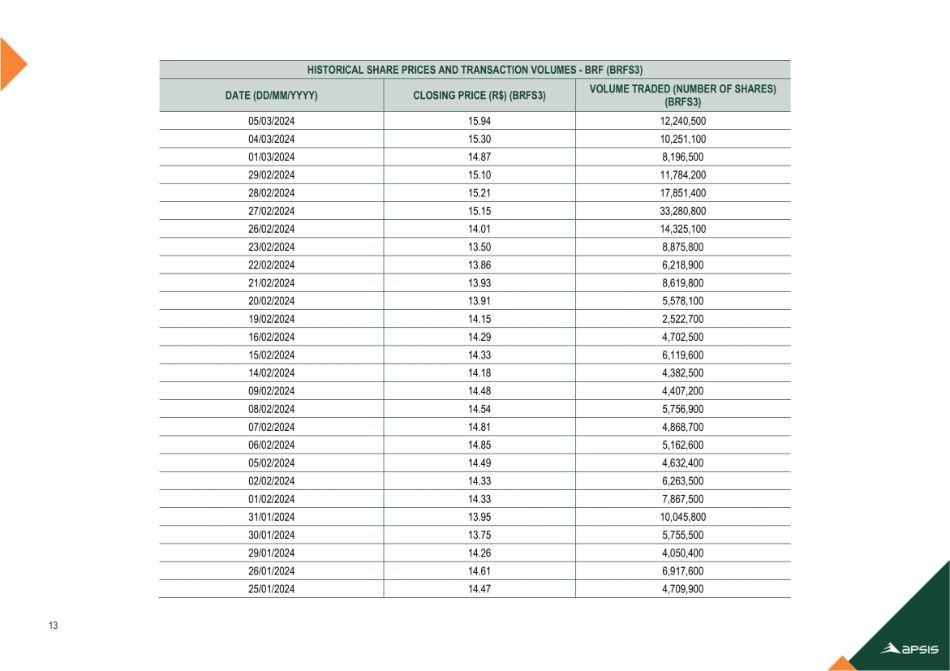

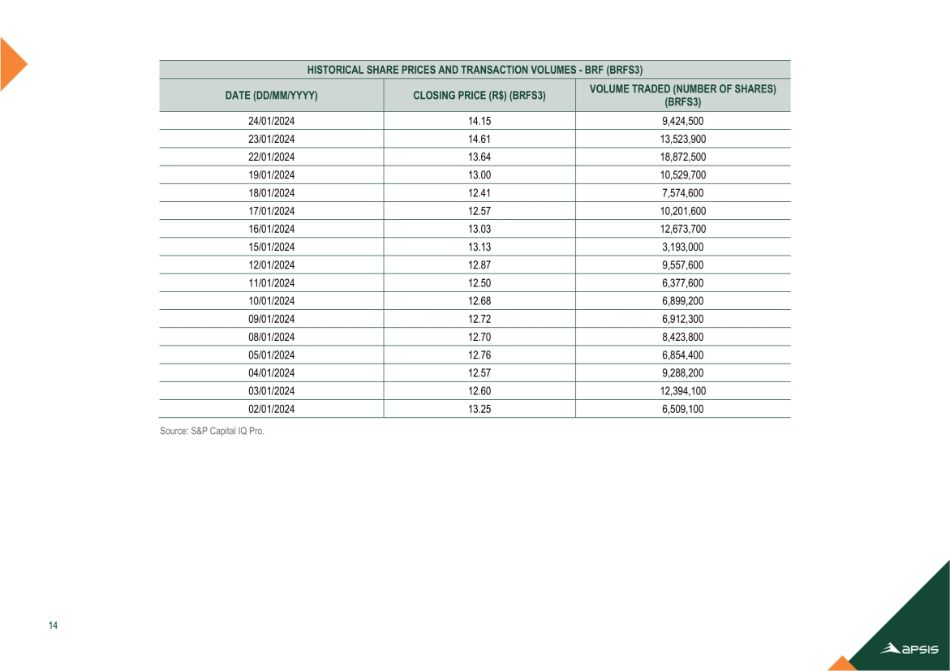

HISTORICAL SHARE PRICES AND TRANSACTION VOLUMES - BRF (BRFS3) The table below presents BRF’s historical share prices and trading volumes used in the valuation methodology based on the volume - weighted average price of the shares. BRF’s closing share prices were obtained from the S&P Capital IQ Pro database. 1

HISTORICAL SHARE PRICES AND TRANSACTION VOLUMES - BRF (BRFS3) VOLUME TRADED (NUMBER OF SHARES) (BRFS3) CLOSING PRICE (R$) (BRFS3) DATE (DD/MM/YYYY) 11,292,700 19.68 14/05/2025 9,697,700 20.20 13/05/2025 8,375,400 19.71 12/05/2025 8,776,600 19.20 09/05/2025 8,273,200 20.39 08/05/2025 5,170,300 20.26 07/05/2025 10,499,200 20.35 06/05/2025 7,519,600 21.44 05/05/2025 5,563,100 22.46 02/05/2025 5,622,100 22.70 30/04/2025 6,045,700 22.75 29/04/2025 8,697,100 22.70 28/04/2025 10,862,300 22.90 25/04/2025 8,688,100 22.01 24/04/2025 7,533,300 21.49 23/04/2025 9,934,200 21.78 22/04/2025 7,661,400 21.15 17/04/2025 9,147,900 20.68 16/04/2025 4,400,300 20.67 15/04/2025 5,401,600 20.41 14/04/2025 4,913,400 20.54 11/04/2025 5,048,800 20.35 10/04/2025 9,422,800 20.56 09/04/2025 4,992,500 19.06 08/04/2025 6,937,400 19.20 07/04/2025 7,681,300 19.25 04/04/2025 4,804,700 19.64 03/04/2025 2

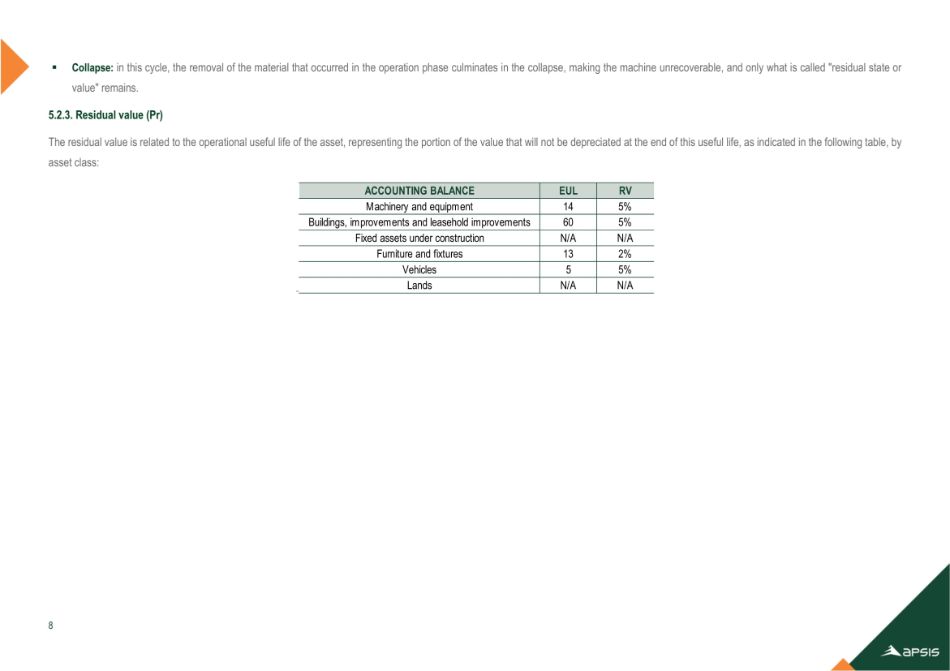

HISTORICAL SHARE PRICES AND TRANSACTION VOLUMES - BRF (BRFS3) VOLUME TRADED (NUMBER OF SHARES) (BRFS3) CLOSING PRICE (R$) (BRFS3) DATE (DD/MM/YYYY) 6,740,600 19.80 02/04/2025 6,581,100 20.14 01/04/2025 5,672,400 19.68 31/03/2025 6,184,600 19.71 28/03/2025 11,670,400 20.24 27/03/2025 5,613,100 19.72 26/03/2025 5,930,100 19.81 25/03/2025 4,771,600 19.42 24/03/2025 9,860,500 19.83 21/03/2025 9,504,900 19.82 20/03/2025 9,680,800 19.56 19/03/2025 10,726,200 19.64 18/03/2025 14,074,000 18.33 17/03/2025 8,474,800 18.11 14/03/2025 5,675,800 18.55 13/03/2025 7,296,900 19.09 12/03/2025 7,006,700 18.49 11/03/2025 5,548,600 18.88 10/03/2025 8,322,300 19.18 07/03/2025 10,560,500 18.50 06/03/2025 12,245,400 18.65 05/03/2025 14,580,500 17.93 28/02/2025 53,797,700 18.40 27/02/2025 9,129,500 19.01 26/02/2025 8,283,100 18.86 25/02/2025 5,179,400 18.70 24/02/2025 4,624,500 19.00 21/02/2025 3