UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _________________________

For the transition period from __________________ to_____________________________

Commission file number 001-42550

| Micropolis Holding Company |

| (Exact name of Registrant as specified in its charter) |

| N/A |

| (Translation of Registrant’s name into English) |

| Cayman Islands |

| (Jurisdiction of incorporation or organization) |

| Warehouse 1, Dar Alkhaleej Building |

| (Address of principal executive offices) |

| Fareed Aljawhari, Chief Executive Officer |

| (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class to be so registered | Name of each exchange on which each class is to be registered | |

| Ordinary shares, par value US$0.0001 per share | NYSE American LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

| None |

| (Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

| None |

| (Title of Class) |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 30,000,000 Ordinary Shares as of December 31, 2024.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer, “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Non-accelerated filer ☒ | |

| Accelerated filer ☐ | Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

TABLE OF CONTENTS

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

3.A. [Reserved]

3.B. Capitalization and Indebtedness

Not applicable.

3.C. Reasons for the Offer and Use of Proceeds

Not applicable.

3.D. Risk Factors

Risks Related to Our Business

Our Group does not have a long operating history as an integrated group.

Our Company was incorporated as a holding company on February 23, 2023. While the businesses of our subsidiary have been in operation since 2014, we do not have a long history of running an integrated group with standardized policies and procedures and on which our past performance may be judged. Given our limited operating history and the rapidly evolving market in which we compete, we may encounter operational, financial and other difficulties as we establish and expand our operations, product and service developments, sales and marketing, technology, and general and administrative capabilities.

There is substantial doubt as to whether we will continue operations. If we discontinue operations, you could lose your investment.

We are a pre-revenue organization since most of our existing projects are collaborative in nature and we do not anticipate earning substantial revenues until such time as we enter into commercial production for our robotics, which is expected to be by the second quarter of 2025. We were founded in 2014 and have a minimal operating history upon which an evaluation of our future success or failure can be made. We have suffered recurring losses from operations and have a significant accumulated deficit. In addition, we continue to experience negative cash flows from operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern and our auditors have issued a going concern opinion in their report included in this report.

We anticipate that we will incur increased expenses without realizing enough revenues. We therefore expect to incur losses in the foreseeable future. Our ability to achieve and maintain profitability and positive cash flow is dependent upon our ability to enter into commercial production for our robotics. We cannot guarantee that we will be successful in finding customers for our robotics and in generating revenues and profit in the future. Failure to generate revenues and profit will cause us to suspend or cease operations. If this happens, you could lose all or part of your investment.

Rapid advancements in robotics and AI technology can potentially outpace our current offerings. Failure to innovate could negatively affect our competitive edge.

The rapid pace of technological advancements in the robotics and AI industry presents a significant risk to the Company’s long-term success. As cutting-edge solutions emerge, there is a possibility that the Company’s current offerings may become outdated or less competitive. To mitigate this risk, the Company aims to allocate substantial resources to R&D, continuously monitor industry trends, and invest in exploring emerging technologies. Maintaining a culture of innovation and fostering collaborations with research institutions can help ensure the Company stays at the forefront of the evolving landscape. However, we cannot assure you that we will be able to continue to innovate, and failure to do so could negatively affect our competitive edge, lead to a loss in market share and adversely affect our business and financial results.

We operate in a regulatory environment that is subject to change, as governments adapt to the implications of robotics and AI. This can affect how we develop and implement our technologies, and non-compliance could lead to fines or reputational damage.

Operating in a dynamic regulatory environment exposes the company to compliance risks. Governments worldwide are grappling with the implications of robotics and AI, leading to evolving regulations and policies. Non-compliance with these changing rules could result in financial penalties and reputational damage. To address this risk, we aim to establish robust compliance procedures, closely monitor regulatory updates, and engage in constructive dialogues with regulatory authorities. All these efforts will lead to an increase in our cost of compliance and thus our operating cost, which may negatively affect our financial results.

We may continue to incur losses in the future.

For the years ended December 31, 2024 and 2023, we recorded net losses of $6.1 million and $3.2 million, respectively. We anticipate that our operating expenses, together with the increased general administrative expenses of a public company, will increase in the foreseeable future as we seek to maintain and continue to grow our business, attract potential customers, and further enhance our service offering. These efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenue sufficiently to offset these higher expenses. As a result of the foregoing and other factors, we may incur net losses in the future and may be unable to achieve or maintain sufficient cash flows or profitability on a quarterly or annual basis for the foreseeable future.

We must maintain sufficient funding for R&D, marketing, and other operational costs. Financial risk could arise from fluctuations in sales, increased costs, or economic downturns. Decisions to raise capital could affect existing shareholders, while opting for debt financing might increase our risk profile.

Our financial stability is subject to various factors that could impact our ability to meet operational expenses and invest in crucial areas like research and development. Fluctuations in sales due to changing market conditions or unforeseen events, increased costs, or economic downturns can strain our financial position. Moreover, increased costs, such as rising raw material prices or higher manufacturing expenses, could erode profit margins, potentially hindering the Company’s growth and expansion plans. Economic downturns can further exacerbate these challenges, constraining our ability to access capital and potentially leading to liquidity issues.

To maintain sufficient funding, we may seek diverse funding options, such as debt financing. Taking on debt could lead to an increase in our overall leverage, potentially resulting in higher interest payments and debt-related expenses. As a result, a significant portion of our earnings may be allocated to service our debt, limiting the funds available for dividend distributions or reinvestment in growth initiatives.

New competitors may enter the robotics industry with competing products and services, which could have a material and adverse effect on our business, results of operations and financial condition.

Our competitors could significantly impede our ability to expand our network and to reach consumers. Our competitors may also develop and market new technologies that render our existing or future products and services less competitive, unmarketable or obsolete. In addition, if competitors develop products or services with similar or superior functionality to our products and services, we may need to decrease the prices for our products and services to remain competitive or our products or services developed by us may be branded or generic, becoming obsolete before they are marketed or before we recover a significant portion of the development and commercialization expenses incurred with respect to these products. If we are unable to maintain our current pricing structure due to competitive pressures, our revenue may be reduced, and our operating results may be negatively affected. Some of our larger competitors may be better able to respond more quickly with new technologies and to undertake more extensive marketing or promotional campaigns. If we are unable to compete with these companies, the demand for our products and services could substantially decline.

Also, if any of our competitors were to merge or partner with another of our competitors, the change in the competitive landscape could materially and adversely affect our ability to compete effectively. Our competitors may also establish or strengthen cooperative relationships with our current or future suppliers, technology partners or other parties with whom we have relationships, thereby limiting our ability to develop, improve and promote our solutions. We may not be able to compete successfully against current or future competitors, and competitive pressures may materially and adversely affect our business, results of operations and financial condition.

Tariff wars and trade uncertainties could adversely affect our operations and financial performance.

Micropolis Holding Company, as a UAE-based robotics company, is exposed to risks arising from ongoing tariff wars and trade uncertainties that could materially impact our operations, financial condition, and results of operations. As of April 2025, tariff wars, particularly between the US and major trading partners, have escalated. On April 2, 2025, President Trump issued an Executive Order imposing a 10% customs duty on all goods imported into the US, effective April 5, 2025, with higher duties up to 50% on imports from specific countries. Tariffs on imported raw materials and components for our robotics, such as microchips, sensors, and mechanical parts, could increase costs for production. Tariffs on components from suppliers like China, subject to additional US tariffs, could disrupt supply chains, leading to delays in project completion and increased operational costs.

These higher costs may elevate production expenses, potentially reducing our profit margins. Furthermore, retaliatory tariffs or trade barriers imposed by other nations could limit our potential ability to compete effectively in key export markets, including the United States, leading to reduced sales volumes, pricing pressures, or the need to seek alternative markets, all of which could adversely affect our revenue and profitability. Additionally, trade-related volatility in commodity prices and foreign exchange rates, particularly affecting the UAE dirham, could complicate financial forecasting and lead to revenue instability. There can be no assurance that we can fully counteract the adverse effects of trade disruptions. The evolving nature of global tariff policies, including the potential for further escalation or broader economic downturns, could exacerbate these challenges and have a material adverse effect on our business, financial performance, and growth prospects.

We may not be able to conduct our marketing activities effectively, properly, or at reasonable costs, which will have an impact on our business operations.

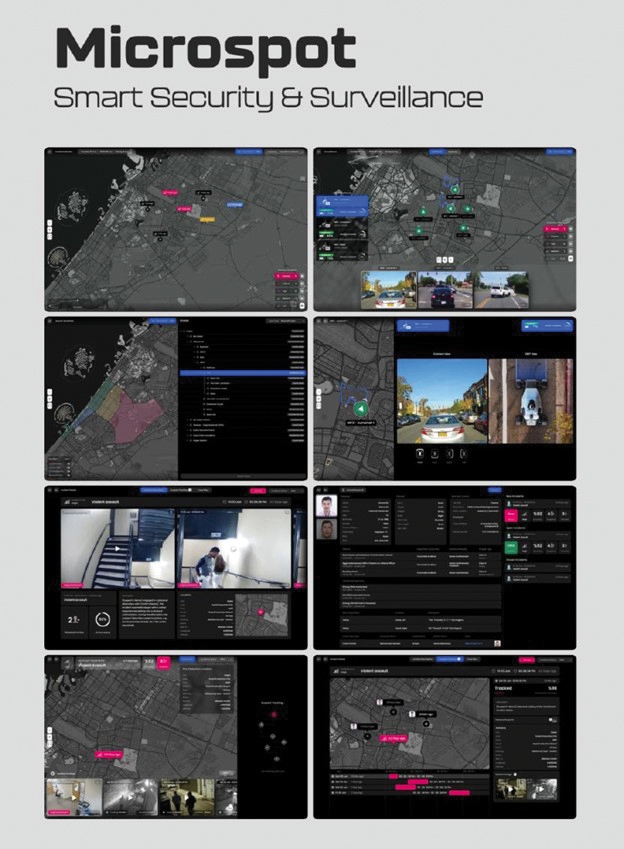

We invest resources in a variety of different marketing and brand promotion efforts designed to enhance our brand recognition and increase sales of our services and products. For the years ended December 31, 2024 and 2023, our marketing and promotion expenses were approximately $204,682 and $3,904, respectively, representing approximately 3.5% and 0.1% of our total expense, respectively. We leveraged relationship with our partners like Dubai Police to increase our brand awareness and showcased our products in various events throughout the period. Also we have active presence on various social media including Instagram, Facebook, LinkedIn, and YouTube.

We may not allocate significant resources to traditional marketing activities due to our focus on B2B communication and our established customer base. However, we recognize the importance of promoting our product to the public to increase awareness about its usability, benefits, and positive impact on people’s lives. Our marketing efforts will aim to educate and inform the public about our technology, ensuring that potential customers understand how our products can simplify and enhance their daily lives. By strategically targeting our promotional activities, we can maximize the effectiveness of our marketing efforts while maintaining reasonable costs.

While we seek to structure our promotional campaigns in the manner that we believe is most likely to encourage people to use our products and services, we may fail to identify advertising opportunities that satisfy our anticipated return on advertising spend as we scale our investments in marketing, accurately predict consumers’ acquisitions, or fully understand or estimate the conditions and behaviors that drive consumers’ behaviors. If for any reason any of our advertising campaigns prove less successful than anticipated in attracting new consumers, we may not be able to recover our advertising expense, and our rate of consumers acquisition may fail to meet market expectations, either of which could have an adverse effect on our business. There can be no assurance that our advertising and other marketing efforts will result in increased sales of our services and products.

Our business will be subject to risks associated with relying on a limited number of customers and suppliers.

Our business will be subject to risks associated with relying on a limited number of customers and suppliers. As we are a pre-revenue company, we did not have any customers until January 2023. Moreover, we develop major components of our robotics in-house. However, since our business is collaboration-based and each of our robotics is customized to meet our partners’ needs, we expect to have a limited number of customers and suppliers in the future once we start to generate substantial revenue. Given that our business will depend on a few customers and suppliers, any changes in the relationships with these future customers and suppliers, such as the loss of a major client or reduced orders, could significantly impact our financial stability and growth prospects. Similarly, a disruption in the supply chain, such as a supplier failing to deliver crucial components on time or of the required quality, could hamper our production schedule and impact product quality. This dependence on a limited pool may also expose us to risks from changes in market conditions, such as price fluctuations or supply shortages. Although we plan to continuously work towards diversifying our customer base and supplier network, maintaining high-quality service and products, and developing strong relationships with multiple reliable suppliers, unforeseen disruptions can still occur, and our business operations and financial conditions may be adversely affected.

Misappropriation or infringement of our intellectual property and proprietary rights, enforcement actions to protect our intellectual property and claims from third parties relating to intellectual property could materially and adversely affect our business, results of operations and financial condition.

Litigation regarding intellectual property rights is common in the technology industries. We expect that robotics technologies and software products and services may be increasingly subject to third-party infringement claims as the number of competitors in our industry segment grows and the functionality of products in different industry segments overlaps. Our ability to compete depends upon our proprietary technology. While we rely on intellectual property laws, confidentiality agreements and technical measures to protect our proprietary rights, we believe that the technical and creative skills of our personnel, continued development of our proprietary systems and technology and brand name recognition are essential in establishing a leadership position and strengthening our brands. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our services or to obtain and use information that we regard as proprietary. Policing unauthorized use of our proprietary rights is difficult and may be expensive. We can provide no assurance that the steps we take will prevent misappropriation of technology or that the agreements entered into for that purpose will be enforceable. Effective trademarks, service mark, patent, copyright and trade secret protection may not be available when we first introduce our products. In addition, if litigation becomes necessary to enforce or protect our intellectual property rights or to defend against claims of infringement or invalidity, such litigation, even if successful, could result in substantial costs and diversion of resources and management attention.

We also cannot provide any assurance that our products and services do not infringe on the intellectual property rights of third parties. Claims of infringement, even if unsuccessful, could result in substantial costs and diversion of resources and management attention. If unsuccessful, we may be subject to preliminary and permanent injunctive relief and monetary damages, which may be trebled in the case of willful infringements.

We do not exclusively own 100% of all intellectual property and technologies that we develop in the projects with our partners, which may adversely affect our ability to effectively utilize and monetize such intellectual property and technologies in our business operations.

One significant aspect of our business model involves partnering with various companies and government entities to develop customized robotics solutions for specific tasks. These collaborative projects often entail the joint development of intellectual property and related technologies. In certain cases, the collaboration agreements may stipulate that the ownership of such intellectual property and technologies will be shared between our partners and our Company. For example, in our partnership with Dubai Police for the development of self-driving cars, intellectual property used in the programs operating the self-driving cars is considered joint intellectual property; and in our partnership with QSS Robotics, QSS Robotics owns the intellectual property related to product design while we own patents or hardware design rights.

As a result of these arrangements, our Company does not exclusively own 100% of all intellectual property developed within such projects. This shared ownership of intellectual property and related technology could have implications on our ability to fully monetize or independently commercialize the developed intellectual property. It might also impact our control over the direction and application of the technology. Additionally, decisions regarding the use, licensing, or further development of these jointly owned intellectual property may require consensus with our partners, which could potentially lead to delays or differences in strategic priorities.

As a robotics company operating in a digital era, we face significant cybersecurity risks that could have adverse implications for our business, reputation and stakeholders.

Cybersecurity threats, such as data breaches, hacking attempts, and malware attacks, pose an imminent danger to the confidentiality, integrity and availability of our sensitive information and proprietary technologies. In particular, we have highlighted the following specific threats that may happen to us:

| ● | System intrusions: Although our operational and security systems operate behind our clients’ firewalls, they may still be exposed to potential cybersecurity threats. Intruders may seek to infiltrate these systems, disrupt operations, or access sensitive data. System vulnerabilities could be exploited if not adequately protected. |

| ● | Software vulnerabilities: Our integrated software in the robots and other products can also be a target for cyber threats. These threats can take many forms, from injecting malicious code to exploiting software vulnerabilities to disrupt robot functioning or compromise data integrity. |

| ● | Data privacy and protection: The data collected and processed by our products or software, whether personal or proprietary, is another potential cybersecurity risk. Unprotected or inadequately protected data can be a target for unauthorized access, misuse, or theft, leading to breaches of privacy and potential legal repercussions. |

| ● | Monitoring and control: Despite our robots’ fleets being monitored from an operations room 24/7, there is still a risk of undetected cyber threats. Sophisticated attackers could potentially bypass detection systems or operate in ways that appear normal to avoid raising alarms. |

| ● | Supply chain threats: Cybersecurity risks can also arise from the supply chain. If any of our suppliers or partners are compromised, it could potentially affect our systems or products. |

| ● | Advanced persistent threats: Given the critical nature of our operations, we could be targeted by advanced persistent threats. These are stealthy and continuous hacking processes orchestrated by individuals or groups targeting specific data or infrastructures. |

We employ a robust cybersecurity strategy that includes regular system updates and patches, stringent data protection protocols, sophisticated threat detection and response systems, and continuous cybersecurity awareness training for our employees. Our commitment to cybersecurity is unwavering, and we continually strive to stay ahead of potential threats to protect our operations, products, and the valuable data we handle. However, we cannot assure you that we can avert all cyber threats and a successful cyber-attack, or any other cyber security incident could result in the theft or unauthorized disclosure of our intellectual property, customer data, or confidential business information, which could disrupt our operations, and lead to financial losses, damage to our reputation and potential legal liabilities. The evolving nature of cyber threats poses an ongoing challenge to us. The emergence of new attack vectors and sophisticated hacking techniques demands continuous investment and training. Failure to keep up with these evolving threats expose us to greater risks.

We face the inherent risk of unproven market demand for our products and services.

As an early player in the robotics industry in the UAE, we face the inherent risk of unproven market demand for our products and services. The market for AMR solutions is relatively new and evolving, with limited historical data to accurately predict customer preferences and long-term adoption trends. The lack of a well-established market for AMR products in the UAE presents challenges in accurately assessing customer needs and preferences. The demand for AMR solutions may be influenced by factors such as the pace of technological advancements, customer awareness, regulatory developments, and economic conditions. A failure to accurately gauge market demand could lead to overproduction or misallocation of resources, resulting in potential financial losses and excess inventory.

As a robotics company, we are exposed to the risk of software malfunctions and design flaws in our AMR products.

Despite rigorous testing and quality assurance measures, the complexity of robotics software and the ever-evolving technology landscape can lead to unforeseen issues that may adversely impact our operations and reputation. Software malfunctions in AMR products could result in unexpected behavior, causing robots to deviate from intended paths, fail to perform critical tasks, or lead to collisions with objects or personnel. Such malfunctions may disrupt workflows, delay operations, and potentially lead to property damage or safety incidents. Any incident involving our robots could lead to reputational damage, customer dissatisfaction, and potential legal liabilities.

Design flaws in robotics software may lead to inefficiencies, suboptimal performance, or vulnerabilities that could be exploited by malicious actors. Security vulnerabilities in the software could expose sensitive customer data or proprietary information, leading to data breaches and potential regulatory non-compliance. A successful cyber-attack on our AMR products could compromise their functionalities and affect our customers’ trust in our technology. Furthermore, the introduction of new features or software updates may inadvertently introduce unforeseen issues or compatibility challenges with existing systems. Incompatibility or software conflicts could cause downtime, negatively impacting customer operations, and eroding trust in our products.

In the rapidly evolving robotics industry, unforeseen design flaws or software malfunctions may necessitate the recall or modification of our AMR products, leading to substantial financial and operational costs. Delays in addressing such issues could result in missed business opportunities, potential loss of market share, and decreased customer confidence.

We cannot assure you that we will be able to continue to successfully develop and launch new products, services or grow our complementary product or service offerings.

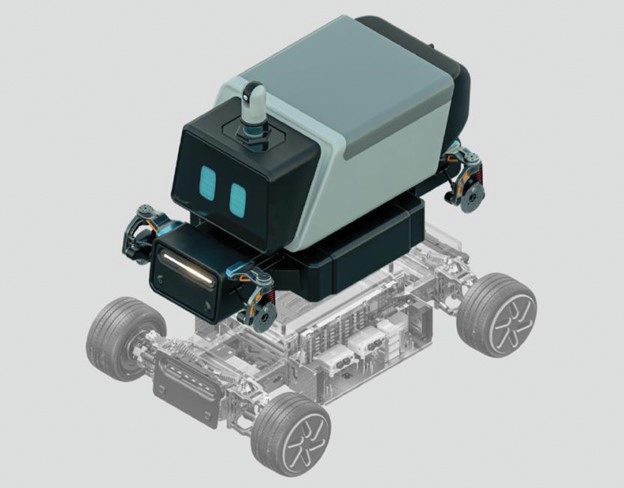

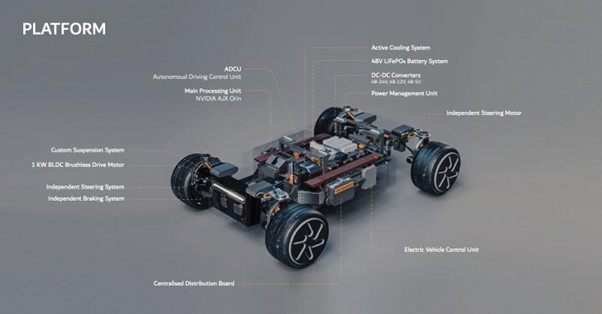

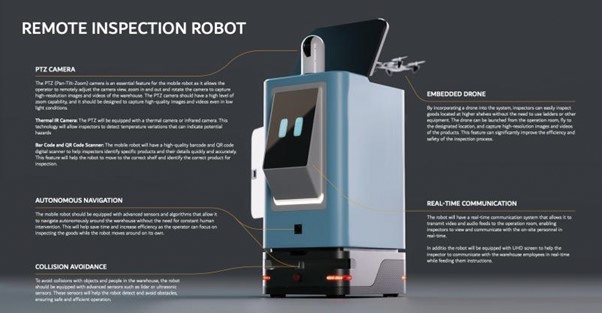

While our current focus is on developing two types of AMRs and the related software bundle to cater to specific customer needs, we cannot provide assurance that we will continue to successfully develop and launch new products.

Our future success will depend, in part, upon our ability to continue enhancing and improving the value of our products and services, with a focus on the development of electronic control units, mechanical systems, and autonomous driving systems for our AMRs. We believe that these advancements will further strengthen our offerings and contribute to our market competitiveness.

The development of our services and products is complex and costly, and we typically have several services and products development simultaneously. Given the complexity, we occasionally have experienced, and could experience in the future, delays in completing the development and introduction of new and enhanced services and products. Problems in the design or quality of our services or products may also have an adverse effect on our brand, business, financial condition, and operating results. Unanticipated problems in developing products and services could also divert substantial research and development resources, which may impair our ability to develop new services and products and enhancements of existing services and products and could substantially increase our costs. If we fail to continue to successfully launch new value-add products and services or to enter new, complementary markets successfully, or to do either of the foregoing in a cost-effective manner, our business, results of operations and financial condition may be materially and adversely affected.

Our business is dependent on keeping pace with advances in technology. If we are unable to keep pace with advances in technology, consumers may stop using our services and our revenues will decrease. If we are required to invest substantial amounts in technology, our business, results of operations and financial condition may be materially and adversely affected.

Our business relies on staying at the forefront of technological advancements. It is crucial for us to keep pace with these advances to maintain consumer trust in our products and services. Failure to do so may result in reduced consumer confidence, making it challenging to achieve our revenue projections, which could eventually lead to a decrease in our revenues. Furthermore, significant investments in technology may be necessary, and if such investments are required, they may have a material and adverse impact on our business, results of operations, and financial condition.

The robotics markets are characterized by rapid technological change, changes in user and customer requirements, frequent new service and product introductions embodying new technologies, including Level 4 autonomous system and advanced control units such as the EV main control unit that is built on an automotive grade microcontroller such as Nvidia AJX Orin, Infineon AURIX and STM ARM Cortex M7 alongside drive/steer/break-by-wire based platform, and the emergence of new industry standards and practices that could render our products, services, and technologies obsolete. These market characteristics are intensified by the emerging nature of the market and the fact that many companies are expected to introduce new Internet products and services in the near future. If we are unable to adapt to changing technologies, our business, results of operations and financial condition may be materially and adversely affected.

Recruiting and retaining talent in the highly specialized fields of AI and robotics is a challenge we face. The departure of key personnel could disrupt our operations and slow our pace of innovation.

Our success depends, in part, upon the continuing contributions of key employees, including our Chief Executive Officer Fareed Aljawhari, and our continuing ability to attract, develop, motivate and retain highly qualified and skilled personnel. The loss of the services of any of our key employees or the failure to attract or replace qualified personnel may have a material and adverse effect on our business.

The limited pool of experienced robotics and AI experts in the UAE can make it challenging to find suitable candidates with the required expertise to drive our research, development, and operational initiatives. Additionally, increased demand from various industries and emerging technology sectors may intensify the competition for qualified professionals, making talent acquisition a complex and resource-intensive process.

Retaining top talent is equally crucial, as our success heavily relies on the innovative contributions and knowledge of our skilled workforce. The talent retention risk is amplified by the emergence of international job opportunities and the potential for employees to seek higher compensation or career growth elsewhere. Losing key personnel may disrupt ongoing projects, slow down innovation, and negatively impact our competitive edge.

We may enter into strategic acquisitions, investments and partnerships which could pose various risks, increase our leverage, dilute existing shareholders and significantly impact our ability to expand our overall profitability.

We may enter into strategic acquisitions, investments, and partnerships; these carry inherent risks, including potential increased leverage and dilution of existing shareholders. Nevertheless, our steadfast commitment to maintaining profitability and sustaining a consistent growth trajectory guides our decision-making process in pursuing such opportunities.

Acquisitions involve inherent risks, such those relating to increased leverage and debt service requirements and post-acquisition integration challenges, which could have a material and adverse effect on our results of operations and/or cash flow and could strain our human resources. We may be unable to successfully implement effective cost controls or achieve expected synergies as a result of a future acquisition. Acquisitions may result in our assumption of unexpected liabilities and the diversion of management’s attention from the operation of our business. Acquisitions may also result in our having greater exposure to the industry risks of the businesses underlying the acquisition. Strategic investments and partnerships with other companies expose us to the risk that we may not be able to control the actions of our investees or partners, which could decrease the amount of benefits we realize from a particular relationship. We are also exposed to the risk that our partners in strategic investments and infrastructure may encounter financial difficulties that could lead to a disruption of investee or partnership activities, or an impairment of assets acquired, which could adversely affect future reported results of operations and shareholders’ equity. Acquisitions may subject us to new or different regulations or tax consequences which could have an adverse effect on our operations.

In addition, we may be unable to obtain the financing necessary to complete acquisitions on attractive terms or at all. If we raise additional funds through future issuances of equity or convertible debt securities, our existing shareholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of holders of our Ordinary Shares. Future equity financings would also decrease our earnings per share and the benefits derived by us from such new ventures or acquisitions might not outweigh or exceed their dilutive effect. Any additional debt financing we secure could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital or to pursue business opportunities. Realization of any of the foregoing risks associated with future strategic acquisitions, investments and partnerships could materially and adversely affect our business, results of operations and financial condition.

Industry consolidation may give our competitors an advantage over us, which could result in a loss of customers and/or a reduction of our revenue.

Some of our competitors have made or may make acquisitions or enter into partnerships or other strategic relationships in order to offer more comprehensive services or achieve greater economies of scale. In addition, new entrants who are not currently considered competitors may enter our market through acquisitions, partnerships or strategic relationships. Many potential entrants may have competitive advantages over us, such as greater name recognition, longer operating histories, more varied services, and larger marketing budgets, as well as greater financial, technical, and other resources. Industry consolidation may result in practices that make it more difficult for us to compete effectively, including on the basis of price, sales and marketing programs, technology or services functionality. These pressures could result in a reduction in our revenue.

As an emerging industry, the potential risks of industry consolidation remain uncertain for our company in the long term. While some competitors may pursue acquisitions, partnerships, or strategic relationships to enhance their services and gain economies of scale, it is unclear if these actions will pose a significant threat to our customer base and revenue. Moreover, new entrants may enter the market through similar means, leveraging their advantages such as brand recognition, operating experience, diverse services, larger marketing budgets, and greater financial and technical resources. Industry consolidation could introduce competitive practices that hinder our ability to effectively compete in terms of pricing, sales and marketing programs, technology, and service functionality, potentially impacting our revenue. However, the full extent of these pressures is yet to be determined.

Negative publicity relating to our Group or our Directors, Executive Officers or Major Shareholders may materially and adversely affect our reputation and Share price.

Negative publicity or announcements relating to our Group or any of our Directors, Executive Officers or Major Shareholders, whether with or without merit, may materially and adversely affect the reputation and goodwill of our Group in our industry, consequently affecting our relationships with our customers and car dealers. In addition, such negative publicity may affect market perception of our Group and the performance of our Share price.

Negative publicity or announcements may include, among others, newspaper reports of accidents at our workplaces, unsuccessful attempts in joint ventures, acquisitions or take-overs, any involvement we may have in litigation or insolvency proceedings, and unfavorable or negative articles on any of our Directors, Executive Officers or Major Shareholders. Any claims and legal actions brought forward by our customers may also have a negative impact on our brand image. If our customers, suppliers, or subcontractors subsequently lose confidence in us, this could result in the termination of business relationships or fewer referrals or invitations to tender or quote for facilities services or other contracts. To this end, our business, financial condition, results of operations and prospects may be adversely impacted.

We may be exposed to liabilities under applicable anti-corruption laws and any determination that we violated these laws could have a materially adverse effect on our business.

We are subject to various anti-corruption laws, including the UAE Federal Law No. 3 of 1987 referred to as Civil Service Law, that prohibit companies and their agents from making improper payments or offers of payments for the purpose of obtaining or retaining business. We may conduct business in countries and regions that are generally recognized as potentially more corrupt business environments. Activities in these countries create the risk of unauthorized payments or offers of payments by one of our employees or agents that could be in violation of various anti-corruption laws. We cannot provide assurance that our internal controls and compliance systems will always protect us from acts committed by our employees or agents. If our employees or agents violate our policies or we fail to maintain adequate record keeping and internal accounting practices to accurately record our transactions, we may be subject to regulatory sanctions. Violations of the Article 236 bis of the Penal Code or other anti-corruption laws, or allegations of any such acts, could damage our reputation and subject us to civil or criminal investigations in the United States and in other jurisdictions. Those and any related shareholder lawsuits could lead to substantial civil and criminal, monetary and nonmonetary penalties and cause us to incur significant legal and investigatory fees which could adversely affect our business, combined financial condition and results of operations.

Operating in the field of robotics and AI, we face risks associated with potential governmental and regulatory scrutiny.

Operating in the field of robotics and AI, we face risks associated with potential governmental and regulatory scrutiny. As these technologies evolve, so do the regulations governing their use, especially in the realm of data privacy. As our solutions involve collecting, processing, and storing data, we are subject to stringent data protection laws. These laws vary by jurisdiction, and non-compliance could lead to significant financial penalties, reputational damage, and operational disruptions. Additionally, new legislation or changes in current laws could impose further restrictions or requirements on our operations. This evolving regulatory landscape necessitates constant vigilance to ensure we remain compliant. We have implemented rigorous data handling and privacy protocols, and we continually monitor regulatory changes. However, the complexities of global data privacy regulations and the rapid pace of change in AI technology may still present challenges.

We operate in jurisdictions such as the UAE and GCC and potentially Europe and the USA, each with its own unique data protection laws and regulations. These laws govern how we can collect, use, and share data for developing and training our AI algorithms. The risk lies in the potential for existing and future legislation to restrict our ability to gather the necessary data, thus impacting our product development and optimization. For instance, stringent data privacy laws could limit the scope of data collection or impose rigorous consent requirements, slowing down our AI training process. Additionally, cross-border data transfer rules may hinder our ability to share data across our operations in different regions. As our flagship products rely heavily on real-time data analysis, any such restrictions could affect their performance and effectiveness. We are actively implementing comprehensive data governance frameworks, and continuously monitoring legal changes in our operating jurisdictions. However, unpredictability in regulatory changes and variations in global data privacy regulations present ongoing challenges to our operations.

We face various environmental risks inherent in our operations and product development.

Critical environmental risks we face lie in resource consumption, waste generation and disposal during the manufacturing and utilization of robotics products. One significant risk lies in the consumption of natural resources during the manufacturing and use of robotics products. High demand for components and materials may lead to resource depletion, increasing costs and causing supply chain disruptions. The overutilization of resources could also lead to environmental degradation and contribute to broader sustainability challenges. Another critical environmental risk involves the generation and disposal of electronic waste (“E-Waste”) from outdated or malfunctioning robots. Inadequate disposal practices can result in environmental pollution, leading to potential health hazards and ecological harm. Mishandling E-Waste may attract regulatory scrutiny and legal penalties, in addition to harming our reputation and brand image. Managing the product lifecycle effectively is vital to minimize environmental harm. Improper disposal of end-of-life robots can lead to environmental pollution, contribute to electronic waste accumulation, and perpetuate resource inefficiency. Such negative impacts may attract public scrutiny and erode stakeholder trust, potentially affecting investor confidence and market perception.

Risks Related to Doing Business in Certain Countries and Regions

Investments in emerging markets are subject to greater risks than those in more developed markets.

You should also be aware that investments in emerging markets, such as the GCC region, are subject to greater risks than those in more developed markets, including risks such as:

| ● | political, social and economic instability; |

| ● | exposure to local economic and social conditions, including cultural and communication challenges; |

| ● | exposure to local political conditions, including political disputes, requirements to expend a portion of funds locally, and government-imposed industrial cooperation requirements, as well as increased risks of fraud and political corruption; |

| ● | exposure to potentially undeveloped legal systems which make it difficult to enforce contractual rights and to potentially adverse changes in laws and regulatory practices, including licensing, approvals, grants, adjudications, and concessions, among others; |

| ● | war, terrorism, rebellion, coup, revolution or similar events; |

| ● | drought, famine, epidemics, pandemics and other complications due to natural or manmade disasters; |

| ● | governments’ actions or interventions, including tariffs, protectionism, subsidies, various forms of exchange controls, expropriation of assets and cancellation of contractual rights; |

| ● | boycotts and embargoes that may be imposed by the international community on countries in which we offer our mobile applications; |

| ● | ambiguities, uncertainties and changes in taxation, licensing and other laws and regulations; |

| ● | arbitrary or inconsistent government action, including capricious application of tax laws and selective tax audits; |

| ● | controls on the repatriation of profits and/or dividends, including the imposition or increase of withholding and other taxes on remittances and other payments by foreign subsidiaries; |

| ● | difficulties and delays in obtaining new permits, licenses and consents for business operations or renewing existing ones; |

| ● | difficulties or an inability to obtain legal remedies in a timely manner; |

| ● | compliance with a variety of US and other foreign laws, including (i) compliance (historical and future) with the requirements of applicable anti-bribery laws, including the UK Bribery Act 2010 and the US Foreign Corrupt Practices Act of 1977; and (ii) compliance (historical and future) with sanctions and export control provisions (including the US Export Administration Regulations) in several jurisdictions, including the European Union, the United Kingdom and the United States; and |

| ● | potential lack of reliability as to title to real property in certain jurisdictions. |

Although the GCC region has enjoyed significant economic growth over the last several years, there can be no assurance that such growth will continue. Moreover, while certain governments’ policies have generally resulted in improved economic performance, there can be no assurance that such a level of performance can be sustained.

Accordingly, you should exercise particular care in evaluating the risks involved and must decide whether, in the light of those risks, your investment is appropriate. Generally, investment in emerging markets is only suitable for sophisticated investors who fully appreciate the significance of the risks involved.

Investing in GCC markets, particularly in the technology sector, carries certain risks that should be taken into consideration. Some of the key risks include:

| 1. | Regulatory Environment: The regulatory landscape in GCC countries may vary, and changes in regulations or government policies can impact the investment climate. It is essential to stay updated on regulations related to foreign investments, technology transfers, intellectual property rights, and data privacy. |

| 2. | Economic and Political Stability: GCC markets are subject to geopolitical tensions and economic fluctuations. Political instability, regional conflicts, or changes in government policies can affect the business environment and investor confidence, however its evident that the local governments policies are focusing on their economic growth and avoiding political conflicts. |

| 3. | Market Maturity: While GCC markets are rapidly growing, the technology sector may still be in its early stages of development. The level of market maturity, infrastructure, and adoption rates for certain technologies can vary across different countries within the GCC region. |

| 4. | Competitive Landscape: The tech industry in the GCC region is becoming increasingly competitive, with local and international players vying for market share. Understanding the competitive landscape and differentiating your offering is crucial to succeed in this dynamic market. |

| 5. | Talent Availability: Finding skilled and experienced talent, particularly in specialized tech fields, can be a challenge in certain GCC countries. Assessing the availability of qualified professionals and building a strong team is vital for the success of tech investments, however the GCC countries have succeeded for decades to attract talents and competencies by offering high wages and unique lifestyle as well as wellbeing and comfort of life. |

| 6. | Cultural Considerations: Cultural norms and business practices in the GCC region may differ from other markets. Adapting to local customs, building relationships, and understanding the local business culture can contribute to successful investments, however the government of UAE and recently Saudi Arabia are adopting more western related culture to make it easier for expats with western cultures to adapt with the local culture. |

The economies of a number of our markets in the GCC region are highly dependent upon the oil and gas industry.

The UAE’s economy as well as a number of other economies within the GCC region are highly dependent upon the oil and gas industry. Oil and gas prices fluctuate in response to changes in many factors, including, but not limited to:

| ● | economic and political developments in oil producing regions; |

| ● | global and regional supply and demand, and expectations regarding future supply and demand, for oil and gas products; |

| ● | the ability of members of OPEC and other crude oil producing nations to agree upon and maintain specified global production levels and prices; |

| ● | the impact of international environmental regulations designed to reduce carbon emissions; |

| ● | actions taken by major crude oil and gas producing or consuming countries; |

| ● | prices and availability of alternative fuels; |

| ● | global economic and political conditions; |

| ● | development of new technologies; and |

| ● | global weather and environmental conditions. |

Oil prices declined significantly beginning in June 2014, and although prices have recovered in 2018, they have remained volatile with periodic declines since October 2018, including during the first quarter of 2020. If oil prices decline again, this is likely to have an adverse effect on the GDP and other economic indicators of oil producing markets, such as the UAE and Saudi Arabia, and may also negatively impact consumer confidence and purchasing power, resulting in lower overall expenditure by mobile users, which could have a material adverse effect on our business, financial condition and results of operations.

Our business may be adversely affected by changes in government policies, laws and regulations in the UAE.

Our operating subsidiary in the UAE, Micropolis Dubai, functions as our primary business operation center and engages in sales, customer service and other business operations. As such, our business may be adversely affected by changes in government policies, laws and regulations in the UAE.

On January 16, 2023, the Ministry of Finance introduced a 9% federal corporate tax regime for the first time in the UAE to be applied on the adjusted accounting net profits of a business above AED 375,000, which came into effect on 1 June 2023. Micropolis Dubai is not currently subject to corporate income tax in the UAE as its net profits do not currently meet the AED 375,000 threshold.

Moreover, value added tax, or VAT, was introduced in the UAE on January 1, 2018, at a rate of 5%. The relevant legislation provides that electronic services that are automatically delivered over the Internet, over an electronic network or over an electronic marketplace are not subject to VAT in the UAE, if such electronic services are used or enjoyed outside of the UAE. The introduction of VAT in the UAE has not had a material impact on our business. However, any further change in VAT in the UAE could increase the costs for users to purchase our virtual currencies and may reduce user spending as a result, which could adversely affect our revenue.

In addition, the AED, which is the legal currency of the UAE, has been pegged to the US dollar at 3.6725 AEDs per U.S. dollar since November 1997. However, there can be no assurance that the AED will not be de-pegged in the future or that the existing peg will not be adjusted in a manner that negatively impacts the level of economic activities in the UAE or negatively impacts the attractiveness of the UAE as a tourist destination, both of which are important factors that drive the level of payments by users from the UAE. Any such de-pegging or adjustment could have a material adverse effect on our business, financial condition, and results of operations.

The economic, political, and social conditions in the GCC region, as well as government policies, laws, and regulations, could affect our business, financial condition, and results of operations.

We are headquartered in the UAE. The GCC region is our key market, and we must comply with the applicable laws and regulations in the jurisdictions of the GCC region. The regulatory bodies in the GCC region may not be as fully matured and as established as those of Western Europe and the United States. Existing laws and regulations may be applied inconsistently with anomalies in their interpretation or implementation. Inconsistent interpretation or implementation in relation to existing laws and regulations could restrict our ability to offer our mobile platform in the relevant jurisdictions, which could materially and adversely affect our business, financial condition, and results of operations.

Our failure to obtain, maintain or renew licenses, approvals, permits, registrations, or filings necessary to conduct our operations could have a material adverse impact on our business, financial condition, and results of operations.

Regulatory authorities in various jurisdictions oversee different aspects of our business operations. We are required to obtain a number of licenses, approvals, permits, registrations, and filings and are subject to certain reporting obligations required for maintaining our subsidiary and personnel in such jurisdictions. We cannot assure you that we have obtained all of these licenses, approvals, permits, registrations, and filings or will continue to maintain or renew all of them or that we have complied with these requirements in full. If we fail to obtain necessary authorizations, we may be subject to various penalties, such as confiscation of illegal revenues, fines and discontinuation or restriction of business operations, which may materially and adversely affect our business, financial condition, and results of operations. In addition, there can be no assurance that we will be able to maintain our existing licenses, approvals, registrations or permits in the relevant jurisdictions, renew any of them when their current term expires, or update existing licenses or obtain additional licenses, approvals, permits, registrations, or filings necessary for our business expansion from time to time. If we fail to do so, our business, financial conditions and operational results may be materially and adversely affected.

Risks Related to Our Ordinary Shares

An active trading market for our Ordinary Shares may not develop and could affect the trading price of our Ordinary Shares.

Prior to the IPO, there has been no public market for our Ordinary Shares. Although our Ordinary Shares are listed on the NYSE American, there can be no assurance that there will be an active, liquid public market for our Ordinary Shares. The lack of an active market may impair your ability to sell your Ordinary Shares at the time you wish to sell them or at a price that you consider reasonable. The lack of an active market may also reduce the fair market value of your Ordinary Shares. An inactive market may also impair our ability to raise capital to continue to fund operations by selling Ordinary Shares and may impair our ability to acquire other companies or technologies by using our Ordinary Shares as consideration.

Our share price may fluctuate significantly in the future, and you may lose all or part of your investment, and litigation may be brought against us.

There is no assurance that the market price for our Ordinary Shares will not decline. Investors may not be able to sell their Ordinary Shares at or above the price at which they purchased the Ordinary Shares. The prices at which our Ordinary Shares will trade in the future may fluctuate significantly and rapidly as a result of, among others, the following factors, some of which are beyond our control:

| ● | variation in our results of operations; |

| ● | perceived prospects and future plans for our business and the general outlook of our industry; |

| ● | changes in securities analysts’ estimates of our results of operations and recommendations; |

| ● | announcements by us of significant contracts, acquisitions, strategic alliances or joint ventures or capital commitments; |

| ● | the valuation of publicly traded companies that are engaged in business activities similar to ours; |

| ● | additions or departures of key personnel; |

| ● | fluctuations in stock market prices and volume; |

| ● | involvement in litigation; |

| ● | general economic and stock market conditions; and |

| ● | discrepancies between our actual operating results and those expected by investors and securities analysts. |

There is no guarantee that our Ordinary Shares will appreciate in value in the future or even maintain the price at which you purchased the Ordinary Shares. You may not realize a return on your investment in our Ordinary Shares and you may even lose your entire investment in our Ordinary Shares.

In addition, the stock markets have from time-to-time experienced significant price and volume fluctuations that have affected the market prices of securities. These fluctuations often have been unrelated or disproportionate to the operating performance of publicly traded companies. In the past, following periods of volatility in the market price of a particular company’s securities, an investor may lose all or part of his or her investment, and litigation has sometimes been brought against that company. If similar litigation is instituted against us, it could result in substantial costs and divert our senior management’s attention and resources from our core business.

Our Ordinary Shares may trade under $5.00 per share and thus would be known as “penny stock”. Trading in penny stocks has certain restrictions and these restrictions could negatively affect the price and liquidity of our Ordinary Shares.

Our Ordinary Shares may trade below $5.00 per share. As a result, our Ordinary Shares would be known as “penny stock,” which is subject to various regulations involving disclosures to be given to you prior to the purchase of any penny stock. The SEC has adopted regulations which generally define a “penny stock” to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Depending on market fluctuations, our Ordinary Shares could be considered to be “penny stock.” A penny stock is subject to rules that impose additional sales practice requirements on broker/dealers who sell these securities to persons other than accredited investors. For transactions covered by these rules, the broker/dealer must make a special suitability determination for the purchase of these securities. In addition, a broker/dealer must receive the purchaser’s written consent to the transaction prior to the purchase and must also provide certain written disclosures to the purchaser. Consequently, the “penny stock” rules may restrict the ability of broker/dealers to sell our Ordinary Shares and may negatively affect the ability of holders of our Ordinary Shares to resell them. These disclosures require you to acknowledge that you understand the risks associated with buying penny stocks and that you can absorb the loss of your entire investment. Penny stocks generally do not have a very high trading volume. Consequently, the price of the shares is often volatile, and you may not be able to buy or sell your shares when you want to.

We may require additional funding in the form of equity or debt for our future growth which will cause dilution in Shareholders’ equity interest.

We may pursue opportunities to grow our business through joint ventures, strategic alliances, acquisitions, or investment opportunities, following the Offering. However, there can be no assurance that we will be able to obtain additional funding on terms that are acceptable to us or at all. If we are unable to do so, our future plans and growth may be adversely affected.

An issue of Ordinary Shares or other securities to raise funds will dilute Shareholders’ equity interests and may, in the case of a rights issue, require additional investments by Shareholders. Further, the issue of Ordinary Shares below the then prevailing market price will also affect the value of the Ordinary Shares then held by investors.

Dilution in Shareholders’ equity interests may occur even if the issue of shares is at a premium to the market price. In addition, any additional debt funding may restrict our freedom to operate our business as it may have conditions that:

| ● | limit our ability to pay dividends or require us to seek consents for the payment of dividends; |

| ● | increase our vulnerability to general adverse economic and industry conditions; |

| ● | require us to dedicate a portion of our cash flow from operations to repayments of our debt, thereby reducing the availability of our cash flow for capital expenditures, working capital and other general corporate purposes; and |

| ● | limit our flexibility in planning for, or reacting to, changes in our business and our industry. |

The volatility or uncertainty of the credit markets could limit our ability to borrow funds or cause our borrowings to be more expensive in the future. As such, we may be forced to pay unattractive interest rates, thereby increasing our interest expense, decreasing our profitability, and reducing our financial flexibility if we take on additional debt financing.

Investors may not be able to participate in future issues or certain other equity issues of our Ordinary Shares.

In the event that we issue new Ordinary Shares, we will be under no obligation to offer those Ordinary Shares to our existing Shareholders at the time of issue, except where we elect to conduct a rights issue. However, in electing to conduct a rights issue or certain other equity issues, we will have the discretion and may also be subject to certain regulations as to the procedures to be followed in making such rights available to Shareholders or in disposing of such rights for the benefit of such Shareholders and making the net proceeds available to them.

Accordingly, certain Shareholders may be unable to participate in future equity offerings by us and may experience dilution in their shareholdings as a result.

We currently do not expect to pay dividends in the foreseeable future and you must rely on price appreciation of our Ordinary Shares for return on your investment.

Subject to the Cayman Islands laws and our Amended and Restated Memorandum and Articles, our Board of Directors has complete discretion as to whether to distribute dividends. In addition, our Shareholders may by ordinary resolution declare a dividend, but no dividend may exceed the amount recommended by our Directors. Under Cayman Islands law, a Cayman Islands company may pay a dividend out of either profit or share premium account, provided that in no circumstances may a dividend be paid if this would result in the company being unable to pay its debts as they fall due in the ordinary course of business. Even if our Board of Directors decides to declare and pay dividends, the timing, amount and form of future dividends, if any, will depend on our future results of operations and cash flow, our capital requirements and surplus, the amount of distributions, if any, received by us from the operating entities, our financial condition, contractual restrictions and other factors deemed relevant by our Board of Directors. Any of these factors could have a material adverse effect on our business, financial position, and results of operations, and hence there is no assurance that we will be able to pay dividends to our Shareholders after the completion of the Offering. Accordingly, the return on your investment in our Ordinary Shares will likely depend entirely upon any future price appreciation of our Ordinary Shares. There is no guarantee that our Ordinary Shares will appreciate in value in the future or even maintain the price at which you purchased the Ordinary Shares. You may not realize a return on your investment in our Ordinary Shares and you may even lose your entire investment in our Ordinary Shares. We currently intend to retain all available funds and any future earnings to fund the development and growth of our business and to repay indebtedness and, therefore, we do not anticipate paying any cash dividends in the foreseeable future. As a result, we do not expect to pay any dividends in the foreseeable future. Therefore, you should not rely on an investment in our Ordinary Shares as a source for any future dividend income.

If we fail to meet applicable listing requirements, NYSE American may delist our Ordinary Shares from trading, in which case the liquidity and market price of our Ordinary Shares could decline.

We cannot assure you that we will be able to meet the continued listing standards of NYSE American in the future. If we fail to comply with the applicable listing standards and NYSE American delists our Ordinary Shares, we and our Shareholders could face significant material adverse consequences, including:

| ● | a limited availability of market quotations for our Ordinary Shares; |

| ● | reduced liquidity for our Ordinary Shares; |

| ● | a determination that our Ordinary Shares are “penny stock,” which would require brokers trading in our Ordinary Shares to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our Ordinary Shares; |

| ● | a limited amount of news about us and analyst coverage of us; and |

| ● | a decreased ability for us to issue additional equity securities or obtain additional equity or debt financing in the future. |

The National Securities Markets Improvement Act of 1996, which is a federal statute, prevents or pre-empts the states from regulating the sale of certain securities, which are referred to as “covered securities.” Because our Ordinary Shares will be listed on NYSE American, such securities will be covered securities. Although the states are pre-empted from regulating the sale of our securities, the federal statute does allow the states to investigate companies if there is a suspicion of fraud, and, if there is a finding of fraudulent activity, then the states can regulate or bar the sale of covered securities in a particular case. Further, if we were no longer listed on NYSE American, our securities would not be covered securities, and we would be subject to regulations in each state in which we offer our securities.

We will incur significant expenses and devote other significant resources and management time as a result of being a public company, which may negatively impact our financial performance and could cause our results of operations and financial condition to suffer.

We will incur significant legal, accounting, insurance, and other expenses as a result of being a public company. Laws, regulations, and standards relating to corporate governance and public disclosure for public companies, including the Dodd-Frank Act of 2010, the Sarbanes-Oxley Act, regulations related thereto and the rules and regulations of the SEC and NYSE American, will significantly increase our costs as well as the time that must be devoted to compliance matters. We expect that compliance with these laws, rules, regulations, and standards will substantially increase our expenses, including our legal and accounting costs, and make some of our operating activities costlier and more time-consuming. These new public company obligations also will require attention from our senior management and could divert their attention away from the day-to-day management of our business. We also expect these laws, rules, regulations, and standards to make it more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified people to serve on our Board of Directors or as officers. As a result of the foregoing, we expect a substantial increase in legal, accounting, insurance, and certain other expenses in the future, which will negatively impact our financial performance and could cause our results of operations and financial condition to suffer. Furthermore, if we are unable to satisfy our obligations as a public company, we could be subject to delisting of our Shares, fines, sanctions and other regulatory actions and potential civil litigation.

If we fail to maintain an effective system of disclosure controls and internal controls over financial reporting, our ability to produce accurate financial statements in time or comply with applicable regulations could be impaired.

The Sarbanes-Oxley Act requires, among other things, that we maintain effective internal disclosure controls and procedures over our financial reporting. We are continuing to develop and refine our disclosure controls and other procedures that are designed to ensure that information required to be disclosed by us in our reports that we will file with the SEC will be recorded, processed, summarized, and reported within the time periods and as otherwise specified in SEC rules, and that information required to be disclosed in reports under the Exchange Act is accumulated and communicated to our principal Executive Officers and financial officers. We are also continuing to improve our internal controls over financial reporting.

Ensuring that we have effective disclosure controls and procedures and internal controls over financial reporting in place so that we can produce accurate financial statements on a timely basis is a costly and time-consuming effort that will need to be re-evaluated frequently. Our internal control over financial reporting are a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with IFRS. Beginning with our second annual report on Form 20-F after we become a company whose securities are publicly listed in the United States, we will be required, pursuant to Section 404 of the Sarbanes-Oxley Act, to make a formal assessment of the effectiveness of our internal controls over financial reporting, and once we cease to be an emerging growth company, we will be required to include an attestation report on internal controls over financial reporting issued by our Independent Registered Public Accounting Firm. During our evaluation of our internal controls, if we identify one or more material weaknesses in our internal controls over financial reporting, we will be unable to assert that our internal controls over financial reporting are effective. We cannot assure you that there will not be material weaknesses or significant deficiencies in our internal controls over financial reporting in the future. Any failure to maintain internal controls over financial reporting could severely inhibit our ability to accurately report our financial condition, or results of operations.

We are an emerging growth company within the meaning of the Securities Act and may take advantage of certain reduced reporting requirements.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from requirements applicable to other public companies that are not emerging growth companies, including, most significantly, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act for so long as we remain an emerging growth company. As a result, if we elect not to comply with such auditor attestation requirements, our investors may not have access to certain information they may deem important.

The JOBS Act also provides that an emerging growth company does not need to comply with any new or revised financial accounting standards until such a date that a private company is otherwise required to comply with such new or revised accounting standards. The extended transition period provision only applies to companies preparing financial statements under U.S. GAAP. Because we prepare our financial statements in accordance with IFRS, we are unable to take advantage of the aforementioned provision. As a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required or permitted by the International Accounting Standards Board.

We qualify as a foreign private issuer and, as a result, we are not subject to U.S. proxy rules and are subject to Exchange Act reporting obligations that permit less detailed and less frequent reporting than that of a U.S. domestic public company.