UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _________________________

For the transition period from ___________ to ___________

Commission file number: 001-41813

TURBO ENERGY, S.A.

(Exact Name of Registrant as Specified in Its Charter)

Not Applicable

(Translation of Registrant’s Name Into English)

Kingdom of Spain

(Jurisdiction of Incorporation or Organization)

Street Isabel la Católica, 8, Door 51,

Valencia, Spain 46004

(Address of Principal Executive Offices)

Alejandro Moragues, CFO

+34 961 196 250

alejandromoragues@turbo-e.com

Street Isabel la Católica, 8, Door 51,

Valencia, Spain 46004

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange On Which Registered | ||

| One American Depositary Share represents five Ordinary Shares | TURB | The Nasdaq Stock Market LLC | ||

| Ordinary Share, par value five cents of euro (€0.05) per share * | * | * |

| * | Not for trading, but only in connection with the listing of the American Depositary Shares on The Nasdaq Stock Market LLC. The American Depositary Shares represent ordinary shares and are being registered under the Securities Act of 1933, as amended, pursuant to a separate Registration Statement on Form F-6. Accordingly, the American Depositary Shares are exempt from the operation of Section 12(a) of the Securities Exchange Act of 1934, as amended, pursuant to Rule 12a-8. |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report (December 31, 2024): There were 55,085,700 shares of the registrant’s ordinary shares outstanding, par value €0.05 per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company.

| Large Accelerated Filer ☐ | Accelerated Filer ☐ | Non-Accelerated Filer ☒ | Emerging growth company ☒ |

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Yes ☐ No ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Annual Report on Form 20-F

Year Ended December 31, 2024

TABLE OF CONTENTS

INTRODUCTORY NOTES

Use of Certain Defined Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

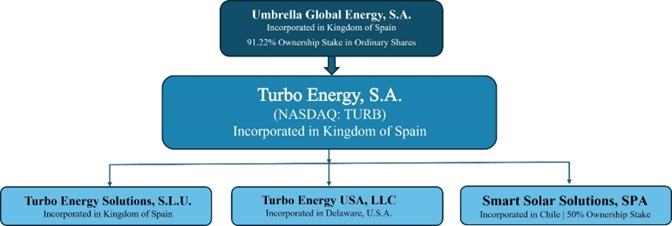

| ● | “we,” “us,” “the Company,” “our” or “our Company” are to the combined business of Turbo Energy, S.A. (named before Turbo Energy S.L.), a Spanish corporation, and its consolidated subsidiary; |

| ● | “Umbrella Global” is to Umbrella Global Energy, S.A. (which changed its name on March 1, 2022 from Umbrella Solar Investments S.A.), a company originally established under the laws of the Kingdom of Spain on May 22, 2020, our parent company. Mr. Enrique Selva Bellvis, our Chairman of the Board, owns 23.21% of the shares of Umbrella Global. Crocodile Investment owns 54% of the shares of Umbrella Global. Umbrella Global is a public company listed in Spain on BME Growth; |

| ● | “Turbo Energy Solutions” is to Turbo Energy Solutions S.L.U. (named before IM2 Proyecto 35 S.L.U), a company established under the laws of the Kingdom of Spain on August 1, 2019, our wholly owned subsidiary; |

| ● | “Crocodile Investment” is to Crocodile Investment, S.L.U., a company incorporated under the laws of the Kingdom of Spain on April 7, 2021. Crocodile Investment is Umbrella Energy’s 54% shareholder. Mr. Enrique Selva Bellvis, our Chairman of the Board, owns 100% of the shares of Crocodile Investment; |

| ● | “EUR euros”, “euros” and “€” are to the legal currency of the European Union; |

| ● | “U.S. dollars,” “dollars,” “USD,” “US$,” or “$” are to the legal currency of the United States. |

Forward-Looking Statements

In addition to historical information, this annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; and any statements regarding future economic conditions or performance, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements. Potential risks and uncertainties include, among other things, the possibility that third parties hold proprietary rights that preclude us from marketing our products, the emergence of additional competing technologies, changes in domestic and foreign laws, regulations and taxes, changes in economic conditions, uncertainties related to legal system and economic, political and social events in Spain, a general economic downturn, a downturn in the securities markets, and other risks and uncertainties which are generally set forth under Item 3 “Key information – D. Risk Factors” and elsewhere in this annual report.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation, except as required by law, to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

PART I.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable for annual reports on Form 20-F.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable for annual reports on Form 20-F.

ITEM 3. KEY INFORMATION

A. [RESERVED]

Not applicable.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable

D. Risk Factors

An investment in our ADSs involves a high degree of risk. The following risk factors describe circumstances or events that could have a negative effect on our business, financial condition or operating results. You should carefully consider the risks described below, together with all of the other information included in this annual report, before making an investment decision. If any of the following risks actually occur, our business, financial condition or results of operations could suffer. In that case, the trading price of our ADSs could decline, and you may lose all or part of your investment. Additional risks and uncertainties not currently known to us or that we currently believe are not material could also impair our business, financial condition or operating results. Some statements in this annual report, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section titled “Cautionary Statement Regarding Forward-Looking Statements.”

Summary of Risk Factors

Investing in our Company involves significant risks. These risks include the following:

| ● | Our products may experience quality problems from time to time that could result in negative publicity, litigation, product recalls and warranty claims, which could result in decreased revenues and harm to our brands. |

| ● | We expect to incur research and development costs and devote significant resources to developing new solar energy storage and management products, which could significantly reduce our profitability and may never result in revenue to the Company. |

| ● | Our success depends on our ability to develop new products and capabilities that respond to customer demand, industry trends or actions by our competitors and failure to do so may cause us to lose our competitiveness in the photovoltaic energy storage industry and may cause our profits to decline. |

| ● | We are dependent on a few customers for a significant amount of our net revenues. |

| ● | We depend on limited-source suppliers for key components and products. If we are unable to source these components and products on a timely basis, we will not be able to deliver our products to our customers. |

| ● | If we or our contract manufacturers are unable to obtain raw materials in a timely manner or if the price of raw materials increases significantly, production time and product costs could increase, which may adversely affect our business. |

| ● | The loss of, or events affecting, one of our major customers could reduce our sales and have an adverse effect on our business, financial condition and results of operations. |

| ● | We currently report our financial results under IFRS, which differs in certain significant respect from U.S. generally accepted accounting principles. |

| ● | We are a Spanish corporation, and it may be difficult to enforce judgments against us in U.S. domestic courts. |

| ● | We are dependent on information technology systems, infrastructure and data. We or third parties upon which we rely could be subject to breaches of our information technology systems caused by system security risks, failure of our data protection, cyberattacks and erroneous or non-malicious actions or failures to act by our employees or others with authorized access to our networks, which could cause significant reputational, legal and financial damages. |

| ● | The software we use in providing system configuration recommendations, potential energy savings estimates, weather forecasts and other data metrics to customers relies, in part, on third party information that may not be accurate, or up-to-date; this may therefore generate inaccurate recommendations or estimates, which could potentially harm our reputation and customer confidence. |

| ● | If we fail to protect, or incur significant costs in enforcing, our intellectual property and other proprietary rights, our business and results of operations could be negatively impacted. |

| ● | If we fail to retain our key personnel or if we fail to attract additional qualified personnel, we may not be able to achieve our anticipated level of growth and our business could suffer. |

| ● | Our planned expansion into existing and new markets could subject us to additional business, financial and competitive risks. |

| ● | If we do not forecast demand for our products accurately, we may experience product shortages, delays in product shipment or excess product inventory, any of which will adversely affect our business and financial condition. |

| ● | Changes in the United States trade environment, including the recent imposition of import tariffs, could adversely affect the amount or timing of our future revenue, results of operations or cash flows. |

| ● | Our international operations subject us to additional risks that could adversely affect our business, results of operations and financial condition. |

| ● | Changes in current laws or regulations or the imposition of new laws or regulations, or new interpretations thereof, in the solar energy sector, by federal or state agencies in the United States or foreign jurisdictions could impair our ability to compete, and could materially harm our business, financial condition and results of operations. |

| ● | The deposit agreement provides that any legal action may only be instituted in a state or federal court in the city of New York, which may result in holders of our ADSs or ordinary shares having limited choice of forum and limited ability to obtain a favorable judicial forum for complaints against us or our respective directors, officers or employees. |

| ● | The deposit agreement waives holders of our ADSs’ right to jury trial in any legal proceeding arising out of the deposit agreement or the ADRs against us and/or the depository, which could result in less favorable outcomes to the plaintiffs in any of such actions. |

| ● | The form of Representative’s Warrant provides that any legal action may only be instituted in a state or federal court in the city of New York, New York, which may result in holders of the Representative’s Warrant having limited choice of forum and limited ability to obtain a favorable judicial forum for complaints against us or our respective directors, officers or employees. |

| ● | We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies. |

| ● | Mr. Enrique Selva Bellvis, our Chairman of the Board, currently owns a majority of our outstanding ordinary shares. As a result, he has the ability to approve all matters submitted to our shareholders for approval. |

| ● | Future issuances of our ADSs or ordinary shares or securities convertible into, or exercisable or exchangeable for, our ordinary shares, or the expiration of lock-up agreements that restrict the issuance of new ADSs or ordinary shares or the trading of outstanding ADSs or ordinary shares, could cause the market price of our ADS to decline and would result in the dilution of your holdings. |

| ● | We have broad discretion in the use of our cash and cash equivalents, including the net proceeds we received in our initial public offering, and may not use them effectively. |

| ● | Holders of ADSs are not treated as holders of our ordinary shares. |

Risks Relating to Our Business and Industry

Our solar energy storage products may experience quality problems from time to time that could result in negative publicity, litigation, product recalls and warranty claims, which could result in decreased revenues and harm to our brands.

A catastrophic failure of our products could cause personal or property damages for which we would be potentially liable. Damage to or the failure of our products to perform to customer specifications could result in unexpected warranty expenses or result in a product recall, which would be time consuming and expensive. Any product recall in the future, whether it involves our or a competitor’s product, may result in negative publicity, damage our brand and materially and adversely affect our business, financial condition and results of operations. In the future, we may voluntarily or involuntarily initiate a recall if any of our products are proven to be or possibly could be defective or noncompliant with applicable environmental laws and regulations, including health and safety standards. Such recalls involve significant expense and diversion of management attention and other resources, which could adversely affect our brand image, as well as our business, financial condition and operating results.

Our solution, by making use of energy monitoring and management software, is susceptible to cyberattacks that could cause the management system to malfunction or even stop, without preventing the photovoltaic generation of the installation.

We may be subject to product liability claims.

If one of our products were to cause injury to someone or cause property damage, including as a result of product malfunctions, defects, or improper installation, then we could be exposed to product liability claims. We could incur significant costs and liabilities if we are sued and if damages are awarded against us. Further, any product liability claim we face could be expensive to defend and could divert management’s attention. The successful assertion of a product liability claim against us could result in potentially significant monetary damages, penalties or fines, subject us to adverse publicity, damage our reputation and competitive position, and adversely affect sales of our products. In addition, product liability claims, injuries, defects, or other problems experienced by other companies in similar industry could lead to unfavorable market conditions for the industry as a whole and may have an adverse effect on our ability to attract new customers, thus harming our growth and financial performance.

We expect to incur research and development costs and devote significant resources to developing new products, which could significantly reduce our profitability and may never result in revenue to the Company.

Our future growth depends on penetrating new markets, adapting existing products to new applications and customer requirements, and introducing new products that achieve market acceptance. We plan to incur significant research and development costs in the future as part of our efforts to design, develop, manufacture and introduce new products and enhance existing products. Our research and development expenses were €361,333 (approximately US$374,016) and €361,420 during the fiscal year ended December 31, 2024 and 2023 and are likely to grow in the future. Further, our research and development program may not produce successful results, and our new products may not achieve market acceptance, create additional revenue or become profitable.

The research and development of new products and technologies is costly and time consuming, and there are no assurances that our research and development of new products will be either successful or completed within anticipated timeframes, if at all. Our failure to technologically evolve and/or develop new or enhanced products may cause us to lose competitiveness in the renewable energy storage market. In addition, in order to compete effectively in the renewable energy storage industry, we must be able to launch new products to meet our customers’ demands in a timely manner. However, we cannot provide assurance that we will be able to install and certify any equipment needed to produce new products in a timely manner, or that the transitioning of our manufacturing facility and resources to full production under any new product programs will not impact production rates or other operational efficiency measures at our manufacturing facility. In addition, new product introductions and applications are risky, and may suffer from a lack of market acceptance, delays in related product development and failure of new products to operate properly. Any failure by us to successfully launch new products, or a failure by our customers to accept such products, could adversely affect our results.

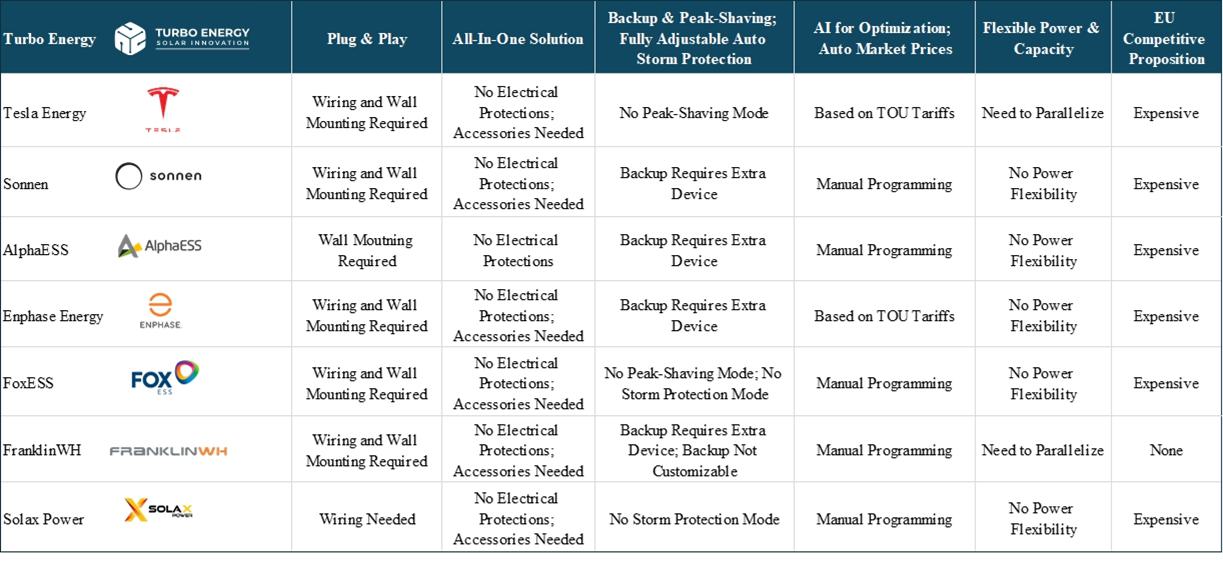

The energy storage markets in which we operate are in their infancy and highly competitive, and we may not be successful in competing in these markets as the industry further develops. We currently face competition from new and established competitors in the global regions we serve and expect to face competition from others in the future, including competition from companies with new technology.

The worldwide energy storage market is in its infancy, and we expect it will become more competitive in the future. We also expect more regulatory burden as customers adopt this new technology. There is no assurance that our energy storage solutions will be successful in the respective markets in which they compete. A significant and growing number of established and new companies, as well as other companies, have entered or are reported to have plans to enter the energy storage market. Most of our current and potential competitors have significantly greater financial, technical, manufacturing, marketing, sales networks and other resources than we do and may be able to devote greater resources to the design, development, manufacturing, distribution, promotion, sale and support of their products. Increased competition could result in lower unit sales, price reductions, revenue shortfalls, loss of customers and loss of market share, which could harm our business, prospects, financial condition and operating results. The energy storage industry is highly competitive.

We face competition from other manufacturers, developers and installers of energy storage systems, as well as from large utilities. Decreases in the retail prices of electricity from utilities or other renewable energy sources could make our products less attractive to customers.

Events that negatively impact the growth of renewable energy will have a negative impact on our business and financial condition.

The growth and profitability of our business is dependent upon the future growth of renewable energy, such as wind and solar. The growth of renewable energy and an increase in the number of renewable energy projects are dependent upon a number of factors, including governmental policies offering incentives that encourage the building of renewable energy projects and offset the cost of alternative energy sources, including new technologies. Any events or change in the regulatory framework or electricity energy market that negatively impact the growth and development of renewable energy, particularly wind and solar energy, will have a negative impact on our business and financial condition.

The solar industry is an evolving industry that has experienced substantial changes over the years, and we cannot be certain that consumers and businesses will adopt solar PV systems as an alternative energy source at levels sufficient to continue to grow our solar energy storage business. Traditional electricity distribution is based on the regulated industry model under which businesses and consumers obtain their electricity from a government regulated utility. For alternative methods of distributed power to succeed, businesses and consumers must adopt new purchasing practices. The viability and continued growth in demand for solar energy solutions and energy storage systems and, in turn, our products, may be impacted by many factors outside of our control, including:

| ● | market acceptance of solar energy storage systems based on our product platform; |

| ● | availability and amount of government subsidies and incentives to support the development and deployment of solar energy solutions; |

| ● | cost competitiveness, reliability and performance of solar energy storage systems compared to conventional and non-solar renewable energy sources and products; |

| ● | our ability to timely introduce and complete new designs and timely qualify and certify our products; |

| ● | the extent to which the electric power industry and broader energy industries are deregulated to permit broader adoption of solar electricity generation and storage; |

| ● | the cost and availability of key raw materials and components used in the production of solar energy systems; |

| ● | prices of traditional utility-provided energy sources; |

| ● | whether solar system installers, system owners and solar financing providers will adopt our energy storage solutions; |

| ● | levels of investment by end-users of solar energy products, which tend to decrease when economic growth slows; and |

| ● | the emergence, continuance or success of, or increased government support for, other alternative energy generation technologies and products. |

If demand for solar energy solutions does not grow, demand for our products from residential homeowners, commercial businesses and utilities will decrease, which would have an adverse impact on our ability to increase our revenue and grow our business. Further, our success depends on continued demand for solar energy solutions and the ability of solar equipment vendors to meet this demand. Supply chain disruptions, increased interest rates and higher inflation, have caused and may continue to cause various negative effects, including an inability to meet the needs of our existing or potential end customers. If demand for solar energy solutions decreases or does not grow, demand for our products will decrease, which would have an adverse impact on our ability to increase our revenue and grow our business.

Increased scrutiny from stakeholders and regulators regarding ESG practices and disclosures, including those related to sustainability, and disclosure could result in additional costs and adversely impact our business and reputation.

Companies across all industries are facing increased scrutiny regarding their ESG practices and disclosures and institutional and individual investors are increasingly using ESG screening criteria in making investment decisions. Our disclosures on these matters or a failure to satisfy evolving stakeholder expectations for ESG practices and reporting, which may conflict with one another, may potentially harm our reputation and impact employee retention, customer relationships and access to capital. For example, certain market participants use third-party benchmarks or scores to measure a company’s ESG practices in making investment decisions and customers and suppliers may evaluate our ESG practices or require that we adopt certain ESG policies as a condition of purchasing our products or services. In addition, our failure or perceived failure to pursue or fulfill our goals, targets and objectives or to satisfy various reporting standards within the timelines we announce, or at all, could expose us to government enforcement actions and private litigation. Furthermore, complying or failing to comply with existing or future federal, state, local, and foreign legislation and regulations applicable to ESG practices, which may conflict with one another, could cause us to incur additional compliance and operational costs or actions and suffer reputational harm, which could materially and adversely affect our business, financial condition and results of operations.

Our ability to achieve any goal or objective, including with respect to environmental and diversity initiatives and compliance with ESG reporting standards, is subject to numerous risks, many of which are outside of our control. Examples of such risks include the availability and cost of technologies and products that meet sustainability and ethical supply chain standards, evolving regulatory requirements affecting ESG standards or disclosures, our ability to recruit, develop and retain diverse talent in our labor markets, and our ability to develop reporting processes and controls that comply with evolving standards for identifying, measuring and reporting ESG metrics. Methodologies for reporting ESG data may be updated and previously reported ESG data may be adjusted to reflect improvement in availability and quality of third-party data, changes in assumptions, changes in the nature and scope of our operations and other changes in circumstances. Our processes and controls for reporting ESG matters across our operations and supply chain are evolving along with multiple disparate standards for identifying, measuring and reporting ESG metrics, including ESG-related disclosures that may be required by the SEC, European and other regulators, and such standards may change over time, which could result in significant revisions to our current goals, reported progress in achieving such goals, or ability to achieve such goals in the future. As ESG best-practices, reporting standards and disclosure requirements continue to develop, we may incur increasing costs related to ESG monitoring and reporting.

If the estimates and assumptions we use to determine the size of our total addressable market are inaccurate, our future growth rate may be affected and the potential growth of our business may be limited.

Market estimates and growth forecasts are subject to significant uncertainty and are based on assumptions and estimates that may prove to be inaccurate. Even if the market in which we compete meets our size estimates and forecasted growth, our business could fail to grow at similar rates, if at all. Our market opportunity is also based on the assumption that our existing and future offerings will be more attractive to our customers and potential customers than competing products and services. If these assumptions prove inaccurate, our business, financial condition and results of operations could be adversely affected.

We have a history of losses and may not be able to achieve or sustain profitability in the future.

We have a history of incurring net losses and we may not achieve or maintain profitability in the future. Our net loss for the years ended December 31, 2024 and 2023 totaled €3,337,000 (approximately US$3,454,130) and €2,013,788, respectively. We cannot predict when or whether we will reach or maintain profitability.

We are dependent on a few customers for a significant amount of our net revenues.

Historically a significant amount of our product sales has been generated from a small number of customers. For example, our top 10 customers, on an aggregate basis, accounted for approximately €4,391,090 (approximately $4,242,189) in revenue or 44.9% of our total revenue for the fiscal year ended December 31, 2024. For the fiscal year ended December 31, 2023, revenues from our top 10 customers accounted for approximately €5,004,061, or 35.9% of our total revenue.

There are inherent risks whenever a large percentage of total revenues are concentrated with a limited number of customers. It is not possible for us to predict the future level of demand for our services that will be generated by these customers. In addition, revenues from these larger customers may fluctuate from time to time based on the commencement and completion of projects, the timing of which may be affected by market conditions or other facts, some of which may be outside of our control. If any of these customers experience declining or delayed sales due to market, economic or competitive conditions, we could be pressured to reduce the prices we charge for our services and products, which could have an adverse effect on our margins and financial position and could negatively affect our revenues and results of operations and/or trading price of our ADSs. If any of these large customers terminates our services, such termination would negatively affect our revenues and results of operations and/or trading price of our ordinary shares. There is no assurance that we will be successful in our efforts to convince customers to accept our products. Our failure to sell our products could have a material adverse effect on our financial condition and results of operations.

For most of our sales and customers, we do not have long-term contracts. Future agreements with respect to pricing, returns, promotions, among other things, are subject to periodic negotiation with such customers. No assurance can be given that our customers will continue to do business with us. The loss of any of our significant customers will have a material adverse effect on our business, results of operations, financial condition and liquidity. In addition, the uncertainty of product orders can make it difficult to forecast our sales and allocate our resources in a manner consistent with actual sales, and our expense levels are based in part on our expectations of future sales. If our expectations regarding future sales are inaccurate, we may be unable to reduce costs in a timely manner to adjust for sales shortfalls.

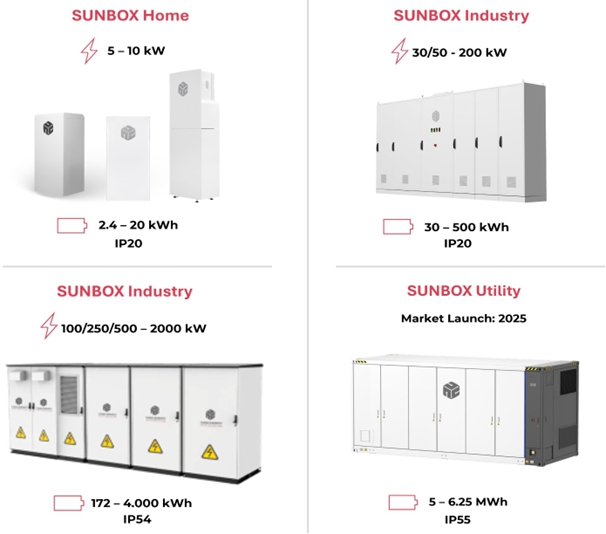

Real or perceived hazards associated with Lithium-ion battery technology may affect demand for our products.

Press reports have highlighted situations in which lithium-ion batteries have caught fire or exploded. For instance, in 2020, LG Chem recalled several residential solar battery storage products because of concerns about fire safety. Five fires involving these battery systems have been reported, including an explosion at an energy storage facility in Arizona that caused several injuries. Such publicity has resulted in a public perception that lithium-ion batteries are dangerous and unpredictable. Although we believe that the battery packs installed in our SUNBOX energy storage systems are safe, these perceived hazards may result in customer reluctance to adopt our SUNBOX energy storage solutions.

Economic conditions may adversely affect consumer spending and the overall general economic health of our retail customers, which, in turn, may adversely affect our financial condition, results of operations and cash resources.

Uncertainty about the existing and future global economic conditions may cause our customers to defer purchases or cancel purchase orders for our products in response to tighter credit, decreased cash availability and weakened consumer confidence. Our financial success is sensitive to changes in general economic conditions both on a global and regional basis. Recessionary economic cycles, higher interest borrowing rates, higher fuel and other energy costs, inflation, increases in commodity prices, higher levels of unemployment, higher consumer debt levels, higher tax rates and other changes in tax laws or other economic factors that may affect consumer spending or buying habits could continue to adversely affect the demand for our products. If credit pressures or other financial difficulties result in insolvency for our customers it could adversely impact our financial results. There can be no assurances that government and consumer responses to the disruptions in the financial markets will restore consumer confidence.

Since 2020, the European Union’s inflation rate has risen from 0.48% in 2020 to 2.7% as of December 2024. However, recent inflationary pressures have not had a significant impact on our operations. While inflation is recognized as a potential risk, we do not believe that the impact of inflation on our operations is material. It is possible, however, that future inflationary pressures could have a greater impact on our operations, and we will monitor this risk closely.

We are dependent on a limited number of suppliers for our batteries, inverters, and photovoltaic modules and the inability of these suppliers to continue to deliver, or their refusal to deliver, these products at prices and volumes acceptable to us would have a material adverse effect on our business, prospects and operating results.

We source batteries, inverters, and photovoltaic modules from a limited number of manufacturers located in China. For batteries, while we obtain components for our products and systems from multiple sources whenever possible, we have spent a great deal of time in developing and testing our batteries that we receive from our key suppliers. We currently have five different battery suppliers who are all located in China. For our inverters, we import them from a two partners suppliers based in China. The current reliance on partners suppliers from China for our main products has not, to date, posed any drawbacks, despite the contraction in the worldwide supply of products caused by the COVID, which effects continued to be felt in 2024. The large number of suppliers in that country means that we can change suppliers with some ease. A geopolitical conflict with China on a global level would be a potential supply problem, although the economic impact on a large scale in all sectors and in all markets would be even more serious than the lack of supplies.

As to the photovoltaic modules and the structures that support them, they are purchased from different suppliers in the market. We generally do not maintain long-term agreements with our source suppliers, as we don’t consider them as a value-added product and we are always looking for the best balance between quality and price. While we believe that we will be able to establish additional supplier relationships, we may be unable to do so in the short term or at all at prices, quality or costs that are favorable to us.

In addition, the conception, design, manufacture of the exterior and structural part, and assembly of components for our SUNBOX energy storage systems are all completed in Spain. The assembly of our SUNBOX systems is provided by a single supplier located in Spain. Any disruption between our relationship with the supplier, or if the supplier is unable to meet our demands, our business and results of operations could be adversely affected.

Changes in business conditions, wars, regulatory requirements, economic conditions and cycles, governmental changes and other factors beyond our control could also affect our suppliers’ ability to deliver components to us on a timely basis or cause us to terminate our relationship with them and require us to find replacements, which we may have difficulty doing. Furthermore, if we experience significant increased demand, or need to replace our existing suppliers, there can be no assurance that additional supplies of component parts will be available when required on terms that are favorable to us, at all, or that any supplier would allocate sufficient supplies to us in order to meet our requirements or fill our orders in a timely manner. The loss of any limited source supplier or the disruption in the supply of components from these suppliers could lead to delays in the deliveries of our battery products and systems to our customers, which could hurt our relationships with our customers and also materially adversely affect our business, prospects and operating results.

If we do not forecast demand for our products accurately, we may experience product shortages, delays in product shipment or excess product inventory, any of which will adversely affect our business and financial condition. We manufacture our products according to our estimates of customer demand. This process requires us to make multiple forecasts and assumptions relating to the demand of our distributors, their end customers and general market conditions. Because we sell most of our products to distributors, who in turn sell to their end customers, we have limited visibility as to end-customer demand. We depend significantly on our distributors to provide us visibility into their end-customer demand, and we use these forecasts to make our own forecasts and planning decisions. If the information from our distributors turns out to be incorrect, then our own forecasts may also be inaccurate. Furthermore, we do not have long-term purchase commitments from our distributors, installers or end customers, and our sales are generally made by purchase orders that may be canceled, changed or deferred without notice to us or penalty. As a result, it is difficult to forecast future customer demand to plan our operations. If we overestimate demand for our products, or if purchase orders are canceled or shipments are delayed, we may have excess inventory that we cannot sell. We may have to make significant provisions for inventory write-downs based on events that are currently not known, and such provisions or any adjustments to such provisions could be material. We may also become involved in disputes with our suppliers who may claim that we failed to fulfill forecasts or minimum purchase requirements. Conversely, if we underestimate demand, we may not have sufficient inventory to meet end-customer demand, and we may lose market share, damage relationships with our distributors and end customers and forgo potential revenue opportunities. Obtaining additional supply in the face of product shortages may be costly or impossible, particularly in the event of supply chain disruptions and our outsourced manufacturing processes, which could prevent us from fulfilling orders in a timely and cost-efficient manner or at all. In addition, if we overestimate our production requirements, our contract manufacturers may purchase excess components and build excess inventory. If our contract manufacturers, at our request, purchase excess components that are unique to our products and are unable to recoup the costs of such excess through resale or return or build excess products, we could be required to pay for these excess parts or products and recognize related inventory write-downs.

Tariffs imposed on lithium-ion batteries by the United States government or a resulting trade war could have a material adverse effect on our results of operations.

In 2018, the United States government announced tariffs on certain steel and aluminum products imported into the United States, which has led to reciprocal tariffs being imposed by the European Union and other governments on products imported from the United States. The lithium-ion battery industry has also been subjected to tariffs implemented by the United States government on goods imported from China. Any restrictions or tariffs imposed on products that we import into the United States for sale could adversely and directly impact our cost of sales. In addition, changes in U.S. trade regulations and policies could have an adverse impact on trade relations between the U.S. and certain foreign countries, which could materially and adversely affect our relationships with our international suppliers and reduce the supply of goods available to us. Further, we cannot predict the extent to which the U.S. will adopt changes to existing trade regulations and policies, which creates uncertainties in planning our sourcing strategies and forecasting our margins. If additional tariffs are imposed on our products, or other retaliatory trade measures are taken, our costs could increase, and we may be required to raise our prices, which could materially and adversely affect our results.

Although we are currently not conducting business in the United States, we plan to enter the U.S. market in 2025. Given that all of our lithium-ion batteries are manufactured in China, tariffs on lithium-ion batteries imported from China are expected to increase our costs, require us to increase prices to our customers or, if we are unable to do so, result in lower gross margins on the products sold by us.

The trade war could have a significant adverse effect on world trade and the world economy, as well as on our results of operations. If governments in the jurisdictions where we conduct business impose tariffs on components imported by us from China, such tariffs could have a material adverse effect on our business and results of operations.

Increases in costs, disruption of supply or shortage of raw materials, in particular lithium-ion phosphate cells, could harm our business.

We may experience increases in the costs or a sustained interruption in the supply or shortage of raw materials. Any such increase or supply interruption could have a materially negative impact on our business, prospects, financial condition and operating results. For instance, we are exposed to multiple risks relating to price fluctuations for lithium-iron phosphate cells.

These risks include:

| ● | the inability or unwillingness of battery manufacturers to supply the number of lithium-iron phosphate cells required to support our sales as demand for such rechargeable battery cells increases; |

| ● | disruption in the supply of cells due to quality issues or recalls by the battery cell manufacturers; and |

| ● | an increase in the cost of raw materials, such as iron and phosphate, used in lithium-iron phosphate cells. |

We may face significant costs relating to environmental regulations for the storage and shipment of our lithium-ion batteries and inverters.

We operate our business globally. Various governmental regulations impose significant environmental requirements on the manufacture, storage, transportation and disposal of various components of advanced energy storage systems. Although we believe that our operations are in material compliance with applicable environmental regulations, there can be no assurance that changes in such laws and regulations will not impose costly compliance requirements on us or otherwise subject us to future liabilities. Moreover, governments may enact additional regulations relating to the manufacture, storage, transportation, and disposal of components of advanced energy storage systems. Compliance with such additional regulations could require us to devote significant time and resources and could adversely affect demand for our products. There can be no assurance that additional or modified regulations relating to the manufacture, storage, transportation, and disposal of components of advanced energy systems will not be imposed.

The economic benefit of our energy storage systems to our customers depends on the cost of electricity available from alternative sources, including local electric utility companies, which cost structure is subject to change.

The economic benefit of our energy storage systems to our customers includes, among other things, the benefit of reducing such customers’ payments to the local electric utility company. The rates at which electricity is available from a customer’s local electric utility company is subject to change and any changes in such rates may affect the relative benefits of our energy storage systems. Further, the local electric utility may impose “departing load,” “standby” or other charges on our customers in connection with their acquisition of our energy storage systems, the amounts of which are outside of our control, and which may have a material impact on the economic benefit of our energy storage systems to our customers. Changes in the rates offered by local electric utilities and/or in the applicability or amounts of charges and other fees imposed by such utilities on customers acquiring our energy storage systems could adversely affect the demand for our energy storage systems.

Additionally, the electricity produced by our energy storage systems is currently not cost competitive in some geographic markets, and we may be unable to reduce our costs to a level at which our energy storage systems would be competitive in such markets. As such, unless the cost of electricity in these markets rises or we are able to generate demand for our energy storage systems based on benefits other than electricity cost savings, our potential for growth may be limited.

If we fail to scale our business operations and otherwise manage future growth and adapt to new conditions effectively as we grow our Company, we may not be able to produce, market, sell and service our products successfully.

Any failure to manage our growth effectively could materially and adversely affect our business, prospects, operating results and financial condition. Our future operating results depend to a large extent on our ability to manage our expansion and growth successfully. We may not be successful in undertaking this expansion if we are unable to control expenses and avoid cost overruns and other unexpected operating costs; adapt our products and conduct our operations to meet local requirements; implement the required infrastructure, systems and processes; and find and hire the right skills to make our growth successful.

If we are unable to achieve our targeted manufacturing costs for our energy storage solutions, our financial condition and operating results will suffer.

There is no guarantee we will be able to achieve sufficient cost savings to reach our gross margin and profitability goals. We may also incur substantial costs or cost overruns in utilizing and increasing the production capability of our energy storage system facilities. If we are unable to achieve production cost targets on our products pursuant to our plans, we may not be able to meet our gross margin and other financial targets. Many of the factors that impact our manufacturing costs are beyond our control, such as potential increases in the costs of our materials and components, such as lithium iron phosphate, nickel and other components of our battery cells. If we are unable to continue to control and reduce our manufacturing costs, our operating results, business and prospects will be harmed.

Our business will be adversely affected if we are unable to protect our intellectual property rights from unauthorized use or infringement by third parties.

Any failure to protect our proprietary rights adequately could result in our competitors offering similar products, potentially resulting in the loss of some of our competitive advantages and a decrease in our revenue, which would adversely affect our business, prospects, financial condition and operating results. Our success depends, at least in part, on our ability to protect our core technology and intellectual property. To accomplish this, we rely on a combination of patents, patent applications, trade secrets, including know-how, employee and third-party nondisclosure agreements, copyright laws, trademarks, intellectual property licenses and other contractual rights to establish and protect our proprietary rights in our technology.

The protection provided by patent laws is and will be important to our future opportunities. However, such patents and agreements, as well as various other measures we may take to protect our intellectual property from use by others, may not be effective for various reasons, including the following:

| ● | the patents we have been granted may be challenged, invalidated or circumvented because of the pre-existence of similar patented or unpatented intellectual property rights or for other reasons; |

| ● | the costs associated with enforcing patents, confidentiality and invention agreements or other intellectual property rights may make aggressive enforcement impracticable; and |

| ● | existing and future competitors may independently develop similar technology and/or duplicate our systems in a way that circumvents our patents. |

Our patent applications may not result in additional issued patents, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours.

Turbo Energy has been granted three patents by the Spanish Patent and Trademark Office (“SPTO”) and has one patent application still pending. Our pending patent application may not result in a patent being issued, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours.

We cannot be certain that we are the first creator of inventions covered by our patents or pending patents or the first to file patent applications on these inventions, nor can we be certain that our pending patent application will result in an issued patent or that any of our issued patents will afford protection against a competitor. In addition, patent applications that we intend to file in different countries are subject to different laws, rules and procedures, and thus we cannot be certain that our patent applications will be issued. In addition, some countries provide significantly less effective patent enforcement than others, such as the United States.

The status of patents involves complex legal and factual questions and the breadth of claims allowed is uncertain. As a result, we cannot be certain that the patent applications that we file will result in patents being issued, or that our patents and any patents that may be issued to us in the near future will afford protection against competitors with similar technology. In addition, patents issued to us may be infringed upon or designed around by others and others may obtain patents that we need to license or design around, either of which would increase costs and may adversely affect our business, prospects, financial condition and operating results.

A failure of our information technology (“IT”) and data security infrastructure could adversely affect our business and operations.

The efficient operation of our business depends on our IT systems, some of which are managed by third-party service providers. We rely upon the capacity, reliability and security of our IT and data security infrastructure and our ability to effectively manage our business data, accounting, financial, legal and compliance functions, communications, supply chain, order entry and fulfillment, and expand and routinely update this infrastructure in response to the changing needs of our business. Our existing IT systems and any new IT systems we utilize may not perform as expected. If we experience a problem with the functioning of an important IT system or a security breach of our IT systems, including during system upgrades or new system implementations, the resulting disruptions could adversely affect our business.

Despite our implementation of reasonable security measures, our IT systems, like those of other companies, are vulnerable to damages from computer viruses, natural disasters, fire, power loss, telecommunications failures, personnel misconduct, human error, unauthorized access, physical or electronic security breaches, cyber-attacks (including malicious and destructive code, phishing attacks, ransomware, and denial of service attacks), and other similar disruptions. Such attacks or security breaches may be perpetrated by bad actors internally or externally (including computer hackers, persons involved with organized crime, or foreign state or foreign state-supported actors). Cybersecurity threat actors employ a wide variety of methods and techniques that are constantly evolving, increasingly sophisticated, and difficult to detect and successfully defend against. Moreover, we may not have the current capability to detect certain vulnerabilities, which may allow those vulnerabilities to persist in our systems over long periods of time. Additionally, it may take considerable time for us to investigate and evaluate the full impact of incidents, particularly for sophisticated attacks. These factors may inhibit our ability to provide prompt, full, and reliable information about the incident to our customers, partners, regulators, and the public. Geopolitical tensions or conflicts, such as Russia’s invasion of Ukraine, may further heighten the risk of cyber-attacks.

The emergence and maturation of Artificial Intelligence (“AI”) capabilities may also lead to new and/or more sophisticated methods of attack, including fraud that relies upon “deep fake” impersonation technology or other forms of generative automation that may scale up the efficiency or effectiveness of cyber-attacks. We have experienced such incidents in the past, and any future incidents could expose us to claims, litigation, regulatory or other governmental investigations, administrative fines and potential liability. Any system failure, accident or security breach could result in disruptions to our operations. A material network breach in the security of our or our service providers’ IT systems could include the theft of our trade secrets, customer information, human resources information or other confidential data, including but not limited to personally identifiable information. Although past incidents have not had a material adverse effect on our business operations or financial performance, to the extent that any disruptions or security breach results in a loss or damage to our data, or an inappropriate disclosure of confidential, proprietary or customer information, it could cause significant damage to our reputation, affect our relationships with our customers and strategic partners, lead to claims against us from governments and private plaintiffs, and otherwise adversely affect our business. We cannot guarantee that future cyberattacks, if successful, will not have a material effect on our business or financial results.

Many governments have enacted laws requiring companies to provide notice of cyber incidents involving certain types of data, including personal data. If an actual or perceived cybersecurity breach of security measures, unauthorized access to our system or the systems of the third-party vendors that we rely upon, or any other cybersecurity threat occurs, we may incur liability, costs, or damages, contract termination, our reputation may be compromised, our ability to attract new customers could be negatively affected, and our business, financial condition, and results of operations could be materially and adversely affected. Any compromise of our security could also result in a violation of applicable domestic and foreign security, privacy or data protection, consumer and other laws, regulatory or other governmental investigations, enforcement actions, and legal and financial exposure, including potential contractual liability. In addition, we may be required to incur significant costs to protect against and remediate damage caused by these disruptions or security breaches in the future. While we carry cyber insurance, we cannot be certain that our coverage will be adequate for liabilities actually incurred, that insurance will continue to be available to us on commercially reasonable terms, or at all, or that any insurer will not deny coverage as to any future claim.

We rely on trade secret protections through confidentiality agreements with our employees, customers and other parties; the breach of such agreements could adversely affect our business and results of operations.

We rely on trade secrets, which we seek to protect, in part, through confidentiality and non-disclosure agreements with our employees, customers and other parties. There can be no assurance that these agreements will not be breached, that we would have adequate remedies for any such breach or that our trade secrets will not otherwise become known to or independently developed by competitors. To the extent that consultants, key employees or other third parties apply technological information independently developed by them or by others to our proposed projects, disputes may arise as to the proprietary rights to such information that may not be resolved in our favor. We may be involved from time to time in litigation to determine the enforceability, scope and validity of our proprietary rights. Any such litigation could result in substantial cost and diversion of effort by our management and technical personnel.

In relation to the field of AI and machine learning, there is uncertainty and ongoing litigation in different jurisdictions as to the degree and extent of protection warranted for AI and machine learning systems, including as to materials that were created by AI technologies. If we fail to protect our intellectual property rights adequately, including with respect to any AI or machine learning technologies, our competitors may gain access to our technology and our business, financial condition and results of operations may be adversely affected. Additionally, we use AI tools, including tools provided by third parties, to develop or assist in the development of our own software code. While use of such tools makes our development process more efficient, AI tools have sometimes generated content that is “substantially similar” to proprietary or open-source code on which the AI tool was trained. If such AI tools generate code that is too similar to other proprietary code, or to software processes that are protected by patent, we could be subject to intellectual property infringement claims. Further, we may be unable to recover any or all defense costs or damages as a result of infringement claims from the third-party providers of such AI tools. If the artificial intelligence tools we use generate code that is too similar to open-source code, we risk losing protection of our own proprietary code that is commingled with such code.

Additionally, new laws regulating AI – in particular generative AI, algorithmic recommendation and deep synthesis technologies - have been enacted in China, and in August 2024, the European Union’s EU AI Act entered into force, establishing a comprehensive, legal framework for the regulation of AI systems across the EU. The majority of obligations under the EU AI Act will apply from August 2026, and once fully applicable, the EU AI Act will have a material impact on the way AI is regulated in the EU, including requirements around transparency, conformity assessments and monitoring, risk assessments, human oversight, security, accuracy, general purpose AI and foundation models. There is also an increase in litigation in a number of jurisdictions, including the United States, relating to the development, security and use of AI.

Our implementation and use of AI and machine learning technologies may not be successful, which may impair our ability to compete effectively, result in reputational harm and have an adverse effect on our business.

We use machine learning, AI and automated decision-making technologies throughout our business, and are making significant investments to continuously improve our use of such technologies. For example, we use machine learning and AI technologies (including generative AI) to power our AI-powered Turbo Energy App, which allows our SUNBOX users to benefit from intelligent data collection, optimized stored energy management and predictive analytics which provide real-time insight into weather and electricity price forecasts, solar panel performance, energy consumption and material cost saving opportunities, among other metrics. As with many technological innovations, there are significant risks and challenges involved in developing, maintaining and deploying these technologies and there can be no assurance that the usage of such technologies will always enhance our products or services or be beneficial to our business, including our efficiency or the profitability of our AI-enabled solutions.

Further, changes and ongoing development in how we use AI and machine learning technologies and how we train our models, in particular if those AI or machine learning models are (i) incorrectly designed or implemented; (ii) trained or reliant on incomplete, inadequate, inaccurate, biased or otherwise poor quality data; and/ or (iii) are adversely impacted by unforeseen defects, technical challenges, cybersecurity threats or material performance issues, could negatively impact the performance of our AI-powered Turbo Energy App and business, as well as our reputation and the reputations of our customers and partners, or we could incur liability through the violation of laws or contracts to which we are a party or through civil claims.

The market for AI and machine learning technologies is rapidly evolving and remains unproven in many industries, including our own. We cannot be sure that the market will continue to grow or that it will grow in ways we anticipate. We are in varying stages of development in relation to our products or services which utilize proprietary AI and machine learning technologies, and we may not be successful in our ongoing development of these technologies in the face of novel and evolving technical, reputational and market factors. Our failure to successfully develop and commercialize our products or services which utilize proprietary machine learning and AI technologies could depress the market price of our stock and impair our ability to (i) raise capital; (ii) expand our business; (iii) provide, improve and diversify our product offerings; (iv) continue our operations and efficiently manage our operating expenses; and (v) respond effectively to competitive developments.

We also use AI technologies licensed from third parties in our technologies and our ability to continue to use such technologies at the scale we need may be dependent on access to specific third-party software and infrastructure. We cannot control the availability or pricing of such third-party AI technologies, especially in a highly competitive environment, and we may be unable to negotiate favorable economic terms with the applicable providers. If any such third-party AI technologies become incompatible with our solutions or unavailable for use, or if the providers of such models unfavorably change the terms on which their AI technologies are offered or terminate their relationship with us, our solutions may become less appealing to our customers and our business will be harmed. In addition, to the extent any third party AI technologies are used as a hosted service, any disruption, outage, or loss of information through such hosted services could disrupt our operations or solutions, damage our reputation, cause a loss of confidence in our solutions, or result in legal claims or proceedings, for which we may be unable to recover damages from the affected provider.

The continuous development, maintenance and operation of our AI and machine learning technologies is expensive and complex, and may involve unforeseen difficulties including material performance problems, undetected defects or errors. For instance, a machine learning model can experience decay (also known as “model drift”) in which its performance and accuracy decreases over time without further human intervention to correct such decay. We may encounter technical obstacles, and it is possible that we may discover additional problems that may prevent our proprietary technologies from operating properly, which could adversely affect our business, customer relationships and reputation.

We face significant competition from other companies in our industry in relation to the development and deployment of AI and machine learning technologies. Those other companies may develop AI technologies that are similar or superior to ours and/or are more cost-effective and/or quicker to develop and deploy. If we cannot develop, offer or deploy new AI technologies as effectively, as quickly and/or as cost-efficiently as our competitors, we could experience a material adverse effect on our operating results of operation, customer relationships and growth. Further, our ability to continue to develop or use such technologies may be dependent on access to specific third-party software, services and infrastructure, such as processing hardware, and we cannot control the availability or pricing of such third-party software and infrastructure, especially in a highly competitive environment.

Any compromise of the cybersecurity of our platform could materially and adversely affect our business, operations and reputation.

Our products use cutting-edge technology through our proprietary software development. Our existing software system and any new software systems we utilize may not perform as expected. If we experience a problem with the functioning of an important software system or a security breach of our information technology (“IT”) systems, including during system upgrades or new system implementations, the resulting disruptions could adversely affect the operation of our Turbo Energy App and our business.

Despite our implementation of reasonable security measures, our IT systems, like those of other companies, are vulnerable to damages from computer viruses, natural disasters, fire, power loss, telecommunications failures, personnel misconduct, human error, unauthorized access, physical or electronic security breaches, cyber-attacks (including malicious and destructive code, phishing attacks, ransomware, and denial of service attacks), and other similar disruptions. Such attacks or security breaches may be perpetrated by bad actors internally or externally (including computer hackers, persons involved with organized crime, or foreign state or foreign state-supported actors).

Cybersecurity is a risk that Umbrella Global’s Board of Directors has identified as a key area to be addressed through collaboration with a consulting firm at the group level. To this end, Turbo Energy has assigned responsibility for cybersecurity oversight to the IT manager, who works closely with an internal team and trusted local vendors. All parties with access to the management software suite have signed a corresponding confidentiality agreement, and information is not shared or accessible to any hardware supplier.

Furthermore, we are actively working to eliminate remote access to hardware data of suppliers involved in the manufacture of our products. We recognize the importance of ensuring the security and privacy of our systems and customer data, and we remain committed to implementing robust cybersecurity measures to mitigate potential risks.

Cybersecurity threat actors employ a wide variety of methods and techniques that are constantly evolving, increasingly sophisticated, and difficult to detect and successfully defend against. Any future incidents could expose us to claims, litigation, regulatory or other governmental investigations, administrative fines and potential liability. Any system failure, accident or security breach could result in disruptions to our operations. A material network breach in the security of our IT systems could include the theft of our trade secrets, customer information, human resources information or other confidential data, including but not limited to personally identifiable information. To the extent that any disruptions or security breach results in a loss or damage to our data, or an inappropriate disclosure of confidential, proprietary or customer information, it could cause significant damage to our reputation, affect our relationships with our customers and strategic partners, lead to claims against us from governments and private plaintiffs, and adversely affect our business. We cannot guarantee that future cyberattacks, if successful, will not have a material effect on our business or financial results.

Many governments have enacted laws requiring companies to provide notice of cyber incidents involving certain types of data, including personal data. If an actual or perceived cybersecurity breach of security measures, unauthorized access to our system or the systems of the third-party vendors that we rely upon, or any other cybersecurity threat occurs, we may incur liability, costs, or damages, contract termination, our reputation may be compromised, our ability to attract new customers could be negatively affected, and our business, financial condition and results of operations could be materially and adversely affected. Any compromise of our security could also result in a violation of applicable security, privacy or data protection, consumer and other laws, regulatory or other governmental investigations, enforcement actions, and legal and financial exposure, including potential contractual liability. In addition, we may be required to incur significant costs to protect against and remediate damage caused by these disruptions or security breaches in the future.

We may need to raise additional capital or financing to continue to execute and expand our business.

While we expect that our available cash and credit facilities will be sufficient to sustain our operations for the next twelve months from the date of this report, we may need to raise additional capital to support our operations and execute our business plan. We may be required to pursue sources of additional capital through various means, including joint venture projects, sale and leasing arrangements and debt or equity financings. Any new securities that we may issue in the future may be sold on terms more favorable for our new investors than the terms of our initial public offering. Newly issued securities may include preferences, superior voting rights, and the issuance of warrants or other convertible securities that will have additional dilutive effects. We cannot ensure that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition and results of operations. Our ability to obtain needed financing may be impaired by such factors as the weakness of capital markets, and the fact that we have not been profitable, which could impact the availability and cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, we may have to reduce our operations accordingly.

While we have not made material acquisitions to date, should we pursue acquisitions in the future, we would be subject to risks associated with acquisitions.

We may acquire additional assets, products, technologies or businesses that are complementary to our existing business. The process of identifying and consummating acquisitions and the subsequent integration of new assets and businesses into our own business would require attention from management and could result in a diversion of resources from our existing business, which in turn could have an adverse effect on its operations. Acquired assets or businesses may not generate the expected financial results. Acquisitions could also result in the use of cash, potentially dilutive issuances of equity securities, the occurrence of goodwill impairment charges, amortization expenses for other intangible assets and exposure to potential unknown liabilities of the acquired business.

If we are unable to recruit and retain key management, technical and sales personnel, our business would be negatively affected.

For our business to be successful, we need to attract and retain highly qualified management, technical and sales personnel. The failure to recruit additional key personnel when needed with specific qualifications and on acceptable terms or to retain good relationships with our partners might impede our ability to continue to develop, commercialize and sell our products. To the extent the demand for skilled personnel exceeds supply, we could experience higher labor, recruiting and training costs in order to attract and retain such employees. We face competition for qualified personnel from other companies with significantly more resources available to them and thus may not be able to attract the level of personnel needed for our business to succeed.

We may be required to obtain the approval of various government agencies to market our products.