UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

For the transition period from to

Commission file number: 001-42379

Founder Group Limited

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

British Virgin Islands

(Jurisdiction of incorporation or organization)

No.17, Jalan Astana 1D, Bandar Bukit Raja, 41050 Klang,

Selangor Darul Ehsan, Malaysia

(Address of principal executive offices)

Lee Seng Chi, Chief Executive Officer

Telephone: +60 3-3358 5638

Email: ericlee@founderenergy.com.my

At the address of the Company set forth above

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Ordinary Shares | FGL | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

An aggregate of 17,665,289 ordinary shares, no par value, were issued and outstanding as of December 31, 2024.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large-accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large-accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large-accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D 1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

| * | If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐ |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒ In this annual report on Form 20-F, unless the context otherwise requires, references to:

TABLE OF CONTENTS

INTRODUCTION

| ● | “BVI” are to the British Virgin Islands; |

| ● | “BVI Act” are to the BVI Business Companies Act, 2020 (Revised Edition); |

| ● | “C&I” are to Commercial and Industrial; |

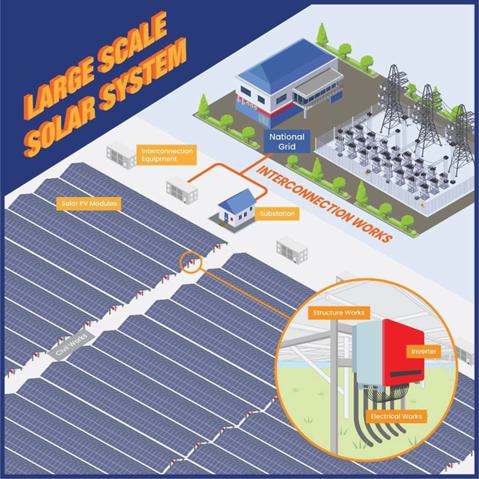

| ● | “EPCC” are to engineering, procurement, construction and commissioning; |

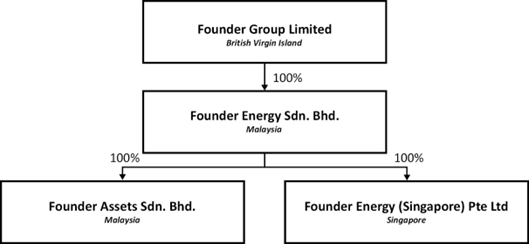

| ● | “Founder Assets” are to Founder Assets Sdn. Bhd., a private company limited by shares incorporated and registered under the laws of Malaysia, which is a wholly owned subsidiary of Founder Energy (Malaysia) (defined below) with registration number 202201035065 (1480762-M); |

| ● | “Founder Assets (Thailand)” are to Founder Assets (Thailand) Company Limited, a private company limited by shares incorporated and registered under the laws of Thailand, which is a 99.99%-owned subsidiary of Founder Group (defined below) with registration number 0105568010250; |

| ● | “Founder Energy (Malaysia)” are to Founder Energy Sdn. Bhd., a private company limited by shares incorporated and registered under the laws of Malaysia, which is a wholly owned subsidiary of Founder Group (defined below) with registration number 202101013707 (1414006-X); |

| ● | “Founder Energy (Singapore)” are to Founder Energy (Singapore) Pte. Ltd., a private company limited by shares incorporated under the laws of Singapore, which is a wholly owned subsidiary of Founder Energy (Malaysia); |

| ● | “Founder Group” are to Founder Group Limited, a BVI business company limited by shares incorporated and registered under the laws of the BVI with company number 2124362; |

| ● | “Founder Solar Solution” are to Founder Solar Solution Sdn. Bhd., a private company limited by shares incorporated and registered under the laws of Malaysia, which is a wholly owned subsidiary of Founder Energy (Malaysia) with registration number 202501005545 (1606959-T); |

| ● | “Insolvency Act” are to the BVI Insolvency Act, 2020 (Revised Edition); |

| ● | “M&A” are to the Memorandum and Articles of Association of Founder Group (as amended and/or amended and restated (as applicable) from time to time); |

| ● | “MYR” or “RM” are to the Malaysian ringgit, the legal currency of Malaysia; |

| ● | “MWac” are to megawatt of alternating current, a unit of electrical power measurement that represents the capacity of a power generation facility to produce electricity at a given moment; |

| ● | “Nasdaq” are to the Nasdaq Stock Market LLC; |

| ● | “Ordinary Shares” are to ordinary shares of Founder Group, no par value; |

| ● | “PV” are to photovoltaic; |

| ● | “SEC” are to the U.S. Securities and Exchange Commission; |

| ● | “U.S. dollars”, “$”, “USD” and “dollars” are to the legal currency of the United States; and |

| ● | “we,” “us,” “our,” “our Company,” or the “Company” are to Founder Group and its subsidiaries on a consolidated basis. |

This annual report on Form 20-F includes our audited consolidated financial statements for the fiscal years ended December 31, 2024, 2023, and 2022. In this annual report, we refer to assets, obligations, commitments, and liabilities in our consolidated financial statements in U.S. dollars. Certain dollar references are based on the exchange rate of Malaysian Ringgit (MYR) to U.S. dollars, determined as of a specific date or for a specific period. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of U.S. dollars which may result in an increase or decrease in the amount of our obligations (expressed in dollars) and the value of our assets, including accounts receivable (expressed in dollars).

This annual report contains translations of certain Malaysian Ringgit (MYR) into U.S. dollars at specified rates. Unless otherwise stated, the following exchange rates are used in this annual report:

| December 31, | ||||||

| US$ Exchange Rate | 2024 | 2023 | 2022 | |||

| At the end of the year – MYR | MYR4.4755 to $1.00 | MYR4.5915 to $1.00 | MYR4.4130 to $1.00 | |||

| Average rate for the year – MYR | MYR4.5712 to $1.00 | MYR4.5653 to $1.00 | MYR3.2740 to $1.00 | |||

Part I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

Item 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Risks Related to Our Business and Industry

Our limited operating history in a rapidly evolving industry makes it difficult to accurately forecast our future operating results and evaluate our business prospects.

We commenced operations through our subsidiary Founder Energy (Malaysia) in April 2021 and have a limited operating history. Members of our management team have been working together only for a short period of time and may still be in the process of exploring approaches to running our Company and reaching consensus among themselves, which may affect the efficiency and results of our operation. Due to our limited operating history, our historical growth rate may not be indicative of our future performance. Our future performance may be more susceptible to certain risks than a company with a longer operating history in the same or a different industry. Many of the factors discussed below could adversely affect our business and prospects and future performance, including:

| ● | our ability to maintain, expand, and further develop our relationships with our clients to meet their increasing demand; |

| ● | the continued growth and development of the solar energy industry; |

| ● | our ability to keep up with the technological developments or new business models of the rapidly evolving solar energy industry; |

| ● | our ability to attract and retain qualified and skilled employees; |

| ● | our ability to effectively manage our growth; and |

| ● | our ability to compete effectively with our competitors in the solar energy industry. |

We may not be successful in addressing the risks and uncertainties listed above, among others, which may materially and adversely affect our business, results of operations, financial condition, and future prospects.

Our business is project based and we may not be able to continuously secure large-scale solar projects to support our high growth in revenue and profit.

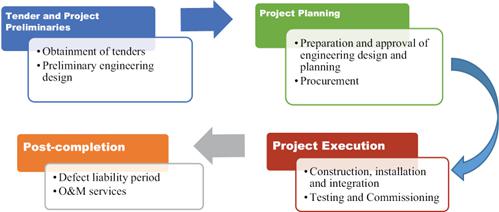

For the fiscal years ended December 31, 2022, 2023, and 2024, our revenue generated from large-scale solar projects services was RM51,761,466, RM131,988,574 (approximately US$28,746,286), and RM68,864,991 (approximately US$15,387,105), respectively, accounting for 82%, 89%, and 76% of our total revenue, respectively. For the fiscal years ended December 31, 2022, 2023, and 2024, our total revenue was RM63,509,466, RM148,053,973 (approximately US$32,245,230), and RM90,344,588 (approximately US$20,186,479), respectively, representing a growth rate of 133% from fiscal year 2022 to fiscal year 2023, and a negative growth rate of 39% from fiscal year 2023 to fiscal year 2024. For the same fiscal years, our net income was RM3,943,506, RM7,147,068 (approximately US$1,556,586), and net loss of RM5,150,005 (approximately US$1,150,711), respectively, representing a growth rate of 81% from fiscal year 2022 to fiscal year 2023, and a negative growth rate of 172% from fiscal year 2023 to fiscal year 2024. The nature of our EPCC services is project based. The project-based nature of our business brings with it a risk of not being able to consistently secure large-scale solar projects, which could impact our ability to support revenue and profit growth. Large-scale solar projects typically have lengthy development cycles, averaging between 13 to 19 months, which introduces uncertainty into our project pipeline and financial projections.

The extended duration of large-scale solar projects poses several challenges. The lengthy development phase increases the time between securing a project and generating revenue from it. This time gap can strain cash flow and working capital, potentially affecting our ability to meet financial obligations and invest in future projects. The prolonged timeline also increases exposure to market fluctuations, regulatory changes, and other external factors that may impact project viability and profitability. In addition, the process of securing large-scale solar projects is typically competitive and subject to various factors beyond our control, such as government policies, incentives, and market dynamics. If we experience delays or face challenges in securing large-scale projects, it may materially and adversely affect our business, results of operations, financial condition, and future prospects.

If our subsidiary Founder Energy (Malaysia) fails to comply with the Construction Industry Development Board Malaysia Act 1994 (“CIDBA 1994”), its business operations could be materially and adversely affected.

The CIDBA 1994 regulates the establishment of Malaysian Construction Industry Development Board (“CIDB”) and provides for its function in relation to the construction industry and all matters connected therewith throughout Malaysia. Under CIDBA 1994, contractors are mandated to register with CIDB and possess a valid certificate of registration to undertake construction works. Additionally, Section 34(1) of the CIDBA 1994 requires contractors to declare and submit awarded construction contracts to CIDB.

As of the date of this annual report, our subsidiary, Founder Energy (Malaysia) holds a valid Grade G7 certificate of registration issued under CIDBA 1994. However, Founder Energy (Malaysia) breached Section 34(1) of the CIDBA 1994 by failing to declare and submit 31 contracts to CIDB. Among these contracts, 12 were awarded to Founder Energy (Malaysia) as the main contractor, with six contracts exceeding RM500,000 in value, while the remaining 19 were awarded to Founder Energy (Malaysia) as a sub-contractor. Founder Energy (Malaysia) potentially faces a fine of up to RM1,550,000.

As a result of the breach, Founder Energy (Malaysia) may be subject to fines or penalties or its certificate of registration may be subject to suspension or revocation, which could result in a material adverse impact on our operations. Although Founder Energy (Malaysia) has rectified this non-compliance by promptly declaring and submitting these contracts with CIDB, Founder Energy (Malaysia) is still subject to risk of fines and/or regulatory actions from the CIDB. As of the date of this annual report, Founder Energy (Malaysia) has not been fined or issued with any notice of non-compliance from CIDB or any other relevant authorities. See “Item 4. Information on the Company—B. Business Overview—Regulations—Regulations Relating to Our EPCC Services in Malaysia—Construction Industry Development Board Malaysia Act 1994.”

If our subsidiary Founder Assets fails to secure approval from the Energy Commission of Malaysia, its business operations could be materially and adversely affected.

In February 2023, our subsidiary, Founder Assets, entered into a deed of novation with two Malaysian entities, party A and party B, and maintain a solar PV system, while party B agrees to purchase power generated from the system for a 20-year term. See “Item 4. Information on the Company—B. Business Overview—Our Growth Strategies—Expand Our Investment in Renewable Energy Assets, Such as Solar PV Systems.” To carry out this project, Founder Assets successfully applied for and were granted a License for Public Installation by the Energy Commission of Malaysia. This license authorizes the use, operation, and maintenance of a solar PV system for the supply of electricity to party B under the PPA. However, this license imposes restrictions on changes in shareholders and the shareholding structure of Founder Assets. As of the date of this annual report, the project has been fully completed and is operating in compliance with all applicable laws; and Founder Assets is actively in the process of seeking written approval from the Energy Commission of Malaysia concerning changes in shareholding structure resulting from Founder Group’s initial public offering (the “IPO”). Even though failure to secure such approval will not materially affect our financial conditions, we may face the risk of having our License for Public Installation suspended or revoked by the Energy Commission of Malaysia., leading to adverse effects on Founder Assets’ business operations. However, as of the date of this annual report, we have confirmed that we have not received any notice of suspension or revocation that would render the license invalid.

We face risks associated with concentration of revenue from a few large clients. Any interruption in operations in such major clients may have an adverse effect on our business, financial condition, and results of operations.

In fiscal year 2024, we derived a significant portion of our revenue from two customers, JS Solar Sdn. Bhd. and Samaiden Sdn. Bhd., which contributed 23.25% and 11.55% of our total revenue, respectively. In fiscal year 2023, we derived a significant portion of our revenue from three customers, Atlantic Blue Sdn Bhd., Samaiden Sdn Bhd. and Customer S, which contributed 29.87%, 15.60%, and 10.60% of our total revenue, respectively. Similarly, in fiscal year 2022, we derived a significant portion of our revenue from two customers, Atlantic Blue Sdn. Bhd. and Savelite Engineering Sdn. Bhd., which contributed 39.67% and 10.79% of our total revenue, respectively.

We are not dependent on the above-mentioned customers for our business continuity as our contracts with them are on project basis and we have been able to secure projects from different customers over the last three fiscal years. As of the date of this annual report, we have three on-going large-scale solar projects and five on-going C&I projects. See “Item 4. Information on the Company—B. Business Overview—Our Solar Projects.” However, the substantial contribution of revenue from specific customers indicates that our financial performance is heavily reliant on their project requirements and timelines. If there are delays, cancellations, or reduced project activity from these customers, our revenue stream could be significantly impacted.

We are exposed to risks related to concentration of suppliers as we rely on a few major suppliers, and such concentration may have a material adverse effect on our business and results of operations.

In fiscal years 2022, 2023, and 2024, a significant portion of our purchase was from Xiamen Solar First Energy Technology Co. Ltd., representing 47.11%, 29.72%, and 14.88% of our total purchase in fiscal years 2022, 2023, and 2024, respectively. In June 2021, by way of a deed of novation, we entered into a distributorship agreement with Xiamen Solar First Energy Technology Co. Ltd. and became its exclusive distributor of solar mounting systems in Malaysia. The distributorship agreement was effective until January 1, 2025. We did not renew the distributorship agreement; however we are still able to make purchases from Xiamen Solar First Energy Technology Co. Ltd., on an as needed basis. If Xiamen Solar First Energy Technology Co. Ltd. would cease allowing us to make purchases, it would materially and adversely affect our results of operations and we may not be able to find a different supplier on commercially reasonable terms or on a timely basis. As of the date of this annual report, all of the solar mounting systems that we sourced have been purchased from Xiamen Solar First Energy Technology Co. Ltd. and its affiliate Solar First Energy Technology Co. Ltd. For other types of equipment and materials, we source and purchase from third-party suppliers on the market.

Due to the concentration of our purchases in a few suppliers, any interruption of the operations of our suppliers, any failure of our suppliers to accommodate our growing business scale, any termination or suspension of our supply arrangements, any change in cooperation terms, or the deterioration of cooperative relationships with these suppliers may materially and adversely affect our results of operations. We cannot assure you that we would be able to find replacement suppliers on commercially reasonable terms or on a timely basis.

We depend on our subcontractors to perform part of our services.

We depend on our subcontractors to perform the physical construction and installation works, including civil works, building works, mechanical works and electrical works. Subcontractors’ costs accounted for approximately 37.00%, 85.75%, and 53.88% of our total cost of sales in fiscal years 2022, 2023, and 2024, respectively. As such, we are subject to risks associated with non-performance, late performance or poor performance by our subcontractors. If our subcontractors fail to meet customer expectations or deliver subpar works, our reputation in the solar energy industry may be damaged. In addition, in the event that our subcontractors cause damage to property, fail to meet safety standards, or violate regulations, we could potentially be exposed to legal and financial liabilities. While we may attempt to seek damages from the relevant subcontractors, we may, from time to time, be required to compensate our clients prior to receiving the said damages from the relevant contractors. In the event that we are unable to seek damages from the relevant subcontractors or the amount of the claims cannot be recovered in full or at all from the subcontractors, we may be required to bear some or all the costs of the claims, which may in turn adversely affect our profitability and financial performance.

We may face unanticipated increases in project costs.

We estimate our project costs at the time of bidding or negotiating for projects. The contract value is priced based on our cost estimates and project scheduling that are derived from assumptions such as prices of solar PV equipment, which are quoted to us or transacted in USD as well as costs and availability of labor and prices of the relevant machineries and equipment. Our cash flows and profit margin from the projects are therefore dependent upon our ability to accurately estimate these costs and timeline. Such costs and timeline may be affected by a variety of factors, such as depreciation of MYR against USD, slower than anticipated progress, conditions at project sites differing materially from what was anticipated at the time we bid for the contract, higher costs of equipment, material and labor, and delay in material deliveries and project financing closure.

In such events, we may incur cost overruns which will affect our cash flows and financial performance. These variations in costs may cause actual gross profit for a project to differ from those originally estimated. As a result, certain projects could have lower margins than anticipated, or incur losses if actual costs for the projects exceed their estimates.

Our business and financial performance are affected by project execution.

We have to adhere to certain agreed milestone for the completion of our projects. We are subject to the risk of claims and/or penalties pertaining to liquidated damages and pre-set penalties for late completion as stipulated in contracts for large-scale solar projects and C&I solar projects. These penalties, if imposed, may have an adverse effect on our financial performance. Incidents which may affect our project execution include delay in delivery of materials, workplace hazards, damage to equipment and materials, weather conditions and major pandemic outbreaks. As of the date of this annual report, we have not experienced any penalty. Nevertheless, there is no assurance that we would not experience penalties pertaining to delays in completion of projects in the future.

We depend on the retention and procurement of certain approvals, registrations, permits and licenses.

In order to operate our business, we are required to obtain and hold valid approvals, permits and licenses such as registrations with the Sustainable Energy Development Authority (“SEDA”) of Malaysia, Energy Commission of Malaysia (“ST”) and the Malaysia Construction Industry Development Board (“CIDB”). Please see “Item 4. Information on the Company—B. Business Overview—Approvals, Permits and Licenses.” We must comply with the restrictions and conditions imposed by the relevant authorities in order to maintain the validity of such approvals, permits and licenses. Our approvals, permits and licenses may be suspended or cancelled if we fail to comply with the applicable requirements or any conditions of the approvals, permits and licenses. Delay or refusal may also occur when renewing such approvals, permits or licenses upon their expiration. Failure to keep or renew the required approvals, permits or licenses could result in suspension or restriction of our business operations. We will not be able to participate in tenders for contracts or carry out our role as the EPCC contractor, which will adversely affect our business and financial performance.

Furthermore, we also plan to venture into hydropower and biogas plant development projects in Southeast Asia countries. We plan to kickstart these initiatives in the second quarter of 2025. Please see “Item 4. Information on the Company—B. Business Overview—Our Growth Strategies—Offer EPCC Services to Other Types of Renewable Energy, Such as Hydropower and Biogas”. The implementation of this business plan is subject to us securing the licenses and/or permits in the relevant countries. In the event that we are unable to meet these regulatory requirements, we may not be able to implement this part of our business strategies and plan, which may affect our future business and financial performance.

Our business is subject to inherent risks in the solar energy industry.

Our business is subject to inherent risks within the solar energy industry. The solar energy industry is influenced by various factors, such as government policies, regulations, subsidies, and incentives. Changes in these factors can lead to market uncertainty and affect the demand for solar PV systems. For example, reductions in government incentives or changes in energy policies can impact the profitability of solar projects. In addition, the cost of solar PV components, such as PV modules, inverters, and installation materials, can be subject to volatility. Fluctuations in raw material prices, supply chain disruptions, and changes in manufacturing capacities can impact the overall cost of solar PV systems. These cost fluctuations can affect project economics and profitability. Furthermore, solar PV systems depend on sunlight to generate electricity. Variations in weather patterns, including cloud cover, shading, and seasonal changes, can affect the energy output of solar installations. Locations with less predictable or insufficient sunlight may have lower energy production, potentially impacting the financial viability of solar projects.

The factors discussed above, which include changes to market conditions or situations, may affect the financial attractiveness of solar PV projects, which in turn may adversely affect our business and financial performance.

Technological improvements in power generation may result in more cost efficient and environmentally friendly methods of power generation compared to using solar PV systems.

There are other environmentally friendly methods of power generation besides solar energy, including using various sources of primary energy, such as wind, waves and current, solar thermal energy and geothermal energy. Currently, Malaysia’s renewable energy capacity stands at 25%, approaching the national target of achieving 31% share of renewables in the overall installed capacity mix by 2025.1 This capacity is primarily attributed to solar and hydro energy. However, improvement in technologies for other methods of power generation may make them more competitive compared to using solar PV panels. As such, in the event that other methods of power generation are preferred compared to using solar PV panels, it may negatively affect our business and financial performance.

The industry in which we operate is highly competitive, and we may not be able to compete successfully against existing or new competitors, which could reduce our market share and adversely affect our competitive position, financial performance and results of operations.

The solar energy industry in Malaysia is highly-competitive and rapidly evolving, with many new companies joining the competition in recent years and a few leading companies. Competition is expected to increase significantly in the future.

Our competitors may operate with different business models, have different cost structures, and may ultimately prove to be more successful or more adaptable to new regulatory, technological, and other developments. They may in the future achieve greater market acceptance and recognition and gain a greater market share. It is also possible that potential competitors may emerge and acquire a significant market share. If existing or potential competitors develop or offer services that provide significant performance, price, creative optimization, or other advantages over those offered by us, our business, results of operations, and financial condition would be negatively affected. Our existing and potential competitors may enjoy competitive advantages over us, such as longer operating history, greater brand recognition, more competitive pricing, and significantly greater financial, technical, and marketing resources.

If we fail to compete successfully, we are at risk of losing clients, which could result in an adverse impact on our financial performance and business prospects. We cannot assure you that our strategies will remain competitive or that they will continue to be successful in the future. Increasing competition may result in pricing pressure and loss of our market share, either of which could have a material adverse effect on our financial condition and results of operations.

| 1 | Malaysian Investment Development Authority (MIDA) (March 20, 2023) “Malaysia Current Renewable Energy Capacity Level is at 25%”, Malaysia |

https://www.mida.gov.my/mida-news/malaysias-current-renewable-energy-capacity-level-is-at-25-says-nik-nazmi/#:~:text=Malaysia’s%20current%20renewable%20energy%20(RE,Minister%20Nik%20Nazmi%20Nik%20Ahmad

Our business is subject to risks related to political, social and economic events in Malaysia.

Our business is subject to prevailing political, social and economic conditions in Malaysia. Any adverse developments in the above conditions may harm our financial position and business prospects. The risks include, among others, political instability due to changes in political leadership, economic downturn, risk of war or civil disturbances, declaration of a state emergency, changes in Malaysia government policies, introduction of new regulations, import and export restrictions, duties and tariffs. The occurrence of these events in Malaysia could adversely affect our business sentiment and consumer confidence, leading to reduced business and consumer spending and investment. This, in turn, may cause our existing and prospective customers to delay, reduce, or abandon their plans to engage our services. As such, there can be no assurance that political, social and economic events in Malaysia and other countries, which are beyond our control, would not materially affect our business operations and financial performance.

We are subject to the risk of claims against system performance warranty and defect liability.

We are exposed to the risk of system performance warranty claims after acceptance of our subcontract works as we provide performance warranty for the large-scale solar projects and C&I projects, in the form of achieving a minimum performance ratio during the defect liability period, which is typically 24 months. See “Item 4. Information on the Company—B. Business Overview—Our Services—Process Flow—Post-completion—Warranties and Defect Liabilities.” We are also exposed to the risk of defect liability claims for our large-scale solar projects and C&I projects. Claims against our failure to meet minimum performance ratio or defect liability claims, may have an impact on our financial performance.

If we fail to manage our growth or execute our strategies and future plans effectively, we may not be able to take advantage of market opportunities or meet the demand of our customers.

Our business has grown substantially since our inception, and we expect it to continue to grow in terms of the scale and diversity of operations. For example, we plan to expand our EPCC services to encompass other types of renewable energy, namely hydropower and biogas. See “Item 4. Information on the Company—B. Business Overview—Our Growth Strategies—Offer EPCC Services to Other Types of Renewable Energy, Such as Hydropower and Biogas”. This expansion increases the complexity of our operations and may cause strain on our managerial, operational, and financial resources. We must hire experienced professionals with expertise in hydropower and biogas, or provide training and development opportunities to existing staff members. If our new hires perform poorly or if we are unsuccessful in hiring, training, managing, and integrating qualified employees, our business, financial condition, and results of operations may be materially harmed.

Our future results of operations also depend largely on our ability to execute our future plans successfully. In particular, our continued growth may subject us to the following additional challenges and constraints:

| ● | we face challenges in recruiting, training, and retaining highly skilled personnel, including areas of sales and marketing, design and technical, optimization skills, and information technology for our growing operations; |

| ● | the execution of our future plan will be subject to the availability of funds to support the relevant capital investment and expenditures; and |

| ● | the successful execution of our strategies is subject to factors beyond our control, such as general market conditions, economic, and political development in Malaysia and globally. |

All of these endeavors involve risks and will require significant management, financial, and human resources. We cannot assure you that we will be able to effectively manage our growth or to implement our strategies successfully. Besides, there is no assurance that the investment to be made by our Company as contemplated under our future plans will be successful and generate the expected return. If we are not able to manage our growth or execute our strategies effectively, or at all, our business, results of operations, and prospects may be materially and adversely affected.

The COVID-19 pandemic has affected, and could continue to affect, the global economy as a whole and the markets in which we operate.

The COVID-19 pandemic resulted in the implementation of significant governmental measures, including lockdowns, closures, quarantines, and travel bans, intended to control the spread of the virus. Specifically, in response to the COVID-19 pandemic and its spread, the Malaysian government implemented intermittent lockdowns in various stages such as (i) imposing full movement control orders (“MCOs”), under which, quarantines, travel restrictions, and the temporary closure of stores and facilities in Malaysia were made mandatory; (ii) easing MCOs to a Conditional Movement Control Order (“CMCO”) under which most business sectors were allowed to operate under strict rules and Standard Operating Procedures mandated by the government of Malaysia; and (iii) further easing the CMCO to Recovery Movement Control Order. On January 12, 2021, due to a resurgence of COVID-19 cases, the Malaysian government declared a state of emergency nationwide to combat COVID-19. On March 5, 2021, lockdowns in most parts of the country were eased to a CMCO, however, COVID-19 cases in the country continued to rise. On May 12, 2021, the Malaysian government re-imposed a full lockdown order nationwide until October 11, 2021.

The impact of COVID-19 on our business and operations for the past three fiscal years has been minimal. As an essential service provider in Malaysia, our industry was permitted to continue operating during the pandemic lockdown period. Therefore, our business operations have not been significantly affected since our incorporation in 2021. Even after the COVID-19 pandemic has subsided, we may continue to experience an adverse impact to our business as a result of the COVID-19 pandemic’s global economic impact, including any economic recession that has occurred or may occur in the future that will have an impact in the growth of the solar energy industry.

Our business is geographically concentrated, which subjects us to greater risks from changes in local or regional conditions.

All of our current operations are located in Malaysia. Due to this geographic concentration, our financial condition and operating results are subject to greater risks from changes in general economic and other conditions in Malaysia, than the operations of more geographically diversified competitors. These risks include:

| ● | changes in economic conditions and unemployment rates; |

| ● | changes in laws and regulations; |

| ● | changes in the competitive environment; and |

| ● | adverse weather conditions and natural disasters. |

As a result of the geographic concentration of our business, we face a greater risk of a negative impact on our business, financial condition, results of operations, and prospects in the event that Malaysia is more severely impacted by any such adverse condition, as compared to other countries.

We may be unsuccessful in expanding and operating our business internationally, which could adversely affect our results of operations.

We plan to expand our business in other countries in Southeast Asia for the next two years, such as Vietnam and the Philippines. We plan to establish our presence in Vietnam and the Philippines in the second quarter of 2025. For details, see “Item 4. Information on the Company—B. Business Overview—Our Growth Strategies—Expand Our Business from Malaysia to Other Countries in the Southeast Asia region.” The entry and operation of our business in these markets could cause us to be subject to unexpected, uncontrollable, and rapidly changing events and circumstances outside Malaysia. As we grow our international operations in the future, we may need to recruit and hire new product development, sales, marketing, and support personnel in the countries in which we will launch our services or otherwise have a significant presence. Entry into new international markets typically requires the establishment of new marketing channels. Our ability to continue to expand into international markets involves various risks, including the possibility that our expectations regarding the level of returns we will achieve on such expansion will not be achieved in the near future, or ever, and that competing in markets with which we are unfamiliar may be more difficult than anticipated. If we are less successful than we expect in a new market, we may not be able to realize an adequate return on our initial investment and our operating results could suffer.

Our international operations may also fail due to other risks inherent in foreign operations, including:

| ● | varied, unfamiliar, unclear, and changing legal and regulatory restrictions, including different legal and regulatory standards applicable to solar energy industry; |

| ● | compliance with multiple and potentially conflicting regulations in other countries in Southeast Asia; |

| ● | difficulties in staffing and managing foreign operations; |

| ● | longer collection cycles; |

| ● | proper compliance with local tax laws, which can be complex and may result in unintended adverse tax consequences; |

| ● | localized spread of infection resulting from the COVID-19 pandemic, including any economic downturns and other adverse impacts; |

| ● | difficulties in enforcing agreements through foreign legal systems; |

| ● | fluctuations in currency exchange rates that may affect service demand and may adversely affect the profitability in MYR of services provided by us in foreign markets where payment for our services is made in the local currency; |

| ● | changes in general economic, health, and political conditions in countries where our services are provided; |

| ● | disruptions caused by acts of war; |

| ● | potential labor strike, lockouts, work slowdowns, and work stoppages; and |

| ● | different consumer preferences and requirements in specific international markets. |

Our current and any future international expansion plans will require management attention and resources and may be unsuccessful. We may find it impossible or prohibitively expensive to continue expanding internationally or we may be unsuccessful in our attempt to do so, and our results of operations could be adversely impacted.

Third parties may claim that we infringe their proprietary intellectual property rights, which could cause us to incur significant legal expenses and prevent us from promoting our services.

We cannot be certain that our operations or any aspects of our business do not or will not infringe upon or otherwise violate trademarks, patents, copyrights, know-how, or other intellectual property rights held by third parties. We may be from time to time in the future subject to legal proceedings and claims relating to infringement of the intellectual property rights of others. We may be subject to allegations that we have infringed on the trademarks, copyrights, patents, and other intellectual property rights of third parties, including our competitors, or that we are involved in unfair trade practices. In addition, there may be third-party trademarks, patents, copyrights, know-how, or other intellectual property rights that are infringed by our products, services, or other aspects of our business without our awareness. Holders of such intellectual property rights may seek to enforce such intellectual property rights against us in various jurisdictions.

If any third-party infringement claims are brought against us, we may be forced to divert management’s time and attention and other resources from our business and operations to defend against these claims, regardless of their merits. Additionally, the application and interpretation of intellectual property right laws and the procedures and standards for granting trademarks, patents, copyrights, know-how, or other intellectual property rights are evolving and may be uncertain, and we cannot assure you that courts or regulatory authorities would agree with our analysis. Such claims, even if they do not result in liability, may harm our reputation. If we were found to have violated the intellectual property rights of others, we may be subject to liability for our infringement activities or may be prohibited from using such intellectual property, and we may incur licensing fees or be forced to develop alternatives of our own. As a result, our business and financial performance may be materially and adversely affected.

If we fail to attract, recruit, or retain our key personnel, including our executive officers, senior management, and key employees, our ongoing operations and growth could be affected.

Our success also depends, to a large extent, on the efforts of our key personnel, including our executive officers, senior management, and other key employees who have valuable experience, knowledge, and connection in the solar energy industry. Mr. Lee Seng Chi, our Director and Chief Executive Officer, has over 11 years of experience in the solar industry and held senior leadership positions in multiple engineering companies before founding Founder Energy in 2021. There is no assurance that these key personnel will not terminate their employment with us. We do not carry key person insurance on any of our senior management team. The loss of any of our key personnel could be detrimental to our ongoing operations. Our success will also depend on our ability to attract and retain qualified personnel to manage our existing operations as well as our future growth. We may not be able to successfully attract, recruit, or retain key personnel, and this could adversely impact our growth.

Future acquisitions may have an adverse effect on our ability to manage our business.

We may acquire businesses, technologies, services, or products that are complementary to our solar PV installation business. Future acquisitions may expose us to potential risks, including risks associated with the integration of new operations, services, and personnel, unforeseen or hidden liabilities, the diversion of resources from our existing business and technology, our potential inability to generate sufficient revenue to offset new costs, the expenses of acquisitions, or the potential loss of or harm to relationships with both employees and customers resulting from our integration of new businesses.

Any of the potential risks listed above could have a material adverse effect on our ability to manage our business, revenue, and net income. We may need to raise additional debt funding or sell additional equity securities to make such acquisitions. The raising of additional debt funding by our Company, if required, would result in increased debt service obligations and could result in additional operating and financing covenants, or liens on their assets, that would restrict their operations. The sale of additional equity securities could result in additional dilution to our shareholders.

We may from time to time be subject to claims, controversies, lawsuits, and legal proceedings, which could adversely affect our business, prospects, results of operations, and financial condition.

We may from time to time become subject to or involved in various claims, controversies, lawsuits, and legal proceedings. However, claims and threats of lawsuits are subject to inherent uncertainties, and we are uncertain whether any of these claims would develop into a lawsuit. Lawsuits, or any type of legal proceeding, may cause our Company to incur defense costs, utilize a significant portion of our resources, and divert management’s time and attention from our day-to-day operations, any of which could harm our business. Any settlements or judgments against our Company could have a material adverse impact on our financial condition, results of operations, and cash flows. In addition, negative publicity regarding claims or judgments made against our Company may damage our reputation and may result in a material adverse impact on us.

We may be the subject of allegations, harassment, or other detrimental conduct by third parties, which could harm our reputation and cause us to lose market share.

We may be subject to allegations by third parties or purported former employees, negative Internet postings, and other adverse public exposure on our business, operations, and staff compensation. We may also become the target of harassment or other detrimental conduct by third parties or disgruntled former or current employees. Such conduct may include complaints, anonymous, or otherwise, to regulatory agencies, media, or other organizations. We may be subject to government or regulatory investigation or other proceedings as a result of such third-party conduct and may be required to spend significant time and incur substantial costs to address such third-party conduct, and there is no assurance that we will be able to conclusively refute each of the allegations within a reasonable period of time, or at all. Additionally, allegations, directly or indirectly against our Company, may be posted on the Internet, including social media platforms, by anyone on an anonymous basis. Any negative publicity about our Company or our management can be quickly and widely disseminated. Social media platforms and devices immediately publish the content of their users’ posts, often without filters or checks on the accuracy of the content posted. The information posted may be inaccurate and adverse to our Company, and it may harm our reputation, business, or prospects. The harm may be immediate without affording us an opportunity for redress or correction. Our reputation may be negatively affected as a result of the public dissemination of negative and potentially false information about our business and operations, which in turn may cause us to lose market share, We believe we maintain insurance coverage that is customary for businesses of our size and type.

Our current insurance policies may not provide adequate levels of coverage against all claims, and we may incur losses that are not covered by our insurance.

However, we may be unable to insure against certain types of losses or claims, or the cost of such insurance may be prohibitive. Uninsured losses or claims, if they occur, could have a material adverse effect on our reputation, business, results of operations, financial condition, or prospects.

Our large-scale solar projects are dependent on our relationship with the project awarders.

For the majority of our large-scale solar projects, we usually act as the contractor to the project awarders. Project awarders are service providers or main contractors who secure solar project bids from project owners and then subcontract the work to subcontractors. In the event that a solar project owner decides to terminate its contract with the project awarder, who has subcontracted work to us, it may lead to the termination of our contract with the project awarder. Such terminations may arise due to various factors, including changes in project priorities, financial constraints, or unforeseen circumstances, and could have a material adverse effect on our financial condition, results of operations, and overall business prospects.

Additionally, there is a risk of contract termination for convenience by the project awarders or the project awarders omitting or terminating any part of the contract works. The termination of our contract or the omission of specific contract works by the main contractor could result in financial consequences, potential project delays, and adverse impacts on our business performance. Further, any disruption in our relationship with project awarders, including but not limited to disputes, financial instability, or changes in strategic direction, may impact our ability to secure contracts and perform EPCC services.

We are subject to work variations due to changes in laws and regulations in Malaysia.

Our operations in Malaysia are subject to the regulatory environment. The regulatory landscape in Malaysia is subject to change. Alterations in laws, regulations, or government policies can impact various aspects of our projects, including licensing requirements, environmental standards, safety protocols, and other compliance measures. Such changes may necessitate modifications to ongoing projects, potentially leading to delays, increased costs, or adjustments in project scope.

In addition, our contractual agreements are often structured based on existing legal frameworks. Changes in laws may trigger variations in contract terms, specifications, or requirements, potentially leading to negotiations with project owners, subcontractors, or other stakeholders. Such variations could have financial implications and may require us to adapt our project execution strategies.

We are subject to risks associated with loan and financing arrangements.

In the ordinary course of our business, we enter into loan and financing agreements with financial institutions to support our operational and growth initiatives. These arrangements are crucial for maintaining liquidity and funding our activities; however, they expose the Company to several significant risks, including interest rate fluctuations, covenant compliance requirements, liquidity constraints, refinancing uncertainties, credit rating vulnerabilities, regulatory and legal risks, foreign exchange exposures, and ownership transfer of receivables in the event of default. The occurrence of such risks could result in such agreements being terminated or becoming less favorable to the Company, which could have a material adverse effect on our financial condition, or prospect.

Risks Related to Our Ordinary Shares and the Trading Market

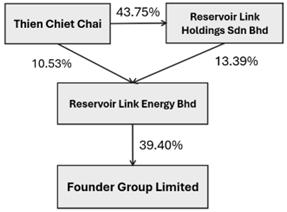

Share ownership remains concentrated in the hands of our largest shareholder Reservoir Link Energy Bhd. and management, who are able to exercise a direct or indirect controlling influence on us.

Our director Lee Seng Chi, our Chief Financial Officer See Sian Seong and our largest shareholder, Reservoir Link Energy Bhd., together beneficially own approximately 65.10% of our total issued and outstanding Ordinary Shares as of the date of this annual report. Reservoir Link Energy Bhd. is controlled by its board of directors. As a result, these shareholders, acting together, have significant influence over all matters that require approval by our shareholders, including the appointment and removal of directors and approval of certain significant corporate transactions. Corporate action might be taken even if other shareholders oppose them. This concentration of ownership might also have the effect of delaying or preventing a change of control of our Company that other shareholders may view as beneficial.

If we fail to implement and maintain an effective system of internal controls or fail to remediate the material weaknesses in our internal control over financial reporting that have been identified, we may fail to meet our reporting obligations or be unable to accurately report our results of operations or prevent fraud, and investor confidence and the market price of our Ordinary Shares may be materially and adversely affected.

We are subject to reporting obligations under U.S. securities laws. The SEC adopted rules pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 requiring every public company to include a management report on such company’s internal control over financial reporting in its annual report, which contains management’s assessment of the effectiveness of its internal control over financial reporting. In addition, if we cease to be an “emerging growth company” as such term is defined in the JOBS Act, our independent registered public accounting firm must attest to and report on the effectiveness of our internal control over financial reporting on an annual basis. Our management may conclude that our internal control over financial reporting is not effective. Moreover, even if our management concludes that our internal control over financial reporting is effective, our independent registered public accounting firm, after conducting its own independent testing, may issue a report that is qualified if it is not satisfied with our internal controls or the level at which our controls are documented, designed, operated, or reviewed, or if it interprets the relevant requirements differently from us. In addition, after we become a public company, our reporting obligations may place a significant strain on our management, operational, and financial resources and systems for the foreseeable future. We may be unable to complete our evaluation testing and any required remediation in a timely manner.

In preparing our consolidated financial statements as of and for the fiscal years ended December 31, 2022, 2023, and 2024, we and our independent registered public accounting firm have identified material weaknesses in our internal control over financial reporting, as defined in the standards established by the Public Company Accounting Oversight Board, and other control deficiencies. The material weaknesses identified included a lack of accounting staff and resources with appropriate knowledge of International Financial Reporting Standards and SEC reporting and compliance requirement and deficiency of internal journal entries procedure. Following the identification of the material weaknesses and control deficiencies, we plan to continue to take remedial measures: such as (i) implementing regular and continuous International Financial Reporting Standards accounting and financial reporting training programs for our accounting and financial reporting personnel; and (ii) engaging an external consulting firm to assist us with assessment of Sarbanes-Oxley compliance requirements and improvement of overall internal control. However, the implementation of these measures may not fully address the material weaknesses in our internal control over financial reporting. Our failure to correct the material weaknesses or our failure to discover and address any other material weaknesses or control deficiencies could result in inaccuracies in our financial statements and could also impair our ability to comply with applicable financial reporting requirements and related regulatory filings on a timely basis. As a result, our business, financial condition, results of operations and prospects, and the trading price of our Ordinary Shares, may be materially and adversely affected. Moreover, ineffective internal control over financial reporting significantly hinders our ability to prevent fraud.

We have incurred substantial increased costs as a result of being a public company.

As a public company, we have incurred significant legal, accounting, and other expenses that we did not incur as a private company prior to our IPO. The Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the SEC and Nasdaq, impose various requirements on the corporate governance practices of public companies. Compliance with these rules and regulations have increased our legal and financial compliance costs and made some corporate activities more time-consuming and costlier. We have incurred additional costs in obtaining director and officer liability insurance. In addition, we have incurred additional costs associated with our public company reporting requirements. It may also be more difficult for us to find qualified persons to serve on our board of directors or as executive officers.

Substantial future sales of our Ordinary Shares or the anticipation of future sales of our Ordinary Shares in the public market could cause the price of our Ordinary Shares to decline.

Sales of substantial amounts of our Ordinary Shares in the public market, or the perception that these sales could occur, could cause the market price of our Ordinary Shares to decline. An aggregate of 19,415,289 Ordinary Shares are issued and outstanding as of the date of this annual report and 3,700,382 are freely tradable. The remaining Ordinary Shares are “restricted securities” as defined in Rule 144. These Ordinary Shares may be sold without registration under the Securities Act to the extent permitted by Rule 144 or other exemptions under the Securities Act. Sales of these shares into the market could cause the market price of our Ordinary Shares to decline.

We do not intend to pay dividends for the foreseeable future.

We currently intend to retain any future earnings to finance the operation and expansion of our business, and we do not expect to declare or pay any dividends in the foreseeable future. As a result, you may only receive a return on your investment in our Ordinary Shares if the market price of our Ordinary Shares increases.

If securities or industry analysts do not publish research or reports about our business, or if they publish a negative report regarding our Ordinary Shares, the price of our Ordinary Shares and trading volume could decline.

Any trading market for our Ordinary Shares may depend in part on the research and reports that industry or securities analysts publish about us or our business. We do not have any control over these analysts. If one or more of the analysts who cover us downgrade us, the price of our Ordinary Shares would likely decline. If one or more of these analysts cease coverage of our Company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which could cause the price of our Ordinary Shares and the trading volume to decline.

The market price of our Ordinary Shares may be volatile or may decline regardless of our operating performance.

The market price of our Ordinary Shares may fluctuate significantly in response to numerous factors, many of which are beyond our control, including:

| ● | actual or anticipated fluctuations in our revenue and other operating results; |

| ● | the financial projections we may provide to the public, any changes in these projections or our failure to meet these projections; |

| ● | actions of securities analysts who initiate or maintain coverage of us, changes in financial estimates by any securities analysts who follow our Company, or our failure to meet these estimates or the expectations of investors; |

| ● | announcements by us or our competitors of significant products or features, technical innovations, acquisitions, strategic partnerships, joint ventures, or capital commitments; |

| ● | price and volume fluctuations in the overall stock market, including as a result of trends in the economy as a whole; |

| ● | lawsuits threatened or filed against us; and |

| ● | other events or factors, including those resulting from war or incidents of terrorism, or responses to these events. |

In addition, the stock markets have experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities of many companies. Stock prices of many companies have fluctuated in a manner unrelated or disproportionate to the operating performance of those companies. In the past, shareholders have filed securities class action litigation following periods of market volatility. If we were to become involved in securities litigation, it could subject us to substantial costs, divert resources and the attention of management from our business, and adversely affect our business.

If we cease to qualify as a foreign private issuer, we would be required to comply fully with the reporting requirements of the Exchange Act applicable to U.S. domestic issuers, and we would incur significant additional legal, accounting and other expenses that we would not incur as a foreign private issuer.

As a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements, and our officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we are not required under the Exchange Act to file periodic reports and financial statements with the SEC as frequently or as promptly as United States domestic issuers, and we are not required to disclose in our periodic reports all of the information that United States domestic issuers are required to disclose. While we currently are a foreign private issuer, we may cease to qualify as a foreign private issuer in the future, in which case we would incur significant additional expenses that could have a material adverse effect on our results of operations.

Because we are a foreign private issuer and are exempt from certain corporate governance standards established by the national securities exchanges that are applicable to U.S. issuers, you have less protection than you would have if we were a domestic issuer.

As a business company limited by shares incorporated under the laws of the British Virgin Islands, we are subject to the Nasdaq corporate governance listing standards. However, Nasdaq rules permit a foreign private issuer like us to follow the corporate governance practices of its home country. Certain corporate governance practices in the British Virgin Islands, which is our home country, may differ significantly from the Nasdaq corporate governance listing standards. We have relied on and plan to rely on home country practice with respect to our corporate governance. Specifically, we have elected to be exempt from the requirements under Nasdaq Listing Rule 5635 to obtain shareholder approval for (i) the issuance 20% or more of our outstanding Ordinary Shares or voting power in a private offering, (ii) the issuance of securities pursuant to a stock option or purchase plan to be established or materially amended or other equity compensation arrangement made or materially amended, (iii) the issuance of securities when the issuance or potential issuance will result in a change of control of our Company, and (iv) certain acquisitions in connection with the acquisition of the stock or assets of another company. As a result, our shareholders may be afforded less protection than they otherwise would enjoy under the Nasdaq corporate governance listing standards applicable to U.S. domestic issuers.

If we cannot continue to satisfy the listing requirements and other rules of the Nasdaq Capital Market, our securities may be delisted, which could negatively impact the price of our securities and your ability to sell them.

Our securities are listed on the Nasdaq Capital Market. We cannot assure you that our securities will continue to be listed on the Nasdaq Capital Market. In order to maintain our listing on the Nasdaq Capital Market, we are required to comply with certain rules of the Nasdaq Capital Market, including those regarding minimum stockholders’ equity, minimum share price, minimum market value of publicly held shares, and various additional requirements. Even if we currently meet the listing requirements and other applicable rules of the Nasdaq Capital Market, we may not be able to continue to satisfy these requirements and applicable rules. If we are unable to satisfy the Nasdaq Capital Market criteria for maintaining our listing, our securities could be subject to delisting.

If the Nasdaq Capital Market subsequently delists our securities from trading, we could face significant consequences, including:

| ● | a limited availability for market quotations for our securities; |

| ● | reduced liquidity with respect to our securities; |

| ● | a determination that our Ordinary Shares are a “penny stock,” which will require brokers trading in our Ordinary Shares to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our Ordinary Shares; |

| ● | limited amount of news and analyst coverage; and |

| ● | a decreased ability to issue additional securities or obtain additional financing in the future. |

Anti-takeover provisions in our M&A may discourage, delay, or prevent a change in control.

Some provisions of our M&A may discourage, delay or prevent a change in control of our Company or management that shareholders may consider favorable, including, among other things, the following:

| ● | provisions that authorize our board of directors to issue shares with preferred, deferred or other special rights or restrictions without any further vote or action by our shareholders; and |

| ● | provisions that restrict the ability of our shareholders to call shareholder meetings. |

Additionally, under the laws of the BVI, our directors may only exercise the rights and powers granted to them under our M&A for what they believe in good faith to be in the best interests of our Company and for a proper purpose.

The exclusive jurisdiction provision in our M&A may limit our shareholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers, or employees.

Our M&A provide that, to the fullest extent permitted by applicable law, unless our board of directors consents in writing to the selection of an alternative forum, the courts of the BVI shall have exclusive jurisdiction to hear and determine:

| ● | (i) any dispute, suit, action, proceedings, controversy, or claim of any kind arising out of or in connection with our M&A, including, without limitation, claims for set-off and counterclaims and any dispute, suit, action, proceedings, controversy, or claim of any kind arising out of or in connection with: (x) the creation, validity, effect, interpretation, performance, or non-performance of, or the legal relationships established by, our M&A; or (y) any non-contractual obligations arising out of or in connection with our M&A; or |

| ● | (ii) any dispute, suit, action (including, without limitation, any derivative action or proceeding brought on behalf or in our name or any application for permissions to bring a derivative action), proceedings, controversy, or claim of any kind relating or connected to us, our board of directors, officers, management, or shareholders arising out of or in connection with the BVI Act, the Insolvency Act, any other statute, rule, or common law of the BVI affecting any relationship between us, our shareholders, and/or our directors and officers (or any of them) or any rights and duties established thereby (including, without limitation, Division 3 of Part VI and Part XI of the BVI Act and section 162(1)(b) of the Insolvency Act, and fiduciary or other duties owed by any director, officer, or shareholder of the Company to the Company or the Company’s shareholders). |

To the fullest extent permitted by applicable laws, unless our board of directors consents in writing to the selection of an alternative forum, the federal district courts of the United States of America shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act or the Exchange Act. Notwithstanding the foregoing, we note that holders of our Ordinary Shares cannot waive compliance with the federal securities laws and the rules and regulations thereunder. Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder, and Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. As a result, the exclusive jurisdiction provision will not preclude or contract the scope of exclusive federal or concurrent jurisdiction for actions brought under the Securities Act or the Exchange Act, or the respective rules and regulations promulgated thereunder.

Although we believe this provision benefits us by providing consistency in the application of BVI law in the types of lawsuits to which it applies, the provision may impose additional litigation costs on shareholders in pursuing such claims, particularly if the shareholders do not reside in or near the BVI. Additionally, the provision may limit our shareholders’ ability to bring a claim in a judicial forum that they find favorable for disputes with us or our directors, officers, or employees, which may discourage the filing of such lawsuits. The courts of the BVI may also reach different judgment or results than would other courts, including courts where a shareholder considering an action may be located or would otherwise choose to bring the action, and such judgments may be more or less favorable to us than our shareholders. Alternatively, if a court were to find the exclusive jurisdiction provision contained in our M&A to be inapplicable or unenforceable in an action, we may incur additional costs associated with resolving such action in other jurisdictions, which could adversely affect our business and financial condition.

Our board of directors may decline to register transfers of Ordinary Shares in certain circumstances.

Our board of directors may, in its sole discretion, decline to register any transfer of any Ordinary Share which is not fully paid up or on which we have a lien. Our directors may also decline to register any transfer of any Ordinary Share unless (i) the instrument of transfer is lodged with us, accompanied by the certificate for the shares to which it relates and such other evidence as our board of directors may reasonably require to show the right of the transferor to make the transfer; (ii) the instrument of transfer is in respect of only one class of shares; (iii) in the case of a transfer to joint holders, the number of joint holders to whom the share is to be transferred does not exceed four; (iv) the shares transferred are free of any lien in favor of us; or (vi) a fee of such maximum sum as the Nasdaq Capital Market may determine to be payable, or such lesser sum as our board of directors may from time to time require, is paid to us in respect thereof. Ordinary Shares listed on the Nasdaq Capital Market, at our directors’ discretion, may be transferred without the need for a written instrument of transfer if the transfer is carried out in accordance with the laws, rules, procedures and other requirements applicable to shares listed on Nasdaq (including, but not limited to, the applicable Nasdaq listing rules). The transfer of a share is only effective once the name of the transferee is entered in the register of shareholders.

If our directors refuse to register a transfer they shall, within three months after the date on which the instrument of transfer was lodged, send to each of the transferor and the transferee notice of such refusal. The registration of transfers may, on fourteen (14) days’ notice being given by advertisement in one or more newspapers or by electronic means, be suspended and the register closed at such times and for such periods as our board of directors may from time to time determine, provided, however, that the registration of transfers shall not be suspended nor the register closed for more than thirty (30) days in any year.

This, however, is unlikely to affect market transactions of the Ordinary Shares purchased by investors in the public market. Our Ordinary Shares are listed on the Nasdaq Capital Market, and the legal title to such Ordinary Shares and the registration details of those Ordinary Shares in the Company’s register of members remain with the Depository Trust Company. All market transactions with respect to those Ordinary Shares are carried out without the need for any kind of registration by the directors, as the market transactions are all conducted through the Depository Trust Company systems.

Because we are an “emerging growth company,” we may not be subject to requirements that other public companies are subject to, which could affect investor confidence in us and our Ordinary Shares.

For as long as we remain an “emerging growth company,” as defined in the JOBS Act, we will elect to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of shareholder approval of any golden parachute payments not previously approved. Because of these lessened regulatory requirements, our shareholders would be left without information or rights available to shareholders of more mature companies. If some investors find our Ordinary Shares less attractive as a result, there may be a less active trading market for our Ordinary Shares and our share price may be more volatile.

You may have difficulty enforcing judgments against us.

We are incorporated under the laws of the BVI as a business company limited by shares. Currently, all of our operations are conducted in Malaysia, and almost all of our assets are and will be located outside of the United States. In addition, almost all of our officers and directors are nationals and residents of a country other than the United States, and almost all of their assets are located outside the United States. As a result, it may be difficult or impossible for you to bring an action against us or against these individuals in the United States in the event that you believe we have violated your rights, either under United States federal or state securities laws or otherwise, or if you have a claim against us. Even if you are successful in bringing an action of this kind, the laws of the BVI and of Malaysia may not allow you to enforce a judgment against our assets or the assets of our directors and officers.

The laws of the BVI may not provide our shareholders with benefits comparable to those provided to shareholders of corporations incorporated in the United States.