UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report ____________

Commission File Number: 001-41972

BitFuFu Inc.

(Exact name of Registrant as specified in its charter)

| Not applicable | Cayman Islands | |

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

9 Temasek Boulevard

Suntec Tower 2, #13-01

Singapore 038989

(Address of Principal Executive Offices)

Leo Lu, Chief Executive Officer

Telephone: +65 6252 7569

9 Temasek Boulevard

Suntec Tower 2, #13-01

Singapore 038989

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of exchange on which registered | ||

| Class A ordinary shares, par value US$0.0001 per share | FUFU | Nasdaq Capital Market (The Nasdaq Stock Market LLC) |

||

| Warrants, each exercisable for three fourths (3/4) of Class A ordinary share | FUFUW | Nasdaq Capital Market (The Nasdaq Stock Market LLC) |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31, 2024, there were 163,106,615 ordinary shares issued and outstanding, being the sum of (i) 28,106,615 Class A ordinary shares and (ii) 135,000,000 Class B ordinary shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☒ | Non-accelerated filer | ☐ |

| Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board | ☐ | Other | ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

TABLE OF CONTENTS

CERTAIN TERMS AND CONVENTIONS

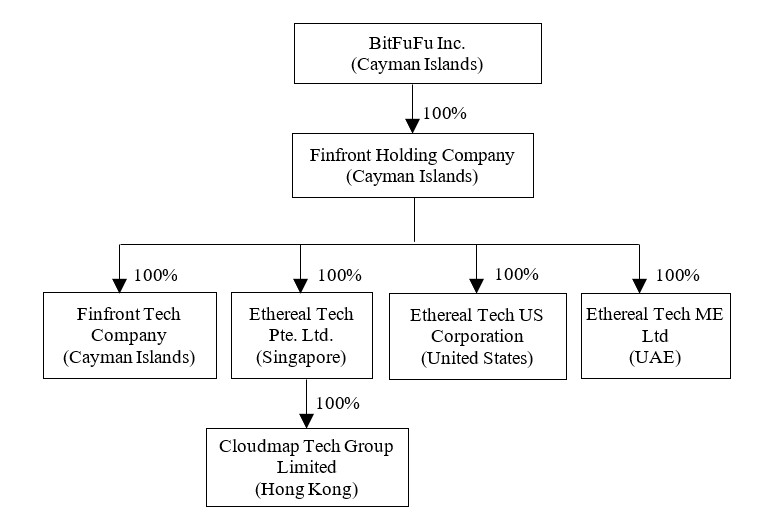

☐ Yes ☐ No Except as otherwise indicated or required by context, references in this annual report on Form 20-F for the fiscal year ended December 31, 2024 (the “Report”) to “we,” “us,” “our,” “our company” and “the Company” are to BitFuFu Inc., a Cayman Islands exempted company with limited liabilities and its subsidiaries.

| ● | References to “Amended and Restated Memorandum and Articles of Association” are to our Amended and Restated Memorandum and Articles of Association adopted by a special resolution of the Company passed on February 29, 2024 (as may be amended from time to time); |

| ● | References to “Arisz” are to Arisz Acquisition Corp.; |

| ● | References to “Arisz Common Stock” are to common stock of Arisz; |

| ● | References to “Arisz Rights” are to rights of Arisz, each right entitling the holder thereof to receive one-twentieth (1/20) of one share of Arisz Common Stock upon the consummation of an initial business combination of Arisz; |

| ● | References to “Arisz Warrants” are to redeemable warrants of Arisz, each entitling the holder thereof to purchase three-fourths (3/4) of one share of Arisz Common Stock at a price of US$11.50 per whole common stock, subject to adjustment; |

| ● | References to “Bitmain” are to Bitmain Technologies Ltd., a world-leading cryptocurrency mining hardware manufacturer and a related party to a shareholder of the Company; |

| ● | References to “BTC,” “ETH,” “BCH” and “USDT” are to Bitcoin, Ethereum, Bitcoin Cash and Tether, respectively; |

| ● | References to “Business Combination” are to the transaction contemplated under the Merger Agreement, including but not limited to (i) the merger of Arisz with and into the Company (the “Redomestication Merger”), with the Company surviving the Redomestication Merger as a publicly traded entity (the time at which the Redomestication Merger became effective is the “Redomestication Merger Effective Time”); and (ii) Merger Sub merged with and into Finfront (the “Acquisition Merger”), with Finfront surviving the Acquisition Merger as a wholly owned subsidiary of the Company; |

| ● | References to “Chardan” are to Chardan Capital Markets, LLC; |

| ● | References to “China” or “mainland China” are to the People’s Republic of China, excluding, for the purpose of this Report only, Taiwan, Hong Kong Special Administrative Region and Macau Special Administrative Region; |

| ● | References to “Class A ordinary shares” are to the Class A ordinary shares of BitFuFu Inc., par value US$0.0001 per share; |

| ● | References to “Class B ordinary shares” are to the Class B ordinary shares of BitFuFu Inc., par value US$0.0001 per share; |

| ● | References to “Closing” are to the closing of the Business Combination, which occurred on February 29, 2024; |

| ● | References to “Companies Act” are to Cayman Islands Companies Act (2025 Revision), as amended; |

| ● | References to “ET” or “Ethereal Singapore” are to Ethereal Tech Pte. Ltd., a subsidiary of BitFuFu Inc., which was incorporated under the laws of Singapore; |

| ● | References to “Ethereal US” are to Ethereal Tech US Corporation, a subsidiary of BitFuFu Inc., which was incorporated under Delaware law; |

| ● | References to “Exchange Act” are to the Securities Exchange Act of 1934, as amended; |

| ● | References to “Finfront” are to Finfront Holding Company, a wholly owned subsidiary of the Company; |

| ● | References to “hash calculation” are to solving cryptographic hash functions on specific blockchain; |

| ● | References to “hash rate” are to the amount of hash calculations that could be processed per second; |

| ● | References to “Investment Company Act” are to the Investment Company Act of 1940, as amended; |

| ● | References to “JOBS Act” are to Jumpstart Our Business Startups Act; |

| ● | References to “Merger Agreement” are to the agreement and plan of merger, dated as of January 21, 2022 (as amended as of April 4, 2022, October 10, 2022, April 24, 2023 and July 28, 2023), by and between Arisz and Finfront, as supplemented by the joinder agreement by and among the Company, Finfront, Merger Sub and Arisz, dated April 4, 2022 and the supplemental joinder agreement by and among the Company, Finfront, Merger Sub and Arisz, dated December 20, 2023; |

| ● | References to “Merger Sub” are to Boundary Holding Company; |

| ● | References to “Nasdaq” are to The Nasdaq Stock Market LLC; |

| ● | References to “ordinary shares” are to the Class A ordinary shares and Class B ordinary shares of BitFuFu Inc.; |

| ● | References to “PIPE” are to private investment in public equity; |

| ● | References to “PIPE Shares” are to the Class A ordinary shares issued to the accredited investors (the “Subscribers”) in the PIPE; |

| ● | References to “SEC” are to the Securities and Exchange Commission; |

| ● | References to “Securities Act” are to the Securities Act of 1933, as amended; |

| ● | References to “Sponsor” are to Arisz Investments LLC, a Delaware limited liability company affiliated with Arisz’s chairman and chief executive officer; |

| ● | References to “U.S. dollars,” “$,” or “US$” are to the legal currency of the United States; |

| ● | References to “U.S. GAAP” or “GAAP” are to accounting principles generally accepted in the United States; | |

| ● | References to “Unit Purchase Option” are to the option, dated November 17, 2021, issued to Chardan, for $100.00, to purchase up to 115,000 units (the “Option Units”) exercisable at $11.50 per unit commencing on the closing of a Business Combination. The Unit Purchase Option may be exercised for cash or on a cashless basis, at the holder’s option. Each Option Unit, upon issuance, contains one Class A Ordinary Share, one Warrant and one right, which upon automatic conversion entitles the holder thereof to receive one-twentieth (1/20) of one Class A Ordinary Shares; and |

| ● | References to “Warrant” are to the warrants of the Company, each entitling its holder thereof to purchase three fourths (3/4) of one Class A ordinary share at an exercise price of US$11.50 per whole share, subject to adjustment. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Report, including statements regarding our future financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. Forward-looking statements include, without limitation, our expectations concerning the outlook for our business, productivity, plans and goals for future operational improvements and capital investments, operational performance, future market conditions or economic performance and developments in the capital and credit markets and expected future financial performance, as well as any information concerning our possible or assumed future results of operations as set forth in this Report. Forward-looking statements also include statements regarding the expected benefits of the Business Combination.

Forward-looking statements involve a number of risks, uncertainties and assumptions, and actual results or events may differ materially from those projected or implied in those statements. Important factors that could cause such differences include, but are not limited to:

| ● | expectations regarding our strategies and future financial performance, including our future business plans or objectives, prospective performance and opportunities and competitors, revenues, customer acquisition and retention, products and services, pricing, marketing plans, operating expenses, market trends and acceptance, liquidity, cash flows and uses of cash, capital expenditures, and our ability to invest in growth initiatives and pursue acquisition opportunities; |

| ● | price fluctuations of digital assets, in particular that of Bitcoin; |

| ● | anticipated trends, growth rates, and challenges in the digital assets industry in general and the markets in which we operate; |

| ● | our ability to stay in compliance with laws and regulations that currently apply or become applicable to our business in Singapore, the United States and other international markets; |

| ● | the outcome of any legal proceedings that may be instituted against us and others; |

| ● | the ability to recognize the anticipated benefits of the Business Combination; |

| ● | our management and board composition; |

| ● | our ability to maintain listing status on Nasdaq; |

| ● | our ability to innovate, develop and provide services and products that meet the expectations of our customers; |

| ● | the possibility that we may be adversely affected by other economic, business, and/or competitive factors; |

| ● | litigation and regulatory enforcement risks, including the diversion of management time and attention and the additional costs and demands on our resources; and |

| ● | the other matters described in the section titled “Item 3. Key Information—D. Risk Factors.” |

We caution you against placing undue reliance on forward-looking statements, which reflect current beliefs and are based on information currently available to us as of the date a forward-looking statement is made. Forward-looking statements set forth herein speak only as of the date of this Report. We do not undertake any obligation to revise forward-looking statements to reflect future events, changes in circumstances, or changes in beliefs. In the event that any forward-looking statement is updated, no inference should be made that we will make additional updates with respect to that statement, related matters, or any other forward-looking statements. Any corrections or revisions and other important assumptions and factors that could cause actual results to differ materially from forward-looking statements, including discussions of significant risk factors, may appear, in our public filings with the SEC, which are accessible at www.sec.gov, and which you are advised to consult.

Market, ranking and industry data used throughout this Report, including statements regarding market size, is based on independent industry surveys and publications. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we are not aware of any misstatements regarding the industry data presented herein, such estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Item 3. Key Information—D. Risk Factors” and “Item 5. Operating and Financial Review and Prospects” in this Report.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Our business and our industry are subject to significant risks. You should carefully consider all of the information set forth in this Report and in our other filings with the SEC, including the following risk factors, in evaluating our business. Any of the following risks or any additional risks not presently known to us or that we currently deem immaterial may materially and adversely affect our business, financial condition, results of operations, and growth prospects. In that event, the trading price of our securities could decline, and you could lose all or portion of your investment. This Report also contains forward-looking statements that involve risks and uncertainties. See the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

Summary of Risk Factors

Risks Related to Our Business

Risks and uncertainties relating to our business include, but are not limited to, the following:

| ● | our limited operating history and rapid growth making it difficult to evaluate our business and prospects; |

| ● | our ability to innovate and provide services and products that meet the expectations of our customers; |

| ● | price fluctuations of digital assets, in particular that of Bitcoin; |

| ● | our ability to compete effectively against current and future competitors; |

| ● | our reliance on a limited number of suppliers to provide us with digital asset mining equipment, hosting facilities, and other products or services critical to our business; |

| ● | our customer concentration; and |

| ● | risks related to power supply, including increases in power costs and power outage. |

Risks Related to Our Operations

Risks and uncertainties relating to our operations include, but are not limited to, the following:

| ● | security breaches, threats and attacks affecting us or the digital asset industry; |

| ● | system failure or other service disruptions of our system; |

| ● | our ability to maintain relevant licenses and permits; |

| ● | our reliance on third-party service providers to safeguard and manage certain digital assets; |

| ● | risks related to loss of digital assets; |

| ● | involvement in legal or other disputes; |

| ● | risks related to prepayments and deposits to suppliers and account receivables from customers; and |

| ● | uncertainties with respect to the accounting treatment of digital assets. |

Risks Related to Our Industry

Risks and uncertainties relating to our industry include, but are not limited to, the following:

| ● | adverse changes in the regulatory and policy environment of digital assets and relevant industry players in multiple jurisdictions; |

| ● | concerns about greenhouse gas emissions, global climate change and other ESG issues; |

| ● | changes to the method of validating blockchain transactions; |

| ● | increase in mining difficulty and reduced economic returns of digital asset mining activities; |

| ● | reduced demand for blockchain technology, blockchain networks and digital assets; and |

| ● | fraud, hacking or other adverse events to the digital asset networks. |

Risks Related to the Regulatory Framework

Risks and uncertainties relating to the regulatory framework include, but are not limited to, the following:

| ● | current and future legislation imposing greater restrictions on the digital assets; |

| ● | determination of us as an investment company under the Investment Company Act and relevant regulatory requirements; |

| ● | requirement to register as money services business or similar compliance requirements; |

| ● | a digital asset’s being determined as a “security” under relevant laws, and the related registration and other compliance requirements; and |

| ● | difficulties in securing relationship with financial institutions due to our operations in the digital asset industry. |

Risks Related to Our Securities

Risks and uncertainties relating to our securities include, but are not limited to, the following:

| ● | uncertainty in the development of an active trading market for our shares; |

| ● | price volatility of our shares; |

| ● | sale or availability for sale of substantial amounts of our shares; | |

| ● | potential additional dilution resulted from the exercise of warrants; | |

| ● | warrant may expire worthless, as they may never be in the money; |

| ● | potential dilution for existing shareholders upon our issuance of additional shares; |

| ● | potential treatment of our company as a passive foreign investment company; |

| ● | our dual-class structure and impact on relevant shareholders’ ability to influence corporate matters; |

| ● | our Amended and Restated Memorandum and Articles of Association and Cayman Islands law may have the effect of discouraging lawsuits against our directors and officers; |

| ● | anti-takeover provisions contained in our Amended and Restated Memorandum and Articles of Association, as well as provisions of Cayman Islands law, could impair a takeover attempt; |

| ● | exemptions from requirements applicable to other public companies due to our status as an emerging growth company; |

| ● | difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions against us or our management named in this Report based on foreign laws; |

| ● | ability to maintain the listing of our securities on Nasdaq in the future; and |

| ● | exemptions from certain corporate governance requirement under the Corporate Governance Rules of Nasdaq due to our status as a “controlled company.” |

Risks Related to Our Business

Our limited operating history and rapid growth may make it difficult to evaluate our business and prospects, and our historical results may not be indicative of our future performance.

We have a short operating history and have experienced rapid growth in terms of revenue, number of customers and total cloud-mining capacity, or the capacity to provide hash calculations, since our establishment in December 2020. In particular, our revenues increased from US$198.2 million in 2022 to US$284.1 million in 2023, and further to US$463.3 million in 2024. Because of our limited operating history and historical data, as well as the limited visibility into future demand trends, our limited operating history and rapid growth may not be indicative of our future performance, and we may not be able to accurately forecast our future performance and growth potentials and budget our costs and operating expenses accordingly.

Our business may be affected by the rapidly evolving the digital asset industry, in particular the fluctuation of Bitcoin price, and the changes in demand or order patterns for our services and products as a result. We may not be able to accurately forecast the longer-term development of the digital assets industry, and as result, may experience fluctuations in orders in the future. Our limited historical results of operations could make it difficult to assess the impact of seasonal factors on our business. If we are unable to increase our access to mining capacities and hosting capacities to meet any increases in demand due to seasonality or other factors, our total revenue and profitability and our reputation among customers would be materially and adversely affected.

If we fail to continually innovate and to provide services and products that meet the expectations of our customers, we may not be able to attract new customers or retain existing customers, and hence our business and results of operations may be adversely affected.

The industries in which we operate and intend to operate in the future are characterized by constant changes, including rapid technological evolution, continual shifts in customer demands, frequent introductions of new services, products and solutions, and constant emergence of new industry standards and practices. Our success will depend, in part, on our ability to respond to these changes in a cost-effective and timely manner, which requires us to anticipate the emergence of new technologies and assess their market acceptance.

Research and development activities are inherently uncertain, and it may be difficult to commercialize the research and development results, which could result in excessive expenses or delays. Given the fast pace with which blockchain has been and will continue to be developed, we and our business partners may not be able to timely upgrade technologies in an efficient and cost-effective manner, or at all. In addition, new developments in blockchain and digital assets could render our services and products obsolete or unattractive. If we are unable to keep up with the technological developments and anticipate market trends, or if new technologies render our technologies, services and products obsolete, customers may no longer be attracted to our offerings. As a result, our business, results of operations and financial condition would be materially and adversely affected.

Our results of operations may be significantly impacted by digital asset price fluctuations, and our business, results of operations and financial condition could be materially and adversely affected by a significant drop in the prices of digital assets and Bitcoin in particular.

The demand for, and pricing of, our services and products are determined primarily by the expected economic return of digital asset mining activities, in particular those of Bitcoin, which in turn is significantly affected by expectations with respect to their prices, among other factors. The price of Bitcoin has experienced significant fluctuations over its short existence and may continue to fluctuate significantly in the future. For example, the price of Bitcoin ranged from approximately US$16,000 to approximately US$46,000 in 2022, from approximately US$17,000 to approximately US$44,000 in 2023, and from approximately US$42,000 to approximately US$106,500 in 2024, and have continued to experience significant volatility since then, reaching approximately US$81,600 as of March 31, 2025, according to Google Finance. In 2022 and 2023, a number of companies in the digital asset industry have declared bankruptcy, including Core Scientific, Celsius, Voyager Digital, Three Arrows Capital, BlockFi, FTX, and Genesis Holdco. Those bankruptcy proceedings contributed, at least in part, to further price decreases in Bitcoin observed during those periods, and a loss of investor confidence in the digital asset industry, which in turn may materially and adversely affect the demand of our cloud-mining services and mining equipment, as well as the profitability of our self-mining business.

Given the volatility of the price of digital assets, we cannot assure you that the price of Bitcoin or other digital assets will remain high enough to sustain the demand for our services and products or that their prices will not decline significantly in the future. Various factors, mostly beyond our control, could impact the prices of digital assets, including:

| ● | the limited use of digital assets as payment currencies, as compared with fiat currencies; |

| ● | government and quasi-government regulation of digital assets and their use, or restrictions on or regulation of access to and operations of digital asset transactions; |

| ● | changes in consumer demographics and market trends; |

| ● | the maintenance and development of open-source software protocols or similar digital asset systems; |

| ● | the availability and popularity of other forms or payment methods, including new means of using fiat currencies; |

| ● | general economic conditions and the regulatory environment relating to digital assets; and |

| ● | negative consumer perception of digital assets, in particular Bitcoin. |

If the price of digital assets or network transaction fees drop, the expected economic return of mining activities will diminish, resulting in a decrease in demand for our services and products. We may need to adjust our pricing strategy to respond to changes in market demand. The future of digital assets and their prices are subject to a high degree of uncertainty. If transaction fees become too high, users may be discouraged from using digital assets, which will decrease the transaction volume of the digital asset network. In addition, any power shortage due to government control measures or other reasons, or increase in energy costs, would raise the mining costs. These instances could affect our customers’ expected economic return for mining activities, which in turn, would adversely affect the demand for and pricing of our services and products.

Furthermore, fluctuations in the price of digital assets may affect the value of our fixed assets or inventories, which primarily consist of Bitcoin miners, as well as the provision we make to the inventory as we manage inventory level based on, among others, forecasts for sales and service provisions. As we may increase our procurement volume for the launch of new services or products or due to expected surge of demand, a significant drop in the price of digital assets can lead to a lower expected sales price and excessive inventories, which in turn will lead to impairment losses with respect to such inventories. A significant drop in the price of digital assets may also subject us to impairment loss for digital assets held for our own account. For example, we recorded impairment losses on digital assets of US$12.9 million, US$7.0 million, and nil in 2022, 2023, and 2024, respectively, when the price of Bitcoin declined significantly against its carrying value. As of January 1, 2024, we have early adopted fair value measurement in accordance with ASU 2023-08, resulting in a fair value gain of US$37.6 million recorded in 2024. As a result, any future significant reductions in the price of Bitcoin and other digital assets will likely have a material and adverse effect on our results of operations and financial condition.

We hold stablecoins for our business operations, and are subject to the risks associated with stablecoins.

We hold stablecoins, in particular USDT, for our business operations. As of December 31, 2022, 2023 and 2024, the total value of USDT that we held for our own account was approximately US$55,515, US$60,860 and US$4,817,051 respectively. For example, we may receive USDT as payments for our cloud-mining service, and other digital assets such as BTC and ETH received by us as service payments are automatically converted into USDT. Since October 2022, we have begun to convert our USDT into U.S. dollars and deposit them with banking institutions on a timely basis according to our treasury management strategy. See “Item 4. Information on the Company—B. Business Overview—Digital Assets.” A stablecoin is a digital asset that seeks to maintain a stable value and is backed by an asset or portfolio of assets, such as fiat currency like the U.S. dollars. There is a risk that the stablecoin issuer does not hold the corresponding asset underlying each stablecoin in circulation and is therefore unable to fulfill one-for-one redemptions. In addition, many stablecoin issuers are unregulated and do not provide transparent disclosure regarding their compliance with applicable licensing and regulatory requirements or the financial institutions that hold the underlying stable assets. Some have also argued that stablecoins may be involved in money laundering. On February 17, 2021, the New York Attorney General entered an agreement with USDT’s operators, requiring them to cease any further trading activity with New York persons and pay US$18.5 million in penalties for false and misleading statements made regarding the assets backing USDT.

Volatility in stablecoins, operational issues with stablecoins (for example, technical issues that prevent settlement), concerns about the sufficiency of any reserves that support stablecoins, or regulatory concerns about stablecoin issuers or intermediaries, such as crypto asset spot markets, that support stablecoins, could also affect, among others, the value, credentials, exchangeability and liquidity of stablecoins. If any of these events affecting stablecoins we hold were to occur, the value of the affected stablecoins we hold could materially decline, and we may not be able to timely convert digital assets into other viable forms, which could materially and adversely affect our results of operations, financial condition and future prospects.

We may not be able to compete effectively against our current and future competitors, which could have a material adverse effect on our business, financial condition and results of operations.

The digital asset industry is highly innovative, rapidly evolving and characterized by competition, experimentation, frequent introductions of new services and products and uncertain and evolving industry and regulatory requirements. We expect competition to further intensify in the future as existing and new competitors introduce new products or enhance existing services and products. We compete against numerous developers, owners and operators in the blockchain industry worldwide. Some of our current and future competitors may have greater brand recognition, longer operating histories, stronger marketing, technical and financial resources and access to greater and less expensive power than we do. Our current and future competitors may vary in size, service offerings and geographic presence. In addition, many companies in the digital asset industry are consolidating, which could further increase their market shares. If we are unable to compete successfully, or if solidifying our competitive advantages requires us to incur significant costs, our business, financial condition and results of operations could be adversely affected.

We compete with our competitors in multiple aspects, including pricing, service quality and user experience, reputation, relationship with suppliers, power resources, ability to obtain replacement for miners or hosting facilities, technical and software expertise, and financial resources. Some of our competitors may be able to:

| ● | develop superior products or services, gain greater market acceptance and expand their service offerings more efficiently or rapidly; |

| ● | adapt to new or emerging technologies and changes in customer requirements more quickly; |

| ● | obtain more favorable terms from the suppliers and procure mining equipment, electricity and other supplies in a more cost-efficient manner; |

| ● | identify and acquire desirable properties that we are interested in from developers; |

| ● | offer services at prices below current market rates or below the prices we currently charge our customers; |

| ● | take advantage of acquisition and other opportunities more readily; and |

| ● | adopt more aggressive pricing policies and devote greater resources to the promotion, marketing and sales of their services. |

In addition, we may face pricing pressure with respect to our services and products. Prices for our services are affected by a variety of factors, including supply and demand conditions and pricing pressures from our competitors. We may be required to lower our prices to remain competitive, which may decrease our profit margins and could have a material adverse effect on our business, financial condition and results of operations.

We rely on a limited number of suppliers to provide us with digital asset mining equipment, hosting facilities, and other products or services critical to our business operations. We may not be able to obtain such supplies at competitive prices during times of high demand, which could have a material adverse effect on our business, financial condition and results of operations.

We rely on a limited number of suppliers to provide us with products and services, including but not limited to miners, hash rates and hosting facilities, at economical prices. For the years ended December 31, 2022, 2023 and 2024, our purchases from top three suppliers accounted for 84%, 83%, and 81% of our total cost of revenue in the same periods, respectively. Particularly, we purchased and leased miners from and gained access to hosting facilities in a number of regions and countries through collaborations with Bitmain, our largest supplier in 2024. In 2022, 2023 and 2024, costs attributed to agreements with Bitmain, as a percentage of our total cost of revenue, was approximately 52%, 61% and 41%, respectively. If we are unable to maintain business relationship with our suppliers such as Bitmain and the other key suppliers, our operations could be disrupted, and our business, financial condition and results of operations would be adversely affected. We may not be unable to obtain miners and hosting services from other suppliers at commercially reasonable term in a timely manner, or at all. Our ability to meet the increasing demand of our services and products and grow our business is dependent, in large part, on the availability of advanced mining equipment and hosting resources offered to us at commercially reasonable prices. The price and availability of such mining equipment fluctuate with the price of Bitcoin or other digital assets. Higher digital asset prices tend to increase the demand for mining equipment and thus increase the cost to acquire or lease such equipment.

In addition, as more companies seek to enter the digital asset mining industry, the demand may outpace supply and create shortages, and we cannot assure you that such key miner suppliers will be able to keep pace with any surge in the demand for mining equipment. These key suppliers may also prioritize the order of our competitors, in which case we may experience difficulties in securing miner supply. Further, as these key suppliers typically can determine the terms of supply agreements, we have limited bargaining power in negotiating the terms of supply agreements or may have little or no recourse in the event a key miner supplier defaults on our delivery commitments. Defects, malfunctions, errors and breakdown of these miners may occur from time to time, and we cannot assure you that we or our suppliers can take remedial measures in a timely manner. Historically, an increase in interest and demand for digital assets has led to a shortage of hosting and transaction processing hardware and increased prices on the market. We may experience difficulty in obtaining new mining equipment to satisfy the demand of our customers, which may have a material adverse impact on the demand for our revenue. If we are not able to obtain a sufficient number of miners at favorable prices, our growth expectations, liquidity, financial condition and results of operations will be materially and adversely affected.

We also rely on Bitmain to provide the miner hosting services under certain hosting service cooperation arrangements, through which Bitmain sources a limited number of hosting facilities to host miners and provide services related to maintenance and technical support, electricity, network and security. These hosting facilities may demand for upward adjustments of their service fees, including electricity cost, which we may not be able to pass on to our customers. We cannot assure you that it can continue to maintain cooperation with these hosting facilities, or the services provided by these parties always meet the level of quality, efficiency and timeliness necessary for us to render satisfactory hosting services to our customers. Such hosting facilities may experience interruption or other incidents from time to time, and may be unable to provide services to us. We may not be able to obtain alternative hosting facility supplies in a time manner and/or at commercially viable terms. If we are unable to effectively address these risks, our ability to serve customers will be affected, and our brand image, reputation and financial performance may be materially and adversely affected.

Our self-mining operations utilize third-party mining pools to receive mining rewards from a given network. Mining pools allow mining participants to combine their hash calculations, which increases the chances of solving a block and receive rewards of a given network. The rewards are distributed by the pool operator, based on our contribution of hash calculations to the pool. We are dependent on the accuracy of mining pool operators to accurately record the total hash calculations provided to the pool for a given Bitcoin or other digital asset mining application in order to assess the proportion of hash calculations contributed by us. While we have internal methods of tracking both our hash calculations provided, the mining pool operator uses its own record-keeping method to determine our effective contribution of hash calculations. We have limited recourse against the mining pool operator if we determine the proportion of the reward pay out by a mining pool operator is incorrect. If we are unable to consistently obtain accurate proportionate rewards from such mining pool operators, we may experience reduced reward for our efforts, which would have an adverse effect on our business and operations.

We have derived a substantial portion of our revenue from sales to a limited number of customers, which may expose us to risks relating to customer concentration.

Our customers include both enterprises and individuals. We have derived a substantial portion of our revenue from sales to a limited number of customers. In 2022, 2023 and 2024, sales to our largest customer accounted for 17%, 15% and 14% of our total revenue in the same periods, respectively. Chainup Technic Limited and its related parties were our largest customer in 2022 and 2023, and Vistra (BVI) Limited was our largest customer in 2024. Additionally, in 2022, 2023 and 2024, sales to our top three customers accounted for 31%, 26% and 31% of our total revenue in the same periods, respectively. Although we continually seek to diversify our customer base, we cannot assure you that the proportion of revenue contribution from our major customers to our total revenue will decrease in the future. Dependence on a limited number of major customers to our total revenue exposes us to risks of substantial losses if any of them reduces or ceases business collaboration with us. Specifically, any one of the following events, among others, may cause material fluctuations or declines in our revenue, and have a material and adverse effect on our business, results of operations, financial condition and prospects:

| ● | a decline in the business of one or more of our major customers; |

| ● | the decision by one or more of the major customers to shift to our competitors; |

| ● | the reduction in the price of our services and products agreed by one or more of our major customers; |

| ● | the failure or inability of any of the major customers to make timely payment to us; or |

| ● | regulatory development that may negatively affect the business of one or more of our major customers or digital asset mining activities in general. |

It may not be possible for us to accurately predict the future demand from our major customers, and it may fail to maintain relationships with these major customers or to do business with them at the same or increased levels. If any of the foregoing were to occur, and we are unable to expand our business with other existing customers or attract new customers in a timely manner or at all, our business, financial condition, results of operations and prospects may be materially and adversely affected.

Mining digital assets requires significant electric power, and the inability to obtain power resources at commercially viable terms could have a material adverse effect on our business, financial condition and results of operations.

Our operations require a significant amount of electric power to power and cool the mining equipment. Power costs represent a significant component underlying our cost of revenue. The amount of power required by us will increase commensurate with the increase in demand for our services and products and mining equipment we operate for ourselves and our customers. Power costs and availability are also vulnerable to seasonality, with increased costs primarily in the summer months. We also face risks of outages and power grid damage as a result of inclement weather, animal incursion, and other events out of our control. We cannot assure you that the facilities hosting our miners will be able to deliver sufficient power to meet the growing needs of our business on commercially reasonable terms. Currently, part of our power costs are covered in our service framework agreement with Bitmain, which may demand for changes to terms of the service framework agreement, including an upward adjustment to the electricity cost. In addition, we may incur additional electricity costs based on specific orders under such framework arrangements, which may include periodic price adjustment mechanism with reference to local electricity price index. We may not be able to pass on such increase in electricity costs to our customers. Failure by our counterparty to perform its obligation under the contract terms may affect our ability to provide services to our customers and disrupt our business operations. Any significant increase in the power costs could have a material adverse effect on our business, financial condition and results of operations.

Power outage may result in disruption of our business.

Our business is vulnerable to disruptions and power outages resulting from weather, animal incursions, accidents, equipment failures, curtailments, acts of war, sabotage and other events. We rely on third-party hosting facility providers to host our miners, and cannot assure you that these hosting facilities have backup power generators to maintain our operations in the event of a power outage. Disruption of our business could impact our ability to generate and maintain the power levels necessary to provide cloud-mining services to customers and mine digital assets for ourselves, which could have a material adverse effect on our business, financial condition and results of operations.

Delays in the expansion of existing facilities or establishment of new facilities, or significant cost overruns could adversely affect our business.

The equipment used for digital asset mining and transaction processing require the use of facilities with a highly specialized infrastructure and considerable and reliable electric power. We expand our business operations by increasing our mining equipment, and expanding cooperation with providers of our existing facilities to gain access to higher mining capacity. We cannot assure you that our hosting facility providers could obtain access to such suitable land to expand hosting capacity, as such suppliers need to work closely with local governments to obtain necessary permits and local power suppliers for power supplies. Delays in actions that require the assistance of such third parties, in receiving required permits and approvals or in mediations with local communities, if any, may negatively impact such hosting facility providers’ construction timelines and budget or result in any new facilities not being completed at all. We cannot assure you that we will not experience quality issues in any expansion or upgrades of those facilities. All of these risks could cause us to be unable to run our mining operations in a way that is technologically advanced, economical and energy efficient and temperature controlled, which will adversely affect our business, financial condition and results of operations. If we experience significant delays in the supply of power and facility spaces required to support our expansion, our ability to deliver services and expand operations will be materially and adversely affected.

The average selling prices of our services and products may fluctuate from time to time, which may in turn adversely affect our profitability.

The digital asset industry is characterized by rapid launches of new services and products, continuous technological advancements and changing market trends and customer preferences, all of which may cause fluctuations in the average selling prices of our services and products over time. We may have to significantly lower the average selling prices of our services and products to retain customers. However, such significant decreases in average selling prices may not be offset by a corresponding decrease in the prices of the equipment and properties, and our profitability may be materially and adversely affected.

Increases in hosting costs, power costs other important cost items may cause us to mine digital assets less cost-efficiently, which may reduce our operating and profit margins, and adversely affect our business, financial condition and results of operations.

We incurred cost of revenue of US$162.0 million, US$271.4 million and US$433.6 million in 2022, 2023 and 2024, respectively, and realized a gross profit margin of 18.3%, 4.5% and 6.4% in the same periods, respectively. We achieved a net profit of US$2.4 million, US$10.5 million and US$54.0 million in 2022, 2023 and 2024, respectively. We expect our cost of revenue to continue representing a substantial portion of our total revenue. If we do not manage those costs effectively, our operating and profit margins may be reduced, and our business, financial condition and results of operations may be adversely affected.

We face risks associated with the expansion of our operations globally, and if we are unable to effectively manage these risks, they could impair our ability to expand our business abroad.

As we continue to grow our business and expand our operations globally, we will continue to sell our services and products into new jurisdictions in which we may have limited or no experience and in which our brands may be less recognized. The expansion exposes us to a number of risks, including, but are not limited to:

| ● | high cost of investment to establish a presence in a new market and manage international operations; |

| ● | competition from unfamiliar markets, including with competitors who are more dominant and have stronger ties with customers and greater financial and other resources; |

| ● | foreign currency exchange rate fluctuations; |

| ● | regulatory differences and difficulties in ensuring compliance with multi-national legal requirements and multi-national operations; |

| ● | changes in economic, legal, political or other local conditions in new markets; |

| ● | our limited customer base and limited sales and relationships with international customers; |

| ● | challenges in providing customer services and support in these markets; |

| ● | difficulties in and costs of overseas operations while complying with the different commercial, legal and regulatory requirements of the international markets in which we offer our services and products; |

| ● | difficulty in ensuring that our customers comply with the sanctions imposed by the Office of Foreign Assets Control in the United States and regulators in other countries and regions, on various foreign states, organizations and individuals; |

| ● | inability to obtain, maintain or enforce intellectual property rights; |

| ● | inability to effectively enforce contractual or legal rights or intellectual property rights in certain jurisdictions where we operate; and |

| ● | governmental policies favoring domestic companies in certain foreign markets or trade barriers including export requirements, tariffs, taxes and other restrictions and charges. |

In particular, a worldwide trend in favor of nationalism and protectionist trade policy, as well as other potential international trade disputes could cause turbulence in international markets. These government policies or trade barriers could increase the prices of our products and make us less competitive in such countries. If we are unable to effectively manage these risks, the ability to expand our business abroad will be impaired, which could have a material and adverse effect on our business, financial condition, results of operations and prospects.

If we fail to accurately estimate the factors for our contract pricing, we may generate lower profit than expected or incur losses on those contracts, which could have a material adverse effect on our business, financial condition and results of operations.

Our service contracts are generally priced based on various internal and external factors, such as miner costs, the technological contents of our services, costs of hosting miners, market price of digital assets, price of competitors, the expected economic return of digital asset mining, the service and cost recovery model, and the market demand. Our ability to set favorable prices at our desired margins and accurately estimate costs, among other factors, has a significant impact on our profitability. We may be unable to maintain our bargaining power, and our profit margin may be driven down by market conditions or other factors. If we see higher pricing pressure due to intensified competition from other competitors, decrease in prices to our customers in the end market or any other reasons, or if we otherwise lose bargaining power due to weaker demand for our services and products, we may need to reduce our prices and lower our profit margins. Moreover, we may not be able to accurately estimate our costs or pass on all or part of any increase in our costs of miner and hosting facilities, to our customers. As a result, our results of operations and financial condition could be materially and adversely affected.

Our future success depends on our ability to keep pace with rapid technological changes that could make our current or future technologies less competitive or obsolete.

Rapid, significant and disruptive technological changes continue to impact the digital asset industry. Services and products offered by us may become less marketable due to demand for new processes and technologies, including, without limitation: (i) customer demand for miners with higher hash rate or for new types of digital assets; (ii) new processes to deliver power to, or eliminate heat from, miners; (iii) customer demand for additional cloud-mining or hosting capacity; (iv) new technology that permits higher levels of critical load and heat removal than the facilities are currently designed to provide; (v) limited power supply to support new, updated or upgraded technology; and (vi) a shift to more power-efficient transaction validation protocols. In addition, the systems that connect miners managed by us to the internet and other external networks may become insufficient, including with respect to latency, reliability and diversity of connectivity. We may not be able to adapt to changing technologies, identify and implement new alternatives successfully or meet customer demands for new processes or technologies in a timely and cost-effective manner, if at all, which would have a material adverse effect on our business, financial condition and results of operations.

Even if we succeed in adapting to new processes and technologies, there is no assurance that our use of such new processes or technology would have a positive impact on our financial performance. For example, we could incur substantial additional costs if we need to materially improve the miner fleet engaged through the implementation of new systems or new server technologies that require levels of critical load and heat removal that the current or future facilities hosting are not designed to provide. In addition, our new services and products could be superior than our prior services and products, and customers could switch away from our prior services and products that could have higher revenue or better margins for the new services and products. Therefore, the adaptation to new processes and technologies could result in lower revenue, lower margins and/or higher costs, which could have a material adverse effect on our business, financial condition and results of operations.

In addition, our competitors or others might develop technologies that are more effective than our current or future technologies, or that render our technologies less competitive or obsolete. Further, many of our competitors may have superior financial and human resources deployed toward research and development efforts. We may not be able to effectively keep pace with relevant technological changes. If competitors introduce superior technologies, and we cannot make upgrades to our hardware or software to remain competitive, it could have a material adverse effect on our business, financial condition and results of operations.

If we are unable to maintain or enhance our brand recognition, our business, financial condition and results of operations may be materially and adversely affected.

Maintaining and enhancing the recognition, image and acceptance of our brand are important to our ability to differentiate our services from and to compete effectively with our peers. Our brand image, however, could be jeopardized if we fail to maintain high service quality, pioneer and keep pace with evolving technology trends, or timely meet the demand for our services. If we fail to promote our brand or to maintain or enhance our brand recognition and awareness among our customers, or if we are subject to events or negative allegations affecting our brand image or the publicly perceived position of our brand, our business, financial condition and results of operations could be adversely affected.

Our business is capital intensive, and failure to obtain the necessary capital when needed may force us to delay, limit or terminate our expansion efforts or other operations, which could have a material adverse effect on our business, financial condition and results of operations.

The costs of operating, maintaining and owning miners and facilities are substantial. Mining equipment experience ordinary wear and tear from operation and may also face more significant malfunctions caused by factors which may be beyond our control. Additionally, as the technology evolves, we may acquire or utilize newer models of mining equipment to remain competitive in the market. Over time, those mining equipment which are no longer functional also needs to be replaced with new mining equipment.

The upgrading process requires substantial investment, and we may face challenges in doing so on a timely and cost-effective basis based on availability of new mining equipment and our access to adequate capital resources. If we are unable to obtain adequate numbers of new and replacement mining equipment at scale, we may be unable to remain competitive in our highly competitive and evolving industry.

Moreover, we need additional facilities to increase our capacity for more mining equipment. The costs of operating and maintaining facilities and growing our operations may increase in the future, which may make it more difficult for us to expand our business and to operate the facilities while maintaining or improving our profit margin.

We will need to raise additional funds through equity or debt financings in order to meet our operating and capital needs. Additional debt or equity financing may not be available when needed or, if available, may not be available on satisfactory terms. As of December 31, 2024, we had pledged 633 Bitcoins as collateral for our loans or other financing arrangements. A significant and permanent drop in the value of digital assets, in particular Bitcoin, may cause us to lose the ability to do so in the future. In addition, any future disruption in the digital asset industry may destabilize the price of Bitcoin and affect investor confidence in the digital asset industry, which may materially and adversely impair our ability to raise capital in the future. An inability to generate sufficient cash from operations or to obtain additional debt or equity financing would adversely affect our results of operations. Additionally, if this happens, we and our customers may not be able to mine digital assets as efficiently or in similar amounts as our competitors and, as a result, our business and financial condition and results of operations could suffer.

Any failure to meet the necessary quality standards of our services and products could adversely affect our reputation, business and results of operation.

The quality of our services and products is critical to the success of our business and depends significantly on the effectiveness of our and our suppliers’ quality control. In our efforts to meet new market trends and adopt new technologies, we and our suppliers may not have adequate time to go through rigorous quality control and assurance procedures, which could result in instances where our services and products cannot reach the required performance standard. These instances could result in our customers suffering losses and harm to their experience and continuous engagement with us. Defects may also result in additional costs for remediation and rework. As a result, our reputation, business and results of operations may be materially and adversely affected.

Any global systemic economic and financial crisis could negatively affect the prices of digital assets, and in turn our business, results of operations, and financial condition.

Any prolonged slowdown in the global economy may have a negative impact on our business, results of operations and financial condition. For example, the global financial markets have experienced significant disruptions since 2008 and the United States, Europe and other economies have experienced periods of recession. The recovery from the lows of 2008 and 2009 has been uneven and there are new challenges. The global outbreak of COVID-19 had a severe and negative impact on the global economy and financial markets from 2020 through 2022, and the global macroeconomic environment still faces numerous challenges. There is considerable uncertainty over the long-term effects of the monetary and fiscal policies adopted by the central banks and financial authorities of some of the world’s leading economies, including the United States and China. There have also been concerns over the significant potential changes to United States trade policies, treaties and tariffs, all of which have resulted in market volatility. Additionally, the Russia-Ukraine conflict, the Hamas-Israel conflict and the attacks on shipping in the Red Sea have heightened geopolitical tensions across the world. The impact of the Russia-Ukraine conflict on Ukraine food exports has contributed to increases in food prices and thus to inflation more generally. There were and could be in the future a number of domino effects from such turmoil on our business, including significant decreases in orders from our customers; insolvency of key suppliers resulting in delays or interruptions of key supplies; inability of customers to finance purchases of our services and products and/or customer insolvencies; and other counterparty failures negatively impacting our operations. Any systemic economic or financial crisis could cause revenues for the digital assets industry as a whole to decline dramatically and could materially and adversely affect our business, results of operations and financial condition.

We may engage in acquisitions or strategic alliances in the future that could disrupt our business, result in increased expenses, and reduce our financial resources, and such acquisitions or strategic alliances may not be successfully implemented or generate positive results as expected.

Although we have limited experience in acquisitions or strategic alliances in the past, we may look for potential acquisitions or strategic alliances in the future to expand our business. However, we may not be able to find suitable acquisition candidates, complete acquisitions on favorable terms, if at all, or integrate any acquired business, products or technologies into our operations. If we do complete such acquisitions, they may still be viewed negatively by customers or investors and they may not enable us to strengthen our competitive position or achieve our strategic goals. In addition, any acquisitions that we make could lead to difficulties in integrating personnel, technologies and operations from the acquired businesses and in retaining and motivating key personnel from these businesses. Moreover, acquisitions or strategic alliances may disrupt our ongoing operations, divert management from day-to-day responsibilities and increase our expenses. Future acquisitions or strategic alliances may reduce our cash available for operations and other uses and could result in increases in amortization expenses related to identifiable intangible assets acquired, potentially dilutive issuances of equity securities or the incurrence of debt. We cannot predict the number, timing or size of future acquisitions or strategic alliances, or their successful implementation or the effect that any such might have on our results of operations and financial condition.

Risks Related to Our Operations

We may be vulnerable to security breaches, or be exposed to cybersecurity threats, which could disrupt our operations, subject us to customers’ claims, and materially and adversely affect our business, financial condition and results of operations.

We receive, process, store and transmit, often electronically, the data of our customers, much of which is confidential. Unauthorized access to our computer systems or stored data could result in the theft, including cyber-theft, or improper disclosure of confidential information, and the deletion or modification of records could cause interruptions in our operations. These cyber-security risks increase when we transmit information from one location to another, including over the internet or other electronic networks. Despite the security measures we have implemented, our miners, systems and procedures, and those of our third-party service providers, may be vulnerable to security breaches, acts of vandalism, software viruses, misplaced or lost data, programming or human errors or other similar events which may disrupt our delivery of services or expose the confidential information of our customers. Any security breach involving the misappropriation, loss or other unauthorized disclosure or use of confidential information of our customers or others, whether by us or a third party, could subject us to civil and criminal penalties, have a negative impact on our reputation, or expose us to liability to our customers, third parties or government authorities.

A party who is able to compromise the physical security measures protecting the facilities supporting our operations could cause interruptions or malfunctions in our operations and misappropriate our property or the property of our customers. We may be required to expend significant capital and resources or replace existing hosting facility suppliers to protect against such threats or to alleviate problems caused by breaches in security. As techniques used to breach security change frequently and are often not recognized until launched against a target, we cannot assure you that we or our hosting facility suppliers will be able to implement new security measures in a timely manner or, if and when implemented, these measures would not be circumvented. Any breaches that may occur could expose us to increased risk of lawsuits, regulatory penalties, loss of existing or potential customers, harm to our reputation and increases in security costs, which could have a material adverse effect on our business, financial condition and results of operations.

In addition, any assertions of alleged security breaches or system failures made against us or our hosting facility suppliers, whether true or not, could harm our reputation, cause us to incur substantial legal fees to defend against such claims, or otherwise have a material adverse effect on our business, financial condition and results of operations. Such claims, irrespective of the outcomes or the merits, would likely be time-consuming and costly to defend and could divert significant resources and management attention. We could also incur significant payment of damages or expenses, or otherwise be restricted from operating our business. Any such claim or potential litigation, including the resources incurred in connection therewith, could have a material adverse effect on our business, financial condition and results of operations.

Furthermore, security breaches, computer malware and computer hacking attacks have been a prevalent concern in the digital asset exchange market. Any security breach caused by hacking, which involves efforts to gain unauthorized access to information or systems, or to cause intentional malfunctions or loss or corruption of data, software, hardware or other computer equipment, and the inadvertent transmission of computer viruses, could harm our business operations or result in loss of our assets.

Moreover, the threats to network and data security are increasingly diverse and sophisticated. Despite our efforts and processes to prevent breaches, our computer servers and computer systems may be vulnerable to cybersecurity risks, including denial-of-service attacks, physical or electronic break-ins, employee theft or misuse and similar disruptions from unauthorized tampering with our computer servers and computer systems. The preventive actions we take to reduce the risk of cyber incidents and protect our information technology and networks may be insufficient to repel a major cyber-attack in the future. To the extent that any disruption or security breach results in a loss or damage to our network, in unauthorized disclosure of confidential information or in a loss of our digital assets, it could cause significant damage to our reputation, lead to claims against us and ultimately have a material adverse effect on our business, financial condition and results of operations. Additionally, we may be required to incur significant costs to protect against damage caused by these disruptions or security breaches in the future.

Any failure in our critical systems could lead to disruptions in our businesses and could harm our reputation and result in financial penalty and legal liabilities, which would reduce our revenue and have a material adverse effect on our business, financial condition and results of operations.

The critical systems underlying our services and products could experience failure, such as a breakdown in critical system, equipment or services, routers, switches or other equipment. The facilities hosting our miners could experience power supply or network connectivity issues. Such failure, whether or not within our control, could interrupt our service provision, and adversely affect our customers’ operation and cause equipment damage, all of which could significantly disrupt our normal business operations, harm our reputation and reduce our revenue. Any such failure or downtime could impact mining rewards generated by us and reduce the profitability of our customers. The total destruction or severe impairment of any of the facilities we operate could result in significant service downtime and loss of customer data. Since our ability to attract and retain customers depends on our ability to provide highly reliable service, even minor interruptions in our service could harm our reputation and negatively impact our revenue and profitability. The services we provide are subject to failures resulting from numerous factors, including:

| ● | power loss; |

| ● | equipment failure; |

| ● | human error or accidents; |

| ● | theft, sabotage and vandalism; |

| ● | failure by us or our suppliers to provide adequate service or maintain the equipment; |

| ● | network connectivity downtime and fiber cuts; |

| ● | service interruptions resulting from server relocation; |

| ● | security breaches; |

| ● | improper maintenance; |

| ● | physical, electronic and cybersecurity breaches; |

| ● | animal incursions; |

| ● | fire, earthquake, hurricane, tornado, flood and other natural disasters; |

| ● | extreme temperatures; |

| ● | water damage; |

| ● | public health emergencies; and |

| ● | terrorism. |

Moreover, service interruptions and equipment failures may expose us to potential legal liability. Any disruption in our services could result in lost profits of or other indirect or consequential damages to our customers. Although our customer contracts typically contain provisions limiting our liability for breach of such agreements, there can be no assurance that a court would enforce any contractual limitations on our liability in the event that one of our customers brings a lawsuit against us as the result of a service interruption that they may ascribe to us. The outcome of any such lawsuit would depend on the specific facts of the case and any legal and policy considerations that we may not be able to mitigate. In such cases, we could be liable for substantial damages, which would as a result have a material adverse effect on our business, financial condition and results of operations.

Any failure to obtain or renew any approvals, licenses, permits or certifications necessary to our operations could materially and adversely affect our business, reputation, results of operations and prospects.

In accordance with the laws and regulations in the jurisdictions in which we operate, we are required to maintain various approvals, licenses, permits and certifications to operate our business. Complying with such laws and regulations may require substantial expense, and any non-compliance may expose us to liability. In the event of non-compliance, we may have to incur significant expenses and divert substantial management time to rectify the incidents. In the future, if we fail to obtain all the necessary approvals, licenses, permits and certifications, we may be subject to fines or the suspension of operations at the production facilities and research and development facilities that do not have all the requisite approvals, licenses, permits and certifications, which could materially and adversely affect our business, reputation, results of operations and prospects. See “Item 4. Information on the Company—B. Business Overview—Government Regulation” for further details on the requisite approvals, licenses, permits and certifications necessary for our business operations.

We cannot assure you that we will be able to fulfill all the conditions necessary to obtain the required government approvals, or that relevant government officials will always, if ever, exercise their discretion in our favor, or that we will be able to adapt to any new laws, regulations and policies. There may also be delays on the part of government authorities in reviewing our applications and granting approvals, whether due to the lack of human resources or the imposition of new rules, regulations, government policies or their implementation, interpretation and enforcement. If we are unable to obtain, or experience material delays in obtaining, necessary government approvals, our operations may be substantially disrupted, which could materially and adversely affect our business, financial condition and results of operations.

We rely on third-party service providers to safeguard and manage certain digital assets. Loss of private keys, security breach and hacking attempts could cause the loss and theft of such digital assets, and materially and adversely impact our business, financial condition and results of operations.

We accumulate Bitcoin mined through our self-mining operations, and will exchange Bitcoin for fiat currencies at established cryptocurrency exchanges, such as Coinbase, to satisfy our working capital needs. We also receive other digital assets, such as BTC, ETH, BCH and USDT, as payments for our cloud-mining service and hosting services. Digital assets that are received as service payments would be automatically converted into USDT. Since October 2022, we have begun to convert USDT into U.S. dollars and deposit them with banking institutions on a timely basis according to our treasury management strategy. Prior to December 2022, we held digital assets pre-paid by customers for their anticipated purchase of services, and temporarily held mining rewards of customers on their behalf if such customers do not have their own digital asset wallets.