UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 21, 2025

Complete Solaria, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-40117 | 93-2279786 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

| 45700 Northport Loop East, Fremont, CA | 94538 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (510) 270-2507

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.0001 per share | CSLR | The Nasdaq Global Market | ||

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | CSLRW | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒ Item 7.01.

Regulation FD Disclosure

The information furnished on Exhibit 99.1 is incorporated by reference under this Item 7.01 as if fully set forth herein.

The information in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made by the Company under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit Number | Description | |

| 99.1 | SunPower Vision Message dated April 21, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Complete Solaria, Inc. | ||

| Dated: April 21, 2025 | ||

| By: | /s/ Daniel Foley | |

| Daniel Foley | ||

| Chief Financial Officer | ||

2

Exhibit 99.1

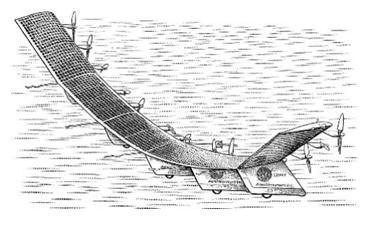

SUNPOWER VISION

Powering America since 1985

A message from TJ Rodgers, SunPower CEO

Given that more than 70 solar companies went out of business last year, any vision for SunPower's future must begin with a solid financial foundation. Consequently, the vision for 2025-2026 is to get from our current $300 million revenue run rate to over $1 billion as quickly as possible and grow expenses much more slowly than that to achieve solid profitability and build cash reserves. The reader should understand that this is the personal vision of T.J. Rodgers, not a forecast. And even when aggressive vision statements are achieved, as happened at Cypress Semiconductor and Enphase Energy, they are rarely achieved on the exact path described in an early vision statement, which nonetheless is necessary to let employees know where we have to get, so when our vision is inevitably disrupted (think about tariff uncertainty), the employees continue to head in the right direction, but invent a new path.

Accordingly, one feasible path to the financial vision is shown below. It assumes rapid revenue growth via acquisition, which is common in the depressed solar industry today, and a conservatively calculated P&L statement consistent with that revenue growth:

If we can grow rapidly from the current $82 million per quarter to $150 million per quarter in 2025 and to $250 million per quarter in 2026, that would drive the bottom line in a compelling way, even with conservative assumptions. Cypress made 26 acquisitions during my 34 years there, so we have excellent acquisition business processes, but acquiring a solar company is much trickier than acquiring a semiconductor company, so we are moving cautiously.

Finally, we want to regain the high technical standards of the SunPower brand, which was synonymous with innovation and excellence at fair retail prices. For this we are pursuing two major technology paths: first to design and bring to market world-class solar panels in partnership with a leading panel supplier, and second to create state-of-the-art energy storage systems with our partner Enphase Energy.

|

||

| /s/ T.J.Rodgers, CEO | ||

| T.J.Rodgers, CEO |

Forward-Looking Statements

The foregoing vision message from TJ Rodgers (the “message”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about Complete Solaria, Inc. (referred to as “SunPower”, “Complete Solaria”, “our”, “we”, “us”, and like expressions), our business and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “focus,” “forecast,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” and “pursue” or the negative of these terms or similar expressions. Forward-looking statements in the message include, without limitation, increasing Complete Solaria’s run rate revenue from $300 million to over $1 billion as quickly as possible, growing our expenses much more slowly than revenue growth, achieving solid profitability and building cash reserves, our use of acquisitions to achieve rapid revenue growth, conservatively calculating and managing P&L statements consistent with our expected revenue growth, the actual Q4’25 (vision) and Q4’26 (vision) revenue, gross margin, commission, operating expense and operating income metrics presented in the message, whether we can grow from our $82 million per quarter to $150 million per quarter in 2025, whether we can grow to $250 million per quarter in 2026, our ability to achieve the benefits of an acquisition strategy, expectations relating to designing and bringing to market world-class solar panels in partnership with a leading panel supplier, expectations relating to creating state-of-the-art energy storage systems with Enphase Energy, and the benefits of using the SunPower name. Our actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties, including, without limitation, our ability to increase revenue, our ability to grow expenses at a rate that is slower than our revenue growth rate, our ability to grow cash reserves while growing revenue, our ability to improve gross margins and operating income while reducing commissions and operating expenses, our ability to achieve the anticipated benefits of acquisitions, global market conditions, inflation, trade policies and tariffs, and other risks and uncertainties applicable to our business. For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results or cause actual results to differ from the results predicted, readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our annual report on Form 10-K filed with the Securities and Exchange Commission on April 1, 2024, our annual report on Form 10-K for fiscal 2024 that we will file with the Securities and Exchange Commission during April 2025, our quarterly reports on Form 10-Q that we will file with the Securities and Exchange Commission and other documents that we have filed with, or will file with, the Securities Exchange Commission. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements in this press release speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Complete Solaria assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.