UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rules 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of April 2025

Commission File Number: 001-41586

MOOLEC SCIENCE SA

(Exact name of Registrant as Specified in Its Charter)

17, Boulevard F. W. Raiffeisen

L-2411 Luxembourg,

Grand Duchy of Luxembourg

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXPLANATORY NOTE

This Form 6-K is incorporated by reference into our registration statements on Form F-3 (Registration No. 333-283113) and Form S-8 (Registration No. 333-282263).

The exhibits to this Form 6-K contain important information relating to the business combination and the contributed entities, including:

| ● | information relating to the structure of the business combination, the Business Combination Agreement, the businesses and assets of each of Bioceres Group PLC, Nutrecon LLC and Gentle Technologies Corp and certain risk factors. See “Exhibit 99.1—Background of the Business Combination,” “Exhibit 99.1—The Business Combination Agreement,” “Exhibit 99.1—Business of the Contributed Entities” and “Exhibit 99.1—Risk Factors”); |

| ● | the unaudited proforma condensed combined consolidated financial information for the year ended June 30, 2024 and unaudited pro forma condensed combined consolidated financial information as of and for the six-month period ended December 31, 2024. See “Exhibit 99.1—Unaudited Pro Forma Condensed Combined Consolidated Financial Information”; |

| ● | the audited consolidated financial statements of Bioceres Group PLC June 30, 2024 and 2023 and for the years ended June 30, 2024, 2023 and 2022. See “Exhibit 99.3”; |

| ● | the unaudited interim consolidated financial statements of Bioceres Group PLC as of December 31, 2024 and for the six-month period ended December 31, 2024 and 2023. See “Exhibit 99.4”; and |

| ● | the annual report on Form 20-F of Bioceres Crop Solutions Corp. for the year ended June 30, 2024 filed with the SEC on October 30, 2024. See “Exhibit 99.5”; and |

| ● | the unaudited consolidated financial statements of Bioceres Crop Solutions Corp. as of and for the six-month period ended December 31, 2024. See “Exhibit 99.6.” |

On April 9, 2025, Bioceres Group PLC converted from a public limited company to a private limited company and changed its name to Bioceres Group Limited. Therefore, the exhibits hereto containing financial statements of Bioceres Group Limited for periods ended prior to April 9, 2025 refer to those financial statements as the financial statements of Bioceres Group PLC.

On March 4, 2025, we received a letter from the staff of the United States Securities and Exchange Commission, which, pursuant to its authority under Rule 3-13 of Regulation S-K, granted us relief from the requirement to include in our registration statements the financial statements of Gentle Technologies Corp and Nutrecon LLC, as required by Rule 3-05 of Regulation S-X, along with related pro forma information.

Unless otherwise stated, references contained in the exhibits hereto to “the Form 6-K” are references to this Form 6-K.

Forward-Looking Statements

This current report on Form 6-K contains “forward-looking statements.” Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward-looking statements with respect to performance, prospects, revenues, and other aspects of our or the contributed entities are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Although we believe that we have a reasonable basis for each forward-looking statement contained in this current report on Form 6-K, we caution you that these statements are based on a combination of facts and factors, about which we cannot be certain. We cannot assure you that the forward-looking statements in this publication will prove accurate. These forward-looking statements are subject to a number of significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among others, changes in applicable laws or regulations, the possibility that we may be adversely affected by economic, business and/or other competitive factors, costs related to the scaling up of our or the acquired businesses and other risks and uncertainties, including those included under the header “Risk Factors” in our Annual Report on Form 20-F filed with the SEC, as well as our other filings with the SEC. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Accordingly, you should not put undue reliance on these statements.

Exhibit List

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| MOOLEC SCIENCE SA | ||

| (Registrant) | ||

| Dated: April 17, 2025 | By: | /s/ Gastón Paladini |

| Name: | Gastón Paladini | |

| Title: | Chief Executive Officer | |

3

Exhibit 99.1

Disclosure Statement relating to the Business Combination

TABLE OF CONTENTS

SUMMARY OF THE BUSINESS COMBINATION

Overview of the Business Combination

The business combination (the “Business Combination”) consists of Moolec Science SA’s (“Moolec”) strategic business combination with Bioceres Group Limited (formerly, Bioceres Group PLC) (“Bioceres Group”), Gentle Technologies Corp (“Gentle Tech”), and Nutrecon LLC (“Nutrecon”), resulting in an enlarged company structure with Moolec as the parent company. Moolec is a public limited liability company (societé anonyme) governed by the laws of the Grand Duchy of Luxembourg and has its ordinary shares and warrants listed on Nasdaq.1 Subject to the terms and conditions of the Business Combination Agreement (the “Business Combination Agreement” or the “BCA”), which was signed on April 17, 2025, several parties will transfer their respective holdings in Bioceres Group, Nutrecon and Gentle Tech (together, the “Contributed Entities”) to Moolec (Cayman Islands). In exchange, Moolec (Cayman Islands) will issue a combination of newly issued shares and warrants of Moolec (Cayman Islands) to the shareholders of the Contributed Entities, as more fully described below.

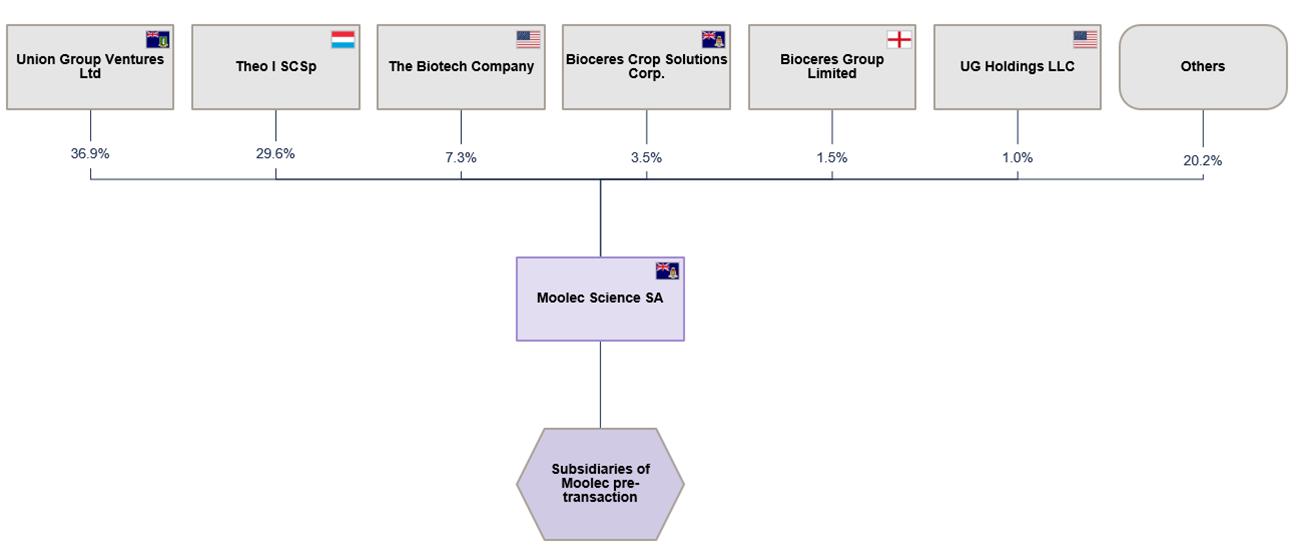

Moolec Structure Pre-Business Combination

The expected corporate structure of Moolec (Cayman Islands) immediately prior to the closing of Business Combination (the “Closing”) is as shown below:

| 1 | Moolec is proposing to change its jurisdiction by discontinuing from the Grand Duchy of Luxembourg and transferring by way of continuation to the Cayman Islands as an exempted company limited by shares registered under the laws of the Cayman Islands (the “Redomiciliation”). An extraordinary general meeting has been called for April 22, 2025 to vote on the Redomiciliation (the “Extraordinary General Meeting”). The re-domiciled Cayman Islands entity is referred to herein as “Moolec (Cayman Islands).” In connection with the Redomiciliation, all of the ordinary shares of Moolec, with nominal value of $0.01 per share, will by operation of law become shares of Moolec (Cayman Islands), par value $0.01 per share (the “Shares”). It is anticipated that the Redomiciliation will occur prior to the Closing. |

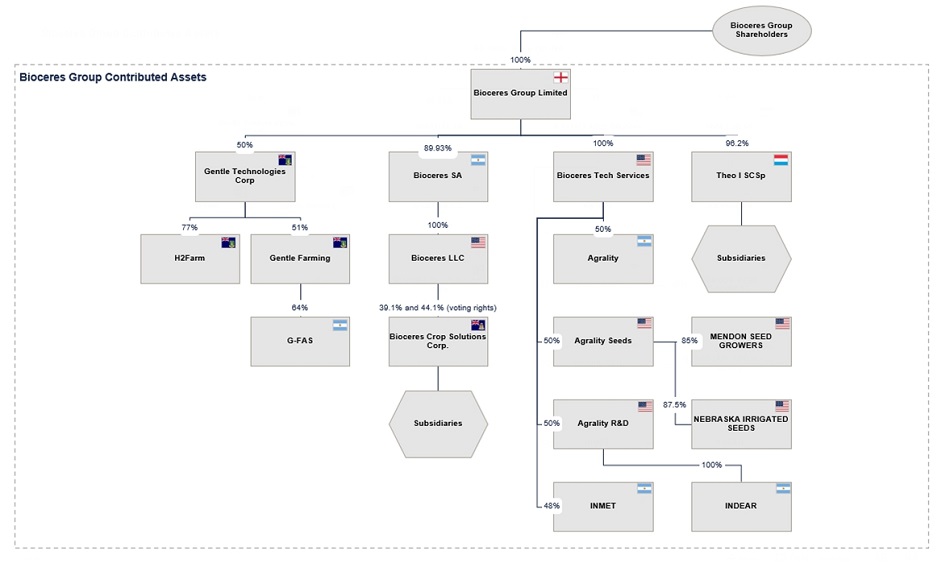

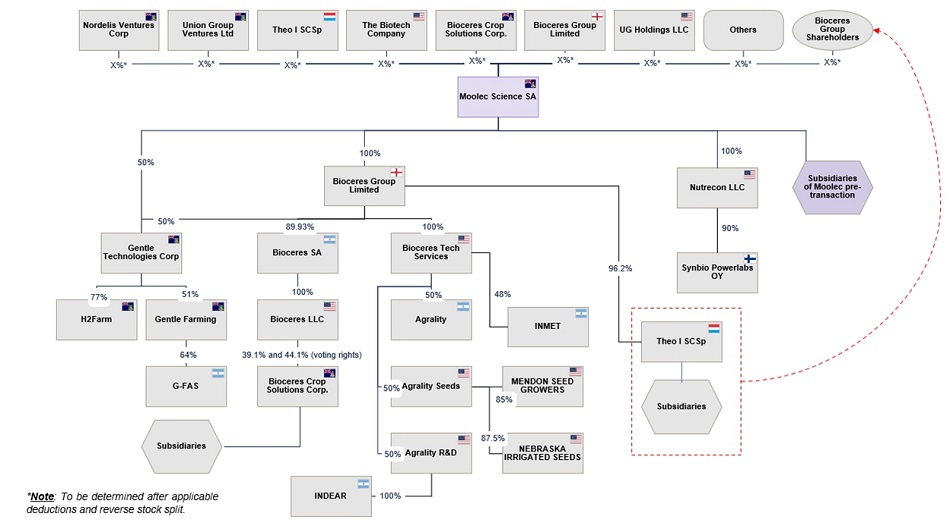

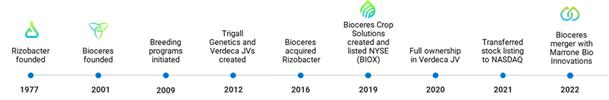

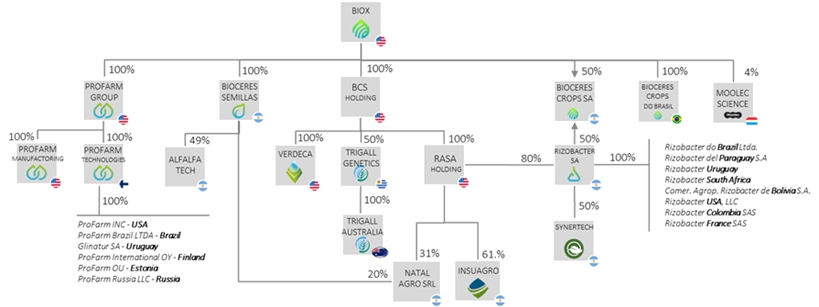

Bioceres Group Pre-Business Combination

The corporate structure of Bioceres Group prior to the Business Combination is as shown below. As noted in the section entitled “The Business Combination Agreement—Post-closing carve-out of Theo,” Theo I SC Sp (“Theo”) is being excluded from the Business Combination and will be transferred to Bioceres Group’s shareholders following the Closing. Also note that 50% of the shares of Gentle Tech are held by Bioceres Group and will be contributed as part of the contribution of Bioceres Group to Moolec (Cayman Islands).

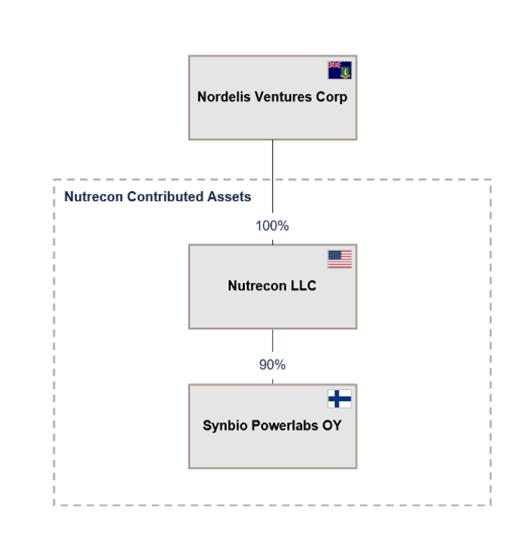

Nutrecon Structure Pre-Business Combination

The corporate structure of Nutrecon prior to the Business Combination is as shown below:

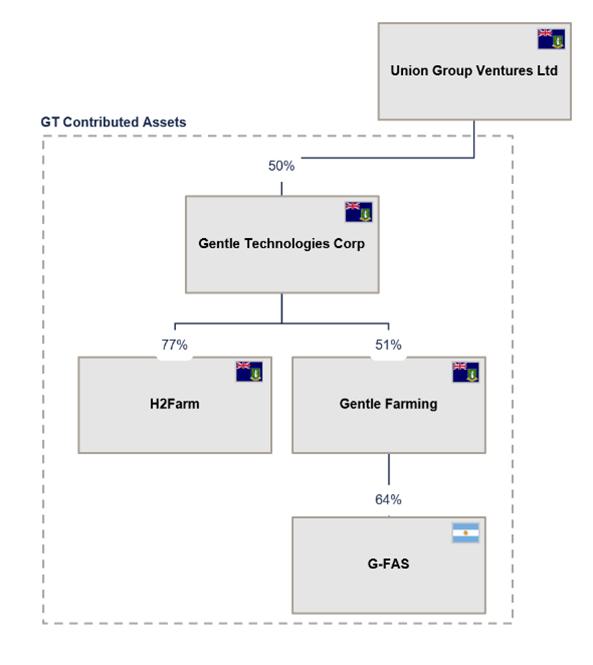

Gentle Tech Structure Pre-Business Combination

The remaining 50% of the shares of Gentle Tech is held by Union Group Ventures Ltd (“Union Group”) and the relevant corporate structure prior to the Business Combination is as shown below:

Consideration for Contribution of Contributed Entities

At the Closing, under the terms and conditions of the BCA, including the indemnity and deduction provisions, the following will occur: (i) Moolec (Cayman Islands) will issue to Bioceres Group shareholders 3.15 Shares for each Bioceres Group share exchanged; (ii) Moolec (Cayman Islands) will issue 5,000,000 Shares and grant 5,000,000 warrants to buy Shares at a price of $2.00 per share, exercisable within three years after the Closing, to Nordelis Ventures Ltd (“Nordelis”) in exchange for 50,000 Nutrecon units; (iii) Moolec (Cayman Islands) will issue 1,475,000 Shares to Union Group in exchange for 1,000,000 issued and outstanding ordinary shares of Gentle Tech (which represent 50% of the outstanding ordinary shares of Gentle Tech). Pursuant to the BCA, the ratio referred to in (i) above and the Share and warrant numbers referred to in (ii) and (iii) above will be adjusted proportionally to reflect the completion of the reverse share split, which is a condition to Closing.

The parties further agreed that (x) the ratio of 3.15 set forth above, as well as any other issuances pursuant to the Business Combination that consider this ratio as a reference, and (y) the number of Shares and the number and exercise price of warrants set forth above, as well as any other issuances pursuant to the Business Combination that consider these numbers or exercise price as references might be adjusted based on the ratio selected at the Extraordinary General Meeting of the shareholders of Moolec which will be held, among other matters, to approve the reverse share split.

Applicable Deductions

The parties have agreed on certain arrangements regarding the Shares to be issued at Closing. Firstly, the Bioceres Group shareholders who are parties to the Moolec Subscription Agreement dated December 20, 2022 (the “Moolec Subscription Agreement”) will see a reduction in the number of Shares they receive, intended to account for the amount owed to Moolec pursuant to the Moolec Subscription Agreement. This adjustment will be calculated based on the greater of the two values (i) the 20-day Volume Weighted Average Price (“VWAP”) for Shares as of two business days before Closing, or (ii) a set price of $2.00 per Share (subject to adjustment to reflect the completion of the reverse share split). Secondly, each Bioceres Group shareholder will have the number of Shares they receive adjusted downward to accommodate the payment of UK stamp tax applicable to the transfer of Bioceres Group shares.

Holdback

Pursuant to the terms and conditions of the BCA, the Bioceres Group shareholders, Nordelis and Union Group will be responsible for defending, indemnifying, and holding harmless Moolec, its affiliates, and their representatives against any liabilities that may arise, including third-party claims. These liabilities, referred to as “Losses”, could be incurred during investigations or defenses, or in maintaining or enforcing their rights under the BCA. Losses may result from a breach or inaccuracy in any representation or warranty made by Bioceres Group shareholders, Bioceres Group, Nordelis, Nutrecon, Gentle Tech and Union Group, or from any tax-related issues. At Closing, Moolec (Cayman Islands) will withhold 10% of the exchange consideration (the “Holdback Amount”), to cover any potential claims.

The Holdback Amount serves as a protection for any claims that may arise. One year after the Closing, Moolec (Cayman Islands) will issue and distribute the Holdback Amount less any amount of Shares corresponding to any claim for Losses (the “Returning Holdback Amount”) pro rata to the Bioceres Group shareholders, Nordelis and Union Group. If any Losses arise, Moolec will inform Bioceres Group shareholders, Nordelis and Union Group in writing, explaining the nature and amount of the claims, along with the deductions from the Holdback Amount due to any claim for Losses, which will be calculated by Moolec in good faith.

Moolec Structure following Closing of the Business Combination

Immediately following the Closing of the Business Combination, the corporate structure of Moolec (Cayman Islands), including the Contributed Entities, will be as shown below. Note that the carve out of Theo from Bioceres Group (the “Theo Carve-Out”), will occur post-Closing of the Business Combination. See the section entitled “The Business Combination Agreement—Post-closing carve-out of Theo.”

It is anticipated that the Theo spin-off will comprise the pro-rata transfer of Bioceres Group Limited’s holdings in Theo to the Bioceres Group shareholders, such that each Bioceres Group shareholder will hold Theo interests proportionate to their percentage shareholding in Bioceres Group Limited prior to the Business Combination.

Reasoning for Moolec Board Approval of the Business Combination

The following discussion sets forth material factors considered by Moolec’s board of directors (the “Board”) in reaching its determination to approve the terms and authorize the execution of the BCA for the purpose of implementing the Business Combination; however, it may not include all of the factors considered. Because of the number and wide variety of factors considered in connection with its evaluation of the BCA, the Board did not consider it practicable to quantify or otherwise assign relative weights to the specific factors it considered in reaching its determination, and did not attempt to do so. The Board viewed its position and determinations as being based on all of the information available and the factors presented to and considered by it. Individual directors may have given different weight to different factors.

This explanation of the reasons for the approval of the Business Combination by the Board and all related information provided in this section constitutes forward-looking information and should be read in conjunction with the section titled “Forward-Looking Statements” in the explanatory note in the Form 6-K.

Main Factors Considered

In the course of reaching its decision to approve the terms and authorize the execution of the BCA for the purpose of consummating the Business Combination, the Board consulted with Moolec senior management, internal legal counsel, external legal counsel and other advisors and reviewed a significant amount of information and considered a number of factors, including, without limitation, the following:

| ● | Moolec’s prospects if it remained a small public company, including its present cash runway and ability to raise additional required capital to continue funding the scale up of the operations until becoming cash flow positive; |

| ● | the fact that the non-binding letter of intent signed on the December 27, 2024 relating to the Business Combination arose from a proposal made by existing shareholders representing more than 70% of our outstanding shares; |

| ● | that Moolec, under the direction of the Board, had conducted an active process previously to identify alternative transactions and determined that the likelihood, if any, of any superior alternative strategic transaction being or becoming available in the near term in view of Moolec’s available capital and sources of additional capital was challenging; |

| ● | the fact that the counterparties are assigning a value of $2.00 per share for Moolec which represents a significant premium considering the current share price in the range of $0.60 per share; |

| ● | the expectation that additional capital resources would be available for Moolec as a result of the Business Combination; |

| ● | The belief that the combined company will be able to benefit Moolec’s existing shareholders by a combination of synergistic assets in the ingredients business, agricultural sector and biotech space; |

| ● | the fact that the principal components of the Business Combination, including issuance of shares pursuant to the BCA would be submitted to the Moolec shareholders for approval at an extraordinary general meeting; |

| ● | the benefit of incorporating the Contributed Entities that follow the Business Combination would cause Moolec to be vertically integrated and with significantly increased revenues and growth going forward; |

| ● | the expectation that the Business Combination provides the combined company with an experienced and qualified management team with a demonstrated record of success; |

| ● | the expectation that the Business Combination would provide a solid large operational platform for Moolec’s management and scientific team to continue scaling up Moolec’s most important projects such as GLASO™, PiggySooy™, Peea1 and fermentation joint ventures projects and products; |

| ● | the results of Moolec’s due diligence review of the most important contributed assets and prospects for value creation for Moolec shareholders in connection with the Business Combination; |

| ● | the Board’s belief that the Business Combination would provide the existing Moolec shareholders with an opportunity to participate in the potential growth of the combined company following the Business Combination and the potential long-term value of the Contributed Entities; and |

| ● | the financial presentation and opinion of Evans & Evans to the Board as to the fairness to Moolec, from a financial point of view, of the consideration to be received under the Business Combination, which opinion was based upon and subject to the factors, assumptions, limitations and qualifications set forth in the section titled “—Fairness Opinion of Evans & Evans.” |

Potential Risks Considered

The Board also considered a number of uncertainties and risks in its deliberations concerning the Business Combination by the BCA, including the following:

| ● | the prohibition on Moolec to solicit alternative acquisition proposals from the signing of the BCA through the Closing; |

| ● | the fact that the Business Combination contributes quality assets but also a significant amount of debt; |

| ● | the possible volatility of the trading price of the Shares resulting from the announcement, pendency or Closing of the Business Combination; |

| ● | the fact that Moolec’s shareholders would experience significant dilution by virtue of the exchange ratio that is central to the Business Combination; |

| ● | the risk to Moolec’s business, operations and financial results in the event that the Business Combination is not consummated in a timely manner or at all; |

| ● | the capital requirements of the combined company and the risk that the combined company may not be able to obtain debt or equity financing sufficient to fund the anticipated needs of the combined company after the Closing; |

| ● | the risk that the combined company will not be successful in scaling up some of the assets of the Contributed Entities such as Gentle Tech and other projects; |

| ● | the risk that revenues from Contributed Entities’ future products and services may be less than expected; |

| ● | the risks, challenges and costs inherent in combining the operations of the all the Contributed Entities; |

| ● | the fact that certain of Moolec’s directors and executive officers may have different opinions in terms of the best path forward for Moolec and the developments of its assets; and |

| ● | various other risks associated with the combined company and the Business Combination. |

Conclusion

The Board weighed the benefits, advantages and opportunities of a potential transaction against the uncertainties and risks described above, as well as the possible diversion of management attention for an extended period of time. After taking into account these and other factors, the Board unanimously concluded that the benefits of the Business Combination outweighed the risks, determined that the Business Combination was in the best interests of Moolec and its shareholders and approved the terms and authorized the execution of the BCA for the purpose of implementing the Business Combination.

Fairness Opinion of Evans & Evans

Moolec retained Evans & Evans to evaluate the fairness, from a financial point of view, to Moolec shareholders of the consideration to be paid to such holders in the Transaction.

On March 19, 2025, at a meeting of the Moolec board of directors, Evans & Evans rendered to the Board an oral opinion, which has been confirmed by delivery of a written opinion dated April 16, 2025, to the effect that, as of that date and based on and subject to the assumptions made, procedures followed, matters considered and qualifications and limitations on the review undertaken described in such opinion that the consideration in the BCA is fair from a financial point of view to the Moolec shareholders.

The summary of the written opinion of Evans & Evans, dated April 16, 2025, set forth in this disclosure statement is qualified in its entirety by reference to the full text of Evans & Evans’ opinion. Evans & Evans’ opinion was rendered to the Board in connection with its evaluation of the BCA and did not address any terms or other aspects (other than the consideration to the extent expressly specified in Evans & Evans’ opinion) of the transactions contemplated by the BCA. Evans & Evans’ opinion did not address Moolec’s underlying business decision to effect such transactions or the relative merits of such transactions as compared to any alternative business strategies or transactions that might be available to Moolec and did not address any legal, regulatory, tax, or accounting matters. Evans & Evans’ opinion is not intended to and does not constitute a recommendation to any Moolec shareholder as to how such shareholder should vote or act with respect to the Business Combination or any matter relating thereto.

With respect to the bullets listed below and in connection with rendering its opinion, although Evans & Evans considered internal information provided to it with respect to the business, earnings, cash flow, assets and liabilities of Moolec, the Contributed Entities and discussions conducted with the management and representatives of Moolec and the Contributed Entities, Evans & Evans created its own financial models that served as the basis for its analysis set forth below and the opinion it rendered to the Board.

In connection with its opinion, Evans & Evans:

| ● | reviewed certain internal information relating to the business, earnings, cash flow, assets and liabilities of Moolec furnished to Evans & Evans by Moolec; |

| ● | prepared financial models and discussed with the management of Moolec the assumptions contained therein; |

| ● | reviewed prospective financial information for the Contributed Entities prepared by management of the Contributed Entities; |

| ● | reviewed consensus prospective financial information for Moolec and Bioceres Crop Solutions Corp. (“BIOX”); |

| ● | conducted discussions with members of the management and representatives of Moolec concerning the information described in the two foregoing bullet points; |

| ● | reviewed publicly available financial and stock market data of certain other companies in lines of business that Evans & Evans deemed relevant for Moolec and the Contributed Entities; |

| ● | reviewed corporate organization charts for the Contributed Entities as provided by management of the Contributed Entities; |

| ● | reviewed trading data for Moolec and BIOX; |

| ● | reviewed websites and investor presentations on Moolec and the Contributed Entities as prepared by their respective management teams; |

| ● | reviewed certain incorporation documents of the Contributed Entities; |

| ● | reviewed broker reports pertaining to Moolec and BIOX; |

| ● | reviewed certain internal information relating to the business, earnings, cash flow, assets and liabilities of the Contributed Entities furnished to Evans & Evans by management of the Contributed Entities; |

| ● | conducted discussions with members of the management and representatives of the Contributed Entities regarding past and prospective future operations; |

| ● | reviewed Moolec’s capital structure furnished to Evans & Evans by the management of Moolec both on a standalone basis pre-transaction and on a pro forma basis giving effect to the transaction contemplated by the BCA; |

| ● | reviewed the BCA; and |

| ● | conducted such other financial studies and analyses and took into account such other information as Evans & Evans deemed appropriate. |

Evans & Evans, with Moolec’s consent, relied upon the information supplied to, discussed with or reviewed by Evans & Evans for purposes of its opinion being complete and accurate in all material respects. Evans & Evans did not assume any responsibility for independent verification of, and did not independently verify, any of such information.

With Moolec’s consent, Evans & Evans relied upon, without independent verification, the assessment by Moolec and its legal, tax and regulatory with respect to legal, tax and regulatory matters. In addition, Evans & Evans relied upon, with Moolec’s consent, the assessments of the management of Moolec as to the existing technology, products and services of the Contributed Entities and the validity of, and risks associated with, the future technology, products and services of the Contributed Entities. Evans & Evans assumed, with Moolec’s consent, that there will be no developments with respect to any of the foregoing that would affect Evans & Evans’ analyses or opinion. With Moolec’s consent, Evans & Evans assumed that any adjustments to the consideration in accordance with the BCA or otherwise would not be material to Evans & Evans’ analysis or its opinion. In addition, Evans & Evans relied upon, with Moolec’s consent, the assessments of the management of Moolec as to Moolec’s ability to retain key employees of the Contributed Entities. In addition, with Moolec’s consent, Evans & Evans did not make any independent evaluation or appraisal of any of the assets or liabilities (contingent, derivative, off-balance-sheet, or otherwise) of Moolec or the Contributed Entities, nor had Evans & Evans been furnished with any such evaluation or appraisal.

Further, Evans & Evans’ opinion was necessarily based on economic, monetary, market and other conditions as in effect on, and the information made available to Evans & Evans as of the date of its opinion. Evans & Evans assumed no responsibility for updating its opinion based on developments after the date of its opinion. As stated above, Evans & Evans’ opinion did not address the underlying business decision to effect the transactions contemplated by the BCA or the relative merits of the same as compared to any alternative business strategies or transactions that might be available to Moolec and does not address any legal, regulatory, tax, or accounting matters.

With Moolec’s consent, Evans & Evans did not opine on what the value of the shares of Moolec would be when issued pursuant to the transactions contemplated by the BCA. Evans & Evans did not express any opinion as to fair value or the solvency of Moolec, the Contributed Entities or Moolec following the Closing. In rendering its opinion, Evans & Evans assumed, with Moolec’s consent, that the transaction contemplated by the BCA, will be consummated in accordance with its terms without any waiver or modification that could be material to Evans & Evans’ analysis, and that the parties to the BCA will comply with all the material terms of the BCA. Evans & Evans assumed, with Moolec’s consent, that all governmental, regulatory, or other consents and approvals necessary for the completion of the transaction contemplated by the BCA will be obtained except to the extent that could not be material to Evans & Evans’ analysis.

The prospective financial information referred to in the fairness opinion has been prepared by, and is the responsibility of, the Company’s management. Price Waterhouse & Co. S.R.L. has not audited, reviewed, examined, compiled nor applied agreed-upon procedures with respect to the accompanying prospective financial information and, accordingly, Price Waterhouse & Co. S.R.L. does not express an opinion or any other form of assurance with respect thereto. The Price Waterhouse & Co. S.R.L. reports included in this document relates to the previously issued financial statements of Bioceres Group plc and Bioceres Crop Solutions Corp. The reports do not extend to the prospective financial information and should not be read to do so.

The prospective financial information referred to below was not prepared with a view toward compliance with published guidelines of the Securities and Exchange Commission or the guidelines established by the American Institute of Certified Public Accountants for preparation or presentation of prospective financial information.

Summary of the Financial Analyses of Evans & Evans

In preparing its opinion to the Board, Evans & Evans performed a variety of financial and comparative analyses, and, for purposes of its opinion, used only those financial models that Evans & Evans created. The summary set forth below does not purport to be a complete description of the financial analyses performed or factors considered by, and underlying Evans & Evans’ opinion, nor does the order of the financial analyses described represent the relative importance or weight given to those financial analyses. The preparation of a financial opinion or analysis is a complex process involving various determinations as to the most appropriate and relevant methods of financial analysis and the application of those methods to the particular circumstances and, therefore, a financial opinion or analysis is not readily susceptible to summary description. In arriving at its opinion, Evans & Evans considered the results of all of the analyses undertaken by it and assessed as a whole and did not draw, in isolation, conclusions from or with regard to any particular factor or method of analysis considered by it. Rather, Evans & Evans made its determination as to fairness on the basis of its experience and professional judgment after considering the results of all of the analyses. Accordingly, Evans & Evans believes that its analyses and factors summarized below must be considered as a whole and in context. Evans & Evans further believes that selecting portions of its analyses and factors or focusing on information presented in tabular format, without considering all analyses and factors or the narrative description of the analyses and factors, could create a misleading or incomplete view of the processes underlying its analyses and opinion.

In performing its analyses, Evans & Evans considered industry performance, general business, economic, market and financial conditions and other matters, existing as of the date of its opinion, many of which are beyond the control of Moolec and the Contributed Entities. No company, business or transaction reviewed is identical or directly comparable to Moolec, the Contributed Entities or their respective businesses or the Business Combination. Accordingly, an evaluation of these analyses is not entirely mathematical. Rather, the analyses involve complex considerations and judgments concerning business, financial and operating characteristics and other factors that could affect the public trading, acquisition or other values of the companies, businesses or transactions reviewed or views regarding the comparability of such companies, businesses or transactions. Accordingly, such analyses may not necessarily include all companies, businesses or transactions that could be deemed relevant. The estimates of the future performance of Moolec and the Contributed Entities in or underlying Evans & Evans’ analyses and the ranges of valuations resulting from any particular analysis are not necessarily indicative of actual values or predictive of future results or values, which may be significantly more or less favorable than those estimates or those suggested by the analyses. In addition, analyses relating to the value of businesses or securities do not purport to be appraisals or to reflect the prices at which a company may actually be sold or the prices at which any securities have traded or may trade at any time in the future. Accordingly, the assumptions and estimates used in, and the ranges of valuations resulting from, any particular analysis described below are inherently subject to substantial uncertainty and should not be taken as the views of Evans & Evans regarding the actual values of Moolec or any of the Contributed Entities. Except as otherwise noted, the following quantitative information, to the extent that it is based on market data, is based on market data as it existed on or before April 7, 2025 and is not necessarily indicative of current market conditions.

The type and amount of consideration payable in the transaction contemplated by the BCA was determined through negotiations between Moolec, Bioceres Group, Nutrecon, and Gentle Tech, rather than by any financial advisor, and was approved by the Board. The decision to enter into the BCA was solely that of the Board. Receipt of Evans & Evans’ opinion and analyses should not be viewed as determinative of the views of the Board or management with respect to the transaction or the consideration payable in the transaction.

Financial Analyses

The summary of the financial analyses described in this section entitled “— Financial Analyses” is a summary of the material financial analyses provided by Evans & Evans in connection with its opinion, dated April 17, 2025, to the Board. The summary set forth below is not a comprehensive description of all analyses undertaken by Evans & Evans in connection with its opinion, nor does the order of the analyses in the summary below indicate that any analysis was given greater weight than any other analysis. The financial analyses summarized below include information presented in tabular format. In order to fully understand Evans & Evans’ financial analyses, the tables must be read together with the text of each summary. The tables alone do not constitute a complete description of the financial analyses performed by Evans & Evans. Considering the data set forth in the tables below without considering the full narrative description of the financial analyses, including the methodologies and assumptions underlying the analyses, could create a misleading or incomplete view of the financial analyses performed by Evans & Evans. Future results may differ from those described and such differences may be material.

The financial data utilized for Moolec and the Contributed Entities in the financial analyses described below were based on, among other things: (i) certain internal information relating to the business, earnings, cash flow, assets and liabilities of Moolec and the Contributed Entities furnished to Evans & Evans by Moolec and the Contributed Entities; (ii) certain internal information relating to expenses expected to result from the transaction furnished to Evans & Evans by Moolec; (iii) Moolec’s capital structure furnished to us by the management of Moolec both on a standalone basis pre-transaction and on a pro forma basis giving effect to the transaction; (iv) publicly available financial and stock market data of certain other companies in lines of business that Evans & Evans deemed relevant; and (v) such other financial studies and analyses and such other information as Evans & Evans deemed appropriate.

In undertaking the Guideline Public Company (“GPC”) Analyses outlined below, Evans & Evans did not have access to non-public information of any of the selected guideline public companies (collectively the “GPCs”). Accordingly, a complete valuation analysis of Moolec or any of the Contributed Entities cannot rely solely upon a quantitative review of the GPCs selected for each entity but involves complex considerations and judgments concerning differences in financial and operating characteristics of such companies, as well as other factors that could affect their value relative to that of the company under review. Therefore, the GPC Analysis is subject to certain limitations.

A GPC analysis is a valuation technique that provides an estimation of value by applying a valuation multiple to a specific financial metric for the subject company. These valuation multiples are either observed or derived from market prices of actively traded public companies, publicly available historical financial information, and consensus equity research analyst estimates of future financial performance. The valuation process includes, but is not limited to, a comparison of various quantitative and qualitative factors between the subject business and other similar businesses.

Evans & Evans also conducted Discounted Cash Flow (“DCF”) Analyses with respect to Moolec and the Contributed Entities as summarized below. Determination of an appropriate discount rate to use in the DCF Analysis requires a degree of judgment. Evans & Evans considered a number of factors in determining the discount rate range for each of the entities, including the results of published studies on discount rates, industry reports, broker reports and professional judgement. In developing the weighted average cost of capital (“WACC”) for each of Moolec and the Contributed Entities, Evans & Evans used a build-up method for the cost of equity. The build up method for equity considers the risk free rate, a large cap equity risk premium and a small cap equity risk premium based on the Kroll Cost of Capital Navigator data, a country specific risk premium based on industry date, an industry specific risk premium based on the average betas of the GPCs and a company specific risk premium (“CSRP”). Where possible, the cost of debt was estimated using each respective entities own cost of debt. For entities with no debt, or where the cost of existing debt was not made available to Evans & Evans, a build up method was used. The build up method includes market data on corporate bonds, a country risk default spread based on industry studies, and a CSRP.

Moolec Analyses

Trading Price Analysis (Market Approach)

Evans & Evans reviewed Moolec’s trading prices over the 10, 30, 90 and 180 trading days preceding the date of the opinion. Using the 10-day and 30-day VWAP of Moolec as of the date of the opinion, Evans & calculated the equity value of Moolec in the range of $26 million to $29 million.

Guideline Public Companies Analysis (Market Approach)

Using public filings and other publicly available information, Evans & Evans compared certain financial information of Moolec to corresponding financial information GPCs that, based on Evans & Evans’ professional judgment and experience, were considered generally relevant for purposes of analysis. Evans & Evans included companies in the plant-based products, ingredients and bioscience industries. In the view of Evans & Evans, Moolec is at such an early stage with respect to revenue generation as compared to the GPCs, that the analysis is limited in its applicability. Evans & Evans selected the companies above because, among other things, the selected companies operate businesses similar in certain respects to the business of Moolec.

Evans & Evans utilized the Selected GPC Analysis to select a weighting of fiscal 2025 and 2026 revenue multiples to estimate a range of enterprise values for Moolec. Evans & Evans initially identified 17 companies whose shares trade on recognized stock exchanges and thereafter upon further review of financial and operating results selected eight publicly traded companies that it deemed relevant in its analysis (the “Moolec GPCs”). Evans & Evans selected the Moolec GPCs based on their relative similarity, primarily in terms of business focus, revenue growth history and outlook, products, profit margins and other characteristics, to that of Moolec. Companies were removed from the analysis for the following reasons: (1) early stage companies with limited relevant operating metrics; (2) target markets that did not have sufficient overlap with Moolec; (3) broader international customer base; and (4) a lack of forward looking data.

Evans & Evans noted that none of the Moolec GPCs are perfectly comparable to Moolec. The tables below summarize certain observed historical and projected financial performance and trading multiples of the Moolec GPCs (“N/A” denotes not publicly available).

| 2025 E | 2026 E | 2027 E | 2025 E | 2026 E | 2027 E | |||||||||||||||||||

| Revenue | Revenue | Revenue | EBITDA | EBITDA | EBITDA | |||||||||||||||||||

| Growth | Growth | Growth | Growth | Growth | Growth | |||||||||||||||||||

| Beyond Meat, Inc. | -0.4 | % | 2.7 | % | 5.3 | % | -49.3 | % | -23.9 | % | -110.3 | % | ||||||||||||

| Simply Better Brands Corp. | -38.9 | % | 59.0 | % | N/A | -135.7 | % | 180.0 | % | N/A | ||||||||||||||

| SunOpta Inc. | 9.2 | % | 8.2 | % | N/A | 29.8 | % | 15.7 | % | N/A | ||||||||||||||

| Ingredion Incorporated | 1.0 | % | 2.7 | % | 1.1 | % | 5.5 | % | 3.2 | % | -2.1 | % | ||||||||||||

| Givaudan SA | 11.3 | % | 4.9 | % | 5.2 | % | 21.3 | % | 4.8 | % | 4.9 | % | ||||||||||||

| International Flavors & Fragrances Inc. | -5.5 | % | -0.9 | % | 4.3 | % | 20.6 | % | 2.0 | % | 6.6 | % | ||||||||||||

| DSM-Firmenich AG | 9.8 | % | 2.6 | % | 4.3 | % | 60.9 | % | 2.3 | % | 6.5 | % | ||||||||||||

| MGP Ingredients, Inc. | -24.5 | % | -2.1 | % | N/A | -41.9 | % | 8.3 | % | N/A | ||||||||||||||

| Average | -4.7 | % | 9.6 | % | 4.0 | % | -11.1 | % | 24.1 | % | -18.9 | % | ||||||||||||

| Median | 0.3 | % | 2.7 | % | 4.3 | % | 13.0 | % | 4.0 | % | 4.9 | % | ||||||||||||

Sources: S&P Capital IQ, SEC Filings, Annual and Interim Reports, Investor Presentations

| 2024A | 2025E | 2026E | TTM | TTM Capital |

||||||||||||||||

| EBITDA | EBITDA | EBITDA | Debt/ | Expenditure / | ||||||||||||||||

| Margin | Margin | Margin | Total Capital | Revenue | ||||||||||||||||

| Beyond Meat, Inc. | -38.4 | % | -19.6 | % | -14.5 | % | 83.8 | % | 3.4 | % | ||||||||||

| Simply Better Brands Corp. | -8.8 | % | 5.1 | % | 9.0 | % | 7.9 | % | N/A | |||||||||||

| SunOpta Inc. | 10.7 | % | 12.7 | % | 13.6 | % | 31.2 | % | 4.4 | % | ||||||||||

| Ingredion Incorporated | 16.4 | % | 17.1 | % | 17.2 | % | 18.5 | % | 4.1 | % | ||||||||||

| Givaudan SA | 22.3 | % | 24.3 | % | 24.3 | % | 11.2 | % | 3.2 | % | ||||||||||

| International Flavors & Fragrances Inc. | 15.1 | % | 19.3 | % | 19.9 | % | 33.1 | % | 4.0 | % | ||||||||||

| DSM-Firmenich AG | 12.5 | % | 18.3 | % | 18.3 | % | 16.7 | % | 5.0 | % | ||||||||||

| MGP Ingredients, Inc. | 26.5 | % | 20.4 | % | 22.6 | % | 36.1 | % | 10.1 | % | ||||||||||

| Average | 7.0 | % | 12.2 | % | 13.8 | % | 29.8 | % | 4.9 | % | ||||||||||

| Median | 13.8 | % | 17.7 | % | 17.7 | % | 24.8 | % | 4.1 | % | ||||||||||

Sources: S&P Capital IQ, SEC Filings, Annual and Interim Reports, Investor Presentations

| EV/ | EV/ | EV/ | EV/ | EV/ | EV/ | |||||||||||||||||||

| TTM | 2025E | 2026E | TTM | 2025E | 2026E | |||||||||||||||||||

| EBITDA | EBITDA | EBITDA | Revenue | Revenue | Revenue | |||||||||||||||||||

| Beyond Meat, Inc. | N/A | N/A | N/A | 3.77 | (x) | 3.78 | (x) | 3.68 | (x) | |||||||||||||||

| Simply Better Brands Corp. | N/A | 26.48 | (x) | 9.46 | (x) | .76 | (x) | 1.36 | (x) | .85 | (x) | |||||||||||||

| SunOpta Inc. | 9.01 | (x) | 6.94 | (x) | 6. | (x) | .96 | (x) | .88 | (x) | .81 | (x) | ||||||||||||

| Ingredion Incorporated | 7.29 | (x) | 6.91 | (x) | 6.7 | (x) | 1.2 | (x) | 1.18 | (x) | 1.15 | (x) | ||||||||||||

| Givaudan SA | 23.05 | (x) | 18.99 | (x) | 18.12 | (x) | 5.14 | (x) | 4.62 | (x) | 4.4 | (x) | ||||||||||||

| International Flavors & Fragrances Inc. | 15.32 | (x) | 12.7 | (x) | 12.45 | (x) | 2.32 | (x) | 2.45 | (x) | 2.47 | (x) | ||||||||||||

| DSM-Firmenich AG | 16.15 | (x) | 10.04 | (x) | 9.81 | (x) | 2.02 | (x) | 1.84 | (x) | 1.79 | (x) | ||||||||||||

| MGP Ingredients, Inc. | 4.67 | (x) | 8.04 | (x) | 7.42 | (x) | 1.24 | (x) | 1.64 | (x) | 1.68 | (x) | ||||||||||||

| Average | 12.58 | (x) | 12.87 | (x) | 9.99 | (x) | 2.17 | (x) | 2.22 | (x) | 2.11 | (x) | ||||||||||||

| Median | 12.17 | (x) | 10.04 | (x) | 9.46 | (x) | 1.63 | (x) | 1.74 | (x) | 1.73 | (x) | ||||||||||||

Historical and projected years indicate 12-month periods ending December 31

TTM = Trailing Twelve Months

EV: Enterprise Value = Market capitalization plus debt, net of cash and cash equivalents

Based on the data shown in the tables above, Evans & Evans selected a range of valuation multiples to apply to a weighting of Moolec’s fiscal year 2025 and 2026 forecast revenues.

Evans & Evans considered the multiple for the Moolec GPCs as outlined in the tables above in its determination of reasonable multiples for Moolec given the Moolec GPCs’ relative similarities to Moolec. Evans & Evans analyzed 2024 through 2026 EBITDA and revenue growth and 2024 through 2026 EBITDA margins for the Moolec GPCs and compared these metrics to those of Moolec for fiscal years 2024, 2025 and 2026. Evans & Evans used these comparisons and the multiples of enterprise value (“EV”) to 2025 revenue and EV to 2026 revenue for the Moolec GPCs to select revenue multiple range of 2.70x to 2.85x to apply to Moolec’s forecast fiscal year 2025 revenues and a multiple of 2.48x to 2.61x to apply to Moolec’s fiscal year 2026 revenues to arrive at an EV range for each set of multiples. Evans & Evans then weighted the two EV ranges resulting in an estimated current enterprise value range for Moolec. Evans & Evans selected multiples that, in its judgment, reflected Moolec’s revenue growth outlook, capital requirements, profit margins, management experience and other characteristics relative to the Moolec GPCs.

Evans & Evans’ GPC Analysis resulted in an estimated equity value range, after adding cash and deducting debt, for Moolec of $9.0 million to $10.5 million, which is significantly lower than Moolec’s market capitalization. In the view of Evans & Evans, limited weighting should be placed on the GPC analysis as Moolec is not at the stage of commercialization where its growth rate has stabilized.

Precedent Transactions Analysis (Market Approach)

Evans & Evans did not identify transactions involving companies with publicly available financial information that Evans & Evans believed, based on its experience and professional judgment, to be generally relevant for purposes of this analysis.

Discounted Cash Flow Analysis (Income Approach)

Evans & Evans performed a DCF Analysis of Moolec using a financial forecast that Evans & Evans developed with the guidance of Moolec’s management and other information and data provided by Moolec’s management to calculate the estimated present value of the future unlevered after-tax free cash flows projected to be generated by Moolec through the end of fiscal year 2033.

Evans & Evans assessed the reasonableness of the Moolec model by comparing Moolec’s revenue growth, EBITDA growth, and EBITDA margins of the Moolec GPCs and professional judgement. Capital expenditures considered in the analysis were estimated by Evans & Evans using industry benchmarking. Annual working capital requirements were based on benchmarking of the Moolec GPCs and professional judgement. Evans & Evans assumed that annually Moolec would require an amount of debt-free-net-working capital equal to 17.5% of revenues.

In developing the CSRP Evans & Evans also considered (i) Moolec’s business plan, (ii) Moolec’s projected financial performance and growth and (iii) risks facing Moolec in order to achieve projected results, including execution risk, financing, tariffs, regulatory and competitive risks, among others. Evans & Evans also considered the experience of the management team and the ability to secure future financing to fund operations. Based on these factors, Evans & Evans used discount rates ranging from 20% to 21% to discount the projected unlevered free cash flows and the terminal value. Evans & Evans believes that this range of discount rates is consistent with the rate of return that shareholders would require on alternative investment opportunities with similar risk profiles, including risks of achieving the projected cash flows based. In developing the discount rate, Evans & Evans considered a capital structure of 25% debt and 75% equity based on benchmarking of the Moolec GPCs and professional judgement.

In determining the unlevered cash flows, Evans & Evans deducted approximately $16 million in capital expenditures over approximately 8 years.

A tax rate of approximately 23.9% was used in the analysis along with an expected long-term growth rate (“LTGR”) of 2.0% and an industry beta of 1.07.

In performing the DCF analysis of Moolec Evans & Evans considered a terminal value multiple of 5.5x free cash flow in the terminal year as a midpoint. The terminal multiple was compared to the EBITDA multiples of the selected GPCs and was found to be conservative. The terminal value represents approximately 61% of Moolec’s enterprise value. After-tax free cash flows from each period in each set were discounted to April 7, 2025 using the mid-period convention.

The equity value of Moolec under the DCF Analysis was determined to be in the range of $87.3 million to $94.3 million.

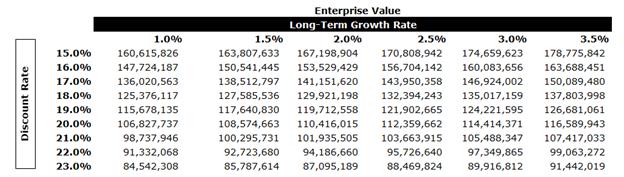

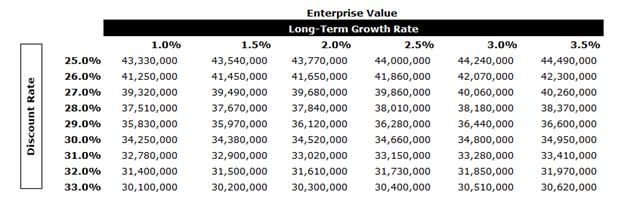

A sensitivity analysis on Moolec’s EV was calculated as outlined below using various LTGRs and discount rates.

Moolec Conclusion

Evans & Evans calculated the equity value of Moolec using the DCF Analysis, the GPC Analysis and the Trading Price Analysis. Evans & Evans then weighted the DCF Analysis and the Trading Price Analysis calculate an equity value of $44.4 million to $48.6 million, which represents a 71% to 87% premium to the Moolec market capitalization as of the date of the opinion.

BIOX Analyses

Trading Price Analysis (Market Approach)

Evans & Evans reviewed BIOX’s trading prices over the 10, 30, 90 and 180 trading days preceding the date of the opinion. Using the 10-day and 60-day VWAP of BIOX as of the date of the opinion, Evans & calculated the equity value of BIOX in the range of $282.4 million to $324.4 million.

Guideline Public Companies Analysis (Market Approach)

Using public filings and other publicly available information, Evans & Evans compared certain financial information of BIOX to corresponding financial information for selected GPCs that, based on Evans & Evans’ professional judgment and experience, Evans & Evans considered generally relevant for purposes of analysis. Evans & Evans included companies in the crop services, agriculture science, specialty chemicals and crop protection industries.

Evans & Evans selected the companies above because, among other things, the selected companies operate businesses similar in certain respects to the business of BIOX.

Evans & Evans utilized the GPC Analysis to select a weighting of trailing 12 month (“TTM”) and 2025 expected EBITDA multiples to estimate a range of enterprise values for BIOX.

Evans & Evans identified 11 companies whose shares trade on recognized stock exchanges which, after review of financial and operating results were deemed relevant in its analysis (the “BIOX GPCs”). Evans & Evans selected the BIOX GPCs based on their relative similarity, primarily in terms of business focus, revenue growth history and outlook, capital requirements, profit margins and other characteristics, to that of BIOX.

Evans & Evans noted that none of the BIOX GPCs are perfectly comparable to BIOX.

The tables below summarize certain observed historical and projected financial performance and trading multiples of the BIOX GPCs.

| 2025 E | 2026 E | 2027 E | 2025 E | 2026 E | 2027 E | |||||||||||||||||||

| Revenue | Revenue | Revenue | EBITDA | EBITDA | EBITDA | |||||||||||||||||||

| Growth | Growth | Growth | Growth | Growth | Growth | |||||||||||||||||||

| Corteva, Inc. | 2.3 | % | 3.4 | % | 2.8 | % | 17.5 | % | 8.4 | % | 8.2 | % | ||||||||||||

| American Vanguard Corporation | -5.0 | % | 4.6 | % | 2.8 | % | -9.6 | % | 17.8 | % | 15.9 | % | ||||||||||||

| Bayer CropScience Limited | 1.8 | % | 10.5 | % | 10.7 | % | -33.8 | % | 52.3 | % | 17.7 | % | ||||||||||||

| FMC Corporation | -1.8 | % | 7.0 | % | 5.5 | % | 10.5 | % | 10.9 | % | 6.9 | % | ||||||||||||

| Nufarm Limited | -7.4 | % | 8.4 | % | 5.6 | % | 86.2 | % | 18.0 | % | 8.6 | % | ||||||||||||

| Evogene Ltd. | 65.3 | % | 52.7 | % | 85.1 | % | -37.3 | % | -22.7 | % | -72.0 | % | ||||||||||||

| Rallis India Limited | -1.1 | % | 12.5 | % | 12.9 | % | 3.3 | % | 21.0 | % | 19.3 | % | ||||||||||||

| Bayer Aktiengesellschaft | 5.4 | % | 1.5 | % | 1.6 | % | 9.2 | % | 4.8 | % | 2.2 | % | ||||||||||||

| Dow Inc. | -0.4 | % | 4.6 | % | 3.8 | % | 2.2 | % | 16.9 | % | 10.0 | % | ||||||||||||

| UPL Limited | 4.3 | % | 7.9 | % | 8.4 | % | 89.2 | % | 20.1 | % | 13.7 | % | ||||||||||||

| Eden Research plc | 32.4 | % | 18.3 | % | N/A | |||||||||||||||||||

| Average | 8.7 | % | 11.9 | % | 13.9 | % | 13.7 | % | 14.8 | % | 3.0 | % | ||||||||||||

| Median | 1.8 | % | 7.9 | % | 5.6 | % | 6.2 | % | 17.3 | % | 9.3 | % | ||||||||||||

Sources: S&P Capital IQ, SEC Filings, Annual and Interim Reports, Investor Presentations

| 2024A | 2025E | 2026E | TTM | TTM Capital |

||||||||||||||||

| EBITDA | EBITDA | EBITDA | Debt/ | Expenditure / | ||||||||||||||||

| Margin | Margin | Margin | Total Capital | Revenue | ||||||||||||||||

| Corteva, Inc. | 18.8 | % | 21.6 | % | 22.6 | % | 6.6 | % | 3.5 | % | ||||||||||

| American Vanguard Corporation | 8.1 | % | 7.7 | % | 8.7 | % | 62.3 | % | 1.7 | % | ||||||||||

| Bayer CropScience Limited | 18.4 | % | 12.0 | % | 16.5 | % | 0.0 | % | n/a | |||||||||||

| FMC Corporation | 19.1 | % | 21.5 | % | 22.3 | % | 43.2 | % | 1.6 | % | ||||||||||

| Nufarm Limited | 5.3 | % | 10.6 | % | 11.6 | % | 39.9 | % | 3.8 | % | ||||||||||

| Evogene Ltd. | -240.9 | % | -91.3 | % | -46.3 | % | 0.0 | % | 7.4 | % | ||||||||||

| Rallis India Limited | 11.3 | % | 11.8 | % | 12.7 | % | 0.0 | % | n/a | |||||||||||

| Bayer Aktiengesellschaft | 19.6 | % | 20.3 | % | 21.0 | % | 65.7 | % | 6.0 | % | ||||||||||

| Dow Inc. | 11.8 | % | 12.1 | % | 13.5 | % | 43.7 | % | 7.6 | % | ||||||||||

| UPL Limited | 9.6 | % | 17.4 | % | 19.4 | % | 0.0 | % | n/a | |||||||||||

| Eden Research plc | -51.1 | % | -30.2 | % | -24.0 | % | 0.0 | % | 3.8 | % | ||||||||||

| Average | -15.5 | % | 1.2 | % | 7.1 | % | 23.8 | % | 4.4 | % | ||||||||||

| Median | 11.3 | % | 12.0 | % | 13.5 | % | 6.6 | % | 3.8 | % | ||||||||||

Sources: S&P Capital IQ, SEC Filings, Annual and Interim Reports, Investor Presentations

| EV/ | EV/ | EV/ | EV/ | EV/ | EV/ | |||||||||||||||||||

| TTM | 2025E | 2026E | TTM | 2025E | 2026E | |||||||||||||||||||

| EBITDA | EBITDA | EBITDA | Revenue | Revenue | Revenue | |||||||||||||||||||

| Corteva, Inc. | 11.87 | (x) | 10.1 | (x) | 9.32 | (x) | 2.23 | (x) | 2.18 | (x) | 2.11 | (x) | ||||||||||||

| American Vanguard Corporation | 13.97 | (x) | 6.49 | (x) | 5.51 | (x) | .5 | (x) | .5 | (x) | .48 | (x) | ||||||||||||

| Bayer CropScience Limited | 33.1 | (x) | 31.48 | (x) | 20.66 | (x) | 3.85 | (x) | 3.77 | (x) | 3.41 | (x) | ||||||||||||

| FMC Corporation | 9.15 | (x) | 8.28 | (x) | 7.46 | (x) | 1.75 | (x) | 1.78 | (x) | 1.66 | (x) | ||||||||||||

| Nufarm Limited | 10.15 | (x) | 5.45 | (x) | 4.62 | (x) | .54 | (x) | .58 | (x) | .54 | (x) | ||||||||||||

| Evogene Ltd. | n/a | n/a | n/a | .94 | (x) | .57 | (x) | .37 | (x) | |||||||||||||||

| Rallis India Limited | 12.32 | (x) | 11.82 | (x) | 9.76 | (x) | 1.4 | (x) | 1.39 | (x) | 1.24 | (x) | ||||||||||||

| Bayer Aktiengesellschaft | 5.91 | (x) | 5.41 | (x) | 5.17 | (x) | 1.16 | (x) | 1.1 | (x) | 1.08 | (x) | ||||||||||||

| Dow Inc. | 6.46 | (x) | 6.33 | (x) | 5.41 | (x) | .76 | (x) | .77 | (x) | .73 | (x) | ||||||||||||

| UPL Limited | 16.17 | (x) | 10.93 | (x) | 9.1 | (x) | 1.95 | (x) | 1.91 | (x) | 1.77 | (x) | ||||||||||||

| Eden Research plc | n/a | n/a | n/a | 1.95 | (x) | 1.8 | (x) | 1.52 | (x) | |||||||||||||||

| Average | 13.23 | (x) | 10.7 | (x) | 8.56 | (x) | 1.55 | (x) | 1.49 | (x) | 1.36 | (x) | ||||||||||||

| Median | 11.87 | (x) | 8.28 | (x) | 7.46 | (x) | 1.4 | (x) | 1.39 | (x) | 1.24 | (x) | ||||||||||||

Historical and projected years indicate 12-month periods ending December 31

TTM = Trailing Twelve Months

EV: Enterprise Value = Market capitalization plus debt, net of cash and cash equivalents

Based on the data shown in the tables above, Evans & Evans also selected a range of valuation multiples to apply to a weighting of BIOX’s TTM EBITDA and fiscal year consensus estimated 2025 EBITDA. EBITDA was selected as the appropriate measure for BIOX given its results have stabilized.

Evans & Evans considered the multiple for the BIOX GPCs as outlined in the tables above in its determination of reasonable multiples for BIOX given the BIOX GPCs relative similarities to BIOX. Evans & Evans analyzed TTM and current fiscal year (2025) EBITDA and revenue growth and 2024 through 2026 EBITDA margins for the BIOX GPCs and compared these metrics to those of BIOX for the comparative periods. Evans & Evans used these comparisons and the multiples of EV to TTM EBITDA and EV to 2025 forecast EBITDA for the BIOX GPCs to select an EBITDA multiple range of 12.5x to 13.0x to apply to BIOX’s TTM EBITDA and a multiple of 10.0x to 10.5x to apply to BIOX’s fiscal year 2025 consensus EBITDA to arrive at an EV range for each set of multiples. Evans & Evans then weighted the two EV ranges resulting in an estimated current EV range for BIOX. Evans & Evans selected multiples that, in its judgment, reflected BIOX’s revenue growth outlook, capital requirements, profit margins, management experience and other characteristics relative to the BIOX GPCs.

Evans & Evans’ GPC Analysis resulted in an estimated equity value range, after adding cash and deducting debt, for BIOX of $467.9 million to $501.9 million, which is significantly above BIOX’s market capitalization. In the view of Evans & Evans, weighting of the GPC Analysis was appropriate as BIOX does appear to be trading below that of its peers.

Precedent Transactions Analysis (Market Approach)

Evans & Evans did not identify transactions involving companies with publicly available financial information that Evans & Evans believed, based on its experience and professional judgment, to be generally relevant for purposes of this analysis.

Discounted Cash Flow Analysis (Income Approach)

Evans & Evans performed a DCF analysis of BIOX using a financial forecast that Evans & Evans developed based on consensus estimates of future results to calculate the estimated present value of the future unlevered after-tax free cash flows projected to be generated by BIOX through the end of fiscal year 2034.

Evans & Evans assessed the reasonableness of the BIOX model by comparing BIOX’s revenue growth, EBITDA growth, and EBITDA margins of the BIOX GPCs and professional judgment. Capital expenditures considered in the analysis were estimated by Evans & Evans based on consensus estimates. Annual working capital requirements were based on benchmarking of the BIOX GPCs and professional judgement. Evans & Evans assumed that annually BIOX would require an amount of debt-free-net-working capital of 34.4% of revenues, based on BIOX historical working capital levels and with reference to benchmarking against the BIOX GPCs.

In developing the CSRP Evans & Evans also considered (i) BIOX historical performance against consensus estimates, (ii) historical financial performance and growth and (iii) risks facing BIOX in order to achieve projected results, including execution risk, financing, tariffs, regulatory and competitive risks, among others. Evans & Evans also considered the experience of the management team and the ability to secure future financing to fund operations given the current debt level. Based on these factors, Evans & Evans used discount rates ranging from 12% to 13% to discount the projected unlevered free cash flows and the terminal value. Evans & Evans believes that this range of discount rates is consistent with the rate of return that shareholders would require on alternative investment opportunities with similar risk profiles, including risks of achieving the projected cash flows based. In developing the discount rate, Evans & Evans considered a capital structure of 35% debt and 65% equity based on benchmarking of the BIOX GPCs and professional judgement.

In determining the unlevered cash flows, Evans & Evans deducted approximately $91 million in capital expenditures over the approximately nine years.

A tax rate of approximately 35% was used in the analysis along with an expected LTGR of 2.0% and an industry beta of 0.84.

In performing the DCF analysis of BIOX Evans & Evans considered a terminal value multiple of 10x free cash flow in the terminal year as a midpoint. The terminal multiple was compared to the EBITDA multiples of the selected GPCs and was found to be in line with current multiples. The terminal value represents approximately 60% of BIOX’s entity value. The equity value of BIOX under the DCF Analysis was determined to be in the range of $519.6 million to $571.2 million.

After-tax free cash flows from each period in each set were discounted to April 7, 2025 using the mid-period convention.

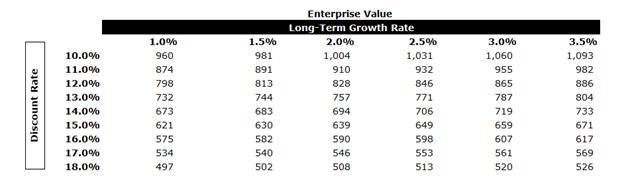

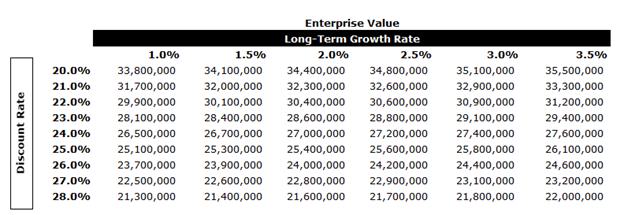

A sensitivity analysis on BIOX’s EV was calculated as outlined below using various LTGRs and discount rates.

BIOX Conclusion

Evans & Evans calculated the equity value of BIOX using the DCF Analysis, the GPC Analysis and the Trading Price Analysis. Evans & Evans then weighted the three analyses to calculate an equity value of $451.5 million to $494.1 million. The concluded equity value represents a premium of 60% to 75% to BIOX’s market capitalization.

Upon arriving at the equity value of 100% of BIOX, Evans & Evans calculated the pro rata portion being contributed per the transaction terms. Lastly, Evans & Evans applied a control premium, based on a review of various control premium studies, of 10%.

Agrality Analyses

Evans & Evans was provided with select information on the Agrality group of companies (“Agrality”) and as such considered the group on a consolidated basis and did not perform an analysis of each entity within Agrality.

Guideline Public Companies Analysis (Market Approach)

Using public filings and other publicly available information, Evans & Evans compared certain financial information of Agrality to corresponding financial information for selected GPCs that, based on Evans & Evans’ professional judgment and experience, Evans & Evans considered generally relevant for purposes of analysis. Evans & Evans included companies in the agriculture science, seed development and crop protection industries.

Evans & Evans selected the companies above because, among other things, the selected companies operate businesses similar in certain respects to the business of Agrality.

Evans & Evans utilized the Selected GPC Analysis to select a weighting of TTM and 2025 expected EBITDA multiples to estimate a range of enterprise values for Agrality.

Evans & Evans identified 14 companies whose shares trade on recognized stock exchanges which, after review of financial and operating results were deemed relevant in its analysis (the “Agrality GPCs”). Evans & Evans selected the Agrality GPCs based on their relative similarity, primarily in terms of business focus, revenue growth history and outlook, capital requirements, profit margins and other characteristics, to that of Agrality.

Evans & Evans noted that none of the Agrality GPCs are perfectly comparable to Agrality.

The tables below summarize certain observed historical and projected financial performance and trading multiples of the Agrality GPCs.

| 2025 E | 2026 E | 2027 E | 2025 E | 2026 E | 2027 E | |||||||||||||||||||

| Revenue | Revenue | Revenue | EBITDA | EBITDA | EBITDA | |||||||||||||||||||

| Growth | Growth | Growth | Growth | Growth | Growth | |||||||||||||||||||

| Cibus, Inc. | 134.6 | % | 51.0 | % | 293.4 | % | -36.4 | % | -22.2 | % | -224.2 | % | ||||||||||||

| Evogene Ltd. | 50.9 | % | 65.3 | % | 52.7 | % | -37.3 | % | -22.7 | % | -72.0 | % | ||||||||||||

| S&W Seed Company | -17.8 | % | -40.6 | % | 14.3 | % | -50.4 | % | N/A | N/A | ||||||||||||||

| Sadot Group Inc. | -2.3 | % | 10.5 | % | 5.5 | % | -122.0 | % | 100.6 | % | N/A | |||||||||||||

| Wanxiang Doneed Co., ltd | 32.2 | % | N/A | N/A | N/A | N/A | N/A | |||||||||||||||||

| Arcadia Biosciences, Inc. | 13.3 | % | 28.8 | % | 21.5 | % | -37.3 | % | -20.0 | % | N/A | |||||||||||||

| Nath Bio-Genes (India) Limited | 8.8 | % | N/A | N/A | N/A | N/A | N/A | |||||||||||||||||

| Vietnam National Seed Group Joint Stock Company | 14.5 | % | N/A | N/A | N/A | N/A | N/A | |||||||||||||||||

| Bombay Super Hybrid Seeds Limited | 11.1 | % | N/A | N/A | N/A | N/A | N/A | |||||||||||||||||

| PT BISI International Tbk | -43.0 | % | N/A | N/A | N/A | N/A | N/A | |||||||||||||||||

| KWS SAAT SE & Co. KGaA | 9.8 | % | 3.3 | % | 4.0 | % | 1.8 | % | 0.0 | % | 7.2 | % | ||||||||||||

| Arcadia Biosciences, Inc. | 13.3 | % | 28.8 | % | 21.5 | % | -37.3 | % | -20.0 | % | N/A | |||||||||||||

| Origin Agritech Limited | 26.4 | % | N/A | N/A | N/A | N/A | N/A | |||||||||||||||||

| Mangalam Seeds Limited | 69.4 | % | N/A | N/A | N/A | N/A | N/A | |||||||||||||||||

| Average | 22.9 | % | 21.0 | % | 59.0 | % | -45.6 | % | 2.6 | % | -96.3 | % | ||||||||||||

| Median | 13.3 | % | 28.8 | % | 21.5 | % | -37.3 | % | -20.0 | % | -72.0 | % | ||||||||||||

Sources: S&P Capital IQ, SEC Filings, Annual and Interim Reports, Investor Presentations

| 2024A | 2025E | 2026E | TTM | TTM Capital |

||||||||||||||||

| EBITDA | EBITDA | EBITDA | Debt/ | Expenditure / | ||||||||||||||||

| Margin | Margin | Margin | Total Capital | Revenue | ||||||||||||||||

| Cibus, Inc. | -692.9 | % | -137.0 | % | 49.2 | % | 1.1 | % | 19.0 | % | ||||||||||

| Evogene Ltd. | -91.3 | % | -46.3 | % | -7.0 | % | 0.0 | % | 7.4 | % | ||||||||||

| S&W Seed Company | -13.9 | % | N/A | N/A | 52.1 | % | 2.7 | % | ||||||||||||

| Sadot Group Inc. | 0.3 | % | 0.6 | % | N/A | 32.1 | % | 0.0 | % | |||||||||||

| Wanxiang Doneed Co., ltd | N/A | N/A | N/A | 0.0 | % | 1.2 | % | |||||||||||||

| Arcadia Biosciences, Inc. | -70.8 | % | -46.6 | % | N/A | 0.0 | % | 0.3 | % | |||||||||||

| Nath Bio-Genes (India) Limited | N/A | N/A | N/A | 0.0 | % | N/A | ||||||||||||||

| Vietnam National Seed Group Joint Stock Company | N/A | N/A | N/A | 11.5 | % | 3.8 | % | |||||||||||||

| Bombay Super Hybrid Seeds Limited | N/A | N/A | N/A | 0.0 | % | N/A | ||||||||||||||

| PT BISI International Tbk | N/A | N/A | N/A | 0.0 | % | 6.9 | % | |||||||||||||

| KWS SAAT SE & Co. KGaA | 22.8 | % | 21.9 | % | 22.5 | % | 23.0 | % | 8.4 | % | ||||||||||

| Arcadia Biosciences, Inc. | -70.8 | % | -46.6 | % | N/A | 0.0 | % | 0.3 | % | |||||||||||

| Origin Agritech Limited | N/A | N/A | N/A | 39.1 | % | 4.4 | % | |||||||||||||

| Mangalam Seeds Limited | N/A | N/A | N/A | 0.0 | % | N/A | ||||||||||||||

| Average | -131.0 | % | -42.3 | % | 21.6 | % | 11.4 | % | 4.9 | % | ||||||||||

| Median | -70.8 | % | -46.4 | % | 22.5 | % | 0.0 | % | 3.8 | % | ||||||||||

Sources: S&P Capital IQ, SEC Filings, Annual and Interim Reports, Investor Presentations

| EV/ | EV/ | EV/ | EV/ | EV/ | EV/ | |||||||||||||||||||

| TTM | 2025E | 2026E | TTM | 2025E | 2026E | |||||||||||||||||||

| EBITDA | EBITDA | EBITDA | Revenue | Revenue | Revenue | |||||||||||||||||||

| Cibus, Inc. | N/A | N/A | N/A | 10.28 | (X) | 6.8 | (X) | 1.73 | (X) | |||||||||||||||

| Evogene Ltd. | N/A | N/A | N/A | .94 | (X) | .57 | (X) | .37 | (X) | |||||||||||||||

| S&W Seed Company | N/A | N/A | N/A | .61 | (X) | .93 | (X) | .82 | (X) | |||||||||||||||

| Sadot Group Inc. | N/A | 8.61 | (X) | 4.29 | (X) | .03 | (X) | .03 | (X) | .03 | (X) | |||||||||||||

| Wanxiang Doneed Co., ltd | 57.61 | (X) | N/A | N/A | 6.39 | (X) | N/A | N/A | ||||||||||||||||

| Arcadia Biosciences, Inc. | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||||||||||||

| Nath Bio-Genes (India) Limited | 7.81 | (X) | N/A | N/A | 1.14 | (X) | N/A | N/A | ||||||||||||||||

| Vietnam National Seed Group Joint Stock Company | 3.81 | (X) | N/A | N/A | .58 | (X) | N/A | N/A | ||||||||||||||||

| Bombay Super Hybrid Seeds Limited | 42.42 | (X) | N/A | N/A | 3.75 | (X) | N/A | N/A | ||||||||||||||||

| PT BISI International Tbk | 9.95 | (X) | N/A | N/A | 1.88 | (X) | N/A | N/A | ||||||||||||||||

| KWS SAAT SE & Co. KGaA | 5.8 | (X) | 5.39 | (X) | 5.4 | (X) | 1.3 | (X) | 1.23 | (X) | 1.18 | (X) | ||||||||||||

| Arcadia Biosciences, Inc. | N/A | N/A | N/A | N/A | N/A | N/A | ||||||||||||||||||

| Origin Agritech Limited | N/A | N/A | N/A | .74 | (X) | N/A | N/A | |||||||||||||||||

| Mangalam Seeds Limited | 15.07 | (X) | N/A | N/A | 2.37 | (X) | N/A | N/A | ||||||||||||||||

| Average | ||||||||||||||||||||||||

| Average | 20.35 | (x) | 7. (x) | 4.84 | (x) | 2.5 | (x) | 1.91 | (x) | .83 | (x) | |||||||||||||

| Median | 9.95 | (x) | 7. (x) | 4.84 | (x) | 1.22 | (x) | .93 | (x) | .82 | (x) | |||||||||||||

Historical and projected years indicate 12-month periods ending December 31

TTM = Trailing Twelve Months

EV: Enterprise Value = Market capitalization plus debt, net of cash and cash equivalents

Based on the data shown in the tables above, Evans & Evans also selected a range of valuation multiples to apply to a weighting of Agrality’s TTM results and fiscal year 2025 forecast EBITDA. EBITDA was selected as the appropriate measure for Agrality given its does have a history of positive EBITDA.

Evans & Evans considered the multiple for the Agrality GPCs as outlined in the tables above in its determination of reasonable multiples for Agrality given the Agrality GPCs relative similarities to Agrality. Evans & Evans analyzed TTM and current fiscal year (2025) EBITDA and revenue growth and 2024 through 2026 EBITDA margins for the Agrality GPCs and compared these metrics to those of Agrality for the comparative periods. Evans & Evans used these comparisons and the multiples of EV to TTM EBITDA and EV to 2025 forecast EBITDA for the Agrality GPCs to select an EBITDA multiple range of 9.3x to 9.5x to apply to Agrality’s TTM EBITDA and a multiple of 7.44x to 7.6x to apply to Agrality’s fiscal year 2025 forecast EBITDA to arrive at an EV range for each set of multiples. Evans & Evans then weighted the two EV ranges resulting in an estimated current EV range for Agrality. Evans & Evans selected multiples that, in its judgment, reflected Agrality’s revenue growth outlook, capital requirements, profit margins, management experience and other characteristics relative to the Agrality GPCs.

Evans & Evans’ Selected GPC Analysis resulted in an estimated equity value range, after adding cash and deducting debt, for Agrality of $123.6 million to $126.6 million.

Precedent Transactions Analysis (Market Approach)

Evans & Evans did not identify transactions involving companies with publicly available financial information that Evans & Evans believed, based on its experience and professional judgment, to be generally relevant for purposes of this analysis.

Discounted Cash Flow Analysis (Income Approach)

Evans & Evans performed a DCF analysis of Agrality using a financial forecast provided by Agrality management to calculate the estimated present value of the future unlevered after-tax free cash flows projected to be generated by Agrality through the end of fiscal year 2029.

Evans & Evans assessed the reasonableness of the Agrality model by comparing Agrality’s revenue growth, EBITDA growth, and EBITDA margins of the Agrality GPCs and professional judgment. Capital expenditures considered in the analysis were provided by Agrality management. Annual working capital requirements were based on benchmarking of the Agrality GPCs, actual working capital amounts and professional judgement. Evans & Evans assumed that annually Agrality would require an amount of debt-free-net-working capital of 21.3% of revenues, based on Agrality historical working capital levels and with reference to benchmarking against the Agrality GPCs.

In developing the CSRP Evans & Evans considered (i) historical financial performance and growth; (ii) country specific risks related to inflation and defaults; and (iii) risks facing Agrality in order to achieve projected results, including execution risk, financing, tariffs, regulatory and competitive risks, among others. Evans & Evans also considered the experience of the management team and the ability to secure future financing to fund operations. Based on these factors, Evans & Evans used discount rates ranging from 14% to 15% to discount the projected unlevered free cash flows and the terminal value. Evans & Evans believes that this range of discount rates is consistent with the rate of return that shareholders would require on alternative investment opportunities with similar risk profiles, including risks of achieving the projected cash flows based. In developing the discount rate, Evans & Evans considered a capital structure of 11% debt and 89% equity based on benchmarking of the Agrality GPCs and professional judgement.

In determining the unlevered cash flows, Evans & Evans deducted approximately $6 million in capital expenditures over the approximately nine years.

A tax rate of approximately 35% was used in the analysis along with an expected LTGR of 2.0% and an industry beta of 0.88.

In performing the DCF analysis of Agrality Evans & Evans considered a terminal value multiple of 8.33x free cash flow in the terminal year as a midpoint. The terminal multiple was compared to the EBITDA multiples of the selected GPCs and was found to be in line with current multiples. The terminal value represents approximately 73% of Agrality’s enterprise value. The equity value of Agrality under the DCF Analysis was determined to be in the range of $183.1 million to $189.7 million.

After-tax free cash flows from each period in each set were discounted to April 7, 2025 using the mid-period convention.

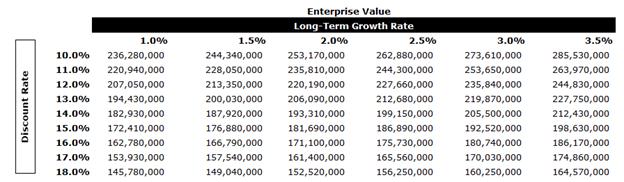

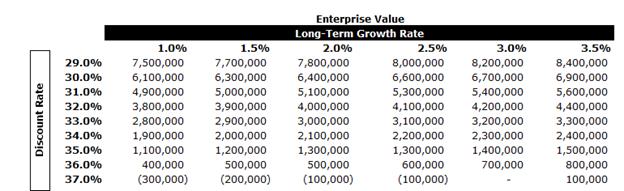

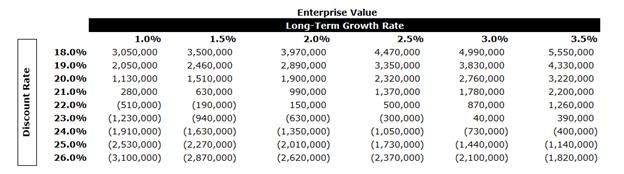

A sensitivity analysis on Agrality’s EV was calculated as outlined below using various LTGRs and discount rates.

Agrality Conclusion

Evans & Evans calculated the equity value of Agrality using the DCF Analysis and the GPC Analysis. Evans & Evans then weighted the two equity value ranges to calculate an equity value of $153.4 million to $158.1 million.

Upon arriving at the equity value of 100% of Agrality, Evans & Evans calculated the pro rata portion being contributed per the transaction terms. Given Moolec is acquiring 50% of Agrality, no control premium was applied.

Nutrecon Analysis

In reviewing Nutrecon, Evans & Evans first determined the value of Nutrecon’s 90% subsidiary Synbio Powerlabs OY (“Synbio”) and then adjusted the book value of Nutrecon to arrive at an equity value for Nutrecon.

Guideline Public Companies Analysis (Market Approach)

Evans & Evans did not conduct a GPC Analysis for Nutrecon. Evans & Evans conducted several searches and did not believe a reasonable set of GPCs could be developed to appropriate assess Nutrecon given its unique service, hybrid business model and pre-revenue stage of development.

Precedent Transactions Analysis (Market Approach)

Evans & Evans did not identify transactions involving companies with publicly available financial information that Evans & Evans believed, based on its experience and professional judgment, to be generally relevant for purposes of this analysis.

Discounted Cash Flow Analysis (Income Approach)

Evans & Evans performed a DCF analysis of Nutrecon using a financial forecast provided by Nutrecon management to calculate the estimated present value of the future unlevered after-tax free cash flows projected to be generated by Nutrecon through the end of fiscal year 2029.

Evans & Evans assessed the reasonableness of the Nutrecon model by comparing Nutrecon’s revenue growth, EBITDA growth, and EBITDA margins of a group of GPCs in the plant based food market and specialty chemicals market (the “Nutrecon GPCs”) and professional judgment. Capital expenditures considered in the analysis were provided by Nutrecon management for fiscal year 2025 and then estimated by Evans & Evans using professional judgement thereafter. Annual working capital requirements were based on benchmarking of the Nutrecon GPCs, actual working capital amounts and professional judgement. Evans & Evans assumed that annually Nutrecon would require an amount of debt-free-net-working capital of 16% of revenues, with reference to benchmarking against industry metrics.