UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2024

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ until ______

Commission File Number: 001-41588

LA ROSA HOLDINGS CORP.

(Exact name of Registrant as specified in its charter)

| Nevada | 87-1641189 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| 1420 Celebration Blvd., 2nd floor Celebration, Florida |

34747 |

|

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (321) 250-1799

Securities registered under Section 12(b) of the Act:

| Title of each class: | Trading Symbol(s) | Name of each exchange on which registered: | ||

| Common Stock | LRHC | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Yes ☐ No ☒ |

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Yes ☐ No ☒ |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Yes ☒ No ☐ |

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit post such files).

| Yes ☒ No ☐ |

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Yes ☐ No ☒ |

The aggregate market value of voting and non-voting common equity held by non-affiliates of the Registrant on June 28, 2024 (the last business day of the Registrant’s most recently completed second quarter) was approximately $31,933,113, which is based on a closing price of $2.11 per share of common stock on such date.

As of April 15, 2025, the Registrant had 37,411,451 shares of common stock, par value $0.0001 per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

In this Annual Report on Form 10-K, unless otherwise stated or as the context otherwise requires, references to “La Rosa Holdings Corp.,” the “Company,” the “Issuer,” the “Registrant,” the “LRHC,” “La Rosa,” “we,” “us,” “our” and similar references refer to La Rosa Holdings Corp., a Nevada corporation. Our logo and other trademarks or service marks of the Company appearing in this Annual Report on Form 10-K are the property of La Rosa Holdings Corp. or its subsidiaries. This Annual Report on Form 10-K also contains registered marks, trademarks, and trade names of other companies. All other trademarks, registered marks, and trade names appearing in this Annual Report on Form 10-K are the property of their respective holders.

Cautionary Note Regarding Forward-Looking Statements and Industry Data

This Annual Report on Form 10-K, in particular, Part II Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements represent our expectations, beliefs, intentions, or strategies concerning future events, including, but not limited to, any statements regarding our assumptions about financial performance; the continuation of historical trends; the sufficiency of our cash balances for future liquidity and capital resource needs; the expected impact of changes in accounting policies on our results of operations, financial condition or cash flows; anticipated problems and our plans for future operations; and the economy in general or the future of the industry in which we operate, all of which were subject to various risks and uncertainties.

When used in this Annual Report on Form 10-K and other reports, statements, and information we have filed with the Securities and Exchange Commission (“SEC”), in our press releases, presentations to securities analysts or investors, in oral statements made by or with the approval of an executive officer, the words or phrases “believes,” “may,” “will,” “expects,” “should,” “continue,” “anticipates,” “intends,” “aims,” “will likely result,” “estimates,” “projects” or similar expressions and variations thereof are intended to identify such forward-looking statements. However, any statements contained in this Annual Report on Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements. These statements are only predictions. All forward-looking statements included in this Annual Report on Form 10-K are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements. Any or all of our forward-looking statements in this document may turn out to be wrong. Actual events or results may differ materially. Our forward-looking statements can be affected by inaccurate assumptions we might make or by known or unknown risks, uncertainties, and other factors.

This Annual Report on Form 10-K also contains estimates, projections, and other information concerning our industry, our business, and particular markets, including data regarding the estimated size of those markets. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained this industry, business, market, and other data from reports, research surveys, studies, and similar data prepared by market research firms and other third parties, industry, general publications, government data, and similar sources.

SUMMARY OF RISK FACTORS

Our business is subject to numerous risks and uncertainties, any one of which could materially adversely affect our results of operations, financial condition or business. The following is a summary of the principal risks described below in Part I, Item 1A “Risk Factors” in this Annual Report on Form 10-K. We believe that the risks described in the “Risk Factors” section are material to our stockholders and investors, but other factors not presently known to us or that we currently believe are immaterial may also adversely affect us. The following summary should not be considered an exhaustive summary of the material risks facing us, and it should be read in conjunction with the “Risk Factors” section and the other information contained in this Annual Report on Form 10-K.

Risks Related to Our Business and Operations

| ● | Our independent registered public accounting firm’s report contains an explanatory paragraph that expresses substantial doubt about our ability to continue as a “going concern.” |

| ● | We have a limited operating history with financial results that may not be indicative of future performance, and our revenue growth rate is likely to slow down as our business matures and may slow down due to the recent antitrust litigation. |

| ● | Impairment of goodwill and intangible assets may adversely impact future results of operations. |

| ● | We may not realize the expected benefits of our recent acquisitions because of integration difficulties and other challenges. |

| ● | If we fail to raise additional capital, our ability to implement our business model and strategy could be compromised. |

| ● | The residential real estate market is cyclical, and we can be negatively impacted by downturns in this market and by general economic conditions. |

| ● | The lack of financing for homebuyers in the U.S. residential real estate market at favorable rates and on favorable terms has had a material adverse effect on our financial performance and results of operations. |

| ● | The housing market is currently in flux with higher mortgage interest rates and generally increasing home prices which makes it difficult to predict future market trends. Any decrease in home sales in the future will have an adverse effect on our financial performance and results of operations. |

| ● | We may fail to successfully execute our strategies to grow our business, including increasing our agent count, expanding the number of our franchisees and agents, or we may fail to manage our growth effectively, which could have a material adverse effect on our brand, our financial performance and results of operations. |

| ● | We might not be able to attract and retain additional qualified agents and other personnel. |

| ● | Our financial results are affected directly by the operating results of franchisees and agents, over whom we do not have direct control. |

| ● | We are dependent upon the truthfulness of our franchisees to provide accurate reports and accounting to us. |

| ● | We depend substantially on our Founder, Joseph La Rosa, and the loss of any our senior management or other key employees or the inability to hire additional qualified personnel could adversely affect our operations, our brand and our financial performance. |

| ● | Concentration of ownership of our voting stock by Mr. La Rosa will prevent new investors from influencing significant corporate decisions. |

| ● | Mr. La Rosa will control all matters that come before the stockholders for a vote and thus we are a “controlled company” within the meaning of the Nasdaq listing requirements and, as a result, the Company will qualify for exemptions from certain corporate governance requirements. If we take advantage of such exemptions, you will not have the same protections afforded to stockholders of companies that are subject to such corporate governance requirements. |

| ● | We are subject to certain risks related to litigation filed by or against us, and adverse results may harm our business and financial condition. |

| ● | Adverse outcomes in litigation and regulatory actions against the NAR (as defined below), other real estate brokerage companies and agents in our industry could adversely impact our financial results. |

| ● | If we attempt to, or acquire other complementary businesses, we will face certain risks inherent with such activities. |

Risks Associated with Our Capital Stock

| ● | Our failure to maintain our compliance with Nasdaq’s continued listing standards or other requirements could result in our Common Stock being delisted from Nasdaq, which could adversely affect our liquidity and the trading volume and market price of our Common Stock and decrease or eliminate your investment. |

| ● | The market price for our Common Stock may be particularly volatile given our status as a relatively unknown company with a small and thinly traded public float, and minimal profits, which could lead to wide fluctuations in our share price. |

| ● | If our securities become subject to the penny stock rules, it would become more difficult to trade our shares. |

| ● | We may have violated Section 13(k) of the Exchange Act (implementing Section 402 of the Sarbanes-Oxley Act of 2002) and may be subject to sanctions as a result. |

| ● | Our status as an “emerging growth company” under the JOBS Act may make it more difficult to raise capital as and when we need it. |

| ● | If we continue to fail to maintain an effective system of disclosure controls and fail to maintain an effective system of internal control over financial reporting, our ability to produce timely and accurate financial statements or comply with applicable regulations could be impaired. |

General Risks

| ● | If we fail to protect the privacy of employees, independent contractors, or consumers or personal information that they share with us, our reputation and business could be significantly harmed. |

| ● | Cybersecurity incidents could disrupt our business operations, result in the loss of critical and confidential information, adversely impact our reputation and harm our business. |

| ● | Anti-takeover provisions in our amended and restated articles of incorporation and bylaws, as well as provisions in Nevada law, might discourage, delay or prevent a change of control of our Company or changes in our management and, therefore, depress the trading price of our securities. |

We discuss these and other risks and uncertainties in the Part I, Item 1A “Risk Factors” of this Annual Report on the Form 10-K.

PART I

Item 1. Business.

Overview

We are the holding company for six agent-centric, technology-integrated, cloud-based, multi-service real estate segments.

Our business was founded by Mr. Joseph La Rosa, a successful real estate developer, business and life coach, author, podcaster, and public speaker. Mr. La Rosa’s self-help book “Do It Now” is a roadmap to personal success and well-being based on his transformative theories of family, passion and growth. His philosophy, seminars and educational forums have attracted numerous successful realtors that have spurred the growth of our business.

In addition to providing person-to-person residential and commercial real estate brokerage services to the public, we cross-sell ancillary technology-based products and services primarily to our sales agents and the sales agents associated with our franchisees. Our business is organized based on the services we provide internally to our agents and to the public, which are residential and commercial real estate brokerage, franchising, real estate brokerage education and coaching, property management, and title services. Our real estate brokerage business operates primarily under the trade name La Rosa Realty. We have 26 La Rosa Realty corporate real estate brokerage offices and branches located in Florida, California, Texas, Georgia, North Carolina and Puerto Rico. The Company also has 6 La Rosa Realty franchised real estate brokerage offices and branches and 3 affiliated real estate brokerage offices, that pay us fees in 7 states in the United States and Puerto Rico. Additionally, the Company has a full-service escrow settlement and title company in Florida. In April 2025, we also formed a company, offering a commission advancement program exclusively for La Rosa agents.

Our real estate brokerage offices, both corporate and franchised, are staffed with 2,769 licensed real estate brokers and sales associates as of March 31, 2025.

Our franchised offices are currently:

| Name | Location | |

| La Rosa Realty Bayamón LLC | Bayamón, Puerto Rico | |

| La Rosa Realty Internacional, LLC | Celebration, Florida | |

| La Rosa Realty Central Florida, LLC | Davenport, Florida | |

| La Rosa Realty Jacksonville, LLC | Jacksonville, Florida | |

| La Rosa Realty Kendall, LLC | Miami, Florida | |

| The Realty Experience Powered By LRR LLC | St. Cloud, Florida |

We have built our business by providing the home-buying public with well-trained, knowledgeable realtors who have access to our proprietary and third-party in-house technology tools and quality education and training, and valuable marketing that attracts some of the best local realtors who provide value-added services to our home buyers and sellers that are attracted to our brands. We give our real estate brokers and sales agents who are seeking financial independence a turnkey solution and support them in growing their brokerages while they fund their own businesses.

Our agent-centric commission model enables our sales agents to obtain higher net commissions than they would otherwise receive from many of our competitors in our local markets. They can then use these additional commissions to reinvest in their businesses or as take-home profit. We believe that this is a strong incentive for them to compete against the discount, flat fee and internet brokerages that have sprung up in the past several years. Instead of us taking a greater share of their income, our agents pay what we believe to be reduced rates for training and mentorship and our proprietary technology. Our franchise model has a similar pricing methodology, permitting the franchise owner the freedom to operate their business with minimal control and lower expense than other franchise offerings.

Moreover, we believe that our proprietary technology, training, and the support that we provide to our agents at a minimal cost to them is one of the best offered in the industry.

Our business stands on three pillars: Family, Passion, and Growth. We believe that our support and philosophy have attracted and will continue to attract and retain the highest producing realtors in our local markets. We believe that our focus on the interaction between our human agents and their clients is a strong weapon against internet-only commodity websites and the low touch discount brokerages. Our agent count continues to grow organically and through acquisition, we attribute our organic growth to the positive culture created in our Company and the competitive plans that we offer our agents. By creating a custom solution and a unique experience, we believe that our agents are able to guide their clients seamlessly through what may be their most expensive lifetime purchase.

In addition, a significant driver of our past growth was, and we believe, of our future growth is our ability to create revenue by referring or requiring that our agents and our franchisee agents use the different business services that we provide. For example, all agents new to our Company are required to have a “coach” and to attend multi-day training sessions to learn the Company’s philosophy, technology and business practices. Concurrently, the agent works with their coach in obtaining listings, working with consumers and closing transactions. All of these activities are run through our La Rosa Coaching, LLC subsidiary that teaches advanced techniques for team building, personal growth and business development, which we believe will enhance our revenue at a nominal increase in cost to us. In addition, unlike other residential real estate brokerages, we encourage our sales agents to pursue commercial real estate transactions and require them to utilize the services of our commercial real estate company. We anticipate acquiring other complementary businesses, such as, for example, insurance agencies and a mortgage brokerage, in the future to enhance our gross revenues and profit margins.

On October 12, 2023, we consummated our initial public offering (the “IPO”). Following our IPO, during the fiscal year ended December 31, 2023, we acquired majority ownership of the following franchisees of the Company: Nona Legacy Powered By La Rosa Realty, Inc. (formerly, La Rosa Realty Lake Nona Inc.), Horeb Kissimmee Realty, LLC, La Rosa Realty Premier, LLC, La Rosa Realty Orlando, LLC, and 100% ownership of the following franchisees of the Company: La Rosa CW Properties, LLC and La Rosa Realty North Florida LLC. In December 2023, we also formed our majority owned subsidiary La Rosa Realty Texas LLC.

The following are developments in our business since the beginning of the fiscal year ended December 31, 2024:

| - | In February 2023, we launched our proprietary technology system - JAEME, part of “My Agent Account.” JAIME is a real estate AI assistant created to support and inspire our agents with personalized content to drive marketing, efficiency, and sales. This advanced technology can help agents to provide services to their clients in a more efficient way - even from their mobile devices. In October 2024, the Company launched My Agent Account version 3.0, a significant upgrade to its proprietary platform, which now includes a new module specifically designed for property management disbursements. This update is expected to improve operational efficiency for agents across the Company. |

| - | In March 2024, the Company officially launched its partnership with Final Offer, online platform that allows sellers to establish a minimum sales price and other deal terms online and pre-approved buyers to make bidding offers. Final Offer is available to real estate brokers on the Company’s platform in key markets across Florida, California and Georgia, with plans to expand the offering across the organization. |

| - | In June 2024, the Company recruited a high-performing group of team leaders in Florida, who closed over 425 transactions and achieved sales exceeding $100 million in their prior 12 months before joining the Company. |

| - | During the fiscal year ended December 31, 2024, we acquired majority ownership of the following companies: La Rosa Realty Georgia LLC, La Rosa Realty California, La Rosa Realty Lakeland LLC DBA La Rosa Realty Prestige, and La Rosa Realty Success LLC, and 100% ownership of La Rosa Realty Winter Garden LLC, BF Prime LLC, Nona Title Agency LLC, La Rosa Realty Beaches LLC, and Baxpi Holdings. Additionally, we acquired the remaining non-controlling interest portions of Nona Legacy Powered By La Rosa Realty, Inc. (formerly, La Rosa Realty Lake Nona Inc.) and La Rosa Realty Premier, LLC, making them both 100% owned entities. |

| - | In December 2024, the Company opened its first office and wholly owned subsidiary in North Carolina, La Rosa Realty NC LLC. |

| - | In December 2024, the Company announced that it will offer Bitcoin and other cryptocurrencies as a payment option for its network of agents. |

We intend to continue growing our business organically and through acquisition.

It is management’s intention to acquire additional franchisees and other entities through the remainder of 2025. We continuously search for potential acquisition targets. Management is in discussions with several franchisees and other entities; however, any future agreements may have terms that are materially different than the terms of completed acquisitions. We cannot guarantee that the Company will actually enter into any binding acquisition agreements with any of those companies. If we do, we cannot assure you that the terms of such acquisitions will be substantially the same or better for the Company than those of completed acquisitions.

On October 10, 2024, we received a letter from the Nasdaq Listing Qualifications Department notifying us that, for the 30 consecutive business day period between August 28, 2024 through October 9, 2024, our common stock (the “Common Stock”) had not maintained a minimum closing bid price of $1.00 per share required for continued listing on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”). Pursuant to Nasdaq Listing Rule 5810(c)(3)(A), the Company was provided an initial period of 180 calendar days, or until April 8, 2025 (the “Compliance Period”), to regain compliance with the Bid Price Rule. In order to regain compliance with the Bid Price Rule, our Common Stock was required to maintain a minimum closing bid price of $1.00 for a minimum of ten consecutive business days during the Compliance Period prior to April 9, 2025.

As of April 8, 2025, the Common Stock has not regained compliance with the Bid Price Rule. However, in a letter dated April 9, 2025 (the “Second Nasdaq Bid Price Letter”), Nasdaq notified the Company that Nasdaq’s Staff has determined that the Company is eligible for an additional 180 calendar day period, or until October 6, 2025, to regain compliance (the “Second Compliance Period”). As of the date of this report the Common Stock has not regained compliance with the Bid Price Rule. If the Company chooses to implement a reverse stock split, it must complete the split no later than ten business days prior to the end of the Second Compliance Period in order to timely regain compliance. If we fail to regain compliance with the Bid Price Rule within the Second Compliance Period, or if we fail to continue to meet all applicable continued listing requirements for Nasdaq in the future, Nasdaq could delist our securities.

The Second Nasdaq Bid Price Letter has no immediate effect on the listing or trading of the Common Stock. Our Common Stock continues to be listed on the Nasdaq Capital Market under the symbol “LRHC”. We are currently evaluating our options for regaining compliance.

Recent Financings

February 2024 Financing

On February 20, 2024, we entered into a securities purchase agreement with the accredited investor (the “Investor”) pursuant to which on February 20, 2024 we issued the Investor a 13% OID senior secured promissory note in the face amount of $1,052,631.58 (the “February Note”), 67,000 shares of Common Stock as a commitment fee, a warrant (the “February First Warrant”) to purchase up to 120,000 shares of Common Stock with an exercise price of $3.00 exercisable until the five-year anniversary of the closing date of the financing, and a second warrant, to purchase up to 95,000 shares of Common Stock with an exercise price of $2.25 exercisable until the five-year anniversary of the closing sate (the “February Second Warrant,” and collectively, the “February Warrants”). The Company also granted the Investor piggy-back registration rights and entered into registration rights agreement with the Investor with respect to the securities issued in this financing. The Company and its subsidiaries (collectively, the “Company Group”) also entered into a security agreement with the Investor pursuant to which the Company Group granted the Investor a security interest in certain property of the Company Group to secure the Company’s obligations under the February Note. The Company also agreed to obtain shareholder approval for the issuance of more than 19.99% of the issued and outstanding Common Stock in this financing. On February 20, 2024, the Investor paid the Company the purchase price of $1,000,000.00 after an original issue discount of $52,631.58.

On February 20, 2024, Joseph La Rosa, as the majority stockholder of the Company, in accordance with Nasdaq Listing Rules 5635(b) and 5635(d), approved the transaction and issuance of the shares upon conversion of the February Note and exercise of the February Warrants, which was effective on March 31, 2024, or 20 days after the commencement of mailing of the definitive information statement regarding this approval to the stockholders of the Company.

In connection with this financing, the Company also issued to its placement agent, Alexander Capital L.P., a 5-year common stock purchase warrant to purchase 21,053 shares of Common Stock at the exercise price of $1.50 per share. The terms of this warrant were substantially similar to the terms of the warrants issued to the Investor.

During fiscal year of 2024, the Company issued Investor 837,630 shares of Common Stock due to partial conversion of February Note. The remaining portion of February Note was repaid by the Company by February 2025 and February Second Warrant was cancelled and extinguished in its entirety due to the full repayment of the note. February First Warrant was fully exercised in the first quarter of 2025.

April 2024 Financing

On April 1, 2024, we entered into a securities purchase agreement with the Investor pursuant to which on April 1, 2024 we issued the Investor a 13% OID senior secured promissory note in the face amount of $1,316,000 (the “April Note”), 50,000 shares of Common Stock as a commitment fee, a warrant (the “First April Warrant”) to purchase up to 150,000 shares of Common Stock with an exercise price of $3.00 exercisable until the five-year anniversary of the closing date of the financing, and a second warrant, to purchase up to 152,300 shares of Common Stock with an exercise price of $2.25 exercisable until the five-year anniversary of the closing sate (the “Second April Warrant,” and collectively, the “April Warrants”). The Company also granted the Investor piggy-back registration rights and entered into registration rights agreement with the Investor with respect to the securities issued in this financing. The Company Group also entered into a security agreement with the Investor pursuant to which the Company Group granted the Investor a security interest in certain property of the Company Group to secure the Company’s obligations under the April Note. The Company also agreed to obtain shareholder approval for the issuance of more than 19.99% of the issued and outstanding Common Stock in this financing. Pursuant to this financing, the Company received net proceeds of $1,122,682, after deducting offering expenses, including a tail fee payable to Alexander Capital L.P.

On April 1, 2024, Joseph La Rosa, as the majority stockholder of the Company, in accordance with Nasdaq Listing Rules 5635(b) and 5635(d), approved the transaction and issuance of the shares upon conversion of the April Note and exercise of the April Warrants, which was effective on May 8, 2024, or 20 days after the commencement of mailing of the definitive information statement regarding this approval to the stockholders of the Company.

During fiscal year of 2024, the Company issued Investor 96,600 shares of Common Stock due to partial conversion of April Note. Remaining portion of April Note was repaid by the Company by February 2025.

July 2024 Financing

On July 16, 2024, we entered into a securities purchase agreement with the Investor pursuant to which on July 16, 2024 we issued the Investor a 13% OID senior secured promissory note in the face amount of $468,000 (the “July Note”), 29,800 shares of Common Stock as a commitment fee, a warrant to purchase up to 53,700 shares of Common Stock with an exercise price of $3.00 exercisable until the five-year anniversary of the closing date of the financing, and a second warrant, to purchase up to 54,200 shares of Common Stock with an exercise price of $2.25 exercisable until the five-year anniversary of the closing sate (collectively, the “July Warrants”). The Company also granted the Investor piggy-back registration rights and entered into registration rights agreement with the Investor with respect to the securities issued in this financing. The Company Group also entered into a security agreement with the Investor pursuant to which the Company Group granted the Investor a security interest in certain property of the Company Group to secure the Company’s obligations under the July Note. The Company also agreed to obtain shareholder approval for the issuance of more than 19.99% of the issued and outstanding Common Stock in this financing. Pursuant to this financing, the Company received net proceeds of $436,100, after deducting offering expenses, including a tail fee payable to Alexander Capital L.P.

On July 16, 2024, Joseph La Rosa, as the majority stockholder of the Company, in accordance with Nasdaq Listing Rules 5635(b) and 5635(d), approved the transaction and issuance of the shares upon conversion of the July Note and exercise of the July Warrants, which was effective on August 18, 2024, or 20 days after the commencement of mailing of the definitive information statement regarding this approval to the stockholders of the Company.

The entire July Note was repaid in full by the Company by February 2025. July First Warrant was fully exercised in the first quarter of 2025.

On January 22, 2025, the Company and Investor entered into Warrant Redemption and Cancellation Agreement, pursuant to which on January 28, 2025 July Second Warrant and April Warrants were redeemed, cancelled and terminated in full upon payment of $379,082.79 by the Company to Investor.

Brown Stone Financing

On August 7, 2025, the Company entered into that certain securities purchase agreement (“Brown Stone Agreement”), with an institutional accredited investor, Brown Stone Capital Ltd. (the “Brown Stone”), pursuant to which the Company agreed to issue and sell to Brown Stone, up to 3,051,336 shares of Common Stock, and/or pre-funded warrants to purchase shares of Common Stock, at a price equal to $0.59 per share. Pursuant to the terms of the Brown Stone Agreement, on August 12, 2024 (“First Closing Date”), Company issued Brown Stone 761,689 shares of Common Stock and a pre-funded warrant to purchase 509,498 shares of Common Stock. The Company received net proceeds of $725,000 from this issuance, after deducting offering expenses. Remaining portion of 1,780,149 shares and/or pre-funded shall be issued to Brown Stone on or before the date that is 14 calendar days after the date of the effectiveness of the registration statement registering the shares issued on the First Closing Date and upon satisfaction of Additional Second Closing Conditions (as defined in the Brown Stone Agreement). Such second closing was never consummated by the parties because Additional Second Closing Conditions were not fully satisfied.

Cash Advance Agreements

In May 2024, the Company entered into a standard merchant cash advance agreement with Cedar Advance LLC (“Cedar”) where the Company sold in the aggregate $761,250 in future receipts of the Company for $500,000. Until the purchase price has been repaid, the Company agreed to pay Cedar $23,000 per week. The purchase price under this agreement was completely repaid in October 2024.

On October 7, 2024, the Company entered into a second standard merchant cash advance agreement (“Cedar Cash Advance Agreement”) with Cedar pursuant to which the Company sold to Cedar $616,250 of its future receivables for a purchase price of $425,000 less underwriting fees and expenses paid. On October 7, 2024, the Company also entered into a Standard Merchant Cash Advance Agreement (the “Arin Cash Advance Agreement”) with Arin Funding LLC (“Arin”) pursuant to which the Company sold to Arin $588,000 of its future receivables for the sale of its goods and services, for a purchase price of $420,000 less fees and expenses paid. The purchase price under Cedar Cash Advance Agreement and Arin Cash Advance Agreement was fully repaid as a result of February 2025 financing described below.

Private Placement

On September 27, 2024, the Company issued to an unaffiliated private investor a promissory note in the principal amount of $200,000. Interest accrued on the principal amount at 12.5% per annum. The promissory note was completely repaid in January 2025.

Abri 2024 Financing

On November 1, 2024, the Company entered into a securities purchase agreement with an institutional accredited investor, Abri Advisors, Ltd. (“Abri”), pursuant to which the Company agreed to issue and sell to Abri, up to 1,335,826 shares of Common Stock and/or pre-funded warrants to purchase shares of Common Stock, at a price equal to $0.3743 per share. The Company also granted Abri piggy-back registration rights and entered into a registration rights agreement with respect to the securities being issued in this financing. The closing took place on November 1, 2024 and the Company issued Abri 936,264 shares of Common Stock and a pre-funded warrant to purchase 399,562 shares of Common Stock. The Company received net proceeds of $480,000 on the closing date, after deducting offering expenses.

ATM Offering

On November 22, 2024, the Company entered into a sales agreement (“ATM Agreement”) with A.G.P./Alliance Global Partners, as sales agent (“AGP”), relating to the sale of Common Stock. During the year ended December 31, 2024, the Company issued an aggregate of 222,000 shares of Common Stock pursuant to such ATM Agreement for net proceeds of $169,236. The Company paid the sales agent compensation with respect to sale of such shares in the amount of $5,728.

February 2025 Financing

On February 4, 2025 (the “Closing Date”), we entered into a securities purchase agreement (the “SPA”) with an institutional investor (“2025 Investor”) pursuant to which we agreed to issue and sell to 2025 Investor, upon the terms and conditions set forth in the SPA: (i) a Senior Secured Convertible Note in the original principal amount of $5,500,000 which matures on the two-year anniversary of the Closing Date (the “Initial Note”); and (ii) sixteen (16) warrants (“Incremental Warrants”), each to purchase additional Notes in an original principal amount up to $2,500,000 at an exercise price of $2,256,250, in substantially the same form as the Initial Note (“Incremental Notes” and together with the Initial Note, the “Notes”). The Incremental Warrants and Initial Note were issued to 2025 Investor on the Closing Date. The purchase price paid by 2025 Investor under the SPA for the Initial Note and Incremental Warrants was $4,963,750, which was used by the Company to pay-off certain indebtedness, pay certain outstanding fees and expenses, acquisitions and general corporate purposes. The Company also granted 2025 Investor registration rights in the shares of Common Stock issuable pursuant to the SPA and conversion of the Notes. The Company Group also entered into a security agreement with 2025 Investor pursuant to which the Company Group granted the 2025 Investor a security interest in certain property of the Company Group to secure the Company’s obligations under the Notes. The Company also agreed to obtain shareholder approval for the issuance of more than 19.99% of the issued and outstanding Common Stock in this financing.

On February 4, 2025, as required by the SPA, Joseph La Rosa, as the majority stockholder of the Company, approved (i) the issuance of the Initial Note, the Incremental Warrants and Incremental Notes, all Interest Shares and all of the Conversion Shares and Incremental Conversion Shares in excess of 19.99% (without regard to any limitation on conversion or exercise thereof) of the Company’s issued and outstanding Common Stock at a price less than the minimum price required by the Nasdaq in accordance with Nasdaq Listing Rules 5635(b) and 5635(d); (ii) authorization to complete a reverse split of our Common Stock; and (iii) authorization to increase the number of authorized shares of our Common Stock to ensure that the Company has a sufficient number of authorized shares reserved for issuance to equal at least 200% of the maximum number of shares issuable upon conversion of the Notes, as determined under the Securities Purchase Agreement. Such approval was effective on March 27, 2025, or 20 days after the commencement of mailing of the definitive information statement regarding this approval to the stockholders of the Company.

Our Organization

La Rosa Holdings Corp. was incorporated in the State of Nevada on June 14, 2021 by its founder, Mr. Joseph La Rosa, to become the holding company for five Florida limited liability companies in which Mr. La Rosa held or controlled a one hundred percent ownership interest: (i) La Rosa Coaching, LLC ( “Coaching”); (ii) La Rosa CRE, LLC (“CRE”); (iii) La Rosa Franchising, LLC (“Franchising”); (iv) La Rosa Property Management, LLC (“Property Management”); and (v) La Rosa Realty, LLC (“Realty”). Coaching, CRE, Franchising, Property Management and Realty became direct, wholly owned subsidiaries of the Company as a result of the closing of the Reorganization Agreement and Plan of Share Exchange dated July 22, 2021, which was effective on August 4, 2021. Pursuant to the Reorganization Agreement, each LLC exchanged 100% of their limited liability company membership interests for one share of the Company’s common stock, $0.0001 par value per share (the “Common Stock”), which share was automatically redeemed for nominal consideration upon the closing of the transaction, resulting each LLC becoming the direct, wholly owned subsidiary of the Company.

The Company conducts its operations through its 24 subsidiaries:

| ● | La Rosa Realty, LLC is engaged in the residential real estate brokerage business; |

| ● | La Rosa Coaching, LLC is engaged in the delivery of coaching services to our brokers and franchisee’s brokers; |

| ● | La Rosa CRE, LLC is engaged in the commercial real estate brokerage business; |

| ● | La Rosa Franchising, LLC is engaged in the franchising of real estate brokerage agencies; |

| ● | La Rosa Property Management, LLC is engaged in property management services to owners of single-family residential properties; |

| ● | La Rosa Realty Premier, LLC is engaged mostly in the residential real estate brokerage business; |

| ● | La Rosa Realty CW Properties, LLC is engaged mostly in the residential real estate brokerage business; |

| ● | La Rosa Realty North Florida, LLC is engaged mostly in the residential real estate brokerage business; |

| ● | La Rosa Realty Orlando, LLC is engaged mostly in the residential real estate brokerage business; |

| ● | Nona Legacy Powered By La Rosa Realty, Inc. (formerly, La Rosa Realty Lake Nona Inc.) is engaged mostly in the residential real estate brokerage business; |

| ● | Horeb Kissimmee Realty, LLC is engaged mostly in the residential real estate brokerage business; |

| ● | La Rosa Realty Winter Garden, LLC is engaged mostly in the residential real estate brokerage business; |

| ● | La Rosa Realty Texas, LLC is engaged mostly in the residential real estate brokerage business; |

| ● | La Rosa Realty Georgia, LLC is engaged mostly in the residential real estate brokerage business; |

| ● | La Rosa Realty California is engaged mostly in the residential real estate brokerage business; | |

| ● | La Rosa Realty Lakeland, LLC is engaged mostly in the residential real estate brokerage business; |

| ● | La Rosa Realty Success, LLC is engaged mostly in the residential real estate brokerage business; |

| ● | BF Prime, LLC is engaged mostly in the residential real estate brokerage business; |

| ● | Nona Title Agency, LLC is engaged in providing title services related to real estate transactions; |

| ● | La Rosa Realty Beaches, LLC is engaged mostly in the residential real estate brokerage business; |

| ● | Baxpi Holdings, LLC is engaged mostly in the residential real estate brokerage business; |

| ● | La Rosa Realty NC, LLC is engaged mostly in the residential real estate brokerage business; |

| ● | LR Luxury, LLC is engaged mostly in the residential real estate brokerage business; and |

| ● | LR Agent Advance, LLC, formed in April 2025 for the purpose of offering a commission advancement program exclusively for La Rosa agents. |

We are a “controlled company” as defined under the corporate governance rules of Nasdaq because our Founder, Mr. Joseph La Rosa, as of April 15, 2025, controls 50.5% of the total voting power of our Common Stock based on his ownership of Common Stock and the 20,000,000 votes provided by his Series X Super Voting Preferred Stock, $0.0001 par value per share, (the “Series X Preferred Stock”) that votes with the Common Stock, with respect to director elections and other matters.

Our Business

We operate primarily in the United States residential real estate market which totaled $49.7 trillion at the end of 2024 reflecting a year over year gain of $2.5 trillion due to sufficient number of buyers competing over a relatively small number of listings, according to Redfin Corp1.

The Company is the holding company for its direct, majority owned subsidiaries, and has no other operations.

Realty was a traditional residential real estate brokerage firm founded in 2004 by Mr. La Rosa to serve the Florida market. In 2011, La Rosa Realty shifted to an agent-centric real estate brokerage format, offering agents more tools and value while offering experienced agents a 100% commission split. Newly licensed and agents still in training operate on a New Agent Coaching (NAC) 70% to agent / 30% commission split (6% to La Rosa Coaching, 14% to the La Rosa individual coach, 7% to the brokerage office who engaged the new agent, and 3% to the Director of Coaching who is employed by La Rosa Holdings) Alternatively, they may choose the Ultimate Plan Business Builder (“UPBB”)and operate on a 60% to agent / 40% that includes 10% revenue share commission split (6% to La Rosa Coaching, 14% to the La Rosa individual coach, 7% to the brokerage office who engaged the new agent, and 3% to the Director of Coaching who is employed by La Rosa Holdings). Realty has expanded its geographic footprint over the years by integrating technology into its operations and creating a brokerage that provides its agents with the tools to handle their transactions, accounting, marketing, social media and customer relations. Realty’s full service, high touch engagement with its clients assists them with navigating the complexity of the home purchase/sale transaction through their intimate knowledge of the local market, guiding them on the right pricing for their sale or purchase, assisting in the negotiation of the sales contract, overseeing the home inspections and possible repairs, reviewing the financial details of the transaction to assure that there are no errors and attending the closing of the sale to ensure that there are no last minute surprises. Realty believes that its services build referrals and repeat clients who appreciate the expertise and personal relationships that they develop with our agents.

In 2018, Mr. La Rosa organized Franchising to study the potential to expand nationally by means of creating a franchise model that would be easily duplicable. Franchising began franchising real estate brokerage businesses based on its Franchise Disclosure Document filed with the Federal Trade Commission in 2019 and converted several of its largest offices in Florida to “La Rosa Realty” franchises. Franchising also oversees and administers the offices that it sells, no matter their brand. Franchising uses the typical model for licensing the use of our two brands together with our proprietary business methodology, technology, tools, and training. Our franchisees own their own brokerage businesses, are solely responsible for their operations and risks, and are able to retain the substantial upside of their business if they are profitable. Our franchisees use our successful and well-known brands, our systems and technology, training and personal assistance and guidance to help run their businesses more efficiently and, we believe, more successfully than other branded real estate franchisees. Our franchisees pay us an initial licensing fee, a royalty fee based on their gross commissions, an annual membership fee, a coaching fee payable to Coaching for coaching services, a commercial royalty fee payable to La Rosa CRE for all commercial real estate transactions, a training fee for its administrative personnel and a fee to use our proprietary software. Because our franchise “product” has been developed over the years and is delivered in a “package” format, our fixed costs are low and our franchising gross margins are relatively higher than our more labor intensive businesses. While we intend to continue the franchise arm of the business, we will, in the future, concentrate on opening corporate offices that produce higher revenue and increased margins.

Coaching grew out of Mr. La Rosa’s life and business coaching seminars which were organized in 2019 to provide education and mentoring to new real estate agents who join Realty in any of our offices. Each agent in coaching is assigned an experienced real estate agent/coach who assists and advises the new agent for, at a minimum, their first three sales transactions and the successful completion of our exclusive core competency courses and examinations. Brokers compensate us for the courses and mentoring by splitting their commissions with us when they are involved in the sale and purchase of a property for which we receive thirty percent (30%) of their share of the real estate brokerage commission. Our franchisee brokers also take the in-house course and ongoing coaching that cover topics, including but not limited to local real estate brokerage law, lead generation, recruiting, business management, industry trends, and leadership. We added a second tier of coaching in 2021 that we believe provide business and personal growth and advanced real estate courses to our and our franchisees’ agents for various fees based on the subject matter and length of the course.

| 1 | https://www.redfin.com/news/housing-market-value-december-2024 |

Unlike most other residential real estate brokerage companies, we encourage our sales agents to seek out property management business. Property Management, which was organized in 2014, trains our sales agents to provide residential property management services to owners of single-family residential properties and provides our agents with the tools to service those property owners. These tools include management, marketing, accounting and financial services. Our agents generally charge the homeowners between eight to twelve percent (8-12%) of the monthly rental. Our agents pay Property Management to be the point of contact for the property owner and their tenants, handle all tenant screenings, applications, contracts, forms and documents, and deal with attorneys if necessary to enforce the agreements. We manage the collection of rents and the disbursement of payments to vendors, service providers, agents, and property owners, while retaining a fee of $55.00 per agent, per property, per month. As of March 31, 2025, we have provided property management services for approximately 650 properties across Florida, including single-family residences, condominiums, townhouses, and other types of residential real estate. Consistent with industry custom, management contract terms typically range from one to three years, although some contracts can be terminated at will at any time following a short notice period, usually 30 to 120 days, as is typical in the industry. Property Management has recently added a division to directly manage properties in Florida and to expand those services to our other offices in other states in the future.

Unlike many other real estate brokerages, we encourage our sales agents to seek out commercial real estate business. CRE was organized in 2014 originally to provide “residential-commercial” real estate advisory services such as helping sales agents’ customers lease office space. CRE now assists agents who have customers who wish to purchase multifamily, office, storage, mixed use and apartment properties. We provide, on a fee basis, training to sales agents who wish to work in the commercial real estate space, and advise customers with respect to office leasing, multi-family property sales and leasing, and land and subdivision development. Our customers come primarily from referrals from our Realty brokers who are asked by their clients to assist them in with various commercial real estate property transactions. In January 2025 2024, the Company hired a leader for this division who possesses vast experience in commercial real estate. We expect stronger growth of this segment of our business in 2025 and beyond.

For our title insurance and settlement services segment, we operate under the brand FPG Title Group which provides comprehensive title insurance and settlement services to protect real estate transactions for residential, commercial, agency, home builders, and vacation ownership properties. Providing these services we aim to ensure that both homeowners and lenders are safeguarded against potential legal claims or disputes related to property ownership. Key services include title insurance services, which help to protect against risks such as undisclosed heirs, errors in public records, forgery or fraud in previous ownership documents, and outstanding liens or unpaid taxes, and settlement services, which help to facilitate smooth and secure property transactions, in compliance with industry regulations. We believe that FPG Title Group is positioned as a trusted partner in Florida, offering tailored solutions for local banks, national lenders, and mortgage servicers. Our expertise allows us to close loans quickly, accurately, and in full compliance with industry standards. Our goal is to provide flexible and customizable services to meet the specific requirements of various lenders and demonstrate our commitment to client satisfaction through our comprehensive service offerings and dedicated team

We have 26 La Rosa Realty corporate real estate brokerage offices and branches located in Florida, California, Texas, Georgia, North Carolina and Puerto Rico, and a title services company located in Florida. In April 2025, we also formed LR Agent Advance, LLC, offering a commission advancement program exclusively for La Rosa agents.

We also have a number of affiliated companies that are wholly, or majority owned by Mr. La Rosa that we refer to in this report as our affiliates. While our affiliates are not owned by us, some do use our services and contribute to our revenue stream. Our affiliates operate residential real estate brokerage, insurance brokerage and real estate title and full commercial real estate brokerage businesses.

Our Focus

Our Mission Statement is that “we are here to support, empower and elevate those who we serve with integrity.” We are committed to excellence in all we do and are respectful, compassionate, trustworthy, responsible, joyful, inspiring and adaptive. At La Rosa, we inculcate these core values to our sales agents and employees and strive to live by them every day.

We believe home buyers and sellers choose agent because of their individual marketing prowess, professionalism, and personality. To capitalize on this, we focus on helping our agents improve professionally and in increase their financial ability to invest in their personal marketing, and, therefore, capture a greater percentage of customers.

We have built our business on what we know to be our customer’s needs. The purchase of a home is likely the most expensive purchase a consumer will make in his or her lifetime. Many first-time home buyers are young and require knowledgeable, experienced guidance from our agents and our franchisor’s agents. Home sellers need the market ken and potential buyer reach that our agents and our franchisee’s agents provide. Our agents and our franchisee’s agents build lasting relationships with their clients that result in repeat business and referral business. Notwithstanding claims of the internet-only brokerages that homes are a commodity that can be bought and sold like a can of beans, this consumer need is borne out in reality. The research conducted by the National Association of Realtors (the “NAR”)2 in 2024 shows that:

| ● | 88% of buyers recently purchased their home through a real estate agent or broker and 5% purchased directly through the previous owner; |

| ● | having an agent to help them find the right home was what buyers wanted most when choosing an agent at 49%; |

| ● | 77% of buyers interviewed only one real estate agent during their home search; |

| 2 | https://www.nar.realtor/sites/default/files/2024-11/2024-profile-of-home-buyers-and-sellers-highlights-11-04-2024_2.pdf |

| ● | 88% of buyers would use their agent again or recommend their agent to others, and 66% of sellers recommended their agent at least once since selling their home; |

| ● | 90% of all sellers used an agent or broker to sell their home and 6% sold to the buyer directly (via FSBO) (all-time low); |

| ● | 40% of buyers used an agent that was referred to them by a friend, neighbor, or relative, 21% used an agent that they had worked with in the past to buy or sell a home; and |

| ● | 81% of all sellers contacted only one agent before finding the right one to assist with the sale of their home. |

We believe that our agents’ training, knowledge of the market, access to public and non-public data related to transactions, and experience with past transactions gives them a unique insight to provide our home buyer clients with invaluable advice and judgement. Their ability to reach potential buyers and our relationships with other brokers, both within and without our Company and franchisors, help our seller clients achieve the maximum possible price for their properties.

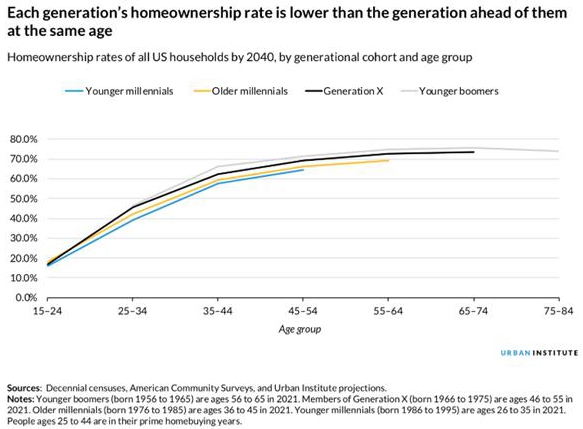

Our Company works in the present but has its eye on the future. We understand that the housing market will change over time and are focusing on how to prepare for that change. The following chart is a projection of the past and future of home ownership rates based on age groups, with the projections noting either slow or fast change.3

As the market slows slightly in out years, we started, and intend to continue, increasing the use of our technology tools to make our agents more efficient and productive.

Our People

Our people are our most important asset. We spend significant time and effort in attracting and retaining talented people for our businesses. Many agents contact us after hearing of or experiencing Mr. La Rosa’s personal and business growth seminars, his book or his podcasts. They are attracted to the Company because they desire to work in a diverse, inclusive, welcoming and learning environment that allows the agents to attain their individual potential. The financial attraction is our ability to offer competitive salaries for our employees, a 100% commission “split” with our experienced realtors and a 70%/30% commission split with our new and inexperienced agents. Experience agents can participate in three plans: our Ultimate Plan Business Builder with a 90%/10% split, our Ultimate Plan and our Premier Plan, both with 100% commission and low annual and monthly dues. In our UPBB plan, an agent can participate in the Company’s Revenue Share Plan rewarding an agent for the recruitment of other agents and for the additional agents these recruited agents recruit. We also have an Agent Incentive Plan pursuant to which agents can earn restricted stock units convertible into our Common Stock through their outstanding performance. But, most importantly, we believe it is the training, education and ongoing support that we provide to our agents that gives them an edge in a very competitive and crowded real estate brokerage marketplace.

Our businesses emphasize diversity and inclusion in the workplace and the value of home ownership. We strive to create a workplace that is inclusive of everyone, where every person can be authentic, and where that authenticity is celebrated as a strength. Management works diligently to make the Company a desirable place to work by creating learning experiences, programs, compensation, and benefits that attract, develop, train, engage, motivate, reward, and retain the best talent. With a focus on teamwork, collaboration, and diversity and inclusion, we aspire to be a company where the best people want to work and are engaged every day. Outside the office, our agents comply and observe non-discrimination laws and policies and work with all clients to ensure that they are able to acquire the home of their dreams.

| 3 | https://www.urban.org/urban-wire/2040-us-will-experience-modest-homeownership-declines-black-households-impact-will-be-dramatic |

Our Technology

We provide our agents and employees with cloud-based real estate brokerage services by utilizing our consumer-facing websites, including our corporate website www.larosarealty.com and our proprietary technology that provides brokerage operations management tools. When an agent is on-boarded, they are required to take our monthly Foundations Series which covers the use of our proprietary applications. Through our websites, we provide buyers, sellers, landlords, and tenants with access to all of the available properties for sale or lease on the multiple listing service (“MLS”), in each of the markets in which we operate. We provide each of our Company franchisees and their agents with their own personal website that they can modify to match their personal branding. Our website also gives consumers access to our network of professional real estate agents and vendors. Additionally, the websites we provide use Artificial Intelligence (“AI”) integrated Client Relationship Management (“CRM”) software to enhance the consumers’ internet experience and assist our agents with lead generation and lead capture through the AI features. For example, our CRM software, which is integrated into our websites, uses artificial intelligence to generate marketing leads for our agents by sending marketing materials to potential buyers and sellers automatically without any agent involvement. Our technology platform also provides unique automated blogging and comprehensive social media marketing campaigns for our agents to create top of mind public awareness of our brand.

In October 2023, we launched our proprietary technology system – JAEME, part of “My Agent Account.” JAIME is a real estate AI assistant created to support and inspire our agents with personalized content to drive marketing, efficiency, and sales. This advanced technology can help agents to provide services to their clients in a more efficient way – even from their mobile devices. Through JAEME, La Rosa’s agents can easily create:

| - | Compelling property descriptions |

| - | Effective email campaigns |

| - | Detailed business plans |

| - | Innovative video scripts |

| - | High-conversion newsletter campaigns |

| - | Exclusive lead generation ideas |

Our proprietary technology and third-party services and platforms provide our agents and franchisees with commission management and accounting systems, an internal agent “intranet” application, customer relationship management applications, a transaction management solution, and automated marketing and social media applications and privacy and identity protections. The combination of our brands, proprietary technology, services, data, lead generation, and marketing tools gives our agents the power to offer best-in-class service to their clients.

Internally, we use our technology to provide our Company agents, employees and franchisees with the means to find and develop new business, manage their relationships both externally with their clients and internally with the Company or their franchisor, develop better skills and knowledge in their areas of endeavor and, we believe, enhance their earning potential. While no one can predict the ups and downs of the real estate market, we believe that the “weapons” we provide to our Company agents, employees and franchisees help them fight the adverse economic conditions, a volatile market and the competition.

While our offices and our franchisor’s offices act as their “home base,” most agents use our offices primarily for real estate closings and training. We monetize our technology by charging our agents and our franchisor’s agents what we believe to be a reasonable monthly fee for the use of our suite of tools.

Our Intellectual Property

It is important that we protect our technology and intellectual property. We rely upon a combination of trademarks, trade secrets, copyrights, patents, confidentiality procedures, contractual commitments, domain names, and other legal rights to establish and protect our intellectual property. We generally enter into confidentiality agreements and invention or work product assignment agreements with our officers, employees, agents, contractors, and business partners to control access to, and clarify ownership of, our proprietary information.

As of April 15, 2025, we had service mark registrations in the United States, including registration for “LR La Rosa Realty” and LR logo. We also had trademark and service mark registrations and applications in certain foreign jurisdictions. Additionally, we are the registered holder of a number of domain names, including “larosarealty.com” and “larosaholdings.com”.

We continually review our development efforts to assess the existence and patentability of new intellectual property. We intend to continue to evaluate the benefit of patent protection with respect to our technology and will file additional applications when we believe it will be beneficial.

Our Markets

Our primary market is in the United States. As of April 15, 2025, we have 26 La Rosa Realty corporate real estate brokerage offices and branches located in Florida, California, Texas, Georgia, North Carolina and Puerto Rico. The Company also has 6 La Rosa Realty franchised real estate brokerage offices and branches and 3 affiliated real estate brokerage offices in the United States and Puerto Rico. Additionally, the Company has a full-service escrow settlement and title company in Florida. In April 2025, we also formed LR Agent Advance, LLC in Florida, offering a commission advancement program exclusively for La Rosa agents.

Our Revenue Streams

Our financial results are driven by the total number of sales agents in our Company, the number of sales agents closing commercial real estate transactions, the number of sales agents utilizing our coaching services, and the number of agents who work with our franchisees. We grew our total agent count from our founding in 2004 to 2,769 agents as of March 31, 2025.

The majority of our revenue is derived from a stable set of fees paid by our brokers, franchisees, and consumers. We have multiple revenue streams, with the majority of our revenue derived from commissions paid by consumers who transact business with our and our franchisee’s agents, royalties paid by our franchisees, dues and technology fees paid by our sales agents, our franchisees and our franchisees’ agents. Our major revenue streams come from such sources as: (i) residential real estate brokerage revenue, (ii) revenue from our property management services, (iii) franchise royalty fees, (iv) fees from the sale or renewal of franchises and other franchise revenue, (v) coaching, training and assistance fees, (vi) brokerage revenue generated transactionally on commercial real estate, (vi) title services revenue and (viii) fees from our events and forums. Our revenue streams are illustrated in the following chart:

| REVENUE STREAM | DESCRIPTION | PERCENT OF TOTAL 2024 REVENUE | PERCENT OF TOTAL 2023 REVENUE | |||||||

| Brokerage Revenue | Percentage fees paid on agent-generated residential real estate transactions. Other revenues recognized monthly (annual and monthly dues charged to our agents). | 82 | % | 64 | % | |||||

| Property Management Revenue | Management fees paid by the sales agents from fees earned from property owners, rental fees, and rents. | 16 | % | 31 | % | |||||

| Franchise Sales and Other Franchise Revenues | One-time fee payable upon signing of the franchise agreement. Other revenues recognized monthly (annual membership, technology, interest, late fees, renewal, transfer, successor, accounting, other related fees). Per agent per closed transaction; payable monthly. | 1 | % | 3 | % | |||||

| Coaching/Training/Assistance Revenue | Based on real estate commissions earned by the sales agent. Event fees and break-out sessions. | 1 | % | 2 | % | |||||

| Commercial Real Estate Revenue | 10% of every real estate commission earned by the sales agent. Other revenues recognized monthly (monthly dues charged to our agents). | * | * | |||||||

| Title Settlement and Insurance | Fees paid by customers for comprehensive title and settlement services | * | N/A | |||||||

| TOTAL | 100 | % | 100 | % | ||||||

| * | Less than 1%. |

Our Industry

The residential real estate industry is cyclical in nature but has shown strong historical long-term growth. We believe that long-term demand for housing in the U.S. will be primarily driven by the economic health of the domestic economy and local factors such as demand relative to supply, and that the residential real estate market in the U.S. will also benefit over the long term from the following fundamental factors:

| ● | pent up demand for affordable housing in the Millennial and Gen Z generations that are seeking to acquire single-family homes; |

| ● | an increase in existing home stock as the Boomer generation downsizes due to retirement, illness and death; and |

| ● | not enough housing starts or resales to accommodate the demand, especially in the Florida market that we primarily serve. |

Our brokers deal primarily in sales of existing homes, rather than the sales of new homes that are typically sold by builders. The recent cycle of growth of the real estate market hit headwinds in the second half of 2022. Mortgage rates dipped from 20-year highs in early 2023 but have risen again and sales have resumed an extended period of declines. The National Association of Realtors(NAR) reported that for February 2025 (the seasonally adjusted annual rate) there were 4.26 million existing home sales, an increase of 4.2% over January 2025 but a decrease of 1.2% from the prior year. Total housing inventory at the end of February 2025 was 1.24 million units, up 5.1% from January and 17% from one year ago (1.06 million). There was a 3.5-month unsold inventory supply in February 2025, identical to January but up from 3.0 months in February 2024. The median existing-home sales price increased to $398,400, an increase of 3.8% from February 2024 ($383,800). Properties typically remained on the market 42 days in February 2025, up from 41 days in January and 38 days in February 2024.

Realtors continue to be an integral part of the home buying process. According to NAR:5

| ● | 88% of buyers recently purchased their home through a real estate agent or broker, 5% purchased their home directly from a builder or builder’s agent, and 5% purchased directly from the previous owner; |

| ● | having an agent to help them find the right home was what buyers wanted most when choosing an agent at 49%; |

| ● | most buyers interviewed only one real estate agent during their home search, with 77% of repeat buyers; |

| ● | 88% of buyers would use their agent again or recommend their agent to others, and nearly 66% of sellers recommended their agent at least once since selling their home. |

| ● | 40% of buyers used an agent that was referred to them by a friend, neighbor, or relative and 21% used an agent that they had worked with in the past to buy or sell a home. |

On July 7, 2024, the NAR has noted on its website:6

| ● | There are more than 360,000 residential real estate brokerage firms and over an estimated 1.5 million active real estate licensees operating in the United States; |

| ● | 88% of all realtors are independent contractors; 5% are employees and 8% are “other;” |

| 5 | https://www.nar.realtor/sites/default/files/2024-11/2024-profile-of-home-buyers-and-sellers-highlights-11-04-2024_2.pdf |

| 6 | https://www.nar.realtor/research-and-statistics/quick-real-estate-statistics |

| ● | The median tenure for realtors with their current firm was five years, up from a median of four years in the 2020 NAR survey; |

| ● | Of the NAR members that use drones in their real estate business of office, 46% hire a professional, 12% have someone in their office that uses drones, and 6% personally use drones. 18% do not use drones; |

| ● | 64% of broker/broker associates and 73% of sales agents have a website, 82% of NAR members have their own listings on their website, 70% have information about buying and selling, and 65% have a link to their firm’s website; and |

| ● | 77% of realtors use Facebook and 55% use LinkedIn for professional purposes, and 19% of all realtor members of the NAR get 1-5% of their business from social media, and 10% get 6-10%. |

Seasonality

Our business is affected by the seasons and weather. The spring and summer seasons, when school is out, have typically resulted in higher sales volumes compared to fall and winter seasons. With the slowdown in the later months, we have experienced slower listing activity, fewer transaction closings and lower revenues and have seen more agent turnover as well. Bad weather or natural disasters also negatively impact listings and sales, which reduces our operating income, net income, operating margins and cash flow. While this pattern is fairly predictable, there can be no assurance that it will continue. Moreover, with the impact of climate change, we expect more business disruptions in the coming years, many of which could be unpredictable and extreme.

Our revenues and operating margins will fluctuate in successive quarters due to a wide variety of factors, including seasonality, weather, health exigencies, holidays, national or international emergencies, the school year calendar’s impact on timing of family relocations, and changes in mortgage interest rates. This fluctuation may make it difficult to compare or analyze our financial performance effectively across successive quarters.

In addition, the residential real estate market and the real estate industry in general is cyclical, characterized by “bubbles” that reflect faster-than-usual housing price increases, heavy demand for single-family homes, interest rate fluctuations, easy credit standards and lax government housing policies on the one hand, and protracted periods of depressed home values, lower buyer demand, inflated rates of foreclosure and often changing regulatory or underwriting standards applicable to mortgages on the other hand. It is unclear as to whether the U.S. is currently experiencing a “bursting bubble” from the unusual pent-up demand and move to remote work created by the Covid-19 pandemic followed by the rapid and extreme mortgage rate hikes that has slowed the market in recent months. The best example of the bubble bursting was the significant downturn in the U.S. residential real estate market between 2005 and 2011. While we believe we are well-positioned to compete during a downturn, our business is affected by these cycles in the residential real estate market, which can make it difficult to compare or analyze our financial performance effectively across successive periods.

Competition

The real estate brokerage business is highly competitive. We primarily compete against other independent real estate brokerage agencies in our local markets as well as the international and national real estate brokerage franchisors seeking to grow their franchise system. We compete against other brokerages to attract transactional clients based on our personalized service with experienced brokers who know the local market, the number and quality of listings, our brand and reputation and our marketing efforts. We also compete to attract real estate professionals based on our brand and reputation, the quality of our training and coaching, our marketing efforts, our generous 100% commission “split” for experienced brokers and our technology tools that make the brokers more efficient and productive.

Our largest national franchise competitors in the U.S. include RE/MAX, Realogy Holdings Corp. (which operates several brands including Century 21 and Coldwell Banker), Fathom Holdings Inc., and eXp World Holdings Inc. We believe that competition in the real estate brokerage franchise business is based principally upon the reputational strength of the brand, the quality of the services offered to franchisees, and the amount of franchise-related fees to be paid by franchisees.

We also face competition from internet-based real estate brokers including Realtor.com, Fathom Holdings Inc., Redfin.com, and Zillow.com, brokers offering deeply discounted commissions like Simple Showing Holdings, Inc., Houwzer LLC and Real Estate Exchange, Inc. (Rexhomes.com) and “flat fee” brokers such as Homie Technology, Inc., Cottage Street Realty, LLC (FlatFeeGroup.com) and Trelora, Inc. These companies do not provide the same personalized brokerage services that we do and emphasize low price and a do-it-yourself philosophy.