UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| FORM 40-F |

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

Commission file number: 001-42015

SOLARIS RESOURCES INC.

(Exact Name of Registrant as Specified in its Charter)

| British Columbia | 1040 | N/A | ||

| (Province or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code) | (I.R.S. Employer Identification No.) |

| Neuhofstrasse 5A, 6340 |

| Baar, Switzerland |

| +41 417695000 |

| (Address and Telephone Number of Registrant’s Principal Executive Offices) |

| Cogency Global Inc. 122 E. 42nd Street, 18th Floor New York, New York 10168 (800) 221-0102 |

| (Name, address (including zip code) and telephone number (including area code) of agent for service in the United States) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Trading Symbol(s) | Name of Each Exchange On Which Registered: | ||

| Common Shares, no par value | SLSS | NYSE American LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this form:

☒ Annual Information Form ☒ Audited Annual Financial Statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: N/A

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). ☒ Yes ☐ No

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

☒ Emerging growth company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report: ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

EXPLANATORY NOTE

Solaris Resources Inc. (the “Company”) is a Canadian issuer eligible to file this annual report pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on Form 40-F pursuant to the multi-jurisdictional disclosure system of the Exchange Act. The Company is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act. Equity securities of the Company are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3.

FORWARD LOOKING STATEMENTS

This annual on Form 40-F, including the exhibits hereto and the documents incorporated herein by reference, contains forward-looking statements. All statements, other than statements of historical facts, are forward-looking statements, including but not limited to estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur; exploration and development plans; timing of such exploration plans, and potential results of such exploration plans; financial capacity and availability of capital; statements regarding perceived merit of properties, budgets, work programs, use of available funds, and operational information; the Company’s intention to retain all future earnings and other cash resources for the future development and operation of its business; the Company’s intention not to declare or pay any cash dividends in the foreseeable future; the anticipated benefits and results of the emigration; the benefits of the Company’s management and board of directors (the “Board of Directors”) changes; timing and completion, if at all, of the proposed spin-out of non-core assets to create Solaris Exploration Inc. (the “Spin-Out”); the anticipated benefits and results of the Spin-Out; and the closing of the undrawn portion of the financing with OMF Fund IV SPV D LLC and OMF Fund IV SPV E LLC, entities managed by Orion Mine Finance Management LP (collectively, “Orion”). In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “is expected”, “scheduled”, “estimates”, “intends”, “anticipates”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, or “might” occur or be achieved. Any such forward-looking statements are based, in part, on assumptions and factors that may change, thus causing actual results or achievements to differ materially from those expressed or implied by the forward-looking statements. Such factors and assumptions may include, but are not limited to: assumptions concerning copper, gold and other base and precious metal prices; cut-off grades; accuracy of mineral resource estimates and resource modeling; timing and reliability of sampling and assay data; representativeness of mineralization; timing and accuracy of metallurgical test work; anticipated political and social conditions; expected government policy, including reforms; ability to successfully raise additional capital; assumptions regarding obtaining required approvals; assumptions regarding Solaris’ ability to satisfy the requirements to draw down the remaining portion of the Orion financing; and other assumptions used as a basis for preparation of the technical report titled “Mineral Resource Estimate Update – NI 43-101 Technical Report for the Warintza Project, Ecuador”, effective July 1, 2024 (filed on SEDAR+ on September 5, 2024) prepared by Mario E. Rossi of GeoSystems International, Inc.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, and without limitation: the ability to raise funding to continue exploration, development and mining activities; debt risk; global economic conditions; limited supplies, supply chain disruptions and inflation; negative operating cash flow; uncertainty of future revenues or of a return on investment; no defined reserves with no mineral properties in production or under development; uncertainty relating to inferred mineral resources; speculative nature of mineral exploration and development; spin-out of non-core assets; risks from international operations; risks associated with an emerging and developing market; relationships with, and claims by, local communities and Indigenous Groups; geopolitical risk; risks related to obtaining future environmental licenses for exploitation; permitting risk; Ecuadorian constitutional court rulings suspending licenses; anti-mining sentiment; failure to comply strictly with applicable laws, regulations and local practices; pressure from artisanal and illegal miners; risks associated with mining, exploration and development; land title risk; surface rights and access risks; changes in U.S. laws and policies regulating international trade; Middle Eastern conflicts; Russia-Ukraine conflict; global outbreaks and contagious diseases; fraud and corruption; ethics and business practices; future legal proceedings; tax regime in Ecuador; mineral assets being located outside Canada and held indirectly through foreign affiliates; commodity price risk; exchange rate fluctuations; joint ventures; property commitments; infrastructure; water management; properties located in remote areas; lack of availability of resources; dependence on highly skilled personnel; competition; significant shareholders; reputational risk; conflicts of interest; uninsurable risks; information systems; public company obligations; reliability of financial reporting and financial statement preparation; foreign subsidiary operations may impact the Company’s ability to fund operations efficiently; share price fluctuation; value of the Company’s common shares (the “Common Shares”); future sales of Common Shares by existing shareholders; costs of land reclamation; measures to protect endangered species; environmental risks and hazards and changes in climate conditions; differences in U.S. and Canadian reporting of mineral reserves and resources; the Company’s “foreign private issuer” status; claims under U.S. securities laws, as well as those factors discussed in ITEM 7: “Risk Factors” in the Company’s Annual Information Form (“AIF”) for the fiscal year ended December 31, 2024, filed with this annual report on Form 40-F as Exhibit 99.1.

Although the Company has attempted to identify important factors and risks that could affect the Company and might cause actual actions, events or results to differ, perhaps materially, from those described in forward-looking statements, there may be other factors and risks not identified herein that cause actions, events or results not to occur as projected, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this annual report and the documents incorporated herein by reference speak only as of the date hereof. The Company does not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as required by law.

MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

The Company’s AIF filed as Exhibit 99.1 to this annual report on Form 40-F and Management’s Discussion and Analysis for the fiscal year ended December 31, 2024 filed as Exhibit 99.3 have been prepared in accordance with the requirements of Canadian provincial securities laws, which differ from the requirements of United States securities laws.

As a result, the Company reports the mineral reserves and resources of the projects it has an interest in according to Canadian standards. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43 101 - Standards of Disclosure for Mineral Projects (“NI 43 101”). NI 43 101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the SEC that are applicable to domestic United States reporting companies under subpart 1300 of Regulation S-K (“SK 1300”) under the Exchange Act. As an issuer that prepares and files its reports with the SEC pursuant to the multijurisdictional disclosure system, the Company is not subject to the requirements of sub part1300 of Regulation S-K. Any mineral reserves and mineral resources reported by the Company in accordance with NI 43 101 may not qualify as such under or differ from those prepared in accordance with SK 1300. Accordingly, information included or incorporated by reference in the Company’s AIF filed as Exhibit 99.1 to this annual report on Form 40-F and management’s discussion and analysis for the fiscal year ended December 31, 2024 filed as Exhibit 99.3 concerning descriptions of mineralization and estimates of mineral reserves and resources under Canadian standards may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of SK 1300.

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Company is permitted, under a multi-jurisdictional disclosure system adopted by the United States and Canada, to prepare this annual report on Form 40-F in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company prepares its financial statements, which are filed with this annual report Form 40-F, in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board (“IFRS”), and the audit is subject to the standards of the Public Company Accounting Oversight Board (United States). Such financial statements may not be comparable to financial statements of United States companies prepared in accordance with United States generally accepted accounting principles.

CURRENCY

Unless otherwise indicated, all dollar amounts in this annual report on Form 40-F are in United States dollars. The exchange rate of Canadian dollars into United States dollars, on December 31, 2024, based upon the closing exchange rate as quoted by the Bank of Canada, was U.S.$1.00 = CAD$ 1.4389 (CAD$1.00 = U.S.$ 0.6950).

ANNUAL INFORMATION FORM

The Company’s AIF for the fiscal year ended December 31, 2024 is filed as Exhibit 99.1 to this annual report on Form 40-F and is incorporated by reference herein.

AUDITED ANNUAL FINANCIAL STATEMENTS

The audited consolidated financial statements of the Company for the years ended December 31, 2024 and 2023, including the report of the Independent Registered Public Accounting Firm with respect thereto, are filed as Exhibit 99.2 to this annual report on Form 40-F and are incorporated by reference herein.

MANAGEMENT’S DISCUSSION AND ANALYSIS

The Company’s Management’s Discussion and Analysis for the fiscal year ended December 31, 2024 is filed as Exhibit 99.3 to this annual report on Form 40-F and is incorporated by reference herein.

TAX MATTERS

Purchasing, holding, or disposing of the Company’s securities may have tax consequences under the laws of the United States and Canada that are not described in this annual report on Form 40-F or the documents incorporated by reference herein.

CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

At the end of the period covered by this annual report on Form 40-F for the fiscal year ended December 31, 2024, an evaluation was carried out under the supervision of, and with the participation of, the Company’s management, including its Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), of the effectiveness of the design and operation of the Company’s disclosure controls and procedures (as defined in Rule 13a-15(e) of the Exchange Act). Based upon that evaluation, the Company’s CEO and CFO have concluded that the Company’s disclosure controls and procedures were effective to give reasonable assurance that the information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is (i) recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms, and (ii) accumulated and communicated to management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

Management’s Report on Internal Control over Financial Reporting and Auditor’s Attestation Report

This annual report does not include a report of management’s assessment regarding internal control over financial reporting or an attestation report of the Company’s registered public accounting firm due to a transition period established by rules of the SEC for newly public companies.

Changes in Internal Control over Financial Reporting

There have been no changes in internal control over financial reporting that occurred during the fiscal year ended December 31, 2024 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

CORPORATE GOVERNANCE

The Company is listed on the Toronto Stock Exchange (“TSX”) and is required to describe its practices and policies with regards to corporate governance with specific reference to TSX guidelines by way of an annual corporate governance statement in the Company’s annual report or information circular filed with the appropriate securities regulators in Canada. The Company is also listed on the NYSE American LLC (“NYSE American”) and additionally complies as necessary with the rules and guidelines of the NYSE American as well as the SEC. The Company reviews its governance practices on an ongoing basis to ensure it is in compliance with all applicable requirements.

The Company’s Board of Directors is responsible for the Company’s Corporate Governance policies and has separately designated standing Audit, Compensation and Nominating & Corporate Governance Committees. The Company’s Board of Directors has determined that all the members of the Audit, Compensation, and Nominating & Corporate Governance Committees are independent, based on the criteria for independence and unrelatedness prescribed by the TSX and Section 803A of the NYSE American Company Guide.

Compensation Committee

Compensation of the Company’s CEO and all other officers is recommended to the Board of Directors for determination by the Compensation Committee. The Compensation Committee develops, reviews and monitors director and executive officer compensation and policies. The Compensation Committee is also responsible for annually reviewing the adequacy of compensation to directors, officers, and other consultants and the composition of compensation packages. The Company’s CEO cannot be present during the Compensation Committee’s deliberations or vote on the CEO’s compensation.

The Compensation Committee is composed of Donald Taylor and Rodrigo Borja, each of whom, in the opinion of the Board of Directors, is independent under the rules of the TSX and pursuant to Sections 803A and 805(c)(1) of the NYSE American Company Guide. The Company’s Compensation Committee Charter is available on the Company’s website at www.solarisresources.com.

Nominating & Corporate Governance Committee

Nominees for the election to the Company’s Board of Directors are recommended by the Nominating & Corporate Governance Committee. The Company has adopted a formal written board resolution addressing the nomination process and such related matters as may be required under the rules of the TSX and the NYSE American and any applicable securities laws.

The Nominating & Corporate Governance Committee is composed of Rodrigo Borja and Hans Wick, each of whom, in the opinion of the Board of Directors, is independent under the rules of the TSX and the NYSE American. The Company’s Nominating and Corporate Governance Committee Charter is available on the Company’s website at www.solarisresources.com.

AUDIT COMMITTEE

Composition and Responsibilities

The Company’s Board of Directors has a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act and Section 803B of the NYSE American Company Guide. During the Company’s year ended December 31, 2021, the Company’s Audit Committee is composed of Donald Taylor, Hans Wick and Rodrigo Borja, each of whom, in the opinion of the Company’s Board of Directors, is independent (as determined under Rule 10A-3 of the Exchange Act, Section 803A of the NYSE American Company Guide, and the rules of the TSX) and each of whom is financially literate. The Audit Committee meets the composition requirements set forth by Section 803B(2) of NYSE American Company Guide.

Donald Taylor has over 30 years of domestic and international mining executive experience taking projects from exploration to mining. He is currently the Chief Executive Officer of Titan Metals Corporation. Donald has worked extensively for large and small cap companies, including Arizona Mining, BHP Minerals, Bear Creek Mining, American Copper and Nickel, Doe Run Resources, Westmont Mining Company, Titan Mining, and Augusta Gold Corp.

Hans Wick has decades of experience in the financial services and investment sector, with his most recent role as the Managing Director of a Swiss private bank. As a senior financial services and investment professional, Hans benefits from an in-depth knowledge of the sector and a wide network of contacts which he applies to his mandates and lends to the boards of directors he serves on. Over the course of his banking career, Hans has also been active in the mining sector for decades as an investor and advisor to numerous companies.

Rodrigo Borja is a senior lawyer with decades of experience in Ecuador, including as the Chief Legal Officer (“CLO”) of several foreign companies with operations in the mining and oil sectors. In the mining sector, Rodrigo was CLO of Kinross’ Ecuador subsidiary, where he managed all legal aspects of the company. He led the negotiations with the Ecuadorian state for the Mining Exploitation Contract for the Fruta del Norte project and the investment contract that protects foreign investment. Rodrigo is currently a partner with AVL Abogados where he leads its mining practice. Prior to this, Rodrigo was the CLO of the Brazilian oil company Petrobras, responsible for all legal aspects of its operation from 2002 to 2010. He was also a member of the Executive Committee, as well as an alternate member of the board of directors of OCP Ecuador, Ecuador’s main oil pipeline.

The members of the Audit Committee do not have fixed terms and are appointed and replaced from time to time by resolution of the Board of Directors.

The Audit Committee meets with the Company’s CEO, President and CFO, and the Company’s independent auditors to review and inquire into matters affecting financial reporting, the system of internal accounting and financial controls, and the Company’s audit procedures and audit plans. The Audit Committee also recommends to the Board of Directors the independent auditors to be appointed for each fiscal year. In addition, the Audit Committee reviews and recommends to the Board of Directors for approval the annual and quarterly financial statements and management’s discussion and analysis. Finally, the Audit Committee undertakes other activities as required by the rules and regulations of the TSX and the NYSE American and other governing regulatory authorities.

The full text of the Audit Committee Charter is set forth in the Company’s AIF, filed as Exhibit 99.1 to this annual report on Form 40-F and incorporated by reference herein.

Audit Committee Financial Expert

The Company’s Board of Directors determined that Mr. Taylor qualifies as the Audit Committee “financial expert,” as defined in Item 407(d)(5)(ii) of Regulation S-K under the Exchange Act and is “financially sophisticated” as determined under Section 803(B)(2)(iii) of the NYSE American Company Guide.

PRINCIPAL ACCOUNTING FEES AND SERVICES – INDEPENDENT AUDITORS

KPMG LLP, Chartered Professional Accountants (“KPMG”) has served as our Independent Registered Public Accounting Firm in each of the last two years. The fees billed to the Company by KPMG can be found in “External Audit Services Fees (By Category)” in the Company’s AIF filed as Exhibit 99.1 to this annual report on Form 40-F, which is incorporated herein by reference.

PRE-APPROVAL OF AUDIT

AND NON-AUDIT SERVICES PROVIDED BY

INDEPENDENT AUDITORS

The Audit Committee pre-approves all audit services to be provided to the Company by its independent auditors. Non-audit services that are prohibited to be provided to the Company by its independent auditors may not be pre-approved. In addition, prior to the granting of any pre-approval, the Audit Committee must be satisfied that the performance of the services in question will not compromise the independence of the independent auditors. All non-audit services performed by the Company’s auditor for the fiscal year ended December 31, 2024 were pre-approved by the Audit Committee of the Company. No non-audit services were approved pursuant to the de minimis exemption to the pre-approval requirement.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance sheet transactions that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors, other than the Company’s obligation for future rental payments described in “Related Party Transactions” in the Management’s Discussion and Analysis for the year ended December 31, 2024 included as Exhibit 99.3 to this annual report on Form 40-F which is incorporated herein by reference.

CASH REQUIREMENTS

The information provided under the heading “Commitments and Contingencies” in the Management’s Discussion and Analysis for the year ended December 31, 2024 included as Exhibit 99.3 to this annual report on Form 40-F, is incorporated herein by reference.

CODE OF ETHICS

The Company has adopted a Code of Business Conduct and Ethics (the “Code”) that applies to all the Company’s directors, executive officers and employees, which is available on the Company’s website at www.solarisresources.com and in print to any shareholder who requests it. The Code meets the requirements for a “code of ethics” within the meaning of that term in General Instruction 9(b) of Form 40-F.

All amendments to the Code, and all waivers of the Code with respect to any of the officers covered by it, will be posted on the Company’s website, www.solarisresources.com within five business days of the amendment or waiver and will remain available for a twelve-month period and provided in print to any shareholder who requests them. During the fiscal year ended December 31, 2024, the Company did not substantively amend, waive or implicitly waive any provision of the Code with respect to any of the directors, executive officers or employees subject to it.

CASH REQUIREMENTS

The Company’s material cash requirements are discussed in management’s discussion and analysis for the fiscal year ended December 31, 2024 filed as Exhibit 99.3 under the headings “Capital Management” and “Commitments and Contingencies”.

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR that the Company sent during the year ended December 31, 2024 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

NYSE AMERICAN CORPORATE GOVERNANCE

A foreign private issuer that follows home country practices in lieu of certain provisions of the listing rules of the NYSE American must disclose the ways in which its corporate governance practices differ from those followed by U.S. domestic companies. As required by Section 110 of the NYSE American Company Guide, the Company discloses on its website, www.solarisresources.com, a description of the significant ways in which the Company’s corporate governance practices differ from those followed by United States domestic companies pursuant to NYSE American standards.

A description of the significant ways in which the governance practices of the Company differ from those followed by domestic companies pursuant to NYSE American standards is as follows:

Proxy Solicitations Under Section 705, listed companies must comply with applicable state and federal laws and rules (including interpretations thereof), including without limitation, Exchange Act Regulations 14A and 14C. The Company is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act, and the equity securities of the Company are accordingly exempt from the proxy rules set forth in Sections 14(a), 14(b), 14(c) and 14(f) of the Exchange Act. The Company solicits proxies in accordance with applicable rules and regulations in Canada.

Quorum Requirements Under Section 123, the NYSE American expects that an appropriate quorum of the shares issued and outstanding and entitled to vote will be provided for by the by-laws of companies listing voting securities. The NYSE American recommends a quorum of at least 33 1/3%. The Company is subject to the Business Corporations Act (British Columbia), which permits the Company to specify a quorum requirement in its memorandum or articles. Under the Company’s articles, quorum for the transaction of business at any meeting of shareholders is at least one shareholder represented in person or by proxy.

Shareholder Approval Requirements Sections 711-713 require that a listed company obtain shareholder approval for: (i) the establishment or material amendment of a plan or other equity compensation arrangement, subject to exceptions; (ii) the issuance of shares as sole or partial consideration for an acquisition of the stock or assets of another company in certain circumstances; and (iii) certain transactions other than public offerings that may result in the issuance of common shares (or securities convertible into common shares) equal to 20% or more of presently outstanding shares for less than the greater of book or market value of the shares. Neither Canadian securities laws nor Canadian corporate law require shareholder approval for such transactions, except where such transactions constitute a “related party transaction” or a “business combination” under Canadian securities laws or where such transaction is structured in a way that requires shareholder approval under the Business Corporations Act (British Columbia), or where the Toronto Stock Exchange requires shareholder approval for a transaction involving a change of control of the Company, or the establishment of or amendments to equity-based compensation plans, in which case, the Company intends to follow its home country requirements. In addition, the Company may from time-to-time seek relief from NYSE American corporate governance requirements on specific transactions under Section 110 of the NYSE American Company Guide by providing written certification from independent local counsel that the non-complying practice is not prohibited by our home country law, in which case, the Company shall make the disclosure of such transactions available on its website at www.solarisresources.com.

MINE SAFETY DISCLOSURE

Pursuant to Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”), issuers that are operators, or that have a subsidiary that is an operator, of a coal or other mine in the United States are required to disclose in their periodic reports filed with the SEC information regarding specified health and safety violations, orders and citations, related assessments and legal actions, and mining-related fatalities under the regulation of the Federal Mine Safety and Health Administration (“MSHA”) under the Federal Mine Safety and Health Act of 1977 (the “Mine Act”). During the fiscal year ended December 31, 2024, the Company had no mines in the United States subject to regulation by MSHA under the Mine Act.

RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

The Company has adopted a compensation recovery policy (referred to as the “Incentive Compensation Clawback Policy”) as required by NYSE American listing standards and pursuant to Rule 10D-1 of the Exchange Act. The Incentive Compensation Clawback Policy is incorporated by reference to Exhibit 97 to this annual report on Form 40-F. At no time during or after the fiscal year ended December 31, 2024 (as of the date of this annual report), was the Company required to prepare an accounting restatement that required recovery of erroneously awarded compensation pursuant to the Incentive Compensation Clawback Policy and, as of December 31, 2024, there was no outstanding balance of erroneously awarded compensation to be recovered from the application of the Incentive Compensation Clawback Policy to a prior restatement.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

Not applicable.

UNDERTAKING

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Company filed an Appointment of Agent for Service of Process and Undertaking on Form F-X with the SEC on April 12, 2024, with respect to the class of securities in relation to which the obligation to file this annual report on Form 40-F arises. Any change to the name or address of the agent for service of process will be communicated promptly to the SEC by amendment to Form F-X/A referencing the Company’s file number.

EXHIBIT INDEX

The following exhibits have been filed as part of this annual report on Form 40-F:

| Exhibit | Description | |

| Incentive Compensation Recovery Policy | ||

| 97 | Incentive Compensation Clawback Policy | |

| Annual Information | ||

| 99.1 | Annual Information Form of the Company for the year ended December 31, 2024 | |

| 99.2 | The following audited consolidated financial statements of the Company, are exhibits to and form a part of this annual report: | |

| Independent Registered Public Accounting Firm’s Reports on Consolidated Financial Statements as at December 31, 2024 and 2023 and for each of the years then ended (KPMG LLP, Vancouver, BC, Canada, Auditor Firm ID:85) | ||

| Consolidated Statements of Financial Position as of December 31, 2024 and December 31, 2023 | ||

| Consolidated Statements of Net Loss and Comprehensive Loss for the years ended December 31, 2024 and December 31, 2023 | ||

| Consolidated Statements of Cash flows for the years ended December 31, 2024 and December 31, 2023 | ||

| Consolidated Statements of Changes in Shareholders; Equity for the years ended December 31, 2024 and December 31, 2023 | ||

| Notes to Consolidated Financial Statements | ||

| 99.3 | Management’s Discussion and Analysis | |

| Certifications | ||

| 99.4 | Certificate of Chief Executive Officer Pursuant to Rule 13a-14(a) of the Exchange Act | |

| 99.5 | Certificate of Chief Financial Officer Pursuant to Rule 13a-14(a) of the Exchange Act | |

| 99.6 | Certificate of Chief Executive Officer Pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |

| 99.7 | Certificate of Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |

| Consents | ||

| 99.8 | Consent of KPMG LLP, Independent Registered Public Accounting Firm | |

| 99.9 | Consent of Jorge Fierro, M.Sc., DIC, PG | |

| 99.10 | Consent of Mario E. Rossi, MSc, Min. Eng | |

| 101 | XBRL Instance Document | |

| 101.SCH | XBRL Taxonomy Extension Schema Document | |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document | |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase Document | |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase Document | |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) | |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

SOLARIS RESOURCES INC. | |

| By: | /s/ Matthew Rowlinson | |

| Name: | Matthew Rowlinson | |

| Title: |

Chief Executive Officer (Principal Executive Officer) |

|

Date: March 20, 2025

Exhibit 97

SOLARIS RESOURCES INC.

INCENTIVE COMPENSATION RECOVERY POLICY

1. Introduction.

The Board of Directors of Solaris Resources Inc. (the “Company”) believes that it is in the best interests of the Company and its shareholders to create and maintain a culture that emphasizes integrity and accountability and that reinforces the Company's compensation philosophy. The Board has therefore adopted this policy, which provides for the recovery of erroneously awarded incentive compensation in the event that the Company is required to prepare an accounting restatement due to material noncompliance of the Company with any financial reporting requirements under the federal securities laws (the “Policy”). This Policy is designed to comply with Section 10D of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), related rules and the listing standards of the NYSE American LLC (“NYSE American”), including but not limited to Section 811 of the NYSE American Company Guide, or any other securities exchange on which the Company’s shares are listed in the future.

2. Administration.

This Policy shall be administered by the Board or, if so designated by the Board, the Compensation Committee (the “Committee”), in which case, all references herein to the Board shall be deemed references to the Committee. Any determinations made by the Board shall be final and binding on all affected individuals.

3. Covered Executives.

Unless and until the Board determines otherwise, for purposes of this Policy, the term “Covered Executive” means a current or former employee who is or was identified by the Company as the Company’s president, principal financial officer, principal accounting officer (or if there is no such accounting officer, the controller), any vice-president of the Company in charge of a principal business unit, division, or function (such as sales, administration, or finance), any other officer who performs a policy-making function, or any other person who performs similar policy-making functions for the Company. Executive officers of the Company’s subsidiaries are deemed “Covered Executives” if they perform such policy-making functions for the Company. “Policy-making function” is not intended to include policy-making functions that are not significant. “Covered Executives” will include, at minimum, the executive officers identified by the Company in its disclose prepared in response to Item B.19 of Form 40-F if the Company files its annual report with the SEC on Form 40-F or Item 6.B of Form 20-F if the Company files its annual report with the SEC on Form 20-F. For the avoidance of doubt, “Covered Executives” will include at least the following Company officers: (a) Executive Chairman, (b) Chief Executive Officer, (c) President, (d) Chief Financial Officer, (e) Chief Operating Officer and (f) Senior Vice Presidents.

This Policy covers Incentive Compensation received by a person after beginning service as a Covered Executive and who served as a Covered Executive at any time during the performance period for that Incentive Compensation.

4. Recovery: Accounting Restatement.

In the event of an Accounting Restatement, the Company will recover reasonably promptly any excess Incentive Compensation received by any Covered Executive during the three completed fiscal years immediately preceding the date on which the Company is required to prepare an Accounting Restatement, including transition periods resulting from a change in the Company’s fiscal year as provided in Rule 10D-1 of the Exchange Act. Incentive Compensation is deemed “received” in the Company’s fiscal period during which the Financial Reporting Measure specified in the Incentive Compensation award is attained, even if the payment or grant of the Incentive Compensation occurs after the end of that period.

| (a) | Definition of Accounting Restatement. |

For the purposes of this Policy, an “Accounting Restatement” means the Company is required to prepare an accounting restatement of its financial statements filed with the Securities and Exchange Commission (the “SEC”) due to the Company’s material noncompliance with any financial reporting requirements under the federal securities laws (including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period).

The determination of the time when the Company is “required” to prepare an Accounting Restatement shall be made in accordance with applicable SEC and national securities exchange rules and regulations.

An Accounting Restatement does not include situations in which financial statement changes did not result from material non-compliance with financial reporting requirements, such as, but not limited to retrospective: (i) application of a change in accounting principles; (ii) revision to reportable segment information due to a change in the structure of the Company’s internal organization; (iii) reclassification due to a discontinued operation; (iv) application of a change in reporting entity, such as from a reorganization of entities under common control; (v) adjustment to provision amounts in connection with a prior business combination; and (vi) revision for stock splits, stock dividends, reverse stock splits or other changes in capital structure.

| (b) | Definition of Incentive Compensation. |

For purposes of this Policy, “Incentive Compensation” means any compensation that is granted, earned, or vested based wholly or in part upon the attainment of a Financial Reporting Measure, including, for example, bonuses or awards under the Company’s short and long-term incentive plans, grants and awards under the Company’s equity incentive plans, and contributions of such bonuses or awards to the Company’s deferred compensation plans or other employee benefit plans that are not tax-qualified plans. For avoidance of doubt, Incentive Compensation that is deferred (either mandatorily or voluntarily) under the Company’s non-qualified deferred compensation plans, as well as any matching amounts and earnings thereon, are subject to this Policy. Incentive Compensation does not include awards which are granted, earned and vested without regard to attainment of Financial Reporting Measures, such as time-vesting awards, discretionary awards and awards based wholly on subjective standards, strategic measures or operational measures.

| (c) | Financial Reporting Measures. |

“Financial Reporting Measures” are those that are determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements (including non-GAAP financial measures) and any measures derived wholly or in part from such financial measures. For the avoidance of doubt, Financial Reporting Measures include stock price and total shareholder return. A measure need not be presented within the financial statements or included in a filing with the SEC or other applicable securities regulators to constitute a Financial Reporting Measure for purposes of this Policy.

| (d) | Excess Incentive Compensation: Amount Subject to Recovery. |

The amount(s) to be recovered from the Covered Executive will be the amount(s) by which the Covered Executive’s Incentive Compensation for the relevant period(s) exceeded the amount(s) that the Covered Executive otherwise would have received had such Incentive Compensation been determined based on the restated amounts contained in the Accounting Restatement. All amounts shall be computed without regard to taxes paid.

For Incentive Compensation based on Financial Reporting Measures such as stock price or total shareholder return, where the amount of excess compensation is not subject to mathematical recalculation directly from the information in an Accounting Restatement, the Board will calculate the amount to be reimbursed based on a reasonable estimate of the effect of the Accounting Restatement on such Financial Reporting Measure upon which the Incentive Compensation was received. The Company will maintain documentation of that reasonable estimate and will provide such documentation to the applicable national securities exchange.

| (e) | Method of Recovery. |

The Board will determine, in its sole discretion, the method(s) for recovering reasonably promptly excess Incentive Compensation hereunder. Such methods may include, without limitation:

| (i) | requiring reimbursement of Incentive Compensation previously paid; |

| (ii) | forfeiting any Incentive Compensation contribution made under the Company’s deferred compensation plans; |

| (iii) | offsetting the recovered amount from any compensation or Incentive Compensation that the Covered Executive may earn or be awarded in the future; |

| (iv) | some combination of the foregoing; or |

| (v) | taking any other remedial and recovery action permitted by law, as determined by the Board. |

Before the Board makes a final determination as to whether an Accounting Restatement is required and any recovery of excess Incentive Compensation is payable under the Policy from a Covered Officer, the Board shall provide the Covered Officer with written notice thereof and the opportunity to be heard at a duly held meeting of the Board, which may take place either in person or by way of a conference or video call, as determined by the Board.

If the Board makes a final determination that an Accounting Restatement is required and recovery of excess Incentive Compensation is payable under the Policy, the Board shall reasonably promptly make a written demand for recovery from the Covered Officer, and in the event that the Covered Officer does not, within a reasonably promptly period thereafter, tender repayment and/or reimbursement in response to such demand, the Board shall be entitled to pursue such other actions or remedies, including, without limitation, legal recourse against the Covered Officer to obtain such repayment and/or reimbursement of excess Incentive Compensation under this Policy, as applicable.

To the extent practicable and as permitted by all applicable laws, including, without limitation, securities legislation and stock exchange rules, all investigations and related findings under this Policy shall be conducted, undertaken and treated in a confidential manner.

5. No Indemnification or Advance.

Subject to applicable law, the Company shall not indemnify, including by paying or reimbursing for premiums for any insurance policy covering any potential losses, any Covered Executives against the loss of any erroneously awarded Incentive Compensation, nor shall the Company advance any costs or expenses to any Covered Executives in connection with any action to recover excess Incentive Compensation.

6. Interpretation.

The Board is authorized to interpret and construe this Policy and to make all determinations necessary, appropriate or advisable for the administration of this Policy. It is intended that this Policy be interpreted in a manner that is consistent with the requirements of Section 10D of the Exchange Act and any applicable rules or standards adopted by the SEC or any national securities exchange on which the Company's securities are listed.

7. Effective Date.

The effective date of this Policy is April 5, 2024 (the “Effective Date”). This Policy applies to Incentive Compensation received by Covered Executives on or after the Effective Date that results from attainment of a Financial Reporting Measure based on or derived from financial information for any fiscal period ending on or after the Effective Date. In addition, this Policy is intended to be and will be incorporated as an essential term and condition of any Incentive Compensation agreement, plan or program that the Company establishes or maintains on or after the Effective Date.

8. Amendment and Termination.

The Board may amend this Policy from time to time in its discretion, and shall amend this Policy as it deems necessary to reflect changes in regulations adopted by the SEC under Section 10D of the Exchange Act and to comply with any rules or standards adopted by NYSE American or any other securities exchange on which the Company’s shares are listed in the future.

9. Other Recovery Rights.

The Board intends that this Policy will be applied to the fullest extent of the law. The Board may require that any employment agreement or similar agreement relating to Incentive Compensation received on or after the Effective Date shall, as a condition to the grant of any benefit thereunder, require a Covered Executive to agree to abide by the terms of this Policy. Any right of recovery under this Policy is in addition to, and not in lieu of, any (i) other remedies or rights of compensation recovery that may be available to the Company pursuant to the terms of any similar policy in any employment agreement, or similar agreement relating to Incentive Compensation, unless any such agreement expressly prohibits such right of recovery, and (ii) any other legal remedies available to the Company. The provisions of this Policy are in addition to (and not in lieu of) any rights to repayment the Company may have under Section 304 of the Sarbanes-Oxley Act of 2002 and other applicable laws.

10. Impracticability.

The Company shall recover any excess Incentive Compensation in accordance with this Policy, except to the extent that certain conditions are met and the Board has determined that such recovery would be impracticable, all in accordance with Rule 10D-1 of the Exchange Act and Section 811 of the NYSE American Company Guide or any other securities exchange on which the Company’s shares are listed in the future.

11. Successors.

This Policy shall be binding upon and enforceable against all Covered Executives and their beneficiaries, heirs, executors, administrators or other legal representatives.

Schedule A

INCENTIVE-BASED COMPENSATION RECOVERY POLICY

RECEIPT AND ACKNOWLEDGEMENT

I, __________________________________________, hereby acknowledge that I have received and read a copy of the Incentive Compensation Recovery Policy. As a condition of my receipt of any Incentive Compensation as defined in the Policy, I hereby agree to the terms of the Policy. I further agree that if recovery of excess Incentive Compensation is required pursuant to the Policy, the Company shall, to the fullest extent permitted by governing laws, require such recovery from me up to the amount by which the Incentive Compensation received by me, and amounts paid or payable pursuant or with respect thereto, constituted excess Incentive Compensation. If any such reimbursement, reduction, cancelation, forfeiture, repurchase, recoupment, offset against future grants or awards and/or other method of recovery does not fully satisfy the amount due, I agree to immediately pay the remaining unpaid balance to the Company.

| Signature | Date |

Exhibit 99.1

ANNUAL INFORMATION FORM

For the Year Ended December 31, 2024

(Dated March 20, 2025)

SOLARIS RESOURCES INC.

Neuhofstrasse 5A Baar

6340 Switzerland

TABLE OF CONTENTS

| ITEM 1: PRELIMINARY NOTES | 1 | |

| 1.1 | Effective Date of Information | 1 |

| 1.2 | Financial Statements and Management Discussion and Analysis | 1 |

| 1.3 | Currency | 1 |

| 1.4 | Scientific and Technical Information | 1 |

| ITEM 2: CAUTIONARY NOTES | 1 | |

| 2.1 | Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information | 1 |

| 2.2 | Cautionary Note to United States Investors Regarding Classification of Mineral Resource Estimates | 2 |

| ITEM 3: CORPORATE STRUCTURE | 3 | |

| 3.1 | Name, Address and Incorporation | 3 |

| 3.2 | Inter-corporate Relationships | 3 |

| ITEM 4: GENERAL DEVELOPMENT OF THE BUSINESS | 4 | |

| 4.1 | Three Year History | 4 |

| ITEM 5: DESCRIPTION OF THE BUSINESS | 6 | |

| ITEM 6: MATERIAL MINERAL PROJECT | 7 | |

| 6.1 | Current Technical Report | 7 |

| ITEM 7: RISK FACTORS | 14 | |

| ITEM 8: DIVIDENDS | 30 | |

| ITEM 9: DESCRIPTION OF CAPITAL STRUCTURE | 30 | |

| ITEM 10: MARKET FOR SECURITIES | 30 | |

| 10.1 | Trading Price and Volume | 30 |

| ITEM 11: ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER | 30 | |

| ITEM 12: DIRECTORS AND OFFICERS | 31 | |

| 12.1 | Name, Occupation and Security Holding | 31 |

| 12.2 | Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 32 |

| 12.3 | Conflicts of Interest | 32 |

| ITEM 13: PROMOTERS | 33 | |

| ITEM 14: LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 33 | |

| 14.1 | Legal Proceedings | 33 |

| 14.2 | Regulatory Actions | 33 |

| ITEM 15: INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 33 | |

| ITEM 16: TRANSFER AGENT AND REGISTRAR | 33 | |

| ITEM 17: MATERIAL CONTRACTS | 33 | |

| ITEM 18: INTERESTS OF EXPERTS | 34 | |

| 18.1 | Names of Experts | 34 |

| 18.2 | Interests of Experts | 34 |

| ITEM 19: AUDIT COMMITTEE | 34 | |

| 19.1 | The Audit Committee Charter | 34 |

| 19.2 | Composition of Audit Committee | 34 |

| 19.3 | Relevant Education and Experience | 35 |

| 19.4 | Reliance on Certain Exemptions | 35 |

| 19.5 | Audit Committee Oversight | 35 |

| 19.6 | Pre-Approval Policies and Procedures | 35 |

| 19.7 | External Audit Service Fees (By Category) | 36 |

| ITEM 20: ADDITIONAL INFORMATION | 36 | |

| SCHEDULE “A” AUDIT COMMITTEE CHARTER | A-1 | |

| 1.1 | Effective Date of Information |

References to “Solaris Resources Inc.”, “Solaris”, “Solaris Resources”, “SLS”, the “Company”, “its”, “our” and “we”, or related terms in this Annual Information Form (“AIF”), refer to Solaris Resources Inc. and include, where the context requires, its subsidiaries.

All information contained in this AIF is as at March 20, 2025, unless otherwise stated.

| 1.2 | Financial Statements and Management Discussion and Analysis |

This AIF should be read in conjunction with the Company’s audited consolidated annual financial statements for the years ended December 31, 2024 and December 31, 2023 (the “Financial Statements”), as well as the accompanying Management’s Discussion and Analysis (“MD&A”) for such periods. The Financial Statements and MD&A are available on the System for Electronic Data Analysis and Retrieval (“SEDAR+”) at www.sedarplus.ca and on Electronic Data Gathering, Analysis, and Retrieval (“EDGAR”) at www.sec.gov.

| 1.3 | Currency |

All references to “$” or “dollars” in this AIF are to United States dollars, unless otherwise expressly stated. References to “C$” are to Canadian dollars.

| 1.4 | Scientific and Technical Information |

Unless otherwise indicated, scientific and technical information in this AIF has been reviewed and approved by Jorge Fierro, M.Sc., DIC, PG, Vice President Exploration of Solaris and a “Qualified Person” (“QP”) as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

| 2.1 | Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information |

Certain information contained in this document constitutes forward-looking statements. All statements, other than statements of historical facts, are forward-looking statements, including but not limited to estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur; exploration and development plans; timing of such exploration plans, and potential results of such exploration plans; financial capacity and availability of capital; statements regarding perceived merit of properties, budgets, work programs, use of available funds, and operational information; the Company’s intention to retain all future earnings and other cash resources for the future development and operation of its business; the Company’s intention not to declare or pay any cash dividends in the foreseeable future; the anticipated benefits and results of the Emigration (as defined below); the benefits of the Company’s management and board of directors (the “Board”) changes; and the closing of the undrawn portion of the Orion (as defined below) financing. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “is expected”, “scheduled”, “estimates”, “intends”, “anticipates”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, or “might” occur or be achieved. Any such forward-looking statements are based, in part, on assumptions and factors that may change, thus causing actual results or achievements to differ materially from those expressed or implied by the forward-looking statements. Such factors and assumptions may include, but are not limited to: assumptions concerning copper, gold and other base and precious metal prices; cut-off grades; accuracy of mineral resource estimates and resource modeling; timing and reliability of sampling and assay data; representativeness of mineralization; timing and accuracy of metallurgical test work; anticipated political and social conditions; expected government policy, including reforms; ability to successfully raise additional capital; assumptions regarding obtaining required approvals; assumptions regarding Solaris’ ability to satisfy the requirements to draw down the remaining portion of the Orion financing; and other assumptions used as a basis for preparation of the Technical Report (as defined below).

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, and without limitation: the ability to raise funding to continue exploration, development and mining activities; debt risk; global economic conditions; limited supplies, supply chain disruptions and inflation; negative operating cash flow; uncertainty of future revenues or of a return on investment; no defined reserves with no mineral properties in production or under development; uncertainty relating to inferred mineral resources; speculative nature of mineral exploration and development; risks from international operations; risks associated with an emerging and developing market; relationships with, and claims by, local communities and Indigenous Groups; geopolitical risk; risks related to obtaining future environmental licenses for exploitation; permitting risk; Ecuadorian constitutional court rulings suspending licenses; anti-mining sentiment; failure to comply strictly with applicable laws, regulations and local practices; pressure from artisanal and illegal miners; risks associated with mining, exploration and development; land title risk; surface rights and access risks; changes in U.S. laws and policies regulating international trade; Middle Eastern conflicts; Russia-Ukraine conflict; global outbreaks and contagious diseases; fraud and corruption; ethics and business practices; future legal proceedings; tax regime in Ecuador; mineral assets being located outside Canada and held indirectly through foreign affiliates; commodity price risk; exchange rate fluctuations; joint ventures; property commitments; infrastructure; water management; properties located in remote areas; lack of availability of resources; dependence on highly skilled personnel; competition; significant shareholders; reputational risk; conflicts of interest; uninsurable risks; information systems; public company obligations; reliability of financial reporting and financial statement preparation; foreign subsidiary operations may impact the Company’s ability to fund operations efficiently; Common Share (as defined below) price fluctuation; value of the Company’s common shares (the “Common Shares”); future sales of Common Shares by existing shareholders; costs of land reclamation; measures to protect endangered species; environmental risks and hazards and changes in climate conditions; differences in U.S. and Canadian reporting of mineral reserves and resources; the Company’s “foreign private issuer” status; claims under U.S. securities laws, as well as those factors discussed in ITEM 7: “Risk Factors” below.

Although the Company has attempted to identify important factors and risks that could affect the Company and might cause actual actions, events or results to differ, perhaps materially, from those described in forward-looking statements, there may be other factors and risks not identified herein that cause actions, events or results not to occur as projected, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this AIF speak only as of the date hereof. The Company does not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as required by law.

| 2.2 | Cautionary Note to United States Investors Regarding Classification of Mineral Resource Estimates |

This AIF was prepared in accordance with Canadian standards for reporting of mineral resource estimates, which differ from United States standards. In particular, and without limiting the generality of the foregoing, the technical and scientific information contained and incorporated by reference in this AIF was prepared in accordance with NI 43-101 under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum Standards for Mineral Resources and Mineral Reserves, Definitions and Guidelines (“CIM Definition Standards”), which differs from the standards adopted by the U.S. Securities and Exchange Commission (the “SEC”) under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, estimates of the Company’s mineral reserves and mineral resources, and other technical and scientific information included or incorporated by reference in this AIF, may differ materially from the information that would be disclosed by a United States company subject to the SEC standards under the Exchange Act.

Investors are cautioned not to assume that any part, or all, mineral deposits categorized as inferred mineral resources or indicated mineral resources will ever be converted into mineral reserves. Inferred mineral resources are mineral resources for which quantity and grade or quality are estimated based on limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. Inferred mineral resources are based on limited information and have a great amount of uncertainty as to their existence and as to their economic and legal feasibility, although it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration.

Under Canadian securities laws, estimates of inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be characterized as mineral reserves and, accordingly, may not form the basis of feasibility or pre-feasibility studies, or economic studies except for a preliminary economic assessment as defined under NI 43-101. Indicated and inferred mineral resources that are not mineral reserves do not have demonstrated economic viability.

| 3.1 | Name, Address and Incorporation |

The Company was incorporated on June 18, 2018 under the Business Corporations Act (British Columbia) (“BCBCA”) under the name “Solaris Copper Inc.” On November 26, 2019, Solaris amended its articles of incorporation to change its name from “Solaris Copper Inc.” to “Solaris Resources Inc.”. The registered and head office of the Company is located at Neuhofstrasse 5A Baar 6340 Switzerland.

| 3.2 | Inter-corporate Relationships |

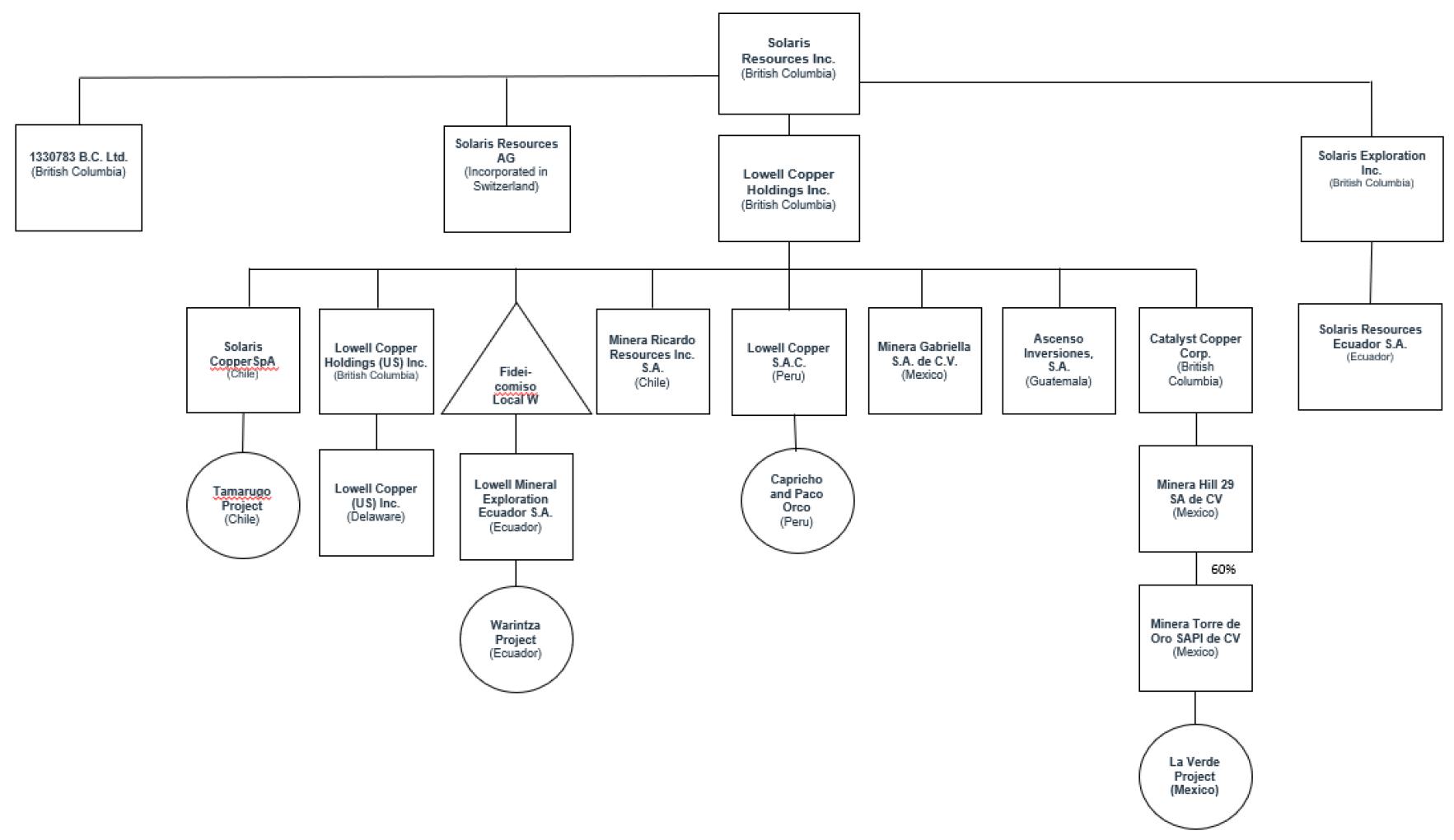

The following diagram illustrates the organizational structure of Solaris, including its subsidiaries, as of the date of this AIF. In certain instances, subsidiaries have been excluded where the total assets of that subsidiary does not exceed 10% of the consolidated assets of Solaris or, for the omitted subsidiaries together, in aggregate of 20% of the consolidated assets of Solaris.

All entities noted in the chart above are 100% owned, except as indicated below:

| 1. | Minera Ricardo Resources Inc. S.A. is 100% owned by Lowell Copper Holdings Inc., except for one share held by Solaris. |

| 2. | Lowell Copper S.A.C. is 100% owned by Lowell Copper Holdings Inc., except for one share held by Solaris. |

| 3. | Lowell Mineral Exploration Ecuador S.A. (“Lowell Ecuador”), a subsidiary of Solaris, owns and operates the Warintza Project (as defined below). Solaris’ wholly owned subsidiary, LCH, is the registered trustor of a guarantee trust that owns all of the issued and outstanding common shares of Lowell Ecuador, and holds the sole and exclusive right to claim restitution of the common shares of Lowell Ecuador upon complying with certain terms of a credit agreement dated December 11, 2023 among Solaris, LCH, Lowell Ecuador and OMF Fund IV SPV relating to the Company’s $60 million senior secured term facility (the “Senior Loan”). |

| 4. | Minera Gabriella S.A. de C.V. is 100% owned by Lowell Copper Holdings Inc., except for one share registered in the name of J. David Lowell. |

| 5. | Minera Torre de Oro, S.A. de C.V. is 60% owned by Minera Hill 29 SA de CV (an indirect subsidiary of Solaris) and 40% owned by Aur Mexcay Inc., a subsidiary of Teck Resources Limited. |

| 6. | Ascenso Inversiones, S.A. is 100% owned by Lowell Copper Holdings Inc., except for 0.01% of shares held by a legal representative. |

| 4.1 | Three Year History |

Set out below is a summary of how the Company’s business has developed over the last three completed financial years. In accordance with Form 51-102F2 – Annual Information Form, the below summary includes only events, such as acquisitions or dispositions, or conditions that have influenced the general development of the business.

2022

On January 18, 2022, Solaris announced a new discovery at Warintza South.

On March 21, 2022, Solaris and Electric Corporation of Ecuador (“CELEC EP”) announced a memorandum of understanding for CELEC EP to supply low cost, emission-free hydroelectric power to the Warintza Project (“Warintza”, the “Project” or the “Warintza Project”) located in southeastern Ecuador and owned by Solaris.

On April 4, 2022, Solaris announced drill results adding to the near surface, high-grade northeast and southeast extensions of the Warintza Project, signaling priorities for further growth beyond mineral resources.

On April 18, 2022, Solaris announced an updated mineral resource estimate at its Warintza Project.

On June 9, 2022, Solaris and the government of Ecuador announced an Investment Protection Agreement for the Warintza Project. The agreement was signed on December 22, 2022, securing the stability of regulations and tax incentives to accelerate development.

On November 14, 2022, Solaris announced a significant expansion at Warintza East.

2023

On February 24, 2023, Solaris announced the appointment of Ms. Poonam Puri to the Board.

On June 14, 2023, Solaris announced a new discovery in its first hole drilled at Patrimonio, a new porphyry southwest of Warintza Central.

On November 6, 2023, Solaris announced the appointment of Mr. Javier Toro as Chief Operating Officer of Solaris to lead the advancement of the Warintza Project.

On December 11, 2023, Solaris announced that Solaris and OMF Fund IV SPV D LLC and OMF Fund IV SPV E LLC, entities managed by Orion Mine Finance Management LP (collectively, “Orion”), had entered into definitive agreements with respect to an $80 million financing package for the advancement of the Warintza Project in Ecuador, comprised of the Senior Loan, a subscription for $10 million in equity at a price of C$5.11 per Common Share and a commitment for $10 million in additional equity financing (the “Orion Subscription Agreement”). In connection with the Orion financing, Solaris entered into a copper offtake agreement (the “Copper Offtake Agreement”) and a molybdenum offtake agreement (the “Molybdenum Offtake Agreement” and, collectively, the “Offtakes”) with Orion for the sale of 20% of metals produced from the Warintza Project for a period of 20 years from the start of production, subject to adjustment in accordance with the Offtakes. If prior to the 18-month anniversary of the Senior Loan closing date a change of control transaction (as defined in the offtake agreements) is approved by the Board and announced, either party may terminate the offtake agreements prior to the end of the term which will require the Company to then pay $27 million to Orion to terminate the Copper Offtake Agreement and $3 million to terminate the Molybdenum Offtake Agreement.

2024

On January 8, 2024, the Company announced a preview of 2024 plans including the intent to list the Common Shares on the NYSE American LLC (“NYSE American”).

On January 11, 2024, Solaris announced that it had entered into a subscription agreement in respect of an approximately C$130 million private placement of Common Shares by an affiliate of Zijin Mining Group Co., Ltd. at a subscription price of C$4.55 per Common Share (the “Zijin Private Placement”). The Company announced the termination of the Zijin Private Placement on May 21, 2024.

On January 22, 2024, Solaris announced the 2024 drill program with a total of six drill rigs at Warintza including the delivery of an updated mineral resource estimate due in late Q2 2024 and ongoing drilling thereafter focused on growth and infill drilling of at least 30 kilometers.

On March 1, 2024, Solaris announced a cooperation agreement with the Interprovincial Federation of Shuar Centers and the Alliance for Entrepreneurship and Innovation of Ecuador.

On April 19, 2024, Solaris’ Common Shares commenced trading on the NYSE American under the symbol “SLSR”. Concurrent with the start of trading on the NYSE American, the Common Shares ceased trading on the OTCQB Venture Market.

On April 17, 2024, Solaris announced it has signed an updated Impact and Benefits Agreement for the Warintza Project (the “IBA”).

On June 10, 2024, Solaris announced it closed a bought deal equity offering for aggregate gross proceeds of C$40,290,250. The Company also issued, on private placement basis, 2,795,102 Common Shares at a price of C$4.90 per Common Share for aggregate gross proceeds of C$13,696,000.

On June 10, 2024, Solaris filed a preliminary short form base shelf prospectus allowing the Company to offer for sale from time to time, for a 25-month period, Common Shares, debt securities, subscription receipts, Common Share purchase contracts, units and warrants in one or more series or issuances, with a total offering price, in the aggregate, of up to $200 million. On June 14, 2024, Solaris filed a final short form base shelf prospectus with the same offering terms.

On July 22, 2024, Solaris announced an updated mineral resource estimate (“MRE” or the “Resource”) for the Warintza Project.

On July 26, 2024, Solaris announced the appointment of Mr. Arun Lamba as Vice President, Corporate Development.

On September 9, 2024, Solaris announced it has submitted an Environmental Impact Assessment to the Ministry of Environment, Water and Ecological Transition for the construction of the Warintza Project.

On November 20, 2024, Solaris announced that the Company would complete its emigration by year-end (the “Emigration”). As part of the final Emigration steps, the Company’s Canadian offices will be closed, the Company and its subsidiaries will have no individuals in Canada who are employed or self-employed in connection with the Company. In connection with the Emigration, the Company announced the appointment of Mr. Matthew Rowlinson as President and Chief Executive Officer of the Company. Solaris also announced the appointment of Mr. Matthew Rowlinson, Mr. Rodrigo Borja, and Mr. Hans Wick to the Board.

2025

On January 8, 2025, Solaris announced the appointment of Mr. Richard Hughes as Chief Financial Officer and Company Secretary, Mr. Patrick Chambers as Vice President, Investor Relations and Mr. Ignacio Shimamoto as Vice President, Finance. The Company further announced that the final Emigration steps were complete, subject to a few administerial matters.

On March 3, 2025, Solaris announced the formation of an Inter-Institutional working group together with the Pueblo Shuar Arutam organization, Solaris’ host communities of Warints and Yawi and the Ecuadorian State.

Summary

Solaris is a copper-gold exploration and development company, committed to a sustainable future by empowering communities and stakeholders through our dedication to participatory and responsible mining. The Warintza Project, a large copper-gold porphyry deposit, is a unique, global scale asset located in southeast Ecuador. The Company also owns a series of grassroot exploration projects with discovery potential in Peru and Chile and a 60% interest in the La Verde joint-venture project with a subsidiary of Teck Resources in Mexico. The Common Shares trade on the TSX under the symbol “SLS” and on NYSE American under the symbol “SLSR”.

Solaris’ headquarters is located at Neuhofstrasse 5A Baar 6340 Switzerland. Further information is available at www.solarisresources.com.

Specialized Skill and Knowledge

Management is comprised of a team of individuals who have extensive expertise and experience in the mineral exploration industry and exploration finance and are complemented by an experienced Board. See ITEM 12: “Directors and Officers” below.

Competitive Conditions

The Company competes with other mineral exploration and mining companies for mineral properties, joint venture partners, equipment and supplies, qualified personnel and exploration and development capital. See ITEM 7: “Risk Factors” below.

Environmental Protection

The current and future operations of the Company are subject to laws and regulations governing exploration, development, tenure, production, taxes, labour standards, occupational health, waste disposal, greenhouse gas emissions, protection and remediation of the environment, reclamation, mine safety, toxic substances and other matters. Specifically, the Warintza Project is being advanced in accordance with Ecuador’s Mining Law, Environmental Organic Code, Mining Environmental Regulations, Unified Text of Secondary Environmental Legislation, and an array of other applicable norms, standards, laws and regulations.

Compliance with such laws and regulations increases costs and may cause delays in planning, designing, drilling and developing the Warintza Project. The Company attempts to diligently apply technically proven and economically feasible measures to advance protection of the environment throughout the exploration and development process, however it is often impossible to anticipate and mitigate all administrative delays. Currently, costs associated with compliance are considered to be normal compared to other South American countries.

Employees

As of December 31, 2024, the Company directly employed 66 employees.

Foreign Operations

The Company’s mineral properties are located in Ecuador, Mexico, Chile and Peru, and its operations are substantially carried out in those countries. See ITEM 7: “Risk Factors” below.

Social or Environmental Policies