FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of February, 2025

Commission File Number 001-15266

BANK OF CHILE

(Translation of registrant’s name into English)

Ahumada 251

Santiago, Chile

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark whether by furnishing the

information contained in this Form, the

registrant is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________ BANCO DE CHILE REPORT ON FORM 6-K

Attached Banco de Chile’s Consolidated Financial Statements with notes as of December 31, 2024.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 12, 2025

| Banco de Chile | ||

| /S/ Eduardo Ebensperger O. | ||

| By: | Eduardo Ebensperger O. | |

| CEO | ||

2

Exhibit 99.1

CONSOLIDATED FINANCIAL STAXTEMENTS

for the years ended December 31, 2024 and 2023

BANCO DE CHILE AND SUBSIDIARIES

(Free translation of Consolidated Financial Statements originally issued in Spanish)

INDEX

| I. | Consolidated Statements of Financial Position |

| II. | Consolidated Statements of Income |

| III. | Consolidated Statements of Other Comprehensive Income |

| IV. | Consolidated Statements of Cash Flows |

| V. | Consolidated Statements of Changes in Equity |

| VI. | Notes to the Consolidated Financial Statements |

| MCh$ | = | Millions of Chilean pesos |

| BCh$ | = | Billions of Chilean pesos |

| MUS$ | = | Millions of U.S. dollars |

| ThUS$ | = | Thousands of U.S. dollars |

| UF or CLF | = | Unidad de Fomento |

| (The UF is an inflation-indexed, Chilean peso denominated monetary unit set daily in advance on the basis of the previous month’s inflation rate). | ||

| Ch$ or CLP | = | Chilean pesos |

| US$ or USD | = | U.S. dollar |

| JPY | = | Japanese yen |

| EUR | = | Euro |

| HKD | = | Hong Kong dollar |

| CHF | = | Swiss Franc |

| PEN | = | Peruvian sol |

| AUD | = | Australian dollar |

| NOK | = | Norwegian krone |

| MXN | = | Mexican peso |

| IFRS | = | International Financial Reporting Standards |

| IAS | = | International Accounting Standards |

| RAN | = | Actualized Standards Compilation issued by the Chilean Commission for the Financial Market (“CMF”) |

| IFRIC | = | International Financial Reporting Interpretations Committee |

| SIC | = | Standards Interpretation Committee |

BANCO DE CHILE AND SUBSIDIARIES

INDEX

BANCO DE CHILE AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

For the years ended December 31,

(Free translation of Consolidated Financial Statements originally issued in Spanish)

| Notes | 2024 | 2023 | ||||||||

| MCh$ | MCh$ | |||||||||

| ASSETS | ||||||||||

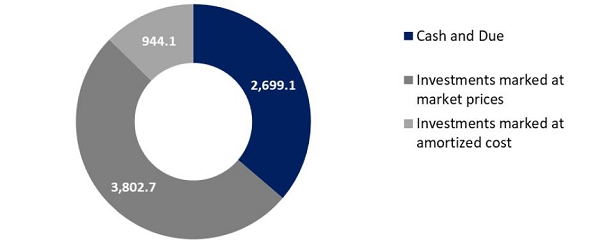

| Cash and due from banks | 7 | 2,699,076 | 2,464,648 | |||||||

| Transactions in the course of collection | 7 | 372,456 | 415,505 | |||||||

| Financial assets held for trading at fair value through profit or loss: | ||||||||||

| Derivative financial instruments | 8 | 2,303,353 | 2,035,376 | |||||||

| Debt financial instruments | 8 | 1,714,381 | 3,363,624 | |||||||

| Others | 8 | 411,689 | 409,328 | |||||||

| Non-trading financial assets mandatorily measured at fair value through profit or loss | 9 | — | — | |||||||

| Financial assets at fair value through profit or loss | 10 | — | — | |||||||

| Financial assets at fair value through other comprehensive income: | ||||||||||

| Debt financial instruments | 11 | 2,088,345 | 3,786,525 | |||||||

| Others | 11 | — | — | |||||||

| Derivative financial instruments for hedging purposes | 12 | 73,959 | 49,065 | |||||||

| Financial assets at amortized cost: | ||||||||||

| Rights from resale agreements and securities lending | 13 | 87,291 | 71,822 | |||||||

| Debt financial instruments | 13 | 944,074 | 1,431,083 | |||||||

| Loans and advances to Banks | 13 | 666,815 | 2,519,180 | |||||||

| Loans to customers - Commercial loans | 13 | 19,724,933 | 19,624,909 | |||||||

| Loans to customers - Residential mortgage loans | 13 | 13,180,186 | 12,269,148 | |||||||

| Loans to customers - Consumer loans | 13 | 5,183,917 | 4,937,679 | |||||||

| Investments in other companies | 14 | 76,769 | 76,994 | |||||||

| Intangible assets | 15 | 158,556 | 137,204 | |||||||

| Property and equipment | 16 | 189,073 | 201,657 | |||||||

| Right-of-use assets | 17 | 96,879 | 108,889 | |||||||

| Current tax assets | 18 | 159,869 | 141,194 | |||||||

| Deferred tax assets | 18 | 556,829 | 539,818 | |||||||

| Other assets | 19 | 1,373,541 | 1,186,013 | |||||||

| Non-current assets and disposal groups held for sale | 20 | 33,450 | 22,891 | |||||||

| TOTAL ASSETS | 52,095,441 | 55,792,552 | ||||||||

The accompanying notes 1 to 49 are an integral part of these consolidated financial statements

BANCO DE CHILE AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

For the years ended December 31,

(Free translation of Consolidated Financial Statements originally issued in Spanish)

| Notes | 2024 | 2023 | ||||||||

| MCh$ | MCh$ | |||||||||

| LIABILITIES | ||||||||||

| Transactions in the course of payment | 7 | 283,605 | 356,871 | |||||||

| Financial liabilities held for trading at fair value through profit or loss: | ||||||||||

| Derivative financial instruments | 21 | 2,444,806 | 2,196,921 | |||||||

| Others | 21 | 990 | 2,305 | |||||||

| Financial liabilities designated as at fair value through profit or loss | 10 | — | — | |||||||

| Derivative Financial Instruments for hedging purposes | 12 | 141,040 | 160,602 | |||||||

| Financial liabilities at amortized cost: | ||||||||||

| Current accounts and other demand deposits | 22 | 14,263,303 | 13,321,660 | |||||||

| Saving accounts and time deposits | 22 | 14,168,703 | 15,365,562 | |||||||

| Obligations by repurchase agreements and securities lending | 22 | 109,794 | 157,173 | |||||||

| Borrowings from financial institutions | 22 | 1,103,468 | 5,360,715 | |||||||

| Debt financial instruments issued | 22 | 9,690,069 | 9,360,065 | |||||||

| Other financial obligations | 22 | 284,479 | 339,305 | |||||||

| Lease liabilities | 17 | 91,429 | 101,480 | |||||||

| Financial instruments of regulatory capital issued | 23 | 1,068,879 | 1,039,814 | |||||||

| Provisions for contingencies | 24 | 194,753 | 192,152 | |||||||

| Provision for dividends, interests and reappraisal of financial instruments of regulatory capital issued | 25 | 597,228 | 611,949 | |||||||

| Special provisions for credit risk | 26 | 774,184 | 769,147 | |||||||

| Currents tax liabilities | 18 | 132 | 808 | |||||||

| Deferred tax liabilities | 18 | 166 | — | |||||||

| Other liabilities | 27 | 1,255,412 | 1,218,738 | |||||||

| Liabilities included in disposal groups held for sale | 20 | — | — | |||||||

| TOTAL LIABILITIES | 46,472,440 | 50,555,267 | ||||||||

| EQUITY | ||||||||||

| Capital | 28 | 2,420,538 | 2,420,538 | |||||||

| Reserves | 28 | 709,742 | 709,742 | |||||||

| Accumulated other comprehensive income | ||||||||||

| Elements that are not reclassified in profit and loss | 28 | 7,552 | 6,756 | |||||||

| Elements that can be reclassified in profit and loss | 28 | (3,775 | ) | 17,486 | ||||||

| Retained earnings from previous years | 28 | 1,878,778 | 1,451,076 | |||||||

| Income for the year | 28 | 1,207,392 | 1,243,634 | |||||||

| Less: Provision for dividends, interests and reappraisal of financial instruments of regulatory capital issued | 28 | (597,228 | ) | (611,949 | ) | |||||

| Shareholders of the Bank | 28 | 5,622,999 | 5,237,283 | |||||||

| Non-controlling interests | 28 | 2 | 2 | |||||||

| TOTAL EQUITY | 5,623,001 | 5,237,285 | ||||||||

| TOTAL LIABILITIES AND EQUITY | 52,095,441 | 55,792,552 | ||||||||

The accompanying notes 1 to 49 are an integral part of these consolidated financial statements

BANCO DE CHILE AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

for the years between January 1, and December 31,

(Free translation of Consolidated Financial Statements originally issued in Spanish)

| Notes | 2024 | 2023 | ||||||||

| MCh$ | MCh$ | |||||||||

| Interest revenue | 30 | 2,919,967 | 3,181,624 | |||||||

| Interest expense | 30 | (1,138,312 | ) | (1,634,708 | ) | |||||

| Net interest income | 1,781,655 | 1,546,916 | ||||||||

| UF indexation revenue | 31 | 829,188 | 832,909 | |||||||

| UF indexation expenses | 31 | (469,992 | ) | (489,165 | ) | |||||

| Net income from UF indexation | 359,196 | 343,744 | ||||||||

| Income from commissions | 32 | 732,922 | 714,380 | |||||||

| Expenses from commissions | 32 | (161,039 | ) | (168,450 | ) | |||||

| Net income from commissions | 571,883 | 545,930 | ||||||||

| Financial income (expense) for: | ||||||||||

| Financial assets and liabilities held for trading | 33 | 102,301 | 351,352 | |||||||

| Non-trading financial assets mandatorily measured at fair value through profit or loss | 33 | — | — | |||||||

| Financial assets and liabilities designated as at fair value through profit or loss | 33 | — | — | |||||||

| Result from derecognition of financial assets and liabilities at amortized cost and financial assets at fair value through other comprehensive income | 33 | 8,289 | (4,181 | ) | ||||||

| Exchange, indexation and accounting hedging of foreign currency | 33 | 164,597 | 120,594 | |||||||

| Reclassification of financial assets for changes in the business model | 33 | — | — | |||||||

| Other financial result | 33 | — | — | |||||||

| Net Financial income (expense) | 33 | 275,187 | 467,765 | |||||||

| Income attributable to investments in other companies | 34 | 17,052 | 14,432 | |||||||

| Result from non-current assets and disposal groups held for sale not admissible as discontinued operations | 35 | (6,465 | ) | 3,146 | ||||||

| Other operating income | 36 | 51,777 | 72,939 | |||||||

| TOTAL OPERATING INCOME | 3,050,285 | 2,994,872 | ||||||||

| Expenses from salaries and employee benefits | 37 | (582,547 | ) | (582,684 | ) | |||||

| Administrative expenses | 38 | (416,696 | ) | (403,255 | ) | |||||

| Depreciation and amortization | 39 | (94,601 | ) | (92,308 | ) | |||||

| Impairment of non-financial assets | 40 | (2,851 | ) | (1,762 | ) | |||||

| Other operating expenses | 36 | (36,039 | ) | (36,090 | ) | |||||

| TOTAL OPERATING EXPENSES | (1,132,734 | ) | (1,116,099 | ) | ||||||

| OPERATING RESULT BEFORE CREDIT LOSSES | 1,917,551 | 1,878,773 | ||||||||

The accompanying notes 1 to 49 are an integral part of these consolidated financial statements

BANCO DE CHILE AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

for the years between January 1, and December 31,

(Free translation of Consolidated Financial Statements originally issued in Spanish)

| Notes | 2024 | 2023 | ||||||||

| MCh$ | MCh$ | |||||||||

| Credit loss expense for: | ||||||||||

| Provisions for credit risk of loans and advances to banks and loans to customers | 41 | (452,448 | ) | (423,015 | ) | |||||

| Special provisions for credit risk | 41 | (3,610 | ) | (3,256 | ) | |||||

| Recovery of written-off credits | 41 | 65,313 | 62,266 | |||||||

| Impairments for credit risk from other financial assets at amortized cost and financial assets at fair value through other comprehensive income | 41 | (1,009 | ) | 2,754 | ||||||

| Credit loss expense | 41 | (391,754 | ) | (361,251 | ) | |||||

| NET OPERATING INCOME | 1,525,797 | 1,517,522 | ||||||||

| Income from continuing operations before tax | 1,525,797 | 1,517,522 | ||||||||

| Income tax | 18 | (318,405 | ) | (273,887 | ) | |||||

| Income from continuing operations after tax | 1,207,392 | 1,243,635 | ||||||||

| Income from discontinued operations before tax | — | — | ||||||||

| Income tax from discontinued operations | 18 | — | — | |||||||

| Income from discontinued operations after tax | 42 | — | — | |||||||

| NET INCOME FOR THE YEAR | 28 | 1,207,392 | 1,243,635 | |||||||

| Attributable to: | ||||||||||

| Shareholders of the Bank | 28 | 1,207,392 | 1,243,634 | |||||||

| Non-controlling interests | — | 1 | ||||||||

| Earnings per share: | $ | $ | ||||||||

| Basic earnings | 28 | 11.95 | 12.31 | |||||||

| Diluted earnings | 28 | 11.95 | 12.31 | |||||||

The accompanying notes 1 to 49 are an integral part of these consolidated financial statements

BANCO DE CHILE AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OTHER COMPREHENSIVE INCOME

for the years between January 1, and December 31,

(Free translation of Consolidated Financial Statements originally issued in Spanish)

| Notes | 2024 | 2023 | ||||||||

| MCh$ | MCh$ | |||||||||

| NET INCOME FOR THE YEAR | 28 | 1,207,392 | 1,243,635 | |||||||

| ITEMS NOT TO BE RECLASSIFIED TO PROFIT OR LOSS | ||||||||||

| Re-measurement of the liability (asset) for net defined benefits and actuarial results for other employee benefit plans | 28 | 115 | (75 | ) | ||||||

| Fair value changes of equity instruments designated as at fair value through other comprehensive income | 28 | (212 | ) | 5,878 | ||||||

| Fair value changes of financial liabilities designated as at fair value through profit or loss attributable to changes in the credit risk of the financial liability | 28 | — | — | |||||||

| Others | 28 | — | — | |||||||

| OTHER COMPREHENSIVE INCOME THAT WILL NOT BE RECLASSIFIED TO PROFIT OR LOSS BEFORE TAX | (97 | ) | 5,803 | |||||||

| Income tax on other comprehensive income that will not be reclassified to profit or loss | 18 | 893 | (1,567 | ) | ||||||

| TOTAL OTHER COMPREHENSIVE INCOME THAT WILL NOT BE RECLASSIFIED TO INCOME AFTER TAXES | 28 | 796 | 4,236 | |||||||

| ELEMENTS THAT CAN BE RECLASSIFIED TO PROFIT OR LOSS | ||||||||||

| Fair value changes of financial assets at fair value through other comprehensive income | 28 | (4,664 | ) | 8,874 | ||||||

| Cash flow hedges | 28 | (21,798 | ) | 113,183 | ||||||

| Participation in other comprehensive income of entities registered under the equity method | 28 | 26 | 116 | |||||||

| OTHER COMPREHENSIVE INCOME THAT WILL BE RECLASSIFIED TO INCOME BEFORE TAXES | (26,436 | ) | 122,173 | |||||||

| Income tax on other comprehensive income that can be reclassified to profit or loss | 28 | 5,175 | (32,365 | ) | ||||||

| TOTAL OTHER COMPREHENSIVE INCOME THAT WILL BE RECLASSIFIED TO PROFIT OR LOSS AFTER TAX | 28 | (21,261 | ) | 89,808 | ||||||

| TOTAL OTHER COMPREHENSIVE INCOME FOR THE YEAR | 28 | (20,465 | ) | 94,044 | ||||||

| CONSOLIDATED COMPREHENSIVE INCOME FOR THE YEAR | 1,186,927 | 1,337,679 | ||||||||

| Attributable to: | ||||||||||

| Shareholders of the Bank | 1,186,927 | 1,337,678 | ||||||||

| Non-controlling interests | — | 1 | ||||||||

The accompanying notes 1 to 49 are an integral part of these consolidated financial statements

BANCO DE CHILE AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

for the years between January 1, and December 31,

(Free translation of Consolidated Financial Statements originally issued in Spanish)

| Notes | 2024 | 2023 | ||||||||

| MCh$ | MCh$ | |||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||||

| Profit for the year before taxes | 1,525,797 | 1,517,522 | ||||||||

| Income tax | 18 | (318,405 | ) | (273,887 | ) | |||||

| Profit for the year after taxes | 1,207,392 | 1,243,635 | ||||||||

| Charges (credits) to income (loss) that do not represent cash flows: | ||||||||||

| Depreciation and amortization | 39 | 94,601 | 92,308 | |||||||

| Impairment of non-financial assets | 40 | 2,851 | 1,762 | |||||||

| Provisions for credit losses | 452,184 | 419,793 | ||||||||

| Provisions for contingencies | 41 | 4,883 | 3,725 | |||||||

| Additional provisions | 41 | — | — | |||||||

| Fair value of debt financial instruments held for trading at fair value through in profit or loss | (1,712 | ) | 2,318 | |||||||

| Change in deferred tax assets and liabilities | 18 | (16,678 | ) | (3,682 | ) | |||||

| Net (income) loss from investments in companies with significant influence | 34 | (8,730 | ) | (13,409 | ) | |||||

| Net (income) loss on sale of assets received in payments | (1,271 | ) | (1,629 | ) | ||||||

| Net (income) loss on sale of sale of fixed assets | 35 | (938 | ) | (2,971 | ) | |||||

| Write-offs of assets received in payment | 35 | 14,942 | 5,252 | |||||||

| Other charges (credits) that do not represent cash flows | 8,739 | (9,953 | ) | |||||||

| Changes due to (increase) decrease in assets and liabilities affecting the operating flow: | ||||||||||

| Net ( increase ) decrease in accounts receivable from banks | 1,853,194 | (340,369 | ) | |||||||

| Net ( increase ) decrease in loans and accounts receivables from customers | (1,566,163 | ) | (1,062,775 | ) | ||||||

| Net ( increase ) decrease of debt financial instruments held for trading at fair value through profit or loss | 297,364 | (323,475 | ) | |||||||

| Net ( increase ) decrease in other assets and liabilities | (261,262 | ) | (116,853 | ) | ||||||

| Increase ( decrease ) in deposits and other demand obligations | 942,650 | (59,946 | ) | |||||||

| Increase ( decrease ) in repurchase agreements and securities loans | (55,184 | ) | (59,887 | ) | ||||||

| Increase ( decrease ) in deposits and other time deposits | (1,167,941 | ) | 1,288,027 | |||||||

| Sale of assets received in lieu of payment | 19,556 | 14,227 | ||||||||

| Increase ( decrease ) in obligations with foreign banks | 91,361 | (42,479 | ) | |||||||

| Increase ( decrease ) in other financial obligations | (54,802 | ) | (4,646 | ) | ||||||

| Increase ( decrease ) in obligations with the Central Bank of Chile | (4,348,400 | ) | — | |||||||

| Net change in exchange rates, interest, readjustments and commissions accrued on assets and liabilities | 547,180 | 248,462 | ||||||||

| Net increase ( decrease ) of debt financial instruments at fair value through other comprehensive income | 1,611,197 | 257,613 | ||||||||

| Net (increase) decrease of financial instruments at amortized cost | 506,337 | (493,631 | ) | |||||||

| Total net cash flows provided by (used in) operating activities | 171,350 | 1,041,417 | ||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||||

| Leasehold improvements | 17 | (872 | ) | (1,993 | ) | |||||

| Fixed assets purchase | 16 | (16,354 | ) | (24,751 | ) | |||||

| Fixed assets sale | 1,294 | 3,626 | ||||||||

| Disposal of investments in companies | 11,791 | — | ||||||||

| Acquisition of intangibles | 15 | (57,617 | ) | (59,955 | ) | |||||

| Acquisition of investments in companies | 14 | — | — | |||||||

| Dividend received of investments in companies | 3,416 | 5,698 | ||||||||

| Total net cash flows from (used in) investing activities | (58,342 | ) | (77,375 | ) | ||||||

| CASH FLOW FROM FINANCING ACTIVITIES: | ||||||||||

| Attributable to the interest of the owners: | ||||||||||

| Redemption and payment of interest of letters of credit | (639 | ) | (1,012 | ) | ||||||

| Redemption and payment of interest on current bonds | (1,447,751 | ) | (1,813,176 | ) | ||||||

| Redemption and payment of interest on subordinated bonds | (50,637 | ) | (52,199 | ) | ||||||

| Current bonds issuance | 22 | 1,012,638 | 1,224,480 | |||||||

| Subordinated bonds issuance | — | — | ||||||||

| Payment of common stock dividends | 28 | (815,932 | ) | (866,929 | ) | |||||

| Principal and interest payments for obligations under lease contracts | 17 | (29,991 | ) | (32,084 | ) | |||||

| Attributable to non-controlling interest: | ||||||||||

| Dividend payment and/or withdrawals of paid-in capital in respect of the subsidiaries corresponding to the non-controlling interest | — | (1 | ) | |||||||

| Total net cash flows from (used in) financing activities | (1,332,312 | ) | (1,540,921 | ) | ||||||

| VARIATION IN CASH AND CASH EQUIVALENTS DURING THE YEAR | (1,219,304 | ) | (576,879 | ) | ||||||

| Effect of exchange rate changes on cash and cash equivalents | 164,743 | 15,637 | ||||||||

| Opening balance of cash and cash equivalent | 7 | 5,544,147 | 6,105,389 | |||||||

| Final balance of cash and cash equivalent | 7 | 4,489,586 | 5,544,147 | |||||||

| 2024 | 2023 | |||||||

| MCh$ | MCh$ | |||||||

| Interest operating cash flow: | ||||||||

| Interest and readjustments received | 3,645,741 | 3,591,440 | ||||||

| Interest and readjustments paid | (1,570,720 | ) | (2,138,298 | ) | ||||

The accompanying notes 1 to 49 are an integral part of these consolidated financial statements

BANCO DE CHILE AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

for the years between January 1, and December 31,

(Free translation of Consolidated Financial Statements originally issued in Spanish)

Reconciliation of liabilities arising from financing activities:

| Changes other than Cash | ||||||||||||||||||||||||

| 12.31.2023 | Net Cash Flow | Acquisition / (Disposals) |

Foreign currency | UF Movement | 12.31.2024 | |||||||||||||||||||

| MCh$ | MCh$ | MCh$ | MCh$ | MCh$ | MCh$ | |||||||||||||||||||

| Letters of credit | 1,444 | (639 | ) | — | — | 45 | 850 | |||||||||||||||||

| Bonds | 10,398,435 | (485,750 | ) | — | 186,420 | 658,993 | 10,758,098 | |||||||||||||||||

| Dividends paid | — | (815,932 | ) | — | — | — | (815,932 | ) | ||||||||||||||||

| Obligations for lease contracts | 101,480 | (29,991 | ) | 13,956 | — | 5,984 | 91,429 | |||||||||||||||||

| Dividend payment and/or withdrawals of paid-in capital in respect of the subsidiaries corresponding to the non-controlling interest | — | — | — | — | — | — | ||||||||||||||||||

| Total liabilities from financing activities | 10,501,359 | (1,332,312 | ) | 13,956 | 186,420 | 665,022 | 10,034,445 | |||||||||||||||||

The accompanying notes 1 to 49 are an integral part of these consolidated financial statements

BANCO DE CHILE AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

for the years between January 1, and December 31, 2024 and 2023

(Free translation of Consolidated Financial Statements originally issued in Spanish)

| Attributable to shareholders of the Bank | ||||||||||||||||||||||||||||||

| Note | Capital | Reserves | Accumulated other comprehensive income | Retained earnings from previous years and income (loss) for the year | Total | Non-controlling interests | Total Equity | |||||||||||||||||||||||

| MCh$ | MCh$ | MCh$ | MCh$ | MCh$ | MCh$ | MCh$ | ||||||||||||||||||||||||

| Opening balances as of January 1, 2023 | 2,420,538 | 709,742 | (69,802 | ) | 1,797,847 | 4,858,325 | 2 | 4,858,327 | ||||||||||||||||||||||

| Dividends distributed and paid | 28 | — | — | — | (866,929 | ) | (866,929 | ) | (1 | ) | (866,930 | ) | ||||||||||||||||||

| Application of provision for payment of common stock dividends | — | — | — | 520,158 | 520,158 | — | 520,158 | |||||||||||||||||||||||

| Provision for payment of common stock dividends | 28 | — | — | — | (611,949 | ) | (611,949 | ) | — | (611,949 | ) | |||||||||||||||||||

| Subtotal: transactions with owners during the year | — | — | — | (958,720 | ) | (958,720 | ) | (1 | ) | (958,721 | ) | |||||||||||||||||||

| Income for the year 2023 | 28 | — | — | — | 1,243,634 | 1,243,634 | 1 | 1,243,635 | ||||||||||||||||||||||

| Other comprehensive income for the year | 28 | — | — | 94,044 | — | 94,044 | — | 94,044 | ||||||||||||||||||||||

| Subtotal: Comprehensive income for the year | — | — | 94,044 | 1,243,634 | 1,337,678 | 1 | 1,337,679 | |||||||||||||||||||||||

| Balances as of December 31, 2023 | 2,420,538 | 709,742 | 24,242 | 2,082,761 | 5,237,283 | 2 | 5,237,285 | |||||||||||||||||||||||

| Opening balances as of January 1, 2024 | 2,420,538 | 709,742 | 24,242 | 2,082,761 | 5,237,283 | 2 | 5,237,285 | |||||||||||||||||||||||

| Dividends distributed and paid | 28 | — | — | — | (815,932 | ) | (815,932 | ) | — | (815,932 | ) | |||||||||||||||||||

| Application of provision for payment of common stock dividends | 28 | — | — | — | 611,949 | 611,949 | — | 611,949 | ||||||||||||||||||||||

| Provision for payment of common stock dividends | 28 | — | — | — | (597,228 | ) | (597,228 | ) | — | (597,228 | ) | |||||||||||||||||||

| Subtotal: transactions with owners during the year | — | — | — | (801,211 | ) | (801,211 | ) | — | (801,211 | ) | ||||||||||||||||||||

| Income for the year 2024 | 28 | — | — | — | 1,207,392 | 1,207,392 | — | 1,207,392 | ||||||||||||||||||||||

| Other comprehensive income for the year | 28 | — | — | (20,465 | ) | — | (20,465 | ) | — | (20,465 | ) | |||||||||||||||||||

| Subtotal: Comprehensive income for the year | — | — | (20,465 | ) | 1,207,392 | 1,186,927 | — | 1,186,927 | ||||||||||||||||||||||

| Balances as of December 31, 2024 | 2,420,538 | 709,742 | 3,777 | 2,488,942 | 5,622,999 | 2 | 5,623,001 | |||||||||||||||||||||||

The accompanying notes 1 to 49 are an integral part of these consolidated financial statements

BANCO DE CHILE AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

As of December 31, 2024 and 2023

(Free translation of Consolidated Financial Statements originally issued in Spanish)

| 1. | Company information: |

Banco de Chile is authorized to operate as a commercial bank since September 17, 1996, being, in conformity with the stipulations of article 25 of Law No. 19,396, the legal continuation of Banco de Chile resulting from the merger of the Banco Nacional de Chile, Banco Agrícola and Banco de Valparaiso, which was constituted by public deed dated October 28, 1893, granted before the Notary Public of Santiago, Mr. Eduardo Reyes Lavalle, authorized by Supreme Decree of November 28, 1893.

The Bank is a Corporation organized under the laws of the Republic of Chile, regulated by the Chilean Commission for the Financial Market (“CMF”). Since 2001, it is subject to the supervision of the Securities and Exchange Commission of the United States of America (“SEC”), in consideration of the fact that the Bank is registered on the New York Stock Exchange (“NYSE”), through a program of American Depositary Receipt (“ADR”).

Banco de Chile offers a broad range of banking services to its customers, ranging from individuals to large corporations. Additionally, the Bank offers international as well as treasury banking services, in addition to those offered by subsidiaries that include securities brokerage, mutual fund and investment management, insurance brokerage and financial advisory services.

Banco de Chile’s legal address is Ahumada 251, Santiago, Chile and its website is www.bancochile.cl.

The accompanying notes 1 to 49 are an integral part of these consolidated financial statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used: |

| (a) | Legal Dispositions: |

Decree Law No. 3,538 of 1980, according to the text replaced by the first article of Law No. 21,000 that “Creates the Commission for the Financial Market”, provides in numeral 6 of its article 5 that the Commission for the Market Financial (“CMF”) may “set the standards for the preparation and presentation of reports, balance sheets, statements of situation and other financial statements of the audited entities and determine the principles under which they must keep their accounting”.

According to the current legal framework, banks must use the accounting principles provided by the CMF and in everything that is not dealt with by it or in contravention of its instructions, they must adhere to the generally accepted accounting principles, which correspond to the technical standards issued by the College of Accountants of Chile AG, coinciding with the International Financial Reporting Standards (“IFRS”) agreed by the International Accounting Standards Board (“IASB”). If there are discrepancies between these accounting principles of general acceptance and the accounting criteria issued by the CMF, the latter shall prevail.

The notes to the Consolidated Financial Statements contain additional information to that presented in the Consolidated Statement of Financial Position, Consolidated Statement of Income, Consolidated Statement of Other Comprehensive Income, Consolidated Statement of Changes in Equity and Consolidated Statement of Cash Flows. They provide narrative descriptions or disaggregation of such statements in a clear, relevant, reliable and comparable way.

| (b) | Basis of Consolidation: |

The Consolidated Financial Statements of Banco de Chile as of December 31, 2024 and 2023, have been consolidated with its subsidiaries, using the global integration method (line-by-line). They include preparation of individual Financial Statements of the Bank and companies that participate in the consolidation and it include adjustments and reclassifications necessary to homologue accounting policies and valuation criteria applied by the Bank. The Consolidated Financial Statements have been prepared using the same accounting policies for similar transactions and other events, in equivalent circumstances.

Significant intercompany transactions and balances (assets and liabilities, equity, income, expenses and cash flows) originated in operations performed between the Bank and its subsidiaries and between subsidiaries have been eliminated in the consolidation process. The non-controlling interest corresponding to the participation percentage of third parties in subsidiaries, which the Bank does not own directly or indirectly, has been recognized and is shown separately in the consolidated shareholders’ equity and consolidated income statement of Banco de Chile.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

| − | Controlled companies (Subsidiaries): |

Consolidated Financial Statements as of December 31, 2024 and 2023 incorporate Financial Statements of the Bank and the controlled companies (subsidiaries) in accordance with IFRS 10 “Consolidated Financial Statements”.

The entities controlled by the Bank and which form parts of the consolidation are detailed as follows:

| Interest Owned | ||||||||||||||||||||||||||||||

| Direct | Indirect | Total | ||||||||||||||||||||||||||||

| Functional | December | December | December | December | December | December | ||||||||||||||||||||||||

| Rut | Entity | Country | Currency | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||

| % | % | % | % | % | % | |||||||||||||||||||||||||

| 96,767,630-6 | Banchile Administradora General de Fondos S.A. | Chile | Ch$ | 99.98 | 99.98 | 0.02 | 0.02 | 100.00 | 100.00 | |||||||||||||||||||||

| 96,543,250-7 | Banchile Asesoría Financiera S.A. | Chile | Ch$ | 99.96 | 99.96 | — | — | 99.96 | 99.96 | |||||||||||||||||||||

| 77,191,070-K | Banchile Corredores de Seguros Ltda. | Chile | Ch$ | 99.83 | 99.83 | 0.17 | 0.17 | 100.00 | 100.00 | |||||||||||||||||||||

| 96,571,220-8 | Banchile Corredores de Bolsa S.A. | Chile | Ch$ | 99.70 | 99.70 | 0.30 | 0.30 | 100.00 | 100.00 | |||||||||||||||||||||

| 96,645,790-2 | Socofin S.A. | Chile | Ch$ | 99.00 | 99.00 | 1.00 | 1.00 | 100.00 | 100.00 | |||||||||||||||||||||

| 77,955,969-6 | Operadora de Tarjetas B-Pago S.A. (*) | Chile | Ch$ | 99.90 | — | 0.10 | — | 100.00 | — | |||||||||||||||||||||

| (*) | On July 29, 2024, the public deed of incorporation of the subsidiary company of Banco de Chile was signed, Operadora de Tarjetas B-Pago S.A. |

| − | Investments in associates and joint ventures: |

Associated entities are those over which the Bank has the capacity to exercise significant influence, without having control over the associate.

Investments in associates where exists significant influence, are accounted for using the equity method (Note No. 14).

Joint Ventures are joint arrangements whereby the parties that have joint control of the arrangement have rights to the net assets of the arrangement. Joint control exists only when decisions about the relevant activities require the unanimous consent of the parties sharing control.

Investments defined as a “Joint Venture” will be registered according to the equity method.

The investment in other companies that, due to its characteristics, is defined as “Joint Venture” is Servipag Ltda.

| − | Minority investments in other companies: |

On initial recognition, the Bank and subsidiaries may make an irrevocable election to present in other comprehensive income subsequent changes in the fair value of an investment in an equity instrument that is not held for trading and is not contingent consideration recognized by an acquirer in a business combination to which IFRS 3 applies.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

| − | Fund administration: |

The Bank and its subsidiaries manage and administer assets held in mutual funds and other investment products on behalf of investors, perceiving a payment according to the service provided and market conditions. Managed resources are owned by third parties and, therefore, not included in the Consolidated Statements of Financial Position.

According to established in IFRS 10, for consolidation purposes is necessary to assess the role of the Bank and its subsidiaries with respect to the funds they manage, must determine whether that role is Agent or Principal.

The Bank and its subsidiaries manage on behalf and for the benefit of investors, acting in that relationship only as Agent. Under this category, and as provided in the aforementioned regulation, it does not control such funds when exercise its authority to make decisions. Therefore, as of December 31, 2024 and 2023 act as agent, and therefore do not consolidate any fund, no funds are part of the consolidation.

| (c) | Non-controlling interest: |

Non-controlling interest represents the share of losses, income and net assets of which, directly or indirectly, the Bank does not own. It is presented separately from the equity of the owners of the Bank in the Consolidated Statements of Income and the Consolidated Statements of Financial Position.

| (d) | Use of Estimates and Judgment: |

Preparing Consolidated Financial Statements requires Management to make judgments, estimations and assumptions that affect the application of accounting policies and the valuation of assets, liabilities, income and expenses presented. Real results could differ from these estimated amounts. The estimates made refer to:

| - | Losses due to impairment of assets and liabilities (Notes No. 11, 13, 15, 16, 17 and No. 40); |

| - | Provision for credit risk (Notes No. 13, 26 and 41); |

| - | Expenses for amortization of intangible assets, depreciation of property and equipment and leased assets and lease liabilities (Notes No. 15, 16 and 17); |

| - | Income taxes and deferred taxes (Note No. 18); |

| - | Provisions (Note No. 24); |

| - | Contingencies and Commitments (Note No. 29); |

| - | Fair value of financial assets and liabilities (Notes No. 8, 11, 12, 21 and 44). |

Estimates and relevant assumptions are regularly reviewed by the management in order to quantify certain assets, liabilities, income, expenses and commitments.

During the year ended December 31, 2024 there have been no significant changes in the estimates made.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

| (e) | Financial Assets: |

The classification, measurement and presentation of financial assets has been carried out based on the standards issued by the CMF in the Compendium of Accounting Standards for Banks “CASB” or “CNCB” (as abbreviated in Spanish), considering the criteria described below:

Classification of financial assets:

On initial recognition, a financial asset is classified within the following categories: Financial assets held for trading at fair value through profit or loss; Financial assets not held for trading mandatorily valued at fair value through profit or loss; Financial assets designated as at fair value through profit or loss; Financial assets at fair value through other comprehensive income and Financial assets at amortized cost.

The criteria for classifying financial assets, which incorporates the standards defined in IFRS 9, depends on the business model with which the entity manages the assets and the contractual characteristics of the cash flows, commonly known as “Solely Payments of Principal and Interest” (SPPI) criterion.

The valuation of these assets should reflect how the Bank manages groups of financial assets and does not depend on the intent for an individual instrument.

A financial asset should be valued at amortized cost if both of the following conditions are met:

| - | It is held within a business model whose objective is to hold financial assets in order to collect contractual cash flows and |

| - | The contractual terms of the financial asset give rise to cash flows that are solely payments of principal and interest. |

A debt financial instrument must be valued at fair value with changes in “Other comprehensive income” if the following two conditions are met:

| - | It is held within a business model whose objective is achieved by both collecting contractual cash flows and selling financial assets and |

| - | The contractual terms of the financial asset give rise to cash flows that are solely payments of principal and interest on the principal amount outstanding. |

A debt financial instrument will be classified at fair value through profit or loss whenever, due to the business model or the characteristics of its contractual cash flows, it is not appropriate to classify it in any of the other categories described.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

Valuation of financial assets:

Initial recognition:

Financial assets are initially recognized at fair value plus, in the case of a financial asset that is not carried at fair value through profit or loss, the transaction costs that are directly attributable to its purchase or issuance, using the Effective Interest Rate method (EIT). The calculation of the EIT includes all fees and other items paid or received that are part of the EIT. Transaction costs include incremental costs that are directly attributable to the acquisition or issuance of a financial asset.

Post measurement:

All variations in the value of financial assets due to the accrual of interest and items assimilated to interest are recorded in “Interest income” or “Interest expense” of the Consolidated Income Statement for the year in which the accrual occurred, except for trading derivatives that are not part of accounting hedges.

The changes in the valuations that occur after the initial registration for reasons other than those mentioned in the previous paragraph, are treated as described below, based on the categories in which the financial assets are classified.

Financial assets held for trading at fair value through profit or loss, Financial assets not held for trading mandatorily valued at fair value through profit or loss and Financial assets designated as at fair value through profit or loss:

In “Financial assets held for trading at fair value through profit or loss” will record financial assets whose business model aims to generate profits through purchases and sales or to generate results in the short term.

The financial assets recorded under “Financial assets not held for trading mandatorily valued at fair value through profit or loss” are assigned to a business model whose objective is achieved by obtaining contractual cash flows and/or selling financial assets but where the cash flows contracts have not met the conditions of the SPPI test.

In “Financial assets designated as at fair value through profit or loss” financial assets will be classified only when such designation eliminates or significantly reduces the inconsistency in the valuation or in the recognition that would arise from valuing or recognizing the assets on a different basis.

The assets recorded in these items are valued after their acquisition at their fair value and changes in their value are recorded, at their net amount, under “Financial assets and liabilities held for trading”, “Financial assets and liabilities financial assets not held for trading mandatorily valued at fair value through profit or loss” and “Financial assets and liabilities designated as at fair value through profit or loss” of the Consolidated Income Statement. Variations originated from exchange differences are recorded under “Foreign currency changes, UF indexation and accounting hedge” in the Consolidated Income Statement.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

Financial assets at fair value through other comprehensive income:

| − | Debt financial instruments: |

The assets recorded in this item are valued at their fair value, interest income and UF indexation of these instruments, as well as exchange differences and impairment arising, are recorded in the Consolidated Statement of Income, while subsequent variations in their valuation are temporarily recorded (for its amount net of taxes) in “Changes in the fair value of financial assets at fair value through other comprehensive income” of the Consolidated Statements of Other Comprehensive Income.

The amounts recorded in “Changes in the fair value of financial assets at fair value through other comprehensive income” continue to form part of the Bank’s consolidated equity until the asset is derecognized in the consolidated balance. In the case of selling these assets, the result is recognized in “Financial result for derecognizing financial assets and liabilities at amortized cost and financial assets at fair value with changes in others comprehensive income” of the Consolidated Income Statement.

Net losses due to impairment of financial assets at fair value through other comprehensive income produced in the year are recorded in “Impairment due to credit risk of other financial assets at amortized cost and financial assets at fair value through other comprehensive income” of the Consolidated Income Statement.

| − | Equity financial instruments: |

At the time of initial recognition, the Bank may make the irrevocable decision to present subsequent changes in fair value in other comprehensive income. Subsequent variations in this valuation will be recognized in “Changes in the fair value of equity instruments designated as at fair value through other comprehensive income”. The dividends received from these investments are recorded in “Income from investments in companies” of the Consolidated Income Statement. These instruments are not subject to the impairment model of IFRS 9.

| − | Financial assets at amortized cost: |

The assets recorded in this item of the Consolidated Statement of Financial Position are valued after their acquisition at their “amortized cost”, in accordance with the “effective interest rate” method. They are subdivided according to the following:

| - | Investment under resale agreements and securities loans (Note No. 13 (a)). |

| - | Debt financial instruments (Note No. 13 (b)). |

| - | Due from banks (Note No. 13 (c)). |

| - | Loans and accounts receivable from customers (Note No. 13 (d)). |

Losses due to impairment of these assets generated in each year are recorded in “Provisions for credit risk and loans and accounts receivable from customers” and “Impairment due to credit risk of other financial assets at amortized cost and financial assets at fair value through other comprehensive income” of the Consolidated Income Statement.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

| − | Investment under resale agreements, obligations under repurchase agreements and securities loans: |

Resale agreement operations are carried out as a form of investment. Under these agreements, financial instruments are purchased, which are included as assets in “Investment under resale agreements and securities loans”, which are valued according to the interest rate of the agreement through the amortized cost method. In accordance with current regulations, the Bank does not record as its own portfolio those papers purchased under resale agreements.

Repurchase agreement operations are also carried out as a form of financing, which are included as liabilities in “Obligations for repurchase agreements and securities loans”. In this regard, the investments that are sold subject to a repurchase obligation and that serve as collateral for the loan correspond to debt financial instruments. The obligation to repurchase the investment is classified in liabilities as “Obligations under repurchase agreements and securities loans” and is valued according to the interest rate of the agreement.

| − | Debt financial instruments at amortized cost: |

These instruments are recorded at their cost value plus accrued interest and UF indexation, less provision for impairment constituted when their recorded amount is greater than the estimated amount of recovery. Interest and UF indexation of debt financial instrument at amortized cost are included in “Interest income” and “UF indexation income”.

| − | Loans and Advances to Banks: |

This item shows the balances of operations with local and abroad banks, including the Central Bank of Chile and foreign Central Banks.

| − | Loans and accounts receivable from customers: |

Loans to customers include originated and purchased non-derivative financial assets with fixed or determinable payments that are not quoted in an active market and which the Bank does not intend to sell immediately or in the short term.

| (i) | Valuation method |

They are initially measured at cost plus incremental transaction costs and income, and subsequently measured at amortized cost, using the effective interest rate method, less any impairment loss, except when the Bank defined some loans as hedged items, measured at fair value through profit or loss as described in letter (p) of this note.

| (ii) | Lease contracts |

These are included under the item “Loans to customers” correspond to periodic rent installments of contracts which meet the definition to be classified as financial leases and are presented at their nominal value net of unearned interest as of each year-end.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

| (iii) | Factoring transactions |

They are valued for the amounts disbursed by the Bank in exchange for invoices or other commercial instruments representative of credit, with or without responsibility of the grantor, received in discount. Price differences between the amounts disbursed and the nominal value of the credits are recorded in the result as interest income, through the effective interest method, during the financing period. In those cases, where the transfer of these instruments it was made without responsibility of the grantor, it is the Bank who assumes the insolvency risks of those required to pay.

| (f) | Credit risk allowance: |

The Bank permanently evaluates the entire portfolio of loans and contingent loans, with the aim of establishing the necessary and sufficient provisions in a timely manner to cover the expected losses associated with the characteristics of the debtors and their credits, based on the payment and subsequent recovery.

Allowances are required to cover the risk of loan losses have been established in accordance with the instructions issued by the CMF. The loans are presented net of those allowances and, in the case of contingent loans are shown in liabilities under the item “Special provisions for credit risk”.

In accordance with what is stipulated by the CMF, models or methods are used based on an individual and group analysis of debtors, to establish allowance for loan losses. The Bank’s Board of Directors approves said models, as well as modifications to their design and application.

(i) Allowance for individual evaluations:

An individual analysis of debtors is applied to companies that are of such significance with respect to size, complexity or level of exposure to the bank, that they must be analyzed in detail.

Likewise, the analysis of borrowers focuses on its credit quality related to the capacity and willingness to meet their credit obligations, through sufficient and reliable information, and should also be analyzed in terms of guarantees, terms, interest rates, currency and revaluation, etc.

For purposes of establish the allowances, the banks must assess the credit quality, then classify to one of three categories of loans portfolio: Normal, Substandard and Non-Complying Loans, it must classify the debtors and their operations related to loans and contingent loans in the categories that apply.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

| − | Normal Loans and Substandard Loans: |

Normal loans: includes those debtors whose payment capacity allows them to meet their obligations and commitments, and according to the evaluation of their economic-financial situation no change in this condition are displayed. Loans classified in categories A1 through A6.

Substandard loans: includes all borrowers with insufficient payment capacity or significant deterioration of payment capacity that may be reasonably expected not to comply with all principal and interest payments obligations set forth in the credit agreement, showing a low flexibility to meet its financial obligations in the short term.

They are also part of the Substandard Portfolio those debtors who have shown arrears of more than 30 days in the recent past. The classifications assigned to this portfolio are categories B1 to B4 of the rating scale.

As a result of individual analysis of the debtors, the Bank must classify them in the following categories, assigning, subsequently, the percentage of probability of default and loss given default resulting in the following percentage of expected loss:

| Type of portfolio | Category of the debtors |

Probability of default (%) PD |

Loss given default (%) LGD |

Expected loss (%) EL |

||||||||||

| Normal Loans | A1 | 0.04 | 90.0 | 0.03600 | ||||||||||

| A2 | 0.10 | 82.5 | 0.08250 | |||||||||||

| A3 | 0.25 | 87.5 | 0.21875 | |||||||||||

| A4 | 2.00 | 87.5 | 1.75000 | |||||||||||

| A5 | 4.75 | 90.0 | 4.27500 | |||||||||||

| A6 | 10.00 | 90.0 | 9.00000 | |||||||||||

| Substandard Loans | B1 | 15.00 | 92.5 | 13.87500 | ||||||||||

| B2 | 22.00 | 92.5 | 20.35000 | |||||||||||

| B3 | 33.00 | 97.5 | 32.17500 | |||||||||||

| B4 | 45.00 | 97.5 | 43.87500 | |||||||||||

Allowances for Normal and Substandard Loans:

To determine the amount of allowances to be constitute for normal and substandard portfolio, previously should be estimated the exposure to subject to the allowances, which will be applied to respective expected loss, which consist of probability of default (PD) and loss given default (LGD) established for the category in which the debtor and/or guarantor belong, as appropriate.

The exposure affects to allowances applicable to loans plus contingent loans minus the amounts to be recovered by way of the foreclosure of financial or real guarantees of the operations. Loans mean the book value of credit of the respective debtor, while for contingent loans, the value resulting from to apply the indicated in No. 3 of Chapter B-3 of the CNCB.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

In the case of real guarantees, the Bank must demonstrate that the value assigned to this deduction reasonably reflects the value that it would obtain in the sale of the assets or capital instruments. Also, in qualified cases, the direct debtor’s credit risk may be substituted for the credit quality of the guarantor. In no case may the guaranteed securities be discounted from the amount of the exposure, since this procedure is only applicable when it comes to financial or real guarantees.

For calculation purposes, the following must be considered:

Provision debtor = (ESA-GE) x (PDdebtor /100) x (LGDdebtor /100) + GE x (PDguarantor /100) x (LGDguarantor /100)

Where:

| ESA | = | Exposure subject to allowances, (Loans + Contingent Loans) – Financial Guarantees |

| GE | = | Guaranteed exposure |

However, the Bank must maintain a minimum provision level of 0.50% over normal portfolio and contingent loans.

| − | Non-complying Loans: |

The non-complying portfolio includes the debtors and their credits for which their recovery is considered remote, as they show an impaired or no payment capacity. This category comprises all debtors who have stopped paying their creditors or with visible evidence that they will stop doing so, as well as those for which a forced restructuring of their debts is necessary, reducing the obligation or postponing the payment of the principal or interest and, in addition, any debtor that has 90 days overdue or more in the payment of interest or principal of any credit. This portfolio is composed of the debtors belonging to categories C1 to C6 of the rating scale and all credits, including 100% of the amount of contingent loans, held by those same debtors.

For purposes to establish the allowances on the non-complying loans, the Bank disposes the use of percentage of allowances to be applied on the amount of exposure, which corresponds to the amount of loans and contingent loans that maintain the same debtor. To apply that percentage, must be estimated an expected loss rate, less the amount of the exposure the recoveries by way of foreclosure of financial or real guarantees that to support the operation and, if there are available specific background, also must be deducting present value of recoveries obtainable exerting collection actions, net of expenses associated with them. This loss percentage must be categorized in one of the six levels defined by the range of expected actual losses by the Bank for all transactions of the same debtor.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

These categories, their range of loss as estimated by the Bank and the percentages of allowance that must be applied on the amount of exposures, are listed in the following table:

| Type of portfolio | Scale of risk | Expected Loss Range | Allowance (%) | |||||

| Non-complying loans | C1 | Up to 3% | 2 | |||||

| C2 | More than 3% up to 20% | 10 | ||||||

| C3 | More than 20% up to 30% | 25 | ||||||

| C4 | More than 30 % up to 50% | 40 | ||||||

| C5 | More than 50% up to 80% | 65 | ||||||

| C6 | More than 80% | 90 | ||||||

For calculation purposes, the following must be considered:

| Expected Loss Rate | = (E−R)/E | |

| Allowance | = E × (AP/100) |

Where:

| E | = Exposure Amount |

| R | = Recoverable Amount |

| AP | = Allowance Percentage (according to the category in which the Expected Loss Rate should be assigned). |

All credits of the debtor must be kept in the Default Portfolio until there is a normalization of their ability or payment behavior, without prejudice to punishment of each particular credit that meets the condition indicated in Title II of Chapter B-2 of the Compendium of Accounting Standards for Banks. To remove a debtor from the Default Portfolio, once the circumstances that lead to classification in this portfolio according to these regulations have been overcome, at least the following copulative conditions must be met:

| - | No obligation of the debtor with the bank with more than 30 calendar days overdue. |

| - | No new refinances granted to pay its obligations. |

| - | At least one of the payments includes amortization of capital. |

| - | If the debtor has a credit with partial payment periods less than six months, has already made two payments. |

| - | If the debtor must pay monthly fees for one or more credits, has paid four consecutive dues. |

| - | The debtor does not have direct debts unpaid in the CMF recast information, except in the case of insignificant amounts. |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

(ii) Allowances for group evaluations

Group evaluations are relevant for residential mortgage and consumer loan exposures, in addition to commercial exposures related to student loans and exposures with debtors that simultaneously meet the following conditions:

| - | The Bank has an aggregate exposure to the same counterparty of less than 20,000 UF. The aggregate exposure should require gross provisions or other mitigations. In addition, for its computation, mortgage loans must be excluded. In the case of off-balance sheet items, the gross amount is calculated by applying the credit conversion factors, defined in chapter B-3 of the CASB. To determine the aggregate exposure, the bank must consider the definition of corporate group established in Title II of Chapter 12-16 of the Actualized Standards Compilation. |

Banks must carry out a complete and permanent monitoring of all operations with entities belonging to business groups. Considering the costs that may result the conformation of groups for all debtors, the bank must at least keep control and form groups, if applicable, for all debtors who maintain a current exposure greater than a minimum amount established by the banking institution which may not be greater than 1% of its effective equity at the time the definition of the group portfolio is made.

| - | Each aggregate exposure to the same counterparty does not exceed 0.2% of the total commercial group portfolio. To avoid circular computation, the criterion will be checked only once. |

For the remaining commercial credit exposures, the individual analysis model of the debtors must be applied.

The determination of the type of analysis (group or individual) must be carried out at the global consolidated level, once a year, or after significant adjustments in the Bank’s portfolio, such as mergers, acquisitions, purchases or significant portfolio sales.

To determine the allowances, the group evaluations require the formation of groups of loans with similar characteristics in terms of type of debtors and conditions agreed, to establish technically based estimates by prudential criteria and following both the payment behavior of the group that concerned as recoveries of defaulted loans and consequently provide the necessary provisions to cover the risk of the portfolio.

To determine its provisions, the Bank segments its debtors into homogeneous groups, according described above, associating to each group a determined probability of default and a percentage of recovery based in a historic analysis. The amount of provisions to register it will be obtained multiplied the total loans of respective group by the percentages of estimated default and of loss given the default, the estimated losses must be related to the type of portfolio and the term of the operations.

The Bank discriminates between provisions on the normal portfolio and on the portfolio in default, and those that protect the risks of contingent credits associated with those portfolios.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

| − | Standard method of provisions for group portfolio |

The standard methodologies presented below establish the variables and parameters that determine the provision factor for each type of portfolio that the CMF has defined as representative, according to the common characteristics shared by the operations that comprise them.

| (a) | Residential mortgage portfolio |

The provision factor applicable, represented by expected loss over the mortgage loans, it will depend to the past due of each credit and the relation, at the end of month, between outstanding capital and the value of the mortgage guarantees (CMG), according the following table:

| Provision factor applicable according to delinquency and CMG | ||||||||||||||||||||||

| Days of default at the end of the month | Non-Complying | |||||||||||||||||||||

| CMG section | Concept | 0 | 1-29 | 30-59 | 60-89 | Portfolio | ||||||||||||||||

| CMG ≤ 40% | PD (%) | 1.0916 | 21.3407 | 46.0536 | 75.1614 | 100.0000 | ||||||||||||||||

| LGD (%) | 0.0225 | 0.0441 | 0.0482 | 0.0482 | 0.0537 | |||||||||||||||||

| EAD (%) | 0.0002 | 0.0094 | 0.0222 | 0.0362 | 0.0537 | |||||||||||||||||

| 40% < CMG≤ 80% | PD (%) | 1.9158 | 27.4332 | 52.0824 | 78.9511 | 100.0000 | ||||||||||||||||

| LGD (%) | 2.1955 | 2.8233 | 2.9192 | 2.9192 | 3.0413 | |||||||||||||||||

| EAD (%) | 0.0421 | 0.7745 | 1.5204 | 2.3047 | 3.0413 | |||||||||||||||||

| 80% < CMG≤ 90% | PD (%) | 2.5150 | 27.9300 | 52.5800 | 79.6952 | 100.0000 | ||||||||||||||||

| LGD (%) | 21.5527 | 21.6600 | 21.9200 | 22.1331 | 22.2310 | |||||||||||||||||

| EAD (%) | 0.5421 | 6.0496 | 11.5255 | 17.6390 | 22.2310 | |||||||||||||||||

| CMG > 90% | PD (%) | 2.7400 | 28.4300 | 53.0800 | 80.3677 | 100.0000 | ||||||||||||||||

| LGD (%) | 27.2000 | 29.0300 | 29.5900 | 30.1558 | 30.2436 | |||||||||||||||||

| EAD (%) | 0.7453 | 8.2532 | 15.7064 | 24.2355 | 30.2436 | |||||||||||||||||

Where:

| PD | : | Probability of default |

| LGD | : | Loss given default |

| EAD | : | Exposure at default |

| CMG | : | Outstanding loan capital /Mortgage Guarantee value |

| (b) | Commercial portfolio |

To determine these allowances, the Bank considers the standard methods presented below, as applicable to commercial leasing operations or other types of commercial loans. Then, the applicable provision factor will be assigned considering the parameters defined for each method.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

| ● | Commercial Leasing Operations |

The provision factor applies to the current value of commercial leasing operations (including the purchase option) and will depends on the default of each operation, the type of leased asset and the relationship between the current value of each operation and the leased asset value (PVB) at each month-end, as indicated in the following tables:

| Probability of default (PD) applicable according to default and type of asset (%) | ||||||||

| Type of asset | ||||||||

| Days of default of the operation at the month-end | Real estate | Non-real estate | ||||||

| 0 | 0.79 | 1.61 | ||||||

| 1-29 | 7.94 | 12.02 | ||||||

| 30-59 | 28.76 | 40.88 | ||||||

| 60-89 | 58.76 | 69.38 | ||||||

| Portfolio in default | 100.00 | 100.00 | ||||||

| Loss given the default (LGD) applicable according to PVB section and type of asset (%) | |||||||

| PVB = Current value of the operation / Value of the leased asset | |||||||

| PVB section | Real estate | Non-real estate | |||||

| PVB ≤ 40% | 0.05 | 18.20 | |||||

| 40% < PVB ≤ 50% | 0.05 | 57.00 | |||||

| 50% < PVB ≤ 80% | 5.10 | 68.40 | |||||

| 80% < PVB ≤ 90% | 23.20 | 75.10 | |||||

| PVB > 90% | 36.20 | 78.90 | |||||

The determination of the PVB relationship is made considering the appraisal value expressed in UF for real estate and in Chilean pesos for non-real estate, recorded at the time of the respective loan granting, taking into account possible situations that may be causing temporary increases in the assets prices at that time.

| ● | Generic commercial loans and factoring |

For the factoring operations and other commercial loans, other than those indicated above, the provision factor, applicable to the amount of the placement and the exposure of the contingent loan risk, will depends on the default of each operation and the relationship that exists at the end of each month, between the obligations that the debtor has with the bank and the value of the collateral that protect them (PTVG), as indicated in the following tables:

| Probability of default (PD) applicable according to default and PTVG section (%) | ||||||||||||

| With collateral | Without | |||||||||||

| Days of default at the month-end | PTVG≤100% | PTVG>100% | collateral | |||||||||

| 0 | 1.86 | 2.68 | 4.91 | |||||||||

| 1-29 | 11.60 | 13.45 | 22.93 | |||||||||

| 30-59 | 25.33 | 26.92 | 45.30 | |||||||||

| 60-89 | 41.31 | 41.31 | 61.63 | |||||||||

| Portfolio in default | 100.00 | 100.00 | 100.00 | |||||||||

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

| Loss given the default (LGD) applicable according to PTVG section (%) | ||||||||||

| Collateral (with / without) | PTVG section | Generic commercial operations or factoring without the responsibility of the transferor |

Factoring with the responsibility of the transferor |

|||||||

| With collateral | PTVG ≤ 60% | 5.00 | 3.20 | |||||||

| 60% < PTVG≤ 75% | 20.30 | 12.80 | ||||||||

| 75% < PTVG ≤ 90% | 32.20 | 20.30 | ||||||||

| 90% < PTVG | 43.00 | 27.10 | ||||||||

| Without collateral | 56.90 | 35.90 | ||||||||

The collaterals used for the purposes of calculating the PTVG relationship of this method may be specific or general, including those that are simultaneously specific and general. Collateral can only be considered if, according to the respective coverage clauses, it was constituted in the first degree of preference in favor of the Bank and only guarantees the debtor’s credits with respect to which it is imputed (not shared with other debtors).

The invoices assigned in the factoring operations will not be considered for purposes of calculating the PTVG. The excess of collateral associated with mortgage loans referred to in numeral 3.1.1 Residential mortgage portfolio in Chapter B-1 of CASB may be considered, computed as the difference between 80% of the property commercial value, according to with the conditions set out in that framework, and the mortgage loan that guarantees.

For the calculation of the PTVG ratio, the following considerations must be taken into account:

| i. | Transactions with specific collaterals: when the debtor granted specific collateral for generic commercial loans and factoring, the PTVG ratio is calculated independently for each covered transaction, such as the division between the amount of the loans and the contingent loans exposure and the collateral’s value of the covered product. |

| ii. | Transactions with general collaterals: when the debtor granted general or general and specific collaterals, the Bank calculates the respective PTVG, jointly for all generic commercial loans and factoring and not contemplated in the preceding paragraph i), as the quotient between the sum of the amounts of the loans and exposures of contingent loans and the general, or general and specific collateral that, according to the scope of the remaining coverage clauses, safeguard the loans considered in the numerator aforementioned coverage ratio. |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

The amounts of the guarantees used in the PTVG ratio of numerals i) and ii), different from those associated with excess guarantees from mortgage loans to which the residential mortgage portfolio refers, must be determined according to:

| - | The last valuation of the collateral, be it appraisal or fair value, according to the type of real guarantee in question. For the determination of fair value, the criteria indicated in Chapter 7-12 (Fair Value of Financial Instruments) of the RAN should be considered. |

| - | Possible situations that could be causing temporary increases in the values of the collaterals. |

| - | Limitations on the amount of coverage established in their respective clauses. |

| − | Portfolio in default. |

Includes all placements and 100% of the amount of the contingent loans, of the debtors that the closing of a month presents a delay equal to or greater than 90 days in the payment of the interest of the capital of any credit. It will also include debtors who are granted a credit to leave an operation that has more than 60 days of delay in their payment, as well as those debtors who were subject to forced restructuring or partial forgiveness of a debt.

They may exclude from the portfolio in default: a) mortgage loans for housing, which delinquent less than 90 days, unless the debtor has another loan of the same type with greater delinquency; and, b) credits for financing higher studies of Law No. 20,027, which do not yet present the non-compliance conditions indicated in Circular No. 3,454 of December 10, 2008.

All credits of the debtor must be kept in the Default Portfolio until there is a normalization of their ability or payment behavior, without prejudice to punishment of each particular credit that meets the condition indicated in Title II of Chapter B-2 of the CASB. To remove a debtor from the Default Portfolio, once the circumstances that lead to classification in this portfolio according to the present rules have been overcome, at least the following copulative conditions must be met:

| - | No obligation of the debtor with the bank with more than 30 calendar days overdue. |

| - | No new refinances granted to pay its obligations. |

| - | At least one of the payments includes amortization of capital. |

| - | If the debtor has a credit with partial payment periods less than six months, has already made two payments. |

| - | If the debtor must pay monthly fees for one or more credits, has paid four consecutive dues. |

| - | The debtor does not appear with unpaid debts direct according to the information recast by CMF, except for insignificant amounts. |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

(iii) Provisions related to financing with FOGAPE COVID-19 guarantee.

On July 17, 2020, the CMF requested to determine specific provisions of the credits guaranteed by the FOGAPE COVID-19 guarantee, for which the expected losses were determined estimating the risk of each operation, without considering the substitution of credit quality of the guarantee, according to the corresponding individual or group analysis method, in accordance with the provisions of Chapter B-1 of the CASB. This procedure must be carried out in an aggregate manner, grouping all those operations to which the same deductible percentage is applicable.

The deductible is applied by the Fund Administrator, which must be borne by each financial institution and does not depend on each particular operation, but is determined based on the total of the balances guaranteed by the Fund, for each group of companies that have the same coverage, according to their net sales size.

(iv) Provisions related to financing with FOGAPE Reactivation guarantee.

To determine the provisions of the amounts guaranteed by the FOGAPE Reactivation, the Bank considers the substitution of the credit quality of the debtors for that of the FOGAPE, for all the types of financing indicated, up to the amount covered by the aforementioned guarantee. Naturally, the option to consider the risk attributable to FOGAPE may be made while said guarantee remains in force, without considering the capitalized interest, in accordance with the provisions of article 17 of the Fund Regulations.

Likewise, for the computation of the provisions of the amount not covered by the guarantee, corresponding to the debtors, the treatment must be differentiated according to the level of default of the refinanced credit and the grace period, which must consider the cumulative consecutive months grace period between the refinanced loan and other prior measures.

For this purpose, the following situations should be considered:

| ● | Refinancing with less than 60 days past due and less than 180 days of grace. |

When the Bank grants the refinancing and is the current creditor, depending on the methodology used in accounting for provisions (standard or internal method) for the group portfolio, the computation of default and the expected loss parameters remain constant at the time to carry out the refinancing, as long as no payment is due.

In the case of debtors evaluated on an individual basis, their risk category is maintained at the time of rescheduling, which does not prevent them from being reclassified to the category that corresponds to them, in the event of a worsening of their payment capacity.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

| ● | Refinancing with past due between 60 and 89 days or grace periods greater than 180 days and less than 360 days. |

The provisions established in the previous point apply, and at least one of the following conditions must also be met:

| i. | In its credit granting policies, the Bank considers at least the following aspects: |

| - | A robust procedure for the categorization of viable debtors, which considers at least the sector and its solvency and liquidity situation. |

| - | Efficient mechanisms for monitoring the debtor’s situation, with formally defined internal governance. |

| ii. | Interest is charged in the months of grace, in accordance with the guidelines established in article 15 letter a) of the Regulation, or there is a demand for payment in another credit with the bank. In the latter case, if noncompliance is observed, the carry forward rules contained in numerals 2.2 and 3.2 of Chapter B-1 of the CASB must be considered, depending on whether it is a credit subject to individual or group evaluation, respectively. |

| ● | Refinancing with grace periods greater than 360 days. |

The Bank must apply the provisions established in Chapter B-1 of the CASB, considering the operation as a forced renegotiation and, therefore, apply the provisions that correspond to the portfolio in default.

(v) Impairment of loans.

The impaired loans include the following assets, according to Chapter B-1 of the CASB of the CMF:

| - | In case of debtors subject to individual assessment, includes credits from “Non-complying loans” those classified in categories B3 and B4 of “Substandard loans”. |

| - | Debtors subject to assessment group evaluation, the impaired portfolio includes all credits of the “Non-complying loans”. |

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS, continued

| 2. | Main Accounting Criteria Used, continued: |

(vi) Charge-offs.

As a general rule, the charge-offs are produced when the contractual rights on cash flows end. In case of loans, even if the above does not happen, it will proceed to charge-offs the respective asset balances.

The charge-off refers to derecognition of the assets in the Consolidated Statement of Financial Position, related to the respective transaction and, therefore, the part that could not be past-due if a loan is payable in installments, or a lease.

| - | Charge-offs of loans to customers |

The charge-off must be to make using credit risk provisions constituted, whatever the cause for which the charge-off was produced.

Write-offs for loans to customers and accounts receivable, other than from leasing operations, should be made in the following circumstances, whichever occurs first:

| - | The Bank, based on all available information, concludes that will not obtain any cash flow of the credit recorded as an asset. |

| - | When the debt without executive title expires 90 days after it was recorded in asset. |

| - | At the expiration of the statute of limitations for actions to demand payment through an executive trial, or at the time of rejection or abandonment of the execution of the judgment by final court resolution. |

| - | When past-due term of a transaction reaches the charge-off term disposed below: |

| Type of Loan | Term | |

| Consumer loans - secured and unsecured | 6 months | |

| Other transactions - unsecured | 24 months | |

| Commercial loans - secured | 36 months | |

| Residential mortgage loans | 48 months |

The term represents the time elapsed since the date on which payment of all or part of the obligation in default became due.