UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number 001-42379

Founder Group Limited

No.17, Jalan Astana 1B, Bandar Bukit Raja, 41050

Klang,

Selangor Darul Ehsan, Malaysia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Explanatory Note

Founder Group Limited (the “Company”) is filing this report of foreign private issuer on Form 6-K to report its financial results for the six months ended June 30, 2024 and to discuss its recent corporate developments.

Attached as exhibits to this report of foreign private issuer on Form 6-K are:

| (1) | the unaudited condensed consolidated interim financial statements and related notes as Exhibit 99.1; and |

| (2) | Management’s Discussion and Analysis of Financial Condition and Results of Operations as Exhibit 99.2. |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this report of foreign private issuer with respect to the Company’s current plans, estimates, strategies and beliefs and other statements that are not historical facts are forward-looking statements about the future performance of the Company. Forward-looking statements include, but are not limited to, those statements using words such as “believe,” “expect,” “plans,” “strategy,” “prospects,” “forecast,” “estimate,” “project,” “anticipate,” “aim,” “intend,” “seek,” “may,” “might,” “could” or “should,” and words of similar meaning in connection with a discussion of future operations, financial performance, events or conditions. From time to time, oral or written forward-looking statements may also be included in other materials released to the public. These statements are based on management’s assumptions, judgments and beliefs in light of the information currently available to it. The Company cautions investors that a number of important risks and uncertainties could cause actual results to differ materially from those discussed in the forward-looking statements, including but not limited to, product and service demand and acceptance, changes in technology, economic conditions, the impact of competition and pricing, government regulation, and other risks contained in reports filed by the Company with the U.S. Securities and Exchange Commission. Therefore, investors should not place undue reliance on such forward-looking statements. Actual results may differ significantly from those set forth in the forward-looking statements.

All such forward-looking statements, whether written or oral, and whether made by or on behalf of the Company, are expressly qualified by the cautionary statements and any other cautionary statements which may accompany the forward-looking statements. In addition, the Company disclaims any obligation to update any forward-looking statements to reflect events or circumstances after the date hereof.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| FOUNDER GROUP LIMITED | ||

| By: | /s/ Lee Seng Chi | |

| Name: | Lee Seng Chi | |

| Title: | Chief Executive Officer, Director, and Chairman of the Board of Directors |

|

Date: December 17, 2024

4

Exhibit 99.1

FOUNDER GROUP LIMITED

INDEX TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

TABLE OF CONTENTS

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS OF DECEMBER 31, 2023 AND JUNE 30, 2024

| Note |

As of (Audited) |

As of (Unaudited) |

As of (Unaudited) |

|||||||||||

| RM | RM | USD | ||||||||||||

| ASSETS | ||||||||||||||

| Non-current assets | ||||||||||||||

| Plant and equipment | 6 | 1,661,549 | 5,256,057 | 1,113,689 | ||||||||||

| Right-of-use assets | 7 | 213,761 | — | — | ||||||||||

| Trade receivables | 9 | 2,665,887 | 3,187,881 | 675,470 | ||||||||||

| Deferred tax asset | 74,000 | 74,000 | 15,680 | |||||||||||

| Total non-current assets | 4,615,197 | 8,517,938 | 1,804,839 | |||||||||||

| Current assets | ||||||||||||||

| Contract assets | 8 | 50,945,548 | 32,695,152 | 6,927,673 | ||||||||||

| Derivative assets | — | 3,565 | 755 | |||||||||||

| Trade receivables | 9 | 13,283,492 | 14,641,106 | 3,102,258 | ||||||||||

| Inventories | 10 | 1,863,933 | 1,797,252 | 380,814 | ||||||||||

| Other receivables and prepayment | 12 | 4,358,044 | 6,012,316 | 1,273,931 | ||||||||||

| Amount due from related parties | 11 | 3,207,158 | 1,666,403 | 353,089 | ||||||||||

| Cash and bank balances | 5,600,147 | 10,034,522 | 2,126,183 | |||||||||||

| Total current assets | 79,258,322 | 66,850,316 | 14,164,703 | |||||||||||

| Total assets | 83,873,519 | 75,368,254 | 15,969,542 | |||||||||||

| LIABILITIES AND EQUITY | ||||||||||||||

| Current liabilities | ||||||||||||||

| Trade payables | 9 | 38,418,873 | 22,945,387 | 4,861,826 | ||||||||||

| Contract liabilities | 8 | — | 2,581,199 | 546,922 | ||||||||||

| Other payables and accrued liabilities | 12 | 1,266,140 | 5,171,236 | 1,095,717 | ||||||||||

| Bank and other borrowings | 13 | 23,897,880 | 26,307,249 | 5,574,160 | ||||||||||

| Lease liabilities | 7 | 141,816 | — | — | ||||||||||

| Amount due to related parties | 11 | 2,759,913 | 2,631,889 | 557,663 | ||||||||||

| Income tax payable | 18 | 1,714,168 | 633,353 | 134,199 | ||||||||||

| Total current liabilities | 68,198,790 | 60,270,313 | 12,770,487 | |||||||||||

| Non-current liabilities | ||||||||||||||

| Lease liabilities | 7 | 73,831 | — | — | ||||||||||

| Bank and other borrowings | 13 | 811,236 | 2,017,877 | 427,562 | ||||||||||

| Total non-current labilities | 885,067 | 2,017,877 | 427,562 | |||||||||||

| Total liabilities | 69,083,857 | 62,288,190 | 13,198,049 | |||||||||||

| Capital and reserves | ||||||||||||||

| Share capital | 69,284 | 69,284 | 15,700 | |||||||||||

| Reserves | 14 | 1,704,989 | 1,704,989 | 361,265 | ||||||||||

| Retained earnings | 13,009,029 | 11,297,207 | 2,393,730 | |||||||||||

| Other comprehensive income/(loss) | 6,360 | 8,584 | 798 | |||||||||||

| Total equity | 14,789,662 | 13,080,064 | 2,771,493 | |||||||||||

| Total liabilities and equity | 83,873,519 | 75,368,254 | 15,969,542 | |||||||||||

The accompanying notes are an integral part of these unaudited interim consolidated financial statements.

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

FOR THE SIX MONTHS ENDED JUNE 30, 2023 AND JUNE 30, 2024

| Note | Six months ended June 30, 2023 |

Six months ended June 30, 2024 |

Six months ended June 30, 2024 |

|||||||||||||

| RM | RM | USD | ||||||||||||||

| Revenue from contract services | 42,724,877 | 21,776,845 | 4,614,228 | |||||||||||||

| Revenue from sales of goods | 23,492,766 | 7,595,546 | 1,609,396 | |||||||||||||

| Revenue from contract services – related parties | 2,509,003 | 1,067,194 | 226,124 | |||||||||||||

| Revenue from sales of goods – related parties | — | — | — | |||||||||||||

| Total Revenue | 15 | 68,726,646 | 30,439,585 | 6,449,748 | ||||||||||||

| Cost of sales from contract services | (37,799,255 | ) | (20,365,868 | ) | (4,315,260 | ) | ||||||||||

| Cost of sales from sales of goods | (20,965,492 | ) | (6,750,913 | ) | (1,430,429 | ) | ||||||||||

| Cost of sales for contract services – related parties | (1,912,129 | ) | (1,095,340 | ) | (232,088 | ) | ||||||||||

| Cost of sales from sales of goods – related parties | — | — | — | |||||||||||||

| Total Cost of sales | 16 | (60,676,876 | ) | (28,212,121 | ) | (5,977,777 | ) | |||||||||

| Gross income | 8,049,770 | 2,227,464 | 471,971 | |||||||||||||

| Selling and administrative | (3,981,104 | ) | (3,454,946 | ) | (732,060 | ) | ||||||||||

| Selling and administrative to related parties | (49,367 | ) | (56,441 | ) | (11,959 | ) | ||||||||||

| Income/(loss) from operation before income tax | 4,019,299 | (1,283,923 | ) | (272,048 | ) | |||||||||||

| Other income | 61,840 | 118,707 | 25,153 | |||||||||||||

| Other income from related parties | 37,521 | 50,188 | 10,634 | |||||||||||||

| Finance cost | (361,758 | ) | (676,835 | ) | (143,413 | ) | ||||||||||

| Finance cost – related party | (154,483 | ) | (90,097 | ) | (19,090 | ) | ||||||||||

| Profit/(loss) before income tax | 3,602,419 | (1,881,960 | ) | (398,764 | ) | |||||||||||

| Income tax expense | 18 | (962,140 | ) | 170,138 | 36,050 | |||||||||||

| Net profit/(loss) for the year | 2,640,279 | (1,711,822 | ) | (362,714 | ) | |||||||||||

| Other comprehensive income | 19,292 | 2,224 | 471 | |||||||||||||

| Total comprehensive income/(loss) for the year | 2,659,571 | (1,709,598 | ) | (362,243 | ) | |||||||||||

| Profit/(loss) attributable to: | ||||||||||||||||

| Equity owners of the Company | 2,659,571 | (1,709,598 | ) | (362,243 | ) | |||||||||||

| Non-controlling interests | — | — | — | |||||||||||||

| Total | 2,659,571 | (1,709,598 | ) | (362,243 | ) | |||||||||||

| Basic and Diluted Net Income per Share | 0.17 | (0.11 | ) | (0.02 | ) | |||||||||||

| Weighted Average Number of Common Shares Outstanding – Basic and Diluted | 15,700,000 | 15,700,000 | 15,700,000 | |||||||||||||

The accompanying notes are an integral part of these unaudited interim consolidated financial statements.

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

FOR THE SIX MONTHS ENDED JUNE 30, 2023 AND 2024

| Number of outstanding shares |

Share capital |

Reserves | Retained earnings |

Other comprehensive income |

Total Shareholders’ equity |

|||||||||||||||||||

| RM | RM | RM | RM | RM | ||||||||||||||||||||

| Balance at January 1, 2023 | 15,700,000 | 69,284 | 1,707,188 | 5,861,961 | — | 7,638,433 | ||||||||||||||||||

| Other comprehensive income | — | — | — | — | 19,292 | 19,292 | ||||||||||||||||||

| Foreign exchange reserve | — | — | (2,199 | ) | — | (2,199 | ) | |||||||||||||||||

| Net profit for the period | — | — | — | 2,640,279 | — | 2,640,279 | ||||||||||||||||||

| Balance at June 30, 2023 (Unaudited) | 15,700,000 | 69,284 | 1,704,989 | 8,502,240 | 19,292 | 10,295,805 | ||||||||||||||||||

| Balance at January 1, 2024 | 15,700,000 | 69,284 | 1,704,989 | 13,009,029 | 6,360 | 14,789,662 | ||||||||||||||||||

| Other comprehensive income | — | — | — | — | 2,224 | 2,224 | ||||||||||||||||||

| Net loss for the period | — | — | — | (1,711,822 | ) | — | (1,711,822 | ) | ||||||||||||||||

| Balance at June 30, 2024 (Unaudited) | 15,700,000 | 69,284 | 1,704,989 | 11,297,207 | 8,584 | 13,080,064 | ||||||||||||||||||

| Share capital |

Reserves | Retained earnings |

Other comprehensive loss |

Total Shareholders’ equity |

||||||||||||||||

| USD | USD | USD | USD | USD | ||||||||||||||||

| Balance at June 30, 2023 | 15,700 | 364,392 | 1,817,106 | 3,231 | 2,200,429 | |||||||||||||||

| Balance at June 30, 2024 | 15,700 | 361,265 | 2,393,730 | 798 | 2,771,493 | |||||||||||||||

The accompanying notes are an integral part of these unaudited interim consolidated financial statements.

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2023 AND 2024

| Six months ended June 30, 2023 |

Six months ended June 30, 2024 |

Six months ended June 30, 2024 |

||||||||||

| RM | RM | USD | ||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||||||

| Net profit/(loss) for the year | 3,602,419 | (1,881,960 | ) | (398,764 | ) | |||||||

| Adjustments to reconcile net profit to net cash used in operating activities: | ||||||||||||

| Extinguishment of right-of-use asset and lease liabilities | (4,691 | ) | (3,188 | ) | (676 | ) | ||||||

| Fair value gain on derivative asset | — | (3,565 | ) | (755 | ) | |||||||

| Impairment/(Reversal) | 296,776 | (10,787 | ) | (2,286 | ) | |||||||

| Depreciation and amortization | 129,116 | 196,028 | 41,536 | |||||||||

| Equipment written off | — | 32,779 | 6,945 | |||||||||

| Imputed interest of lease liability | 3,433 | 5,049 | 1,070 | |||||||||

| Interest income | (15,050 | ) | (34,881 | ) | (7,391 | ) | ||||||

| Finance cost | 516,241 | 766,932 | 162,503 | |||||||||

| Unrealized foreign losses/(gains) losses | 4,779 | (8,678 | ) | (1,839 | ) | |||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Trade receivables | (20,597,485 | ) | (1,879,608 | ) | (398,264 | ) | ||||||

| Contract assets | (10,798,302 | ) | 18,261,184 | 3,869,305 | ||||||||

| Contract liabilities | (6,000 | ) | 2,581,199 | 546,922 | ||||||||

| Other receivables and prepayment | 248,557 | (1,654,273 | ) | (350,518 | ) | |||||||

| Inventories | 216,091 | 66,681 | 14,129 | |||||||||

| Other payables and accrued liabilities | 1,211,024 | 3,942,595 | 835,383 | |||||||||

| Trade payables | 17,642,419 | (15,473,486 | ) | (3,278,628 | ) | |||||||

| Income tax payable | (680,000 | ) | (910,677 | ) | (192,961 | ) | ||||||

| Income tax refund | 41,481 | — | — | |||||||||

| Net cash provided (used in)/by operating activities | (8,189,192 | ) | 3,991,344 | 845,711 | ||||||||

| Investing activities | ||||||||||||

| Interest income | 15,050 | 34,881 | 7,391 | |||||||||

| Purchase of plant and equipment | (1,106,030 | ) | (3,789,561 | ) | (802,958 | ) | ||||||

| Net cash used in investing activities | (1,090,980 | ) | (3,754,680 | ) | (795,567 | ) | ||||||

| Financing activities | ||||||||||||

| Interest paid | (516,241 | ) | (766,932 | ) | (162,503 | ) | ||||||

| Repayment of lease liabilities | (51,000 | ) | (75,000 | ) | (15,892 | ) | ||||||

| Amount due (to)/from related parties | (197,697 | ) | 1,412,732 | 299,339 | ||||||||

| Proceeds from bank facility | 5,749,222 | 3,616,009 | 766,185 | |||||||||

| Net cash provided by financing activities | 4,984,284 | 4,186,809 | 887,129 | |||||||||

| Effect of exchange rate changes | 12,315 | 10,902 | 2,312 | |||||||||

| Net (decrease)/increase in cash and cash equivalents | (4,295,887 | ) | 4,423,473 | 937,273 | ||||||||

| Cash and bank balances at beginning of year | 8,231,746 | 5,600,147 | 1,186,598 | |||||||||

| Cash and bank balances at end of year | 3,948,174 | 10,034,522 | 2,126,183 | |||||||||

The accompanying notes are an integral part of these unaudited interim consolidated financial statements.

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 1 | ORGANIZATION AND PRINCIPAL ACTIVITIES |

Founder Group Limited (the “Company”) was incorporated in the British Virgin Islands on May 18, 2023 with registered office at Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands while principal place of business of the Company at No. 17, Jalan Astana 1D, Bandar Bukit Raja 41050 Klang, Selangor, Malaysia.

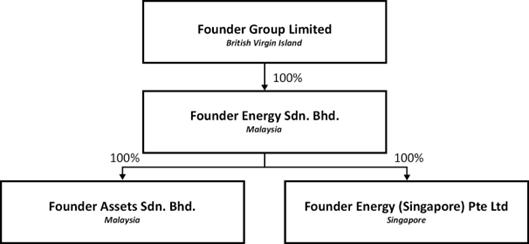

The group structure which represents the operating subsidiaries and dormant companies as of the reporting date is as follow:

Details of the Company and its subsidiaries (collectively, the “Group”) are shown in the table below:

| Percentage of effective ownership | ||||||||||||||

| June 30, | ||||||||||||||

| Name | Date of incorporation |

2024 | 2023 | Place of incorporation |

Principal activities |

|||||||||

| % | % | |||||||||||||

| Founder Group Limited | May 18, 2023 | — | — | British Virgin Islands | Holding company | |||||||||

| Founder Energy Sdn. Bhd. | April 13, 2021 | 100 | 100 | Malaysia | Business of renewable energy activities and related business and activities of holding companies | |||||||||

| Founder Energy (Singapore) Pte Ltd | May 27, 2022 | 100 | 100 | Singapore | Dormant | |||||||||

| Founder Assets Sdn. Bhd. | September 21, 2022 | 100 | 100 | Malaysia | Business in the investment of renewable energy project. | |||||||||

The Company provides engineering, procurement, construction and commissioning (“EPCC”) services for solar photovoltaic (“PV”) facilities in Malaysia primarily through Founder Energy Sdn. Bhd.

On April 13, 2021, Mr. Lee Seng Chi incorporate Founder Energy Sdn. Bhd. with 100% equity interest.

On August 25, 2021, Reservoir Energy Link Berhad acquired 51% equity interest in Founder Energy Sdn. Bhd. from Mr. Lee Seng Chi.

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 1 | ORGANIZATION AND PRINCIPAL ACTIVITIES (cont.) |

On May 27, 2022, the Company incorporate Founder Energy (Singapore) Pte Ltd with domicile in Singapore for future business expansion purpose in Singapore.

On September 21, 2022, the Company incorporate Founder Assets Sdn. Bhd. with domicile in Malaysia to carry out business in the investment of renewable energy project.

On May 18, 2023, Reservoir Energy Link Berhad and Mr. Lee Seng Chi incorporate Founder Group Limited with 51% and 49% equity interest, respectively.

On June 14, 2023, Founder Group Limited acquire 100% equity interest of Founder Energy Sdn. Bhd. from Reservoir Energy Link Berhad and Mr. Lee Seng Chi.

| 2 | MATERIAL ACCOUNTING POLICY INFORMATION |

BASIS OF PREPARATION

The unaudited interim consolidated financial statements have been prepared in accordance with the historical cost basis, except as disclosed in the accounting policies below, and are drawn up in accordance with the provisions of the International Accounting Standards (“IAS”) 34 Interim Financing Reporting as issued by the International Accounting Standards Board (“IASB”).

Historical cost is generally based on the fair value of the consideration given in exchange for goods and services.

ADOPTION OF NEW AND REVISED STANDARDS

At the date of authorization of those financial statements, our Company has not adopted the new and revised IFRS Accounting Standards and amendments to IFRS Accounting Standards that have been issued but are not yet effective to them. We do not anticipate that the adoption of these new and revised IFRS Accounting Standards pronouncements in future periods will have a material impact on our financial statements in the period of their initial adoption.

NEW AND REVISED IFRS IN ISSUE BUT NOT YET EFFECTIVE

The Group has not applied in advance the following accounting standards and/or interpretations (including the consequential amendments, if any) that have been issued by the International Accounting Standards Board (IASB) but are not yet effective for the current financial period:

| IFRSs and/or IC Interpretations (Including The Consequential Amendments) | Effective Date | |

| IFRS 19 Subsidiaries without Public Accountability: Disclosures | 1 January 2027 | |

| IFRS 18 Presentation and Disclosure in Financial Statements | 1 January 2027 | |

| Annual Improvements of IFRS Accounting Standards – Volume 11 | 1 January 2026 | |

| Amendments to IFRS 9 and IFRS 7 Amendments to the Classification and Measurement of Financial Instruments | 1 January 2026 | |

| Amendment to IAS 21 Lack of Exchangeability | 1 January 2025 | |

| Amendments to IFRS 10 and IFRS 28: Sale or Contribution of Assets between an Investor and its Associate or Joint Venture | Deferred |

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICY INFORMATION (cont.) |

RECENTLY ADOPTED IFRS

The Group has adopted the following accounting standards and/or interpretations (including the consequential amendments, if any) that have been issued by the International Accounting Standards Board (IASB) for the current financial period:

| IFRSs and/or IC Interpretations (Including The Consequential Amendments) | Effective Date | |

| Amendment to IAS 1 Non-current Liabilities with Covenants | 1 January 2024 | |

| Amendments to IAS 7 and IFRS 7 Supplier Finance Arrangements | 1 January 2024 | |

| Amendment to IFRS 16 Lease Liability in a Sale and Leaseback | 1 January 2024 |

BASIS OF CONSOLIDATION

The acquisition of entities, businesses or assets under common control are accounted for in accordance with merger accounting.

The combined financial statements incorporate the financial statements of the combined entities or businesses in which the common control combination occurs as if they had been combined from the date when the combining entities or businesses first came under the control of the controlling party.

The combined financial statements have prepared using uniform accounting policies for like transactions and other events in similar circumstances.

All intra-group balances, transactions, income and expenses are eliminated in full on combination and the combined financial statements reflect external transactions only.

The net assets of the combined entities or businesses are combined using the existing carrying amounts from the controlling party’s perspective. No amount is recognized in respect of goodwill or excess of the acquirer’s interest in the net fair value of acquiree’s identifiable assets, liabilities and contingent liabilities over the acquisition cost at the time of common control combination. All differences between the cost of acquisition (fair value of consideration paid) and the amounts at which the assets and liabilities are recorded, arising from common control combination, have been recognized directly in equity as part of the capital reserve.

The combined statements of profit or loss and other comprehensive income include the results of each of the combining entities or businesses from the earliest date presented or since the date when the combined entities or businesses first came under the common control, where this is a shorter period, regardless of the date of the common control combination.

CONVENIENCE TRANSLATION

Translations of amounts in the unaudited interim consolidated statements of financial position, unaudited interim consolidated statements of profit or loss and other comprehensive income and unaudited interim consolidated statement of cash flows from RM into USD as of and for the period ended June 30, 2024 are solely for the convenience of the reader. Unless otherwise noted, all translations from RM into USD for the six months ended June 30, 2024 were calculated at the noon buying rate of USD1 = RM4.71950, as published by Bank Negara Malaysia, or an average rate of USD1 = RM4.72715.

FINANCIAL ASSETS

Classification and measurement

The Group classifies its financial assets at fair value through other comprehensive income, fair value through profit and loss and amortized cost.

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICY INFORMATION (cont.) |

The classification depends on the Group’s business model for managing the financial assets as well as the contractual terms of the cash flows of the financial assets.

| 1. | Financial assets at FVTPL are initially recorded at fair value and transaction costs are expensed in the statements of income and comprehensive income. Realized and unrealized gains and income arising from changes in the fair value of the financial asset held at FVTPL are included in the statements of income and comprehensive income in the period in which they arise. The Company has classified cash as FVTPL. |

| 2. | Financial assets at FVTOCI are initially recognized at fair value plus transaction costs. Subsequently they are measured at fair value, with gains and losses arising from changes in fair value recognized in other comprehensive income. There is no subsequent reclassification of fair value gains and losses to profit or loss following the derecognition of the investment. There are no financial assets classified as FVTOCI. |

| 3. | Financial assets at amortized cost are initially recognized at fair value, net of transaction costs, and subsequently carried at amortized cost less any impairment. They are classified as current assets or non- current assets based on their maturity date. The Company has classified trade receivables, contract assets, other receivables and amounts due from related parties at amortized cost. |

Impairment

The Company assesses at end of each reporting period whether there is objective evidence that a financial asset or group of financial assets is impaired.

The Company recognizes expected credit losses (“ECL”) for accounts receivable based on the simplified approach. The simplified approach to the recognition of expected losses does not require the Company to track the changes in credit risk; rather, the Company recognizes a loss allowance based on lifetime expected credit losses at each reporting date from the date of the account receivable.

The Company measures expected credit loss by considering the risk of default over the contract period and incorporates forward-looking information into its measurement. ECLs are a probability-weighted estimate of credit losses.

ECLs are measured as the difference in the present value of the contractual cash flows that are due to the Company under the contract, and the cash flows that the Company expects to receive. The Company assesses all information available, including past due status, and forward looking macro-economic factors in the measurement of the ECLs associated with its assets carried at amortized cost.

The maximum period considered when estimating ECLs is the maximum contractual period over which the Company is exposed to credit risk.

FINANCIAL LIABILITIES

Financial liabilities are classified as either financial liabilities at FVTPL or at amortized cost. The Company determines the classification of its financial liabilities at initial recognition.

Financial liabilities are classified as measured at amortized cost, net of transaction costs unless classified as FVTPL. The Company’s trade payables, other payables and accrued liabilities, amounts due to related parties, lease liabilities and bank loans are classified as measured at amortized cost.

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICY INFORMATION (cont.) |

PLANT AND EQUIPMENT

Plant and equipment is recognized and subsequently measured at cost less accumulated depreciation and any accumulated impairment losses, if any. When components of property and equipment have different useful lives they are accounted for separately. Depreciation is provided at rates which are calculated to write off the assets over their estimated useful lives as follows:

| Computer and Software | 5 years straight line | |

| Motor Vehicles | 5 years straight line | |

| Office Equipment | 5 years straight line | |

| Equipment and Tools | 5 years straight line | |

| Signboard | 4 years straight line | |

| Solar Asset Plant | 4 years straight line | |

| Office Renovation | 4 years straight line | |

| Mould | 5 years straight line | |

| Plant and Machinery | 5 years straight line | |

| Forklift | 5 years straight line | |

| Right-Of-Use Assets | Over term of lease |

Assets under construction are not depreciated as these assets are not available for use.

Plant or equipment is derecognized upon disposal or when no future economic benefits are expected from its use. Any gain or loss arising from derecognition of the asset, being the difference between the net disposal proceeds and the carrying amount, is recognized in profit or loss. The revaluation reserve included in equity is transferred directly to retained profits on retirement or disposal of the asset.

INVENTORIES

Inventories are stated at the lower of cost and net realizable value. Cost is determined based on weighted average method and comprises the purchase price and incidentals incurred in bringing the inventories to their present location and condition.

Net realizable value represents the estimated selling price less the estimated costs of completion and the estimated costs necessary to make the sale.

IMPAIRMENT OF NON-FINANCIAL ASSETS

Impairment of assets are reviewed at the end of each reporting period for impairment when there is an indication that the assets might be impaired. Impairment is measured by comparing the carrying values of the assets with their recoverable amounts. When the carrying amount of an asset exceeds its recoverable amount, the asset is written down to its recoverable amount and an impairment loss shall be recognized. The recoverable amount of an asset is the higher of the asset’s fair value less costs to sell and its value in use, which is measured by reference to discounted future cash flows using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. An impairment loss is recognized in profit or loss.

When there is a change in the estimates used to determine the recoverable amount, a subsequent increase in the recoverable amount of an asset is treated as a reversal of the previous impairment loss and is recognized to the extent of the carrying amount of the asset that would have been determined (net of amortization and depreciation) had no impairment loss been recognized. The reversal is recognized in profit or loss immediately.

CONTRACT ASSETS AND LIABILITIES

Contract assets includes unbilled amounts resulting from performance obligation satisfied measured under input method. Contract assets are subsequently transferred to trade receivable upon satisfaction of billing milestone base on contract and entitlement to pay becomes unconditional. A contract asset is subject to impairment requirement of IFRS 9.

Contract liabilities include advance payments from customers that performance obligation yet to satisfied. A contract liabilities is stated at cost and represents the obligation of the Group to transfer goods or services to a customer for which consideration has been received (or the amount is due) from the customers.

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICY INFORMATION (cont.) |

LEASES

The Group assesses whether a contract is or contains a lease, at inception of the contract. The Group recognizes a right-of-use asset and corresponding lease liability with respect to all lease arrangements in which it is the lessee, except for low-value assets and short-term leases with 12 months or less. For these leases, the Group recognizes the lease payments as an operating expense on a straight-line method over the term of the lease unless another systematic basis is more representative of the time pattern in which economic benefits from the leased assets are consumed.

The Group recognizes a right-of-use asset and a lease liability at the lease commencement date. The right-of-use assets and the associated lease liabilities are presented as a separate line item in the statements of financial position.

The right-of-use asset is initially measured at cost. Cost includes the initial amount of the corresponding lease liability adjusted for any lease payments made at or before the commencement date, plus any initial direct costs incurred, less any incentives received.

The right-of-use asset is subsequently measured at cost less accumulated depreciation and any impairment losses, and adjustment for any remeasurement of the lease liability. The depreciation starts from the commencement date of the lease. If the lease transfers ownership of the underlying asset to the Group or the cost of the right-of-use asset reflects that the Group expects to exercise a purchase option, the related right-of-use asset is depreciated over the useful life of the underlying asset. Otherwise, the Group depreciates the right-of-use asset to the earlier of the end of the useful life of the right-of-use asset or the end of the lease term. The estimated useful lives of the right-of-use assets are determined on the same basis as those property, plant and equipment.

The lease liability is initially measured at the present value of the lease payments that are not paid at the commencement date, discounted by using the rate implicit in the lease. If this rate cannot be readily determined, the Group uses its incremental borrowing rate.

The lease liability is subsequently measured at amortised cost using the effective interest method. It is remeasured when there is a change in the future lease payments (other than lease modification that is not accounted for as a separate lease) with the corresponding adjustment is made to the carrying amount of the right-of-use asset, or is recognized in profit or loss if the carrying amount has been reduced to zero.

PROVISIONS

Provisions are recognized when the Group has a present obligation (legal or constructive) as a result of past events, when it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation, and when a reliable estimate of the amount can be made. Provisions are reviewed at the end of each reporting period and adjusted to reflect the current best estimate. Where the effect of the time value of money is material, the provision is the present value of the estimated expenditure required to settle the obligation. The discount rate shall be a pre-tax rate that reflects current market assessments of the time value of money and the risks specific to the liability. The unwinding of the discount is recognized as interest expense in profit or loss.

REVENUE RECOGNITION

The Group accounts for its revenue under IFRS 15 Revenue from Contracts with Customers. (“IFRS 15”) The five-step model defined by IFRS 15 requires the Company to:

| (1) | identify its contracts with customers; |

| (2) | identify its performance obligations under those contracts; |

| (3) | determine the transaction prices of those contracts; |

| (4) | allocate the transaction prices to its performance obligations in those contracts; and |

| (5) | recognise revenue when each performance obligation under those contracts is satisfied. Revenue recognized when promised goods and services are transferred to the client in an amount that reflects the consideration expected in exchange for those services. |

Revenues are recognized when persuasive evidence of an arrangement exists, service has occurred, and all performance obligations have been performed pursuant to the terms of the agreement, the sales price is fixed oi determinable and collectability is reasonably assured. Our revenue agreements generally do not include a right of return in relation to the delivered goods or services. Depending on the terms of the agreement and the laws that apply to the agreement, control of the services may be transferred over time or at a point in time. Control of the services is transferred over time if our performance:

| - | provides all of the benefits received and consumed simultaneously by the client; |

| - | creates and enhances an asset that the client controls as the Group performs; or |

| - | does not create an asset with an alternative use to the Group and the Group has an enforceable right to payment for performance complete to date. |

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICY INFORMATION (cont.) |

REVENUE RECOGNITION (cont.)

The Group recognises revenue from the following major sources:

| (i) | Large-scale solar projects (“LSS”) |

LSS are utility scale solar PV power plants with installed generating capacity of 1 MWac or more. Large-scale solar projects are ground mounted and are designed to supply power to the power grid. For the majority of our large-scale solar projects, we usually act as the contractor to the project awarder, who is the main contractor for a solar project. As an EPCC provider, we assume most of the responsibility for the entire project lifecycle, from design and engineering to material procurement, construction, installation, integration, and commissioning.

| (ii) | Commercial and industrial (“C&I”) solar projects |

C&I projects are smaller scale solar projects where the solar PV systems are installed on rooftops and are designed to generate electricity for commercial and industrial properties for their own consumption, such as factories, warehouses and commercial stores. For C&I projects, we usually sign a service contract with the project owner and act as the main contractor. As the main contractor, we engage in comprehensive services encompassing project design, engineering, equipment procurement, construction, and commissioning.

Rendering of Services

Revenue from providing product and services related to renewable energy services industry is recognized over time in the year in which the services are rendered using input method, determined based on the proportion of costs incurred for work performed to date over the estimated total costs. Transaction price is computed based on the price specified in the contract and adjusted for any variable consideration such as incentives and penalties.

A receivable is recognized when the services are rendered as this is the point in time that the consideration is unconditional because only the passage of time is required before the payment is due. If the services rendered exceed the payment received, a contract asset is recognized. If the payments exceed the services rendered, a contract liability is recognized.

Sale of Goods

Revenue is recognized at a point in time when the goods have been delivered to the customer and upon its acceptance, and it is probable that the Group will collect the considerations to which it would be entitled to in exchange for the goods sold.

The Company generally provides standard warranties to its customers, from date of delivery cost or satisfactory completion of the project. There is no warranty claim historically.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents comprise cash in hand, bank balances, fixed deposits, demand deposits, and short-term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value with original maturity periods of three months or less. For the purpose of the statement of cash flows, cash and cash equivalents are presented net of bank overdrafts.

SHARE CAPITAL

Ordinary shares are classified as equity. Incremental costs directly attributable to the issuance of new ordinary shares are deducted against the share capital account.

INCOME TAX

Current tax assets and liabilities are the expected amount of income tax recoverable or payable to the taxation authorities, measured using tax rates and tax laws that have been enacted or substantively enacted at the end of the reporting period and are recognized in profit or loss except to the extent that the tax relates to items recognized outside profit or loss (either in other comprehensive income or directly in equity).

Deferred taxes are recognized using the liability method for temporary differences other than those that arise from the initial recognition of an asset or liability in a transaction which is not a business combination and at the time of the transaction, affects neither accounting profit nor taxable profit.

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply in the period when the asset is realized or the liability is settled, based on the period.

Deferred tax assets are recognized for all deductible temporary differences, unused tax losses and unused tax credits to the extent that it is probable that future taxable profits will be available against which the deductible temporary differences, unused tax losses and unused tax credits can be utilised. The carrying amounts of deferred tax assets are reviewed at the end of each reporting period and reduced to the extent that it is no longer probable that the related tax benefits will be realized.

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 2 | MATERIAL ACCOUNTING POLICY INFORMATION (cont.) |

INCOME TAX (cont.)

Current and deferred tax items are recognized in correlation to the underlying transactions either in profit or loss, other comprehensive income or directly in equity.

Current tax assets and liabilities or deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current tax liabilities and when the deferred taxes relate to the same taxable entity (or on different tax entities but they intend to settle current tax assets and liabilities on a net basis) and the same taxation authority.

FOREIGN CURRENCY TRANSACTIONS

The functional currency used by the Company is the Malaysia Ringgit. Consequently, operations in currencies other than the Malaysia Ringgit are considered to be denominated in foreign currency and are recorded at the exchange rates in force on the dates of the operations.

At year-end, monetary assets and liabilities denominated in foreign currency are converted by applying the exchange rate on the balance sheet date. The profits or losses revealed are charged directly to the profit and loss account for the year in which they occur. Non-monetary items in foreign currency measured in terms of historical cost are converted at the exchange rate on the date of the transaction.

The exchange differences of the monetary items that arise both when liquidating them and when converting them at the closing exchange rate, are recognized in the results of the year, except those that are part of the investment of a business abroad, which are recognized directly in equity net of taxes until the time of its disposal.

EARNINGS PER SHARE

Basic income per share is calculated by dividing the income attributable to ordinary shareholders by the weighted average number of ordinary shares outstanding in the period. For all periods presented, the income attributable to ordinary shareholders equals the reported income attributable to owners of the Company.

Diluted income per share is calculated by the treasury stock method. Under the treasury stock method, the weighted average number of ordinary shares outstanding for the calculation of diluted income per share assumes that the proceeds to be received on the exercise of dilutive share options and warrants are used to repurchase ordinary shares at the average market price during the period.

The Company has no potentially dilutive securities, such as options or warrants, currently issued and outstanding, as of June 30, 2024, and 2023.

| 3 | CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION UNCERTAINTY |

Management believes that there are no key assumptions made concerning the future, and other key sources of estimation uncertainty at the reporting date, that have a significant risk of causing a material adjustment to the carrying amounts of the assets and liabilities within the next financial year other than as disclosed below:-

Impairment of Trade Receivables and Contract Assets

The Group uses the simplified approach to estimate a lifetime expected credit loss allowance for all trade receivables and contract assets. The contract assets are grouped with trade receivables for impairment assessment because they have substantially the same risk characteristics as the trade receivables for the same types of contracts. The Group develops the expected loss rates based on the payment profiles of past sales and the corresponding historical credit losses, and adjusts for qualitative and quantitative reasonable and supportable forward-looking information. If the expectation is different from the estimation, such difference will impact the carrying value of trade receivables and contract assets.

Contract Revenue Recognition

Revenue from providing product and services related to renewable energy services industry is recognized over time measure via input method, determined based on the proportion of costs incurred for work performed to date over the estimated total costs. Transaction price is computed based on the price specified in the contract and adjusted for any variable consideration such as incentives and penalties. The Group applied judgement and assumptions significantly affects the determination of the amount and the timing of revenue recognized from contract with customers for commercial & industrial and large scale solar. The Group measures the performance of service work done by comparing the actual costs incurred with the estimated total costs required to complete the services. Significant judgements are required to estimate the total contract costs to complete. In making these estimate, management relied on estimates and also on past experience of completed projects. A change in estimate will directly affect the revenue to be recognized.

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 3 | CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION UNCERTAINTY (cont.) |

Acquisitions of assets and businesses accounted under common control

The acquisition of entities, businesses or assets under common control are accounted for in accordance with merger accounting.

The combined financial statements incorporate the financial statements of the combining entities or businesses in which the common control combination occurs as if they had been combined from the date when the combining entities or businesses first came under the control of the controlling party.

The combined financial statements have prepared using uniform accounting policies for like transactions and other events in similar circumstances.

All intra-group balances, transactions, income and expenses are eliminated in full on combination and the combined financial statements reflect external transactions only.

The net assets of the combining entities or businesses are combined using the existing carrying amounts from the controlling party’s perspective. No amount is recognized in respect of goodwill or excess of the acquirer’s interest in the net fair value of acquiree’s identifiable assets, liabilities and contingent liabilities over the acquisition cost at the time of common control combination. All differences between the cost of acquisition (fair value of consideration paid) and the amounts at which the assets and liabilities are recorded, arising from common control combination, have been recognized directly in equity as part of the capital reserve.

The combined statements of profit or loss and other comprehensive income include the results of each of the combining entities or businesses from the earliest date presented or since the date when the combining entities or businesses first came under the common control, where this is a shorter period, regardless of the date of the common control combination.

| 4 | ACQUISITION OF FOUNDER ENERGY SDN. BHD. AT DISCOUNT UNDER COMMON CONTROL |

On June 14, 2023, Founder Group Limited acquired 100% equity interests of Founder Energy Sdn. Bhd. from Reservoir Energy Link Berhad and Mr. Lee Seng Chi under common control. The Company accounted the transaction as following:

| RM | Convenience Translation USD |

|||||||

| Obligation assumed by the Company | 4 | 1 | ||||||

| Book value of Share Capital of Founder Energy Sdn. Bhd. | (1,300,000 | ) | (294,583 | ) | ||||

| Bargain purchase accounted as merger reserve in equity | 1,299,996 | 294,582 | ||||||

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 5 | ACQUISITION OF ASSETS AND BUSINESS FROM SOLAR BINA ENGINEERING SDN. BHD. AT DISCOUNT UNDER COMMON CONTROL |

On July 31, 2021, Founder Energy Sdn. Bhd. entered into a Business and Asset Transfer Agreement with Solar Bina Engineering Sdn. Bhd., a common control entity owned and controlled by Mr. Lee Seng Chi, acquiring a variety of fixed assets and inventory at the net asset value as define in aforementioned agreement.

In addition to assets, Founder Energy Sdn. Bhd. acquired renewable energy, mounting structure system, building structural design and installation, solar system installation services and project management business from Solar Bina Engineering Sdn. Bhd.

The net asset value of transferred inventory and other assets by Solar Bina Engineering Sdn Bhd. as of January 1, 2021 amounted to RM1,375,507, whereas the net asset value of inventory and other assets as of July 31, 2021 amounted to RM1,020,236, which is also the amount of consideration stipulated in said agreement. As such, the Company accounted for the bargain purchase, as other reserve in equity amounting to RM355,271.

Business transferred from Solar Bina Engineering Sdn Bhd., resulted in a loss of RM49,722, which Founder Energy Sdn Bhd. acquired without consideration. As such, the Company accounted for the bargain purchase, as other reserve in equity amounting to RM49,722.

The consideration, amounting to RM1,020,236, was made in cash, with payment being completed by Founder Energy Sdn. Bhd. to Solar Bina Engineering Sdn. Bhd. in the year 2021.

The Company account the acquisition of assets and business under common control similarly to business combination under common control, measured at book value of transferring entity tabled as following:

| RM | Convenience Translation USD |

|||||||

| Acquisition of assets from Solar Bina Engineering Sdn. Bhd. | ||||||||

| Computer and Software | 44,171 | 10,009 | ||||||

| Motor Vehicle | 14,746 | 3,342 | ||||||

| Office Equipment | 30,800 | 6,979 | ||||||

| Mould | 8,502 | 1,927 | ||||||

| Plant and Machinery | 691,187 | 156,625 | ||||||

| Forklift | 45,800 | 10,378 | ||||||

| Inventory | 540,301 | 122,434 | ||||||

| Total fixed assets acquired from Solar Bina Engineering Sdn. Bhd. | 1,375,507 | 311,694 | ||||||

| Consideration transferred by Founder Energy Sdn. Bhd. | (1,020,236 | ) | (231,189 | ) | ||||

| Bargain purchase accounted as other reserve in equity | 355,271 | 80,505 | ||||||

| Acquisition of business from Solar Bina Engineering Sdn. Bhd. | ||||||||

| Sales | 20,268 | 4,593 | ||||||

| Staff Costs | (69,990 | ) | (15,860 | ) | ||||

| Net loss absorbed by Solar Bina Engineering Sdn. Bhd. accounted as other reserve in equity | (49,722 | ) | (11,267 | ) | ||||

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 6 | PLANT AND EQUIPMENT |

|

As of (Audited) |

As of (Unaudited) |

As of (Unaudited) |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Plant and equipment, at cost | ||||||||||||

| Computer and Software | 223,714 | 227,164 | 48,133 | |||||||||

| Motor Vehicles | 79,747 | 79,746 | 16,897 | |||||||||

| Office Equipment | 39,318 | 43,558 | 9,229 | |||||||||

| Equipment and Tools | 33,389 | 58,189 | 12,329 | |||||||||

| Signboard | 7,180 | 7,180 | 1,521 | |||||||||

| Office Renovation | 41,500 | 41,500 | 8,793 | |||||||||

| Solar Asset Plant | 1,320,000 | 1,282,500 | 271,745 | |||||||||

| Solar Asset Under Construction | — | 3,757,071 | 796,074 | |||||||||

| Plant and Machinery | 705,569 | 705,569 | 149,501 | |||||||||

| Forklift | 45,800 | 45,800 | 9,704 | |||||||||

| Total plant and equipment | 2,496,216 | 6,248,277 | 1,323,926 | |||||||||

| Less: Accumulated depreciation | (834,667 | ) | (959,441 | ) | (203,292 | ) | ||||||

| Less: Equipment written off | — | (32,779 | ) | (6,945 | ) | |||||||

| Total property, plant and equipment, net | 1,661,549 | 5,256,057 | 1,113,689 | |||||||||

| Depreciation expenses, class under cost of sale | 20,952 | 32,484 | 6,883 | |||||||||

| Depreciation expenses, class separately from cost of sale | 183,787 | 92,290 | 19,555 | |||||||||

| Total depreciation expenses | 204,739 | 124,774 | 26,438 | |||||||||

| Investment in plant and equipment: | ||||||||||||

| Computer and Software | 75,450 | 3,450 | 731 | |||||||||

| Office Equipment | 3,930 | 4,240 | 898 | |||||||||

| Equipment and Tools | — | 24,800 | 5,255 | |||||||||

| Office Renovation | 41,500 | — | — | |||||||||

| Solar Asset Plant | 1,320,000 | — | — | |||||||||

| Solar Asset Under Construction | — | 3,757,071 | 796,074 | |||||||||

| Plant and Machinery | 14,382 | — | — | |||||||||

| Total | 1,455,262 | 3,789,561 | 802,958 | |||||||||

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 7 | RIGHT-OF-USE ASSETS |

|

As of (Audited) |

As of (Unaudited) |

As of (Unaudited) |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Right-Of-Use Assets | ||||||||||||

| Balance brought forward | 141,572 | 213,761 | 45,293 | |||||||||

| Less: Amortization | (118,444 | ) | (71,253 | ) | (15,098 | ) | ||||||

| Termination of right-of-use asset | (94,381 | ) | (142,508 | ) | (30,195 | ) | ||||||

| Add: New lease recognized | 285,014 | — | — | |||||||||

| Balance carried forward | 213,761 | — | — | |||||||||

| Lease Liability | ||||||||||||

| Balance brought forward | 146,640 | 215,647 | 45,693 | |||||||||

| Add: Imputed interest | 9,066 | 5,049 | 1,070 | |||||||||

| Less: Principal repayment | (126,000 | ) | (75,000 | ) | (15,892 | ) | ||||||

| Termination of lease liability | (99,073 | ) | (145,696 | ) | (30,871 | ) | ||||||

| Add: New lease recognized | 285,014 | — | — | |||||||||

| Balance carried forward | 215,647 | — | — | |||||||||

| Lease liability current portion | 141,699 | — | — | |||||||||

| Lease liability non-current portion | 73,948 | — | — | |||||||||

| Maturities of Lease | ||||||||||||

| Year ending June 30, 2025 | — | — | ||||||||||

| Total | — | — | ||||||||||

On June 1, 2023, Founder Energy Sdn. Bhd. renewed its Tenancy Agreement with Mr. Lee Seng Chi pertaining to the rental of our principal office for another year with option to renew for additional year with monthly rental amounted RM12,500 payable in advance.

The extension options for lease of office premise has not been included in lease liabilities because the Group has not renew the lease rental.

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 8 | CONTRACT ASSETS AND CONTRACT LIABILITIES |

|

As of (Audited) |

As of (Unaudited) |

As of (Unaudited) |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Contract Assets | ||||||||||||

| Contract cost | 128,952,000 | 149,198,865 | 31,613,277 | |||||||||

| Contract margin | 22,018,596 | 23,024,089 | 4,878,502 | |||||||||

| Contract revenue recognized | 150,970,596 | 172,222,954 | 36,491,779 | |||||||||

| Less: Bill to trade receivables | (100,687,277 | ) | (139,241,813 | ) | (29,503,509 | ) | ||||||

| Contract assets carried forward | 50,283,319 | 32,981,141 | 6,988,270 | |||||||||

| Contract cost assets | 959,005 | — | — | |||||||||

| Less: Provision for impairment loss | (296,776 | ) | (285,989 | ) | (60,597 | ) | ||||||

| Balance carried forward | 50,945,548 | 32,695,152 | 6,927,673 | |||||||||

| Increase/(Decrease) in contract assets | 32,709,220 | (18,261,184 | ) | (3,869,305 | ) | |||||||

| Decrease in provision for impairment loss | (296,776 | ) | 10,787 | 2,286 | ||||||||

| Contract Liabilities | ||||||||||||

| Balance brought forward | 806,058 | — | — | |||||||||

| Add: Deposits and prepayment from customer | (800,058 | ) | 2,581,199 | 546,922 | ||||||||

| Adjustment for unrealized foreign exchange movement | 12,070 | — | — | |||||||||

| Adjustment to other payables | (18,070 | ) | — | — | ||||||||

| Balance carries forward | — | 2,581,199 | 546,922 | |||||||||

| (Decrease)/Increase in contract liabilities | (806,058 | ) | 2,581,199 | 546,922 | ||||||||

Significant decrease in contract assets for the period ended June 30, 2024 primarily due to a decrease in unbilled revenue related to the satisfaction of performance obligation in excess of amounts billed to customers.

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 9 | TRADE RECEIVABLES AND TRADE PAYABLES |

|

As of (Audited) |

As of (Unaudited) |

As of (Unaudited) |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Non-Current | ||||||||||||

| Project retention receivables | 2,665,887 | 3,187,881 | 675,470 | |||||||||

| Current | ||||||||||||

| Trade receivables | 12,156,133 | 12,012,227 | 2,545,232 | |||||||||

| Accrued revenue | 47,499 | 222,932 | 47,236 | |||||||||

| Project retention receivables | 698,429 | 422,212 | 89,462 | |||||||||

| Accrued liquidated ascertained damages to Sub-contractor | 408,980 | 2,011,284 | 426,165 | |||||||||

| Less: Provision for expected credit loss | (27,549 | ) | (27,549 | ) | (5,837 | ) | ||||||

| Total trade receivables | 15,949,379 | 17,828,987 | 3,777,728 | |||||||||

| Increase in total trade receivables | 11,922,137 | 1,879,608 | 398,264 | |||||||||

|

As of (Audited) |

As of (Unaudited) |

As of (Unaudited) |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Trade payables | 37,268,115 | 21,337,719 | 4,521,182 | |||||||||

| Project retention payable | 1,150,758 | 1,607,668 | 340,644 | |||||||||

| Total trade payables | 38,418,873 | 22,945,387 | 4,861,826 | |||||||||

| Increase/(Decrease) in total trade payables | 19,827,253 | (15,473,486 | ) | (3,278,628 | ) | |||||||

| 10 | INVENTORIES |

|

As of (Audited) |

As of (Unaudited) |

As of (Unaudited) |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Inventories | 1,863,933 | 1,797,252 | 380,814 | |||||||||

The amount of inventories recognized as an expense in cost of sales of the Group was RM28,212,121 (USD5,977,777) (June 30, 2023: RM60,676,876).

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 11 | AMOUNT DUE FROM/(TO) RELATED PARTIES |

|

As of (Audited) |

As of (Unaudited) |

As of (Unaudited) |

||||||||||

| RM | RM |

Convenience USD |

||||||||||

| Amount due from Solar Bina Engineering Sdn. Bhd. | 1,119,848 | 24,727 | 5,239 | |||||||||

| Amount due from RL Sunseap Energy Sdn. Bhd. | 256,256 | 433,752 | 91,906 | |||||||||

| Amount due from Reservoir Link Energy Bhd. | 1,831,054 | 180,092 | 38,159 | |||||||||

| Amount due from Reservoir Link Renewable Sdn. Bhd. | — | 659,863 | 139,817 | |||||||||

| Amount due from Sunseap Energy (Malaysia) Sdn. Bhd. | — | 367,969 | 77,968 | |||||||||

| Amount due from related parties | 3,207,158 | 1,666,403 | 353,089 | |||||||||

| Amount due to Reservoir Link Energy Bhd. | 2,474,525 | 2,372,290 | 169 | |||||||||

| Amount due to Reservoir Link Sdn. Bhd. | 285,388 | 258,804 | 502,657 | |||||||||

| Amount due to Solar Bina Engineering Sdn. Bhd. | — | 795 | 54,837 | |||||||||

| Amount due to related parties | 2,759,913 | 2,631,889 | 557,663 | |||||||||

Both amount due to and from related parties on an on-demand basis. Other than amount due to and from related parties that is trade nature, amount due to and from related parties subject to interest rate of BLR + 1.5% per annum.

Material Transactions with Related Parties

| Name of Related Party | Relationship to Us | |

| Solar Bina Engineering Sdn. Bhd. | An entity controlled by our Chief Executive Officer and Director Mr. Lee Seng Chi | |

| Reservoir Link Energy Bhd. | Our largest shareholder | |

| Reservoir Link Sdn. Bhd. | An entity controlled by Reservoir Link Energy Bhd. | |

| Reservoir Link Renewable Sdn. Bhd. | An entity controlled by Reservoir Link Energy Bhd. | |

| Lee Seng Chi | Our Chief Executive Officer and Director | |

| RL Sunseap Energy Sdn. Bhd. | Related company with Reservoir Link Energy Bhd. | |

| Thien Chiet Chai | A director of certain of our related parties, including Reservoir Link Energy Bhd., Reservoir Link Renewable Sdn. Bhd., and RL Sunseap Energy Sdn. Bhd. |

| For the six months ended | ||||||||||||

| June 30, 2023 |

June 30, 2024 |

June 30, 2024 |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Rental payment to Mr. Lee Seng Chi | 51,000 | 75,000 | 15,892 | |||||||||

| Revenue from Solar Bina Engineering Sdn. Bhd. | 1,310,409 | 74,034 | 15,687 | |||||||||

| Revenue from Reservoir Link Energy Bhd. | — | 138,170 | 29,276 | |||||||||

| Revenue from RL Sunseap Energy Sdn. Bhd. | 1,102,528 | 1,000,483 | 211,989 | |||||||||

| Revenue from Reservoir Link Renewable Sdn. Bhd. | 96,066 | (145,493 | ) | (30,828 | ) | |||||||

| Total revenue from related parties | 2,509,003 | 1,067,194 | 226,124 | |||||||||

| Expenses charged to Reservoir Link Energy Bhd. | 37,521 | 50,188 | 10,634 | |||||||||

| Expenses charged to Reservoir Link Sdn. Bhd. | — | 26,583 | 5,633 | |||||||||

| 37,521 | 76,771 | 16,267 | ||||||||||

| Expenses charged by Reservoir Link Energy Berhad | 49,367 | 56,441 | 11,959 | |||||||||

| Finance cost charged by Reservoir Link Energy Bhd. | 90,618 | 90,097 | 19,090 | |||||||||

| Finance cost charged by Reservoir Link Sdn. Bhd. | 63,865 | — | — | |||||||||

| Finance cost charged by related parties | 154,483 | 90,097 | 19,090 | |||||||||

| Purchases from Reservoir Link Renewable Sdn. Bhd. | — | 1,799 | 381 | |||||||||

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 11 | AMOUNT DUE FROM/(TO) RELATED PARTIES (Cont.) |

The related party transactions mainly derived from the sales of renewable energy products and services, recharge of expenses, interest charged for advances and management fees.

In the six months period ended June 30, 2024 and 2023, recharge of expenses, interest charged and management fees charged by Reservoir Link Energy Bhd. and Reservoir Link Sdn. Bhd. represent expenses paid on behalf of the Group and interest charged for funds advanced to the Group.

Significant related party transaction with Solar Bina Engineering Sdn. Bhd. was due to contract secured via Solar Bina Engineering Sdn. Bhd. for supply of mounting structure, where the customer is unable to novate the contract from Solar Bina Engineering Sdn. Bhd. to the Group.

The Group was appointed as contractor by RL Sunseap Energy Sdn. Bhd. for the sales of renewable energy products and services.

The Group was appointed as contractor by Reservoir Link Renewable Sdn. Bhd. for the sales of renewable energy products and services.

| 12 | OTHER RECEIVABLES AND PREPAYMENT AND OTHER PAYABLES AND ACCRUED LIABILITIES |

|

As of (Audited) |

As of (Unaudited) |

As of (Unaudited) |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Other Receivables | ||||||||||||

| Project deposits | 252,490 | 242,830 | 51,452 | |||||||||

| Prepayment to supplier | 1,843,652 | 2,940,669 | 623,089 | |||||||||

| Other receivables | 813,020 | 2,190,242 | 464,084 | |||||||||

| Other deposits | 1,448,882 | 638,575 | 135,306 | |||||||||

| 4,358,044 | 6,012,316 | 1,273,931 | ||||||||||

|

As of (Audited) |

As of (Unaudited) |

As of (Unaudited) |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Other Payables | ||||||||||||

| Accrued staff cost | 349,035 | 326,797 | 69,244 | |||||||||

| Other payables | 782,911 | 4,841,645 | 1,025,881 | |||||||||

| Prepayment from customer | 134,194 | 2,794 | 592 | |||||||||

| 1,266,140 | 5,171,236 | 1,095,717 | ||||||||||

| 13 | BANK BORROWINGS |

| Capacity |

As of (Audited) |

As of (Unaudited) |

As of (Unaudited) |

|||||||||||||

| RM | RM | RM | Convenience Translation USD |

|||||||||||||

| Line of Credit | ||||||||||||||||

| Ambank Islamic Bank – Domestic Recourse Factoring, at Base Financing Rate – 1% | 10,000,000 | 1,324,110 | 2,523,108 | 534,614 | ||||||||||||

| Ambank Islamic Bank – Invoice Financing, at Base Financing Rate | 20,000,000 | 6,935,623 | 9,744,320 | 2,064,693 | ||||||||||||

| Ambank Islamic Bank – Banker Acceptance, at Islamic Interbank Discounting Rate + 1.50% | 10,200,000 | 5,243,619 | 6,488,539 | 1,374,836 | ||||||||||||

| Ambank Islamic Bank – Invoice Financing, at Base Financing Rate | 4,413,485 | — | — | |||||||||||||

| CIMB Islamic Bank – Accepted Bills, at Accepted Bills + 1.50% | 8,000,000 | 3,371,782 | — | — | ||||||||||||

| CIMB Islamic Bank – Multi Currency Trade Financing-i, at Cost of Funds + 1.5% | 1,421,601 | 7,448,477 | 1,578,234 | |||||||||||||

| Sunway SCF Sdn Bhd. – Invoice Factoring | — | 1,056,440 | — | — | ||||||||||||

| Ambank Islamic Bank – Term Financing, at Base Financing Rate – 1% | — | 455,000 | 633,686 | 134,270 | ||||||||||||

| Ambank Islamic Bank – Term Financing, at Base Financing Rate – 1% | — | 487,456 | 1,486,996 | 315,075 | ||||||||||||

| 56,100,000 | 24,709,116 | 28,325,126 | 6,001,722 | |||||||||||||

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 13 | BANK BORROWINGS (cont.) |

The maturities schedule is as follow:

Twelve months ending June 30,

| RM | Convenience Translation USD |

|||||||

| Maturities | ||||||||

| 2025 | 26,307,249 | 5,574,160 | ||||||

| 2026 | 156,780 | 33,220 | ||||||

| 2027 | 156,780 | 33,220 | ||||||

| 2028 | 156,780 | 33,220 | ||||||

| 2029 | 1,547,537 | 327,902 | ||||||

| Total | 28,325,126 | 6,001,722 | ||||||

The term loans are secured by bank loan assignment over an insurance policy for directors of the Group.

| 14 | RESERVES |

|

As of (Audited) |

As of (Unaudited) |

As of (Unaudited) |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Bargain purchases from acquisition of Founder Energy Sdn. Bhd. under common control accounted as merger reserve | 1,299,996 | 1,299,996 | 275,452 | |||||||||

| Bargain purchase from acquisition of plant, equipment and inventory from Solar Bina Engineering Sdn. Bhd. under common control accounted as other reserve | 355,271 | 355,271 | 75,277 | |||||||||

| Bargain purchase from acquisition of business from Solar Bina Engineering Sdn. Bhd. under common control accounted as other reserve | 49,722 | 49,722 | 10,536 | |||||||||

| 1,704,989 | 1,704,989 | 361,265 | ||||||||||

| 15 | REVENUE |

| For the six months ended | ||||||||||||

| June 30, 2023 |

June 30, 2024 |

June 30, 2024 |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Revenue from contract services | 42,724,877 | 21,776,845 | 4,614,228 | |||||||||

| Revenue from sales of goods | 23,492,766 | 7,595,546 | 1,609,396 | |||||||||

| Revenue from contract services – related party | 2,509,003 | 1,067,194 | 226,124 | |||||||||

| Revenue from sales of goods – related party | — | — | — | |||||||||

| 68,726,646 | 30,439,585 | 6,449,748 | ||||||||||

| Timing of revenue recognition: | ||||||||||||

| Point in time | 23,492,766 | 7,595,546 | 1,609,396 | |||||||||

| Over time | 45,233,880 | 22,844,039 | 4,840,352 | |||||||||

| 68,726,646 | 30,439,585 | 6,449,748 | ||||||||||

| Unsatisfied performance obligation | 38,147,362 | 36,756,234 | 7,788,163 | |||||||||

Revenue from contract services primarily involved in project execution, including construction, installation and integration works, testing and commissioning of our solar projects. Revenue from sales of goods involved in supply and selling of solar mounting structure and its accessories.

Unsatisfied performance obligation was duly satisfied and recognized as revenue within 12 months after the reporting year end, respectively. Revenue from contract services primarily involved in project execution, including construction, installation and integration works, testing and commissioning of our solar projects. Revenue from sales of goods involved in supply and selling of parts and accessories.

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 16 | COST OF SALE |

| For the six months ended | ||||||||||||

| June 30, 2023 |

June 30, 2024 |

June 30, 2024 |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Material Cost | 31,265,416 | 9,968,658 | 2,112,228 | |||||||||

| Construction Cost | 23,668,446 | 14,022,382 | 2,971,158 | |||||||||

| Staff Cost | 1,687,762 | 2,166,300 | 459,010 | |||||||||

| Logistic Cost | 704,317 | 722,336 | 153,054 | |||||||||

| Tools & Machinery | 318,866 | 114,303 | 24,219 | |||||||||

| Miscellaneous | 3,032,069 | 1,185,657 | 251,225 | |||||||||

| Depreciation | — | 32,485 | 6,883 | |||||||||

| Total cost of sale | 60,676,876 | 28,212,121 | 5,977,777 | |||||||||

Included in Cost of Sale of the Group is related party transactions amounting to RM1,095,340 (USD232,088) (30 June 2023: RM1,912,129).

| 17 | EMPLOYEES SALARY AND RELATED COSTS |

| For the six months ended | ||||||||||||

| June 30, 2023 |

June 30, 2024 |

June 30, 2024 |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Director salaries | 296,259 | 336,589 | 71,319 | |||||||||

| Admin salaries | 1,126,817 | 1,476,661 | 312,885 | |||||||||

| Technical staff salaries | 1,443,137 | 1,906,227 | 403,904 | |||||||||

| Total | 2,866,213 | 3,719,477 | 788,108 | |||||||||

| For the six months ended | ||||||||||||

| June 30, 2023 |

June 30, 2024 |

June 30, 2024 |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Director related expenses | 7,053 | 47,360 | 10,035 | |||||||||

| Admin related expenses | 69,965 | 214,660 | 45,484 | |||||||||

| Technical staff related expenses | 164,535 | 263,395 | 55,810 | |||||||||

| Total | 241,553 | 525,415 | 111,329 | |||||||||

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 18 | INCOME TAX EXPENSES |

| For the six months ended | ||||||||||||

| June 30, 2023 |

June 30, 2024 |

June 30, 2024 |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Net income/(loss) before taxes | 3,602,419 | (1,881,960 | ) | (398,764 | ) | |||||||

| Adjustment for temporary differences | 622,146 | — | — | |||||||||

| Adjustment for permanent differences | (215,648 | ) | 130,416 | 36,280 | ||||||||

| Taxable income | 4,008,917 | (1,751,411 | ) | (362,484 | ) | |||||||

| Tax rate | 24 | % | 24 | % | 24 | % | ||||||

| Tax expenses | 962,140 | (420,371 | ) | (86,996 | ) | |||||||

| Under provision of income tax expense in prior years | — | 250,233 | 50,946 | |||||||||

| Changes in deferred tax | 149,315 | — | — | |||||||||

| Tax payable for the year | 1,111,455 | (170,138 | ) | (36,050 | ) | |||||||

| Tax payment | (680,000 | ) | (910,677 | ) | (192,961 | ) | ||||||

| Tax refund | 41,481 | — | — | |||||||||

| Tax payable brought forward | 157,293 | 1,714,168 | 363,210 | |||||||||

| Tax payable carry forward | 630,229 | 633,353 | 134,199 | |||||||||

| 19 | FINANCIAL INSTRUMENTS AND RISK MANAGEMENT |

|

As of (Unaudited) |

As of (Unaudited) |

As of (Unaudited) |

||||||||||

| RM | RM | Convenience Translation USD |

||||||||||

| Cash and bank balances | 3,948,174 | 10,034,522 | 2,126,183 | |||||||||

| Financial assets at amortized cost | ||||||||||||

| Contract assets | 29,034,631 | 32,695,152 | 6,927,673 | |||||||||

| Trade receivables | 24,327,951 | 17,828,987 | 3,777,728 | |||||||||

| Other receivables | 1,272,044 | 2,512,817 | 532,433 | |||||||||

| Amount due from related parties | 439,062 | 1,666,403 | 353,089 | |||||||||

| Financial liabilities at amortized cost | ||||||||||||

| Trade payables | (36,243,039 | ) | (22,945,387 | ) | (4,861,826 | ) | ||||||

| Contract liabilities | (800,058 | ) | (2,581,199 | ) | (546,922 | ) | ||||||

| Other payables & accrued liabilities | (1,431,059 | ) | (5,171,236 | ) | (1,095,717 | ) | ||||||

| Bank and other borrowings | (10,130,735 | ) | (28,325,126 | ) | (6,001,722 | ) | ||||||

| Lease liabilities | (285,014 | ) | — | — | ||||||||

| Amount due to related parties | (2,543,258 | ) | (2,631,889 | ) | (557,663 | ) | ||||||

| 7,597,699 | 3,083,044 | 653,256 | ||||||||||

Foreign Currency Risk

We are exposed to foreign currency risk with transactions and balances that are denominated in currencies other than our functional currency. The currencies giving rise to this risk are primarily Chinese Renminbi (“RMB”) and United States Dollar (“USD”). Foreign currency risk is monitored closely on an on-going basis to ensure that the net exposure is at an acceptable level.

F-

FOUNDER GROUP LIMITED AND ITS SUBSIDIARIES

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 19 | FINANCIAL INSTRUMENTS AND RISK MANAGEMENT (cont.) |

Interest Rate Risk

We are exposed to interest rate risk as we have bank loans which are interest bearing. The interest rates and terms of repayment of the loans are disclosed in Note 13 to the financial statements. We currently do not have an interest rate hedging policy.

Liquidity Risk

Liquidity risk arises mainly due to general funding and business activities. We practice prudent risk management by maintaining sufficient cash balances and the availability of funding through certain committed credit facilities.

Capital Risk Management

We manage our capital to ensure that entities within our Company will be able to maintain an optimal capital structure so as to support our businesses and maximize shareholders value. To achieve this objective, we may make adjustments to the capital structure in view of changes in economic conditions, such as adjusting the amount of dividend payment, returning of capital to shareholders or issuing new shares.

We manage our capital based on debt-to-equity ratio that complies with debt covenants and regulatory, if any. The debt-to-equity ratio is calculated as net debt divided by total equity. We include within net debt, loans, and borrowings from financial institutions. Capital includes equity attributable to the owners of the parent and non-controlling interest.

| 20 | CONCENTRATION OF RISK |

Customer Concentration

For the six months period ended June 30, 2024, the Company generated total revenue of RM30,439,585, of which four customers accounted for more than 10% of the Company’s total revenue.

For the six months period ended June 30, 2023, the Company generated total revenue of RM68,726,646, of which three customers accounted for more than 10% of the Company’s total revenue.

| For the six months ended June 30 (Unaudited) | ||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Revenues | Percentage of revenues |

Trade receivables | ||||||||||||||||||||||

| RM | RM | % | % | RM | RM | |||||||||||||||||||

| Customer A | 9,467,487 | — | 31.10 | — | 2,043,279 | — | ||||||||||||||||||

| Customer B | 6,570,203 | 359,994 | 21.58 | 0.52 | 6,022,475 | 809,922 | ||||||||||||||||||

| Customer C | 5,842,660 | 600,360 | 19.19 | 0.87 | 6,543 | 574,103 | ||||||||||||||||||

| Customer D | 3,503,863 | — | 11.51 | — | 2,033,500 | |||||||||||||||||||

| Customer E | — | 32,301,155 | — | 47.00 | — | 12,354,912 | ||||||||||||||||||

| Customer F | — | 11,413,371 | — | 16.61 | — | 6,751,137 | ||||||||||||||||||

| Customer G | — | 9,626,039 | — | 14.01 | — | 2,040,547 | ||||||||||||||||||

| Others | 5,055,372 | 14,425,727 | 16.62 | 20.99 | 7,723,190 | 1,797,330 | ||||||||||||||||||