UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to __________

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

Commission File Number: 001-39171

BROOGE ENERGY LIMITED

(Exact name of Registrant as specified in its charter)

| Not applicable | Cayman Islands | |

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

c/o Brooge Petroleum and Gas Investment Company

FZE

P.O. Box 50170

Fujairah, United Arab Emirates

+971 9 201 6666

(Address of Principal Executive Offices)

Siavosh Hossein

P.O. Box 50170

Fujairah, United Arab Emirates

+971 9 201 6666

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Ordinary shares, $0.0001 par value per share | BROG | The Nasdaq Stock Market LLC | ||

| Warrants to purchase ordinary shares | BROGW | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 109,587,853 ordinary shares out of which 21,552,500 are held in Escrow

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ |

| Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

BROOGE ENERGY LIMITED

TABLE OF CONTENTS

INTRODUCTION

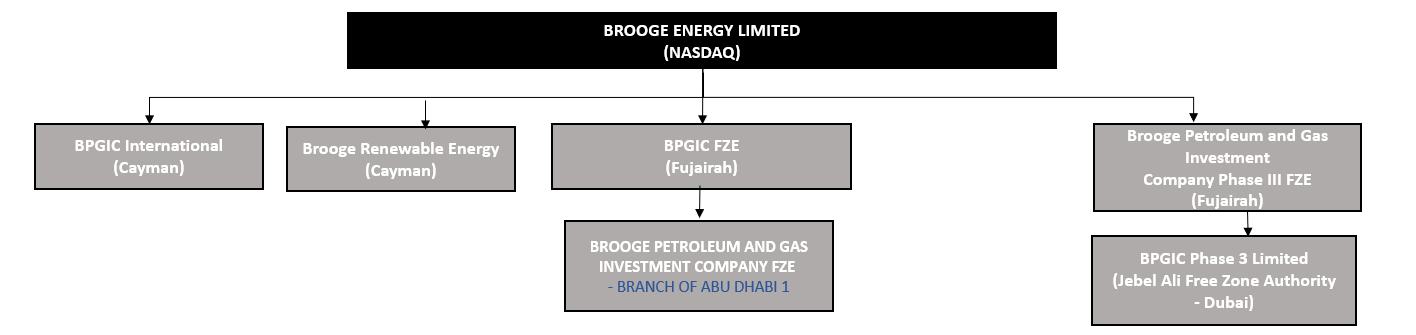

Brooge Energy Limited (the “Company”) was incorporated under the laws of the Cayman Islands as an exempted company on April 12, 2019, under the name Brooge Holdings Limited. On April 7, 2020, the Company changed its name to Brooge Energy Limited. The Company was incorporated for the purpose of effectuating the Business Combination (as defined below) and to hold Brooge Petroleum and Gas Investment Company FZE, a company formed under the laws of the Fujairah Free Zone, United Arab Emirates (“BPGIC”). Prior to the Business Combination, the Company owned no material assets and did not operate any business.

On December 20, 2019, pursuant to a business combination agreement (the “Business Combination Agreement”) among the Company, Twelve Seas Investment Company (now known as BPGIC International), a Cayman Islands exempted company (“Twelve Seas”), Brooge Merger Sub Limited, the Company’s wholly-owned subsidiary (“Merger Sub”), BPGIC, BPGIC Holdings Limited, a Cayman Islands exempted company (“BPGIC Holdings”), among other things:

| (i) | Twelve Seas merged with and into Merger Sub, with Twelve Seas continuing as the surviving entity and a wholly-owned subsidiary of the Company (under the name BPGIC International (“BPGIC International”)), with the holders of Twelve Seas’ securities receiving substantially equivalent securities of the Company; and |

| (ii) | the Company acquired all of the issued and outstanding ordinary shares of BPGIC from BPGIC Holdings in exchange for 98,718,035 Ordinary Shares of the Company and cash in the amount of $13,225,827.22, with BPGIC becoming a wholly-owned subsidiary of the Company. |

The foregoing transaction is referred to in this Annual Report on Form 20-F (this “Report”) as the “Business Combination”.

Upon consummation of the Business Combination, the Company’s Ordinary Shares and warrants to purchase Ordinary Shares became listed on the Nasdaq Capital Market.

Unless otherwise indicated, the “Company,” the “Group,” “we,” “us,” “our,” and similar terminology refers to Brooge Energy Limited together with its subsidiaries subsequent to the Business Combination.

The Company previously filed an Annual Report on Form 20-F on April 5, 2021, as amended by Amendment No. 1 to the Annual Report on Form 20-F/A filed with the Securities and Exchange Commission on April 6, 2021, inclusive of any six month financial statements previously filed (collectively, the “Previous 2020 Form 20-F”). As previously reported, as a result of an investigation by the Audit Committee of the Board of Directors, the Committee decided to withdraw reliance on such filings on August 17, 2022. Due to the on-going investigation by Securities and Exchange Commission previously disclosed, the Company was not able to file the required Annual Reports on Form 20-F for fiscal years ended December 31, 2021 and December 31, 2022, including any related six month financial statements that should have been filed. On April 26, 2023 (with amendments on May 1 and May 2, 2023), the Company filed a Form 20-F which replaced and restated in full the Previous 2020 Form 20-F, which also covered the fiscal years ended December 31, 2021 and December 31, 2022, inclusive of any six month financial statements that should have been filed.

Following a winding up order made on November 20, 2023 by the Grand Court of the Cayman Islands (the “Court”), the majority shareholder of the Company, BPGIC Holdings, was placed into official liquidation and Messrs. Alexander Lawson and Guy Wall were appointed by the Court as joint official liquidators (“JOLs”) of BPGIC Holdings.

Following a request from the JOLs, on December 14, 2023, the Board of Directors of the Company appointed the JOLs as directors of the Company.

During the Company’s 2023 Annual General Meeting (the “2023 AGM”) that took place on December 15, 2023, the JOLs attended the meeting in person and cast their votes on behalf of BPGIC Holdings, voting against the reelection of the previous directors and declaring themselves the only two directors of the Company, with effect from December 15, 2023.

Following the 2023 AGM, the two new directors were supposed to appoint new independent board members and to constitute the audit and compensation committees accordingly.

On December 27, 2023, BPGIC, a subsidiary of the Company was served with a court order from a court in the UAE and as a precautionary measure, the court appointed a Judicial Guardian (“JG”) over BPGIC.

On March 12, 2024, Mr. Guy Wall resigned from his position as director of the Company and Mr. Alexander Lawson became the sole director of the Company.

With the absence of an audit committee, the Company was unable to confirm the engagement of a PCAOB certified accounting firm to file its Form 20-F in a timely manner. Additionally, the gap or lack of communication between the JOLs at the shareholder level and the JG at the subsidiary level contributed to delays in decision-making processes. Consequently, this Form 20-F has been filed hereby on a delayed basis.

On September 02, 2024, the Company held an extraordinary general meeting of shareholders (the “2024 EGM”).

At the 2024 EGM, holders of ordinary shares of the Company were asked to consider and vote upon the proposals set forth on the proxy card, including the election of a Board. As a result of the Meeting, the Company’s board of directors now consists of Kamal Pharran, Saleh Mohamed Yammout, Rasool Alameri, Tony Boutros, and Siavosh Hossein; effective from September 04,2024, the board of directors has appointed Mr. Siavosh as the Chairman of the Board. Following the EGM, the previous sole director, Alexander Lawson, resigned as a director of the Company. On September 4, 2024, the Board of Directors updated the composition of its Audit Committee.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report (including information incorporated by reference herein) contains forward-looking statements as defined in Section 27A of the Securities Act, and Section 21E of the Exchange Act that involve significant risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements include information about our possible or assumed future results of operations or our performance. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “estimates,” and variations of such words and similar expressions are intended to identify some, but not all, forward-looking statements. The risk factors and cautionary language referred to or incorporated by reference in this Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in or implied by our forward-looking statements, including among other things, the items identified in “Item 3.D Risk Factors”.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. Although we believe that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements contained in this Report, or the documents to which we refer readers in this Report, to reflect any change in our expectations with respect to such statements or any change in events, conditions or circumstances upon which any statement is based.

INDUSTRY AND MARKET DATA

In this Report, the Company relies on and refers to industry data, information and statistics regarding the markets in which it competes from research as well as from publicly available information, industry and general publications and research and studies conducted by third parties. The Company has supplemented this information where necessary with its own internal estimates and information obtained from discussions with its customers, taking into account publicly available information about other industry participants and Company management’s best view as to information that is not publicly available. The Company has taken such care as it considers reasonable in the extraction and reproduction of information from such data from third-party sources.

Industry publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this Report. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Item 3.D Risk Factors”. These and other factors could cause results to differ materially from those expressed in the forecasts or estimates from independent third parties and us.

FREQUENTLY USED TERMS

“$,” “USD,” “US$” and “US dollar” each refer to the United States dollar.

“AED,” refers to the Arab Emirate Dirham, the official currency of the United Arab Emirates.

“Amended and Restated Memorandum and Articles of Association” means the amended and restated memorandum and articles of association of Brooge Energy Limited.

“ASMA Capital” means ASMA Capital Partners B.S.C.(c).

“Atlantis” means Atlantis Commodities Trading HK Limited

“Audex” means Audex Fujairah LL FZC.

”b/d” means barrels per day.

“Bond Financing Facility” means five-year senior secured bonds issued by BPGIC pursuant to Bond Terms dated September 22, 2020 and amended October 23, 2020 and April 27, 2022 by and between BPGIC and the Bond Trustee, with maximum issue size of $250 million and initial issuance of $200 million.

“Bond Trustee” means Nordic Trustee AS, as bond trustee under the Bond Financing Facility.

“BPGIC” means Brooge Petroleum and Gas Investment Company FZE.

“BPGIC III” means Brooge Petroleum and Gas Investment Company Phase III FZE, a company formed under the laws of the Fujairah Free Zone, United Arab Emirates.

“BPGIC Management” means Brooge Petroleum and Gas Management Company Ltd.

“BPGIC PLC” means Brooge Petroleum and Gas Investment Company (BPGIC) PLC, a company formed under the laws of England and Wales.

“BPGIC Terminal” means the terminal that the Company is developing on two plots of land located in close proximity to the Port of Fujairah’s berth connection points.

“BRE” means Brooge Renewable Energy Limited.

“Business Combination” means the transactions whereby (a) Twelve Seas merged with and into Merger Sub, with Twelve Seas continuing as the surviving entity with the name BPGIC International, and as a wholly-owned subsidiary of the Company and with holders of the Twelve Seas’ securities receiving substantially equivalent securities of the Company, and (b) the Company acquired all of the issued and outstanding ordinary shares of BPGIC from BPGIC Holdings in exchange for Ordinary Shares of the Company, subject to the withholding of the escrow shares being deposited in the escrow account in accordance with the terms and conditions of the Business Combination Agreement and the escrow agreement, and with BPGIC becoming a wholly-owned subsidiary of the Company, and other transactions contemplated by the Business Combination Agreement.

“Business Combination Agreement” means the Business Combination Agreement, dated as of April 15, 2019, as amended, by and among the Company, BPGIC, Twelve Seas, Merger Sub, and BPGIC Holdings pursuant to which the Business Combination was consummated.

“CenGeo” means CenGeo New Energy FZ-LLC

“Closing” means the closing of the Business Combination on December 20, 2019.

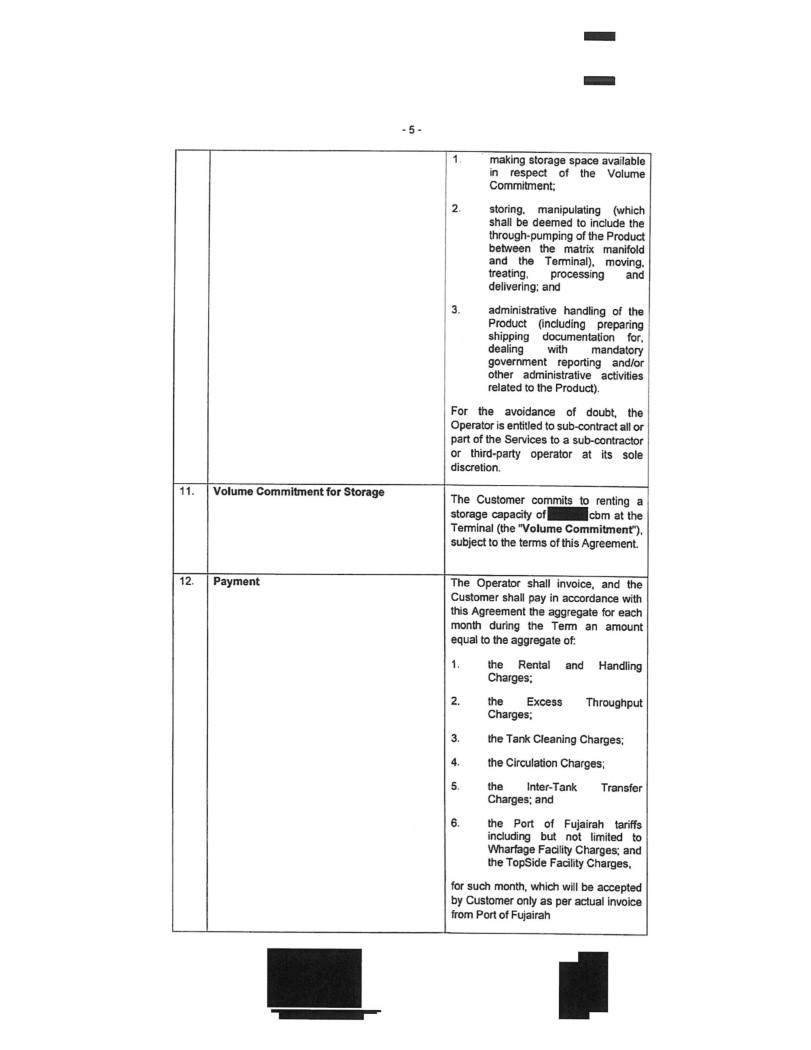

“Commercial Storage Agreements” means, collectively, the Avis Storage Agreements dated May 10 2022, the Sahra Storage Agreements dated November 21 2022, the Cengeo Storage Agreements dated July 01, 2022, August 04, 2022, September 09, 2022 and December 13, 2022; the Aachim Storage Agreement dated July 15, 2022, the Actirays Storage Agreement dated August 19, 2022; the Atlantis Storage Agreement dated February, 01 2023; the Valens DMCC Storage Agreement dated June 15, 2023; the 1Energin DMCC Storage Agreement dated 23 June 2023; and the Turkiz Fuel Trading LLC Storage Agreement dated 07 July 2023.

“Companies Law” means the Companies Law (2020 Revision) of the Cayman Islands.

“Construction Funding Account” means the account with Offshore Account Bank with $85 million on deposit from the Bond Financing Facility to be set aside for payment of Phase II construction, with $45 million to be paid at the time of disbursement and $5 million payable monthly for eight months.

“Continental” means Continental Stock Transfer & Trust Company.

“Debt Service Retention Account” means the account with Offshore Account Bank into which one-sixth of the amortization and interest payment payable on the next interest payment date of Bond Financing Facility shall be transferred monthly.

“Early Bird Capital” means EarlyBirdCapital, Inc.

“EIBOR” means the Emirates Interbank Offered Rate.

“1Energin” means 1Energin DMCC.

“EPC” means engineering, procurement and construction.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“FAB” means First Abu Dhabi Bank PJSC.

“Financing Facilities” means, collectively, the Phase I Financing Facilities and the Phase II Financing Facility, and Commercial Bank of Dubai Financing Facility for office.

“FOIZ” means the Fujairah Oil Industry Zone.

“Fujairah Municipality” means the local government organization in Fujairah, UAE specializing in municipal urban and rural municipal affairs.

“Green Hydrogen and Green Ammonia Project” means the project to be located in Abu Dhabi, led by BRE which aims to produce renewable, carbon-free fuel using solar power.

“Group” means the Company and each of its subsidiary undertakings.

“IFRS” refers to International Financial Reporting Standards as issued by the International Accounting Standards Board (IASB).

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012.

“June 15 Phase I Construction Facilities Amendment” means the agreement entered into by BPGIC and FAB on June 15, 2020, to amend the Phase I Construction Facilities.

“Land Leases” means, collectively, the Phase I & II Land Lease and the Phase III Land Lease.

“Liquidity Account” means the bank account established by BPGIC as part of Bond Financing Facility with the Offshore Account Bank to maintain $8,500,000, which amount is equal to the interest payment due on the first interest payment date.

“MENA” means Middle East and North Africa.

“Merger Sub” means Brooge Merger Sub Limited, a Cayman Islands exempted company.

“Modular Refinery” means a refinery with a capacity of 25,000 b/d to be installed at the BPGIC Terminal.

“MUC” means MUC Oil & Gas Engineering Consultancy, LLC.

“NASDAQ” means the NASDAQ Stock Market LLC.

“Offshore Account Bank” means HSBC Bank Plc.

“Ordinary Resolution” means a resolution passed by the affirmative vote of a simple majority of the shareholders of the Company as, being entitled to do so, vote in person or, where proxies are allowed, by proxy at a meeting.

“Ordinary Shares” means the ordinary shares, par value $0.0001 per share, of Brooge Energy Limited, unless otherwise specified.

“Orit” means Orit Pte. Ltd.

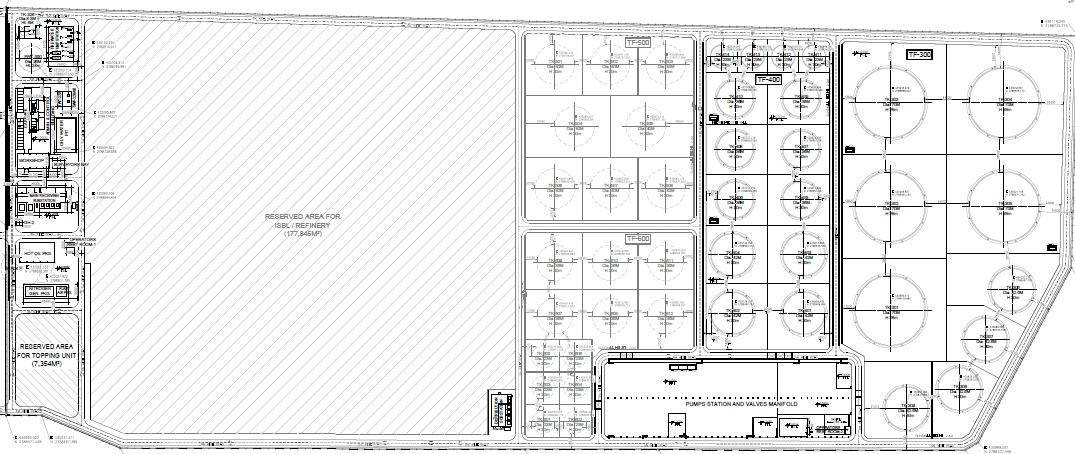

“Phase I” means the first phase of the BPGIC Terminal consisting of 14 oil storage tanks with an aggregate geometric oil storage capacity of approximately 0.399 million m3 and related infrastructure located on the Phase I & II Land.

“Phase I & II Land” means the plot of land of approximately 153,917 m2 in the Port of Fujairah where BPGIC has located its Phase I facility and is locating its Phase II facility.

“Phase I & II Land Lease” means the land lease dated as of March 10, 2013, by and between Fujairah Municipality and BPGIC, as amended by the novation agreement, dated September 1, 2014, by and among Fujairah Municipality, BPGIC and FOIZ pursuant to which BPGIC leases the Phase I & II Land.

“Phase I Admin Building Facility” means the secured Shari’a compliant financing arrangement of $11.1 million entered into by BPGIC with FAB to fund a portion of the construction costs of Phase I.

“Phase I Construction Facilities” means, collectively, the Phase I Admin Building Facility and the Phase I Construction Facility.

“Phase I Construction Facility” means the secured Shari’a compliant financing arrangement of $84.6 million entered into by BPGIC with FAB to fund a portion of the construction costs of Phase I.

“Phase I Financing Facilities” means, collectively, the Phase I Admin Building Facility, the Phase I Construction Facility and the Phase I Short Term Financing Facility.

“Phase I Internal Manifold” means the internal manifold that connects the 14 oil storage tanks of Phase I.

“Phase I Short Term Financing Facility” means the Shari’a compliant financing arrangement of $3.5 million entered into by BPGIC with FAB to settle certain amounts due under the Phase I Construction Facilities.

“Phase II” means the second phase of the BPGIC Terminal which consists of eight oil storage tanks with an aggregate geometric oil storage capacity of approximately 0.601 million m3 and related infrastructure located on the Phase I & II Land.

“Phase II Financing Facility” means the secured Shari’a compliant financing arrangement of $95.3 million entered into by BPGIC with FAB to fund a portion of the capital expenditures in respect of Phase II.

“Phase II Internal Manifold” means the internal manifold that will connect the eight oil storage tanks of Phase II.

“Phase III” means the third phase of the Company’s development in the Port of Fujairah to the located on the Phase III Land.

“Phase III Land” means the plot of land of approximately 455,369 m2 in the Port of Fujairah near the Phase I & II Land where the Company expects to locate its Phase III facilities.

“Phase III Land Lease” means the land lease agreement, dated as of February 2, 2020, by and between BPGIC and FOIZ, which was novated by BPGIC to BPGIC III on October 1, 2020, whereby BPGIC III leases the Phase III Land.

“Port of Fujairah” or “Port” means the port of Fujairah.

“SAA” means S A A Trading Refined Oil Products Abroad.

”Sahra” means Sahra Oil FZE

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“Senior Management” and “Senior Managers” refer to those persons named as officers in “Item 6.A Directors, Senior Management and Employees — Directors and Executive Officers”.

“Special Resolution” means a resolution passed by the affirmative vote of a majority of at least two-thirds of the shareholders of the Company as, being entitled to do so, vote in person or, where proxies are allowed, by proxy at a meeting, of which notice specifying the intention to propose the resolution as a “special resolution” has been duly given.

“Storage Customers” means, collectively, any customer who has executed a Commercial Storage Agreements with BPGC during the year of 2023, including: Cengeo New Energy FZ-LLC, Avis Trading Crude Oil Abroad L.L.C, Sahra Oil FZE, Aachim Energy FZE, Actirays Middle East Trading FZE, Atlantis Commodities Trading HK Limited; Valens DMCC; 1Energin DMCC; and Turkiz Fuel Trading LLC.

“Strait of Hormuz” means the strait of Hormuz.

“Twelve Seas” means Twelve Seas Investment Company (now known as BPGIC International), a Cayman Islands exempted company.

“Twelve Seas Sponsor” means Twelve Seas Sponsors I LLC, a Delaware limited liability company.

“US,” “U.S.” or “United States” means the United States of America.

“U.S. GAAP” means United States generally accepted accounting principles.

“UAE” means the United Arab Emirates.

“Valens” means Valens DMCC

“Valor” means Valor International FZC.

“VLCC” means very large crude carrier.

“Warrants” means the warrants to purchase one Ordinary Share of the Company at an exercise price of $11.50 per Ordinary Share.

“Warrant Agreement” means the agreement signed on June 19, 2018 and the amended agreement signed on December 20, 2019.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in our Company involves a high degree of risk. Before deciding whether to invest in our Company, you should consider carefully the risks described below, together with all of the other information set forth in this Report, including the information set forth under the heading “Item 5. Operating and Financial Review and Prospects,” and our consolidated financial statements and related notes. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be materially and adversely affected, which could cause the trading price of our securities to decline, resulting in a loss of all or part of your investment. The risks described below and elsewhere in this Report are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business. You should only consider investing in our Company if you can bear the risk of loss of your entire investment.

Summary of Risk Factors

The following is a summary of the principal risks that could adversely affect our business, financial condition, results of operations and cash flow.

Risks Related to our Transaction with GulfNav

Risks Related to BPGIC

| ● | BPGIC is the subject of a Judicial Guardianship in the UAE. BPGIC has a limited operating history. |

| ● | BPGIC is currently reliant on the Company’s storage customers of Phase I and Phase II for the majority of its revenues. |

| ● | The Phase I and Phase II users’ usage of our ancillary services has an impact on our profitability. |

| ● | In the event that the Commercial Storage Agreements expire or otherwise terminate, we may have difficulty locating replacements due to competition. |

| ● | The scarcity of available land in the Fujairah oil zone region could limit our ability to expand our facilities in Fujairah beyond Phase III. |

| ● | Accidents involving the handling of oil products at the BPGIC Terminal could disrupt our business operations and/or subject us to environmental and other liabilities. |

| ● | The Modular Refinery will face operating hazards, which could expose us to potentially significant liability costs. |

| ● | When the Modular Refinery is completed, our financial results will be affected by volatile refining margins. |

| ● | Our competitive position and prospects depend on the expertise and experience of our Senior Management. |

| ● | The Green Hydrogen and Green Ammonia Project may face operating hazards, which could expose us to potentially significant liability costs. |

| ● |

In connection with the preparation of our financial statements, two material weaknesses in our internal control over financial reporting were identified.

|

|

| ● | No adequate documentation is obtained regarding the other payable under liabilities on the balance sheet. | |

| ● | We are subject to a wide variety of regulations. |

| ● | Any material reduction in the quality or availability of the Port of Fujairah’s facilities could have a material adverse effect on us. |

| ● | BPGIC is subject to restrictive covenants in the Bond Financing Facility. |

| ● | The fixed cost nature of our operations could result in lower profit margins if certain costs were to increase and we are unable to offset such costs. |

| ● | We are dependent on our IT and operational systems, which may fail or be subject to disruption. |

| ● | Beyond Phase II, expansion of our business may require substantial capital investment. |

Risks Related to the Company’s Structure and Capitalization

| ● | We do not expect to pay cash dividends for the foreseeable future. |

| ● | The escrow release provisions of the Escrow Agreement may affect management decisions and incentives. |

| ● | We may issue additional Ordinary Shares or other equity securities without your approval, which would dilute your ownership interests and may depress the market price of our Ordinary Shares. |

| ● | Fluctuation of the exercise price of our Warrants could result in material dilution of our then existing shareholders. |

| ● | Because we are a Cayman Islands exempted company, you could have less protection of your shareholder rights than you would under U.S. law. |

| ● | Provisions of our Amended and Restated Memorandum and Articles of Association may inhibit a takeover of the Company. |

| ● | As a “foreign private issuer”, we are subject to certain reduced reporting requirements and other exemptions, which limits the information you might otherwise receive and could make our Ordinary Shares less attractive to investors. |

| ● | Our controlling shareholder has substantial influence over us. |

Risks Related to Doing Business in Countries in Which the Group Operates

| ● | We are subject to political and economic conditions in Fujairah, the UAE, and the region in which we operate. |

| ● | Our business operations could be adversely affected by terrorist attacks, natural disasters or other catastrophic events beyond our control. |

| ● | Climate change-related legislation or regulations could result in increased operating and capital costs and reduced demand for our storage services. |

| ● | We may incur significant costs to maintain compliance with, or address liabilities under, environmental, health and safety regulation applicable to our business. |

| ● | We could be adversely affected by violations of anti-corruption laws or economic sanctions programs. |

| ● | Tax liabilities associated with indirect taxes on the oil products we service could result in losses. |

| ● | Changes to VAT law in the UAE may have an adverse effect on us. |

| ● | Our business may be adversely affected if the US dollar/UAE dirham-tied exchange rate were to be removed or adjusted. |

| ● | Our business may be materially adversely affected by unlawful or arbitrary governmental action. |

| ● | Legal and regulatory systems may create an uncertain environment for investment and business activities. |

| ● | The grant and future exercise of registration rights, or sales of a substantial number of our securities in the public market, could adversely affect the market price of our Ordinary Shares. |

| ● | NASDAQ may delist our securities. |

General Risk Factors

| ● | Fluctuations in our operating results, quarter-to-quarter earnings and other factors, may result in significant decreases in the price of our securities. |

| ● | The market for our securities may not be sustained, which would adversely affect the liquidity and price of our securities. |

| ● | The price of our Ordinary Shares may be volatile. |

| ● | Reports published by analysts could adversely affect the price and trading volume of our Ordinary Shares. |

Risks Related to our Transaction with GulfNav

The Company is currently evaluating a potential sale of its operating subsidiaries in the UAE (the “GulfNav Transaction”) that could significantly impact our operations, financial condition, and strategic direction. While we believe that this merger could provide opportunities for growth and enhanced market position for the operating subsidiaries in the UAE, there are inherent risks associated with the merger process that could adversely affect the business of the subsidiaries.

The evaluation and negotiation phases of such a transaction can be complex and time-consuming, and there is no guarantee that the GulfNav Transaction will be completed on favorable terms or at all. If the GulfNav Transaction does not proceed as planned, we may incur substantial costs related to the due diligence process, legal fees, and other expenses without realizing any benefits.

Additionally, if the GulfNav Transaction is completed, GulfNav and the operating subsidiaries will face challenges in integrating their operations, cultures, and systems of both entities, which could disrupt the business and lead to operational inefficiencies and impact any anticipated synergies.

Furthermore, the GulfNav Transaction may attract scrutiny from regulatory authorities, which could lead to delays, additional costs, or conditions that could limit operational flexibility. Market reactions to the announcement of the final terms of the GulfNav Transaction could also affect our stock price.

As a result, investors should carefully consider these risks associated with the GulfNav Transaction when evaluating their investment in our company.

Risks Related to BPGIC

In the event that we do not complete the GulfNav Transaction, we will continue to be exposed to risks associated with BPGIC.

BPGIC is the subject of a Judicial Guardianship in the UAE

The Company conducts substantially all of its activities through its subsidiary BPGIC. On December 27, 2023, BPGIC was served with a court order from a court in the UAE under which the court appointed a Judicial Guardian (“JG”) over BPGIC. In the UAE, judicial guardianship over a company typically refers to a legal arrangement where a court appoints a guardian to oversee and manage the affairs of a company. This usually happens when the company is facing significant financial difficulties or other serious issues that threaten its viability. The guardian, often a legal or financial expert, is responsible for making decisions to stabilize and potentially turn around the company’s operations. This process is governed by UAE’s commercial laws and is intended to protect the interests of creditors, shareholders, and other stakeholders by ensuring that the company is managed effectively during a period of crisis. The JG has the authority to make critical decisions, including restructuring the company’s debts, managing its assets, and possibly even selling parts of the business to ensure its survival. Consequently, the Company has lost, or may lose, the ability to directly influence BPGIC’s decisions. Although the JG normally acts in the best interests of the parties, the JG could take actions that are harmful to the Company and the Company’s shareholders, including selling assets that are otherwise necessary to either complete the GulfNav Transaction or continue with the Company’s strategy, or selling shares in BPGIC to raise capital but dilute the Company’s stake and make it impossible to complete the GulfNav Transaction.

BPGIC has a limited operating history, which makes it particularly difficult for a potential investor to evaluate the Company’s financial performance and predict its future prospects.

BPGIC commenced operations of Phase I in late Fourth Quarter 2017 and began operating it at full capacity on April 1, 2018, and Phase II in September 2021 and began operating it at full capacity from January 2022. As a result, although the Company’s Senior Management and site teams have relevant international and industry experience, the Company has only limited operating results to demonstrate its ability to operate its business on which a potential investor may rely to evaluate the Company’s business and prospects. Accordingly, the financial information included in this Report may be of limited use in assessing the Company’s business. The Company is also subject to the business risks and uncertainties associated with any new business, including the risk that it will not achieve its operating objectives and business strategy. BPGIC’s limited operating history increases the risks and uncertainties that potential investors face in making an investment in our securities and the lack of historic information may make it particularly difficult for a potential investor to evaluate the Company’s financial performance and forecast reliable long-term trends.

BPGIC is currently reliant on its storage customers of Phase I and Phase II for the majority of its revenues and any material non-payment or non-performance by its storage customers would have a material adverse effect on the Company’s business, financial condition and results of operations.

Phase I of the BPGIC Terminal consists of 14 oil storage tanks with an aggregate geometric oil storage capacity of approximately 0.399 million m3 and related infrastructure. Phase II of the BPGIC Terminal consists of 8 oil storage tanks with an aggregate geometric oil storage capacity of approximately 0.601 million m3 and related infrastructure.

A majority of the BPGIC’s revenues for the immediate future are expected to consist of the fees it receives from storage customers.

BPGIC is susceptible to general economic conditions, natural catastrophic events and public health crises, which could adversely affect our operating results.

BPGIC’s results of operations could be adversely affected by general conditions in the global economy, including conditions that are outside of our control, such as the impact of health and safety concerns from any potential future outbreaks of COVID-19. Governments in affected countries, including the UAE, have in the past imposed travel bans, quarantines and other emergency public health measures. Those measures, though temporary in nature, may happen again depending on developments of new strains of the COVID-19’s virus. Though neither our oil storage and services operations nor the activities of our executives and corporate staff was significantly impacted by the COVID-19 pandemic, some of the vendors and professionals with whom we work have experienced disruptions which resulted in the delay of the construction and commencement of operations of Phase II. Our executives and corporate staff have been, and may continue to be, focused on mitigating potential future effects of COVID-19, which may delay other value-add initiatives.

In addition, the COVID-19 pandemic significantly increased economic uncertainty. Such adverse impact on the global economy may negatively impact the availability of debt and equity financing on commercially reasonable terms, which, in turn, may adversely affect our ability to successfully execute our business strategies and initiatives, such as the funding of capital expenditures.

The extent, if any, to which the coronavirus impacts our results will depend on future developments, which will include emerging information concerning the severity of the coronavirus and the actions taken by governments and private businesses to attempt to contain the coronavirus.

The ongoing Ukrainian Russian conflict has had a significant impact on the oil industry, with increased volatility in oil prices and disruptions to logistics and supply chains. Heightened geopolitical tensions due to the current conflict involving Israel, could result in regulatory changes, restrictions on trade, or sanctions that may directly affect our operations in the UAE. Such developments could also lead to a decline in investor confidence, impacting our stock price and overall market valuation. BPGIC’s operations could be adversely affected by these two conflicts, as changes in oil prices and logistics could impact demand for its storage services and increase its operating costs. BPGIC has implemented measures to manage these risks, such as maintaining flexible logistics arrangements, and having long-term contracts. However, the Company cannot guarantee that these measures will be effective in mitigating the potential impacts of the Ukrainian Russian conflict on its business, financial condition, and results of operations.

The Phase I and Phase II users’ usage of BPGIC’s ancillary services has an impact on BPGIC’s profitability. The demand for such ancillary services can be influenced by a number of factors including current or expected prices and market demand for refined petroleum products, each of which can be volatile.

With respect to the Commercial Storage Agreements currently in effect, the total monthly storage fees are fixed and the total monthly fees for BPGIC’s ancillary services are subject to variation based on the customers’ usage of BPGIC’s ancillary services. The Company expects BPGIC’s revenue from the ancillary services offered in Phase I and Phase II to vary based on the orders received from the Storage Customers. The needs of the Storage Customers tend to vary based on a number of factors including current or expected refined petroleum product prices and trading activity. Factors that could lead to a decrease in the demand for BPGIC’s ancillary services include:

| ● | changes in expectations for future prices of refined petroleum products; | |

| ● | the level of worldwide oil and gas production and any disruption of those supplies; | |

| ● | a decline in global trade volumes, economic growth, or access to markets; | |

| ● | higher fuel taxes or other governmental or regulatory actions that increase, directly or indirectly, the cost of gasoline and diesel; and |

| ● | New sanctions or changes of laws. |

Any of the factors referred to above, either alone or in combination, may result in the Storage Customers’ reduced usage of BPGIC’s ancillary services, which would ultimately have a material adverse effect on the Company’s business, financial condition and results of operations.

In the event that the Commercial Storage Agreements expire or otherwise terminate, BPGIC may have difficulty locating replacements due to competition with other oil storage companies in the Port of Fujairah and at other ports.

The Commercial Storage Agreements currently in effect have terms ranging from one to three years, subject to renewals. There can be no assurance that any of the Commercial Storage Agreements currently in effect will be renewed or that any of such agreements will not be terminated prior to expiration of its term or that we will find adequate replacements upon non-renewal or earlier termination of such agreements.

BPGIC may have to compete with other oil storage companies in the Port of Fujairah to secure a third party to contract for BPGIC’s services in the event that any of the Commercial Storage Agreements currently in effect expire or otherwise terminate. Such third parties may not only consider competitors in the Port of Fujairah but may also consider companies located at other ports. Although the Company believes that BPGIC has a best-in-class technically designed terminal in Fujairah and there is a scarcity of land in Fujairah available for expansion by competitors, BPGIC’s ability to compete could be harmed by factors it cannot control, including:

| ● | BPGIC’s competitors’ construction of new assets or conversion of existing terminals in a manner that would result in more intense competition in the Port of Fujairah; | |

| ● | BPGIC’s competitors, which currently provide services to their own businesses (i.e., captive storage), seeking to provide their services to third parties, including third-party oil companies and oil traders; | |

| ● | BPGIC’s competitors making significant investments to upgrade or convert their facilities in a manner that, while limiting their capacity in the short term, would eventually enable them to meet or exceed BPGIC’s capabilities; | |

| ● | the perception that another company or port may provide better service; and | |

| ● | the availability of alternative heating and blending facilities located closer to users’ operations. |

Any combination of these factors could result in third parties entering into long-term contracts to utilize the services of BPGIC’s competitors instead of BPGIC’s services, or BPGIC being required to lower its prices or decrease its costs to attract such parties or retain its existing customers, either of which could adversely affect the Company’s business, financial condition and results of operations.

BPGIC is anticipated to become reliant on revenue from the Modular Refinery, and the delay in the construction of the Modular Refinery would have a material adverse effect on the Company’s business, financial condition and results of operations.

Upon completion of the Modular Refinery, BPGIC would become reliant on the Modular Refinery for another portion of its revenues. BPGIC may incur substantial cost if it suffers delays in locating a third party or if modifications or installation of a new refinery are required. The occurrence of any one or more of these events could have a material adverse effect on the Company’s business, financial condition and results of operations.

The scarcity of available land in the Fujairah oil zone region could subject BPGIC to competition for additional land, unfavorable lease terms for that land and limit BPGIC’s ability to expand its facilities in Fujairah beyond Phase III.

BPGIC entered into the Phase III Land Lease, a land lease agreement, dated as of February 2, 2020, by and between BPGIC and FOIZ, to lease the Phase III Land, for an additional plot of land that has a total area of approximately 450,000 m2. On October 1, 2020, BPGIC, FOIZ and BPGIC III, entered into a novation agreement, whereby BPGIC novated the Phase III Land Lease to BPGIC III. BPGIC intends to use the relevant land to expand its storage, service and refinery capacity.

However, all land in the Fujairah oil zone region is owned and controlled by FOIZ. The Fujairah oil zone region currently has limited available land to lease. As a result, BPGIC’s ability to further expand its facilities if it wishes to expand in Fujairah beyond Phase III is limited. This could subject BPGIC to enhanced competition both in terms of price and lease terms for any land that becomes available to lease.

If BPGIC is able to lease additional land, there can be no assurance that it would be able to do so on terms that are as favorable as or more favorable than the terms of the Phase I & II Land Lease or the Phase III Land Lease, or that would allow BPGIC to use the land as intended. BPGIC’s inability to secure new land from FOIZ in the Fujairah oil zone region could substantially impair BPGIC’s regional growth prospects in Fujairah beyond Phase III, leading to fewer remaining options for its expansion in Fujairah, other than the acquisition of an existing third-party owned oil storage terminal in Fujairah.

BPGIC is bearing development cost for Phase III and there is no assurance that it can eventually materialize due to unforeseen changes in the investment and commercial environment.

Accidents involving the handling of oil products at the BPGIC Terminal could disrupt BPGIC’s business operations and/or subject it to environmental and other liabilities.

Accidents in the handling of oil products (hazardous or otherwise) at the BPGIC Terminal could disrupt BPGIC’s business operations during any repair or clean-up period, which could negatively affect its business operations. The BPGIC Terminal was designed to minimize the risk of oil leakage and has state-of-the-art control facilities. In addition, pursuant to the Fujairah Municipality environmental regulations, BPGIC installed impermeable lining over the ground soil throughout its tank farm area in the Phase I & II Land and any other area where oil leakage could occur and potentially reach the ground soil. Further, BPGIC has in place Physical Loss or Damage and Business Interruption Insurances to minimize any risk of business disruption. BPGIC intends to take similar steps to minimize the risk of oil leakage in connection with Phase III. Nevertheless, there is a risk that oil leakages or fires could occur at the terminal and, in the event of an oil leakage, there can be no assurance that the installed lining will prevent any oil products from reaching the ground soil. Although the Company believes that BPGIC has adequate insurance in place to insure against the occurrence of any of the foregoing events, any such leakages or fires could disrupt terminal operations and result in material remediation costs. Any such damage or contamination could reduce gross throughput and/or subject BPGIC to liability in connection with environmental damage, any or all of which could have a material adverse effect on the Company’s business, financial condition and results of operations.

The Modular Refinery, once completed, will face operating hazards, and the potential limits on insurance coverage could expose BPGIC to potentially significant liability costs.

Once completed, the Modular Refinery will be subject to certain operating hazards, and BPGIC’s cash flow from its operations could decline if it experiences a major accident, pipeline rupture or spill, explosion or fire, or if it is damaged by severe weather or other natural disaster, or otherwise is forced to curtail its operations or shut down. These operating hazards could result in substantial losses due to personal injury and/or loss of life, severe damage to and destruction of property and equipment and pollution or other environmental damage and may result in significant curtailment or suspension of BPGIC’s related operations.

Although we intend to maintain insurance policies, including personal and property damage and business interruption insurance for each of our facilities, we cannot assure you that this insurance will be adequate to protect us from all material expenses related to potential future claims for personal and property damage or significant interruption of operations.

When the Modular Refinery is completed, our financial results will be affected by volatile refining margins, which are dependent upon factors beyond our control, including the price of crude oil, to the extent such volatility reduces customer demand of ancillary services.

When the Modular Refinery is operational, our financial results will be affected by the relationship, or margin, between refined petroleum product prices and the prices for crude oil and other feedstocks to the extent decreases in refining margins reduce the use of the Modular Refinery and BPGIC’s ancillary services. Historically, refining margins have been volatile, and we believe they will continue to be volatile in the future. The costs to acquire feedstocks and the price at which BPGIC can ultimately sell refined petroleum products depend upon several factors beyond BPGIC’s control, including regional and global supply of and demand for crude oil, gasoline, diesel, and other feedstocks and refined petroleum products. These in turn depend on, among other things, the availability and quantity of imports, production levels, levels of refined petroleum product inventories, productivity and growth (or the lack thereof) of global economies, international relations, political affairs, and the extent of governmental regulation. Some of these factors can vary by region and may change quickly, adding to market volatility, while others may have longer-term effects. The longer-term effects of these and other factors on refining and marketing margins are uncertain. Decreased refining margins could have a significant effect on the extent to which BPGIC use the Modular Refinery and its ancillary services which, in turn, could have a significant effect on our financial results.

The Green Hydrogen and Green Ammonia Project, once completed, will face operating hazards, and the potential limits on insurance coverage could expose BPGIC to potentially significant liability costs.

Once completed, the Green Hydrogen and Green Ammonia Project will be subject to certain operating hazards, and BPGIC’s cash flow from its operations could decline if it experiences a major accident, pipeline rupture, explosion or fire, or if it is damaged by severe weather or other natural disaster, or otherwise is forced to curtail its operations or shut down. These operating hazards could result in substantial losses due to personal injury and/or loss of life, severe damage to and destruction of property and equipment or other environmental damage and may result in significant curtailment or suspension of BPGIC’s related operations.

Although we intend to maintain insurance policies, including personal and property damage and business interruption insurance for each instance of this project, we cannot assure you that this insurance will be adequate to protect us from all material expenses related to potential future claims for personal and property damage or significant interruption of operations.

BPGIC’s competitive position and prospects depend on the expertise and experience of Senior Management and our ability to continue to attract, retain and motivate qualified personnel.

Our business is dependent on retaining the services of, or in due course promptly obtaining equally qualified replacements for Senior Management. Competition in the UAE for personnel with relevant expertise is intense and it could lead to challenges in locating qualified individuals with suitable practical experience in the oil storage industry. Although the Company has employment agreements with all of the members of Senior Management, the retention of their services cannot be guaranteed. Should they decide to leave the Company, it may be difficult to replace them promptly with other managers of sufficient expertise and experience or at all. To mitigate this risk, the Company intends to enter into long-term incentive plans with members of Senior Management in due course. In the event of any increase in the levels of competition in the oil storage industry or general price levels in the Fujairah region, the Company may experience challenges in retaining members of the Senior Management team or recruiting replacements with the appropriate skills. Should the Company lose any of the members of Senior Management without prompt and equivalent replacement or if the Company is otherwise unable to attract or retain such qualified personnel for BPGIC’s requirements, this could have an adverse effect on the Company’s business, financial condition and results of operations. For more information regarding Senior Management, see “Item 6.A Directors, Senior Management and Employees — Directors and Executive Officers”.

In connection with the preparation of the Company’s consolidated financial statements as of and for the years ended December 31, 2019, 2020, 2021 and 2022, the Company and its independent registered public accounting firm identified two material weaknesses in the Company’s internal control over financial reporting, one related to lack of sufficient skilled personnel and one related to lack of sufficient entity level and financial reporting policies and procedures.

Prior to the consummation of the Business Combination, the Company was neither a publicly listed company, nor an affiliate or a consolidated subsidiary of, a publicly listed company, and it has had limited accounting personnel and other resources with which to address its internal controls and procedures. Effective internal control over financial reporting is necessary for the Company to provide reliable financial reports and, together with adequate disclosure controls and procedures, are designed to prevent fraud.

In connection with the preparation and external audit of the Company’s financial statements as of and for the years ended December 31, 2019, 2020, 2021 and 2022, the Company and our auditors, noted material weaknesses in the Company’s internal control over financial reporting. The SEC defines a material weakness as a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s financial statements will not be prevented or detected on a timely basis.

The material weaknesses identified were (i) a lack of sufficient skilled personnel with requisite IFRS and SEC reporting knowledge and experience and (ii) a lack of sufficient entity level and financial reporting policies and procedures that are commensurate with IFRS and SEC reporting requirements. During the years 2020, 2021, and 2022, the Company took the steps below to minimize the effects of both these material weaknesses:

| ● | The Company appointed a new chief financial officer and other finance personnel with relevant public reporting experience and also plan conducting trainings for new employees with respect to IFRS and SEC reporting requirements; and |

| ● | The Company appointed a third party consultant to prepare the processes of financial reporting and help the Company to implement them. |

In this regard, the Company has, and is continuing to, dedicate internal resources, training their personnel with public reporting experience, and ensure that outside consultants adopted a detailed work plan to assess and document the adequacy of its internal control over financial reporting. This has, and may continue to, include taking steps to improve control processes as appropriate, validating that controls are functioning as documented and implementing a continuous reporting and improvement process for internal control over financial reporting.

If in subsequent years the Company is unable to assert that the Company’s internal control over financial reporting is effective, or if the Company’s auditors express an opinion that the Company’s internal control over financial reporting is ineffective, the Company could lose investor confidence in the accuracy and completeness of its financial reports, which could have an adverse effect on the price of the Company’s securities.

For more information regarding our controls and procedures, see “Item 15. Controls and Procedures”.

The Company has hired new management personnel and has implemented a number of corporate governance and financial reporting procedures and other policies, processes, systems and controls which have a limited operating history. The effectiveness of these policies, processes systems and controls might be impaired by weaknesses related to lack of sufficient skilled personnel and lack of sufficient entity level and financial reporting policies and procedures.

The Company started hiring new management personnel subsequent to the listing of the Company, including a new chief financial officer, and implemented a number of corporate governance and financial reporting procedures and other policies, processes, systems and controls to comply with the requirements for a foreign private issuer on NASDAQ. The Company does not have a long track record on which it can assess the performance and effectiveness of these policies, processes, systems and controls or the analysis of their outputs.

The Company and its independent registered public accounting firm have identified two material weaknesses in internal control over financial reporting related to lack of sufficient skilled personnel and lack of sufficient entity level and financial reporting policies and procedures in 2022. Any material inadequacies, weaknesses or failures in the Company’s policies, processes, systems and controls could have a material adverse effect on the Company’s business, financial condition and results of operations.

The Company has implemented measures to address the material weaknesses, including (i) hiring personnel with relevant public reporting experience, (ii) conducting training for Company personnel with respect to IFRS and SEC financial reporting requirements and (iii) engaging a third party to prepare standard operating procedures for the Company. In this regard, the Company has, and will need to continue to, dedicate internal resources, train personnel with public reporting experience, ensuring outside consultant adopted a detailed work plan to assess and document the adequacy of their internal control over financial reporting. This has, and may continue to, include taking steps to improve control processes as appropriate, validating that controls are functioning as documented and implementing a continuous reporting and improvement process for internal control over financial reporting.

If the Company is unable to make acquisitions on economically acceptable terms, its future growth would be limited, and any acquisitions it makes could adversely affect its business, financial condition and results of operations.

As discussed further in “Item 4.B Business Overview — Strategy”, one of the Company’s medium to long-term strategies is to potentially grow its business through the acquisition and development of oil storage terminals globally. The Company’s strategy to grow its business is dependent on its ability to make acquisitions that improve its financial condition. If the Company is unable to make acquisitions from third parties because it is unable to identify attractive acquisition candidates or negotiate acceptable purchase contracts, it is unable to obtain financing for these acquisitions on economically acceptable terms or it is outbid by competitors, its future growth will be limited. Furthermore, even if the Company consummates acquisitions that it believes will be accretive, they may in fact harm its business, financial condition and results of operations. Any acquisition involves potential risks, some of which are beyond the Company’s control, including, among other things:

| ● | inaccurate assumptions about revenues and costs, including synergies; | |

| ● | an inability to successfully integrate the various business functions of the businesses the Company acquires; | |

| ● | an inability to hire, train or retain qualified personnel to manage and operate the Company’s business and newly acquired assets; | |

| ● | an inability to comply with current or future applicable regulatory requirements; | |

| ● | the assumption of unknown liabilities; | |

| ● | limitations on rights to indemnity from the seller; | |

| ● | inaccurate assumptions about the overall costs of equity or debt; | |

| ● | the diversion of management’s attention from other business concerns; | |

| ● | unforeseen difficulties operating in new product areas or new geographic areas; and | |

| ● | customer or key employee losses at the acquired businesses. |

If the Company consummates any future acquisitions, its business, financial condition and results of operations may change significantly, and holders of the Company’s securities may not have the opportunity to evaluate the economic, financial and other relevant information that the Company will consider in making such acquisitions.

BPGIC is subject to a wide variety of regulations and may face substantial liability if it fails to comply with existing or future regulations applicable to its businesses or obtain necessary permits and licenses pursuant to such regulations.

BPGIC’s operations are subject to extensive international, national and local laws and regulations governing, among other things, the loading, unloading and storage of hazardous materials, environmental protection and health and safety. BPGIC’s ability to operate its business is contingent on its ability to comply with these laws and regulations and to obtain, maintain and renew as necessary related approvals, permits and licenses from governmental agencies and authorities in Fujairah and the UAE. Because of the complexities involved in ensuring compliance with different regulatory regimes, BPGIC’s failure to comply with all applicable regulations and obtain and maintain requisite certifications, approvals, permits and licenses, whether intentional or unintentional, could lead to substantial penalties, including criminal or administrative penalties or other punitive measures, result in revocation of its licenses and/or increased regulatory scrutiny, impair its reputation, subject it to liability for damages, or invalidate or increase the cost of the insurance that it maintains for its business. Additionally, BPGIC’s failure to comply with regulations that affect its staff, such as health and safety regulations, could affect its ability to attract and retain staff. BPGIC could also incur civil liabilities such as abatement and compensation for loss in amounts in excess of, or that are not covered by, its insurance. For the most serious violations, BPGIC could also be forced to suspend operations until it obtains such approvals, certifications, permits or licenses or otherwise brings its operations into compliance.

In addition, changes to existing regulations or tariffs or the introduction of new regulations or licensing requirements are beyond BPGIC’s control and may be influenced by political or commercial considerations not aligned with BPGIC’s interests. Any such changes to regulations, tariffs or licensing requirements could adversely affect BPGIC’s business by reducing its revenue, increasing its operating costs or both.

Finally, any expansion of the scope of the regulations governing BPGIC’s environmental obligations, in particular, would likely involve substantial additional costs, including costs relating to maintenance and inspection, development and implementation of emergency procedures and insurance coverage or other financial assurance of BPGIC’s ability to address environmental incidents or external threats. If BPGIC is unable to control the costs involved in complying with these and other laws and regulations, or pass the impact of these costs on to users through pricing, the Company’s business, financial condition and results of operations could be adversely affected.

Any material reduction in the quality or availability of the Port of Fujairah’s facilities could have a material adverse effect on the Company’s business, financial condition and results of operations.

BPGIC is dependent on the Port of Fujairah to operate and maintain the Port’s facilities at an appropriate standard and BPGIC is dependent on such facilities, including the berths, the VLCC jetty and the associated pipelines, to operate its business. Any interruptions or reduction in the capabilities or availability of these facilities would result in reduced volumes being transported through the BPGIC Terminal. Reductions of this nature are beyond BPGIC’s control. If the utilization or the costs to BPGIC or users to deliver oil products through these facilities were to significantly increase, BPGIC’s profitability could be reduced. The Port of Fujairah’s facilities are subject to deterioration or damage, due to potential declines in the physical condition of its facilities and ship collisions, among other things. Any failure of the Port of Fujairah to carry out necessary repairs, maintenance and expansions of its facilities and any resulting interruptions for access to its facilities could adversely affect BPGIC’s business volumes, cause delays in the arrival and departure of oil tankers or disruptions to BPGIC’s operations, in part or in whole, may subject BPGIC to liability or impact its brand and reputation and may otherwise hinder the normal operation of the BPGIC Terminal, which could have a material adverse effect on the Company’s business, financial condition and results of operations.

BPGIC is subject to restrictive covenants in the Bond Financing Facility that may limit its operating flexibility and, if it defaults under its covenants, it may not be able to meet its payment obligations.

BPGIC entered into the Bond Financing Facility of $200.00 million to repay the Phase I Financing Facilities, fund capital projects for Phase II, repay the promissory note payable to Early Bird Capital, pre-fund the Liquidity Account and for general corporate purposes. The proceeds of the bonds were drawn down during November 2020 and outstanding term loans were fully settled. The Bond Financing Facility contains covenants limiting BPGIC’s ability to incur indebtedness, grant liens, engage in transactions with affiliates and make distributions on or redeem or repurchase ordinary shares.

The Bond Financing Facility contains covenants which were amended under Amendment Agreements dated October 23, 2020 and April 27, 2022, requiring BPGIC (including its subsidiaries) and the Company to maintain the following covenants:

1. Financial Covenants

| i. | Minimum Liquidity: Maintain $8.5 million in the Liquidity Account. | |

| ii. |

Leverage Ratio: Not to exceed: (A) 3.5x at December 31, 2022 (for the 12-month period from and including 1 January 2022 to December 31, 2022 and so that no testing shall be made thereof until December 31, 2022); and (B) 3.0x anytime thereafter. |

|

| iii. | Working Capital: Maintain a positive working capital except for the period from 31 December 2021 to and including December 30, 2022 and during which period no such requirement shall apply. | |

| iv. | Brooge Energy Limited to maintain a minimum equity ratio of 25%. |

2. Account Maintenance Covenants

| i. | BPGIC to maintain a Construction Funding Account. | |

| ii. | BPGIC to maintain Debt Service Retention Account. | |

| iii. | BPGIC to maintain Liquidity Account. |

3. Other Covenants

| i. | BPGIC is subject to the following restrictions on distributions: | ||

| a. | no distributions for one year from the Phase II facility completion date. | ||

| b. | distributions cannot exceed in the aggregate 50% of BPGIC’s net profit after tax based on the audited annual financial statements for the previous financial year. | ||

| c. | any distribution shall only be released out of BPGIC and its subsidiaries in the form of a group company loan to the Phase III company. | ||

| d. | BPGIC must be in compliance with the financial covenants (on the last reporting date). | ||

| e. | no event of default is continuing or would arise from such distribution. | ||

| ii. | BPGIC (including its subsidiaries) cannot invest and/or undertake any capital expenditure obligation that exceeds an aggregate of $10.0 million during the term of the Bond Financing Facility, except for the remaining capital expenditure obligation under the construction contract for Phase II, any maintenance capital expenditure and/or enhancements relating to Phase I and/or Phase II in its ordinary course of business. | ||

BPGIC’s ability to comply with these restrictions and covenants may be affected by events beyond its control, including prevailing economic, financial and industry conditions.

Due in part to the delayed ramp up of the Phase II storage facility, resulting primarily from logistical challenges associated with the COVID 19 pandemic, BPGIC was in technical breach with leverage ratio and working capital financial covenant requirements under the Bond Financing Facility document. In March 2022, the Group entered into an agreement with its lender to waive off the requirement for the Group to comply with leverage ratio and working capital financial covenant for December 31, 2021 and June 30, 2022. See “Item 10.C Material Contracts— Bond Waiver” for additional information regarding the waiver.

If BPGIC is unable to comply with these restrictions and covenants following such date, or is unable to comply with the restrictions and covenants as specified in the waiver approved by the Bondholders, a significant portion of the indebtedness under the Bond Financing Facility may become immediately due and payable. BPGIC might not have, or be able to obtain, sufficient funds to make these accelerated payments. In addition, BPGIC’s obligations under the Bond Financing Facility are secured by substantially all of BPGIC’s assets, and if BPGIC is unable to repay the indebtedness under the Bond Financing Facility, the Bond Trustee, on behalf of the bondholders, could seek to foreclose on such assets, which would adversely affect BPGIC’s business, financial condition and results of operations. The Bond Financing Facility also has cross-default provisions that apply to any other material indebtedness that BPGIC may have. For more information regarding the Bond Financing Facility, see “— Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Debt Sources of Liquidity”.

The fixed cost nature of BPGIC’s operations could result in lower profit margins if certain costs were to increase and BPGIC was not able to offset such costs with sufficient increases in its storage or ancillary service fees or its customers’ utilization of BPGIC’s ancillary services.

BPGIC’s fixed costs for Phase I, Phase II and the Modular Refinery are, or will be, paid for with the fixed storage fees it receives or will receive, as the case may be, from BPGIC’s existing and future storage customers. The Company expects that a large portion of BPGIC’s future expenses related to the operation of the BPGIC Terminal will be relatively fixed because the costs for full-time employees, rent in connection with the Land Leases, maintenance, depreciation, utilities and insurance generally do not vary significantly with changes in users’ needs. However, the Company expects that BPGIC’s profit margins could change if its costs change.

In particular, if wages in the region’s oil storage industry were to increase, BPGIC may need to increase the levels of its employee compensation more rapidly than in the past to remain competitive or keep up with increases in general price levels or inflation in the UAE and in Fujairah. If wage costs were to increase at a greater rate than our customers’ utilization of BPGIC’s ancillary services, then such increased wage costs may reduce BPGIC’s profit margins.

The Commercial Storage Agreements with the Storage Customers allow BPGIC to review its storage and ancillary service upon each renewal. As such, if wages were to increase, BPGIC may yield lower margins for a period of time before it is able to review and amend its storage and ancillary service fees.

BPGIC III expects that its fixed costs for Phase III will be paid for with the fixed storage fees it will receive from the Phase III customer(s). BPGIC III expects that a large portion of its future expenses related to the operation of Phase III will be relatively fixed because the costs for full-time employees, rent in connection with the Phase III Land Lease, maintenance, depreciation, utilities and insurance generally do not vary significantly with changes in users’ needs.

BRE expects that its fixed costs for the Green Hydrogen and Green Ammonia Project will be paid for with the fixed storage fees it will receive from the Ammonia offtake agreements. However, as with its fixed costs for Phase I and Phase II, BPGIC III and BRE expect that their profit margins could change if their costs, in particular wage costs, change.

If any of BPGIC, BPGIC III and BRE are unable to maintain their margins, it could have a material adverse effect on the Company’s business, financial condition and results of operations.

BPGIC is dependent on its IT and operational systems, which may fail or be subject to disruption.