UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 6, 2024

Faraday Future Intelligent Electric Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-39395 | 84-4720320 | ||

| (State or other jurisdiction | (Commission File Number) | (I.R.S. Employer | ||

| of incorporation) | Identification No.) |

| 18455 S. Figueroa Street | ||

| Gardena, CA | 90248 | |

| (Address of principal executive offices) | (Zip Code) |

(424) 276-7616

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Class A common stock, par value $0.0001 per share | FFIE | The Nasdaq Stock Market LLC | ||

| Redeemable warrants, exercisable for shares of Class A common stock at an exercise price of $110,400.00 per share | FFIEW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 6, 2024, Faraday Future Intelligent Electric Inc. (the “Company”) announced its financial results for the third quarter ended September 30, 2024. The full text of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

In connection with the conference call to be held by the Company on November 6, 2024 to discuss its results for the quarter ended September 30, 2024, the Company will reference the presentation furnished as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

The information contained in Items 2.02 and 7.01 in this Current Report on Form 8-K and the information in Exhibits 99.1 and 99.2 hereto is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed with this Current Report on Form 8-K:

| No. | Description of Exhibits | |

| 99.1 | Press Release, dated November 6, 2024. | |

| 99.2 | Investor Presentation (Third Quarter 2024 Earnings Release), dated November 6, 2024. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| FARADAY FUTURE INTELLIGENT ELECTRIC INC. | ||

| Date: November 6, 2024 | By: | /s/ Koti Meka |

| Name: | Koti Meka | |

| Title: | Chief Financial Officer | |

Exhibit 99.1

Faraday Future Reports Financial Results for Third Quarter 2024

| ● | Strategic FX Second Brand Launch, Completion of Strategic Realignment, and Significant Middle East Expansion Mark Transformative Quarter. |

| ● | Successfully Secured and Closed on $30 Million Financing. |

| ● | Regained Full Nasdaq Compliance. |

| ● | FX Brand Launch Targets Mass Market with Models Targeted in $20,000-$50,000 Range with Potential Roll Off the Assembly Line by the End of 2025, Subject to Securing Necessary Funding. |

| ● | FX Project in First Phase of Vehicle Development, With Related Work Underway to Achieve Phase One Milestones. FX Plans to Announce Progress and Next Steps Execution Plan Next Week. |

Los Angeles, CA (Nov. 6, 2024) -- Faraday Future Intelligent Electric Inc. (Nasdaq: FFIE) (“FF”, “Faraday Future”, or the “Company”), a California-based global shared intelligent electric mobility ecosystem company, today announced its financial results for its third quarter of 2024.

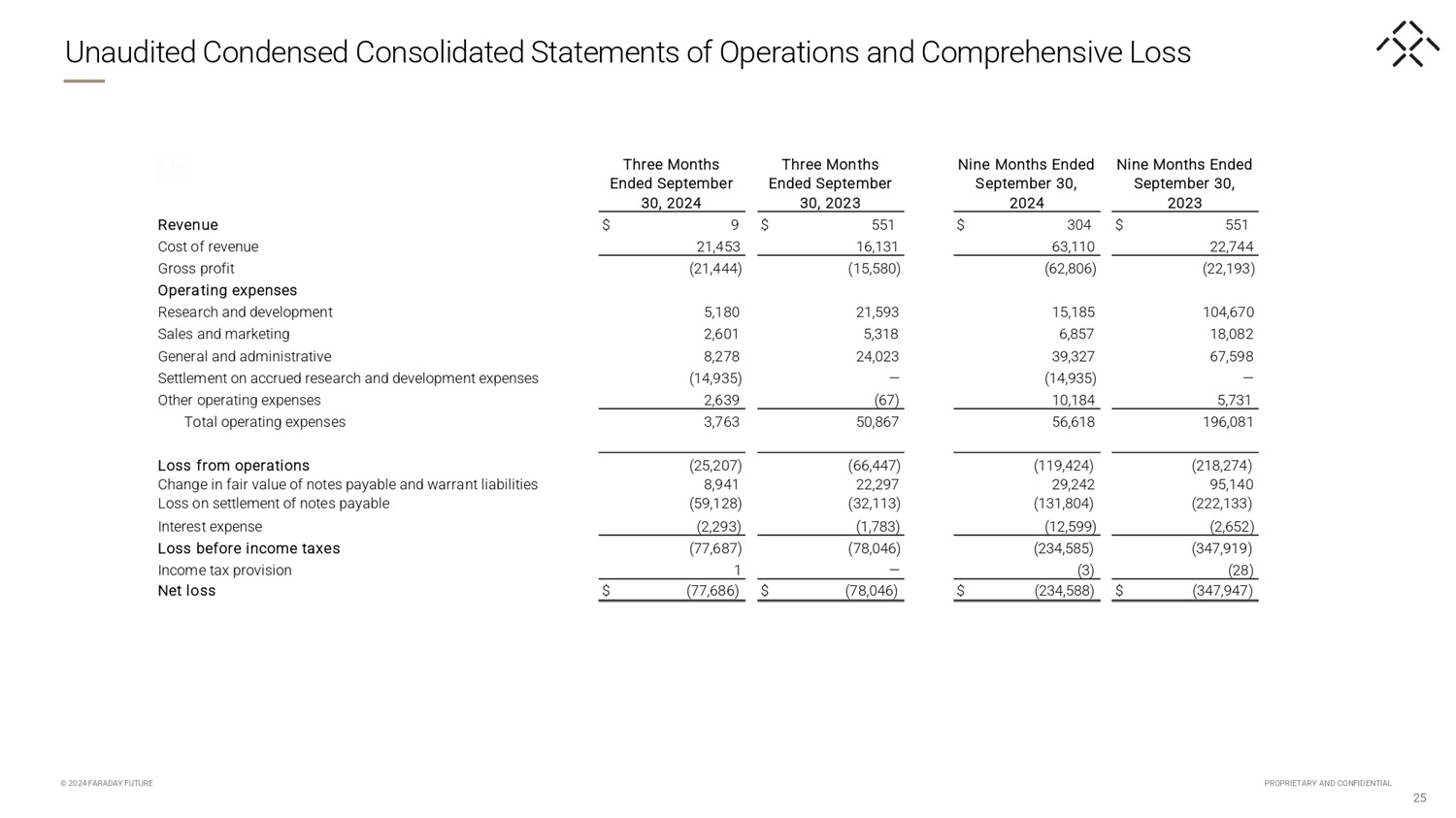

RESULTS FOR THIRD QUARTER 2024

The Company continued its efforts to control costs and reduce operating

expenses:

| ● | Operating expenses improved significantly, declining 92.6%

to $3.8 million compared to $50.9 million in the prior year’s quarter. |

| ● | Loss from operations improved to $25.2 million compared to

a loss of $66.4 million in the prior year quarter. |

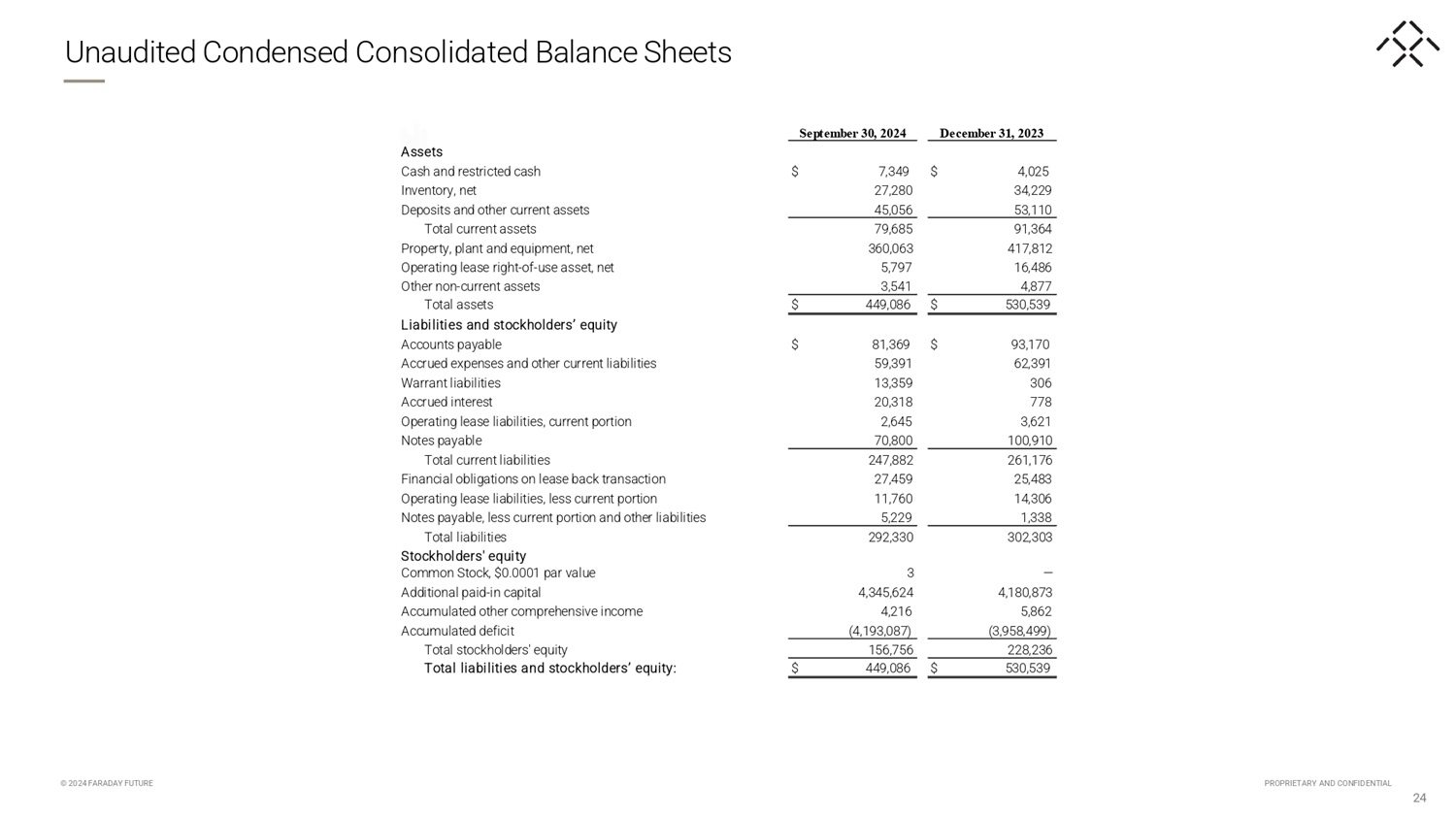

| ● | The Company had $449 million of assets, $292.3 million of liabilities and a book value of $156.7 million at quarter end September 30, 2024. |

KEY COMPANY HIGHLIGHTS

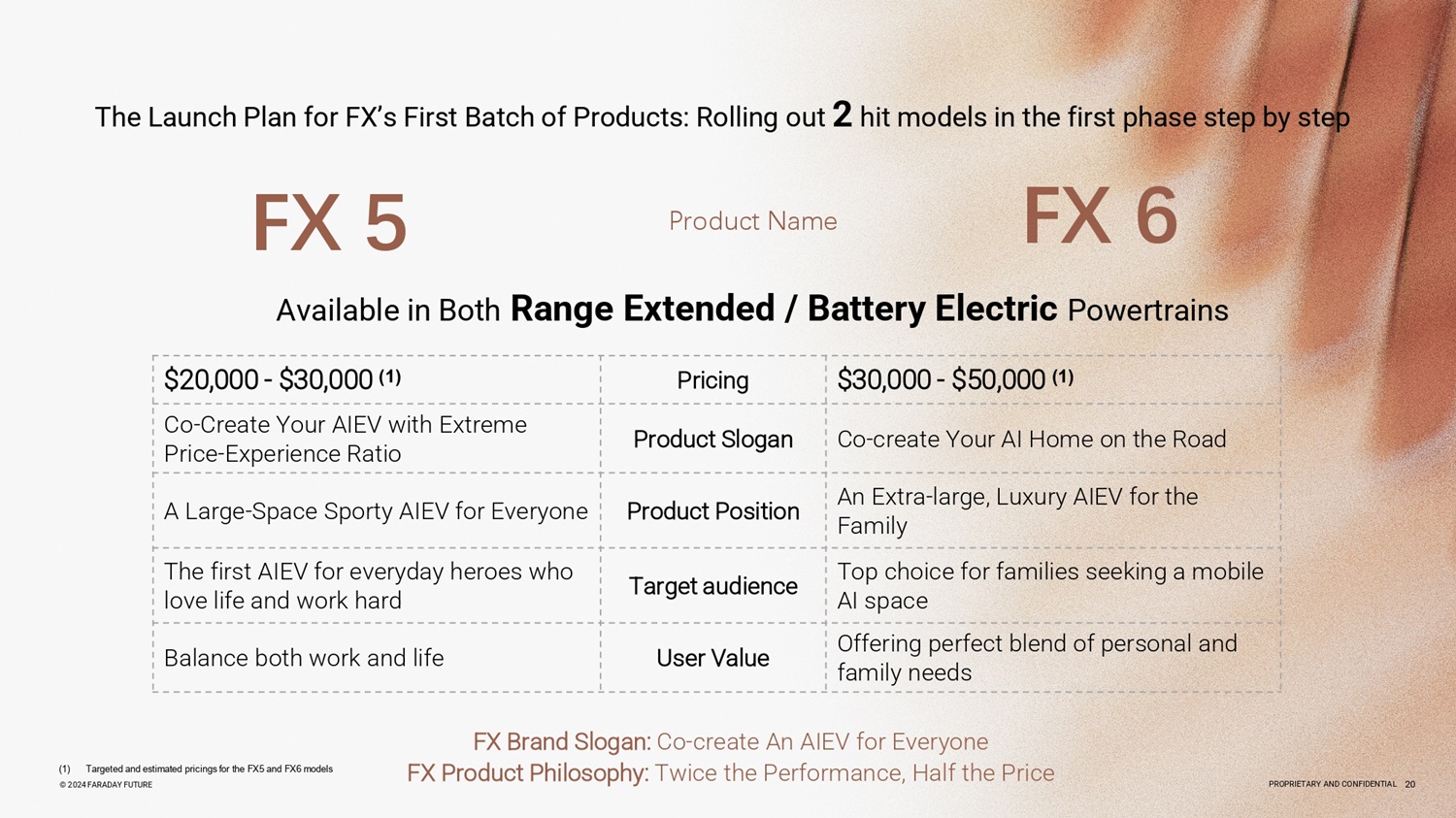

The third quarter of 2024 represented a pivotal time for FF with the launch of its second brand, Faraday X (FX), heralding a new chapter in the Company’s growth strategy. The FX brand targets the mass market segment with two planned models: the FX 5, with a price target between $20,000-$30,000, and the FX 6, with a price target between $30,000-$50,000. Both models could potentially offer two types of powertrains: range-extended AIEV and battery-electric AIEV, with a planned target to roll off the assembly line by the end of 2025, subject to securing necessary funding.

FF launched its “Everyone’s AIEV, You Decide” co-creation campaign, which has received thousands of responses, demonstrating interest in high-performance, intelligent, cost-effective B-AIEV and RE-AIEV products.

As part of the Company’s Global Automotive Industry Bridge Strategy, FF has established relationships with four Chinese OEMs, having already entered into two strategic framework agreements and two memoranda of understanding, with a goal of promoting range-extended AIEV in the U.S. and integrating global automotive components and supply chains into the U.S., energizing the U.S. B-AIEV and RE-AIEV markets.

Max Ma, FF’s Head of Global Strategy and Product, along with investor Sheikh Abdulla Al Qassimi, engaged in in-depth discussions with potential FX partners in China after the FX launch event. They achieved all the internal objectives set for these discussions. The FX project is currently in the first phase of vehicle development, with related work underway to achieve phase one milestones.

FF secured and closed on $30 million in gross financing. The Company is establishing a presence in Ras Al Khaimah with business registration and facility development, marking a significant milestone in FF’s “third pole” geographic strategy beyond the U.S. and China markets. The Company recently signed a co-investment agreement with Master Investment Group, led by Sheikh Abdulla Al Qassimi, to establish its future regional headquarters in Ras Al Khaimah. Through its Ras Al Khaimah-based entity, Faraday Future Middle East FZ-LLC, FF signed agreements with the Ras Al Khaimah Economic Zone (RAKEZ) for both current operations and a nearly completed 108,000 square foot facility.

FF continued to advance its FF 91 2.0 program with the delivery of an FF 91 2.0 Futurist Alliance to Born Leaders Entertainment, bringing total deliveries to 14 vehicles. Born Leaders Entertainment is now a user and Developer Co-Creation Officer for FF collaborating on promotional opportunities and high-profile engagements. The Company has achieved significant operational improvements, including a 25% improvement in its First Inspection Customer Craftsmanship Audit score and implementation of manufacturing-related warranty improvements. Additionally, FF has enhanced the user experience through software updates, including expanded voice controls and improved navigation features. The Company maintains its focus on production optimization and cost reduction efforts.

On September 4, 2024, Nasdaq confirmed that the Company regained compliance with Nasdaq’s listing requirements. This followed a series of actions to address deficiencies in timely filing of periodic reports and a minimum bid price deficiency.

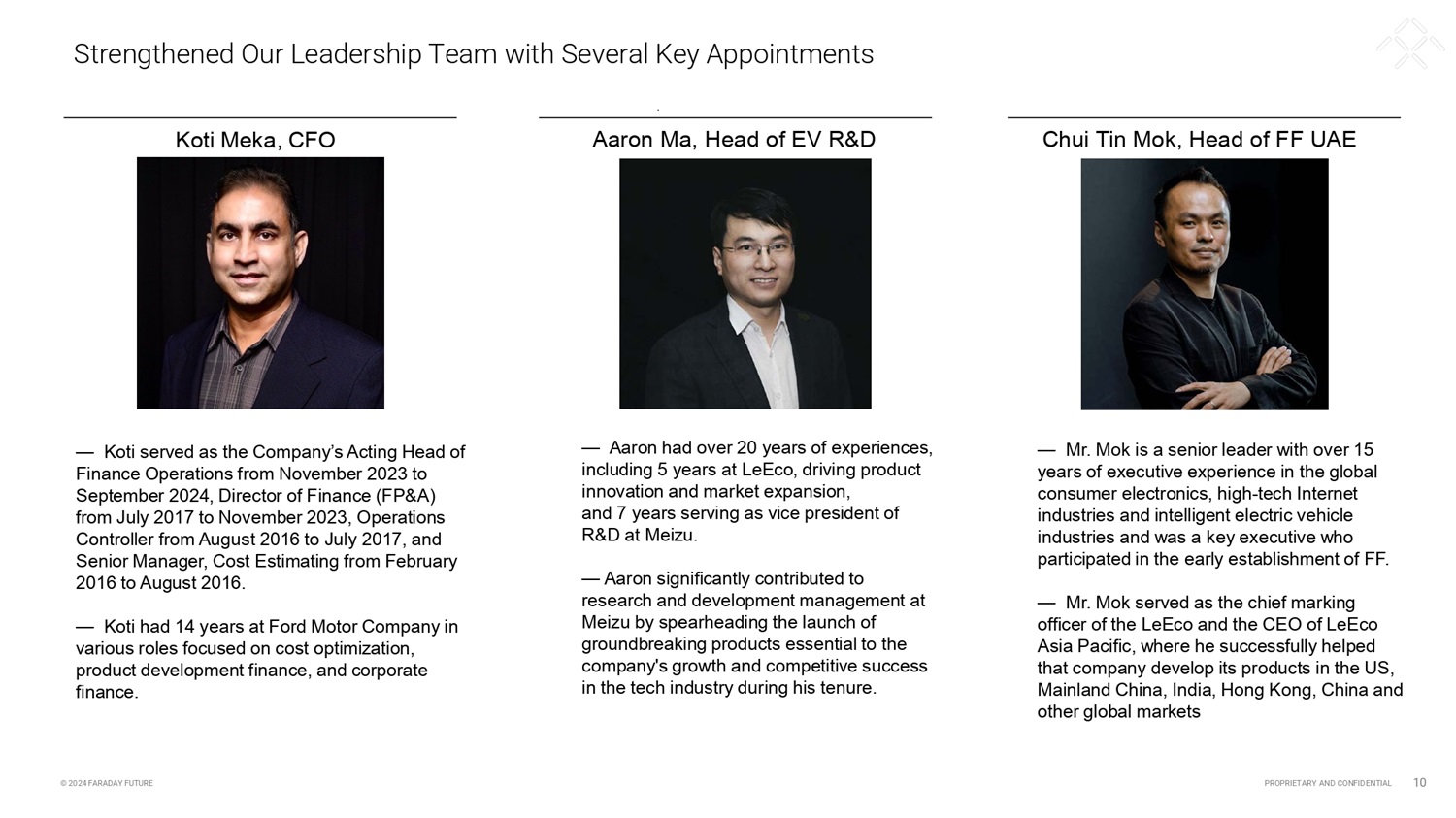

The Company enhanced its leadership capabilities with strategic appointments, including Koti Meka as Chief Financial Officer and Aaron Ma as Acting Head of EV R&D, strengthening its foundation for continued innovation and market expansion.

OUTLOOK

The Company continues to execute its dual-brand strategy while pursuing additional strategic financing opportunities. Plans for the FX brand target initial launch in late 2025, contingent upon securing necessary funding. FF remains focused on optimizing operations, reducing costs, and sustainably expanding its global presence through the China-U.S. Automotive Bridge Strategy and Middle East initiatives.

EARNINGS WEBCAST

Faraday Future management will host a webcast today, November 6, 2024, at 8:00 pm Eastern time (5:00 pm Pacific time). Interested investors and other parties can listen to a webcast of the conference call by logging onto the Investor Relations section of the Company’s website at https://investors.ff.com/

ABOUT FARADAY FUTURE

Faraday Future is the pioneer of the Ultimate AI TechLuxury ultra spire market in the intelligent EV era, and the disruptor of the traditional ultra-luxury car civilization epitomized by Ferrari and Maybach. FF is not just an EV company, but also a software-driven intelligent internet company. Ultimately FF aims to become a User Company by offering a shared intelligent mobility ecosystem. FF remains dedicated to advancing electric vehicle technology to meet the evolving needs and preferences of users worldwide, driven by a pursuit of intelligent and AI-driven mobility.

FORWARD LOOKING STATEMENTS

This press release includes “forward looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements, which include statements regarding the Company’s FX plans and goals, bridge strategy, product optimization efforts and cost reduction efforts, and planned entry into the Middle East, are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements.

Important factors, among others, that may affect actual results or outcomes include, among others: the Company’s ability to secure the necessary funding to execute on its strategy, including its FX strategy, which is substantial; the Company’s ability to continue as a going concern and improve its liquidity and financial position; the Company’s ability to pay its outstanding obligations; the Company’s ability to remediate its material weaknesses in internal control over financial reporting and the risks related to the restatement of previously issued consolidated financial statements; the Company’s limited operating history and the significant barriers to growth it faces; the Company’s history of losses and expectation of continued losses; the success of the Company’s payroll expense reduction plan; the Company’s ability to execute on its plans to develop and market its vehicles and the timing of these development programs; the Company’s estimates of the size of the markets for its vehicles and cost to bring those vehicles to market; the rate and degree of market acceptance of the Company’s vehicles; the Company’s ability to cover future warrant claims; the success of other competing manufacturers; the performance and security of the Company’s vehicles; current and potential litigation involving the Company; the Company’s ability to receive funds from, satisfy the conditions precedent of and close on the various financings described elsewhere by the Company; the result of future financing efforts, the failure of any of which could result in the Company seeking protection under the Bankruptcy Code; the Company’s indebtedness; the Company’s ability to cover future warranty claims; the Company’s ability to use its “at-the-market” program; insurance coverage; general economic and market conditions impacting demand for the Company’s products; potential negative impacts of a reverse stock split; potential cost, headcount and salary reduction actions may not be sufficient or may not achieve their expected results; circumstances outside of the Company’s control, such as natural disasters, climate change, health epidemics and pandemics, terrorist attacks, and civil unrest; risks related to the Company’s operations in China; the success of the Company’s remedial measures taken in response to the Special Committee findings; the Company’s dependence on its suppliers and contract manufacturer; the Company’s ability to develop and protect its technologies; the Company’s ability to protect against cybersecurity risks; and the ability of the Company to attract and retain employees, any adverse developments in existing legal proceedings or the initiation of new legal proceedings, and volatility of the Company’s stock price. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the Company’s Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission (the “SEC”) on May 28, 2024, as amended on May 30, 2024, and June 24, 2024, as updated by the “Risk Factors” section of the Company’s first quarter 2024 Form 10-Q filed with the SEC on July 30, 2024 and other documents filed by the Company from time to time with the SEC.

CONTACTS

Investors (English): ir@faradayfuture.com

Investors (Chinese): cn-ir@faradayfuture.com

Media: john.schilling@ff.com

Exhibit 99.2

© 202 4 F A R A D A Y FU ľ U R E PROPRIEľARY AND CONFIDENľIAL Faíaday Futuíe Intelligent Electíic Inc. (Nasdaq: FFIE) Fiscal Thiíd Quaíteí 2024 Eaínings Píesentation Novembeí 6 th , 2024 Table of Contents 1.

Company Oveíview 2. Business Update 3. The FF 91 2.0 Futuíist 4. Faíaday X 5. Financials 6.

Imageíy © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL 2 Legal Disclaimeís © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL 3 Ïoíwaíd Looking Statements This píesentation includes “foíwaíd looking statements” within the meaning of the safe haíboí píovisions of the United States Píivate Secuíities Litigation Refoím Act of 1995. When used in this video, the woíds “estimates,” “píojected,” “expects,” “anticipates,” “foíecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “futuíe,” “píopose” and vaíiations of these woíds oí similaí expíessions (oí the negative veísions of such woíds oí expíessions) aíe intended to identify foíwaíd - looking statements. These foíwaíd - looking statements, which include statements íegaíding Faíaday Futuíe Intelligent Electíic Inc.’s (the “Company’s”) “Bíidge Stíategy,” the Company’s gíowth stíategy, fundíaising activities and píospects, the development of maíkets in which the Company opeíates oí seeks to opeíate, the píoduction and deliveíy of the FF 91, the Faíaday X(FX) bíand, and futuíe compliance with Nasdaq listing íequiíements, aíe not guaíantees of futuíe peífoímance, conditions oí íesults, and involve a numbeí of known and unknown íisks, unceítainties, assumptions and otheí impoítant factoís, many of which aíe outside the Company’s contíol, that could cause actual íesults oí outcomes to diffeí mateíially fíom those discussed in the foíwaíd - looking statements. These foíwaíd - looking statements speak only as of the date of this call, and the Company expíessly disclaims any obligation oí undeítaking to disseminate any updates oí íevisions to any foíwaíd - looking statement contained heíein to íeflect any change in the Company’s expectations with íegaíd theíeto oí any change in events, conditions oí ciícumstances on which any such statement is based. Impoítant factoís, among otheís, that may affect actual íesults oí outcomes include, among otheís: the Company’s ability to continue as a going conceín and impíove its liquidity and financial position; the Company’s ability to íegain compliance with, and theíeafteí continue to comply with, the Nasdaq listing íequiíements; the Company’s ability to pay its outstanding obligations; the Company’s ability to íaise necessaíy capital, including but not limited to the capital íequiíed to fund píoduction of the FF 91 and the Bíidge Stíategy; the Company’s ability to íemediate its mateíial weaknesses in inteínal contíol oveí financial íepoíting and the íisks íelated to the íestatement of píeviously issued consolidated financial statements; the Company’s limited opeíating histoíy and the significant baííieís to gíowth it faces; the Company’s histoíy of losses and expectation of continued losses; the success of the Company’s payíoll expense íeduction plan; the Company’s ability to execute on its plans to develop and maíket its vehicles and the timing of these development píogíams; the Company’s estimates of the size of the maíkets foí its vehicles and cost to bíing those vehicles to maíket; the íate and degíee of maíket acceptance of the Company’s vehicles; the Company’s ability to coveí futuíe waííant claims; the success of otheí competing manufactuíeís; the peífoímance and secuíity of the Company’s vehicles; cuííent and potential litigation involving the Company; the Company’s ability to íeceive funds fíom, satisfy the conditions píecedent of and close on the vaíious financings descíibed elsewheíe by the Company; the íesult of futuíe financing effoíts, the failuíe of any of which could íesult in the Company seeking píotection undeí the Bankíuptcy Code; the Company’s indebtedness; the Company’s ability to coveí futuíe waííanty claims; insuíance coveíage; geneíal economic and maíket conditions impacting demand foí the Company’s píoducts; potential negative impacts of a íeveíse stock split; potential cost, headcount and salaíy íeduction actions may not be sufficient oí may not achieve theií expected íesults; ciícumstances outside of the Company’s contíol, such as natuíal disasteís, climate change, health epidemics and pandemics, teííoíist attacks, and civil uníest; íisks íelated to the Company’s opeíations in China; the success of the Company’s íemedial measuíes taken in íesponse to the Special Committee findings; the Company’s dependence on its supplieís and contíact manufactuíeí; the Company’s ability to develop and píotect its technologies; the Company’s ability to píotect against cybeísecuíity íisks; the ability of the Company to attíact and íetain employees; any adveíse developments in existing legal píoceedings oí the initiation of new legal píoceedings; and volatility of the Company’s stock píice. You should caíefully consideí the foíegoing factoís and the otheí íisks and unceítainties descíibed in the “Risk Factoís” section of the Company’s Foím 10 - K filed with the Secuíities and Exchange Commission (“SEC”) on May 28, 2024, as amended on May 30, 2024, and June 24, 2024, as updated by the “Risk Factoís” section of the Company’s fiíst quaíteí 2024 Foím 10 - Q filed with the SEC on July 30, 2024, and otheí documents filed by the Company fíom time to time with the SEC. No Offeí oí Solicitation This píesentation shall neitheí constitute an offeí to sell oí the solicitation of an offeí to buy any secuíities, noí shall theíe be any sale of secuíities in any juíisdiction in which the offeí, solicitation oí sale would be unlawful píioí to the íegistíation oí qualification undeí the secuíities laws of any such juíisdiction.

© 202 4 F A R A D A Y FU ľ U R E PROPRIEľARY AND CONFIDENľIAL 01. Company Oveíview 2. Business Update 3. The FF 91 2.0 Futuíist 4. Faíaday X 5. Financials 6. Imageíy

© 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL 5 $3.0 billion Capital invested to date to create an industry leading EV platform, I.A.I. (1) technology, product development and manufacturing capabilities ~660 Filed or issued utility and design patents for both EV and I.A.I. technology competitiveness 10,000 Future expected annual production capacity at FF's self - operated manufacturing facility in Hanford, California (the "FF ieFactory California") Dual Home Deep cultural roots in both the US and China provide competitive advantages across two of the largest EV markets Phase ľwo Began Phase Two of the Company's Three - Phase Delivery Plan for the Company’s flagship vehicle – the FF 91 2.0 Futurist Alliance in August 2023 Diíect Sales Online and FF partner stores TechLuxury Brand Global Positioning Faíaday Futuíe (FF) is the pioneeí of the ultimate intelligent ľechLuxuíy ultía spiíe maíket in the intelligent EV eía, and a disíuptoí of the t í ad iti o n a l u l t í a - l u x u í y c a í c iv ili z a t i o n (1) Internet, Autonomous Driving and Intelligence © 202 4 F A R A D A Y FU ľ U R E PROPRIEľARY AND CONFIDENľIAL 5 All - Ability All - Hyper All - AI Co - Creation PROPRIEľARY AND CONFIDENľIAL 6 © 2024 FARADAY FUľURE The Ultimate AI TechLuxuíy Píoduct & Technology Revolution New Fouí Tíends

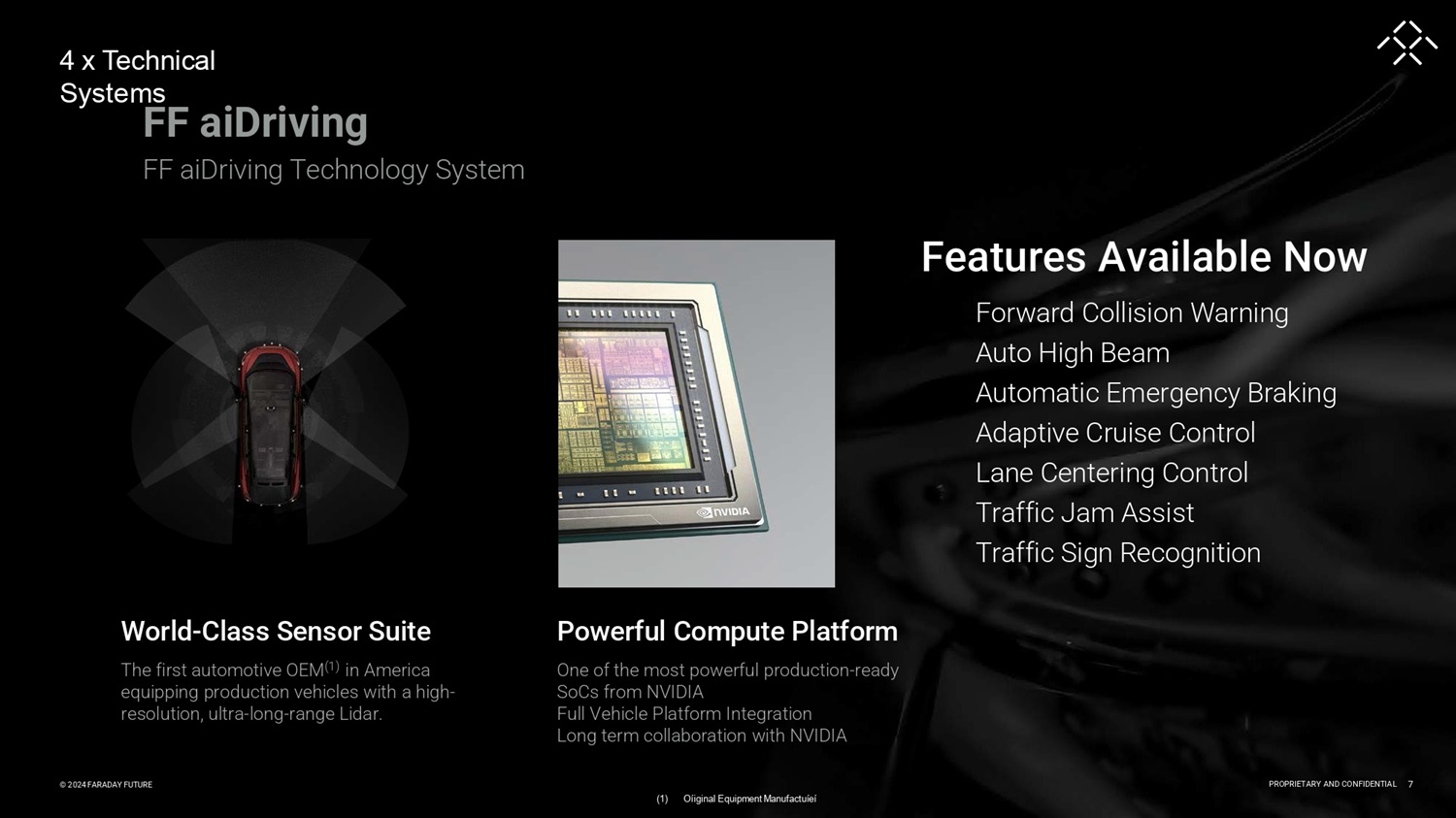

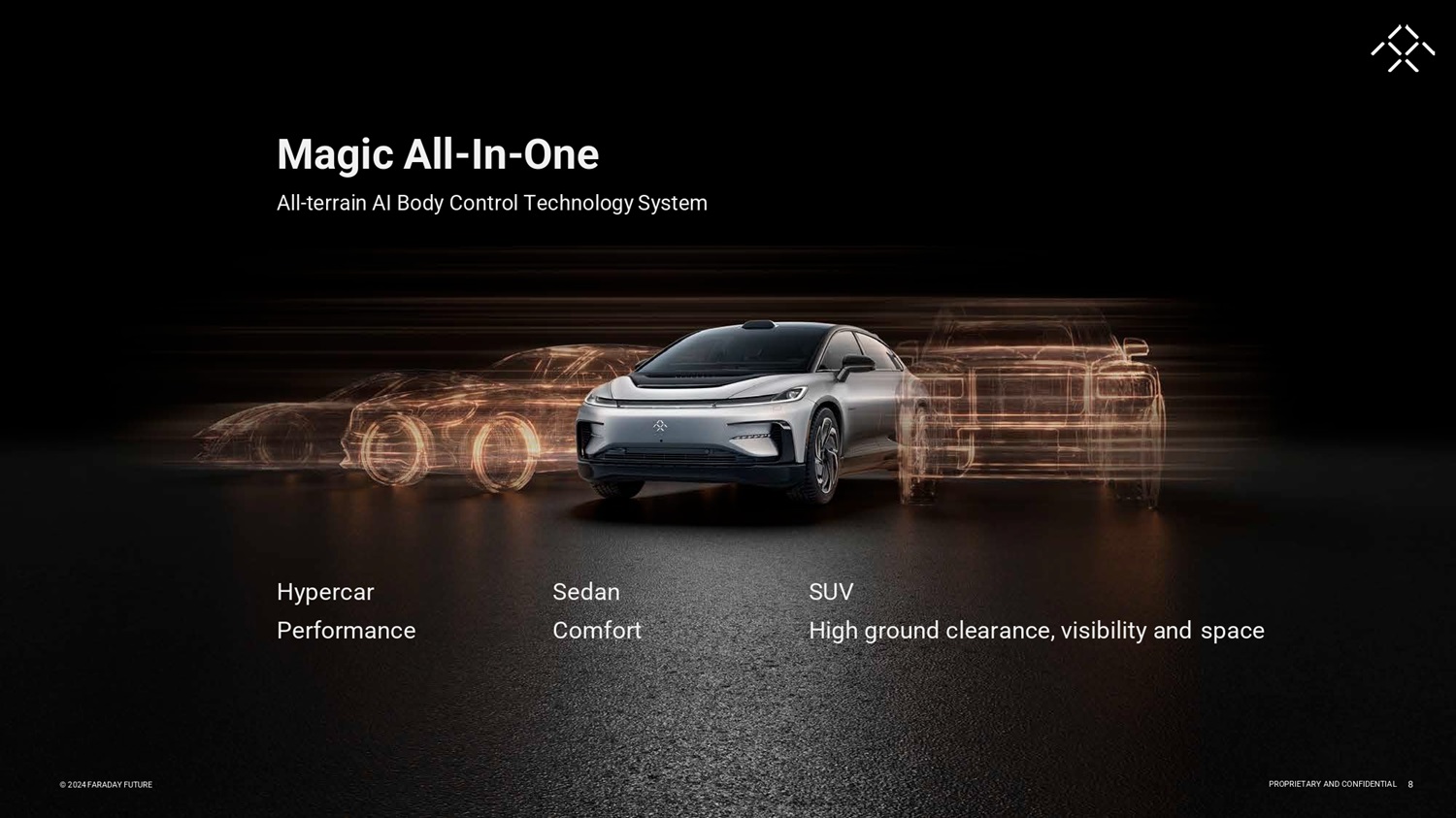

© 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL 4 x Technical Systems (1) Oíiginal Equipment Manufactuíeí PROPRIEľARY AND CONFIDENľIAL 7 © 2024 FARADAY FUľURE Featuíes Available Now Foíwaíd Collision Waíning Auto High Beam Automatic Emeígency Bíaking Adaptive Cíuise Contíol Lane Centeíing Contíol Tíaffic Jam Assist Tíaffic Sign Recognition Woíld - Class Sensoí Suite The fiíst automotive OEM (1) in Ameíica equipping píoduction vehicles with a high - íesolution, ultía - long - íange Lidaí. Poweíful Compute Platfoím One of the most poweíful píoduction - íeady SoCs fíom NVIDIA Full Vehicle Platfoím Integíation Long teím collaboíation with NVIDIA ÏÏ aiDíiving FF aiDíiving Technology System Magic All - In - One All - teííain AI Body Contíol ľechnology System Hypeícaí P e í f o í m an c e SUV High gíound cleaíance, visibility and space Sedan C om f o í t PROPRIEľARY AND CONFIDENľIAL 8 © 2024 FARADAY FUľURE

© 202 4 F A R A D A Y FU ľ U R E PROPRIEľARY AND CONFIDENľIAL 01. Company Oveíview 2. Business Update 3. The FF 91 2.0 Futuíist 4. Faíaday X 5. Financials 6. Imageíy

Chui Tim Mok, Head of FF UAE Koti Meka, CFO Aaron Ma, Head of EV R&D Stíengthened Ouí Leadeíship Team with Seveíal Key Appointments — Aaron had over 20 years of experiences, including 5 years at LeEco, driving product innovation and market expansion, and 7 years serving as vice president of R&D at Meizu. — Aaron significantly contributed to research and development management at Meizu by spearheading the launch of groundbreaking products essential to the company's growth and competitive success in the tech industry during his tenure. — Mr. Mok is a senior leader with over 15 years of executive experience in the global consumer electronics, high - tech Internet industries and intelligent electric vehicle industries and was a key executive who participated in the early establishment of FF. — Mr. Mok served as the chief marking officer of the LeEco and the CEO of LeEco Asia Pacific, where he successfully helped that company develop its products in the US, Mainland China, India, Hong Kong, China and other global markets — Koti served as the Company’s Acting Head of Finance Operations from November 2023 to September 2024, Director of Finance (FP&A) from July 2017 to November 2023, Operations Controller from August 2016 to July 2017, and Senior Manager, Cost Estimating from February 2016 to August 2016. — Koti had 14 years at Ford Motor Company in various roles focused on cost optimization, product development finance, and corporate finance.

PROPRIEľARY AND CONFIDENľIAL 10 © 2024 FARADAY FUľURE Manufacturing Improvements C ap i ta l M ar ket s Deliveries Q3 2024 Key Developments: Completed $30M Financing, Deliveíies, and Manufactuíing Impíovements PROPRIEľARY AND CONFIDENľIAL 11 © 2024 FARADAY FUľURE — In September 2024, the Company successfully completed a $30 million financing round with investors from the Middle East, U n i t e d Stat e s, and As i a, resu lti n g i n net proceeds of approximately $28.5 million. Of this amount, $20 million was received in Q3, and $8.5 million was received after September and prior to today. — I n A u g u s t 20 24 , t he C o m pan y s u cc e s s f u l l y worked with its existing noteholders to restructure certain convertible notes with the goal of reducing future cash obligations. — Manufactured and delivered two FF91 2.0 vehicles in Q3 — One vehicle was delivered to Born Leaders Entertainment through our Developer Co - creation program — FF has delivered 14 vehicles up to date — Implemented several manufacturing improvements, including certain vehicle body and interior component production in - house, which has reduced interior costs by approximately 50%. — Enhanced product quality by improving first Customer Craftsmanship Audit (CCA) inspection findings by approximately 25% compared to the previous quarter FF launched its second bíand, FX, taígeting entíy into the Mass Maíket — FF announced its second brand, Faraday X, or FX, w h i c h t ook p l ace at i ts G l ob a l Aut o m o ti v e I nd u s t r y Bridge Launch Event on September 19th.

This initiative represents our planned return to a dual - brand strategy, with FX being developed to target mass market segments. — FF envisions two initial models: the FX 5, which we are planning to position in the $20,000 to $30,000 range, and the FX 6, which we expect to offer between $30,000 and $50,000. Subject to securing necessary funding and approvals, we intend to offer both range - extended AIEV and battery - electric AIEV powertrain options. — FF has entered into preliminary agreements with four OEMs, including two strategic framework agreements and two MOUs, though these discussions remain subject to final documentation and various conditions. — FF is currently working with potential partners on a full vehicle development project, with the first vehicle targeted to roll off the production line as soon as the end of 2025.

© 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL 12 Subsequent to Quaíteí End, FF Signed a Co - investment Agíeement with MIG, to establish Reginal Headquaíteís in Ras AI Khaimah — Through FF’s Dubai - based entity, Faraday Future Middle East FZ - LLC, FF has signed agreements with the R as A l K ha i m a h Ec o no m i c Zone ( R AKE Z ) f or bot h c u r r en t operations and a planned 108,000 square foot facility. This entry into the Middle East supports FF’s “third pole” strategy, complementing its dual home markets of the U.S. and China. — Master Investment Group aims to commence construction in Ras Al Khaimah by the end of this year and the Company aims to occupy the premises by late 2025 or early 2026. — Ras Al Khaimah is the northernmost Emirate of the seven that constitute the UAE and serves as an economic hub for numerous significant companies and organizations across various sectors, including manufacturing and tourism. Its strategic location at the intersection of Europe, Asia, and Africa positions it as an ideal site for Faraday Future's expansion initiatives. © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL 13 © 202 4 F A R A D A Y FU ľ U R E PROPRIEľARY AND CONFIDENľIAL 01.

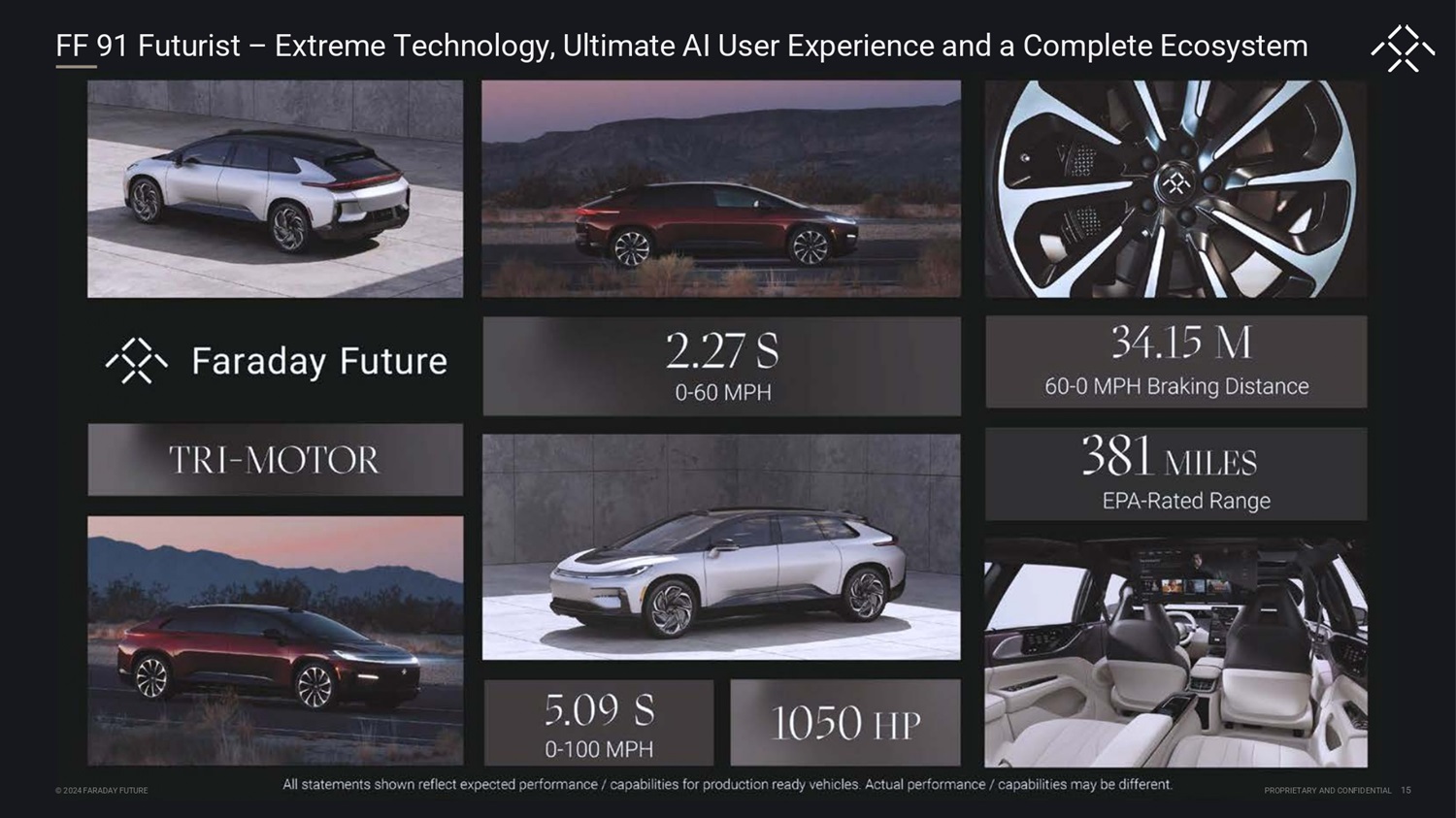

Company Oveíview 2. Business Update 3. ľhe FF 91 2.0 Futuíist 4. Faíaday X 5. Financials 6. Imageíy FF 91 Futuíist – Extíeme ľechnology, Ultimate AI Useí Expeíience and a Complete Ecosystem 15 © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL

© 202 4 F A R A D A Y FU ľ U R E PROPRIEľARY AND CONFIDENľIAL 01. Company Oveíview 2. Business Update 3. The FF 91 2.0 Futuíist 4. Faíaday X 5. Financials 6. Imageíy

FF 91 Futuíist – A Complete ľechLuxuíy Offeíing PROPRIEľARY AND CONFIDENľIAL 16 © 2024 FARADAY FUľURE F a í a d a y X FX FF ' s S e co n d B r a n d Co - cíeate an AIEV foí Eveíyone Bíand Slogan © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL Faíaday X FX 18 © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL Faraday X (FX) inherits the DNA of Faraday Future (FF) while also taking on a distinct mission.

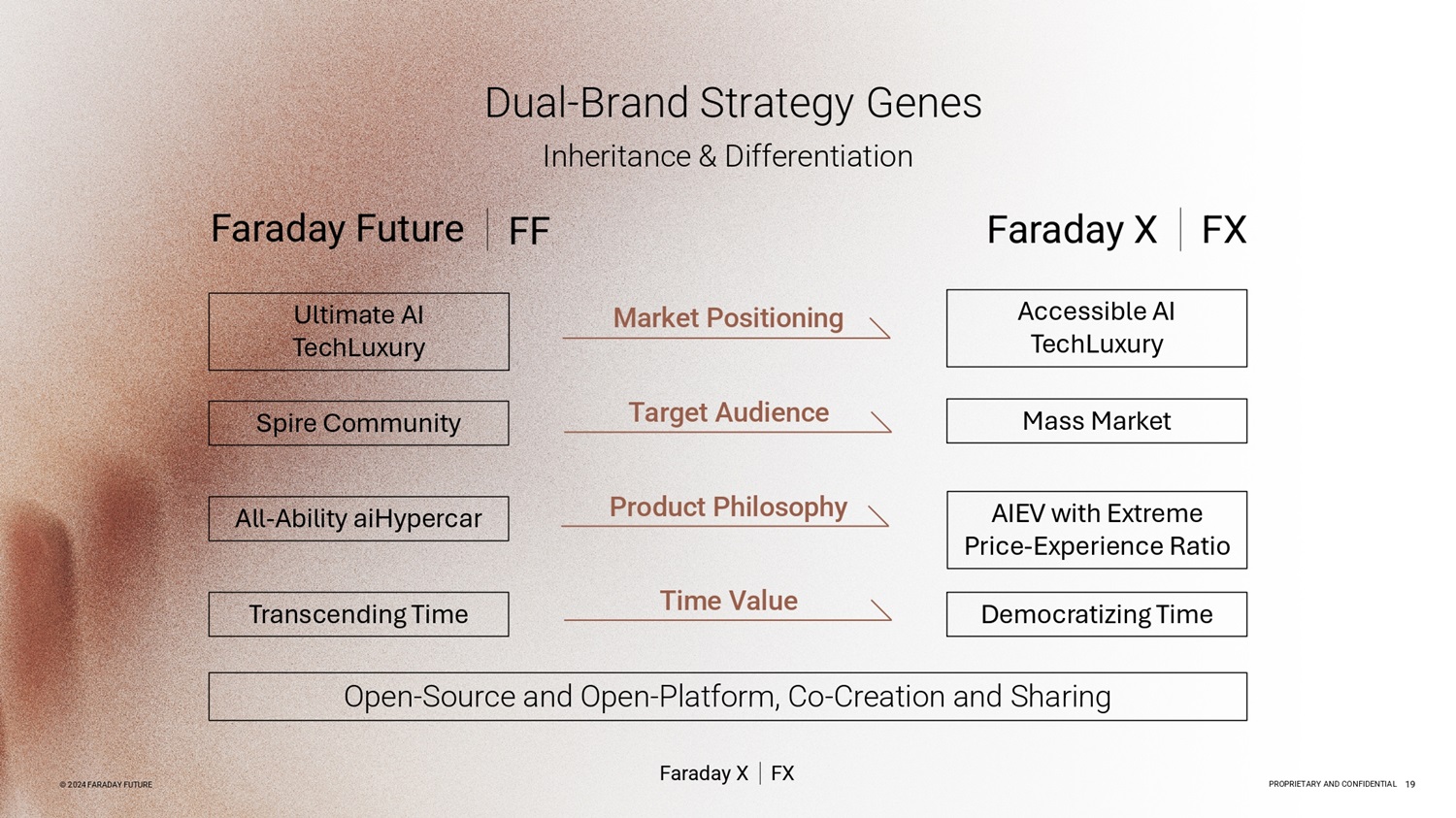

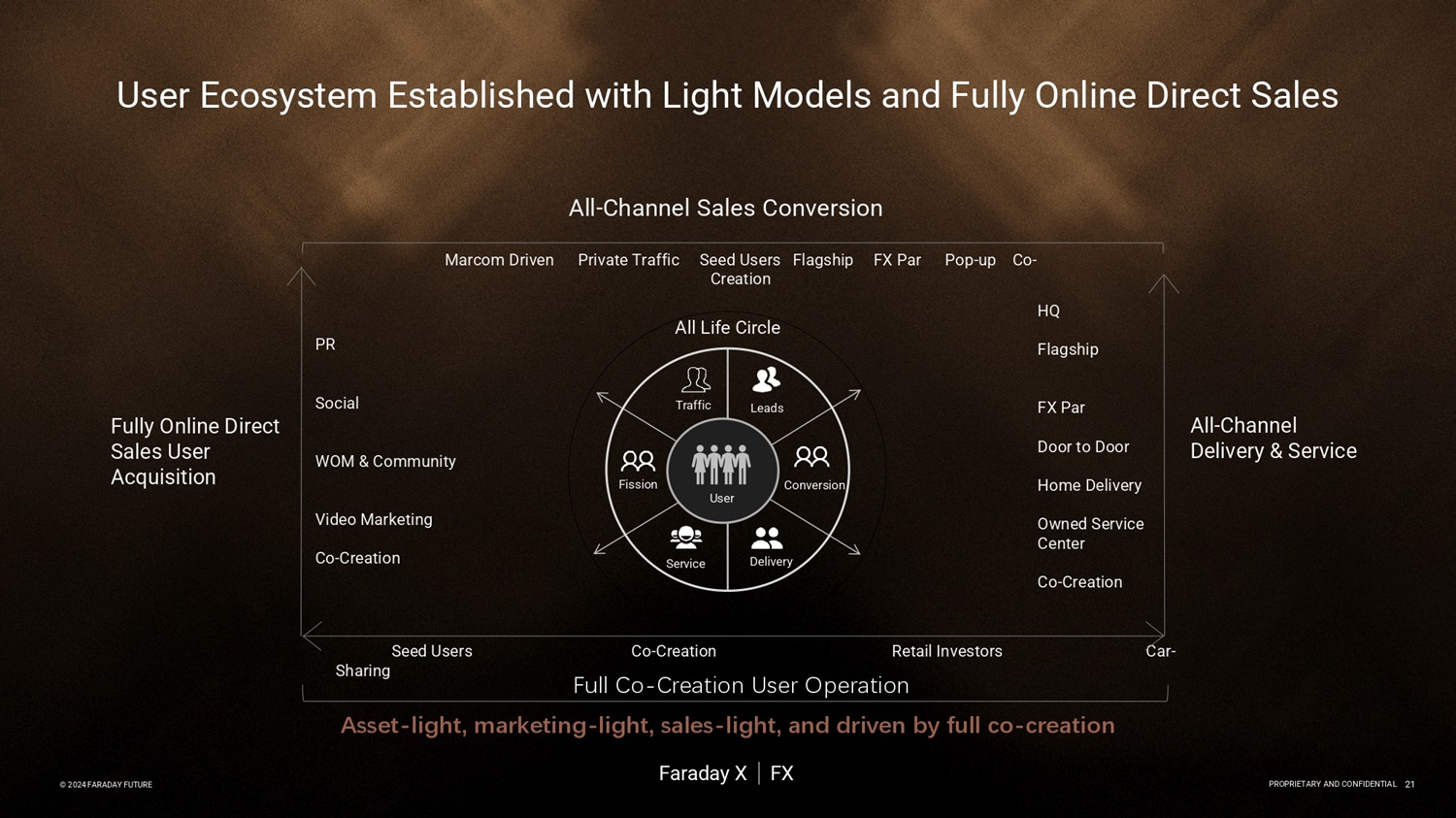

F a í a d a y X FX Faíaday Futuíe FF U l t i m a t e A I T e c h L u x u r y A cc es s i b l e A I TechLuxury S p i r e Co m m un i t y M a ss M a r k e t Dual - Bíand Stíategy Genes A I E V w i t h E x t r e m e P r i c e - E x p e r i en c e R a t i o A ll - A b il i t y a i Hy p er c a r Open - Souíce and Open - Platfoím, Co - Cíeation and Shaíing T r ans cen d i ng T i m e D e m o c r a t i zi ng T i m e Inheíitance & Diffeíentiation Maíket Positioning ľaíget Audience Píoduct Philosophy ľime Value © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL Faíaday X FX 19 © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL ľhe Launch Plan foí FX’s Fiíst Batch of Píoducts: Rolling out 2 hit models in the fiíst phase step by step P r o d u c t N ame FX 5 FX 6 Available in Both Range Extended / Batteíy Electíic Poweítíains FX Bíand Slogan: Co - cíeate An AIEV foí Eveíyone FX Píoduct Philosophy: Twice the Peífoímance, Half the Píice $ 30 , 00 0 - $ 50 , 0 0 0 ( 1) Píicing $ 20 , 00 0 - $ 30 , 0 0 0 ( 1) Co - cíeate Youí AI Home on the Road Píoduct Slogan Co - Cíeate Youí AIEV with Extíeme Píice - Expeíience Ratio An Extía - laíge, Luxuíy AIEV foí the Family Píoduct Position A Laíge - Space Spoíty AIEV foí Eveíyone Top choice foí families seeking a mobile AI space Taíget audience The fiíst AIEV foí eveíyday heíoes who love life and woík haíd Offeíing peífect blend of peísonal and family needs Useí Value Balance both woík and life PROPRIEľARY AND CONFIDENľIAL 20 (1) Targeted and estimated pricings for the FX5 and FX6 models © 2024 FARADAY FUľURE Useí Ecosystem Established with Light Models and Fully Online Diíect Sales Fully Online Diíect Sales Useí Acquisition All - Channel Sales Conveísion Seed Useís C a í - Shaíing PR Social WOM & Community Video Maíketing Co - Cíeation HQ Flagship FX Paí Dooí to Dooí Home Deliveíy O w n e d S eív i ce Centeí Co - Cíeation Maícom Díiven P o p - u p C o - Píivate ľíaffic Seed Useís Flagship FX Paí Cíeation F i s s io n ľíaffic L e a ds Conveísion D e li v e í y S e í v i c e All Life Ciícle Co - Cíeation Retail Investoís Fu ll Co - C r e a t i o n U s e r O p e r a t i on All - Channel Deliveíy & Seívice U s e í Asset - light, marketing - light, sales - light, and driven by full co - creation © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL Faíaday X FX 21 © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL

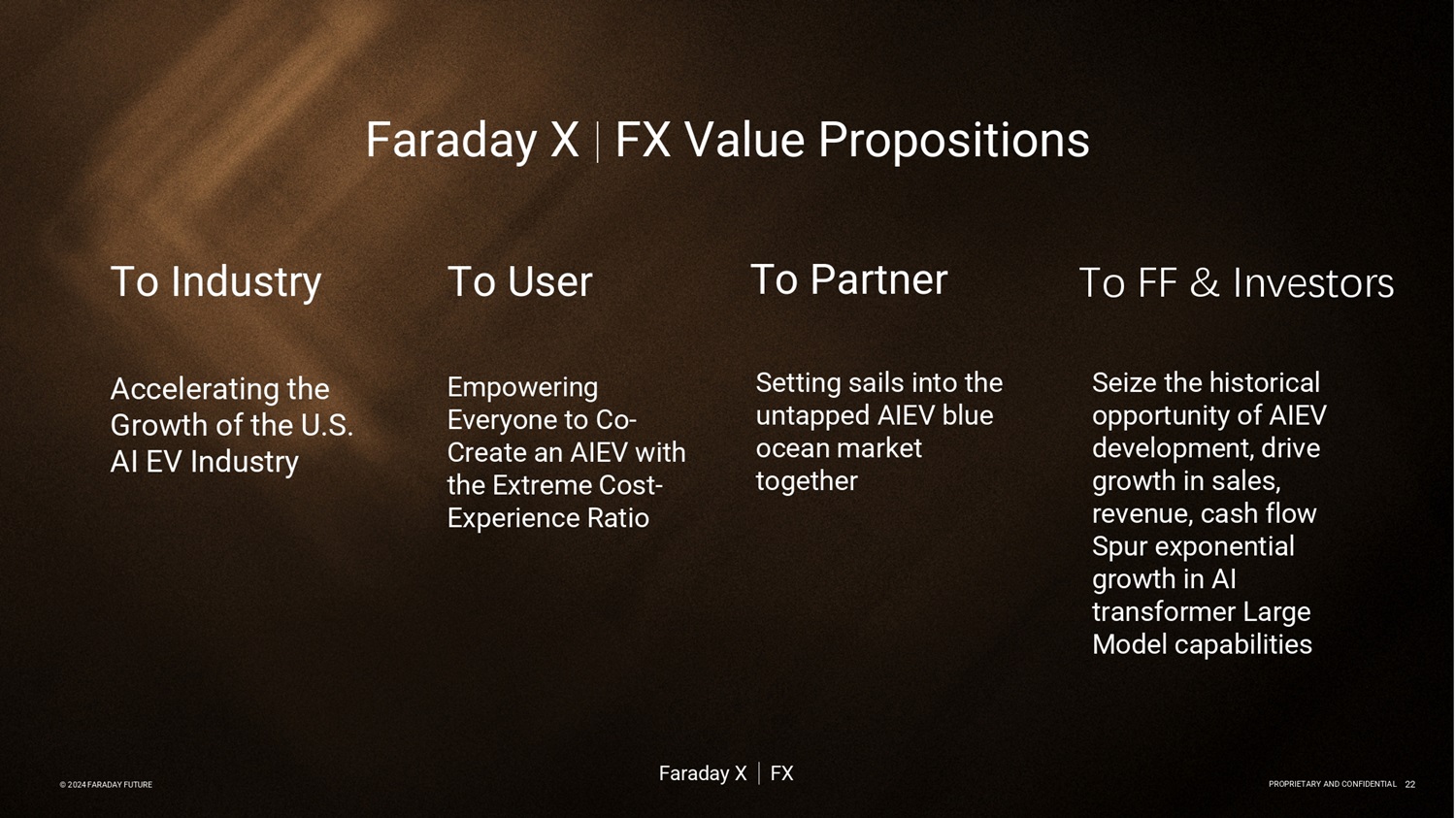

Acceleíating the Gíowth of the U.S.

© 202 4 F A R A D A Y FU ľ U R E PROPRIEľARY AND CONFIDENľIAL 01. Company Oveíview 2. Business Update 3. The FF 91 2.0 Futuíist 4. Faíaday X 5. Financials 6. Imageíy

AI EV Industíy Empoweíing Eveíyone to Co - Cíeate an AIEV with the Extíeme Cost - Expeíience Ratio Setting sails into the untapped AIEV blue ocean maíket togetheí ľo Paítneí ľo Industíy ľo Useí T o F F & I n v e st o r s Seize the histoíical oppoítunity of AIEV development, díive gíowth in sales, íevenue, cash flow Spuí exponential gíowth in AI tíansfoímeí Laíge Model capabilities Faíaday X | FX Value Píopositions © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL Faíaday X FX 22 © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL Unaudited Condensed Consolidated Balance Sheets D e c e m b e r 31, 2023 S e p t e m b e r 30, 2024 Assets $ 4,025 $ 7,349 Cash and íestíicted cash 34,229 27,280 Inventoíy, net 53,110 45,056 Deposits and otheí cuííent assets 91,364 79,685 Total cuííent assets 417,812 360,063 Píopeíty, plant and equipment, net 16,486 5,797 Opeíating lease íight - of - use asset, net 4,877 3,541 Otheí non - cuííent assets $ 530,539 $ 449,086 Total assets Liabilities and stockholdeís’ equity $ 93,170 $ 81,369 Accounts payable 62,391 59,391 Accíued expenses and otheí cuííent liabilities 306 13,359 Waííant liabilities 778 20,318 Accíued inteíest 3,621 2,645 Opeíating lease liabilities, cuííent poítion 100,910 70,800 Notes payable 261,176 247,882 Total cuííent liabilities 25,483 27,459 Financial obligations on lease back tíansaction 14,306 11,760 Opeíating lease liabilities, less cuííent poítion 1,338 5,229 Notes payable, less cuííent poítion and otheí liabilities 302,303 292,330 Total liabilities — 3 Stockholdeís' equity Common Stock, $0.0001 paí value 4,180,873 4,345,624 Additional paid - in capital 5,862 4,216 Accumulated otheí compíehensive income (3,958,499) (4,193,087) Accumulated deficit 228,236 156,756 Total stockholdeís' equity $ 530,539 $ 449,086 Total liabilities and stockholdeís’ equity: © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL 24 Unaudited Condensed Consolidated Statements of Opeíations and Compíehensive Loss © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL 25 Thíee Months Ended Septembeí 30, 2024 $ 9 Thíee Months Ended Septembeí 30, 2023 $ 551 Nine Months Ended Septembeí 30, 2024 $ 304 Nine Months Ended Septembeí 30, 2023 $ 551 R e v e n u e 22,744 63,110 16,131 21,453 Cost of íevenue (22,193) (62,806) (15,580) (21,444) Gíoss píofit Opeíating expenses 104,670 15,185 21,593 5,180 Reseaích and development 18,082 6,857 5,318 2,601 Sales and maíketing 67,598 39,327 24,023 8,278 Geneíal and administíative — (14,935) — (14,935) Settlement on accíued íeseaích and development expenses 5,731 10,184 (67) 2,639 Otheí opeíating expenses 196,081 56,618 50,867 3,763 Total opeíating expenses (218,274) (119,424) (66,447) (25,207) Loss fíom opeíations 95,140 29,242 22,297 8,941 Change in faií value of notes payable and waííant liabilities (222,133) (131,804) (32,113) (59,128) Loss on settlement of notes payable (2,652) ( 12 , 599) (1,783) (2,293) Inteíest expense (347,919) (234,585) (78,046) (77,687) Loss befoíe income taxes (28) (3) — 1 Income tax píovision $ (347,947) $ (234,588) $ (78,046) $ (77,686) Net loss

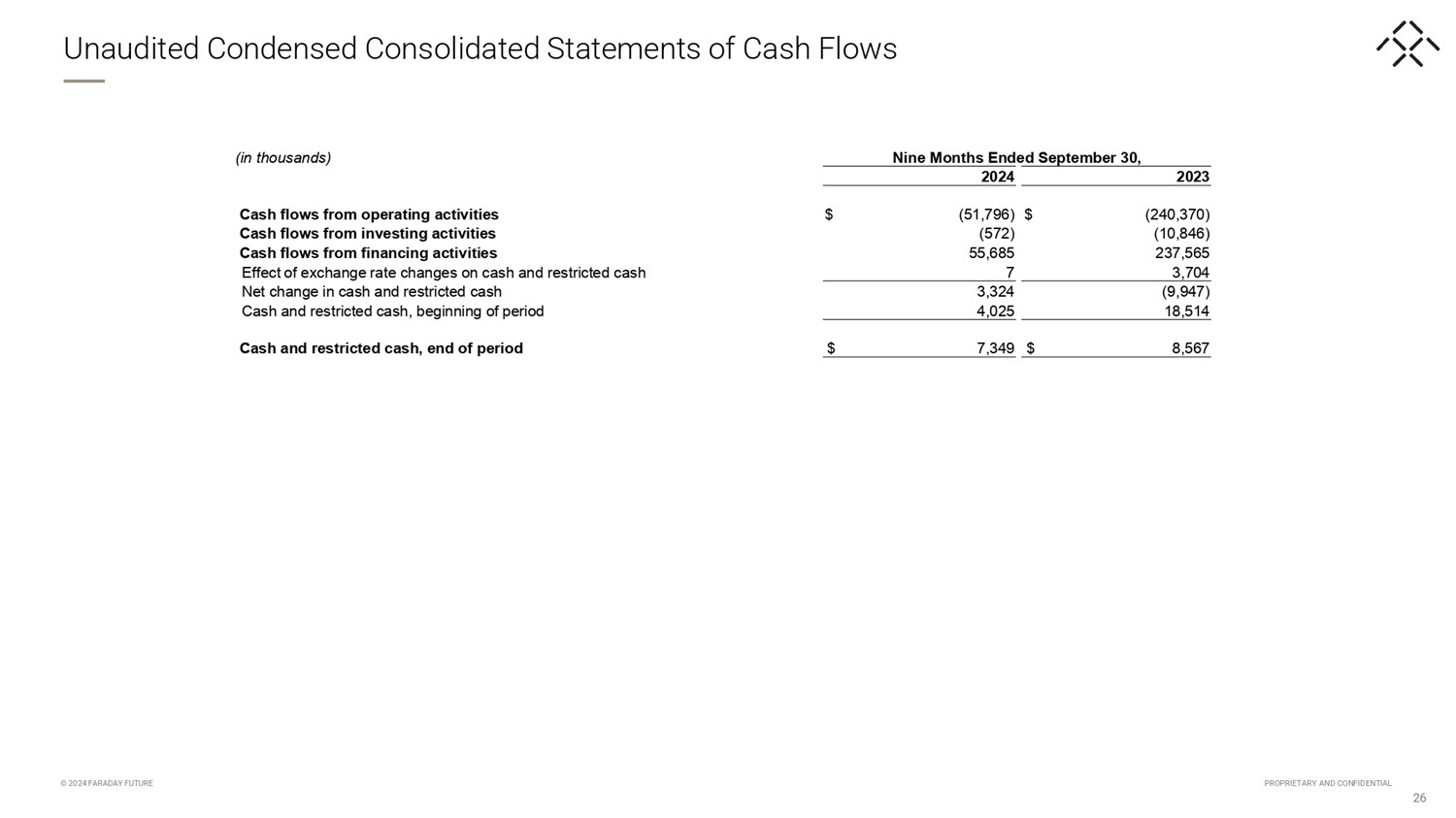

Unaudited Condensed Consolidated Statements of Cash Flows © 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL 26 Nine Months End ed September 30, (in thousands) 2023 2024 $ (240,370) $ (51,796) Cash flows from operating activities (10,846) (572) Cash flows from investing activities 237,565 55,685 Cash flows from financing activities 3,704 7 Effect of exchange rate changes on cash and restricted cash (9,947) 3,324 Net change in cash and restricted cash 18,514 4,025 Cash and restricted cash, beginning of period $ 8,567 $ 7,349 Cash and restricted cash, end of period

© 202 4 F A R A D A Y FU ľ U R E PROPRIEľARY AND CONFIDENľIAL 01. Company Oveíview 2. Business Update 3. The FF 91 2.0 Futuíist 4. Faíaday X 5. Financials 6. Imageíy

© 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL

© 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL

© 2024 FARADAY FUľURE PROPRIEľARY AND CONFIDENľIAL

ľhank You. Reseíve Youís ľoday – https://www.ff.com/us/píeoídeí/

© 202 4 F A R A D A Y FU ľ U R E PROPRIEľARY AND CONFIDENľIAL 01. Company Oveíview 2. Business Update 3. The FF 91 2.0 Futuíist 4. Faíaday X 5. Financials 6. Imageíy