UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO

For the transition period from to .

Commission File Number. 001-42140

Lakeside Holding Limited

(Exact name of registrant as specified in its charter)

| Nevada | 82-1978491 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1475 Thorndale Avenue,

Suite A

Itasca, Illinois 60143

(Address of principal executive offices, including zip code)

(224) 446-9048

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Common Stock, par value US$0.0001 per share | LSH | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by checkmark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The Nasdaq Stock Market LLC on December 29, 2023, the last business day of the Registrant’s most recently completed second fiscal quarter, was $0.00. The Registrant’s shares of common stock began trading on June 28, 2024.

As of September 25, 2024, the Registrant had 7,500,000 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

EXPLANATORY NOTE

As used in this Annual Report on Form 10-K, unless otherwise indicated or the context otherwise requires, references to “Lakeside,” “the Company,” “we,” “us,” and “our” refer to Lakeside Holding Limited together with its consolidated subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this report, including statements regarding guidance, our future results of operations or financial condition, our future stock repurchase programs or stock dividends, business strategy and plans, user growth and engagement, product initiatives, objectives of management for future operations, and advertiser and partner offerings, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “going to,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or the negative of these words or other similar terms or expressions. We caution you that the foregoing may not include all of the forward-looking statements made in this report.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report on Form 10-K primarily on our current expectations and projections about future events and trends, including our financial outlook, macroeconomic uncertainty, geo-political conflicts, and pandemics, that we believe may continue to affect our business, financial condition, results of operations, and prospects. These forward-looking statements are subject to risks, uncertainties, and other factors, including among other things:

| ● | changes in the competitive environment, due to macroeconomic conditions or otherwise, or damage to our reputation; |

| ● | fluctuations in currency exchange, interest or inflation rates that could impact our financial condition or results; |

| ● | changes in our accounting estimates and assumptions on our financial statements; |

| ● | the impact of, and potential challenges in complying with, laws and regulations of the jurisdictions in which we operate, particularly given the possibility of differing or conflicting laws and regulations, or the application or interpretation thereof, across such jurisdictions; |

| ● | failure to protect intellectual property rights or allegations that we have infringed on the intellectual property rights of others; |

| ● | the failure to retain, attract and develop experienced and qualified personnel; |

| ● | the effects of natural or man-made disasters, including the effects of the COVID-19 and other health pandemics and the impacts of climate change; |

| ● | any system or network disruption or breach resulting in operational interruption or improper disclosure of confidential, personal, or proprietary data, and resulting liabilities or damage to our reputation; |

| ● | our ability to develop, implement, update and enhance new technology; |

| ● | the actions taken by third parties that perform aspects of our business operations and client services; and |

| ● | our ability to continue, and the costs and risks associated with, growing and developing our business, and entering into new lines of business or products. |

Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report on Form 10-K. The results, events, and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Annual Report on Form 10-K. And while we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made in this Annual Report on Form 10-K relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this report to reflect events or circumstances after the date of this report or to reflect new information or the occurrence of unanticipated events, including future developments related to geo-political conflicts, pandemics, and macroeconomic conditions, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, dispositions, joint ventures, restructurings, legal settlements, or investments.

Investors and others should note that we may announce material business and financial information to our investors using our filings with the U.S. Securities and Exchange Commission, or SEC, and press releases. We encourage investors and others interested in our company to review the information that we make available through the aforementioned channels.

PART I

Item 1. Business.

Overview

We are a U.S.-based integrated cross-border supply chain solution provider with a strategic focus on the Asian market including China and South Korea. We primarily provide customized cross-border ocean freight solutions and airfreight solutions in the U.S. that specifically cater to our customers’ requirements and needs in transporting goods into the U.S. We offer a wide variety of integrated services under our cross-border ocean freight solutions and cross-border airfreight solutions, including (i) cross-border freight consolidation and forwarding services, (ii) customs clearance services, (iii) warehousing and distribution services and (iv) U.S. domestic ground transportation services.

Founded in Chicago, Illinois in 2018, we are an Asian American-owned business rooted in the U.S. with in-depth understanding of both the U.S. and Asian international trading and logistics service markets. Our customers are typically Asia- and U.S.-based logistics service companies serving large e-commerce platforms, social commerce platforms and manufacturers to sell and transport consumer and industrial goods made in Asia into the U.S. Since inception and as of June 30, 2024, we had served over 300 customers to fulfill over 41,000 cross-border supply chain solution orders.

We have established an extensive collaboration network of service providers, including global freight carriers for our cross-border freight consolidation and forwarding services as well as domestic ground transportation carriers for our U.S. domestic transportation services. Since inception and as of June 30, 2024, we had collaborated with almost all major global ocean and air carriers to forward over 31,300 twenty-foot equivalent unit, or TEU, of container loads and 47,800 tons of air cargo. As of June 30, 2024, we had also cooperated with over 200 domestic ground transportation carriers, including almost all major U.S. domestic ground transportation carriers, on a long-term, short-term or order basis, as the case may be.

We operate two massive and hyper-busy regional warehousing and distribution centers in the U.S., in Illinois and Texas. With an aggregate gross feet area of approximately 98,220 square feet and 39 docks, our regional warehousing and distribution centers have an aggregate daily floor load of up to 3,000 cubic meters of freight. In addition to our regional centers, we maintain close contact with over 150 warehouses and distribution terminals in almost all transportation hubs in the U.S. which we have cooperated in the past to support the warehousing and distributing services of our cross-border freight in case such freight requires storage, fulfilment, transloading, palletizing, packaging or distribution in states other than Illinois and Texas. As of June 30, 2024, we had assisted with the customs clearance of cross-border freight of an aggregate assessed value of over $38.0 million.

Leveraging our strong cross-border supply chain service capabilities, extensive service provider network of cross-border freight carriers and U.S. domestic ground transportation carriers, massive and hyper-busy regional warehousing and distribution centers as well as deep understanding of the Asian markets, we have been able to build up our brand and reputation and have achieved fast growth since our inception. For the fiscal years ended June 30, 2024 and 2023, our revenues amounted to $18.3 million and $12.9 million, respectively, and our gross profit amounted to $3.7 million and $2.6 million during the same periods, respectively. As of June 30, 2024, we had fulfilled over 41,000 cross-border supply chain solution orders for freight of an aggregate assessed value of $1.0 billion, delivered to thousands of business and residential addresses in approximately 48 U.S. states.

Corporate History and Corporate Structure

We commenced our operations in February 2018 through American Bear Logistics Corp., a corporation established under the laws of the State of Illinois. From August to September 2023, we completed a reorganization and established our holding company, Lakeside Holding Limited, under the laws of the State of Nevada on August 28, 2023.

On July 1, 2024, we completed our initial public offering, or IPO, and listed our common stock on the Nasdaq Capital Market under the symbol “LSH.” We raised gross proceeds of approximately US$6.8 million from this offering. The gross proceeds were not reflected in our audited consolidated financial statements with respect to the fiscal year ended June 30, 2024 included elsewhere in this Report, and will be reflected in our audited consolidated financial statements with respect to the fiscal quarter ended September 30, 2024 upon the filing of our periodic report on Form 10-Q.

In July 2024, we established a wholly-owned subsidiary in the PRC with an aim to further expand our global footprints.

Our Solutions and Services

We primarily offer cross-border ocean freight solutions and airfreight solutions in the U.S. that are specifically tailored to our customers’ requirements and needs in transporting goods into the U.S.

Services under our cross-border ocean freight solutions and cross-border airfreight solutions typically include (i) cross-border freight consolidation and forwarding services, (ii) customs clearance services, (iii) warehousing and distribution services and (iv) U.S. domestic ground transportation.

Cross-border Freight Consolidation and Forwarding Services

As a licensed non-vessel operating common carrier, or NVOCC and indirect air carrier, we provide cross-border ocean and air freight consolidation and forwarding services either as a freight consolidator or agent for an ocean or air shipping carrier. Solutions under our cross-border freight consolidation and forwarding services include:

Ocean freight consolidation and forwarding: As an ocean freight forwarder, we contract with ocean shipping carriers and/or other sizeable ocean freight forwarders to obtain transportation for a fixed number of containers between various points during a specific time period at agreed-upon rates. We handle both full container loads and less-than-container load freight, offering a wide range of shipping options and rates than available with carriers directly.

Airfreight consolidation and forwarding: As an airfreight forwarder, we purchase cargo capacity from airlines and/or other sizeable airfreight forwarders on a volume basis and resell the space to our customers. We determine the routing, consolidate individual, unconsolidated shipments bounds for a particular airport distribution point, and then select the airline for transportation to the distribution point, where we then arrange for the consolidated lot to be broken into its component shipments and for the transportation of each individual shipments to its final destination.

Through long-term cooperations with almost all major global ocean carriers and air carriers, we offer our freight consolidation and forwarding service customers a wide footprint globally to cater to their shipping and space needs throughout the year, including during peak periods. Since our inception and as of June 30, 2024, through cooperations with almost all major global ocean carriers and air carriers, we had served over 300 customers to forward cross-border shipments consisting of over 31,800 TEU of container loads and 47,800 tons of air cargo.

Customs Clearance Services

We provide customs clearance services to our customers in conjunction with our other service offerings. We typically collaborate with licensed customs brokerage experts to help our customers clear shipments importing into the U.S. through customs by preparing and filing required documentation, calculating and providing for payment of duties, taxes and fees on behalf of our customers as well as arranging for any required inspections by governmental agencies such as the U.S. Customs and Border Protection, or CBP. Our customs clearance services include screening commercial documentation for assessed value, country of origin, application for special trade programs and classification. Since our inception and as of June 30, 2024, we had assisted with the customs clearance of cross-border freight of an aggregate assessed value of over $38.0 million.

Warehousing and Distribution Services

For cross-border freight we pick up at ocean ports and airports that require storage, fulfilment, trans-loading, palletizing, packaging or distribution, we offer ancillary warehousing and distribution services at our two regional warehousing and distribution centers in Illinois and Texas, adjacent to the O’Hare International Airport and Dallas Fort Worth International Airport, respectively, and are connected to almost all major U.S. domestic railroads and/or ports. With an aggregate gross feet area of approximately 98,220 square feet and 39 docks, our regional warehousing and distribution centers have an aggregate daily operation capacity of up to 3,000 cubic meters of freight for storage, packaging and other fulfilment services. Our regional warehousing and distribution centers are generally utilized by multiple customers at a time so that such customers may benefit from cost savings related to shared space, labor, equipment and other efficiencies.

U.S. Domestic Ground Transportation Services

We provide flexible, cost-competitive full-truckload and less-than-truckload ground transportation of cross-border freight to businesses and residences in the U.S. either directly from port to door, or from our regional warehousing and distribution centers to such domestic addresses. Our U.S. domestic ground transportation services are offered through an extensive network in collaboration with our ground transportation service providers.

As of June 30, 2024, we had established a ground transportation network in collaboration with over 200 domestic ground transportation carriers, including almost all major U.S. domestic ground transportation carriers, capable of delivering to thousands of business and residential addresses in approximately 48 U.S. states, on a long-term, short-term or order basis, as the case may be.

In addition, through establishing in-depth and long-standing partnerships with leading supply chain service providers in Asia for domestic supply chain services in the U.S., we have opened pathways to e-commerce and social commerce and have empowered several Asia-based e-commerce and social commerce platform giants to sell into the U.S. more easily and to deliver small-package goods to end consumers in the U.S. more smoothly.

Market Opportunity

The cross-border supply chain solutions industry is highly fragmented with thousands of companies of various sizes competing in domestic and international markets. The overall opportunities in the cross-border supply chain solutions sector are significant. According to McKinsey1, the cross-border supply chain solutions sector is expected to see a significant growth in the coming years. It is estimated that the market size of cross-border e-commerce will expand to around $1 trillion in merchandise value by 2030, from a current value of approximately $300 billion.

We maintain a strong focus on the Asian market. According to McKinsey2, Asia is expected to account for 57% of the growth of the global e-commerce logistics market between 2020 and 2025, making it one of the most important regions for global trade and logistics activities going forward. Our concentration on the Asian market enables us to develop in-depth expertise in serving Asian countries such as China and South Korea and provides us an edge in understanding the nuances and demands in this rapidly evolving market.

Partnering with almost all major global ocean and air carriers, our vast network of global freight carrier partners and in-depth connections with U.S. ground transportation providers can offer customers consistent services, even during peak periods. Such service reliability can be significantly beneficial for e-commerce platforms, social commerce platforms and manufacturers that often times may face supply chain disruptions during peak seasons.

| 1 | McKinsey,

Signed, sealed, and delivered: Unpacking the cross-border parcel market’s promise

(March 2022),https://www.mckinsey.com/industries/travel-logistics- and-infrastructure/our-insights/signed-sealed-and-delivered-unpacking-the-cross-border-parcel-markets-promise#. |

| 2 | McKinsey, Asia: The highway of value for global logistics (May 2021), https://www.mckinsey.com/featured-insights/asia-pacific/asia-the-highway-of-value-for-global-logistics |

Strengths

We believe the following strengths contribute to our success and differentiate us from our competitors:

Fast-growing U.S.-based cross-border supply chain solution provider with a unique focus on the Asian market

We are an integrated cross-border supply chain solution provider based in the U.S. with a strategic focus on the Asian market. Leveraging our strong cross-border supply chain service capabilities, superior service quality, extensive service provider network of cross-border freight carriers and U.S. domestic ground transportation carriers, massive and hyper-busy regional warehousing and distribution centers as well as deep understanding of the Asian market, we have been able to provide our Asia-based customers with individually-tailored solutions that specifically cater to their requirements and needs in transporting goods into the U.S. Our solutions encompass a wide variety of services such as cross-border ocean and air freight consolidation and forwarding, customs clearance, warehousing and distributing as well as U.S. domestic ground transportation.

We have grown our business rapidly since our inception in 2018. As an Asian American-owned business deeply rooted in the U.S., our accumulated insights and deep understanding of both the U.S. and Asian international trading and logistics service markets have enabled us to build up our brand and reputation cross-border and achieve fast growth since our inception. As of June 30, 2024, we operated two regional warehousing and distribution centers in the U.S., in Illinois and Texas, and we had served over 300 customers and fulfilled over 41,300 cross-border supply chain solution orders for ocean freight and airfreight of an aggregate assessed value of $1.0 billion delivered to thousands of business and residential addresses in approximately 48 U.S. states.

Our revenues increased from $12.9 million for the fiscal year ended June 30, 2023 and to $18.3 million for the fiscal year ended June 30, 2024. The total number of our cross-border supply chain solution orders fulfilled increased significantly from over 10,000 for the fiscal year ended June 30, 2023 to over 16,000 for the fiscal year ended June 30, 2024, while the total number of our customers increased from approximately 190 to 206, respectively, during the same periods.

Extensive service provider network of global freight carriers and U.S. ground transportation carriers

We have established an extensive, long-standing service provider network of global freight carriers for our cross-border freight consolidation and forwarding services. Since inception and as of June 30, 2024, we had collaborated with almost all major global ocean and air carriers to serve over 300 customers to forward cross-border shipments consisting of over 31,800 TEU of container loads and 47,800 tons of air cargo. We have also established a massive, in-depth and long-standing U.S. domestic ground transportation service provider network in collaboration with domestic ground transportation carriers. As of June 30, 2024, we had cooperated with over 200 domestic ground transportation carriers, including almost all major U.S. domestic ground transportation carriers, on a long-term, short-term or order basis, as the case may be. We believe such extensive collaboration network has enabled us to provide our customers with more flexible and optimized options of origin ports, shipping routes, shipping frequency and delivery times that suit their needs better.

Symbiotic relationships with a large base of customers with high demands for supply chain solutions

We forge symbiotic relationships with a large base of customers that are typically Asia- and U.S.-based logistics service companies serving large e-commerce platforms, social commerce platforms and manufacturers to sell and transport consumer and industrial goods made in Asia into the U.S. Since inception and as of June 30, 2024, we had served over 300 customers with over 41,300 cross-border supply chain solution orders fulfilled. We believe our solutions have become a vital, indispensable part of our customers’ international trading and/or service value chain. Our solutions lift the burden associated with searching for, contracting with, coordinating with and paying various freight carriers, customs brokers and U.S. domestic transportation brokers on individual basis and enable our customers to commit their limited operational and managerial resources to their core business activities and achieve their business objectives cost-effectively. For example, we are among the earliest U.S.-based third-party supply chain service suppliers of a top integrated logistics service provider headquartered in China and have served this customer for over three years, enabling this customer to effectively obtain integrated supply chain capabilities and expertise in the U.S. without having devoted substantial operational resources and costs. Leveraging our strong supply chain service capabilities and deep understanding of the Asian market, we have been able to provide our Asia-based customers with customized solutions that specifically cater to their needs. We believe our customized cross-border supply chain solutions offer compelling value propositions to our customers, allowing us to become their go-to third-party service suppliers for exporting and transporting into the U.S.

Persistent focus on providing superior service efficiency and quality

We are driven by a persistent focus on providing highly efficient quality services to our customers. We have standardized, unified and streamlined the protocols and criteria of our wide variety of supply chain service offerings, aiming to provide reliable and best-quality services to customers. For example, we manage our cross-border freight consolidation and forwarding services and our U.S. domestic ground transportation services to specific objectives, such as high customer service scores for on-time delivery and damage-free freight. During the fiscal years ended June 30, 2023 and 2024, among our overall cross-border ocean freight and airfreight supply chain solution orders, the damage rate of the total shipments delivered through our service network of global freight carriers and U.S. domestic ground transportation carriers consistently maintained less than 1.0%. We have also established a customer support regime that is available from 8am to 11pm, seven days a week, to address the needs of our international customers. During the fiscal years ended June 30, 2023 and 2024, over 40.0% and 46.0% of our customers were repeat customers.

Visionary and accomplished young management team with strong industry expertise and in-depth understanding of Asian market

We were founded by two Asian American entrepreneurs who have worked closely together for over seven years. Mr. Henry Liu, our co-founder, chairman of the board of directors and chief executive officer, is a successful Asia-born, U.S.-educated entrepreneur. Mr. Shuai Li, our co-founder, president and chief operating officer, is also of an Asian descent. We benefit from the leadership of such management team with prominent strategic visions, in-depth industry expertise, extensive managerial and operational experience as well as deep understanding of both the U.S. and Asian market. The key members of our management have an average of more than ten years of experience in the logistics service industry. We believe our management’s industry expertise, coupled with their vision and entrepreneurial spirit, has enabled us and will continue to enable us to navigate in the cross-border supply chain solution market successfully.

Our Growth Strategies

We believe that we have a significant opportunity before us, both to further our mission and to strengthen our business and grow our revenues. We are focused on the following strategies to drive our growth:

Solidify our competitive edge and further grow customer base

We have established a global ocean freight and airfreight carrier collaboration network as well as an extensive U.S. domestic ground transportation collaboration network that cater to the needs of our large base of customers in Asia seeking integrated cross-border supply chain solutions, and we have achieved a robust revenue growth during the past few years. We intend to solidify our competitive edge in the cross-border ocean freight solution sector and further grow the scale of our cross-border airfreight solution operations. We seek to deepen the strategic long-term relationships with our global ocean and air carrier service provider as well as U.S. domestic transportation service providers, tap into new markets with them and explore new ways of collaborations. On the other hand, we strive to strengthen our branding and sales efficiencies, increase our presence in Asia and the globe as a U.S.-based integrated cross-border supply chain solution provider, capitalize on the massive opportunities for cross-border supply chain solutions within the thriving global social commerce market driven by consumer purchases directly through social media channels, and expand our customer base globally. We will also continue to optimize our service quality and enhance the experience and loyalty of our customers.

Expand our global footprints more extensively

We seek to provide integrated supply chain solutions to customers globally. We believe there are significant opportunities in the merchandise trade between the U.S. and emerging economies in Southeast Asia and South America, which we intend to leverage on and further expand our global footprints. For example, in addition to our two existing regional warehousing and distribution centers in Illinois and Texas, we plan to establish new hubs and centers in other major border cities in the U.S., such as Houston, Texas and Miami, Florida to cater to the needs in cross-border supply chain solutions from customers in Canada and South America. We also plan to expand our already extensive coverage of Asia-to-U.S. shipping routes provided by our ocean carrier service providers and allow our customers in Asia to have more flexible and optimized options of origin ports, shipping routes and shipping frequency. Moreover, we aim to extend our carrier collaboration network’s reach to penetrate Europe and bring our integrated and streamlined cross-border supply chain solutions to European customers, facilitating the flow of goods from Europe to the U.S. as well as elsewhere in the world.

Diversify and increase the breadth and depth of our service offerings through an organic growth and/or mergers and acquisitions

We intend to expand our portfolio of supply chain solutions and diversify our service offerings to more upstream and downstream sectors throughout the entire international trade value chain through an organic growth and/or mergers and acquisitions. For example, leveraging our existing extensive cross-border logistics network and strong supply chain management capabilities, we plan to expand into the prospective trading market and establish integrated cross-border trading businesses in free-trade zones with a focus on the export of U.S.-made consumer goods to the Asian market and the import of Asia-made consumer goods into the U.S. In addition, we plan to continue to deepen and broaden our current supply chain service offerings by (i) expanding the categories of cargo transported through our cross-border ocean freight solutions and airfreight solutions to cover special cargo, including dangerous goods such as lithium batteries, perishable cargo, wet cargo, and temperature-sensitive goods, and (ii) launching new services such as last mile, inventory management and one-stop multi-model solutions, with an aim to bring more value-adds to our customers.

Optimize operational efficiency and maintain premier service quality

We aim to drive further the operational efficiency of each service offering under our cross-border ocean freight and airfreight solutions, reduce costs and maximize the overall profitability. For example, in addition to utilizing a core technology platform which streamlines and monitors our various service offerings in real time, we plan to upgrade the standardization machinery, systems and functions at our regional warehousing and distribution centers, including to further invest in automation equipment such as industrial conveyor belts to advance the automation processes of sorting, packaging, distribution and trans-loading at these regional centers. We will also continue to strengthen the training of our personnel among the various function departments and adopt a holistic yet rigorous service quality management approach to ensure the premier quality of each service offering under our integrated cross-border supply chain solutions.

Continue to invest in and advance our technologies

We plan to continue to invest in and further digitize our technology platform to address our needs or those of our customers. We believe that efficient and effective use of information technology and advanced automation systems will allow us to further enhance our competitive position and drive our continued growth and profitability. We intend to establish a core technology platform which encompasses our warehousing and distribution system, pricing engine, cross-border ocean and air carrier interface as well as U.S. domestic ground transportation carrier interface, allowing our customers to track the movement of their cross-border freight from end to end. In addition, we aim to develop a proprietary suite of intelligent tools and analytics, incorporating dynamic data science, predictive analytics and machine learning, to aid our daily operations and drive further productivity across our various cross-border supply chain service offerings.

Service Provider Network

We have established an extensive and long-standing service provider network of (i) global freight carriers and (ii) U.S. domestic ground transportation carriers. Since inception and as of June 30, 2024, we had collaborated with almost all major global ocean and air carriers to serve over 300 customers to forward cross-border shipments consisting of over 31,800 TEU of container loads and 47,800 tons of air cargo. We had also cooperated with over 200 domestic ground transportation carriers including almost all major U.S. domestic ground transportation carriers with a domestic ground transportation network of approximately 60,000 drivers and 150 terminals as of June 30, 2024, on a long-term, short-term or order basis, as the case may be. We also collaborate with licensed customs brokerage experts to help our customers clear shipments.

Under our extensive collaboration network, we enable and empower global ocean freight carriers, airfreight carriers, licensed cross-border customs brokers as well as U.S. ground transportation carriers to connect and collaborate, providing reliable, timely and integrated services to our customers.

Our ability to provide services to our customers is highly dependent on good working relationships with these service providers. Maintaining acceptable working relationships with these service parties has gained increased importance in particular as a result of the effect of the pandemic, ongoing concern over terrorism, security, changes in governmental regulation and oversight of international trade. We use a consistent approach in selecting and managing the service suppliers across all of our solution and service offerings, beginning with a rigorous qualification and risk-based diligence process. We only select and engage compliance-focused, efficiently-run and growth-oriented service providers with superior service quality based upon defined value elements and are intentional in our relationship and performance management activities. We consider our current working relationships with these service providers to be satisfactory. However, changes in the financial stability and operating capabilities and capacity of asset-based carriers, capacity allotments available from carriers, governmental regulation or deregulation efforts, modernization of the regulations governing customs brokerage, and/or changes in governmental restrictions, quota restrictions or trade accords could affect our business in unpredictable ways.

Technology

One of the ways in which we deliver superior service to our customers is by empowering our employees with technology. Our industry is evolving, and customers tend to de-risk their supply chains by forming relationships with reliable service providers that have invested in innovation.

We have built a highly scalable proprietary technology platform on the cloud — the American Bear Logistics Data Tool Management Platform, which streamlines our variety of service offerings and promotes our overall operating efficiency. Our technology platform, powered by sophisticated analytics of the massive amounts of route and price data derived from the past provision of our solutions and services, (i) optimizes the route-building and pricing for both our cross-border freight forwarding and domestic ground transportation services, (ii) allows for automated, real-time fee quotes for our cross-border ocean freight solutions and airfreight solutions between almost any origin and destination ports at any time and (iii) provides for automatic contractual account management, document generation and recordkeeping.

In addition, for our two regional warehousing and distribution centers, we developed an intelligent warehousing system which allows us to manage our storage remotely, prevents stockouts and overstocking and enables intelligent replenishment and order fulfilment. For example, this warehousing system automatically sends alerts when inventory levels reach predetermined thresholds, ensuring timely restocking and promoting operational efficiency.

We have developed reliable and stable network infrastructure to ensure high availability and a low risk of downtime. We primarily utilize third-party cloud service providers to host our network infrastructure for core operational functionality, data backup, and intelligence application.

We process a large amount of freight-related data on our platform. We take the privacy of personal data and confidential information seriously and have implemented an internal data security management policy. We also utilize a system of firewalls to prevent unauthorized access to our internal systems. Our technology department monitors the performance of our websites, technology systems and network infrastructure and responds promptly to potential problems. We also review, improve and iterate our data privacy policies and security foundation on a continued basis.

Competition

The market for integrated cross-border supply chain solution providers is a highly fragmented market with fierce competition. We face competition with other cross-border supply chain solution providers, particularly those with a focus on the Asian market.

We compete primarily on the following factors:

| ● | customer relationships; |

| ● | caliber and quality of services; |

| ● | modes of transportation; |

| ● | technology infrastructure and capabilities; and |

| ● | industry experience and expertise. |

We are well-positioned to effectively compete based on the factors listed above. However, some of our current or future competitors may have greater financial or operational resources, greater brand recognition, or a longer operating history, which could enable them to respond more quickly to changes in market dynamics and customer demands and preferences, devoting greater resources towards seizing this market than we can.

Sales and Marketing

We believe brand recognition is critical to our ability to acquire or retain our existing or new customers, and our general marketing efforts are designed to enhance our brand awareness and reputation among them. We primarily attract new customers with testimonials of our cross-border supply chain solutions and referrals by our existing customers. We also approach prospective customers by attending international trade fairs, exhibitions and conferences as well as events held by local chambers of commerce. We regularly conduct key performance indicator reviews with our customers and take measures to maintain close rapport with them.

Intellectual Property

Our ability to obtain and maintain intellectual property protection for our proprietary technology platform, preserve the confidentiality of our trade secrets, and operate without violating the intellectual property rights of others is important to our success. We have adopted a number of measures to protect our intellectual property and brand, including trademarks, confidentiality procedures, non-disclosure agreements and employee non-disclosure agreements, to establish and protect our proprietary rights. Despite these efforts, there can be no assurance that we will adequately protect our intellectual property.

As of June 30, 2024, we had obtained the trademark registration for our key trademark, American Bear Logistics. In addition, we have registered domain names for websites that we use in our business, such as www.americanbearlogistics.com.

Insurance

We maintain insurance for commercial automobile and trucker’s liability, commercial general liability and cargo legal liability, as well as property coverage with coverage limits, deductibles and self-insured retention levels that we believe are reasonable given the varying historical frequency, severity and timing of claims.

Seasonality

Our revenue and profitability in the fourth quarter are typically higher than those during the first, second and third quarters of the calendar year. We believe the surge in the fourth quarter of the calendar year is in part due to the increase in demand experienced by many of our customers as a result of the increased purchases during the holiday season, which leads to higher need for our supply chain solutions and services. It is not possible to reliably predict whether our historical revenue and profitability trends will continue to occur in future periods.

Employees

Our people are key to our success. As of June 30, 2024, we had a workforce of 50 full-time employees across various functions. None of our employees are represented by labor unions or work under any collective bargaining agreements. We have not experienced any work stoppages, and we believe that our employee relations are strong.

We work diligently to create an equitable and inclusive work environment for our diverse group of people who are young, energetic, highly educated and multi-lingual. As of June 30, 2024, our overall workforce is 100% of a minority ethnicity and 62% of female. In addition, among such workforce, 30% holds a bachelor’s degree, 46% holds an advanced degree such as a master’s degree, and 98% is bi-lingual. We provide equal opportunities for growth, success, promotion, learning and development, and aim to achieve parity in the way we organize and manage operations. We are focused on building support across all functions and individuals, ensuring everyone has a voice, and treats each other with respect.

Government Regulations

As a U.S.-based integrated cross-border supply chain solution provider offering customized ocean freight solutions and airfreight solutions in the U.S. that specifically cater to customers’ requirements and needs in transporting goods into the U.S., our operations are substantially governed by U.S. laws and regulations. We are required to obtain certain licenses, permits and approvals from the relevant governmental authorities in order to operate our business, including but not limited to licenses of an ocean transportation intermediary (sometimes referred to as an NVOCC), an indirect air carrier, a container freight station, and licenses issued by the International Air Transport Association. To the extent material to our understanding, as of the date of this report, we believe that we have obtained all licenses, permits and approvals from the relevant governmental authorities necessary for our business operations in the U.S. Given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by relevant government authorities, and the promulgation of new laws and regulations and amendment to the existing ones, we may be required to obtain additional licenses, permits, registrations, filings or approvals for our business operations in the future. We cannot assure you that we will be able to obtain, in a timely manner or at all, or maintain such licenses, permits or approvals, and we or the affiliated entities may also inadvertently conclude that such permissions or approvals are not required. Any lack of or failure to maintain requisite approvals, licenses or permits applicable to us or the affiliated entities may have a material adverse impact on our business, results of operations, financial condition and prospects and cause the value of any securities we offer to significantly decline or become worthless.

This section provides an overview of the key regulations and legal considerations in the U.S. pertaining to our cross-border ocean freight solutions and cross-border airfreight solutions. To the extent material to our understanding, we do not believe any current foreign governmental regulations impose material restraints on our business operations as of the date of this report. We further acknowledge that in the course of our operations, we are committed to complying with applicable data protection laws and regulations that govern the privacy and security of data it handles, which are increasingly global in scope due to the nature of cross-border supply chain solutions.

Regulations Relating to Labor and Employment

Pursuant to federal and state laws, we adhere to labor and employment laws at the federal and state levels. This includes fair employment practices, wage and hour regulations, worker safety, and anti-discrimination law. We are committed to providing a fair and inclusive workplace environment that respects the rights of our employees and fosters a culture of diversity and equality.

Regulations Regarding Cross-border Freight Forwarding Services

Interstate and international transportation of freight is highly regulated under U.S. law, and failure to comply with these regulations can have significant consequences, including substantial fines or the revocation of operating permits and authorities for both transportation intermediaries and their shipper customers. As a freight forwarder in operating the cross-border freight forwarding services by collaboration with the shipping carriers, the regulations that currently impact our operations and those that may affect us in the future are as follows.

Air Freight Forwarding Services

In accordance with the Federal Aviation Act enforced by the Federal Aviation Administration within the U.S. Department of Transportation, and the Transportation Security Administration (the “TSA”) within the Department of Homeland Security (the “DHS”), an air freight forwarder is classified as an indirect air cargo carrier. Even if air freight forwarders enjoy exemptions from the majority of the Federal Aviation Act’s requirements through compliance with the Economic Aviation Regulations, the industry remains under the constant scrutiny of evolving regulatory and legislative developments, and these developments have the potential to significantly impact the industry’s economic landscape, necessitating adjustments to operational practices and exerting influence on both service demands and associated costs. Regarding our involvement in the air transportation sector within the United States, we are subject to regulatory oversight by the TSA within the DHS as an indirect air carrier. All indirect air carriers operating in the United States must adhere to mandated security protocols and undergo periodic audits conducted by the TSA. According to Federal Code 71 FR 33255, each indirect air carrier must allow the TSA, at any time or place, to make any inspections or tests, including copying records, to determine compliance of an airport operator, aircraft operator, foreign air carrier, and indirect air carrier. At the request of the TSA, each indirect air carrier also has to provide evidence of compliance with this subchapter and its indirect air carrier security program, including copies of records. The TSA may enter and be present with in areas where security measures required by the TSA are carried out without access media or identification media issued or approved by the indirect air carrier, an airport operator, or aircraft operator, in order to inspect or test compliance, or perform other such duties as the TSA may direct.

Ocean Freight Forwarding Services/NVOCC

As a licensed NVOCC, we fall within the regulatory purview of the FMC, a regulatory authority that oversees and licenses ocean forwarding operations. This oversight includes compliance with FMC tariff filing and surety bond mandates, as well as adherence to the Shipping Act of 1984, which contains provisions that specifically prohibit rebating practices.

Pursuant to FMC rules, all NVOCCs based in the U.S. and all international ocean freight forwarding agencies and their branches are required to obtain a license from the FMC’s Bureau of Certification and Licensing by filing Form FMC-18. Entities engaging in international freight forwarding operations or conducting business as NVOCCs who do not complete or maintain the filing may result in denial, revocation or suspension of an ocean transportation intermediary license. We hold the license as an Ocean Transportation Intermediary (“OTI”), which is sometimes interchangeably referred to as an NVOCC, and persons who operate without the proper license may be subject to civil penalties not to exceed $9,000 for each violation. Additionally, the FMC has also established precise criteria for shipping agents, inclusive of specific surety bonding prerequisites, and it is responsible for the economic regulation of OTI/NVOCC activity originating or terminating in the United States as well. In order to comply with these economic regulations, OTI/NVOCC entities, such as our company, are mandated to electronically submit tariffs, delineating the rates applicable to the transportation of specified commodities to and from the United States, and the FMC possesses the authority to enforce these regulations, including the imposition of penalties for non-compliance.

Freight Forwarder Liability

Generally, the limitation of liability of freight forwarders is identical to the international agreements that are applicable to carriers. There are multiple conventions that restrict the carriers’ liability such as by setting as specific monetary limit per package or weight. For instance, ocean carriers can incorporate the Carriage of Goods by Sea Act into their Bills of Lading to limit their liability to $500 per unit. The Montreal Convention imposes a limit on the air carrier’s liability, capping it at a maximum of 22 special drawing rights per gross kilogram of the cargo that has been lost or damaged.

Freight forwarder’s liability also depends on their insurance coverage. In situations where goods get damaged or lost during transportation without an All Risk Cargo Policy or if the shipper chooses not to initiate a claim, the shipper will seek damages from all parties engaged in the transportation of goods, including carriers, warehouse operators, and the freight forwarders. If the insurance coverage is “All Risk,” then the shipper will recover through the insurance. However, if the losses exceed the amount recovered, shippers will go after the outstanding parties.

Furthermore, the extent of a freight forwarder’s liability is determined by the roles it assumes. When a freight forwarder issues a House Bill of Lading stating itself as the carrier, it assumes the role of principal, subjecting itself to the laws, regulations, and limitations applicable to carriers. When a freight forwarder issues a House Bill of Lading designating the common carrier (not the freight forwarder) as the carrier, the freight forwarder takes on the role of a broker or agent. In this scenario, the freight forwarder is often exempted from legal liabilities.

Forwarding agents must comply with the Export Administration Regulations (the “EAR”), a set of United States export guidelines and prohibitions that regulate the export restrictions of sensitive goods. It is essential to note that regardless of whether they are freight forwarders or other agents, their involvement in various tasks does not exempt them from their compliance obligations. Agents are accountable for the representations they make when filing export data. No individual, including an agent, may engage in any transaction if they have knowledge that it violates the EAR, has the potential to violate it, or is intended to do so. Pursuant to the Supplement No. 1 to Part 732 of the EAR, agents and exporters must assess the presence of red flags, exercise due diligence in investigating them, and ensure they do not overlook suspicious circumstances. Neglecting these responsibilities could result in a violation of the EAR. Additionally, it’s worth noting that the primary responsibility for EAR compliance rests with the principal parties in interest (the “PPI”) involved in a transaction. The EAR stipulates that the U.S. PPI must provide the foreign PPI and its agent with the correct Export Control Classification Number (the “ECCN”) or sufficient technical information to determine it, upon request. The U.S. PPI is obligated to furnish any information that could impact the determination of licensing authority as well. Under the Foreign Trade Regulations (15 C.F.R. Part 30), the U.S. PPI must supply specific data to the agent for electronic export information filing purposes.

Further, in a routed export transaction, the U.S. agent representing the foreign PPI is considered the “exporter” under the EAR. They are responsible for determining licensing authority and obtaining the necessary license or authorization for the export. In such cases, the agent representing the foreign PPI must obtain a power of attorney or written authorization to act on their behalf. However, if the U.S. PPI fails to obtain the required authorization from the foreign PPI, they become the “exporter” and must handle licensing authority and obtain the appropriate license, even in the context of a routed export transaction for electronic export information filing. However, in a non-routed transaction, if the U.S. PPI authorizes an agent to prepare and file the export declaration on their behalf, the U.S. PPI assumes the role of the “exporter” under the EAR. In this scenario, the U.S. PPI is obliged to: (i) provide the agent with necessary information for the Automated Export System (the “AES”) submission, which is a system the U.S. exporters use to electronically declare their international exports, known as the Electronic Export Information (the “EEI”), to the Census Bureau to help compile U.S. export and trade statistics; (ii) authorize the agent to complete the AES submission through a power of attorney or written authorization; and (iii) maintain documentation supporting the information provided to the agent for the AES submission.

If authorized by either the U.S. or foreign PPI, the agent bears responsibility for: (i) preparing the AES submission based on information from the U.S. PPI; (ii) maintaining documentation supporting the AES submission information; and (iii) furnishing a copy of the AES filing to the U.S. PPI upon request. It is crucial to highlight that both the agent and the authorized PPI share responsibility for the accuracy of entries in an AES submission. Agents should exercise caution in using “No License Required” designations and avoid unsupported entries. In cases where agents lack technical expertise for commodity classifications, they should obtain supporting documentation for ECCNs.

Regarding documentation requirements in EAR’s Part 762, which applies to all transactions subject to the EAR, it outlines records that must be maintained, those exempt from maintenance, requirements for producing records, and the retention period. Additionally, various other recordkeeping requirements apply, including those from Customs (19 CFR Part 163), the Department of State (ITAR and 22 CFR Part 122.5), the Census Bureau (15 CFR 30.66(c)), and Treasury’s OFAC (31 CFR Part 501). Further details on EAR rules and regulations applicable to freight forwarders can be consulted in Sections 758.1 through 758.6, 748.4, and 750.7(d) within the EAR.

Regulations Relating to Cargo Examinations

One of the integral functions performed by freight forwarders is to handle customs examinations. Regulations enforced by CBP mandate that all cargo entering the U.S. from any foreign territories undergo physical examination by the U.S. government to ensure compliance with U.S. laws and regulations. Under the Title 19 of the United State Code (19 U.S.C.), CBP is authorized to inspect, examine and search all goods entering the U.S., including but not limited to cargo transported by air, sea, land, or mail. CBP facilitates this process through the use of an electronic system, allowing importers, brokers, and other trade partners to submit data and documentation, as well as providing the cargo information, including entry summaries and customs declarations to CBP. Additionally, the TSA established rules for air cargo security, mandating screening and inspection to mitigate the potential threats. Pursuant to 49 CFR part 1549, TSA-certified cargo screening facilities across the United States to screen cargo before it is transported on passenger flights. Certified facilities must adhere to strict security programs and chain of custody requirements to secure cargo from screening until it is loaded onto passenger aircraft.

Regulations Regarding Warehousing and Distribution Services

Container Freight Stations (“CFS”) Regulations

Our operations encompass warehousing and distribution services conducted within our regional warehousing and distribution centers. We own a CFS, which is licensed and certified by U.S. Customs. CFS facilities are an integral part of the logistics and shipping industry, where cargo containers are consolidated, deconsolidated, and temporarily stored during the import and export process. Besides consolidation and storage, CFS provide aspect rum of supplementary services, including documentation, custom examination, export clearance procedure. CFS facilities often handle imported and exported goods, so they must comply with customs regulations specific to the country or region in which they are located. This can include procedures for customs clearance, documentation, and security measures to prevent smuggling and ensure compliance with trade laws.

Pursuant to 19 CFR Part 19, the establishment of a container station, independent of the importing carrier, is subject to application submission and approval by the port director. Additionally, a Customs Form 301 must be filed, featuring bond conditions as stipulated in § 113.63 of such chapter, with the bond amount determined by the port director. Any alterations to or relocation of a container station require permission from the relevant port director. Furthermore, an application fee will be assessed by customs, with charges based on the average time required by customs officers to perform the service.

For containerized cargo, whether it needs transportation from the point of unloading to a designated container station or is received directly at the container station from a bonded carrier following in-bond transportation, an entry of merchandise must be filed. Permission is sought for the purpose of breaking bulk and redelivery of the cargo. In addition, concerning the transfer of containers, our container station operator must file an application for the transfer of merchandise with the customs authorities or customs inspector at the location where the container is unloaded, or for merchandise transported in-bond, at the designated facility of the bonded carrier as determined by the port director. Such filings must adhere to the prescribed format as per regulations. As outlined in 39 FR 4876, when the container station operator utilizes their own vehicle to transfer merchandise to their station, the merchandise may only be transferred by a bonded cartman or bonded carrier. The station operator, cartman, or carrier must issue a receipt for the merchandise on both copies of the application.

Regulations of Transportation Security Administration

Pursuant to 49 CFR part 1548, we, as an indirect air carrier, must adopt and carry out a TSA-approved security program that meets current TSA requirements and is renewed annually. TSA principal security inspectors are the primary point of contact for the application process and approval of certification. Moreover, the TSA requires us to conduct known shipper programs and as the TSA’s known shipper management system requires, we must comply with a range of specific security requirements to qualify our clients as known shippers.

Regulations Relating to Intellectual Property, Data Protection and Security

In the rapidly digitizing landscape of supply chains, data protection has emerged as a significant challenge for the logistics sector. The Privacy Act of 1974 and the General Data Protection Regulation (the “GDPR”) have been enacted to ensure data privacy, regulatory frameworks and laws in order to safeguard this valuable information. Companies like us now shoulder the added responsibility of overseeing the proper collection and utilization of the vast volumes of customer data circulating within the logistics supply chain.

The Privacy Act of 1974, with amendments up to the present day, including Statutory Notes (5 U.S.C.552a), plays a vital role in protecting records about individuals, retrieved by personal identifiers such as names, social security numbers, or other identifying information. It dictates how federal agencies collect and use data related to individuals in their records systems. The act unequivocally bars agencies from disclosing personal information without written consent from the individual, except under specific circumstances, such as for statistical purposes by the Census Bureau. Individuals also retain the right to access their records, request corrections if inaccuracies exist, and demand protection against unwarranted invasions of their privacy. Additionally, we also recognize the importance of data privacy and security and comply with applicable regulations, including the GDPR, where applicable. Companies implement measures to safeguard customer and employee data, ensuring proper collection, storage, and usage practices. Non-compliance with these regulations carries the potential for legal consequences that could impact the company’s operations and financial performance. We are unwavering in our commitment to upholding the highest standards of regulatory compliance to ensure the long-term success and sustainability of our business operations.

Third-Party Logistics Providers, or 3PLs, like us, commonly find themselves privy to sensitive or confidential information about shippers or carriers, often protected by statutes or contractual agreements. Even in cases where no negligence is involved, 3PLs can be held accountable for disclosing such private and safeguarded information. Given their substantial involvement in a shipper’s operations while providing logistics services, contracts between shippers and 3PLs often incorporate confidentiality provisions. These provisions are essential safeguards to protect the integrity of sensitive data in the complex landscape of logistics, where trust and security are paramount.

Available Information

Our website address is www.lakeside-holding.com and our subsidiary's website address is www.americanbearlogistics.com. The information on, or that can be accessed through, our websites is not part of this report and is not incorporated by reference herein. We have included our websites address as inactive textual reference only.

Item 1A. Risk Factors.

We are a smaller reporting company and are not required to provide the information required under this item. For risks relating to our Company and our operations, see the section titled “Risk Factors” contained in our prospectus dated June 27, 2024, filed with the Securities and Exchange Commission, or the SEC, pursuant to Rule 424(b)(4) under the Securities Act.

Item 1B. Unresolved Staff Comments.

We are a smaller reporting company and are not required to provide the information required under this item.

Item 1C. Cybersecurity.

Risk Management and strategy

As part of our broader risk management system and processes, we maintain procedures for identifying, assessing, and managing material risks from cybersecurity threats that is designed to protect the confidentiality, integrity, and availability of our critical systems and information.

We track and log security incidents across our company and our customers to remediate and resolve any such incidents. Significant incidents, if any, shall be reviewed by chief executive officer and chief operating officer, with the assistance from our information technology department, to assess and determine its materiality or potentiality of becoming material. Our senior management makes the final materiality determinations and disclosure and other compliance decisions.

As of the date of this annual report, we have not experienced any material cybersecurity incidents or identified any material cybersecurity threats that have affected or are reasonably likely to materially affect us, our business strategy, results of operations or financial condition.

Governance

Our board of directors does not have a standing risk management committee, but rather directly administers its oversight function as a whole. Our board of directors will (i) lead in a direction that minimizes the risk of unauthorized and malicious use, disclosure, potential theft, alteration or damaging effects of our operations while concurrently enabling the sharing of information in cyberspace, and (ii) ensure that risks to the confidentiality, integrity or availability of Company-owned information assets are managed appropriately, and (iii) review disclosure concerning cybersecurity matters in our annual report on 10-K presented by our chief executive officer, chief financial officer, and other personnel in charge of cybersecurity matters.

Item 2. Properties.

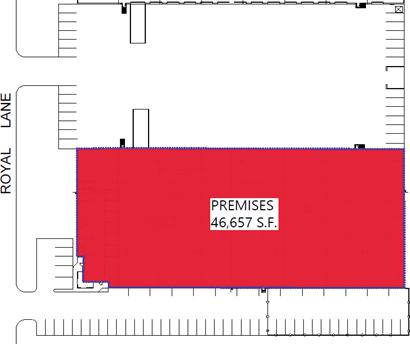

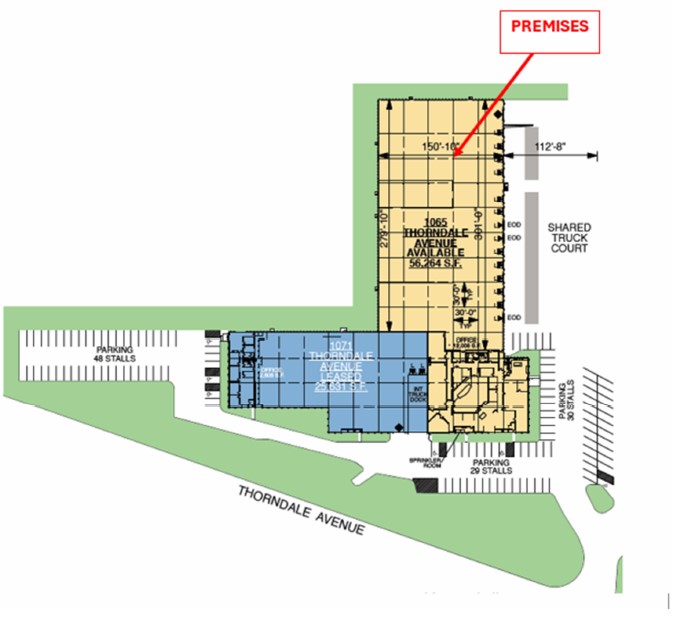

We lease approximately 65,981 square feet in Itasca, Illinois, including approximately 8,838 square feet for our U.S. headquarters and 57,143 square feet for a regional warehousing and distribution center. The lease of our facility in Itasca, Illinois expires in April 2026 with an option to extend the lease for an additional five-year term. We also lease approximately 46,657 square feet in Irving, Texas, where we operate another regional warehousing and distribution center. The lease of this facility expires in May 2029 with an option to extend the lease for an additional five-year term. We may add additional offices as we expand our business to other states and countries. We believe that our facilities are sufficient for our current needs and that, should it be needed, additional facilities will be available to accommodate the expansion of our business.

Item 3. Legal Proceedings.

From time to time, we may be subject to legal proceedings, investigations and claims incidental to the conduct of our business. We are currently not a party to, nor are we aware of, any legal proceedings, investigations or claims which, in the opinion of our management, are likely to have a material adverse effect on our business, financial condition or results of operations.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Stock, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock trades on the Nasdaq Capital Market under the symbol “LSH.” On September 25, 2024, the closing sale price of our common stock was $2.25 per share.

Holders of Record

As of September 25, 2024, we had approximately six holders of record of our common stock.

Dividend Policy

We have never declared or paid, and do not anticipate declaring or paying, any cash dividends on our capital stock. Any future determination as to the declaration and payment of dividends, if any, will be at the discretion of our board of directors and will depend on then-existing conditions, including our financial condition, operating results, contractual restrictions, capital requirements, business prospects and other factors that our board of directors may deem relevant.

Securities Authorized for Issuance under Equity Compensation Plans

None.

Performance Graph

We are a smaller reporting company and are not required to provide the information required under this item.

Recent Sale of Unregistered Securities and Use of Proceeds

None.

Use of Proceeds from Initial Public Offering of Common Stock

On July 1, 2024, we completed our IPO of 1,500,000 shares of common stock, at a price of $4.50 per share, before underwriting discounts and commissions. The offering was registered under the Securities Act pursuant to a registration statement on Form S-1 (File No. 333-278416), which was declared effective by the SEC on June 27, 2024.

As of the date of this annual report, with the proceeds of the IPO, we used approximately $1.8 million for in marketing activities and business expansion and used approximately $1.3 million for working capital needs.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

There were no purchases of the issuer’s securities by the issuer or affiliated purchasers, as defined in Rule 10b-18(a) (3) the Exchange Act, during the fourth quarter of the fiscal year ended June 30, 2024.

Item 6. [Reserved]

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and the related notes included elsewhere in this Report. In addition to historical consolidated financial information, the following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. All amounts included herein with respect to the fiscal years ended June 30, 2024 and 2023 are derived from our audited consolidated financial statements included elsewhere in this Report. Our financial statements have been prepared in accordance with the U.S. GAAP.

Overview

We are a U.S.-based integrated cross-border supply chain solution provider with a strategic focus on the Asian market including China and South Korea. We primarily provide customized cross-border ocean freight solutions and airfreight solutions in the U.S. that specifically cater to our customers’ requirements and needs in transporting goods into the U.S. We offer a wide variety of integrated services under our cross-border ocean freight solutions and cross-border airfreight solutions, including (i) cross-border freight consolidation and forwarding services, (ii) customs clearance services, (iii) warehousing and distribution services and (iv) U.S. domestic ground transportation services.

Founded in Chicago, Illinois in 2018, we are an Asian American-owned business rooted in the U.S. with in-depth understanding of both the U.S. and Asian international trading and logistics service markets. Our customers are typically Asia- and U.S.-based logistics service companies serving large e-commerce platforms, social commerce platforms and manufacturers to sell and transport consumer and industrial goods made in Asia into the U.S. Since inception and as of June 30, 2024, we had served over 300 customers to fulfill over 41,000 cross-border supply chain solution orders.

We have established an extensive collaboration network of service providers, including global freight carriers for our cross-border freight consolidation and forwarding services as well as domestic ground transportation carriers for our U.S. domestic transportation services. Since inception and as of June 30, 2024, we had collaborated with almost all major global ocean and air carriers to forward 31,300 TEU of container loads and 47,800 tons of air cargo. As of June 30, 2024, we had also cooperated with over 200 domestic ground transportation carriers, including almost all major U.S. domestic ground transportation carriers, on a long-term, short-term or order basis, as the case may be.

We operate two massive and hyper-busy regional warehousing and distribution centers in the U.S., in Illinois and Texas. With an aggregate gross feet area of approximately 75,014 square feet and 34 docks, our regional warehousing and distribution centers have an aggregate daily floor load of up to 3,000 cubic meters of freight. In addition to our self-operated regional centers, we maintain close contact with over 150 warehouses and distribution terminals in almost all transportation hubs in the U.S. which we have cooperated in the past to support the warehousing and distributing services of our cross-border freight in case such freight requires storage, fulfilment, transloading, palletizing, packaging or distribution in states other than Illinois and Texas. As of June 30, 2024, we had assisted with the customs clearance, in conjunction with our other service offerings, of cross-border freight of an aggregate assessed value of over $38.0 million.

Leveraging our strong cross-border supply chain service capabilities, extensive service provider network of cross-border freight carriers and U.S. domestic ground transportation carriers, massive and hyper-busy regional warehousing and distribution centers as well as deep understanding of the Asian market, we have been able to build up our brand and reputation and have achieved fast growth since our inception. For the fiscal years ended June 30, 2024 and 2023, our revenues amounted to $18.3 million and $12.9 million, respectively, and our gross profit amounted to $3.7 million and $2.6 million during the same periods, respectively. As of June 30, 2024, we had fulfilled over 41,000 cross-border supply chain solution orders for freight of an aggregate assessed value of $1.0 billion, delivered to thousands of business and residential addresses in approximately 48 U.S. states.

Key Factors Affecting Our Results of Operations

We believe the most significant factors that affect our business and results of operations include the following:

Our Ability to Expand Our Customer Base

Our results of operations are dependent upon our ability to expand and maintain our customer base. Since inception and as of June 30, 2024, we had served over 300 customers to fulfill over 41,000 cross-border supply chain solution orders. We will continue to expand our customer base to achieve a sustainable business growth. We aim to attract new customers and maintain our existing customers. We plan to improve the quality and expand the variety of our services to obtain more customers.

Our Ability to Control Costs