UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-39685

INMED PHARMACEUTICALS INC.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | 98-1428279 | |

| (State or other jurisdiction of incorporation or organization) | (IRS employer Identification number) |

|

| 1445, 885 West Georgia St., Vancouver, B.C., Canada | V6C 3E8 | |

| (Address of principal executive office) | (Zip Code) |

(604) 669-7207

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange On Which Registered | ||

| Common Stock, no par value | INM | The Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has fi led a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting fi rm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of December 31, 2023, the last business day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the Company’s voting and non-voting common equity held by non-affiliates of the Registrant was $2,351,381.

On September 20, 2024, there were 13,340,245 shares of the registrant’s common shares, no par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the registrant’s 2024 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A within 120 days of the registrant’s fiscal year ended June 30, 2024 are incorporated herein by reference into Part III of this Annual Report (as defined below).

InMed Pharmaceuticals Inc.

TABLE OF CONTENTS

PART I

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (this “Annual Report”) contains “forward-looking statements” within the meaning of United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities law, which are included but are not limited to statements with respect to InMed Pharmaceuticals Inc.’s (the “Company” “InMed”, “we”, “our”, or “us”) anticipated results and progress of the Company’s operations, research and development in future periods, plans related to its business strategy, and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. We may, in some cases, use words such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”, “project”, “will”, “would”, “budget”, “possible”, “should”, “future”, and similar expressions that convey uncertainty of future events or outcomes to identify these forward-looking statements. These forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. You should not place undue reliance on these forward-looking statements. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements. Among the factors that could cause actual results to differ materially are the risks and uncertainties described under “Item 1A. Risk Factors” of this Annual Report, “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report, and the following:

| ● | The Company’s ability to stem operating losses and the Company’s ability to obtain additional financing to fund its operations. |

| ● | The revenues of BayMedica, LLC (“BayMedica”) and the commercial viability of its product portfolio; | |

| ● | The Company’s ability to effectively research, develop, manufacture and commercialize pharmaceutical drug candidates that will treat diseases with high unmet medical needs; |

| ● | The continued optimization of key, proprietary manufacturing approaches and technologies; |

| ● | Our ability to commercialize and, where required, register products in the pharmaceutical R&D programs (“Product Candidates”) and those targeted to the health and wellness sector (“Products”) in the United States and other jurisdictions; |

| ● | Our success in initiating discussions with potential partners for licensing various aspects of our Product Candidates; |

| ● | Our ability to successfully access existing manufacturing capacity via leases with third-parties or to transfer our manufacturing processes to contract manufacturing organizations; |

| ● | Our belief that our manufacturing approaches that we are developing are robust and effective and will result in commercially viable yields of cannabinoids and will be a significant improvement upon existing manufacturing platforms; |

| ● | Our ability to successfully scale up our IntegraSyn approach to cannabinoid manufacturing. InMed has created genetically engineered microbes that produce proprietary enzymes, which are then used to optimize subsequent biotransformation reactions or other cost-effective manufacturing approaches so that it will be commercial-scale ready after Phase 2 clinical trials are completed, after which time we may no longer need to source active pharmaceutical ingredients (“APIs”) from third-party API manufacturers; |

| ● | The success of the key next steps in our manufacturing approaches, including continuing efforts to diversify the number of products produced, scaling-up the processes to larger vessels and identifying external vendors to assist in the commercial scale-up of the process; |

| ● | Our ability to successfully make determinations as to which research and development programs to continue based on several strategic factors; |

| ● | Our ability to continue to outsource the majority of our research and development activities through scientific collaboration agreements and arrangements with various scientific collaborators, academic institutions and their personnel; |

| ● | The success of work to be conducted under the research and development collaboration between us and various contract development and manufacturing organizations (“CDMOs”); |

| ● | Our ability to develop our therapies through early human testing; |

| ● | Our ability to evaluate the financial returns on various commercialization approaches for our Product Candidates, such as a ‘go-it-alone’ commercialization effort, out-licensing to third parties, or co-promotion agreements with strategic collaborators; |

| ● | Our ability to find a partnership early in the development process for our various programs; |

| ● | Our ability to explore our manufacturing technologies as processes which may confer certain benefits, including cost, yield, speed, or all the above, when pursuing specific types of molecules, and filing a provisional patent application for same; |

| ● | Plans regarding our next steps, options, and targeted benefits of our manufacturing technologies; |

| ● | Our Products being bio-identical to the naturally occurring molecules, and offering superior ease, control and quality of manufacturing when compared to alternative methods; |

| ● | U.S. Food and Drug Administration (“FDA”) regulatory acceptance of Product Candidates for potential use in the pharmaceutical industry; |

| ● | Our ability to successfully file, prosecute and defend patent applications; | |

| ● | The potential for any of our patent applications to provide intellectual property protection for us; |

| ● | The termination or renegotiation of our supplier, technology and other material contracts, including the invoking of force majeure or termination clauses, and actual or threatened claims of our failure to comply with any obligations set forth under such contracts; | |

| ● | The adequacy of, or gaps in, insurance coverage upon the occurrence of a catastrophic or other material adverse event, as well as our ability to (i) expand our insurance coverage to include the commercial sale of Products and Product Candidates and (ii) secure insurance coverage for shipping and storage of Product Candidates, and clinical trial insurance; |

| ● | Developing patentable New Chemical Entities (“NCE”) which, if issued, will confer market exclusivity to us for the potential development into pharmaceutical Product Candidates, license, partner or sell to interested external parties; | |

| ● | Our ability to initiate discussions and conclude strategic partnerships to assist with development of certain programs; |

| ● | Our ability to position ourselves to achieve value-driving, near term milestones for our Product Candidates with limited investment; |

| ● | Our ability to effectively execute our business strategy; |

| ● | The sufficiency of our internal controls, including any exposure arising from the failure to (i) establish and maintain effective internal control over financial reporting in accordance with applicable regulatory requirements, and (ii) fully remediate any material weakness identified with respect to such internal controls; |

| ● | Epidemics, pandemics, global health crises, or other public health events and concerns, including any future resurgence of COVID-19, and the effectiveness of associated vaccinations and treatments; |

| ● | Consolidation of our competitors and suppliers; |

| ● | Effects of new products and new technology on the market, including with respect to automation and the use of artificial intelligence (“AI”); |

| ● | The impact of geopolitical, global, regional or local economic and financial market risks and challenges, applicability of foreign laws, including foreign labor and employment laws, foreign tax and customs regimes, and foreign currency exchange rate risk; |

| ● | Political disturbances, geopolitical instability and tensions, or terrorist attacks, and associated changes in global trade policies and economic sanctions, including, but not limited to, in connection with (i) the Russo-Ukrainian war and (ii) any impact, effect, damage, destruction and/or bodily harm directly or indirectly relating to the ongoing hostilities in the Middle East; and |

| ● | Our failure to satisfy any applicable listing standards, including compliance with the minimum bid price rule, and the actual or threatened delisting of our securities by Nasdaq. |

This list is not exhaustive of the factors, events, conditions and circumstances that may affect the “forward-looking statements” and “forward-looking information” contained in this Annual Report. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated, or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made and are based only on the information available to us at that time. Except as required by law, we disclaim any obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Overview

We are a pharmaceutical company developing a pipeline of proprietary small molecule drug candidates that are preferential signaling ligands of the endogenous cannabinoid 1 (“CB1”) and cannabinoid 2 (“CB2”) receptors as well as other receptor targets linked to human diseases. CB1 and CB2 receptors are each part of the endocannabinoid system that is found throughout the human body and is responsible for many homeostatic functions. CB1 receptors are primarily located in the brain and central nervous system, while CB2 receptors are involved in modulating neuroinflammation and immune responses. Our research efforts target the treatment of diseases with high unmet medical needs. Together with our wholly-owned subsidiary, BayMedica, we also have garnered significant know-how in developing proprietary manufacturing approaches to produce and sell bulk rare cannabinoids as ingredients for various market sectors (“Products”).

InMed has sought to focus on the research and development of preferential signaling ligands of CB1 and CB2 and has produced a library of novel, proprietary drug candidates (“Product Candidates’). These Product Candidates are patentable NCEs for pharmaceutical drug development, aimed at targeting diverse clinical indications. Our current pharmaceutical pipeline consists of three programs, with drug candidates targeting Alzheimer’s disease, dry age-related macular degeneration (“AMD”), and Epidermolysis Bullosa (“EB”).

InMed’s INM-901 is a proprietary small molecule, disease modifying drug candidate that is being developed as a potential treatment for Alzheimer’s disease. INM-901 has multiple potential mechanisms of action as a preferential signaling agonist for both CB1 and CB2 receptors, as well as impacting the PPAR signaling pathway. Combined, these mechanisms of action may offer a unique treatment approach targeting several biological pathways associated with Alzheimer’s disease.

Outcome from our ocular research, based on the proprietary small molecule INM-089, indicates potentially promising neuroprotective effects in the back of the eye, which may lead to the preservation of the retinal function. Neuroprotection in dry Aged-related Macular Degeneration (“dry AMD”) remains an unmet medical need and a new treatment option may help solve this multifactorial disease.

InMed has completed a Phase 2 clinical trial of INM-755 (cannabinol) cream studying its safety and efficacy in treating symptoms related to EB. Results from the Phase 2 clinical trial conducted during 2022 and 2023 showed a positive indication of enhanced anti-itch activity for INM-755 (cannabinol) cream versus the control cream alone in an exploratory clinical evaluation. The Company is also pursuing strategic partnership opportunities for INM-755 in EB and other itch-related skin conditions.

Together with our wholly owned subsidiary BayMedica, our manufacturing capabilities include traditional approaches such as chemical synthesis and biosynthesis, as well as a proprietary, integrated manufacturing approach called IntegraSyn. With several manufacturing approaches, InMed has sought to maintain enhanced flexibility to select the most cost-effective method to deliver high quality, high-purity Products and Product Candidates fit for their intended use. BayMedica’s commercial business specializes in the business-to-business (“B2B”) commercialization of bulk rare, non-intoxicating cannabinoids as raw materials for the ‘health and wellness’ sector that are bioidentical to those found in nature.

Corporate Information

We were originally incorporated in the Province of British Columbia, under the Business Corporations Act (British Columbia) (the “BCBCA”), on May 19, 1981 (the “Incorporation Date”), and we have undergone a number of executive management, corporate name and business sector changes since such Incorporation Date, ultimately changing our name to “InMed Pharmaceuticals Inc.” on October 6, 2014. Our principal executive offices are located at Suite 1445, 885 West Georgia Street, Vancouver, BC, V6C3E8 and our telephone number is +1-604-669-7207. Our website is https://www.inmedpharma.com/. The contents of our website are not incorporated, in whole or in part, into this Annual Report in any respect.

Employees and Human Capital

Our management team is comprised of highly experienced pharmaceutical and biotechnology executives with successful track records in researching, developing, gaining approval for and commercializing novel medicines to treat serious diseases. Each member of our management team has 20 to 30+ years of industry experience, including our Chief Executive Officer (“CEO”), Chief Operating Officer (“COO”), Chief Financial Officer (“CFO”), General Manager and VPs of Preclinical Drug Development, Discovery Research, Chemistry, Synthetic Biology and of Sales & Marketing. Together, this management team has covered the spectrum of pharmaceutical drug discovery, preclinical research, formulation development, manufacturing, human clinical trials, regulatory submissions and approval, and global commercialization of pharmaceutical and wellness products. Additionally, the management team has significant experience in company formation, capital raises, mergers and acquisitions, business development, and sales and marketing in the pharmaceutical and other industries. Our Board is constituted by individuals with significant experience in the pharmaceutical and biotechnology industries. As of September 20, 2024, inclusive of our management team, we had 13 full-time employees, and we also utilize the services of several consultants. None of our employees are represented by a collective bargaining agreement, nor have we experienced any work stoppage. We believe that we maintain strong relations with our employees.

We are committed to growing our business over the long-term. As a result of the competitive nature of the industry in which we operate, employees have significant career mobility and opportunity, and as a result, the competition for experienced employees is great. The existence of this competition, and the need for talented and experienced employees to realize our business objectives, underlies the design and implementation of our compensation programs. At the same time, we seek to keep our approach to compensation simple and streamlined to reflect the still relatively moderate size of the Company. We have therefore implemented compensation, leave and benefits programs necessary to attract and retain the talented and experienced employees necessary to develop our business, including what we believe to be competitive salaries, stock options awards to permanent employees (both upon initial hiring and on an annual basis thereafter), and pay annual bonuses to permanent employees contingent on the achievement of corporate and/or personal objectives. We have developed an Employee Handbook that contains all corporate policies and guidelines for professional behavior. Our policies and practices apply to all employees, regardless of title. These guidelines include, among others, our Code of Business Conduct as well as our policies for corporate disclosure, insider trading and whistle blower, all of which are posted on our website.

For all current and future pharmaceutical Product Candidates we intend to submit new drug applications (“NDAs”) (or their international equivalents) in most major jurisdictions, including the United States, either alone or with development/commercial partners.

Our Business Strategy

Our goal is to develop a pipeline of prescription-based Product Candidates targeting treatments for diseases with high unmet medical needs.

| ● | Develop and produce proprietary small molecule Product Candidates for use in our drug development programs |

| ● | Advance pharmaceutical drug Product Candidates through preclinical and clinical development, thereby establishing important human proof-of-concept in multiple therapeutic applications |

These activities are at various stages of development, including, with INM-901 (for the treatment of Alzheimer’s disease), INM-089 (for the treatment of dry AMD) and INM-755 (for the treatment of symptoms related to EB). We have the internal capabilities to design and execute, together with multiple external vendors, the preclinical experimentation and clinical studies required to advance pharmaceutical drug candidates towards commercialization.

| ● | Actively seek avenues to accelerate drug development via licensing, partnering or sale to external companies |

We do not currently have an internal organization for the sales, marketing and distribution of pharmaceutical Products. With respect to the commercialization of each Product Candidate, we may therefore rely on (i) a “go-it-alone” commercialization effort; (ii) out-licensing to third parties; or, (iii) co-promotion agreements with strategic collaborators for our Product Candidates. The decision to pursue a “go-it-alone” commercialization effort versus out-licensing to third parties will depend on various factors including, but not limited to, the complexity of the Product Candidate and process, the expertise required and related cost of building any such infrastructure for our Product Candidates. For INM-755 in EB, we are actively seeking development and commercial partnerships. The optimal commercial strategy for the INM-901 and INM-089 compounds will be evaluated in due course.

| ● | Expand portfolio and revenues of Products into the existing distribution network and to end-product manufacturers of specialty health and wellness products |

| ● | Develop cost effective and scalable manufacturing processes for high quality Products and Product Candidates as APIs for our core internal drug candidate pipeline and for licensing opportunities of non-core drug candidates. |

Our Strengths

We are a pharmaceutical drug development company as well as a developer and supplier of rare, naturally occurring cannabinoids that is focused on commercializing important \ medicines to treat diseases with high unmet medical needs. Our key strengths include the following:

Experienced executive team and board of directors with proven track records.

One key critical success factor in the field of pharmaceutical drug development is the experience and skill set of the individuals leading the company. We have been successful in attracting and retaining executive and directors with extensive experience in all facets of the pharmaceutical industry, including fundamental research and development, multiple manufacturing techniques, drug formulation, clinical trial execution, regulatory approvals, pharmaceutical commercialization, company and capital formation, business development, legal, and corporate governance. Our leadership team is well-poised to lead us through all facets of drug development and product commercialization, either internally or externally via partnerships. It is this group of individuals that will help optimize our chances for success.

Scope of research and robust pharmaceutical pipeline

Over several years of dedicated research, InMed has built a robust pipeline of drug development candidates, including two preclinical programs targeting Alzheimer’s (INM-901) and ocular diseases (INM-088 for glaucoma and INM-089 for AMD), as well as a completed Phase 2 study in dermatology (INM-755). The INM-089 and INM-901 preclinical programs offer a differentiated treatment approach using proprietary, disease-modifying small molecules that target the CB1 and CB2 receptors, which management believes is a key strength of the Company.

Multiple manufacturing approaches.

Our management team believes that the combined manufacturing technologies from InMed and BayMedica provide us with a competitive advantage to utilize the most cost-efficient methodology (i.e. chemical synthesis, biosynthesis and IntegraSyn) for the development and commercialization of new Products and Product Candidates to a wide spectrum of market opportunities.

Early mover status as a B2B supplier of rare cannabinoids to the health and wellness sector.

As demonstrated by the launch of several rare cannabinoids into the health and wellness sector, the team at BayMedica has substantial expertise in the commercial manufacturing scale-up to produce rare cannabinoids at large scale as well as extensive sales and marketing expertise. This know-how is important to establishing an early-mover status and to maintain cost leadership with regards to specific rare cannabinoids.

Diverse portfolio of patent applications covering a spectrum of commercial opportunities.

Success in pharmaceutical markets often rests with the strength of intellectual property, including patents, to protect our commercialization interests. We have filed several patents on our novel findings and expect to continue to do so. The acquisition of BayMedica brought several additional new patent families to bolster our manufacturing as well as drug development opportunities.

BayMedica’s chemical synthesis and biosynthesis technologies for the development and production of cannabinoids, their variants and analogs

BayMedica continues to develop manufacturing techniques that are ‘method agnostic’, utilizing the most practicable, expeditious and cost-effective means to produce any particular Product or novel Product Candidate.

Research and Development Pipeline of Therapeutic Drug Candidates

INM-901 for the Treatment of Alzheimer’s Disease (“AD”)

Traditionally, Alzheimer’s disease has been defined by the buildup of amyloid beta (“Aβ”) plaques and neurofibrillary, also referred to as tau protein, tangles within the brain, making it a central focus of neurological research for many years. However, more recently, other factors such as neuroprotection and synaptic dysfunction are being recognized as contributors to disease progression.

Our early research demonstrating the neuroprotective capabilities of CB1 and CB2 agonists in the eye led us to investigate how such molecules might play a role in protecting other neurons in the human body, potentially, impacting different diseases. To this end, we initiated research on the neurons that are associated with the brain and how our proprietary CB1 and CB2 agonist drug candidates could affect neurodegenerative diseases such as Alzheimer’s, Parkinson’s, and Huntington’s. In October 2023, InMed announced it had selected and would be advancing a lead AD drug candidate, named INM-901, following positive results from several proof-of-concept studies. INM-901 is a proprietary small molecule drug candidate. which, based on preclinical studies in well-characterized AD study models, may address multiple pathologies related to AD progression. In these preclinical study models, INM-901 demonstrated neuroprotective effects, reduced neuroinflammation, the ability to extend the length of neurites signifying enhanced neuronal function, and improvement in behavior, cognitive function and memory. These early studies show the potential of INM-901 to reverse neuronal damage from AD and potentially provide disease-modifying effects.

As a small molecule compound, INM-901 may offer various modes of administration including oral delivery, which could overcome several limitations associated with currently approved antibody therapies for AD, such as the high drug expenses, complicated and inconvenient drug administration and its associated compliance and accessibility challenges.

INM-901’s promising preclinical studies, multifactorial mechanism of action and small molecule profile offer a potentially attractive treatment option for AD.

Alzheimer’s Disease Prevalence and Impact – A Major Medical and Societal Burden

Alzheimer’s disease is a progressive neurodegenerative condition that predominantly afflicts the elderly, resulting in severe cognitive impairments. It is a subset of dementia that impacts the part of the brain that controls memory and language and leads to increased morbidity and mortality.

According to the U.S. Alzheimer’s Disease Association, AD accounts for 60-80% of dementia cases and is the fifth leading cause of death for people aged 65 and older. It’s estimated that 6.9 million Americans are living with AD, and it’s expected to grow to 12.7 million by 2050. About 1 in 9 people aged 65 and older has AD (10.7%), affecting 1 in 5 women and 1 in 10 men in their lifetime.

The disease has a major medical and societal burden with health and long-term care costs valued at $360 billion. In addition to the cost to the healthcare system, it’s estimated 11 million Americans are providing 18.4 billion hours of unpaid care valued at $350 billion for people living with AD or other dementias, making it one of the costliest diseases to society.

Additionally, the emotional and mental health burden on patients and their caregivers cannot be overstated.

Pathology of Alzheimer’s disease

Alzheimer’s disease is a complex neurodegenerative disease with multiple pathologies leading to its development and progression. Hallmarks of the disease point to the toxicity and disruption of proteostasis caused by misfolded amyloid beta protein and neurofibrillary tangles or tau tangles. Amyloid-beta is a naturally occurring protein in the brain, but when abnormal levels of amyloid-beta clump together to form plaques, it causes damage to neuronal cell function resulting in AD.

The focus of Alzheimer’s research has been traditionally centered around amyloid-beta plaques and tau protein, which play a crucial role in stabilizing microtubules within neurons, supporting their structure and function. Increased activity of enzymes called tau kinase causes the tau protein to misfold and clump, creating neurofibrillary tangles which disrupt the normal functioning of neurons. The stage and severity of AD is associated with an abundance of tau tangles.

In addition to these two aspects of Alzheimer’s disease, neuroinflammation and synaptic dysfunction are also recognized as contributors to AD progression. Microglia, the brain’s immune cells, are involved in the removal of amyloid-beta and has been a focus of research in neuroinflammation. Therapies targeting the modulation of microglial activity aim to reduce inflammation and protect neurons.

Current treatments in Neurodegenerative Diseases

| Brand | Company | Mechanism of Action | Status | |||

| Aducanumab (Aduhelm™) | Biogen | Anti-amyloid beta target both insoluble and soluble aggregates | Approved June 2021 | |||

| Lecanemab (Leqembi™) | Biogen/ Eisai | Anti-amyloid beta, electively binds to large, soluble Aβ protofibrils | Approved January 2023 | |||

| Gantenerumab | Roche | Anti-amyloid beta, target aggregated forms of AB including oligomers and plaques | Phase 3 failed November 2022 | |||

| Donanemab | Eli Lilly | Anti-amyloid beta, target pyroglutamated AB in plaques | Approved July 2024 | |||

| Semorinemab | Genentech | Anti-tau | Phase 2 Failed | |||

| HMTM | TauRx Therapeutics | Anti-Tau, tau aggregation inhibitor | Applied to UK MAA for market authorization |

Currently approved medications for AD fall into two main categories. The first category comprises drugs designed to address symptoms related to memory and cognitive function. While these medications cannot halt the damage that AD inflicts on brain cells, they can help alleviate or stabilize symptoms for a limited duration by influencing specific chemicals responsible for transmitting messages between nerve cells in the brain. Essentially, these medications are aimed at preserving neurotransmitters. However, they do not replace the deteriorating ones and thus do not impede the disease’s progression.

Until recently, cholinesterase inhibitors and glutamate regulators were the only treatments available to people living with AD. These drugs are intended to improve cognitive and behavioral symptoms and do not address the prevention or progression of the disease.

Over the past three decades, only four drugs have received approval for AD treatment, and while they can manage certain symptoms, they do not address the prevention or progression of the disease. These drugs, known as cholinesterase inhibitors and glutamate regulators, primarily target cognitive symptoms.

In recent years, there has been a growing emphasis on developing disease-modifying treatments that target the underlying biology of AD. One major focus of these research and development endeavors has centered on addressing the accumulation of amyloid plaques and the removal of both these plaques and tau proteins. This approach aligns with the long-standing amyloid hypothesis, which posits that AD is triggered by the buildup of (Aβ) in the brain. This accumulation leads to neuronal toxicity within the central nervous system, disrupting neuronal and synaptic function, ultimately culminating in neuronal degeneration and cell death.

Role of CB1 and CB2 Agonists in Alzheimer’s disease:

Numerous studies have indicated dysregulation of the Endocannabinoid System (“ECS”), which encompasses receptors, endocannabinoids, and synthesizing/metabolizing enzymes, in various neurodegenerative conditions, notably AD. These investigations have unveiled the potential of CB1 and CB2 agonists, both endogenous and synthetic, in mitigating the harmful effects of AD pathology. These CB1 and CB2 agonists have been suggested to diminish Aβ toxicity, reduce tau hyper-phosphorylation, and suppress neuroinflammatory responses while curbing the production of reactive oxygen species (“ROS”). As a result, they may enhance the survival of neurons in the aftermath of Aβ aggregation.

CB1 and CB2 agonists exert their biological effects through two primary membrane receptors, endogenous CB1 and CB2 receptors, which are widely distributed in the central nervous system and peripheral tissues. Activation of CB1 has demonstrated its ability to alleviate neurotoxicity in various AD models. Conversely, CB2 agonism and increased expression have been associated with the removal of Aβ by macrophages.

The precise molecular mechanisms responsible for safeguarding specific neuronal populations remain elusive. However, several observations support this concept:

a) CB1 and CB2 agonists possess a capacity to exert broad effects on multiple molecular targets, including critical brain structures and behavior;

b) CB1 and CB2 agonists act not only through ECS receptors but also interact with other non-ECS receptors such as transient receptor potential vanilloid 1, peroxisome proliferator-activated receptors (“PPARs”), and transcription factors such as nuclear factor kappa B (“NFkB”); and

c) CB1 and CB2 agonists exhibit anti-inflammatory properties, modulate neurotransmitter release, and limit oxidative stress, collectively contributing to the enhancement of neuronal viability.

AD is a progressive neurodegenerative condition primarily driven by the toxicity and disruption of proteostasis caused by misfolded Aβ protein. CB1 and CB2 agonists have emerged as promising agents capable of preserving neuronal integrity and functionality, offering a potential strategy to slow down disease progression and enhance the quality of life for affected individuals. Furthermore, CB1 and CB2 agonists exhibit the capacity to mitigate neuroinflammation, shield against beta-amyloid-induced neurotoxicity, and mitigate neurodegeneration in animal models of AD. Additionally, research has unveiled dysregulation of the ECS in the brains of AD patients, which could contribute to the cognitive and behavioral symptoms associated with the disease.

INM-901 is highly lipophilic (dissolves in fats, oils and lipids) and can easily cross the blood-brain barrier, a capability that renders it a promising candidate for pharmaceutical use in the treatment of neurological disorders.

The use of CB1 and CB2 agonists in AD treatment holds great promise; however, further research is needed to fully understand the mechanisms to develop safe and effective CB1 and CB2 agonists-based therapeutics.

INM-901: A Multi-factorial Approach to Treating Alzheimer’s disease

While progress has been made recently in the development of new treatments for AD, there are no treatments addressing the multiple aspects of this complex disease such as neuroinflammation, neuroprotection, synaptic dysfunction or the restoration of the damaged neurons – factors that may help to restore brain function loss or reverse the damage caused by AD.

Preclinical studies indicate that INM-901 may target multiple biological pathways. InMed has conducted several in vitro and in vivo studies to test the pharmacological effects of INM-901 in well-characterized AD preclinical models.

Figure 1. Neuroprotection of human neuronal cells

Phyto-cannabinoids (pCBx) promote neuroprotection. (A) Amyloid peptide (Aβ, 5µM) induces cytotoxicity in SHSY5Y cells. Aβ1-42 insult induced approximately ~45% cytotoxicity of the SH-SY5Y cells. (B) Concurrent exposure of Aβ with pCBx at 5 µM and 10 µM concentrations protected cells from Aβ induced toxicity in a dose-dependent manner. Cell viability was determined by MTT assay.

Figure 2. Neurogenesis of human neuronal cells

Cannabinoid (pCBx) promotes neuritogenesis. Tuj1 Tubulins are building blocks of microtubules. As such, Tuj1 expression can reveal the fine details of axonal structures and dendrites. Therefore, changes in Tuj1 expression can be directly correlated with neuronal health and communication. (A) Photomicrographs illustrating Tuj1 expression in control and pCBx (5 and 10µM) treated cells. The formation of extended neurites and arborization is evident upon pCBx treatment.

Key Results:

Preclinical studies in AD models demonstrated the following:

| ● | neuroprotective effects by reducing cell death in an amyloid-beta-induced cytotoxicity and attenuated increased Bax/Cas-3 expression in the presence of Aβ (5µM) in SH-SY5Y neuroblastoma cells; |

| ● | improves neuritogenesis in human neuroblastoma cells, enhanced expression of neurite marker MAP2 and Tuj1; |

| ● | reduces neuroinflammation; |

| ● | promotes neurite outgrowth, signifying the potential to improve neuronal function, a potential breakthrough in the treatment of AD; and |

| ● | improvement in cognitive function and memory, locomotor activity, anxiety-based behavior, sound awareness and neuronal function. |

INM-901 Interacts with Specific Receptors in the Brain

Studies of INM-901 demonstrate activity as a preferential signaling ligand for CB1 and CB2 and impacts the PPAR signaling pathway. Research indicates that activating CB1 and CB2 receptors may induce neuroprotective effects and may help to protect brain cells from damage and death. Enhancing the activity of these receptors may help to slow down the progression of the AD, in which neuronal cell death is a hallmark. Moreover, the activation of these receptors, along with other cellular receptors, has also been shown to have an impact on neuroinflammation. As neuroinflammation is believed to contribute to the progression of AD, targeting these receptors could help alleviate this inflammatory response.

INM-901 is a Proprietary Small Molecule Compound

INM-901 is a small molecule compound, one of several cannabinoid analogs developed by the Company’s scientists. Cannabinoids are small molecules known to be highly lipophilic and can safely cross the blood-brain barrier, enabling the potential therapeutic modulation of brain signaling and making them promising pharmaceutical targets for neurological diseases such as AD.

Small molecule drugs have several advantages that contribute to their widespread use. Those advantages include oral administration (making it convenient for patients to comply), good bioavailability (allowing these compounds to be efficiently absorbed), ability to cross the blood-brain barrier (enabling therapeutic modulation in brain signaling), stability in storage and transport (ease of drug handling and dose adjustment) and low-cost manufacturing.

INM-901 Next Steps

Research & Development

| ● | Assess long-term (7-month dosing) study in 5xFAD mice (on-going) |

| ● | Plan/execute study in PS19 Tau model |

| ● | Continue Chemistry/Manufacturing/Controls (“CMC”) activities for drug substance and drug product |

| ● | Continue studies of receptor interactions (MoA) and Distribution, Metabolism, Pharmacokinetics (“DMPK”) |

| ● | Plan to execute IND enabling toxicology studies |

Key Milestones

| ● |

November 3, 2021 — we announced the filing of an international patent application demonstrating neuroprotection and enhanced neuronal function using a rare cannabinoid for the potential treatment of neurodegenerative diseases such as Alzheimer’s Disease, Parkinson’s Disease, Huntington’s Disease and others. This Patent Cooperation Treaty (PCT) application, entitled “Compositions and Methods for Treating Neuronal Disorders with Cannabinoids”, specifies a rare cannabinoid that may inhibit or slow the progression of neurodegenerative diseases by providing neuroprotection in a population of affected neurons. Furthermore, the PCT application also demonstrates the subject cannabinoid compound can also be used to promote neurite outgrowth, signifying the potential to enhance neuronal function. The rare cannabinoid included in the PCT application is new to InMed’s portfolio. |

| ● | November 16, 2022 — we announced announces the launch of its neurodegenerative disease program (INM-900 series), investigating the effects of cannabinoid analogs in diseases such as Alzheimer’s, Huntington’s and Parkinson’s. In addition, Dr. Ujendra Kumar of the Faculty of Pharmaceuticals Sciences at UBC has been awarded an Alliance grant from NSERC, with InMed as the named industry partner. The funding will support the research and development studies of InMed’s cannabinoid pharmaceutical candidates, investigating their potential therapeutic effects in neurodegenerative diseases. The collaboration project is entitled “Pharmacological Characterization of Phytocannabinoids and the Endocannabinoid System”. |

| ● | June 1, 2023 — we announced that results from a neurodegenerative disease study was presented in a scientific poster at the Canadian Neuroscience Meeting in Montreal from May 28-31, 2023. The InMed sponsored research, entitled “Cannabinoids modulate cytotoxicity and neuritogenesis in Amyloid-beta-treated neuronal cells”, demonstrated the ability of a specific rare cannabinoid (“pCBx”) in our INM-900 series of potential candidates that reduces amyloid toxicity and tau protein expression while enhancing neuronal cell growth and neuritogenesis markers in vitro, all considered to be important targets in the potential treatment of neurodegenerative diseases such as Alzheimer’s. | |

| ● | October 2, 2023 — we announced the selection of a lead Alzheimer’s disease drug candidate, named INM-901, following positive results from several proof-of-concept studies in a validated Alzheimer’s disease treatment model. InMed will be advancing INM-901, a cannabinoid analog, in its pharmaceutical drug development program. In vitro Alzheimer’s disease studies showed that INM-901 treated groups display neuroprotection and extended neurite length, a potential marker for improved neuronal function. INM-901 treated groups in an in vivo Alzheimer’s disease model demonstrated improved behavioral, cognitive and memory outcomes in several Alzheimer’s proof-of-concept studies. | |

| ● | April 4, 2024 — we announced additional preclinical data demonstrating INM-901’s positive pharmacological effects in the potential treatment of Alzheimer’s disease (“AD”). Additionally, the studies demonstrated INM-901 is a preferential signaling agonist of the CB1and CB2 receptors and impacts the PPAR signaling pathway, reduced neuroinflammation and improved neuronal function, and that mRNA data supports the observations made in the previously released behavior studies in locomotor activity, cognition and memory. |

| ● | April 18, 2024 — we announced the addition of Dr. David G. Morgan, a renowned leader in neurodegenerative disease to its Scientific Advisory Board (“SAB”) reinforcing the Company’s commitment to advancing it’s INM-901 program in the treatment of Alzheimer’s disease. |

| ● | July 30, 2024 — we announced positive results from initial data sets from a long-term (7 months of dosing) in vivo preclinical Alzheimer’s Disease (“AD”) study of INM-901 which confirms previously reported findings from a short-term (3 months of dosing) pilot study. All assessments of the INM-901-treated AD groups showed a positive trend towards behaviour similar to the untreated disease-free group, with most assessments demonstrating a clear dose response. Furthermore, INM-901-treated AD groups achieved a statistically significant improvement in certain behavior criteria in comparison to the placebo-treated AD groups. These results not only supported but, in several instances, improved upon the prior short-term pilot study outcomes. |

|

| ● | August 20, 2024 — we announced the confirmation of INM-901 as an oral formulation that will be utilized in its development programs for Alzheimer’s disease. Recent preclinical studies have demonstrated that INM-901can be administered orally and achieve therapeutic levels in the brain comparable to those obtained through intraperitoneal (“IP”) injection, which is a common route of administration for preclinical investigation of neurodegenerative diseases. The data indicates the INM-901 formulation can be administered orally and maintains a similar drug exposure levels as IP delivery over a 24-hour period in the brain. This oral delivery method offers potential advantages such as reduction in treatment delivery costs versus intravenous delivery of current disease modifying large molecule antibody therapies. |

INM-089 for the Treatment of AMD

Introduction

While conducting the preclinical studies of a previous drug candidate, INM-088 in glaucoma, which involved comparing various naturally occurring compounds including InMed’s proprietary small molecule candidates, it was discovered that one of InMed’s candidates was demonstrating interesting pharmacological effects in the back of the eye. Further preclinical studies of this compound using AMD study models demonstrated significant functional and pathological improvements. InMed has selected drug candidate INM-089, a proprietary small molecule analog of INM-088, for further preclinical development in the potential treatment of dry AMD.

AMD is a progressive eye disease that causes damage to the macula which affects a person’s central vision. AMD is common amongst the elderly and is a leading cause of vision loss. Dry AMD is the most common form of AMD, accounting for 80% of AMD cases according to the American Academy of Ophthalmology.

Until recently, there were no approved pharmaceutical treatments for people with dry age-related macular degeneration. In 2023, the FDA approved two new treatments which are complement inhibitors for advanced stages of dry AMD (called geographic atrophy (“GA”)).

In vitro and in vivo studies of INM-089 have demonstrated neuroprotection of photoreceptors, improvement of the integrity of the retinal pigment epithelium, a reduction in extracellular autofluorescent deposits (a hallmark of AMD), preservation of the retinal function in the back of the eye and improvement in the thickness of the outer nuclear layer of the retina.

As a small molecule, INM-089 is likely deliverable via various modes of administration, such as a topical eye drop or intravitreal injection (“IVT”) formulation.

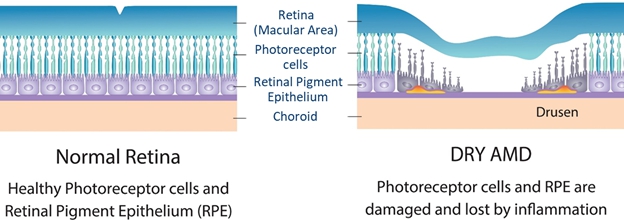

Pathology of Age-related Macular Degeneration

AMD is a progressive eye disease that causes damage to the macula which is part of the retina at the back of the eye. The macula controls the sharp vision straight ahead of you, and damage to the macular affects a person’s central vision.

There are two principal forms of AMD, atrophic (non-exudative) dry AMD and neovascular (exudative) wet AMD. Wet AMD constitutes about 10%-20% of all cases of AMD and occurs when an abnormal blood vessel grows in or under the retina leading to central vision loss. Dry AMD is the most common form affecting nearly 80%-90% of all patients with AMD. It is associated with the gradual loss of the outer nuclear layer (ONL) photoreceptors and the retinal pigment epithelium (RPE) thinning, formation of drusen deposits, and loss of the vessels in the retinal choriocapillaris. Advanced stage of dry AMD is characterized by geographic atrophy (GA) at the center of the macula extending through the outer neuroretina, RPE and choroid. GA is characterized by the atrophy of RPE, photoreceptors, choriocapillaris, and ONL. The loss of functional RPE and photoreceptors in GA is not endogenously replaced and can result in complete sight loss.

AMD is a leading cause of vision loss in adults

According to the World Health Organization, 196 million people worldwide live with age-related macular degeneration. An estimated 19.8M Americans aged 40+, about 12.6% of the population, suffer from AMD. While AMD does not cause complete vision loss, it affects central vision and impairs one’s ability to perform daily tasks such as cooking, reading and driving.

As the name suggests, aging is a strong risk factor for developing AMD. Adults aged 50 or older, smoke, have a diet of high saturated fat, have cardiovascular disease or have a family history of AMD are more at risk of developing AMD. People of European ancestry are more likely to develop AMD than Blacks, Hispanics or Asians. In addition, people with blue eyes have higher incidence rates of AMD than someone with brown eyes.

Early detection is key to slowing the progression of AMD. A sign of whether you might have AMD is when straight lines look wavy.

A Major Unmet Medical Need for New AMD Treatments

Until recently, there were no approved pharmaceutical treatments for people with dry age-related macular degeneration, which accounts for about 80%-90% of AMD cases.

In 2023, the FDA approved two new treatments which are complement inhibitors for advanced stages of dry AMD (or geographic atrophy). These complement inhibitors are injected directly into the eye every one to two months.

Syforvre® (pegcetacoplan), developed by Apellis Pharmaceuticals, was approved by the FDA in February of 2023 for the treatment of geography atrophy, the late stage of dry AMD. Syforvre®, a C3 complement inhibitor, is injected into each eye every 25-60 days and reduces the rate of lesion growth in the eye.

In August 2023, the FDA approved Iveric’s Izervay® (avacincaptad pegol), a complement C5 inhibitor, which aims to reduce an immune response that damages retinal cells. Similar to Syforvre®, the drug is approved for geographic atrophy and is administered via intravitreal injection every month. According to the Alzheimer’s Association, these new complement inhibitor drugs slow the development of GA by about 14%-20%, but do not improve eyesight, nor restore lost vision. Side effects of these new treatments include inflammation, bleeding beneath the clear lining of the eye, blurred vision and fluid pressure, and some patients develop wet AMD.

In addition to the new complement inhibitors, there are surgical implants and ongoing clinical drug trials. An ophthalmologist may recommend specific vitamins to slow the progression of AMD in its intermediate stage.

The approval of complement inhibitors offers hope to people living with dry AMD, however, the modest effect, inconvenient drug delivery and the increased risk of developing wet AMD may outweigh the benefit for some patients and their physicians. There remains a large unmet medical need for more effective and convenient treatments for the large patient population affected by dry AMD.

Treatments approved or in late-stage development for Geographic Atrophy (late-stage dry AMD)

| Brand | Company | Mechanism of Action | Status | |||

| Syforvre® | Apellis Pharmaceuticals | Complement C3 inhibitor | Approved February 2023 | |||

| Izervay® | Iveric | Complement C5 inhibitor | Approved August 2023 | |||

| Tinlarebant | Belite Bio | Targets retinol binding protein 4 (RBP4) | Phase 3 | |||

| ANX007 | Annexon Biosciences | Anti-C1q antibody | Initiating Phase 3 | |||

| JNJ-1887/HMR59 | Hemmera/ Janssen | Increase expression of soluble form of CD59 | Phase 2 | |||

| IONIS-FB-LRx / RG6299 | Ionis /Roche | Anti-sense complement factor B inhibitor | Phase 2 | |||

| Danicopan (ALXN2040) | Alexion | Complement Factor D inhibitor | Phase 2 |

Role of CB1 and CB2 agonists in ocular disease

Mounting scientific research is pointing to the neuroprotective effects of CB1 and CB2 agonists, supporting their therapeutic potential in ocular diseases such as AMD and glaucoma, in which neuroprotection is key to preserving the nerve cells in the eyes and potentially slowing or reversing eye damage. Several preclinical studies conducted by InMed in three of its drug development programs have consistently shown the neuroprotective effects of naturally occurring CB1 and CB2 agonists and their analogs in well-recognized study models.

In was during this research of INM-088 when InMed scientists observed the ability of a novel CB1 and CB2 agonist, now called INM-089, to proactively protect the nerve cells in the back of the eye. As a result of this discovery, InMed launched the INM-089 drug development program for the potential treatment of AMD.

INM-089: Small molecule compound acting as a selective dual CB1 / CB2 agonist

CB1 and CB2 receptors are both part of the endocannabinoid system and are found throughout the body and are responsible for many homeostatic functions. CB1 receptors are primarily located in the brain and central nervous system, while CB2 receptors are involved in modulating neuroinflammation and immune responses. Activation of CB1 and CB2 receptors has been shown to have neuroprotective effects and protect cells from damage and death.

INM-089 is a small molecule compound, one of several proprietary CB1and CB2 agonists discovered and developed by the Company’s team of scientists.

INM-089 in vitro and in vivo studies to date

Preclinical studies of INM-089 demonstrate significant functional and pathological improvements in an AMD disease study model. Results from several in vitro and in vivo studies demonstrate INM-089’s pharmacological effects in the potential treatment of dry AMD:

| ● | INM-089 provides neuroprotection of retinal cells |

| ● | INM-089 improves the integrity of the retinal pigment epithelium (“RPE”) |

| ● | INM-089 reduces extracellular autofluorescent (“AF”) deposits, including drusen, a hallmark of dry AMD |

| ● | INM-089 preserves photoreceptor function and retinal cells in the back of the eye |

| ● | INM-089 improves thickness of outer nuclear layer (“ONL”) of the retina where photoreceptors are located. |

Based on widely accepted ocular research, the thickness of the outer nuclear layer is strongly correlated with photoreceptor preservation and visual acuity.

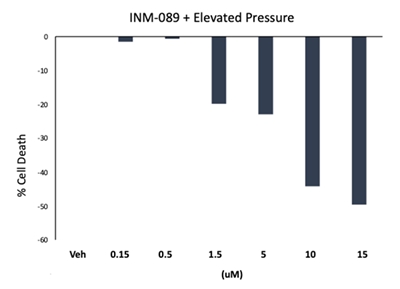

INM-089 Study: Neuroprotective effects

INM-089 demonstrates neuroprotective effects in pressure-induced toxicity in vitro model in retinal ganglion cells in a dose-dependent manner.

INM-089 Study: Photoreceptor Function Preservation

In a light-induced toxicity in vivo AMD model, a single intravitreal injection was performed at the back of the eye to deliver either INM-089, INM-088 or vehicle control. INM-089 outperforms INM-088 (‘CBN’ in the graph below) and vehicle control in preserving photo-receptor function.

INM-089 Study: Autofluorescent Extracellular Deposit Level

In a light-induced toxicity in vivo AMD model, a single intravitreal injection was performed at the back of the eye to deliver either INM-089 or vehicle control. INM-089 reduced build-up of autofluorescent extracellular deposits, which causes damage to the macular. The build-up of autofluorescent deposits such as drusen is a hallmark of dry AMD.

INM-089 Next Steps

Research & Development

| ● | Additional Protein and RNA analysis results are pending |

| ● | Continuing CMC activities for drug substance and drug product |

| ● | On-going studies of receptor interactions (MoA) and DMPK |

| ● | GLP studies to follow |

INM-755 for the Treatment of Epidermolysis Bullosa (‘EB’)

Introduction

INM-755 (cannabinol, or ‘CBN’) cream is a proprietary, topical product candidate intended as a therapy in dermatological diseases. The first clinical indication under development is treatment of symptoms related to EB. EB is a collective name for a group of genetic disorders of connective tissues characterized by skin fragility leading to extensive blistering and wounding. It affects skin and mucous membranes, particularly of the gastrointestinal tract, genitourinary and respiratory systems. EB is a debilitating disease affecting a small proportion of people in the United States, thus earning it an orphan-disease status. The disease has no definitive cure, and all current treatments are directed towards symptom relief. There are, however, a number of products, mainly gene therapies, currently in clinical trials, in which a cure is being explored, according to several recent scientific publications. Our preclinical research has identified a specific Product Candidate, CBN, that may prove beneficial to patients: first, by addressing certain key disease hallmarks (which may include wound healing, infection, pain, inflammation, and itch); and second, by regulating the expression of various proteins (keratins) that may compensate for reduced expression of others.

The active ingredient in INM-755, CBN, is an agonist for both CB 1 and CB2 receptors, with a higher affinity for CB2, which means it should have a greater effect on the immune system than on the central nervous system. The distribution of CB1 and CB2 receptors in sensory nerves and inflammatory cells in the skin make it an attractive pharmaceutical agent for dermal treatments in medical conditions characterized by inflammation and pain.

Summary of Completed Clinical Trials

Phase 1 Clinical Trials (Studies 755-101-HV and 755-102-HV)

A regulatory application to support our first Phase 1 clinical trial in healthy volunteers with INM-755 (755-101-HV) was submitted November 4, 2019 and approved December 6, 2019 in the Netherlands. The initial Phase 1 clinical trial evaluated the safety, tolerability, and pharmacokinetics of INM-755 cream in 22 healthy volunteers with normal, intact skin; the volunteers had cream applied once daily for a period of 14 days. All subjects in this first clinical trial completed treatment and evaluations by March 27, 2020. Database completion and data analyses were delayed by pandemic restrictions. Study results were reported November 25, 2020. A blinded interim safety review from the first 16 subjects in this Phase 1 clinical trial were included in a regulatory application that was approved April 17, 2020, for a second Phase 1 clinical trial of 8 healthy volunteers to test the local safety and tolerability of applying sterile INM-755 cream to small wounds once daily for 14 days. As with the initial Phase 1 trial, the second clinical trial (755-102-HV) was conducted with two different drug concentrations and a vehicle control. Enrollment began in early July 2020 and the clinical trial completed treatment and evaluations at the end of September 2020. Study results were reported January 8, 2021.

Phase 2 Clinical Trial (Study 755-201-EB)

Regulatory applications to support this global trial were filed for review by the National Competent Authorities and Ethics Committees in 8 countries for 13 clinical sites. Approvals were obtained in all countries (Austria, France, Germany, Greece, Israel, Italy, Serbia, and Spain) as of March 2022. Enrollment and patient treatment began in December 2021 and completed in April 2023.

The goal of the Phase 2 study was to obtain safety and preliminary efficacy of INM-755 cream in treating symptoms and wound healing in patients with EB, using a within-patient design in which matched index areas were randomized to INM-755 cream or vehicle (no drug) cream in a blinded manner. A target of up to 20 patients were to be enrolled with treatment for 28 days, the longest period supported by nonclinical toxicology studies.

No single primary endpoint was set for the trial to allow for possible variations in presenting symptoms in each patient. These include the presence of open wounds, wound pain associated with dressing changes, background wound pain, wound itch, and itch in non-wound areas. To this end, InMed’s goal was to harvest data from the trial to evaluate the ability of INM-755 to treat chronic non-wound itch and to heal wounds and treat associated pain and itch.

The Phase 2 Trial enrolled a total of 19 patients. Data from one patient were excluded from efficacy analyses due to a significant protocol deviation. Of the 18 remaining patients whose data were considered reliable for clinical review, 17 were treated for chronic non-wound itch and one patient was treated for wound-related itch. The remaining endpoints (pain, wound healing) could not be analyzed due to too few enrollees with such symptoms.

Of the 18 participants assessed, chronic itch improved by a clinically meaningful amount in 12 patients (66.7%), of whom:

| ● | 6 patients (33.3%) had the same level of itch improvement with INM-755 cream as with control cream; |

| ● | 5 patients (27.8%) treated with INM-755 showed meaningful anti-itch activity beyond that of the control cream; and |

| ● | 1 patient (5.6%) showed better itch reduction with the control cream. |

In summary, results from the Phase 2 clinical trial showed a positive indication of enhanced anti-itch activity for INM-755 cream versus the control cream alone in an exploratory clinical evaluation. The results for non-wound itch were not statistically significant in this small trial due, in part, to the clinically important anti-itch effect of the underlying control cream. We are, nevertheless, encouraged by and satisfied with the INM-755 clinical data for non-wound itch treatment. That the majority of the assessed patients in the trial showed clinically meaningful improvement in non-wound itch from the application of INM-755, be it with similar outcomes to the control cream or better than the control cream, can be considered impressive.

Based on the safety and efficacy data for treating non-wound itch in this EB study, as well as previous safety data from Phase 1 trials, we are now seeking R&D and commercial partnership opportunities for any continued development of INM-755 cream. Continued development of INM-755 cream will likely move beyond EB into broader indications involving chronic itch, with potentially much larger target populations and commercial opportunities than offered solely by the EB indication.

On average, it takes at least ten years to complete the development of an investigational drug from its initial discovery to the marketplace, with clinical trials alone taking six to seven years on average. It is not possible with any degree of certainty to estimate how long it will take to complete clinical trials and potentially obtain marketing approval for INM-755. To the extent that INM-755 may potentially be designated as either a Fast Track drug, a Breakthrough Therapy, or eligible for Priority/Accelerated Review, the timeline to any potential marketing approval may be shorter than might otherwise be the case.

Additional Indications for INM-755

Once a company has gone to the significant investments of bringing a new chemical entity into human clinical trials, the traditional approach is to investigate as many therapeutic uses as possible of that product in different indications, or specific diseases. We intend to pursue this strategy with a co-development partner as a way to leverage our knowledge of CBN and investment in the development of INM-755 as a topical skin cream. Under the assumption that we would use the same formulation for other dermatological indications, there should be no need for further Phase 1 safety studies allowing us to proceed directly to Phase 2 safety and preliminary efficacy studies in humans, since the toxicology and initial human safety studies have been completed; however, the adequacy of the nonclinical and human safety data to support new dermatologic indications will be determined by the appropriate health authority.

Key Milestones for the EB Program:

| ● | April 30, 2020 — we announced clinical trial application approval in the Netherlands for Study 755-102-HV, a randomized, double-blind, vehicle-controlled Phase 1 study designed to evaluate the safety and tolerability of INM-755 (two strengths) applied daily for 14 days on epidermal wounds in 8 healthy volunteers. |

| ● | November 25, 2020 — we announced the top-line results of Study 755-101-HV (“Study 101”). Study 101 was a randomized, vehicle-controlled, double-blind, Phase 1 trial, which examined the safety and tolerability of two strengths of INM-755 cream on intact skin in 22 healthy adult volunteers over a 14-day treatment period. The Study 101 results indicate that INM-755 was safe and well-tolerated on intact skin, caused no systemic or serious adverse effects. In addition, there were no subject withdrawals due to adverse events. Drug concentrations in the blood were very low, as expected. |

| ● | January 8, 2021 — we announced the top-line results of Study 755-102-HV (“Study 102”). Study 102 was a randomized, double-blind, vehicle controlled, single-center study, in 8 healthy adult volunteers to test the tolerability of 14 days of application of the INM-755 cream on epidermal wounds under treatment procedures designed to simulate wound care for Epidermolysis Bullosa (“EB”) patients with open wounds. Results of Study 102 indicate that INM-755 cream was safe and well-tolerated on induced open epidermal wounds, caused no systemic or serious adverse effects. In addition, there were no subject withdrawals due to adverse events. These data from Study 101 and Study 102 support moving forward into clinical trials in patients with EB. |

| ● | April 28, 2021 — we announced that we filed Clinical Trial Applications (“CTAs”) in Austria, Israel and Serbia as part of a Phase 2 clinical trial of INM-755 (cannabinol) cream in EB. Additional CTAs for 755-201-EB (the ‘201 study) will be submitted to National Competent Authorities (“NCAs”) and Ethics Committees (“ECs”) in France, Germany, Greece, and Italy in the coming weeks. |

| ● | September 30, 2021 — we announced commencement of a Phase 2 clinical trial, the 755-201-EB study, of INM-755 (cannabinol) cream in the treatment of EB, marking the first time cannabinol has advanced to a Phase 2 clinical trial to be studied as a therapeutic option to treat a disease. The 755-201-EB study is designed to enroll up to 20 patients. InMed will evaluate the safety of INM-755 (cannabinol) cream and its preliminary efficacy in treating symptoms and wound healing over a 28-day treatment period. All four subtypes of inherited EB; EB Simplex, Dystrophic EB, Junctional EB, and Kindler Syndrome are eligible for this study. | |

| ● | July 25, 2022 — we announced, based on the safety data of the first five adult patients who completed treatment with INM-755 CBN cream for the treatment of symptoms in the Phase 2 clinical trial, an independent Data Monitoring Committee agreed it was safe to allow the enrollment of adolescent patients, defined as persons aged twelve to seventeen. |

| ● | March 28, 2023 — we announced we had concluded enrollment of our Phase 2 clinical trial using investigational drug INM-755 cannabinol (“CBN”) cream for the treatment of patients with EB. The Phase 2 study enrolled 19 of its targeted 20 patients. |

| ● | June 22, 2023 — we announced safety and efficacy results from the Phase 2 clinical trial (755-201-EB) for the treatment of symptoms in patients with EB. |

Rare Cannabinoid Products in the Health and Wellness Sector

BayMedica has a revenue-generating commercial business unit that leverages our significant expertise in synthetic biology and chemistry to develop efficient, scalable, and proprietary manufacturing approaches to produce high quality, regulatory-compliant, non-intoxicating rare cannabinoids (“Products”) for consumer applications. BayMedica is currently commercializing Products as a B2B supplier to distributors and manufacturers in the health and wellness sector, including nutraceuticals, cosmetics, functional foods and beverages, as well as animal health markets. BayMedica currently has a robust portfolio of four different non-intoxicating Products including: cannabichromene (“CBC”), cannabidivarin (“CBDV”) tetrahydrocannabivarin (“THCV”) and cannabicitran (“CBT”).

Following the acquisition of BayMedica in 2021, a key priority in 2022 was accelerating commercial activities and building out a robust product portfolio as a supplier of Products to the health and wellness sector. While there was slower than expected revenue growth in 2022, we have seen increased demand through 2023 and the first half of 2024 due to better research of rare cannabinoids, companies and brands looking for product innovation and effects-based outcomes, and the ability of companies like ours to reliably supply high quality and consistent Products. During the financial year ended June 30, 2024, BayMedica had sales of approximately $4.6 million.

The increased sales in part resulted from expanded marketing efforts and increased demand for certain Products. BayMedica will continue to evaluate opportunities for potential structured supply arrangements and collaborations for the commercial business. Sales and marketing efforts will remain focused on Products that contribute highest margins where BayMedica continues to hold a strong competitive position.

Chemical Synthesis-Derived Cannabinoids Commercialized by BayMedica

Cannabichromene (CBC)

The high cost of goods for rare / minor cannabinoids (e.g. CBC) extracted and purified from the plant made adoption of these more difficult due to the cost of manufacture and cost to include in the final marketed product(s). Chemical synthesis has provided a consistent, scalable approach to produce CBC and other minor cannabinoids at a highly competitive cost of goods with consistent batch to batch variability and high purity of the cannabinoid. BayMedica has successfully manufactured and commercialized the rare cannabinoid CBC, for sale to distributors into the health and wellness industry. The development of a scalable process for the manufacturing of CBC began in 2018 using well established chemical synthesis protocols.

In 2019, a Material Services Agreement was completed with a multinational contract research, development and manufacturing organization (“Chemistry CDMO”) to facilitate the optimization and scale-up of BayMedica’s proprietary CBC manufacturing process using commercially available starting materials sourced from various manufacturers. We scaled to a batch size of greater than 1kg by calendar 2019 at which time we contracted a leading U.S. manufacturer to provide the final purification of CBC to greater than 95% purity. This manufacturer also operates a North American based toll-processing facility with the capability to process from 10kg to metric ton quantities of our crude CBC material under food-grade GMP conditions. By late 2019, our Chemistry CDMO had scaled the process to greater than 10kg, and by year end 2019 to almost 30kg with final purification at the NA contractor. We commenced commercial sales of CBC in November 2019.

Large scale manufacturing of crude CBC began at our Chemistry CDMO in 2020 at >40kg. The emergence of the Covid-19 pandemic significantly impacted sales beginning in calendar 2020. Large scale production continues with current batch sizes exceeding 100kg.

Cannabicitran (CBT)

We have developed a process for the efficient chemical synthesis of CBT through both in-house R&D efforts and via our CDMO. We began scaling this process and conducted downstream processing and purification trials in late calendar 2021. We received initial purchase orders and commenced commercial sales of CBT in calendar 2022.

Cannabidivarin (CBDV)

Beginning in early 2021, BayMedica worked internally and with external parties to access and develop manufacturing technologies for the chemical synthesis of the rare, non-intoxicating “varin” cannabinoid, CBDV. In calendar 2021, via a Chemistry CDMO, we successfully scaled CBDV synthesis to commercial quantities. In April 2022, we commenced B2B sales of CBDV to the health and wellness sector. As of fiscal 2023, a new source of CBDV was developed to provide a lower cost of goods replacement to the previously produced CBDV. Sales of this CBDV were initiated in the second quarter of calendar 2024.

Tetrahydrocannabivarin (THCV)

As part of the R&D into manufacturing techniques to synthesize and produce CBDV, we also began researching and developing processes to convert CBDV to the non-intoxicating rare cannabinoid THCV. In conjunction with our Chemistry CDMO and our in-house team, we developed a robust pilot-scale process that produces THCV. We have now developed a purification process to produce the finished THCV material. We began scale-up of our novel process with this CDMO in the first quarter of calendar 2022 and commenced sales in second half of calendar 2022. A new, more cost-effective, manufacturing approach for the supply of THCV was initiated in calendar 2023 with initial sales in the third quarter of calendar 2023. We will continue to assess further initiatives to reduce cost of goods for THCV.

Analogs of Cannabinoids / New Chemical Entities (“NCE”)

In addition to the natural cannabinoids above, we have leveraged our expertise in pharmaceutical chemistry and biosynthesis to produce a number of novel cannabinoid analogs and variants of pharmaceutical interest.

In the field of pharmaceutical drug development, the term analog is used to describe structural and functional similarity between an original (or parent) molecule and one that has been somewhat modified. While any company researching a naturally occurring compound, like cannabinoids, cannot own a patent on the molecule itself for commercial exclusivity, a modified molecule, which has certain structural and pharmacological similarities with the original compound, can be patented. As well, modifications of the original molecule (ie, the analog) can be designed to confer certain improvement in activity of the parent, such as an elevation of the desired physiological effects, a decrease in unwanted side effects, improvement in aspects related to drug delivery to targeted tissues, etc., or a combination of these targeted outcomes. We have filed patents covering numerous structural additions and modifications of the naturally occurring cannabinoids. Each individual modification to each individual cannabinoid represents a NCE which can be patented. If issued, this patent family will confer market exclusivity to us for the analogs that we intend to develop into pharmaceutical Product Candidates, license, partner or sell to interested external parties.

Notable Milestones: