UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2024

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to ____________________

Commission file number 001-38767

DATASEA INC.

(Exact name of registrant as specified in its charter)

| Nevada | 45-2019013 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 20th Floor, Tower B, Guorui Plaza 1 Ronghua South Road, Technological Development Zone Beijing, People’s Republic of China | 100176 | |

| (Address of principal executive offices) | (Zip Code) |

+86 10-56145240

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| Common Stock, $0.001 par value | DTSS | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and FF“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the shares of common stock outstanding, other than shares held by persons who may be deemed affiliates of the Registrant as at December 30, 2022, computed by reference to the closing price of $3.52 for the Registrant’s common stock on December 29, 2023, as reported on Nasdaq Capital Market, was approximately $13,358,252.

As of September 24, 2024, 5,154,778 shares of common stock, $0.001 par value per share, were issued and outstanding.

DATASEA INC.

Annual Report on Form 10-K

For the Fiscal Year Ended June 30, 2024

TABLE OF CONTENTS

All references to “Company,” “we,” or “us” in this report refer to Datasea Inc., a Nevada corporation, its consolidated subsidiaries, and the variable interest entity (“VIE”), unless the context otherwise indicates.

All references to “Datasea” in this report refer to Datasea Inc., a Nevada corporation, not including its consolidated subsidiaries and VIE, unless the context otherwise indicates.

“VIE” or “consolidated VIE” refers to Shuhai Information Technology Co., Ltd. (“Shuhai Beijing”), a variable interest entity.

“WFOE” or “PRC Subsidiary,” which is a wholly foreign owned entity and is a corporation organized under the laws of the PRC and wholly owned by us, through our subsidiary. The WFOE is Tianjin Information Sea Information Technology Co., Ltd. (“Tianjin Information” or “WFOE”).

“PRC” or “China” refers to the People’s Republic of China, excluding, for the purpose of this report only, Taiwan. “RMB” or “Renminbi” refers to the legal currency of China and “$”, “US$”, “USD” or “U.S. Dollars” refers to the legal currency of the United States.

Our reporting currency is the US$. The functional currency of the entities located in China is the RMB. For the entities whose functional currency is the RMB, results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the exchange rate at the end of the period, and equity is translated at historical exchange rates. As a result, amounts relating to assets and liabilities reported on the statements of cash flows may not necessarily agree with the changes in the corresponding balances on the balance sheets. Translation adjustments resulting from the process of translating the local currency financial statements into US$ are included in determining comprehensive income/loss. Transactions denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing on the transaction dates. Assets and liabilities denominated in foreign currencies are translated into the functional currencies at the exchange rates prevailing at the balance sheet date with any transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions of performance; and statements of belief; and any statements of assumptions underlying any of the foregoing. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

In some cases, you can identify forward looking statements by terms such as “may,” “intend,” “might,” “will,” “should,” “could,” “would,” “expect,” “believe,” “anticipate,” “estimate,” “predict,” “potential,” or the negative of these terms. These terms and similar expressions are intended to identify forward-looking statements. The forward-looking statements in this report are based upon management’s current expectations and belief, which management believes are reasonable. However, we cannot assess the impact of each factor on our business or the extent to which any factor or combination of factors, or factors we are aware of, may cause actual results to differ materially from those contained in any forward-looking statements. You are cautioned not to place undue reliance on any forward-looking statements. These statements represent our estimates and assumptions only as of the date of this report. Except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Our business operations are primarily based in China, and the VIE and its subsidiaries are subject to certain legal and operational risks associated with being based in China. On December 28, 2021, the Cyberspace Administration of China (“CAC”), and 12 other relevant PRC government authorities published the amended Cybersecurity Review Measures, which came into effect on February 15, 2022. The final Cybersecurity Review Measures provide that a “network platform operator” that possesses personal information of more than one million users and seeks a listing in a foreign country must apply for a cybersecurity review. Further, the relevant PRC governmental authorities may initiate a cybersecurity review against any company if they determine certain network products, services, or data processing activities of such company affect or may affect national security. As of the latest practicable date, our Company, the VIE and its subsidiaries have not been involved in any investigations on cybersecurity review initiated by any PRC regulatory authority, nor has any of them received any inquiry, notice or sanction. We do not believe that we are subject to: (a) the cybersecurity review with the CAC, as we do not possess a large amount of personal information in our business operations, and our business does not involve the collection of data that affects or may affect national security, implicates cybersecurity, or involves any type of restricted industry; or (b) merger control review by China’s anti-monopoly enforcement agency due to the fact that we do not engage in monopolistic behaviors that are subject to these statements or regulatory actions. On February 17, 2023, the China Securities Regulatory Commission (“CSRC”), issued the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the Trial Measures, which became effective on March 31, 2023. Pursuant to the Trial Measures, domestic companies that seek to offer or list securities overseas, both directly and indirectly, should fulfill the filing procedure and report relevant information to the CSRC. We are required by the Trial Measures to submit a filing to the CSRC and complete the filing procedures of any overseas public offering, but there is no certainty that we will be able to complete such filings in a timely manner. Any failure or perceived failure by us to comply with such filing requirements under the Trial Measures may result in forced corrections, warnings and fines against us and could materially hinder our ability to offer or continue to offer our securities. It remains highly uncertain the impact of such modified or new laws and regulations will have on our daily business operation, our ability to accept foreign investments and list on an U.S. or other foreign exchange. As a result of the legal and operational risks associated with us being based in and having the majority of our operations in China, such risks could result in a material change in our operations and/or the value of our securities and could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. Please see “Risks Associated With Doing Business in China” and the associated risk factor on page 58.

Since 2021, the Chinese government has strengthened its anti-monopoly supervision, mainly in three aspects: (1) establishing the National Anti-Monopoly Bureau; (2) revising and promulgating anti-monopoly laws and regulations, including: the Anti-Monopoly Law (draft Amendment published on October 23, 2021 for public opinions), the anti-monopoly guidelines for various industries, and the detailed Rules for the Implementation of the Fair Competition Review System; and (3) expanding the anti-monopoly law enforcement targeting Internet companies and large enterprises. As of the date of this report, the Chinese government’s recent statements and regulatory actions related to anti-monopoly concerns have not impacted our ability to conduct business, accept foreign investments, or list on a U.S. or other foreign exchange because neither the Company nor its PRC operating entities engage in monopolistic behaviors that are subject to these statements or regulatory actions. Please see “Risks Associated With Doing Business in China” and the associated risk factor on page 58.

As a holding company with no material operations of our own, we conduct a substantial majority of our operations through our operating entities established in the People’s Republic of China, or the PRC, primarily our variable interest entity and its subsidiaries, collectively, the VIE. Due to PRC legal restrictions on foreign ownership in certain internet-related businesses we may explore and operate in the future, we do not have any equity ownership of the VIE, but instead we control and receive the economic benefits of the VIE’s business operations through certain contractual arrangements. We believe such VIE contractual arrangements have not been tested in a court of law in the PRC. Our shares of common stock listed on the Nasdaq Capital Market are shares of our Nevada holding company that maintains service agreements with the associated operating companies. As an investor of our common stock, you may never directly hold equity interests in the Chinese operating companies. There is a risk that the Chinese government may in the future seek to affect operations of any company with any level of operations in PRC, including its ability to offer securities to investors, list its securities on a U.S. or other foreign exchange, conduct its business or accept foreign investment. Substantial uncertainties and restrictions with respect to the political and economic policies of the PRC government and PRC laws and regulations could have a significant impact upon the business that we may be able to conduct in the PRC and accordingly on the results of our operations and financial condition. If the Chinese regulatory authorities disallow our structure or any or all of the foregoing were to occur, it could, in turn, result in a material change in the Company’s operations and/or the value of its common stock and/or significantly limit or completely hinder its ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

On May 20, 2020, the U.S. Senate passed the Holding Foreign Companies Accountable Act (“HFCAA”) requiring a foreign company to certify it is not owned or controlled by a foreign government if the Public Company Accounting Oversight Board (“PCAOB”) is unable to audit specified reports because the company uses a foreign auditor not subject to PCAOB inspection. If the PCAOB is unable to inspect the company’s auditors for three consecutive years, the issuer’s securities are prohibited to trade on a national exchange. On December 18, 2020, the HFCAA was signed into law. On September 22, 2021, the PCAOB adopted a final rule implementing the Holding Foreign Companies Accountable Act (“HFCAA”), which became law in December 2020 and prohibits foreign companies from listing their securities on U.S. exchanges if the company has been unavailable for PCAOB inspection or investigation for three consecutive years. In addition, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”), and on December 29, 2022, a legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by President Biden, which contained, among other things, an identical provision to the AHFCAA and amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time period for triggering the prohibition on trading. Our auditor, an independent registered public accounting firm that issued the audit report with this annual report, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. Our auditor is headquartered in New York and has been inspected by the PCAOB on a regular basis. Notwithstanding the foregoing, in the future, if there is any regulatory change or step taken by PRC regulators that does not permit our auditor to provide audit documentations located in China or Hong Kong to the PCAOB for inspection or investigation, you may be deprived of the benefits of such inspection which could result in limitation or restriction to our access to the U.S. capital markets and trading of our securities, including trading on the national exchange and trading on “over-the-counter” markets. Please see “Risks Associated With Doing Business in China” and the associated risk factor on page 58 for more information.

Our contractual agreements with the VIE have not been tested in court in China and this structure involves unique risks to investors. For example, the PRC government could disallow the VIE arrangements, which would likely result in a material change in our operations and structure and significant change in the value of our securities. Such could cause the value of such securities to significantly decline or become worthless. See “Risk Factors—Risks Relating to our Corporate Structure” and the associated risk factor on page 54 for more information.

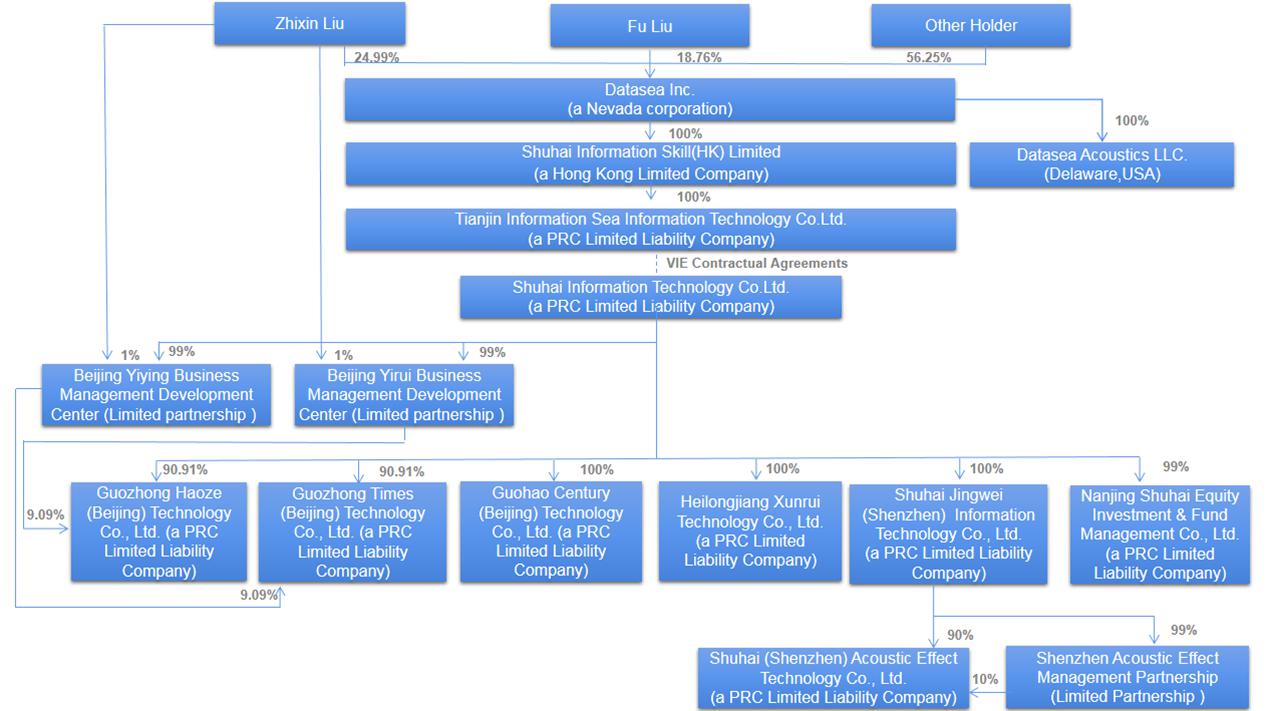

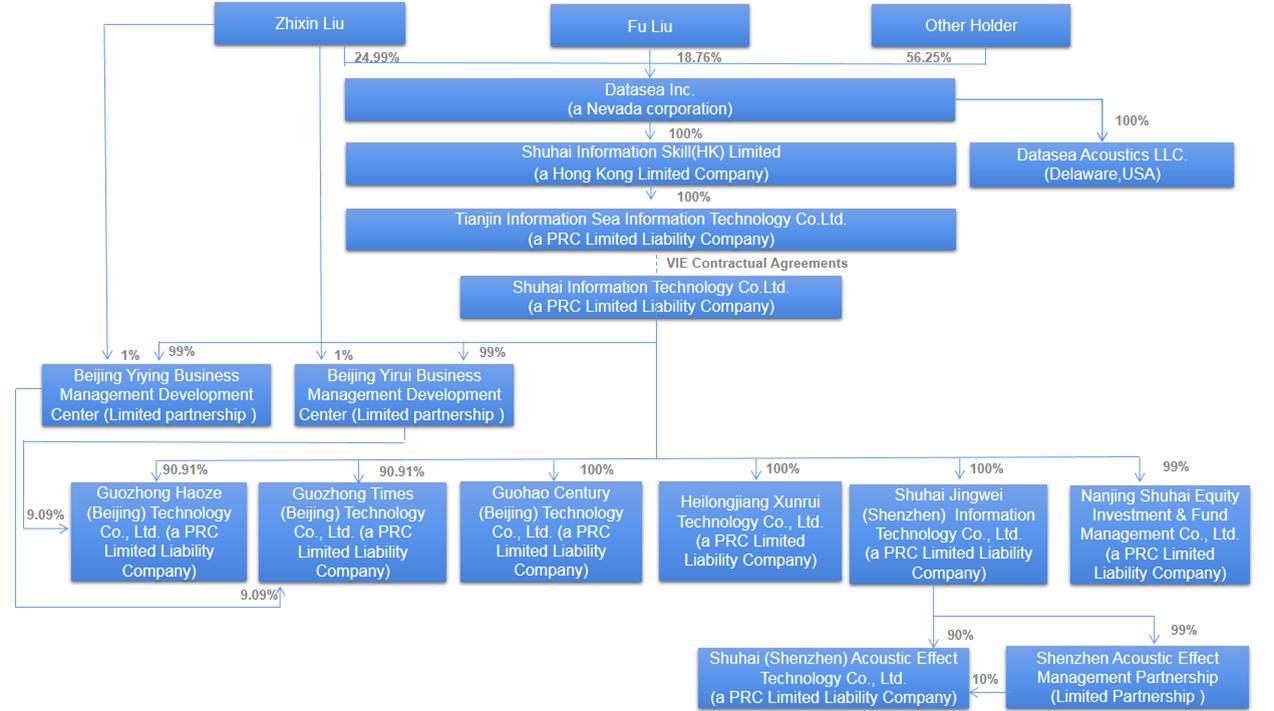

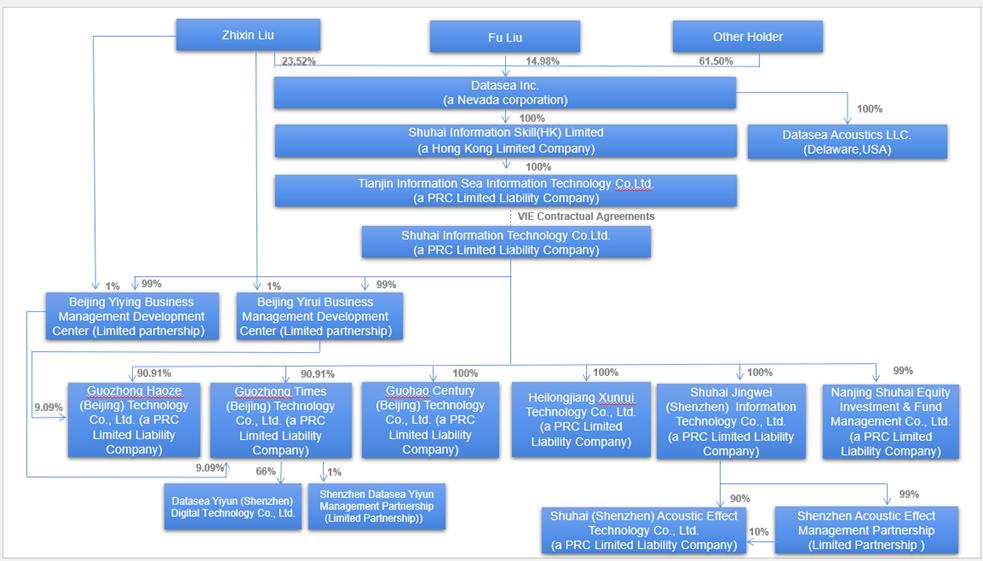

Below is our organizational chart as of the date of this annual report.

You should be aware that our actual results could differ materially from those contained in the forward-looking statements due to a number of factors (some of which may be beyond our control), including:

| ● | uncertainties relating to our ability to establish and operate our business in China; uncertainties regarding the enforcement of laws and the fact that rules and regulations in China can change quickly with little advance notice, along with the risk that the Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers could result in a material change in our operations, financial performance and/or the value of our common stock or impair our ability to raise money. |

| ● | We depend upon the VIE Agreements in conducting our business in the PRC, which may not be as effective as a direct ownership structure. |

| ● | We may not be able to consolidate the financial results of some of our affiliated companies through the VIE Agreements or such consolidation could materially adversely affect our operating results and financial condition. |

| ● | our ability to operate our company as a U.S. publicly-reporting and listed enterprise; |

| ● | uncertainties relating to general economic and business conditions in China and worldwide; |

| ● | industry trends and changes in demand for our products and services; |

| ● | uncertainties relating to customer plans and commitments and the timing of orders received from customers; |

| ● | announcements or changes in our pricing policies or that of our competitors; |

| ● | unanticipated delays in the development, commercialization or market acceptance of our products and services; |

| ● | changes in Chinese government regulations; |

| ● | availability, terms and deployment of capital; relationships with third-party equipment suppliers; and |

| ● | political stability and economic growth in China. |

PART I

Item 1. Description of Business

OVERVIEW

Company Structure

Datasea Inc. is a technology company incorporated in Nevada, USA, on September 26, 2014, with subsidiaries and operating entities located in Delaware, US, and China. The company provides acoustic business services (focusing on high-tech acoustic technologies and applications such as ultrasound, infrasound, and Schumann resonance), 5G application services (5G AI multimodal digital business), and other products and services to various corporate and individual customers.

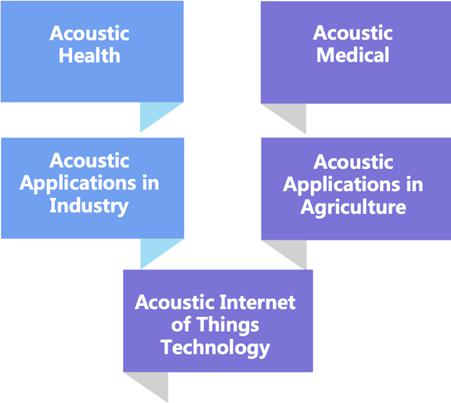

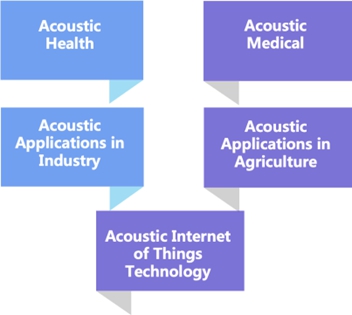

In the acoustic business sector, Datasea is a global pioneer of the “acoustic effect” concept. Utilizing global leading “Acoustics + AI” precision manufacturing as the digital application framework, and leveraging sound wave technologies combined with acoustic effects as the technological system, the company outputs acoustic high-tech products and solutions worldwide. Datasea strives to be a leader in the development of China’s high-tech precision manufacturing in the acoustic industry. Our products have wide-ranging applications across various industries and sectors, including acoustic agriculture, acoustic industry, acoustic medicine, acoustic health, and acoustic IoT technologies. In the 5G application sector, Datasea provides digital and intelligent services to enterprises and individual users in China, leveraging AI, machine learning, and data analytic capabilities to offer a wide range of 5G application products and solutions.

For the fiscal year ending June 30, 2024, our revenue was $23,975,867, reflecting a 558.6% increase compared to the same period in 2023. This revenue growth is primarily due to the rapid expansion of our 5G AI multimodal communication business in China, with the company’s 5G AI digital business maintaining a leading position in the industry. Our growing customer base continues to support substantial business growth.

Additionally, as of the date of September 20, the company has received approximately RMB 152.40 million (equivalent to $21.37 million) in cash prepayments from large customers of our 5G AI multimodal digital business. These prepayments represent service obligations that have not yet been recognized as revenue for this fiscal year and will be recognized in future financial statements. The total value of contracts currently in execution, which will be recognized as revenue, exceeds $100 million.

Datasea’s common stock currently listed on the Nasdaq Capital Market are shares of our Nevada holding company that maintains service agreements with the associated operating companies which enable us to consolidate the financial results of the VIE and its subsidiaries with Datasea’s corporate group under U.S. GAAP, making Datasea the primary beneficiary of the VIE for accounting purposes. For a description of our corporate structure and contractual arrangements, see “Our Organizational Structure” on page 34 and “VIE Agreements” on page 5.

Datasea is not a Chinese operating company but a Nevada-based holding company with its Delaware subsidiary, Datasea Acoustics LLC, serving as our U.S.-based international business platform. Additionally, through the Company’s subsidiary in China – Tianjin Information Sea Information Technology Co., Ltd (“Shuhai Tianjin”) and the VIE, Shuhai Information Technology Co., Ltd. (“Shuhai Beijing”), we carry out business activities in China, along with their subsidiary entities. Shuhai Beijing possesses cutting-edge products and solutions in acoustics high tech and 5G AI multimodal digital applications to support commercial enterprises, households and individuals in China.

The development and internationalization of acoustic products, including acoustic industry, acoustic agriculture, acoustic medicine, and acoustic health, have always been a crucial strategy for the Company. Following the establishment of its wholly-owned subsidiary, Datasea Acoustics LLC, in Delaware in July 2023, the Company has actively implemented its global strategy. As of the date of this report, the Company has partnered with several well-known U.S. online retailers and local smart product distributors, including iPower Inc. (NASDAQ: IPW) and Meglio Interiors LLC (“Meglio”), based in Chamblee, Georgia, to expand the online and physical store distribution of its acoustic-related products in the U.S. Additionally, in collaboration with the renowned U.S. intellectual property firm Paul & Paul, we are actively pursuing patent applications and acquiring high-quality patents to build a strong international intellectual property portfolio. Focusing on the core area of acoustic high-tech, we are seeking potential merger and acquisition targets in applications for agriculture and industry, acoustic medical aesthetics, acoustic health, and acoustic IoT technologies. This is part of our strategy for international expansion through mergers and acquisitions. On October 16, 2023, the Company’s Delaware-based subsidiary, Datasea Acoustics LLC, signed a marketing promotion and sales cooperation agreement with Meglio to develop, promote, and distribute itsacoustics high tech products in the U.S. On April 19, 2024, the Company entered into a Framework Agreement with iPower Inc. (NASDAQ: IPW) for product cooperation, marking the beginning of a joint effort to enhance product distribution in the U.S. online market.

On the other hand, Datasea continues to invest in the research and application of 5G AI multimodal digital technology, aiming to provide customers with cutting-edge intelligent solutions. As a pioneer in China’s 5G multimodal digital field, Datasea deeply integrates the high-speed, low-latency capabilities of 5G networks with AI and big data processing technologies to create a comprehensive AI multimodal digital platform spanning multiple industries. Datasea’s AI multimodal digital products and solutions are widely applied in areas such as rural revitalization, healthcare, and logistics, helping over 48.42 million enterprises and households in China (with over 99% being small and medium-sized enterprises) by providing digital and intelligent services, driving industrial upgrades and fostering innovative development.

Technology and Innovation

Datasea is one of the global initiators of the concept of “acoustic high-tech.” By leveraging cutting-edge “acoustic + AI” precision manufacturing for digital applications and integrating acoustic technology with digital electronics, we aim to deliver advanced acoustic high-tech products and solutions worldwide, positioning ourselves as a leader and pioneer in China’s high-tech precision manufacturing within the acoustic industry.

The company focuses on the acoustic high-tech industry, particularly in the research of ultrasound, infrasound, and Schumann resonance technologies. By analyzing and introducing new industry segments within acoustic high-tech, we drive the development and application of these technologies, including in-depth research on non-audible mechanical wave effects, which distinguishes us from others in the field. We combine acoustic chemistry, mechanical transduction, and vibrational dynamics with artificial intelligence (AI), large language models, and data analytics. Our acoustic high-tech products and 5G AI multimodal communication solutions serve over 48.42 million enterprises (with over 99% being small and medium-sized enterprises) and households in China.

Datasea, rooted in the acoustic intelligence industry, is advancing rapidly in terms of technological innovation, product creation, and industry application. The company emphasizes deep domestic and international collaboration and fosters the integration of industry, academia, and research. Focusing on the acoustic intelligence industry, we have established five key segments in the acoustic sector, leading the industry forward and providing cutting-edge acoustic intelligence technologies and products.

As of the date of this report, Shuhai Beijing and its subsidiaries own 21 Patents and 139 Software Copyrights in the PRC, which include 9 pending patent applications in core technologies, to empower and grow the business. In addition, the U.S. subsidiary, Datasea Acoustics, is actively acquiring U.S. patents, as well as international patents, and collaborating with U.S. universities and world-renowned research institutions.

The Company holds an outstanding position in the field of acoustics, particularly in areas such as ultrasound, infrasound, and directional sound. To promote research and innovation in these areas, the Company actively collaborates with several prominent research institutions and universities, including Chinese Academy of Sciences Institute of Acoustics, China Academy of Information and Communications Technology Cloud Computing and Big Data Research Institute, Tsinghua University Internet Industry Research Institute, Harbin Institute of Technology Artificial Intelligence Research Institute, Beijing Union University, and Jilin University Remote Sensing Research Institute. The Company, together with these partners, is dedicated to conducting research on new topics and developing novel technology applications to drive advancements in the field of acoustics. To better achieve this goal, the Company collaborated for oint laboratories to enhance the integration and collaboration of research resources. These collaborations and the establishment of these laboratories further solidify the Company’s leading position in the field of acoustics, providing a strong foundation for future innovations and development.

China’s inaugural White Paper on High-Tech Acoustic Industry.Additionally, the company has jointly released China’s first white paper on the high-tech acoustic industry with the Ministry of Industry and Information Technology, the Key Laboratory for Artificial Intelligence Technologies and Applications Evaluation, and the Cloud Computing and Big Data Research Institute of the China Academy of Information and Communications Technology. This white paper provides a comprehensive analysis and authoritative presentation of acoustic technology, its commercialization, and industry prospects. It discusses in detail the application of high-tech acoustics in various sectors, showcases Datasea’s proactive initiatives in leading industry development, and highlights the company’s leading position in the high-tech acoustic field both in China and globally. The white paper not only demonstrates Datasea’s pioneering role in setting industry standards but also further consolidates the company’s strategic importance in advancing acoustic technology on both a national and global scale.

Business Strategy

Sustained Revenue Growth: Implement strategic initiatives such as expanding the sales team, enhancing distribution networks, exploring new markets in both domestic and U.S. regions, and offering value-added services to drive continuous revenue expansion.

Technological Innovation: Datasea continues to invest in research and development (R&D) to maintain its leading position in the field of non-audible mechanical wave effects in acoustics. This includes leveraging the cavitation, thermal, and mechanical effects of ultrasound to meet various application needs, such as disinfection, pesticide-free pest control for crops, livestock and pet health management, skincare, and medical wellness. These innovations are designed to address global market demands and ensure a competitive edge.

Additionally, Datasea is continuously upgrading its core 5G AI multimodal digital business through AI processing technology. This includes AI-driven creation and generation of various information forms, such as sound, text, images, and videos, as well as efficient transmission and AI digital marketing functions. These advancements ensure Datasea’s leading position in shaping the 5G digital technology landscape.

International Expansion: Focus on international growth, particularly in the U.S. market. Leverage the operations of U.S. subsidiaries, engage in mergers and acquisitions, ensure compliance, adapt to market dynamics, and practice effective cross-cultural management.

Technology Collaboration: Datasea can foster collaborations with renowned U.S. universities and research institutions through its U.S. subsidiary. By partnering with these institutions, the Company can engage in joint research and development initiatives to create and adopt cutting-edge acoustics high tech technologies. This collaborative approach helps Datasea maintain its technological leadership and obtain technical capabilities and reserves in relevant fields globally.

U.S. Patent Acquisition and Technology Protection: Building on its extensive portfolio of Chinese patents, Datasea prioritizes acquiring U.S. patents to protect its innovations and intellectual property. Rapidly securing U.S. patents is crucial for maintaining competitive advantage and defending against potential infringement. This proactive patent acquisition strategy will ensure that Datasea’s intellectual property is protected in the U.S. market, while also creating opportunities for licensing and monetization. These strategies will further strengthen Datasea’s position in the global market and enhance its innovation capacity.

Mergers and Acquisitions (M&A) and Joint Ventures: Datasea can expand its product and service portfolio globally through mergers and acquisitions or by forming joint ventures to meet growing market demands. By identifying companies that are related to or complementary to its existing areas of expertise, Datasea can rapidly scale its business and market presence. For instance, through M&A and collaborations in the U.S. market, Datasea can further solidify its foundation, market depth, and brand localization in the high-tech acoustics industry.

Compensation and Incentives: To recognize the contributions of directors, executives, employees, consultants, and other external partners to the Company’s growth, a multi-layered compensation and incentive system has been established. This includes stock awards for publicly traded companies and equity holdings in core business subsidiaries. To date, the Company has consistently issued relevant stocks under its stock incentive program to directors, executives, employees, and external consultants. Additionally, stockholding platforms have been set up for three core business subsidiaries in China, attracting key teams and sales partners to maximize the incentive effect. Looking ahead, the Company plans to extend stock incentive measures to more teams and consulting agencies that make significant contributions, further encouraging and ensuring active participation from talent within the organization.

Sustainable Growth: The Company can adopt a sustainable approach to ensure long-term success. This involves focusing on Environmental, Social, and Governance (ESG) issues, ensuring that the Company’s operations align with global best practices, and providing sustainable solutions to meet demands of customers.

Market diversification: In the domestic market, Datasea can continue to provide acoustics high tech and 5G AI multimodal digital products to various end users, such as corporate customers and household users, to ensure market diversification. In the international market, Datasea intends to target U.S. households and large corporate customers including hospitals, hotels, and schools with leading and high-quality ultrasonic air sterilization, bathroom and cloakroom sterilization and odor removal products, helping to diversify risks and provide broader growth opportunities.

Regulatory Compliance: When expanding into international markets, the Company needs to closely adhere to regulations and laws in various countries and regions. Ensuring compliance is crucial for our long-term success.

Cost Control and Efficiency Improvement: Optimize enterprise operational processes, reduce costs, enhance production efficiency and resource utilization efficiency to strengthen profitability.

Brand Building and Reputation Management: Strengthen corporate brand image, enhance brand awareness and influence, maintain good corporate reputation, ensure the company’s competitive position and sustainable development in the market.

Risk Management: Diligently identify, evaluate, and manage various risks, including those related to the market, legal compliance, and the supply chain.

In summary, Datasea can pursue its business strategy through international business expansion, technological innovation, contracts and collaborations, and a sustainable growth approach. This will help ensure that the Company gains a competitive advantage in global markets and creates sustainable value for its shareholders.

VIE AGREEMENTS

Shuhai Information Technology Co., Ltd. (“Shuhai Beijing” or the “VIE”) is the VIE of our corporate group that is under contractual control by Datasea. Through contractual arrangements (the “VIE Agreements”) with Shuhai Beijing, and its shareholders, Zhixin Liu, a stockholder as well as the Chairman, President and CEO of Datasea, and Fu Liu, a stockholder as well as a Director of Datase, we receive benefits from the business and lead the daily operation of Shuhai Beijing. Please refer to a condensed consolidating schedule that disaggregates the operations and depicts the financial position, cash flows, and results of operations as of the dates and for the periods stated therein at pages F-1 to F-34 of this Annual Report.

Operation and Intellectual Property Service Agreement – The Operation and Intellectual Property Service Agreement allows Tianjin Information Sea Information Technology Co., Ltd (“WFOE”) to manage and operate Shuhai Beijing and collect an operating fee equal to Shuhai Beijing’s pre-tax income, per month. If Shuhai Beijing suffers a loss and as a result does not have pre-tax income, such loss shall be carried forward to the following month to offset the operating fee to be paid to WFOE if there is pre-tax income of Shuhai Beijing the following month. Furthermore, if Shuhai Beijing cannot pay off its debts, WFOE shall pay off the debt on Shuhai Beijing’s behalf. If Shuahi Beijing’s net assets fall lower than its registered capital balance, WFOE shall provide capital for Shuahi Beijing to make up for the deficit.

Under the terms of the Operation and Intellectual Property Service Agreement, Shuhai Beijing entrusts Tianjin Information to manage its operations, manage and control its assets and financial matters, and provide intellectual property services, purchasing management services, marketing management services and inventory management services to Shuhai Beijing. Shuhai Beijing and its stockholders shall not make any decisions nor direct the activities of Shuhai Beijing without Tianjin Information’s consent.

Stockholders’ Voting Rights Entrustment Agreement – Tianjin Information has entered into a stockholders’ voting rights entrustment agreement (the “Entrustment Agreement”) under which Zhixin Liu and Fu Liu (collectively the “Shuhai Beijing Stockholders”) have vested their voting power in Shuhai Beijing to Tianjin Information or its designee(s). The Entrustment Agreement does not have an expiration date, but the parties can agree in writing to terminate the Entrustment Agreement. Zhixin Liu, is the Chairman of the Board, President, CEO of DataSea and Corporate Secretary, and Fu Liu, a Director of the DataSea (Fu Liu is the father of Zhixin Liu).

Equity Option Agreement – Shuhai Beijing stockholders and Tianjin Information entered into an equity option agreement (the “Option Agreement”), pursuant to which the Shuhai Beijing stockholders have granted Tianjin Information or its designee(s) the irrevocable right and option to acquire all or a portion of Shuhai Beijing Stockholders’ equity interests in Shuhai Beijing for an option price of RMB0.001 for each capital contribution of RMB1.00. Pursuant to the terms of the Option Agreement, Tianjin Information and the Shuhai Beijing Stockholders have agreed to certain restrictive covenants to safeguard the rights of Tianjin Information under the Option Agreement. Tianjin Information agreed to pay RMB1.00 annually to Shuhai Beijing stockholders to maintain the option rights. Tianjin Information may terminate the Option Agreement upon prior written notice. The Option Agreement is valid for a period of 10 years from the effective date and renewable at Tianjin Information’s option.

Equity Pledge Agreement – Tianjin Information and the Shuhai Beijing Stockholders entered into an equity pledge agreement on October 27, 2015 (the “Equity Pledge Agreement”). The Equity Pledge Agreement serves to guarantee the performance by Shuhai Beijing of its obligations under the Operation and Intellectual Property Service Agreement and the Option Agreement. Pursuant to the Equity Pledge Agreement, Shuhai Beijing Stockholders have agreed to pledge all of their equity interests in Shuhai Beijing to Tianjin Information. Tianjin Information has the right to collect any and all dividends, bonuses and other forms of investment returns paid on the pledged equity interests during the pledge period. Pursuant to the terms of the Equity Pledge Agreement, the Shuhai Beijing Stockholders have agreed to certain restrictive covenants to safeguard the rights of Tianjin Information. Upon an event of default or certain other agreed events under the Operation and Intellectual Property Service Agreement, the Option Agreement and the Equity Pledge Agreement, Tianjin Information may exercise the right to enforce the pledge.

There are a number of uncertainties regarding the status of the rights of Datasea, our Nevada holding company, with respect to its contractual arrangements with the VIE, its founders and owners, including whether the PRC legal system could limit our ability to enforce these contractual agreements due to uncertainties under Chinese law and jurisdictional limits. Due to PRC legal restrictions on foreign ownership in any internet-related businesses we may explore and operate, we do not have any equity ownership of the VIE, but instead we receive the economic benefits of the VIE’s business operations through certain contractual arrangements. Our common stock currently listed on the Nasdaq Capital Markets are shares of our Nevada holding company that maintains service agreements with the associated operating companies. The Chinese regulatory authorities could disallow our structure, which could result in a material change in our operations and the value of our securities could decline or become worthless.

We believe that our corporate structure and contractual arrangements comply with the current applicable PRC laws and regulations. We also believe that each of the contracts among our wholly-owned PRC subsidiary, our consolidated VIE and its shareholders is valid, binding and enforceable in accordance with its terms. However, there are substantial uncertainties regarding the interpretation and application of current and future PRC laws and regulations. Thus, the PRC governmental authorities may take a view contrary to the opinion of our PRC legal counsel. It is uncertain whether any new PRC laws or regulations relating to variable interest entity structure will be adopted or if adopted, what they would provide. PRC laws and regulations governing the validity of these contractual arrangements are uncertain and the relevant government authorities have broad discretion in interpreting these laws and regulations.

Having our operations conducted by the subsidiaries and through contractual arrangements with a variable interest entity (VIE) based in China involves unique risks to investors. The VIE structure is used to allow foreign investment in China-based companies where Chinese law prohibits or restricts direct foreign investment in the operating entities, and Datasea’s shareholders may never directly hold equity interests in our Chinese operating entities. The VIE contractual agreement has not been tested in court. We may have to incur substantial costs and expend significant resources to enforce such arrangements in reliance on legal remedies under PRC law.

All of these contractual arrangements are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. Accordingly, these contracts would be interpreted in accordance with PRC laws and any disputes would be resolved in accordance with PRC legal procedures. In addition, contractual arrangements entered into by the subsidiary and the PRC operating affiliate may be subject to scrutiny by the PRC tax authorities. Such scrutiny may lead to additional tax liability and fines, which would hinder our ability to achieve or maintain profitability. If the PRC government deems that the VIE Agreements do not comply with PRC regulatory restrictions on foreign investment in the relevant industries or other laws or regulations of the PRC, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations, which may therefore materially reduce the value of our ordinary shares. In the event that in the future a company we hold as a VIE no longer meets the definition of a VIE under applicable accounting rules, or we are deemed not to be the primary beneficiary, we would not be able to consolidate line by line that entity’s financial results in our consolidated financial statements for reporting purposes. For a detailed discussion of risks facing the Company as a result of this VIE structure, please see “Risks Relating to our Corporate Structure” from page 54 to page 57 in the Annual Report.

SUMMARY CONSOLIDATED FINANCIAL DATA

The following historical statements of operations and statements of cash flows for the fiscal years ended June 30, 2023 and June 30, 2024, and balance sheet data as of June 30, 2023 and June 30, 2024, which have been derived from our audited financial statements for those periods. Our historical results are not necessarily indicative of the results that may be expected in the future.

Condensed Consolidated Statements of Operations Information

| Year Ended June 30, 2024 | ||||||||||||||||||||||||

| PARENT | SUBSIDIARIES | WOFE | VIE | Elimination | Consolidated | |||||||||||||||||||

| Revenue - third parties | $ | - | $ | - | $ | 69,541 | $ | 23,906,326 | $ | 23,975,867 | ||||||||||||||

| Revenue - Parent provided service to WOFE | 275,100 | (275,100 | ) | - | ||||||||||||||||||||

| Revenue-Parent provided service to VIE | 143,600 | (143,600 | ) | - | ||||||||||||||||||||

| Revenue - WOFE provided service to VIE | 489,386 | (489,386 | ) | - | ||||||||||||||||||||

| Revenue - VIE purchased materials from WOFE | 57,082 | (57,082 | ) | |||||||||||||||||||||

| Revenue - from VIE’s label that was used by WOFE | 264,533 | (264,533 | ) | - | ||||||||||||||||||||

| Revenue - WOFE purchased materials from VIE | 57,082 | (57,082 | ) | |||||||||||||||||||||

| - | ||||||||||||||||||||||||

| Cost of Revenue - third parties | 69,156 | 23,432,606 | 23,501,762 | |||||||||||||||||||||

| COST - VIE purchased materials from WOFE | 57,082 | (57,082 | ) | |||||||||||||||||||||

| COST - WOFE purchased materials from VIE | - | 57,082 | (57,082 | ) | ||||||||||||||||||||

| - | - | |||||||||||||||||||||||

| Gross profit | 418,700 | - | 489,771 | 738,253 | (1,172,619 | ) | 474,105 | |||||||||||||||||

| Operating expenses | 6,996,227 | 324,954 | 3,535,554 | 1,742,757 | 12,599,492 | |||||||||||||||||||

| Operating expenses - VIE expenses, corresponding to services provided by WOFE | 489,386 | (489,386 | ) | - | ||||||||||||||||||||

| Operating expenses - WOFE expenses for using VIE’s label | 264,533 | (264,533 | ) | |||||||||||||||||||||

| Operating expenses – WOFE expenses, corresponding to services provided by Parent | 278,862 | (278,862 | ) | |||||||||||||||||||||

| Operating expenses - VIE expenses, corresponding to services provided by Parent | 146,150 | (146,150 | ) | - | ||||||||||||||||||||

| Loss from operations | (6,577,527 | ) | (324,954 | ) | (3,589,178 | ) | (1,640,040 | ) | 6,312 | (12,125,387 | ) | |||||||||||||

| Other income (expenses), net | (1,665 | ) | (61 | ) | 3,108 | (97,300 | ) | (95,918 | ) | |||||||||||||||

| Income tax expense | - | |||||||||||||||||||||||

| Loss before noncontrolling interest | (6,579,192 | ) | (325,015 | ) | (3,586,070 | ) | (1,737,340 | ) | 6,312 | (12,221,305 | ) | |||||||||||||

| Less: loss attributable to noncontrolling interest | (10,695 | ) | (10,695 | ) | ||||||||||||||||||||

| Net loss to the Company | (6,579,192 | ) | (325,015 | ) | (3,586,070 | ) | (1,726,645 | ) | 6,312 | (12,210,610 | ) | |||||||||||||

| Year Ended June 30, 2023 | ||||||||||||||||||||||||

| PARENT | SUBSIDIARIES | WOFE | VIE | Elimination | Consolidated | |||||||||||||||||||

| Revenue - third parties | $ | - | $ | - | $ | - | $ | 7,045,311 | $ | 7,045,311 | ||||||||||||||

| Revenue - Parent provided service to VIE | 453,500 | (453,500 | ) | - | ||||||||||||||||||||

| Revenue - WOFE’s label that was used by VIE | 81,544 | (81,544 | ) | - | ||||||||||||||||||||

| Revenue - from VIE’s label that was used by WOFE | 751,125 | (751,125 | ) | - | ||||||||||||||||||||

| Cost of Revenue - third parties | 6,704,380 | 6,704,380 | ||||||||||||||||||||||

| Gross profit | 453,500 | 81,544 | 1,092,056 | (1,286,169 | ) | 340,931 | ||||||||||||||||||

| Operating expenses | 5,082,029 | 366,767 | 766,269 | 3,811,086 | 10,026,151 | |||||||||||||||||||

| Operating expenses -VIE expenses, corresponding to services provided by WOFE | 81,544 | (81,544 | ) | - | ||||||||||||||||||||

| Operating expenses -WOFE expenses for using VIE’s label | 751,460 | (751,460 | ) | - | ||||||||||||||||||||

| Operating expenses -VIE expenses, corresponding to services provided by Parent | 453,500 | (453,500 | ) | - | ||||||||||||||||||||

| Loss from operations | (4,628,529 | ) | (366,767 | ) | (1,436,185 | ) | (3,253,739 | ) | (9,685,220 | ) | ||||||||||||||

| Other income (expenses), net | (1,005 | ) | (584 | ) | (5,260 | ) | (5,946 | ) | (12,795 | ) | ||||||||||||||

| Income tax expense | - | |||||||||||||||||||||||

| Loss before noncontrolling interest | (4,629,534 | ) | (367,351 | ) | (1,441,455 | ) | (3,259,685 | ) | (9,698,015 | ) | ||||||||||||||

| Less: loss attributable to noncontrolling interest | (218,323 | ) | (218,323 | ) | ||||||||||||||||||||

| Net loss to the Company | (4,629,534 | ) | (367,351 | ) | (1,441,445 | ) | (3,041,362 | ) | - | (9,479,692 | )* | |||||||||||||

| * | Include the operation of Zhangxun (see Note 13 Disposal of Subsidiary) |

Condensed Consolidated Balance Sheets Information

| As of June 30, 2024 | ||||||||||||||||||||||||

| PARENT | SUBSIDIARIES | WOFE | VIE | Elimination | Consolidated | |||||||||||||||||||

| Cash | $ | 79,225 | $ | 1,249 | $ | 7,634 | $ | 93,154 | $ | 181,262 | ||||||||||||||

| Accounts receivable | 718,546 | 718,546 | ||||||||||||||||||||||

| Accounts receivable - VIE | 760,708 | (760,708 | ) | - | ||||||||||||||||||||

| Accounts receivable - WOFE | - | |||||||||||||||||||||||

| Inventory | 34,530 | 119,053 | 153,583 | |||||||||||||||||||||

| Inventory - VIE | - | - | ||||||||||||||||||||||

| Inventory - WOFE | 41,147 | (41,147 | ) | - | ||||||||||||||||||||

| Other receivables-Subsidiaries | 5,015 | 832 | 2,427 | (8,274 | ) | - | ||||||||||||||||||

| Other receivables - VIE | 475,223 | 12,971,457 | (13,446,680 | ) | - | |||||||||||||||||||

| Other receivables - WOFE | 6,304,226 | 1,412,607 | (7,716,833 | ) | - | |||||||||||||||||||

| Other receivables - Parent | 5,000 | (5,000 | ) | |||||||||||||||||||||

| Other current assets | 5,000 | - | 1,292,945 | 295,305 | 1,251 | 1,594,501 | ||||||||||||||||||

| Total current assets | 6,868,689 | 6,249 | 15,068,106 | 2,682,239 | (21,977,391 | ) | 2,647,892 | |||||||||||||||||

| Property and equipment, net | 17,532 | 30,934 | 48,466 | |||||||||||||||||||||

| Intangible assets, net | 101,042 | 62,406 | 441,485 | (58,932 | ) | 546,001 | ||||||||||||||||||

| Right of use asset, net | 38,300 | 11,045 | 49,345 | |||||||||||||||||||||

| Investment into subsidiaries | 14,320,480 | (14,320,480 | ) | - | ||||||||||||||||||||

| Investment into WOFE | 12,450,340 | (12,450,340 | ) | - | ||||||||||||||||||||

| Other non-current assets | - | - | - | - | ||||||||||||||||||||

| Total non-current assets | 14,320,480 | 12,551,382 | 118,238 | 483,464 | (26,829,752 | ) | 643,812 | |||||||||||||||||

| Total Assets | $ | 21,189,169 | $ | 12,557,631 | $ | 15,186,344 | $ | 3,165,703 | (48,807,143 | ) | $ | 3,291,704 | ||||||||||||

| Accounts payable | $ | 262,385 | 2,500 | $ | 44,758 | $ | 765,998 | $ | 1,075,641 | |||||||||||||||

| Accounts payable - VIE | - | - | - | |||||||||||||||||||||

| Accounts payable - WOFE | 760,708 | (760,708 | ) | - | ||||||||||||||||||||

| Short term loan | 1,170,298 | 1,170,298 | ||||||||||||||||||||||

| Advance from customers | 463 | 48,776 | 49,239 | |||||||||||||||||||||

| Accrued expenses and other payables | 23,254 | 109,121 | 713,827 | (249,488 | ) | 596,714 | ||||||||||||||||||

| Lease liability | 41,549 | 11,981 | 53,530 | |||||||||||||||||||||

| Loan payable | - | - | ||||||||||||||||||||||

| Other payables - Datasea | 5,015 | 6,182,249 | 468,998 | (6,656,262 | ) | - | ||||||||||||||||||

| Other payables - Subsidiaries | 5,000 | (5,000 | ) | |||||||||||||||||||||

| Other payables - VIE | 2,536 | 1,412,607 | (1,415,143 | ) | - | |||||||||||||||||||

| Other payables - WOFE | 845 | 12,971,457 | (12,972,302 | ) | - | |||||||||||||||||||

| Other current liabilities | 32,000 | 520,501 | 102,059 | 654,560 | ||||||||||||||||||||

| Total current liabilities | 322,639 | 10,896 | 8,311,248 | 17,014,102 | (22,058,903 | ) | 3,599,982 | |||||||||||||||||

| Accumulated deficit | (13,649,331 | ) | (1,773,745 | ) | (9,705,672 | ) | (14,479,788 | ) | 168,214 | (39,440,322 | ) | |||||||||||||

| Other equity | 34,515,861 | 14,320,480 | 16,580,768 | 631,389 | (26,916,454 | ) | 39,132,044 | |||||||||||||||||

| Total equity | 20,866,530 | 12,546,735 | 6,875,096 | (13,848,399 | ) | (26,748,240 | ) | (308,278 | ) | |||||||||||||||

| Total liabilities and stockholders’ equity | $ | 21,189,169 | $ | 12,557,631 | $ | 15,186,344 | $ | 3,165,703 | (48,807,143 | ) | $ | 3,291,704 | ||||||||||||

| As of June 30, 2023 | ||||||||||||||||||||||||

| PARENT | SUBSIDIARIES | WOFE | VIE | Elimination | Consolidated | |||||||||||||||||||

| Cash | $ | 1,487 | $ | 809 | $ | 3,715 | $ | 13,717 | $ | 19,728 | ||||||||||||||

| Accounts receivable | 255,725 | 255,725 | ||||||||||||||||||||||

| Accounts receivable - VIE | 1,181,256 | (1,181,256 | ) | - | ||||||||||||||||||||

| Accounts receivable - WOFE | 754,242 | (754,242 | ) | - | ||||||||||||||||||||

| Inventory | 241,380 | 241,380 | ||||||||||||||||||||||

| Inventory - VIE | - | |||||||||||||||||||||||

| Inventory - WOFE | 26,562 | (26,562 | ) | - | ||||||||||||||||||||

| Other receivables -Subsidiaries | 111 | 2,394 | (2,505 | ) | - | |||||||||||||||||||

| Other receivables - VIE | 8,601,966 | (8,601,966 | ) | - | ||||||||||||||||||||

| Other receivables - WOFE | 88,145 | (88,145 | ) | - | ||||||||||||||||||||

| Other receivables - Parent | 5,000 | 14,884 | (19,884 | ) | - | |||||||||||||||||||

| Other current assets | 123,251 | 649,433 | 772,684 | |||||||||||||||||||||

| Total current assets | 89,632 | 5,809 | 9,910,299 | 1,958,337 | (10,674,560 | ) | 1,289,517 | |||||||||||||||||

| Property and equipment, net | 43,044 | 42,886 | 85,930 | |||||||||||||||||||||

| Intangible assets, net | 417,708 | 68,504 | 757,700 | (58,125 | ) | 1,185,787 | ||||||||||||||||||

| Right of use asset, net | 77,508 | 60,348 | 137,856 | |||||||||||||||||||||

| Investment into subsidiaries | 12,920,480 | (12,920,480 | ) | - | ||||||||||||||||||||

| Investment into WOFE | 11,050,890 | (11,050,890 | ) | - | ||||||||||||||||||||

| Other non -current assets | 55,358 | 55,358 | ||||||||||||||||||||||

| Total non-current assets | 12,920,480 | 11,468,598 | 189,056 | 916,292 | (24,029,495 | ) | 1,464,931 | |||||||||||||||||

| Total Assets | $ | 13,010,112 | $ | 11,474,407 | $ | 10,099,355 | $ | 2,874,629 | $ | (34,704,055 | ) | $ | 2,754,448 | |||||||||||

| Accounts payable | $ | 288,020 | $ | 66,633 | $ | 650,406 | $ | 1,005,059 | ||||||||||||||||

| Accounts payable - VIE | 754,242 | (754,242 | ) | - | ||||||||||||||||||||

| Accounts payable - WOFE | 1,181,256 | (1,181,256 | ) | - | ||||||||||||||||||||

| Short term loan | 594,906 | 594,906 | ||||||||||||||||||||||

| Advance from customers | 456 | 608,719 | 609,175 | |||||||||||||||||||||

| Accrued expenses and other payables | 34,780 | 107,881 | 1,480,947 | (213,669 | ) | 1,409,939 | ||||||||||||||||||

| Lease liability | 85,417 | 39,223 | 124,640 | |||||||||||||||||||||

| Other payables - Datasea | 78,926 | (78,926 | ) | - | ||||||||||||||||||||

| Other payables - VIE | 2,536 | (2,536 | ) | - | ||||||||||||||||||||

| Other payables - WOFE | 122 | 8,596,015 | (8,596,137 | ) | - | |||||||||||||||||||

| Other current liabilities | 32,000 | 100,165 | 1,030,691 | 1,162,856 | ||||||||||||||||||||

| Total current liabilities | 354,800 | 2,658 | 1,193,720 | 14,182,163 | (10,826,766 | ) | 6,216,881 | |||||||||||||||||

| Lease liability - noncurrent | 26,449 | 26,449 | ||||||||||||||||||||||

| Long term loan | 1,401,521 | 91,215 | ||||||||||||||||||||||

| Total non-current liabilities | 1,427,970 | 117,664 | ||||||||||||||||||||||

| Total liabilities | 354,800 | 2,658 | 1,193,720 | 15,610,133 | (10,826,766 | ) | 6,334,545 | |||||||||||||||||

| Accumulated deficit | (7,069,628 | ) | (1,448,731 | ) | (6,136,980 | ) | (13,586,686 | ) | 178,767 | (28,063,258 | ) | |||||||||||||

| Other equity | 19,724,940 | 12,920,480 | 15,042,615 | 851,182 | (24,056,056 | ) | 24,483,161 | |||||||||||||||||

| Total equity | 12,655,312 | 11,471,749 | 8,905,635 | (12,735,504 | ) | (23,877,289 | ) | (3,580,097 | ) | |||||||||||||||

| Total liabilities and stockholders’ equity | $ | 13,010,112 | $ | 11,474,407 | $ | 10,099,355 | $ | 2,874,629 | (34,704,055 | ) | $ | 2,754,448 | ||||||||||||

Condensed Consolidated Statements of Cash Flows Information

| Year Ended June 30, 2024 | ||||||||||||||||||||||||

| PARENT | SUBSIDIARIES | WOFE | VIE | Elimination | Consolidated | |||||||||||||||||||

| Net cash provided by/(used in) operating activities | $ | 134,284 | $ | (5,849 | ) | $ | (5,076,644 | ) | $ | (1,450,675 | ) | $ | (6,398,884 | ) | ||||||||||

| Net cash provided by/(used in) operating activities (WOFE to VIE) | (1,992,684 | ) | 1,992,684 | - | ||||||||||||||||||||

| - | ||||||||||||||||||||||||

| Net cash provided by/(used in) investing activities | - | (167,957 | ) | (167,957 | ) | |||||||||||||||||||

| Net cash provided by/(used in) investing activities (Parent to subsidiaries) | (1,405,015 | ) | 1,405,015 | - | ||||||||||||||||||||

| Net cash provided by/(used in) investing activities (Parent to WOFE) | (6,231,281 | ) | 6,231,281 | |||||||||||||||||||||

| Net cash provided by/(used in) investing activities (Subsidiaries to WOFE) | (1,399,449 | ) | 1,399,449 | - | ||||||||||||||||||||

| Net cash provided by/(used in) investing activities (WOFE to VIE) | (2,859,142 | ) | 2,859,142 | - | ||||||||||||||||||||

| Net cash provided by/(used in) investing activities (Parent to VIE) | (475,223 | ) | 475,223 | - | ||||||||||||||||||||

| Net cash provided by/(used in) investing activities (VIE to subsidiaries) |

2,536 | (2,536 | ) | - | ||||||||||||||||||||

| Net cash provided by/(used in) financing activities | 8,061,286 | 418,608 | (1,640,317 | ) | 6,839,577 | |||||||||||||||||||

| Net cash provided by/(used in) financing activities (Parent to VIE) | 483,698 | (483,698 | ) | - | ||||||||||||||||||||

| Net cash provided by/(used in) financing activities (Parent to Subsidiaries) | 1,405,015 | (1,405,015 | ) | - | ||||||||||||||||||||

| Net cash provided by/(used in) financing activities (VIE to subsidiaries) |

(2,536 | ) | 2,536 | - | ||||||||||||||||||||

| Net cash provided by/(used in) financing activities (parent to WOFE) | 6,097,306 | (6,097,306 | ) | - | ||||||||||||||||||||

| Net cash provided by/(used in) financing activities (subsidiaries to WOFE) | 1,424,455 | (1,424,455 | ) | - | ||||||||||||||||||||

| Net cash provided by/(used in) financing activities (WOFE to VIE) | 2,859,142 | (2,859,142 | ) | - | ||||||||||||||||||||

| Net increase (decrease) in cash and cash equivalents | $ | 77,738 | $ | (2,819 | ) | $ | (1,988,041 | ) | $ | 2,074,656 | - | $ | 161,534 | |||||||||||

| Year Ended June 30, 2023 | ||||||||||||||||||||||||

| PARENT | SUBSIDIARIES | WOFE | VIE | Elimination | Consolidated | |||||||||||||||||||

| Net cash provided by/(used in) operating activities | $ | (41,815 | ) | $ | (3,185 | ) | $ | (528,833 | ) | $ | (2,527,577 | ) | $ | (3,101,410 | ) | |||||||||

| Net cash provided by/(used in) operating activities (WOFE to VIE) | (34,671 | ) | (34,671 | ) | ||||||||||||||||||||

| Net cash provided by/(used in) investing activities | (113,131 | ) | (113,131 | ) | ||||||||||||||||||||

| Net cash provided by/(used in) investing activities (WOFE to VIE) | 407,905 | (407,905 | ) | - | ||||||||||||||||||||

| Net cash provided by/(used in) investing activities (Parent to VIE) | 14,622 | (14,622 | ) | - | ||||||||||||||||||||

| Net cash provided by/(used in) investing activities (VIE to HK entity) | 2,536 | (2,536 | ) | - | ||||||||||||||||||||

| Net cash provided by/(used in) financing activities | 32,000 | 73,151 | 3,004,056 | 3,109,207 | ||||||||||||||||||||

| Net cash provided by/(used in) financing activities (Parent to VIE ) | (14,622 | ) | 14,622 | - | ||||||||||||||||||||

| Net cash provided by/(used in) financing activities (VIE to HK entity) | (2,536 | ) | 2,536 | - | ||||||||||||||||||||

| Net cash provided by/(used in) financing activities (WOFE to VIE) | (407,905 | ) | 407,905 | - | ||||||||||||||||||||

| Net increase (decrease) in cash and cash equivalents | $ | 9,209 | $ | (5,649 | ) | $ | (86,346 | ) | $ | (61,703 | ) | - | $ | (144,489 | ) | |||||||||

CASH TRANSFERS AND DIVIDEND DISTRIBUTION

Shuhai Beijing receives substantially all of its revenue in RMB. Under Shuhai Beijing’s current corporate structure, to fund any cash and financing requirements Shuhai Beijing may have, Datasea may rely on dividend payments from its subsidiaries. The WFOE may receive payments from Shuhai Beijing, and then can remit payments to Shuhai Information Skill (HK) Limited in accordance with its registration with the Chinese authority under the “Notice of the State Administration of Foreign Exchange on Relevant Issues concerning Foreign Exchange Administration for Domestic Residents to Engage in Financing and in Return Investment via Overseas Special Purpose Companies” and pursuant to the VIE Agreements. Then Shuhai Information Skill (HK) Limited may make distribution of such payments directly to Datasea as dividends thereto. Cash dividends, if any, on our shares of common stock will be paid in U.S. dollars.

Under the existing PRC foreign exchange regulations, payments of current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval from the State Administration of Foreign Exchange (the “SAFE”) by complying with certain procedural requirements. Pursuant to the SAFE Circular 37, Shuhai Beijing is allowed to pay dividends in foreign currencies to WFOE without prior approval from the SAFE, subject to the condition that the remittance of such dividends outside of the PRC shall comply with certain procedures under the PRC foreign exchange regulations applicable to PRC residents only. Approval from or registration with appropriate PRC government authorities is, however, required where RMB is to be converted into a foreign currency and remitted out of China to pay capital expenses, such as the repayment of loans denominated in foreign currencies. The PRC government may also, at its discretion, restrict access in the future to foreign currencies for Shuhai Beijing’s accounts with little advance notice.

Datasea is a Nevada company conducting substantially all of its operations in China through its PRC subsidiaries, the VIE and its subsidiaries established in China. Datasea may make loans to the PRC subsidiaries and VIE entities subject to the approval from governmental authorities and limitation of amount, or may make additional capital contributions to subsidiaries and VIE entities in China.

Any loans to the subsidiaries or VIE entities in China are subject to foreign investment and are under PRC regulations and foreign exchange loan registrations. For example, loans by us to the wholly foreign-owned subsidiaries or VIE entities in China to finance their activities must be registered with the local counterpart of SAFE. In addition, a foreign invested enterprise shall use its capital pursuant to the principle of authenticity and self-use within its business scope. The capital of a foreign invested enterprise shall not be used for the following purposes: (i) directly or indirectly used for payment beyond the business scope of the enterprises or the payment prohibited by relevant laws and regulations; (ii) directly or indirectly use for investment in securities or investments other than banks’ principal-secured products unless otherwise provided by relevant laws and regulations; (iii) the granting of loans to non-affiliated enterprises, except where it is expressly permitted in the business license; and (iv) paying the expenses related to the purchase of real estate that is not for self-use (except for the foreign-invested real estate enterprises). On October 23, 2019, the SAFE promulgated the Notice of the State Administration of Foreign Exchange on Further Promoting the Convenience of Cross-border Trade and Investment, or the SAFE Circular 28, which, among other things, allows all foreign-invested companies to use Renminbi converted from foreign currency-denominated capital for equity investments in China, as long as the equity investment is genuine, does not violate applicable laws, and does not violate with the negative list on foreign investment. However, since the SAFE Circular 28 is newly promulgated, it is unclear how SAFE and competent banks will carry this out in practice. In light of the various requirements imposed by PRC regulations on loans to and direct investment in PRC entities by offshore holding companies, we cannot assure you that we will be able to complete the necessary government registrations or obtain the necessary government approvals on a timely basis.

Current PRC regulations permit WFOE to pay dividends to Shuhai Information Skill (HK) Limited only out of its accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, in accordance with Article 166 of the PRC Company Law, each of the subsidiaries in China is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each such entity in China may further set aside a portion of its after-tax profits as the discretionary common reserve, although the amount to be set aside, if any, is determined at the discretion of such entities board of directors. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation.

As of September 26, 2024, neither Shuhai Beijing nor any of Datasea’s subsidiaries have ever paid dividends, made earnings distributions, transferred cash or other assets by kind to Datasea directly or indirectly. Datasea has not made any distributions or paid dividends to its shareholders, including U.S. investors, as of the date of this report. We intend to keep any future earnings to re-invest in and finance the expansion of our business in China. We do not have the intentions to distribute earnings or settle amounts owed under the VIE Agreements in the near future nor do we anticipate that any cash dividends will be paid or Shuhai Beijing’s earnings will be distributed and transferred to the holding company in the foreseeable future. See “Summary Consolidated Financial Data”.

OUR BUSINESS SUMMARY

Acoustic business

The company focuses on acoustic business with an emphasis on ultrasound, infrasound, and Schumann resonance technology. In the field of high-tech acoustics, the company is one of the global initiators of the “acoustic effects” concept, providing advanced acoustic products and solutions worldwide. Simultaneously, in the 5G multimodal domain, Datasea leverages its AI-driven services and solutions to offer digital and intelligent services to both businesses and individual users.

We deeply understand the market’s demand for new application areas, technologies, and requirements. Therefore, through the relentless efforts of our team, we have achieved leading-edge advancements in acoustic understanding and algorithms. Our company’s acoustic technologies and products are widely applied across various industries and fields, including acoustic industrial applications, acoustic agriculture, acoustic medicine, acoustic health, and acoustic IoT technologies.

Acoustic High-Tech is a new field that integrates fundamental acoustic theory with artificial intelligence to collect and process acoustic data and address various challenges. Datasea utilizes advanced technologies in this domain, combining basic acoustic theories with AI to create a robust technology system centered around the effects of non-audible mechanical waves. This includes leveraging ultrasonic technology for sterilization, which effectively combats viruses and prevents infections. The technology exploits the mechanical, thermal, and cavitation effects of ultrasound. When microorganisms, including viruses like the coronavirus, are exposed to ultrasound, they experience intense vibrational strains that disrupt their outer shells and internal RNA. The rapid movement of protons caused by the ultrasound ultimately destroys microbial structures, eliminating harmful pathogens.

Especially in the field of ultrasonic technology, we utilize the cavitation, thermal, and mechanical effects of ultrasound to address various application needs, including disinfection, sterilization, crop drying, safety monitoring, skincare, and medical wellness. For example, in the field of ultrasonic disinfection, when ultrasound stimulates microorganisms (including coronaviruses), it causes significant vibrational strain, disrupting the virus’s outer shell and internal RNA. Ultimately, through a combination of mechanical destruction, cavitation effects, and advanced oxidative processes, pathogenic microorganisms are eliminated. This method provides a broad-spectrum, non-selective disinfection alternative to antibiotics.

Leveraging Datasea’s cutting-edge acoustic high-tech combined with AI technology, we have successfully developed a series of ultrasonic disinfection products. These include the acoustic health series ultrasonic disinfectors, ultrasonic sterilizers and purifiers for restrooms, bedrooms, living rooms, kitchens, and pets, as well as innovative non-contact ultrasonic skin repair devices. These products are suitable for environments such as hospitals, airports, hotels, transportation, and residential settings. Leading laboratories, including the Wuhan Institute of Virology, have proven that this ultrasonic disinfection technology achieves 99.83% efficacy against Covid-19 within nine seconds and 99.99% efficacy against Staphylococcus Albus and E. coli. This strategic shift aims to offer more effective environmental purification solutions and healthier lifestyles, serving China, the United States, and globally, particularly in the post-pandemic era when there is a higher demand for protection and quality of life.

Additionally, the Company makes innovations in Schumann resonance, directional sound and others, launching ultrasonic Skin Repair with AI diagnosis and Schumann frequency sleep monitors and further creating a higher quality living environment for customers in application fields such as acoustic antivirus, acoustic health, and acoustic agriculture. With a diverse product lineup, we strive to achieve a global leading position in this field within three years.

To showcase the Company’s technology and products on the global market, Datasea, through its wholly-owned subsidiary, Datasea Acoustics LLC, based in Delaware, U.S., operates as the primary entity to offer advanced acoustic precision manufacturing products and solutions in fields including acoustic industry, acoustic agriculture, acoustic medicine, and acoustic health, and more. After obtaining certification from internationally renowned testing organizations for our sound disinfection products, we will launch large-scale sales of these products in the U.S. market. This strategy aims to tap into the continuously growing consumer audience worldwide. The company has already established partnerships with various online and offline channels in the United States, laying out the market plan for acoustic-related products. Additionally, measures such as collaborations with universities and research institutions in the United States, obtaining patents through multiple channels, production assembly planning, and potential acquisitions contribute to the sustainable development of Datasea Acoustics LLC.

5G AI multimodal digital

Datasea continues to invest in the research and application of 5G AI multimodal digital technology, committed to providing customers with leading intelligent solutions. As a pioneer in China’s 5G multimodal digital field, Datasea deeply integrates the high-speed and low-latency characteristics of 5G networks with AI and big data processing technologies to create a comprehensive AI multimodal digital platform that spans multiple industries. This platform integrates various data forms, such as text, audio, and video, enabling efficient information generation, precise transmission, and automation. It provides enterprise clients with high-quality services, including data packages and new media marketing. Powered by AI, Datasea’s 5G platform enhances customer acquisition, marketing, and brand building efficiency while creating new opportunities for digital transformation and business models. Datasea’s 5G products and solutions are widely applied in rural revitalization, healthcare, and logistics, providing digital and intelligent services to over 48.42 million enterprises and households in China (with more than 99% being small and medium-sized enterprises), driving industrial upgrades and innovative development.

OUR BUSINESS ANALYSIS

Acoustics Business

Industry overview

Definition of Acoustics.Acoustics is the science of studying sound, encompassing the generation, propagation, reception, conversion, and various effects of sound waves. It covers all forms of linear and nonlinear mechanical wave phenomena, from infrasound to ultrasound, and from microscopic to macroscopic scales.

Acoustics is highly interdisciplinary and expansive, intersecting with numerous fields to form a vibrant, multidisciplinary science that has given rise to a vast number of branches.

Modern acoustics is a broadly applicable discipline that plays a critical role in various fields, holding a pivotal position in contemporary science and technology. It is indispensable to the development of modern science and technology, the progress of the social economy and modernization, and the improvement of both the material and spiritual aspects of people’s lives.

Specifically, based on the frequency of sound waves, they can be categorized into audible sound and non-audible sound (such as ultrasound and infrasound). The function of sound waves is to transmit vibration energy and information. A sound wave is a wave that travels through a medium in the form of vibration. The vibrating object causes the air layer particles around it to compress and expand alternately. This change is from near to far, so that the vibration of the excited object spreads at a certain speed. The transmission of this vibration energy is the nature of the propagation of sound waves.

Datasea’s acoustic high-tech business focuses on key applications of sound waves, integrating basic acoustic theory with artificial intelligence. This involves studying and applying non-audible mechanical wave effects, utilizing sound wave technology and acoustic effects as a technical system for collecting and processing acoustic data and solving problems.

In particular, ultrasound technology uses the cavitation, thermal, and mechanical effects of ultrasound to meet various application needs, such as disinfection and sterilization, crop drying, safety monitoring, skincare, and medical health. For example, in the field of ultrasonic disinfection, when ultrasound stimulates microorganisms (including viruses like coronavirus), it causes significant vibrational strain, damaging the virus’s outer shell and internal RNA. Ultimately, through mechanical damage, cavitation effects, and advanced oxidation processes, pathogenic microorganisms are eliminated. This method of disinfection is a broad-spectrum, non-selective approach distinct from antibiotics.