UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-41362

Ostin Technology Group Co., Ltd.

(Translation of registrant’s name into English)

Building 2, 101

1 Kechuang Road

Qixia District, Nanjing

Jiangsu Province, China 210046

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Ostin Technology Group Co., Ltd. (the “Company”) is filing its unaudited financial results for the six months ended March 31, 2024 and to discuss its recent corporate developments. Attached as exhibits to this Report on Form 6-K are:

| ● | the management’s discussion and analysis of financial condition and results of operations as Exhibit 99.1; |

| ● | the unaudited condensed consolidated financial statements and related notes as Exhibit 99.2; and |

| ● | interactive data file disclosure as Exhibit 101 in accordance with Rule 405 of Regulation S-T. |

This report shall be deemed to be incorporated by reference into the registration statement of the Company on Form F-3 (File No. 333-279177) and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report on Form 6-K and the exhibits hereto contain “forward-looking statements” for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 that represent the Company’s beliefs, projections and predictions about future events. All statements other than statements of historical fact are “forward-looking statements,” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as “may”, “will”, “should”, “could”, “would”, “predicts”, “potential”, “continue”, “expects”, “anticipates”, “future”, “intends”, “plans”, “believes”, “estimates” and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause the Company’s actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in the Company’s forward-looking statements, including with respect to correct measurement and identification of factors affecting the Company’s business or the extent of their likely impact, and the accuracy and completeness of the publicly available information with respect to the factors upon which the Company’s business strategy is based or the success of the Company’s business.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the times by which, the Company’s performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those factors discussed more fully under the caption “Risk Factors” as well as other risks and factors identified from time to time in the Company’s SEC filings.

Exhibit Index

| Exhibit No. | Description | |

| 99.1 | Management’s Discussion and Analysis of Financial Condition and Results of Operations for the Six Months Ended March 31, 2024 and 2023 | |

| 99.2 | Condensed Consolidated Financial Statements for the Six Months Ended March 31, 2024 and 2023 | |

| 101.INS | Inline XBRL Instance Document (the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document) | |

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document | |

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document | |

| 101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document | |

| 101.LAB | Inline XBRL Taxonomy Extension Labels Linkbase Document | |

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document | |

| 104 | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Ostin Technology Group Co., Ltd. | ||

| By: | /s/ Tao Ling | |

| Name: | Tao Ling | |

| Title: | Chief Executive Officer | |

Date: August 23, 2024

3

Exhibit 99.1

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited consolidated financial statements and related notes as set forth in Exhibit 99.2 entitled “Condensed Consolidated Financial Statements for the Six Months Ended March 31, 2024 and 2023.” In addition to historical unaudited consolidated financial information, the following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below and “Risk Factors” as more fully disclosed in our Annual Report on Form 20-F for the fiscal year ended September 30, 2023, as filed with the U.S. Securities and Exchange Commission (the “SEC”) on January 31, 2024. All amounts included herein with respect to the six months ended March 31, 2024 and 2023 are derived from our unaudited consolidated financial statements included elsewhere in Exhibit 99.2. Our financial statements have been prepared in accordance with U.S. Generally Accepted Accounting Principles, or U.S. GAAP. Unless the context indicates otherwise, references to “Ostin” are to Ostin Technology Group Co., Ltd., a Cayman Islands exempted company and references to “we,” “us,” “our,” “our company,” the “Company” or similar terms used in this Exhibit 99.1 are to Ostin and/or its consolidated subsidiaries.

Overview

We are a supplier of display modules and polarizers based in China. We design, develop, and manufacture TFT-LCD modules in a wide range of sizes, including custom sizes tailored to our customers’ specifications. Our display modules are primarily used in consumer electronics, commercial LCD displays, and automotive displays. In addition to manufacturing polarizers used in TFT-LCD display modules, we are also in the process of developing protective films for OLED display panels. Furthermore, we distribute various sizes of display products through business-to-business (B2B) offline channels and business-to-consumer (B2C) online channels such as Tmall flagship store, JD.com and Douyin online stores and are currently marketing Pintura, our new IoT display products.]

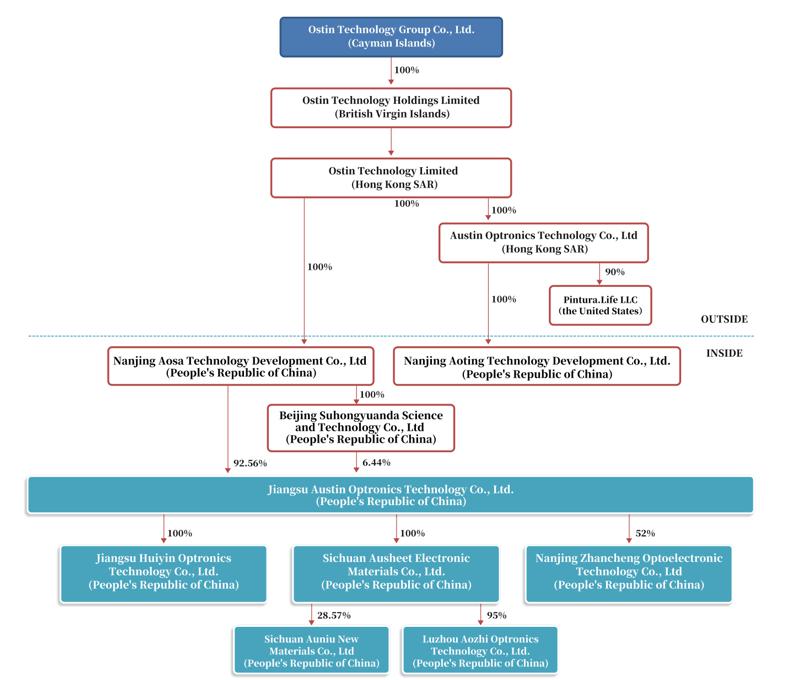

We were founded in 2010 by a group of industry veterans, and have been operating our business, primarily through our wholly-owned subsidiary, Jiangsu Austin Optronics Technology Co., Ltd. (“Jiangsu Austin”), and its subsidiaries. We currently operate our headquarter and three manufacturing facilities across China, collectively spanning 50,335 square meters. Our headquarter and one factory for the manufacture of display modules is located in Jiangsu Province, one factory for the manufacture of TFT-LCD polarizers is located in Chengdu, Sichuan Province, and another factory for the manufacture of display modules which are primarily used in display devices for education, healthcare, transportation, and commercial offices is located in Luzhou, Sichuan Province.

We seek to improve our market position through our close collaborative customer relationships and emphasizing the development of high-end display products and new display materials. Our customers include leading manufacturers of computers, automotive electronics, and LCD displays, in Greater China. We successfully introduced our polarizers to the Chinese market, and expanded our product lines to include polarizers used for both vertical alignment (VA) panels and in-plane switching (IPS) panels in 2020.

Recent Developments

During the six months ended March 31, 2024 we continued our efforts on new product development, including introduction of a new protection film for OLED panels and wafers, offering enhanced protection against dust and scratches. This protection film will be produced using the same facilities we used for polarizers. We continued our efforts on research and development, and refining our manufacturing process after extensive testing for improvement during the six months ended March 31, 2024, and started mass production of the protective film in the second half of 2024.

In an effort to increase profits and fully utilize our expertise in the display panel industry, we have expanded our production to include end-user display products, such as commercial displays and consumer electronics, which generally offer higher profit margins than our display module products. Additionally, we have independently developed new technologies for our proprietary products, including the all-in-one intelligent conference system and the Pintura wireless photo transmission system which was launched in China since September 2022. Our sales focus has been primarily on the B2B market. However, as our sales progressed, extensive market analysis led us to strategically pivot towards the B2C market, necessitating a comprehensive upgrade of our products to align with this shift. To bolster the marketing of these innovative products, we have strengthened our sales force by adding more representatives, provided targeted end-user sales training, increased our participation in electronics exhibitions, and amplified our advertising expenditures. These efforts are part of our broader strategy to enhance market penetration for our products oriented towards end-users. We launched a crowdfunding campaign for Pintura wireless photo transmission system products in the United States in March 2024, and raised nearly $100,000 on a crowdfunding platform by June 2024. In addition, we have introduced Pintura wireless photo transmission system products in China since mid-February 2024 through different sales channels, including traditional e-commerce platforms, new media business, and domestic offline stores. We plan to expand Pintura wireless photo transmission system products’ presence on more e-commerce platforms and enter European and other international markets.

During the six months ended March 31, 2024 we have leveraged on our research and development capabilities and expertise in the display module field to develop customized solutions for our clients. We continue to apply new technologies to our self-developed products, including the all-in-one intelligent conference system and the Pintura wireless photo transmission system. For the all-in-one intelligent conference system, we have enhanced its AI functionalities, such as the accuracy of facial and voice recognition. The Pintura wireless photo transmission system has undergone simultaneous hardware and software upgrades based on feedbacks from our current customers.

On January 19, 2024, the Company entered into certain securities purchase agreement with an accredited investor pursuant to which the Company sold a senior unsecured convertible note in the original principal amount of $550,000 at a purchase price of $500,000. Subject to certain sales limitation, the note is convertible into class A ordinary shares, par value US$0.0001 per share (“Class A Ordinary Shares”) of the Company beginning on the date that is six months from the closing date. On January 22, 2024, the Company completed its issuance and sale of the note pursuant to the securities purchase agreement. The issuance of the note was made pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act and Regulation D promulgated thereunder. The gross proceeds from the sale of the note were $500,000 prior to deducting transaction fees and estimated expenses. The Company intended to use the proceeds for working capital and general corporate purposes. On June 24, 2024, the Company repaid the convertible promissory note dated January 19, 2024 in full, and the investor released the Company from any and all obligations and liabilities under the note. As a result, the note was deemed paid in full, canceled and of no further force or effect.

On January 31, 2024, the Company entered into certain subscription agreement and registration rights agreement with a “non-U.S. Person” investor as defined in Regulation S of the Securities Act for a private placement of unregistered shares. Pursuant to the subscription agreement, the Company agreed to issue and sell to the investor 2,800,000 unregistered Class A Ordinary Shares of the Company at a purchase price equivalent to US$0.35 per share. The Company received US$980,000 in gross proceeds from the private placement of unregistered Class A Ordinary Shares. The private placement was closed on February 7, 2024. The issuance of these unregistered Class A Ordinary Shares in the private placement is exempt from the registration requirements of the Securities Act, pursuant to Regulation S promulgated thereunder.

On June 21, 2024, the Company entered into certain securities purchase agreement with an accredited investor pursuant to which the Company sold a senior unsecured convertible note in the original principal amount of $1,360,000, at a purchase price of $1,250,000. Subject to certain sales limitation, the note is convertible into Class A Ordinary Shares of the Company beginning on the closing date and continuing thereafter until the note is repaid in full. On June 24, 2024, the Company completed its issuance and sale of the note pursuant to the securities purchase agreement. The investor has previously invested in securities of the Company or otherwise had pre-existing relationships with the Company; however, the Company did not engage in general solicitation or advertising with regard to the issuance and sale of the note. The Class A Ordinary Shares, as converted, were registered with the SEC pursuant to a prospectus supplement to the Company’s currently effective registration statement on Form F-3 (File No. 333-279177), which was initially filed with the SEC on May 7, 2024, and was declared effective on May 28, 2024 (the “Shelf Registration Statement”). The Company filed the prospectus supplement to the Shelf Registration Statement with the SEC on June 21, 2024. The gross proceeds from the sale of the note were $1,2500,000, prior to deducting transaction fees and estimated expenses. The Company intends to use the proceeds for repayment of the prior convertible promissory note dated January 19, 2024, and working capital for general corporate and administrative purposes.

Key Factors Affecting Our Results

Our results are primarily derived from the sales of display modules and polarizers to display manufacturers, end-brand customers or their system integrators in China, Hong Kong and Taiwan. The historical performance and outlook for our business is influenced by numerous factors, including the following:

| ● | Fluctuations in Prices of Electronic Component, Polarizer Materials, Other Costs - Fluctuations in the prices of raw materials can lead to volatility in the pricing of our products, which influences the buying patterns of our customers. Because the raw material cost represents over half of our total cost of sales, higher or lower raw material cost affects our gross margins. Increases in the market price of raw materials typically enable us to raise our selling prices. To a lesser extent, our gross margins and selling prices can also be impacted by the prices of other raw materials, transportation and labor. |

| ● | Price Fluctuations Due to Cyclical Market Condition - The display panel industry in general is characterized by cyclical market conditions. From time to time, the industry has been subject to imbalances between excess supply and a slowdown in demand, and in certain periods, resulting in declines in selling prices. In addition, capacity expansion anticipated in the display panel industry may lead to excess capacity. Capacity expansion in the display panel industry may be due to scheduled ramp-up of new manufacturing facilities, and any large increases in capacity as a result of such expansion could further drive down the selling prices of our products, which would affect our results of operations. We cannot assure you that any continuing or further decrease in selling prices or future downturns resulting from excess capacity or other factors affecting the industry will not be severe or that any such continuation, decrease or downturn would not seriously harm our business, financial condition and results of operations. |

| ● | General Competition - Our products, competing in Greater China, have historically faced significant competition. Our strategy of excellent customer service, high-quality products, and rapid order fulfillment has been effective. However, the current downturn in demand within the broader display and IT industries has intensified competition. This situation could be challenging if competitors provide lower prices, enhance on-time delivery, or take other competitive actions potentially impacting our customers’ purchase decisions. |

Impact of the Covid-19 Pandemic

During the six months ended March 31, 2024, the adverse effects of the COVID-19 pandemic on the business sector that we operate in persists, due to the negative impact on both international and domestic economies, as well as various geopolitical factors. Although the Chinese government has now lifted the restrictions and we have resumed normal business operations, the COVID-19 pandemic still has negatively impacted, and may continue to negatively impact, the global economy and disrupt normal business activity, which may have an adverse effect on our results of operations.

The impacts of COVID-19 on our business, financial condition, and results of operations include, but are not limited to, the following:

| ● | The demand for consumer electronics, including TVs, monitors, and entertainment devices, has experienced a decline due to market saturation. This saturation emerged during the period of government restrictions when there was an increased demand for in-home entertainment. Now, with the lifting of these controls, the market has transitioned into a state of saturation for consumer electronics. Additionally, a shift in consumer spending towards outdoor activities such as tourism has further diminished the demand for these products. This shift, coupled with the economic impacts of the pandemic such as reduced savings and wages, has led to a decline in our sales and prices of display modules for the year ended March 31, 2024, compared to the previous year. |

In the longer-term, the adverse effects of the COVID-19 pandemic on the economies and financial markets of many countries are expected to persist, and may lead to an economic downturn or recession. This could adversely affect demand for some of our products and those of our customers, such as display modules used for automotive display, which may, in turn negatively impact our results of operations.

The degree to which the pandemic and its subsequent effects ultimately impacts our business and results of operations will depend on future developments beyond our control, including the severity of the pandemic, the actions to contain or treat the virus, how quickly and to what extent the economic and operating conditions can resume, and the severity and duration of the global economic downturn as a result of the pandemic.

Results of Operations

For the Six Months Ended March 31, 2024 and 2023

The following table summarizes the results of our operations for the six months ended March 31, 2024 and 2023, respectively, and provides information regarding the dollar and percentage increase or (decrease) during such periods.

(All amounts, other than percentages, are in U.S. dollars)

| For the Six Months | ||||||||||||||||

| Ended March 31, | Variance | |||||||||||||||

| 2024 | 2023 | Amount | Percentage | |||||||||||||

| Sales | $ | 14,973,048 | $ | 34,295,114 | $ | (19,322,066 | ) | (56 | )% | |||||||

| Cost of sales | 14,082,663 | 33,603,125 | (19,520,462 | ) | (58 | )% | ||||||||||

| Gross profit | $ | 890,385 | 691,989 | 198,396 | 29 | % | ||||||||||

| Operating expenses: | ||||||||||||||||

| Selling and marketing expenses | 897,059 | 1,325,919 | (428,860 | ) | (32 | )% | ||||||||||

| General and administrative expenses | 2,900,993 | 3,175,731 | (274,738 | ) | (9 | )% | ||||||||||

| Research and development costs | 965,157 | 1,430,401 | (465,244 | ) | (33 | )% | ||||||||||

| Gain from disposal of property, plant and equipment | 81,036 | 160,288 | (79,252 | ) | (49 | )% | ||||||||||

| Total operating expenses | $ | 4,682,173 | 5,771,763 | (1,089,590 | ) | (19 | )% | |||||||||

| Operating income (loss) | $ | (3,791,788 | ) | $ | (5,079,774 | ) | $ | (1,287,986 | ) | (25 | )% | |||||

| Other income (expenses): | ||||||||||||||||

| Interest expense, net | (1,102,464 | ) | (544,923 | ) | 557,541 | 102 | % | |||||||||

| Other income (expenses), net | 244,873 | 499,982 | (255,109 | ) | 51 | % | ||||||||||

| Total other income (expenses), net | (857,591 | ) | (44,941 | ) | 812,650 | 1,808 | % | |||||||||

| Income before income taxes | $ | (4,649,379 | ) | $ | (5,124,715 | ) | $ | 475,336 | (9 | )% | ||||||

| Income tax provision | - | 108,189 | (108,189 | ) | (100 | )% | ||||||||||

| Net income (loss) | $ | (4,649,379 | ) | $ | (5,016,526 | ) | $ | 367,147 | 7 | % | ||||||

Sales

The following table presents revenue by major product and service categories for the six months ended March 31, 2024 and 2023, respectively.

| March 31, 2024 | March 31, 2023 | |||||||||||||||

| Revenues Amount |

As % of | Revenues Amount |

As % of | |||||||||||||

| Revenue Category | (In USD) | Revenues | (In USD) | Revenues | ||||||||||||

| Display modules | $ | 8,285,437 | 55 | % | $ | 15,137,071 | 44 | % | ||||||||

| Polarizers | 5,983,816 | 40 | % | 16,974,322 | 49 | % | ||||||||||

| Research and development services | - | % | - | - | % | |||||||||||

| Others (repair services) | 703,795 | 5 | % | 2,183,721 | 6 | % | ||||||||||

| Total | $ | 14,973,048 | 100 | % | $ | 34,295,114 | 100 | % | ||||||||

Revenues decreased by approximately $19.32 million or 56%, to approximately $14.97 million for the six months ended March 31, 2024 from approximately $34.30 million for the six months ended March 31, 2023. The significant decrease in revenues was primarily due to the decline in market demand, which resulted in decreased sales of polarizers and display modules, as more fully discussed below.

Sales of display modules decreased by approximately $6.85 million or 45%, to approximated $8.29 million for the six months ended March 31, 2024 from approximately $15.14 million for the six months ended March 31, 2023. Based on seasonality in our business and cyclical nature of our industry, we believe that the market demand will gradually recover in the second half of 2024 and give a steady boost to our sales of display modules in the next 6 to 12 months. We have also improved our research and development capabilities based on accumulated experience and expertise of new products research and development catering to our major end-brand clients and expanded certain product lines which have already entered mass production and sales stages. For the six months ended March 31, 2024 and 2023, revenue generated from sales of the display modules accounted for 54% and 44% of our total revenues, respectively.

For the six months ended March 31, 2024 and 2023, revenue generated from the polarizers were approximately $5.98 million and $16.97 million, respectively, representing a substantial decrease of approximately $10.99 million or 65%. Due to the slowdown in the electronics consumer market, there has been a decline in customer demand for polarizers during the six months ended on March 31, 2024. In 2018, we made a strategic decision to launch our new business segment - polarizers and our Chengdu manufacturing facility commenced mass production of polarizers in April 2019. Polarizer is an essential part of TFT-LCD display panel and was in high demand in China due to limited domestic production capacity and concentration of supply in oversea suppliers. To facilitate mass production of polarizers, we invested substantial amounts of capital and human resources to construct and operate our Chengdu manufacturing facility during the six months ended March 31, 2024, and closed other low-margin product lines of display modules.

For the six months ended March 31, 2024 and 2023, revenue generated from our research and development services was nil and nil, respectively. This was primarily due to the fact that the research and development team suspended the external service to put its main efforts into the independent product development of our own since October 2022.

Sales of others decreased by approximately $1.48 million or 68%, to approximated $0.70 million for the six months ended March 31, 2024 from approximately $2.18 million for six months ended March 31, 2023. The significant decrease in revenues was primarily due to the decline in sales of customer product, which reduced the after-sales repair rate of the products, thereby decreasing our repair service revenue.

The following table shows our revenues by geographic region for the six months ended March 31, 2024 and 2023. To mitigate impact of the fluctuation of exchange rates and transportation costs, we switched from overseas to domestic markets, and therefore, our sales to Hong Kong and Taiwan decreased substantially during the six months ended March 31, 2024 as compared to the same period last year.

| March 31, 2024 | March 31, 2023 | |||||||||||||||

| Revenues Amount |

As % of | Revenues Amount |

As % of | |||||||||||||

| Country/Region | (In USD) | Revenues | (In USD) | Revenues | ||||||||||||

| Mainland China | $ | 14,641,702 | 98 | % | $ | 33,524,738 | 98 | % | ||||||||

| Hong Kong and Taiwan | 331,346 | 2 | % | 761,136 | 2 | % | ||||||||||

| Southeast Asia | - | - | 9,240 | - | ||||||||||||

| Total | $ | 14,973,048 | 100 | % | $ | 3,4974,469 | 100 | % | ||||||||

Cost of sales

The following table presents cost of sales by major product and service categories for the six months ended March 31, 2024 and 2023, respectively.

| For the Six Months Ended March 31, |

||||||||

| 2024 | 2023 | |||||||

| Product Category | ||||||||

| Display modules | $ | 7,616,421 | $ | 13,986,161 | ||||

| Polarizers | 5,802,198 | 16,226,347 | ||||||

| Research and development services | - | 1,434,771 | ||||||

| Others (repair services) | 664,045 | 1,955,845 | ||||||

| Total | $ | 14,082,663 | $ | 33,603,125 | ||||

| Gross Margin | ||||||||

| Display modules | 8 | % | 8 | % | ||||

| Polarizers | 3 | % | 4 | % | ||||

| Research and development services | - | - | /% | |||||

| Others (repair services) | 6 | % | 10 | % | ||||

| Total Gross Margin | 6 | % | 2 | % | ||||

Cost of sales decreased by approximately $19.52 million or 58%, to approximately $14.08 million for the six months ended March 31, 2024 from approximately $33.60 million for six months ended March 31, 2023. The decrease in cost of sales was generally in line with the decrease of total sales.

Our gross profit increased by approximately $0.20 million, or 29%, to approximately $0.89 million for the six months ended March 31, 2024 from approximately $0.69 million for the six months ended March 31, 2023. Overall gross profit margin was 5.9% for six months ended March 31, 2024 as compared to 2.0% for six months ended March 31, 2023. The increase in gross margin was primarily due to the increased proportion of new product models with higher gross margins in overall sales

The decreases in gross profit margin of polarizers were primarily attributable to the decrease in customer orders resulting in a decline in sales volume, leading to an increase in the allocation of fixed costs.

Selling and marketing expenses

Selling and marketing expenses decreased by approximately $0.43 million, or 32%, to approximately $0.90 million for the six months ended March 31, 2024 as compared to approximately $1.33 million for the six months ended March 31, 2023. The decrease in selling and marketing expenses was mainly due to the reduction in market development activities.

General and administrative expenses

General and administrative (“G&A”) expenses decreased by approximately $0.27 million, or 9%, to approximately $2.90 million for the six months ended March 31, 2024 as compared to approximately $3.18 million for the six months ended March 31, 2023. By implementing effective cost management strategies, the Company has reduced administrative expenses, resulting in a noticeable decrease in G&A expenses.

Research and development expenses

Our research and development expenses decreased by approximately $0.47 million to $0.97 million for the six months ended March 31, 2024 from approximately $1.43 million for the same period in 2023. The decrease in research and development expenses was attributed to the completion of the Pintura wireless photo transmission system products, thus eliminating the need for significant investment in R&D funds during this period.

Gain from disposal of property, plant and equipment

For the six months ended March 31, 2024, the Company disposed machinery, equipment and transportation vehicles with a net book value of $373,778 (cost of $635,843, accumulated depreciation of $262,065) and received cash from disposal of $455,532, resulting in a net disposal income of $81,036. Similarly, for the six months ended March 31, 2023, the Company disposed of machinery, equipment and transportation vehicles with a net book value of $205,928 (cost of $290,302, accumulated depreciation of $84,374) and received cash from disposal of $366,216, resulting in a net disposal income of $160,288. The disposals were targeted to reduce maintenance costs of underutilized machinery, equipment, and transportation, and to improve production efficiency post-disposal.

Other income (expenses)

Other income was approximately $0.24 million for the six months ended March 31, 2024, which primarily consisted of other non-business income of $0.25 million and other non-business expenses of $0.01 million. Other non-business income was mainly government subsidiaries of $0.23 million.

Other income was approximately $0.50 million for the six months ended March 31, 2023, which primarily consisted of other non-business income of $0.52 million and other non-business expenses of $0.02 million. Other non-business income was mainly government subsidiaries of $0.48 million.

Net income (loss)

As a result of the foregoing, we recorded a net loss of approximately $4.65 million and a net loss of $5.02 million for the six months ended March 31, 2024 and 2023, respectively.

For the Six Months Ended March 31, 2023 and 2022

The following table summarizes the results of our operations for the six months ended March 31, 2023 and 2022, respectively, and provides information regarding the dollar and percentage increase or (decrease) during such periods.

(All amounts, other than percentages, are in U.S. dollars)

| For the Six Months | ||||||||||||||||

| Ended March 31, | Variance | |||||||||||||||

| 2023 | 2022 | Amount | Percentage | |||||||||||||

| Sales | $ | 34,295,114 | $ | 60,094,661 | $ | (25,799,547 | ) | (43 | )% | |||||||

| Cost of sales | 33,603,125 | 51,460,589 | (17,857,464 | ) | (35 | )% | ||||||||||

| Gross profit | $ | 691,989 | 8,634,072 | (7,942,083 | ) | (92 | )% | |||||||||

| Operating expenses: | ||||||||||||||||

| Selling and marketing expenses | 1,325,919 | 1,419,660 | (93,741 | ) | (7 | )% | ||||||||||

| General and administrative expenses | 3,175,731 | 3,550,877 | (375,146 | ) | (11 | )% | ||||||||||

| Research and development costs | 1,430,401 | 2,028,038 | (597,637 | ) | (29 | )% | ||||||||||

| Loss (Gain)from disposal of property, plant and equipment | (160,288 | ) | 1,242 | (161,530 | ) | (13,006 | )% | |||||||||

| Total operating expenses | $ | 5,771,763 | 6,999,817 | (1,228,054 | ) | (18 | )% | |||||||||

| Operating income | $ | (5,079,774 | ) | $ | 1,634,255 | $ | (6,714,029 | ) | (411 | )% | ||||||

| Other income (expenses): | ||||||||||||||||

| Interest expense, net | (544,923 | ) | (741,667 | ) | 196,744 | (27 | )% | |||||||||

| Other income (expenses), net | 499,982 | 615,587 | (115,605 | ) | (19 | )% | ||||||||||

| Total other income (expenses), net | (44,941 | ) | (126,080 | ) | 81,139 | (64 | )% | |||||||||

| Income before income taxes | $ | (5,124,715 | ) | $ | 1,508,175 | $ | (6,632,890 | ) | (440 | )% | ||||||

| Income tax provision | 108,189 | (306,515 | ) | 414,704 | (135 | )% | ||||||||||

| Net income | $ | (5,016,526 | ) | $ | 1,201,660 | $ | (6,218,186 | ) | (517 | )% | ||||||

Sales

The following table presents revenue by major product and service categories for the six months ended March 31, 2023 and 2022, respectively.

| March 31, 2023 | March 31, 2022 | |||||||||||||||

| Revenues Amount |

As % of | Revenues Amount |

As % of | |||||||||||||

| Revenue Category | (In USD) | Revenues | (In USD) | Revenues | ||||||||||||

| Display modules | $ | 15,137,071 | 44 | % | $ | 27,961,103 | 47 | % | ||||||||

| Polarizers | 16,974,322 | 49 | % | 23,750,420 | 40 | % | ||||||||||

| Research and development services | - | - | 4,957,518 | 8 | % | |||||||||||

| Others (repair services) | 2,183,721 | 6 | % | 3,425,620 | 5 | % | ||||||||||

| Total | $ | 34,295,114 | 100 | % | $ | 60,094,661 | 100 | % | ||||||||

Revenues decreased by approximately $25.80 million or 43%, to approximately $34.30 million for the six months ended March 31, 2023 from approximately $60.09 million for the six months ended March 31, 2022. The significant decrease in revenues was primarily due to the decrease in sales from both display modules and polarizers resulted from the large-scale outbreak of coronavirus infections in mainland China in the fourth quarter of 2022 as more fully discussed below.

Revenue from sales of display modules decreased by approximately $12.82 million or 46%, to approximated $15.14 million for the six months ended March 31, 2023 from approximately $27.96 million for the six months ended March 31, 2022. Based on seasonality in our business and cyclical nature of our industry, we believe that the market demand will gradually recover in the second half of 2023 and give a steady boost to our sales of display modules in the next 12 to 18 months. We have also improved our research and development capabilities based on accumulated experience and expertise of new products research and development catering to our major end-brand clients and expanded certain product lines from trial production to mass production. For the six months ended March 31, 2023 and 2022, revenue generated from sales of the display modules accounted for 44% and 47% of our total revenues, respectively.

In 2018, we made a strategic decision to launch our new business segment - polarizers and our Chengdu manufacturing facility commenced mass production of polarizers in April 2019. Polarizer is an essential part of TFT-LCD display panel and has been in high demand in China due to limited domestic production capacity and concentration of supply in oversea suppliers. By adding polarizers in our product offering portfolio, we effectively expanded our business horizon, extended customer outreach, and strengthened our competitiveness. To facilitate mass production of polarizers, we invested substantial amounts of capital and human resources to construct and operate our Chengdu manufacturing facility during the six months ended March 31, 2023 and closed other low-margin product lines of display modules. For the six months ended March 31, 2023 and 2022, revenue generated from the polarizers were approximately $16.97 million and $23.75 million, respectively, representing a decrease of approximately $6.78 million or 29%. The prolonged COVID-19 pandemic has had a negative impact on the economy and thereby lowered the expectations of income, which has subsequently affected the demand for electronic consumer goods. Such decreased demand in the six months ended March 31, 2023 resulted decrease in the sales of our polarizers. For the six months ended March 31, 2023 and 2022, revenue generated from sales of polarizers accounted for 49% and 40% of our total revenues, respectively.

In addition to revenue from sales of display modules and polarizers, we also provide display panel repair services to our customers at extra charges, which involves sales of our products as replacement of certain parts of the display panels. The repair services were originally offered to a limited number of customers at their request and represent only a small portion of our revenues. As a result of our extending repair services customer base to those who did not purchase our display panel products, our revenues from repair services decreased by approximately $1.24 million, or 36%, to approximately $2.18 million for the six months ended March 31, 2023 from approximately $3.43 million for the six months ended March 31, 2022.

For the six months ended March 31, 2023, revenue generated from our new products R&D services was nil, representing significant decrease as compared to approximately $4.96 million for the six months ended March 31, 2022. This was primarily due to the fact that our R&D team suspended the external service to put its main efforts into our independent product development.

The following table shows our revenues by geographic region for the six months ended March 31, 2023 and 2022. To mitigate impact of the fluctuation of exchange rates and transportation costs, we switched from overseas to domestic markets, and therefore, our sales to Hong Kong and Taiwan decreased substantially during the six months ended March 31, 2023 as compared to the same period last year.

| March 31, 2023 | March 31, 2022 | |||||||||||||||

| Revenues Amount |

As % of | Revenues Amount |

As % of | |||||||||||||

| Country/Region | (In USD) | Revenues | (In USD) | Revenues | ||||||||||||

| Mainland China | $ | 33,524,738 | 98 | % | $ | 55,034,541 | 92 | % | ||||||||

| Hong Kong and Taiwan | 761,136 | 2 | % | 5,060,120 | 8 | % | ||||||||||

| Southeast Asia | 9,240 | - | - | - | ||||||||||||

| Total | $ | 34,295,114 | 100 | % | $ | 60,094,661 | 100 | % | ||||||||

Cost of sales

The following table presents cost of sales by categories for the six months ended March 31, 2023 and 2022, respectively.

| For the Six Months Ended March 31, |

||||||||

| 2023 | 2022 | |||||||

| Product Category | ||||||||

| Display modules | $ | 13,986,161 | $ | 26,117,379 | ||||

| Polarizers | 16,226,347 | 21,386,213 | ||||||

| Research and development services | 1,434,771 | 1,629,328 | ||||||

| Others | 1,955,845 | 2,327,669 | ||||||

| Total | $ | 33,603,125 | $ | 51,460,589 | ||||

| Gross Margin | ||||||||

| Display modules | 8 | % | 7 | % | ||||

| Polarizers | 4 | % | 10 | % | ||||

| Research and development services | - | 67 | % | |||||

| Others | 10 | % | 32 | % | ||||

| Total Gross Margin | 2 | % | 14 | % | ||||

Cost of sales decreased by approximately $17.86 million or 35%, to approximately $33.60 million for the six months ended March 31, 2023 from approximately $51.46 million for the six months ended March 31, 2022. The decrease in cost of sales was in line with the decrease in our revenue.

Our gross profit decreased by approximately $7.94 million, or 92%, to approximately $0.69 million for the six months ended March 31, 2023 from approximately $8.63 million for the six months ended March 31, 2022. Overall gross profit margin was 2% for the six months ended March 31, 2023, as compared to 14% for the six months ended March 31, 2022. The decrease in gross profit is due to we reduced unit sales price in an effort to clear lower-end products inventory.

The decrease in gross profit margin of display modules and polarizers was primarily attributable from high costs relating to the procurement of raw materials and decline in the market demand, resulting in a decrease in our products’ unit sale price and sales volume.

The decrease in gross profit for R&D services was due to the progress under new R&D services contracts had not yet reached milestones and had not generated revenue.

Selling and marketing expenses

Selling and marketing expenses decreased by approximately $0.09 million, or 7%, to approximately $1.33 million for the six months ended March 31, 2023 as compared to approximately $1.42 million for the six months ended March 31, 2022. The decrease in selling and marketing expenses was mainly due to the reduction in market development activities.

General and administrative expenses

General and administrative (“G&A”) expenses decreased by approximately $0.38 million, or 11%, to approximately $3.18 million for the six months ended March 31, 2023 as compared to approximately $3.55 million for the six months ended March 31, 2022. The decrease in G&A expenses was due to the reduction of professional service fees upon the completion of our initial public offering.

Research and development expenses

Our research and development expenses decreased by approximately $0.6 million to $1.43 million for the six months ended March 31, 2023 from approximately $2.03 million for the same period in 2022. The decrease was mainly attributable to the outbreaks of the COVID-19 pandemic in the fourth quarter of 2022in mainland China. Such outbreaks caused some of our employees, including R&D personnel, to contract the virus and became unable to work. As a result, we decided to halt some of our R&D projects, leading to a reduction in our R&D expenses.

Other income (expenses)

Other income (expenses) was approximately $0.50 million for the six months ended March 31, 2023, which primarily consisted of other non-business income of $0.52 million and other non-business expenses of $0.02 million. Other non-business income was mainly government subsidiaries of $0.48 million.

Other income (expenses) was approximately $0.62 million for the six months ended March 31, 2022, which primarily consisted of other non-business income of $0.63 million and other non-business expenses of $0.01 million. Other non-business income was mainly government subsidiaries of $0.56 million.

Net income (loss)

As a result of the foregoing, we recorded net loss of $5.02 million and net income of $1.20 million for the six months ended March 31, 2023 and 2022, respectively.

Liquidity and Capital Resources

| For the Six Months Ended March 31, |

||||||||

| 2024 | 2023 | |||||||

| Net cash provided by (used in) operating activities | $ | (3,893,451 | ) | $ | 254,142 | |||

| Net cash used in investing activities | (263,379 | ) | (4,894,435 | ) | ||||

| Net cash provided by financing activities | 5,201,336 | 4,546,954 | ||||||

| Effect of exchange rate changes on cash and cash equivalents | (151,218 | ) | (771,380 | ) | ||||

| Net increase in cash and cash equivalents | $ | 893,288 | $ | (864,719 | ) | |||

| Cash and cash equivalents, beginning of period | 1,157,424 | 3,806,920 | ||||||

| Cash and cash equivalents, end of period | $ | 2,050,712 | $ | 2,942,201 | ||||

Operating Activities:

Net cash used in operating activities for the six months ended March 31, 2024 was approximately $3.89 million, which was primarily attributable to a net loss of approximately $4.65 million, adjusted for non-cash items of approximately $2.03 million and adjustments for changes in working capital of approximately $1.27 million. The adjustments for changes in working capital mainly included:

| (i) | decrease in accounts receivable of approximately $1.65 million – our accounts receivable balance decreased significantly due to the collection of receivables from our major customers during the six months ended March 31, 2024; |

| (ii) | decrease in accounts payable of approximately $5.09 million mainly due to the payment in material purchase at the end of the previous reporting period; |

| (iii) | decrease in inventory of approximately $3.16 million due to the decrease in sales during the six months ended March 31, 2024; |

| (iv) | decrease in advance from customers of approximately $0.32 million due to the significant decrease in sales during the six months ended March 31, 2024; |

| (v) | increase in advance to suppliers of approximately $0.39 million due to the need to accommodate the increased purchase of raw materials for new orders. |

Net cash provided by operating activities for the six months ended March 31, 2023 was approximately $0.25 million, which was primarily attributable to a net loss of approximately $5.02 million, adjusted for non-cash items of approximately $1.71 million and adjustments for changes in working capital of approximately $3.56 million. The adjustments for changes in working capital mainly included:

| (i) | decrease in accounts receivable of approximately $1.77 million – our accounts receivable balance decreased significantly due to the collection of receivables from our major customers during the six months ended March 31, 2023; | |

| (ii) | increase in inventory of approximately $0.43 million – our inventory increased significantly due to the higher quantity of display modules in response to market changes. |

| (iii) | decrease in advances to suppliers of approximately $2.99 million – from time to time we are required to make advance payments to our suppliers for purchase of raw materials. Due to the decreased demand for raw materials resulted from the decreased sales and the effort to enhance the efficiency of our cash flows, we made less advance payments to our suppliers during the six months ended March 31, 2023; |

| (iv) | increase in accounts payable of approximately $0.45 million due to an increase in the purchase of raw materials; and |

| (v) | increase in advance from customers of approximately $0.22 million due to a change in our sales credit policy from offering a credit period of one to three months to requiring advance payments from certain new customers. |

Investing Activities:

Net cash used in investing activities was approximately $0.26 million for the six months ended March 31, 2024, mainly attributable to the addition of fixed assets of $0.62 million for production needs during the period. Additionally, the addition of intangible assets of $0.10 million for production operations during the same period. Furthermore, there was a proceed of $0.46 million from the disposal of fixed assets and construction in progress.

Net cash used in investing activities was approximately $4.89 million for the six months ended March 31, 2023, mainly attributable to the addition of fixed assets of $4.93 million for production needs during the period. Additionally, the addition of intangible assets of $0.33 million for production operations during the same period. Furthermore, there was a proceed of $0.37 million from the disposal of fixed assets and construction in progress.

Financing Activities:

Net cash provided by financing activities was approximately $5.20 million for the six months ended March 31, 2024, primarily attributable to the proceeds from capital contribution of approximately $1.27 million, proceeds from private placement of approximately $0.98 million, proceeds from long-term liability of approximately $0.98 million, proceeds from bank borrowings of approximately $9.96 million, proceeds from third-party borrowings of approximately $1.52 million, and proceeds from related-party borrowings of approximately $5.47 million, and proceeds from convertible notes of $0.50 million, and offset by repayments to bank borrowings of approximately $8.99 million, repayments to third-party borrowings of approximately $2.01 million, and repayment to related party borrowings of approximately $4.48 million.

Net cash provided by financing activities was approximately $4.55 million for the six months ended March 31, 2023, primarily attributable to the proceeds from bank borrowings of approximately $13.64 million, proceeds from third-party borrowings of approximately $0.16 million, and proceeds from related-party borrowings was approximately $1.58 million, and offset by repayments to bank borrowings of approximately $10.62 million, repayments to third-party borrowings of approximately $0.22 million.

Primary Sources of Liquidity

Our primary sources of liquidity consist of existing cash balances, cash flows from our operating activities and availability under our loan arrangements with banks and certain third-party individuals, and securities financing. Our ability to generate sufficient cash flows from our operating activities is primarily dependent on our sales of display modules and polarizers to our customers at margins sufficient to cover fixed and variable expenses.

As of March 31, 2024 and September 30, 2023, we had cash and cash equivalents of $2,050,712 and $1,157,424, respectively. We believe that our current cash, cash to be generated from our operations and access to funds under our loan arrangements with banks will be sufficient to meet our working capital needs for at least the next twelve months.

We finance our operations through short-term loans provided by a syndicate of banks in China, as more fully described in Note 13 Short-term and long-term Borrowings to our consolidated financial statements. As of March 31, 2024, we had a total of 19 outstanding short-term loans provided by banks, with an aggregate principal amount of RMB136,000,000, or approximately $18.84 million. As of September 30, 2023, we had a total of 16 outstanding short-term loans and 3 outstanding long-term loans provided by banks, with an aggregate principal amount of RMB129,000,000, or approximately $17.68 million. Each of these loans has a term of one to two years and, pursuant to our agreements with these banks, the majority all of the loans were renewed and funds were accessed immediately when the outstanding principal and interest are repaid in full. All of these loans have a fixed interest rate. The average interest rates were 4.04% and 4.03% for the outstanding bank loans as of March 31, 2024 and September 30, 2023, respectively.

We do not have any amounts committed to be provided by our related parties. After deducting the total expenses, we received net proceeds of approximately $12,409,022 from our initial public offering. Besides the indemnification escrow of $0.40 million, we used $2.5 million, $2.80 million, and $3.80 million on plant construction, research and development and working capital, respectively. The proceeds from our initial public offering replenished our working capital. However, we plan to expand our business by investing in new technologies either through acquisition or research and development and construction of facilities and purchase of equipment for production of new products. We will need to raise more capital through financings, including additional public or private offering and factoring arrangements, to implement these growth strategies and strengthen our position in the market.

We also finance our operations through securities financing. As of March 31, 2024, we issued a convertible note of $550,000 and completed a private placement of unregistered ordinary shares in an amount of $980,000. We also plan to raise proceeds through future financing activities. These measures ensure sufficient liquidity to support our operations, strategic initiatives, and growth plans.

Based on current operating plan, our management believes that the above-mentioned measures collectively will provide sufficient liquidity for us to meet our future liquidity and capital requirement for at least next six months from the date of the issuance of the unaudited financial statements included elsewhere in this current report.

Substantially all of our operations are conducted in China and a majority portion of our revenues, expense, cash and cash equivalents are denominated in RMB. RMB is subject to the exchange control regulation in China, and, as a result, we may have difficulty distributing any dividends outside of China due to PRC exchange control regulations that restrict our ability to convert RMB into U.S. dollars.

Capital Expenditures

Our capital expenditures consist primarily of expenditures for the purchase of fixed assets as a result of our business expansion in China mainland and overseas markets, and the construction and launch of, and the continuous investment in the manufacturing facility of polarizers. Our capital expenditures amounted to $0.26 million for the six months ended March 31, 2024, and $6.99 million for the fiscal year ended September 30, 2023.

Contractual Obligations

As of March 31, 2024, and September 30, 2023, we had significant contractual obligations and commercial commitments of $1.48 million and $2.85 million, respectively, excluding our bank borrowings as disclosed herein as of March 31, 2024 and September 30, 2023.

Off-balance Sheet Commitments and Arrangements

There were no off-balance sheet arrangements for the six months ended March 31, 2024 and 2023 that have or that in the opinion of management are likely to have, a current or future material effect on our consolidated financial condition or results of operations.

Critical Accounting Policies

We prepare our consolidated financial statements in conformity with accounting principles generally accepted by the U.S. GAAP, which requires us to make judgments, estimates and assumptions that affect our reported amount of assets, liabilities, revenue, costs and expenses, and any related disclosures. Although there were no material changes made to the accounting estimates and assumptions in the past three years, we continually evaluate these estimates and assumptions based on the most recently available information, our own historical experience and various other assumptions that we believe to be reasonable under the circumstances. Since the use of estimates is an integral component of the financial reporting process, actual results could differ from our expectations as a result of changes in our estimates.

We believe that the following accounting policies involve a higher degree of judgment and complexity in their application and require us to make significant accounting estimates. Accordingly, these are the policies we believe are the most critical to understanding and evaluating our consolidated financial condition and results of operations.

Use of Estimates

The preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported and disclosed in the consolidated financial statements and the accompanying notes. Such estimates include, but are not limited to, allowances for doubtful accounts, inventory valuation, useful lives of property, plant and equipment, intangible assets, and income taxes related to realization of deferred tax assets and uncertain tax position. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash and cash equivalents primarily consist of cash and deposits with financial institutions which are unrestricted as to withdrawal and use. Cash equivalents consist of highly liquid investments that are readily convertible to cash generally with original maturities of three months or less when purchased.

Value-added Tax (“VAT”)

Sales revenue represents the invoiced value of goods, net of VAT. All of our products sold in the PRC are subject to a VAT on the gross sales price. We are subject to a VAT rate of 13% effective on April 1, 2019. The VAT may be offset by VAT paid by us on raw materials and other materials included in the cost of producing or acquiring our finished products.

Revenue Recognition

We generate our revenues mainly from sales of display modules and polarizers to third-party customers, who are mainly display manufacturers. We follow Financial Accounting Standards Board (FASB) ASC 606 and accounting standards updates (“ASU”) 2014-09 for revenue recognition. On October 1, 2017, we have early adopted ASU 2014-09, which is a comprehensive new revenue recognition model that requires revenue to be recognized in a manner to depict the transfer of goods or services to a customer at an amount that reflects the consideration expected to be received in exchange for those goods or services. We consider revenue realized or realizable and earned when all the five following criteria are met: (1) identify the contract with a customer, (2) identify the performance obligations in the contract, (3) determine the transaction price, (4) allocate the transaction price to the performance obligations in the contract, and (5) recognize revenue when (or as) the entity satisfies a performance obligation.

We consider customer purchase orders, which in some cases are governed by master sales agreements, to be the contracts with a customer. As part of our consideration of the contract, we evaluate certain factors including the customer’s ability to pay (or credit risk). For each contract, we consider the promise to transfer products, each of which is distinct, to be the identified performance obligations.

In determining the transaction price, we evaluate whether the price is subject to refund or adjustment to determine the net consideration to which we expect to be entitled. We offer customers warranty of six months to five years for defective products that is beyond contemplated defective rate mutually agreed in contract with customer. We analyzed historical sales returns and concluded that they have been immaterial.

Revenues are reported net of all value added taxes. As our standard payment terms are less than one year, we have elected the practical expedient under ASC 606-10-32-18 to not assess whether a contract has a significant financing component. We allocate the transaction price to each distinct product based on their relative standalone selling price.

Revenue is recognized when control of the product is transferred to the customer (i.e., when our performance obligation is satisfied at a point in time), which typically occurs at delivery. For international sales, we sell our products primarily under free onboard (“FOB”) shipping point term. For sales under FOB shipping point term, we recognize revenues when products are delivered from us to the designated shipping point. Prices are determined based on negotiations with our customers and are not subject to adjustment. As a result, we expect returns to be minimal.

Research and Development Costs

Research and development activities are directed toward the development of new products as well as improvements in existing processes. These costs, which primarily include salaries, contract services and supplies, are expensed as incurred.

Inventories

Inventories are stated at the lower of cost or net realizable value. Cost is principally determined using the weighted-average method. The Company records adjustments to inventory for excess quantities, obsolescence or impairment when appropriate to reflect inventory at net realizable value. These adjustments are based upon a combination of factors including current sales volume, market conditions, lower of cost or market analysis and expected realizable value of the inventory.

Impact of Inflation

Inflationary factors such as increases in product costs and indirect expenses may adversely affect our operational performance. While we currently believe that inflation has not had a significant impact on our financial position or operational results, higher inflation rates in the future, coupled with stagnant service prices, could challenge our ability to maintain current gross profit levels and the proportion of selling, general, and administrative expenses relative to net sales. Our operations are based in China, where inflation rates have remained relatively stable. Therefore, we consider the impact of inflation on the company to be minor.

Holding Company Structure

We are a holding company with no material operations of our own. We conduct our operations primarily through Jiangsu Austin and its subsidiaries in China. As a result, our ability to pay dividends and to finance any debt we may incur depends upon dividends paid by our subsidiaries. Our PRC subsidiaries may purchase foreign exchange from relevant banks and make distributions to offshore companies after completing relevant foreign exchange registration with the SAFE. Our offshore companies may inject capital into or provide loans to our PRC subsidiaries through capital contributions or foreign debts, subject to applicable PRC regulations. If our subsidiaries or any newly formed subsidiaries incur debt on their own behalf in the future, the instruments governing their debt may restrict their ability to pay dividends to us. In addition, our PRC subsidiaries are permitted to pay dividends to us only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations.

Under PRC law, each of our PRC subsidiaries in China is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reached 50% of its registered capital, after which any mandatory appropriation stops. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation of the companies. The reserved amounts as determined pursuant to PRC statutory laws totaled $1,497,772, and $1,497,771 as of March 31, 2024 and September 30, 2023, respectively.

Research and Development, Patents and Licenses, etc.

The display panel industry is subject to rapid technological changes. We believe that effective research and development is essential to maintaining our competitive position in the market.

We conduct research and development primarily internally and through collaborations with various universities. We spend approximately 4.4% of revenue each year on our research and development activities. We have developed a research and development management system that encourages our engineers to make new project proposals and implement strict evaluation standards for each stage of a project development. New projects are selected primarily based on their feasibility and consistency with our overall research and development strategy, and are reviewed on a quarterly basis. As of March 31, 2024 our research and development department had a total of 60 employees, of which 23% have a master’s degree or higher.

The following are examples of products and technologies that have been developed through our research and development activities in recent years:

To strengthen our technology leadership and improve our competitiveness, we have focused on diversifying the use of our products to new industries, such as automotive, outdoor media, public education, and IoT terminals. In our research and development, we have aimed at upgrading the display technology of our products to cater for different application scenarios.

We have also expanded our research and development efforts to upstream raw materials. Through our cooperation with Inabata & Co., Ltd. in Japan, our polarizer manufacturing facilities in Chengdu started production in January 2019. We worked with Inabata & Co., Ltd. to jointly develop new polarizers to meet the technical specifications of customers in China. We will continue to invest in the research and development of polarizers for LCD and OLED display panels.

To enhance competitiveness in the end product market, our research and development team has been developing innovative products with a unique market positioning. We have started to independently develop new technologies, such as face recognition, simultaneous language translation, wireless charging, and synchronous projection, which are being applied to our own products, such as the all-in-one intelligent conference system and wireless photo transmission system. Additionally, in 2023, to complement the versatility and convenience of our Pintura product, we established a specialized Pintura R&D team, dedicated to the development of a custom app tailored specifically for enhancing the Pintura user experience. We launched a crowdfunding campaign for Pintura wireless photo transmission system products in the United States in March 2024, and raised nearly $100,000 on a crowdfunding platform by June 2024. In addition, we have introduced Pintura wireless photo transmission system products in China since mid-February 2024 through different sales channels, including traditional e-commerce platforms, new media business, and domestic offline stores. We plan to expand Pintura wireless photo transmission system products’ presence on more e-commerce platforms and enter European and other international markets.

Furthermore, with the expansion of the use of display panels, an increasing number of customers who are unable to independently develop their own control systems, are searching for one-stop display, control and transmission solutions that meet their needs. Since 2017, we have strengthened our technological capabilities to offer client-centric, one-stop solutions and services that cover product design, research and development as well as production and sales.

Intellectual Property

We currently hold a total of 104 PRC patents including patents for TFT-LCD and OLED display module manufacturing processes, display module product structures and applications, TFT-LCD and OLED polarizer manufacturing processes and applications. These patents will expire at various dates upon the expiration of their respective terms ranging from 2024 to 2041. We also have 4 pending patent applications in China, including one invention patent. In addition, we hold 25 software copyrights relating to our module manufacturing process control and display control and five trademarks for our brand name “Ostin”, “Zhipingtai.”, “OSPERI”, “Pintura” and “Xiaoxianping”.

As part of our ongoing efforts to prevent infringements on our intellectual property rights and to keep abreast of critical technology developments by our competitors, we closely monitor patent applications in China, Korea, Japan and the United States. We also filed patent applications in the United States, where appropriate, to protect our proprietary technologies. At present, we have two pending patent application in the United States.

We enter into agreements with our employees and consultants who may have access to our proprietary information upon the commencement of an employment or consulting relationship. These agreements generally provide that all inventions, ideas, discoveries, improvements and copyrightable material made or conceived by the individual arising out of the employment or consulting relationship and all confidential information developed or made known to the individual during the term of the relationship are our exclusive property.

Trend Information

Following the COVID-19 pandemic’s onset in 2019, which led to a significant surge in customer demand, peaking in 2021 in particular. During the six months ended March 31, 2024, the adverse effects of the COVID-19 pandemic on the business sector that we operate in persists, due to the negative impact on both international and domestic economies, as well as various geopolitical factors. Although the Chinese government has now lifted the restrictions and we have resumed normal business operations, the COVID-19 pandemic still has negatively impacted, and may continue to negatively impact, the global economy and disrupt normal business activity, which may have an adverse effect on our results of operations. Concurrently, our costs of sales, production, and raw materials sharply decreased in response to the reduced market demand. By aligning our production plans with sales orders, we successfully circumvented the issues of overstocking that plagued the broader market.

Critical Accounting Estimates

The preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported and disclosed in the consolidated financial statements and the accompanying notes. Such estimates include, but are not limited to, allowances for doubtful accounts, inventory valuation, useful lives of property, plant and equipment, intangible assets, and income taxes related to realization of deferred tax assets and uncertain tax position. Actual results could differ from those estimates.

17

Exhibit 99.2

OSTIN TECHNOLOGY GROUP CO., LTD.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(UNAUDITED)

F-

OSTIN TECHNOLOGY GROUP CO., LTD.

INDEX TO UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

Condensed Consolidated Financial Statements

F-

OSTIN TECHNOLOGY GROUP CO., LTD.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF MARCH 31, 2024 AND SEPTEMBER 30, 2023

(IN U.S. DOLLARS, EXCEPT FOR NUMBER OF SHARES DATA)

|

March 31, 2024 |

September 30, 2023 |

|||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 1,744,631 | $ | 854,518 | ||||

| Restricted cash | 306,081 | 302,906 | ||||||

| Accounts receivable, net of allowance for credit losses of $82,032 and $46,722, respectively | 4,807,938 | 6,484,945 | ||||||

| Inventories, net | 11,122,152 | 14,418,925 | ||||||

| Advances to suppliers, net | 1,871,457 | 1,509,477 | ||||||

| Tax receivables | 614,227 | 646,565 | ||||||

| Due from related parties | 66,206 | |||||||

| Prepaid expenses and other receivables | 464,637 | 220,346 | ||||||

| Total Current Assets | 20,997,329 | 24,437,682 | ||||||

| Property, plant and equipment, net | 23,733,821 | 25,056,027 | ||||||

| Land use rights, net | 1,452,215 | 1,481,595 | ||||||

| Intangible assets, net | 4,694,198 | 4,978,082 | ||||||

| Long-term investment | 207,748 | 205,592 | ||||||

| Right-of-use lease assets | 87,986 | 141,772 | ||||||

| Other long-term receivables | 267,823 | 248,011 | ||||||

| TOTAL ASSETS | $ | 51,441,120 | $ | 56,548,761 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | 5,310,619 | $ | 10,798,453 | ||||

| Convertible notes | 511,030 | |||||||

| Accrued expenses and other current liabilities | 2,019,855 | 2,043,830 | ||||||

| Advances from customers | 339,343 | 648,359 | ||||||

| Due to related parties | 4,223,696 | 3,005,577 | ||||||

| Current portion of long-term payable | 532,426 | |||||||

| Short-term borrowings | 26,100,081 | 23,915,792 | ||||||

| Operating lease liabilities – current | 104,000 | |||||||

| Deferred tax liability | 15,558 | 15,396 | ||||||

| Total Current Liabilities | 39,052,608 | 40,531,407 | ||||||

| Operating lease liabilities – non-current | 12,895 | |||||||

| Long-term borrowings | 1,644,737 | |||||||

| Long-term payables | 725,175 | 271,590 | ||||||

| TOTAL LIABILITIES | $ | 39,777,783 | $ | 42,460,629 | ||||

| COMMITMENTS AND CONTINGENCIES | ||||||||

| SHAREHOLDERS’ EQUITY | ||||||||

|

Class A ordinary share, $0.0001 par value, 4,991,000,000 shares authorized, 14,806,250 and 14,006,250 shares issued and outstanding as of March 31, 2024 and September 30, 2023 |

1,481 | 1,401 | ||||||

|

Class B ordinary share, $0.0001 par value, 8,000,000 shares authorized, 2,000,000 and 0 shares issued and outstanding as of March 31, 2024 and September 30, 2023 |

200 | |||||||

| Preference share, $0.0001 per value, 1,000,000 shares authorized, 0 shares issued and outstanding as of March 31, 2024 and September 30, 2023 | ||||||||

| Additional paid-in capital | 24,235,939 | 23,256,219 | ||||||

| Statutory reserves | 1,497,772 | 1,497,771 | ||||||

| Accumulated deficit | (13,107,089 | ) | (8,465,867 | ) | ||||

| Accumulated other comprehensive loss | (2,343,787 | ) | (2,331,612 | ) | ||||

| Total Equity Attributable to Ostin Technology Group Co., Ltd. | 10,284,516 | 13,957,912 | ||||||

| Equity attributable to non-controlling interests | 1,378,821 | 130,220 | ||||||

| Total Shareholders’ Equity | 11,663,337 | 14,088,132 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 51,441,120 | $ | 56,548,761 | ||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

F-

OSTIN TECHNOLOGY GROUP CO., LTD.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF INCOME (LOSS) AND

COMPREHENSIVE INCOME (LOSS)

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(IN U.S. DOLLARS, EXCEPT SHARES DATA)

| For the six months ended | ||||||||

| March 31, | ||||||||

| 2024 | 2023 | |||||||

| Sales | $ | 14,973,048 | $ | 34,295,114 | ||||

| Cost of sales | (14,082,663 | ) | (33,603,125 | ) | ||||

| Gross profit | 890,385 | 691,989 | ||||||

| Operating expenses: | ||||||||

| Selling and marketing expenses | (897,059 | ) | (1,325,919 | ) | ||||

| General and administrative expenses | (2,900,993 | ) | (3,175,731 | ) | ||||

| Research and development costs | (965,157 | ) | (1,430,401 | ) | ||||

| Gain from disposal of property, plant and equipment | 81,036 | 160,288 | ||||||

| Total operating expenses | (4,682,173 | ) | (5,771,763 | ) | ||||

| Operating income (loss) | (3,791,788 | ) | (5,079,774 | ) | ||||

| Other income (expenses): | ||||||||

| Interest income (expense), net | (1,102,464 | ) | (544,923 | ) | ||||

| Other income (expenses), net | 244,873 | 499,982 | ||||||

| Total other income (expenses), net | (857,591 | ) | (44,941 | ) | ||||

| Loss before income taxes | (4,649,379 | ) | (5,124,715 | ) | ||||

| Income tax benefit / (provision) | 108,189 | |||||||

| Net loss | (4,649,379 | ) | (5,016,526 | ) | ||||

| Net loss attributable to non-controlling interests | (8,158 | ) | (27,324 | ) | ||||

| Net loss attributable to Ostin Technology Group Co., Ltd. | (4,641,221 | ) | (4,989,202 | ) | ||||

| Net loss | (4,649,379 | ) | (5,016,526 | ) | ||||

| Other comprehensive income (loss): | ||||||||

| Foreign currency translation adjustment | 56,198 | (422,092 | ) | |||||

| Comprehensive loss | (4,593,181 | ) | (5,438,618 | ) | ||||

| Comprehensive (loss) income attributable to non-controlling interests | 60,215 | (50,125 | ) | |||||

| Comprehensive loss attributable to Ostin Technology Group Co., Ltd. | (4,653,396 | ) | (5,388,493 | ) | ||||

| Loss per share | ||||||||

| $ | (0.29 | ) | $ | (0.36 | ) | |||

| Weighted average number of ordinary shares outstanding | ||||||||

| 15,844,501 | 14,006,250 | |||||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

F-

OSTIN TECHNOLOGY GROUP CO., LTD.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND SEPTEMBER 30, 2023

(IN U.S. DOLLARS, EXCEPT SHARES DATA)

| Class A Shares |

Amount | Class B Shares |

Amoun | Additional paid-in capital |

Statutory reserves |

Accumulated deficit |

Accumulated other comprehensive income (loss) |

Non- controlling interests |

Total shareholders’ equity |

|||||||||||||||||||||||||||||||

| Balance at September 30, 2023 | 14,006,250 | $ | 1,401 | $ | $ | 23,256,219 | $ | 1,497,771 | $ | (8,465,867 | ) | $ | (2,331,612 | ) | $ | 130,220 | $ | 14,088,132 | ||||||||||||||||||||||

| Private placement | 280 | 979,720 | 980,000 | |||||||||||||||||||||||||||||||||||||

| Private placement | 2,000,000 | 200 | 200 | |||||||||||||||||||||||||||||||||||||

| Shares repurchase | (2,000,000 | ) | (200 | ) | (200 | ) | ||||||||||||||||||||||||||||||||||

Capital contribution by Non- |

1,188,386 | 1,188,386 | ||||||||||||||||||||||||||||||||||||||

| Foreign currency translation loss | - | (12,175 | ) | 68,373 | 56,198 | |||||||||||||||||||||||||||||||||||