UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended __________

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report: July 9, 2024

Commission File Number: 001-42162

CROWN LNG HOLDINGS LIMITED

(Exact name of Registrant as specified in its charter)

| Not applicable | Jersey, Channel Islands | |

|

(Translation of Registrant’s name into English) |

(Jurisdiction of incorporation or organization) |

3rd Floor, 44 Esplanade

St. Helier, Jersey

JE4 9WG

(Address of principal executive offices)

Copy to:

Swapan Kataria

Chief Executive Officer

3rd Floor, 44 Esplanade

St. Helier, Jersey

JE4 9WG

Telephone: +47 980 25 359

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Ordinary shares, no par value per share | CGBS | The Nasdaq Stock Market LLC | ||

| Warrants, each exercisable to purchase one ordinary share at an exercise price of $11.50 per share | CGBSW | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the shell company report:

On July 15, 2024, the issuer had 68,979,384 ordinary shares, no par value per share outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☒ | |

| Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☐

TABLE OF CONTENTS

| EXPLANATORY NOTE | iii | ||

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | vii | ||

| PART I | 1 | ||

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 1 | |

| A. | Directors and Senior Management | 1 | |

| B. | Advisers | 1 | |

| C. | Auditors | 1 | |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | 1 | |

| ITEM 3. | KEY INFORMATION | 1 | |

| A. | [Reserved.] | 1 | |

| B. | Capitalization and Indebtedness | 1 | |

| C. | Reasons for the Offer and Use of Proceeds | 2 | |

| D. | Risk Factors | 2 | |

| ITEM 4. | INFORMATION ON THE COMPANY | 4 | |

| A. | History and Development of the Company | 4 | |

| B. | Business Overview | 4 | |

| C. | Organizational Structure | 4 | |

| D. | Property, Plants and Equipment | ||

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 5 | |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 5 | |

| A. | Directors and Senior Management | 5 | |

| B. | Compensation | 5 | |

| C. | Board Practices | 9 | |

| D. | Employees | 9 | |

| E. | Share Ownership | 9 | |

| ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 10 | |

| A. | Major Shareholders | 10 | |

| B. | Related Party Transactions | 11 | |

| C. | Interests of Experts and Counsel | 11 | |

| ITEM 8. | FINANCIAL INFORMATION | 11 | |

| A. | Consolidated Statements and Other Financial Information | 11 | |

| B. | Significant Changes | 11 | |

| ITEM 9. | THE OFFER AND LISTING | 11 | |

| A. | Offer and Listing Details | 11 | |

| B. | Plan of Distribution | 12 | |

| C. | Markets | 12 | |

| D. | Selling Shareholders | 12 | |

| E. | Dilution | 12 | |

| F. | Expenses of the Issue | 12 | |

| ITEM 10. | ADDITIONAL INFORMATION | 12 | |

| A. | Share Capital | 12 | |

| B. | Memorandum and Articles of Association | 12 | |

| C. | Material Contracts | 12 | |

| D. | Exchange Controls and Other Limitations Affecting Security Holders | 12 | |

| E. | Taxation | 13 | |

| F. | Dividends and Paying Agents | 13 | |

| G. | Statement by Experts | 13 | |

| H. | Documents on Display | 13 | |

| I. | Subsidiary Information | 13 | |

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISKS | 13 | |

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 13 | |

| PART II | 14 | ||

| PART III | 15 | ||

| ITEM 17. | FINANCIAL STATEMENTS | 15 | |

| ITEM 18. | FINANCIAL STATEMENTS | 15 | |

On July 9, 2024 (the “Closing Date”), Crown LNG Holdings Limited, a private limited company incorporated under the laws of Jersey, Channel Islands (“Pubco” or the “Company”), consummated the previously announced business combination pursuant to the Business Combination Agreement dated as of August 3, 2023 (as amended, the “BCA”), by and among the Company, Catcha Investment Corp, a Cayman Islands exempted company limited by shares (“Catcha”), CGT Merge II Limited, a Cayman Islands exempted company limited by shares (“Merger Sub”), and Crown LNG Holding AS, a private limited liability company incorporated under the laws of Norway (“Crown”).

The following transactions occurred pursuant to the terms of the BCA (collectively, the “Business Combination”):

| ● | Merger Sub merged with and into Catcha (the “Merger”), with Catcha surviving as the surviving company and becoming a wholly owned subsidiary of PubCo; |

| ● | in connection with the Merger, each (a) issued and outstanding Class A ordinary share, par value $0.0001 per share, of Catcha (“Catcha Class A Ordinary Shares”) was converted into the right to receive one newly issued ordinary share, no par value, of PubCo (together, the “PubCo Ordinary Shares” and each individually, a “PubCo Ordinary Share”), (b) issued and outstanding Class B ordinary share, par value $0.0001 per share, of Catcha (“Catcha Class B Ordinary Shares”) was converted into the right to receive one newly issued PubCo Ordinary Share, (c) outstanding and unexercised public and private placement warrant of Catcha was converted into one warrant of PubCo (“PubCo Warrants”) that entitles the holder thereof to purchase one PubCo Ordinary Share in lieu of one Catcha Class A Ordinary Share and otherwise upon substantially the same terms and conditions; and |

| ● | following the Merger, subject to the terms and procedures set forth under the Business Combination Agreement, the Crown Shareholders (as defined in the accompanying proxy statement/prospectus) transferred to PubCo, and PubCo acquired from the Crown Shareholders, all of the ordinary shares of Crown held by the shareholders in exchange for the issuance of PubCo Ordinary Shares. |

In connection with the closing of the Business Combination, Pubco completed the issuance of securities pursuant to the financing agreements as described below and received aggregate gross proceeds of approximately $7.9 million therefrom on or around the Closing Date.

Financing Agreements

April 2024 Notes

On April 30, 2024, PubCo entered into subscription agreements with certain investors with respect to convertible promissory notes issuable upon closing of the business combination (the “April 2024 Notes”) with an aggregate original principal amount of $1.05 million for an aggregate purchase price of $1.0 million, reflecting a 5% original issue discount.

The April 2024 Notes bear interest at an annual rate of 10% and mature on the first anniversary of the issuance of the applicable note (the date of such issuance, the “Issuance Date”). Interest on the April 2024 Notes is payable in cash or in-kind through the issuance of additional April 2024 Notes, at the option of PubCo.

The April 2024 Notes are convertible into PubCo Ordinary Shares at the option of the holder. The number of ordinary shares issuable upon conversion of the April 2024 Notes is determined by dividing (x) such Conversion Amount by (y) the Conversion Price (the “Conversion Rate”). “Conversion Amount” means the sum of (A) the portion of the principal of a note to be converted, redeemed or otherwise with respect to which this determination is being made, (B) accrued and unpaid interest with respect to such principal of the applicable note, and (C) any other unpaid amounts, if any. “Conversion Price” means $10.00 initially at the date of issuance of the April 2024 Notes. The Conversion Price will reset to 95% of the lowest closing volume weighted average price observed over the 5 trading days immediately preceding the 270th calendar day following the Issuance Date, subject to a minimum price of $2.50 (the “Minimum Price”).

PubCo has the option to redeem the April 2024 Notes in full at any time after the Issuance Date and prior to maturity thereof upon 10 Trading Days’ (as defined in the April 2024 Notes) notice for cash at a redemption price equal to 110% of the aggregate principal amount thereof, plus accrued and unpaid interest thereon.

PIPE

On May 6, 2024, PubCo and Catcha entered into a subscription agreement (the “PIPE Subscription Agreement”) for a private placement (the “PIPE”) with a certain accredited investor (the “Purchaser”). Pursuant to the PIPE Subscription Agreement, at consummation of the Business Combination, the Purchaser purchased an aggregate of 176,470 PubCo Ordinary Shares, at a price per share of $8.50, representing aggregate gross proceeds of $1.5 million.

On May 14, 2024, PubCo and Catcha entered into additional subscription agreements (together with the PIPE Subscription Agreement above, the “PIPE Subscription Agreements”) for a private placement with certain accredited investors who are existing shareholders of Crown (the “Existing Shareholder Purchasers”). Pursuant to the PIPE Subscription Agreement, at consummation of the Business Combination, the Existing Shareholder Purchasers purchased an aggregate of 26,393 PubCo Ordinary Shares (together with the PubCo Ordinary Shares to be purchased by the Purchaser, the “PIPE Shares”), at a price per share of $10.00, representing aggregate gross proceeds of $263.9 thousand.

The PIPE Subscription Agreements contain customary representations and warranties of Catcha, PubCo, the Purchaser, and the Existing Shareholder Purchasers, and customary conditions to closing, as well as customary indemnification obligations. Pursuant to the PIPE Subscription Agreements, PubCo has agreed to register the resale of the PIPE Shares and is required to prepare and file a registration statement with the U.S. Securities and Exchange Commission no later than thirty days following the closing date of the Business Combination.

The closing of the PIPE Subscription Agreements took place concurrently with the closing of the Business Combination.

Securities Lending Agreement

On May 22, 2024, Pubco entered into a securities lending agreement (the “Securities Lending Agreement”) with Millennia Capital Partners Limited (the “Lender”) pursuant to which the Lender agreed to loan PubCo up to $4.0 million (the “Loan”) at fifty-five (55%) Loan to Value of the current market value of shares of Crown pledged to the Lender (“Transferred Collateral”). “Loan to Value” means the ratio of the Loan to the value of the Transferred Collateral, calculated by dividing the amount borrowed by the fair market value of the Transferred Collateral. The Loan matures thirty-six (36) months after the Closing Date (as defined in the Securities Lending Agreement) and bears interest at an annual rate of 6.0% to be paid quarterly.

As of the Closing Date, there has not been any amounts drawn down pursuant to the Securities Lending Agreement.

Securities Purchase Agreement

On June 4, 2024, PubCo entered into a definitive securities purchase agreement (the “Securities Purchase Agreement”) with Helena Special Opportunities LLC (the “Investor”), an affiliate of Helena Partners Inc., a Cayman-Islands based advisor and investor, providing for up to approximately USD$20.7 million in funding through a private placement for the issuance of convertible notes (the “SPA Notes”). Capitalized terms used but not defined in the description below shall have the meanings ascribed thereto in the Securities Purchase Agreement.

Pursuant to the Securities Purchase Agreement, the Company will issue the SPA Notes and warrants (the “Warrants”) to the Investor across multiple tranches (the “Tranches”) consisting of an initial tranche (the “Initial Tranche”) of (i) an aggregate principal amount of $2.95 million and including an original issue discount (“OID”) of up to an aggregate of $442,500, plus Warrants to purchase a number of PubCo Ordinary Shares equal to the applicable Warrant Share Amounts (defined as 50% of the principal amount of each issued Tranche, divided by $10). The second tranche (the “Second Tranche”) consists of an aggregate principal amount of SPA Notes of up to $2.95 million and including an OID of up to $442,500 and Warrants to purchase a number of PubCo Ordinary Shares equal to the applicable Warrant Share Amounts with respect to such Tranche. The Securities Purchase Agreement contemplates up to five subsequent Tranches, each of which will be in an aggregate principal amount of SPA Notes of $2.95 million each and each including an OID of $442,5000 and Warrants to purchase a number of PubCo Ordinary Shares equal to the applicable Warrant Share Amounts with respect to such Tranches. The purchase price of an SPA Note and its accompanying Warrant will be computed by subtracting the portion of the OID represented by such SPA Note from the portion of the principal amount represented by such SPA Note (a “Purchase Price”).

The Closing of the purchase of each Tranche shall be subject to certain terms and conditions, including but not limited to:

| (a) | Initial Tranche. Closing of the Initial Tranche occurred on closing of the Business Combination |

| (b) | The Second Tranche. Closing of the Second Tranche shall not occur prior to the date that is the earlier of (i) the date that is 90 days following the Closing Date of the Initial Tranche and (ii) such date as the Notes and Warrants issuable in such Tranche may be resold pursuant to an effective registration statement pursuant to Rule 144 under the 1933 Act. |

| (c) | Third and Fourth Tranches. |

| a. | Closing of each such Tranche shall be for only one Tranche of Notes having an initial aggregate Principal Amount equal to the greater of (i) $50,000 and (ii) the lesser of (x) two and one half times the median of the value of shares traded over each of the thirty (30) Trading Days preceding the Closing Day for such Tranche, and (y) $2.95 million, and |

| b. | the Closing Date of such Tranche shall not occur prior to the date that is the earlier of (i) the date that is 90 days following the Closing Date of the previous Tranche and (ii) such date as the Company and the Investor shall mutually agree. |

| (d) | Fifth, Sixth and Seventh Tranches. Closing of any subsequent Tranche shall occur on such date as the Company and the Investor shall mutually agree, if at all; provided that the Closing of any subsequent Tranche shall be for only one Tranche of Notes having an initial aggregate Principal Amount equal to the greater of (i) $50,000 and (ii) the lesser of (x) two and one half times the median of the value of shares traded over each of the 30 Trading Days preceding the Closing Date for such Tranche, and (y) $2.95 million. |

Cohen & Company Capital Markets, a division of J.V.B. Financial Group, LLC. acted as placement agent to Pubco for the facility described above.

Non-Redemption Agreements

On June 20, 2024, Catcha entered into non-redemption agreements (the “Non-Redemption Agreements”) with one or more investors (each, a “Backstop Investor”), each acting on behalf of certain funds, investors, entities or accounts that are managed, sponsored or advised by each such Backstop Investor or its affiliates. Pursuant to the Non-Redemption Agreements, the Backstop Investors agreed that, on or prior to closing of the Business Combination, the Backstop Investors will rescind or reverse their previous election to redeem an aggregate of up to approximately 800,000 Catcha ordinary shares (the “Backstop Shares”), which redemption requests were made in connection with Catcha’s extraordinary general meeting of shareholders held on June 12, 2024. Upon consummation of the Business Combination, Catcha paid or caused to be paid to each Backstop Investor a payment in respect of its respective Backstop Shares in cash released from Catcha’s trust account in an amount equal to the product of (x) the number of Backstop Shares and (y) $2.075, which is equal to (A) the price per share for a pro rata portion of the amount on deposit in the trust account, less (B) $9.50.

Fee Deferrals, Share Transfers and Other Transaction Expense Reductions

Transaction Expense Reduction

Prior to the closing of the Business Combination, PubCo, Catcha, Crown and Catcha Holdings LLC (“Sponsor”) entered into several agreements with service providers (the “Service Providers”) to Catcha and Crown in connection with the Business Combination, resulting in a reduction of the aggregate transaction expenses otherwise payable thereby at closing (the “Transaction Expense Reduction”).

Founder Share Transfers

On July 8, 2024, Sponsor transferred an aggregate of 6,511,627 Catcha Class A Ordinary Shares (“Catcha Shares”) to third parties who provided financing in connection with the Business Combination, Transaction Expense Reduction as well as settlement of liabilities, including on behalf of Crown. This includes 1,500,000 Catcha Shares as commitment shares to the Investor in consideration for its entry into the Securities Purchase Agreement described above, 550,000 Catcha Shares to Chardan Capital Markets LLC as consideration for an advisory service fee due to Chardan Capital Markets LLC, 1,350,000 Catcha Shares to other Service Providers to Catcha in partial consideration for the Transaction Expense Reduction, including fee deferrals, and 3,111,627 Catcha Shares to certain investors in consideration for providing financing to Crown and Catcha, including providing the Transferred Collateral securing the Securities Lending Agreement described above, and settlement of certain liabilities. The Catcha Shares were exchanged for PubCo Ordinary Shares in the Business Combination, in a transaction registered under the Securities Act of 1933, as amended pursuant to PubCo’s Registration Statement on Form F-4 declared effective by the Securities and Exchange Commission on February 14, 2024 (File No. 333-274832) and, accordingly, may be freely transferred without restrictions under the Securities Act by the recipients thereof.

The agreements with certain of the Service Providers provide that, if the Service Provider sells the Service Provider Shares for proceeds equal to an agreed upon amount, then such Service Provider shall return any remaining Service Provider Shares to Sponsor.

Vendor Promissory Notes for Fee Deferrals

From June 18, 2024 to June 26, 2024, Pubco issued five convertible promissory notes to the vendors Ernst & Young Advokatfirma AS, Wikborg Rein Advokatfirma AS, Ernst & Young AS, Ogier (Jersey) LLP, and Nelson Mullins Riley Scarborough LLP (each a “Vendor,” and collectively, the “Vendors”), agreeing to defer payment for services provided (the “Convertible Vendor Notes”). The aggregate principal amount for all the Convertible Vendor Notes is approximately $5.0 million, bearing interest at 12% per annum. The Convertible Vendor Notes provides that twenty to fifty percent of the principal amount is payable within 30 days after the Closing Date, depending on Vendor. The remaining unpaid principal amount for each Convertible Vendor Note shall be increased by 20%, and payable in equal installments each quarter ending date subsequent to the Closing Date, from between one year and up to five years, depending on Vendor. If Pubco raises additional capital after Close, Pubco will use best endeavors to pay any outstanding principal under the Convertible Vendor Notes.

All the Convertible Vendor Notes provides that upon occurrence of a default, at the option of the Vendor any amounts outstanding under the Convertible Vendor Note may be converted into ordinary shares of at a conversion price equal to the VWAP Price: (i) on the date that is one hundred fifty (150) days following the Closing Date (the “Initial Election Date”), up to an amount equal to fifty percent (50%) of the then outstanding principal amount of this Note; and (ii) on each thirty (30) day anniversary following the Initial Election Date (each such anniversary together with the Initial Election Date, each, an “Election Date”) up to an additional ten percent (10%) of the then outstanding principal amount of the Convertible Vendor Note (collectively, the “Conversion Rights”); provided that (i) the foregoing calculation of the aggregate amount available to be converted into Shares pursuant to the Conversion Rights assumes that there has been no prior payment of the principal of the Convertible Vendor Note and (ii) any amounts that were otherwise available to be converted pursuant to the Conversion Rights on an Election Date that were not so converted shall remain available for conversion pursuant to the Conversion Rights on subsequent Election Dates until so converted. A default is constituted in the event of (i) failure by Pubco to pay any portions of the principal amount within five (5) business days after the dates specified in the Convertible Vendor Notes or issue shares pursuant to the Vendor Notes, if so, elected by the Vendor; (ii) voluntary bankruptcy; and (iii) involuntary bankruptcy.

In addition, on July 9, 2024, PubCo also issued promissory notes (the “Promissory Notes”) in an aggregate principal amount of $3.5 million to another Service Provider to Crown and Catcha, with such amounts representing deferrals of fees owed thereto. Such Promissory Notes bear interest at a rate of 12% per annum, payable quarterly, subject to Crown’s option to defer 50% thereof as paid-in-kind, with principal due thereunder payable at maturity on the 18-month anniversary of the issuance thereof. There is no conversion feature provided for under such Promissory Notes.

Amendments to Material Agreements

In connection with the foregoing, PubCo, Catcha and Sponsor entered into certain amendments to material agreements previously disclosed in the Registration Statement, as described below.

Agreements with Polar

On July 8, 2024, PubCo, Catcha, Sponsor and Polar Multi-Strategy Master Fund (“Polar”) entered into an Amendment (the “March Amendment”) to the March 2023 Subscription Agreement, which was originally entered into between Catcha, Sponsor and Polar, pursuant to which Polar provided $300,000 to Catcha (the “March Capital Contribution”) for working capital purposes.

Pursuant to this Amendment, PubCo, Catcha and the Sponsor jointly and severally, agreed to promptly repay, as a return of capital, an amount equal to the March Capital Contribution funded by Polar to Catcha within five (5) business days of the Closing of the Business Combination, by:

| A) | Issuance of a convertible promissory note by the Company in favor of Polar or its nominee, with consideration for such note equal to 50% of the March Capital Contribution; and |

| B) | Payment in cash in U.S. Dollars equal to 50% of the March Capital Contribution. |

On July 8, 2024, PubCo, Catcha, Sponsor and Polar entered into an Amendment (the “October Amendment”) to the October 2023 Subscription Agreement, which was originally entered into between Catcha, Sponsor and Polar, pursuant to which Polar provided $750,000 to Catcha (the “October Capital Contribution”) for working capital purposes.

Pursuant to this Amendment, PubCo, Catcha and the Sponsor jointly and severally, agreed to promptly repay, as a return of capital, an amount equal to the October Capital Contribution funded by Polar to Catcha within five (5) business days of the Closing of the Business Combination, by:

| A) | Issuance of a convertible promissory note by the Company in favor of Polar or its nominee, with consideration for such note equal to 50% of the October Capital Contribution; and |

| B) | Payment in cash in U.S. Dollars equal to 50% of the October Capital Contribution. |

On July 8, 2024, PubCo and Polar entered into a Securities Purchase Agreement, pursuant to which PubCo shall issue Promissory Notes for an aggregate purchase price of up to $525,000, divided into two separate notes, with an aggregate principal amount of $583,334, reflecting original issue discount of 10%. The issuance of such Promissory Notes was in satisfaction of 50% of the payment due upon the Closing of the Business Combination under the March Amendment and the October Amendment, as described above, with no additional amount paid by Polar.

CCM Amendment Agreement

On June 25, 2024, Cohen & Company Capital Markets division (“CCM”), Catcha and PubCo entered into an Amendment (“CCM Amendment”) to the Engagement Letter, which was originally entered into between CCM and Catcha on May 18, 2023. Pursuant to the CCM Amendment, the fees contemplated in the Engagement Letter were amended as follows:

| ● | $100,000 paid in full in U.S. dollars simultaneously with the closing of the Business Combination; |

| ● | $100,000 paid in full in U.S. dollars simultaneously with the funding of the second tranche of funding pursuant to the Securities Purchase Agreement with Helena Special Opportunities LLC described above; |

| ● | 350,000 ordinary shares of Pubco, which was satisfied by Sponsor on behalf of PubCo within the aggregate of 1,900,000 of such transfers to Service Providers described above; and |

| ● | Issuance by PubCo to CCM at the closing of the Business Combination of a Promissory Note in the principal amount of $1,000,000, which shall be convertible at CCM’s election beginning six months following closing of the Business Combination. The conversion price shall equal the lessor of (x) the 5 VWAP trading days ending on the VWAP trading day immediately preceding the applicable conversion and (y) 95% of the previous trading day closing price of PubCo Ordinary Shares. Upon the second anniversary of issuance, all remaining amounts due under the note shall convert into PubCo Ordinary Shares. |

Pubco Ordinary Shares and Pubco Warrants are traded on The Nasdaq Stock Market LLC (“Nasdaq”) under the symbols “CGBS” and “CGBSW”, respectively.

Except as otherwise indicated or required by context, references in this Shell Company Report on Form 20-F (the “Report”) to “we”, “us”, “our”, “Pubco” or the “Company” refer to Crown LNG Holdings Limited, a private limited company incorporated under the laws of Jersey, Channel Islands.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report and the documents incorporated by reference herein include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements relate to, among others, our plans, objectives and expectations for our business, operations and financial performance and condition, and can be identified by terminology such as “may”, “should”, “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “continue” and similar expressions that do not relate solely to historical matters. Forward-looking statements are based on management’s belief and assumptions and on information currently available to management. Although we believe that the expectations reflected in forward-looking statements are reasonable, such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements.

Forward-looking statements in this Report and in any document incorporated by reference in this Report may include, but are not limited to, statements about:

| ● | the ability of Pubco to realize the benefits expected from the Business Combination and to maintain the listing of the Pubco Ordinary Shares on Nasdaq; |

| ● | changes in global, regional or local business, market, financial, political and legal conditions, including the development, effects and enforcement of laws and regulations and the impact of any current or new government regulations in the United States and Jersey affecting Pubco’s operations and the continued listing of Pubco’s securities; |

| ● | Pubco’s success in retaining or recruiting, or changes required in, its officers, key employees or directors; |

| ● | Actions relating to the business, operations and financial performance of Pubco |

| ● | Pubco’s ability and market opportunity to supply liquefied natural gas (“LNG”) infrastructure to under-served markets around the world; |

| ● | the global market and demand for natural gas, LNG, and liquefication and re-gasification services; |

| ● | Pubco’s ability to obtain regulatory approval for its operations, and any related restrictions or limitations of any approved operation; |

| ● | Pubco’s ability to respond to general economic conditions; |

| ● | Pubco requires substantial additional capital to finance its operations, and if it is unable to raise such capital when needed or on acceptable terms, it may be forced to delay, reduce, and/or eliminate one or more of its development programs or future commercialization efforts; and |

| ● | Pubco’s ability to develop and maintain effective internal controls; |

| ● | assumptions regarding interest rates and inflation; and |

| ● | competition and competitive pressures from other companies worldwide in the industries in which Pubco operates. |

Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors discussed under the “Risk Factors” section of the proxy statement/prospectus (the “Proxy Statement/Prospectus”) forming a part of the Registration Statement filed in connection with the Business Combination, which section is incorporated herein by reference. Accordingly, you should not rely on these forward-looking statements, which speak only as of the date of this Report. We undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this Report or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks described in the reports we will file from time to time with the SEC after the date of this Report.

Although we believe the expectations reflected in the forward-looking statements were reasonable at the time made, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assume responsibility for the accuracy or completeness of any of these forward-looking statements. You should carefully consider the cautionary statements contained or referred to in this section in connection with the forward looking statements contained in this Report and any subsequent written or oral forward-looking statements that may be issued by the Company or persons acting on its behalf.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

Information regarding the directors and executive officers of the Company after the closing of the Business Combination is included in the Proxy Statement/Prospectus under the section titled “Management of Pubco Following the Business Combination” and is incorporated herein by reference.

The business address for each of the directors and executive officers of the Company is 3rd Floor, 44 Esplanade, St. Helier, Jersey, JE4 9WG.

Nelson Mullins Riley & Scarborough LLP, 101 Constitution Avenue, NW Suite 900, Washington, D.C. 20001, United States, has acted as U.S. securities counsel for the Company and will continue to act as U.S. securities counsel to the Company following the completion of the Business Combination.

Ogier (Jersey) LLP, Jersey, Channel Islands, 44 Esplanade, St Helier, Jersey JE4 9WG, has acted as counsel for the Company with respect to Jersey law and will continue to act as counsel for the Company with respect to Jersey law following the completion of the Business Combination.

For the years ended December 31, 2023, 2022, and 2021, KPMG AS, has acted as the independent registered public accounting firm for Crown LNG Holding AS and will be the Company’s independent registered public accounting firm following the Business Combination.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

B. Capitalization and Indebtedness

The following table sets forth the capitalization of the Company on an unaudited pro forma combined basis as of July 9, 2024, after giving effect to the Business Combination and the agreements as described above:

| AS OF DECEMBER 31, 2023 | ||||

| PRO FORMA | ||||

| (IN THOUSANDS) | ||||

| CASH AND CASH EQUIVALENTS | $ | 5,607 | ||

| EQUITY: | ||||

| PubCo ordinary shares | 7 | |||

| Share premium | 322,553 | |||

| Reserves | 12,341 | |||

| Accumulated deficit | (118,135 | ) | ||

| Cumulative translation differences | 1,684 | |||

| Non-controlling interest | (88 | ) | ||

| TOTAL EQUITY: | 218,362 | |||

| DEBT: | ||||

| Current interest-bearing liabilities | 1,212 | |||

| Current lease liabilities | 13 | |||

| Trade payables | 2,861 | |||

| Provisions | 10,511 | |||

| Other current Liabilities | 750 | |||

| April 2024 Notes | 1,000 | |||

| SPA Notes - derivative liability | 771 | |||

| Polar convertible promissory notes | 372 | |||

| Polar convertible promissory notes – derivative | 153 | |||

| CCM convertible promissory notes – derivative liability | 1,079 | |||

| Vendor promissory notes | 3,500 | |||

| Vendor promissory notes – derivative liability | 5,723 | |||

| Due to related party | 241 | |||

| TOTAL DEBT: | 28,186 | |||

| TOTAL CAPITALIZATION | $ | 246,548 | ||

C. Reasons for the Offer and Use of Proceeds

Not applicable.

The risk factors related to the business and operations of the Company are described in the Proxy Statement/Prospectus under the section titled “Risk Factors”, which is incorporated herein by reference.

Following the consummation of the Business Combination, Pubco has a significant number of outstanding convertible notes which will be subject to reset provisions to the conversion price. The conversion of such convertible notes at a reduced conversion price could result in an issuance of a large number of Pubco Ordinary Shares, significant dilution, and an adverse impact on the price of Pubco Ordinary Shares.

On April 30, 2024, Pubco entered into subscription agreements with certain investors with respect to the April 2024 Notes which has an aggregate original principal amount of $1.05 million for an aggregate purchase price of $1.0 million. The April 2024 Notes will be convertible into PubCo Ordinary Shares at the option of the holder. The conversion price will initially be $10.00 at the date of issuance of the April 2024 Notes. However, the Conversion Price will reset to 95% of the lowest closing volume weighted average price observed over the 5 trading days immediately preceding the 180th calendar day following the date of issuance of the April 2024 Notes, subject to the “Minimum Price” of $2.50. If the Conversion Price is lowered to the Minimum Price of $2.50, up to 400,000 PubCo Ordinary Shares would be issuable upon conversion thereof.

On June 4, 2024, Pubco entered into a entered into a definitive securities purchase agreement with an institutional investor with respect to the issuance of up to approximately $21 million aggregate principal amount of convertible notes pursuant to a convertible note facility, providing for the issuance of such Facility Notes in up to seven tranches of approximately $2.9 million. Such Facility Notes would be convertible at a conversion price of $10.00, subject to a reset to a discount to a trailing volume-weighted average price as of the time of each conversion. The Facility Notes are expected to have a minimum conversion price, giving effect to any such reset, of only $0.50. The conversion of the Facility Notes in full would result in the issuance of more than 40,000,000 PubCo Ordinary Shares.

If conversion of the April 2024 Notes and the Facility Notes occurs at a reduced conversion price, a large number of Pubco Ordinary Shares could be issued, leading to substantial dilution to our stockholders’ equity and the market price of Pubco Ordinary Shares may decrease as a result of the additional selling pressure in the market. Any downward pressure on the trading price of PubCo Ordinary Shares caused by the sale, or potential sale, of shares issuable upon conversion of the convertible notes could also encourage short sales by third parties, creating additional selling pressure on our share price.

Pubco may not be able to draw down the full amount of the capital available under the financing agreements it has entered into, should the required terms and conditions under the respective terms and conditions of the financing agreements not be met.

On May 22, 2024, PubCo entered into a securities lending agreement with Millennia Capital Partners Limited pursuant to which the Lender agreed to loan PubCo up to $4.0 million at fifty-five (55%) Loan to Value of the current market value of 730,000 shares of PubCo pledged to the Lender. If the value of the shares decline due to market conditions or any other reasons, the amount available under the loan to Pubco may be reduced, or Lender may require Pubco to furnish additional securities or cash to Lender to increase the collateral.

On June 4, 2024, PubCo entered into a entered into a definitive securities purchase agreement with an institutional investor with respect to the issuance of up to approximately $21 million aggregate principal amount of convertible notes pursuant to a convertible note facility, providing for the issuance of such Facility Notes in up to seven tranches of approximately $2.9 million. The issue sizes of the third and subsequent tranches are subject to certain trading volume conditions of Pubco shares, and may be limited to two and one half times the median of the value of shares traded over each of the thirty trading days preceding the closing date for such Tranche.

If the terms and conditions for the draw down of capital under each of these financing agreements are not met, Pubco may be limited in terms of the amount of capital it may be able to draw down, which could have an adverse impact on the financial and operating conditions of the company.

Pubco may not have sufficient funds to develop its projects, service our expenses and other liquidity needs and may require additional capital, and our independent registered public accountants and management have determined that there is substantial doubt as to Crown’s ability to continue as a going concern.

Following the business combination, Pubco may not have sufficient funds to develop our projects, service our expenses and other liquidity needs and may require additional capital, and our independent registered public accountants and management have determined that there is substantial doubt as to our ability to continue as a going concern. There can be no assurance that Pubco will be able to timely secure such additional funding on acceptable terms and conditions, or at all. If we cannot obtain sufficient capital, Pubco will not have sufficient cash and liquidity to finance our operations, develop its projects and make required payments and may need to substantially alter, or possibly even discontinue, its operations. Pubco plans to continue to seek opportunities for raising additional funds through potential alternatives, which may include, among other things, the issuance of equity, equity-linked, and/or debt securities, debt financings or other capital sources and/or strategic transactions. However, Pubco may not be successful in securing additional financing on a timely basis, on acceptable terms and conditions, or at all. In addition, substantial doubt regarding our ability to continue as a going concern may cause investors or other financing sources to be unwilling to provide funding to us on commercially reasonable terms, if at all. If sufficient funds are not available on a timely basis and on acceptable terms, Pubco may have to delay, revise or reduce the scope of some of its business activities, including project development and related operating expenses, which would adversely affect its business prospects and its ability to continue its operations and would have a negative impact on its financial condition and ability to pursue its business strategies. If Pubco is ultimately unable to continue as a going concern, Pubco may have to seek the protection of bankruptcy laws or liquidate our assets and may receive less than the value at which those assets are carried on our audited financial statements, and it is possible that its shareholders will lose all or a part of their investment.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

See “Explanatory Note” in this Report for additional information regarding the Company and the BCA. Certain additional information about the Company is included in the Proxy Statement/Prospectus under the section titled “Information About the Company” and is incorporated herein by reference. The material terms of the Business Combination are described in the Proxy Statement/Prospectus under the section titled “The Business Combination Agreement,” which is incorporated herein by reference.

The Company is subject to certain of the informational filing requirements of the Exchange Act. Since the Company is a “foreign private issuer,” it is exempt from the rules and regulations under the Exchange Act prescribing the furnishing and content of proxy statements, and the officers, directors and principal shareholders of the Company are exempt from the reporting and “short-swing” profit recovery provisions contained in Section 16 of the Exchange Act with respect to their purchase and sale of Pubco Ordinary Shares. In addition, the Company is not required to file reports and financial statements with the SEC as frequently or as promptly as U.S. public companies whose securities are registered under the Exchange Act. However, the Company is required to file with the SEC an Annual Report on Form 20-F containing financial statements audited by an independent accounting firm. The SEC also maintains a website at www.sec.gov that contains reports and other information that the Company files with or furnishes electronically to the SEC.

The website address of the Company is www.crownlng.com. The information contained on the website does not form a part of, and is not incorporated by reference into, this Report.

Information regarding the business of the Company is included in the Proxy Statement/Prospectus under the sections titled “Information About Crown” and “Crown’s Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which are incorporated herein by reference.

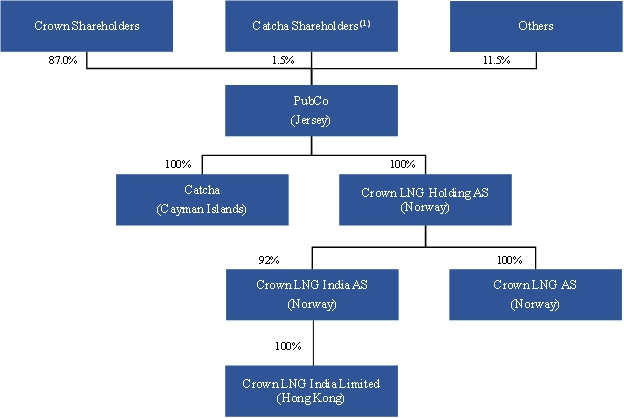

The diagram below depicts a simplified version of the Company immediately following the consummation of the Business Combination.

| (1) | Catcha Shareholders include Catcha Investment Corp public shareholders and the Sponsor. |

D. Property, Plants and Equipment

Information regarding the terminals of the Company is included in the Proxy Statement/Prospectus under the section titled “Information About Crown”, which is incorporated herein by reference.

ITEM 4A. UNRESOLVED STAFF COMMENTS

None.

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

The discussion and analysis of the financial condition and results of operations of Crown is set forth in Exhibit 15.2 hereto, which is incorporated herein by reference.

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

A. Directors and Senior Management

Information regarding the directors and executive officers of the Company after the closing of the Business Combination is included in the Proxy Statement/Prospectus under the section titled “Management of Pubco Following the Business Combination” and is incorporated herein by reference.

In addition, upon Closing of the Business Combination, Andrew Judson, 56, was appointed as a director of PubCo. Mr. Judson currently serves as a Senior Advisor at Fort Capital, one of Canada’s leading independent investment banking advisory firms. Prior to joining Fort Capital, Mr. Judson was Managing Director at Camcor Partners, a Calgary based boutique Private Equity firm investing in upstream companies active in the Western Canadian Sedimentary Basin on behalf of Institutional and private LPs., from 2013 – 2018. From 2007 – 2013, Mr. Judson served as Managing Director of FirstEnergy Capital, an investment bank focused on the energy sector. In addition, Mr. Judson has served as a director of Pieridae Energy Limited since 2015 and lead director of Condor Energies Inc. since 2019. We believe Mr. Judson’s over 20 years of experience in the finance industry related to the energy sector and his service on the board of directors of publicly traded companies qualify him to serve as a director on our board of directors.

Crown Named Executive Officer and Director Compensation

This section discusses material components of the executive compensation programs for Crown’s executive officers who are named in the “Summary Compensation Table” below. In 2023, Crown’s named executive officers (“NEO”) and their positions were as follows:

| ● | Swapan Kataria, Chief Executive Officer |

| ● | Jørn Husemoen, Chief Financial Officer |

| ● | Gunnar Knutsen, President |

This discussion may contain forward-looking statements that are based on Crown’s current plans, considerations, expectations, and determinations regarding future compensation programs.

Summary Compensation Table

The following table contains information pertaining to the compensation of Crown’s named executives for the fiscal years 2022 and 2023.

Summary Compensation Table—Fiscal Years 2023 and 2022

| Name and Principal Position | Year | Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Non-Qualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||||||||||||

| Swapan Kataria* | 2023 | $ | — | — | — | — | — | — | $ | 666,000 | $ | 666,000 | ||||||||||||||||||||||

| Chief Executive Officer | 2022 | $ | 499,287 | — | — | — | — | — | — | $ | 499,287 | |||||||||||||||||||||||

| Jørn Husemoen | 2023 | $ | 155,000 | — | — | — | — | — | $ | 308,000 | $ | 463,000 | ||||||||||||||||||||||

| Chief Financial Officer | 2022 | $ | 162,000 | — | — | — | — | — | $ | 325,000 | $ | 487,000 | ||||||||||||||||||||||

| Gunnar Knutsen* | 2023 | $ | 132,000 | — | — | — | — | — | $ | 379,000 | $ | 511,000 | ||||||||||||||||||||||

| President | 2022 | — | — | — | — | — | — | $ | 222,000 | $ | 222,000 | |||||||||||||||||||||||

| * | Gunnar Knutsen resigned as CEO as of July 10, 2022. As of April 25, 2023, Swapan Kataria entered into the position as CEO of Crown LNG Holding AS and as of April 1, 2023, Gunnar Knutsen entered into the position as President of Crown LNG AS. |

Outstanding Equity Awards as of December 31, 2023

There were no outstanding options to acquire Crown ordinary shares held by the Crown’s NEOs as of December 31, 2023. The Crown NEOs did not hold any other outstanding equity awards as of that date.

Executive Employment Agreements

Swapan Kataria Management Consultancy Services Agreement

On January 10, 2022, Crown entered into a Management Consultancy Services Agreement and Service Order Form (the “SK Management Agreement”) with Swapan Kataria, pursuant to which Mr. Kataria hires subcontractors to provide management and consulting services and administrative assistance to Crown in connection with the implementation of its global sales strategy. Pursuant to the SK Management Agreement, Crown makes monthly payments to Mr. Kataria in the amount of NOK 400,000, or approximately $37,452, as adjusted for sick-leave and/or vacation, in exchange for the services and to cover all performance related expenses that are incurred. Pursuant to the SK Management Agreement, the compensation covers (i) wages regarding special supplements, subsistence and other compensation associated with the site location, and all personal taxes, social security contributions and other government levies payable with respect to such remuneration and allowances, (ii) mobilization and demobilization expenses, (iii) pay on public holidays, (iv) wages during illness, military service and leaves of absence, (v) insurance premiums and voluntary or obligatory pension contributions, (vi) medical service expenses, (vii) employer contributions and other applicable taxes and levies payable to public authorities, (viii) fees to employer and employee organizations, (ix) fees to establish and renew the residence and immigration permits, work permits, certificates, licenses, and health certificates, (x) overhead and management fees, (xi) risk and profit related fees, and (xii) business travel expenses. The SK Management Agreement also contains customary provisions and representations, including confidentiality, non-solicitation, and non-disclosure undertakings by Mr. Kataria.

Black Kite Management Consultancy Services Agreement

On July 7, 2020, Crown entered into a Management Consultancy Services Agreement and Service Order Form (the “Kite Management Agreement”) with Black Kite AS (“Kite”), Mr. Husemoen’s management company, pursuant to which Kite hires subcontractors to provide management and advisory services to Crown in connection with the business operations and financial matters of Crown together with Crown’s board of directors. Pursuant to the Kite Management Agreement, Crown makes monthly payments to Kite in the amount of NOK 400,000, or approximately $37,452, as adjusted for sick-leave and/or vacation, in exchange for the services and to cover all performance related expenses that are incurred. Pursuant to the Kite Management Agreement, the compensation includes, but is not limited to: (i) wages for special supplements, subsistence and other compensation associated with the site location, and all personal taxes, social security contributions and other government levies payable with respect to such remuneration and allowances, (ii) wages for mobilization and demobilization, (iii) pay on public holidays, (iv) wages during illness, military service and leaves of absence, (v) wages for insurance premiums and voluntary or obligatory pension contributions, (vi) medical service expenses, (vii) employer contributions and other applicable taxes and levies payable to public authorities, (viii) fees to employer and employee organizations, (ix) fees to establish and renew the residence and immigration permits, work permits, certificates, licenses, and health certificates, (x) overhead and management fees, (xi) wages regarding risk and profit, and (xii) business travel expenses. The Kite Management Agreement also contains customary provisions and representations, including confidentiality, non-solicitation, and non-disclosure undertakings by Kite.

Management for Hire Agreement

On April 1, 2023, Crown entered into a Management for Hire Agreement AS (the “Gantt Hire Agreement”) with Gantt Consulting AS (“Gantt”). The Gantt Hire Agreement stipulates that Crown will engage Mr. Knutsen, owner of Gantt, as the Managing Director of Crown, beginning on April 1, 2023 and remaining in effect for 24 consecutive months, at which point the Gantt Hire Agreement will automatically expire. Either party can terminate the agreement by giving 3 months written notice. In addition to the agreed monthly remuneration of NOK 570,000, or approximately $53,000, Crown will pay for documented travel expenses, representation on behalf of Crown, and a daily allowance for travel corresponding to the rates set by the Norwegian Directorate of Taxes.” The Gantt Agreement stipulates that the Fee is to be raised in accordance with the Norwegian Consumer Price Index on July 1, 2023, and may be adjusted for any sick-leave and or vacation periods.

Director Compensation—Fiscal 2023

The following table sets forth information regarding the compensation paid to, or earned by our directors, during fiscal 2023:

| Name | Fees Earned or Paid in Cash ($) |

Stock Awards ($) |

Total ($) |

|||||||||

| Jørn Skule Husemoen | $ | 135,000 | — | $ | 135,000 | |||||||

| Swapan Kataria | $ | 41,000 | — | $ | 41,000 | |||||||

| Aslak Aslaksen | $ | 52,000 | — | $ | 52,000 | |||||||

As of December 31, 2023, Crown had no formal plan for compensating its directors. Crown’s directors are entitled to reimbursement for reasonable travel and other out-of-pocket expenses incurred. Crown’s board may award special remuneration to any director undertaking any special services on Crown’s behalf other than services ordinarily required of a director.

Following the Closing, we expect Pubco’s executive compensation program to be consistent with Crown’s existing compensation policies and philosophies, which are designed to:

| ● | attract, retain and motivate senior management leaders who are capable of advancing Crown’s mission and strategy and, ultimately, creating and maintaining its long-term equity value. Such leaders must engage in a collaborative approach and possess the ability to execute its business strategy in an industry characterized by competitiveness and growth; |

| ● | reward senior management in a manner aligned with Crown’s financial performance; and |

| ● | align senior management’s interests with Crown Shareholders’ long-term interests through equity participation and ownership. |

Following Closing, decisions with respect to the compensation of Pubco’s executive officers, including its named executive officers, will be made by the compensation committee of the Pubco Board. The following discussion is based on the present expectations as to the compensation of the named executive officers and directors following the Business Combination. The actual compensation of the named executive officers will depend on the judgment of the members of the compensation committee and may differ from that set forth in the following discussion.

Pubco anticipates that compensation for its executive officers will have the following components: base salary, cash bonus opportunities, long-term incentive compensation, broad-based employee benefits, supplemental executive perquisites and severance benefits. Base salaries, broad-based employee benefits, supplemental executive perquisites and severance benefits will be designed to attract and retain senior management talent. PubCo intends to also use annual cash bonuses and long-term equity awards to promote performance-based pay that aligns the interests of its named executive officers with the long-term interests of its equity owners and to enhance executive retention.

Base Salary

PubCo expects that the base salaries of its named executive officers in effect prior to the Business Combination as described above will be subject to increases made in connection with reviews by the compensation committee.

Annual Bonuses

Pubco expects that it will use annual cash incentive bonuses for the named executive officers to motivate their achievement of short-term performance goals and tie a portion of their cash compensation to performance. It expects that, near the beginning of each year, the compensation committee will select the performance targets, target amounts, target award opportunities and other terms and conditions of annual cash bonuses for the named executive officers, subject to the terms of their employment and service agreements. Following the end of each year, the compensation committee will determine the extent to which the performance targets were achieved and the amount of the award that is payable to the named executive officers.

Stock-Based Awards

Pubco expects to use stock-based awards in future years to promote its interests by providing these executives with the opportunity to acquire equity interests as an incentive for their remaining in its service and aligning the executives’ interests with those of PubCo shareholders. Stock-based awards for its directors and named executive officers may be awarded in future years under a new employee incentive plan upon or after consummation of the Business Combination, which would be adopted by the PubCo Board in connection with the Business Combination.

Other Compensation

Pubco expects to continue to maintain various employee benefit plans currently maintained by Crown and to continue to provide its named executive officers with specified perquisites and personal benefits currently provided by Crown that are not generally available to all employees.

Director Compensation

Following the Business Combination, non-employee directors of Pubco will receive varying levels of compensation for their services as directors and members of committees of the Pubco Board, in accordance with a non-employee director compensation policy that will be put in place following the Business Combination. Pubco anticipates determining director compensation in accordance with industry practice and standards.

The Company has entered into indemnification agreements with its directors and executive officers. Information regarding such indemnification agreements is included in the Proxy Statement/Prospectus under the sections titled “Comparison of Corporate Governance and Shareholder Rights” and “Description of Pubco Securities” and is incorporated herein by reference.

Information regarding the board of directors of the Company subsequent to the Business Combination is included in the Proxy Statement/Prospectus under the section titled “Management of Pubco Following the Business Combination” and is incorporated herein by reference.

Information regarding the employees of the Company is included in the Proxy Statement/Prospectus under the section titled “Information About Crown— Human Resources & Social Responsibility” and is incorporated herein by reference.

Information regarding the ownership of the Post-Closing Pubco Ordinary Shares by our directors and executive officers is set forth in Item 7.A of this Report.

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

The following table sets forth information relating to the beneficial ownership of the Post-Closing Pubco Ordinary Shares as of the Closing Date by:

| ● | each person, or group of affiliated persons, known by us to beneficially own more than 5% of outstanding Pubco Ordinary Shares; |

| ● | each of our directors; |

| ● | each of our executive officers; and |

| ● | all of our directors and executive officers as a group. |

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, and includes shares underlying options and warrants that are currently exercisable or exercisable within 60 days. In computing the number of shares beneficially owned by a person or entity and the percentage ownership of that person or entity in the table below, all shares subject to options or warrants held by such person or entity were deemed outstanding if such securities are currently exercisable, or exercisable within 60 days of the Closing Date. These shares were not deemed outstanding, however, for the purpose of computing the percentage ownership of any other person or entity.

The percentage of Pubco Ordinary Shares beneficially owned is computed on the basis of 68,979,384 Pubco Ordinary Shares outstanding on the Closing Date, after giving effect to the Business Combination and the agreements described above, and including 17,346,632 Ordinary Shares issuable upon the exercise of outstanding warrants..

Unless otherwise indicated, we believe that all persons named in the table below have sole voting and investment power with respect to all Post-Closing Pubco Ordinary Shares beneficially owned by them. To our knowledge, no Post-Closing Pubco Ordinary Shares beneficially owned by any executive officer, director or director nominee have been pledged as security.

Unless otherwise noted, the business address of each of our shareholders is 3rd Floor, 44 Esplanade, St. helier, Jersey, JE4 9WG.

| Name and Address of Beneficial Owner | Number of Pubco Ordinary Shares Beneficially Owned |

Percentage of Pubco Ordinary Shares |

||||||

| 5% Holders of Pubco: | ||||||||

| Catcha Holdings LLC (1) | 8,037,855 | 9.3 | % | |||||

| Swapan Kataria (2) | 17,539,225 | 20.3 | % | |||||

| Raghava Corporate Pte Ltd (3) | 6,855,862 | 7.9 | % | |||||

| Directors and Executive Officers of PubCo | ||||||||

| Swapan Kataria (2) | 17,539,225 | 20.3 | % | |||||

| Jørn Skule Husemoen (4) | 1,377,815 | 1.5 | % | |||||

| Gunnar Knutsen (5) | 312,175 | 0.3 | % | |||||

| All Executive Officers and Directors as a Group | 19,229,215 | 22.1 | % | |||||

| (1) | The address for Catcha Holdings LLC is 3 Raffles Place, #06-01 Bharat Building, Singapore 048617. Represents (1) 838,723 PubCo Ordinary Shares directly held by Catcha Holdings LLC, and (2) 7,199,132 PubCo Ordinary Shares issuable pursuant to 7,199,132 PubCo Warrants held by Catcha Holdings LLC that are exercisable within 60 days of the Closing Date. This amount excludes up to 1,550,000 Service Provider Shares that may be transferred to Catcha Holdings LLC by the applicable Service Provider to the extent that the proceeds of sales of Service Provider Shares by such Service Provider exceed agreed upon amounts. Please see “Explanatory Note – Founder Share Transfers.” Patrick Grove and Luke Elliott share voting and investment control over the shares held by Catcha Holdings LLC. Mr. Grove and Mr. Elliott disclaim any beneficial ownership of the securities held by Catcha Holdings LLC other than to the extent of any pecuniary interest they may have therein, directly or indirectly. |

| (2) | Represents shares held by Citibank, N.A. Nominee. The Kataria Capital Corporation owns 100% of the interest in the securities held by Citibank, N.A. Nominee and has sole voting and investment power of the securities held by Citibank, N.A. Nominee. The Kataria Trust owns 100% of the interest in Kataria Capital Corporation and has sole voting and investment power of the securities held by Kataria Capital Corporation. Swapan Kataria is the trustee of the Kataria trust and has sole voting and investment power of the securities held by the Kataria Trust. The address for Citibank, N.A. Nominee is 1 North Wall Quay, Dublin. |

| (3) | Devavarapu Tvisha Ragendri owns 100% of the interest in Raghava Corporate Pte Ltd and has sole voting and investment power of the securities held by Raghava Corporate Pte Ltd. The address for Raghava Corporate Pte Ltd is 7500A Beach Road, #14-302, The Plaza, Singapore 199591. |

| (4) | Represents 1,377,815 shares held by Wealins S.A. as a Nominee for Black Kite AS. Black Kite AS owns 100% of the interest in the 1,377,815 securities held by Wealins S.A. and has sole voting and investment power of the 1,377,815 securities held by Wealins S.A. Jørn Skule Husemoen owns 100% of the interest in Black Kite AS and has sole voting and investment power of the securities held by Black Kite AS. The address for Jørn Skule Husemoen is Askekroken 11, 0277 Oslo, Norway. |

| (5) | Represents 244,615 shares held directly and 67,560 shares held indirectly by Gantt Consulting AS. Gunnar Knutsen owns 100% of the interest in Gantt Consulting AS and has sole voting and investment power of the securities held by Gantt Consulting AS. The address for Gunnar Knutsen is Askekroken 11, 0277 Oslo, Norway. |

B. Related Person Transactions

Information regarding certain related person transactions is included in the Proxy Statement/Prospectus under the section titled “Certain Relationships and Related Person Transactions — Crown” and is incorporated herein by reference.

C. Interests of Experts and Counsel

None.

A. Consolidated Financial Statements and Other Financial Information

See Item 18 of this Report for consolidated financial statements and other financial information.

A discussion of significant changes since December 31, 2023 is provided under Item 4 of this Report and is incorporated herein by reference.

Nasdaq Listing of Pubco Ordinary Shares and Pubco Warrants

Pubco Ordinary Shares and Pubco Warrants are listed on Nasdaq under the symbols “CGBS” and “CGBSW”, respectively. Holders of the Pubco Ordinary Shares and Pubco Warrants should obtain current market quotations for their securities.

Lock-ups

Information regarding the lock-up restrictions applicable to the Pubco Ordinary Shares is included in the Proxy Statement/Prospectus under the section titled “Related Agreements” and is incorporated herein by reference.

Warrants

Upon the completion of the Business Combination, there were 17,346,632 Pubco Warrants outstanding. The Warrants, which entitle the holder to purchase one Pubco Ordinary Share at an exercise price of $11.50 per share, will become exercisable 30 days after the completion of the Business Combination. The Warrants will expire five years after the completion of the Business Combination or earlier upon redemption or liquidation in accordance with their terms.

In addition, each Catcha warrant outstanding and unexercised immediately prior to the Effective Time was converted into one PubCo Warrant that entitles the holder thereof to purchase one PubCo Ordinary Share.

Not applicable.

The Pubco Ordinary Shares and Warrants are listed on Nasdaq under the symbols CGBS and CGBSW, respectively. There can be no assurance that the Ordinary Shares and/or Warrants will remain listed on Nasdaq.

Not applicable.

Not applicable.

Not applicable.

ITEM 10. ADDITIONAL INFORMATION

The Company is a no par value company and there is no limit on the number of shares of any class which the Company is authorized to issue.

Information regarding our share capital is included in the Proxy Statement/Prospectus under the section titled “Description of Pubco’s Securities” and is incorporated herein by reference.

B. Amended and Restated Memorandum of Association

Information regarding certain material provisions of the A&R Memorandum of Association is included in the Proxy Statement/Prospectus under the section titled “Charter Documents of PubCo Following the Business Combination” and is incorporated herein by reference.

Except as described above under the heading “Explanatory Note”, information regarding certain material contracts is included in the Proxy Statement/Prospectus under the sections titled “The Business Combination Agreement” and “Related Agreements” and is incorporated herein by reference.

D. Exchange Controls and Other Limitations Affecting Security Holders

There are no governmental laws, decrees, regulations or other legislation in Jersey that may affect the import or export of capital, including the availability of cash and cash equivalents for use by Pubco, or that may affect the remittance of dividends, interest, or other payments by Pubco to non-resident holders of its Post-Closing Pubco Ordinary Shares. There is no limitation imposed by Jersey law or in the A&R Memorandum of Association on the right of non-residents to hold or vote shares.

Information regarding certain tax consequences of owning and disposing of Pubco Ordinary Shares and Pubco Warrants is included in the Proxy Statement/Prospectus under the section titled “Material Tax Considerations” and is incorporated herein by reference.

F. Dividends and Paying Agents

Pubco has not paid any dividends to its shareholders. Following the completion of the Business Combination, Pubco’s board of directors will consider whether or not to institute a dividend policy. The determination to pay dividends will depend on many factors, including, among others, Pubco’s financial condition, current and anticipated cash requirements, contractual restrictions and financing agreement covenants, solvency tests imposed by applicable corporate law and other factors that Pubco’s board of directors may deem relevant.

The financial statements of Catcha Investment Corp as of and for the years ended December 31, 2023 and 2022, appearing in the Proxy Statement/Prospectus have been audited by Marcum LLP, independent registered public accounting firm, as set forth in their report thereon (which report contains an explanatory paragraph regarding the ability of Catcha Investment Corp to continue as a going concern), appearing elsewhere therein, and are included in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

The consolidated financial statements of Crown LNG Holding AS as of December 31, 2023 and 2022 and for each of the years in the three-year period ended December 31, 2023, have been incorporated by reference herein and in the registration statement in reliance upon the report of KPMG AS, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

The audit report covering the December 31, 2023 consolidated financial statements includes an explanatory paragraph that states that the ' recurring losses and net capital deficiency of Crown LNG Holding AS raise substantial doubt about the entity's ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of that uncertainty.

We are subject to the informational requirements of the Exchange Act. Accordingly, we are required to file reports and other information with the SEC, including annual reports on Form 20-F and reports on Form 6-K. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information we have filed electronically with the SEC. As a foreign private issuer, we are exempt under the Exchange Act from, among other things, the rules prescribing the furnishing and content of proxy statements, and our executive officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we are not required under the Exchange Act to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

We also make available on our website, free of charge, our Annual Report and the text of our reports on Form 6-K, including any amendments to these reports, as well as certain other SEC filings, as soon as reasonably practicable after they are electronically filed with or furnished to the SEC. Our website address is www.crownlng.com. The reference to our website is an inactive textual reference only, and information contained therein or connected thereto is not incorporated into this Form 20-F.

Not applicable.

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISKS

Information regarding quantitative and qualitative disclosure about market risk is set forth in Exhibit 15.2 hereto, which is incorporated herein by reference.

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

Information pertaining to the Pubco Warrants is described in the Proxy Statement/Prospectus under the section titled “Description of Pubco’s Securities—Warrants.”

ITEM 16F. CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT

Following the consummation of the Business Combination on the Closing Date, KPMG AS, the independent registered public accounting firm of Crown LNG Holding AS, is being engaged as the independent auditor of PubCo. In connection with the Business Combination, on the Closing Date, Marcum, which was the auditor for Catcha Investment Corp., was informed that it would no longer be our auditor. Such cessation of audit services was effective upon consummation of the Business Combination on the Closing Date.

The reports of Marcum on the financial statements of Catcha Investment Corp. as of December 31, 2023 and December 31, 2022, and for the years ended December 31, 2023 and December 31, 2022 did not contain any adverse opinion or a disclaimer of opinion, nor were such reports qualified or modified as to uncertainty, audit scope, or accounting principles. Marcum’s audit reports contained an explanatory paragraph related to the substantial doubt of Catcha Investment Corp.'s ability to continue as a going concern.