UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended ____________

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report: July 1, 2024

Commission

File Number: 001-42153

TOYO Co., Ltd

(Exact name of Registrant as specified in its charter)

| Not applicable | Cayman Islands | |

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

Tennoz First Tower F5, 2-2-4

Higashi-shinagawa, Shinagawa-ku

Tokyo, Japan 140-0002

(Address of principal executive offices)

Junsei Ryu

Telephone: +81 3-6433-2789

Email: IR@toyosolar

At the address of the Company set forth above

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of exchange on which registered |

||

| Ordinary shares, par value $0.0001 per share | TOYO | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the shell company report: 46,095,743 ordinary shares and 4,970,012 warrants as of July 1, 2024.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting over Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☐

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

TABLE OF CONTENTS

| Page | |

| EXPLANATORY NOTE | ii |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | iii |

| PART I | |

| ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 1 |

| ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE | 1 |

| ITEM 3. KEY INFORMATION | 1 |

| ITEM 4. INFORMATION ON THE COMPANY | 2 |

| ITEM 4A. UNRESOLVED STAFF COMMENTS | 3 |

| ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 3 |

| ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 3 |

| ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 3 |

| ITEM 8. FINANCIAL INFORMATION | 5 |

| ITEM 9. THE OFFER AND LISTING | 5 |

| ITEM 10. ADDITIONAL INFORMATION | 5 |

| ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 8 |

| ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 8 |

| PART II | |

| PART III | |

| ITEM 17. FINANCIAL STATEMENTS | 10 |

| ITEM 18. FINANCIAL STATEMENTS | 10 |

| ITEM 19. EXHIBITS | 11 |

| SIGNATURE | 13 |

EXPLANATORY NOTE

On July 1, 2024 (the “Closing Date”), TOYO Co., Ltd, a Cayman Islands exempted company (“TOYO” or the “Company”), consummated the previously announced business combination pursuant to the Agreement and Plan of Merger, dated as of August 10, 2023 (as amended on December 6, 2023, February 6, 2024 and February 29, 2024, the “Business Combination Agreement”), by and among (i) the Company, (ii) Blue World Acquisition Corporation, a Cayman Islands exempted company (“BWAQ”), (iii) Vietnam Sunergy Cell Company Limited, a Vietnamese company and wholly-owned subsidiary of TOYO (“TOYO Solar”), (iv) TOYOone Limited, a Cayman Islands exempted company and wholly-owned subsidiary of TOYO (“Merger Sub”), (v) TOPTOYO INVESTMENT PTE. LTD., a Singapore private company limited by shares (“SinCo,” together with TOYO, Merger Sub and TOYO Solar, the “Group Companies,” or each individually, a “Group Company”), (vi) Vietnam Sunergy Joint Stock Company, a Vietnam joint stock company (“VSUN”), (vii) Fuji Solar Co., Ltd, a Japanese company (“Fuji Solar”), (viii) WA Global Corporation, a Cayman Islands exempted company (“WAG”), (ix) Belta Technology Company Limited, a Cayman Islands exempted company (“Belta”), and (x) BestToYo Technology Company Limited, a Cayman Islands exempted company (“BestToYo”).

Pursuant to the Business Combination Agreement, (a) the Group Companies, VSUN, Fuji Solar, WAG, Belta and BestToYo shall consummate a series of transactions involving the Group Companies, including (A) TOYO acquiring one hundred percent (100%) of the issued and paid-up share capital of SinCo from Fuji Solar at an aggregate consideration of SGD1.00 (such transaction, the “Share Exchange”), and (B) SinCo acquiring one hundred percent (100%) of the issued and outstanding shares of capital stock of TOYO Solar from VSUN at an aggregate consideration of no less than $50,000,000 (the “SinCo Acquisition,” and together with the Share Exchange, the “Pre-Merger Reorganization”), as a result of which (i) SinCo shall become a wholly-owned subsidiary of TOYO, (ii) TOYO Solar shall become a wholly-owned subsidiary of SinCo; and (iii) immediately prior to the closing of the SinCo Acquisition, WAG, Belta and BestToYo (collectively, the “Sellers”) shall hold an aggregate of 41,000,000 ordinary shares of TOYO, par value $0.0001 per share (such ordinary shares, “Ordinary Shares”), representing all issued and outstanding share capital of TOYO, and (b) following the consummation of the Pre-Merger Reorganization, BWAQ shall merge with and into Merger Sub, with Merger Sub continuing as the surviving company (the “Merger”), as a result of which, among other things, all of the issued and outstanding securities of BWAQ immediately prior to the filing of the plan of merger with respect to the Merger (the “Plan of Merger”) to the Registrar of Companies of the Cayman Islands, or such later time as may be specified in the Plan of Merger (the “Merger Effective Time”) shall no longer be outstanding and shall automatically be cancelled, in exchange for the right of the holders thereof to receive substantially equivalent securities of the Company, in each case, upon the terms and subject to the conditions set forth in the Business Combination Agreement and in accordance with the provisions of the Companies Act (Revised) of the Cayman Islands and other applicable laws. The Merger, the Pre-Merger Reorganization and each of the other transactions contemplated by the Business Combination Agreement or any of the other relevant Transaction Documents (as defined in the Business Combination Agreement) are collectively referred to as “Business Combination.”

On March 6, 2024, the Company entered into a share purchase agreement (as amended on June 26, 2024, the “PIPE Purchase Agreement”) with BWAQ and a certain investor, NOTAM Co., Ltd., a Japanese corporation (the “PIPE Investor” or “NOTAM”), in connection with the Business Combination. Pursuant to the PIPE Purchase Agreement, the PIPE Investor agrees to purchase a total of 600,000 BWAQ Class A Ordinary Shares (as defined below), at a purchase price of $10.00 per share, for an aggregate purchase price of $6,000,000, and that the Company agrees to, conditioned on the completion of the PIPE Closing (as defined in the PIPE Purchase Agreement) and the closing of the Business Combination (the “Merger Closing”), issue additional Ordinary Shares to the PIPE Investor subject to the conditions set forth therein.

At the Merger Effective Time, (a) each of BWAQ’s units, each consisting of (i) one Class A ordinary share of BWAQ, par value $0.0001 per share (“BWAQ Class A Ordinary Share”), (ii) one-half of one BWAQ warrant of which one whole warrant entitling the holder thereof to purchase one BWAQ Class A Ordinary Share at a purchase price of $11.50 per share (“BWAQ Warrant”), and (iii) one right of BWAQ, each convertible into one-tenth of one BWAQ Class A Ordinary Share (“BWAQ Right”) outstanding immediately prior to the Merger Effective Time (to the extent not already separated) was separated into one BWAQ Class A Ordinary Share and one-half of one BWAQ Warrant of which one whole warrant entitling the holder thereof to purchase one BWAQ Class A Ordinary Share at a purchase price of $11.50 per share, and one right of BWAQ (the “Unit Separation”); (b) immediately following the Unit Separation, (i) each issued and outstanding BWAQ Warrant was converted into one warrant of the Company (“Warrant”) to purchase one Ordinary Share, (ii) each outstanding BWAQ Right outstanding was cancelled in exchange for one-tenth of one BWAQ Class A Ordinary Share, (iii) each BWAQ Class B ordinary share, par value US$0.0001 per share (“BWAQ Class B Ordinary Share”) issued and outstanding immediately prior to the Merger Effective Time, automatically converted into one BWAQ Class A Ordinary Share, and (iv) each BWAQ Class A Ordinary Share issued and outstanding immediately prior to the Merger Effective Time, was cancelled in exchange for the right to receive one newly issued Ordinary Share.

The Business Combination was consummated on July 1, 2024. The Business Combination was approved at the extraordinary general meeting of BWAQ’s shareholders held on May 28, 2024 (the “Extraordinary General Meeting”). BWAQ’s shareholders also voted to approve all other proposals presented at the Extraordinary General Meeting. As a result of the Business Combination, TOYO Solar became a wholly-owned subsidiary of the Company, and BWAQ merged with and into Merger Sub with Merger Sub continuing as the surviving company and a wholly owned subsidiary of the Company. On July 2, 2024, Ordinary Shares commenced trading on the Nasdaq Stock Market (“Nasdaq”) under the symbol “TOYO.” and the Warrants commenced trading on the OTC Markets.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This shell company report on Form 20-F (including information incorporated herein by reference, this “Report”) contains or may contain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve significant risks and uncertainties. Forward-looking statements include all statements that are not historical statements of fact and statements regarding, but not limited to, the respective expectations, hopes, beliefs, intention or strategies of the Company, TOYO Solar or BWAQ regarding the future. You can identify these statements by forward-looking words such as “may,” “expect,” “predict,” “potential,” “anticipate,” “contemplate,” “believe,” “estimate,” “intends,” “will,” “would” and “continue” or similar words. The risk factors and cautionary language referred to or incorporated by reference in this Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in our forward-looking statements, including among other things, the matters identified in the section titled “Risk Factors” of the Company’s Registration Statement on Form F-4 (Registration No. 333-277779) and the Registration Statement on Form F-4 filed pursuant to Rule 462(b) (Registration No. 333-279028) under the Securities Act (together, as amended by a post-effective amendment, the “Form F-4”) filed with the Securities and Exchange Commission (the “SEC”) on May 1, 2024, which are incorporated by reference into this Report.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. Although we believe that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements contained in this Report, or the documents to which we refer readers in this Report, to reflect any change in our expectations with respect to such statements or any change in events, conditions or circumstances upon which any statement is based.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

| A. | Directors and Senior Management |

The directors and executive officers of the Company upon the consummation of the Business Combination are set forth in the Form F-4, in the section titled “Management of PubCo Following the Transactions,” which is incorporated herein by reference. The business address for each of the Company’s directors and executive officers is 5F, Tennoz First Tower, 2-2-4, Higashi-Shinagawa, Shinagawa-ku, Tokyo, Japan 140-0002.

| B. | Adviser |

Robinson & Cole LLP will act as counsel to the Company upon and following the consummation of the Business Combination.

| C. | Auditors |

Marcum Asia CPAs LLP (formerly known as Marcum Bernstein & Pinchuk LLP) acted as the independent auditor of the Company as of December 31, 2023 and 2022 and for the year ended December 31, 2023 and for the period from November 8, 2022 (inception) to December 31, 2022 and will continue to act as the independent auditor of the Company upon the consummation of the Business Combination.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

The following table sets forth the capitalization of the Company on an unaudited pro forma combined basis as of December 31, 2023, after giving effect to the Business Combination and the PIPE Purchase Agreement.

| As of December 31, 2023 (pro forma) | ($ in thousands) |

|||

| Cash and cash equivalents | 29,804 | |||

| Total equity | 63,855 | |||

| Debt: | ||||

| Non-current debt | 12,192 | |||

| Current debt | 142,648 | |||

| Total indebtedness | 154,840 | |||

| Total capitalization | 218,695 | |||

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

The risk factors associated with the Company are described in the Form F-4 in the section titled “Risk Factors,” which is incorporated herein by reference.

ITEM 4. INFORMATION ON THE COMPANY

| A. | History and Development of the Company |

The legal name of the Company is TOYO Co., Ltd. The Company was incorporated as an exempted company limited by shares under the laws of Cayman Islands on May 16, 2023, solely for the purpose of effectuating the Business Combination. The Company has been the consolidating entity for purposes of TOYO Solar’s financial statements since the consummation of the Pre-Merger Reorganization. The history and development of the Company and the material terms of the Business Combination are described in the Form F-4 in the sections titled “Summary of the Proxy Statement/Prospectus,” “Proposal No. 1 — The Business Combination Proposal,” “Information related to PubCo” and “Description of PubCo Securities,” which are incorporated herein by reference. See “Explanatory Note” in this Report for additional information regarding the Company and the Business Combination. Certain information about the Company is set forth in “Item 4.B — Business Overview” and is incorporated herein by reference.

The Company’s registered office is c/o Harneys Fiduciary (Cayman) Limited, 4th Floor, Harbour Place, 103 South Church Street, P.O. Box 10240, Grand Cayman KY1-1002, Cayman Islands, and the Company’s principal executive office is 5F, Tennoz First Tower, 2-2-4, Higashi-Shinagawa, Shinagawa-ku, Tokyo, Japan 140-0002. The Company’s principal website address is https://www.toyo-solar.com/#. We do not incorporate the information contained on, or accessible through, the Company’s websites into this Report, and you should not consider it a part of this Report. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The SEC’s website is www.sec.gov.

| B. | Business Overview |

Following and as a result of the Business Combination, all business of the Company is conducted through TOYO Solar and its subsidiaries. A description of the business is included in the Form F-4 in the sections titled “Information Related to PubCo” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations of PubCo,” which are incorporated herein by reference.

| C. | Organizational Structure |

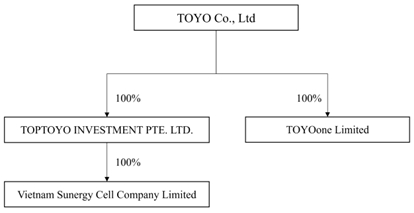

Upon the consummation of the Business Combination, TOYO Solar became a wholly-owned subsidiary of the Company, and BWAQ merged with and into Merger Sub with Merger Sub continuing as the surviving company and a wholly owned subsidiary of the Company. The following diagram depicts an organizational structure of the Company as of the date of this Report. All principal subsidiaries of the Company are set forth in Exhibit 8.1 to this Report.

| D. | Property, Plants and Equipment |

TOYO’s property, plants and equipment are held through TOYO Solar. Information regarding TOYO Solar’s property, plants and equipment is described in the Form F-4 in the section titled “Information related to PubCo — Property and equipment, net” which is incorporated herein by reference.

ITEM 4A. UNRESOLVED STAFF COMMENTS

None.

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

The discussion and analysis of the financial condition and results of operation of the Company is included in the Form F-4 in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations of PubCo,” which is incorporated herein by reference.

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

| A. | Directors and Senior Management |

The directors and executive officers upon the consummation of the Business Combination are set forth in the Form F-4, in the section titled “Management of PubCo Following the Transactions,” which is incorporated herein by reference.

| B. | Compensation |

Information pertaining to the compensation of the directors and executive officers of the Company is set forth in the Form F-4, in the sections titled “Management of PubCo Following the Transactions — Compensation of Directors and Executive Officers,” “Management of PubCo Following the Transactions — Employment Agreements and Indemnification Agreements” and “Management of PubCo Following the Transactions — Share Incentive Plan,” which are incorporated herein by reference.

| C. | Board Practices |

Information pertaining to the Company’s board practices is set forth in the Form F-4, in the section titled “Management of PubCo Following the Transactions,” which is incorporated herein by reference.

| D. | Employees |

Information pertaining to the Company’s employees is set forth in the Form F-4, in the section titled “Information Related to PubCo— Employees,” which is incorporated herein by reference.

| E. | Share Ownership |

Ownership of the Ordinary Shares by its directors and executive officers upon the consummation of the Business Combination is set forth in Item 7.A of this Report.

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

| A. | Major Shareholders |

The following table sets forth information regarding the beneficial ownership of Ordinary Shares as of July 1, 2024 by:

| ● | each person known by us to be the beneficial owner of more than 5% of Ordinary Shares; | |

| ● | each of our directors and executive officers; and | |

| ● | all our directors and executive officers as a group. |

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if that person possesses sole or shared voting or investment power over that security. A person is also deemed to be a beneficial owner of securities that the person has a right to acquire within 60 days including, without limitation, through the exercise of any option, warrant or other right or the conversion of any other security. Such securities, however, are deemed to be outstanding only for the purpose of computing the percentage beneficial ownership of that person but are not deemed to be outstanding for the purpose of computing the percentage beneficial ownership of any other person. Under these rules, more than one person may be deemed to be a beneficial owner of the same securities.

The calculations of the percentage of beneficial ownership are based on 46,095,743 Ordinary Shares issued and outstanding, as of July 1, 2024.

Unless otherwise indicated, we believe that all persons named in the table below have sole voting and investment power with respect to all Ordinary Shares beneficially owned by them.

Name of Beneficial Owner

| Ordinary Shares |

% of Total Ordinary Shares / Voting Power |

|||||||

| Principal Shareholders | ||||||||

| WWB Corporation and Affiliated Entities(1) | 31,485,066 | (2) | 68.3 | % | ||||

| Belta(3) | 10,045,000 | 21.8 | % | |||||

| Directors and Executive Officers(4) | ||||||||

| Junsei Ryu(2) | 31,485,066 | 68.3 | % | |||||

| Taewoo Chung | — | — | ||||||

| Aihua Wang | — | — | ||||||

| Alfred “Trey” Hickey(5) | 30,000 | * | ||||||

| Anders Karlsson | — | — | ||||||

| Hiroyuki Tahara | — | — | ||||||

| June Han | — | — | ||||||

| All directors and executive officers as a group (7 individuals) | 31,515,066 | 68.4 | % | |||||

| * | Less than 1% of the total number of outstanding Ordinary Shares |

| (1) | WWB Corporation (“WWB”), a Japanese company and a wholly-owned subsidiary of Abalance Corporation (TYO: 3856) (“Abalance”). Abalance is a Japanese public company listed on Tokyo Stock Exchange. As of the date of this Report, WWB holds approximately 51% of the voting securities of Fuji Solar and approximately 82% of the voting securities of WAG. Mr. Junsei Ryu holds approximately 31.4% of the voting securities of Abalance and approximately 50.1% of the voting securities of BestToYo. Mr. Ryu also serves as a director of Abalance, representative of directors of WWB, representative of directors of Fuji Solar, and sole director of WAG. The business address for WWB is Tennozu First Tower F5, 2-2-4, Higashishinagawa, Shinagawa-ku, Tokyo 140-0002. The business address for Fuji Solar is Tennoz First Tower, 2-2-4, Higashi-Shinagawa, Shinagawa-ku, Tokyo, Japan 140-0002. The registered address for WAG is 4th Floor, Harbour Place, 103 South Church Street, P.O. Box 10240, Grand Cayman KY1-1002, George Town, Cayman Islands. The registered address for BestToYo is 4th Floor, Harbour Place, 103 South Church Street, P.O. Box 10240, Grand Cayman KY1-1002, George Town, Cayman Islands. |

| (2) | Represents (i) 25,420,000 Ordinary Shares directly held by WAG, (ii) 5,535,000 Ordinary Shares directly held by BestToYo, and (iii) 530,066 Ordinary Shares held by Fuji Solar. |

| (3) | Represents 10,045,000 Ordinary Shares directly held by Belta, which is controlled by Mr. Jianfeng Cai. The registered address for Belta is 4th Floor, Harbour Place, 103 South Church Street, P.O. Box 10240, Grand Cayman KY1-1002, George Town, Cayman Islands. |

| (4) | The business address of each of the directors and executive officers of the Company is 5F, Tennoz First Tower, 2-2-4, Higashi-Shinagawa, Shinagawa-ku, Tokyo, Japan 140-0002. |

| (5) | Represents 30,000 Ordinary Shares held by Alfred “Trey” Hickey, an independent director of BWAQ prior to consummation of the Business Combination, and the independent director of the Company, following the consummation of the Business Combination. |

| B. | Related Party Transactions |

Information pertaining to the Company’s related party transactions is set forth in the Form F-4 in the section titled “Certain Relationships and Related Person Transactions — PubCo Relationships and Related Party Transactions,” which is incorporated herein by reference.

| C. | Interests of Experts and Counsel |

None / Not applicable.

| A. | Consolidated Statements and Other Financial Information |

Financial Statements

Consolidated financial statements have been filed as part of this Report. See Item 18 “Financial Statements.”

Legal Proceedings

Legal or arbitration proceedings are described in the Form F-4 in the section titled “Information Related to PubCo — Legal Proceedings,” which is incorporated herein by reference.

Dividend Policy

The Company’s policy on dividend distributions is described in the Form F-4 in the section titled “Description of PubCo Securities—Ordinary Shares—Dividends,” which is incorporated herein by reference.

| A. | Offer and Listing Details |

Ordinary Shares are listed on Nasdaq under the symbol “TOYO.” Warrants are traded on the OTC Markets. Holders of Ordinary Shares and Warrants should obtain current market quotations for their securities.

| B. | Plan of Distribution |

Not applicable.

| C. | Markets |

Ordinary Shares are listed on Nasdaq under the symbol “TOYO.” Warrants are traded on the OTC Markets.

| D. | Selling Shareholders |

Not applicable.

| E. | Dilution |

Not applicable.

| F. | Expenses of the Issue |

Not applicable.

ITEM 10. ADDITIONAL INFORMATION

| A. | Share Capital |

The Company’s authorized share capital is 500,000,000 ordinary shares of par value of US$0.0001 per share. As of July 1, 2024, subsequent to the Merger Closing, 46,095,743 Ordinary Shares were outstanding and issued.

There are also 4,970,012 Warrants outstanding, each whole Warrant exercisable at US$11.50 per one Ordinary Share, of which 4,252,988 are publicly tradable and registered, and the rest are registered with contractual lock-up held by (i) Fuji Solar and (ii) Blue World Holdings Limited, a Hong Kong private company limited by shares and the sponsor of BWAQ (“Sponsor”), or not registered held by (i) MWH (HONGKONG) CO., LIMITED, one of the members of the Sponsor, and (ii) Zenin Investments Limited, one of the members of the Sponsor.

| B. | Memorandum and Articles of Association |

The amended and restated articles of association of the Company (“Company Charter”) effective as of July 1, 2024 are filed as part of this Report.

The description of the Company Charter contained in the Form F-4 in the section titled “Description of PubCo Securities” is incorporated herein by reference.

| C. | Material Contracts |

Material Contracts Relating to TOYO’s Operations

Information pertaining to the Company’s material contracts is set forth in the Form F-4, in the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations of PubCo — Liquidity, Capital Resources and Going Concern –– Related Party Borrowing,” “Information related to PubCo — Land Lease Agreement for the 6GW Solar Cell Plant in Phu Tho Province, Vietnam,” “Risk Factors— Risks Related to TOYO Solar and PubCo’s Business and Industry,” and “Certain Relationships and Related Person Transactions — PubCo Relationships and Related Party Transactions,” each of which is incorporated herein by reference.

Material Contracts Relating to the Business Combination

Business Combination Agreement

The description of the Business Combination Agreement in the Form F-4 in the section titled “Proposal No. 1 — The Business Combination Proposal” is incorporated herein by reference.

Related Agreements

The description of the material provisions of certain additional agreements entered into pursuant to the Business Combination Agreement in the Form F-4 in the section titled “The Business Combination Agreement and Other Transaction Documents — Related Agreements and Documents” is incorporated herein by reference.

Amendment to PIPE Purchase Agreement

On March 6, 2024, the Company entered into the PIPE Purchase Agreement, as amended by an amendment on June 26, 2024 (such amendment, separately referred to as “PIPE Amendment”), with BWAQ and NOTAM.

Pursuant to the PIPE Purchase Agreement, NOTAM agrees to purchase a total of 600,000 BWAQ Class A Ordinary Shares (the “NOTAM PIPE Shares”), at a purchase price of $10.00 per share, for an aggregate purchase price of $6,000,000. The PIPE Amendment provides that the Company agrees to, conditioned on the completion of the PIPE Closing (as defined in the PIPE Purchase Agreement) and Merger Closing, issue additional Ordinary Shares to NOTAM, on the following terms and conditions:

(i) In the event that, the average closing price of each Ordinary Share (the “Closing Price”) with respect to all trading days in July 2024 is below $10.00 per share (such average Closing Price, the “First Tranche Average Closing Price”), NOTAM may, following the last trading day in July 2024 (the “First Tranche Cut-off Date”), elect to purchase from the Company at a total purchase price of $100 such number of Ordinary Shares (“First NOTAM Tranche Additional Shares”) calculated as below:

Number of First NOTAM Tranche Additional Shares = (6,000,000/First Tranche Average Closing Price - 600,000) x Share Held Ratio X.

Shares Held Ratio X = Number of Remaining Converted Shares held by NOTAM as of the First Tranche Cut-off Date /600,000.

Notwithstanding the foregoing, the maximum number of NOTAM First Tranche Additional Shares that NOTAM is entitled to subscribe for under the PIPE Purchase Agreement shall not exceed 500,000.

“Remaining Converted Shares” means the remaining the Ordinary Share acquired by NOTAM upon the conversion of the NOTAM PIPE Shares upon the Merger Closing purchased pursuant to the PIPE Purchase Agreement, excluding any other Ordinary Shares acquired by NOTAM upon and following the Merger Closing, in the open market, from any other parties, or the Additional Shares, if any.

(ii) In the event that the average Closing Price with respect to all trading days in July 2024 and August 2024 is below $10.00 per share (the “Second Tranche Average Closing Price”), NOTAM may, following the last trading day in August 2024 (the “Second Tranche Cut-off Date”), purchase from the Company at a total purchase price of $100 such number of Ordinary Shares (“Second NOTAM Tranche Additional Shares”) calculated as below:

Number of Second NOTAM Tranche Additional Shares = (6,000,000/Second NOTAM Tranche Average Closing Price - 600,000 - First NOTAM Tranche Additional Shares) x Share Held Ratio Y.

Shares Held Ratio Y = Number of Remaining Converted Shares held by NOTAM as of the Second Tranche Cut-off Date/600,000.

Notwithstanding the foregoing, the maximum number of Second NOTAM Tranche Additional Shares that NOTAM is entitled to subscribe for under the PIPE Purchase Agreement shall equal to 500,000 minus the number of the First NOTAM Tranche Additional Shares.

(iii) In the event that the average Closing Price with respect to all trading days in July 2024 through September 2024 is below $10.00 per share (the “Third Tranche Average Closing Price”), NOTAM may, following the last trading day in September 2024 (the “Third Tranche Cut-off Date” and together with the Frist Tranche Cut-off Date and the Second Tranche Cut-off Date, each a “Cut-off Date”), purchase from the Company at a total purchase price of $100 such number of Ordinary Shares (“Third NOTAM Tranche Additional Shares” and together with the First NOTAM Tranche Additional Shares and the Second Tranche Additional Shares, collectively, the “Additional NOTAM Shares”) calculated as below

Number of Third NOTAM Tranche Additional Shares = (6,000,000/ Third Tranche Average Closing Price - 600,000 - First NOTAM Tranche Additional Shares – Second NOTAM Tranche Additional Shares) x Share Held Ratio Z

Shares Held Ratio Z = Number of Remaining Converted Shares held by NOTAM as of the Third Tranche Cut-off Date/600,000

Notwithstanding the foregoing, the maximum number of Third NOTAM Tranche Additional Shares that NOTAM is entitled to subscribe for under the PIPE Purchase Agreement shall equal to 500,000 minus the sum of number of the First NOTAM Tranche Additional Shares and the Second NOTAM Tranche Additional Shares.

Earnout Equities Vesting Agreement

On June 29, 2024, in consideration of the development and efforts by the relevant parties in completing the Business Combination, the Company, the Sellers, BWAQ, the Sponsor, TOYO Solar and other relevant parties entered into a certain Earnout Equities Vesting Agreement (the “Earnout Equities Vesting Agreement”) to, among the others, release all the founder shares of BWAQ (“Founder Shares”) held by the Sponsor from being subject to potential surrender or cancellation as provided under the Sponsor Support Agreement (as defined below).

On August 10, 2023, the Sponsor entered into a Sponsor Support Agreement (the “Sponsor Support Agreement”) with BWAQ and the Company, to agree to, among the others, provide certain support for the Business Combination. Pursuant to the Earnout Equities Vesting Agreement, the parties agree that 1,380,000 Founder Shares are deemed vested and released from the Sponsor Earnout Equities (as defined in the Sponsor Support Agreement) and the Sponsor will have the right to covert such 1,380,000 Founder Shares into the right to receive Ordinary Shares at the Merger Closing. Sponsor is also relieved of any of its obligations with respect to either the subscription of additional BWAQ Class A Ordinary Shares or the surrender of additional Sponsor Earnout Equities under the Sponsor Support Agreement.

| D. | Exchange Controls |

There are no governmental laws, decrees, regulations or other legislation in the Cayman Islands that may affect the import or export of capital, including the availability of cash and cash equivalents for use by the Company, or that may affect the remittance of dividends, interest, or other payments by the Company to non-resident holders of its Ordinary Shares. There is no limitation imposed by the laws of the Cayman Islands or in the Company Charter on the right of non-residents to hold or vote shares.

| E. | Taxation |

Information pertaining to tax considerations is set forth in the Form F-4, in the section titled “Material Tax Considerations,” which is incorporated herein by reference.

| F. | Dividends and Paying Agents |

Information regarding Company’s policy on dividends is described in the Form F-4, in the section titled “Description of PubCo Securities — Ordinary Shares — Dividends,” which is incorporated herein by reference. The Company has not identified a paying agent.

| G. | Statement by Experts |

The consolidated financial statements of the Company and its subsidiaries incorporated by reference in this Report have been so incorporated by reference in reliance upon such report of Marcum Asia CPAs LLP, an independent registered public accounting firm, upon the authority of the said firm as expert in accounting and auditing.

The financial statements of BWAQ incorporated by reference in this Report have been so incorporated by reference in reliance upon such report of Marcum Asia CPAs LLP, an independent registered public accounting firm, upon the authority of the said firm as expert in accounting and auditing.

| H. | Documents on Display |

We are subject to certain of the informational filing requirements of the Exchange Act. Since we are a “foreign private issuer,” we are exempt from the rules and regulations under the Exchange Act prescribing the furnishing and content of proxy statements, and our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions contained in Section 16 of the Exchange Act, with respect to their purchase and sale of our shares. In addition, we are not required to file reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act. However, we are required to file with the SEC an Annual Report on Form 20-F containing financial statements audited by an independent accounting firm. We may, but are not required, to furnish to the SEC, on Form 6-K, unaudited financial information after each of our first three fiscal quarters. The SEC also maintains a website at http://www.sec.gov that contains reports and other information that we file with or furnish electronically with the SEC.

| I. | Subsidiary Information |

Not applicable.

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The information set forth in the Form F-4, in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operation of PubCo — Quantitative and Qualitative Disclosures about Market Risk,” is incorporated herein by reference.

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

Warrants

Upon closing of the Business Combination, there were 4,970,012 Warrants outstanding, each whole Warrant exercisable at US$11.50 per one Ordinary Share, of which 4,252,988 are publicly tradable and registered, and the rest are registered with contractual lock-up held by (i) Fuji Solar, and (ii) the Sponsor, or not registered held by (i) MWH (HONGKONG) CO., LIMITED, one of the members of the Sponsor, and (ii) Zenin Investments Limited, one of the members of the Sponsor.

PART II

Not applicable.

PART III

Not applicable.

The audited consolidated financial statements of the Company and its subsidiaries as of December 31, 2023 and 2022, for the year ended December 31, 2023 and for the period from November 8, 2022 (inception) to December 31, 2022 contained in the Form F-4 between pages F-2 and F-24 are incorporated herein by reference.

The unaudited condensed financial statements of BWAQ as of December 31, 2023 and for the three and six months ended December 31, 2023 and the audited financial statements of BWAQ as of June 30, 2023 and 2022, and for the year ended June 30, 2023 and for the period from July 19, 2021 (inception) through June 30, 2022 contained in the Form F-4 between pages F-25 and F-72 are incorporated herein by reference.

The unaudited pro forma condensed combined financial information of the Company and BWAQ are attached as Exhibit 15.1 to this Report.

EXHIBIT INDEX

| * | Filed herewith. |

| † | Indicates a management contract or any compensatory plan, contract or arrangement. |

| ^ | Portion of this exhibit has been omitted in accordance with Item 601(b)(10)(iv) of Regulation S-K |

| # | Schedules and annexes have been omitted |

SIGNATURE

The registrant hereby certifies that it meets all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this Report on its behalf.

| TOYO Co., Ltd | ||

| July 8, 2024 | By: | /s/ Junsei Ryu |

| Name: Junsei Ryu | ||

| Title: Director and Chief Executive Officer | ||

13

Exhibit 4.5

TOYO CO., LTD

2024 SHARE INCENTIVE PLAN

ARTICLE 1

PURPOSE

The purpose of this 2024 SHARE INCENTIVE PLAN is to promote the success and enhance the value of TOYO Co., Ltd, a Cayman Islands exempted company (the “Company”), by linking the personal interests of the Directors, Employees, Consultants, and other Persons to those of the Company’s shareholders and by providing such individuals with an incentive for outstanding performance to generate superior returns to the Company’s shareholders. The Plan is further intended to provide flexibility to the Company in its ability to motivate, attract, and retain the services of the above individuals upon whose judgment, interest, and special effort the successful conduct of the Company’s operation is largely dependent.

ARTICLE 2

DEFINITIONS AND CONSTRUCTION

Wherever the following terms are used in the Plan they shall have the meanings specified below, unless the context clearly indicates otherwise. The singular pronoun shall include the plural where the context so indicates.

2.1 “Applicable Laws” means the legal requirements relating to the Plan and the Awards under applicable provisions of the corporate, securities, tax and other laws, rules, regulations and government orders, and the rules of any applicable stock exchange or national market system, of any jurisdiction applicable to Awards granted to residents therein.

2.2 “Award” means an Option, Restricted Share or Restricted Share Unit award(s) granted to a Participant pursuant to the Plan, and an Award may consist of one such security or benefit, or two or more of them in any combination or alternative.

2.3 “Board” means the board of directors of the Company.

2.4 “Cause” with respect to a Participant means (unless otherwise expressly provided in the applicable Notice of Grant, or another applicable contract with the Participant that defines such term for purposes of determining the effect that a “for cause” termination has on the Participant’s Awards) each of the following and the determination of the existence of Cause shall be determined by the Committee:

(a) the Participant has been negligent in the discharge of his or her duties to the Service Recipient, has refused to perform stated or assigned duties or is incompetent in or (other than by reason of a disability or analogous condition) incapable of performing those duties;

(b) the Participant has been dishonest or committed or engaged in an act of theft, embezzlement or fraud, a breach of confidentiality, an unauthorized disclosure or use of inside information, customer lists, trade secrets or other confidential information;

(c) the Participant has breached a fiduciary duty, or willfully and materially violated any other duty, law, rule, regulation, or policy of the Service Recipient; or has been convicted of, or plead guilty or nolo contendere to, a felony or misdemeanor (other than minor traffic violations or similar offenses); (f) the Participant has improperly induced a vendor or customer to break or terminate any contract with the Service Recipient or induced a principal for whom the Service Recipient acts as agent to terminate such agency relationship.

(d) the Participant has materially breached any of the provisions of any agreement with the Service Recipient;

(e) the Participant has engaged in unfair competition with, or otherwise acted intentionally in a manner injurious to the reputation, business, or assets of, the Service Recipient; or

A termination for Cause shall be deemed to occur (subject to reinstatement upon a contrary final determination by the Committee) on the date on which the Service Recipient first delivers written notice to the Participant of a finding of termination for Cause.

2.5 “Code” means the Internal Revenue Code of 1986 of the United States, as amended.

2.6 “Committee” means a committee of the Board described in Article 10.

2.7 “Consultant” means any Person who renders services directly or indirectly to a Service Recipient and recognized by the Committee; provided that such services are not in connection with the offer or sale of securities in a capital-raising transaction and do not directly or indirectly promote or maintain a market for the Company’s securities.

2.8 “Corporate Transaction”, unless otherwise defined in a Notice of Grant, means any of the following transactions, provided, however, that the Committee may determine, under (d) and (e) whether multiple transactions are related, and its determination shall be final, binding and conclusive:

(a) an amalgamation, arrangement or consolidation or scheme of arrangement (i) in which the Company is not the surviving entity, except for a transaction the principal purpose of which is to change the jurisdiction in which the Company is incorporated or (ii) following which the holders of the voting securities of the Company do not continue to hold more than 50% of the combined voting power of the voting securities of the surviving entity;

(b) the sale, transfer or other disposition of all or substantially all of the assets of the Company;

(c) the complete liquidation or dissolution of the Company;

(d) any reverse takeover or series of related transactions culminating in a reverse takeover (including, but not limited to, a tender offer followed by a reverse takeover) in which the Company is the surviving entity but (A) the Company’s equity securities outstanding immediately prior to such takeover are converted or exchanged by virtue of the takeover into other property, whether in the form of securities, cash or otherwise, or (B) in which securities possessing more than fifty percent (50%) of the total combined voting power of the Company’s outstanding securities are transferred to a Person or Persons different from those who held or beneficially owned such securities immediately prior to such takeover or the initial transaction culminating in such takeover, but excluding any such transaction or series of related transactions that the Committee determines shall not be a Corporate Transaction; or (e) acquisition in a single or series of related transactions by any Person or related group of Persons (other than the Company, or a person that directly or indirectly controls, is controlled by or is under common control with the Company, or by a Company-sponsored employee benefit plan) of beneficial ownership (within the meaning of Rule 13d-3 of the Exchange Act) of securities possessing more than fifty percent (50%) of the total combined voting power of the Company’s outstanding securities but excluding any such transaction or series of related transactions that the Committee determines shall not be a Corporate Transaction.

2.9 “Director” means a member of the Board or a member of the board of directors of any Parent, Subsidiary or Related Entity of the Company.

2.10 “Disability”, unless otherwise defined in a Notice of Grant, means that the Participant qualifies to receive long-term disability payments under the Service Recipient’s long-term disability insurance program, as it may be amended from time to time, to which the Participant provides services regardless of whether the Participant is covered by such policy. If the Service Recipient to which the Participant provides service does not have a long-term disability plan in place, “Disability” means that a Participant is unable to carry out the responsibilities and functions of the position held by the Participant by reason of any medically determinable physical or mental impairment for a period of not less than ninety (90) consecutive days. A Participant will not be considered to have incurred a Disability unless he or she furnishes proof of such impairment sufficient to satisfy the Committee in its discretion.

2.11 “Effective Date” shall have the meaning set forth in Section 11.1.

2.12 “Employee” means any person, including an officer of the Company (if any) or any Parent, Subsidiary or Related Entity of the Company, who is in the employment of a Service Recipient, subject to the control and direction of the Service Recipient as to both the work to be performed and the manner and method of performance. The payment of a director’s fee by a Service Recipient shall not be sufficient to constitute “employment” by the Service Recipient.

2.13 “Exchange Act” means the Securities Exchange Act of 1934 of the United States, as amended.

2.14 “Fair Market Value” means, as of any date, the value of Shares determined as follows:

(a) If the Shares are listed on one or more established stock exchanges or national market systems, including without limitation, The New York Stock Exchange and The Nasdaq Stock Market, its Fair Market Value shall be the closing sales price for such shares (or the closing bid, if no sales were reported) as quoted on the principal exchange or system on which the Shares are listed (as determined by the Committee) on the date of determination (or, if no closing sales price or closing bid was reported on that date, as applicable, on the last trading date such closing sales price or closing bid was reported), as reported in The Wall Street Journal or such other source as the Committee deems reliable;

(b) If the Shares are regularly quoted on an automated quotation system (including the OTC Bulletin Board) or by a recognized securities dealer, its Fair Market Value shall be the closing sales price for such shares as quoted on such system or by such securities dealer on the date of determination, but if selling prices are not reported, the Fair Market Value of a Share shall be the mean between the high bid and low asked prices for the Shares on the date of determination (or, if no such prices were reported on that date, on the last date such prices were reported), as reported in The Wall Street Journal or such other source as the Committee deems reliable; or

(c) In the absence of an established market for the Shares of the type described in (a) and (b) above, the Fair Market Value thereof shall be determined by the Committee in good faith and in its discretion by reference to one or more of the following and such Fair Market Value shall be binding on all participants: (i) the placing price of the latest private placement of the Shares and the development of the Company’s business operations and the general economic and market conditions since such latest private placement, (ii) other third party transactions involving the Shares and the development of the Company’s business operation and the general economic and market conditions since such sale, (iii) an independent valuation of the Shares, or (iv) such other methodologies or information as the Committee determines, to be indicative of Fair Market Value and relevant.

2.15 “Incentive Share Option” means an Option that is intended to meet the requirements of Section 422 of the Code or any successor provision thereto.

2.16 “Independent Director” means (i) before the Shares or other securities representing the Shares are listed on a stock exchange, a member of the Board who is a Non-Employee Director; and (ii) after the Shares or other securities representing the Shares are listed on a stock exchange, a member of the Board who meets the independence standards under the applicable corporate governance rules of the stock exchange.

2.17 “Non-Employee Director” means a member of the Board who qualifies as a “Non-Employee Director” as defined in Rule 16b-3(b)(3) of the Exchange Act, or any successor definition adopted by the Board.

2.18 “Non-Qualified Share Option” means an Option that is not intended to be an Incentive Share Option.

2.19 “Notice of Grant” means the notice of grant to be sent from the Committee, on behalf of the Company, to the Participant evidencing an Award, including through electronic medium, which shall contain such terms and conditions with respect to an Award as the Committee may determine consistent with the Plan.

2.20 “Option” means a right granted to a Participant pursuant to Article 5 of the Plan to purchase a specified number of Shares at a specified price during specified time periods. An Option may be either an Incentive Share Option or a Non-Qualified Share Option.

2.21 “Participant” means a Person who has been granted an Award as determined by the Committee pursuant to the Plan, including but not limited to a Director, Employee, and Consultant, etc.

2.22 “Parent” means a parent corporation under Section 424(e) of the Code.

2.23 “Person” means any individual, general partnership, limited partnership, limited liability partnership, limited liability company, corporation, joint venture, trust, business trust, cooperative or association and the heirs, executors, administrators, legal representatives, successors and assigns of such Person where the context so permits.

2.24 “Plan” means this 2024 Share Incentive Plan, as it may be amended from time to time.

2.25 “Related Entity” means any business, corporation, partnership, limited liability company or other entity in which the Company, a Parent or Subsidiary of the Company holds a substantial ownership interest, directly or indirectly, but which is not a Subsidiary and which the Committee designates as a Related Entity for purposes of the Plan.

2.26 “Restricted Share” means a Share awarded to a Participant pursuant to Article 6 that is subject to certain restrictions on transfer, rights of first refusal, repurchase provisions, forfeiture provisions and other terms and conditions established by the Committee and may be subject to risk of forfeiture.

2.27 “Restricted Share Unit” means the right granted to a Participant pursuant to Article 7 to receive a Share at a future date.

2.28 “Securities Act” means the Securities Act of 1933 of the United States, as amended.

2.29 “Service Recipient” means the Company, any Parent, Subsidiary or Related Entity of the Company, to which a Participant provides services as an Employee, a Consultant or a Director.

2.30 “Share” means ordinary shares of the Company, and such other securities of the Company that may be substituted for Shares pursuant to Article 9.

2.31 “Subsidiary” means any corporation or other entity of which a majority of the outstanding voting shares or voting power is beneficially owned directly or indirectly by the Company.

2.32 “Trading Date” means the closing of the first sale to the general public of the Shares pursuant to a registration statement filed with and declared effective by the U.S. Securities and Exchange Commission under the Securities Act.

ARTICLE 3

SHARES SUBJECT TO THE PLAN

3.1 Number of Shares.

(a) Subject to the provisions of Article 9 and Section 3.1(b), the maximum aggregate number of Shares which may be issued pursuant to all Awards (including Incentive Share Options) shall initially be 4,440,500 ordinary shares of the Company (the “Share Limit”). Subject to the authorized share capital as provided in the memorandum of association and articles of association of the Company then in effect, the Share Limit will be increased automatically on January 1st of each calendar year during the term of this Plan commencing on January 1st 2025 (each, an “Evergreen Date”), by an amount equal to one percent (1%) of the total number of outstanding shares of the Company on the end of the calendar year immediately preceding the applicable Evergreen Date.

(b) To the extent that an Award terminates, expires, or lapses for any reason, any Shares subject to the Award shall again be available for the grant of an Award pursuant to the Plan. To the extent permitted by Applicable Laws, Shares issued in assumption of, or in substitution for, any outstanding awards of any entity acquired in any form or combination by the Company or any Parent or Subsidiary of the Company shall not be counted against Shares available for grant pursuant to the Plan. Shares delivered by the Participant or withheld by the Company in payment of the exercise price thereof or tax withholding thereon (including Shares which have been issued upon the exercise of any Award under the Plan and then surrendered by the Participant or repurchased by the Company in the consideration of the exercise price thereof or withholding tax thereon), may again be optioned, granted or awarded hereunder, subject to the limitations of Section 3.1(a).If any Awards are forfeited by the Participant or repurchased by the Company, the Shares underlying such Awards may again be optioned, granted or awarded hereunder, subject to the limitations of Section 3.1(a). Notwithstanding the provisions of this Section 3.1(b), no Shares may again be optioned, granted, or awarded if such action would cause an Incentive Share Option to fail to qualify as an Incentive Share Option under Section 422 of the Code.

3.2 Shares Distributed. Any Shares distributed pursuant to an Award may consist, in whole or in part, of authorized and unissued Shares, treasury shares (subject to Applicable Laws) or Shares purchased on the open market. Additionally, if applicable, in the discretion of the Committee, American depository shares (the “American Depository Shares”) in an amount equal to the number of Shares which otherwise would be distributed pursuant to an Award may be distributed in lieu of Shares in settlement of any Award. If the number of Shares represented by an American Depository Share is other than on a one-to-one basis, the Share Limit of Section 3.1 shall be adjusted to reflect the distribution of American Depository Shares in lieu of Shares.

ARTICLE 4

ELIGIBILITY AND PARTICIPATION

4.1 Eligibility. Persons eligible to participate in this Plan include Persons recognized by the Committee, e.g., Directors, Employees and Consultants, as determined by the Committee.

4.2 Participation. Subject to the provisions of the Plan, the Committee may, from time to time, select from among all eligible individuals, those to whom Awards shall be granted and determine the nature and amount of each Award. No individual shall have any right to be granted an Award pursuant to this Plan, unless otherwise determined by the Committee in accordance with the Plan.

4.3 Jurisdictions. In order to assure the viability of Awards granted to Participants employed in various jurisdictions, the Committee may provide for such special terms as it may consider necessary or appropriate to accommodate differences in local law, tax policy, or custom applicable in the jurisdiction in which the Participant resides or is employed. Moreover, the Committee may approve such supplements to, or amendments, restatements, or alternative versions of, the Plan as it may consider necessary or appropriate for such purposes without thereby affecting the terms of the Plan as in effect for any other purpose; provided, however, that no such supplements, amendments, restatements, or alternative versions shall increase the Share Limit contained in Section 3.1 of the Plan. Notwithstanding the foregoing, the Committee may not take any actions hereunder, and no Awards shall be granted, that would violate any Applicable Laws.

ARTICLE 5

OPTIONS

5.1 General. The Committee is authorized to grant Options to Participants on the following terms and conditions:

(a) Exercise Price. The exercise price per Share subject to an Option shall be determined by the Committee and set forth in the Notice of Grant which may be a fixed or variable price related to the Fair Market Value of the Shares and no less than the par value of such Shares. The exercise price per Share subject to an Option may be amended or adjusted in the absolute discretion of the Committee, the determination of which shall be final, binding, and conclusive. For the avoidance of doubt, to the extent not prohibited by Applicable Laws or any exchange rule, a downward adjustment of the exercise prices of Options mentioned in the preceding sentence may be effective without the approval of the Company’s shareholders or the approval of the affected Participants.

(b) Time and Conditions of Exercise. The Committee may determine the time or times at which an Option may be exercised in whole or in part, including exercise prior to vesting; provided that the term of any Option granted under the Plan shall not exceed ten years, except as provided in Section 12.1. The Committee may also determine any conditions, if any, that must be satisfied before all or part of an Option may be exercised.

(c) Payment. The Committee may determine the methods by which the exercise price of an Option may be paid, the form of payment, including, without limitation (i) cash or check denominated in U.S. Dollars, (ii) to the extent permissible under the Applicable Laws, cash or check in Chinese Renminbi, (iii) cash or check denominated in any other local currency as approved by the Committee, (iv) Shares held for such period of time as may be required by the Committee in order to avoid adverse financial accounting consequences and having a Fair Market Value on the date of delivery equal to the aggregate exercise price of the Option or exercised portion thereof, (v) after the Trading Date the delivery of a notice that the Participant has placed a market sell order with a broker with respect to Shares then issuable upon exercise of the Option, and that the broker has been directed to pay a sufficient portion of the net proceeds of the sale to the Company in satisfaction of the Option exercise price; provided that payment of such proceeds is then made to the Company upon settlement of such sale, (vi) other property acceptable to the Committee with a Fair Market Value equal to the exercise price, or (vii) any combination of the foregoing. Notwithstanding any other provision of the Plan to the contrary, no Participant who is a member of the Board or an “executive officer” of the Company within the meaning of Section 13(k) of the Exchange Act shall be permitted to pay the exercise price of an Option in any method which would violate Section 13(k) of the Exchange Act.

(d) Evidence of Grant. All Options shall be evidenced by a Notice of Grant sent from the Committee on behalf of the Company to the Participant. The Notice of Grant shall include such additional provisions as may be specified by the Committee.

(e) Effects of Termination of Employment or Service on Options. Termination of employment or service shall have the following effects on Options granted to the Participants:

(i) Dismissal for Cause. Unless otherwise provided in the Notice of Grant, if a Participant’s employment by or service to the Service Recipient is terminated by the Service Recipient for Cause, the Participant’s Options will terminate upon such termination, whether or not the Option is then vested and/or exercisable;

(ii) Death or Disability. Unless otherwise provided in the Notice of Grant, if a Participant’s employment by or service to the Service Recipient terminates as a result of the Participant’s death or Disability:

(1) the Participant (or his or her legal representative or beneficiary, in the case of the Participant’s Disability or death, respectively), will have the right to exercise the Participant’s Options (or portion thereof) until the tenth anniversary of the grant date to the extent that such Options were vested and exercisable on the date of the Participant’s termination of employment on account of death or Disability;

(2) the Options, to the extent not vested and exercisable on the date of the Participant’s termination of employment or service, shall immediately terminate for nil consideration upon the Participant’s termination of employment or service on account of death or Disability; and

(3) the Options, to the extent exercisable on the date of the Participant’s termination of employment on account of death or Disability and not exercised prior to the tenth anniversary of the grant date, shall terminate at the close of business on the tenth anniversary of the grant date.

(iii) Other Terminations of Employment or Service. Unless otherwise provided in the Notice of Grant, if a Participant’s employment by or service to the Service Recipient terminates for any reason other than a termination by the Service Recipient for Cause or because of the Participant’s death or Disability:

(1) the Participant will have the right to exercise his or her Options (or portion thereof) until the tenth anniversary of the grant date to the extent that such Options were vested and exercisable on the date of the Participant’s termination of employment or service;

(2) the Options, to the extent not vested and exercisable on the date of the Participant’s termination of employment or service, shall terminate upon the Participant’s termination of employment or service; and

(3) the Options, to the extent exercisable on the date of the Participant’s termination of employment or service and not exercised prior to the tenth anniversary of the grant date, shall terminate at the close of business on the tenth anniversary of the grant date.

5.2 Incentive Share Options. Incentive Share Options may be granted to Employees of the Company (if any), a Parent or Subsidiary of the Company. Incentive Share Options may not be granted to Employees of a Related Entity or to Independent Directors or Consultants. The terms of any Incentive Share Options granted pursuant to the Plan, in addition to the requirements of Section 5.1, must comply with the following additional provisions of this Section 5.2:

(a) Individual Dollar Limitation. The aggregate Fair Market Value (determined as of the time the Option is granted) of all Shares with respect to which Incentive Share Options are first exercisable by a Participant in any calendar year may not exceed $100,000 or such other limitation as imposed by Section 422(d) of the Code, or any successor provision. To the extent that Incentive Share Options are first exercisable by a Participant in excess of such limitation, the excess shall be considered Non-Qualified Share Options.

(b) Exercise Price. The exercise price of an Incentive Share Option shall be equal to the Fair Market Value on the date of grant. However, the exercise price of any Incentive Share Option granted to any individual who, at the date of grant, owns Shares possessing more than ten percent of the total combined voting power of all classes of shares of the Company may not be less than 110% of Fair Market Value on the date of grant and such Option may not be exercisable for more than five years from the date of grant.

(c) Transfer Restriction. The Participant shall give the Committee prompt notice of any disposition of Shares acquired by exercise of an Incentive Share Option within (i) two years from the date of grant of such Incentive Share Option or (ii) one year after the transfer of such Shares to the Participant.

(d) Expiration of Incentive Share Options. No Award of an Incentive Share Option may be made pursuant to this Plan after the tenth anniversary of the Effective Date.

(e) Right to Exercise. During a Participant’s lifetime, an Incentive Share Option may be exercised only by the Participant.

ARTICLE 6

RESTRICTED SHARES

6.1 Grant of Restricted Shares. The Committee, at any time and from time to time, may grant Restricted Shares to Participants as the Committee, in its sole discretion, shall determine. The Committee, in its sole discretion, may determine the number of Restricted Shares to be granted to each Participant.

6.2 Restricted Shares Notice of Grant. Each Award of Restricted Shares shall be evidenced by a Notice of Grant that shall specify the period of restriction, the number of Restricted Shares granted, the vesting schedule and such other terms and conditions as the Committee, in its sole discretion, may determine. Unless the Committee determines otherwise, Restricted Shares shall be held by the Company as escrow agent until the restrictions on such Restricted Shares have lapsed.

6.3 Issuance and Restrictions. Restricted Shares shall be subject to such restrictions on transferability and other restrictions as the Committee may impose (including, without limitation, limitations on transfer, right of first refusal, repurchase provisions, forfeiture provisions, the right to vote Restricted Shares or the right to receive dividends on the Restricted Share). These restrictions may lapse separately or in combination at such times, pursuant to such circumstances, in such installments, or otherwise, as the Committee determines at the time of the grant of the Award or thereafter.

6.4 Forfeiture/Repurchase. Except as otherwise determined by the Committee at the time of the grant of the Award or thereafter, upon termination of employment or service during the applicable restriction period, the unvested Restricted Shares and the Restricted Shares that are at that time subject to restrictions shall be forfeited or repurchased in accordance with the Notice of Grant; provided, however, the Committee may (a) provide in any Restricted Share Notice of Grant that restrictions or forfeiture and repurchase conditions relating to Restricted Shares will be waived in whole or in part in the event of terminations resulting from specified causes, and (b) in other cases waive in whole or in part restrictions or forfeiture and repurchase conditions relating to Restricted Shares.

6.5 Certificates for Restricted Shares. Restricted Shares granted pursuant to the Plan may be evidenced in such manner as the Committee may determine. If certificates representing Restricted Shares are registered in the name of the Participant, certificates must bear an appropriate legend referring to the terms, conditions, and restrictions applicable to such Restricted Shares, and the Committee may, at its discretion, retain physical possession of the certificate until such time as all applicable restrictions lapse.

6.6 Removal of Restrictions. Except as otherwise provided in this Article 6, Restricted Shares granted under the Plan shall be released from escrow as soon as practicable after the last day of the period of restriction. The Committee, in its discretion, may accelerate the time at which any restrictions shall lapse or be removed. After the restrictions have lapsed, the Participant shall be entitled to have any legend or legends under Section 6.5 removed from his or her Share certificate, and the Shares shall be freely transferable by the Participant, subject to applicable legal restrictions. The Committee (in its discretion) may establish procedures regarding the release of Shares from escrow and the removal of legends, as necessary or appropriate to minimize administrative burdens on the Company.

ARTICLE 7

RESTRICTED SHARE UNITS

7.1 Grant of Restricted Share Units. The Committee, at any time and from time to time, may grant Restricted Share Units to Participants as the Committee, in its sole discretion, may determine. The Committee, in its sole discretion, may determine the number of Restricted Share Units to be granted to each Participant.

7.2 Restricted Share Units Notice of Grant. Each Award of Restricted Share Units shall be evidenced by a Notice of Grant that shall specify any vesting conditions, the number of Restricted Share Units granted, the vesting schedule and the delivery schedule (which may include deferred delivery later than the vesting date) and such other terms and conditions as the Committee, in its sole discretion, may determine.

7.3 Performance Objectives and Other Terms. The Committee, in its discretion, may set performance objectives or other vesting criteria which, depending on the extent to which they are met, will determine the number or value of Restricted Share Units that will be paid out to the Participants.

7.4 Form and Timing of Payment of Restricted Share Units. At the time of grant, the Committee may specify the date or dates on which the Restricted Share Units shall become fully vested and nonforfeitable. Upon vesting, the Committee, on behalf of the Company, may pay Restricted Share Units in the form of cash, in Shares, or other forms of payment or in any combination of the foregoing, as agreed in the Notice of Grant.

7.5 Forfeiture/Repurchase. Except as otherwise determined by the Committee at the time of the grant of the Award or thereafter, upon termination of employment or service during the applicable restriction period or for other reasons recognized by the Committee, Restricted Share Units that are at that time unvested shall be forfeited or repurchased by the Company in accordance with the Notice of Grant; provided, however, the Committee may (a) provide in any Restricted Share Notice of Grant that restrictions or forfeiture and repurchase conditions relating to Restricted Share Units will be waived in whole or in part in the event of terminations resulting from specified causes, and (b) in other cases waive in whole or in part restrictions or forfeiture and repurchase conditions relating to Restricted Share Units.

ARTICLE 8

PROVISIONS APPLICABLE TO AWARDS

8.1 Notice of Grant. Awards under the Plan shall be evidenced by Notice of Grant that set forth the terms, conditions and limitations for each Award which may include the term of an Award, the provisions applicable in the event the Participant’s employment or service terminates, and the Company’s authority to unilaterally or bilaterally amend, modify, suspend, cancel, or rescind an Award.

8.2 No Transferability; Limited Exception to Transfer Restrictions.

8.2.1 Limits on Transfer. Unless otherwise expressly provided in (or pursuant to) this Section 8.2, by Applicable Law and by the Notice of Grant, as the same may be amended: all Awards are non-transferable and will not be subject in any manner to sale, transfer, anticipation, alienation, assignment, pledge, encumbrance, or charge;

(a) Awards will be exercised only by the Participant or the Participant’s legal representative or beneficiary in the case of the Participant’s Disability or death, respectively, as set forth under Section 5.1(e)(ii); and

(b) amounts payable or shares issuable pursuant to an Award will be delivered only to (or for the account of), and, in the case of Shares, registered in the name of, the Participant.

In addition, the Shares shall be subject to the restrictions set forth in the applicable Notice of Grant.

8.2.2 Further Exceptions to Limits on Transfer. The exercise and transfer restrictions in Section 8.2.1 will not apply to:

(a) transfers to the Company or a Subsidiary;

(b) transfers by gift to “immediate family” as that term is defined in SEC Rule 16a-1(e) promulgated under the Exchange Act;

(c) the designation of a beneficiary to receive benefits if the Participant dies or, if the Participant has died, transfers to or exercises by the Participant’s beneficiary, or, in the absence of a validly designated beneficiary, transfers by will or the laws of descent and distribution; or

(d) if the Participant has suffered a disability, permitted transfers or exercises on behalf of the Participant by the Participant’s duly authorized legal representative; or