UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from___________ to___________

Commission file number 001-42122

Fly-E Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 92-0981080 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| 136-40 39th Avenue Flushing, New York | 11354 | |

| (Address of principal executive offices) | (Zip Code) | |

| (929) 410-2770 | ||

| (Registrant’s telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.01 per share | FLYE | The Nasdaq Stock Market LLC |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of September 30, 2023, there was no established market for the registrant’s common stock.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

As of June 27, 2024, there were 24,587,500 shares of common stock of the registrant issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any annual report filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None.

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report, including, without limitation, statements under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes,” “estimates,” “anticipates,” “expects,” “intends,” “plans,” “may,” “will,” “potential,” “projects,” “predicts,” “continue,” or “should,” or, in each case, their negative or other variations or comparable terminology. These statements are based on management’s current expectations, but actual results may differ materially due to various factors, including, but not limited to:

| ● | our ability to obtain additional funding to market our vehicles and develop new products; |

| ● | our ability to produce our vehicles with sufficient volume and quality to satisfy customers; |

| ● | the inability of our principal vendors to deliver the necessary components for our vehicles at prices and volumes acceptable to us; |

| ● | our principal vendors failing to perform quality control on our products; |

| ● | the inability to obtain sufficient intellectual property protection for our brand and technologies; |

| ● | our vehicles failing to perform as expected; |

| ● | our facing product warranty claims or product recalls; |

| ● | our facing adverse determinations in significant product liability claims; |

| ● | customers not adopting electric vehicles; |

| ● | the development of alternative technology that adversely affects our business; |

| ● | the lingering impact of COVID-19 on our business; |

| ● | increased government regulation of our industry; and |

| ● | tariffs and currency exchange rates. |

The forward-looking statements contained in this annual report are based on our current expectations and beliefs concerning future developments and their potential effects on us. Future developments affecting us may not be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) and other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this annual report. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Part I

Item 1. Business

Overview

Fly-E Group, Inc. (“Fly-E Group,” and collectively with its subsidiaries, the “Company,” “we” or similar terminology), is an electric vehicle (“EV”) company that is principally engaged in designing, installing and selling smart electric motorcycles (“E-motorcycles”), electric bikes (“E-bikes”), electric scooters (“E-scooters”) and related accessories under the brand “Fly E-Bike.” At Fly E-Bike, our commitment is to encourage people to incorporate eco-friendly transportation into their active lifestyles, ultimately contributing towards building a more environmentally friendly future.

Our first store was established in 2018 in New York. Our business has grown rapidly since then and we believe we are now one of the leading providers of E-bikes for food delivery workers in New York City. As of June 27, 2024, we have 40 stores, including 39 stores in the United States and one store in Canada. We also operate one online store at flyebike.com, focusing on selling E-motorcycles, E-bikes and E-scooters, serving customers in the United States. In addition, we plan to open a second online store focusing on selling gas bikes in the future. We plan to expand our presence in the United States and extend our business into South America and Europe.

We have a diversified product portfolio that is designed to satisfy the various demands of our customers and address different urban travel scenarios. Additionally, we aim to refresh our product offerings continuously to align with evolving market trends. As of June 27, 2024, we offered 21 E-motorcycle products, 21 E-bike products and 34 E-scooter products.

We build our smart E-bikes based on advanced and innovative technologies, including smart technologies, powertrain and battery technologies and automotive inspired functionalities. Adhering to our user-centric philosophy in product design, we collect user feedback and product performance data to develop new products or functionalities to satisfy unmet demand. All our products are designed to embody themes of style, freedom and technology. Some of our E-bikes are specifically designed for food delivery workers and are featured with longer battery life and stable backseat for holding a basket. In addition, we designed an easy battery swap system for these E-bikes, allowing food delivery workers to easily replace a fully charged battery at any of our stores within a minute.

Our net revenues were approximately $32.2 million for the year ended March 31, 2024, consisting of retail sales revenue of approximately $26.4 million and wholesale revenue of $5.8 million. Our net revenues were approximately $21.8 million for the year ended March 31, 2023, consisting of retail sales revenue of approximately $18.8 million and wholesale revenue of approximately $2.9 million.

Recent Developments

Stock Split

In April 2024, we effected a stock split of our authorized and all issued and outstanding shares of our common stock and preferred stock at a split ratio of 1-for-110,000, where the par value of the Company’s common stock remained unchanged at $0.01 per share, and the number of authorized shares of the Company’s capital stock was increased from 440 to 48,400,000, with the number of authorized shares of common stock and preferred stock being increased from 400 to 44,000,000 and from 40 to 4,400,000, respectively. The issued and outstanding shares of our common stock immediately following the split were increased to 22,000,000. The share number and related data in this annual report has been updated to reflect the stock split referenced above.

Initial Public Offering

On June 7, 2024, we sold 2,250,000 shares of common stock, at a price of $4.00 per share in our initial public offering (the “IPO”). The gross proceeds of the offering were $9.0 million, prior to deducting the underwriting discounts, commissions and offering expenses payable by the Company. In addition, we granted the underwriters a 30-day option to purchase an additional 337,500 shares of common stock at the initial public offering price, less underwriting discounts and commissions, to cover over-allotments. On June 25, 2024, we sold an additional 337,500 shares of common stock to the underwriter of our IPO for gross proceeds of $1.4 million upon full exercise of the overallotment option. Net proceeds received by us from our initial public offering, including the exercise of the over-allotment option, were approximately $9.2 million. We also issued to The Benchmark Company, LLC, the representative of the underwriters, and its designees warrants to purchase 129,375 shares of our common stock.

Our History and Corporate Structure

We initially started our business in 2018 as Ctate Inc. (“Ctate”), a New York corporation. Our business has experienced rapid growth since then and we opened multiple retail stores within a short period of time. In the interest of efficient management, each retail store was managed by a separate company wholly owned by Ctate.

Fly E-Bike, Inc. (“Fly E-Bike”), a Delaware corporation, was a wholly owned subsidiary of Ctate incorporated on August 22, 2022. On September 12, 2022, Ctate and Fly E-Bike entered into an Agreement and Plan of Merger, pursuant to which Ctate merged into and with Fly E-Bike, with Fly E-Bike being the surviving corporation.

Fly-E Group, a Delaware corporation, was incorporated on November 1, 2022. On December 21, 2022, Fly E-Bike, the stockholders of Fly E-Bike and Fly-E Group entered into a Share Exchange Agreement, pursuant to which Fly-E Group acquired all of the issued and outstanding shares of Fly E-Bike by issuing its shares to the stockholders of Fly E-Bike on a one-for-one basis (the “Share Exchange”). As a result of the Share Exchange, Fly E-Bike became a wholly owned subsidiary of Fly-E Group. Fly-E Group has no substantive operations other than holding all of the issued and outstanding shares of Fly E-Bike and Fly EV, Inc. Our business is primarily conducted through Fly E-Bike and its subsidiaries. Fly EV. Inc. is a Delaware corporation incorporated on November 1, 2022 and currently has no substantive operations.

Our Industry

E-motorcycles, E-bikes and E-scooters are the two-wheelers that run on electric energy that is converted into mechanical energy rather than running on fuel. They are chargeable and eco-friendly automotive solutions. E-motorcycles and E-bikes are built with solid metal and fiber frames that are combined with mechanical and electronic components. An E-scooter is a plug-in EV powered by electric power. These scooters offer additional advantages such as agility, flexibility, versatility and ease of maneuver in high traffic congestion areas.

The EV industry has been experiencing significant growth and innovation in recent years. With the advancement of technology and the increasing demand for environmentally friendly transportation options, E-bikes, E-motorcycles and E-scooters have become popular choices for commuting, leisure and sports. As the demand for sustainable transportation options continues to grow, the EV industry is poised for further growth and development.

Some of the major trends driving the growth of the EV industry include the increasing demand for sustainable transportation options, advancements in battery and motor technology, and the growing popularity of E-bike sharing services. Government incentives and regulations, such as tax credits and subsidies for the purchase of EVs, are also driving the growth of the industry.

The Asia-Pacific region is the largest market for the electric two-wheelers due to the growing awareness about the benefits of electric vehicles, rising personal disposable income, growing demand for affordable electric vehicles for short-distance commuting and increasing adoption of smart technologies. We believe that North America is expected to experience significant growth in the future due to growing government initiatives to raise awareness of such products among individuals.

City bikes and city E-bikes are popular in big cities in the United States, such as New York City, Miami and Dallas. There is also a growing popularity of E-scooters as an increasing number of EV merchants are launching their businesses in these cities.

The growth of the EV industry is further accelerated by the rise in small package deliveries in big cities. New York City is a major commercial hub and the largest metropolitan area in the United States. As a result, the volume of small package deliveries in New York City is remarkably high, and it has continued to grow over the years. With the rise of E-commerce and online shopping, more and more people in New York City are relying on package deliveries for their everyday needs, leading to a significant increase in small package delivery volume. The COVID-19 pandemic has further accelerated this trend as more people have turned to online shopping.

The high volume of package deliveries in New York City has led to concerns about traffic congestion and delivery vehicle emissions, which the city is working to address through initiatives such as congestion pricing and EV incentives. For short-distance deliveries within urban areas, E-bike delivery can be a more efficient and environmentally friendly option compared to truck delivery. E-bikes can navigate through congested city streets, often taking shorter routes that trucks cannot access, and deliver packages quickly without contributing to traffic congestion or air pollution. Additionally, E-bikes are often cheaper to operate and maintain than trucks. We expect that other large densely populated cities in the United States, such as Miami and Dallas, face similar challenges and will continue to adopt the use of E-bikes, E-motorcycles, and E-scooters to meet their delivery needs.

Our Strengths

Early Entry into the Market: We entered the EV market early and were able to seize the market opportunities to experience rapid growth. We started our business in 2018 and were able to leverage the potential created by the thriving E-commerce industry. Additionally, the COVID-19 lockdown further amplified the demand for online food and essential item deliveries, creating a favorable environment for the expansion and utilization of EVs, particularly E-bikes, which further accelerated our business growth.

Brand Reputation: We have a strong brand reputation for consistent delivery of high-quality EV products and excellent customer service. Our brand and retail stores have become reliable business partners for most food delivery workers, especially in New York City. As a result, they have come to recognize our name and trust our services, establishing a loyal customer base for us.

Innovative Products and Services: We continue to offer innovative, differentiated products and services that help set us apart from our competitors. Since 2018, we have launched over 67 new products and introduced new versions to our existing products with upgrades to design, motor and battery technology. Additionally, we are developing the Fly E-Bike app, which will be used by customers to better manage and enjoy their riding experience. We are also developing the Fly E-Bike Care, an extended warranty program that will provide value-added options for our customers in the near future.

Our Strategies

Our plan to grow our business using the following key strategies:

Enhance our position as a leader in urban mobility: We believe we are one of the leading providers of urban mobility solutions for New York City, particularly for food and package delivery workers. We intend to leverage this first mover advantage to continue to solidify our market leadership, by enhancing our brand, continuing to innovate, growing our product and service portfolio and expanding our sales network.

Improve brand recognition: We will maintain our commitment to providing exceptional customer service as a means of further enhancing our brand. We will provide an enhanced shopping experience by effectively managing and upgrading our retail stores. In addition, we plan to open more flagship stores in high-traffic retail locations in New York City and other major cities in the United States to further elevate the quality of our brand messaging. Furthermore, we plan to increase our offerings of accessories, such as introducing more style options to our branded apparel, to further strengthen our customers’ connection to Fly E-Bike. We also intend to collaborate with other lifestyle brands across different industries to further promote our brand image.

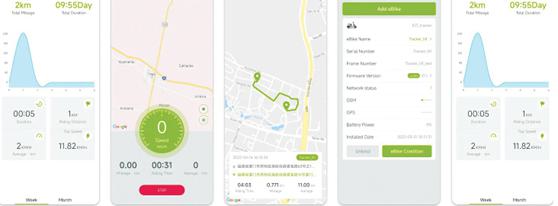

Continue our innovation: We will persist in advancing our product line by incorporating cutting-edge design, optimizing user experience and delivering optimal performance. We are developing our Fly E-Bike app, which we plan to include functions to improve the communication between our customers and our products. Additionally, we plan to launch Fly E-Bike Care in the near future, a service designed to function as an insurance policy and provide customers with continuous maintenance services beyond the manufacturer and battery warranty period.

Expand our sales network: We plan to further expand our sales network in the United States and internationally. As of June 27, 2024, we operate one store in Canada and 39 retail stores in the United States, spanning across the states of New York, Texas, Florida, Washington D.C., California and New Jersey. We also operate one online store at flyebike.com, focusing on selling E-motorcycles, E-bikes and E-scooters, serving customers in the United States. In addition, we plan to open a second online store focusing on selling gas bikes in the future.. We plan to significantly increase our footprint in the United States by opening our stores in additional states. In addition, we intend to enter selected overseas markets that offer identified growth opportunities and favorable government policies, such as South America and Europe.

Diversify our service offerings: We are planning to broaden our business by leveraging our existing retail stores as logistics hubs for small package delivery. We are currently in the process of seeking business partners, assembling a delivery team and developing an app for the delivery business.

Our Products

We offer a diverse product portfolio that satisfies various demands of our customers and addresses different urban travel scenarios. Following market trends and technological updates, we continuously develop and add new products into our portfolio to meet our customers’ needs. We also regularly introduce upgrades and refreshes to our existing models.

E-motorcycles

Our E-motorcycle category consists of 21 different products, which include a range of E-moped, E-motorcycle and E-tricycle.

E-moped

|

|

|

||

| (Fly-7) | (Fly-10) | (Fly-Pro) |

Our E-moped product line is one of our most popular, featuring a range of eight different models. Our E-mopeds can run an average of 20-70 miles on a single charge, with a top speed of 20-38 miles per hour. Additionally, our E-mopeds are capable of holding a payload of 185-400 pounds. Each E-moped offer several standard features, including a remote key fob, alarm system, lockable under-seat storage, front and rear suspension, and a complete lighting package. Some models also offer a USB phone charging port for added convenience. These features make them an ideal choice for delivery workers.

All of our E-mopeds feature a low seat height and large tires, providing excellent stability at all speeds and on all surfaces. Moreover, their electric drivetrain requires no clutch or gears, making them easy to operate for almost anyone.

E-motorcycle

|

|

|

||

| (RZ) | (FTC) | (DY-VNM SL) |

We also offer E-motorcycles that are designed for urban commuting and city riding, offering a range of 25-80 miles on a single charge and a top speed of 30-59 miles per hour. They have a payload capacity of 160-400 pounds and feature a powerful electric motor with multiple riding modes to choose from. Additionally, our E-motorcycles are equipped with advanced safety features, including anti-lock brakes and a high-performance suspension system, ensuring optimal handling and rider safety.

E-tricycle

(Fly-Tricycle)

The Fly-Tricycle is an electric three-wheel vehicle that offers three seats. The interior of this vehicle is crafted with high-quality automotive-grade materials, ensuring long-lasting durability. This vehicle can run a range of 43-62 miles on a single charge, with a top speed of 30 miles per hour. Additionally, the Fly-Tricycle is capable of holding a payload of 1,239 pounds.

E-bikes

We currently offer 34 different E-bike products, which include a range of City E-bike, foldable E-bike and standard E-bike.

City E-bike

(City E-Bike)

Our City E-Bike has a range of 15-20 miles on a single charge and a maximum speed of 20 miles per hour. It has a payload capacity of 200 pounds and an under-seat storage area.

Foldable E-bike

|

|

|

| (Dolphin E-Bike) | (Air-2) |

Our foldable E-bikes, including the Dolphin E-Bike and the Air-2, are versatile and convenient for folding. They are capable of running 20-25 miles on a single charge with a top speed of 23 miles per hour. In addition, our foldable E-bikes have a payload capacity of 250 pounds. They are compact, portable and easy to store, making them a good choice for people who are conscious of space limitations, such as those who live in small apartments in big cities.

Standard E-bike

|

|

|

| (Sword Fish E-Bike) | (Rhino) |

Our standard E-bikes are designed to be lightweight and come in a variety of different outlook designs, with multiple speed options to choose from. They offer a range of 20-60 miles on a single charge, with a top speed range of 15-32 miles per hour, and have a payload capacity of 180-250 pounds.

E-scooters

Our E-scooter segment currently offers 12 different products, which include the Insurgent E-Scooter, Flytron, H-Max and H-1 models.

|

|

|

|

|||

| (Insurgent E-Scooter) | (Flytron) | (H-Max) | (H-1) |

Our E-scooters offer a range of 15-45 miles on a single charge and a top speed range of 15-40 miles per hour. They are also capable of holding a weight range of 250-330 pounds. Additionally, our smart E-scooters are equipped with hydraulic disc brakes made from special alloys. The brake discs are slotted to extend the life of the system. The hardware of the brakes is complemented by the electronic braking system, which provides for intelligent braking and recycling kinetic energy. Certain of our models also employ the combined braking system, which splits braking force between the front and rear discs to shorten the braking distance at higher speeds.

Accessories and spare parts

We offer a comprehensive line of Fly E-Bike branded accessories and spare parts. We also sell traditional bikes.

For accessories, we offer riding gear, such as raincoats, gloves and knee pads, and accessories that can be installed on our products to enhance their functionality, such as storage baskets and tail boxes, smart phone holders, backrests and locks, among others. We also sell branded apparel.

In addition, we provide performance upgrades, including high-performance upgrade components for wheels, shock absorbers, brake calipers and carbon fiber body panels, among others.

Fly E-Bike App

We are currently developing the Fly E-Bike app, which is a management service mobile software for our EVs. We aim to design an app that will bring users a comprehensive intelligent experience to create a safer and more satisfying riding life. The development of the app is still in its preliminary stage. We have launched a testing version of the app, which is currently unavailable to our customers. Once development is completed, the app is expected to include functions such as GPS, navigation, battery and tire pressure management, online shopping, and anti-theft features.

After Sales Services

Our EVs are primarily serviced through our retail stores, which provide repair, maintenance and bodywork services. Our regular maintenance services include exterior check, mechanical structure service, motor system check, electrification service, battery maintenance service, tire pressure check and cleaning services. We also provide other value-added services through our retail stores, including GPS add-on and installation, and theft reporting.

Warranty Policy

Manufacturer Warranty

We offer a three-month limited manufacturer’s warranty on all models of our E-bikes, E-motorcycles and E-scooters. The warranty period starts on the day the product is delivered to the customer. This warranty only covers limited factory defects and minor cosmetic damages. It does not cover misuse or broken parts caused by the user or by any other events.

Battery Warranty

We also offer a three-month warranty on battery for any manufacturer defect in material or workmanship. If a battery becomes faulty within the specified warranty period, we will replace it free of charge.

Fly E-Bike Care

We plan to launch our value-added Fly E-Bike Care program in the near future, which will function as an insurance policy to provide customers with continuous maintenance services beyond the warranty period mentioned above. This program will be designed to offer a wider range of coverage than the manufacturer and battery warranties, including accidental damages caused by customers. Additionally, we intend to add a “Fly E-Bike Care” feature to our app, which will send maintenance reminders to users based on their driving behavior and mileage.

Manufacturing and Assembly

We source a significant portion of our vehicle components from China and the United States. For the years ended March 31, 2024 and 2023, over 50% and 40% of the parts were sourced from China, respectively. For the year ended March 31, 2024 and 2023, we sourced over 40% and over 50% of our vehicle components from the United States, respectively. Although we rely on certain principal vendors in China and the United States for most of our components, we believe there are multiple sources for each of our critical components.

To ensure a secure and reliable supply chain, we have implemented a centralized vendor management system that consolidates all vendor management activities under a centralized team. This approach enables us to streamline our purchasing process, enhance our negotiating power and maintain better relationships with our vendors.

We are currently working with three principal vendors, Depcl Corp.(previously known as Fly Wing E-Bike Inc.), Xiamen Innolabs Technology Co., Ltd. (“XFT”), and Anhui Ineo International Trading Co., Ltd., each of which respectively supplied approximately 36%, 21% and 13% of our accessories and components during the year ended March 31, 2024. During the year ended March 31, 2023, our top three principal vendors included Transpro US Inc., Anhui Ineo International Trading Co., Ltd. and Depcl Corp, each of which respectively supplied approximately 33%, 21% and 12% accessories and components. Our principal vendors are responsible for sourcing all the parts used in our vehicles from various suppliers, and they also oversee the quality control process. We maintain close relationships with our principal vendors to ensure that we have access to high-quality accessories and components for our EVs at competitive prices and receive reliable and timely deliveries. We work closely with them to improve our supply chain efficiency and reduce costs.

Our centralized vendor management system also helps us to manage risk more effectively by identifying potential risks and developing strategies to mitigate them. Rather than dealing with the original suppliers, we monitor the performance of our principal vendors, which enables us to quickly identify and address any problems and manage the supply resources more efficiently. Our system ensures each critical product component is supported by at least three vendors, thereby minimizing the risk of supply chain disruptions. This approach helps us to reduce the risk of supply chain disruptions, which can have a significant impact on our business operations.

After importing the accessories and components, we assemble them into our vehicles in a leased facility located in Brooklyn, New York. For the year ended March 31, 2023, we produced 2,039 E-motorcycles, 5,953 E-bikes and 2,279 E-scooters in this facility. For the year ended March 31, 2024, we produced 8,390 E-motorcycles, 7,638 E-bikes and 3,171 E-scooters at the same facility. In response to the increasing demand for our products, we are currently looking to lease a larger assembling facility to replace our current facility in the near future.

Quality Control

We believe that the quality of our products is crucial to our continued growth. We place great emphasis on quality control and have implemented stringent monitoring and quality control systems to manage our operations.

For the parts sourced from China, we rely on our one of our principal vendors in China, XFT, to monitor the factories responsible for manufacturing these parts used in our vehicles. Its duties include the following:

Factory check: XFT is responsible for confirming the size, production capacity and certification qualifications of a factory, confirming whether the equipment required for the production line is complete and whether the testing equipment is complete, checking the factory’s quality assurance process and other quality control procedures.

Proofing: After the samples that meet the requirements are confirmed by XFT and us, they will be sealed as golden samples, and mass production is required to follow the golden sample standard.

Mass production: Before the start of mass production, the factory is required to develop and review standard operating procedures and quality assurance standards that are acceptable to XFT and us. XFT will closely follow the production process, ensuring that strict quality control measures are implemented at every stage of production. After the mass production starts, XFT will perform the first article inspection to confirm whether the mass production meets the required standards.

Inspection: After mass production, in addition to requiring the factory to submit a quality control report, XFT will send its own quality control personnel to conduct random inspections on the products according to the corresponding standards of acceptable quality level.

We also source certain parts used in our vehicles from the United States. For these parts, our U.S. principal vendors and our quality control team perform quality control procedures similar to those discussed above for our China-sourced parts. This includes ensuring that the parts meet our quality standards and specifications, as well as conducting regular factory audits and inspections to identify any potential issues, and ensure ongoing compliance with our requirements.

We have not experienced any significant product recall, refunds or other quality control outbreak since we commenced operations.

Sales and Marketing

We have established an omnichannel retail model network to sell our products and provide services to our customers. We currently operate 39 retail stores and work with 80 distributors in the United States to sell our products. In addition, we have our own online store where we promote and sell our products. Our Fly E-Bike app, which is under development, can also become a venue where we can advertise our products. We also leverage our omnichannel retail network to deliver maintenance and repair services at our retail stores and to collect data for business insights.

We focus on promoting awareness of our brand as a lifestyle brand with high-quality smart E-bikes, E-motorcycles and E-scooters. Our brand and products are marketed to retail customers through digital and experiential activities as well as through more traditional promotional and advertising activities. We aim to engage in cost-effective marketing activities by taking advantage of social media and to build an online and offline ecosystem of users that will promote awareness of our brand.

One key component of our strategy is to expand our presence on social media platforms. We currently have accounts on Facebook, Instagram, TikTok and WeChat, on which we frequently post guides, videos and tutorials that educate people on how to use and maintain E-bikes, E-scooters and E-motorcycles, as well as benefits of E-mobility.

In terms of offline marketing, we prioritize in-store promotions and targeted advertising. This includes offering discounts and special deals in our retail stores, as well as using targeted advertising to reach potential customers who are likely to be interested in our products. We also place ads in local newspapers and magazines and distribute flyers on the streets to promote the opening of new stores. Additionally, our products have gained significant visibility among food delivery workers in New York City, who make up the majority of our customer base. The increasing trend of people ordering food delivery, particularly during and after the COVID-19 lockdown, has contributed to the widespread visibility of our products in the cities.

Our Distribution Channels

Retail Distribution Network

Our sales are conducted through both retail stores and distributors.

Out of our 39 retail stores in the United States, 28 are situated in New York, while four are in New Jersey, two in Florida, two in Texas, one in California and one in Washington, D.C. We also operate one retail store in Canada. Our retail stores adopt a consistent design and layout and provide a consistent shopping experience. We closely monitor the sales performance, service level and activities within our retail stores. We will continue to collect store operation data such as consumer traffic flow and traffic flow sources, test drive frequencies and sales conversion rate. This information helps us adjust store-specific retailing and marketing strategies, thereby increasing per store sales.

In terms of our distributors, most of them are located in the United States. Our distributors purchase products from us at a wholesale price, and are responsible for the logistics, warehousing and distribution to other retail stores. We do not charge any initial fees or continuing fees to our distributors. The majority of our distributors make full payments upfront for their orders, which helps us improve cash flow management.

We intend to expand our overseas market and are currently working with one distributor in the Dominican Republic.

Online Distribution Network

All of our products can be purchased on our website, flyebike.com. In addition, we plan to open a second online store focusing on selling gas bikes in the future.

We have adopted an online to offline model that enables us to seamlessly integrate the online and offline networks to provide a cohesive and consistent experience to our customers. The online platform acts as a conduit for influencing customers and directing sales to our retail stores. Our customers can conveniently place orders online and pick up their products at our retail stores.

Our Customers

We acquire customers through multiple channels, including (i) referrals from our existing customers, (ii) our distributors, and (iii) our marketing and promotional activities. Due to our strong brand image, loyal customer base and evolving product portfolio, we believe there are significant growth opportunities across these channels. No customers account for more than 10% of our revenues for the years ended March 31, 2024 and 2023. The majority of our customers are food delivery workers in New York City. This group constitutes approximately 70% and 70% of our customer base for the year ended March 31, 2023 and 2024, respectively.

Environmental Matters

We are subject to federal, state and local environmental laws and regulations that impose limitations on the discharge of pollutants into the environment and establish standards for the handling, generation, emission, release, discharge, treatment, storage and disposal of certain materials, substances and wastes and the remediation of environmental contaminants (collectively, “Environmental Laws”). In the ordinary course of our assembling processes, we may use materials or generate waste that are subject to these Environmental Laws.

We endeavor to adhere to all applicable Environmental Laws and act as necessary to comply with these laws. We maintain an environmental and safety program at our facilities. The environmental and safety program includes obtaining environmental permits as required, capturing and appropriately disposing of any waste by-products, tracking hazardous waste generation and disposal, air emissions, safety situations, material safety data sheet management, storm water management and recycling, and auditing and reporting on its compliance.

Intellectual Property

We currently hold one trademark in the United States, which covers our logo. We also hold four trademarks in China, which cover the names “FLY E-BIKE”, “FLY EBIKE”, “FLYEBIKE” and our logo. Additionally, we have two trademarks in the Dominican Republic covering the name “FLY E-BIKE” and our logo, and one trademark in Panama covering the name “FLY E-BIKE”. All these trademarks are effective from 2022 to 2033. In addition, we have applied for trademark rights for the name “FLY E-BIKE” in Canada, and the application is currently pending.

Other than the trademarks mentioned above, we do not own any patents, copyrights or other intellectual property registrations in the United States. We plan to seek further intellectual property registrations in the United States in the future. We currently also seek to protect our trade secrets and other proprietary information through common law copyright and trademark principles.

Competition

There are numerous companies that sell E-bikes, E-motorcycles and E-scooters in the United States and even more globally. The markets for EVs are highly competitive based on a number of factors, including innovation, performance, price, technology, product features, styling, fit and finish, brand recognition, quality and distribution. We believe our ability to compete successfully in these markets depends on our ability to capitalize on our competitive strengths and build brand recognition.

Many companies, which have greater financial and marketing resources than us, make electric two-wheelers, including Trek Bicycle Corporation, Specialized Bicycle Components, Inc., Specialized Bicycle Components, Inc. and Rad Power Bikes Inc. While we believe we are well positioned in this competitive market, there is no assurance that our vehicles will be successful in the respective markets in which they compete. See “Item 1A. Risk Factors — Risks Related to the Company’s Business, Operations, and Industry — The markets in which we operate are in their infancy and highly competitive, and we may not be successful in competing in this industry.”

Regulation

We are subject to a wide variety of laws and regulations in the United States. These laws and regulations govern various items directly or indirectly related to our business, such as labor and employment, anti-discrimination, product liability, vehicle defects, vehicle maintenance and repairs, personal injury, rider text messaging, service payments, consumer protection, taxation, privacy, data security, intellectual property, competition, terms of service, mobile application accessibility, insurance, money transmittal, and environmental, health and safety. They are often complex and subject to varying interpretations, in many cases due to their lack of specificity. As a result, their application in practice may change or develop over time through judicial decisions or as new guidance or interpretations are provided by regulatory and governing bodies, such as federal, state, and local administrative agencies.

The micromobility industry is relatively nascent and rapidly evolving. New laws and regulations continue to be adopted, implemented, interpreted and iterated upon in response to our growing industry and associated technology. As we expand our business into new markets or introduce new offerings into existing markets, regulatory bodies or courts may claim that (i) we are subject to additional requirements or (ii) we are prohibited from conducting our business in certain jurisdictions.

Our products may also be subject to various environmental, health, and safety regulations, including, but not limited to, those regarding product safety and waste management. For example, we are subject to environmental laws and regulations regarding the handling and disposal of hazardous substances and solid wastes, including electronic wastes and batteries. These laws regulate the generation, storage, treatment, transportation and disposal of solid and hazardous waste, and may impose strict, joint and several liability for the investigation and remediation of areas where hazardous substances may have been released or disposed. For instance, the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended (“CERCLA”) and comparable state laws impose liability, without regard to fault or the legality of the original conduct, on certain classes of persons that contributed to the release of a hazardous substance into the environment. These persons include current and prior owners or operators of the site where the release of the hazardous substance occurred as well as companies that disposed or arranged for the disposal of hazardous substances found at the site. Under CERCLA, these persons may be subject to joint and several strict liability for the costs of cleaning up the hazardous substances that have been released into the environment, for damages to natural resources, and for the costs of certain health studies. CERCLA also authorizes the Environmental Protection Agency (“EPA”) and, in some instances, third parties to act in response to threats to the public health or the environment and seek to recover costs incurred from the responsible classes of persons. In the course of ordinary operations, we, through third parties and contractors, may handle hazardous substances within the meaning of CERCLA and similar state statutes and, as a result, may be jointly and severally liable for all or part of the costs required to clean up sites at which these hazardous substances have been released into the environment.

We may also be subject to the Resource Conservation and Recovery Act (“RCRA”) and comparable state statutes for the generation, storage, or disposal of solid wastes, which may include hazardous wastes. RCRA regulates both solid and hazardous wastes, but, in particular, imposes strict requirements on the generation, storage, treatment, transportation and disposal of hazardous wastes. In addition, federal and state laws may require or otherwise regulate the reuse and recycling of batteries, including lead-acid and lithium-ion batteries, used in our products.

Certain of our products are also regulated by the U.S. Consumer Product Safety Commission (“CPSC”) pursuant to various federal laws. CPSC can require the manufacturer of products containing a safety defect to recall or repurchase such products and may also impose fines or penalties on the manufacturer. Similar laws exist in some states, cities, and other countries in which we sell our products.

Certain of our products are also regulated by the National Highway Traffic Safety Administration (“NHTSA”) pursuant to various federal laws and regulations. NHTSA can require the manufacturer of motor vehicles or motor vehicle equipment containing a safety defect to recall or repurchase such products and may also impose fines or penalties on the manufacturer. Certain of our products are also regulated by EPA, and the California Air Resources Board (“CARB”) for products sold in California. EPA and CARB can require the manufacturer to recall or repurchase vehicles that are uncertified or that contain an emission-related defect and may also impose fines or penalties on the manufacturer.

In addition, some of our products may be subject to local laws and regulations. For instance, in March 2023, the New York City Council amended its administrative code to require that all powered bicycles, powered mobility devices including electric scooters, and storage batteries for such mobility devices distributed, sold, leased, rented, or offered for sale, lease, or rental in New York City must be certified as compliant with the applicable Underwriter Laboratories (UL) standard, which is a widely recognized standard for safety in electrical products in the United States. The law became effective in September 2023.

Additionally, because we receive, use, transmit, disclose, and store personally identifiable information and other data relating to users on our platform, we are subject to numerous local, municipal, state, federal, and international laws and regulations that address privacy, data protection, and the collection, storing, sharing, use, transfer, disclosure, and protection of certain types of data. Such regulations include the Controlling the Assault of Non-Solicited Pornography and Marketing Act, the Telephone Consumer Protection Act of 1991, the U.S. Federal Health Insurance Portability and Accountability Act of 1996 and Section 5(a) of the Federal Trade Commission Act of 1914.

We plan to sell and distribute our vehicles internationally through international distributors. As such, we will be subject to the local laws of each jurisdiction in which we sell our vehicles. These regulations may result in increased costs and expenses, which may materially and adversely affect our business, results of operations or financial condition.

Employees

As of June 27, 2024, we had 84 employees, consisting of 57 full-time employees and 27 part-time employees.

Our employees are not represented by a labor organization or covered by a collective bargaining agreement. We believe that we maintain a good working relationship with our employees and to date, we have not experienced any significant labor disputes.

Item 1A. Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this annual report, including “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes before making a decision to invest in our common stock. Our business, operating results, financial condition, or prospects could be materially and adversely affected by any of these risks and uncertainties. If any of these risks actually occurs, the trading price of our common stock could decline and you might lose all or part of your investment. Our business, operating results, financial performance, or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material.

Risks Related to the Company’s Business, Operations, and Industry

We may be unable to meet our growing production plans and delivery plans, any of which could harm our business and prospects.

In order to meet the increasing demand of our products, we plan to open more stores in the future. Our plans call for achieving and sustaining increases in vehicles production and deliveries. Our ability to achieve these plans will depend upon a number of factors, including our suppliers’ ability to support our needs and our ability to utilize our current assembling capacity, achieve the planned production yield and further increase capacity as planned while maintaining our desired quality levels and optimize design and production changes. If we are unable to realize our plans, our brand, business, prospects, financial condition and operating results could be materially damaged.

We are dependent on certain principal vendors in China for a significant portion of our vehicle components, and the inability of these vendors to deliver necessary components of our products according to our schedule and at prices, quality levels and volumes acceptable to us, or our inability to efficiently manage these components, could have a material adverse effect on our financial condition and operating results.

We source a significant portion of our vehicle components from China and then assemble these parts into our products in the United States. We rely on certain principal vendors who help us source and supply parts used in our vehicles from various suppliers in China. We currently do not maintain long-term contracts with our suppliers and vendors. While we believe our contract management processes are strong, we nevertheless could experience difficulties.

If our principal vendors decide to terminate their partnership with us, experience sourcing failures, or otherwise become unable to provide us with the necessary components in sufficient quantities, in a timely manner, and on acceptable terms, we may have to delay the production and sale of our products or find an alternative vendor. Any significant unanticipated demand would require us to procure additional components in a short amount of time. While we believe that we will be able to secure additional or alternate sources of supply for most of our components in a relatively short time frame, there is no assurance that we will be able to do so or develop our own replacements for certain highly customized components of our products.

In addition, as a result of COVID-19, normal economic life throughout China was sharply curtailed and there were disruptions to normal operation of businesses in various areas. For example, in 2022, when China rigorously enforced its “Zero-COVID” policy, some manufacturing facilities were closed and work at other facilities was curtailed in many places where we sourced our vehicle components. Some of our vendors had to temporarily close a facility for disinfecting after employees tested positive for COVID-19, and others faced staffing shortages from employees who were sick or apprehensive about coming to work. Further, the ability of our vendors to ship their goods to us became difficult as transportation networks and distribution facilities reduced capacity, all of which caused an increase in shipping costs and time and affected the availability of inventories to meet our sales demand.

Although the anti-pandemic policies have been lifted in China since the beginning of 2023, it is uncertain whether the Chinese government will mandate similar restrictive policies and measures again in the future. Furthermore, the lingering impacts of the global pandemic may continue adversely affecting our supply chain, which in turn may materially and adversely affect our business and results of operations. Although our business operations were not materially impacted because of measures we took during the lockdown period in 2022 in China, which included increasing order quantities for vehicle components and maintaining higher inventory levels, as well as avoiding heavy reliance on a single vendor, there can be no assurance as to whether and to what extent these mitigation measures will be effective in the event of future supply chain disruptions. Maintenance of high inventories can increase our costs and involve other risks. See “Item 1A. Risk Factors — Risks Related to the Company’s Business, Operations, and Industry — Changes in our supply chain may result in increased cost. If we are unsuccessful in our efforts to control and reduce supplier costs and manage inventory at optimal levels, our operating results will suffer.” In addition, if we encounter unexpected difficulties with our principal vendors, and if we are unable to fill these needs from other vendors in a timely manner, we could experience production delays and potential loss of access to important technology and parts for producing, servicing and supporting our vehicles. The loss of any vendors or the disruption in the supply of components from these vendors could lead to design changes and delays in product deliveries to our customers, which could hurt our relationships with our customers and result in negative publicity, damage to our brand and a material and adverse effect on our business, prospects, financial condition and operating results.

We rely on third parties for quality control on the parts sourced from China.

We rely on one of our principal vendors in China to monitor the factories manufacturing the parts sourced from China for use in our vehicles. We have limited control over the ability of third-party manufacturers to maintain adequate quality control, quality assurance and qualified personnel. If our principal vendor fails to perform its duties, including proper inspections on sample products before mass production, the third-party manufacturers may fail to manufacture our product components according to our schedule and requirements or at all. The quality of our products is crucial to our continued growth. If our principal vendor fails to perform its supervising and inspecting duties properly, our final products could have quality issues, which could result in product recall, return of products and potential lawsuits against us if our products cause any injuries or damages due to the quality issues. Any occurrence of the foregoing could hurt our relationship with our customers and result in negative publicity, damage to our brand and a material and adverse effect on our business, prospects, financial condition and operating results.

Our success will depend on our ability to economically produce our vehicles at scale, and our ability to produce vehicles of sufficient quality and appeal to customers on schedule and at scale is unproven.

Our business success will depend in large part on our ability to economically produce, market and sell our vehicles at sufficient capacity to meet the demands of our customers. We will need to scale our production capacity in order to successfully implement our growth strategy.

We currently have one facility in which we assemble all of our products in Brooklyn, New York. We have no experience in large-scale production of our vehicles, and we do not know whether we will be able to develop efficient, automated, low-cost production capabilities and processes, such that we will be able to meet the quality, price and production standards, as well as the production volumes, required to successfully market our vehicles and meet our business objectives and customer needs. Any failure to develop and scale our production capability and processes could have a material adverse effect on our business, prospects, financial condition and operating results.

Changes in our supply chain may result in increased cost. If we are unsuccessful in our efforts to control and reduce supplier costs and manage inventory at optimal levels, our operating results will suffer.

As we plan to continue expanding our business, we expect to include more products and their components in our inventory, which will make it more challenging for us to manage our inventory effectively and will put more pressure on our warehousing system. Maintaining excessive inventory levels beyond customer demand can lead to higher inventory carrying costs. High inventory levels may also require us to commit substantial capital resources, preventing us from using that capital for other important purposes. On the other hand, if we underestimate customer demand or encounter delays from our vendors in supplying vehicle components promptly, we may face inventory shortages. This could potentially compel us to procure vehicle components at higher costs, leading to a backorder situation or unfulfilled customer orders, which could lead to potential cancellations or loss of customers to competitors and negatively impact our brand image and reputation.

There is no assurance that our suppliers will ultimately be able to meet our cost, quality and volume needs, or do so on a timely basis. Furthermore, as the volume of our sales increases, we will need to accurately forecast, purchase and warehouse components at much higher volumes than we have experience with. If we are unable to accurately match the timing and quantities of component purchases to our actual needs, or successfully implement automation, inventory management and other systems to accommodate the increased complexity in our supply chain, we may incur unexpected production disruption, or storage, transportation and write-off costs. Any of the above could have a material adverse effect on our business, prospects, financial condition and operating results.

Increases in costs, disruption of supply, or shortage of materials used to manufacture the component parts used in our vehicles, including potential risks stemming from the conflict between Russia and Ukraine, could harm our business.

We may experience increases in the cost or a sustained interruption in the supply or shortage of materials. Any such increase, supply interruption or shortage could materially and negatively impact our business, prospects, financial condition and operating results. The prices for these materials fluctuate, and their available supply may be unstable, depending on market conditions and global demand for these materials, including as a result of increased production of similar products by our competitors, and could adversely affect our business and operating results. These risks include:

| ● | an increase in the cost, or decrease in the available supply, of materials used in the battery packs; |

| ● | tariffs on the materials we source in China; and |

| ● | fluctuations in the value of the Chinese Renminbi against the U.S. dollar as our purchases for the components of our products are denominated in Chinese Renminbi. |

Disruption in our supply chain and rising prices of raw materials as a result of the conflict between Russia and Ukraine may also negatively impact our businesses. In February 2022, Russian military forces launched a military action in Ukraine. The ongoing military action between Russia and Ukraine, sanctions and other measures imposed against Russia, Belarus, the Crimea Region of Ukraine, the so-called Donetsk People’s Republic and the so-called Luhansk People’s Republic by the U.S. and other countries and bodies around the world, as well as the existing and potential further responses from Russia or other countries to such sanctions, tensions and military actions, has in the past and in the future could continue to adversely affect the global economy and financial markets and could adversely affect our business, prospects, financial condition and operating results. Additional potential sanctions and penalties have also been proposed and/or threatened. Although our operations have not experienced a material adverse impact on supply chain or other aspects of our business from the ongoing conflict between Russia and Ukraine, during times of war and other major conflicts, we and the third parties upon which we rely may be vulnerable to a heightened risk of these attacks that could materially disrupt our operations, supply chain, and ability to produce, sell and distribute our products. We cannot predict the progress or outcome of the conflict in Ukraine or its impacts in Ukraine, Russia or Belarus as the conflict, and any resulting government reactions, are rapidly developing and beyond our control. The extent and duration of the military action, sanctions and resulting market disruptions could be significant, could result in increases in commodity, freight, logistics and input costs and could potentially have substantial impact on the global economy and our business for an unknown period of time.

Substantial increases in the prices for our materials or prices charged to us would increase our operating costs, and could reduce our margins if we cannot recoup the increased costs through increased prices. Any attempts to increase prices in response to increased material costs could result in cancellations of vehicle orders and therefore materially and adversely affect our brand, business, prospects, financial condition and operating results.

Our vehicles may not perform in line with customer expectations.

Our vehicles may not perform in line with customers’ expectations. For example, our vehicles may not have the durability or longevity of other vehicles in the market, and may not be as easy and convenient to repair as other vehicles on the market. Any product defects or any other failure of our vehicles to perform as expected could harm our reputation and result in adverse publicity, lost revenue, delivery delays, product recalls, product liability claims, harm to our brand and reputation, and significant warranty and other expenses, and could have a material adverse impact on our business, prospects, financial condition and operating results.

In addition, the range of our vehicles on a single charge declines principally as a function of usage, time and charging patterns as well as other factors. For example, a customer’s use of his or her electric vehicle as well as the frequency with which he or she charges the battery can result in additional deterioration of the battery’s ability to hold a charge. Furthermore, our vehicles may contain defects in design and manufacture that may cause them not to perform as expected or that may require repair. If any of our vehicles fail to perform as expected, we may need to delay deliveries, initiate product recalls and provide servicing or updates under warranty at our expenses, which could materially and adversely affect our brand, business, prospects, financial condition and operating results.

Our future growth is dependent on the demand for, and upon consumers’ willingness to adopt electric vehicles.

Demand for our products depends to a large extent on general, economic, political and social conditions in a given market and the introduction of new electric vehicles and technologies. As our business grows, economic conditions and trends will impact our business, prospects and operating results as well.

Demand for our electric vehicles may also be affected by factors directly impacting the price or the cost of purchasing and operating electric vehicles such as sales and financing incentives, prices of raw materials, parts and components and governmental regulations, including tariffs, import regulation and other taxes. Volatility in demand may lead to lower vehicle unit sales, which may result in further downward price pressure and adversely affect our business, prospects, financial condition and operating results.

In addition, the demand for our vehicles and services will highly depend upon the adoption by consumers of new energy vehicles in general and electric vehicles in particular. The market for new energy vehicles is still rapidly evolving, characterized by rapidly changing technologies, price and other competition, evolving government regulation and industry standards and changing consumer demands and behaviors.

Other factors that may influence the adoption of new energy vehicles, and specifically electric vehicles, include:

| ● | perceptions about electric vehicle quality, safety, design, performance and cost, especially if adverse events or accidents occur that are linked to the quality or safety of electric vehicles, whether or not such vehicles are produced by us or other companies; |

| ● | perceptions about vehicle safety in general; |

| ● | the limited range over which electric vehicles may be driven on a single battery charge and the speed at which batteries can be recharged; |

| ● | the decline of an electric vehicle’s range resulting from deterioration over time in the battery’s ability to hold a charge; |

| ● | the availability of service for electric vehicles; |

| ● | the environmental consciousness of consumers; |

| ● | the availability of tax and other governmental incentives to purchase and operate electric vehicles or future regulation requiring increased use of nonpolluting vehicles; and |

| ● | macroeconomic factors. |

Any of the factors described above may cause current or potential customers not to purchase our electric vehicles and use our services. If the market for electric vehicles does not develop as we expect or develops more slowly than we expect, our business, prospects, financial condition and operating results will be affected.

The electric mobility industry is subject to rapidly changing and often complex regulatory environments.

The electric mobility industry is subject to rapidly changing and often complex regulatory environments at local, state, national, and international levels. Evolving regulations related to safety standards, emissions, licensing, and operational requirements can have a substantial impact on our business operations and profitability. Compliance with these changing regulations may necessitate costly modifications to our products, business processes, or market strategies, which could lead to increased expenses and delays in product development and market entry. Failure to navigate and adhere to evolving regulations adequately could result in legal and financial liabilities, damage to our reputation, and potential market restrictions. Furthermore, inconsistency in regulations between different jurisdictions may create challenges in maintaining uniform business practices and product offerings, increasing our exposure to regulatory risks. Furthermore, a significant portion of our customer base comprises food delivery workers, and if leading food delivery platforms like Uber Eats and DoorDash impose new requirements on the type of electric vehicles they allow, non-compliance on our part could result in the loss of these customers. While we believe we are presently in compliance with applicable laws and regulations in our operating regions, there can be no assurance that we can always promptly adapt to the rapidly changing regulatory environment. If we fail to effectively adjust to the changing regulatory landscape and comply with applicable laws and regulations in our operating regions, our business, prospects, financial condition and operating results would be materially and adversely affected.

We may be unable to adequately control the costs associated with our operations.

We expect to incur significant costs which will impact our profitability, including research and development expenses as we roll out new models and improve existing models, raw material procurement costs and selling and distribution expenses as we build our brand and market our vehicles. Our ability to remain profitable in the future will not only depend on our ability to successfully market our vehicles and other products and services but also to control our costs. If we are unable to cost efficiently design, manufacture, market, sell and distribute and service our vehicles and services, our business, prospects, financial condition and operating results would be materially and adversely affected.

We may not succeed in establishing, maintaining and strengthening our brand, which could materially and adversely affect customer acceptance of our products, which could in turn materially affect our business, results of operations or financial condition.

Our business and prospects heavily depend on our ability to develop, maintain and strengthen the Fly E-Bike brand. If we are unable to establish, maintain and strengthen our brand, we may lose the opportunity to build and maintain a critical mass of customers. Our ability to develop, maintain and strengthen our brand will depend heavily on the success of our marketing efforts. Failure to develop and maintain a strong brand could materially and adversely affect customer acceptance of our vehicles, could result in suppliers and other third parties being less likely to invest time and resources in developing business relationships with us, and could materially adversely affect our business, prospects, financial condition and operating results.

We have a relatively short operating history, which makes it difficult to evaluate our future prospects, forecast financial results, and assess the risks and challenges we may face.

Our business is relatively new and rapidly evolving. We first launched our business in 2018 and have a limited operating history. We have encountered in the past, and will encounter in the future, risks and uncertainties frequently experienced by growing companies with limited operating histories in rapidly changing industries. Risks and challenges we have faced or expect to face as a result of our relatively limited operating history and evolving business model include our ability to:

| ● | make operating decisions and evaluate our future prospects and the risks and challenges we may encounter; |

| ● | forecast our revenue and budget for and manage our expenses; |

| ● | attract new customers and retain existing customers in a cost-effective manner; |

| ● | comply with existing and new or modified laws and regulations applicable to our business; |

| ● | manage our business assets and expenses; |

| ● | plan for and manage capital expenditures for our current and future offerings and manage our supply chain and supplier relationships related to our current and future offerings; |

| ● | anticipate and respond to macroeconomic changes and changes in the markets in which we operate; |

| ● | maintain and enhance the value of our reputation and brand; |

| ● | effectively manage our growth and business operations; |

| ● | successfully expand our geographic reach; |

| ● | hire, integrate and retain talented people at all levels of our organization; and |

| ● | successfully develop new features, offerings and services to enhance the experience of customers. |

If our assumptions regarding these risks and uncertainties, which we use to plan and operate our business, are incorrect or change, or if we do not address these risks successfully, our results of operations could differ materially from our expectations and our business, prospects, financial condition and operating results could be adversely affected.

We identified material weaknesses in our internal control over financial reporting. If we are unable to remediate these material weaknesses, or identify additional material weaknesses in the future or otherwise fail to maintain an effective system of internal controls, we may not be able to accurately or timely report our financial condition or results of operations, which may adversely affect our business and stock price.

In connection with the preparation and audit of our consolidated financial statements for the year ended March 31, 2024, we identified material weaknesses in our internal control over financial reporting. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim consolidated financial statements will not be prevented or detected on a timely basis. The material weaknesses that have been identified included our lack of (i) sufficient financial reporting and accounting personnel with appropriate knowledge of generally accepted accounting principles in the United States of America (the “U.S. GAAP”) and SEC reporting requirements to properly address complex U.S. GAAP accounting issues and to prepare and review our consolidated financial statements and related disclosures to fulfill U.S. GAAP and SEC financial reporting requirements, (ii) formal internal control policies and internal independent supervision functions to establish formal risk assessment process and internal control framework, and (iii) sufficient controls designed and implemented in IT environment and IT general control activities, which are mainly associated with areas of logical access management, change management, computer operation, service organization management as well as cyber security management.