UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _____

For the transition period from ____ to ____

Commission file number 001-36578

Enlivex Therapeutics Ltd.

(Exact name of Registrant as specified in its charter)

State of Israel

(Jurisdiction of incorporation or organization)

14 Einstein Street, Ness Ziona, Israel 7403618

(Address of principal executive offices)

Mr. Oren Hershkovitz

Tel:

+972.2.6208072

Email: Oren@enlivexpharm.com

Facsimile: +972.2.6208070

14 Einstein Street, Ness Ziona, Israel 7403618

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol | Name of each exchange on which registered | ||

| Ordinary Shares, par value NIS 0.40 per share | ENLV | Nasdaq Capital Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

18,598,555 ordinary shares, par value NIS 0.40 per share, as of December 31, 2023

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-Accelerated filer | ☒ | Emerging growth company | ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are being registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statement. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.1D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes ☐ No ☒

TABLE OF CONTENTS

INTRODUCTION

Business Description of Enlivex

Enlivex Therapeutics Ltd., a company organized under the laws of the State of Israel (including its consolidated subsidiaries, “Enlivex”, “we”, “us”, “our” or the “Company”), is a clinical-stage macrophage reprogramming immunotherapy company, developing AllocetraTM, a universal, off-the-shelf cell therapy designed to reprogram macrophages into their homeostatic state. Resetting non-homeostatic macrophages into their homeostatic state is critical for immune system rebalancing and resolution of debilitating and life-threatening conditions. Non-homeostatic macrophages contribute significantly to the severity of diseases. By restoring macrophage homeostasis, Allocetra™ has the potential to provide a novel immunotherapeutic mechanism of action for debilitating and life-threatening clinical indications that are defined as “unmet medical needs,” as a stand-alone therapy or in combination with leading therapeutic agents.

Macrophages are tissue-resident or infiltrating immune cells critical for innate immunity, normal tissue development, and repair of damaged tissue. Macrophages’ function is a result of their original designation, their local micro-environment, and the type of metabolites, substances, or pathogens to which they are exposed. Reprogrammed out of their homeostatic state, macrophages contribute to the pathophysiology of multiple inflammatory diseases, including sepsis, osteoarthritis and other inflammatory disorders.

We believe the Company’s primary innovative immunotherapy, AllocetraTM, represents a paradigm shift in macrophage reprogramming, moving from targeting a specific subset of macrophages or a specific pathway affecting macrophages activity, to a fundamental view of macrophage homeostasis. Restoring macrophage homeostasis may induce the immune system to rebalance itself to normal levels of operation, thereby promoting disease resolution.

The Company is focused on two clinical program verticals as its main inflammatory and autoimmune indications: sepsis and osteoarthritis (the “Indications”). Additionally, the Company is seeking external collaborations or out-licensing opportunities for the development of Allocetra™ as a next-generation solid cancer immunotherapy. The Company believes that negatively-reprogrammed macrophages may be key contributors to disease severity across the Indications, and effective reprogramming of these negative-reprogrammed macrophages into their respective homeostatic states may facilitate disease resolution for the Indications, some of which are considered “unmet medical needs.” All planned and expected timelines for execution of the clinical trials in the Indications are subject to certain risks and uncertainties. For further discussion of risks and uncertainties related to our clinical trial in the Indications please see Item 3.D. “Risk Factors” below.

Strategic Reprioritization Plan

In September 2023, we announced a strategic reprioritization plan, pursuant to which we determined to increase our existing focus on inflammatory and autoimmune indications. As part of the strategic reprioritization plan, in addition to the ongoing Phase II trial of AllocetraTM in patients with sepsis, we initiated a clinical program in osteoarthritis, which is a degenerative disease with low grade inflammation and an indication with a substantial unmet medical need that potentially represents a multibillion commercial market.

Pursuant to the strategic reprioritization plan, and in light of the new guidelines and regulatory initiatives set by the U.S. Food and Drug Administration (the “FDA”) for drug development in oncology, which may result in longer clinical development cycles as foundations for regulatory approvals, the Company ceased the internal clinical development of its various oncology indications and plans to seek external collaborations or out-licensing opportunities for the development of Allocetra™ as a next-generation solid cancer immunotherapy.

As a result of the Company’s reprioritization of its clinical indications and focus on the inflammatory and auto-immune verticals, the Company reduced its workforce by approximately 50%. The workforce reduction and the savings associated with the reclassification of the oncology indications as candidates for external collaborations or out-licensing opportunities in lieu of internal development are expected to result in a substantial extension of the Company’s cash runway through the end of 2025. The revised, extended cash runway is expected to support the timeline for the topline data readouts of the end-stage knee osteoarthritis Phase I/II trial as well as the randomized, controlled Phase II clinical trial in osteoarthritis.

Sepsis: Topline Results of Phase II Trial Evaluating Allocetra™ in Patients with Sepsis

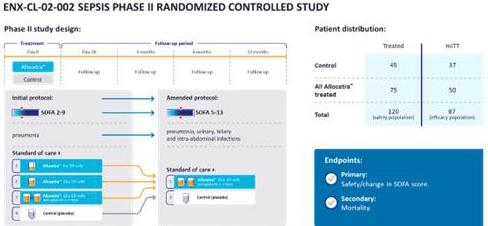

In 2021, we initiated a placebo-controlled, randomized, dose-finding, multi-center, Phase II trial evaluating liquid Allocetra™ in patients with pneumonia-associated sepsis. During 2022, we amended the protocol of this clinical trial to treat newly recruited patients with frozen formulation Allocetra™ and expand the study population to include patients whose septic condition stemmed from biliary, urinary tract or peritoneal infections. An additional amendment to the study protocol was filed in the second quarter of 2023, to include an increase in the patients’ sequential organ failure assessment (“SOFA”) score range, effectively allowing recruitment of patients with higher levels of sepsis severity, and a change to two cohorts (treatment and placebo) in lieu of the four-cohort structure previously contemplated. The first patient was dosed under the amended protocol during the second quarter of 2023, and, in December 2023, we completed enrollment of all 120 patients in the trial.

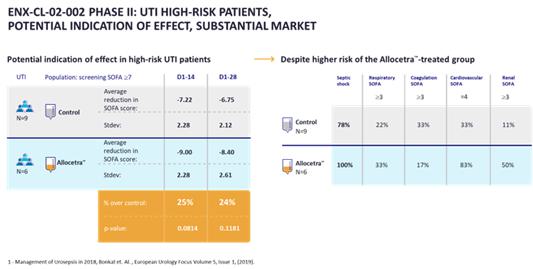

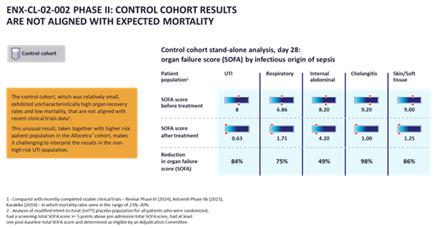

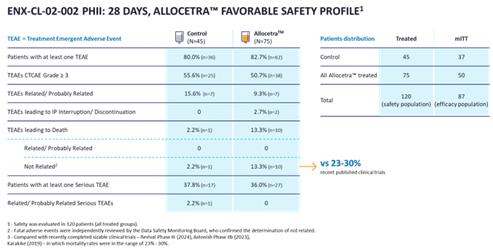

In April 2024, we announced the 28-day topline data from the Phase II trial evaluating AllocetraTM in patients with sepsis. Stand-alone analysis1 of the AllocetraTM-treated patients, of which 78% had septic shock and 58% had invasive ventilation at screening, demonstrated substantial reductions in SOFA scores and a 65% reduction in overall mortality rate as compared with expected mortality based on real-world data and recent sizeable clinical studies in sepsis. By day 28, the analysis showed 90% reductions of SOFA scores for sepsis patients whose infection source was urinary tract, 68% for patients whose infection source was community-acquired pneumonia, and 36% for patients whose infection source was an internal abdominal infection. Relative analysis demonstrates a potential indication of effect of Allocetra™, as compared with placebo, in the high-risk severe sepsis patient population originating from urinary tract infections (“High-Risk UTI”). Up to an estimated 31% of sepsis cases start as urinary tract infections, representing up to 9.8 million cases and up to 1.6 million deaths annually worldwide (G. Bonkat et. al. 2018), which represents a substantial potential market opportunity for Allocetra™. We intend to consider a potential follow-on, randomized, controlled study of a solely High-Risk UTI sepsis population upon reviewing the totality of the data.

The study was designed for patients to be randomized with equal degree of SOFA scores across treatment and placebo groups. The randomization resulted in the Allocetra™-treated cohorts having 20% higher frequency of septic shock and 35% higher frequency of invasive ventilation prior to treatment, as compared with the control group. Both of these patient attributes are associated with a significantly higher degree of difficulty of treatment and higher mortality rates. These imbalances made it challenging to deduce the relative effect in other patient subgroups.

Finally, stand-alone and placebo-compared analysis across all sepsis patient subgroups and risk categories demonstrated acceptable safety and tolerability profile of Allocetra™ IV infusions.

For additional information on the topline results of our Phase II sepsis trial, see Item 4.B. “Information on the Company—Business Overview.”

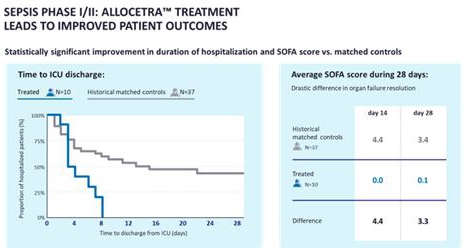

Our Phase II sepsis trial is supported by previously reported positive results from a Phase Ib trial that demonstrated AllocetraTM’s favorable safety profile and showed vastly improved clinical outcomes, including SOFA scores, duration of hospitalization, and mortality in Allocetra-treated sepsis patients compared to a group of matched historical controls who received standard-of-care therapy. Sepsis is a life-threatening disease with no therapies approved by the FDA and a high unmet medical need. According to the U.S. Centers for Disease Control and Prevention (the “CDC”), each year, at least 1.7 million adults in the United States develop sepsis, with approximately 270,000 dying of the disease.

| 1 | Analysis of modified intent-to-treat (mITT) population for all patients who were randomized, received the high dose of AllocetraTM or placebo, had a screening total SOFA score >= 5 points above pre-admission total SOFA score, had at least one post-baseline total SOFA score, and determined as eligible by an adjudication committee. |

Knee Osteoarthritis: First End-Stage Patient Dosed and Initiation of Randomized Controlled Phase I/II Study Clinical Trials

During 2023, we reprioritized our clinical program and initiated a clinical program in osteoarthritis, which is the most common chronic degenerative joint disease characterized by cartilage degradation, low grade inflammation, pain and disability. Osteoarthritis is an indication with a substantial unmet medical need that potentially represents a multibillion commercial market.

In the third quarter of 2023, we announced the dosing of the first patient with a direct injection of AllocetraTM to the knee in a Phase I/II investigator-initiated clinical trial evaluating the safety and initial efficacy of AllocetraTM in end-stage knee osteoarthritis patients indicated for knee replacement surgery. In January 2024, following our receipt of regulatory approval from the Israeli Ministry of Health (“IMOH”), we initiated a Company-sponsored multi-country, double-blind, randomized, placebo-controlled Phase I/II trial to evaluate the efficacy, safety and tolerability of Allocetra™ following injections into the target knee joint of up to 160 moderately to severely symptomatic osteoarthritis patients. In April 2024, we announced that the Danish Medicines Agency authorized the expansion of this trial into Denmark, as well as the dosing of the first two patients in the trial. This Phase I/II multi-center trial is composed of two stages. The first stage is a safety run-in, open-label dose escalation phase to characterize the safety and tolerability of Allocetra™ injections to the target knee in order to identify the dose and injection regimen for the second, randomized stage. The second stage is a double-blind, randomized, placebo-controlled stage, which we expect to initiate following the completion of the safety run-in stage and confirmation by the safety and tolerability independent Data and Safety Monitoring Board. In addition to evaluating safety, the blinded randomized stage is statistically-powered to assess the efficacy of Allocetra™ injections into the knee. We expect that the primary measurements will evaluate joint-pain and joint-function compared to placebo at three months, six months and 12 months. We are targeting to receive the topline readout from the randomized stage of the study by the third quarter of 2025.

The initiation of the clinical program in osteoarthritis followed preclinical evidence of the potential applicability of Allocetra’sTM mechanism of action to resolve chronic low-grade inflammation of joints afflicted with osteoarthritis, as well as a substantial recovery in a case of a 70-year old patient who suffered for many years from vanishing bone disease (Gorham-Stout syndrome). Despite exhaustive therapeutic attempts, the patient’s disease remained refractory to treatment, requiring extended hospitalization for a duration of nine months prior to compassionate treatment with AllocetraTM to the shoulder joint. Following five intra-articular AllocetraTM injections, substantial improvement was documented in multiple clinical parameters, and the patient was successfully discharged from the hospital. At a two-year follow-up, the improvement in the afflicted shoulder was maintained, and no subsequent hospital re-admissions were required.

Manufacturing Plant Update

In September 2021, we entered into a lease agreement (the “Lease Agreement”) for a 2,500 square meter property in Yavne, Israel to construct a new 1,600 square meter facility for the manufacture of Allocetra™, which was completed in the fourth quarter of 2022. As part of our strategic reprioritization plan, we determined to sell such leased manufacturing facility, together with the equipment installed by us therein (the “Equipment”), and assign the Lease Agreement.

On March 31, 2024, we entered into an agreement (the “Yavne Facility Sale Agreement”) with BioHarvest Ltd., an Israeli company (the “purchaser”), pursuant to which the purchaser agreed to acquire the Equipment and assume all of our obligations under the Lease Agreement, effective as of April 1, 2024, for an aggregate purchase price (the “Purchase Price”) payable to the Company of 13.0 million New Israeli Shekels (“NIS”) (approximately $3.5 million). The Purchase Price is payable in installments, consisting of an initial payment of NIS 4.0 million (approximately $1.08 million), which was paid on April 2, 2024, and 24 equal monthly installment payments of NIS 375,000 (approximately $102,000), commencing on April 1, 2024. Pursuant to the Yavne Facility Sale Agreement, title to the Equipment will transfer to the purchaser only upon full payment of the total Purchase Price, but risk of loss to the Equipment passed to the purchaser on April 1, 2024. Subject to certain conditions, the purchaser may, in its sole discretion, prior to October 1, 2025, prepay (i) all of the remaining outstanding Purchase Price at a 4% discount, or (ii) a portion of the remaining outstanding Purchase Price, in an amount of not less than NIS 4.0 million (approximately $1.08 million), at a 2% discount, in which case, the Purchase Price remaining outstanding thereafter shall continue to be paid in monthly instalments of NIS 375,000 each (approximately $102,000).

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other U.S. Federal securities laws. These forward-looking statements include, but are not limited to:

| ● | our expectations regarding the timing of clinical trials with respect to Allocetra™; |

| ● | the continued listing of our ordinary shares on Nasdaq; |

| ● | our expectations regarding the progress of our clinical trials, including the duration, cost and whether such trials will be conducted at all; |

| ● | our intention to successfully complete clinical trials in order to be in a position to submit applications for accelerated regulatory paths in the EU and the United States; |

| ● | the possibility that we will apply in the future for regulatory approval for our current and any future product candidates we may develop, and the costs and timing of such regulatory approvals; |

| ● | the likelihood of regulatory approvals for any product candidate we may develop; |

| ● | the timing, cost or other aspects of the commercial launch of any product candidate we may develop, including the possibility that we will build a commercial infrastructure to support commercialization of our current and any future product candidates we may develop; |

| ● | future sales of our product candidates or any other future products or product candidates; |

| ● | our ability to achieve favorable pricing for our product candidates; |

| ● | the potential for our product candidates to receive orphan drug designations; |

| ● | that any product candidate we develop potentially offers effective solutions for various diseases; |

| ● | whether we will develop any future product candidates internally or through strategic partnerships; |

| ● | our expectations regarding the manufacturing and supply of any product candidate for use in our clinical trials, and the commercial supply of those product candidates; |

| ● | third-party payer reimbursement for our current or any future product candidates; |

| ● | our estimates regarding anticipated expenses, capital requirements and our needs for substantial additional financing; |

| ● | patient market sizes and market adoption of our current or any future product candidates by physicians and patients; |

| ● | completion and receiving favorable results of clinical trials for our product candidates; |

| ● | protection of our intellectual property, including issuance of patents to us by the United States Patent and Trademark Office (the “USPTO”), and other governmental patent agencies; |

| ● | our intention to pursue marketing and orphan drug exclusivity periods that are available to us under regulatory provisions in certain countries; |

| ● | the development and approval of the use of our current or any future product candidates for the Indications; |

| ● | our expectations regarding commercial and pre-commercial activities; |

| ● | our expectations regarding licensing, acquisitions, and strategic operations; |

| ● | our liquidity; and |

| ● | the impact of the economic, public health, political and security situation in Israel, the U.S. and other countries in which we may operate or obtain approvals for AllocetraTM and any future product candidates. |

In some cases, forward-looking statements are identified by terminology such as “may,” “will,” “could,” “should,” “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “predicts,” “hope,” “targets,” “potential,” “goal” or “continue” or the negative of these terms or other comparable terminology. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or performance to differ materially from those suggested in such forward-looking statements. These statements are current only as of the date of this Annual Report on Form 20-F and are subject to known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from those suggested in the forward-looking statements. In addition, historic results of scientific research and clinical and preclinical trials do not guarantee that the conclusions of future research or trials would not suggest different conclusions or that historic results referred to in this Annual Report on Form 20-F would not be interpreted differently in light of additional research, clinical and preclinical trials results. The forward-looking statements contained in this Annual Report on Form 20-F are subject to risks and uncertainties, including those discussed in Item 3.D. “Risk Factors” and in our other filings with the Securities and Exchange Commission (the “SEC”). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 20-F. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Except as required by law, we do not intend to (and expressly disclaim any such obligation to) update or revise any of the forward-looking statements, whether as a result of new information, future events or otherwise.

RISK FACTOR SUMMARY

Our business is subject to numerous risks and uncertainties, including those described in Item 3.D. “Risk Factors.” These risks include, but are not limited to the following:

| ● | We are a clinical-stage macrophage reprogramming immunotherapy company with a history of operating losses; we expect to incur additional losses in the future and may never be profitable; |

| ● | We have not generated any revenue from Allocetra™ or any other product candidate, and we may never be profitable; |

| ● | We will need substantial additional capital in the future; if additional capital is not available, we will have to delay, reduce or cease operations; |

| ● | We are unable to estimate our long-term capital requirements due to uncertainties associated with the development and commercialization of our product candidates; if we fail to obtain necessary funds for our operations, we will be unable to develop and commercialize any of our product candidates; |

| ● | Our business, operating results and growth may be adversely affected by current or future unfavorable economic and market conditions due to geopolitical tensions and political, economic and military instability; |

| ● | We have focused substantially all of our efforts and resources on Allocetra™, and we may not obtain regulatory approval of Allocetra™; |

| ● | It is possible that none of our product candidates will achieve commercial success in a timely and cost-effective manner, or ever; |

| ● | Results from our clinical trials may be negative or may not replicate the results of our preclinical trials or earlier clinical trials, which could require that we abandon development of Allocetra™, our other product candidates or any future product candidates, which will significantly impair our ability to generate revenues; |

| ● |

Our strategic reprioritization and related reduction in force may not achieve our intended outcome;

|

|

| ● | The clinical trial process is complex and expensive, and commencement and completion of clinical trials can be delayed or prevented for a number of reasons; |

| ● | We cannot be certain that the results of our potential clinical trials, even if all endpoints are met, will support regulatory approval in any territory, of any of our product candidates for any indication; |

| ● | Our manufacturing processes are complex, delicate and susceptible to contamination, and involve biological intermediates that are subject to stringent regulations; |

| ● | If we or any potential CMOs we retain in the future fail to comply with manufacturing regulations, our financial results and financial condition could be adversely affected; |

| ● | Our product candidates may produce undesirable side effects that we may not detect in our clinical trials, which could prevent us from achieving or maintaining market acceptance of any such product candidate and could substantially increase commercialization costs or even force us to cease operations; |

| ● | Even if Allocetra™ or any other product candidate that we may develop receives marketing approval in any territory, we will continue to face extensive regulatory requirements, and any such product may still face future development and regulatory difficulties; |

| ● | We expect the healthcare industry to face increased limitations on reimbursement, rebates and other payments as a result of healthcare reform, which could adversely affect third-party coverage of our products and how much or under what circumstances healthcare providers will prescribe or administer our products; | |

| ● | Significant disruptions of information technology systems, cyberattacks and other security breaches could compromise our proprietary and confidential information, which could harm our business and reputation; |

| ● | If product liability lawsuits are successfully brought against us, our insurance may be inadequate; |

| ● | We manage our business through a small number of senior executive officers; | |

| ● | We intend to rely primarily on third parties to market and sell Allocetra™ and any other product candidate; |

| ● | Any collaboration arrangements that we may enter into in the future may not be successful, which could adversely affect our ability to develop and commercialize our current and any future product candidates; |

| ● | We depend on third parties to conduct our clinical trials; |

| ● | The failure to obtain or maintain patents, licensing agreements and other intellectual property could impact our ability to compete effectively; and |

| ● | We cannot predict the scope and extent of patent protection for our product candidates because the patent positions of pharmaceutical products are complex and uncertain. |

PART ONE

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

3.A. [Reserved]

3.B. Capitalization and Indebtedness

Not applicable.

3.C. Reasons for the Offer and Use of Proceeds

Not applicable.

3.D. Risk Factors

Investing in our ordinary shares involves a high degree of risk. You should carefully consider the risks described below before investing in our ordinary shares.

There are a number of risks and uncertainties that could affect our business and cause our actual results to differ from past performance or expected results. We consider the following risks and uncertainties to be those material to our business. If any of these risks actually occur, our business, financial condition and results of operations could suffer, and the trading price of our ordinary shares could decline. We urge investors to consider carefully the risk factors described below, together with the other information contained in this Annual Report on Form 20-F, in evaluating any investment in our ordinary shares.

Risks Related to Our Financial Position and Capital Requirements

We are a clinical-stage macrophage reprogramming immunotherapy company with a history of operating losses. We expect to incur additional losses in the future and may never be profitable.

We are a clinical-stage macrophage reprogramming immunotherapy company with a limited operating history and no currently approved products. To date, we have focused almost exclusively on developing our related product candidate, Allocetra™, a universal, off-the-shelf cell therapy designed to reprogram macrophages into their homeostatic stage, currently focusing on treatment of the Indications. We have funded our operations to date primarily through proceeds from private placements of ordinary shares and convertible debt. We have no saleable products and have not generated any revenue from product sales. We have incurred losses in each year since our inception in 2005. Our loss attributable to holders of our ordinary shares for the years ended December 31, 2023 and 2022 was $29 million and $31 million, respectively. As of December 31, 2023, we had an accumulated deficit of approximately $112.1 million. Substantially all of our operating losses resulted from costs incurred in connection with our development program and from general and administrative costs.

We expect to continue to incur significant research and development expenses in the future as we continue the advancement of our clinical studies and as we potentially pursue additional indications. We may also incur expenses in connection with third-party studies and trials involving our product candidates or other intellectual property. In addition, if we obtain marketing approval for any of our product candidates, we will likely initially incur significant outsourced sales, marketing and manufacturing expenses, as well as continued research and development expenses. As a result, we expect to continue to incur significant and increasing operating losses for the foreseeable future. Because of the numerous risks and uncertainties associated with developing cell immunotherapy products, we are unable to predict the extent of any future losses or when we will become profitable, if at all.

We have not generated any revenue from Allocetra™ or any other product candidate, and we may never be profitable.

Our ability to become profitable depends upon our ability to generate revenue in excess of our expenses. We have not generated any revenue from our development of Allocetra™, or any other product candidate. We do not know when, or if, we will generate any revenue. We do not expect to generate revenue unless and until we obtain regulatory and marketing approval of, and commercialize, Allocetra™ or any other product candidate. We will continue to incur research and development and general and administrative expenses related to our operations. We expect to continue to incur losses for the foreseeable future, and such losses will likely increase as we:

| ● | initiate and manage preclinical development and clinical trials for our current and any new product candidates; |

| ● | seek regulatory approvals for our product candidates, or future product candidates, if any; |

| ● | implement internal systems and infrastructure, including, without limitation, hiring of additional personnel as needed and to develop sales and marketing functions if and when our product candidate receives applicable regulatory approval; |

| ● | seek to in-license additional technologies for development, such as cell delivery, processing and testing technologies; |

| ● | hire additional management and other personnel; and |

| ● | move towards commercialization of our product candidates and future product candidates, if any. |

We may out-license our ability to generate revenue from our product candidates, depending on a number of factors, including our ability to:

| ● | obtain favorable results from and progress the clinical development of our product candidates, particularly Allocetra™; |

| ● | develop and obtain regulatory approvals in various countries and for the uses we intend to pursue for our product candidates; |

| ● | subject to successful completion of registration, clinical trials and perhaps additional clinical trials of any product candidate, apply for and obtain marketing approval in the countries we intend to pursue for such product candidate; |

| ● | contract for the manufacture of commercial quantities of our product candidates at acceptable cost levels, subject to the receipt of marketing approval; and |

| ● | establish external, and potentially, internal, sales and marketing capabilities to effectively market and sell our product candidates in the United States and other countries. |

Even if Allocetra™, our lead product candidate, which is currently being developed for the Indications, is approved for commercial sale for any indication, it may not gain market acceptance or achieve commercial success. In addition, we anticipate incurring significant costs associated with commercialization. We may not achieve profitability soon after generating product revenue, if ever. If we are unable to generate product revenue, we will not become profitable and would be unable to continue operations without additional funding.

We have not yet commercialized any products and we may never become profitable.

We have not yet commercialized any products, and we may never do so. We do not know when or if we will complete any of our product development efforts, obtain regulatory approval for any product candidates or successfully commercialize any approved products. Even if we are successful in developing products that are approved for marketing, we will not be successful unless these products gain market acceptance for appropriate indications. The degree of market acceptance of any of our planned future products will depend on a number of factors, including, but not limited to:

| ● | the timing of regulatory approvals in the countries, and for the uses, we intend to pursue with respect to the commercialization of our product candidates; |

| ● | the competitive environment; |

| ● | the acceptance by the medical community of the safety and clinical efficacy of our products and their potential advantages over other therapeutic products; |

| ● | the adequacy and success of distribution, sales and marketing efforts, including through strategic agreements with pharmaceutical and biotechnology companies; and |

| ● | the pricing and reimbursement policies of government and third-party payors, such as insurance companies, health maintenance organizations and other plan administrators. |

Physicians, patients, third-party payors or the medical community in general may be unwilling to accept, utilize or recommend coverage of, and in the case of third-party payors, cover any of our planned future products. As a result, we are unable to predict the extent of future losses or the time required to achieve profitability, if at all. Even if we successfully develop one or more products, we may not become profitable.

Our limited operating history makes it difficult to evaluate our business and prospects.

Although we have been in existence since 2005, we have a limited operating history, and our operations to date have been limited primarily to research and development, clinical trials, raising capital and recruiting scientific and management personnel. Therefore, it is difficult to evaluate our business and prospects. We have not yet commercialized or obtained regulatory approval for any product candidate. Consequently, any predictions about our future performance may not be accurate, and you may not be able to fully assess our ability to complete development or commercialize our product candidates, or any future product candidates, obtain regulatory approvals or achieve market acceptance or favorable pricing for our product candidates or any future product candidates.

We will need substantial additional capital in the future. If additional capital is not available, we will have to delay, reduce or cease operations.

We will need to raise substantial additional capital to fund our operations and to develop and commercialize our product candidates, particularly Allocetra™. Our future capital requirements may be substantial and will depend on many factors, including, but not limited to:

| ● | our clinical trial results; |

| ● | the cost, timing and outcomes of seeking marketing approval of our product candidates; |

| ● | the cost of filing and prosecuting patent applications and the cost of defending our patents; |

| ● | the cost of prosecuting infringement actions against third parties; |

| ● | exploration and possible label expansion of our product candidates for the treatment of other conditions or indications; |

| ● | the costs associated with commercializing our product candidates if we receive marketing approval, including the cost and timing of establishing external, and potentially in the future, internal, sales and marketing capabilities to market and sell such product candidates; |

| ● | subject to receipt of marketing approval, revenue received from sales of approved products, if any, in the future; |

| ● | any product liability or other lawsuits related to our future product candidates or products, if any; |

| ● | the demand for our products, if any; |

| ● | the expenses needed to attract and retain skilled personnel; and |

| ● | the costs associated with being a public company. |

Based on our current operating plan, we anticipate that our existing resources will be sufficient to maintain our currently planned operations, including our continued product development, through the end of 2025. We will require significant additional funds to initiate and complete the FDA and the European Medicines Agency (“EMA”) approval process. However, changing circumstances may cause us to consume capital significantly faster than we currently anticipate, including, without limitation, regulatory requests by the FDA or EMA, changes in our development strategy, delays in or an inability to execute our development plans, unsuccessful preclinical or clinical studies and losing our “Small and Medium Enterprise” status at the EMA, which entitles us to significant fee reductions. Because of the numerous risks and uncertainties associated with the development and commercialization of our product candidates, we are unable to estimate the amount of increased capital and operating expenditures associated with our anticipated clinical trials and general operations. We have no committed external sources of funds. Additional financing may not be available when we need it or on terms that are favorable to us. If adequate funds are not available to us on a timely basis, or at all, we may be required to terminate or delay planned clinical trials or other development activities for our product candidates, which would materially and adversely affect our liquidity and results of operations.

Raising additional financing may be costly or difficult to obtain, may dilute current shareholders’ ownership interests and may require that we relinquish our rights to certain of our technologies, products or marketing territories.

Any debt or equity financing that we may need may not be available on terms favorable to us, or at all. If we obtain funding through a strategic collaboration or licensing arrangement, we may be required to relinquish our rights to certain of our technologies, products or marketing territories. If we are unable to obtain required additional capital, we may have to curtail our growth plans or cut back on existing business, and we may not be able to continue operating.

We may incur substantial costs in pursuing future financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition and results of operations.

Any additional capital raised through the sale of equity or equity-linked securities may dilute our current shareholders’ ownership in us and could also result in a decrease in the market price of our ordinary shares. The terms of the securities issued by us in future capital transactions may be more favorable to new investors and may include the issuance of warrants or other derivative securities, which may have a further dilutive effect.

We are unable to estimate our long-term capital requirements due to uncertainties associated with the development and commercialization of our product candidates. If we fail to obtain necessary funds for our operations, we will be unable to develop and commercialize any of our product candidates.

We expect our long-term capital requirements to depend on many potential factors, including, among others:

| ● | the number of product candidates in development; |

| ● | the duration and cost of discovery and preclinical development; |

| ● | the regulatory path of product candidates, including our lead product candidate, Allocetra™, which is being developed for treating the Indications; |

| ● | the results of preclinical and clinical testing, which can be unpredictable in product candidate development; |

| ● | our ability to successfully commercialize our product candidates, including securing commercialization and out-licensing agreements with third parties and favorable pricing and market share; |

| ● | the progress, success and costs of our clinical trials and research and development programs, including those associated with milestones and royalties; |

| ● | the costs, timing and outcome of regulatory review and obtaining regulatory approval of our lead product candidate and addressing regulatory and other issues that may arise post-approval; |

| ● | the breadth of the labeling, assuming that any of our product candidates are approved for commercialization by the relevant regulatory authority; |

| ● | our need, or decision, to acquire or in-license complementary technologies or new platform technologies or product candidate targets; |

| ● | the costs of enforcing our issued patents and defending intellectual property-related claims; |

| ● | the costs of investigating patents that might block us from developing potential product candidates; |

| ● | the costs of recruiting and retaining qualified personnel; |

| ● | our revenue, if any; and |

| ● | our consumption of available resources more rapidly than currently anticipated, resulting in the need for additional funding sooner than anticipated. |

If we are unable to obtain the funds necessary for our operations, we will be unable to develop and commercialize any of our product candidates, or any future product candidates, which would materially and adversely affect our business, liquidity and results of operations.

Due to our recurring operating losses, our ability to continue to operate as a going concern is dependent on additional financial support.

We devote substantially all of our efforts toward research and development activities. In the course of such activities, we have sustained operating losses and expect such losses to continue for the foreseeable future. We have no current source of revenue to sustain our present activities, and we do not expect to generate revenue until, and unless, the FDA or other regulatory authorities approve one of our product candidates and we successfully commercialize (including out-licensing) such product candidate. Accordingly, our ability to continue operating will require us to obtain additional financing to fund our operations. According to our estimates, if we are not successful in obtaining additional capital resources, there is a substantial doubt that we will be able to continue our activities beyond the end of 2025. The perception of our inability to continue as a going concern may make it more difficult for us to obtain financing for the continuation of our operations and could result in the loss of confidence by investors, suppliers and employees.

Our business, operating results and growth may be adversely affected by current or future unfavorable economic and market conditions due to geopolitical tensions and political, economic and military instability.

Our business depends on the economic health of the global economies. U.S. and global markets have recently experienced volatility and disruption, including as a result of the escalation of geopolitical tensions following the start of the war between Russia and Ukraine in February 2022 and the war between Israel and Hamas in October 2023. If the conditions in the global economies remain uncertain or continue to be volatile, or if they deteriorate, including as a result of the impact of military conflict, such as the war between Russia and Ukraine and Israel and Hamas, terrorism or other geopolitical events, such as political instability in Israel, our business, operating results and financial condition may be materially adversely affected. Economic weakness, inflation and increases in interest rates, limited availability of credit, liquidity shortages and constrained capital spending have at times in the past resulted, and may in the future result, in a challenging capital raising environment, slower adoption of new technologies and increased competition, and any such disruptions may also magnify the impact of other risks described in this Annual Report on Form 20-F. See also “Risks Related to Israeli Law and Our Operations in Israel—Our headquarters and other significant operations are located in Israel and, therefore, our business and operations may be adversely affected by political, economic and military instability in Israel.”

Risks Related to Our Business, Industry and Regulatory Requirements

We have focused substantially all of our efforts and resources on Allocetra™, and we may not obtain regulatory approval of Allocetra™.

We have focused substantially all of our efforts and financial resources in the research and development of Allocetra™. As a result, our business is primarily dependent on our ability to complete the development of, obtain regulatory approval for and successfully commercialize Allocetra™. The process to develop, obtain regulatory approval for and commercialize Allocetra™ is long, complex and costly, and its outcome is uncertain.

The research, testing, manufacturing, labeling, approval, sale, marketing and distribution of drugs and pharmaceutical products, including biologics, are subject to extensive regulation by the FDA, the EMA and regulatory agencies in other countries. These regulations differ from jurisdiction to jurisdiction. We are not permitted to market Allocetra™, or any other product candidate, in the United States until we receive approval of a biologics license application (“BLA”) from the FDA, or in the European Union until we receive a marketing authorization application (“MAA”) from the EMA, or in any foreign countries until we receive the requisite approval from the respective regulatory agencies in such countries. We have not yet obtained regulatory clearance to conduct confirmatory clinical trials that are necessary to file a BLA with the FDA or comparable applications to other regulatory authorities in other countries, nor have we received marketing approval for Allocetra™ in any country. The results of clinical trials may be unsatisfactory and, even if endpoints are successfully met, the FDA, or other regulatory authorities, may not approve our marketing application should we be in a position to file one.

Marketing approval procedures and timelines vary among countries and can involve additional product testing and additional administrative review periods. The approval process may include the risks detailed above, as well as other risks. In some countries and in specific programs, product approval depends on showing superiority to an approved alternative therapy. This can result in significant expenses for conducting complex clinical trials. In addition, time from approval to commercialization may significantly differ between countries. In particular, in many countries outside the United States, it is required that a product receives pricing and reimbursement approval before it can be commercialized. This can result in substantial delays in such countries. If we fail to comply with regulatory requirements in the United States or international markets or to obtain and maintain required approvals or if regulatory approvals in the United States or international markets are delayed, our target market will be reduced and our ability to realize the full market potential of our products will be harmed.

Marketing approval in one jurisdiction does not ensure marketing approval in another, but a failure or delay in obtaining marketing approval in one jurisdiction may have a negative effect on the regulatory process in others. Failure to obtain marketing approval in other countries or any delay or setback in obtaining such approval would impair our ability to develop foreign markets for Allocetra™ or any other product candidate. This would reduce our target market and limit the full commercial potential of Allocetra™ or any other product candidate.

It is possible that none of our product candidates will achieve commercial success in a timely and cost-effective manner, or ever.

Even if regulatory authorities approve any of our product candidates, they may not be commercially successful. Our product candidates may not be commercially successful because, among other things, government agencies or other third-party payors may not provide reimbursement for the costs of the product or the reimbursement may be too low to be commercially successful. Also, physicians and others may not use or recommend our product candidates, even following regulatory approval. In addition, a product approval, even if issued, may limit the uses for which such product may be distributed, which could adversely affect the commercial viability of the product. Moreover, third parties may develop superior products or have proprietary rights that preclude us from marketing our product. Physician and patient acceptance of, and demand for, our products, if we obtain regulatory approval, will depend largely on many factors, including, but not limited to, the extent, if any, of reimbursement of costs by government agencies and other third-party payors, pricing, the effectiveness of our marketing and distribution efforts, the safety and effectiveness of alternative products, and the prevalence and severity of side effects associated with such products. If physicians, government agencies and other third-party payors do not accept the use or efficacy of our products, we will not be able to generate significant revenue, if any.

Results from our clinical trials may be negative or may not replicate the results of our preclinical trials or earlier clinical trials, which could require that we abandon development of Allocetra™, our other product candidates or any future product candidates, which will significantly impair our ability to generate revenues.

Upon the completion of any clinical trial, the results might not support the outcomes sought by us. Further, success in preclinical testing and early clinical trials does not ensure that later clinical trials will be successful, and the results of later clinical trials may not replicate the results of prior clinical trials and preclinical testing. A number of companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in late-stage clinical trials even after achieving promising results in early-stage development. Accordingly, the results from the completed preclinical studies and clinical trials for Allocetra™ may not be predictive of the results we may obtain in later stage trials of Allocetra™ or clinical trials of any of our other product candidates. Our clinical trials may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional clinical trials. Moreover, clinical data are often susceptible to varying interpretations and analyses, and many companies that believed their product candidates performed satisfactorily in preclinical studies and clinical trials have nonetheless failed to obtain FDA or EMA, or other regulatory agency, approval for their products.

In addition, the clinical trial process may fail to demonstrate that Allocetra™ is safe and effective for its indicated uses. Any such failure may cause us to abandon Allocetra™ and may delay development of other product candidates. Any delay in, or termination or suspension of, our clinical trials will delay the requisite filings with the FDA or other regulatory agencies and, ultimately, our ability to commercialize our product candidates and generate revenues. If the clinical trials do not support our product claims, the completion of development of such product candidate may be significantly delayed or abandoned, which will significantly impair our ability to generate revenues and will materially adversely affect our results of operations.

Our strategic reprioritization and related reduction in force may not achieve our intended outcome.

In September 2023, we announced a strategic reprioritization plan, pursuant to which we determined to increase our existing focus on inflammatory and autoimmune indications. We have taken actions to reduce certain operational and workforce expenses that are no longer deemed core to our ongoing operations in order to extend our cash runway and support the timeline for the topline data readouts of the end-stage knee osteoarthritis Phase I/II trial as well as the randomized, controlled Phase II clinical trial in osteoarthritis. These actions included the sale of the leased manufacturing facility we constructed in Yavne, Israel, inclusive of the Equipment, and the suspension of the internal clinical development of our various oncology indications. As part of this strategy, we reduced our workforce by approximately 50%.

The reduction in force may result in unintended consequences and costs, such as the loss of institutional knowledge and expertise, attrition beyond the intended number of employees, decreased morale among our remaining employees, and the risk that we may not achieve the anticipated benefits of the reduction in force. The reduction in workforce could also make it difficult for us to pursue, or prevent us from pursuing, new opportunities and initiatives due to insufficient personnel, or require us to incur additional and unanticipated costs to hire new personnel to pursue such opportunities or initiatives. The workforce reduction could also harm our reputation, making our ability to recruit skilled personnel difficult. If we are unable to realize the anticipated benefits from the reduction in force, or if we experience significant adverse consequences from the reduction in force, our business, financial condition, and results of operations may be materially adversely affected.

Additionally, the prioritization of our capital resources in accordance with our reprioritization plan may not prove successful, and we may forego the pursuit of other indications, whether through future collaborations, licenses, other similar arrangements, or otherwise, that could be more successful. Furthermore, we may undertake further similar cost-saving initiatives, which may include additional restructuring or workforce reductions. These types of cost-reduction activities can be complex and result in unintended consequences and costs, including decreased employee morale, loss of institutional knowledge and expertise and could adversely impact our business and financial condition.

The clinical trial process is complex and expensive, and commencement and completion of clinical trials can be delayed or prevented for a number of reasons.

We may not be able to commence or complete the clinical trials required to support our submission of a BLA to the FDA or a MAA to the EMA or any similar submission to regulatory authorities in other countries. Drug development is a long, expensive and uncertain process, and delay or failure can occur at any stage of any of our clinical trials. The fact that the FDA, EMA or other regulatory authorities permit a company to conduct human clinical trials is no guarantee that the trial will be successful. To the contrary, most product candidates that enter clinical trials do not prove to be successful and do not result in the filing of a BLA, MAA or similar filing. Drug candidates that prove successful at one clinical trial phase may prove unsuccessful at a subsequent phase. Human clinical trials are very expensive and difficult to design and implement, in part because they are subject to rigorous regulatory requirements and in part because the results of clinical trials are inherently uncertain and unpredictable. Regulatory authorities, such as the FDA, may preclude clinical trials from proceeding. Additionally, the clinical trial process is time-consuming, and failure can occur at any stage of the trials. We may encounter problems that cause us to abandon or repeat clinical trials. The commencement and completion of clinical trials may be delayed by several factors, including:

| ● | difficulties obtaining regulatory clearance or approval to commence a clinical trial or complying with conditions imposed by a regulatory authority regarding the scope or term of a clinical trial; |

| ● | delays in reaching or failing to reach agreement on acceptable terms with prospective contract research organizations (“CROs”), contract manufacturing organizations (“CMOs”), pharmaceutical shipping companies and trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs, CMOs, shipping companies and trial sites; |

| ● | insufficient or inadequate supply or quality of a product candidate or other materials necessary to conduct our clinical trials; |

| ● | difficulties in obtaining institutional review board (“IRB”) approval to conduct a clinical trial at a prospective site; |

| ● | delays resulting from a decision of the FDA or EMA not to review a BLA or MAA for Allocetra™, respectively, or any of our other product candidates, under the FDA’s Fast Track Development Program or as a Breakthrough Therapy; and |

| ● | challenges in recruiting and enrolling patients or donors to participate in clinical trials for a variety of reasons, including size and nature of patient population, proximity of patients to clinical sites, eligibility criteria for the trial, nature of trial protocol, the availability of approved effective treatments for the relevant disease and competition from other clinical trial programs for similar indications. |

Clinical trials may also be delayed or terminated as a result of ambiguous or negative interim results. In addition, a clinical trial may be suspended or terminated by us, the FDA or other regulatory authorities, the IRBs at the sites where such boards are overseeing a trial, or a Data and Safety Monitoring Board overseeing the clinical trial at issue or other regulatory authorities due to a number of factors, including:

| ● | failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols; |

| ● | inspection of the clinical trial operations or trial sites by the FDA or other regulatory authorities; |

| ● | unforeseen safety issues or lack of effectiveness; and |

| ● | lack of adequate funding to continue the clinical trials. |

Even when clinical trials are designed for patients to be randomized with comparable attributes across the treatment and placebo groups, significant imbalances in patient attributes across patient subgroups could make it challenging to analyze the efficacy of our product candidates. For example, in our Phase II trial evaluating Allocetra™ in patients with sepsis, the randomization resulted in the Allocetra™-treated cohorts having 20% higher frequency of septic shock and 35% higher frequency of invasive ventilation prior to treatment, as compared with the control group. Both of these patient attributes are associated with a significantly higher degree of difficulty of treatment and higher mortality rates. These imbalances have made it challenging to deduce the relative effect in other patient subgroups.

In addition, we or regulatory authorities may suspend our clinical trials at any time if it appears that we are exposing participants to unacceptable health risks, or if others report that similar products pose an unacceptable risk to patients, or if the regulatory authorities find deficiencies in our regulatory submissions or the conduct of such trials. Any suspension of clinical trials will delay possible regulatory approval, if any, and adversely affect our ability to develop products and generate revenue.

Obtaining approval of a BLA, MAA or other regulatory approval, even after clinical trials that are believed to be successful is an uncertain process.

Even if we complete our planned clinical trials and believe the results to be successful, all of which are uncertain, obtaining approval of a BLA, or similar regulatory application, is an extensive, lengthy, expensive and uncertain process, and the EMA, IMOH, the FDA and other regulatory agencies may delay, limit or deny approval of our product candidates for many reasons, including:

| ● | we may not be able to demonstrate to the satisfaction of the applicable regulatory agencies that our product candidates are safe and effective for any indication; |

| ● | the results of our clinical trials may not meet the level of statistical significance or clinical significance required by the applicable regulatory agencies for approval; |

| ● | the applicable regulatory agencies may disagree with the number, design, size, conduct or implementation of our clinical trials; |

| ● | the applicable regulatory agencies may not find the data from preclinical studies and clinical trials sufficient to demonstrate that our product candidates’ clinical and other benefits outweigh their respective safety risks; |

| ● | the applicable regulatory agencies may disagree with our interpretation of data from preclinical studies or clinical trials; |

| ● | the applicable regulatory agencies may not accept data generated at our clinical trial sites; |

| ● | the data collected from preclinical studies and clinical trials of our product candidates may not be sufficient to support the submission of a BLA or similar regulatory application; |

| ● | the applicable regulatory agencies may not schedule an advisory committee meeting in a timely manner or the advisory committee may recommend against approval of our application or may recommend that the applicable regulatory agencies require, as a condition of approval, additional preclinical studies or clinical trials, limitations on approved labeling or distribution and use restrictions; |

| ● | the applicable regulatory agencies may require development of a risk evaluation and mitigation strategy as a condition of approval; |

| ● | the applicable regulatory agencies may require simultaneous approval for both adults and children which would delay needed approvals, or we may have successful clinical trial results for adults, but not children, or vice versa; |

| ● | the applicable regulatory agencies may change their approval policies or adopt new regulations that may impede consideration or approval of our BLA, or similar regulatory application; |

| ● | the applicable regulatory agencies may identify deficiencies in the manufacturing processes or facilities of third-party manufacturers, or suppliers of blood and cell samples or providers of cell collection, freezing and transportation services, with which we enter into agreements for clinical and commercial supplies; and |

| ● | the applicable regulatory agencies may demand post-marketing approval studies, such as Phase IV clinical trials, in connection with our product candidates. |

For example, in the sepsis clinical program vertical, before we can submit a marketing application, or similar regulatory application, to EMA, or other regulatory authorities, as applicable, we must complete the analysis of the results from our Phase II clinical trial, determine whether to pursue a potential follow-on, randomized, controlled study of a solely High Risk UTI sepsis population, and then must conduct pivotal Phase III clinical trials. Phase III clinical trials frequently produce unsatisfactory results even though prior clinical trials were successful. Therefore, the results of the additional trials that we conduct may or may not be successful. The applicable regulatory agencies may suspend all clinical trials or require that we conduct additional clinical, nonclinical, manufacturing, validation or drug product quality studies and submit those data before considering or reconsidering the marketing application, or similar regulatory application. Depending on the extent of these, or any other studies, approval of any applications that we submit may be delayed by several years, or may require us to expend more resources than we have available. It is also possible that additional studies, if performed and completed, may not be considered sufficient by the applicable regulatory agencies to provide regulatory approval. If any of these outcomes occur, we likely would not receive approval for Allocetra™, or any of our other product candidates, and may be forced to cease operations.

Even if we obtain regulatory approval for Allocetra™, or any of our other product candidates, the approval might contain significant limitations related to the intended uses for which the product is approved, including, without limitation, restrictions related to certain labeled populations, age groups, warnings, precautions or contraindications, or an approval may be subject to significant post-marketing studies or risk mitigation requirements. If we are unable to successfully commercialize Allocetra™, or any of our other product candidates, we may be forced to cease operations.

Changes in regulatory requirements and guidance or unanticipated events during our clinical trials may occur, which may result in necessary changes to clinical trial protocols, which could result in increased costs to us, delay our development timeline or reduce the likelihood of successful completion of our clinical trials.

Changes in regulatory requirements and guidance or unanticipated events during our clinical trials may occur, and as a result, we may need to amend our clinical trial protocols. Amendments may require us to resubmit our clinical trial protocols to IRBs for review and approval, which may adversely affect the cost, timing and successful completion of a clinical trial. If we experience delays in the completion of, or if we terminate, any of our clinical trials, the commercial prospects for our affected product candidates would be harmed and our ability to generate product revenue would be delayed, possibly materially.

Our manufacturing processes are complex, delicate and susceptible to contamination, and involve biological intermediates that are subject to stringent regulations.

Blood is a raw material that is susceptible to damage and contamination and may contain human pathogens, any of which would render the blood unsuitable as raw material for further manufacturing. For instance, improper storage of blood, by us or third-party suppliers, may require us to destroy some of our raw material. If unsuitable blood is not identified and discarded prior to the release of the blood to the manufacturing process, it may be necessary to discard intermediate or finished product made from that blood or to recall any finished product released to the market or individual patients, resulting in a charge to cost of goods sold.

The manufacture of Allocetra™ is a complex and delicate process of cell collection, separation, freezing, storing, incubation, harvesting, formulating and testing, each under aseptic conditions. First, cells are collected by separation from the blood donations at collection centers and medical centers. Donations for AllocetraTM are collected from healthy donors through apheresis. The cells sourced for AllocetraTM are then shipped to a manufacturing site for cryopreservation by trained personnel pursuant to current Good Manufacturing Practices (“cGMP”) requirements, FDA guidelines and our manufacturing protocol, as detailed in our Chemistry Manufacturing and Controls (“CMC”) protocols. Second, the cells are thawed, processed, prepared in an intravenous bag and tested according to our quality assurance and quality control assays and cGMP requirements. The final product is then shipped to the clinical site where it is infused into the patient within the predetermined expiration period. All shipping and handling are pursuant to carefully controlled conditions, including controlled temperatures, as required by applicable regulations. The manufacturing sites must be registered manufacturing facilities operating under cGMP requirements and all manufacturing activities, including cell collection, processing, testing, freezing, shipping, final product preparations, packaging and labeling, must be conducted by properly and adequately trained personnel in accordance with detailed protocols, batch records and our CMC and based on cGMP requirements and FDA, or other applicable regulatory, guidelines.

Allocetra™, and our other potential drug candidates, if any, may fail to meet our stringent specifications through a failure in one or more of these process steps. Such failure would prohibit us from releasing the drug at issue for human use until the failure is properly and sufficiently corrected and resolved. We may detect instances in which an unreleased product was produced, either internally (as is the case for small scale preclinical or early stage clinical production) or by a CMO (as would be the case for large scale production for which we would provide appropriate technology training and require EMA or FDA approval), without adherence to our manufacturing procedures or blood used in our production process was not collected, shipped, processed or stored in a compliant manner consistent with our current cGMP, or other regulations or regulatory requests, including those by the EMA. Such an event of non-compliance would likely result in our determination that the implicated product candidates should not be released and therefore should be destroyed. Even if handled properly, biologics may form or contain particulates or have other issues or problems after storage which may require destruction or recalls. The impact of such non-compliance or issues or problems would be exacerbated if our manufacturing efforts are scaled to conduct a Phase II or Phase III clinical trial in Europe, Israel or the United States, where there may be numerous collection sites and where shipments may be made to multiple locations with large numbers of patients across a large geographical area. There can be no assurance that we can scale such a manufacturing process, including in Europe, Israel and the United States, in a cost-effective or efficient manner, or in a manner that will meet all regulatory requirements, including EMA, IMOH or FDA requirements, if at all.

While we expect to write-off small amounts of work-in-progress in the ordinary course of business due to the complex nature of blood, our processes and our product candidates, unanticipated events may lead to write-offs and other costs materially in excess of our expectations and the reserves we have established for these purposes. Such write-offs and other costs could cause material fluctuations in our liquidity and results of operations. Furthermore, contamination of our product candidates could cause consumers or other third parties with whom we conduct business to lose confidence in the reliability of our manufacturing procedures, which could adversely affect our liquidity and results of operations. In addition, faulty or contaminated product candidates that are unknowingly distributed could result in patient harm, threaten the reputation of our products and expose us to product liability damages and claims from companies for whom we do contract manufacturing.

If we or any potential CMOs we retain in the future fail to comply with manufacturing regulations, our financial results and financial condition could be adversely affected.

Before a marketing application is approved, or before we begin the commercial manufacture of any of our products, CMOs and other outsourced manufacturing service providers we may engage must obtain regulatory approval of their manufacturing facilities, processes and quality systems. In addition, pharmaceutical manufacturing facilities are continuously subject to inspection by EMA and foreign regulatory authorities before and after product approval. Due to the complexity of the processes used to manufacture pharmaceutical products and product candidates, any potential third-party manufacturer may be unable to continue to pass or initially pass federal, state or international regulatory inspections in a cost-effective manner.

The EMA and foreign regulators require manufacturers to register manufacturing facilities. The EMA and foreign regulators also inspect these facilities to confirm compliance with requirements that the EMA or foreign regulators establish. We, to the extent we may manufacture our products in the future, or our materials suppliers may face manufacturing or quality control problems causing product production and shipment delays or a situation where we or the supplier may not be able to maintain compliance with the EMA’s or foreign regulators’ requirements necessary to continue manufacturing our product candidate. Any failure to comply with EMA or foreign regulatory requirements could adversely affect our clinical research activities and our ability to develop and market our product candidate and any future product candidates.

If a third-party manufacturer with whom we contract is unable to comply with manufacturing regulations, we may be subject to fines, unanticipated compliance expenses, recall or seizure of our products, total or partial suspension of production and/or enforcement actions, including injunctions, and criminal or civil prosecution. These possible sanctions would adversely affect our financial results and financial condition.

Our ability to produce safe and effective products depends on the safety of our blood supply against transmittable diseases.