UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

April 16, 2024

Date of Report (Date of earliest event reported)

AGBA GROUP HOLDING LIMITED

(Exact Name of Registrant as Specified in its Charter)

| British Virgin Islands | 001-38909 | N/A | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

| AGBA Tower 68 Johnston Road Wan Chai, Hong Kong SAR |

N/A | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: +852 3601 8363

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Ordinary Shares, $0.001 par value | AGBA | NASDAQ Capital Market | ||

| Warrants, each warrant exercisable for one-half of one Ordinary Share for $11.50 per full share | AGBAW | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

Domestication of AGBA to the United States under the Merger Agreement

AGBA Group Holding Limited, a British Virgin Islands business company (“AGBA”), has previously announced that on April 16, 2024, it has entered into that certain Agreement and Plan of Merger (as may be amended, supplemented or otherwise modified from time to time, the “Merger Agreement”), by and between AGBA, its wholly owned subsidiary AGBA Social Inc., Triller Corp., a Delaware corporation (“Triller”) and Bobby Sarnevesht, solely as representative of the Triller stockholders.

As disclosed previously in a Current Report on Form 8-K filed by AGBA on April 18, 2024, the Merger Agreement, provides that, prior to the effective date of the Merger, AGBA will domesticate to the United States as a Delaware corporation (the “Domestication”) and will, for all purposes of the laws of the State of Delaware, be deemed to be the same entity as AGBA (AGBA, when domesticated as a Delaware corporation, “Delaware Parent”). Upon the Domestication, among other things, all AGBA ordinary shares, par value $0.001 per share will automatically convert into the same number of shares of common stock of Delaware Parent.

On April 19, 2024, AGBA issued a press release highlighting the possible Domestication pursuant to the Merger Agreement. Attached hereto as Exhibit 99.1 and incorporated into this Item 8.01 by reference is the copy of the press release.

The information in this Item 8.01 (including Exhibits 99.1) is being furnished and shall not be deemed to be filed for purposes of Section 18 of the Exchange Act, or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

IMPORTANT NOTICES

Important Notice Regarding Forward-Looking Statements

This Current Report on Form 8-K contains certain “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended. Statements that are not historical facts, including statements about the pending transactions described above, and the parties’ perspectives and expectations, are forward-looking statements. Such statements include, but are not limited to, statements regarding the proposed transaction, including the anticipated initial enterprise value and post-closing equity value, the benefits of the proposed transaction, integration plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including estimates for growth, the expected management and governance of the combined company, and the expected timing of the transactions. The words “expect,” “believe,” “estimate,” “intend,” “plan” and similar expressions indicate forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to various risks and uncertainties, assumptions (including assumptions about general economic, market, industry and operational factors), known or unknown, which could cause the actual results to vary materially from those indicated or anticipated.

Such risks and uncertainties include, but are not limited to: (i) the risk that the Merger may not be completed in a timely manner or at all, which may adversely affect the price of AGBA’s securities; (ii) the failure to satisfy the conditions to the consummation of the Merger, including the approval of the Merger Agreement by the shareholders of AGBA; (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement; (iv) the outcome of any legal proceedings that may be instituted against any of the parties to the Merger Agreement following the announcement of the entry into the Merger Agreement and proposed Merger; (v) the ability of the parties to recognize the benefits of the Merger Agreement and the proposed Merger; (vi) the lack of useful financial information for an accurate estimate of future capital expenditures and future revenue; (vii) statements regarding Triller’s industry and market size; (viii) financial condition and performance of Triller, including the anticipated benefits, the implied enterprise value, the expected financial impacts of the Merger, the financial condition, liquidity, results of operations, the products, the expected future performance and market opportunities of Triller; (ix) the impact from future regulatory, judicial, and legislative changes in Triller’s industry; (x) competition from larger technology companies that have greater resources, technology, relationships and/or expertise; and (xi) those factors discussed in AGBA’s filings with the SEC and those that will be contained in the definitive proxy statement relating to the Merger. You should carefully consider the foregoing factors and the other risks and uncertainties that will be described in the “Risk Factors” section of the definitive proxy statement and other documents to be filed by AGBA from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and while AGBA and Triller may elect to update these forward-looking statements at some point in the future, they assume no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, subject to applicable law. Neither AGBA nor Triller gives any assurance that AGBA, or Triller, or the combined company, will achieve its expectations.

Additional Information and Where to Find It

In connection with the Merger Agreement and the proposed Merger, AGBA intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A, which will be mailed or otherwise disseminated to the shareholders of AGBA as of the record date established for voting on the proposed transactions contemplated by the Merger Agreement. AGBA may also file other relevant documents regarding the proposed Merger with the SEC. THIS PRESS RELEASE DOES NOT CONTAIN ALL THE INFORMATION THAT SHOULD BE CONSIDERED CONCERNING THE PROPOSED MERGER AND IS NOT INTENDED TO FORM THE BASIS OF ANY INVESTMENT DECISION OR ANY OTHER DECISION IN RESPECT OF THE MERGER. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF AGBA ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER AS THEY BECOME AVAILABLE, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

Investors and security holders may obtain free copies of the definitive proxy statement (if and when available) and other documents that are filed or will be filed with the SEC by AGBA through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by AGBA will be available free of charge at: AGBA Group Holding Limited, AGBA Tower, 68 Johnston Road, Wan Chai, Hong Kong SAR, attention: Mr. Ng Wing Fai, Chief Executive Officer.

Participants in Solicitation

AGBA and Triller, and their respective directors and executive officers, may be deemed participants in the solicitation of proxies from AGBA’s shareholders in respect of the proposed Business Combination. AGBA’s shareholders and other interested persons may obtain more detailed information about the names and interests of these directors and officers in AGBA’s proxy statement on Schedule 14A, when it is filed with the SEC. Information about AGBA’s directors and executive officers and their ownership of AGBA ordinary shares is set forth in AGBA’s annual report on Form 10-K, filed with the SEC on March 28, 2024. These documents can be obtained free of charge from the sources specified above and at the SEC’s web site at www.sec.gov.

No Offer or Solicitation

This Current Report on Form 8-K is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the transactions described above and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of AGBA or Triller, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Item 9.01. Financial Statements and Exhibits.

| (d) | Exhibits. |

| Exhibit No. | Description | |

| 99.1 | Press Release dated April 19, 2024 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AGBA GROUP HOLDING LIMITED | |||

| By: | /s/ Shu Pei Huang, Desmond | ||

| Name: | Shu Pei Huang, Desmond | ||

| Title: | Acting Group Chief Financial Officer | ||

| Dated: April 19, 2024 | |||

4

Exhibit 99.1

AGBA/TRILLER $4 billion MERGER: ELEVATING SHAREHOLDER VALUE TO NEW HEIGHTS - IMMEDIATELY AND FOR THE LONG TERM

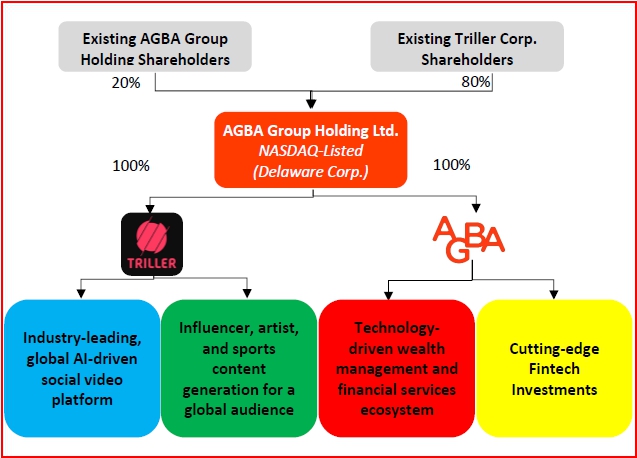

LOS ANGELES, April 19, 2024 (GLOBE NEWSWIRE) -- NASDAQ-listed, AGBA Group Holding Limited (“AGBA”), has previously announced that on April 16, 2024, it had entered into a definitive merger agreement (the “Merger Agreement”) to combine AGBA with Triller Corp. (“Triller”), a leading Artificial Intelligence-driven social video platform (together, the “Merger” or the “Transaction”). Upon completion of the Transaction, AGBA will become a Delaware corporation that wholly owns Triller, and AGBA itself will be majority-owned (80%) by current Triller stockholders and restricted stock unit (“RSU”) holders.

The Boards of Directors of Triller and AGBA have agreed to value the Combined Group (i.e. AGBA + Triller) at US$4.0 billion. Triller shareholders (including holders of Triller RSUs) will own 80% of the pro forma Combined Group representing a valuation of US$3,200 million (80% of US$4,000 million). AGBA has 74.4 million shares outstanding today, and current AGBA shareholders will own 20% of the pro forma Combined Group; the implied value of AGBA’s current outstanding shares at US$800 million (20% of US$4,000 million) is US$10.75 per share.

The Merger Agreement provides that, prior to the effective date of the Merger, AGBA will domesticate to the United States as a Delaware corporation (the “Domestication”) and will, for all purposes of the laws of the State of Delaware, be deemed to be the same entity as AGBA (AGBA, when domesticated as a Delaware corporation, “Delaware Parent”). Upon the Domestication, among other things, all AGBA ordinary shares, par value $0.001 per share will automatically convert into the same number of shares of common stock of Delaware Parent.

For more details, please refer to the Company’s Report on Form 8-K filed with the Securities and Exchange Commission on 18 April 2024. The latest press release is available on the company’s website, please visit www.agba.com/ir

# # #

About AGBA Group:

Established in 1993, AGBA Group Holding Limited (NASDAQ: “AGBA”) is a leading one-stop financial supermarket based in Hong Kong offering the broadest set of financial services and healthcare products in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) through a tech-led ecosystem, enabling clients to unlock the choices that best suit their needs. Trusted by over 400,000 individual and corporate customers, the Group is organized into four market-leading businesses: Platform Business, Distribution Business, Healthcare Business, and Fintech Business.

For more information, please visit www.agba.com

About Triller Corp:

Triller is the AI-powered open garden technology platform for creators. Pairing music culture with sports, fashion, entertainment, and influencers through a 360-degree view of content and technology, Triller uses proprietary AI technology to push and track content virally to affiliated and non-affiliated sites and networks, enabling them to reach millions of additional users. Triller additionally owns Triller Sports, Bare-Knuckle Fighting Championship; Amplify.ai, a leading generative AI platform; FITE, a premier global PPV, AVOD, and SVOD streaming service; and Thuzio, a leader in B2B premium influencer events and experiences.

Investor Relations and Media Contact:

Ms. Bethany Lai

media@agba.com/ ir@agba.com

+852 5529 4500

Social Media Channels:

agbagroup

LinkedIn | X | Instagram | Facebook | YouTube

Important Information About the Proposed Merger and Where to Find It

For more information, visit www.triller.co In connection with the Merger Agreement and the proposed Merger, AGBA intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A, which will be mailed or otherwise disseminated to the shareholders of AGBA as of the record date established for voting on the proposed transactions contemplated by the Merger Agreement. The Company may also file other relevant documents regarding the proposed Merger with the SEC. THIS PRESS RELEASE DOES NOT CONTAIN ALL THE INFORMATION THAT SHOULD BE CONSIDERED CONCERNING THE PROPOSED MERGER AND IS NOT INTENDED TO FORM THE BASIS OF ANY INVESTMENT DECISION OR ANY OTHER DECISION IN RESPECT OF THE MERGER. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF AGBA ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER AS THEY BECOME AVAILABLE, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

Investors and security holders may obtain free copies of the definitive proxy statement (if and when available) and other documents that are filed or will be filed with the SEC by AGBA through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by AGBA will be available free of charge at: AGBA Group Holding Limited, AGBA Tower, 68 Johnston Road, Wan Chai, Hong Kong SAR, attention: Mr. Ng Wing Fai, Chief Executive Officer.

Participants in Solicitation

AGBA and Triller, and their respective directors and executive officers, may be deemed participants in the solicitation of proxies from AGBA’s shareholders in respect of the proposed Merger. AGBA’s shareholders and other interested persons may obtain more detailed information about the names and interests of these directors and officers in AGBA’s proxy statement on Schedule 14A, when it is filed with the SEC. Information about AGBA’s directors and executive officers and their ownership of AGBA ordinary shares is set forth in AGBA’s annual report on Form 10-K, filed with the SEC on March 28, 2024. These documents can be obtained free of charge from the sources specified above and at the SEC’s web site at www.sec.gov.

This press release does not contain all the information that should be considered concerning the Merger and is not intended to form the basis of any investment decision or any other decision in respect of the Merger. Before making any voting or investment decision, investors and security holders are urged to read AGBA’s proxy statement on Schedule 14A and all other relevant documents filed or that will be filed with the SEC in connection with the proposed Merger as they become available because they will contain important information about the proposed Merger.

No Offer or Solicitation

This press release will not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Merger. This press release will also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor will there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, as amended, or an exemption therefrom.

Forward-Looking Statements

The information in this press release contains certain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 with respect to the proposed Merger. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions, but the absence of these words does not mean that a statement is not forward-looking. Such statements include, but are not limited to, statements regarding the proposed transaction, including the anticipated initial enterprise value, the benefits of the proposed transaction, integration plans, anticipated future financial and operating performance and results, including estimates for growth, and the expected timing of the transactions. Consequently, you should not rely on these forward-looking statements as predictions of future events. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) the risk that the Merger may not be completed in a timely manner or at all, which may adversely affect the price of AGBA’s securities; (ii) the failure to satisfy the conditions to the consummation of the Merger, including the approval of the Merger Agreement by the shareholders of AGBA; (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement; (iv) the outcome of any legal proceedings that may be instituted against any of the parties to the Merger Agreement following the announcement of the entry into the Merger Agreement and proposed Merger; (v) the ability of the parties to recognize the benefits of the Merger Agreement and the proposed Merger; (vi) the lack of useful financial information for an accurate estimate of future capital expenditures and future revenue; (vii) statements regarding Triller’s industry and market size; (viii) financial condition and performance of Triller, including the anticipated benefits, the implied enterprise value, the expected financial impacts of the Merger, the financial condition, liquidity, results of operations, the products, the expected future performance and market opportunities of Triller; (ix) the impact from future regulatory, judicial, and legislative changes in Triller’s industry; (x) competition from larger technology companies that have greater resources, technology, relationships and/or expertise; and (xi) those factors discussed in AGBA’s filings with the SEC and those that will be contained in the definitive proxy statement relating to the Merger. You should carefully consider the foregoing factors and the other risks and uncertainties that will be described in the “Risk Factors” section of the definitive proxy statement and other documents to be filed by AGBA from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and while AGBA and Triller may elect to update these forward-looking statements at some point in the future, they assume no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, subject to applicable law. Neither AGBA nor Triller gives any assurance that AGBA, or Triller, or the combined company, will achieve its expectations.

4