UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2024

Commission File Number: 001-40613

DIGIASIA CORP.

(Registrant)

One Raffles Place #28-02

Singapore 048616

(Address of Principal Executive Offices)

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

CONTENTS

On April 18, 2024, DigiAsia Corp. (the “Company”) made available an updated investor presentation. A copy of the presentation is attached hereto as Exhibit 99.1.

The information contained in this presentation does not constitute a prospectus or other offering document, nor does it constitute or form part of any invitation or offer to sell, or any solicitation of any invitation or offer to purchase or subscribe for, any securities of the Company or any other entity, nor shall the information or any part of it or the fact of its distribution form the basis of, or be relied on in connection with, any action, contract, commitment whatsoever relating to the securities of the Company.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| DIGIASIA CORP. | ||

| (Registrant) | ||

| Date April 18, 2024 | By | /s/ Subir Lohani |

| Subir Lohani | ||

| Chief Financial Officer | ||

EXHIBIT INDEX

| Exhibit | Description of Exhibit | |

| 99.1 | Investor Presentation of DigiAsia Corp. |

Exhibit 99.1

DigiAsia Bios Investor Presentation

Disclaimer This presentation (together with oral statements made in connection herewith, this “Presentation”) is provided for informational purposes only . This Presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful . This Presentation has been prepared to assist interested parties in making their own evaluation with respect to aDigiAsia Corp . (DigiAsia or the "Company") and its securities and for no other purpose . Nothing herein should be construed as legal, financial, tax or other advice . You should consult your own advisers concerning any legal, financial, tax or other considerations concerning the opportunity described herein . The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs . No Offer or Solicitation This Presentation does not constitute an offer, or a solicitation of an offer, to buy or sell any securities, investment or other specific product, or a solicitation of any vote or approval, nor shall there be any sale of securities, investment or other specific product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . Any offering of securities (the “Securities”) will not be registered under the Securities Act of 1933 , as amended (the “Securities Act”), and will be offered as a private placement in reliance on exemptions from the registration requirements of the Securities Act and other applicable laws . Accordingly, the Securities must continue to be held unless a subsequent disposition is exempt from the registration requirements of the Securities Act . Investors should consult with their counsel as to the applicable requirements for a purchaser to avail themselves of any exemption under the Securities Act . The transfer of the Securities may also be subject to conditions set forth in an agreement under which they are to be issued . Investors should be aware that they might be required to bear the final risk of their investment for an indefinite period of time . DigiAsia is not making an offer of the Securities in any jurisdiction where the offer is not permitted . NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE . ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE . Industry and Market Data This Presentation relies on and refers to information and statistics regarding the markets in which DigiAsia competes and other industry data . This information and statistics were obtained from third - party sources, including reports by market research firms . Although DigiAsia believes these sources to be reliable, It has not independently verified the information and does not guarantee its accuracy and completeness . This Presentation contains preliminary information only, is subject to change at any time and is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding your engagement with DigiAsia . Viewers of this Presentation should each make their own evaluation of DigiAsia and of the relevance and adequacy of the information and should make such other investigations as they deem necessary . Trademarks and Trade Names DigiAsia owns and has rights to various trademarks, service marks and trade names that it uses in connection with the operation of its business . This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners . The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to and does not imply a relationship with DigiAsia , or an endorsement or sponsorship by or of DigiAsia . Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that DigiAsia will not assert, to the fullest extent under applicable law, its rights or the right of the applicable licensor to these trademarks, service marks and trade names .

Forward - Looking Statements This Presentation includes “forward - looking statements” within the meaning of the “safe harbour” provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements may be identified by the use of words such as “estimate,” “plan,” “project”, “forecast”, “intend,” “expect”, “anticipate,” “believe,” “seek,” “may,” “will,” “continue,”, “should,” “would,” “predict” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters . These forward - looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity and market share . These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of DigiAsia’s management and are not predictions of actual performance . These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability . Actual events and circumstances are difficult or impossible to predict and will differ from assumptions . Many actual events and circumstances are beyond the control of DigiAsia . These forward - looking statements are subject to a number of risks and uncertainties, including the possibility that the expected growth of DigiAsia’s business will not be realized, or will not be realized within the expected time period, due to, among other things : DigiAsia’s goals and strategies, future acquisitions or business development, financial condition and results of operations ; DigiAsia’s ability to attract and retain hosts and guests ; DigiAsia’s ability to accurately predict future revenues for the purpose of appropriately budgeting and adjusting DigiAsia’s expenses ; DigiAsia’s ability to grow and expand into new markets ; the effects of increased competition in DigiAsia’s markets and the ability to address those trends and developments ; DigiAsia’s ability to attract, train and retain key qualified personnel ; the impact of the COVID - 19 pandemic on DigiAsia’s business, results of operations and financial condition ; the impact of the COVID - 19 pandemic on the global economy ; and regulatory developments in foreign countries . Forward - looking statements are also subject to additional risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions ; risks relating to the uncertainty of the projected financial information with respect to DigiAsia ; risks related to the rollout of DigiAsia’s business and the timing of expected business milestones ; the effects of competition on DigiAsia’s business ; and those factors discussed in DigiAsia's Form 20 - F filed with the SEC on April 8 , 2024 under the heading "Risk Factors" and other documents of DigiAsia filed with the SEC . If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . There may be additional risks that DigiAsia presently doesn’t know and DigiAsia currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . In addition, forward - looking statements reflects DigiAsia’s expectations, plans or forecasts of future events and views as of the date of this Presentation . DigiAsia anticipates that subsequent events and developments will cause DigiAsia’ assessments to change . However, while DigiAsia may elect to update these forward - looking statements at some point in the future, DigiAsia specifically disclaims any obligation to do so . These forward - looking statements should not be relied upon as representing DigiAsia’s assessments as of any date subsequent to the date of this Presentation . Accordingly, undue reliance should not be placed upon the forward - looking statements . Use of Projections This Presentation contains projected financial information with respect to DigiAsia . Such projected financial information constitutes forward - looking information, is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results . The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the projected financial information . See the “Forward - Looking Statements” paragraph above . Actual results may differ materially from the results contemplated by the projected financial information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such information (DigiAsia did not express) will be achieved . DigiAsia’s independent auditors have not audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, have not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation . Certain of the measures included in the Initial Projections are non - GAAP financial measures, namely EBITDA . Non - GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with U . S . GAAP, and non - GAAP financial measures as used by DigiAsia may not be comparable to similarly titled amounts used by other companies . These non - GAAP measures are uncertain and depend on various factors that cannot be reliably predicted and so reconciliations for projections of non - GAAP financial measures have not been provided .

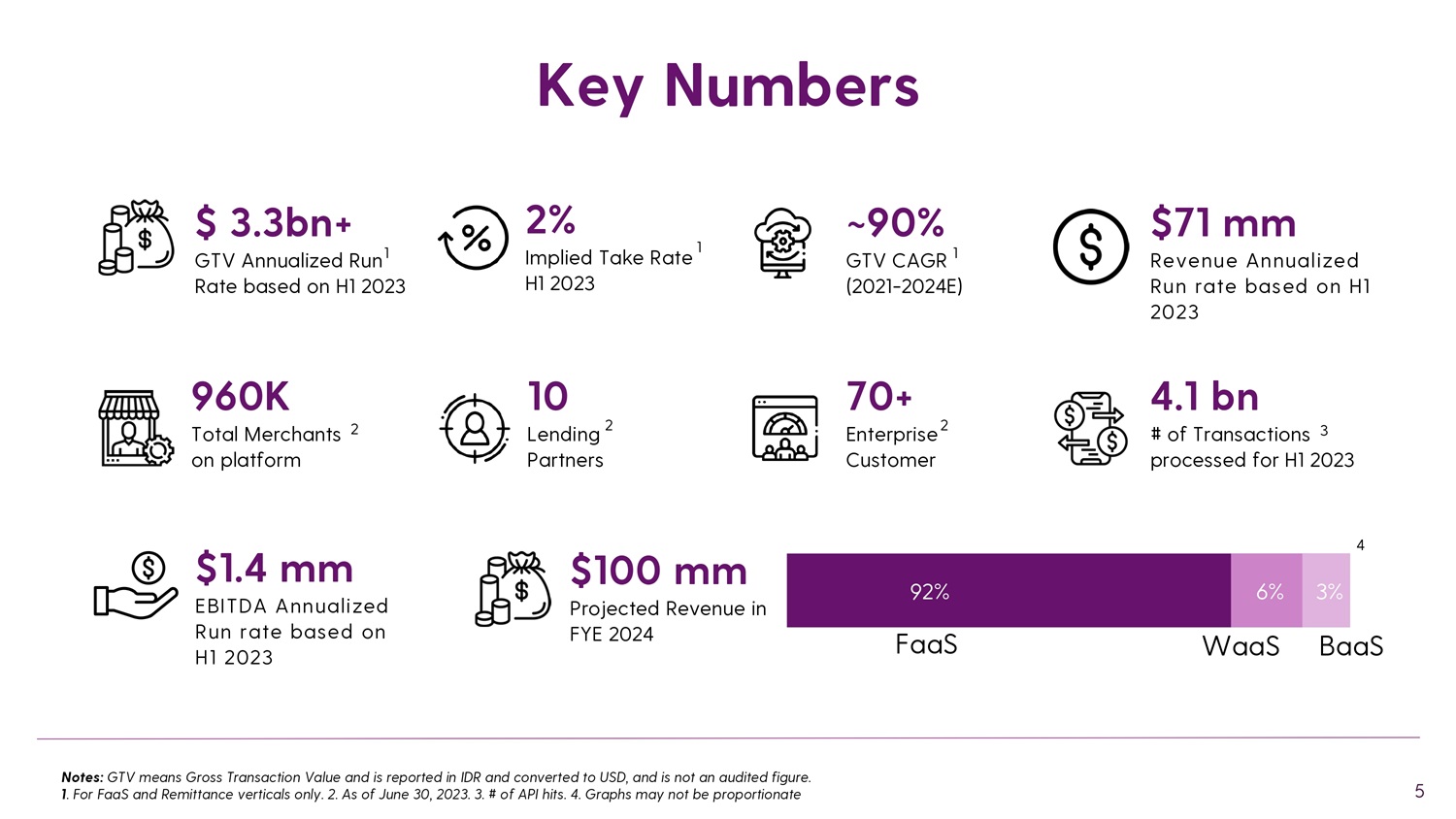

Disclaimer Offers Pre - Paid cards Enables P2P lending Facilitate Remittances WaaS Wallet as a Service Offers wallets to customers for loyalty and transactions FaaS Fintech as a Service Offers B2B fintech platform to merchants, partners, and end customers for bill payments, supply chain payments, branchless banking solutions BaaS Banking as a Service Bill Payments E - wallets Building a AI - powered Embedded finance platform for emerging markets in Southeast Asia, with a three - pronged strategy DigiAsia Branchless Banking Lending Marketplace Remittances Supply Chain Payments 4 Pre - Paid Cards $ 3.3bn+ GTV Annualized Run 1 Rate based on H1 2023 2% Implied Take Rate 1 H1 2023 $71 mm Revenue Annualized Run rate based on H1 2023 ~90% GTV CAGR 1 (2021 - 2024E) 960K Total Merchants 2 on platform 4.1 bn # of Transactions 3 processed for H1 2023 10 Lending 2 Partners 70+ Enterprise 2 Customer Key Numbers $100 mm Projected Revenue in FYE 2024 FaaS 6% 3% 92% WaaS BaaS Notes: GTV means Gross Transaction Value and is reported in IDR and converted to USD, and is not an audited figure.

1 . For FaaS and Remittance verticals only. 2. As of June 30, 2023. 3. # of API hits. 4. Graphs may not be proportionate 5 4 $ 1 . 4 mm EBITDA Annualized Run rate based on H 1 2023 Leadership Team Board Members Subir Lohani Chief Strategy Officer & CFO DigiAsia Prashant Gokarn Co - Founder & Co - CEO DigiAsia.

1 Transaction overview 2 Partnerships 3 Market potential 4 Company overview 5 Financial overview

Alexander Rusli Co - Founder & Co - CEO DigiAsia 7 Independent Directors. 1. Leadership Team with Track Record Across Financial Services & Technology Bhargava Marepally CEO, StoneBridge Prabhu Antony President & CFO, StoneBridge Prashant Gokarn Co - Founder & Co - CEO DigiAsia.

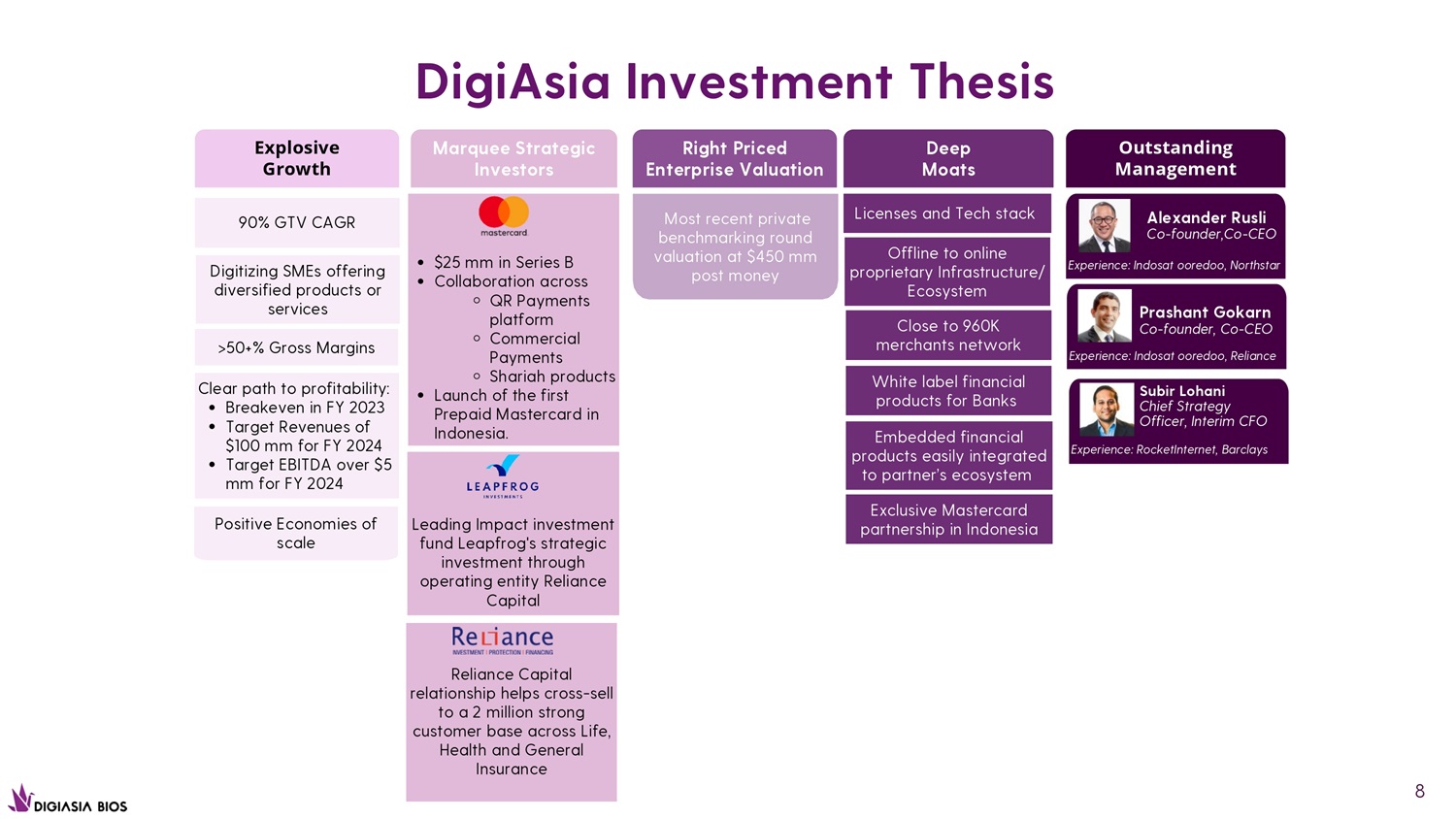

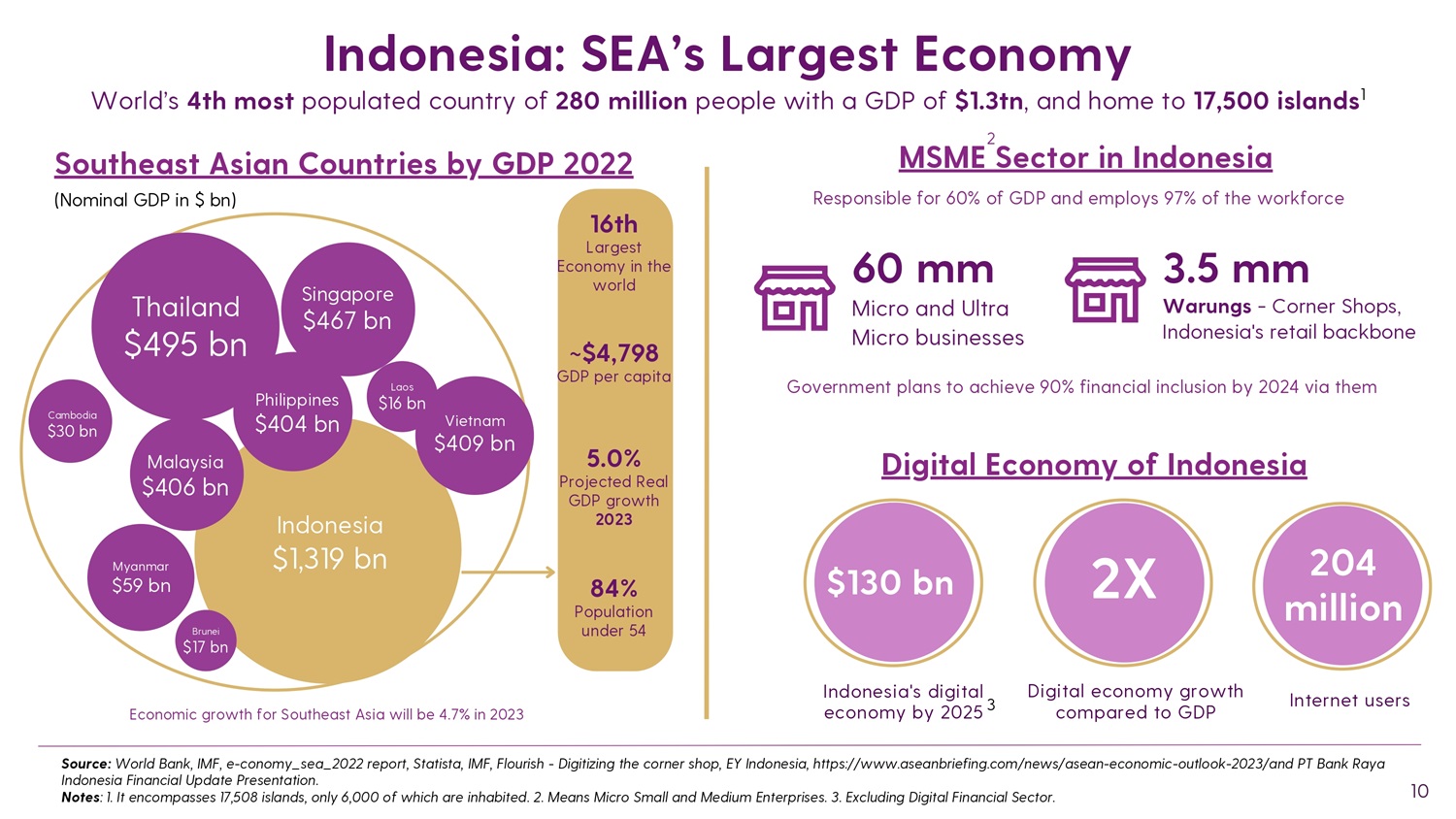

Alexander Rusli Co - Founder & Co - CEO DigiAsia Ken Sommer 1 Board Member Ex - CEO & CFO - Visa Rudiantara Board Member 1 Andreas Gregori Board Member Digitizing SMEs offering diversified products or services >50+% Gross Margins Most recent private benchmarking round valuation at $450 mm post money Licenses and Tech stack Offline to online proprietary Infrastructure/ Ecosystem Close to 960K merchants network White label financial products for Banks Embedded financial products easily integrated to partner’s ecosystem Exclusive Mastercard partnership in Indonesia Clear path to profitability: Breakeven in FY 2023 Target Revenues of $100 mm for FY 2024 Target EBITDA over $5 mm for FY 2024 Positive Economies of scale $25 mm in Series B Collaboration across QR Payments platform Commercial Payments Shariah products Launch of the first Prepaid Mastercard in Indonesia. Marquee Strategic Investors Explosive Growth Right Priced Enterprise Valuation Deep Moats Outstanding Management Reliance Capital relationship helps cross - sell to a 2 million strong customer base across Life, Health and General Insurance Leading Impact investment fund Leapfrog's strategic investment through operating entity Reliance Capital 90% GTV CAGR DigiAsia Investment Thesis 8 Alexander Rusli Co - founder,Co - CEO Prashant Gokarn Co - founder, Co - CEO Experience: Indosat ooredoo, Reliance Experience: Indosat ooredoo, Northstar Subir Lohani Chief Strategy Officer, Interim CFO Experience: RocketInternet, Barclays 2X 204 million $130 bn Digital economy growth compared to GDP Internet users Digital Economy of Indonesia MSME Sector in Indonesia Responsible for 60% of GDP and employs 97% of the workforce Government plans to achieve 90% financial inclusion by 2024 via them economy by 2025 Indonesia's digital 3 Indonesia: SEA’s Largest Economy Indonesia $1,319 bn Thailand $495 bn Malaysia $406 bn Singapore $467 bn Philippines $404 bn Vietnam $409 bn Myanmar $59 bn Cambodia $30 bn Laos $16 bn Brunei $17 bn Source: World Bank, IMF, e - conomy_sea_2022 report, Statista, IMF, Flourish - Digitizing the corner shop, EY Indonesia, https:// www.aseanbriefing.com/news/asean - economic - outlook - 2023/and PT Bank Raya Indonesia Financial Update Presentation.

1 Transaction overview 2 Partnerships 3 Market potential 4 Company overview 5 Financial overview

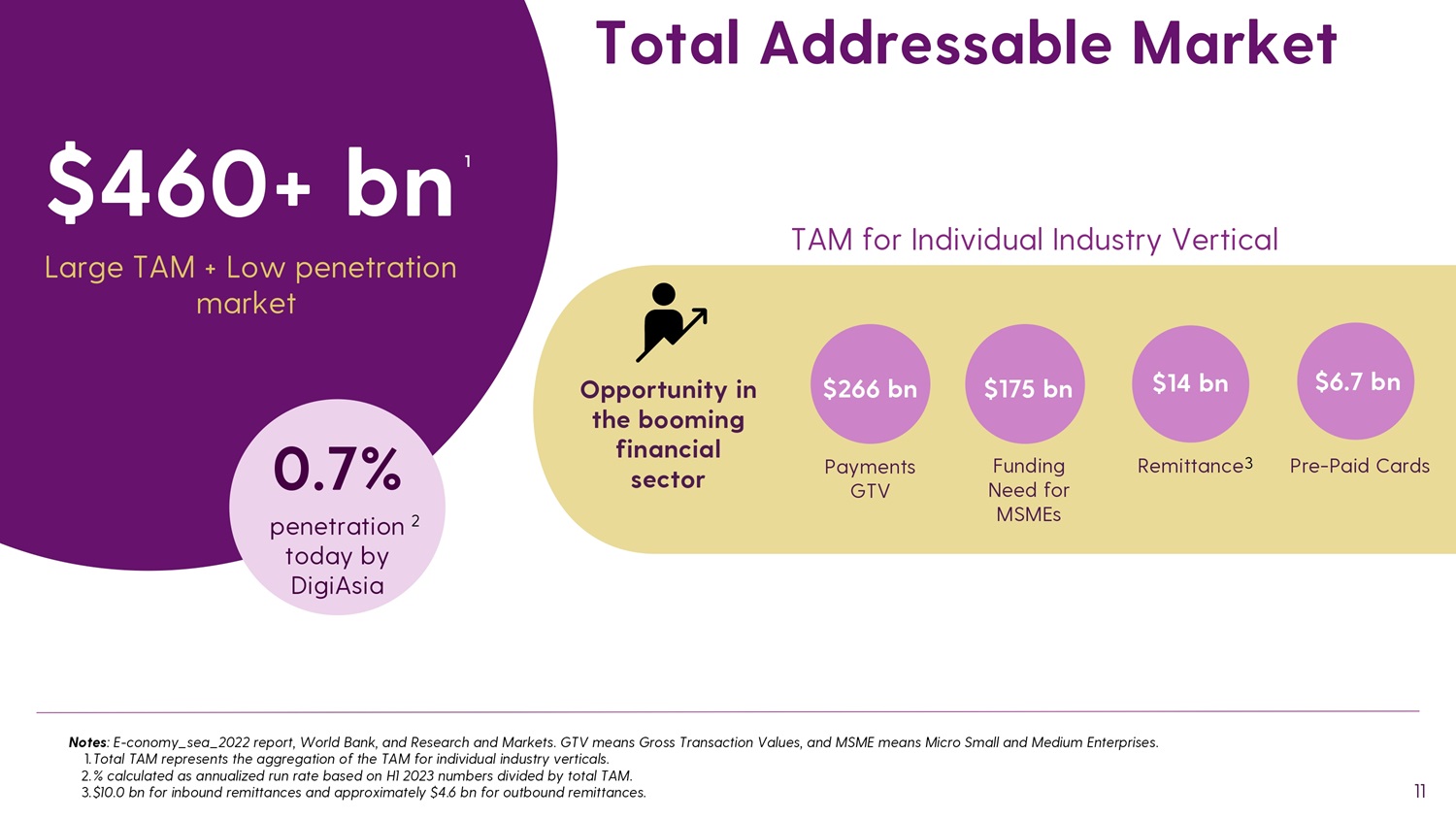

Notes : 1. It encompasses 17,508 islands, only 6,000 of which are inhabited. 2. Means Micro Small and Medium Enterprises. 3. Excluding Digital Financial Sector. world ~$4,798 GDP per capita 5.0% Projected Real GDP growth 2023 84% Population under 54 Southeast Asian Countries by GDP 2022 (Nominal GDP in $ bn) 16th Largest Economy in the 60 mm Micro and Ultra Micro businesses 3.5 mm Warungs - Corner Shops, Indonesia's retail backbone World’s 4th most populated country of 280 million people with a GDP of $1.3tn , and home to 17,500 islands 1 10 2 Economic growth for Southeast Asia will be 4.7% in 2023 $266 bn $175 bn $14 bn $6.7 bn Payments GTV Pre - Paid Cards Total Addressable Market Notes : E - conomy_sea_2022 report, World Bank, and Research and Markets.

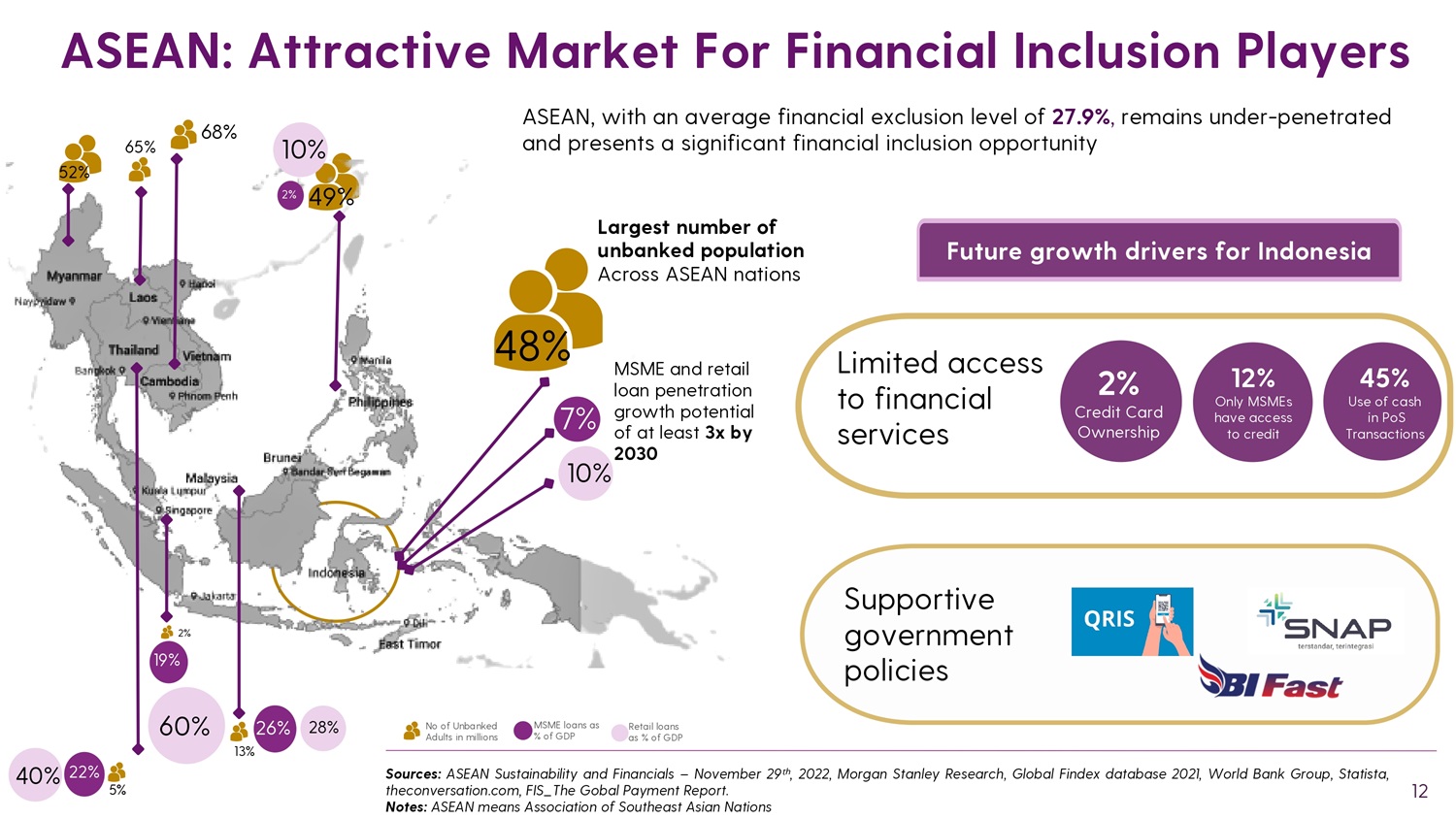

GTV means Gross Transaction Values, and MSME means Micro Small and Medium Enterprises. 1. Total TAM represents the aggregation of the TAM for individual industry verticals. 2. % calculated as annualized run rate based on H1 2023 numbers divided by total TAM. 3. $10.0 bn for inbound remittances and approximately $4.6 bn for outbound remittances. Funding Need for MSMEs Opportunity in the booming financial sector 0.7% penetration 2 today by DigiAsia Remittance 3 $460+ bn 1 Large TAM + Low penetration market 11 TAM for Individual Industry Vertical ASEAN, with an average financial exclusion level of 27.9% , remains under - penetrated and presents a significant financial inclusion opportunity Sources: ASEAN Sustainability and Financials – November 29 ᵗʰ , 2022, Morgan Stanley Research, Global Findex database 2021, World Bank Group, Statista, theconversation.com, FIS_The Gobal Payment Report.

Notes: ASEAN means Association of Southeast Asian Nations ASEAN: Attractive Market For Financial Inclusion Players No of Unbanked Adults in millions 49% 52% 5% 13% 65% 68% MSME and retail loan penetration growth potential of at least 3 x by 2030 2% Credit Card Ownership 45% Use of cash in PoS Transactions 12% Only MSMEs have access to credit MSME loans as % of GDP 26% 48% 7% 10% 2% 28% 60% 40% 22% Retail loans as % of GDP Largest number of unbanked population Across ASEAN nations 10% 2% 19% Future growth drivers for Indonesia Limited access to financial services Supportive government policies 12 Businesses in Indonesia face a four - fold challenge when accessing and integrating financial solutions Lack of experience to build FinTech - grade tech with compliance, standards & security requirements Difficult to acquire Offline - to - Online ecosystem Time & cost to connect to digital ecosystems Difficult & expensive to obtain a FinTech license Problem Companies (including traditional financial companies) need such services to build improved customer experiences 14

1 Transaction overview 2 Partnerships 3 Market potential 4 Company overview 5 Financial overview

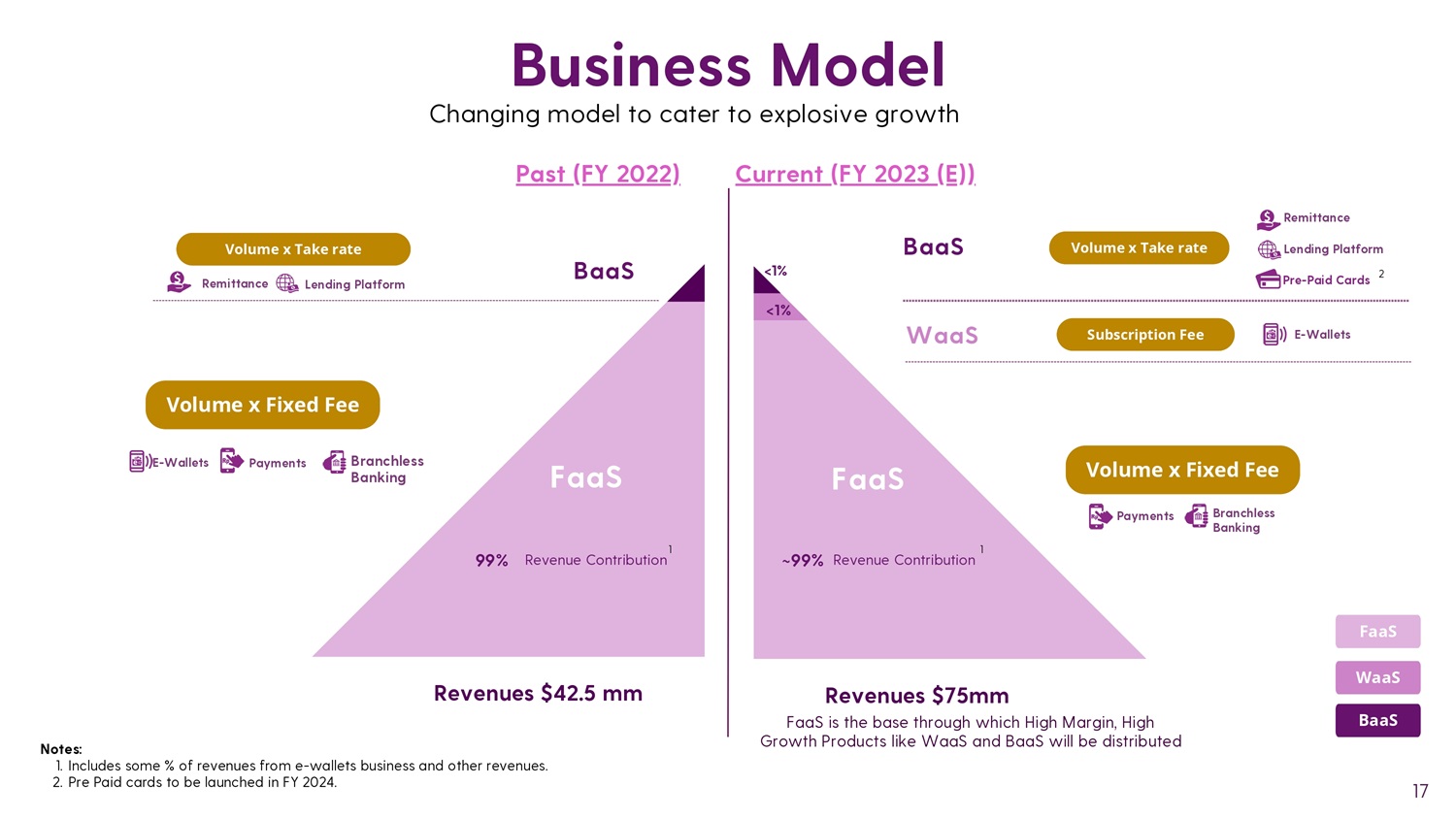

Product Solutions SME Merchants (FMCG, Building materials, Telco) Cooperatives & local banks State - owned enterprises Large corporates Industries Served FaaS WaaS BaaS 15 Product & Technology Stack Licenses Analytics Off - Line Touch Points (micro retail shops) FaaS,WaaS, BaaS Partner customers can have their branded or white - labelled fintech services or banking platforms, live and operational within weeks Company collects the relevant data and is in a position to monetize it through internal scores, credit ratings, and other revenue generating avenues Powerful network of 960k merchants Provide easy access to licenses for companies that need integration of payment in their ecosystem Creating a Strong Competitive Moat *Prepaid virtual and plastic cards expected to be launched in Q4 2023 under license from Bank Indonesia 16 BaaS Business Model Changing model to cater to explosive growth 17 Notes: 1.

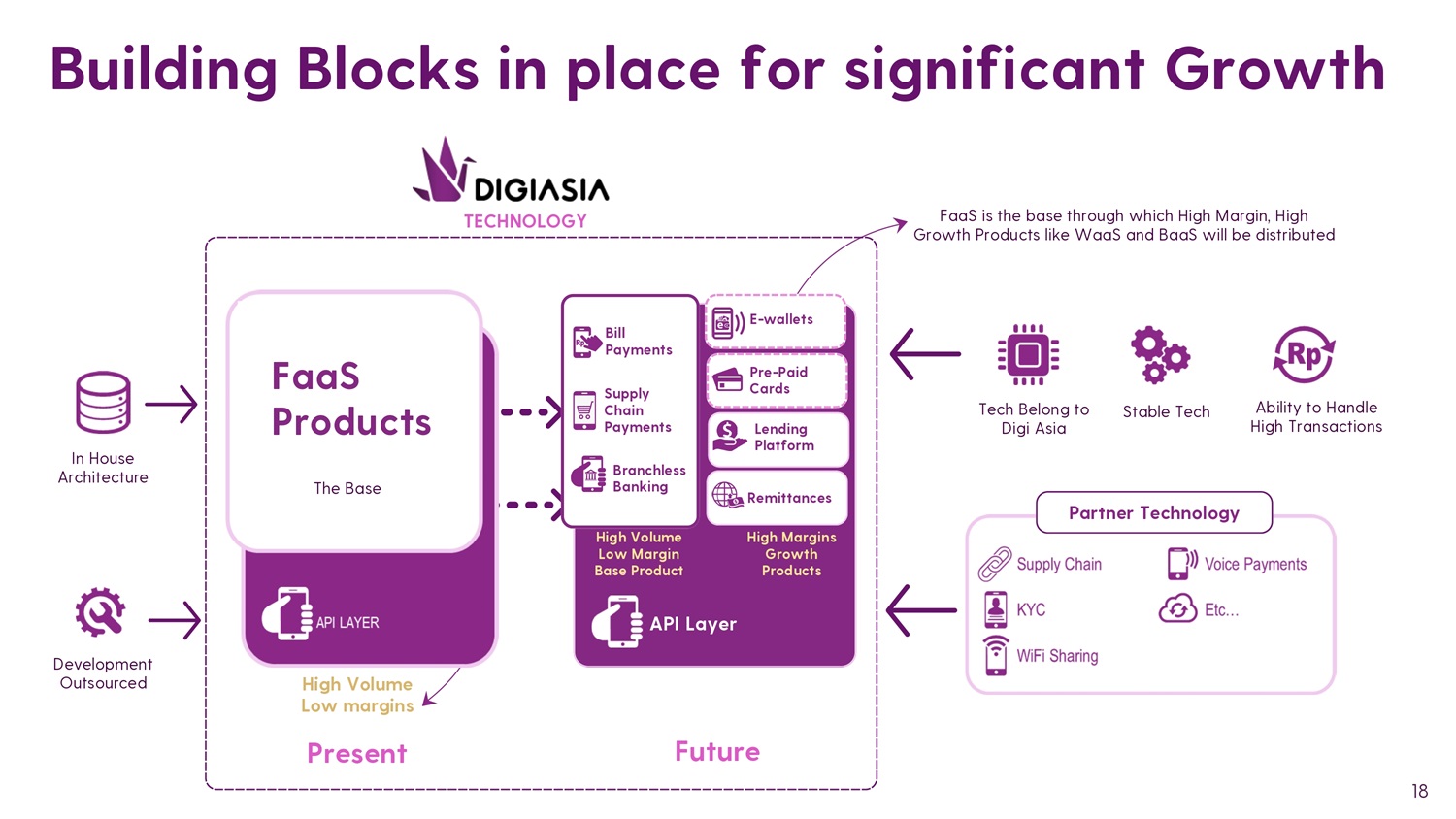

Includes some % of revenues from e - wallets business and other revenues. 2. Pre Paid cards to be launched in FY 2024. Past ( FY 2022) Current ( FY 2023 (E)) FaaS 99% FaaS BaaS E - Wallets Payments Branchless Banking Volume x Fixed Fee Volume x Take rate Remittance Lending Platform 1 Revenue Contribution WaaS Payments Branchless Banking Volume x Fixed Fee E - Wallets Subscription Fee Volume x Take rate Remittance Lending Platform Pre - Paid Cards FaaS WaaS BaaS Revenues $42.5 mm Revenues $75mm FaaS is the base through which High Margin, High Growth Products like WaaS and BaaS will be distributed 2 <1% <1% 1 ~99% Revenue Contribution Supply Chain Payments Building Blocks in place for significant Growth 18 Tech Belong to Digi Asia Stable Tech Bill Payments E - wallets Branchless Banking Lending Platform Remittances Pre - Paid Cards API Layer FaaS Products High Volume Low margins High Margins Growth Products Present Future Partner Technology In House Architecture Development Outsourced Ability to Handle High Transactions TECHNOLOGY The Base High Volume Low Margin Base Product FaaS is the base through which High Margin, High Growth Products like WaaS and BaaS will be distributed

While most fintech players in Indonesia serve banked customers/Type A, DigiAsia serves unbanked / underbanked / Type B customers and MSME Focusing on financial inclusion in Indonesia for the unbanked and underbanked 19 Digitize local and corporative banks to provide fintech services Enable MSMEs /non banking outlets to act as branchless banking points and provide fintech services Provide customer access to pre - paid cards in partnership with Mastercard to facilitate online payments Allow financial institutions to have a widest reach to consumers Provide SMSE access to lending services Lending Platforms Indonesian Bank Indonesian Bank Japanese Financial Services Company Indonesian Nation Health Insurance System Flagship carrier of Indonesia Government Bank FMCG distributor Cement manufacturing Companies West Java Provincial government Indonesian convenience store chains Electronic transactions solutions Provider Remittances Payments Key Partnerships Nahdlatul Ulama – World Largest Islamic Organization Coffee and Café Brand E - Money Supply Chains 21 Banking Platform Notes: Includes direct and indirect partners.

1 Transaction overview 2 Partnerships 3 Market potential 4 Company overview 5 Financial overview

2018 Partnered with Mastercard to enable Mastercard’s QR payments platform for all non - Indonesia cardholders to access domestic QR payments Enabled end - to - end consumer and merchant applications for the first cashless ASEAN Games where 100% of the purchases were non - cash 2020 Mastercard completed a $25 mm Series B investment Multiple future partnerships and collaborations agreed on post - investment Pre investment DigiAsia won its first B2B fintech services implementation for the ASEAN Games in Indonesia Strategic investment Future Partnerships Further development of DigiAsia’s B2B2C and B2B2M business models, DigiAsia approached Mastercard for a strategic investment Commercial Payments Converting terms of payment (credit) offered between principals, distributors and merchants into a card product Remittance Cross - border remittance collaboration with Transfast and Mastercard Send for bulk disbursements and real - time cross - border payments and transfers Cards Enable and launch the first prepaid Mastercard in Indonesia, allowing for greater financial inclusion for the masses and unique use cases for corporate co - branded prepaid and G2C initiatives Shariah Products Enable acceleration of Shariah digital financial solutions, which are currently under - penetrated in Indonesia Strong and Growing Strategic Partnership with Mastercard 22 Notes: ASEAN means Association of Southeast Asian Nations, B2B2C means Business to Business to Consumer, B2B2M means Business to Business to Merchant.

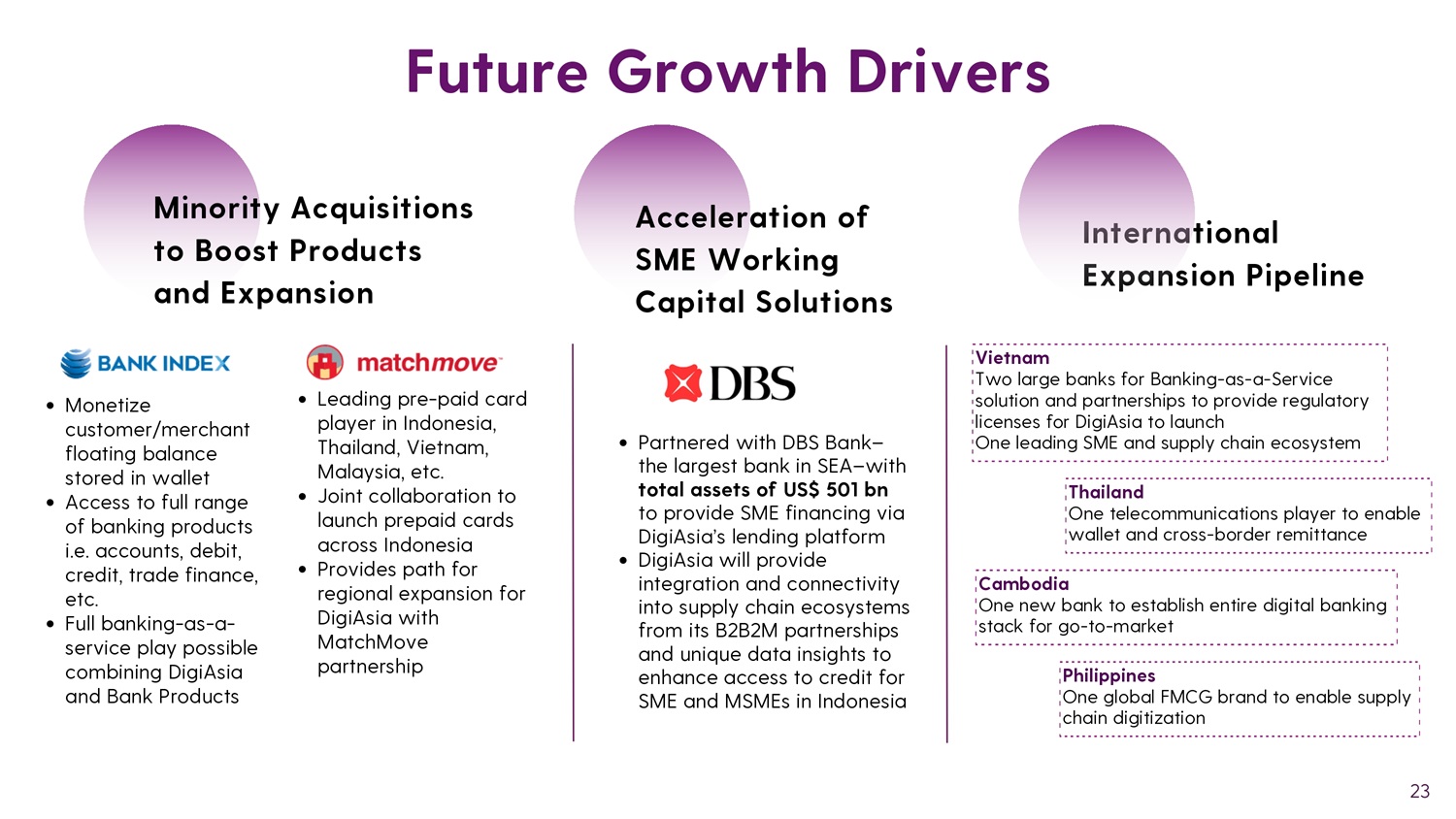

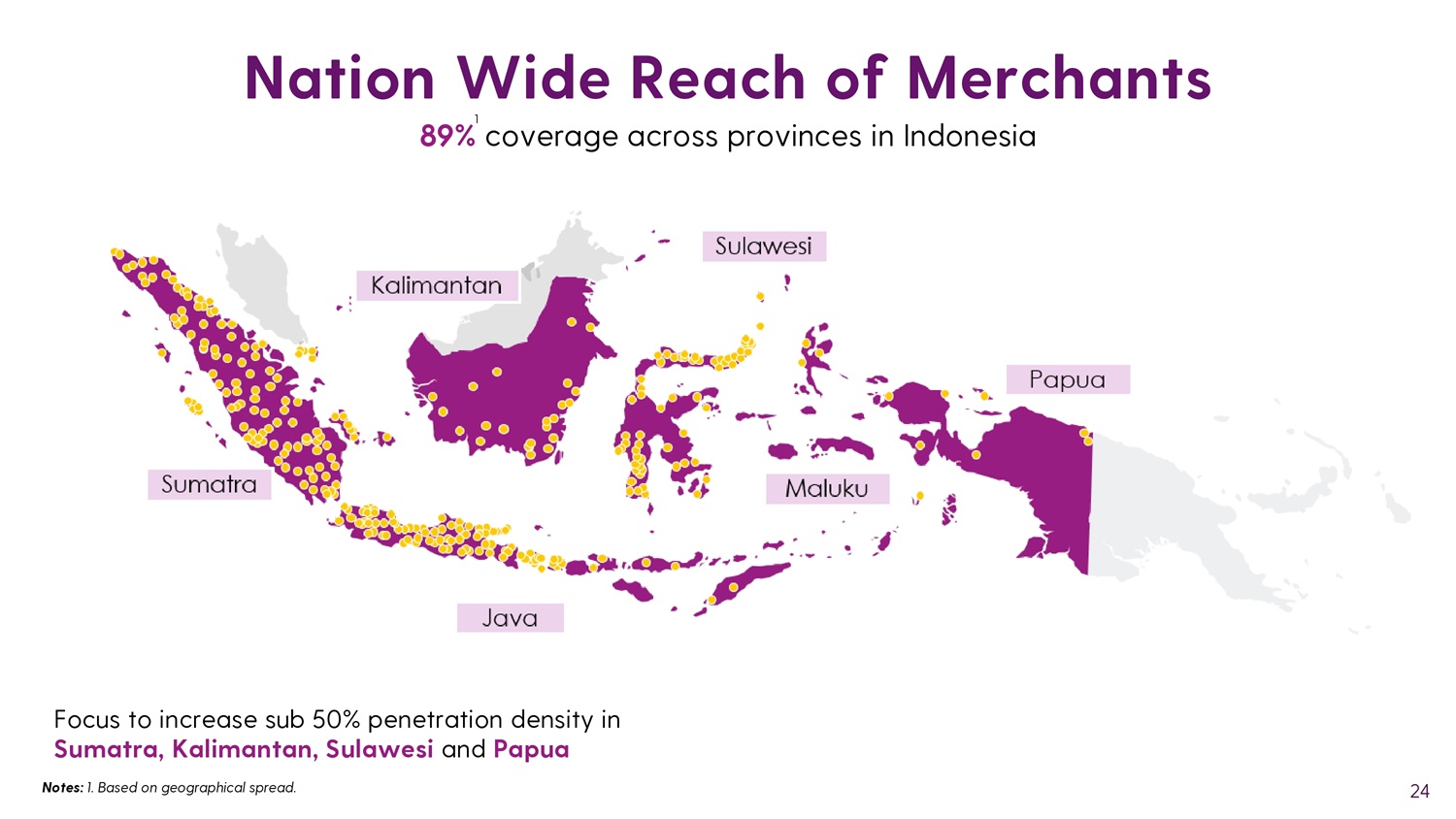

Minority Acquisitions to Boost Products and Expansion Monetize customer/merchant floating balance stored in wallet Access to full range of banking products i.e. accounts, debit, credit, trade finance, etc. Full banking - as - a - service play possible combining DigiAsia and Bank Products Leading pre - paid card player in Indonesia, Thailand, Vietnam, Malaysia, etc. Joint collaboration to launch prepaid cards across Indonesia Provides path for regional expansion for DigiAsia with MatchMove partnership Acceleration of SME Working Capital Solutions Partnered with DBS Bank – the largest bank in SEA – with total assets of US$ 501 bn to provide SME financing via DigiAsia’s lending platform DigiAsia will provide integration and connectivity into supply chain ecosystems from its B2B2M partnerships and unique data insights to enhance access to credit for SME and MSMEs in Indonesia International Expansion Pipeline Vietnam Two large banks for Banking - as - a - Service solution and partnerships to provide regulatory licenses for DigiAsia to launch One leading SME and supply chain ecosystem Thailand One telecommunications player to enable wallet and cross - border remittance Cambodia One new bank to establish entire digital banking stack for go - to - market Philippines One global FMCG brand to enable supply chain digitization Future Growth Drivers 23 Nation Wide Reach of Merchants 89% coverage across provinces in Indonesia Focus to increase sub 50% penetration density in Sumatra, Kalimantan, Sulawesi and Papua Notes: 1.

Based on geographical spread. 24 1

1 Transaction overview 2 Partnerships 3 Market potential 4 Company overview 5 Financial overview

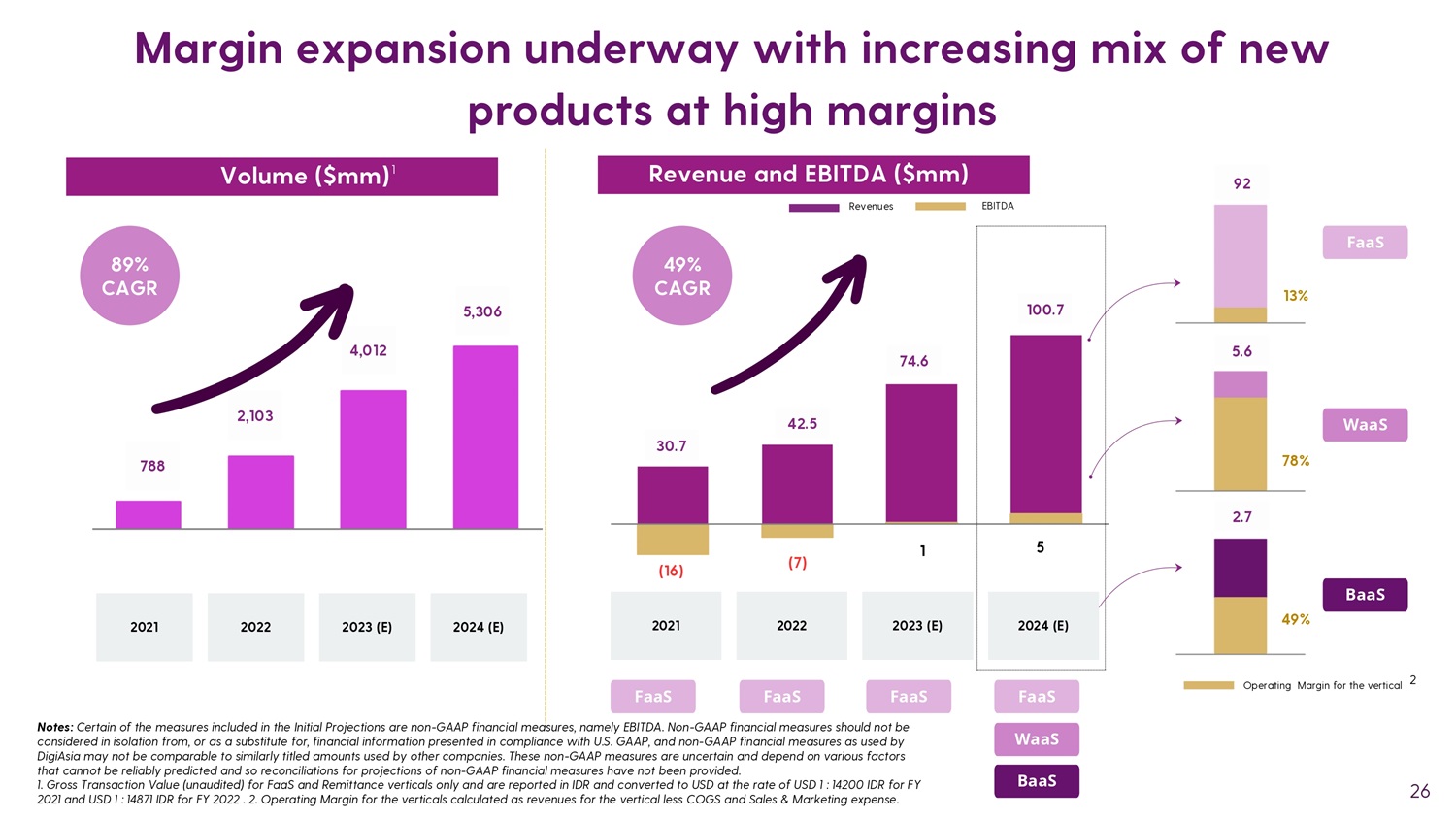

2021 2022 2023 (E) 2024 (E) 788 2,103 4,012 89% CAGR 49% CAGR 30.7 42.5 100.7 (16) (7) 5 WaaS BaaS FaaS FaaS FaaS FaaS WaaS BaaS FaaS 92 13% 5.6 78% 2.7 49% Revenues EBITDA 5,306 2021 2022 2023 (E) 2024 (E) 74.6 1 Operating Margin for the vertical Revenue and EBITDA ($mm) Margin expansion underway with increasing mix of new products at high margins 26 Notes: Certain of the measures included in the Initial Projections are non - GAAP financial measures, namely EBITDA. Non - GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with U . S . GAAP, and non - GAAP financial measures as used by DigiAsia may not be comparable to similarly titled amounts used by other companies . These non - GAAP measures are uncertain and depend on various factors that cannot be reliably predicted and so reconciliations for projections of non - GAAP financial measures have not been provided . 1 . Gross Transaction Value (unaudited) for FaaS and Remittance verticals only and are reported in IDR and converted to USD at the rate of USD 1 : 14200 IDR for FY 2021 and USD 1 : 14871 IDR for FY 2022 . 2 . Operating Margin for the verticals calculated as revenues for the vertical less COGS and Sales & Marketing expense .

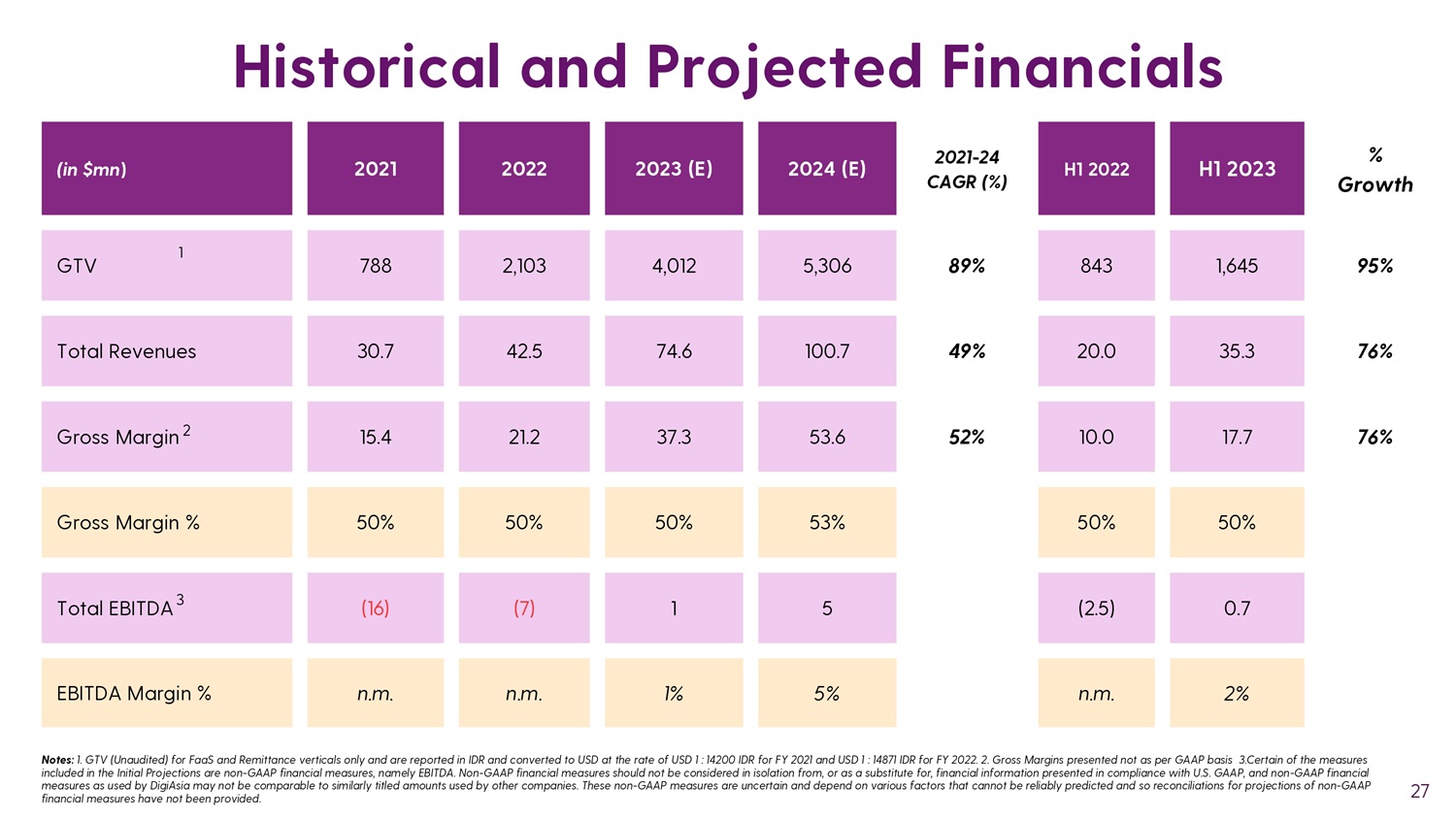

Volume ($mm) 1 2 95% 1,645 843 89% 5,306 4,012 2,103 788 GTV 1 76% 35.3 20.0 49% 100.7 74.6 42.5 30.7 Total Revenues 76% 17.7 10.0 52% 53.6 37.3 21.2 15.4 Gross Margin 2 50% 50% 53% 50% 50% 50% Gross Margin % 0.7 (2.5) 5 1 (7) (16) Total EBITDA 3 2% n.m. 5% 1% n.m. n.m. EBITDA Margin % (in $mn ) 2021 2022 2023 (E) 2024 (E) 2021 - 24 CAGR (%) H1 2022 H1 2023 % Growth Historical and Projected Financials 27 Notes : 1 . GTV (Unaudited) for FaaS and Remittance verticals only and are reported in IDR and converted to USD at the rate of USD 1 : 14200 IDR for FY 2021 and USD 1 : 14871 IDR for FY 2022 . 2 . Gross Margins presented not as per GAAP basis 3 . Certain of the measures included in the Initial Projections are non - GAAP financial measures, namely EBITDA . Non - GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with U . S . GAAP, and non - GAAP financial measures as used by DigiAsia may not be comparable to similarly titled amounts used by other companies . These non - GAAP measures are uncertain and depend on various factors that cannot be reliably predicted and so reconciliations for projections of non - GAAP financial measures have not been provided .

Leader in embedded Fintech & Banking in Indonesia High margin products such as WaaS and Pre - paid cards (under BaaS) being rolled out on the FaaS infrastructure Large enterprise client base with profitable economics Strong base of merchant payment infrastructure with a nation wide network of 960 K merchants Investment Highlights Clear path to profitability 28 Access to US public capital markets will make it a highly attractive player for consolidation in local fintech market Risk Factors Introduction I n evaluating DigiAsia and its securities, you should carefully read the registration statement on Form F - 4 filed by StoneBridge Acquisition Corporation : ("StoneBridge" subsequently renamed DigiAsia Corp . ) the proxy statement/prospectus contained therein) and any other relevant documents filed with the SEC, and especially consider the factors discussed under the section entitled "Risk Factors" in the proxy statement/prospectus and under similar headings in other relevant documents filed with the SEC . Such risks include, but are not limited to the following : Risk Factor Summary The business and financial condition of PubCo subsequent to the Closing are subject to numerous risks and uncertainties, including those highlighted in the section title “Risk Factors . ” The occurrence of one or more of the events or circumstances described below, alone or in combination with other events or circumstances, may adversely affect the business, cash flows, financial condition and results of operations subsequent to the Business Combination . Such risks include, but are not limited to, the following : DigiAsia has a limited operating history, a history of losses, anticipates increasing expenses in the future, and may not be able to achieve or maintain profitability in the foreseeable future ; The loss of operating revenues as a result of DigiAsia’s strategic partnership, significant key partners, API management platforms or large marquee B 2 B partners and customers, could adversely affect DigiAsia’s business ; DigiAsia’s success depends (and subsequent to the Business Combination, PubCo’s success will depend) on DigiAsia’s ability to develop products and services to address the rapidly evolving markets that DigiAsia serves, and if DigiAsia is not able to implement successful enhancements and new features for DigiAsia’s solutions, products and services, DigiAsia could lose customers or have trouble attracting new customers, and DigiAsia’s ability to grow may be limited ; Future revenue growth depends or will depend on DigiAsia’s ability to retain existing customers, attract new customers, and increase sales to both new and existing customers ; If DigiAsia is unable to renew enterprise customer contracts or to adjust certain contract components at favorable terms or DigiAsia loses a significant enterprise or marketplace customer, or if DigiAsia’s API merchant integration platform were to prevent DigiAsia’s customers or signed up merchants from using any of DigiAsia’s services from such marketplace, DigiAsia’s and PubCo’s results of operations and financial condition may be adversely affected ; While DigiAsia’s offerings are mostly white labelled, DigiAsia has established a strong brand and leadership position in the B 2 B fintech market with a trusted brand positioning, and failure to maintain and protect DigiAsia’s position and brand or any damage to DigiAsia’s reputation, or the reputation of DigiAsia’s partners, could adversely affect DigiAsia’s and PubCo’s business, financial condition or results of operations; The COVID - 19 pandemic or any other such comparable event could adversely affect DigiAsia’s business, results of operations and financial condition. The bulk of DigiAsia’s revenues comes from the supply chain ecosystem, consisting of “warungs” (corner shops) as well as master distributors of large brands within the telecommunication, fast - moving consumer goods, construction and other industry verticals, and if their supply chains are disrupted for any reason, such disruptions could adversely affect the growth prospects of DigiAsia; API - based revenues are the bulk of DigiAsia’s revenues currently, and while contracts are long term in nature, termination of such contract could impact DigiAsia’s business; DigiAsia is subject to various risks relating to the availability of capital for its working capital lending offerings through KreditPro, as well as risk of losses for its lending partners relating to its working capital offerings through their balance sheet exposure; Because DigiAsia relies on third parties to provide white - labeled or co - branded services and to manage API platforms, DigiAsia and PubCo could be adversely impacted if such third parties fail to fulfill their obligations or if DigiAsia’s arrangements with such third parties are terminated and suitable replacements cannot be found on commercially reasonable terms or at all; DigiAsia depends on counterparty financial institutions and payment service providers to support its operations .

If one or more of DigiAsia’s counterparty financial institutions or payment service providers default on their financial or performance obligations to DigiAsia, change their business strategy or requirements, become subject to regulatory action, or fail, DigiAsia’s and PubCo’s results of operations and financial condition may be adversely affected ; DigiAsia and PubCo may fail to attract, motivate and retain key members of their management team or other experienced and capable employees ; DigiAsia and PubCo will require additional capital but may not be able to obtain such capital on favorable terms or at all ; • DigiAsia has limited business insurance coverage ; 29 Risk Factors The fintech market in Asia is developing, and the expansion of DigiAsia’s business depends on the continued growth of the various segments of the fintech industry, as well as increased availability, quality and usage of mobile devices and the Internet in Asia; DigiAsia participates in extremely competitive and continuously evolving markets; A significant change, material slowdown or complete disruption in international migration patterns could adversely affect DigiAsia’s B2B remittance business; DigiAsia conducts money transfer transactions through agents in some regions that are politically volatile or, in a limited number of cases, that are subject to certain United States Office of Foreign Assets Control restrictions; DigiAsia’s solutions and services may not function as intended due to errors in DigiAsia’s or DigiAsia’s third - party providers’ software, hardware, systems, product defects, or due to security breaches or human error in administering these systems, which could materially and adversely affect DigiAsia’s business; DigiAsia’s operations are dependent on its in - house developed and external technology platforms and comprehensive ecosystems, and any systems failures, interruptions, delays in service, catastrophic events, and resulting interruptions in the availability of DigiAsia’s products or services could result in harm to DigiAsia’s business DigiAsia is subject to risks related to data privacy and data security; Failure to deal effectively with fraud, fictitious transactions, failed transactions or negative customer experiences would increase DigiAsia’s loss rate and harm its business, and could severely diminish merchant, partner and user confidence in and use of DigiAsia’s services; DigiAsia’s risk management system may not be adequate or effective in all respects; DigiAsia may not be successful in managing rapid change and significant growth in its business; As a player in the fintech industry in Indonesia, DigiAsia is subject to extensive government regulations and oversight, that governs money, banking, credit and lending businesses, particularly delivered over a technology platform; DigiAsia may fail to obtain, maintain or renew requisite licenses and approvals; Uncertainties with respect to the legal system in certain markets in Southeast Asia could adversely affect DigiAsia; DigiAsia is subject to anti - money laundering laws and regulations; DigiAsia is subject to geopolitical risks; You may face difficulties in protecting your interests, and your ability to protect your rights through U.S.

courts may be limited; DigiAsia is a holding company and does not have any material assets other than its interests in its majority - owned entities, controlled entities (including variable interest entities for which DigiAsia is the primary beneficiary) and corporate joint ventures, and any change in DigiAsia’s ability to repatriate dividends or other payments from its majority - owned entities, controlled entities and corporate joint ventures, could materially adversely affect DigiAsia ; While DigiAsia has effective control over all of its operating entities in Indonesia, it does not currently have beneficial ownership interest in the equity shares of those operating entities ; 30 Risks Related to Information Technology, Intellectual Property, Data Security and Data Privacy : Any major disruption or failure of our information technology systems, or our failure to successfully implement new technology effectively, could adversely affect our business and results of operations or the effectiveness of internal controls over financial reporting . We are subject to stringent and changing laws, regulations, and standards, and contractual obligations related to privacy and data security . The actual or perceived failure to comply with applicable data protection, privacy, and security laws, regulations, standards, and other requirements could adversely affect our business, results of operations, and financial condition . Breaches and other types of security incidents of our networks or systems, or those of our third - party service providers, could negatively impact our ability to conduct our business, our brand and reputation, and our ability to retain existing hosts and guests and attract new hosts and guests, and may cause us to incur significant liabilities and adversely affect our business, results of operations, financial condition, and future prospects . The successful operation of our business depends upon the performance and reliability of internet, mobile, and other infrastructures that are not under our control . We rely on mobile operating systems and app marketplaces to make our app available to hosts and guests, and if we do not effectively operate with or receive favorable placements within such app marketplaces and maintain high user reviews, our usage or brand recognition could decline and our business, financial results, and results of operations could be adversely affected . We currently rely, and may in the future rely, on a small number of third - party service providers to host and deliver a significant portion of our offering, and any interruptions or delays in services from these third parties could impair the delivery of our services and adversely affect our business . Our platform is highly complex, and any undetected errors could materially adversely affect our business, results of operations, and financial condition . Our failure to protect our intellectual property rights and proprietary information could diminish our brand and other intangible assets . We may be subject to claims that we violated the intellectual property rights of others, which are extremely costly to defend and could require us to pay significant damages, limit our ability to operate, or both . Risks Related to Other Legal, Regulatory and Tax Matters Adverse litigation judgments or settlements resulting from legal proceedings in which we may be involved could expose us to monetary damages or other monetary payments or limit our ability to operate our business . We are subject to anti - corruption, anti - bribery, anti - money laundering, and economic sanctions laws and regulations, and non - compliance with such laws can subject us to criminal or civil liability and harm our business, financial condition, and results of operations . The insurance coverage and other elements of protection plans afforded to hosts and guests may be inadequate, which could adversely affect our business, results of operations, and financial condition. We could be required to collect additional sales taxes or be subject to other indirect tax liabilities in various jurisdictions which could adversely affect our results of operations. Changes in global tax laws could increase our worldwide tax rate and could have an adverse effect on our business, cash flow, results of operations, or financial conditions. Uncertainty in the application of taxes to our hosts, guests, or platform could increase our tax liabilities and may discourage hosts and guests from conducting business on our platform. We may have exposure to greater than anticipated tax liabilities. General Risk Factors We will incur significant expenses as a result of being a public company, which could materially adversely affect our business, results of operation, and financial condition. Failure to establish and maintain effective internal control over financial reporting in accordance with Section 404 of the Sarbanes - Oxley Act could have a material adverse effect on our business and stock price. The failure to successfully implement and maintain accounting systems could materially adversely impact our business, results of operation, and financial condition. Our results of operations and financial condition could be materially adversely affected by changes in accounting principles. The estimates of market opportunity and forecasts of market growth included in this presentation may prove to be inaccurate, and even if the markets in which we compete achieve the forecasted growth, our business could fail to grow at similar rates, or at all. Our disclosure controls and procedures may not prevent or detect all errors or acts of fraud. If our estimates or judgments relating to our critical accounting policies are based on assumptions that change or prove to be incorrect, our results of operations could fall below the expectations of securities analysts and investors, resulting in a decline in the trading price of our common stock. Risk Factors 31