UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

April 16, 2024

Date of Report (Date of earliest event reported)

AGBA GROUP HOLDING LIMITED

(Exact Name of Registrant as Specified in its Charter)

| British Virgin Islands | 001-38909 | N/A | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

| AGBA Tower 68 Johnston Road Wan Chai, Hong Kong SAR |

N/A | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: +852 3601 8363

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Ordinary Shares, $0.001 par value | AGBA | NASDAQ Capital Market | ||

| Warrants, each warrant exercisable for one-half of one Ordinary Share for $11.50 per full share | AGBAW | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

The Merger Agreement

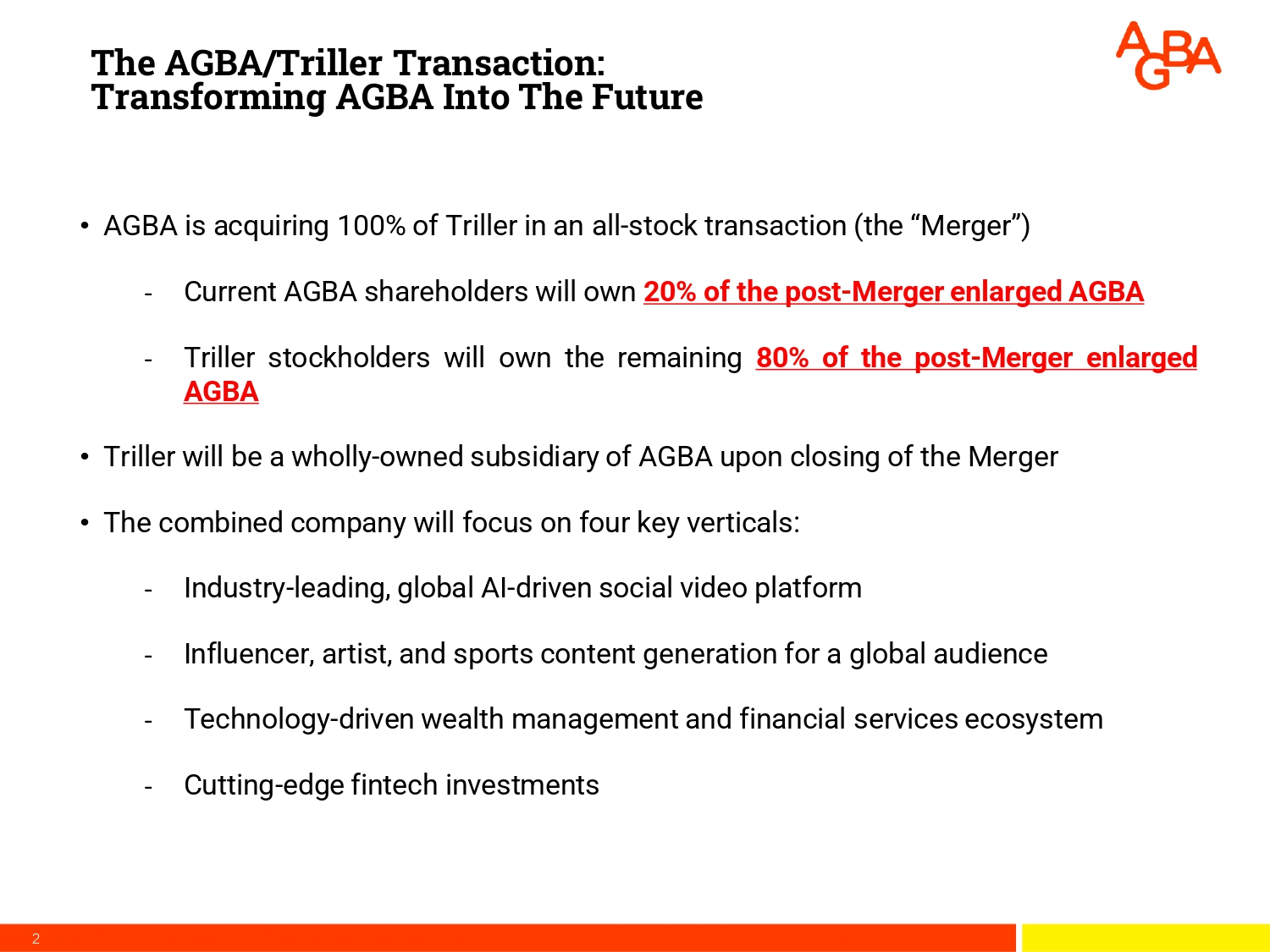

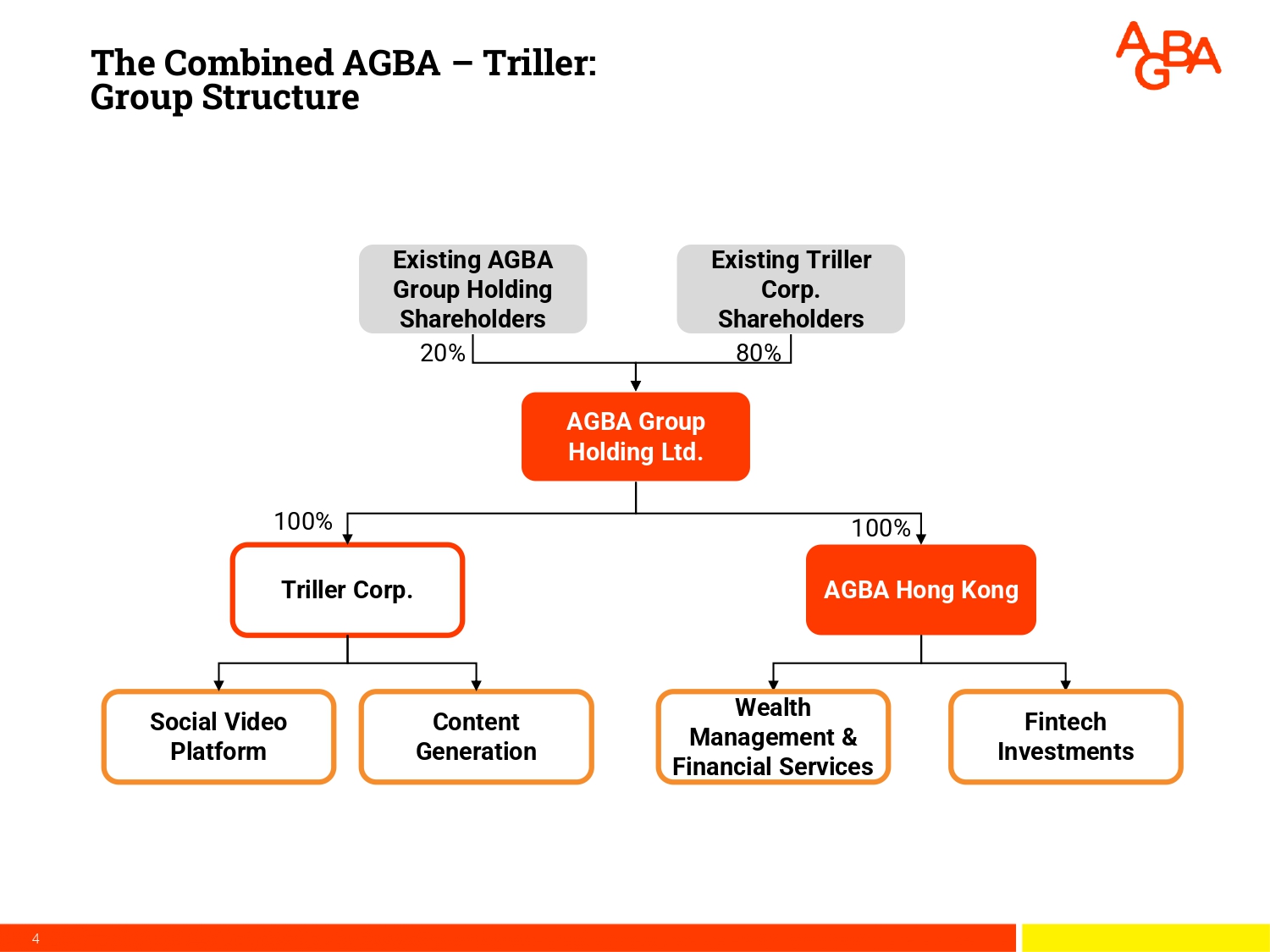

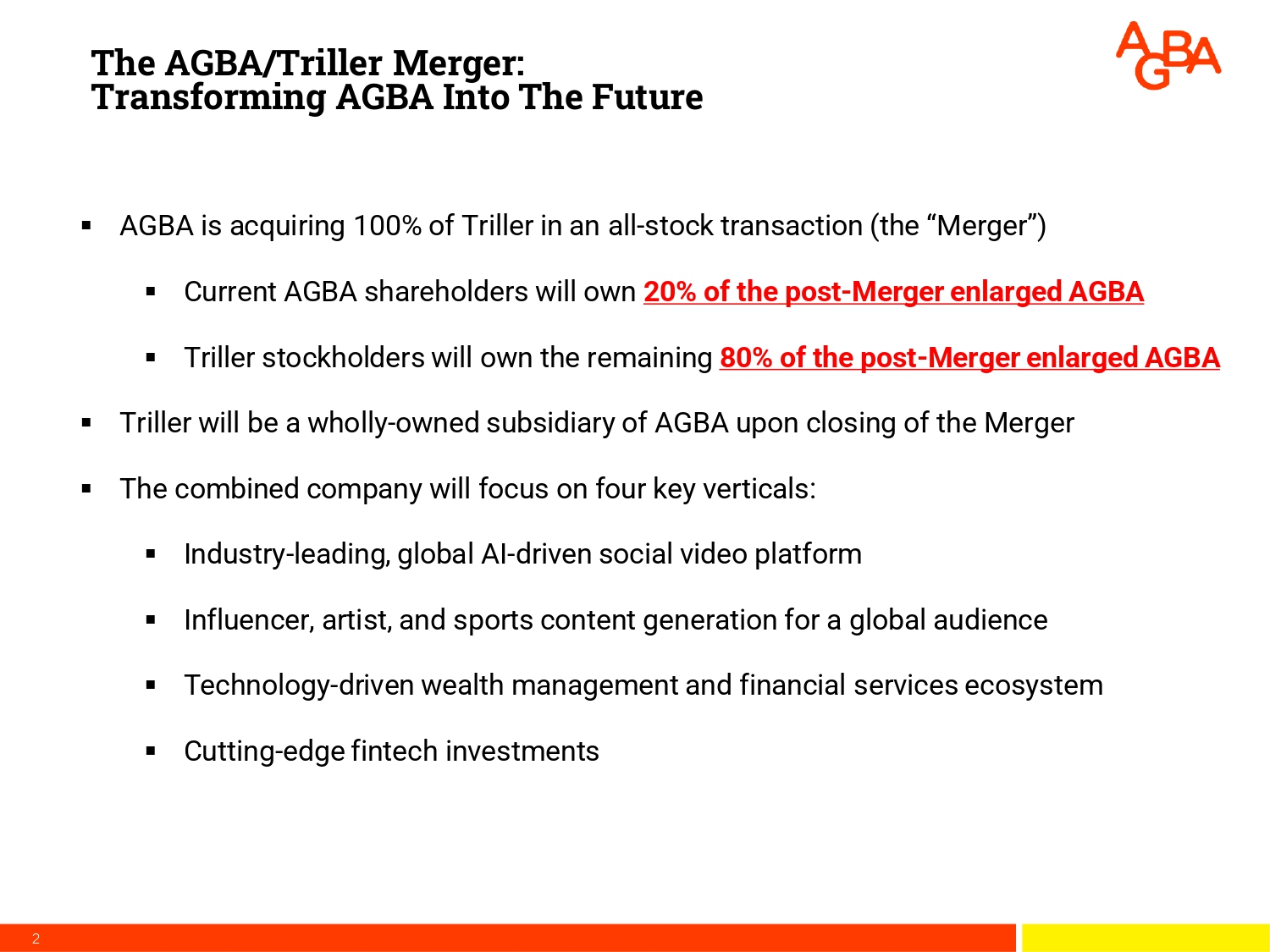

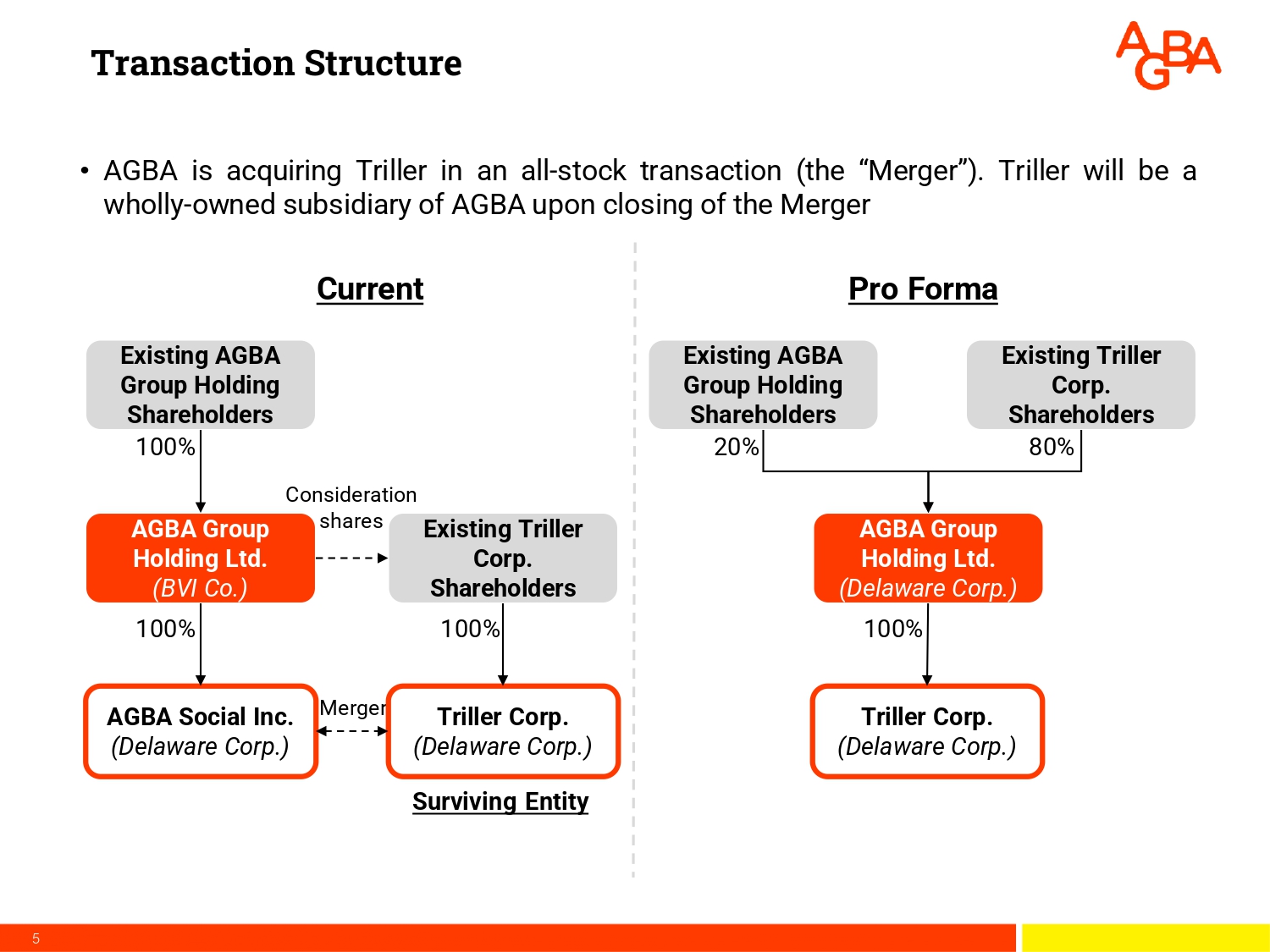

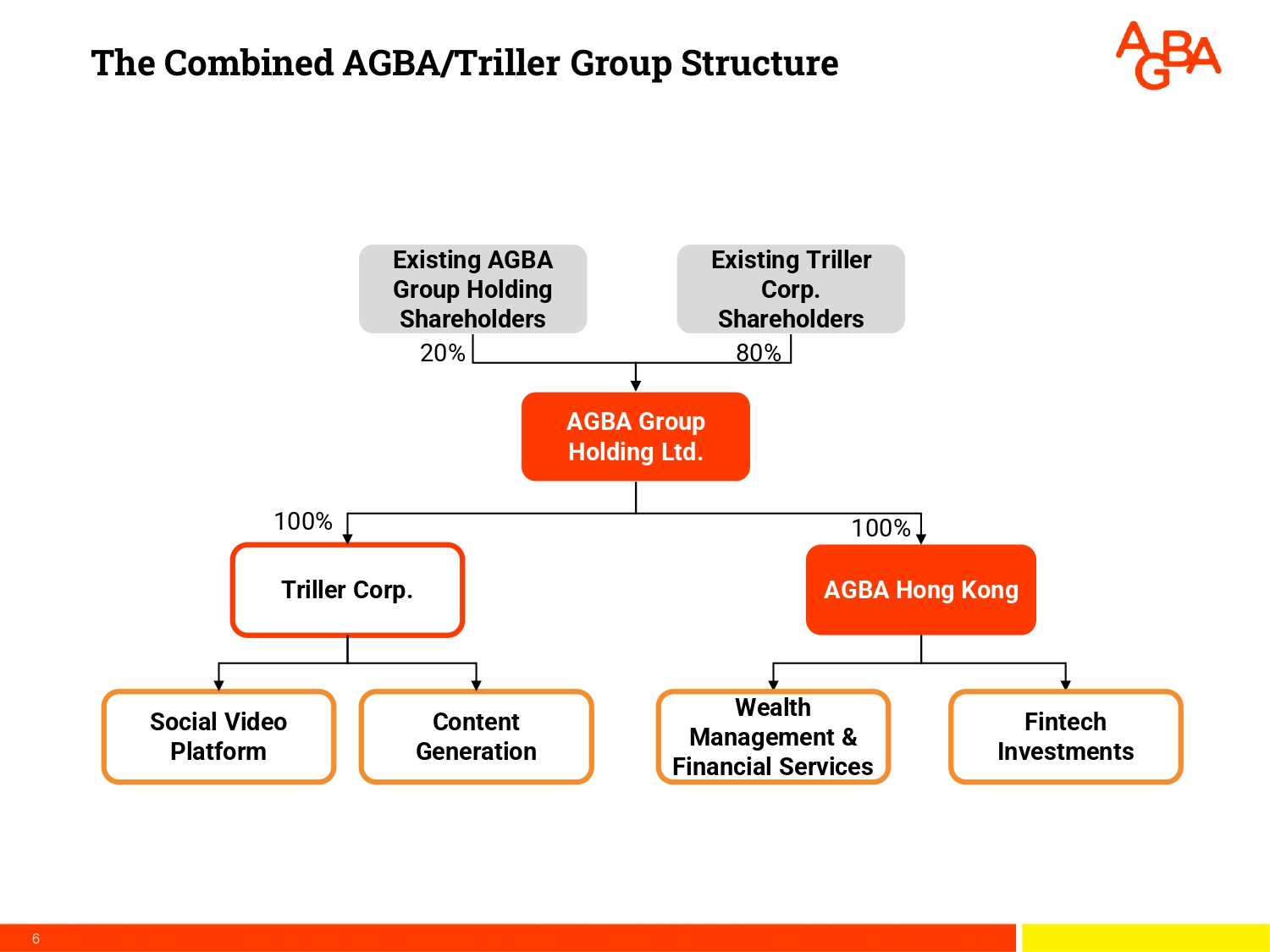

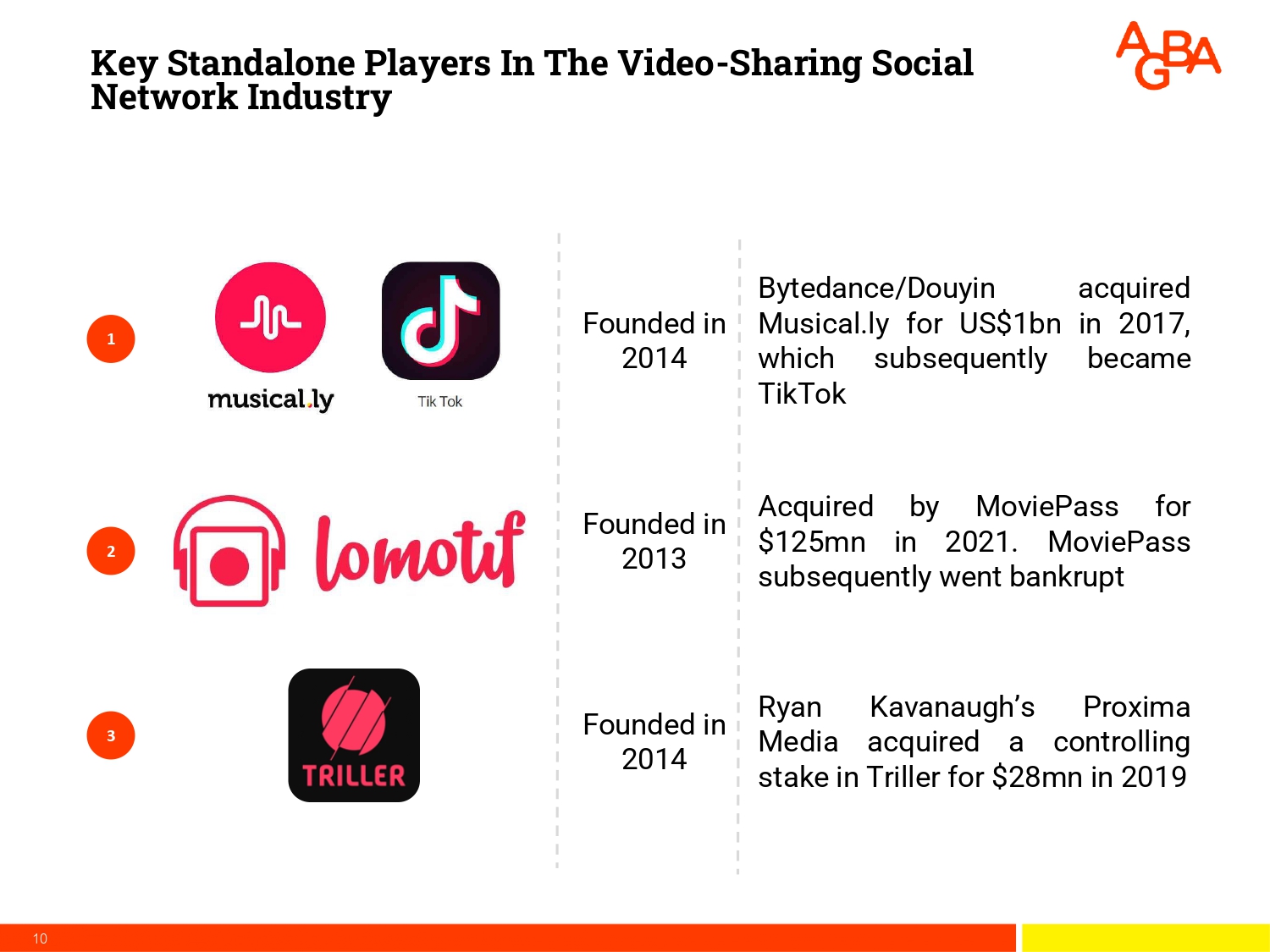

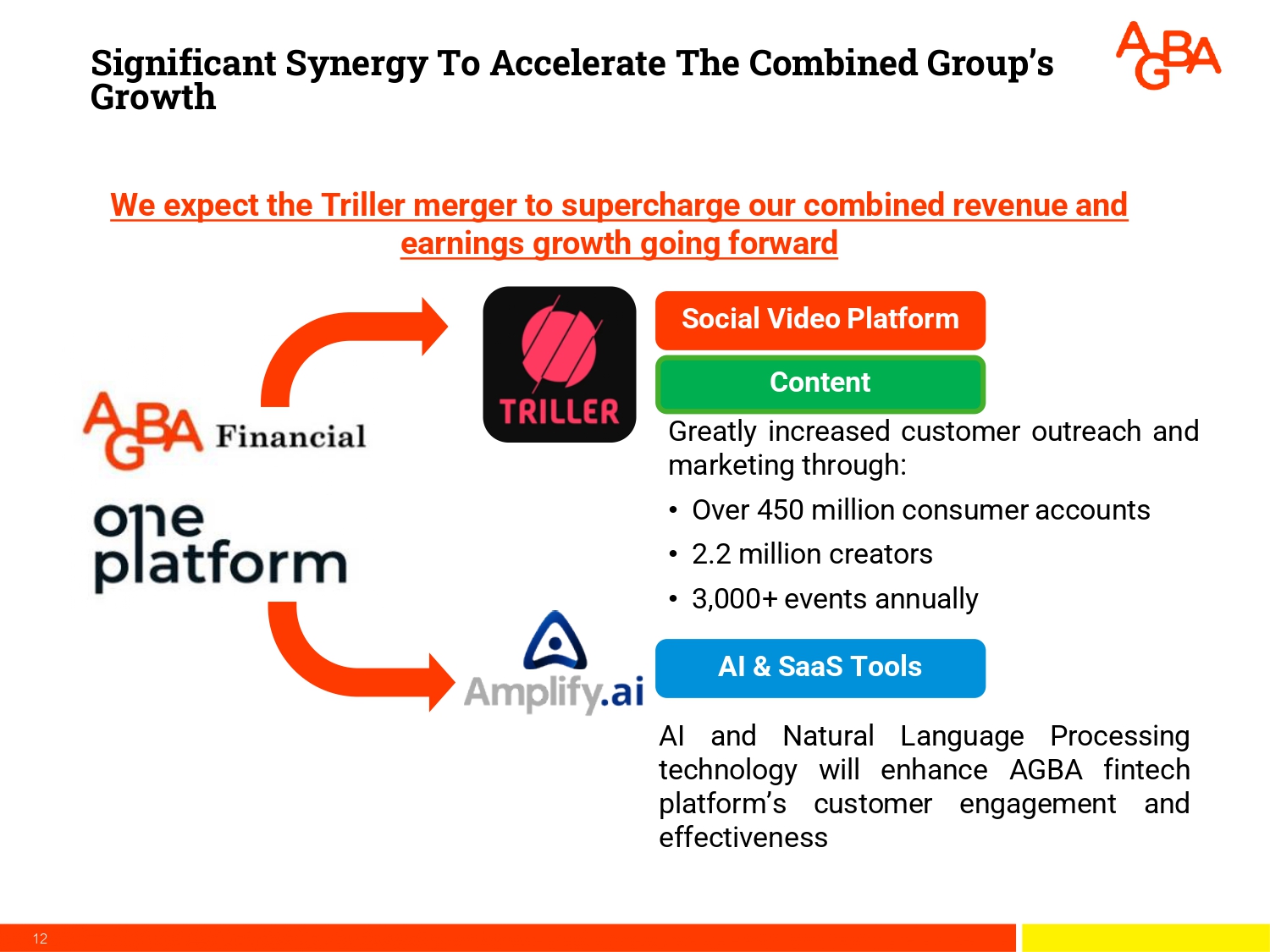

On April 16, 2024, AGBA Group Holding Limited, a British Virgin Islands business company (“AGBA” or “Parent”), entered into that certain Agreement and Plan of Merger (as may be amended, supplemented or otherwise modified from time to time, the “Merger Agreement”), by and between AGBA, its wholly owned subsidiary AGBA Social Inc. (“Merger Sub”), Triller Corp., a Delaware corporation (“Triller” or the “Company”) and Bobby Sarnevesht, solely as representative of the Triller stockholders. Pursuant to the Merger Agreement, (a) the Company will complete its reorganization (the “Triller Reorganization”) with Triller Hold Co LLC (“Triller LLC”), such that Triller LLC will reorganize into the Company as a Delaware Corporation, (b) AGBA will domesticate to the United States as a Delaware corporation (the “AGBA Domestication”), pursuant to which, among other things, all AGBA ordinary shares, par value $0.001 per share (“AGBA Ordinary Shares”) will automatically convert into the same number of shares Delaware Parent Common Stock, as defined below (AGBA, when domesticated as a Delaware corporation, is sometimes referred to as “Delaware Parent”) and (c) after giving effect to the Triller Reorganization and the AGBA Domestication, Merger Sub will be merged into Triller (the “Merger), with Triller surviving the Merger and becoming a wholly owned subsidiary of Delaware Parent.

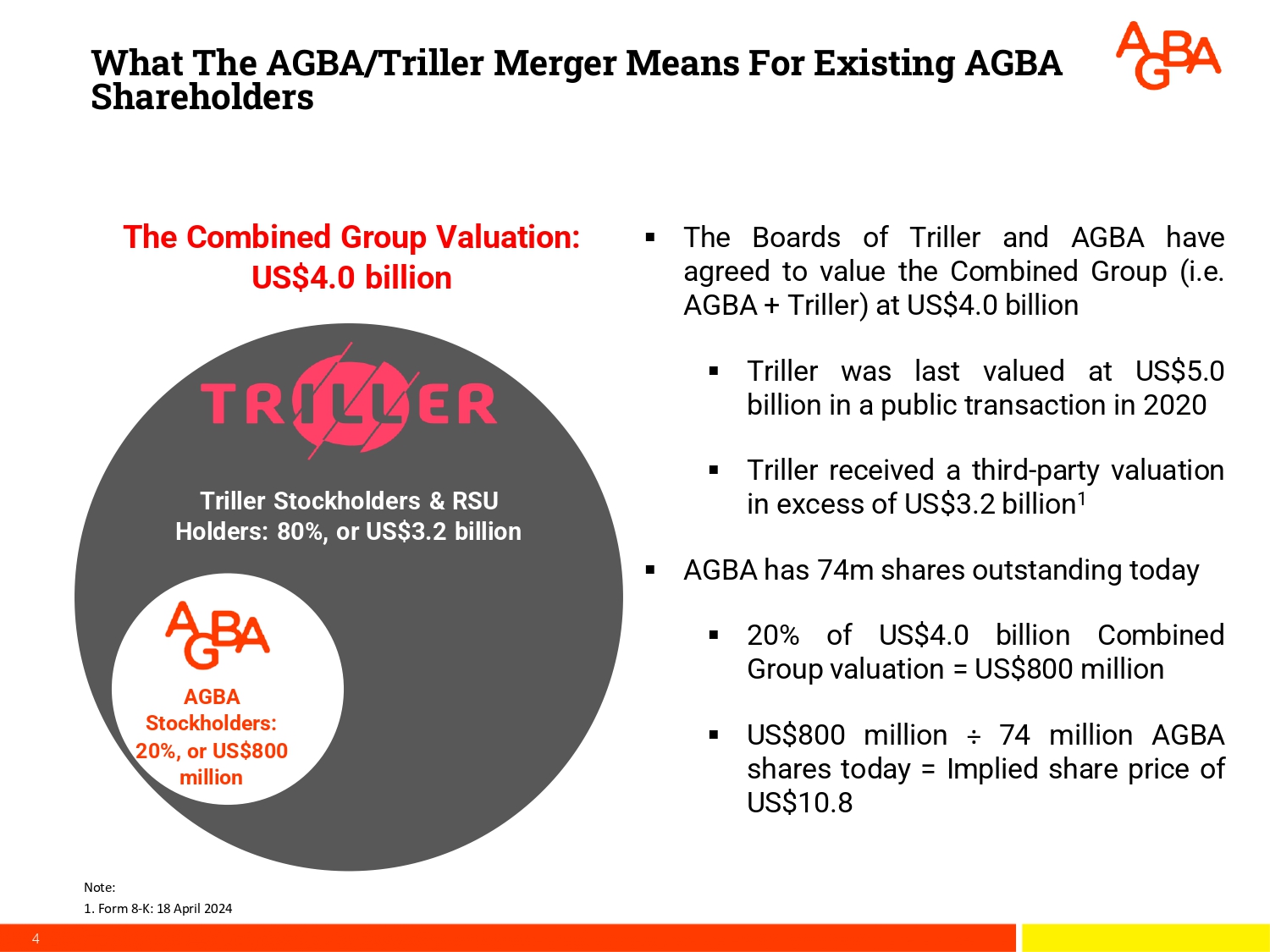

Consideration

The merger consideration provided for in the Merger Agreement (the “Merger Consideration”) will be an aggregate of 406,907,038 shares of Delaware Parent common stock, par value $0.001 per share (“Delaware Parent Common Stock”). Delaware Parent (i) will issue 313,157,105 shares of Delaware Parent Common Stock to the current common stockholders of the Company, (ii) will issue 35,328,888 shares of preferred stock to the current preferred stockholders of the Company (the holders of the Company’s common and preferred stock are referred to together as the “Stockholders”), and (iii) will convert all existing Company restricted stock units into 58,352,059 Delaware Parent restricted stock units; and Delaware Parent also will reserve an aggregate of 58,421,134 shares of Delaware Parent Common Stock for future issuance upon the vesting of such restricted stock units.

The Closing

AGBA and the Company have agreed that the closing of the Merger (the “Closing”) shall occur as soon as possible, subject to regulatory clearance, approval by AGBA’s shareholders and the other closing conditions provided for in the Merger Agreement and summarized below. Triller LLC’s members and Triller’s stockholders approved the Triller Reorganization, and Triller’s stockholders approved the Merger Agreement (including all transactions contemplated therein), each on April 16, 2024.

Representations and Warranties

In the Merger Agreement, the Company makes certain representations and warranties (with certain exceptions set forth in the disclosure schedules to the Merger Agreement) relating to, among other things: (1) Organization and Good Standing; Books and Records; (2) Authority and Enforceability; (3) Capitalization, Stock Rights and Subsidiaries; (4) No Approvals, No Conflicts; (5) Financial Statements, No Undisclosed Liabilities; (6) Absence of Certain Changes or Events; (7) Property; (8) Labor and Employment Matters, Nondisclosure and Non-Competition Agreements; (9) Employee Benefit Plans; (10) Intellectual Property; (11) Contracts; (12) Claims, Legal Proceedings, and Orders; (13) Corporation Permits, Compliance with Laws; (14) Environmental Compliance; (15) Taxes; (16) Tax Consequences; (17) Related Party Interests; (18) Insurance; (19) Brokers or Finders; (20) Bank Accounts; (21) Customers and Suppliers; and (22) Full Disclosure.

In the Merger Agreement, AGBA makes certain representations and warranties relating to, among other things: (1) Organization and Good Standing; (2) Authority and Enforceability; (3) Capitalization; (4) Brokers; (5) No Approvals; No Conflicts; and (6) Full Disclosure.

The representations and warranties of the parties expire as of the Closing.

Conduct Prior to Closing; Covenants Pending Closing

The Company has agreed to operate its business in the ordinary course, consistent with past practices, prior to the closing of the transactions contemplated by the Merger Agreement (with certain exceptions) and not to take certain specified actions without the prior written consent of AGBA.

The Merger Agreement also contains customary pre-closing covenants.

Conditions to Closing

Company’s Conditions to Closing

The obligations of the Company to consummate the transactions contemplated by the Merger Agreement are conditioned upon each of the following, among other things: (1) the representations and warranties of AGBA and Merger Sub being, if qualified as to materiality, true and correct in all respects, and, if not so qualified, true and correct in all material respects, on and as of the date of the Merger Agreement and the closing date of the transactions; (2) AGBA and Merger Sub complying with all of its obligations under the Merger Agreement in all material respects; (3) the consummation of the transactions being permitted by applicable law to which AGBA, Merger Sub, or the Company is subject; (4) closing deliveries having been delivered to the Company by AGBA, including among other things, customary closing certificates, certificate of merger executed by Merger Sub; the certificate of discontinuance, executed Operative Documents (as defined below); and (5) no third party approvals being anticipated by the parties.

AGBA and Merger Sub’s Conditions to Closing

The obligations of AGBA and Merger Sub to consummate the transactions contemplated by the Merger Agreement are conditioned upon each of the following, among other things: (1) the representations and warranties of the Company being, if qualified as to materiality, true and correct in all respects, and, if not so qualified, true and correct in all material respects, on and as of the date of the Merger Agreement and the closing date of the transactions; (2) the Company complying with all of its obligations under the Merger Agreement in all material respects; (3) the consummation of the transactions being permitted by applicable law to which AGBA, Merger Sub, or the Company is subject; (4) there having been no material adverse effect to the Company; (5) no order having been issued by any court, regulatory or governmental body limiting the consummation of the Merger or AGBA’s ownership, conduct, or operation of the Company’s business following the Closing; (6) Triller LLC Form S-1 Registration Statement (Registration No. 333-273623) filed with the Securities and Exchange Commission (“SEC”) on January 29, 2024 having been withdrawn; (7) no third party approvals being anticipated by the parties; and (8) closing deliveries having been delivered to AGBA by the Company, including among other things, customary closing certificates, third party consents, final closing consideration spreadsheet, written resignation of each director and officer of the Company, statement certifying interests in the Company do not constitute “United States real property interests”, written consents evidencing the stockholder approval, Operative Documents (as defined below), and certificate of merger executed by the Company.

Termination

The Merger Agreement may be terminated at any time prior to the Closing by:

| (a) | the written consent of AGBA and the Company; |

| (b) | AGBA, if AGBA reasonably concludes in good faith that any of AGBA and Merger Sub’s Conditions to closing is or becomes impossible to satisfy (other than solely as a result of any breach of the Merger Agreement by AGBA); |

| (c) | AGBA, in the event of a breach by the Company of any representation, warranty, covenant, or agreement contained in the Merger Agreement and the other agreements, documents, and certificates referenced in the Merger Agreement to be executed and delivered on the Agreement Date or prior to or at the Closing (collectively, the “Operative Documents”) that has not been cured or is not curable by the Company within 15 days after AGBA delivers notice to the Company regarding such breach; |

| (d) | the Company, in the event of a breach by AGBA of any representation, warranty, covenant, or agreement contained herein or in any Operative Document that has not been cured or is not curable by AGBA within 15 days after the Company delivers notice to AGBA regarding such breach; |

| (e) | the Company if AGBA experiences a material adverse effect, or by AGBA if the Company experiences a material adverse effect; or |

| (f) | AGBA, if the Company has not provided the notices required pursuant to Section 4.10 no later than five business days after the Agreement Date. |

Lock-Ups

Of the 313,157,015 shares of Delaware Parent Common Stock to be issued to the Stockholders at the Closing, holders of an aggregate of 297,686,312 shares of Delaware Parent Common Stock will be bound by a standard lock-up covenant as to those shares for a period of 165 days after the date of Closing.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the actual agreement, a copy of which is included as Exhibit 2.1 to this Current Report on Form 8-K, and incorporated herein by reference.

Related Agreements

AGBA Shareholder Support Agreement

Contemporaneously with the execution of the Merger Agreement, certain holders of AGBA ordinary shares, representing over 75% of the voting power of AGBA as of April 12, 2024, entered into a support agreement (the “AGBA Shareholder Support Agreement”), pursuant to which such holders agreed to, among other things, agree to vote their shares in favor of the Merger Agreement and the Merger, and other proposals to be presented to them as described in the proxy statement to be delivered to AGBA’s shareholders in connection with the shareholder meeting to approve the transactions set forth in the Merger Agreement (including, without limitation, the AGBA Domestication.

The foregoing description of the AGBA Shareholder Support Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the actual agreement, a copy of which is included as Exhibit 10.1 to this Current Report on Form 8-K, and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On April 18, 2024, AGBA and Triller issued a press release announcing the execution of the Merger Agreement. Attached hereto as Exhibit 99.1 and incorporated into this Item 7.01 by reference is the copy of the press release.

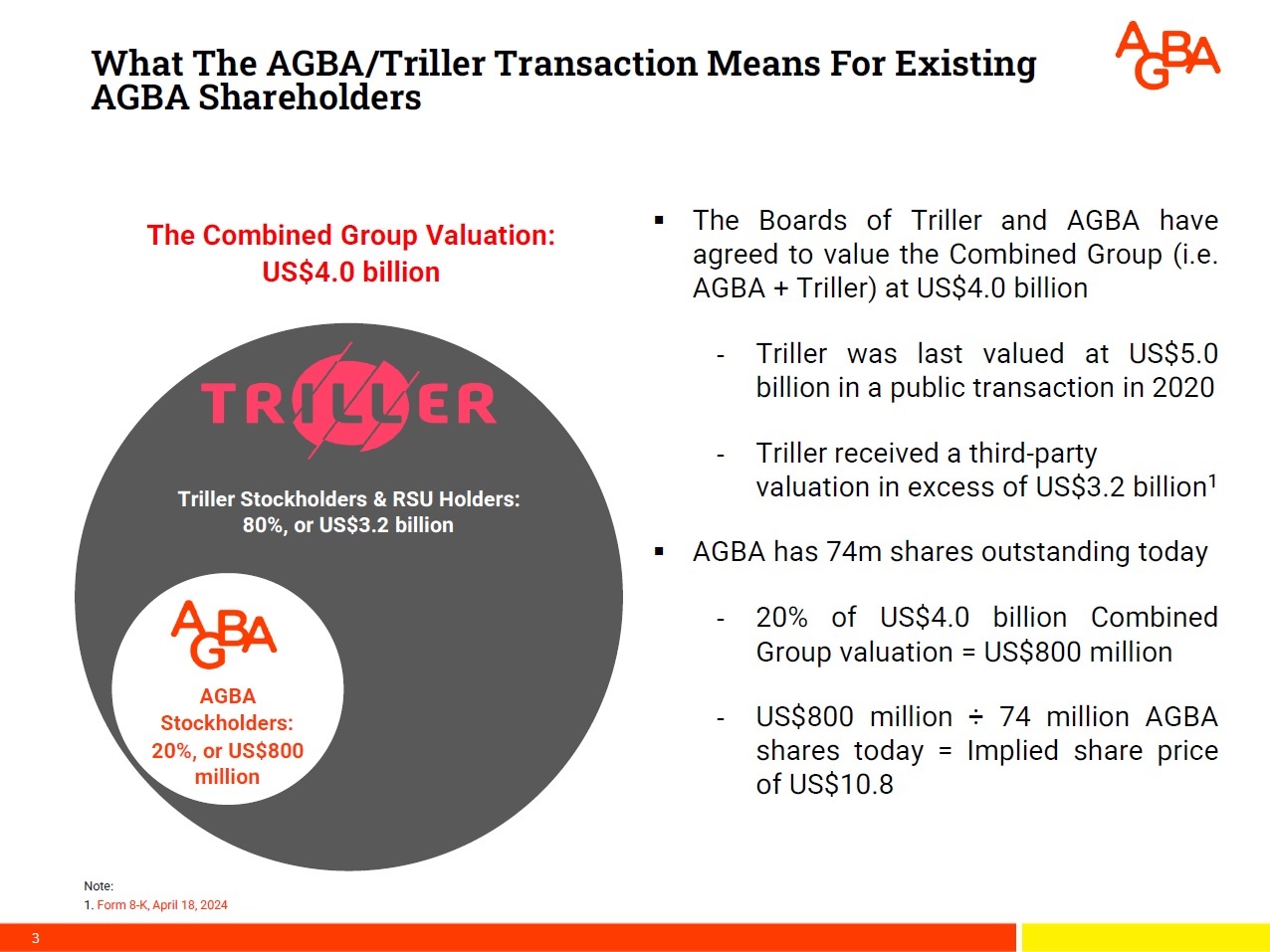

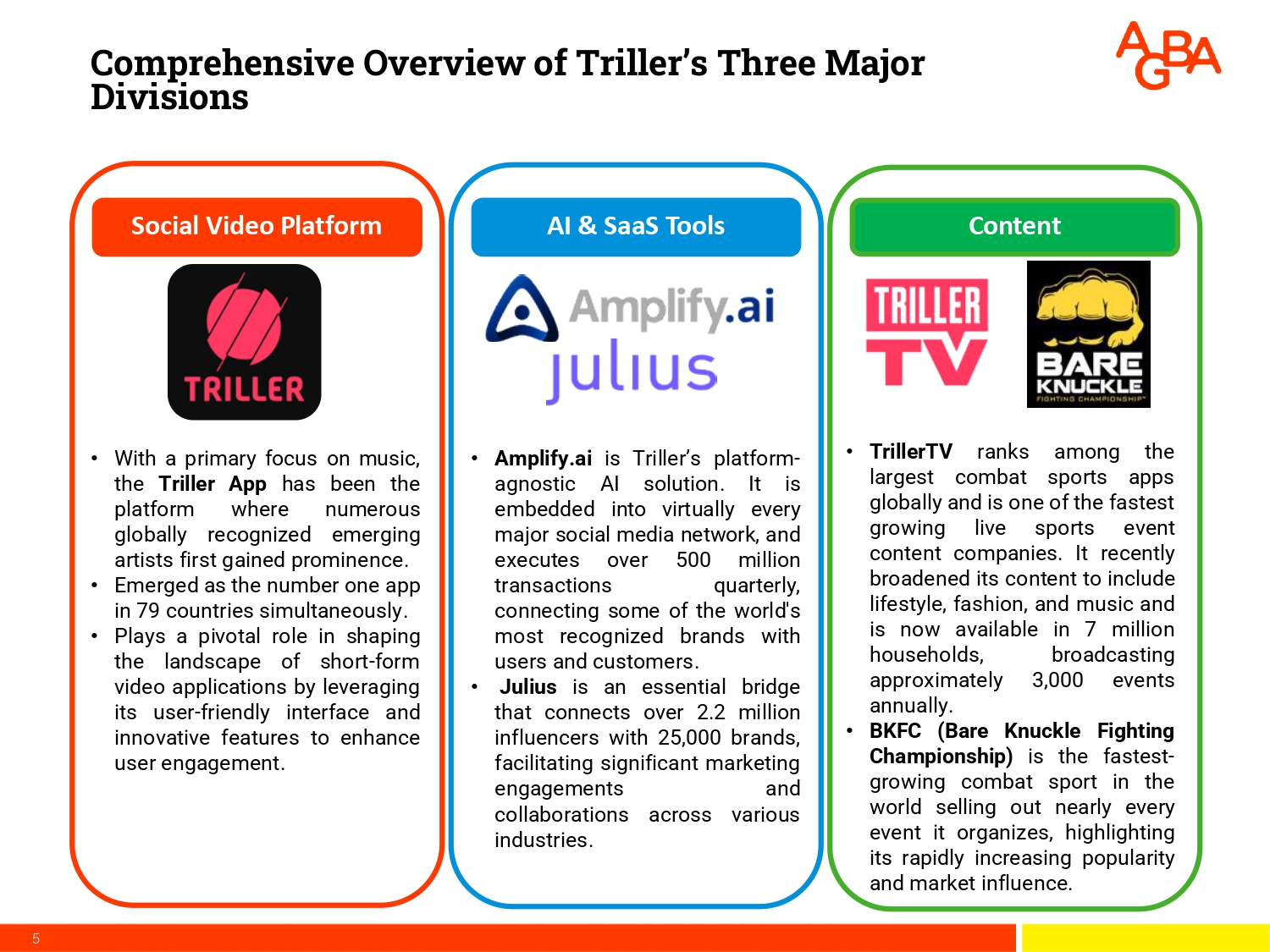

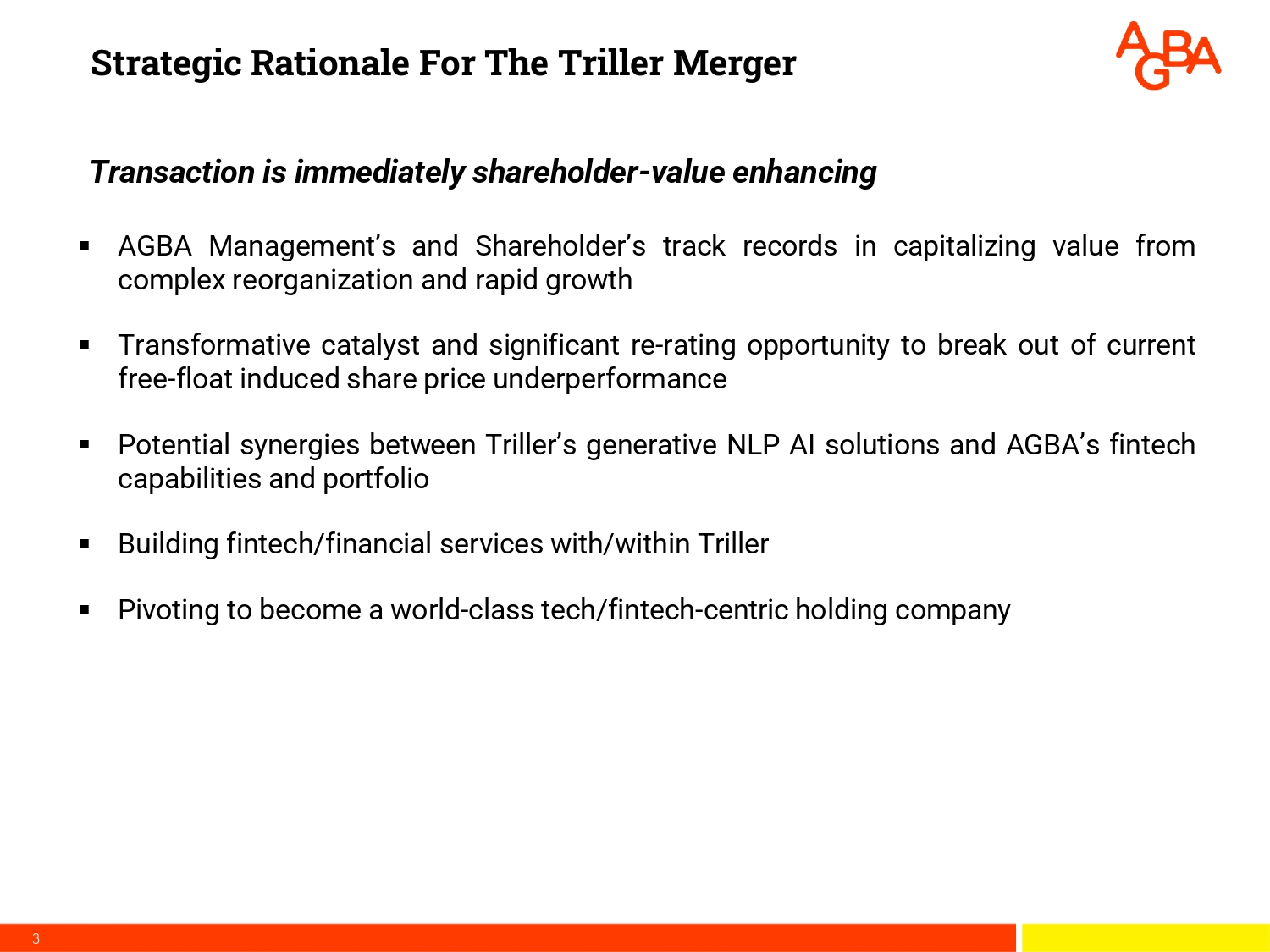

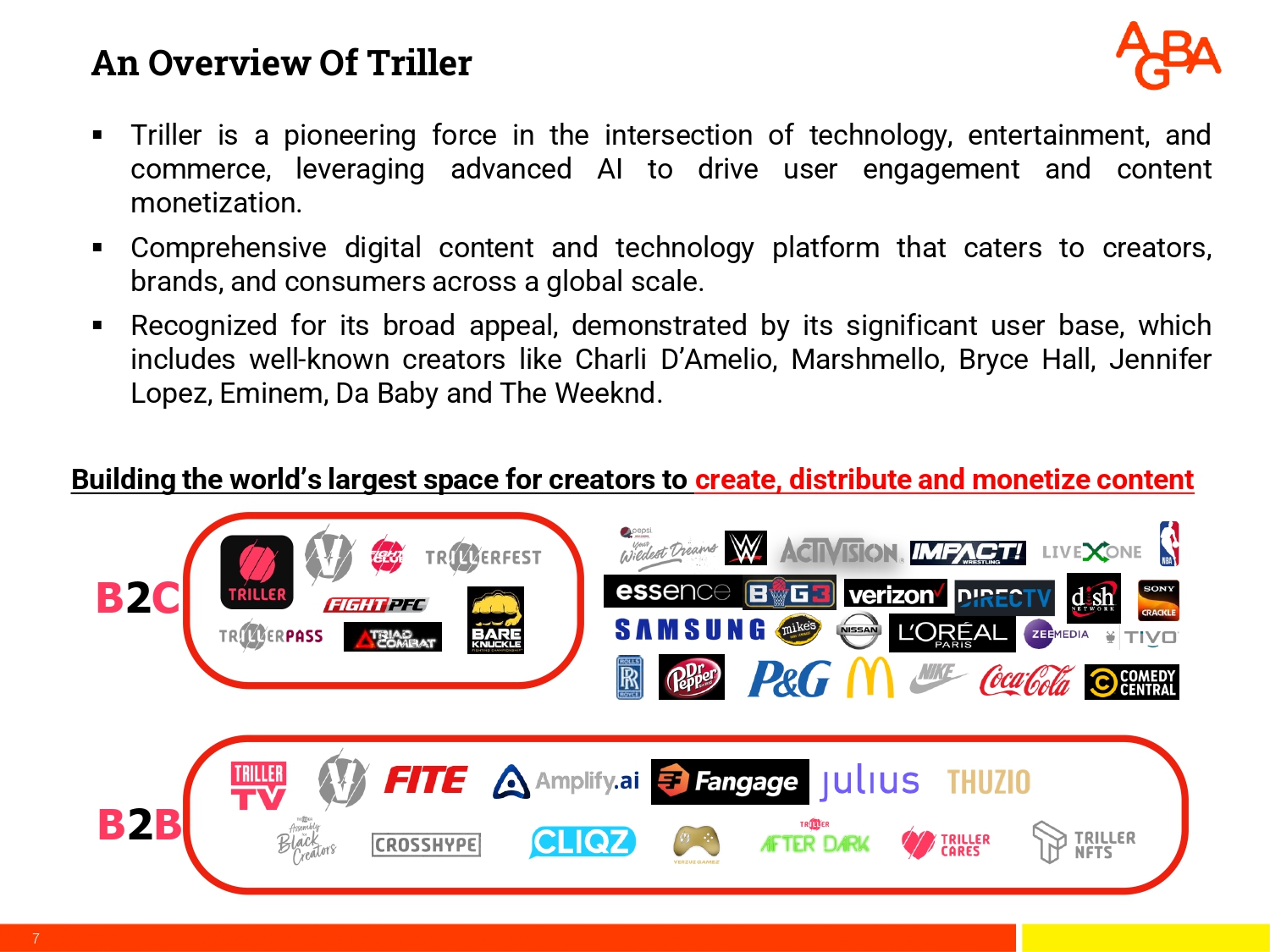

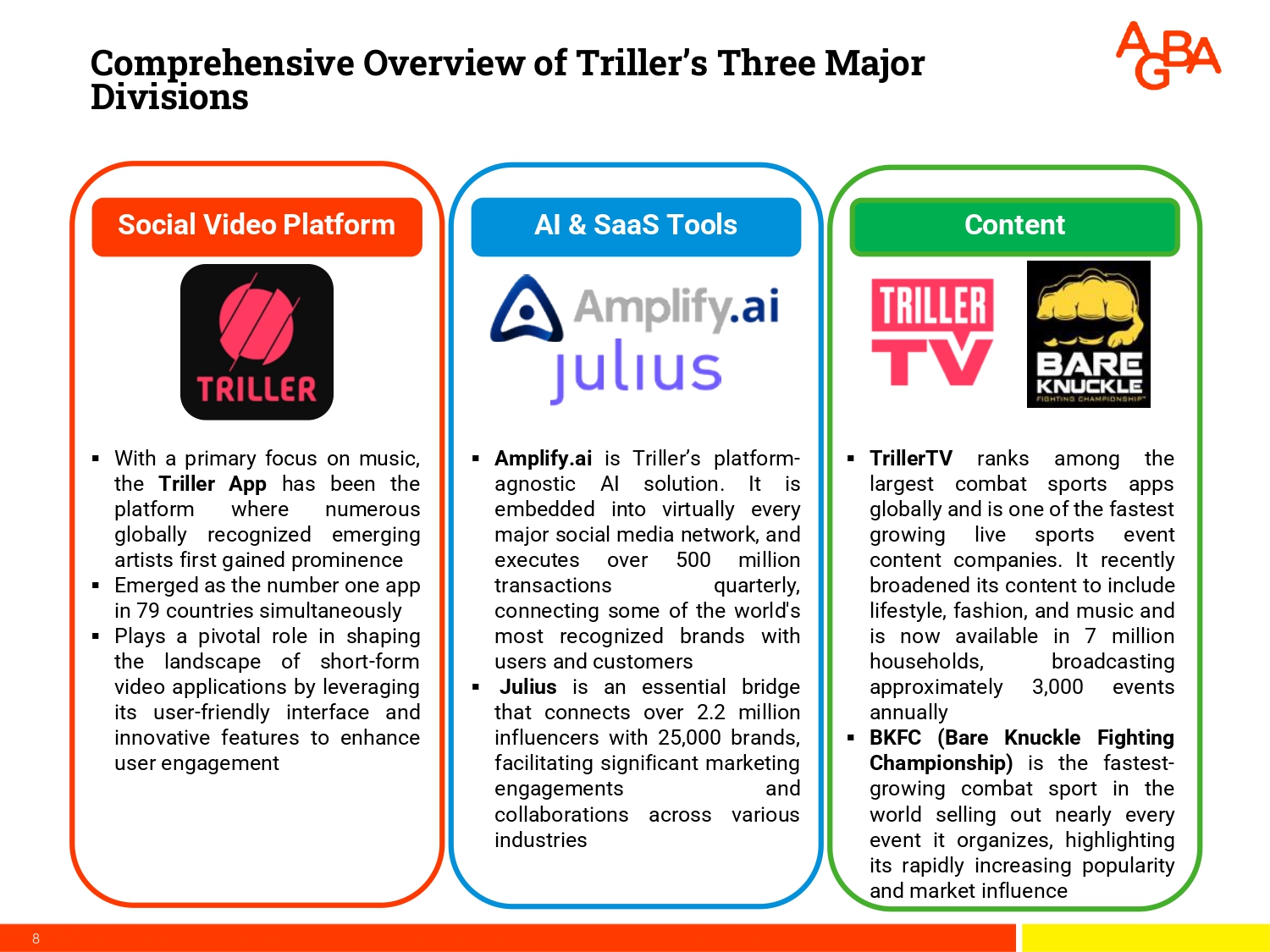

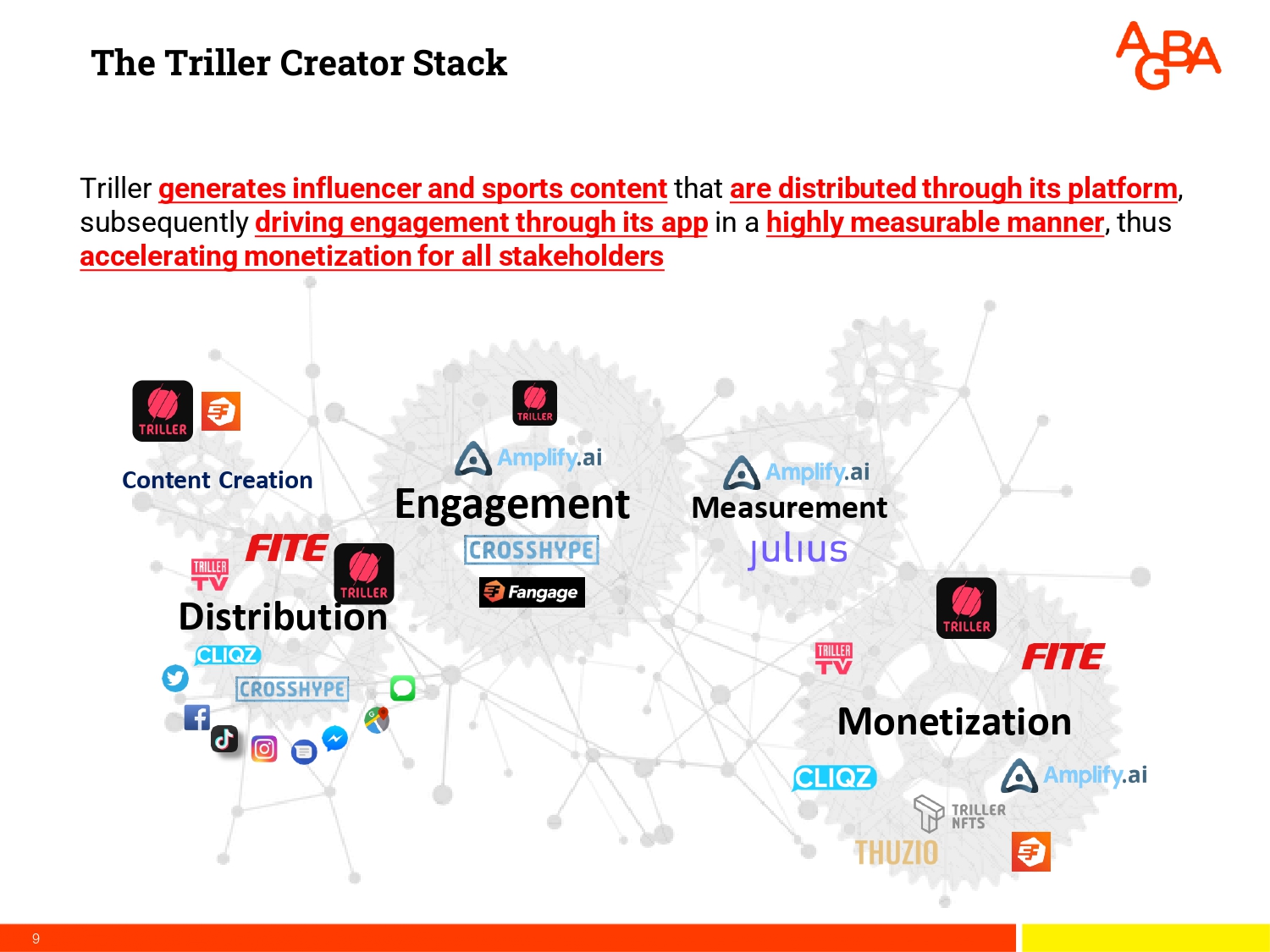

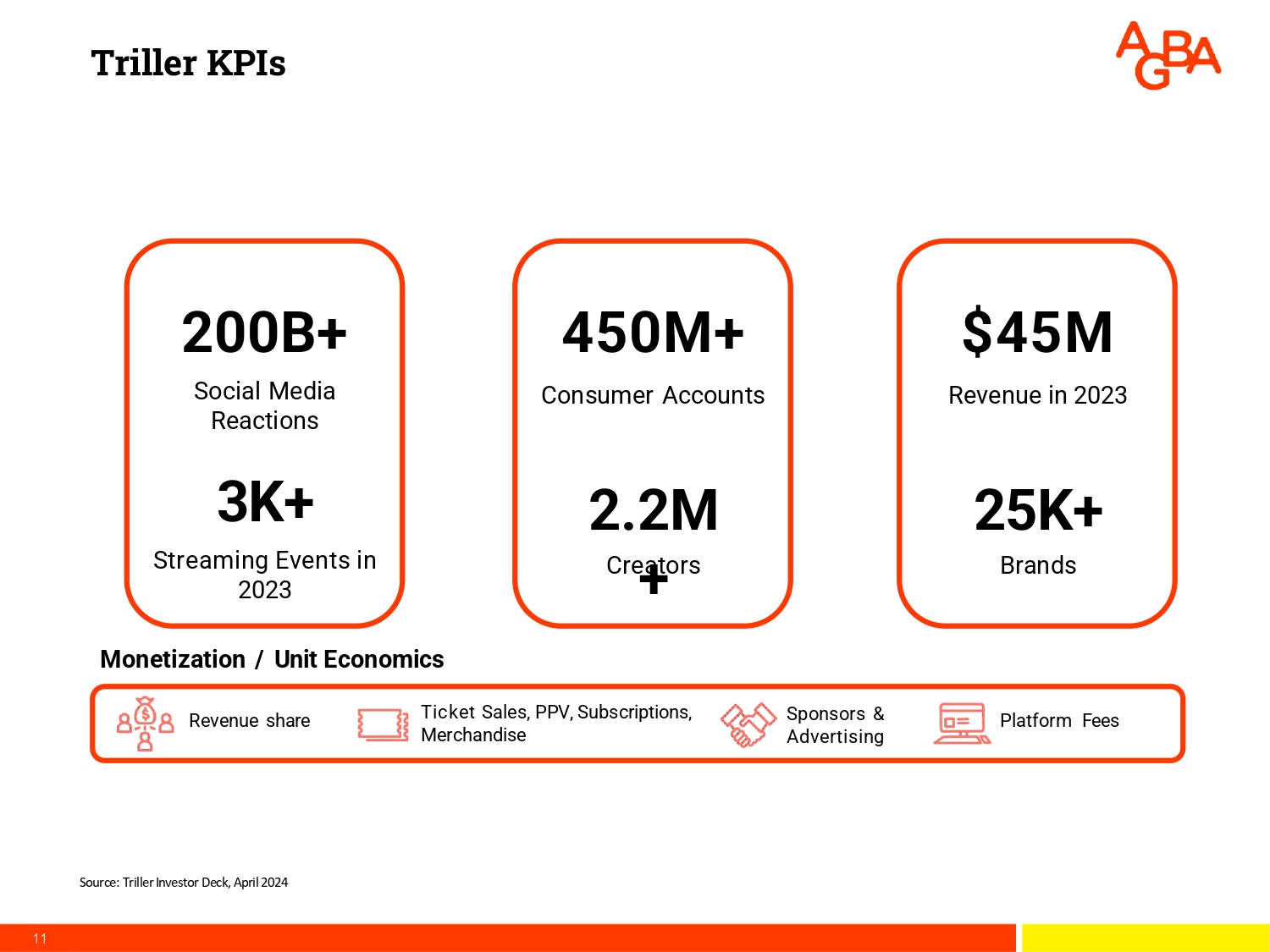

On April 18, 2024, AGBA released two investor presentations (the “Investor Presentations”) which include, among other things, information about Triller and terms of the Merger Agreement. AGBA may use the Investor Presentations from time to time in investor communications and conferences. Copies of the Investor Presentations are attached hereto as Exhibits 99.2 and 99.3 and are also available on the AGBA’s investor relations website, https://www.agba.com/ir/.

The information contained in the press release and the Investor Presentations is summary information that is intended to be considered in the context of AGBA’s SEC filings and other public announcements that AGBA may make, by press release or otherwise, from time to time.

The information in this Item 7.01 (including Exhibits 99.1, 99.2 and 99.3) is being furnished and shall not be deemed to be filed for purposes of Section 18 of the Exchange Act, or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

IMPORTANT NOTICES

Important Notice Regarding Forward-Looking Statements

This Current Report on Form 8-K contains certain “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended. Statements that are not historical facts, including statements about the pending transactions described above, and the parties’ perspectives and expectations, are forward-looking statements. Such statements include, but are not limited to, statements regarding the proposed transaction, including the anticipated initial enterprise value and post-closing equity value, the benefits of the proposed transaction, integration plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including estimates for growth, the expected management and governance of the combined company, and the expected timing of the transactions. The words “expect,” “believe,” “estimate,” “intend,” “plan” and similar expressions indicate forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to various risks and uncertainties, assumptions (including assumptions about general economic, market, industry and operational factors), known or unknown, which could cause the actual results to vary materially from those indicated or anticipated.

Such risks and uncertainties include, but are not limited to: (i) the risk that the Merger may not be completed in a timely manner or at all, which may adversely affect the price of AGBA’s securities; (ii) the failure to satisfy the conditions to the consummation of the Merger, including the approval of the Merger Agreement by the shareholders of AGBA; (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement; (iv) the outcome of any legal proceedings that may be instituted against any of the parties to the Merger Agreement following the announcement of the entry into the Merger Agreement and proposed Merger; (v) the ability of the parties to recognize the benefits of the Merger Agreement and the proposed Merger; (vi) the lack of useful financial information for an accurate estimate of future capital expenditures and future revenue; (vii) statements regarding Triller’s industry and market size; (viii) financial condition and performance of Triller, including the anticipated benefits, the implied enterprise value, the expected financial impacts of the Merger, the financial condition, liquidity, results of operations, the products, the expected future performance and market opportunities of Triller; (ix) the impact from future regulatory, judicial, and legislative changes in Triller’s industry; (x) competition from larger technology companies that have greater resources, technology, relationships and/or expertise; and (xi) those factors discussed in AGBA’s filings with the SEC and those that will be contained in the definitive proxy statement relating to the Merger. You should carefully consider the foregoing factors and the other risks and uncertainties that will be described in the “Risk Factors” section of the definitive proxy statement and other documents to be filed by AGBA from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and while AGBA and Triller may elect to update these forward-looking statements at some point in the future, they assume no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, subject to applicable law. Neither AGBA nor Triller gives any assurance that AGBA, or Triller, or the combined company, will achieve its expectations.

Additional Information and Where to Find It

In connection with the Merger Agreement and the proposed Merger, AGBA intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A, which will be mailed or otherwise disseminated to the shareholders of AGBA as of the record date established for voting on the proposed transactions contemplated by the Merger Agreement. AGBA may also file other relevant documents regarding the proposed Merger with the SEC. THIS PRESS RELEASE DOES NOT CONTAIN ALL THE INFORMATION THAT SHOULD BE CONSIDERED CONCERNING THE PROPOSED MERGER AND IS NOT INTENDED TO FORM THE BASIS OF ANY INVESTMENT DECISION OR ANY OTHER DECISION IN RESPECT OF THE MERGER. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF AGBA ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER AS THEY BECOME AVAILABLE, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

Investors and security holders may obtain free copies of the definitive proxy statement (if and when available) and other documents that are filed or will be filed with the SEC by AGBA through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by AGBA will be available free of charge at: AGBA Group Holding Limited, AGBA Tower, 68 Johnston Road, Wan Chai, Hong Kong SAR, attention: Mr. Ng Wing Fai, Chief Executive Officer.

Participants in Solicitation

AGBA and Triller, and their respective directors and executive officers, may be deemed participants in the solicitation of proxies from AGBA’s shareholders in respect of the proposed Business Combination. AGBA’s shareholders and other interested persons may obtain more detailed information about the names and interests of these directors and officers in AGBA’s proxy statement on Schedule 14A, when it is filed with the SEC. Information about AGBA’s directors and executive officers and their ownership of AGBA ordinary shares is set forth in AGBA’s annual report on Form 10-K, filed with the SEC on March 28, 2024. These documents can be obtained free of charge from the sources specified above and at the SEC’s web site at www.sec.gov.

No Offer or Solicitation

This Current Report on Form 8-K is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the transactions described above and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of AGBA or the Company, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Item 9.01. Financial Statements and Exhibits.

| (d) | Exhibits. |

| Exhibit No. | Description | |

| 2.1 | Merger Agreement dated April 16, 2024 by, among others, AGBA and Triller | |

| 10.1 | AGBA Shareholder Support Agreement dated April 16, 2024 | |

| 99.1 | Press Release dated April 18, 2024 | |

| 99.2 | Investor presentation titled “Triller + AGBA What it Means to Existing AGBA Shareholders” | |

| 99.3 | Investor presentation titled “Triller + AGBA Forging A New Path Ahead” | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AGBA GROUP HOLDING LIMITED | |||

| By: | /s/ Shu Pei Huang, Desmond | ||

| Name: | Shu Pei Huang, Desmond | ||

| Title: | Acting Group Chief Financial Officer | ||

| Dated: April 18, 2024 | |||

6

Exhibit 2.1

EXECUTION VERSION

AGREEMENT AND PLAN OF MERGER

by and among

AGBA GROUP HOLDING LIMITED,

AGBA SOCIAL INC.,

TRILLER CORP.

and

HOLDER REPRESENTATIVE

as the HOLDER REPRESENTATIVE

Dated as of April 16, 2024

TABLE OF CONTENTS

| Page | ||

| ARTICLE I | THE REORGANIZATION, DOMESTICATION AND MERGER | 3 |

| 1.1 | The Reorganization and the Domestication | 3 |

| 1.2 | The Merger | 3 |

| 1.3 | The Closing | 3 |

| 1.4 | Effective Date and Time | 4 |

| 1.5 | Certificate of Incorporation and Bylaws of the Surviving Corporation | 4 |

| 1.6 | Directors and Officers | 4 |

| 1.7 | Effect of the Merger | 4 |

| 1.8 | Reserved Shares | 8 |

| 1.9 | Corporation RSUs | 8 |

| 1.10 | Closing Deliveries | 8 |

| 1.11 | Tax Withholding | 9 |

| 1.12 | Securities Act Matters | 9 |

| ARTICLE II | REPRESENTATIONS AND WARRANTIES OF THE CORPORATION | 10 |

| 2.1 | Organization and Good Standing; Books and Records | 10 |

| 2.2 | Authority and Enforceability | 11 |

| 2.3 | Capitalization and Stock Rights; Consideration Spreadsheet; Subsidiaries | 11 |

| 2.4 | No Approvals; No Conflicts | 13 |

| 2.5 | Financial Statements; No Undisclosed Liabilities | 13 |

| 2.6 | Absence of Certain Changes or Events | 14 |

| 2.7 | Property | 14 |

| 2.8 | Labor and Employment Matters; Nondisclosure and Non-Competition Agreements | 15 |

| 2.9 | Employee Benefit Plans | 17 |

| 2.10 | Intellectual Property | 20 |

| 2.11 | Contracts | 27 |

| 2.12 | Claims, Legal Proceedings, and Orders | 28 |

| 2.13 | Corporation Permits; Compliance with Laws | 29 |

| 2.14 | Environmental Compliance | 30 |

| 2.15 | Taxes | 30 |

| 2.16 | Tax Consequences | 34 |

| 2.17 | Related Party Interests | 34 |

| 2.18 | Insurance | 34 |

| 2.19 | Brokers or Finders | 34 |

| 2.20 | Bank Accounts | 35 |

| 2.21 | Customers and Suppliers | 35 |

| 2.22 | Full Disclosure | 35 |

TABLE OF CONTENTS CONTINUED

| Page | ||

| ARTICLE III | REPRESENTATIONS AND WARRANTIES OF PARENT AND MERGER SUB | 36 |

| 3.1 | Organization and Good Standing | 36 |

| 3.2 | Authority and Enforceability | 36 |

| 3.3 | Capitalization | 36 |

| 3.4 | Brokers | 37 |

| 3.5 | No Approvals; No Conflicts | 37 |

| 3.6 | Full Disclosure | 37 |

| ARTICLE IV | COVENANTS | 38 |

| 4.1 | Covenants of the Corporation Prior to the Merger Effective Time | 38 |

| 4.2 | Notices; Actions | 40 |

| 4.3 | Further Action | 40 |

| 4.4 | Confidentiality | 40 |

| 4.5 | Additional Financing | 41 |

| 4.6 | Exclusivity | 41 |

| 4.7 | Tax Matters | 41 |

| 4.8 | Notification of Certain Matters | 42 |

| 4.9 | Access to Information; Interim Period Cooperation | 42 |

| 4.10 | Stockholder Approval Matters | 43 |

| 4.11 | Parent Proxy Statement | 43 |

| ARTICLE V | CONDITIONS PRECEDENT TO OBLIGATIONS OF PARENT AND MERGER SUB TO THE CLOSING | 44 |

| 5.1 | Accuracy of Representations and Warranties | 44 |

| 5.2 | Performance of Agreements | 44 |

| 5.3 | Compliance with Laws | 44 |

| 5.4 | Material Adverse Effect | 45 |

| 5.5 | Legal Proceedings | 45 |

| 5.6 | Withdrawal of S-1 Registration Statement | 45 |

| 5.7 | Regulatory and Third Party Approvals | 45 |

| 5.8 | Receipt of Closing Deliveries | 45 |

| ARTICLE VI | CONDITIONS PRECEDENT TO OBLIGATIONS OF THE CORPORATION TO THE CLOSING | 46 |

| 6.1 | Accuracy of Representations and Warranties | 46 |

| 6.2 | Performance of Agreements | 46 |

| 6.3 | Compliance with Laws | 46 |

| 6.4 | Receipt of Closing Deliveries | 47 |

| 6.5 | Regulatory and Third Party Approvals | 47 |

| ARTICLE VII | SURVIVAL; HOLDER REPRESENTATIVE | 47 |

| 7.1 | No Survival of Representations, Warranties, and Covenants | 47 |

| ARTICLE VIII | TERMINATION | 48 |

| 8.1 | Termination | 48 |

| 8.2 | Effect of Termination | 48 |

| ARTICLE IX | GENERAL | 48 |

| 9.1 | Expenses | 48 |

| 9.2 | Notices | 49 |

| 9.3 | Severability | 50 |

| 9.4 | Entire Agreement | 50 |

| 9.5 | Assignment; Parties in Interest | 50 |

| 9.6 | Governing Law; Jurisdiction; Waiver of Jury Trial | 50 |

| 9.7 | Headings; Construction | 51 |

| 9.8 | Counterparts | 51 |

| 9.9 | Remedies | 52 |

| 9.10 | Amendment | 52 |

| 9.11 | Waiver | 52 |

AGREEMENT AND PLAN OF MERGER

This Agreement and Plan of Merger (this “Agreement”) is made and entered into as of April 16, 2024, by and among AGBA Group Holding Limited, a British Virgin Islands business company (“Parent”), AGBA Social Inc., a Delaware corporation and wholly owned subsidiary of Parent (“Merger Sub”), Triller Corp., a Delaware corporation (the “Corporation”), and Bobby Sarnevesht, solely in the capacity of the Holder Representative. Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to such terms in Annex A.

WHEREAS, the board of directors of the Corporation has unanimously, and the requisite majority of the Stockholders have, (a) determined that this Agreement and the Transactions are fair to, and in the best interests of, the Corporation and the Stockholders and (b) approved and declared advisable the execution, delivery, and performance of this Agreement and the consummation of the Transactions;

WHEREAS, the board of directors of Parent has unanimously (a) determined that this Agreement and the Parent Transactions are fair to, and in the best interests of, Parent and its shareholders, (b) approved and declared advisable the execution, delivery, and performance of this Agreement and the consummation of the Parent Transactions, and (c) resolved to recommend that the Parent’s shareholders adopt this Agreement and approve the Parent Transactions;

WHEREAS, the board of directors and sole stockholder of Merger Sub have approved and declared advisable the execution, delivery, and performance of this Agreement and the consummation of the Parent Transactions;

WHEREAS, Triller Hold Co LLC, a Delaware limited liability (“Triller LLC”) and the Corporation have executed documentation relating to the reorganization of Triller LLC into the Corporation (the “Reorganization”) and have, concurrently with the execution of this Agreement, filed a certificate of merger relating to the Reorganization in the form of Exhibit A hereto (the “Delaware Reorg Certificate”) with the Secretary of State of the State of Delaware (the “Delaware Secretary of State”), pursuant to which the Reorganization shall be legally effectuated within two business days of the Agreement Date, and as a result of which the Corporation shall become the 100% owner of Triller LLC (such time of effectiveness is referred to as the “Reorg Effective Time”);

WHEREAS, this Agreement shall become effective and legally binding on the Parties at the Reorg Effective Time (the date on which the Reorg Effective Time occurs is referred to herein as the “Agreement Date”);

WHEREAS, prior to the Merger Effective Time, Parent will domesticate into the United States as a Delaware corporation (the “Domestication”) by filing a Notice of Continuation Out of the Virgin Islands together with supporting documents with the British Virgin Islands Registrar of Corporate Affairs (the “Registrar”) under section 184 of the BVI Companies Act and receiving a Certificate of Discontinuance from the Registrar in relation to the Domestication pursuant to section 184 of the BVI Companies Act (the “Certificate of Discontinuance”), a Certificate of Domestication under Section 388 of the DGCL in the form attached hereto as Exhibit B (the “Certificate of Domestication”) along with a Certificate of Incorporation under Section 103 of the DCGL in the form attached hereto as Exhibit C (the “Delaware Parent Certificate of Incorporation”), upon which Parent shall become a Delaware corporation (Parent, after giving effect to the Domestication, is sometimes referred to herein as “Delaware Parent”); WHEREAS, at the Merger Effective Time, Merger Sub shall be merged with and into the Corporation (the “Merger”), with the Corporation as the surviving corporation after the Merger Effective Time as a wholly owned subsidiary of Delaware Parent;

WHEREAS, Parent intends that, for U.S. federal and applicable state income tax purposes, the Domestication will qualify as a “reorganization” within the meaning of Section 368(a) of the Code and the Treasury Regulations promulgated thereunder (the “Domestication Intended Tax Treatment”), and this Agreement is intended to constitute a “plan of reorganization” within the meaning of Section 368 of the Code and Treasury Regulations Sections 1.368-2(g) and 1.368-3(a) for purposes of Sections 354, 361 and 368 of the Code (a “Plan of Reorganization”) with respect to the Domestication;

WHEREAS, Each of the parties hereto intends that, for U.S. federal and applicable state income tax purposes, the Merger will qualify as (i) a “reorganization” within the meaning of Section 368(a) of the Code and the Treasury Regulations promulgated thereunder, to which each of Parent and the Company are to be parties under Section 368(b) of the Code, and this Agreement is intended to constitute a “Plan of Reorganization” with respect to the Merger, and (ii) an exchange under Section 351 of the Code ((i) and (ii), collectively, the “Merger Intended Tax Treatment”);

WHEREAS, concurrently with the execution of this Agreement, the majority shareholder and certain other shareholders of Parent, who together own in excess of 90% of the outstanding Parent Ordinary Shares, have executed a voting agreement with the Corporation (the “Parent Shareholder Voting Agreement”) which is attached as Exhibit D hereto, pursuant to which such shareholders have irrevocably agreed to vote in favor of this Agreement and the Parent Transactions, which, at the Parent Shareholder Meeting, will constitute the full vote required to consummate the Parent Transactions;

WHEREAS, the board of directors of the Corporation has unanimously, and the requisite majority of the Stockholders have, voted in favor of this Agreement and the Transactions;

WHEREAS, Triller LLC has recently received a third party valuation in excess of $3.2 billion;

WHEREAS, The parties acknowledge that, after giving effect to Domestication and the Merger, the pro forma valuation of the combined Delaware Parent shall be $4 billion, with the Stockholders and the holders of Corporation RSUs receiving an aggregate of 406,907,308 shares of Delaware Parent Common Stock, Delaware Parent Preferred Stock and/or Delaware Parent RSUs, collectively, representing in the aggregate 80% of the combined post-Merger Parent valuation, and the current Parent shareholders owning an aggregate of 101,726,759 shares of Delaware Parent Common Stock representing 20% of the post-Merger Parent combined valuation; WHEREAS, Parent believes that it is in the interests of all Parties that the Stockholders, other than the Unrestricted Stockholders to the extent of their Unrestricted Shares, be subject to the Lock-Up; and the Corporation has agreed to enforce the Lock-Up from and after the Effective Time as to all Delaware Parent Common Stock and Delaware Parent Preferred Stock to be issued to the Stockholders other than the Unrestricted Shares;

WHEREAS, Parent has agreed (on its behalf and, as of the Domestication, on behalf of Delaware Parent) to invest or arrange for an investment in the form of equity in the amount of $500 million into Delaware Parent, post-Merger, on terms and conditions to be agreed pursuant to long form definitive agreements;

NOW, THEREFORE, in consideration of the premises, representations, warranties, and the mutual agreements and covenants set forth herein, and intending to be legally bound, Parent, Merger Sub, the Corporation and the Holder Representative hereby agree as follows:

ARTICLE I

THE REORGANIZATION, DOMESTICATION AND MERGER

| 1.1 | The Reorganization and the Domestication |

(a) The Reorganization. At the Reorg Effective Time, Triller LLC shall have reorganized into the Corporation. The Corporation shall provide evidence to Parent of the filing of the Delaware Reorg Certificate (including the certificate of merger to be filed in conjunction therewith and all other required exhibits thereto) filed with the Delaware Secretary of State in connection therewith, promptly after receipt thereof.

(b) The Domestication. After the Reorg Effective Time, and on the Domestication Date, Parent shall cause the Domestication to become effective by filing (i) a Notice of Continuation Out of the Virgin Islands together with supporting documents with the Registrar and the Parent shall have received a Certificate of Discontinuance, (ii) a Plan of Domestication pursuant to Sections 265 and 388 of the DGCL, (iii) the Certificate of Domestication and (iv) the Delaware Parent Certificate of Incorporation, as to (ii) through (iv), with the Delaware Secretary of State. As of the effectiveness of the Domestication, the bylaws in the form of Exhibit E hereto (the “Delaware Parent Bylaws”) shall be the bylaws of Delaware Parent.

| 1.2 | The Merger |

Upon the terms and subject to the conditions of this Agreement, (a) at the Merger Effective Time, the separate existence of Merger Sub shall cease and Merger Sub shall be merged with and into the Corporation, with the Corporation as the surviving corporation after the Merger Effective Time (the “Surviving Corporation”) and a wholly owned subsidiary of Delaware Parent and (b) from and after the Merger Effective Time, the Merger shall have all the effects of a merger under the DGCL and other Applicable Law.

| 1.3 | The Closing |

Upon the terms and subject to the conditions of this Agreement, the closing of the Merger (the “Closing”) shall take place at the offices of Loeb & Loeb LLP, 10100 Santa Monica Blvd #2200, Los Angeles, CA 90067, at 10:00 a.m. local time as soon as practicable after the satisfaction or waiver of the conditions set forth in Article V and Article VI (other than such conditions that, by their terms, are intended to be satisfied at the Closing, but subject to the satisfaction or waiver of such conditions) or at such other time and place as Parent and the Corporation may mutually agree in writing. The Closing may be effected by electronic means. The date on which the Closing occurs is referred to herein as the “Closing Date.”

| 1.4 | Effective Date and Time |

On the Closing Date, upon the terms and subject to the conditions of this Agreement, the parties hereto shall cause the certificate attached hereto as Exhibit F (the “Certificate of Merger”) complying with the applicable provisions of the DGCL to be properly executed and filed with the Delaware Secretary of State. The Merger shall become effective on the date and at the time of the filing of the Certificate of Merger or at such other date and time as may be specified in the Certificate of Merger (the “Merger Effective Time”).

| 1.5 | Certificate of Incorporation and Bylaws of the Surviving Corporation |

Unless otherwise specified by Parent prior to the Merger Effective Time, at the Merger Effective Time, by virtue of the Merger, the certificate of incorporation (the “Surviving Corporation Certificate of Incorporation”) and bylaws of the Corporation (the “Surviving Corporation Bylaws”), each in the form of Exhibit G and Exhibit H, respectively, as in effect on the Agreement Date shall be the certificate of incorporation and Bylaws of the Surviving Corporation. Thereafter, the Certificate of Incorporation and Bylaws of the Surviving Corporation may be amended in accordance with their respective terms and as provided by Applicable Law.

| 1.6 | Directors and Officers |

At the Merger Effective Time, the directors and executive officers of Delaware Parent shall include the persons designated on Exhibit I, and such appointed directors and officers shall hold office until their respective successors are duly elected or appointed and qualified or until their earlier death, resignation, or removal in accordance with, and subject to, the Delaware Parent Certificate of Incorporation and the Delaware Parent Bylaws.

| 1.7 | Effect of the Merger |

| 1.7.1 | Treatment of Equity |

At the Merger Effective Time, upon the terms and subject to the conditions of this Agreement (including, as and to the extent applicable, Section 1.7.2), by virtue of the Merger and without any action on the part of any party hereto or the holders thereof:

(a) All shares of any class of capital stock of the Corporation held by the Corporation as treasury shares shall be canceled.

(b) Each issued and outstanding share of Series A Common Stock and Series B Common Stock, other than Dissenting Shares, shall be converted into the right to receive from Delaware Parent the Common Per Share Merger Consideration; and in the aggregate, the 318,694,432 shares of Common Stock as of the Agreement Date shall be converted into an aggregate of 313,157,015 shares of Delaware Parent Common Stock.

(c) Each issued and outstanding share of Preferred Stock, other than Dissenting Shares, shall be converted into the right to receive from Delaware Parent the Preferred Per Share Merger Consideration; and in the aggregate, the 37,702,230 shares of Preferred Stock as of the Agreement Date shall be converted into an aggregate of 35,328,888 shares of Delaware Parent Preferred Stock.

(d) Each Corporation RSU shall be canceled and converted into 0.9371 of a Delaware Parent RSU; and in the aggregate, the 62,345,778 Corporation RSUs outstanding as of the Agreement Date shall be converted into an aggregate of 58,421,134 Delaware Parent RSUs.

(e) Each issued and outstanding share of capital stock of Merger Sub shall be converted into one share of common stock of the Surviving Corporation.

(f) All Stockholders other than the Unrestricted Stockholders (as to their Unrestricted Shares) will be subject to the Lock-Up as to the portion of the Merger Consideration received by each of them.

| 1.7.2 | Consideration Spreadsheet |

Annex B (the “Initial Closing Consideration Spreadsheet”) sets forth, as of the Agreement Date, (a) the name of each Stockholder, and the number of shares of Stock (by class of Stock) held by such Stockholder, (b) the portion of the Merger Consideration to be paid to each Stockholder, (c) the name, address and email address (to the extent available) of each holder of Corporation RSUs, and the number of Corporation RSUs held by each such Person and (d) such other information reasonably requested by Parent. If there are any changes required to be made to the Initial Closing Consideration Spreadsheet between the Agreement Date and the Merger Effective Time, the Corporation shall deliver to Parent not less than three Business Days prior to the Closing Date a revised Initial Closing Consideration Spreadsheet (the “Final Closing Consideration Spreadsheet”), certified by the Chief Executive Officer of the Corporation, updated with the Corporation’s good faith estimates of such information as of the Closing Date (including without limitation the vesting of any Corporation RSUs into Stock) and reasonably satisfactory to Parent. The Final Closing Consideration Spreadsheet shall be prepared on the same basis and using the same methodologies, and in accordance with the same principles, as the Initial Closing Consideration Spreadsheet, including being reasonably satisfactory to Delaware Parent; provided, however, that the Final Closing Consideration Spreadsheet also shall include such other information that is reasonably necessary to effectuate the conversion of Stock and Company RSUs into Delaware Parent Common Stock and Delaware Parent RSUs and the delivery of Delaware Parent Stock and Delaware Parent RSUs to the respective recipients thereof, as soon as possible after the Closing and in an accurate and efficient manner.

| 1.7.3 | Dissenting Shares |

Stockholders who have complied with all the requirements for perfecting appraisal or dissenters’ rights, as required under the DGCL, shall be entitled to their appraisal or dissenters’ rights under the DGCL with respect to such shares (“Dissenting Shares”). Notwithstanding anything to the contrary herein, (a) if any holder of Dissenting Shares shall effectively withdraw or lose (through failure to perfect or otherwise) such holder’s appraisal or dissenters’ rights, then, as of the later of the Merger Effective Time and the occurrence of such event, such holder’s shares shall automatically be converted into and represent only the right to receive the portion of the Merger Consideration to which such holder is then entitled under this Agreement, without interest thereon and upon surrender of the certificate representing such shares in accordance with this Agreement together with any other documents required under Section 1.7.4 and (b) any Dissenting Shares held by a Stockholder who has perfected such Stockholder’s appraisal or dissenters’ rights for such shares in accordance with the DGCL shall not be converted into the right to receive any portion of the Merger Consideration pursuant to Section 1.7.1. The Corporation shall provide to Delaware Parent (i) prompt notice of any demands for appraisal or purchase received by the Corporation, withdrawals of such demands, and any other instruments related to such demands served in accordance with the DGCL and received by the Corporation and (ii) the right to direct all negotiations and proceedings with respect to such demands under the DGCL. The Corporation shall not, except with the prior written consent of Delaware Parent, or as otherwise required under the DGCL, voluntarily make any payment or offer to make any payment with respect to, or settle or offer to settle, any Claim or demand in respect of any Dissenting Shares. The payment of consideration under this Agreement to the Stockholders (other than in respect of Dissenting Shares, which shall be treated as provided in this Section 1.7.5 and under the DGCL) shall not be affected by the exercise or potential exercise of appraisal or dissenters’ rights under the DGCL by any Stockholder.

| 1.7.4 | Exchange of Certificates and Payment |

(a) Prior to the Merger Effective Time, Delaware Parent shall designate Continental Stock Transfer and Trust Company to act as exchange agent (the “Exchange Agent”) in the Merger. The Exchange Agent shall be responsible for exchanging and/or verifying the cancellation of share certificates (where share certificates were issued) representing Stock in exchange for Delaware Parent Common Stock or Delaware Parent Preferred Stock, as the case may be (together referred to as “Delaware Parent Stock”).

(b) At or prior to the Merger Effective Time, Delaware Parent shall deposit, or cause to be deposited, a copy of the stockholder list of the Corporation with the Exchange Agent updated to reflect, at the Merger Effective Time, the issuance of the Merger Consideration receivable by the Stockholders in accordance with the Final Closing Consideration Spreadsheet. The Merger Consideration shall be duly issued to the appropriate Stockholders upon the entry of the names of the Stockholders on the stockholder list of the Corporation. Prior to the Merger Effective Time, and if requested by the Exchange Agent, Parent shall send, or shall cause the Exchange Agent to send, to each Stockholder, a Letter of Transmittal for use in such exchange and/or verification, in form and substance reasonably satisfactory to Parent and the Corporation (a “Letter of Transmittal”) which shall specify that the delivery and/or cancellation of Corporation stock certificates (“Corporation Stock Certificates”) in respect of the portion of the Merger Consideration to be issued to each Stockholder shall be effected, and risk of loss and title shall pass, only upon proper delivery and/or cancellation of the Corporation Stock Certificates and other related transmittal documents to the Exchange Agent for use in such exchange.

(c) Upon surrender of a Corporation Stock Certificate for cancellation to the Exchange Agent or to such other agent or agents as may be appointed by Delaware Parent, together with a duly executed Letter of Transmittal (if required), which includes a release of certain Claims set forth therein, and such other documents (including IRS Form W-8 or W-9, as applicable) as may reasonably be required by Delaware Parent or the Exchange Agent, the holder of such Corporation Stock Certificate shall be entitled to receive in exchange therefor the portion of the Merger Consideration that such holder has the right to receive pursuant to Section 1.7.1, if any, and the Corporation Stock Certificate so surrendered shall forthwith be canceled. If any Corporation Stock Certificates shall have been lost, stolen, or destroyed, upon the making of an affidavit of such fact by the Stockholder Claiming such certificate to be lost, stolen, or destroyed, in form reasonably satisfactory to Delaware Parent, the Exchange Agent shall pay in exchange for such lost, stolen, or destroyed Corporation Stock Certificate the portion of the Merger Consideration that such Stockholder is entitled to receive pursuant to Section 1.7.1. Delaware Parent may, in its discretion and as a condition precedent to the issuance thereof, require such Stockholder to provide Delaware Parent with an indemnity agreement, in a form reasonably satisfactory to Delaware Parent, against any Claim that may be made against Delaware Parent with respect to the Corporation Stock Certificate alleged to have been lost, stolen, or destroyed, and a surety bond, reasonably satisfactory to Delaware Parent, to secure such indemnity obligation. No interest shall accrue on the Merger Consideration. If the Merger Consideration (or any portion thereof) is to be delivered to any Person other than the Person in whose name the Corporation Stock Certificate(s) surrendered in exchange therefor is registered, it shall be a condition to such delivery that the Person requesting such delivery shall pay to Delaware Parent any transfer or other Taxes required by reason of the payment of the Merger Consideration (or any portion thereof) to a Person other than the registered holder of the Corporation Stock Certificate(s) so surrendered, or shall establish to the satisfaction of Delaware Parent that such Tax has been paid or is not applicable.

(d) Delaware Parent’s delivery of the Merger Consideration to the Exchange Agent and/or the Surviving Corporation in accordance with and as set forth in this Section 1.7.4 constitutes Delaware Parent’s full performance of its obligations with respect to the payment of the Merger Consideration to the Stockholders in connection with the consummation of the Merger. Delaware Parent’s delivery of the applicable portion of the Merger Consideration to the Exchange Agent and/or the Surviving Corporation in accordance with and as set forth in this Section 1.7.4 constitutes Delaware Parent’s full performance of its obligations with respect to the payment of the Merger Consideration to each Stockholder in connection with the consummation of the Merger.

(e) Notwithstanding anything to the contrary contained herein, no fractional Delaware Parent Stock will be issued by virtue of the Merger, and each Person who would otherwise be entitled to a fraction of a share of Delaware Parent Stock (after aggregating all fractional shares of Delaware Parent Stock that otherwise would be received by such holder) shall instead have the number of shares of Delaware Parent Stock issued to such Person rounded down to the nearest whole share, without payment in lieu of such fractional shares.

| 1.7.5 | No Further Transfers |

After the Merger Effective Time, there shall be no transfers of any shares of Stock on the stock transfer books of the Corporation or the Surviving Corporation. If, after the Merger Effective Time, certificates formerly representing shares of Stock are presented to the Surviving Corporation, such shares shall be forwarded to the Exchange Agent and shall be canceled and exchanged in accordance with Section 1.7.4, subject, in the case of Dissenting Shares, to Section 1.7.53.

| 1.8 | Reserved Shares |

At the Closing, Delaware Parent shall issue certain shares of Delaware Parent Common Stock constituting a portion of the Merger Consideration, as a reserve (as further provided on Exhibit J hereto), which shares will be deposited into an escrow account and used to settle certain matters, if any, that relate to the affairs of the Corporation prior to the Reorganization Date, in each instance in the reasonable judgment of the Holder Representative. The Holder Representative shall give written instructions to the escrow agent to release such number of these reserved shares from time to time in settlement of any such matters, no later than six years after the Closing Date (or such shorter period to the extent that any statute of limitations for any such matters have expired). If Holder Representative fails to deliver such notice within such holding period, then Delaware Parent may, at its option and in its discretion, take legal title to all such remaining reserved shares (as treasury shares) and/or cancel such shares.

| 1.9 | Corporation RSUs |

Each Corporation RSU shall be canceled and converted into 0.9371 of a Delaware Parent RSU(s) as provided in Section 1.7.1(c). The Corporation agrees that the board of directors of the Corporation (or, if appropriate, any committee administering the Corporation RSU Plan) shall adopt such resolutions or take such other actions (including obtaining any required consents from the holders of such Corporation RSUs and providing notices required under the Corporation RSU Plan) as may be required to (a) effect the treatment of the Corporation RSUs as set forth in Section 1.7.1(c) as of the Closing and (b) terminate the Corporation RSU Plan and each Corporation RSU, as well as all other equity based incentive plans of the Corporation as of the Closing. The Corporation RSUs shall become restricted stock units of Delaware Parent (“Delaware Parent RSUs”) as of the Closing and Delaware Parent shall, prior to closing, establish and adopt an incentive plan that covers and governs the Delaware Parent RSUs. Any Corporation RSUs that have been converted into Delaware Parent RSUs and that have not, as of the end of their respective vesting periods, been vested by their terms, shall be cancelled and of no further legal effect.

| 1.10 | Closing Deliveries |

At or prior to the Closing, (a) Delaware Parent shall deliver to the Corporation all certificates, instruments, documents, and other deliverables set forth in Article VI and (b) the Corporation shall deliver to Delaware Parent all certificates, instruments, documents, and other deliverables set forth in Article V.

| 1.11 | Tax Withholding |

Each of Parent, Delaware Parent and Merger Sub and their agents shall be entitled to deduct and withhold from the Merger Consideration otherwise payable pursuant to this Agreement such amounts as it is required to deduct and withhold with respect to the making of such payment under the Code, or any provision of state, local or non-U.S. Tax Applicable Law (as reasonably determined by Parent, Delaware Parent or Merger Sub, respectively). To the extent that amounts are so withheld by Parent, Delaware Parent or Merger Sub or their agents, as the case may be, and paid over to the appropriate Governmental Body, such withheld amounts shall be treated for all purposes of this Agreement as having been paid to the Person in respect of which such deduction and withholding was made.

| 1.12 | Securities Act Matters |

(a) The parties acknowledge that the Delaware Parent Stock to be issued to the Stockholders in connection with the Merger will not be registered under the Securities Act.

(b) Each certificate representing Delaware Parent Common Stock and Delaware Parent Preferred Stock issued to the Stockholders shall be stamped or otherwise imprinted with a legend in substantially the following form: “THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE BEEN ACQUIRED FOR INVESTMENT AND HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR UNDER THE SECURITIES LAWS OF ANY STATE OR OTHER JURISDICTION. NEITHER THESE SECURITIES NOR ANY INTEREST OR PARTICIPATION HEREIN MAY BE REOFFERED, SOLD, ASSIGNED, TRANSFERRED, PLEDGED, ENCUMBERED OR OTHERWISE DISPOSED OF IN THE ABSENCE OF SUCH REGISTRATION OR AN EXEMPTION THEREFROM PURSUANT TO THE ACT AND APPLICABLE STATE SECURITIES LAWS. ANY OFFER, SALE, ASSIGNMENT, TRANSFER OR OTHER DISPOSITION OF THESE SECURITIES IN A TRANSACTION THAT IS NOT REGISTERED UNDER THE ACT IS SUBJECT TO THE CORPORATION’S RIGHT TO REQUIRE DELIVERY OF AN OPINION OF COUNSEL TO THE EFFECT THAT ANY PROPOSED TRANSFER OR RESALE IS IN COMPLIANCE WITH THE ACT AND ANY APPLICABLE STATE SECURITIES LAWS.”

(c) Each certificate representing Delaware Parent Common Stock, other than certificates representing Unrestricted Shares, shall be stamped or otherwise imprinted with a legend in substantially the following form: “THE SECURITIES REPRESENTED BY THIS CERTIFICATE AND ANY INTEREST THEREIN MAY NOT BE DIRECTLY OR INDIRECTLY SOLD, OFFERED FOR SALE, ASSIGNED, PLEDGED, HYPOTHECATED, OR OTHERWISE TRANSFERRED OR DISPOSED OF PRIOR TO [*], 202[*]1, EXCEPT AS PROVIDED IN THAT CERTAIN AGREEMENT AND PLAN OF MERGER DATED APRIL 16, 2024 AMONG THE COMPANY AND TRILLER, CORP., AND CERTAIN OTHER PARTIES, A COPY OF WHICH AGREEMENT IS ON FILE AT THE OFFICE OF THE COMPANY. A COPY OF SUCH AGREEMENT MAY BE OBTAINED UPON WRITTEN REQUEST TO THE COMPANY. ANY PURPORTED TRANSFER IN VIOLATION OF THAT AGREEMENT SHALL BE VOID.”

| 1 | 165 days after Closing |

(d) Each certificate representing Delaware Parent Preferred Stock shall be stamped or otherwise imprinted with a legend in substantially the following form: “THE SECURITIES REPRESENTED BY THIS CERTIFICATE AND ANY INTEREST THEREIN MAY NOT BE DIRECTLY OR INDIRECTLY SOLD, OFFERED FOR SALE, ASSIGNED, PLEDGED, HYPOTHECATED, OR OTHERWISE TRANSFERRED OR DISPOSED OF PRIOR TO [*], 202[*]2, EXCEPT AS PROVIDED IN THAT CERTAIN AGREEMENT AND PLAN OF MERGER DATED APRIL 16, 2024 AMONG THE COMPANY AND TRILLER, CORP., AND CERTAIN OTHER PARTIES, AND EXCEPT AS PROVIDED IN THAT CERTAIN LETTER AGREEMENT 2024 BETWEEN CASTLE LION INVESTMENTS LIMITED, COPIES OF WHICH AGREEMENTS ARE ON FILE AT THE OFFICE OF THE COMPANY. A COPY OF EACH SUCH AGREEMENT MAY BE OBTAINED BY THE HOLDER OF THIS CERTIFICATE UPON WRITTEN REQUEST TO THE COMPANY. ANY PURPORTED TRANSFER IN VIOLATION OF THE FOREGOING AGREEMENTS SHALL BE VOID.”

ARTICLE II

REPRESENTATIONS AND WARRANTIES OF THE CORPORATION

Except as disclosed in the Triller LLC 2024 S-1 or in the corresponding schedules of the disclosure memorandum delivered by the Corporation to Parent prior to the execution of this Agreement (the “Corporation Disclosure Memorandum”), in order to induce Parent and Merger Sub to enter into and perform this Agreement, the Corporation represents and warrants to Parent and Merger Sub, as to the Corporation (and, for all periods prior to the Reorg Effective Time, except where the context requires otherwise, also as to Triller LLC), except as otherwise provided, as follows:

| 2.1 | Organization and Good Standing; Books and Records |

The Corporation is a corporation duly organized, validly existing, and in good standing under the laws of the State of Delaware, and the Corporation has all requisite power and authority to own, operate, and lease its properties and assets and to carry on its business as now conducted and as currently proposed to be conducted. The Corporation is duly qualified to do business and is in good standing in each of the jurisdictions in which it conducts its business, which are the only jurisdictions in which such qualification is necessary. The Corporation has furnished to Parent accurate and complete copies of the Corporation’s (i) governing documents, (ii) minute books, and (iii) stock ledger and stock or unit transfer records. Such books and records accurately reflect all meetings of the members or stockholders, as the case may be, and the boards of directors (including any committees thereof) of the Corporation and all actions taken by written consent of the Stockholders, as well as their boards of directors (including any committees thereof), as applicable, since the inception of the Corporation through the Agreement Date; the minutes contained therein accurately reflect the events of and actions taken at such meetings; and such stock ledger and stock transfer records accurately reflect all issuances, transfers, and cancellations of shares of capital stock of the Corporation.

| 2 | One year after Closing |

| 2.2 | Authority and Enforceability |

(a) Authority. The Corporation has full power and authority to execute this Agreement and the other Operative Documents to which it is (or will be) a party and to perform its obligations hereunder and thereunder. The board of directors of the Corporation, at a meeting duly called and held, or by written consent in lieu thereof, has unanimously (i) determined that this Agreement and the Transactions are fair to, and in the best interests of, the Corporation and its Stockholders, (ii) approved and declared advisable the execution, delivery, and performance of this Agreement and the consummation of the Transactions, and (iii) resolved to recommend that the Stockholders adopt this Agreement and approve the Transactions. This Agreement and the Transactions have been duly authorized, adopted and approved by the requisite vote or written consent of the Stockholders in compliance with the Corporation Certificate of Incorporation, the Corporation Bylaws and the DGCL and by the members of Triller LLC (the consents of the requisite Stockholders and the members of Triller LLC, and the form of notice to be provided to the other Stockholders and members, collectively, the “Stockholder Approval”). A true copy of the documents evidencing the Stockholder Approval is attached to this Agreement as Exhibit K. All actions relating to the solicitation and obtainment of the Stockholder Approval with respect to this Agreement have been and/or will be taken in compliance with Applicable Law. The Corporation has provided or, pursuant to Section 4.10 will provide, all legally required notices to all its Stockholders that have not voted for or provided written consent to the Merger and all other Transactions to which the Corporation is a party. The Corporation has full power and authority to consummate the Transactions to which it is a party.

(b) Enforceability. This Agreement has been duly executed and delivered by the Corporation and, assuming the due authorization, execution, and delivery by each of the other parties hereto, this Agreement is the valid and binding obligation of the Corporation, enforceable against it in accordance with its terms, and each of the other Operative Documents to which it is (or will be) a party, when executed by the Corporation, and assuming the due authorization, execution, and delivery by each of the other parties thereto, is (or will be) the valid and binding obligation of the Corporation, enforceable against it in accordance with its terms, in each case, except to the extent such enforceability is subject to the effect of any applicable bankruptcy, insolvency, reorganization, moratorium, or other Applicable Law affecting or relating to creditors’ rights generally and general principles of equity. the Corporation. Except for any regulatory consents, no third party consents are required for the Corporation to consummate the Transactions.

| 2.3 | Capitalization and Stock Rights; Consideration Spreadsheet; Subsidiaries |

(a) The Corporation as of the Reorganization

(i) The capitalization of the Corporation as of the Agreement Date shall be as follows:

(A) Series A Common Stock: 850,000,000 shares authorized, 302,169,278 shares issued.

(B) Series B Common Stock: 50,000,000 shares authorized, 16,525,154 shares issued.

(C) Preferred Stock: 100,000,000 shares authorized, of which 50,000,000 have been designated as Series A-1 Preferred Stock and of which 37,702,230 shares are issued.

(D) All Stock: 356,396,662 shares issued.

(E) Corporation RSU Plan: 62,345,778 Corporation RSUs issued under the Corporation RSU Plan; and 62,345,778 shares of Series A Common Stock reserved for issuance upon the vesting of Corporation RSUs.

As of the Agreement Date, the Delaware Reorg Certificate and all other filings required to be made in Delaware in connection with the Reorganization shall have been filed with the Delaware Secretary of State. As of the Agreement Date, the Stock shall be held of record and beneficially by the Stockholders as set forth on the Initial Closing Consideration Spreadsheet, free and clear of any Encumbrances (except with respect to the Reserved Shares). As of the Agreement Date, each share of Stock shall be authorized and validly issued and shall be fully paid and non-assessable, and shall be issued in compliance with Applicable Law. As of the Agreement Date, except as set forth on the Initial Closing Consideration Spreadsheet , there shall be no other outstanding shares of capital stock of, or other equity or voting interests in, the Corporation, and no outstanding securities of the Corporation convertible into or exchangeable for shares of capital stock of, or other equity or voting interests in, the Corporation, and no outstanding options, warrants, rights, or other commitments or agreements to acquire from the Corporation, or that obligate the Corporation to issue, any capital stock of, or other equity or voting interests in, or any securities convertible into or exchangeable for shares of capital stock of, or other equity or voting interests in, the Corporation Except as otherwise amended in the Final Closing Consideration Spreadsheet, as of the Closing Date, the ownership of all Stock and Corporation RSUs shall be as set forth in the Initial Closing Consideration Spreadsheet. As of the Agreement Date, except for the Corporation RSUs, there shall be no options, restricted stock, stock appreciation rights, phantom stock rights, or any other rights with respect to the equity the Corporation. Triller LLC and the Corporation has never declared or paid any dividends on any shares of Stock or other equity, and there is no Liability for dividends accrued and unpaid by the Corporation or Triller LLC.

(ii) The Initial Closing Consideration Spreadsheet is accurate and complete in all respects. The Final Closing Consideration Spreadsheet, when delivered, will be accurate and complete in all respects, and upon payment of the amounts set forth therein, no Parent Entity or any of their respective Representatives will have any obligation to the Stockholders with respect to the Stock or to any equity or convertible equity interests in Triller LLC.

(iii) Each Stockholder is an “accredited investor,” as such term is defined in Regulation D promulgated under the Securities Act.

(iv) Exhibit 21.1 of the Triller LLC 2024 S-1 sets forth a complete list of the Corporation’s Subsidiaries as of the Agreement Date. The Corporation is not under any current or prospective obligation to form or participate in, provide funds to, make any loan, capital contribution or other investment in, or assume any liability or obligation of, any Person.

| 2.4 | No Approvals; No Conflicts |

The execution, delivery, and performance by the Corporation of this Agreement and the other Operative Documents to which the Corporation is (or will be) a party and the consummation by the Corporation of the Transactions do not and will not (a) violate (with or without the giving of notice or lapse of time, or both) Applicable Law, (b) require any consent, approval, or authorization of, declaration, filing, or registration with, or notice to, any Person, other than, to the extent not already achieved prior to the Agreement Date, (i) the Stockholder Approval and (ii) the filing of the Certificate of Merger, (c) result in a default (with or without the giving of notice or lapse of time, or both) under, or acceleration or termination of, or the creation in any Person of the right to accelerate, terminate, modify, or cancel, any Encumbrance, Contract, obligation, or Liability to which the Corporation is a party or by which it is bound or to which any its assets is subject, (d) result in the creation of any Encumbrance on any assets of the Corporation, (e) conflict with or result in a breach of or constitute a default under any provision of the governing documents of the Corporation, (f) invalidate or adversely affect any Corporation Permit, or (g) impair the right of the Corporation (or any Parent Entity after the Closing) to Exploit any Corporation IP.

| 2.5 | Financial Statements; No Undisclosed Liabilities |

(a) The Triller LLC 2024 S-1 sets forth (i) the audited balance sheets and statements of operations, cash flows, and equity of Triller LLC at and for the two fiscal years ended December 31, 2022 and 2021 and accompanying notes (the “Annual Financial Statements”) and (ii) an unaudited balance sheet and statements of cash flows of Triller LLC at and for the nine month period ended September 30, 2023 (the “Interim Financial Statements”). Schedule 2.5(a) to the Corporation Disclosure Memorandum sets forth the unaudited balance sheets and statements of operations, cash flows, and equity of Triller LLC at and for the fiscal year ended December 31, 2023, without notes (the “2023 Unaudited Financial Statements” and collectively with the Annual Financial Statements and the Interim Financial Statements, the “Financial Statements”). The Financial Statements (i) are accurate, complete, and consistent with the books and records of Triller LLC and the Corporation, (ii) have been prepared in conformity with GAAP on a basis consistent with prior accounting periods, and (iii) fairly present the financial position, results of operations, and changes in financial position of Triller LLC as of the dates and for the periods indicated, subject, in the case of the Interim Financial Statements, solely to normal recurring period end adjustments. The unaudited balance sheet of Triller LLC as of December 31, 2023 (the “Corporation Balance Sheet Date”) is herein referred to as the “Corporation Balance Sheet.” The Company has no Liabilities that are not fully reflected or reserved against, as prescribed by GAAP, in the Corporation Balance Sheet, except Liabilities incurred since the Corporation Balance Sheet Date in the ordinary course of business and consistent with past practice. The Corporation is not a guarantor, indemnitor, surety, or other obligor of any indebtedness of any other Person. The Corporation has delivered to Parent accurate and complete copies of all management letters and other correspondence received from accountants of the Corporation relating to the Corporation’s financial statements, accounting controls, and all related matters. There has been no incidence of Fraud that involves any current or former Corporation Service Providers.

(b) The Corporation maintains a system of internal accounting controls sufficient to provide reasonable assurances that: (i) transactions are executed in accordance with management’s general or specific authorization, (ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with applicable GAAP and to maintain accountability for assets, (iii) access to assets is permitted only in accordance with management’s general or specific authorization, (iv) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences, and (v) the obligations of the Corporation are satisfied in a timely manner and as required under the terms of each Contract to which the Corporation is a party or by which the Corporation is bound. To the Knowledge of the Corporation, the Corporation has no unremedied significant deficiencies or material weaknesses (as such terms are defined under GAAP) in the design or operation of internal control over financial reporting.

| 2.6 | Absence of Certain Changes or Events |

(a) Financial. Except for transactions specifically contemplated in this Agreement or as set forth in the Triller LLC 2024 S-1 and/or in Schedule 2.6(b), since the Corporation Balance Sheet Date: (a) the business of the Company has been conducted only in, and the Corporation has taken no action except in, the ordinary course of business and consistent with past practice and (b) there has not occurred any Material Adverse Effect. Since the Corporation Balance Sheet Date, the Corporation has not experienced any business disruption, or taken any actions outside of the ordinary course of business and consistent with past practice.

(b) Bring Down. Schedule 2.6(b) of the Corporation Disclosure Memorandum sets forth all material updates and changes to (i) the Corporation’s business and operations, and (ii) the representations and warranties of the Corporation set forth in this Article II, that have occurred since January 29, 2024.

| 2.7 | Property |

(a) The Corporation does not own and has never owned any real property.

(b) The Corporation has provided to Parent all lease agreements (the “Leases”) with respect to all real property leased or currently being used by the Corporation (the “Real Property”). All Leases are valid, binding, and enforceable in accordance with their terms and are in full force and effect. Except as provided in Schedule 2.12(a) of the Corporation Disclosure Memorandum, the Corporation has performed all material obligations imposed on it under the Leases, and neither the Corporation nor any other party thereto is in default thereunder, nor is there any event that with notice or lapse of time, or both, would constitute a default by the Corporation, or, to the Knowledge of the Corporation, any other party thereto, that would result in a Material Adverse Effect. There is not, and within the past 12 months there has not been, any material disagreement or dispute with any other party to any of the Leases, nor is there any pending request for amendment of any of the Leases, except as provided in Schedule 2.12(a) of the Corporation Disclosure Memorandum. The Corporation has not received any notification that any party to any of the Leases intends to cancel, terminate, materially modify, refuse to perform, or refuse to renew any of the Leases. There is no Encumbrance applicable to the Real Property that could reasonably be expected to materially impair the use or the occupancy of the Real Property other than Permitted Encumbrances. The Corporation has provided to Parent accurate and complete copies of all Leases.

(c) All of the material assets and properties of the Corporation are in good condition and repair subject to normal wear and tear, in sufficient working order and have been properly maintained to a material extent. Each asset included in the Financial Statements or material asset acquired by the Corporation since the Corporation Balance Sheet Date, and each material asset used by the Corporation or that is in the reputed ownership of the Corporation, is: (i) legally and beneficially owned solely by the Corporation free from all Encumbrances other than Permitted Encumbrances and (ii) where capable of possession, in the possession or under the control of the Corporation.

| 2.8 | Labor and Employment Matters; Nondisclosure and Non-Competition Agreements |

(a) The Corporation keeps accurate and up to date records of: (i) the names, titles, national, and local jurisdictions of service to the Corporation, work authorization status in such jurisdictions, classification for purposes of all applicable wage-and-hours laws, part- or full-time status, permanent or temporary status, leave status, accrued paid time off, and current base and variable compensation amounts or rates (whether salaried or otherwise) of all directors, officers, and employees (full-time and part-time, whether permanent or temporary) of the Corporation and (ii) the names, titles, national, and local jurisdictions of service to the Corporation, permanent or temporary status, current compensation packages, and descriptions of services to the Corporation of all consultants and independent contractors of the Corporation.

(b) The Corporation is not party to any labor, collective bargaining, or similar agreement, and there are currently no organizational campaigns, petitions, or other unionization activities seeking recognition of a collective bargaining unit that could affect the Corporation. No employees of the Corporation are, or in the past three years have been, represented by any labor organization, or other collective Representative entity, union, or organization. None of the Transactions could reasonably be expected to require approval or consent by any works council, labor collective group, or other similar third-party entity. There is no labor dispute pending or, to the Knowledge of the Corporation, threatened against or affecting the Corporation, and the Corporation has not experienced any work stoppage since its inception. To the Knowledge of the Corporation, no employee, contractor, or consultant of the Corporation intends to terminate his or her employment or relationship with the Corporation. All individuals who have provided or are providing services of any kind to the Corporation are correctly classified as either being an employee or an independent contractor, and if classified as an employee are correctly classified as being exempt or non-exempt from overtime under Applicable Law.

(c) Since the inception of the Corporation, the Corporation has been in compliance with Applicable Law respecting employment, including hiring, termination, discrimination, harassment, retaliation, accommodation, terms and conditions of employment, wages, hours, and occupational safety and health, and has not engaged in any unfair labor practice. Since the inception of the Corporation, the Corporation has withheld all amounts required by Applicable Law or by Contract to be withheld from the wages, salaries, and other payments to its employees, including common law employees, and is not liable for any arrears of wages (including commissions, bonuses, or other compensation) or any Taxes or any penalty for failure to comply with any of the foregoing (or, if any arrears, penalty or interest was assessed against the Corporation regarding the foregoing, it has been fully satisfied). The Corporation is not liable for any payment to any trust or other fund, or to any Governmental Body with respect to unemployment compensation benefits, workers’ compensation benefits, social security, social benefits, or other benefits or obligations for employees (other than routine payments to be made in the ordinary course of business and consistent with past practice). There are no pending Claims against the Corporation under any workers compensation plan or policy or for long-term Disability. There are no controversies pending or threatened between the Corporation, on the one hand, and any current or former Corporation Service Providers, or any other Person, arising out of the Corporation’s status as employer or purported employer, or as an entity that engages contractors or consultants, on the other hand, that have resulted, or could reasonably be expected to result, in a Claim before any Governmental Body, including Claims for compensation, wage and hour violations, severance benefits, vacation time, vacation pay or pension benefits, discrimination, harassment, retaliation, failure to accommodate, wrongful discharge, or otherwise. Since the inception of the Corporation, the Corporation has obtained from all its former employees whose employment was involuntarily terminated general releases of all Claims (whether actual or potential, known or unknown) against the Corporation, and all releases of employment Claims in favor of the Corporation obtained from former employees since the inception of the Corporation are effective and binding to release all employment Claims from such employees and comply in all respects with Applicable Law.