UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2023

Or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number: 001-41306

ALTERNUS CLEAN ENERGY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 87-1431377 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

360 Kingsley Park Drive, Suite 250, Fort Mill, South Carolina 29715

(803) 280-1468

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (803) 280-1468

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of each exchange on which registered | ||

| Common Stock, par value $0.0001 per share | ALCE | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company, in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

| Non-Accelerated Filer | ☒ | Smaller Reporting Company | ☒ |

| Emerging Growth Company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Act).

Yes: ☐ No: ☒

The aggregate market value of voting stock held by non-affiliates of the Registrant on June 30, 2023, based on the closing price of $10.43 for shares of the Registrant’s Class A common stock as reported by The Nasdaq Stock Market, was approximately $84,807,477. Shares of common stock beneficially owned by each executive officer and director have been excluded in that such persons may be deemed to be affiliates.

The number of shares outstanding of the Registrant’s common stock, par value $0.0001 per share, on April 15, 2024 was 80,076,664.

Documents Incorporated by Reference

None

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We have based these forward-looking statements on our current expectations and projections about future events. All statements, other than statements of present or historical fact included in this Annual Report on Form 10-K regarding our future financial performance, as well as our strategy, future operations, financial position, estimated revenues, losses, projected costs, prospects, plans and objectives of management are forward-looking statements. Any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” or the negative of such terms or other similar expressions. These forward-looking statements are based on management’s current expectations, assumptions, hopes, beliefs, intentions and strategies regarding future events and are based on currently available information as to the outcome and timing of future events. Although we believe such expectations and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. In addition, management’s assumptions about future events may prove to be inaccurate. All readers are cautioned that the forward-looking statements contained in this Annual Report on Form 10-K are not guarantees of future performance and we cannot assure any reader that such statements will be realized or that the forward-looking events and circumstances will occur.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

| ● | our ability to successfully integrate into our business and recognize the anticipated benefits of recently completed business combinations and related transactions and generate profit from their operations; |

| ● | changes in applicable laws or regulations; |

| ● | a financial or liquidity crisis; |

| ● | the effects of inflation and changes in interest rates; |

| ● | a financial or liquidity crisis; geopolitical factors, including, but not limited to, the Russian invasion of Ukraine and the Israel-Hamas war; |

| ● | the risk of global and regional economic downturns; |

| ● | the projected financial information, anticipated growth rate, and our market opportunity; |

| ● | foreign currency, interest rate, exchange rate and commodity price fluctuations; |

| ● | various environmental requirements; |

| ● | retention or recruitment of executive and senior management and other key employees; |

| ● | the possibility that Alternus may be adversely affected by other economic, business, and/or competitive factors; |

| ● | our ability to maintain an effective system of internal controls over financial reporting; |

| ● | our ability to manage its growth effectively; |

| ● | our ability to achieve and maintain profitability in the future; |

| ● | our ability to access sources of capital to finance operations and growth; |

| ● | the success of strategic relationships with third parties; |

| ● | the impact of reduction, modification or elimination of government subsidies and economic incentives (including, but not limited to, with respect to solar parks); |

| ● | the impact of decreases in spot market prices for electricity; |

| ● | dependence on acquisitions for our growth; |

| ● | inherent risks relating to acquisitions and our ability to manage its growth and changing business; |

| ● | risks relating to developing and managing renewable solar projects; |

| ● | risks relating to photovoltaic plant quality and performance; |

| ● | risks relating to planning permissions for solar parks and government regulation; |

| ● | Alternus’ need for significant financial resources (including, but not limited to, for growth in its business); |

| ● | the need for financing in order to maintain future profitability; |

| ● | the lack of any assurance or guarantee that we can raise capital or meet its funding needs; |

| ● | our limited operating history; and |

| ● | and other factors detailed herein under the section entitled “Risk Factors.”. |

Given these risks and uncertainties, you should not place undue reliance on these forward-looking statements. Should one or more of the risks or uncertainties described in this Annual Report on Form 10-K, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact the operations and projections discussed herein may be disclosed under “Item 1A. Risk Factors” contained in Part I of this Annual Report on Form 10-K and in our periodic filings with the SEC. Our SEC filings are available publicly on the SEC’s website at www.sec.gov.

You should read this Annual Report on Form 10-K with the understanding that our actual future results, levels of activity and performance as well as other events and circumstances may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

Market and Industry Data

This Annual Report on Form 10-K includes market and industry data and forecasts that Alternus has derived from publicly available information, reports of governmental agencies, various industry publications, other published industry sources and internal data and estimates. All market and industry data used herein involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Although we are responsible for the disclosure contained in this Annual Report on Form 10-K and we believe the information from industry publications and other third-party sources included herein is reliable, such information is inherently imprecise and we have not had this information verified by any independent sources. The industry in which Alternus operates is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section of this Annual Report on Form 10-K entitled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

SUMMARY OF RISK FACTORS

The following is a summary of some of the risks and uncertainties that could materially adversely affect our business, financial condition and results of operations. This summary should be read together with the more detailed description of each risk factor disclosed under “Item 1A: Risk Factors” contained in Part I of this Annual Report on Form 10-K.

| ● | Our substantial indebtedness could adversely affect our business, financial condition and results of operations. |

| ● | Decreases in the spot market price of electricity could harm our revenue and reduce the competitiveness of solar parks in grid-parity markets. |

| ● | Our power purchase agreements may not be successfully completed. |

| ● | The seasonality of our Subsidiaries’ operations may materially affect our business, results of operations, cash flow, and financial condition. |

| ● | The acquisition of renewable energy facilities or of companies that own and operate renewable energy facilities is subject to substantial risk. |

| ● | The delay between making significant upfront investments in solar parks and receiving revenue could materially and adversely affect our liquidity, business and results of operations. |

| ● | Solar project development is challenging and may ultimately not be successful and miscalculations in planning a project may negatively affect engineering procurement and construction (“EPC”) prices, all of which could increase the costs, delay or cancel a project, and have a material adverse effect on its business, financial condition, results of operations and profit margins. |

| ● | Development activities may be subject to cost overruns or delays, which may materially and adversely affect our financial results and results of operations. |

| ● | Impact of RePowerEU programme on our business and future prospects. |

| ● | PV plants quality or PV plants performance. |

| ● | Operation and maintenance of renewable energy projects involve significant risks that could result in unplanned outages, reduced output, interconnection or termination issues, or other adverse consequences. |

| ● | We and any third parties with which we do business may be subject to cyber-attacks, network disruptions, and other information systems breaches, as well as acts of terrorism or war that could have a material adverse effect on our business, NAV, financial condition, and results of operations, as well as result in significant physical damage to our renewable energy projects. |

| ● | We depend on certain key personnel and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations. |

| ● | We are subject to risks associated with fluctuations in the prices of PV modules and balance-of-system components or in the costs of design, construction and labor. |

| ● | Refurbishment of renewable energy facilities involve significant risks that could result in unplanned power outages or reduced output. |

| ● | Our project operations may be adversely affected by weather and climate conditions, natural disasters and adverse work environments. |

| ● | Business interruptions, whether due to catastrophic disasters or other events, could adversely affect Alternus’ operations, financial condition and cash flows. |

| ● | Global economic conditions and any related ongoing impact of supply chain constraints and the market of our product and service could adversely affect our results of operations. |

| ● | Fluctuations in foreign currency exchange rates may negatively affect our revenue, cost of sales and gross margins and could result in exchange losses. |

| ● | If we fail to comply with financial and other covenants under debt arrangements, our financial condition, results of operations and business prospects may be materially and adversely affected. |

| ● | If the ownership of Solis and all of its subsidiaries were to be transferred to the Solis bondholders in connection with an event of default under the Solis Bond, the majority of our operating assets and related revenues and EBIDTA would be eliminated. |

| ● | We are subject to counterparty risks under our FiT price support schemes and Green Certificates (“GC”) Schemes. |

| ● | Our international operations require significant management resources and present legal, compliance and execution risks in multiple jurisdictions. |

| ● | The development and installation of solar energy systems is highly regulated; we may fail to comply with laws and regulations in the countries where it develops, constructs and operates solar power projects and the government approval process may change from time to time, which could severely disrupt our business operations. |

| ● | Existing rules, regulations and policies pertaining to electricity pricing and technical interconnection of customer-owned electricity generation may not continue, and changes to these regulations and policies might deter the purchase and use of solar energy systems and negatively impact development of the solar energy industry. |

| ● | Risk related to legal rights to real property in foreign countries. |

| ● | The Company conducts its business operations globally and is subject to global and local risks related to economic, regulatory, tax, social and political uncertainties. |

| ● | Recent increases in inflation and in the United States and internationally could adversely affect our business. |

| ● | The solar energy industry is a new and evolving market, which may not grow to the size or at the rate we expect. |

| ● | Our business prospects could be harmed if solar energy is not widely adopted or sufficient demand for solar energy systems does not develop or takes longer to develop than we anticipate. |

| ● | Our business has benefited from the declining cost of solar energy system components, and might be harmed to the extent that declines in the cost of such components stabilize or that such costs increase in the future. |

| ● | Although average selling prices of solar modules in many global markets have declined for several years, recent spot pricing for solar modules has increased, in part, due to elevated commodity and freight costs. |

| ● | Shortages in the supply of silicon could adversely affect the availability and cost of the solar photovoltaic modules used in our solar energy systems. |

| ● | A material reduction in the retail price of electricity charged by electric utilities or other retail electricity providers would harm our business, financial condition and results of operations. |

| ● | Electric utility statutes and regulations and changes to such statutes or regulations might present technical, regulatory and economic barriers to the purchase and use of our solar service offerings that may significantly reduce demand for such offerings. |

| ● | Technological changes in the solar power industry could render our products uncompetitive or obsolete, which could reduce our market share and cause our revenue and net income to decline. |

| ● | The ability to deliver electricity to our various counterparties requires the availability of and access to interconnection facilities and transmission systems. |

| ● | We may pursue acquisitions that involve inherent risks related to potential internal control weaknesses and significant deficiencies which may be costly for us to remedy and could impact management assessment of internal control effectiveness. |

| ● | Uncertain global macro-economic and political conditions could materially adversely affect our results of operations and financial condition. |

| ● | Our stock price is subject to volatility, which could have a material adverse impact on investors and employee retention. |

| ● | We may be unable to maintain the listing of our securities on Nasdaq in the future. |

| ● | We may issue additional shares of common stock or other equity securities without your approval, which would dilute your ownership interests and may depress the market price of our common stock. |

| ● | Delaware law and provisions in our certificate of incorporation and bylaws could make a merger, tender offer, or proxy contest difficult, thereby depressing the trading price of our common stock. |

| ● | If we fail to establish and maintain proper and effective internal control over financial reporting, as a public company, our ability to produce accurate and timely financial statements could be impaired, investors may lose confidence in our financial reporting and the trading price of our common stock may decline. |

PART I

Item 1. Business

Each of the terms “Alternus,” the “Company,” “we,” “our,” “us,” and similar terms used herein refer collectively to Alternus Clean Energy, Inc., formerly known as Clean Earth Acquisitions Corp., and where appropriate, our wholly owned subsidiaries.

The Company

The Company was incorporated on May 14, 2021 under the laws of Delaware and currently has 28 employees; 14 employees are located Dublin, Ireland, 10 are located at the Company’s headquarters located in Fort Mill, SC, 1 remote employee in the US and 3 are located in Europe . Our employees perform various services such as business development, finance and management functions.

We are an independent clean energy producer that develops, installs, and operates a diverse portfolio of utility scale solar PV parks in North America and Europe, as long-term owners. You may also hear the term IPP, or independent power producer, to describe similar companies, however we want to focus on the clean nature of the energy generated from the solar parks we own and operate.

As a long-term owner operator, we focus on ensuring that the projects we acquire or develop and install for our own use are designed to deliver the most efficient operating results over the full project lifetime, which averages over 30 years. The solar parks benefit from long-term government offtake contracts and/or Power Purchase Agreements (“PPAs”) with investment grade off-takers with terms of 15 – 20 years, plus energy sales to local power grids, typically for 5 to 15 years at a time during the full life of the projects.

As of April 2024, we have approximately 8 operating parks, a total of 44 MWp in operation and circa $16 million in recurring annual revenues.

Business Combination with Clean Earth Acquisitions Corp.

On October 12, 2022, Clean Earth Acquisitions Corp. (“CLIN”) entered into a business combination agreement, as amended by that certain First Amendment to the Business Combination Agreement, dated as of April 12, 2023 (the “First BCA Amendment”) (as amended by the First BCA Amendment, the “Initial Business Combination Agreement”), and as amended and restated by that certain Amended and Restated Business Combination Agreement, dated as of December 22, 2023 (the “A&R BCA”) (the Initial Business Combination Agreement, as amended and restated by the A&R BCA, the “Business Combination Agreement”), by and among Clean Earth, Alternus Energy Group Plc (“AEG”) and the Sponsor. Following the approval of the Initial Business Combination Agreement and the transactions contemplated thereby at the special meeting of the stockholders of Clean Earth held on December 4, 2023, the Company consummated the Business Combination on December 22, 2023 (the “Closing”). In accordance with the Business Combination Agreement, Clean Earth issued 57,500,000 shares of common stock of Clean Earth, par value $0.0001 per share, to AEG, and AEG transferred to Clean Earth, and Clean Earth received from AEG, all of the issued and outstanding equity interests in the Acquired Subsidiaries (as defined in the Business Combination Agreement) (the “Equity Exchange,” and together with the other transactions contemplated by the Business Combination Agreement, the “Business Combination”). In connection with the Closing, the Company changed its name from Clean Earth Acquisition Corp. to Alternus Clean Energy, Inc.

Business Model

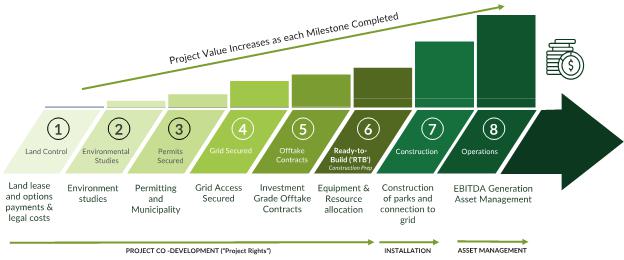

As a vertically integrated business, Alternus operates across all key segments of the solar project development life cycle from ‘greenfield’ planning and permitting phases, through to construction and long-term revenue and margin generation from sales of energy to customers. This integration of activities under one common ownership and management creates a ‘production line’ of new projects supporting organic growth, and visibility of pipeline, in the business going forward. This business model is designed to lock in lasting shareholder value by significantly reducing capex for newly developed projects, and lowering acquisition costs for acquired projects at pre-operation from other market participants.

The earlier in the cycle that we acquire new solar projects means we retain more of the project market value created as it passes each milestone. If we acquire projects further along the value chain then we pay more capital (and value) out to third parties for those projects. The value creation at each stage results from the de-risking of the projects as they get closer to operation and as a result, attract higher valuations at the later stages as the project risk declines.

Alternus Clean Energy Project Stage Classification

This method of operation is designed to bring the value created during the development cycle directly to Alternus, thereby reducing capital expenditure requirements to build out a larger portfolio, as the cost of acquisition and value captured can be reinvested in future growth. In addition, it provides greater certainty of future revenue streams as the projects owned today reach planned operation dates in the future. This is what drives the stair step revenue growth in the business. As of the date of this Annual Report, Alternus owns 533MW of projects in the development phase, all of which are expected to reach full operation and revenue generation over the next three to four years, in line with industry norms.

Alternus generates its new project pipeline by working closely with a cultivated network of local and international project development partners that provide a continuous pipeline of new projects for acquisition and construction.

We believe that a benefit of being a long-term owner of these projects is the stairstep long term recurring income created from the stable and predictable income streams as the cumulative operational portfolio grows. Every time we add a new project into the portfolio, we get a potential lift in long term incomes that then accumulates each time. Other participants in our market sometimes ‘build-to-sell’ the projects they develop and/or install, making their annual numbers more one-off and volatile. Our business model is designed to steadily add long-term income, locking in sustainable returns and value for shareholders as we stair step up growth.

Organization structured as focused expert teams.

In order to maximize the value created from this integrated project approach, Alternus is structured into three operating groups, reflecting each of the project development phases — development, installation, operation. Each operating group brings decades of experience and expertise to their respective segment and allows them to operate independently as required, to achieve greatest cost efficiencies and market focus, but with the coordination and support of a larger organization behind them. The operating groups are supported by specialist in-country management and corporate functions to ensure best overall collaboration to a common goal of long-term project ownership across multiple countries.

Revenue model

Alternus has a straight-forward revenue model. The sun shines on the panels in the parks and the clean energy produced is delivered directly to national utility power grids. Revenues are generated by multiplying the energy produced – measured in megawatt hours (MWh) – by the rate received for these hours. The rates received from either local government or investment grade commercial customers are either contracted under long term contracts - typically 10 to 15 years – or from local energy markets at the rates prevailing as the energy is delivered. At any one time, Alternus aims to have approximately 70% of the energy rates contracted long term. This revenue mix approach creates high margin and long-term predictable income streams that provides us with more flexible debt options that we deploy in ways to maximize returns on equity.

The following chart illustrates our revenue model, although there can be no assurance that we will achieve these results:

Vision and Strategy

The Company aims to become one of the leading producers of clean energy in Europe and the US by 2030 and to have commenced delivery of 24/7 clean energy to national power grids. The Company’s business strategy of developing to own and operate a diverse portfolio of solar PV assets that generate stable long-term incomes, in countries which currently have unprecedented positive market forces, positions us for sustained growth in the years to come.

To achieve its goals, the Company intends to pursue the following strategies:

| ● | Continue our growth strategy which targets acquiring independent solar PV projects that are in development, in construction, newly installed or already operational, in order to build a diversified portfolio across multiple geographies; |

| ● | Developer and Agent Relationships: long term relationships with high-quality developer partners, both local and international, can reduce competition in acquisition pricing and provide the Company with exclusive rights to projects at varying stages of development. Additionally, the Company works with established agents across Europe. Working with both groups provides the Company with an understanding of the market and in some cases enables it to contract for projects at the pre- market level. This allows the Company to build a structured pipeline of projects in each country where it currently operates or intends to operate. |

| ● | Expand our pan-European IPP portfolio in regions with attractive returns on investments, and increase the Company’s long-term recurring revenue and cash flow; |

| ● | Long-term FIT (feed-in tariff) contracts combined with the Company’s efficient operations are expected to provide for strong and predictable cash flows from projects and allow for high leverage capacity and flexibility of debt structuring. Our strategy is to reinvest of project cash flows into additional solar PV projects to provide non-dilutive capital for Alternus to “self-fund” organic growth; |

| ● | Optimization of financing sources to support long-term growth and profitability in a cost-efficient manner; |

| ● | As a renewable energy company, we are committed to growing our portfolio of clean energy parks across Europe in the most sustainable way possible. The Company is highly aware and conscious of the ever growing need to mitigate the effects of climate change which is evident by its core strategy. As the Company grows, it intends to establish a formal sustainability policy framework in order to ensure that all project development is carried out in a sustainable manner mitigating any potential local and environmental impacts identified during the development, construction and operational process. |

Given the long-term nature of our business, the Company does not operate its business on a quarter-by-quarter basis, but rather, with long-term shareholder value creation as a priority. The Company aims to maximize return for its shareholders by developing its own parks from the ground up and/or acquiring projects during the development cycle, installation stage, or already operational.

On some projects, the Company will look to provide construction management (EPCM) services in-house where the margins normally paid to third parties can be retained in the group and reinvested into new projects reducing the need for additional equity issuances.

We intend that the parks we own and operate will have a positive cash flow with long-term income streams at the lowest possible risk. To this end we use Levelized Cost of Energy (“LCOE”) as a key criterion to ranking the projects we consider for development and/or acquisition. The LCOE calculates the total cost of ownership of the parks over their expected life reflected as a rate per megawatt hour (MWh). Once the income rates for the selected projects are higher than this rate, the project will be profitable for its full life — including initial capex costs. The Company will continue to operate with this priority as we continue to invest in internal infrastructure and additional solar PV power plants to increase installed power and resultant stable long-term revenue streams.

Our Operating Subsidiaries

As of the date of filing, the Company is a holding company that operates through 8 operating subsidiaries, as listed in Exhibit 21.1 to this Annual Report.

Competitive Strengths

The Company believes the following competitive strengths have contributed and will continue to contribute to its success:

| ● | The Company is a clean energy owner operator at its core and therefore comfortable in operating across all aspects of the solar PV project value chain from development and installation through to long term operational ownership. This is as opposed to simply buying operating parks where higher levels of competition exist from market participants — such as specialist investment funds — with lower costs of capital are more prominent. |

Entering at earlier stages of the value chain allows Alternus opportunities to build and/or acquire projects earlier in the process and to lock out these types of competitors in certain situations;

| ● | The Company’s existing owned and contracted solar PV projects pipeline — over 1.5GW as of the date of this Annual Report — provides it with clear and actionable opportunities to grow power generation and earnings in the near term. |

About 50% of planned growth to 2026 is already owned or contracted today and is driven by some of our development projects reaching production in the period and also by current contracted acquisitions completing as we expect;

| ● | We believe that being a long-term owner operator of renewable projects is an important distinction for Alternus in the marketplace. As a long term owner, we focus on ensuring that the parks we own are designed for the most efficient operations and built to last and built to sell to other parties that require shorter term investment returns as an example. |

This approach, we believe, makes us more attractive to our developer partners in-country who want a partner that has a repeat nature and one that’s obviously also more flexible in the approach and more in tune with the realities of project development than funds or larger participants typically are.

In addition, we believe this also makes it very attractive to both banks and local governments who prefer long-term focused market participants, as it prevents them from having to deal with multiple owners over time, which we believe has become a benefit for Alternus over single project developers in certain markets, when competing projects may be chasing the same grid connections, for example;

| ● | The Company’s track record of identifying and entering new countries, coupled with our on-the-ground capabilities and cultivated network of development partners gives us potential competitive advantages in developing and operating solar parks across Europe and the US; |

| ● | The Company is technology and supplier agnostic and as such has the flexibility to choose from a broad range of leading manufacturers, top tier advisors and suppliers and equipment vendors around the globe that should allow us to continue to benefit from falling component and service costs; and |

| ● | The Company is led by a highly experienced management team and supported by strong, localized execution capabilities across all key functions and locations. |

Competitive Landscape

Energy generation is a capital-intensive business with numerous industry participants. The Company competes to acquire solar PV parks and project rights with other renewable energy developers, IPPs and financial investors based on the cost of capital, development expertise, pipeline, price, operations and management expertise, global footprint, brand reputation and the ability to monetize green attributes of renewable power.

As such the Company faces significant competition in two distinct areas, specifically projects in the installation and operational phase. Each segment has different competitors due to the nature of market participants as outlined below.

| ● | Contracted means that binding contracts or share purchase agreements (SPAs) have been signed. Closing of the transaction therefore is subject to the projects achieving the conditions precedent to complete the acquisition and or suitable financing. |

| Competitor Type | Competitor Strength | Competitor Weakness | How the Company Competes | |||||||

|

● ● |

Pension Funds

Insurance Companies |

●

● |

Lower cost of capital

Large funds available to deploy |

● | Tend to focus exclusively on acquiring operational parks (even if just completed) | ● | Focus on fragmented mid-size solar PV segment | |||

|

●

● |

Other energy Companies

Specialist Investment Funds |

● | May also commission projects to be constructed for them — but large ones | ●

● |

Generally, will not take any construction or development risk

Only acquire large scale projects due to minimum transaction size requirement |

● | Entering the PV value cycle earlier with niche and strategic partners, thereby locking competitors out of projects the Company acquires from small developer partners who cannot access these competitors due to their size | |||

|

●

● |

May or may not take construction or development risk

Smaller operators will have similar cost of capital as Alternus |

● | Provide minimum purchase commitments of developed projects under exclusive right of first refusal contracts that locks out other potential competitors. | |||||||

Notwithstanding the above, it is management’s belief that the solar PV market is experiencing high growth on a global level. There is also an increasing demand for projects from both government and corporations. Although there are many competitors and participants in this environment, there does not appear to be significant industry consolidation and it remains a very fragmented market.

With the Company’s established niche focus on partner and project acquisition, we believe that we currently compete effectively in the markets we engage in. In addition, the Company believes that our current growth strategy as well as being a public reporting company, we will have opportunities to consolidate certain market participants and segments in certain geographies over time that may not be available to other participants not similarly situated. If successful, the Company’s market position will be further enhanced, and we can sustain competitiveness in the medium to long term.

Nevertheless, the Company expects to face increased competition in all aspects of its business, target markets and industry segments, financing options, and partner availability as markets mature as countries reach their targeted renewable energy generation.

The Market

Alternus currently operates in two key regions, Europe and the United States. Both regions are currently experiencing unprecedented market forces creating a generational opportunity as the world continues its world is on a one- time, permanent transition from fossil to clean energy.

The same drive is now seen in the US where the Inflation Reduction Act supported renewables through tax equity extensions and increases in order to grow the renewable significantly by 2030.

It’s not just about climate anymore in Europe, it is now also all about energy independence, driven by the recent geopolitical turmoil in the region. This is encapsulated in the comment by Mrs. von der Leyen, President of the European Commission who states that “Energy security is one of the most pressing topics for Europe. The EU will diversify away from Russian fossil fuels and will invest heavily in clean renewable energy.” Renewables in Europe are in a clear direction of growth, with forecasted growth targets being over four times the current size by just 2030. The EU has unveiled massive support packages, both financial and regulatory, to speed up this deployment.

Given our transatlantic operations, integrated operating model and strong execution track record, management coupled with long-term ownership and stable, predictable income streams, management believes that Alternus represents an attractive opportunity for investors on both sides of the Atlantic to actively participate in both the European and American energy transitions.

Solar Continues Strong Growth as Leading and Lowest Cost Renewable Source

In 2021, 167.8 GW of solar capacity was grid-connected globally, a 21% growth over the 139.2 GW added the year before, establishing yet another global annual installation record for the sector. This brings the total operating solar fleet to 940 GW by the end of 2021, with the Terawatt milestone already achieved in May 2022.

This remarkable growth has no match among any other power generation technology. Out of the over 300GW of new global renewable power generating capacity, solar alone installed more capacity than all other renewable technologies combined, claiming a share of 56%. Solar also deployed more capacity than all fossil fuel power generation technologies together in 2021. At the same time, however, solar still meets only a small share of around 4% of the global electricity demand, while over 70% is provided by non- renewable sources, according to Solar Power Europe in their Global Outlook for Solar Power 2022-2026, published in May 2022.

Solar’s success story over other technologies has many reasons, but a key factor is its steep cost reduction curve over the last decade, which has made solar the global cost leader. While the cost of solar has been lower than fossil fuel generation and nuclear for several years, it is also now lower than wind in many regions around the world. The Levelised Cost of Energy (LCOE) analysis, version 15.0, published in October 2021 by US investment bank Lazard, shows how the downward trip of utility-scale solar cost has progressed by a further 3% compared to the previous year. The spread with conventional generation technologies is widening, considering that the cost of gas and nuclear went up. Solar’s cost decrease has truly been extraordinary: compared to 2009 solar power generation cost has decreased by 90%.1

| 1 | SolarPower Europe (2022): Global Market Outlook for Solar Power 2022-2026. — May 2022 |

Solar electricity generation cost in comparison with conventional power sources 2021

Global Solar Market Developments 2023 to 2026

The mid-term global economic outlook is hard to predict and will depend a lot on the development of the war in Ukraine. The IMF forecasted in its April- released World Economic Outlook ‘War Sets Back the Global Recovery’ that global growth will slow from 6.1% in 2021 to 3.6% in 2022 and 2023, and further decrease beyond. Still, the world should see very strong demand for solar for the four years starting from 2023 to 2026, as this clean technology not only offers a price hedge, but also energy security on the national and individual levels, this according to Solar Power Europe in their Global Market Outlook for Solar Power 2022-2026.

The strong growth on the demand side is expected to be facilitated by massive new production capacity expansions across the solar value chain coming online, including silicon. Every serious PV manufacturer seems to invest in additional capacities, while newcomers are entering the space, and investors seriously look into it. Beyond the Chinese leaders getting even larger, global trade frictions, increasingly ESG related, are feeding the narrative for local production hubs as the importance of solar as a key technology for more energy independence is increasingly understood by policy makers.

Seasonality and Resource Availability

The amount of electricity produced, and revenues generated by, the Company’s solar generation facilities is dependent, in part, on the amount of sunlight, or irradiation, where the assets are located. As shorter daylight hours in winter months result in less irradiation, the electricity generated by these facilities will vary depending on the season.

Irradiation can also be variable at a particular location from period to period due to weather or other meteorological patterns, which can affect operating results. As the majority of the Company’s solar power plants are located in the Northern Hemisphere (Europe) the Company expects its current solar portfolio’s power generation to be at its lowest during the first and fourth quarters of each year.

Therefore, the Company expects its first and fourth quarter solar revenue to be lower than in other quarters. As a result, on average, each solar park generates approximately 15% of its annual revenues in Q1 every year, 37% in each of Q2 and Q3, and the remaining 11% in Q4. The Company’s costs are relatively flat over a year, and so it will always report lower profits in Q1 and Q4 as compared to the middle of the year.

Our Portfolio

Alternus owns a diversified portfolio of solar PV parks in both the United States and Europe. The portfolio is at various stages in the solar value chain with 44MWp operating and generating revenues, c. 45MWp currently in construction and c. 257 MWp expected to reach construction ready status in 2024 and start generating revenues during 2025. The remaining 224MWp of development projects are expected to reach construction ready status after 2024.

The Company’s operating portfolio consists of over eight owned and operational parks in Romania and the United States, totaling 44MWp of installed capacity. The Romanian parks operate under a “green certificate” government incentive scheme over a minimum of 15 years whereby the projects earn a certain number of Green Certificates (GC’s) for the energy produced that are then subsequently sold to the Romanian energy market. Approximately six GC’s are earned for every MWh produced at a price of 29.4 € per MWh. In addition to the GC income, the parks also earn additional income in the Romania energy market for the same energy produced, or under PPA contracts with local energy companies, from rates prevailing at the time the energy is delivered to the grid.

Our US projects benefit from a long term contract of 35-years for 100% of the energy produced and delivered at an equivalent rate of $75 per MWh.

The following table lists the owned portfolio and under contract solar PV parks as of the date of this Annual Report:

| MWs owned | ||||||||||||

| Country | (Installed and operational) | (In development and under construction) |

Total (MW) |

|||||||||

| Romania | 40.1 | -- | 40.1 | |||||||||

| Italy | -- | 210.0 | 210.0 | |||||||||

| Spain | -- | 257.0 | 257.0 | |||||||||

| United States | 3.8 | 59.2 | 63.0 | |||||||||

| Total | 43.9 | 526.2 | 570.1 | |||||||||

Government Regulations

Environmental

The Company is subject to environmental laws and regulations in the jurisdictions in which it owns and operates renewable energy facilities. These laws and regulations generally require that governmental permits and approvals be obtained and maintained both before construction and during operation of these renewable energy facilities. The Company incurs costs in the ordinary course of business to comply with these laws, regulations and permit requirements. The Company does not anticipate material capital expenditures for environmental compliance for its renewable energy facilities in the next several years. While the Company does not expect that the costs of compliance would generally have a material impact on its business, financial condition or results of operations, it is possible that as the size of its portfolio grows, it may become subject to new or modified regulatory regimes that may impose unanticipated requirements on the business as a whole that the Company did not anticipate with respect to any individual renewable energy facility. Additionally, environmental laws and regulations frequently change and often become more stringent, or subject to more stringent interpretation or enforcement, and therefore future changes could require the Company to incur materially higher costs which could have a material negative impact on its financial performance or results of operations.

Regulatory Matters, Government Legislation and Incentives

In Romania, Italy, Spain and the United States, the Company is generally subject to the regulations of the relevant energy regulatory agencies applicable to all producers of electricity under the relevant FiT or other governmental incentive programs (including the FiT rates); however, it is not subject to regulation as a traditional public utility (i.e., regulation of its financial organization and rates other than FiT rates).

As the size of the Company’s portfolio grows, or as applicable rules and regulations evolve, it may become subject to new or modified regulatory regimes that may impose unanticipated requirements on the business as a whole that were not anticipated with respect to any individual renewable energy facility. Any local, state, federal or international regulations could place significant restrictions on the Company’s ability to operate its business and execute its business plan by prohibiting or otherwise restricting the sale of electricity. If the Company was deemed to be subject to the same state, federal or foreign regulatory authorities as traditional utility companies, or if new regulatory bodies were established to oversee the renewable energy industry in Europe or in international markets, its operating costs could materially increase, adversely affecting results of operations.

The Company has established various incentives and financial mechanisms to reduce the cost of renewable energy and to accelerate the adoption of PV solar and other renewable energies in each of the countries in which the Company operates. These incentives include tax credits, cash grants, favorable tax treatment and depreciation, rebates, GCs, net energy metering programs, FiTs, other governmental incentive programs and other incentives. These incentives help catalyze private sector investments in renewable energy and efficiency measures. Changes in the government incentives in each of these jurisdictions could have a material impact on the Company’s financial performance.

Implications of Being an “Emerging Growth Company”

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross revenues of $1.235 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will remain an emerging growth company for the foreseeable future, but cannot retain our emerging growth company status indefinitely and will no longer qualify as an emerging growth company on or before the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies.

These exemptions include:

| ● | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| ● | not being required to comply with the requirement of auditor attestation of our internal controls over financial reporting; |

| ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| ● | reduced disclosure obligations regarding executive compensation; and |

| ● | not being required to hold a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We have taken advantage of certain reduced reporting requirements in this Annual Report. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

An emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption of such standards is required for other public reporting companies.

We are also a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies.

Corporate Information

We were originally known as Clean Earth Acquisitions Corp. Following the approval of the Initial Business Combination Agreement and the transactions contemplated thereby at the special meeting of the stockholders of Clean Earth held on December 4, 2023 (the “Special Meeting”), we consummated the Business Combination. In connection with the Closing, we changed our name from Clean Earth Acquisition Corp. to Alternus Clean Energy, Inc.

Our principal executive offices are located at 360 Kingsley Park Drive, Suite 250, Fort Mill, South Carolina 29715. Our main telephone number is (803) 280-1468. Our website is https://alternusce.com/.

Available Information

Our website address is https://alternusce.com/. We make available on our website, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC maintains a website that contains reports, proxy and information statements and other information regarding our filings at www.sec.gov. The information found on our website is not incorporated by reference into this Annual Report on Form 10-K or any other report we file with or furnish to the SEC.

Item 1A. Risk Factors.

Investing in us involves a high degree of risk. Before you invest in us, you should carefully consider the following risks, as well as general economic and business risks, and all of the other information contained in this Annual Report on Form 10-K. Any of the following risks could have a material adverse effect on our business, operating results and financial condition and cause the trading price of our common stock to decline, which would cause you to lose all or part of your investment. When determining whether to invest, you should also refer to the other information contained in this Annual Report on Form 10-K, including our financial statements and the related notes thereto, and the other financial information concerning us included elsewhere in this Annual Report on Form 10-K.

We cannot assure you that we will achieve or maintain profitability and our auditor has expressed substantial doubt about our ability to continue as a going concern.

We will need to raise additional working capital to continue our normal and planned operations. We will need to generate and sustain significant revenue levels in future periods in order to become profitable, and, even if we do, we may not be able to maintain or increase our level of profitability. In addition, as a public company, we will incur accounting, legal and other expenses. These expenditures will make it necessary for us to continue to raise additional working capital. Our efforts to grow our business may be costlier than we expect, and we may not be able to generate sufficient revenue to offset our increased operating expenses. We may incur significant losses in the future for a number of reasons, including unforeseen expenses, difficulties, complications and delays and other unknown events. Accordingly, substantial doubt exists about our ability to continue as a going concern and we cannot assure you that we will achieve sustainable operating profits as we continue to expand our business, and otherwise implement our growth initiatives.

The financial statements included with this Annual Report have been prepared on a going concern basis. We may not be able to generate profitable operations in the future and/or obtain the necessary financing to meet our obligations and pay liabilities arising from normal business operations when they come due. The outcome of these matters cannot be predicted with any certainty at this time. These factors raise substantial doubt that we will be able to continue as a going concern. We plan to continue to provide for our capital needs through sales of our securities and/or other financing activities. Our financial statements do not include any adjustments to the amounts and classification of assets and liabilities that may be necessary should we be unable to continue as a going concern.

Our substantial indebtedness could adversely affect our business, financial condition and results of operations.

We believe that our substantial indebtedness will increase as an independent power producer (“IPP”). As of December 31, 2023, we had $198.4 million in outstanding short-term borrowing. It is likely that we will continue to be highly leveraged. The degree to which we remain leveraged could have important consequences to stockholders of the Company, including, but not limited to:

| ● | making it more difficult for the Company to satisfy its obligations with respect to its other debt and liabilities; |

| ● | increasing the Company’s vulnerability to, and reducing its flexibility to respond to, general adverse economic and industry conditions; |

| ● | requiring the dedication of a substantial portion of the cash flow of the Company from operations to the repayment of principal of, and interest on, indebtedness, thereby reducing the availability of such cash flow and limiting the ability to obtain additional financing to fund working capital, capital expenditures, acquisitions, joint ventures or other general corporate purposes, such as payments to suppliers for PV modules and balance-of-system components and contractors for design, engineering, procurement, and construction services; |

| ● | limiting the Company’s flexibility in planning for, or reacting to, changes in its business and the competitive environment and the industry in which it operates; and |

| ● | placing the Company at a competitive disadvantage as compared to its competitors, to the extent that they are not as highly leveraged. |

If the Company incurs new debt or other obligations, the related risks the Company now faces, as described in this risk factor and elsewhere in these “Risk Factors,” could intensify.

Our business as an independent power producer requires significant financial resources, and our growth prospects and future profitability depends to a significant extent on the availability of additional funding options with acceptable terms. If we do not successfully undertake subsequent financing plan(s), it may have to sell certain of its solar parks.

Our principal resources of liquidity to date have been cash from its operations and borrowings from banks and its shareholders. We have leveraged bank facilities in certain countries in order to meet working capital requirements for its activities. Our principal use of cash has been for pipeline development, working capital, and general corporate purposes.

We will require significant amounts of cash to fund the acquisition, development, installation, and construction of our projects and other aspects of our operations. We may also require additional cash due to changing business conditions or other future developments, including any investments or acquisitions it may decide to pursue in order to remain competitive. Historically, we have used bank loans, bridging loans, and third-party equity contributions to fund its project acquisition and development. We expect to seek to expand our business with third-party financing options, including bank loans, equity partners, financial leases, and securitization. However, it cannot be guaranteed that we will be successful in locating additional suitable sources of financing in the time periods required or at all, or on terms or at costs that it finds attractive or acceptable, which may render it impossible for us to fully execute our growth plan.

Any debt financing may require restrictive covenants and additional funds may not be available on terms commercially acceptable to us, vis-à-vis acquired assets and subsidiaries. Failure to manage discretionary spending and raise additional capital or debt financing as required may adversely impact our ability to achieve our intended business objectives.

We are a holding company that relies on distributions and other payments, advances and transfers of funds from our subsidiaries to meet our obligations.

We have no direct operations and derive all our revenue and cash flow from our subsidiaries. Because we conduct our operations through subsidiaries, we depend on those entities for payments or distributions in order to meet our obligations. The deterioration of the earnings from, or other available assets of, our subsidiaries for any reason could limit or impair their ability to pay us and adversely affect our operations.

The reduction, modification or elimination of government subsidies and economic incentives may reduce the economic benefits of existing solar parks and the opportunities to develop or acquire suitable new solar parks.

Government subsidies and incentives have primarily been in the form of FiT price support schemes, tax credits, net metering, and other incentives to end-users, distributors, system integrators and manufacturers of solar energy products. The availability and size of such subsidies and incentives depend, to a large extent, on political and policy developments relating to environmental concerns in a given country. Changes in policies could lead to a significant reduction in, or discontinuation of, the support for renewable energies in such country, which could, in turn, have a material adverse effect on our business, financial condition, results of operations, and prospects.

Decreases in the spot market price of electricity could harm our revenue and reduce the competitiveness of solar parks in grid-parity markets.

The price of electricity from our solar parks is fixed through PPAs or FiTs for a majority of its owned capacity. A FiT is a policy designed to support the development of renewable energy sources by providing a guaranteed, above-market price for producers. FiTs usually involve long-term contracts, anywhere from 15 to 20 years, whereas the PPAs that currently provide the additional revenue are typically renewed and may be terminated annually. In countries where the price of electricity is sufficiently high such that solar parks can be profitably developed without the need for government price supports, solar parks may choose not to enter into PPAs and would instead sell based on the spot market price of electricity. Revenue for our solar parks in Italy and Romania could fluctuate with the electricity spot market after the expiration of any PPA, unless it is renewed. The market price of electricity can be subject to significant fluctuations.

Decreases in the spot price of electricity in such countries could render PV energy less competitive compared to other forms of electricity. Thus, the spot market price of electricity may have a material adverse effect on our business, results of operations, cash flows, and financial condition.

Our power purchase agreements may not be successfully completed.

Payments by power purchasers under a PPA may provide the majority of a Subsidiary’s or a project’s cash flows. There can be no assurance that any or all of the power purchasers will fulfill their obligations under their PPAs or that a power purchaser will not become bankrupt, or that upon any such bankruptcy, its obligations under its respective PPA will not be rejected by a bankruptcy trustee. There are also additional risks relating to PPAs, including the occurrence of events beyond the control of a power purchaser that may excuse it from its obligation to accept and pay for the delivery of energy generated by the project company’s plant. The failure of a power purchaser to fulfill its obligations under any PPA or the termination of any PPA may have a material adverse effect on the respective project or project company and therefore on us.

The seasonality of our Subsidiaries’ operations may materially affect our business, results of operations, cash flows, and financial condition.

The energy production industry is subject to seasonal variations as well as other significant events. For instance, the amount of electricity and revenues generated by our solar generation facilities is dependent in part, on the amount of sunlight, or irradiation, where the assets are located. Due to shorter daylight hours in winter months, there is less irradiation and the generation produced by these facilities will vary depending on the season.

The seasonality of our energy production may create increased demands on liquidity during periods when cash generated from operating activities are lower and we may also require additional equity or debt financing to maintain its solvency, which may not be available when required or available on commercially favorable terms. Thus, the Company may struggle to maintain sufficient financial liquidity to absorb the impact of seasonal variations in energy productions. Other significant events and seasonal variations may adversely affect the Company’s business, results of operations, cash flows, and financial condition.

The acquisition of renewable energy facilities or of companies that own and operate renewable energy facilities is subject to substantial risk.

A significant part of our business model has been to acquire new renewable energy facilities and companies that own and operate renewable energy facilities. Acquisition of renewable energy facilities or of companies that own and operate renewable energy facilities is subject to substantial risk. While we believe that we have performed adequate due diligence on prospective acquisitions, we may not have been able to discover all potential operational deficiencies in such renewable energy facilities. In addition, our expectations for the operating performance of newly constructed renewable energy facilities as well as those under construction are based on assumptions and estimates made without the benefit of an operating history.

If we consummate any future acquisition, in line with our business model, our capitalization and results of operations may change significantly, and shareholders will generally not have the opportunity to evaluate the economic, financial and other relevant information that we consider in determining the application of these funds and other resources. As a result, the consummation of acquisitions may have a material adverse effect on the our business, financial condition, results of operations and cash flows.

Further, we may not be able to successfully integrate acquired businesses and, where desired, their product portfolios, and therefore the Company may not be able to realize the intended benefits of such acquisitions. The failure to integrate acquired businesses effectively may adversely impact the our business, results of operations or financial condition.

The delay between making significant upfront investments in solar parks and receiving revenue could materially and adversely affect our liquidity, business and results of operations.

There are generally multiple months between the initial significant upfront investments in solar parks, solar park development and obtaining permits to build solar parks which we expect to own and operate and when we begin to receive revenues from the sale of electricity generated by such solar parks after grid connection. Historically, we have relied on third-party equity contribution, bridging and bank loans to pay for costs and expenses incurred during project development, especially to third parties for PV modules and balance-of-system components and EPC and O&M services. Such investments may be non-refundable. Solar parks typically generate revenue only after becoming commercially operational and once they are able to sell electricity to the power grid. Between our initial investments in the development of solar parks (through its model of working with local developers) and their connection to the transmission grid, there may be adverse developments impacting such solar parks. The timing gap between its upfront investments and actual generation of revenue, or any added delay due to unforeseen events, could put strains on our liquidity and resources and materially and adversely affect its profitability and results of operations.

We may experience delays related to developing and maintaining renewable energy projects.

Development of solar power projects can take many months or years to complete and may be delayed for reasons beyond its control. Development usually requires a company to make some up-front payments for, among other things, land/rooftop use rights and permitting in advance of commencing construction, and revenue from these projects may not be recognized for several additional months following contract signing. Furthermore, we may become constrained in our ability to simultaneously fund other investments in such projects.

Development, operation and maintenance of renewable energy projects and related infrastructure expose us to numerous risks, including construction, environmental, regulatory, permitting, commissioning, start-up, operating, economic, commercial, political and financial risks. This involves risks of failure to obtain or substantial delays in obtaining: (i) regulatory, environmental or other approvals or permits; (ii) financing; (iii) leasing; and (iv) suitable equipment supply, operating and off-take contracts. Moreover, renewable energy assets are subject to energy regulation and require governmental licenses and approval for their operation. The failure to obtain, maintain or comply with the licenses and approvals relating to our assets and the resulting costs, fines and penalties, could materially and adversely affect our ability to operate the assets. Renewable energy projects also require significant expenditure before the assets begin to generate income and often require long-term investment to enable projects to generate expected levels of income. The development of solar power projects also requires significant management attention to negotiate the terms of engagement and monitor the progress of the projects which may divert management’s attention from other matters.

Solar project development is challenging and may ultimately not be successful and miscalculations in planning a project may negatively affect engineering procurement and construction (“EPC”) prices, all of which could increase the costs, delay or cancel a project, and have a material adverse effect on its business, financial condition, results of operations and profit margins.

The development of solar projects involves numerous risks and uncertainties and requires extensive research, planning and due diligence. We may be required to incur significant amounts of capital expenditure for land/rooftop use rights, interconnection rights, preliminary engineering, permits, legal and other expenses before we can determine whether a solar power project is economically, technologically or otherwise feasible. Success in developing a solar power project is contingent upon, among other things:

| ● | securing investment or development rights; |

| ● | securing suitable project sites, necessary rights of way, satisfactory land/rooftop use or access rights in the appropriate locations with capacity on the transmission grid and related permits, including completing environmental assessments and implementing any required mitigation measures; |

| ● | rezoning land, as necessary, to support a solar power project; |

| ● | negotiating satisfactory EPC agreements; |

| ● | negotiating and receiving required permits and approvals for project development from government authorities on schedule; |

| ● | completing all required regulatory and administrative procedures needed to obtain permits and agreements; |

| ● | procuring rights to interconnect the solar power project to the electric grid or to transmit energy; |

| ● | paying interconnection and other deposits, some of which are non-refundable; |

| ● | signing grid connection and dispatch agreements, power purchase agreements, or PPAs, or other arrangements that are commercially acceptable, including adequate for providing financing; |

| ● | obtaining project financing, including debt financing and own equity contribution; |

| ● | negotiating favorable payment terms with suppliers; and |

| ● | completing construction on schedule in a satisfactory manner. |

Successful completion of a particular solar project may be adversely affected by numerous factors, including without limitation:

| ● | unanticipated changes in project plans or defective or late execution; |

| ● | difficulties in obtaining and maintaining governmental permits, licenses and approvals required by existing laws and regulations or additional regulatory requirements not previously anticipated; |

| ● | potential challenges from local residents, environmental organizations, and others who may not support the project; |

| ● | uncertainty in the timing of grid connection; |

| ● | the inability to procure adequate financing with acceptable terms; |

| ● | unforeseeable engineering problems, construction or other unexpected delays and contractor performance shortfalls; |

| ● | labor, equipment and materials supply delays, shortages or disruptions, or work stoppages; |

| ● | adverse weather, environmental and geological conditions, force majeure and other events outside of owner’s control; and |

| ● | cost overruns, due to any one or more of the foregoing factors. |

Accordingly, some of the solar power projects in our pipeline may not be completed or even proceed to construction. If several solar power projects are not completed, our business, financial condition and results of operations could be materially and adversely affected.

Development activities may be subject to cost overruns or delays, which may materially and adversely affect our financial results and results of operations.

Development of our solar power projects may be adversely affected by circumstances outside of its control, including inclement weather, a failure to receive regulatory approvals on schedule or third-party delays in providing solar modules, inverters or other materials. Obtaining full permits for solar power projects is time consuming and we may not be able to meet the expected timetable for obtaining full permits for solar power projects in the pipeline. In addition, we usually rely on external contractors for the development and construction of solar power projects and may not be able to negotiate satisfactory agreements with them. If contractors do not satisfy their obligations or do not perform work that meets our quality standards or if there is a shortage of third-party contractors or if there are labor strikes that interfere with the ability of employees or contractors to complete their work on time or within budget, we could experience significant delays or cost overruns. Changes in project plans or designs, or defective or late execution may increase our costs and cause delays. Increases in the prices of solar products and balance-of-system components may increase procurement costs. Labor shortages, work stoppages or labor disputes could significantly delay a project or otherwise increase costs. In addition, delays in obtaining, our inability to obtain, or a lack of proper construction permits or post-construction approvals could delay or prevent the construction of solar power projects, commencing operation and connecting to the relevant grid.

We may not be able to recover any of these losses in connection with construction cost overruns or delays. In addition, in certain cases of delay, we might not be able to obtain any FiT or PPA at all, as certain FiTs or PPAs require that it connects to the transmission grid by a certain date. A reduction or forfeiture of FiT or PPA payments would materially and adversely affect the financial results and results of operations for that solar power project.

Impact of RePowerEU programme on our business and future prospects.