UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2024

Commission File Number: 001-38773

CHINA SXT PHARMACEUTICALS, INC.

(Translation of registrant’s name into English)

178 Taidong Rd North, Taizhou

Jiangsu, China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Explanatory Note

China SXT Pharmaceuticals, Inc. (the “Company”) is furnishing this Form 6-K to provide its financial results for the six months ended September 30, 2023.

The Company hereby furnishes the following documents as the exhibits to this report: “Unaudited Condensed Consolidated Financial Statements for the Six Months Ended September 30, 2023 and 2022” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Exhibits

| Exhibit No. | Description | |

| 99.1 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| 99.2 | Unaudited Condensed Consolidated Financial Statements for the Six Months Ended September 30, 2023 and 2022 | |

| 101.INS | Inline XBRL Instance Document. | |

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document. | |

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document. | |

| 101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document. | |

| 101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document. | |

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document. | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: April 4, 2024

| China SXT Pharmaceuticals, Inc. | ||

| By: | /s/ Feng Zhou | |

| Name: | Feng Zhou | |

| Title: | Chief Executive Officer | |

Exhibit 99.1

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our results of operations and financial condition should be read together with our unaudited condensed consolidated financial statements and the notes thereto and other financial information, which are included elsewhere in this Form 6-K. Our unaudited financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). In addition, our unaudited financial statements and the financial information included in this Form 6-K reflect our organizational transactions and have been prepared as if our current corporate structure had been in place throughout the relevant periods.

This section contains forward-looking statements. These forward-looking statements are subject to various factors, risks and uncertainties that could cause actual results to differ materially from those reflected in these forward-looking statements. Further, as a result of these factors, risks and uncertainties, the forward-looking events may not occur. Relevant factors, risks and uncertainties include, but are not limited to, those discussed in the section entitled “Business,” “Risk Factors” and elsewhere in this Form 6-K. Readers are cautioned not to place undue reliance on forward-looking statements, which reflect management’s beliefs and opinions as of the date of this Form 6-K. We are not obligated to publicly update or revise any forward-looking statements, whether as a result of new Information, future events or otherwise. See “Special Note Regarding Forward-Looking Statements.”

Unless otherwise indicated or the context requires otherwise, “we”, “us” or the “Company” in this prospectus are to China SXT Pharmaceuticals, Inc., its subsidiaries and its affiliated entities in the context of describing our business, operations and consolidated financial information.

Overview

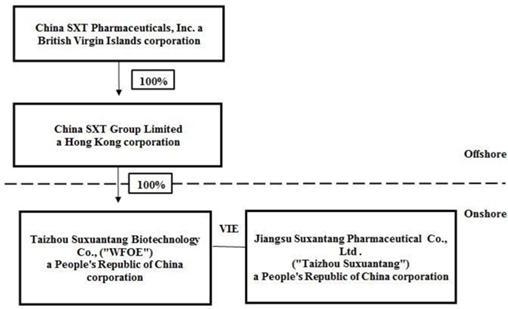

We are an offshore holding company incorporated in British Virgin Islands, conducting all of our business through our subsidiaries and variable interest entity, Jiangsu Taizhou Suxantang Pharmaceutical Co., Ltd. (“Taizhou Suxuantang” or the “VIE”) in China. Neither we nor our subsidiaries own any share in Taizhou Suxuantang. Instead, we control and receive the economic benefits of Taizhou Suxuantang’s business operation through a series of contractual arrangements, also known as VIE Agreements. The VIE Agreements by and among our wholly-owned subsidiary, Taizhou Suxantang Biotechnology Co. Ltd. (the “WFOE”), Taizhou Suxuantang, and Taizhou Suxuantang’s shareholders include (i) certain power of attorney agreements and equity interest pledge agreement, which provide WFOE effective control over Taizhou Suxuantang; (ii) an exclusive technical consulting and service agreement which allows WFOE to receive substantially all of the economic benefits from Taizhou Suxuantang; and (iii) certain exclusive equity interest purchase agreements which provide WFOE with an exclusive option to purchase all or part of the equity interests in and/or assets of Taizhou Suxuantang when and to the extent permitted by PRC laws. Through the VIE Agreements among WFOE, Taizhou Suxuantang and Taizhou Suxuantang’s shareholders, we are regarded as the primary beneficiary of Taizhou Suxuantang for accounting purpose, and, therefore, we are able to consolidate the financial results of Taizhou Suxuantang in our consolidated financial statements in accordance with U.S. GAAP. However, the VIE structure cannot completely replicate a foreign investment in China-based companies, as the investors will not and may never directly hold equity interests in the Chinese operating entities. Instead, the VIE structure provides contractual exposure to foreign investment in us. Because we do not directly hold equity interests in the VIE, we are subject to risks due to uncertainty of the interpretation and the application of the PRC laws and regulations, including but not limited to limitation on foreign ownership of internet technology companies, regulatory review of oversea listing of PRC companies through a special purpose vehicle, and the validity and enforcement of the VIE Agreements. We are also subject to the risks of uncertainty about any future actions of the PRC government in this regard that could disallow the VIE structure, which would likely result in a material change in our operations and the value of Ordinary Shares may depreciate significantly or become worthless.

Our VIE Agreements may not be effective in providing control over Taizhou Suxuantang. We may also subject to sanctions imposed by PRC regulatory agencies including Chinese Securities Regulatory Commission, or CSRC, if we fail to comply with their rules and regulations.

We rely principally on dividends and other distributions on equity from Taizhou Suxuantang and its subsidiaries for our cash requirements, including for services of any debt we may incur. Taizhou Suxuantang and its subsidiaries’ ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit Taizhou Suxuantang and its subsidiaries to pay dividends to their respective shareholders only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, each of Taizhou Suxuantang and its subsidiaries are required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of each of their registered capitals. These reserves are not distributable as cash dividends. If our PRC subsidiaries incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments to us. Any limitation on the ability of Taizhou Suxuantang and its subsidiaries to distribute dividends or other payments to their respective shareholders could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our businesses, pay dividends or otherwise fund and conduct our business.

To address the persistent capital outflow and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China and the State Administration of Foreign Exchange, or SAFE, have implemented a series of capital control measures in the subsequent months, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments and shareholder loan repayments. For instance, the Circular on Promoting the Reform of Foreign Exchange Management and Improving Authenticity and Compliance Review, or the SAFE Circular 3, issued on January 26, 2017, provides that the banks shall, when dealing with dividend remittance transactions from domestic enterprise to its offshore shareholders of more than US$50,000, review the relevant board resolutions, original tax filing form and audited financial statements of such domestic enterprise based on the principal of genuine transaction. The PRC government may continue to strengthen its capital controls and Taizhou Suxuantang and its subsidiaries’ dividends and other distributions may be subject to tightened scrutiny in the future. Any limitation on the ability of Taizhou Suxuantang and its subsidiaries to pay dividends or make other distributions to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends, or otherwise fund and conduct our business.

In addition, the Enterprise Income Tax Law and its implementation rules provide that a withholding tax at a rate of 10% will be applicable to dividends payable by Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC central government and governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant to the tax agreement between Mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect to the payment of dividends by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10% if the Hong Kong enterprise (i) directly holds at least 25% of the PRC enterprise, (ii) is a tax resident in Hong Kong and (iii) could be recognized as a beneficial owner of the dividend from PRC tax perspective. Under administrative guidance, a Hong Kong resident enterprise must meet the following conditions, among others, in order to apply the reduced withholding tax rate: (i) it must be a company; (ii) it must directly own the required percentage of equity interests and voting rights in the PRC resident enterprise; and (iii) it must have directly owned such required percentage in the PRC resident enterprise throughout the 12 months prior to receiving the dividends. Nonresident enterprises are not required to obtain pre-approval from the relevant tax authority in order to enjoy the reduced withholding tax. Instead, nonresident enterprises and their withholding agents may, by self-assessment and on confirmation that the prescribed criteria to enjoy the tax treaty benefits are met, directly apply the reduced withholding tax rate, and file necessary forms and supporting documents when performing tax filings, which will be subject to post-tax filing examinations by the relevant tax authorities. Accordingly, our wholly owned subsidiary China SXT Group Limited (“SXT HK”) incorporated in Hong Kong may be able to benefit from the 5% withholding tax rate for the dividends it receives from our PRC subsidiaries, if it satisfies the conditions prescribed under Guoshuihan [2009] 81 and other relevant tax rules and regulations. However, if the relevant tax authorities consider the transactions or arrangements we have are for the primary purpose of enjoying a favorable tax treatment, the relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly, there is no assurance that the reduced 5% will apply to dividends received by SXT HK from Taizhou Suxuantang and its subsidiaries. This withholding tax will reduce the amount of dividends we may receive from Taizhou Suxuantang and its subsidiaries.

Through our subsidiaries and Taizhou Suxuantang, we are an innovative pharmaceutical company based in China that focuses on the research, development, manufacture, marketing and sales of TCMP. TCMP is a type of TCM products that has been widely accepted by Chinese people for thousands of years. Throughout the decades of years, TCMP products’ origin, identification, prepared process, quality standard, indication, dosage and administration, precautions, and storage have been well documented, listed and specified in “China Pharmacopoeia” a state-governmental issued guidance on manufacturing TCMP. In recent years, TCMP industry enjoyed more rapid growth than any other segments of the pharmaceutical industry primarily due to the favorable government policies for the TCMP industry. Because of the favorable government policies, TCMP products do not have to go through rigorous clinical trials before commercialization. We currently sell three types of TCMP products: Advanced TCMP, Fine TCMP and Regular TCMP. Although all of our TCMP products are generic TCMP drugs and we did not change the medical effects of these products in any significant way, these products are innovative in terms of their unconventional administration. The complexity of the manufacturing process is what differentiates these types of products. Advanced TCMP typically has the highest quality because it requires specialized equipment and prepared processes to manufacture, and has to go through more manufacturing steps to produce than Fine TCMP and Regular TCMP. Fine TCMP is also manufactured with more refined ingredients than Regular TCMP.

Consolidation

We conduct all of our business in China via Taizhou Suxuantang and its subsidiaries, due to PRC legal restrictions of foreign ownership in certain sectors. Substantially all of our revenues, costs and net income in China are directly or indirectly generated through Taizhou Suxuantang and its subsidiaries. The VIE agreements allow the transfer of economic benefits from Taizhou Suxuantang to us and to direct the activities of Taizhou Suxuantang.

Total assets and liabilities presented on our consolidated balance sheets and revenue, expense, net income presented on consolidated statement of operations and comprehensive income as well as the cash flow from operating, investing and financing activities presented on the consolidated statement of cash flows are substantially the financial position, operation and cash flow of Taizhou Suxuantang and its subsidiaries. We have not provided any financial support to Taizhou Suxuantang and its subsidiaries for the six months ended September 30, 2023 and the years ended at March 31, 2023 and 2022. As of September 30, 2023, our variable interest entities accounted for an aggregate of 98% and 66% of our total assets and total liabilities, respectively. As of March 31, 2023, our variable interest entities accounted for an aggregate of 97% and 75% of our total assets and total liabilities, respectively. As of September 30, 2023 and March 31, 2023, $11,460,445 and $16,735,938 of cash and cash equivalents were denominated in RMB, respectively. The following table sets forth the assets, liabilities, results of operations and changes in cash, cash equivalents the VIE subsidiary taken as a whole, which were included in the Company’s condensed consolidated balance sheets and statements of comprehensive income and statements of cash flows with intercompany transactions eliminated:

| September 30, 2023 |

March 31, 2023 |

|||||||

| Current assets | $ | 13,168,215 | $ | 18,507,901 | ||||

| Non-current assets | 1,092,661 | 10,032,809 | ||||||

| Total assets | $ | 14,260,876 | $ | 28,540,710 | ||||

| Total liabilities | 12,096,990 | 16,280,994 | ||||||

| Total shareholders’ equity | $ | 2,163,886 | $ | 12,259,716 | ||||

| For the six months ended September 30, |

||||||||

| 2023 | 2022 | |||||||

| Revenue | $ | 939,583 | $ | 1,208,288 | ||||

| Net loss | $ | (9,329,818 | ) | $ | (636,861 | ) | ||

| For the six months ended September 30, |

||||||||

| 2023 | 2022 | |||||||

| Net cash used in operating activities | $ | (632,605 | ) | $ | (290,590 | ) | ||

| Net cash provided by investing activities | 19,639 | 39,310 | ||||||

| Net cash used in financing activities | (3,609,666 | ) | (10,071,028 | ) | ||||

| Effects of foreign currency translation | (875,442 | ) | 1,997,882 | |||||

| Net decrease in cash and cash equivalents | $ | (5,098,074 | ) | $ | (8,324,426 | ) | ||

Key Factors Affecting Our Results of Operation

Working capital required to implement our business plan will most likely be provided by funds obtained through offerings of our equity, debt, debt-linked securities, and/or equity-linked securities, and revenues generated by us. No assurance can be given that we will have revenues sufficient to support and sustain our operations or that we would be able to obtain equity/debt financing in the current economic environment. If we do not have sufficient working capital and are unable to generate sufficient revenues or raise additional funds, we may delay the completion of or significantly reduce the scope of our current business plan; delay some of our development and clinical or marketing efforts; postpone the hiring of new personnel; or, under certain dire financial circumstances, substantially curtail or cease our operations.

Our past operating results are not an accurate indication of the lines of business we are principally engaged in currently. Thus, you should consider our future prospects in light of the risks and uncertainties experienced by early-stage companies in evolving markets rather than typical companies of our age. Some of these risks and uncertainties relate to our ability to:

| ● | attract additional customers and increased spending per customer; |

| ● | increase awareness of our brand and develop customer loyalty; |

| ● | respond to competitive market conditions; |

| ● | respond to changes in our regulatory environment; |

| ● | manage risks associated with intellectual property rights; |

| ● | maintain effective control of our costs and expenses; |

| ● | raise sufficient capital to sustain and expand our business; |

| ● | attract, retain and motivate qualified personnel; and |

| ● | upgrade our technology to support additional research and development of new products. |

Results of Operations for the Six Months Ended September 30, 2023 Compared to September 30, 2022

| For the six months ended September 30, |

Change | |||||||||||||||

|

2023 (Unaudited) |

2022 (Unaudited) |

Amount | % | |||||||||||||

| Revenues | $ | 939,583 | 1,208,288 | $ | (268,705 | ) | (22 | )% | ||||||||

| Revenues generated from third parties | 926,805 | 1,191,808 | (265,003 | ) | (22 | )% | ||||||||||

| Revenue generated from related parties | 12,778 | 16,480 | (3,702 | ) | (22 | )% | ||||||||||

| Cost of revenues | (651,242 | ) | (1,118,604 | ) | 467,362 | (42 | )% | |||||||||

| Gross profit | 288,341 | 89,684 | 198,657 | 222 | % | |||||||||||

| Selling expenses | (176,950 | ) | (272,166 | ) | 95,216 | (35 | )% | |||||||||

| General and administrative expenses | (9,460,412 | ) | (967,964 | ) | (8,492,448 | ) | 877 | % | ||||||||

| Total operating expenses | (9,637,362 | ) | (1,240,130 | ) | (8,397,232 | ) | 677 | % | ||||||||

| Loss from operations | (9,349,021 | ) | (1,150,446 | ) | (8,198,575 | ) | 713 | % | ||||||||

| Interest expenses, net | (336,520 | ) | (384,286 | ) | 47,766 | (12 | )% | |||||||||

| Other income (expenses), net | (10,617 | ) | 40,123 | (50,740 | ) | (126 | )% | |||||||||

| Total other expenses, net | (347,137 | ) | (344,163 | ) | (2,974 | ) | 1 | % | ||||||||

| Loss before income taxes expense | (9,696,158 | ) | (1,494,609 | ) | (8,201,549 | ) | 549 | % | ||||||||

| Provision for income taxes | - | - | - | - | % | |||||||||||

| Net Loss | $ | (9,696,158 | ) | (1,494,609 | ) | $ | (8,201,549 | ) | 549 | % | ||||||

Revenues

We generated revenues primarily from manufacture and sales of four types of traditional Chinese medicine pieces (the “TCMP”) products: Advanced TCMP, Fine TCMP, Regular TCMP, and raw medicinal materials. As compared with the six months ended September 30, 2022, our total revenues decreased by $268,705, or 22% for the six months ended September 30, 2023. The decrease was primarily due to the decrease in sales of Fine TCMP products and raw medicinal materials, offset by the increase in sales of Advanced TCMP products and Regular TCMP products.

The following table sets forth the breakdown of revenues by categories for the six months ended September 30, 2023 and 2022 presented:

| For the six months ended September 30, |

Change | |||||||||||||||

| 2023 | 2022 | Amount | % | |||||||||||||

| Advanced TCMP | $ | 492,414 | 242,075 | $ | 250,339 | 103 | % | |||||||||

| Fine TCMP | 24 | 110,215 | (110,191 | ) | (100 | )% | ||||||||||

| Regular TCMP | 424,239 | 413,505 | 10,734 | 3 | % | |||||||||||

| Raw medicinal materials | 22,906 | 442,493 | (419,587 | ) | (95 | )% | ||||||||||

| Total Revenue | $ | 939,583 | $ | 1,208,288 | $ | (268,705 | ) | (22 | )% | |||||||

Advanced TCMP

Advanced TCMP products are comprised of nine Directly Oral TCMP products (the “Directly-Oral-TCMP”) and nine After-soaking-oral TCMP products (the “After-Soaking-Oral-TCMP”). Both Directly Oral TCMP and After-soaking-oral TCMP are new types of advanced TCMP.

Revenue from advanced TCMP accounted for 52% and 20% of revenue recognized during the six months ended September 30, 2023 and 2022, respectively. As compared with the six months ended September 30, 2022, our revenue generated from advanced TCMP increased by $250,339, or 103% for the six months ended September 30, 2023. The increase was mainly due to that after the lift of lockdown measure, the supply of raw materials for the production of Advance TCMP products was secured and the Company's production efficiency was gradually improved, market demand gradually recovered and therefore sales volume of Advanced TCMP increased during the six months ended September 30, 2023. Additionally, the sales price of major Advanced TCMP products (DBC products) increased significantly during the six months ended September 30, 2023.

Fine TCMP

We currently produce over 10 fine TCMP products for drug stores and hospitals. Our fine TCMP products are manufactured manually from only high-quality authentic ingredients derived from their region of origin.

Revenue from fine TCMP accounted for 0% and 9% of revenue recognized during the six months ended September 30, 2023 and 2022. As compared with the six months ended September 30, 2022, our revenue generated from fine TCMP decreased by $110,191, or 100% for the six months ended September 30, 2023. The decrease was primarily attributable to the fact that we decided to discontinue cooperation with major clients in the sales of fine TCMP, as the purchase price of raw materials surged since July 2022.

Regular TCMP

We currently manufacture 235 regular TCMP products listed on China Pharmacopoeia (version 2020) Part I for hospitals and drug store in treatment of various diseases or serving as dietary supplements.

Revenue from regular TCMP accounted for 45% and 34% of revenue recognized during the six months ended September 30, 2023 and 2022, respectively. Revenue from regular TCMP products increased slightly by $10,734, or 3%, to $424,239 for the six months ended September 30, 2023 from $413,505 for the six months ended September 30, 2022. The market demand for our Regular TCMP product remained stable.

Raw medicinal materials

During the six months ended September 30, 2023 and 2022, we generated revenue from sales of raw medicinal materials of $22,906 and $442,493, which represented 2% and 37% of our total revenue, respectively. As the low gross margin rate and declined market demand for our raw medicinal materials, we discontinued the sales of raw medicinal materials during the six months ended September 30, 2023.

Gross Profit

Cost of revenues primarily include cost of materials, direct labors, overhead, and other related incidental expenses that are directly attributable to the Company’s principal operations. Total cost of revenue decreased by $467,362, or 42%, to $651,242 for the six months ended September 30, 2023 from $1,118,604 for the six months ended September 30, 2022. The decrease of cost of revenues was mainly due to the decrease of the sales of our products.

Gross profit increased by $198,657, or 222%, to $288,341 for the six months ended September 30, 2023 from $89,684 for the six months ended September 30, 2022. Gross margin was 30.7% for the six months ended September 30, 2023, as compared to 7.4% for the six months ended September 30, 2022. The increase in gross margin was mainly due to the following reasons: (i) the sales in our Advanced TCMP products increased significantly for the six months ended September 30, 2023 compared to the same period in 2022, and Advanced TCMP products have relatively high margin; (ii) the sales of raw medicinal material, which have very low margin, accounted for a small portion of our total revenue for the six months ended September 30, 2023 while a significant portion of total revenue for the six months ended September 30, 2022.

Operating loss

Selling expenses primarily consisted of sales staff payroll and welfare expenses, travelling expenses, advertisement expenses, distribution expenses. Selling expenses decreased from $272,166 for the six months ended September 30, 2022 to $176,950 for the six months ended September 30, 2023, representing a decrease of $95,216, or 35%. The decrease was mainly due to the decrease in our sales volume and our efforts in cost control.

General and administrative expenses primarily consisted of staff payroll and welfare expenses, research and development expenses, professional consulting expenses, bad debt expenses, entertainment expenses, travelling expenses, depreciation and amortization expenses for administrative purposes, and office supply expenses. General and administrative expenses increased from $967,964 for the six months ended September 30, 2022 to $9,460,412 for the six months ended September 30, 2023, representing an increase of $8,492,448, or 877%. The increase in general and administrative expenses was mainly due to provision for credit loss of accounts receivable of $26,518, provision for credit loss of long-term deposit of $8,416,681, and the increase in entertainment expenses comparing to the six months ended September 30, 2022.

Operating loss increased $8,198,575, or 713%, from $1,150,446 for the six months ended September 30, 2022 to $9,349,021 for the six months ended September 30, 2023.

Other expenses, net

Interest expenses for the six months ended September 30, 2023 mainly consists of accretion of finance cost and interest expense of Convertible Notes issued on December 19, 2022 and March 7, 2023. For the six months ended September 30, 2023, the company record amortization of issuance cost and debt discount of $212,708 and Convertible Notes interest expense of $114,736.

Interest expenses for the six months ended September 30, 2022 mainly consists of accretion of finance cost and interest expense of Convertible Notes issued on March 16, 2022. For the six months ended September 30, 2022, the company record amortization of issuance cost and debt discount of $311,642 and Convertible Notes interest expense of $72,880.

Other expenses, net of $10,617 for the six months ended September 30, 2023 was mainly due to inventory count shortage. Other income, net of $40,123 for the six months ended September 30, 2022 was mainly due to the government subsidies we received from local government for research and development activities.

Income tax expense

Income tax expense represented current and deferred income tax expenses derived from income before taxes generated by Suxuantang, the variable interest entity of the Company. Income tax benefit expense for the six months ended September 30, 2023 and 2022 were $Nil and $Nil.

Net loss

As a result of the foregoing, net loss for the six months ended September 30, 2023 was $9,696,158, representing an increase in net loss of $8,201,549 from $1,494,609 for the six months ended September 30, 2022.

Liquidity and Capital Resources

To date, we have financed our operations primarily through shareholder capital contributions, shareholder loans, convertible notes, and cash flow from operations. As a result of our total activities, we had cash and cash equivalents of $11,465,020 and $17,368,478 as of September 30, 2023 and March 31, 2023, respectively. We primarily hold our excess unrestricted cash in short-term interest-bearing bank accounts at financial institutions. With the current cash and cash equivalents and anticipated financing from our related parties and equity plans in the next six months, we believe that our cash position is sufficient to meet our liquidity needs for at least the next 12 months.

| For the six months ended September 30, |

||||||||

| 2023 | 2022 | |||||||

| Net Cash Used in Operating Activities | (579,568 | ) | (549,125 | ) | ||||

| Net Cash Provided by Investing Activities | 19,639 | 39,310 | ||||||

| Net Cash Used in Financing Activities | (4,461,735 | ) | (11,069,358 | ) | ||||

| Effect of Exchange Rate Changes on Cash | (881,794 | ) | (1,009,412 | ) | ||||

| Net decrease in cash, cash equivalents | (5,903,458 | ) | (12,588,585 | ) | ||||

Cash Flow in Operating Activities

For the six months ended September 30, 2023, net cash used in operating activities was $579,568, as compared to net cash used in operating activities of $549,125 for the six months ended September 30, 2022, representing an increase of $30,443. The increase in net cash used in operating activities primarily resulted from the change of following accounts:

| a) | A net loss for the six months ended September 30, 2023 of $9,696,158, compared with the net loss for the six months ended September 30, 2022 of $1,494,609. |

| b) | Change in inventories was $7,006 net cash inflow for the six months ended September 30, 2023. For the six months ended September 30, 2022, change in inventories was $294,421 net cash inflow, which led to $287,415 decrease in net cash inflow from operating activities. |

| c) | Change in accounts payable was $19,353 net cash inflow for the six months ended September 30, 2023. For the six months ended September 30, 2022, change in accounts payables was $253,976 net cash inflow, which led to $234,623 decrease in net cash inflow from operating activities |

| d) | Equity incentive plan – non-cash expense adjustment of equity incentive plan was $Nil for the six months ended September 30, 2023. For the six months ended September 30, 2022, non-cash expense adjustment of equity incentive plan was $277,285, which led to $277,285 increase in net cash outflow from operating activities. |

And offset by the change of following accounts:

| a) | Expected credit loss – non-cash expense adjustment of expected credit loss was $8,450,277 for the six months ended September 30, 2023. For the six months ended September 30, 2022, non-cash expense adjustment of expected credit loss was $Nil, which led to $8,450,277 decrease in net cash outflow from operating activities. |

| b) | Change in accounts receivable was $72,969 net cash outflow for the six months ended September 30, 2023. For the six months ended September 30, 2022, change in accounts receivable was $372,734 net cash outflow, which led to $299,765 decrease in net cash outflow from operating activities. |

| c) | Change in accrued expenses and other current liabilities was $308,019 net cash inflow for the six months ended September 30, 2023. For the six months ended September 30, 2022, change in accrued expenses and other current liabilities was $84,552 net cash inflow, which led to $223,467 increase in net cash inflow from operating activities. |

Cash Flow in Investing Activities

We had net cash provided by investing activities of $19,639 for the six months ended September 30, 2023, which was collection of receivables from Huangshan Panjie Investment Management Co., Ltd. of $19,639.

We had net cash provided by investing activities of $39,310 for the six months ended September 30, 2022, which primarily consisted of purchase of property and equipment of $20,115 and collection of receivables from Huangshan Panjie Investment Management Co., Ltd. of $59,425.

Cash Flow in Financing Activities

For the six months ended September 30, 2023, the net cash used in financing activities was $4,461,735, which was primarily attributable to repayments to related parties of $4,582,113, and repayment of the short-term borrowings of $4,469, offset by proceeds from short-term borrowings of $124,847.

For the six months ended September 30, 2022, the net cash used in financing activities was $11,069,358, which was primarily attributable to repayments to related parties of $11,061,683 and payment of the bank borrowings of $7,675.

The Equity Incentive Plan

On March 11, 2022, the board of directors of the Company adopted the 2022 equity incentive plan and approved the filing of a registration statement on Form S-8 (File No. 333-263563) to register such plan. On May 15, 2022, the Company has issued 6,094,180 ordinary shares (12,188 shares retrospectively restated for effect of reverse stock split on May 19, 2022 and October 5, 2023), which were all the ordinary shares available under the 2022 equity incentive plan.

On January 5, 2024, the board of directors of the Company adopted the 2024 equity incentive plan and approved the filing of a registration statement on Form S-8 (File No. 333-276472) to register such plan. On January 24, 2024, the Company has issued 185,316 ordinary shares (on a post-split basis), which were all the ordinary shares available under the 2024 equity incentive plan.

The Convertible Notes

The Convertible Note 2022-1

On March 16, 2022, the Company entered into a securities purchase agreement with an institutional investor pursuant to which the Company issued an unsecured convertible promissory note with a 12-months maturity (the “Convertible Note 2022-1”) to the investor. The Convertible Note 2022-1 has the original principal amount of $2,804,848 including the original issue discount of $168,291 and the investor’s legal and other transaction costs of $20,000. The Company anticipates using the proceeds for general working capital purposes. The Convertible Note 2022-1 was fully converted on February 2, 2023. As of the date of this report, there is $0 outstanding under the Convertible Note 2022-1.

Material Terms of the Convertible Note 2022-1:

| ● | Interest accrues on the outstanding balance of the Note at 6% per annum from the purchase price date until the same is paid in full. All interest calculations hereunder shall be computed on the basis of a 360-day year comprised of twelve (12) thirty (30) day months, shall compound daily and shall be payable in accordance with the terms of this Note. |

| ● | Upon the occurrence of a trigger event, the investor may increase the outstanding balance payable under the Note by 12% or 5%, depending on the nature of such event. If the Company fails to cure the trigger event within the required five trading days, the trigger event will automatically become an event of default and interest will accrue at the lesser of 22% per annum or the maximum rate permitted by applicable law. |

| ● | Subject to adjustment as set forth in this Note, the price at which the lender has the right to convert all or any portion of the outstanding balance into ordinary shares is $0.30 per share. |

The Convertible Note 2022-2

On December 19, 2022, the Company entered into a securities purchase agreement with Streeterville Capital, LLC, pursuant to which the Company issued the investor an unsecured promissory note on December 19, 2022 in the original principal amount of $1,595,000 (the “Convertible Note 2022-2”), convertible into ordinary shares, $0.08 par value per share, of the Company for $1,500,000 in gross proceeds. The Company anticipates using the proceeds for general working capital purposes. As of the date of this report, there is $875,436 outstanding under the Convertible Note 2022-2.

Material Terms of the Convertible Note 2022-2:

| ● | Interest accrues on the outstanding balance of the Note at 6% per annum from the purchase price date until the same is paid in full. All interest calculations hereunder shall be computed on the basis of a 360-day year comprised of twelve (12) thirty (30) day months, shall compound daily and shall be payable in accordance with the terms of this Note. |

| ● | Upon the occurrence of a trigger event, the investor may increase the outstanding balance payable under the Note by 15% or 5%, depending on the nature of such event. If the Company fails to cure the trigger event within the required five trading days, the trigger event will automatically become an event of default and interest will accrue at the lesser of 15% per annum or the maximum rate permitted by applicable law. |

| ● | Subject to adjustment as set forth in this Note, the price at which the lender has the right to convert all or any portion of the outstanding balance into ordinary shares is the lower of (i) the Lender Conversion Price which is initially $0.60 and (ii) 80% of the average of the lowest VWAP during the fifteen (15) trading days immediately preceding the redemption notice is delivered. |

The Convertible Note 2023

On March 7, 2023, the Company entered into a securities purchase agreement with Streeterville Capital, LLC, pursuant to which the Company issued the investor an unsecured promissory note on March 7, 2023 in the original principal amount of $2,126,667 (the “Convertible Note 2023”), convertible into ordinary shares, $0.08 par value per share, of the Company for $2,000,000 in gross proceeds. The Company anticipates using the proceeds for general working capital purposes. The Convertible Note 2023 was fully converted on January 25, 2024. As of the date of this report, there is $0 outstanding under the Convertible Note 2023.

Material Terms of the Convertible Note 2023:

| ● | Interest accrues on the outstanding balance of the Note at 6% per annum from the purchase price date until the same is paid in full. All interest calculations hereunder shall be computed on the basis of a 360-day year comprised of twelve (12) thirty (30) day months, shall compound daily and shall be payable in accordance with the terms of this Note. |

| ● | Upon the occurrence of a trigger event, the investor may increase the outstanding balance payable under the Note by 15% or 5%, depending on the nature of such event. If the Company fails to cure the trigger event within the required five trading days, the trigger event will automatically become an event of default and interest will accrue at the lesser of 15% per annum or the maximum rate permitted by applicable law. |

| ● | Subject to adjustment as set forth in this Note, the price at which the lender has the right to convert all or any portion of the outstanding balance into ordinary shares is the lower of (i) the Lender Conversion Price which is initially $0.60 and (ii) 80% of the average of the lowest VWAP during the fifteen (15) trading days immediately preceding the redemption notice is delivered. |

Please refer to Note 11 of our Condensed Consolidated Financial Statements included in this Form 6-K for details of accounting of the Convertible Notes.

Going Concern

The condensed consolidated financial statements for the six months ended September 30, 2023 and 2022 have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business.

As reflected in the consolidated financial statements, we reported net loss of $9,696,158 and $1,494,609 for the six months ended September 30, 2023 and 2022, respectively. We had accumulated deficits of $31,309,291 and $21,613,133 as of September 30, 2023 and March 31, 2023, respectively. We used funds in operating activities of $579,568 and $549,125 for the six months ended September 30, 2023 and 2022, respectively. In addition, we suffered a continuous decline in revenue for the six months ended September 30, 2023 and 2022. These factors raise substantial doubt about our ability to continue as a going concern.

We are in the process of building its customer base to generate more revenues as well as cutting expenses, and we are seeking to raise capital through additional debt from equity financings to fund its operations. However, there can be no assurance that these plans and arrangements will be sufficient to fund our ongoing capital expenditure, working capital, and other requirements. The accompanying consolidated financial statements do not include any adjustments related to the recoverability or classification of asset and the amounts or classification of liabilities that may result from the outcome of this uncertainty. If the going concern assumption is not appropriate, material adjustments to the financial statements could be required.

Off-Balance Sheet Arrangements

On April 12, 2021, Taizhou Suxuantang signed a financial guarantee agreement with Jiangsu Changjiang Commercial Bank for Taizhou Jiutian Pharmaceutical Co. Ltd. in borrowing of $383,772 (equivalent of RMB 2,800,000) for three-year period. Taizhou Suxuantang is obliged to pay on behalf of the related party the principal, interest, penalty and other expenses if Taizhou Jiutian Pharmaceutical Co. Ltd. defaults in payment. The Company did not charge financial guarantee fees over Taizhou Jiutian Pharmaceutical Co. Ltd.

On October 28, 2013, Taizhou Suxuantang signed a financial guarantee agreement with Fenlan Xu for Jianping Zhou in borrowing of $794,956 (equivalent of RMB 5,800,000) for an unlimited period. Taizhou Suxuantang is obliged to pay the amount if Jianping Zhou in default of the payment of principal and interests. Since Jianping Zhou deceased after yearend, Taizhou Suxuantang should bear all the risk for the repayment. However, subsequent to yearend, Taizhou Jiutian Pharmaceutical Co. Ltd. signed an agreement with Taizhou Suxuantang to take all the responsibility and obligation for repay the amount borrowed from Fenlan Xu on behalf of Jianping Zhou. This additional agreement releases Taizhou Suxuantang from future obligation in regard to the guarantee agreement. The Company did not charge financial guarantee fees over Jianping Zhou. Taizhou Jiutian Pharmaceutical Co. Ltd. is fully obliged to pay the principal, interests from January 1, 2021 to the actual date of repayment, including penalty and other expenses. As such, the Company expects no liabilities from the financial guarantee.

The Company had the following operating lease commitment as of September 30, 2023:

| Office Rental | For the year ended September 30, |

|||

| 2024 | $ | 68,586 | ||

| 2025 | 68,586 | |||

| 2026 | 68,586 | |||

| 2027 | 68,586 | |||

| Thereafter | 17,146 | |||

| Total | $ | 291,490 | ||

Except for the guarantee and commitment listed above, the Company does not have any other off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on its financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Inflation

We do not believe our business and operations have been materially affected by inflation.

Related Parties and Material Related Party Transactions

Please refer to Note 16 of our Condensed Consolidated Financial Statements included in this Form 6-K for details of related parties and material related party transactions.

Critical Accounting Policies

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amount of assets, liabilities and contingencies at the date of the condensed consolidated financial statements as well as the reported amounts of expenses during the reporting period. As a result, management is required to routinely make judgments and estimates about the effects of matters that are inherently uncertain. Actual results may differ from these estimates under different conditions or assumptions. Management determined there were no critical accounting policies or accounting estimates.

9

Exhibit 99.2

CHINA SXT PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2023 AND 2022

(UNAUDITED)

CHINA SXT PHARMACEUTICALS, INC.

INDEX TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

F-

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(IN U.S. DOLLARS, EXCEPT FOR NUMBER OF SHARES DATA)

| September 30, 2023 (Unaudited) |

March 31, 2023 |

|||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 11,465,020 | $ | 17,368,478 | ||||

| Accounts receivable, net | 1,311,005 | 1,344,569 | ||||||

| Inventories | 493,214 | 531,254 | ||||||

| Advance to suppliers | 88,103 | 46,304 | ||||||

| Prepayments, receivables and other current assets | 137,978 | 230,642 | ||||||

| Total Current Assets | 13,495,320 | 19,521,247 | ||||||

| Property, plant and equipment, net | 809,039 | 962,214 | ||||||

| Intangible assets, net | 22,514 | 27,868 | ||||||

| Long-term deposit | 8,736,677 | |||||||

| Right-of-use assets - operating leases -related party | 261,108 | 306,050 | ||||||

| Total Non-current Assets | 1,092,661 | 10,032,809 | ||||||

| TOTAL ASSETS | $ | 14,587,981 | $ | 29,554,056 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Short-term borrowings | $ | 267,270 | $ | 167,453 | ||||

| Long-term borrowings – current | 19,737 | 7,863 | ||||||

| Short-term convertible note | 2,496,184 | 3,157,492 | ||||||

| Accounts payable | 1,315,855 | 1,377,850 | ||||||

| Refund liabilities | 146,049 | 111,951 | ||||||

| Advance from customers | 190,193 | 165,534 | ||||||

| Amounts due to related parties | 421,168 | 5,203,762 | ||||||

| Accrued expenses and other liabilities | 3,249,143 | 3,142,084 | ||||||

| Taxes payable | 1,038,364 | 1,104,860 | ||||||

| Operating lease liabilities - current – related party | 56,171 | 58,089 | ||||||

| Total Current Liabilities | 9,200,134 | 14,496,938 | ||||||

| Non-current Liabilities | ||||||||

| Long-term borrowings | 106,575 | 117,862 | ||||||

| Operating lease liabilities – non-current – related party | 204,937 | 247,961 | ||||||

| Total Non-current Liabilities | 311,512 | 365,823 | ||||||

| TOTAL LIABILITIES | 9,511,646 | 14,862,761 | ||||||

| SHAREHOLDERS’ EQUITY | ||||||||

| Ordinary shares, unlimited shares authorized, $2 par value, 727,851 shares issued and outstanding as of September 30, 2023 (457,365 shares issued and outstanding as of March 31, 2023)* | 1,454,756 | 913,785 | ||||||

| Additional paid-in capital | 35,949,681 | 35,588,214 | ||||||

| Accumulated deficits | (31,309,291 | ) | (21,613,133 | ) | ||||

| Accumulated other comprehensive income | (1,018,811 | ) | (197,571 | ) | ||||

| Total Shareholders’ Equity | 5,076,335 | 14,691,295 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 14,587,981 | $ | 29,554,056 | ||||

| * | Retrospectively restated for effect of reverse stock split on February 22, 2021, May 19, 2022 and October 5, 2023. |

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

F-

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME/(LOSS) AND COMPREHENSIVE INCOME/(LOSS)

(IN U.S. DOLLARS, EXCEPT SHARES DATA)

(UNAUDITED)

| For the six months ended September 30, |

||||||||

| 2023 (Unaudited) |

2022 (Unaudited) |

|||||||

| Revenues | $ | 939,583 | $ | 1,208,288 | ||||

| Revenues generated from third parties | 926,805 | 1,191,808 | ||||||

| Revenue generated from related parties | 12,778 | 16,480 | ||||||

| Cost of revenues | (651,242 | ) | (1,118,604 | ) | ||||

| Gross profit | 288,341 | 89,684 | ||||||

| Operating expenses: | ||||||||

| Selling and marketing | (176,950 | ) | (272,166 | ) | ||||

| General and administrative | (9,460,412 | ) | (967,964 | ) | ||||

| Total operating expenses | (9,637,362 | ) | (1,240,130 | ) | ||||

| Operating Loss | (9,349,021 | ) | (1,150,446 | ) | ||||

| Other income (expenses): | ||||||||

| Interest expenses, net | (336,520 | ) | (384,286 | ) | ||||

| Other income (expenses), net | (10,617 | ) | 40,123 | |||||

| Total other expenses, net | (347,137 | ) | (344,163 | ) | ||||

| Loss before income taxes | (9,696,158 | ) | (1,494,609 | ) | ||||

| Income tax provision | ||||||||

| Net loss | (9,696,158 | ) | (1,494,609 | ) | ||||

| Other comprehensive income (loss): | ||||||||

| Foreign currency translation adjustment | (821,240 | ) | (1,735,537 | ) | ||||

| Comprehensive loss | (10,517,398 |

) | (3,230,146 | ) | ||||

| Earnings per ordinary share | ||||||||

| $ | (19.34 | ) | $ | (14.61 | ) | |||

| Weighted average number of ordinary shares outstanding | ||||||||

| 501,467 | 102,316 | |||||||

| * | Retrospectively restated for effect of reverse stock split on February 22, 2021, May 19, 2022 and October 5, 2023. |

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

F-

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2023 and 2022

(IN U.S. DOLLARS, EXCEPT SHARES DATA)

(UNAUDITED)

| Shares* | Amount | Additional paid-in capital |

Accumulated deficits |

Accumulated other comprehensive income (loss) |

Total equity |

|||||||||||||||||||

| Balance as of March 31, 2022 | 81,256 | $ | 162,468 | $ | 30,642,840 |

$ | (15,678,361 | ) | $ | 956,142 | $ | 16,083,089 |

||||||||||||

| Net loss | - | (1,494,609 | ) | (1,494,609 | ) | |||||||||||||||||||

| Shares issued as employee incentives | 12,188 | 24,377 | 530,194 | 554,571 | ||||||||||||||||||||

| Share issued due to reverse-split round up | 451 | |||||||||||||||||||||||

| Shares issued for convertible notes | 50,620 | 101,240 | 1,039,242 | 1,140,482 | ||||||||||||||||||||

| Foreign currency translation gain | - | (1,735,537 | ) | (1,735,537 | ) | |||||||||||||||||||

| Balance as of September 30, 2022 (Unaudited) | 144,515 | $ | 288,085 | $ | 32,212,276 |

$ | (17,172,970 | ) | $ | (779,395 | ) | $ | 14,547,996 |

|||||||||||

| Balance as of March 31, 2023 | 457,365 | $ | 913,785 | $ | 35,588,214 | $ | (21,613,133 | ) | $ | (197,571 | ) | $ | 14,691,295 | |||||||||||

| Net loss | - | (9,696,158 | ) | (9,696,158 | ) | |||||||||||||||||||

| Shares issued for convertible notes | 270,486 | 540,971 | 361,467 | 902,438 | ||||||||||||||||||||

| Foreign currency translation gain | - | (821,240 | ) | (821,240 | ) | |||||||||||||||||||

| Balance as of September 30, 2023 (Unaudited) | 727,851 | 1,454,756 | 35,949,681 | (31,309,291 | ) | (1,018,811 | ) | 5,076,335 | ||||||||||||||||

| * | Retrospectively restated for effect of reverse stock split on February 22, 2021, May 19, 2022 and October 5, 2023. |

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

F-

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN U.S. DOLLARS)

(UNAUDITED)

| For the six months ended September 30, |

||||||||

| 2023 (Unaudited) |

2022 (Unaudited) |

|||||||

| Cash Flows from Operating Activities: | ||||||||

| Net loss from operations | $ | (9,696,158 | ) | $ | (1,494,609 | ) | ||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Convertible note - Accretion of financing cost | 212,708 | 311,642 | ||||||

| Expected credit loss | 8,450,277 | |||||||

| Depreciation and amortization expenses | 102,750 | 109,966 | ||||||

| Equity incentive plan | 277,285 | |||||||

| Non-cash operating lease expense | 35,098 | |||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (72,969 | ) | (372,734 | ) | ||||

| Note receivable | 33,441 | |||||||

| Inventory | 7,006 | 294,421 | ||||||

| Advance to suppliers | (45,562 | ) | (14,045 | ) | ||||

| Prepayments, receivables and other assets | 59,857 | (61,775 | ) | |||||

| Accounts payable | 19,353 | 253,976 | ||||||

| Refund liabilities | 41,626 | |||||||

| Advance from customers | 35,185 | (4,063 | ) | |||||

| Taxes payable | (1,660 | ) | 32,818 | |||||

| Change in related party lease liability – operating lease | (35,098 | ) | ||||||

| Accrued expenses and other current liabilities | 308,019 | 84,552 | ||||||

| Net cash used in operating activities | (579,568 | ) | (549,125 | ) | ||||

| Cash Flows from Investing Activities: | ||||||||

| Purchase of property, plant and equipment | (20,115 | ) | ||||||

| Other receivable - Huangshan Panjie | 19,639 | 59,425 | ||||||

| Net cash provided by investing activities | 19,639 | 39,310 | ||||||

| Cash Flows from Financing Activities: | ||||||||

| Proceeds from borrowings | 124,847 | |||||||

| Repayment of borrowings | (4,469 | ) | (7,675 | ) | ||||

| Payment to related parties | (4,582,113 | ) | (11,061,683 | ) | ||||

| Net cash used in financing activities | (4,461,735 | ) | (11,069,358 | ) | ||||

| Effect of exchange rate changes on cash and cash equivalents and restricted cash | (881,794 | ) | (1,009,412 | ) | ||||

| Net decrease in cash, cash equivalents and restricted cash | (5,903,458 | ) | (12,588,585 | ) | ||||

| Cash, cash equivalents and restricted cash at the beginning of period | 17,368,478 | 15,569,619 | ||||||

| Cash, cash equivalents and restricted cash at the end of period | $ | 11,465,020 | $ | 2,981,034 | ||||

| Supplemental disclosures of cash flows information: | ||||||||

| Cash paid for income taxes | $ | $ | ||||||

| Cash paid for interest expense | $ | 9,449 | $ | |||||

| Non-cash transactions: | ||||||||

| Issuance of shares for equity incentive plan | $ | $ | 277,285 | |||||

| Issuance of shares for convertible notes principal and interest settlement | $ | 902,438 | $ | 1,140,482 | ||||

| Offset between due from related parties and due to related parties balances | $ | 3,306,031 |

$ | |||||

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

F-

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTITIVIES

China SXT Pharmaceutical, Inc. (“SXT” or the “Company”) is a holding company incorporated in British Virgin Islands on July 4, 2017. The Company focuses on the research, development, manufacture, marketing and sales of traditional Chinese medicine pieces (the “TCMP”), through its variable interest entity (“VIE”), Jiangsu Suxuantang Pharmaceutical Co., Ltd, (“Taizhou Suxuantang”) in China. The Company currently sells three types of TCMP products: Advanced TCMP, Fine TCMP and Regular TCMP, and TCM Homologous Supplements (“TCMHS”) products. We currently have a product portfolio of 19 advanced TCMPs, 10 Fine TCMPs, 235 Regular TCMPs and 4 TCMHS solid beverage products that address a wide variety of diseases and medical indications. Most of our products are sold on a prescription basis across China. The Company’s principal executive offices are located in Taizhou, Jiangsu province, China.

Restructuring and Share Issuance

On July 4, 2017, we were incorporated in the British Virgin Islands by issuance of 10,300,000 common stocks at 0.001 par value to Ziqun Zhou, Di Zhou and Feng Zhou Management Limited (“China SXT Pharmaceuticals, Inc. shareholders”). Feng Zhou Management Limited is a BVI company 100% owned by Feng Zhou. Feng Zhou, Ziqun Zhou and Di Zhou collectively hold 100% shares of Taizhou Suxuantang. Later on October 20, 2017, the 10,300,000 shares common stocks (5,150 shares retrospectively restated for effect of reverse stock split on February 22, 2021, May 19, 2022 and October 5, 2023) were reallocated among China SXT Pharmaceuticals, Inc. shareholders. On October 20, 2017, the Company issued 9,700,000 common stocks (4,850 shares retrospectively restated for effect of reverse stock split on February 22, 2021, May 19, 2022 and October 5, 2023) at 0.001 par value to ten individual shareholders (“Restructuring”).

On July 21, 2017, our wholly owned subsidiary China SXT Group Limited (“SXT HK”) was incorporated in Hong Kong. China SXT Group Limited in turn holds all the capital stocks of Taizhou Suxantang Biotechnology Co. Ltd. (“WFOE”), a wholly foreign owned enterprise incorporated in China on October 13, 2017. On the same day, Taizhou Suxuantang and its shareholders entered into such a series of contractual arrangements, also known as VIE Agreements.

Taizhou Suxuantang was incorporated on June 9, 2005 by Jianping Zhou, Xiufang Yuan (the spouse of Jianping Zhou) and Jianbin Zhou, who held 83%, 11.5% and 5.5% shares in Taizhou Suxuantang respectively. On May 8, 2017, the three shareholders transferred all shares to Feng Zhou, Ziqun Zhou and Di Zhou (collectively “Taizhou Shareholders”), who hold 83%, 11.5% and 5.5% shares in Taizhou Suxuantang, respectively, after the transfer of shares. Feng Zhou and Ziqun Zhou are the children of Jianping Zhou and Xiufang Yuan, and Di Zhou is the child of Jianbin Zhou.

The discussion and presentation of financial statements herein assumes the completion of the Restructuring, which is accounted for retroactively as if the aforementioned transactions had become effective as of the beginning of the first period presented in the accompanying condensed consolidated financial statements.

F-

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTITIVIES (CONTINUED)

The following diagram illustrates our corporate structure, including our subsidiary and condensed consolidated variable interest entity as of the date of the financial statements assuming the completion of our Restructuring:

VIE Agreements with Taizhou Suxuantang

Due to PRC legal restrictions on foreign ownership in the pharmaceutical sector, neither the Company nor our subsidiaries own any equity interest in Taizhou Suxuantang. Instead, the Company controls and receives the economic benefits of Taizhou Suxuantang’s business operations through a series of contractual arrangements. WFOE, Taizhou Suxuantang and its shareholders entered into such a series of contractual arrangements, also known as VIE Agreements, on October 13, 2017. The VIE agreements are designed to provide WFOE with the power, rights and obligations equivalent in all material respects to those it would possess as the sole equity holder of Taizhou Suxuantang, including absolute control rights and the rights to the assets, property and revenue of Taizhou Suxuantang.

According to the Exclusive Business Cooperation Agreement between WFOE and Taizhou Suxuantang, which is one of the VIE Agreements that was also entered into on October 13, 2017, Taizhou Suxuantang is obligated to pay service fees to WFOE approximately equal to the net income of Taizhou Suxuantang.

Each of the VIE Agreements is described in detail below:

Exclusive Business Cooperation Agreement

Pursuant to the Exclusive Business Cooperation Agreement between Taizhou Suxuantang and WFOE, WFOE provides Taizhou Suxuantang with technical support, consulting services and other management services relating to its day-to-day business operations and management, on an exclusive basis, utilizing its advantages in technology, human resources, and information. Additionally, Taizhou Suxuantang granted an irrevocable and exclusive option to WFOE to purchase from Taizhou Suxuantang, any or all of Taizhou Suxuantang’s assets at the lowest purchase price permitted under the PRC laws. Should WFOE exercise such option, the parties shall enter into a separate asset transfer or similar agreement. For services rendered to Taizhou Suxuantang by WFOE under this agreement, WFOE is entitled to collect a service fee calculated based on the time of services rendered multiplied by the corresponding rate, plus the amount of the services fees or ratio decided by the board of directors of WFOE based on the value of services rendered by WFOE and the actual income of Taizhou Suxuantang from time to time, which is approximately equal to the net income of Taizhou Suxuantang.

F-

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTITIVIES (CONTINUED)

The Exclusive Business Cooperation Agreement shall remain in effect for ten years unless it is terminated by WFOE with 30-day prior notice. Taizhou Suxuantang does not have the right to terminate the agreement unilaterally. WFOE may unilaterally extend the term of this agreement with prior written notice.

The CEO and president of WFOE, Mr. Feng Zhou, is currently managing Taizhou Suxuantang pursuant to the terms of the Exclusive Business Cooperation Agreement. WFOE has absolute authority relating to the management of Taizhou Suxuantang, including but not limited to decisions with regard to expenses, salary raises and bonuses, hiring, firing and other operational functions. The Exclusive Business Cooperation Agreement does not prohibit related party transactions. The audit committee is required to review and approve in advance any related party transactions, including transactions involving WFOE or Taizhou Suxuantang.

Share Pledge Agreement

Under the Share Pledge Agreement among WFOE and Feng Zhou, Ziqun Zhou, and Di Zhou, who together hold 100% shares of Taizhou Suxuantang (“Taizhou Suxuantang Shareholders”), the Taizhou Suxuantang Shareholders pledged all of their equity interests in Taizhou Suxuantang to WFOE to guarantee the performance of Taizhou Suxuantang’s obligations under the Exclusive Business Cooperation Agreement. Under the terms of the agreement, in the event that Taizhou Suxuantang or its shareholders breach their respective contractual obligations under the Exclusive Business Cooperation Agreement, WFOE, as pledgee, will be entitled to certain rights, including, but not limited to, the right to collect dividends generated by the pledged equity interests. The Taizhou Suxuantang Shareholders also agreed that upon occurrence of any event of default, as set forth in the Share Pledge Agreement, WFOE is entitled to dispose of the pledged equity interest in accordance with applicable PRC laws. The Taizhou Suxuantang Shareholders further agree not to dispose of the pledged equity interests or take any actions that would prejudice WFOE’s interest.

The Share Pledge Agreement shall be effective until all payments due under the Exclusive Business Cooperation Agreement have been paid by Taizhou Suxuantang. WFOE shall cancel or terminate the Share Pledge Agreement upon with no additional expense.

The purposes of the Share Pledge Agreement are to (1) guarantee the performance of Taizhou Suxuantang’s obligations under the Exclusive Business Cooperation Agreement, (2) make sure the shareholders of Taizhou Suxuantang shall not transfer or assign the pledged equity interests, or create or allow any encumbrance that would prejudice WFOE’s interests without WFOE’s prior written consent and (3) provide WFOE control over Taizhou Suxuantang. Under the Exclusive Option Agreement (described below), WFOE may exercise its option to acquire the equity interests in Taizhou Suxuantang any time to the extent permitted by the PRC Law. In the event Taizhou Suxuantang breaches its contractual obligations under the Exclusive Business Cooperation Agreement, WFOE will be entitled to foreclose on the Taizhou Suxuantang Shareholders’ equity interests in Taizhou Suxuantang and may (1) exercise its option to purchase or designate third parties to purchase part or all of their equity interests in Taizhou Suxuantang and in this situation, WFOE may terminate the VIE agreements after acquisition of all equity interests in Taizhou Suxuantang or form a new VIE structure with the third parties designated by WFOE; or (2) dispose the pledged equity interests and be paid in priority out of the proceeds from the disposal in which case the VIE structure will be terminated.

F-

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTITIVIES (CONTINUED)

Exclusive Option Agreement

Under the Exclusive Option Agreement, the Taizhou Suxuantang Shareholders irrevocably granted WFOE (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, part or all of their equity interests in Taizhou Suxuantang at the exercise price of RMB10.00.

Under the Exclusive Option Agreement, WFOE may at any time under any circumstances, purchase, or have its designated person to purchase, at its discretion, to the extent permitted under PRC law, all or part of the shareholders’ equity interests in Taizhou Suxuantang.

This Agreement shall remain effective until all equity interests held by Taizhou Suxuantang Shareholders in Taizhou Suxuantang have been transferred or assigned to WFOE and/or any other person designated by WFOE in accordance with this Agreement.

Power of Attorney

Under the Power of Attorney, the Taizhou Suxuantang Shareholders authorize WFOE to act on their behalf as their exclusive agent and attorney with respect to all rights as shareholders, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all the shareholder’s rights, including voting, that shareholders are entitled to under the laws of China and the Articles of Association, including but not limited to the sale or transfer or pledge or disposition of shares in part or in whole; and (c) designating and appointing on behalf of shareholders the legal representative, the executive director, supervisor, the chief executive officer and other senior management members of Taizhou Suxuantang.

Although it is not explicitly stipulated in the Power of Attorney, the term of the Power of Attorney shall be the same as the term of that of the Exclusive Option Agreement.

This Power of Attorney is coupled with an interest and shall be irrevocable and continuously valid for each shareholder from the date it is executed until the date he/she no longer is a shareholder of Taizhou Suxuantang.

The Exclusive Option Agreement, together with the Share Pledge Agreement and the Power of Attorney enable WFOE to exercise effective control over Taizhou Suxuantang.

Basis of presentation and principles of consolidation

The accompany unaudited condensed consolidated financial statements of the Company has been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The accompanying condensed consolidated financial statements include our accounts and those of our wholly owned subsidiaries and VIE. Accordingly, all intercompany balances and transactions have been eliminated through the consolidation process.

In the opinion of management, these unaudited condensed consolidated interim financial statements reflect all adjustments, consisting of normal recurring adjustments, which are necessary to present fairly, in all material respects, the Company’s condensed consolidated financial position, results of operations, cash flows and changes in equity for the interim periods presented. These unaudited condensed financial statements do not include certain information and footnote disclosures as required by the U.S. GAAP for complete annual financial statements. Therefore, these unaudited condensed consolidated interim financial statements should be read in conjunction with the financial statements and related notes included in the Company’s first initial offering Registration Statement on Form 20-F for the year ended March 31, 2023 and 2022.

The VIE, Taizhou Suxuantang is owned by three shareholders, each of which act as the Company’s nominee shareholder. For the consolidated VIEs, the Company’s management made evaluations of the relationships between the Company and the VIE and the economic benefit flow of contractual arrangements with Taizhou Suxuantang. In connection with such evaluation, management also took into account the fact that, as a result of such contractual arrangements, the Company control the shareholders’ voting interests in these VIEs. As a result of such evaluation, management concluded that the Company is the primary beneficiary of the consolidated VIEs, Taizhou Suxuantang. The Company does not have any VIEs that are not consolidated in the financial statements.

F-

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

Risks in relation to the VIE structure

It is possible that the Company’s operation of certain of its operations and businesses through its VIE could be found by PRC authorities to be in violation of PRC law and regulations prohibiting or restricting foreign ownership of companies that engage in such operations and businesses. While the Company’s management considers the possibility of such a finding by PRC regulatory authorities under current law and regulations to be remote. On January 19, 2015, the Ministry of Commerce of the PRC, or (the “MOFCOM”) released on its Website for public comment a proposed PRC law (the “Draft FIE Law”) that appears to include VIE within the scope of entities that could be considered to be foreign invested enterprises (or “FIEs”) that would be subject to restrictions under existing PRC law on foreign investment in certain categories of industry. Specifically, the Draft FIE Law introduces the concept of “actual control” for determining whether an entity is considered to be an FIE. In addition to control through direct or indirect ownership or equity, the Draft FIE Law includes control through contractual arrangements within the definition of “actual control.” If the Draft FIE Law was passed by the People’s Congress of the PRC and went into effect in its current form and as a result the Company’s VIE could become explicitly subject to the current restrictions on foreign investment in certain categories of industry. The Draft FIE Law includes provisions that would exempt from the definition of foreign invested enterprises entities where the ultimate controlling shareholders are either entities organized under PRC law or individuals who are PRC citizens. The Draft FIE Law is silent as to what type of enforcement action might be taken against existing VIEs that operate in restricted or prohibited industries and are not controlled by entities organized under PRC law or individuals who are PRC citizens. If a finding were made by PRC authorities, under existing law and regulations or under the Draft FIE Law if it becomes effective, about the Company’s operation of certain of its operations and businesses through its VIEs, regulatory authorities with jurisdiction over the licensing and operation of such operations and businesses would have broad discretion in dealing with such a violation, including levying fines, confiscating the Company’s income, revoking the business or operating licenses of the affected businesses, requiring the Company to restructure its ownership structure or operations, or requiring the Company to discontinue all or any portion of its operations. Any of these actions could cause significant disruption to the Company’s business operations and have a severe adverse impact on the Company’s cash flows, financial position and operating performance.

In addition, it is possible that the contracts among Taizhou Suxuantang, WFOE, and the nominee shareholders of Taizhou Suxuantang would not be enforceable in China if PRC government authorities or courts were to find that such contracts contravene PRC laws and regulations or are otherwise not enforceable for public policy reasons. In the event that the Company was unable to enforce these contractual arrangements, the Company would not be able to exert effective control over the VIEs. Consequently, the VIEs’ results of operations, assets and liabilities would not be included in the Company’s condensed consolidated financial statements. If such were the case, the Company’s cash flows, financial position, and operating performance would be materially adversely affected. The Company’s contractual arrangements Taizhou Suxuantang, WFOE, and the nominee shareholders of Taizhou Suxuantang are approved and in place. Management believes that such contracts are enforceable and considers the possibility remote that PRC regulatory authorities with jurisdiction over the Company’s operations and contractual relationships would find the contracts to be unenforceable.

The Company’s operations and businesses rely on the operations and businesses of its VIEs, which hold certain recognized revenue-producing assets. The VIEs also have an assembled workforce, focused primarily on research and development, whose costs are expensed as incurred. The Company’s operations and businesses may be adversely impacted if the Company loses the ability to use and enjoy assets held by its VIE.

F-

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Foreign currency translation

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the statement of operations.

The reporting and functional currencies of the Company and SXT HK are the United States Dollars (“US$”) and the accompanying financial statements have been expressed in US$. In addition, the WFOE and the VIE maintain their books and records in their respective local currency, Renminbi (“RMB”), which is also the respective functional currency for each subsidiary and VIE as they are the primary currency of the economic environment in which each subsidiary operates.

In general, for consolidation purposes, assets, and liabilities of its subsidiaries whose functional currency is not the US$ are translated into US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of a foreign subsidiary are recorded as a separate component of accumulated other comprehensive income within the statement of stockholders’ equity. Other equity items are translated using the exchange rates on the transaction date.

Translation of amounts from the local currencies of the Company into US$ has been made at the following exchange rates for the respective periods:

| September 30, 2023 |

March 31, 2023 |

September 30, 2022 |

||||||||||

| Balance sheet items, except for equity accounts | 7.2960 | 6.8676 | 7.1135 | |||||||||

| Items in the statements of income(loss) and comprehensive income(loss), and statements of cash flows | 7.1287 | 6.8516 | 6.7312 | |||||||||

Measurement of credit losses on financial instruments

On April 1, 2023, the Company adopted ASU 2016-13, “Financial Instruments — Credit Losses (Topic 326) — Measurement of Credit Losses on Financial Instruments,” for financial assets at amortized cost including accounts receivable, refundable deposits, other receivables, and retention receivable. This guidance replaced the “incurred loss” impairment methodology with an approach based on “expected losses” to estimate credit losses on certain types of financial instruments and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. The guidance requires financial assets to be presented at the net amount expected to be collected. The allowance for credit losses is a valuation account that is deducted from the cost of the financial asset to present the net carrying value at the amount expected to be collected on the financial asset.

Use of estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. On an ongoing basis, management reviews these estimates and assumptions using the currently available information.