UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

or

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _________

Commission file number: 0001-38762

BIOMX INC.

(Exact name of registrant as specified in its charter)

| Delaware | 82-3364020 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 22 Einstein St., Floor 4, Ness Ziona, Israel | 7414003 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +972 723942377

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Units, each consisting of one share of common stock, $0.0001 par value, and one warrant exercisable for one-half of one share of common stock | PHGE.U | NYSE American | ||

| Common stock, $0.0001 par value | PHGE | NYSE American |

Securities registered pursuant to Section 12(g) of the Act

Warrants, each exercisable for one-half of one share of common stock, $0.0001 par value, at an exercise price of $11.50 per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

On June 30, 2023, the last day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the Registrant’s shares of Common Stock held by non-affiliates of the Registrant was $16,530,774 based on the closing sale price of the Registrant’s shares of Common Stock on June 30, 2023 (the last trading day of the fiscal quarter) of $0.36 per share.

The number of shares outstanding of the Registrant’s shares of Common Stock as of March 28, 2024 was 55,220,077.

BIOMX INC.

Annual Report on Form 10-K for the Year Ended December 31, 2023

On March 15, 2024, BiomX Inc. acquired Adaptive Phage Therapeutics, Inc., a Delaware corporation, or APT, and such acquisition, the Acquisition, pursuant to an agreement and plan of merger, or the Merger Agreement, by and among BiomX Inc., APT, BTX Merger Sub I, Inc., a Delaware corporation, and BTX Merger Sub II, LLC, a Delaware limited liability company. References in this Annual Report on Form 10-K , or the Annual Report to the “Company,” “BiomX,” “we,” “us” or “our” mean BiomX Inc. and its consolidated subsidiaries, including APT, unless otherwise expressly stated or the context indicates otherwise, provided, however, that all financial information included in this Annual Report, including financial information as of and for the years ended December 31, 2023 and December 31, 2022 and other information as of a date before March 15, 2024, unless noted specifically, does not include APT. References in this Annual Report to BiomX Ltd. mean BiomX Ltd., our wholly owned Israeli subsidiary. The description of the Company herein describes the post Acquisition Company and reflects the integration of APT’s business. As further described elsewhere in this Annual Report, on October 28, 2019, Chardan Healthcare Acquisition Corp., a special purpose acquisition company, combined with BiomX Ltd. in the Business Combination (as defined below) and changed its name to BiomX Inc.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended or the Exchange Act. The statements contained in this Annual Report that are not purely historical are forward-looking statements. Forward-looking statements include statements about our expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts. Words or phrases such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “will” or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. Examples of forward-looking statements in this Annual Report include, but are not limited to, statements regarding our disclosure concerning our operations, cash flows, financial position and also regarding our preclinical and clinical development plans, the safety, tolerability and efficacy of our phage therapy and the conducting, design, aims and timing of its preclinical and clinical studies and announcing results thereof.

Forward-looking statements appear in a number of places in this Annual Report including, without limitation, in the sections entitled “Management’s Discussion and Analysis of Financial Conditions and Results of Operations,” and "Business.” The risks and uncertainties include, but are not limited to:

| ● | the ability to generate revenues, and raise sufficient financing to meet working capital requirements; |

| ● | the integration of the operations of APT into the Company; |

| ● | the receipt of our stockholders’ approval to certain proposals relating to the Acquisition and related private investment transaction; |

| ● | the unpredictable timing and cost associated with our approach to developing product candidates using phage technology; |

| ● | political and economic instability, including, without limitation, due to natural disasters or other catastrophic events, such as the Russian invasion of Ukraine and world sanctions on Russia, Belarus, and related parties, terrorist attacks, hurricanes, fire, floods, pollution and earthquakes; |

| ● | obtaining U.S. Food and Drug Administration, or FDA, acceptance of any non-U.S. clinical trials of product candidates; |

| ● | our ability to enroll patients in clinical trials and achieve anticipated development milestones when expected; |

| ● | the ability to pursue and effectively develop new product opportunities and acquisitions and to obtain value from such product opportunities and acquisitions; |

| ● | penalties and market withdrawal associated with any unanticipated problems with product candidates and failure to comply with labeling and other restrictions; |

| ● | general economic conditions, our current low stock price and other factors on our operations, the continuity of our business, including our preclinical and clinical trials, and our ability to raise additional capital; | |

| ● | expenses associated with compliance with ongoing regulatory obligations and successful continuing regulatory review; |

| ● | market acceptance of our product candidates and ability to identify or discover additional product candidates; |

| ● | our ability to obtain high titers for specific phage cocktails necessary for preclinical and clinical testing; |

| ● | the availability of specialty raw materials and global supply chain challenges; |

| ● | the ability of our product candidates to demonstrate requisite, safety and efficacy for drug products, or safety, purity and potency for biologics without causing adverse effects; |

| ● | the success of expected future advanced clinical trials of our product candidates; |

| ● | our ability to obtain required regulatory approvals; |

| ● | delays in developing manufacturing processes for our product candidates; |

| ● | competition from similar technologies, products that are more effective, safer or more affordable than our product candidates or products that obtain marketing approval before our product candidates; |

| ● | the impact of unfavorable pricing regulations, third-party reimbursement practices or healthcare reform initiatives on our ability to sell product candidates or therapies profitably; |

| ● | protection of our intellectual property rights and compliance with the terms and conditions of current and future licenses with third parties; |

| ● | infringement on the intellectual property rights of third parties and claims for remuneration or royalties for assigned service invention rights; |

| ● | our ability to acquire, in-license or use proprietary rights held by third parties necessary to our product candidates or future development candidates; |

| ● | ethical, legal and social concerns about synthetic biology and genetic engineering that may adversely affect market acceptance of our product candidates; |

| ● | reliance on third-party collaborators; |

| ● | political, economic and military instability in the State of Israel, and in particular, the war in Gaza following the October 7 attack, additional potential conflicts with other middle eastern countries and the continuation of the proposed judicial and other legislation reform by the Israeli government; |

| ● | our ability to attract and retain key employees or to enforce the terms of noncompetition agreements with employees; |

| ● | the failure to comply with applicable laws and regulations other than drug manufacturing compliance; |

| ● | potential security breaches, including cybersecurity incidents; and |

| ● | other factors discussed in the section of this report entitled “Risk Factors” beginning on page 29. |

Forward-looking statements are subject to known and unknown risks and uncertainties and are based on our management’s potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. While these statements are based upon information available to us as of the filing date of this Annual Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. Actual results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors discussed in the section of this Annual Report entitled “Risk Factors”. Except as may be required by applicable law, we undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this Annual Report or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks we describe in the reports we will file from time to time with the U.S. Securities and Exchange Commission or the SEC, after the date of this Annual Report.

RISK FACTORS SUMMARY

The summary below provides an overview of many of the risks the Company faces, and a more detailed discussion of risks can be found in Item 1A. “Risk Factors” below. You should carefully consider these risks and uncertainties when investing in our securities. The principal risks and uncertainties affecting our business include, but are not limited to, the following:

| ● | We are a clinical-stage company with limited operating history and have incurred losses since our inception. We anticipate that we will continue to incur significant expenses, and we will continue to incur significant losses for the foreseeable future. |

| ● | We will need to raise additional capital in the future to support our operations which may not be available at terms that are favorable to us and might cause significant dilution to our stockholders or increase our debt towards third parties. |

| ● | Our financial statements contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all. |

| ● | There is no guarantee that our acquisition of APT will increase stockholder value. | |

| ● | We are seeking to develop product candidates using phage technology, an approach for which it is difficult to predict the potential success and time and cost of development. To our knowledge, no bacteriophage has thus far been approved as a drug in the United States or in the European Union. |

| ● |

We are required to use reasonable best efforts to solicit stockholder approval for the conversion of shares of Convertible Preferred Stock (as defined below) and the exercise of the Warrants (as defined below) issued in the Acquisition (as defined below) and the March 2024 PIPE (as defined below). If we do not obtain such approval within 150 days of the initial issuance of the Convertible Preferred Stock, we could be required to cash settle the Convertible Preferred Stock. |

| ● | Our product candidates must undergo clinical testing which may fail to demonstrate the requisite safety and efficacy for drug products, or safety, purity, and potency for biologics, and any of our product candidates could cause adverse effects, which would substantially delay or prevent regulatory approval and/or commercialization. | |

| ● |

We have not completed composition development of our product candidates. |

| ● |

We may not be successful in our efforts to identify or discover additional product candidates. |

| ● |

We intend to continue to rely on our BOLT proprietary product platform to develop our phage therapies. Our competitive position could be materially harmed if our competitors develop similar platforms and develop rival product candidates. |

|

| ● |

Our limited operating history may make it difficult to evaluate the success of our business to date and to assess our future viability. |

| ● | We have never generated any revenue from product sales and may never be profitable or, if achieved, may not sustain profitability. | |

| ● |

Results from preclinical studies of our product candidates may not be predictive of the results of clinical trials or later stage clinical development. |

| ● | Our product candidates are subject to significant regulatory approval requirements, which could delay, prevent or limit our ability to market or develop our product candidates. |

| ● | Our relationships with healthcare providers, physicians and third-party payors will be subject to applicable anti-kickback, fraud and abuse and other healthcare laws and regulations, which could expose us to criminal sanctions, civil penalties, contractual damages, reputational harm and other consequences. |

| ● | Even if we receive regulatory approval of any product candidates for therapeutic indications, we will be subject to ongoing regulatory compliance obligations and continued regulatory review which may result in significant additional expense. Additionally, any of our product candidates, if approved, could be subject to labeling and other restrictions and market withdrawal, and we may be subject to penalties if we fail to comply with regulatory requirements or experience unanticipated problems with our product candidates. | |

| ● |

Any products that we may develop may become subject to unfavorable pricing regulations, third-party reimbursement practices or healthcare reform initiatives, which could make it difficult for us to sell any product candidates or therapies profitably. |

|

| ● |

Ongoing health care legislative and regulatory reform measures may have a material adverse effect on our business and results of operations. |

| ● | The license agreements we maintain, including the Yeda 2015 License Agreement (as defined below), are important to our business. If we or the other parties to our license agreements fail to adequately perform under the license agreements, or if we or they terminate the license agreements, the development, testing, manufacture, production and sale of our phage-based therapeutic product candidates would be delayed or terminated, and our business would be adversely affected. |

| ● | We are highly dependent on intellectual property licensed from third parties, and termination or limitation of any of these licenses could result in the loss of significant rights and materially harm our business. |

| ● | We are dependent on patents and proprietary technology. If we fail to adequately protect this intellectual property or if we otherwise do not have exclusivity for the marketing of our products, our ability to commercialize products could suffer. | |

| ● |

If we infringe the rights of third parties, we could be prevented from selling products, forced to pay damages and/or royalties, and forced to defend against litigation. |

|

| ● |

We rely on our proprietary product platform to identify phage-based therapies. Our competitive position could be materially harmed if our competitors develop a similar platform and develop rival product candidates. |

|

| ● |

We rely on trade secrets and other forms of non-patent intellectual property protection. If we are unable to protect our trade secrets, other companies may be able to compete more effectively against us. |

|

| ● |

If we are sued for infringing intellectual property rights of third parties or if we are forced to engage in an interference proceeding, it will be costly and time-consuming, and an unfavorable outcome in that litigation or interference would have a material adverse effect on our business. |

|

| ● |

Third-party relationships are important to our business. If we are unable to maintain our collaborations or enter into new relationships, or if these relationships are not successful, our business could be adversely affected. |

| ● | Our headquarters, research and development and other significant operations are located in Israel, and, therefore, our results may be adversely affected by political, economic and military instability in Israel, including the recent war with Hamas and other terrorist organizations from the Gaza Strip |

| ● |

The Israeli government grants we have received for research and development expenditures restrict our ability to manufacture products and transfer technology outside of Israel and require us to satisfy specified conditions. If we fail to satisfy these conditions, we may be required to refund grants previously received, together with interest and penalties. |

| ● | Exchange rate fluctuations between the U.S. Dollar, the New Israeli Shekel, the Euro and other foreign currencies, may negatively affect our future revenues and expenses. | |

| ● |

It may be difficult to enforce a U.S. judgment against us or our officers and directors in Israel or the United States or to assert U.S. securities laws claims in Israel or serve process on our officers and directors. |

|

| ● |

Our product candidates rely on the availability of specialty raw materials, which may not be available to us on acceptable terms or at all. |

| ● | A significant number of shares of our Common Stock are subject to issuance upon exercise of outstanding warrants and options or conversion of our Convertible Preferred Stock, which upon exercise or conversion may result in dilution to our security holders. | |

| ● |

We have never paid dividends on our Common Stock, and we do not anticipate paying any cash dividends on our Common Stock in the foreseeable future. |

|

| ● |

Our Public Warrants (as defined below) have been delisted, and we may be unable to maintain the listing of our securities in the future. |

|

| ● |

The market price of our Common Stock and other securities may be volatile and fluctuate substantially, which could result in substantial losses for purchasers of our Common Stock. |

|

| ● |

As a “smaller reporting company” we are permitted to provide less disclosure than larger public companies, which may make our Common Stock less attractive to investors. |

|

| ● |

Our success depends, in part, on our ability to retain key executives and to attract, retain and motivate qualified personnel. |

|

| ● |

Expectations relating to environmental, social and governance (ESG) programs may impose additional costs and expose us to new risks. |

|

| ● |

Our business and operations would suffer in the event of computer system failures, cyber-attacks or deficiencies in our cyber-security. |

PART I

ITEM 1. BUSINESS

Overview

We are a clinical stage product discovery company developing products using both natural and engineered phage technologies designed to target and kill specific harmful bacteria associated with chronic diseases, such as cystic fibrosis, or CF and diabetic foot osteomyelitis, or DFO. Bacteriophage or phage are bacterial, species-specific, strain-limited viruses that infect, amplify and kill the target bacteria and are considered inert to mammalian cells. By utilizing proprietary combinations of naturally occurring phage and by creating novel phage using synthetic biology, we develop phage-based therapies intended to address both large-market and orphan diseases.

Based on the urgency of treating the infection (whether acute or chronic), the susceptibility of the target bacteria to phage (e.g. the ability to identify a phage cocktail that would target a broad range of bacterial strains) and other considerations, we offer two phage-based product types:

| (1) | Fixed cocktail therapy – in this approach a single product containing a fixed number of selected phages is developed to cover a wide range of bacterial strains, thus allowing treatment of broad patient populations with the same product. Fixed cocktails are developed using our proprietary BOLT platform, in which high throughput screening, directed evolution, and bioinformatic approaches are leveraged to produce an optimal phage cocktail. | |

| (2) | Personalized therapy – in this approach a large library of phages is developed, of which single optimal phages are personally matched to treat specific patients. Matching optimal phages with patients is carried out using a proprietary phage susceptibility testing, or PST, where multiple considerations are analyzed simultaneously – allowing for an efficient screen of the phage library while maintaining short turnaround times. |

In our therapeutic programs, we focus on using phage therapy to target specific strains of pathogenic bacteria that are associated with diseases. Our phage-based product candidates are developed utilizing our BOLT proprietary research and development platform. The BOLT platform is unique, employing cutting edge methodologies and capabilities across disciplines including computational biology, microbiology, synthetic engineering of phage and their production bacterial hosts, bioanalytical assay development, manufacturing and formulation, to allow agile and efficient development of natural or engineered phage combinations, or cocktails. The cocktail contains phage with complementary features and is optimized for multiple characteristics such as broad target host range, ability to prevent resistance, biofilm penetration, stability and ease of manufacturing.

Our goal is to develop multiple products based on the ability of phage to precisely target harmful bacteria and on our ability to screen, identify and combine different phage, both naturally occurring and created using synthetic engineering, to develop these treatments.

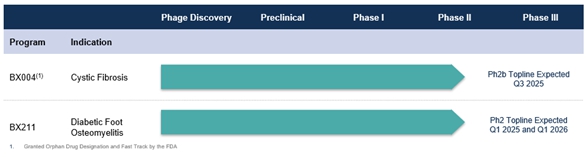

Our Product Pipeline

The chart below identifies our product candidates’ pipeline, their current status and expected timing for upcoming milestones. We do not have any products approved or available for sale, our product candidates are still in the preclinical and clinical development stages, and we have not generated any revenue from product sales.

Ongoing Programs

BX004 – Treatment of Cystic Fibrosis

BX004 is our therapeutic phage product candidate under development for chronic pulmonary infections caused by Pseudomonas aeruginosa, or P. aeruginosa, a main contributor to morbidity and mortality in patients with CF. Enhanced resistance to antibiotics develops, particularly in CF patients, due to extensive drug use consisting of prolonged and repeated broad-spectrum antibiotic courses often beginning in childhood, and leading to the appearance of multidrug-resistant strains. In preclinical in vitro studies, BX004 was shown to be active against antibiotic resistant strains of P. aeruginosa and demonstrated the ability to penetrate biofilm, an assemblage of surface-associated microbial cells enclosed in an extracellular polymeric substance and one of the leading causes for antibiotic resistance.

The Phase 1b/2a trial in CF patients with chronic respiratory infections caused by P. aeruginosa. was comprised of two parts. The study design was based on recommendations from the Cystic Fibrosis Therapeutic Development Network.

In February 2023, we announced positive results from Part 1 of the Phase 1b/2a trial evaluating BX004. Part 1 evaluated the safety, tolerability, pharmacokinetics, or PK, and microbiologic activity of BX004 over a 7-day ascending treatment period in nine CF patients (7 on BX004, 2 on placebo) with chronic P. aeruginosa pulmonary infection in a single ascending dose and multiple dose design.

Results from Part 1 of the Phase 1b/2a trial included the following findings: No safety events related to treatment with BX004 occurred; Mean P. aeruginosa colony forming units, or CFU, at Day 15 (compared to baseline): -1.42 log (BX004) vs. -0.28 log (placebo). This reduction was seen on top of standard of care inhaled antibiotics; Phage were detected in all patients treated with BX004 during the dosing period, including in several patients up to Day 15 (one week after end of therapy); no phage were detected in patients receiving placebo; there was no evidence of treatment-related resistance to BX004 during or after treatment , compared to placebo; and as expected due to the short duration of treatment, there was no detectable effect on % predicted forced expiratory volume in 1 second, or FEV1.

In November 2023, we announced positive topline results from Part 2 of the Phase 1b/2a trial evaluating BX004. The objectives of Part 2 of the Phase 1b/2a trial were to evaluate the safety and tolerability of BX004 in a larger number of CF patients dosed for a longer treatment duration than Part 1 of the study, with the anticipation that the longer treatment might result in greater effects than in the Part 1. In Part 2, 34 CF patients were randomized in a 2:1 ratio with 23 CF patients receiving BX004 and 11 patients receiving placebo via nebulization twice daily for 10 days.

Key results from Part 2 of the Phase 1b/2a trial included the following findings:

| ● | Study drug was safe and well-tolerated, with no related SAEs (serious adverse events) or related APEs (acute pulmonary exacerbations) to study drug. |

| ● | In the BX004 arm, 3 out of 21 (14.3%) patients with quantitative CFU at baseline converted to sputum culture negative for P. aeruginosa after 10 days of treatment (including 2 patients after 4 days) compared to 0 out of 10 (0%) in the placebo arm. |

| ● | BX004 vs. placebo showed a positive clinical effect in a predefined subgroup of patients with reduced baseline lung function (FEV1<70%). Difference between groups at Day 17: relative FEV1 improvement of 5.67% (change from baseline +1.46 vs. -4.21) and +8.87 points in Cystic Fibrosis Questionnaire-Revised (CFQR) respiratory symptom scale (change from baseline +2.52 vs. -6.35). |

| ● | In full population, BX004 vs. placebo P. aeruginosa levels were more variable in sputum, potentially driven by aligning initiation of study drug administration with the initiation of standard of care antibiotic treatment regimen. In a prespecified subgroup of patients on standard of care inhaled antibiotics on continuous regimen, BX004 vs. placebo reduced sputum P. aeruginosa levels at Day 10: difference in change from baseline between groups of -2.8 log10 CFU/g sputum (change from baseline -2.91 vs -0.11), exceeding Part 1 results. |

| ● | Alternating/cycling background antibiotic regimen likely associated with fluctuations in P. aeruginosa levels potentially confounding the ability to observe a P. aeruginosa reduction in this subgroup. |

| ● | During the study period, based on current available data, no evidence of treatment-related phage resistance was observed in patients treated with BX004 compared to placebo. |

In August 2023, the FDA granted BX004 Fast Track designation for the treatment of chronic respiratory infections caused by P. aeruginosa bacterial strains in patients with CF. In addition, in December 2023, BX004 received orphan drug designation from the FDA.

BiomX expects to initiate a randomized, double blind, placebo-controlled, multi-center Phase 2b study in CF patients with chronic P. aeruginosa pulmonary infections in the fourth quarter of 2024. The study is designed to enroll approximately 60 patients randomized at a 2:1 ratio to BX004 or placebo. Treatment is expected to be administered via inhalation twice daily for a duration of 8 weeks. The study is designed to monitor the safety and tolerability of BX004 and is designed to demonstrate improvement in microbiological reduction of P. aeruginosa burden and evaluation of effects on clinical parameters such as lung function measured by FEV1 and patient reported outcomes. Study results are expected in the third quarter 2025.

BX211 – Treatment of Diabetic Foot Osteomyelitis (DFO)

BX211 is a personalized phage therapy for the treatment of DFO associated with Staphylococcus aureus, or S. aureus. The personalized phage treatment tailors a specific phage selected from a proprietary phage-bank according to the specific strain of S. aureus biopsied and isolated from each patient. DFO is a bacterial infection of the bone that usually develops from an infected foot ulcer and is a leading cause of amputation in patients with diabetes. We believe that scientific literature demonstrating the potential benefit in treating osteomyelitis using phage in animal models as well as numerous successful compassionate cases using phage therapy to treat DFO patient support our approach of using phage therapy to treat DFO.

The ongoing randomized, double-blind, placebo-controlled, multi-center phase 2 study investigating the safety, tolerability, and efficacy of BX211 for subjects with DFO associated with S. aureus is expected to enroll approximately 45 subjects randomized at a 2:1 ratio to BX211 or placebo. BX211 or placebo is designed to be administered weekly, by topical and intravenous, or IV route at week 1 and by the topical route only at each of weeks 2-12. Over the 12-week treatment period, all subjects are expected to continue to be treated in accordance with standard of care which will include antibiotic treatment as appropriate. A first readout of study topline results is expected at week 13 evaluating healing of the wound associated with osteomyelitis, followed by a second readout at week 52 evaluating amputation rates and resolution of osteomyelitis based on X-ray, clinical assessments, and established biomarkers (Erythrocyte Sedimentation Rate, or ESR, and C-Reactive Protein, or CRP). These readouts are expected in the first quarter of 2025 and the first quarter of 2026, respectively.

National Institutes of Health, or NIH study in Cystic Fibrosis

We are supporting a study conducted by the NIH and The Antibacterial Resistance Leadership Group targeting P. Aeruginosa infections in CF patients under FDA emergency Investigational New Drug, or eIND allowance. The Phase 1b/2, multi-centered, randomized, double-blind, placebo-controlled trial is assessing the safety and microbiological activity of a single IV dose of bacteriophage therapy in cystic fibrosis subjects colonized with P. aeruginosa.

Programs on hold

BX005 – Treatment of Atopic Dermatitis

BX005 is our topical phage product candidate targeting Staphylococcus aureus, or S. aureus, a bacterium associated with the development and exacerbation of inflammation in atopic dermatitis. S. aureus is more abundant on the skin of atopic dermatitis patients than on the skin of healthy individuals and on lesional skin than non-lesional skin. It also increases in abundance, becoming the dominant bacteria, when patients experience flares. By reducing the load of S. aureus, BX005 is designed to shift the skin microbiome composition to its ‘pre-flare’ state and potentially provide a clinical benefit. In preclinical in vitro studies, BX005 was shown to eradicate over 90% of strains, including antibiotic resistant strains, from a panel of S. aureus strains (120 strains isolated from skin of subjects from the U.S. and Europe). On April 8, 2022, the FDA approved the Company’s IND application for BX005.

As of the date of this Annual Report, we have paused development efforts for BX005 due to prioritizing resources towards our CF and DFO programs, and we cannot provide guidance on resuming its development.

Prosthetic Joint Infections, or PJI

Our personalized phage therapy for treating PJI targets multiple bacterial organisms such as Staphylococcus aureus, Staphylococcus epidermidis and Enterococcus faecium. This treatment was granted Orphan-drug designation by the FDA in July 2020. As of the date of this Annual Report, we have paused development efforts of this program due to prioritizing resources towards our CF and DFO programs, and we cannot provide guidance on resuming its development.

Our Strategy

Our goal is to develop multiple products based on the ability of phage to precisely target harmful bacteria and on our ability to screen, identify and optimally combine different phage, both naturally occurring and generated using synthetic engineering, to develop these treatments. We intend to continue to:

| ● | Investigate clinical safety and efficacy of our lead phage-based product candidates to treat CF and DFO; |

| ● | Identify new pathogenic bacteria to be targeted by phage therapy for our existing indications and possible new indications; and |

| ● | Develop and partner microbiome-based biomarker tests, based on our proprietary XMarker platform, that can be used for disease diagnosis or as companion diagnostics. |

Our phage discovery platform

Our approach is driven by the convergence of several factors: a rapidly increasing understanding of phage, including the links between phage behaviors and their genomes; growing evidence that the presence of specific harmful bacteria may impact chronic diseases, such as CF, making them in principle, amenable to treatment with phage; and by a growing number of anecdotal reports from different academic centers of successful compassionate use of phage to treat seriously ill patients who were unresponsive to other therapies. We believe our phage therapeutic product candidates have the potential to treat conditions and diseases by precisely targeting pathogenic bacteria without disrupting elements of the healthy microbiota.

Our phage-based product candidates, either fixed phage cocktails or personalized phage treatments, are developed utilizing our proprietary research and development platforms, named BOLT and PST. The BOLT, platform is unique, employing cutting edge methodologies and capabilities across disciplines including computational biology, microbiology, synthetic engineering of phage and their production bacterial hosts, bioanalytical assay development, manufacturing and formulation, to allow agile and efficient development of natural or engineered phage combinations, or cocktails.

The PST platform utilizes proprietary assays to allow us to screen extensive phage libraries in search of optimal phage for treatment of the specific target bacteria isolated from a given patient.

BOLT is designed to allow the rapid development of optimized phage cocktails. These cocktails may be comprised of naturally-occurring or synthetically engineered phage. The cocktail contains phage with complementary features and is optimized for multiple characteristics such as broad target host range, ability to prevent resistance, biofilm penetration, stability and ease of manufacturing. Pre-clinical development of the optimized phage cocktail is anticipated to require 1-2 years.

We combine multiple technologies that originate from the laboratories of our scientific founders and that were developed internally. Technologies that were developed by our scientific founders are described in leading scientific journals. One of our scientific founders, Professor Rotem Sorek, a Professor in the Department of Molecular Genetics at the Weizmann Institute of Science, or WIS, is a world leader in phage genomics and bacterial defense mechanisms. Another scientific founder, Professor Eran Elinav, a Professor in the Department of Immunology at the WIS, is an expert in investigating the link between the microbiome and human health and disease. Our third scientific founder, Professor Timothy K. Lu, is a world leader in synthetic biology approaches to engineering gene circuits and phage, leading the Synthetic Biology Group in the Department of Electrical Engineering and Computer Science and the Department of Biological Engineering at the Massachusetts Institute of Technology. In addition, through the acquisition of the privately held Israel-based company, RondinX Ltd. in 2017, we gained access to high throughput genomic analyses techniques developed by Professor Eran Segal, a leading computational biologist from the Department of Computer Science and Applied Mathematics at the WIS. The combination of the technologies and expertise from these leaders in each of their respective fields is critical in enabling us to focus on treating complex human diseases and conditions by precise manipulation of the microbiome.

Additionally, we developed proprietary assays and screening technology for robust and high throughput testing PST. The PST platform combines state of the art automation with advanced microbiology assays. The output is a reproducible conclusive decision for optimal phage matching, based on multiple factors, including success of phage infection, suppression of resistant mutants, and antibiofilm activity.

Manufacturing

We have developed manufacturing processes that utilize state of the art industrial methods for the manufacturing of our product candidates. These processes are designed to comply with current Good Manufacturing Practice, or cGMP, with the appropriate scale to meet our clinical study needs, and to fulfill the requirements of regulators for human studies.

In February 2021, we consolidated our U.S. Good Manufacturing Practice, or GMP, manufacturing, testing and development into a 6,100 square feet space in our Gaithersburg facility and in March 2021, we moved into a new 6,500 square feet manufacturing facility in our headquarters, in Ness Ziona, Israel. Both facilities are designed to produce clinical quantities of our product candidates required for early-stage clinical development with compliance suitable for this stage of development and to support eIND.

The Ness Ziona facility consists of two suites for drug substance phage production/development as well as formulation and final drug product production rooms to support topical, oral, inhaled and injectable phage-based products in a liquid, cream, semi-solid or dry form.

The Gaithersburg facility consists of three manufacturing suites, one for upstream seed banking, one for drug substance phage production, and one for formulation and fill of the final drug product. This facility is also equipped with in-house quality control testing laboratories to support the release of injectable phage-based products in a liquid form. Additional laboratory space is allocated for process development and there are laboratory and office spaces available that can be repurposed for future GMP expansion.

We currently operate a manufacturing model that combines in-house process development, manufacturing and testing with the flexibility to outsource to third-party development, manufacturing, testing, and logistics organizations, when needed. We maintain service agreements with multiple manufacturers, testing laboratories and a third-party logistics warehouse for product candidate distribution. These service agreements are generally short-term in nature and can be extended or renewed. As such, for BX004, we have engaged a third-party to supplement our in-house process development activities. We selected this organization based on its experience, capability, capacity and regulatory status. Manufacturing and development projects are managed by a team of internal staff who assure compliance with the technical aspects and regulatory requirements of the manufacturing process.

Additional phage bank product candidates collectively known as BX211 are manufactured at our in-house GMP facility in Gaithersburg. Such product candidates are produced and released by internal staff in compliance with cGMPs. We perform release testing in house for most release assays and also outsource testing to qualified laboratories. In addition, we utilize a third-party logistics warehouse for product storage and distribution to clinical sites.

We are considering consolidation of the two GMP sites into one based on future needs. While we do not have a current need for a commercial scale manufacturing capacity, at the appropriate time we intend to evaluate building large scale cGMP internal manufacturing capabilities, which may include expansion of our operations.

Intellectual Property

We strive to protect the proprietary technology that we believe is important to our business, including seeking and maintaining patent protection in the United States and internationally for our product candidates and discovery platform. We also rely on trademarks, trade secrets, know-how, copyrights, continuing technological innovation and in-licensing opportunities to develop and maintain our proprietary position. For more information regarding the risks related to our intellectual property, see “Risk Factors — Risks Related to our Licensed and Co-Owned Intellectual Property.”

We plan to continue to expand our intellectual property estate by filing patent applications directed to formulations, related methods of treatment, methods of manufacture or identification from our ongoing development of our product candidates, as well as discovery based on our proprietary product platform. Our success will depend on our ability to obtain and maintain patent and other proprietary protection for commercially important technology, inventions and know-how related to our business, defend, and enforce any patents that we may obtain, preserve the confidentiality of our trade secrets and know-how and operate without infringing the valid and enforceable patents and proprietary rights of third parties.

Because patent applications in the United States and certain other jurisdictions are maintained in secrecy for 18 months or potentially even longer, and because publication of discoveries in the scientific or patent literature often lags behind actual discoveries and patent application filings, we cannot be certain of the priority of inventions covered by pending patent applications. Accordingly, we may not have been the first to invent the subject matter disclosed in some of its patent applications or the first to file patent applications covering such subject matter, and we may have to participate in interference proceedings or derivation proceedings declared by the United States Patent and Trademark Office, or USPTO, to determine priority of invention.

Patent portfolio

Our patent portfolio consists of owned patent applications, as well as both licensed and co-owned patent applications (that are also licensed). See “Risk Factors — Risks Related to our Licensed and Co-Owned Intellectual Property.” For some of these applications, prosecution has not started, and others are in the early stages of prosecution in the United States and in selected jurisdictions outside of the United States. We solely own four patent families. We co-own one US patent family with Keio University in Tokyo, Japan, or Keio, one international patent family (United States, Australia, Canada, European Patent Office national filings) with Yeda Research and Development Company Limited, the technology transfer office of the WIS, or Yeda, and one international patent family (United States, Europe) with both Keio and Yeda. We have an exclusive license from Yeda and Keio for these co-owned patent applications. We have exclusive licenses from Yeda or Keio for the rest of the patents and patent applications in its portfolio.

A significant portion of our portfolio is directed to our product candidates, specifically: CF and atopic dermatitis as well as product candidates relevant to programs which we have stopped their development such as: inflammatory bowel disease, or IBD, primary sclerosing cholangitis and colorectal cancer, or CRC, as well as to our bacterial target discovery and bacteriophage discovery technology platforms. Prosecution has yet to commence for most of the pending patent applications covering our product candidates. Prosecution is a lengthy process, during which the scope of the claims initially submitted for examination by the USPTO are often significantly narrowed by the time they issue, if they issue at all. We expect this to be the case with respect to our licensed and co-owned patent applications, described briefly below.

In connection with the Acquisition, we further enhanced our intellectual property portfolio with the addition of APT’s portfolio comprising of 7 issued or allowed patents, 19 patent families (including applications in United States, Europe, Australia, Canada, China, India, Japan, Korea, Israel, Brazil, and South Africa). APT’s patents and patent applications consist of patents and patent applications with respect to pharmaceutical compositions and methods of treatment, methods of manufacture of such compositions and expire between June 2037 and October 2043.

CF

We solely own one patent family (United States, Australia, Canada, European Patent Office, Japan and China) containing claims directed to pharmaceutical compositions comprising combinations of bacteriophage to treat chronic Pseudomonas lung infections, especially common in CF patients, methods of use for these bacteriophage combinations, and methods of identifying patients who will respond to these bacteriophage combinations. Any United States patents issuing from the pending application covering our lead bacteriophage combination in this program, if issued, are expected to expire in 2042. Patent term adjustments or patent term extensions could result in later expiration dates.

Atopic Dermatitis

We solely own one patent family (United States, Australia, Canada, European Patent Office and Japan) containing claims directed to pharmaceutical compositions comprising combinations of bacteriophage to treat skin infections, especially common in atopic dermatitis patients, methods of use for these bacteriophage combinations, and methods of identifying patients who will respond to these bacteriophage combinations. Any United States patents issuing from the pending application covering our lead bacteriophage combination in this program, if issued, are expected to expire in 2042. Patent term adjustments or patent term extensions could result in later expiration dates.

Patent term

The term of individual patents depends upon the legal term of the patents in the countries in which they are obtained. In most countries in which we file patent applications, including the United States, the base term is 20 years from the filing date of the earliest-filed non-provisional patent application from which the patent claims priority. The term of a United States patent can be lengthened by patent term adjustment, which compensates the owner of the patent for administrative delays at the USPTO. In some cases, the term of a United States patent is shortened by a terminal disclaimer that reduces its term to that of an earlier-expiring patent. The term of a United States patent may be eligible for patent term extension under the Drug Price Competition and Patent Term Restoration Act of 1984, referred to as the Hatch-Waxman Act, to account for at least some of the time the drug is under development and regulatory review after the patent is granted. With regard to a drug for which FDA approval is the first permitted marketing of the active ingredient, the Hatch-Waxman Act allows for extension of the term of one United States patent that includes at least one claim covering the composition of matter of such an FDA-approved drug, an FDA-approved method of treatment using the drug and/or a method of manufacturing the FDA-approved drug. The extended patent term cannot exceed the shorter of five years beyond the non-extended expiration of the patent or fourteen years from the date of the FDA approval of the drug, and a patent cannot be extended more than once or for more than a single product. During the period of extension, if granted, the scope of exclusivity is limited to the approved product for approved uses. Some foreign jurisdictions, including Europe and Japan, have analogous patent term extension provisions, which allow for extension of the term of a patent that covers a drug approved by the applicable foreign regulatory agency.

In the future, if and when our product candidates receive FDA approval, we expect to apply, if appropriate, for patent term extension on patents directed to those product candidates, their methods of use and/or methods of manufacture. However, there is no guarantee that the applicable authorities, including the FDA in the United States, will agree with our assessment of whether such extensions should be granted, and if granted, the length of such extensions.

Trade Secrets and Know-How

In addition to patents, we rely on trade secrets and know-how to develop and maintain our competitive position. We typically rely on trade secrets to protect aspects of our business that are not amenable to, or that we do not consider appropriate for, patent protection. We protect trade secrets and know-how by establishing confidentiality agreements and invention assignment agreements with our employees, consultants, scientific advisors, contractors and collaborators. These agreements provide that all confidential information developed or made known during the course of an individual’s or entities’ relationship with us must be kept confidential during and after the relationship. These agreements also provide that all inventions resulting from work performed for us or relating to our business and conceived or completed during the period of employment or assignment, as applicable, shall be our exclusive property. In addition, we take other appropriate precautions, such as physical and technological security measures, to guard against misappropriation of its proprietary information by third parties.

Although we take steps to protect our proprietary information and trade secrets, including through contractual means with our employees and consultants, third parties may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets or disclose our technology. Thus, we may not be able to meaningfully protect our trade secrets and benefit from the exclusive use thereof. For more information regarding the risks related to our intellectual property, see “Risk Factors — Risks Related to Our Licensed and Co-Owned Intellectual Property.”

Competition

The biotechnology and pharmaceutical industries are characterized by rapidly advancing technologies, strong competition and an emphasis on proprietary products. While we believe that our technology, knowledge and experience provide us with competitive advantages, we face substantial competition from many different sources, including larger pharmaceutical companies with more resources. Specialty biotechnology companies, academic research institutions, governmental agencies, as well as public and private institutions are also potential sources of competitive products and technologies. We believe that the key competitive factors affecting the success of any of our product candidates will include efficacy, safety profile, time to market, cost, level of promotional activity and intellectual property protection.

We are aware of a number of biotechnology companies developing bacteriophage products to treat diseases. To our knowledge, several biotechnology companies, such as Locus Biosciences, Inc., Armata Pharmaceuticals, Inc. and SNIPR Biome, as well as academic institutions, have discovery stage or clinical programs utilizing naturally occurring phage or synthetic biology approaches. In addition, we are aware of several investigational and marketed products to treat the indications that we are targeting with our product candidates, including, but not limited to:

| ● | CF: Trikafta, Symdeco, Pulmozyme, Tobramycin, Aztreonam |

| ● | DFO: TP-102 being developed by Technophage, a phage-based product being developed by Phaxiam |

Many of our competitors, either alone or with their strategic partners, have substantially greater financial, technical and human resources than ours and significantly greater experience in the discovery and development of product candidates, obtaining FDA and other regulatory approvals of products and the commercialization of those products. Accordingly, our competitors may be more successful than us in discovering product candidates, obtaining approval for such product candidates and achieving widespread market acceptance. Our competitors’ products may be more effective, or more effectively marketed and sold, than any product we may commercialize and may render our product candidates obsolete or non-competitive before we can recover the expenses of developing and commercializing any of our product candidates. We anticipate that we will face intense and increasing competition as new drugs enter the market and advanced technologies become available.

These third parties compete with us in recruiting and retaining qualified scientific, clinical, manufacturing, sales and marketing and management personnel, establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our program.

Sales and Marketing

We intend to pursue the commercialization of our drug product candidates either by building internal sales and marketing capabilities or through collaborations with others.

In October 2021, we entered into a stock purchase agreement with a subsidiary of Maruho, a leading dermatology-focused pharmaceutical company in Japan, pursuant to which we issued to Maruho 375,000 shares of Common Stock, at a price of $8.00 per share for gross proceeds of $3 million. We also granted Maruho a right of first offer to license our BX005 product candidate for atopic dermatitis in Japan. The right of first offer will commence following the availability of results from a the Phase 1/2 study which is currently on hold.

Government Regulation

Government authorities in the United States and other countries regulate, among other things, the research, development, testing, manufacture, quality control, approval, labeling, packaging, storage, record-keeping, promotion, advertising, distribution, post-approval monitoring and reporting, marketing and export and import of drug and biological products. Generally, before a new drug or biologic can be studied in human clinical trials or marketed, considerable data demonstrating its quality, safety, efficacy, purity, and/or potency must be obtained, organized into a format specific for each regulatory authority, submitted for review and approved by the regulatory authority where the product is intended to be studied or marketed.

U.S. Biological Product Development Process

In the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act, or the FDCA, and its implementing regulations under the FDCA, the Public Health Service Act, or the PHSA, and their implementing regulations. Both drugs and biologics are also subject to other federal, state and local statutes and regulations. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state and local statutes and regulations requires the expenditure of substantial time and financial resources. Failure to comply with applicable U.S. requirements at any time during the product development, approval, or post-marketing process may subject an applicant to administrative or judicial sanctions. These sanctions could include, among other actions, the FDA’s refusal to approve pending applications, withdrawal of an approval or license revocation, a clinical hold, untitled or warning letters, product recalls or market withdrawals, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement and civil or criminal penalties. Any agency or judicial enforcement action could have a material adverse effect on us.

Certain of our current product candidates and future product candidates must be approved by the FDA through a Biologics License Application, or BLA, process before they may be legally marketed in the United States. The process generally involves the following:

| ● | Completion of extensive preclinical studies in accordance with applicable regulations, including studies conducted in accordance with GLP requirements, if needed; |

| ● | Submission to the FDA of an IND, which must become effective before human clinical trials may begin; |

| ● | Approval by an institutional review board, or IRB, at each clinical trial site before each trial may be initiated; |

| ● | Performance of adequate and well-controlled human clinical trials in accordance with applicable IND regulations, good clinical practice, or GCP, requirements and other clinical trial-related regulations to establish the safety, purity, potency and efficacy of the investigational product for each proposed indication; |

| ● | Submission to the FDA of a BLA; |

| ● | A determination by the FDA within 60 days of its receipt of a BLA to accept the application for review; |

| ● | Satisfactory completion of an FDA pre-approval inspection of the manufacturing facility or facilities where the biologic will be produced to assess compliance with cGMP requirements to assure that the facilities, methods and controls are adequate to preserve the biologic’s identity, strength, quality and purity; |

| ● | Potential FDA audit of the clinical trial sites that generated the data in support of the BLA; |

| ● | Payment of user fees for FDA review of the BLA (unless a fee waiver applies); and |

| ● | FDA review and approval of the BLA, including consideration of the views of any FDA advisory committee, prior to any commercial marketing or sale of the biologic in the United States. |

Preclinical Studies and IND

Preclinical studies include laboratory evaluation of product chemistry and formulation, as well as in vitro and animal studies to establish a rationale for therapeutic use and in some cases to assess the potential for adverse events. The conduct of preclinical studies is subject to federal regulations and requirements, including in some cases GLP regulations for safety/toxicology studies. An IND sponsor must submit the results of the preclinical tests, together with manufacturing information, analytical data, any available clinical data or literature and plans for clinical trials, among other things, to the FDA as part of an IND. An IND is a request for authorization from the FDA to administer an investigational product to humans, and, must become effective before human clinical trials may begin. Some long-term preclinical testing may continue after the IND is submitted. An IND automatically becomes effective 30 days after receipt by the FDA, unless before that time, the FDA raises concerns or questions related to one or more proposed clinical trials and places the trial on clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. As a result, submission of an IND may not result in the FDA allowing clinical trials to commence.

Clinical Trials

Clinical trials involve the administration of the drug or biological product candidate to healthy volunteers or disease-affected patients under the supervision of qualified investigators, generally physicians not employed by, or under, the trial sponsor’s control. Clinical trials are conducted under protocols detailing, among other things, the objectives of the clinical trial, dosing procedures, subject selection and exclusion criteria, and the parameters to be used to monitor subject safety and efficacy, including stopping rules that assure a clinical trial will be stopped if certain adverse events should occur. Each protocol and any amendments to the protocol must be submitted to the FDA as part of the IND. Clinical trials must be conducted and monitored in accordance with the FDA’s regulations comprising the GCP requirements, including the requirement that all research subjects provide informed consent. Further, each clinical trial must be reviewed and approved by an IRB at or servicing each institution at which the clinical trial will be conducted. An IRB is charged with protecting the welfare and rights of study participants and considers such items as whether the risks to individuals participating in the clinical trials are minimized and are reasonable in relation to anticipated benefits. The IRB also approves the form and content of the informed consent that must be signed by each clinical trial subject or his or her legal representative and must monitor the clinical trial until completed. There are also requirements governing the reporting of ongoing clinical trials and completed clinical trial results to public registries. Information about certain clinical trials, including clinical trial results, must be submitted within specific timeframes for publication on the www.clinicaltrials.gov website.

Clinical trials generally are conducted in three sequential phases, known as Phase 1, Phase 2 and Phase 3, and may overlap.

| ● | Phase 1 clinical trials generally involve a small number of healthy volunteers or disease-affected patients who are initially exposed to a single dose and then multiple doses of the product candidate. The primary purpose of these clinical trials is to assess the metabolism, pharmacologic action, side effect tolerability and safety of the product candidate. |

| ● | Phase 2 clinical trials generally involve studies in disease-affected patients to evaluate proof of concept and/or determine the dosing regimen(s) for subsequent investigations. At the same time, safety and sometimes further pharmacokinetic and pharmacodynamic information is collected, possible adverse effects and safety risks are identified and a preliminary evaluation of efficacy is conducted. |

| ● | Phase 3 clinical trials generally involve a large number of patients at multiple sites and are designed to provide the data necessary to demonstrate the effectiveness of the product for its intended use, its safety in use and to establish the overall benefit/risk relationship of the product and provide an adequate basis for labeling for new drugs. |

Post-approval trials, sometimes referred to as Phase 4 clinical trials, may be conducted after initial marketing approval. These trials are conducted to gain additional experience from the treatment of patients in the intended therapeutic indication. In certain instances, the FDA may mandate the performance of Phase 4 clinical trials as a condition of approval of a BLA.

Progress reports detailing the results of the clinical trials, among other information, must be submitted at least annually to the FDA and written IND safety reports must be submitted to the FDA and the investigators for serious and unexpected suspected adverse events, findings from other studies or animal or in vitro testing that suggest a significant risk for human subjects and any clinically important increase in the rate of a serious suspected adverse reaction over that listed in the protocol or investigator brochure.

It is possible for Phase 1, Phase 2, Phase 3 and other types of clinical trials not to be completed successfully within a specified period, if at all. The FDA or the sponsor may suspend or terminate a clinical trial at any time on various grounds, including a finding that the patients are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the biologic has been associated with unexpected serious harm to patients. Additionally, some clinical trials are overseen by an independent group of qualified experts organized by the clinical trial sponsor, or the Data Safety Monitoring Board. This group provides authorization for whether a trial may move forward at designated check points based on access to certain data from the trial.

Concurrent with clinical trials, companies may complete additional animal studies and also must develop additional information about the chemistry and physical characteristics of the biologic as well as finalize a process for manufacturing the product in commercial quantities in accordance with cGMP requirements. The manufacturing process must be capable of consistently producing quality batches of the product and, among other things, companies must develop methods for testing the identity, strength, quality and purity of the final product. Additionally, appropriate packaging must be selected and tested, and stability studies must be conducted to demonstrate that the product candidates do not undergo unacceptable deterioration over their shelf life.

FDA Review Process

Following completion of the clinical trials, data are analyzed to assess whether the investigational product is safe and effective for the proposed indicated use or uses, and also meets the regulatory requirements for potency and purity. The results of preclinical studies and clinical trials are then submitted to the FDA as part of a BLA, along with proposed labeling, chemistry and manufacturing information to ensure product quality and other relevant data. The BLA is a request for approval to market the biologic for one or more specified indications and must contain proof of safety, purity and potency. The application may include both negative and ambiguous results of preclinical studies and clinical trials, as well as positive findings. Data may come from company-sponsored clinical trials intended to test the safety and efficacy of a product’s use or from a number of alternative sources, including studies initiated by investigators. To support marketing approval, the data submitted must be sufficient in quality and quantity to establish the safety and efficacy in the intended indication, purity and potency of the investigational product to the satisfaction of the FDA. FDA approval of a BLA must be obtained before a biologic may be marketed in the United States. Under the Prescription Drug User Fee Act, or PDUFA, as amended, each BLA must be accompanied by a user fee. The FDA adjusts the PDUFA user fees on an annual basis. Fee waivers or reductions are available in certain circumstances, including a waiver of the application fee for the first application filed by a small business. Additionally, no user fees are assessed on BLAs for products designated as orphan drugs, unless the product also includes a non-orphan indication.

The FDA reviews all submitted BLAs before it accepts them for filing and may request additional information rather than accept the BLA for filing. The FDA must make a decision on accepting a BLA for filing within 60 days of receipt, and such a decision could include a refusal to file by the FDA. Once the submission is accepted for filing, the FDA begins an in-depth review of the BLA. Under the goals and policies agreed to by the FDA under PDUFA, the FDA has 10 months, from the filing date, in which to complete its initial review of an original BLA and respond to the applicant, and six months from the filing date of an original BLA designated for priority review. The FDA does not always meet its PDUFA goal dates for standard and priority BLAs, and the review process is often extended by FDA requests for additional information or clarification.

Before approving a BLA, the FDA will conduct a pre-approval inspection of the manufacturing facilities for the new product to determine whether they comply with cGMP requirements. The FDA will not approve the product unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. The FDA also may audit data from clinical trials to ensure compliance with GCP requirements. Additionally, the FDA may refer applications for novel products or products which present difficult questions of safety or efficacy to an advisory committee, typically a panel that includes clinicians and other experts, for review, evaluation and a recommendation as to whether the application should be approved and under what conditions, if any. The FDA is not bound by recommendations of an advisory committee, but it considers such recommendations when making decisions on approval. The FDA likely will reanalyze the clinical trial data, which could result in extensive discussions between the FDA and the applicant during the review process.

After the FDA evaluates a BLA, it will issue an approval letter, or a Complete Response Letter. An approval letter authorizes commercial marketing of the biologic with specific prescribing information for specific indications. A Complete Response Letter indicates that the review cycle of the application is complete and the application will not be approved in its present form. A Complete Response Letter usually describes all the specific deficiencies in the BLA identified by the FDA. The Complete Response Letter may require additional clinical data and/or other significant and time-consuming requirements related to clinical trials, preclinical studies or manufacturing. If a Complete Response Letter is issued, the applicant may either resubmit the BLA, addressing all the deficiencies identified in the letter, or withdraw the application. Even if such data and information are submitted, the FDA may decide that the BLA does not satisfy the criteria for approval. Data obtained from clinical trials are not always conclusive and the FDA may interpret data differently than the sponsor’s interpretation of the same data.

Orphan Drug Designation

Under the Orphan Drug Act of 1983, or the Orphan Drug Act, the FDA may grant orphan designation to a drug or biological product intended to treat a rare disease or condition, which is generally a disease or condition that affects fewer than 200,000 individuals in the United States, or more than 200,000 individuals in the United States and for which there is no reasonable expectation that the cost of developing and making the product available in the United States for this type of disease or condition will be recovered from sales of the product. Orphan drug designation for a biologic must be requested before submitting a BLA. After the FDA grants orphan drug designation, the identity of the therapeutic agent and its potential orphan use are disclosed publicly by the FDA. orphan drug designation does not convey any advantage in or shorten the duration of the regulatory review and approval process.

Orphan drug designation entitles a party to financial incentives such as opportunities for grant funding towards clinical trial costs, tax advantages and user-fee waivers. If a product that has orphan designation subsequently receives the first FDA approval for the disease or condition for which it has such designation, the product is entitled to orphan drug exclusivity, which means that the FDA may not approve any other applications to market the same drug for the same indication for seven years from the date of such approval, except in limited circumstances, such as a showing of clinical superiority to the product with orphan exclusivity by means of greater effectiveness, greater safety or providing a major contribution to patient care, or in instances of drug supply issues. Competitors, however, may receive approval of either a different product for the same indication or the same product for a different indication but that could be used off-label in the orphan indication. Orphan drug exclusivity also could block the approval of one of our products for seven years if a competitor obtains approval before we do for the same product, as defined by the FDA, for the same indication we are seeking approval, or if our product is determined to be contained within the scope of the competitor’s product for the same indication or disease. If one of our products designated as an orphan drug receives marketing approval for an indication broader than that which is designated, it may not be entitled to orphan drug exclusivity. In December 2023, BX004, received orphan drug designation from the FDA.

Expedited Development and Review Programs

The FDA has a fast-track program that is intended to expedite or facilitate the process for reviewing new drugs and biologics that meet certain criteria. Specifically, new drugs and biologics are eligible for fast-track designation if they are intended to treat a serious or life-threatening condition and preclinical or clinical data demonstrate the potential to address unmet medical needs for the condition. Fast track designation applies to the combination of the product and the specific indication for which it is being studied. Any product submitted to the FDA for marketing, including under a fast-track program, may be eligible for other types of FDA programs intended to expedite development and review, such as priority review and accelerated approval. A product is eligible for priority review if it treats a serious or life-threatening condition and, if approved, would provide a significant improvement in safety and effectiveness compared to available therapies. The FDA will attempt to direct additional resources to the evaluation of an application for a new drug or biologic designated for priority review in an effort to facilitate the review.

A product may also be eligible for accelerated approval if it treats a serious or life-threatening condition and demonstrates an effect on a surrogate endpoint that is reasonably likely to predict clinical benefit or on a clinical endpoint that can be measured earlier than irreversible morbidity or mortality, or IMM, that is reasonably likely to predict an effect on IMM or other clinical benefit. As a condition of approval, the FDA generally requires that a sponsor of a drug or biologic receiving accelerated approval perform adequate and well-controlled post-marketing clinical trials. Products receiving accelerated approval may be subject to expedited withdrawal procedures if such clinical trials fail to verify the predicted clinical benefit or if the sponsor fails to conduct such trials in a timely manner.