UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No.: 001-38610

ALARUM TECHNOLOGIES LTD.

(Exact name of registrant as specified in its charter)

Translation of registrant’s name into English: Not applicable

State of Israel

(Jurisdiction of incorporation or organization)

30 Haarba’a Street (P.O. Box 174)

Tel Aviv, 6473926

Israel

(Address of principal executive offices)

Shachar Daniel

Chief Executive Officer

+972-9-8666110

Shachar.daniel@alarum.io

30 Haarba’a Street (P.O. Box 174)

Tel Aviv, 6473926

Israel

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| American Depository Shares each representing ten Ordinary Shares, no par value per share(1) Ordinary Shares, no par value per share(2) | ALAR | Nasdaq Capital Market |

| (1) | Evidenced by American Depositary Receipts. |

| (2) | Not for trading, but only in connection with the listing of the American Depositary Shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

59,681,632 Ordinary Shares, no par value, as of December 31, 2023.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ |

| Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the Exchange Act. ☐

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

U.S. GAAP ☐

International Financial Reporting Standards as issued by the International Accounting Standards Board ☒

Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company.

Yes ☐ No ☒

TABLE OF CONTENTS

INTRODUCTION

We are a global internet access and web data collection provider. We operate in two distinct segments, providing solutions according to specific needs. The segments include enterprise internet access and web data collection solutions, which is our main segment, and consumer internet access solutions and services.

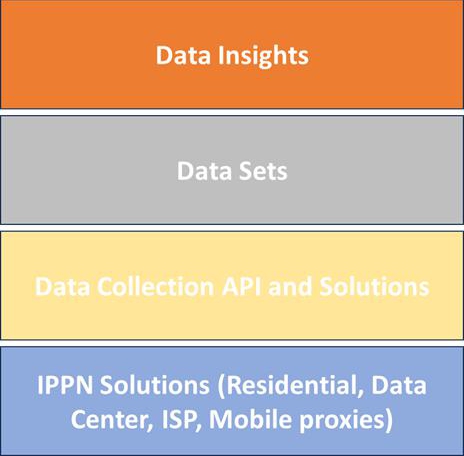

Our enterprise internet access and web data collection segment offers a global web data collection cloud service, based on our proprietary proxy traffic optimization and routing technology, and built on partnership agreements with tens of Internet Service Providers, or ISPs, and with application publishers.

Our service allows organizations to collect vast amounts of web and internet data by simultaneously connecting to the internet from different IP addresses while maintaining full anonymity and privacy. Our customers can choose from various types of Internet Protocol addresses, or IPs, from our IP pool which contains millions of IPs, including ISP IPs, data center IPs and residential service provider IPs.

With our web data collection service, organizations can collect accurate, transparent web data from public online sources. The solution also allows access to undiscovered data from non-traditional data sources and allows customers to gain additional data-driven information that provides valuable insights with respect to predictive capabilities or behaviors, thereby assisting ongoing business management operation and decision making. An added benefit to our customers is the fact that utilizing our network completely hides enterprises from the internet by modifying IP addresses, thus ensuring high levels of privacy for their online presence.

Our internet access solutions for consumers provide a powerful, secured and encrypted connection, masking consumers’ online activity and keeping them safe from hackers. The solutions are designed for advanced and basic users, ensuring complete protection for all personal and digital information.

In July 2023, we decided to scale down the operations of the internet access solutions for consumers, a decision that resulted in material reductions of expenses and headcount. In this consumer internet access solutions segment, we continue to maintain our products and the service only to current paying users, which allows us to generate revenue from past investments of acquiring such users, with minimal costs. In addition, in July 2023 we sold our legacy cybersecurity solutions, which is considered in this annual report on Form 20-F as a discontinued operation.

Unless otherwise indicated, all references to the “Company,” “we,” “our” and “Alarum” refer to Alarum Technologies Ltd. and its wholly owned Israeli subsidiaries NetNut Ltd., or NetNut, NetNut’s wholly owned subsidiary - NetNut Networks Inc., a Delaware corporation, or NetNut Networks, Safe-T Data A.R Ltd., or Safe-T Data, CyberKick Ltd., or CyberKick, CyberKick’s wholly owned subsidiaries - RoboVPN Technologies Ltd., a Cyprus corporation (under voluntary dissolution), and Spell Me Ltd., a Seychelles corporation.

References to “U.S. dollars” and “$” are to currency of the United States of America, and references to “NIS” are to New Israeli Shekels. References to “Ordinary Shares” are to our Ordinary Shares, no par value per share that have been trading on the Tel Aviv Stock Exchange, or TASE, under the symbol “ALAR”. References to ADSs are to our American Depository Shares, representing our Ordinary Shares, that have been trading on the Nasdaq Capital Market, or Nasdaq, under the symbol “SFET” since August 17, 2018, and effective from January 25, 2023, under the symbol “ALAR” following the Company’s change of name, which was made effective by the Israeli Corporations Authority, Registrar of Companies and Partnerships, on January 8, 2023. We report financial information under International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information included or incorporated by reference in this annual report on Form 20-F may be deemed to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws and the Israeli securities law. Forward-looking statements are often characterized using forward-looking terminology such as “may,” “will,” “expect,” “plans,” “anticipate,” “estimate,” “continue,” “believe,” “should,” “intend,” “project” or other similar words, but are not the only way these statements are identified.

These forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, statements that contain projections of results of operations or of financial condition, expected capital needs and expenses, statements relating to the research, development, completion and use of our products, and all statements (other than statements of historical facts) that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate.

Important factors that could cause actual results, developments, and business decisions to differ materially from those anticipated in these forward-looking statements include, among other things:

| ● | our planned level of revenues and capital expenditures; | |

| ● | our ability to market and sell our products; | |

| ● | our plans to continue to invest in research and development to develop technology for both existing and new products; | |

| ● | our ability to maintain our relationships with partners and customers; | |

| ● | our ability to maintain or protect the validity of our European, U.S. and other patents and other intellectual property; | |

| ● | our ability to launch and penetrate markets in new locations, including taking steps to expand our worldwide activities and to enter into engagements with new business partners in those markets; | |

| ● | our intention to increase marketing and sales activities; | |

| ● | our intention to establish partnerships with industry leaders; | |

| ● | our ability to locate additional funding available to us on acceptable terms; | |

| ● | our ability to retain professional employees and executive members; | |

| ● | our ability to internally develop new inventions and intellectual property; | |

| ● | our expectations regarding future changes in our cost of revenues and our operating expenses; | |

| ● | our expectations regarding our tax classifications; | |

| ● | interpretations of current laws and the passages of future laws and/or regulations; | |

| ● | our ability to continue to effectively comply with the requirements of Nasdaq; |

| ● | the potential impact of litigation; |

| ● | acceptance of our business model and performance by investors; | |

| ● | general market, political, and economic conditions in the countries in which we operate including those related to recent unrest and actual or potential armed conflict in Israel and other parts of the Middle East, such as the Israel-Hamas war; and | |

| ● | those factors referred to in “Item 3. Key Information – D. Risk Factors,” “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects”, as well as in this annual report on Form 20-F generally. |

Readers are urged to carefully review and consider the various disclosures made throughout this annual report on Form 20-F which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

You should not put undue reliance on any forward-looking statements. Any forward-looking statements in this annual report on Form 20-F are made as of the date hereof, and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In addition, the section of this annual report on Form 20-F entitled “Item 4. Information on the Company” contains information obtained from independent industry sources and other sources that we have not independently verified.

Summary Risk Factors

The risk factors described below are a summary of the principal risk factors associated with an investment in us. These are not the only risks we face. You should carefully consider these risk factors, together with the risk factors set forth in Item 3D. of this Report and the other reports and documents filed by us with the SEC.

| Risks Related to Our Business and Industry |

| ● | We may need to raise additional capital in the event we return to negative cash flows. | |

| ● | If we are unable to sell additional products and services to our existing customers and/or to acquire new customers, our future revenues and operating results will be harmed; |

| ● | We face intense competition from SaaS internet access vendors, some of which are larger and better known than we are, and we may lack sufficient financial or other resources to maintain or improve our competitive position; |

| ● | If our internal network system is compromised by cyber attackers or other malicious cyber activity, or if our hosting and infrastructure fails, public perception of our products and services will be harmed; | |

| ● | Our business is subject to risks arising from a pandemic, such as COVID-19, including the risk that we may not be able to successfully execute our business or strategic plans, as well as the risk that we will not be able to anticipate, identify and respond quickly to changing market trends and customer preferences or changes in the consumer environment, including changing expectations of service, all of which could have a material adverse effect on our business and results of operations. |

| Risks Related to Our Intellectual Property |

| ● | If we are unable to obtain and maintain effective patent and trademark rights for our products, we may not be able to compete effectively in our markets; |

| ● | Third-party claims of intellectual property infringement may prevent or delay our development and commercialization efforts, as well as apply financial burdens; |

| ● | We may be involved in lawsuits to protect or enforce our intellectual property. |

| Risks Related to the Ownership of Our ADSs or Ordinary Shares |

| ● | Issuance of a significant amount of additional Ordinary Shares due to exercise or conversion of outstanding warrants and/or substantial future sales of our Ordinary Shares may depress our share price; |

| ● | Our warrants are speculative in nature and holders of our warrants will have no rights as shareholders until such holders exercise their warrants and acquire our Ordinary Shares or ADSs, as applicable; |

| ● | Holders of ADSs may not have the same voting rights as the holders of our Ordinary Shares; |

| ● | Holders of ADSs must act through the depositary to exercise their rights as shareholders of our company; | |

| ● | We cannot guarantee that we will continue to comply with Nasdaq requirements. If we fail to comply with Nasdaq requirements, our ADSs could be delisted from Nasdaq, and as a result we and our shareholders could incur material adverse consequences, including a negative impact on our liquidity, our shareholders’ ability to sell shares and our ability to raise capital. |

| Risks Related to Israeli Law and Our Operations in Israel |

| ● | Political, economic and military instability due to the Israel-Hamas war in Israel, where our headquarters, members of management, production facilities and employees are located, may adversely affect our results of operations; | |

| ● | Provisions of Israeli law and our articles of association may delay, prevent or otherwise impede a merger with, or acquisition of, our company; | |

| ● | The rights and responsibilities of a holder of our securities will be governed by Israeli law, which differs in some material respects from the rights and responsibilities of U.S. companies. |

| General Risk Factors |

| ● | Raising additional capital would cause dilution to holders of our equity securities, and may affect the rights of existing holders of equity securities; | |

| ● | The increasing use of social media platforms and new technologies presents risks and challenges for our business and reputation; | |

| ● | Unsuccessful management of environmental, social and governance matters could adversely affect our reputation and we may experience difficulties meeting the expectations of our stakeholders; | |

| ● | We are subject to a number of risks associated with global sales and operations; | |

| ● | The price of the Ordinary Shares or ADSs may be volatile; | |

| ● | We may be subject to securities litigation, which is expensive and could divert management attention; | |

| ● | We may be subject to geopolitical events and resulting macroeconomic consequences. |

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved.]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

You should carefully consider the risks described below, together with all of the other information in this annual report on Form 20-F. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business operations. If any of these risks actually occurs, our business and financial condition could suffer and the price of our ADSs could decline.

Risks Related to Our Business and Industry

The internet access markets are rapidly evolving within the increasingly challenging landscape. If the industry does not continue to develop as we anticipate, our sales will not grow as quickly as expected and our share price could decline.

We operate in a rapidly evolving industry focused on providing organizations and consumers with internet access solutions. We experience intense competition from smaller new players and need to constantly adapt our solutions to the new technologies and growing and constantly changing challenges. It is therefore difficult to predict how large the markets will be for our solutions. If solutions such as ours are not viewed by organizations as necessary, or if business or consumer customers do not recognize the benefit of our solution as a critical layer of an effective security strategy, then our revenues may not grow as quickly as expected, or may decline, and our share price could suffer.

We are engaged in on-going development of our current and future products. Our research and development efforts may not produce successful products or enhancements to our solution that result in significant revenue or other benefits in the near future, if at all.

We expect to continue to dedicate significant financial and other resources to our research and development efforts in order to continuously evolve the development of our products and maintain our competitive position. As a result, our business is significantly dependent on our ability to successfully complete the development of our next- generation products. Investing in research and development personnel, developing new products, and enhancing existing products is expensive and time consuming, and there is no assurance that such activities will result in successful development of our products, significant new marketable products or enhancements to our products, design improvements, cost savings, revenues or other expected benefits. If we spend significant time and effort on research and development and are unable to generate an adequate return on our investment, our business and results of operations may be materially and adversely affected.

If we fail to effectively manage our growth, our business and operations will be negatively affected, and as we invest in the growth of our business, we expect our operating and net profit margins to decline in the near-term.

We have experienced rapid growth in the last five years and intend to continue to grow our business. Our annual operating expenses may continue to increase as we invest in sales, marketing, research and development. Our growth to date has placed significant demands on our management, sales, operational and financial infrastructure, and our growth will continue to place significant demands on these resources. We may not be able to successfully implement these improvements in a timely or efficient manner, and our failure to do so may materially impact our projected growth rate. We may also not be able to effectively manage the expansion of our operations, which may result in weaknesses in our infrastructure, operational mistakes, loss of business opportunities, failure to deliver and timely deliver our products to customers, loss of employees and reduced productivity among remaining employees. Our expected growth could require significant capital expenditures and may divert financial resources from other projects, such as the development of current and additional new products. If our management is unable to effectively manage our growth, our expenses may increase more than expected, our ability to generate and/or grow revenue could be reduced, and we may not be able to implement our business strategy.

As we invest in the growth of our business, we expect that these investments will result in increased costs and may impact our short and mid-term operating and net profit margins. A failure to meet market expectations regarding our profitability and our position as a growth company has had and could continue to have an adverse effect on the price of our Ordinary Shares and ADSs.

Our quarterly and annual results of operations may fluctuate for a variety of reasons.

Our operating results and financial condition may fluctuate from quarter to quarter and year to year and may continue to vary due to several factors, many of which will not be within our control. If our operating results do not meet the guidance that we provide to the market or the expectations of securities analysts or investors, the market price of our Ordinary Shares and the ADSs will likely decline. Fluctuations in our operating results and financial condition may be due to several factors:

| ● | the degree of market acceptance of our products and services; | |

| ● | our ability to attract and retain new customers; | |

| ● | our ability to sell additional products to current customers; | |

| ● | changes in consumers’ and enterprises’ requirements and expectations or channel partner requirements; | |

| ● | changes in the growth rate of the internet access solutions markets; | |

| ● | the timing and success of new product and service introductions by us or our competitors or any other change in the competitive landscape of the internet access markets, including consolidation among our customers or competitors; | |

| ● | a disruption in, or termination of, our relationship with partners; | |

| ● | our ability to successfully expand our business globally; | |

| ● | changes in our pricing policies or those of our competitors and our responses to price competition; | |

|

● |

general economic conditions in our markets, including political, economic and military instability due to the Israel-Hamas war in Israel; |

| ● | unexpected changes in regulatory practices, laws, regulations and the court systems of certain jurisdictions; | |

| ● | future accounting pronouncements or changes in our accounting policies or practices; | |

| ● | the amount and timing of our operating costs; | |

| ● | a change in our mix of products and services; and | |

| ● | increases or decreases in our expenses caused by fluctuations in foreign currency exchange rates. |

Any of the above factors, individually or in the aggregate, may result in significant fluctuations in our financial and other operating results from period to period. These fluctuations could result in our failure to meet our operating plan or the expectations of investors or analysts for any period. If we fail to meet such expectations for these or other reasons, the market price of our Ordinary Shares and the ADSs could fall substantially, and we could face costly lawsuits, including securities class action suits.

Our reputation and business could be harmed based on real or perceived shortcomings, defects or vulnerabilities in our solution or the failure of our solution to meet customers’ expectations.

Organizations and consumers are facing increasingly sophisticated and targeted cyber threats, including the growing threat of cyber terrorism throughout the world. If we fail to identify and respond to new and increasingly complex methods of attack and update our products to detect or prevent such threats, our business and reputation will suffer. In particular, we may suffer significant adverse publicity and reputational harm if a significant breach occurs generally or if any breach occurs at a high-profile customer. Moreover, if our solutions are adopted by an increasing number of enterprises and consumers, it is possible that attackers will begin to focus on finding ways to defeat our solutions. An actual or perceived security breach or theft of our customers’ sensitive business or personal data, regardless of whether the breach or theft is attributable to the failure of our products, could adversely affect the market’s perception of the efficacy of our solutions and current or potential customers may look to our competitors for alternatives to our solutions. The failure of our products may also subject us to lawsuits and financial losses stemming from indemnification demands of our partners and other third parties, as well as the expenditure of significant financial resources to analyze, correct or eliminate any vulnerabilities. Any claim brought against us, regardless of its merit, could result in material expense, diversion of management time and attention, and damage to our reputation, and could cause us to fail to retain or attract customers. Costs or payments made in connection with warranty and product liability claims and product recalls, or other claims could materially affect our financial condition and results of operations. It could also cause us to suffer reputational harm, lose existing customers or deter them from purchasing additional products and services and prevent new customers from purchasing our solutions.

False detection of threats, while typical in our industry, may reduce perception of the reliability of our products and may therefore adversely impact market acceptance of our products. If our solutions restrict legitimate privileged access by authorized personnel to IT systems and applications by falsely identifying those users as an attack or otherwise unauthorized, or fail to provide privacy and security web browsing to consumers, our customers’ businesses could be harmed. There can be no assurance that, despite testing by us, errors will not be found in existing and new versions of our products, resulting in loss of or delay in market acceptance. In such an event, we may be required, or may choose, for customer relations or other reasons, to expend additional resources in order to help correct the problem. In addition, the network of enterprise internet access solutions is built on a mix of IPs, which we source from various providers and technologies. A significant portion of our IP pool is sourced from third-party IP proxy providers and ISPs around the world from which we lease and then resell. We have separate agreements with each provider. If such a provider chooses to terminate the agreement, we will be at a risk of reducing the size of our IP pool and might not be able to support the demands of our customer base.

If we are unable to acquire new customers, our future revenues and operating results will be harmed.

Our success depends on our ability to acquire new customers. The number of customers that we add in a given period impacts both our short-term and long-term revenues. If we are unable to attract a sufficient number of new customers, we may be unable to generate revenue growth at desired rates. The markets we operate in are competitive and many of our competitors have substantial financial, personnel, and other resources that they utilize to develop products and attract customers. As a result, it may be difficult for us to add new customers to our customer base. Competition in the marketplace may also lead us to win fewer new customers or result in us providing discounts and other commercial incentives. Additional factors that impact our ability to acquire new customers include the perceived need for cyber security, the size of our prospective customers’ infrastructure budgets, the utility and efficacy of our existing and new offerings, whether proven or perceived, our ability to reach a significant portion of the consumer market, and general economic conditions. These factors may have a meaningful negative impact on future revenues and operating results. With respect to our enterprise access business, while many companies understand the problem of doing competitive analysis, data collection, and other privacy-related use cases, widespread awareness of the need for access solutions is still lacking. Proxy networks are well understood, and virtual private networks are commonly popular, but access solutions are still in the early adoption phase among companies and individuals that stand to benefit from them. This restraint accounts for not all enterprise access vendors having the marketing budgets to promote themselves.

If we are unable to sell additional products and services to our existing customers, our future revenues and operating results will be harmed.

Our revenues are also generated from sales to existing customers. Our future success depends, in part, on our ability to obtain recurring sales to our existing customers. However, we face customer retention challenges due to fierce competition in the market. We devote significant efforts to developing, marketing and selling additional products to existing customers and rely on these efforts for a portion of our revenues. These efforts require a significant investment in building and maintaining customer relationships, as well as significant research and development efforts in order to provide product upgrades and launch new products. The rate at which our existing customers purchase additional products and services depends on a number of factors, including, but not limited to, the perceived need for additional access services, the fit and efficacy of our solutions and the utility of our new offerings, whether proven or perceived, our customers’ budgets, general economic conditions, our customers’ overall satisfaction with the maintenance and professional services we provide and the continued growth and economic health of our customer base to require incremental users and servers to be covered. If our efforts to sell additional products and services to our customers are not successful, our future revenues and operating results will be harmed.

We face intense competition from access vendors, some of which are larger and better known than we are, and we may lack sufficient financial or other resources to maintain or improve our competitive position.

The markets in which we operate are characterized by intense competition, constant innovation and evolving security threats. We compete with companies that offer a broad array of internet access and web data collection products. Our current and potential future competitors include providers of access solutions, such as Bright Data Ltd., or Bright Data, Oxylabs Networks Pvt. Ltd., BiScience Inc. and others in the enterprise access segment, and Kape Technologies plc, McAfee Corp., Nord VPN, Norton LifeLock, Aura and others in the consumer segment. Some of our competitors are large companies that have the technical and financial resources and broad customer bases needed to bring competitive solutions to the market and already have existing relationships as a trusted vendor for other products. Such companies may use these advantages to offer products and services that are perceived to be as effective as ours at a lower price or for free as part of a larger product package or solely in consideration for maintenance and services fees. They may also develop different products to compete with our current solutions and respond more quickly and effectively than we do to new or changing opportunities, technologies, standards, or client requirements. Additionally, from time to time we may compete with smaller regional vendors that offer products with a more limited range of capabilities that purport to perform functions similar to our solution. Such companies may enjoy stronger sales and service capabilities in their particular regions. With respect to the enterprise access and the consumer markets, we face the emergence of small competitors in this field due to high profitability margins, which can result in pressure on prices to decline. Furthermore, these margins can lead also to competition from bigger companies that can invest larger human, cash and technological resources into this industry. Such increased competition can lead to lower margins and, consequently, impact our revenues, profitability and business.

Our competitors may enjoy potential competitive advantages over us, such as:

| ● | greater name recognition, a longer operating history and a larger customer base; |

| ● | larger sales and marketing budgets and resources; | |

| ● | broader distribution and established relationships with channel and distribution partners and customers; | |

| ● | greater customer support resources; | |

| ● | greater resources to make acquisitions; | |

| ● | larger intellectual property portfolios; and | |

| ● | greater financial, technical and other resources. |

Our current and potential competitors may also establish cooperative relationships among themselves or with third parties that may further enhance their resources. Current or potential competitors may be acquired by third parties with greater available resources. As a result of such acquisitions, our current or potential competitors might be able to adapt more quickly to new technologies and customer needs, devote greater resources to the promotion or sale of their products and services, initiate or withstand substantial price competition, take advantage of other opportunities more readily or develop and expand their product and service offerings more quickly than we do. Larger competitors with more diverse product offerings may reduce the price of products that compete with ours in order to promote the sale of other products or may bundle them with other products, which would lead to increased pricing pressure on our products and could cause the average sales prices for our products to decline.

We may not be able to successfully anticipate or adapt to changing technology or customer requirements on a timely basis, or at all. If we fail to keep up with technological changes or to convince our customers and potential customers of the value of our solution even in light of new technologies, our business, results of operations and financial condition could be materially and adversely affected.

If our network system is compromised by cyber attackers or other data thieves, or if our hosting and infrastructure fails, public perception of our products and services will be harmed.

We will not succeed unless the marketplace is confident that we provide effective cybersecurity protection. Further, we may be targeted by cyber terrorists because we are an Israeli company. If we experience an actual or perceived breach of our network and our internal systems, it could adversely affect the market perception of our products and services. In addition, we may need to devote more resources to address security vulnerabilities in our solution, and the cost of addressing these vulnerabilities could reduce our operating margins. If we do not address security vulnerabilities or otherwise provide adequate security features in our products, certain customers, particularly government customers, may delay or stop purchasing our products. Further, a security breach could impair our ability to operate our business, including our ability to provide maintenance and support services to our customers. If this happens, our revenues could decline, and our business could suffer. With respect to the enterprise access services and consumers services, if we will experience short period hosting/infrastructure failures, or longer periods of disconnection blocking of our network of IPs to access certain websites, and do not offer our customers various immediate alternatives, some customers may choose to delay or stop purchasing our products.

In the ordinary course of our business, we rely on information technology systems, networks and services, including internet sites, data hosting and processing tools, hardware (including laptops and mobile devices), software, and technical platforms and applications, to process, store and transmit data and to help us manage our business and to collect and store the Company’s sensitive data, including intellectual property, personal information and proprietary business information. The secure maintenance and transmission of this information is critical to our operations and business strategy. We rely on commercially available systems, software, tools, and domestically available monitoring to provide security for processing, transmitting and storing this sensitive data. As part of our implemented efficiency and cost-saving measures, we are using cloud service providers. While benefits for using cloud computing services are well documented and are mostly related to resources sharing, on-demand self-services, rapid scalability, improved economies of scale and collaboration, there are risks that could outweigh the expected benefits, and require close attention and management. For example, there is no guarantee that the features we use will be provided for the same price in the future, there is a risk in relying on a cloud service for business-related tasks because no service can guarantee 100% uptime and there is always a risk of data leakage when a company’s data is held by a third-party vendor.

Information technology systems, including those managed or hosted by third parties, could be subject to sophisticated cyber-attacks (including phishing and ransomware attacks) and threats by external or internal parties’ intent on disrupting business processes or otherwise extracting or corrupting information. In recent years, ransomware attacks against organizations have become more frequent and while we continue to implement additional protective measures to reduce the risk of and detect cyber incidents, cyber-attacks are becoming more sophisticated and frequent, and the techniques used in such attacks change rapidly. We may also face increased cybersecurity risks due to the number of our employees and our third-party providers’ who are (and may continue to be) working remotely, which creates additional opportunities for cybercriminals to launch attacks and exploit vulnerabilities in non-corporate IT environments. Unauthorized access to our systems could disrupt our business, and/or lead to theft, loss or misappropriation of critical assets or to outside parties having access to confidential information, including privileged data, personal data or strategic information. Such information could also be made public in a manner that harms our reputation and financial results and, particularly in the case of personal data, could lead to regulators imposing significant fines on us.

Also, our information technology networks and infrastructure may still be vulnerable to damage, disruptions, or shutdowns due power outages, computer viruses, telecommunication or utility failures, systems failures, natural disasters or other catastrophic events. Any such compromise could disrupt our operations, damage our reputation, and subject us to additional costs and liabilities, any of which could adversely affect our business. See “Item 16.K. Cybersecurity” for additional information.

If we do not effectively expand, train and retain our sales force, we may be unable to acquire new customers or sell additional products and services to existing customers, and our business will suffer.

We depend significantly on our sales force to attract new customers and expand sales to existing customers. As a result, our ability to increase our revenues depends in part on our success in recruiting, training and retaining sufficient numbers of sales personnel to support our growth. We expect to continue to expand our sales personnel and face a number of challenges in achieving our hiring and integration goals. There is intense competition for individuals with sales training and experience. In addition, the training and integration of a large number of sales personnel in a short time requires the allocation of internal resources. We invest significant time and resources in training new sales force personnel to understand our solutions and growth strategy. Based on our past experience, it takes an average of approximately six to nine months before a new sales force member operates at target performance levels. However, we may be unable to achieve or maintain our target performance levels with large numbers of new sales personnel as quickly as we have done in the past. Our failure to hire a sufficient number of qualified sales force members and train them to operate at target performance levels may materially and adversely impact our projected growth rate.

If our products fail to help our customers achieve and maintain compliance with certain government regulations and industry standards, our business and results of operations could be materially and adversely affected.

On the enterprise access side of our business, we primarily engage directly with ISPs in order to gain access to their networks. The legality of scraping publicly available web data was first upheld in late 2019, and then reaffirmed by the Ninth Circuit Court of Appeals (hiQ vs LinkedIn) in April 2022. We also note that X Corp (formerly Twitter) has launched several complaints on scraping of its platform, separately bringing three lawsuits against alleged scrapers of its site. The Meta v. Bright Data case may serve as a precedent. However, as the web continues to evolve as a vast source of information, the debate over data accessibility versus privacy is likely to intensify, as well as in connection with the way in which some of the automated software programs are built, and changes in regulations may impact the means or ability to provide such solutions.

International regulatory bodies are increasingly focused on online privacy issues and user data protection. In particular, the General Data Protection Regulation, or the GDPR, in the European Union, or EU, and the UK intends to strengthen and unify data protection for all individuals within the EU. It also addresses the export of personal data outside the EU. The GDPR aims primarily to give control back to citizens and residents over their personal data and to simplify the regulatory environment for international business by unifying the regulation within the EU. Additionally, the uncertainty created by these laws and regulations can be compounded when services hosted in one jurisdiction are directed at users in another jurisdiction. For instance, European data protection rules may apply to companies which are not established in the EU (this is the so-called extraterritorial scope of the GDPR). Similarly, there have been laws and regulations adopted throughout the United States and Israel that impose obligations in areas such as privacy, in particular protection of personal information and implementing adequate cybersecurity measures to protect such information. The most prominent to which we are exposed is the California Consumer Privacy Act of 2020, or the CCPA, which increases the privacy and security obligations companies have towards the consumer when handling personal data. The CCPA allows civil penalties for violations as well as private right of action for data breaches. In addition, the California Privacy Rights Act, or the CPRA, which became effective as of January 1, 2023, imposes additional obligations such as expanding the current data privacy compliance requirements under the CCPA. As an Israeli company we are also subject to the Israeli Privacy Protection Law 1981 and its regulations, as well as the guidelines of the Israeli Privacy Protection Authority.

These industry standards may change with little or no notice, including changes that could make them more or less onerous for businesses. Any inability to adequately address privacy and security concerns or comply with applicable privacy and data security laws, rules and regulations could have an adverse effect on our business prospects, results of operations and/or financial position. In addition, governments may also adopt new laws or regulations, or make changes to existing laws or regulations, that could impact whether our solution enables our customers to maintain compliance with such laws or regulations. If we are unable to adapt our solution to changing government regulations and industry standards in a timely manner, or if our solution fails to expedite our customers’ compliance initiatives, our customers may lose confidence in our products and could switch to products offered by our competitors. In addition, if government regulations and industry standards related to the access sectors are changed in a manner that makes them less onerous, our customers may view compliance as less critical to their businesses, and our customers may be less willing to purchase our products and services. In either case, our sales and financial results would suffer.

Our model for long-term growth depends upon the introduction of new products. If we are unable to develop new products or if these new products are not adopted by customers, our growth will be adversely affected.

Our business depends on the successful development and marketing of new products, including adding complementary offerings to our current products. Development and marketing of new products require significant up-front research, development and other costs, and the failure of new products we develop to gain market acceptance may result in a failure to achieve future sales and adversely affect our competitive position. There can be no assurance that any of our new or future products will achieve market acceptance or generate revenues at forecasted rates or that the margins generated from their sales will allow us to recoup the costs of our development efforts.

If we do not successfully anticipate market needs and enhance our existing products or develop new products that meet those needs on a timely basis, we may not be able to compete effectively and our ability to generate revenues will suffer.

Our customers operate in markets characterized by rapidly changing technologies and business plans, which require them to adapt to increasingly complex IT infrastructures that incorporate a variety of hardware, software applications, operating systems and networking protocols. As our customers’ technologies and business plans grow more complex, we expect them to face new and increasingly sophisticated methods of attack. We face significant challenges in ensuring that our solutions effectively identify and respond to these advanced and evolving attacks without disrupting the performance of our customers’ IT systems. As a result, we must continually modify and improve our products in response to changes in our customers’ IT and industrial control infrastructures.

We cannot guarantee that we will be able to anticipate future market needs and opportunities or be able to develop product enhancements or new products to meet such needs or opportunities in a timely manner, if at all. Even if we are able to anticipate, develop and commercially introduce enhancements and new products, there can be no assurance that enhancements or new products will achieve widespread market acceptance.

Our product enhancements or new products could fail to attain sufficient market acceptance for many reasons, including:

| ● | delays in releasing product enhancements or new products; |

| ● | failure to accurately predict market demand and to supply products that meet this demand in a timely fashion; | |

| ● | inability to interoperate effectively with the existing or newly introduced technologies, systems or applications of our existing and prospective customers; | |

| ● | inability to protect against new types of attacks or techniques used by cyber attackers or other data thieves; |

| ● | defects in our products, errors or failures of our solutions to secure privileged accounts; | |

| ● | negative publicity about the performance or effectiveness of our products; | |

| ● | introduction or anticipated introduction of competing products by our competitors; | |

| ● | installation, configuration or usage errors by our customers; and | |

| ● | easing or changing of regulatory requirements related to IT / cybersecurity / privacy. |

If we fail to anticipate market requirements or fail to develop and introduce product enhancements or new products to meet those needs in a timely manner, it could cause us to lose existing customers and prevent us from gaining new customers, which would significantly harm our business, financial condition, and results of operations.

Defects and bugs in products could give rise to product returns, cancellation of orders or product liability, warranty or other claims that could result in material expenses, diversion of management time and attention, and damage to our reputation.

Even if we are successful in introducing our products to the market, our products may contain undetected defects or errors that, despite testing, are not discovered until after a product has been used. Our software could have, or could be alleged to have, defects, bugs or other errors or failures. This could result in cancellation of orders, difficulties in maintaining business relations with customers that use our software, delayed market acceptance of those products, claims from distributors, end-users or others, increased end-user service and support costs and warranty claims, damage to our reputation and business and the ability to attract new customers, or significant costs to correct the defect or error. We may from time to time become subject to warranty or product liability claims that could lead to significant expenses as we need to compensate affected end-users for costs incurred related to product quality issues.

Any claim brought against us, regardless of its merit, could result in material expense, diversion of management time and attention, and damage to our reputation, and could cause us to fail to retain or attract customers.

Our business is subject to risks arising from a pandemic, such as COVID-19, include the risk that we may not be able to successfully execute our business or strategic plans, as well as the risk that we will not be able to anticipate, identify and respond quickly to changing market trends and customer preferences or changes in the consumer environment, including changing expectations of service, all of which could have a material adverse effect on our business and results of operations.

Our business, operations and financial condition could be materially affected by the outbreak of epidemics or pandemics or other health crises. For example, the COVID-19 pandemic disrupted businesses globally resulting in general economic slowdown. Our operations and business were impacted by COVID-19 as we were forced to modify our day-to-day operation and adopt early and strict prevention measures to protect the health of our employees (including employees’ travel, employees’ work locations and cancellation of physical participation in meetings, events, and conferences).

Market events and conditions, including disruptions in the financial markets and deteriorating global economic conditions, could increase the cost of capital or impede our access to capital. Economic and geopolitical events, as well as global outbreaks of contagious diseases, such as COVID 19, may create uncertainty in global financial and equity markets. Such disruptions could make it more difficult for us to obtain capital and financing for our operations, or increase the cost of it, among other things. If we do not raise capital when we need it, or access it on reasonable terms, it could have a material adverse effect on our business, results of operations, financial condition and the Company’s Ordinary Shares or ADSs price. If the negative economic conditions persist or worsen, it could lead to increased political and financial uncertainty, which could result in regime or regulatory changes in the jurisdictions in which we operate. High levels of volatility and market turmoil could have an adverse effect on our business, results of operations, financial condition and the Company share price.

The extent to which any pandemic or similar event impacts our results will depend on future developments, which are highly uncertain and cannot be predicted.

If we are unable to hire, retain and motivate qualified personnel, our business will suffer.

Our future success depends, in part, on our ability to continue to attract and retain highly skilled personnel. Our inability to attract or retain qualified personnel or delays in hiring required personnel, particularly in sales and software engineering, may seriously harm our business, financial condition and results of operations. Any of our employees may terminate their employment at any time. Competition for highly skilled personnel is frequently intense, especially in Israel, where we are headquartered. Moreover, certain of our competitors or other technology businesses may seek to hire our employees. There is no assurance that any equity or other incentives that we grant to our employees will be adequate to attract, retain and motivate employees in the future. If we fail to attract, retain and motivate highly qualified personnel, our business will suffer. In addition, to the extent we hire personnel from competitors, we may be subject to allegations that they have been improperly solicited or divulged proprietary or other confidential information.

We are exposed to fluctuations in currency exchange rates, which could negatively affect our financial condition and results of operations.

Our functional and reporting currency is the U.S. dollar, and we generate a majority of our revenues in U.S. dollars. A material portion of our operating expenses is incurred outside the United States, mainly in NIS and are subject to fluctuations due to changes in foreign currency exchange rates, particularly changes in NIS. Our foreign currency-denominated expenses consist primarily of personnel, rent and other overhead costs. Since a significant portion of our expenses is incurred in NIS and is substantially greater than our revenues in NIS, any appreciation of the NIS relative to the U.S. dollar would adversely impact our net loss or net income, as relevant. During 2023, the NIS depreciated by 3% against the dollar but has appreciated in prior years. We are therefore exposed to foreign currency risk due to fluctuations in exchange rates. This may result in gains or losses with respect to movements in exchange rates which may be material and may also cause fluctuations in reported financial information that are not necessarily related to its operating results. We expect that most of our revenues will continue to be generated in U.S. dollars with the balance in NIS for the foreseeable future, and that a significant portion of our expenses will continue to be denominated in NIS and partially in U.S. dollar. To date, foreign currency transaction gains and losses and exchange rate fluctuations have not been material to our consolidated financial statements, and we have not engaged in any foreign currency hedging transactions. See “Item 11. Quantitative and Qualitative Disclosure About Market Risk—Foreign Currency Exchange Risk.”

We may acquire other businesses, which could require significant management attention, disrupt our business, dilute shareholder value, and adversely affect our results of operations.

As part of our business strategy and in order to remain competitive, we are evaluating acquiring or making investments in complementary companies, products or technologies on an on-going basis. We have completed two main acquisitions to date – the acquisition of NetNut and CyberKick. Going forward, we may not be able to find suitable acquisition candidates, and we may not be able to complete such acquisitions on favorable terms, if at all. If we do complete acquisitions, we may not ultimately strengthen our competitive position or achieve our goals, and any acquisitions we complete could be viewed negatively by our customers, analysts and investors. In addition, if we are unsuccessful at integrating such acquisitions or the technologies associated with such acquisitions, our revenues and results of operations could be adversely affected. Any integration process may require significant time and resources, and we may not be able to manage the process successfully. We may not successfully evaluate or utilize the acquired technology or personnel, or accurately forecast the financial impact of an acquisition transaction, including accounting charges. We may have to pay cash, incur debt, or issue equity securities to pay for any such acquisition, each of which could adversely affect our financial condition or the value of our Ordinary Shares. The sale of equity or issuance of debt to finance any such acquisitions could result in dilution to our shareholders. The incurrence of indebtedness would result in increased fixed obligations and could also include covenants or other restrictions that would impede our ability to manage our operations.

We are subject to governmental export and import controls that could subject us to liability in the event of non-compliance or impair our ability to compete in international markets.

We are subject to U.S. and Israeli export control and economic sanctions laws, which prohibit the delivery and sale of certain products to embargoed or sanctioned countries, governments, and persons. Our products could be exported to these sanctioned targets by our channel partners despite the contractual undertakings they have given us, and any such export could have negative consequences, including government investigations, penalties, and reputational harm. Any change in export or import regulations, economic sanctions or related legislation, shift in the enforcement or scope of existing regulations, or change in the countries, governments, persons or technologies targeted by such regulations, could require export licenses or result in decreased use of our products by, or in our decreased ability to export or sell our products to, existing or potential customers with international operations or cessation of export or sale of our products in sanctioned countries or to sanctioned persons. Any decreased use of our products or limitation on our ability to export or sell our products would likely adversely affect our business, financial condition, and results of operations.

We may be subject to geopolitical risks resulting from Russia’s ongoing invasion of Ukraine.

Geopolitical risks and associated military action may result in, among other things, global security issues that may adversely affect international business and economic conditions, and economic sanctions which may impact the global economy. For example, the outbreak of hostilities between Russia and Ukraine in February 2022 led to global sanctions that have impacted the international economy and given rise to potential global security issues that may adversely affect international business and economic conditions. Additional geopolitical and macroeconomic consequences of this invasion and associated sanctions cannot be predicted, and future geopolitical events, including further hostilities in Ukraine or elsewhere, could negatively impact global financial markets our business as it may limit our ability to provide our services in those and in neighboring countries and cause the price of our ordinary shares to decline. See also “Our headquarters and other significant operations are located in Israel, and, therefore, our results may be adversely affected by political, economic and military instability in Israel.”

Our use of third-party software and other intellectual property may expose us to risks.

Some of our products and services include software or other intellectual property licensed from third parties, and we otherwise use software and other intellectual property licensed from third parties in our business. This exposes us to risks over which we may have little or no control. For example, a licensor may have difficulties keeping up with technological changes or may stop supporting the software or other intellectual property that it licenses to us. There can be no assurance that the licenses we use will be available on acceptable terms, if at all. In addition, a third party may assert that we or our customers are in breach of the terms of a license, which could, among other things, give such third party the right to terminate a license or seek damages from us, or both. Our inability to obtain or maintain certain licenses or other rights or to obtain or maintain such licenses or rights on favorable terms, or the need to engage in litigation regarding these matters, could result in delays in releases of new products, and could otherwise disrupt our business, until equivalent technology can be identified, licensed, or developed.

Our use of open-source software could negatively affect our ability to sell our software and subject us to possible litigation.

We use open-source software and expect to continue to use open-source software in the future. Some open-source software licenses require users who distribute or make available as a service open-source software as part of their own software product to publicly disclose all or part of the source code of the users’ software product or to make available any derivative works of the open-source code on unfavorable terms or at no cost. We may face ownership claims of third parties over, or seeking to enforce the license terms applicable to, such open-source software, including by demanding the release of the open-source software, derivative works or our proprietary source code that was developed using such software. These claims could also result in litigation, require us to purchase a costly license or require us to devote additional research and development resources to change our software, any of which would have a negative effect on our business and results of operations. In addition, if the license terms for the open-source code change, we may be forced to re-engineer our software or incur additional costs.

Under applicable employment laws, we may not be able to enforce covenants not to compete and therefore may be unable to prevent our competitors from benefiting from the expertise of some of our former employees.

We generally enter into non-disclosure and non-competition agreements with our employees. These agreements prohibit our employees from competing directly with us or working for our competitors or customers for a limited period after they cease working for us. We may be unable to enforce these agreements under the laws of the jurisdictions in which our employees work, and it may be difficult for us to restrict our competitors from benefiting from the expertise that our former employees or consultants developed while working for us. For example, Israeli courts have required employers seeking to enforce non-compete undertakings of a former employee to demonstrate that the competitive activities of the former employee will harm one of a limited number of material interests of the employer that have been recognized by the courts, such as the secrecy of a company’s confidential commercial information or the protection of its intellectual property. If we cannot demonstrate that such interests will be harmed, we may be unable to prevent our competitors from benefiting from the expertise of our former employees or consultants and our ability to remain competitive may be diminished.

Risks Related to Our Financial Condition and Capital Requirements

Despite the fact that we have recently begun to generate a positive cash flow, we may need to raise additional capital in the event we return to negative cash flow. This additional financing may not be available on acceptable terms, or at all. Failure to obtain the necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

According to our management’s estimates, based on our current cash on hand and further based on our budget, we believe that we have sufficient resources to continue our activities for a period of more than 12 months. Nevertheless, in case we won’t be able to generate sufficient revenue or cash flow to fund our operations for the foreseeable future, we may need to seek additional equity or debt financing to provide the capital required to maintain or expand our operations. We expect we will also need additional funding for developing products and services and other related activities, increasing our sales and marketing capabilities, and promoting brand identity, as well as for working capital requirements and other operating and general corporate purposes.

There can be no assurance that we will be able to raise sufficient additional capital on acceptable terms, or at all. If such financing is not available on satisfactory terms, or is not available at all, we may be required to delay, scale back or eliminate the development of business opportunities, research or development programs and our operations and financial condition may be materially adversely affected. If we raise additional funds through collaborations and licensing arrangements, we may be required to relinquish some rights to our technologies or candidate products, or to grant licenses on terms that are not favorable to us.

We maintain some of our cash balances at financial institutions that may exceed federally insured limits.

A small portion of our cash is held in accounts at U.S. banking institutions that we believe are of high quality. Cash held in non-interest-bearing and interest-bearing operating accounts may exceed the Federal Deposit Insurance Corporation, or FDIC, insurance limits. If such banking institutions were to fail, we could lose all or a portion of those amounts held in excess of such insurance limitations.

Risks Related to Our Intellectual Property

If we are unable to obtain and maintain effective patent rights for our products, we may not be able to compete effectively in our markets. If we are unable to protect the confidentiality of our trade secrets or know-how, such proprietary information may be used by others to compete against us.

Our reverse access technology is patent protected in several jurisdictions: United States, Europe (including Austria, Switzerland, Germany, Spain, France, United Kingdom and Italy), Israel, China and Hong-Kong.

There is no guarantee that pending or future patent applications will result in patent grants. Failure to file patent applications or obtain patent grants may allow other entities to manufacture our products and compete with them.

Further, there is no assurance that all potentially relevant prior art relating to our patent applications has been found, which can invalidate a patent or prevent a patent from being issued from a pending patent application. Even if patents are successfully issued, and even if such patents cover our products, third parties may challenge their validity, enforceability, or scope, which may result in such patents being narrowed, found unenforceable or invalidated. Furthermore, even if they are unchallenged, our patent applications and any future patents may not adequately protect our intellectual property, provide exclusivity for our new products, or prevent others from designing around our claims. Any of these outcomes could impair our ability to prevent competition from third parties, which may have an adverse impact on our business.

If we cannot obtain and maintain effective patent rights for our products, we may not be able to compete effectively, and our business and results of operations may be harmed.

If our trademarks and trade names are not adequately protected, we may not be able to build name recognition in our markets of interest and our business may be affected.

We have filed for trademark registration of certain marks relating to our branding. If our unregistered trademarks and trade names are not adequately protected, we may not be able to build name recognition in our markets of interest and our business may be affected. Our trademarks or trade names may be challenged, infringed, circumvented, or declared generic or determined to be infringing on other marks. Competitors may adopt trade names or trademarks similar to ours, thereby impeding our ability to build brand identity and possibly leading to market confusion. In addition, there could be potential trade name or trademark infringement claims brought by owners of other registered trademarks or trademarks that incorporate variations of our trademarks or trade names. In the long term, if we are unable to successfully register trademarks and trade names and establish name recognition based on such trademarks and trade names, then we may not be able to compete effectively, and our business may be affected. Our efforts to enforce or protect our proprietary rights related to trademarks, trade secrets, domain names, copyrights or other intellectual property may be ineffective and could result in substantial costs and diversion of resources and could impact our financial condition or results of operations.

If we are unable to maintain effective proprietary rights for our products, we may not be able to compete effectively in our markets.

Historically, we have relied on trade secret protection and confidentiality agreements to protect proprietary know-how that is not patentable or that we elect not to patent; processes that are not easily known, knowable or easily ascertainable, and for which patent infringement is difficult to monitor and enforce; and any other elements of our product candidate discovery and development processes that involve proprietary know-how, information or technology that is not covered by patents. However, trade secrets can be difficult to protect. We seek to protect our proprietary technology and processes, in part, by entering into confidentiality agreements with our employees, consultants, advisors, and contractors. We also seek to preserve the integrity and confidentiality of our data, trade secrets and intellectual property by maintaining physical security of our premises and physical and electronic security of our IT systems. Agreements or security measures may be breached, and we may not have adequate remedies for any breach. In addition, our trade secrets and intellectual property may otherwise become known or be independently discovered by competitors.

We cannot provide any assurances that our trade secrets and other confidential proprietary information will not be disclosed in violation of our confidentiality agreements or that competitors will not otherwise gain access to our trade secrets or independently develop substantially equivalent information and techniques. Also, misappropriation or unauthorized and unavoidable disclosure of our trade secrets and intellectual property could impair our competitive position and may have a material adverse effect on our business. Additionally, if the steps taken to maintain our trade secrets and other confidential information are deemed inadequate, we may have insufficient recourse against third parties for misappropriating any trade secret.

Intellectual property rights of third parties could adversely affect our ability to commercialize our products, and we might be required to litigate or obtain licenses from third parties in order to develop or market our product candidates. Such litigation or licenses could be costly or not available on commercially reasonable terms.

It is inherently difficult to conclusively assess our freedom to operate without infringing on third party rights. Our competitive position may be adversely affected if existing patents or patents resulting from patent applications issued to third parties or other third-party intellectual property rights are held to cover our products or elements thereof or uses relevant to our development plans. In such cases, we may not be in a position to develop or commercialize products or our product candidates unless we successfully pursue litigation to nullify or invalidate the third-party intellectual property right concerned or enter a license agreement with the intellectual property right holder, if available on commercially reasonable terms. There may also be pending patent applications that if they result in issued patents, could be alleged to be infringed by our new products. If such an infringement claim should be brought and be successful, we may be required to pay substantial damages, be forced to abandon our new products, or seek a license from any patent holders. No assurances can be given that a license will be available on commercially reasonable terms, if at all.

It is also possible that we have failed to identify relevant third-party patents or applications. For example, U.S. patent applications filed before November 29, 2000, and certain U.S. patent applications filed after that date that will not be filed outside the United States, remain confidential until patents issue. Patent applications in the United States and elsewhere are published approximately 18 months after the earliest filing for which priority is claimed, with such earliest filing date being commonly referred to as the priority date. Therefore, patent applications covering our new products or technology could have been filed by others without our knowledge. Additionally, pending patent applications which have been published can, subject to certain limitations, be later amended in a manner that could cover our technologies, our new products, or the use of our new products. Third party intellectual property right holders may also actively bring infringement claims against us. We cannot guarantee that we will be able to successfully settle or otherwise resolve such infringement claims. If we are unable to successfully settle future claims on terms acceptable to us, we may be required to engage in or continue costly, unpredictable, and time-consuming litigation and may be prevented from or experience substantial delays in pursuing the development of and/or marketing our new products. If we fail in any such dispute, in addition to being forced to pay damages, we may be temporarily or permanently prohibited from commercializing our new products that are held to be infringing. We might, if possible, also be forced to redesign our new products so that we no longer infringe the third-party intellectual property rights. Any of these events, even if we were ultimately to prevail, could require us to divert substantial financial and management resources that we would otherwise be able to devote to our business.

Third-party claims of intellectual property infringement may prevent or delay our development and commercialization efforts.

Our commercial success depends in part on our avoiding infringement of the patents and proprietary rights of third parties. Numerous U.S. and foreign issued patents and pending patent applications, which are owned by third parties, exist in the fields in which we are developing our products. As our industries expand and more patents are issued, the risk increases that our products may be subject to claims of infringement of the patent rights of third parties.