UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2024

Commission File Number: 001-40370

BITFARMS LTD.

(Exact Name of Registrant as Specified in Its Charter)

110 Yonge Street, Suite 1601, Toronto, Ontario, M5C 1T4

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒ See the exhibits listed below.

DOCUMENTS INCLUDED AS PART OF THIS FORM 6-K

| * | Portions of this exhibit have been redacted that both (a) are not material and (b) are the type of information that the Registrant treats as private or confidential. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BITFARMS LTD. | |||

| By: | /s/ L. Geoffrey Morphy | ||

| Name: | L. Geoffrey Morphy | ||

| Title: | President and Chief Executive Officer | ||

Date: March 7, 2024

2

Exhibit 99.1

BITFARMS LTD.

Foundry USA Pool Payout Methodology

As at March 6, 2024

Material contract filed in accordance with section 12.2 of

National Instrument 51-102 – Continuous Disclosure Obligations

| 1. | Foundry USA Pool’s payout methodology | 2 |

FPPS Calculations

What is Foundry USA Pool’s Payout Methodology?

Foundry USA Pool pays out to all pool members according to the Full-Pay-Per-Share (FPPS) payout scheme.

Foundry USA Pool pays out to all pool members according to the Full-Pay-Per-Share (FPPS) payout scheme. Daily Earnings are calculated from midnight-to-midnight UTC time, and the sub-account balance is credited one hour later at l AM UTC time. If Auto-Withdrawal is on, earnings accrued in the Balance would be withdrawn to the selected whitelisted wallet addresses, once a day, during 9 AM to 5 PM UTC time

There are 3 steps to calculate the FPPS payout for every Foundry USA Pool subaccount.

Step l

Foundry USA Pool calculates the daily Pay-per-Share (PPS) earnings amount denominated in BTC per Subaccount, by summing the daily PPS base earnings for every worker in the subaccount. The daily PPS earnings per worker is based on every accepted share received from that worker in the 24hr contract period. (midnight-to-midnight UTC time). The running total increments with every accepted share throughout the day. Accepted share means a share that meets the worker difficulty target.

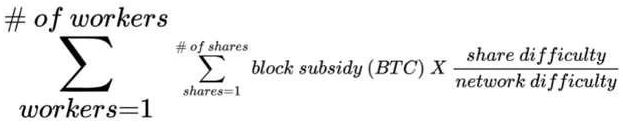

| ● | Daily PPS Base per Subaccount |

For example, if there are 2 workers in a subaccount, and each worker submits 2 shares during the 24hr contract period:

| Worker | Block Subsidy (BTC) | Share Difficulty | Network Difficulty | Allocated PPS | ||||

| worker 1 | 6.25 | 3,352,746,667 | 21,448,277,761,059 | 0.00097699 | ||||

| worker1 | 6.25 | 6,705,493,333 | 21,448,277,761,059 | 0.00195397 | ||||

| worker 2 | 6.25 | 4,526,208,000 | 21,448,277,761,059 | 0.00131893 | ||||

| worker 2 | 6.25 | 5,532,032,000 | 21,448,277,761,059 | 0.00161203 | ||||

| 24hr Base PPS | 0.00586192 BTC |

Step 2

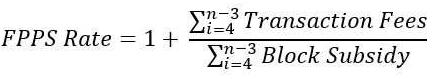

Next, calculate the FPPS rate,in order to account for the transaction fee aspect of the FPPS payout, in addition to the PPS base,

| ● | FPPS Rate |

Let n be the number of blocks observed in the contract period and i be the observation after sorting the set of Transaction Fees per Block in ascending order.

The numerator is the sum of Transaction Fees per Block in the contract period excluding the highest 3 observations and lowest 3 observations, including empty blocks.

The denominator is the sum of all Block Subsidies per Block in the contract period excluding the highest and lowest 3 observations.

For example, if 10 blocks were placed during the contract period according to the table, only the middle 4 would be included in the calculation and the FPPS rate would be 105.000%.

| Blockheight | Status | Transaction

fees per block (BTC) |

Block

subsidy (BTC) |

Transaction

fee percentage |

FPPS Rate | |||||

| 815000 | Excluded | 3 | 6.25 | |||||||

| 815001 | Excluded | 1.5 | 6.25 | |||||||

| 815002 | Excluded | 0.8 | 6.25 | |||||||

| 815003 | Included | 0.3125 | 6.25 | |||||||

| 815004 | Included | 0.3125 | 6.25 | |||||||

| 815005 | Included | 0:3125 | 6.25 | |||||||

| 815006 | Included | 0.3125 | 6.25 | |||||||

| 815007 | Excluded | 0.25 | 6.25 | |||||||

| 815008 | Excluded | 0.1 | 6.25 | |||||||

| 815009 | Excluded | 0 | 6.25 | |||||||

| 24hr Total | 6.9 | 62.5 | ||||||||

| 24hr Total (excl.top/bottom 3) | 1.25 | 2.5 | 5.000% | 105.000% |

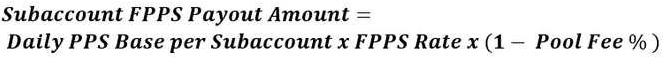

Step 3

Finally calculate the Subaccount FPPS Payout Amount denominated in BTC by multiplying the Daily PPS Base per Subaccount (l) with the FPPS rate (2), net of pool fees.

Definitions

Accepted Share: A share that has a difficulty that meets or exceeds the share difficulty and is neither stale nor rejected. These shares that included as part of the PPS calculations.

Stale Share: A share that has a difficulty that meets or exceeds the share difficulty, but relates to a previous job assigned to the worker.

Empty Block: A Bitcoin block which contains no transactions and thus has no transaction fees.

Rejected Share: A share that has a difficulty that does not meet or exceed the share difficulty.

Share Difficulty (Worker difficulty): Difficulty required for our pool to accept a share. This difficulty is set on a per worker basis, to ensure that it sends shares at a target rate.

Worker: A mining machine or group of mining machines under the same worker name.

Network Difficulty: Difficulty required to mine a block on the Bitcoin network.

Block Subsidy: Part of the BTC reward for mining a block coming from newly issued BTC; not including the block transaction fees.

4

Exhibit 99.2

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THE EXHIBIT BECAUSE IT IS BOTH NOT MATERIAL AND IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL. SUCH EXCLUDED INFORMATION HAS BEEN MARKED WITH “[***].”

ORDER FORM

| Anchorage Contact | Client Contact |

| Name: Manuel Andreani | Name: Jeffrey Gao |

| Email: [***] | Email: [***] |

This MASTER CUSTODY SERVICE AGREEMENT (“Agreement”) is made and entered into as of the Effective Date provided herein, by and between Anchorage Digital Bank N.A. (“Anchorage”), and each Client as provided herein (each a “Client”) (Anchorage and Client, each a “Party” and collectively, the “Parties”).

The Agreement consists of the terms in this Order Form and the following Standard Terms and Conditions attached herein.

| 1. Effective Date: | 8/1/2023 | 7:20 AM PDT |

| 2. Initial Term: |

One (1) year |

| 3. Renewal Term: |

One (1) year |

| 4. Client(s). Each “Client” listed herein is subject to the Agreement as if this Agreement were between such individual Client and Anchorage, except specifically the Fees will be calculated on an aggregated basis, including the sum of all Clients’ Assets Under Custody. | |

| Backbone Hosting Solutions Inc., a Canada Corporation | |

5. FEES

In full consideration for Anchorage’s provision of the Services described in the Agreement, Client will pay Anchorage the following fees (“Fees”). Fees will commence on the first date that any Digital Assets are deposited into any Client Account (“Fees Commencement Date”).

Changes to the Services, including the inclusion of new assets or Clients, are subject to changes in Fees. Fee shall be invoiced by Anchorage, and paid by Client, in US Dollars (“USD”).

| Page |

Confidential & Proprietary |

[***]

Fees shall be calculated separately on a graduated basis for the amount of [***] in each [***] according to the applicable [***].

Example:

[***]

[***]

Client shall pay [***]

[***]

| Page |

Confidential & Proprietary |

6. Address for Notices:

| To Client(s): | [***] | |

| [***] | ||

| 1040 rue du Lux #312 | ||

| Brossard, QC J4Y OE3 | ||

| Canada | ||

| To Anchorage: | [***] | |

| [***] | ||

| Anchorage Digital Bank N.A. | ||

| 101 S. Reid Street, Suite 329 | ||

| Sioux Falls, South Dakota 57103 |

IN CONSIDERATION AND WITNESS WHEREOF, Anchorage and Client, by their duly authorized representatives, hereby execute this Agreement as of the Effective Date.

| ANCHORAGE DIGITAL BANK N.A. | ON BEHALF OF EACH CLIENT HEREIN | |||

| [***] | [***] | |||

| Name: | Rachel Anderika | Name: | Jeffrey Lucas | |

| Title: | Bank Chief Operating Officer | Title: | Chief Financial Officer | |

| Company: | Backbone Hosting Solutions Inc. | |||

| Page |

Confidential & Proprietary |

AFFILIATED BUSINESS DISCLOSURE

AND CONFLICT OF INTEREST WAIVER

Anchorage Digital Bank is affiliated with Anchor Labs, Inc., Anchorage Hold LLC, and Anchorage Lending CA, LLC (each an “Anchorage Affiliate”), through common ownership and management. In particular, Anchor Labs, Inc., provides certain administrative, technology, marketing, and other support services for custodial accounts on behalf of Anchorage Digital Bank. Because the two companies are under common ownership and management, the owners of Anchor Labs, Inc., will receive an indirect benefit from any fees you pay to Anchorage Digital Bank.

In addition, Anchorage Digital Bank and Anchorage Affiliates may also refer clients to each other for the performance of services offered by such companies. Your use of services of Anchorage Digital Bank may result in benefits from such referral to the other companies by virtue of the companies’ common ownership and management.

ACKNOWLEDGEMENT

I, duly authorized and on behalf of each Client as set forth in the Order Form, have read this disclosure form, and I acknowledge and understand that Anchorage Digital Bank and Anchorage Affiliates are under common ownership and control. I further acknowledge and understand that by retaining Anchorage Digital Bank, I am providing an indirect financial benefit to the owners of Anchorage Affiliates. Understanding the common ownership and control of the companies, I agree to utilize the services of Anchorage Digital Bank freely and with no influence from anyone

I also understand and agree that referrals for services among Anchorage Digital Bank and Anchorage Affiliates may result in the owners of the referring company receiving an indirect financial benefit from the services provided.

| ON BEHALF OF EACH CLIENT SET FORTH HERETO | ||

| [***] | ||

| Name: | Jeffrey Lucas | |

| Title | Chief Financial Officer | |

| Company: | Backbone Hosting Solutions Inc. | |

| Page |

Confidential & Proprietary |

ANCHORAGE DIGITAL BANK

STANDARD TERMS AND CONDITIONS

Capitalized terms not defined in the Order Form, body of these Terms and Conditions, or supporting Schedules are defined in Schedule A (Definitions).

| 1. | Anchorage Appointment and Provision of the Services. |

| 1.1. | Appointment. Client appoints Anchorage to provide the Services, including acting as custodian of Client Digital Assets pursuant to this Agreement, and Anchorage hereby accepts such appointment. The Parties agree that for purposes of this Agreement, Anchorage shall be considered to be an “excluded fiduciary” under SDCL 55-1B-2 and shall follow the Directions from Client. Client for such purposes shall be considered to be a Trust Advisor (in its capacity as a custody account holder) under SDCL 55-1B-1(3), and the provisions of such statutes shall apply to the responsibilities of the parties hereunder. Anchorage is a qualified custodian as defined under Investment Advisers Act of 1940. |

| 1.2. | Provision of the Services. |

| (a) | Subject to (i) Client’s successful completion of the account acceptance process as provided in Section 2.1, and (ii) provided that Client is in compliance with this Agreement, during the Term, Anchorage will provide the Services to Client. |

| (b) | Anchorage will, in its sole discretion, determine the requirements for any Direction, including Authenticated Instructions, and whether such requirements have been satisfied as to any Direction. Anchorage is entitled to rely upon information, data, and instructions from Client (or otherwise persons or parties authorized to act on its behalf) related to a Direction in all respect. Client acknowledges that (i) Anchorage’s acceptance of Directions related to Client’s deposit and withdrawal of assets is based on the parameters of Authenticated Instructions and in accordance with Anchorage’s Services requirements; and (ii) Anchorage has no duty to inquire into or investigate the legality, validity, or accuracy of any information, data, or instructions related to a Direction. |

| (c) | The Services are available only in connection with those Digital Assets and protocols that Anchorage, in its sole discretion, supports. The type and scope of Services that Anchorage supports for each Digital Asset, and applicable Fees for such Services, may differ. Under no circumstances should Client attempt to use the Services to store, send, request, or receive Digital Assets and protocols that Anchorage does not support. Anchorage assumes no responsibility in connection with any attempt to use any Account or Vault with Digital Assets that Anchorage does not support, and any such unsupported Digital Assets deposited to or received in any Account or Vault are subject to forfeiture and loss. The Digital Assets that Anchorage supports may change from time to time, based on Anchorage’s sole and absolute discretion. Anchorage will notify Client in advance if it ceases to support a particular Digital Asset for which Anchorage has provided Services to Client. |

| Page |

Confidential & Proprietary |

| (d) | Client acknowledges that Anchorage will not monitor Digital Assets for actions taken by the issuer of such Digital Asset, if any. Such actions may include an issuer instruction requiring the holder of a Digital Asset to transfer it to a certain location. For the avoidance of doubt, Client is solely responsible for satisfying or responding to any such actions of an issuer. |

| (e) | Unless acting in accordance with Section 1.2(f) or (g), Anchorage shall only follow the Directions from Client. Anchorage is released and held harmless by Client for following the Directions from the Client, Client Service Providers and Control Parties, when acting in accordance with any Client Service Provider Agreement or Control Agreement, as the case may be. |

| (f) | In the event Client enters into any of the following agreements (any such agreement, a “Client Service Provider Agreement”): |

| i) | A brokerage services agreement with Anchorage Hold, LLC (“Trader”), under which Client appoints Trader to act as Client’s agent to issue Directions to Anchorage for the transfer of Client’s Digital Assets or fiat currency to an Account or Vault in the name of, and solely controlled by, Trader or its affiliates, for the purpose of trading, clearing, settling, netting, accounting for, and providing other services in connection with, Client’s Digital Assets or fiat currency; |

| ii) | A lending agreement, a loan agreement and security agreement, or other similar agreement, regardless of how titled, with Anchorage Lending CA, LLC (“Lending”), under which Client appoints Lending to act as Client’s agent to issue Directions to Anchorage for the transfer of Client’s Digital Assets or fiat currency to or from an Account or Vault in the name of, and solely controlled by, Lending or its affiliates, or an omnibus account held for Client’s benefit, for the purpose of (i) advancing Client’s Digital Assets or fiat currency to Lending; or (ii) borrowing Digital Assets or fiat currency from Lending and providing collateral in connection therewith; or |

| iii) | An agency appointment with any other party, under which Client appoints such Third Party (“Agent’’) to act as Client’s agent to issue Directions to Anchorage for any purpose set forth in the appointment; |

then, in each applicable case, Client shall promptly notify Anchorage in writing of any such agency appointment using a form of notice acceptable to Anchorage. Where Client has duly appointed any of Trader, Lending or Agent (each, a “Client Service Provider”) as its agent pursuant to the foregoing agreements or a control Agreement (each a Client Service Provider Agreement), Client directs Anchorage to follow, and Anchorage shall follow, any Direction initiated by a Client Service Provider related to Digital Assets or Fiat Services as if initiated directly by the Client provided that such Directions followed by Anchorage shall be limited to those contemplated by a Client Service Provider Agreement or otherwise agreed between Client Service Provider and Anchorage, including, without limitation, through an Authenticated Instruction by a Client Service Provider on Client’s behalf.

| Page |

Confidential & Proprietary |

| (g) | In the event Client enters into an account control agreement, vault control agreement, or other similar agreement (regardless of how titled, a “Control Agreement”) with Anchorage, a lender (a “Control Party”) and any other parties (each, an “Ancillary Party”), under which Client directs Anchorage to follow such Control Party’s instructions as described therein, Client directs Anchorage to follow, and Anchorage shall follow, any Direction initiated by such Control Party related to Digital Assets or Fiat Services as if initiated directly by the Client. Directions of a Control Party or Ancillary Party may be initiated by any method contemplated by a Control Agreement or otherwise agreed between a Control Party, Ancillary Party and Anchorage, including, without limitation, through an Authenticated Instruction by a Control Party on Client’s behalf or Ancillary Party on Client’s behalf. |

| (h) | From time to time, Anchorage may, in its sole discretion, offer Client additional optional services involving settlement services (“Optional Settlement Services’’). Client may elect to accept Optional Settlement Services by signing the Settlement Services Addendum attached to this Agreement, or by accepting such services in the Anchorage Platform if offered therein. In the event Client accepts Optional Settlement Services, Client agrees to comply with all terms and conditions set forth under the Settlement Services Addendum. |

| (i) | Client agrees that Client is solely responsible for any gas or network fees necessary for the transfer of Digital Assets pursuant to Client Directions. To the extent a Client’s Digital Assets are unable to be transferred out of the Account due to insufficient gas or network fees necessary for the transfer, Client agrees to deposit additional Digital Assets to permit such transfer, otherwise the Direction to transfer such Digital Assets shall be deemed canceled and void. Anchorage shall not be liable for paying any gas or network fees on behalf of Client, unless otherwise agreed in writing between the parties, and shall not be liable for any canceled Directions due to insufficient gas or network fees. |

| 1.3. | Storage of Digital Assets. Anchorage will receive Digital Assets for storage by generating Private Keys and their Public Key pairs, with Anchorage retaining custody of such Private Keys. Upon receipt, Anchorage will custody the Digital Assets in Client’s name or Accounts established for the benefit of the Client, unless otherwise specified in (a) an applicable Client Service Provider Agreement, or (b) instructions provided by a Client Service Provider or a Control Party pursuant thereto. Anchorage shall be deemed to have received a Digital Asset after the Digital Asset’s receipt has been confirmed on the relevant Blockchain or otherwise ledgered to Anchorage’s satisfaction. |

| 1.4. | Accounting for Digital Assets. At all times, Client owns Digital Assets and fiat currency (if applicable) held by Anchorage on behalf of Client under this Agreement, unless otherwise specified in (a) an applicable Client Service Provider Agreement, or (b) instructions provided by a Client Service Provider or a Control Party pursuant thereto. Client Digital Assets and fiat currency shall be kept separate from the assets of Anchorage and shall not be reflected on Anchorage’s balance sheet as assets of Anchorage. Anchorage will record on its books and records all Digital Assets and fiat currency (if applicable) received by it for the Account and will segregate Digital Assets from those of any other person or entity, unless otherwise specified in (i) an applicable Client Service Provider Agreement, or (ii) instructions provided by a Client Service Provider or a Control Party pursuant thereto. Anchorage will provide Client with access to the Technology Platform for transaction records and holdings and will provide Client monthly statements that show balances and transaction records of Client Digital Assets. Upon commercially reasonable notice to Anchorage, Anchorage will provide Client copies of the books and records pertaining to the Client that are in the possession or under the control of Anchorage. The books and records maintained by Anchorage will, to the extent applicable, be prepared and maintained in all material respects as required by applicable Laws. |

| Page |

Confidential & Proprietary |

| 1.5. | Authority to Assign or Pledge. Subject to applicable Law and Section 5.4, Client’s Digital Assets and fiat currency shall not be subject to any right, charge, security interest, lien or claim of any kind in favor of Anchorage or any of its Affiliates or of any creditor of any of them, and Anchorage shall not have the independent right or authority to assign, hypothecate, pledge, encumber or otherwise dispose of any Client Digital Assets or fiat currency. The Digital Assets in the Account and the fiat currency in the Deposit Account, as defined in Section 2.7, are not general assets of Anchorage or of any of its Affiliates and are not available to satisfy claims of any creditors of Anchorage or of any of its Affiliates. |

| 1.6. | Application of UCC. Except as may be otherwise provided in this Agreement or applicable Law, the Parties agree the relationship between Anchorage and Client is governed by Article 8 of the Uniform Commercial Code, as adopted and implemented under South Dakota law (“UCC”), and that for the purposes of this Agreement, (i) Client is an “entitlement holder” and any Digital Assets credited to the Account for Digital Assets or the Deposit Account for fiat currency, as defined in Section 2.7, shall be treated as a “financial asset” within the meaning of SDCL 57A-8-102(a)(7) and (9); (ii) Anchorage is a “securities intermediary” pursuant to SDCL 57A-8-102(a)(14) with respect to all financial assets held in such securities accounts; and (iii) Anchorage maintains its accounts as “securities accounts” pursuant to SDCL 57A-8-501 in the ordinary course of business; and (iv) should Client enter into an agreement with Lending, then instructions given by Lending hereunder are “entitlement orders” pursuant to SDCL 57A-8-507, and Lending is an “entitlement holder” pursuant to SDCL 57A-8-102. |

| 1.7. | Rights of Use; Limits on Use. Subject to the terms of this Agreement, including compliance with Schedule B (Technical and Equipment Specifications) and Client’s confidentiality obligations under Section 8, Anchorage hereby grants to Client a non-sublicensable, non-exclusive, worldwide right during the Term to access the Technology Platform. The foregoing rights grant extends to access and use by Authorized Persons, and for the Anchorage API only, to Third Parties authorized by Client, subject to Section 2.3(b). Client will not, and will not permit Authorized Persons or Third Parties to: (i) directly or indirectly copy, disseminate, display, distribute, publish, sell, or otherwise use or disclose any part of the Technology Platform, or create any works or other materials based on or derived from any part of the Technology Platform; (ii) reverse engineer, decompile, or disassemble the software used in the Technology Platform; (iii) sell, rent, lease, or license Client’s right to use the Technology Platform except as may be set out under this Agreement; or (iv) use the Technology Platform or Services in any other way not expressly authorized by this Agreement. Client will be responsible for all acts and omissions of Authorized Persons in connection with or relating to this Agreement. |

| 1.8. | Support and Maintenance. Subject to applicable Law, as part of the Services and at no additional cost to Client, Anchorage will (i) make available the Technology Platform, and (ii) provide other Support Services as described in this Agreement. |

| 1.9. | Business Continuity Policy. Anchorage shall maintain a business continuity policy applicable to Anchorage’s performance of Services. |

| Page |

Confidential & Proprietary |

| 1.10. | Forks, Airdrops. |

| (a) | Should a Fork occur: (i) Anchorage retains the right, in its sole discretion, to determine whether or not to support (or cease supporting) either Forked Network; (ii) in connection with determining to support a Forked Network, Anchorage may suspend certain operations, in whole or in part (with or without advance notice), for however long Anchorage deems necessary, in order to take the necessary steps, as determined in its sole discretion, to perform obligations hereunder with respect to supporting a Forked Network; (iii) Client hereby agrees that Anchorage shall determine, in its sole discretion, whether to support such Forked Network and that Client shall have no right or claim against Anchorage related to value represented by any change in the value of any Digital Asset (whether on a Forked Network or otherwise), including with respect to any period of time during which Anchorage exercises its rights described herein with respect to Forks and Forked Networks; (iv) Anchorage will use commercially reasonable efforts to timely select, in its sole discretion, at least one (1) of the Forked Networks to support and will identify such selection in a written notice. |

| (1) | With respect to a Forked Network that Anchorage chooses not to support, it may, in its sole discretion, elect to (x) abandon or otherwise not pursue obtaining the Digital Assets from that Forked Network, or (y) deliver the Digital Assets from that Forked Network to Client within a time period as determined by Anchorage in its sole discretion, together with any credentials, keys, or other information sufficient to gain control over such Digital Assets (subject to the withholding and retention by Anchorage of any amount reasonably necessary, as determined in Anchorage’s sole discretion, to fairly compensate Anchorage for the efforts expended to obtain and deliver such Digital Assets to Client). |

| (2) | With respect to Forked Networks that Anchorage chooses to support, Client may be responsible for the fees for such support (to be negotiated), and Client acknowledges and agrees that Anchorage assumes no responsibility with respect to any Forked Network and related Digital Assets that it chooses not to support. |

| Page |

Confidential & Proprietary |

| (b) | Client acknowledges that Digital Asset values can fluctuate substantially which may result in a total loss of the value of Digital Assets. The supply of Digital Assets available as a result of a Forked Network and Anchorage’s ability to deliver Digital Assets resulting from a Forked Network may depend on circumstances or Third Party providers that are outside of Anchorage’s control. Anchorage does not own or control any of the protocols that are used in connection with Digital Assets and their related Digital Asset networks, including those resulting from a Forked Network. Accordingly, Anchorage disclaims all liability relating to Forked Network and any change in the value of any Digital Assets (whether on a Forked Network or otherwise), and makes no guarantees regarding the security, functionality, or availability of such protocols or Digital Asset networks. Client accepts all risks associated with the use of Anchorage’s services to conduct transactions, including, but not limited to, in connection with the failure of hardware, software, and internet connections. |

| (c) | In the event that a Digital Asset network, entity or person (a “Sender”) attempts to or does contribute (sometimes called “airdropping” or “bootstrapping”) its Digital Assets (collectively, “Airdropped Digital Assets”) to holders of Digital Assets on an existing Digital Asset network and Client notifies Anchorage in writing of such event, Anchorage may, in its sole discretion, elect to: (i) subject to an airdrop fee to be determined, support the Airdropped Digital Asset for Custody and, if appropriate, reconcile Account(s); (ii) abandon or otherwise not pursue obtaining the Airdropped Digital Assets; or (iii) within a time period as determined by Anchorage in its sole discretion, deliver the Airdropped Digital Assets from that Digital Asset network to Client, together with any credentials, keys, or other information sufficient to gain control over such Airdropped Digital Assets (subject to the withholding and retention by Anchorage of any amount reasonably necessary, as determined in Anchorage’s sole discretion, to fairly compensate Anchorage for the efforts expended to obtain and deliver such Airdropped Digital Assets to Client). If Anchorage supports, obtains or delivers Airdropped Digital Assets, such actions will not create any relationship between the Sender and Anchorage, grant any interest or rights to the Sender (including, without limitation, any Third Party beneficiary rights), or subject Anchorage to any obligations as it relates to the Sender. |

| 1.11. | Generally. Notwithstanding any federal, state or local Law to the contrary regarding any common law or contractual duty, Client agrees that Anchorage will perform only such duties as are expressly set forth herein as Services, and no additional duties or obligations shall be implied. Anchorage has the authority to do all acts that Anchorage reasonably determines are necessary, proper, or convenient for it to perform its obligations under this Agreement and shall have no obligation to perform acts which it reasonably believes do not comply with applicable Laws. In providing the Services, Anchorage has no duty to inquire as to the provisions of or application of any agreement or document other than this Agreement, notwithstanding its receipt of such agreement or document. |

| Page |

Confidential & Proprietary |

| 2. | Client Responsibilities and Acknowledgements. |

| 2.1. | Account Acceptance; Authorized Person Designations. |

| (a) | Services will be provided only after Client’s successful completion of the account acceptance process, including but not limited to the onboarding process in Section 2.3(a), as determined in Anchorage’s sole discretion. Anchorage may terminate this Agreement upon fourteen (14) days’ prior written notice to the Client due to Client’s failure to complete the onboarding process with Anchorage. To complete the acceptance process, Client shall provide Anchorage with information and documents, which include but are not limited to, information necessary for Achorage’s compliance with the Bank Secrecy Act (“BSA”), and all Laws and regulations relating to anti-money laundering (“AML”), Know-Your-Customer (“KYC”), counter-terrorist financing, sanctions screening requirements, or any other legal obligations, in each case, as determined by Anchorage in its sole discretion. Upon acceptance of Client by Anchorage, Client shall nominate and manage Authorized Persons; provided that if Client has entered into, or at any time enters into, a Client Service Provider Agreement or Control Agreement that (i) contemplates or requires an Authorized Person to be nominated by a Third Party or (ii) can only be reasonably implemented through the use of Authorized Persons that are nominated by a Third Party, then Authorized Persons shall be nominated in accordance with such agreement. |

| (b) | In order to be approved as an Authorized Person, nominated persons must agree to data collection permissions and related policies provided in the Anchorage application and Technology Platform, including privacy policies and other terms, which may be amended from time to time. A copy of the then-current versions of such privacy policies and other terms will be provided at the written request of Client. Client is solely responsible for the actions or inactions of all Authorized Persons at all times, including their intentional, unintentional, or coerced use of the Services. With respect to Client’s primary custody Account, Client will initially nominate three (3) or more individuals as Authorized Persons prior to initiation of Client on-boarding by Anchorage, and a minimum of two (2) of three (3) Authorized Persons must approve an Authenticated Instruction. Anchorage reserves the right in its reasonable sole discretion to change the minimum number of Authorized Persons to be designated or which are required to approve a Direction. |

| (c) | With respect to any Account or Vault opened in connection with a Client Service Provider Agreement or Control Agreement, the applicable Third Party shall nominate the agreed-upon number of individuals as Authorized Persons, and the Quorum shall be determined as required by such agreement. Subsequent to the approval and on-boarding of initial Authorized Persons, Client or an approved Third Party (pursuant to a Client Service Provider Agreement or Control Agreement) may nominate additional Authorized Persons or revoke an Authorized Person’s status, each through a Direction to be approved by a Quorum. |

| Page |

Confidential & Proprietary |

| 2.2. | Acceptable Devices. Unless expressly agreed upon otherwise, Client shall maintain a separate Acceptable Device for each Authorized Person. The Acceptable Device must have Internet accessibility and meet other technical specifications prescribed by Anchorage in Schedule B. |

| 2.3. | Authorized Persons; Anchorage API. |

| (a) | Each person nominated by Client as an Authorized Person must be confirmed by Anchorage as an Authorized Person. Authorized Persons may be required to successfully complete the onboarding process and training, which may include (i) installing the Anchorage application onto the person’s Acceptable Device; and (ii) training on the Services regarding the creation of Directions or joining a Quorum. Upon completion of Anchorage’s onboarding process and any training, to Anchorage’s satisfaction in its sole discretion, the nominated person will be designated by Anchorage as one of Client’s Authorized Persons and their device designated by Anchorage as an Acceptable Device, such that they may create Directions or join a Quorum. |

| (b) | As part of the Services, Anchorage may provide Client with access to the Anchorage API, through which Client may permit Third Party access to the Account(s) or Technology Platform. Anchorage shall follow any Directions submitted via the Anchorage API, including Directions for withdrawals and external transfers of Client’s Digital Assets, as though such Directions were submitted from and by Client and without additional authentication, unless otherwise specified in this Agreement. Authorized Persons may generate API keys and assign roles to a Third Party, including without limitation, a Third Party application, subject to their compliance with the Anchorage API’s Documentation, and applicable Law. Client and all Authorized Persons shall use industry best practices to safeguard any generated Anchorage API keys. Client shall be responsible for all Third Party access to the Account(s) and Directions submitted via the Anchorage API, and Anchorage shall not be liable for following any instructions submitted via an Anchorage API key unless Anchorage’s gross negligence or willful misconduct caused unauthorized access to or possession of such key. |

| 2.4. | On-Chain Services. From time to time, Anchorage may, in its sole discretion, offer Client additional optional services involving on-chain transactions (other than deposits and withdrawals included in Anchorage’s basic custody service), which may include staking, voting, vesting, signaling, and other activities requiring interaction with the applicable blockchain (“On-Chain Services”). |

| (a) | Offer and Acceptance of On-Chain Services. Anchorage may offer On-Chain Services by presenting the option to elect such services in the Anchorage application to Authorized Persons of Client. Any offer for On-Chain Services will include the following terms: |

| i) | a basic description of the On-Chain Service; |

| ii) | a disclosure of the material risks of the On-Chain Service; |

| Page |

Confidential & Proprietary |

| iii) | a description of any associated fees; |

| iv) | any other key terms of the On-Chain Service, as applicable (for example, Anchorage will disclose if Digital Assets must be locked for a minimum period and would not be immediately accessible to Client); and |

| v) | an option to expressly agree to the On-Chain Service. |

Any Authorized Person may accept an On-Chain Service on behalf of Client by clicking on the button indicating the Authorized Person’s election of such service (“Agree” or similar) on behalf of Client.

| (b) | Cancellation of On-Chain Services. |

| i) | Any Authorized Person may cancel an On-Chain Service at any time; provided, however, that in cases where Digital Assets are locked up for a certain period pursuant to the blockchain protocol, Anchorage will release locked Digital Assets when and as permitted by the applicable blockchain protocol. If Client desires to cancel an On-Chain service, Client may do so through the Anchorage application. |

| ii) | Anchorage may discontinue an On-Chain Service at any time without notice for any reason. If Anchorage decides to discontinue an On-Chain Service, Anchorage will endeavor to provide as much notice to Client as reasonably possible, however Anchorage shall not be liable for any loss of rewards, slashing, penalty, or additional fees that may be incurred by the Client on the blockchain protocol. |

| 2.5 | Legal Compliance. Notwithstanding any other provision in this Agreement, Client agrees at all times to (i) fully satisfy Anchorage’s information requests and other requirements, including but not limited to those relating to Authorized Persons or Digital Assets; (ii) fully comply with all applicable Laws, including the BSA and all other Laws and regulations related to AML, KYC, counter-terrorist financing, sanctions screening requirements, or other legal obligations; (iii) notify Anchorage if Client becomes a target of any BSA or Digital Asset related action, investigation or prosecution; (iv) notify Anchorage of any changes in jurisdiction or material ownership; and (v) provide Anchorage full cooperation in connection with any inquiry or investigation made or conducted by the U.S. Office of the Comptroller of the Currency (“OCC”). Anchorage will have no obligation to provide the Services if Client or Authorized Persons fail to comply with the foregoing to Anchorage’s reasonable satisfaction. Client agrees to immediately notify Anchorage if it becomes aware of any suspicious activity or pattern of activity, or any activity which upon investigation may be a suspicious activity or pattern of activity under applicable Laws. |

| 2.6. | Acknowledgements. Client acknowledges that: |

| (a) | Client is an “Entitlement Holder” in a “Financial Asset,” as defined by, and for purposes of, the UCC; |

| (b) | Anchorage does not provide investment advice or exercise investment discretion. Client is capable of evaluating transaction and investment risks independently, both in general and with regard to all transactions and investment strategies. Client is solely responsible for, and Anchorage has no involvement in, determining whether any Digital Asset transaction (whether an investment or otherwise), investment strategy, or related transaction is appropriate for Client; |

| Page |

Confidential & Proprietary |

| (c) | Anchorage has no control over the Blockchains and markets in which Digital Assets are purchased and traded, and such may be subject to technology flaws, manipulations, hacks, double spending, “51%” attacks, other attacks, and operational limitations; |

| (d) | Anchorage does not control and makes no guarantee as to the functionality of any Blockchain’s decentralized governance, which could, among other things, lead to delays, conflicts of interest, or operational decisions that may impact Client or its Digital Assets; |

| (e) | Advancements in cryptography could render current cryptography algorithms utilized by a Blockchain supporting a specific Digital Asset inoperative; |

| (f) | The price and liquidity of Digital Assets has been subject to large fluctuations in the past and may be subject to large fluctuations in the future; |

| (g) | Deposits into Client’s Accounts may not be considered “deposits,” as that term may be used under the applicable Laws, rules, or regulations in Client’s jurisdiction; |

| (h) | Digital Assets in Client’s Accounts are not subject to deposit insurance protection of the Federal Deposit Insurance Corporation (“FDIC”) and may not be subject to the protection afforded customers under the Securities Investor Protection Act of 1970, as amended; |

| (i) | Digital Assets are not legal tender and are not backed by any government; |

| (j) | Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of Digital Assets; |

| (k) | Transactions in Digital Assets may be irreversible, and, accordingly, losses due to fraudulent or accidental transactions may not be recoverable; |

| (l) | Some Digital Asset transactions shall be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that transaction was initiated; |

| (m) | The value of Digital Assets may be derived from the continued willingness of market participants to exchange fiat currency or Digital Assets for Digital Assets, which may result in the potential for permanent and total loss of value of a particular Digital Asset should the market for that Digital Asset disappear; |

| Page |

Confidential & Proprietary |

| (n) | There is no assurance that a person who accepts a Digital Assets as payment today will continue to do so in the future; |

| (o) | Due to the volatility and unpredictability of the price of Digital Assets relative to fiat currency trading and owning Digital Assets may result in significant loss over a short period of time; |

| (p) | The nature of Digital Assets may lead to an increased risk of fraud or cyber-attack; |

| (q) | The nature of Digital Assets mean that technological difficulties experienced by Anchorage may prevent the access to or use of Client’s Digital Assets; |

| (r) | Any bond, insurance or trust account maintained by Anchorage for the benefit of its customers may not be sufficient to cover all losses incurred by Client; |

| (s) | Client agrees to indemnify and hold Anchorage harmless from any loss or liability related to the acknowledgments in this paragraph 2.6 (a)-(r), it being recognized that Anchorage is a passive custodian only and is treated under this Agreement as if it were considered an “excluded fiduciary” under SDCL 55-1B-2; and |

| (t) | The Fees and any other payments or compensation otherwise agreed to by Anchorage and Client represent reasonable compensation for Anchorage’s Services and expenses. |

| 2.7 | Fiat Currency Instructions and Acknowledgements; Undirected Cash Disclosures. Anchorage may, in its sole discretion, offer Fiat Services to Client. If Anchorage offers Fiat Services, and Client accepts Fiat Services, Anchorage will, acting as Client’s agent: |

| (a) | Deposit all cash deposited by Client with Anchorage, for which the Client has not already provided transfer instructions, into deposit accounts at FDIC-insured, regulated depository institutions selected by Anchorage (each, a “Fiat Institution”), which accounts will be held for the benefit of (FBO) Anchorage clients (“Deposit Accounts”). Deposit Accounts will be non-interest-bearing and may be segregated by client or pooled into omnibus accounts; |

| (b) | Enter into such sub-accounting agreements as may be required by the Fiat Institution, and; |

| (c) | Initiate wire transfer requests from time to time for the withdrawal of Client funds from the Deposit Accounts, which requests are to be honored by the Fiat Institution for withdrawal of Client’s funds from such Deposit Accounts for distributions, investments, fees and other disbursements directed or agreed to by the Client or Client’s delegate. All applicable wire transfer fees shall be paid by the Client. |

| Page |

Confidential & Proprietary |

For the sub-account held for the benefit of Client, Anchorage will keep records to obtain pass-through FDIC coverage of up to the maximum coverage level of $250,000 per Client at a single Fiat Institution Anchorage makes no guarantee that pass-through FDIC coverage will be available, and Client acknowledges and accepts the risk that pass-through FDIC coverage may not be available. Anchorage shall not be liable for any defaults by a Fiat Institution, including but not limited to any bankruptcy filing or insolvency of a Fiat Institution, and any Losses incurred by Client due to Fiat Institution’s actions, omissions, failures, or insolvency.

| 3. | Ownership and Intellectual Property Rights. |

| 3.1. | Services and Documentation. As between the Parties and subject to Section 3.2 (Outputs of Services) and 3.3 (Client Data), Anchorage owns the Services, the Documentation, and all Intellectual Property Rights in the Services and the Documentation. |

| 3.2. | Outputs of Services. Anchorage hereby grants Client a perpetual, royalty-free, non-transferable (except as provided in Section 12.10), non-sublicensable, worldwide license to all output and results from use of the Services by Client or Authorized Persons, including any reports, graphics, data, specification, programs and all other materials or computer output (“Outputs”). |

| 3.3. | Client Data. As between the Parties, Client owns all Client Data and all Intellectual Property Rights in Client Data. Client hereby grants Anchorage, and any of its Affiliates that provide or may provide additional services to Client, a perpetual, royalty-free, non-transferable (except as provided in this Section 3.3 or Section 12.10), non-sublicensable, worldwide license to disclose and use Client Data (i) to operate and manage the Services for Client; (ii) to monitor, process and support Directions or as necessary to effect, administer, or enforce a transaction or directive that Client otherwise requests or authorizes, including to facilitate Client’s use of services provided by Anchorage Affiliates; (iii) to comply with legal or regulatory obligations applicable to the Services including financial reporting and retention of related data; and (iv) in de-identified and anonymized form in aggregation with other clients’ data, to improve Anchorage’s services. |

| 3.4. | Feedback. From time to time, Client may submit or provide suggestions, requests for features, recommendations, or ideas to Anchorage (“Feedback”). By submitting Feedback, Client grants Anchorage a non-exclusive, worldwide, royalty-free, irrevocable, sub-licensable, perpetual license to use the Feedback, without consideration or compensation to Client or Authorized Persons, Affiliates, agents, partners, or personnel. |

| 4. | Term and Termination. |

| 4.1. | Term. This Agreement is effective as of the Effective Date and will continue in full force and effect for the Initial Term period in the Order Form, and will be automatically renewed for each successive Renewal Term specified in the Order Form (the Initial Term and each Renewal Term collectively referred to herein as the “Term”). For each Renewal Term, Anchorage reserves the right to change the Fees, institute new charges, or to otherwise change the Services upon written notice to Client no less than sixty (60) days prior to the commencement of the Renewal Term. Either Party may elect not to renew the Agreement by providing written notice of cancellation no less than thirty (30) days prior to the expiration of the current Term or unless sooner terminated as set forth in this Agreement. |

| Page |

Confidential & Proprietary |

| 4.2. | Termination for Cause. This Agreement may be terminated by the non-breaching party upon a material breach which is not cured within thirty (30) days after receipt by the breaching Party of written notice from the non-breaching party of such breach. Notwithstanding the foregoing, this Agreement may be terminated immediately (without an opportunity to cure) upon written notice by the non-breaching Party in the following cases: (i) either Party reasonably determines that any part of the Services is or may become in violation of applicable Laws or raises material regulatory, risk, or reputational issues; (ii) Client or Authorized Persons have acted fraudulently or made a willful misrepresentation; (iii) the other Party files bankruptcy or is declared insolvent, or has an administrative or other receiver, manager, trustee, liquidator, administrator, or similar officer appointed over all or any substantial part of its assets; (iv) the other Party enters into or proposes any composition or arrangement with its creditors generally; or (v) the other Party violates Section 8. |

| 4.3. | Effect of Termination Notice. Upon termination of this Agreement, Client will pay Anchorage all Fees, as provided in the Order Form, and documented expenses for Services rendered to Client through the effective date of termination of this Agreement. |

| 4.4. | Obligations and Rights on Termination. |

| (a) | Timeline for Termination. Client shall, within thirty (30) days (or as otherwise agreed in writing between the Parties) of the date of any termination notice whether sent by Anchorage or by Client, transfer all of Client’s Digital Assets or fiat currency out of all Account or Vault with Anchorage, subject to applicable Laws and provided that Anchorage has received payment from Client on all Fees and associated costs of such return (if any). If the Client fails to transfer their Digital Assets or fiat currency within thirty (30) days (or as otherwise agreed in writing between the Parties) of termination, Client agrees to abandon and forfeit any claims to such Digital Assets and fiat currency upon closure of Client Account and Vault. Notwithstanding the foregoing, Clients may be required to transfer all of Client’s Digital Assets or fiat currency earlier than the time period agreed herein if Anchorage reasonably determines that any part of the Services is or may become in violation of applicable Laws, or raises material regulatory, risk, or reputational issues. For avoidance of doubt, and regardless of termination, Client shall be be responsible for payment of any Fees accrued until the Client transfers all of Client’s Digital Assets from Client’s Account with Anchorage |

| Page |

Confidential & Proprietary |

| (b) | Digital Assets. A Digital Asset will be deemed to have been returned to Client when: (i) a transfer of the Digital Asset initiated by Anchorage has received a reasonable number of confirmations on the relevant Blockchain; or (ii) via an alternative method mutually agreed upon between Anchorage and Client. To the extent a Client’s Digital Assets are unable to be transferred out of the Account due to insufficient gas or network fees necessary for the transfer, Client agrees to deposit additional Digital Assets to permit such transfer, or otherwise abandons and forfeits any claims to such Digital Assets upon closure of the Account. Client acknowledges and agrees that any Digital Assets transferred into any wallet address associated with any Client’s Account or Vault after the termination of this Agreement are abandoned and forfeited by the Client. |

| (c) | Confidential Information and Client Data. At the Disclosing Party’s written request, the Receiving Party will return or destroy any or all of the Disclosing Party’s Confidential Information. In addition, upon Client’s written request, Anchorage will return or destroy all Client Data. Notwithstanding the foregoing, either Party may retain a copy of Confidential Information and Client Data (i) for audit, legal, accounting or compliance purposes; (ii) if included within unstructured backup files or that technically cannot be deleted; (iii) as licensed pursuant to Section 3.3; or (iv) as may be required by applicable Laws, including requirements of the OCC, provided that Section 8 shall continue to apply to all such retained information, notwithstanding termination of this Agreement. |

| (d) | Timeline for Claims. The Parties agree that any claim, suit, proceeding, cause of action, or arbitration request arising out of or relating to this Agreement must be asserted within twelve (12) months of the date the event or circumstances giving rise to such claim, suit, proceeding, cause of action, or arbitration request. |

| 5. | Fees and Taxes. |

| 5.1. | Fees. Client will pay Anchorage the Fees for the Services as set forth in the Order Form, in any addendum or attachment to this Agreement, or as otherwise agreed in writing between the Parties. Upon termination, Client shall be responsible for payment of any Fees accrued until the Client transfers all of Client’s assets out of Client’s Account, or until the assets are abandoned and forfeited. |

| 5.2. | Invoices; Payment Terms. Anchorage will submit invoices for the Services as set forth in the Order Form. Except as otherwise set forth in the Order Form, Client agrees to pay all undisputed invoices net thirty (30) days following receipt. If Client reasonably disputes any portion of an invoice, Client agrees, within the foregoing 30-day period, to (i) pay the undisputed amounts; and (ii) provide a detailed explanation with all supporting documentation of the basis for its dispute. The first invoice will be sent after the end of the calendar month including the Fees Commencement Date, unless otherwise agreed in writing by the Parties. |

| Page |

Confidential & Proprietary |

| 5.3. | Taxes. The Fees do not include all taxes, assessments, duties, and other governmental and similar charges (“Taxes”) that may be assessed on Client or Client’s assets by governmental authorities, which are Client’s sole obligation to remit unless otherwise mandated by law. Client shall be liable for all Taxes relating to any Digital Assets held on behalf of Client or any transaction related thereto. Client shall remit to Anchorage for the amount of any Tax that Anchorage is required under applicable Laws (whether by assessment or otherwise) to pay on behalf of, or in respect of activity in the Account of Client. In the event that Anchorage is required under applicable law to pay any Tax on behalf of Client, Anchorage shall promptly notify Client of the amount required and Client shall promptly transfer to Anchorage the amount necessary to pay the Tax. |

| 5.4. | Lien and Right of Setoff, Reserve. To secure payment or performance of Client’s Obligations, Client hereby pledges and grants to Anchorage (acting for itself and as agent for each Anchorage Affiliate) and each Anchorage Affiliate, and agrees that Anchorage and each Anchorage Affiliate will have, to the maximum extent permitted by Law, a continuing first lien and security interest in, and right of setoff against Accounts, all assets and property credited to the Accounts (including, for the avoidance of doubt, Digital Assets and fiat currency) or otherwise transferred to Anchorage, contractual and non-contractual rights in respect of any of the foregoing, and all proceeds of the foregoing. Client acknowledges and agrees that Anchorage has no duties or responsibilities with respect to the foregoing property (including any duty to collect any distributions or enforce or preserve any rights pertaining to such property) other than those expressly set forth under applicable Law. Client also acknowledges that Anchorage is acting as agent for each Anchorage Affiliate for purposes of this Section 5.4. |

Further, with prior written notice to Client, Anchorage may establish a reserve account to ensure Client pays Fees (“Reserve Account”) if Client: (i) breaches this Agreement; (ii) is subject to a material regulatory action or proceeding that Anchorage reasonably determines makes it prudent for it to engage counsel or incur expenses to manage the Account; or (iii) is likely to become the subject of bankruptcy or insolvency proceedings, each as reasonably determined by Anchorage. If Anchorage creates a Reserve Account, Anchorage will provide prior written notice to the Client of the reasons therefore and the required Reserve Account balance. Anchorage may use Reserve Account funds to pay Client obligations to Anchorage, and if such funds are used, Anchorage will account to Client for such funds used in Client’s monthly statements. In no case shall any amounts held in the Reserve Account constitute “demand deposits” or be withdrawable by check or similar means for payment to Third Parties or others, within the meaning of 12 U.S.C. 1841(c)(2)(D)(iv)(1).

| 6. | Representations and Warranties; Disclaimers. |

| 6.1. | Mutual Representations and Warranties. Each Party represents, warrants, and covenants that: (i) it is a validly organized entity under the laws of the jurisdiction of its incorporation; (ii) it has all rights, power, and authority necessary to enter into this Agreement and perform its obligations hereunder; (iii) its performance of this Agreement, and the other Party’s exercise of its rights under this Agreement, will not conflict with or result in a breach or violation of any of the terms or provisions or constitute a default under any agreement by which it is bound or any applicable Laws; and (iv) it will comply with all applicable Laws in performing its obligations under this Agreement. |

| Page |

Confidential & Proprietary |

| 6.2. | Anchorage Representations and Warranties. Anchorage represents, warrants and covenants that: (i) the Services will conform to this Agreement; (ii) it is the owner of or is duly authorized to provide all Services; (iii) it has all rights necessary to grant all the rights and licenses that it purports to grant and perform all of its obligations under this Agreement; (iv) it is not aware of any claim that the Services, and the use thereof by any Authorized Person in accordance with this Agreement, infringe upon or otherwise violate any statutory, common law or other rights of any Third Party in or to any Intellectual Property Rights therein; and (v) as of the Effective Date, there is no pending, threatened, or anticipated claim, suit, or proceeding affecting or that could affect Anchorage’s ability to perform and fulfill its obligations under this Agreement. |

| 6.3. | Client Representations and Warranties. The Client represents, warrants and covenants as of the Effective Date and as of each Direction from Client provided hereunder that: (i) Client is and has been for the past five (5) years or since its formation, whichever is more recent, based on a reasonable investigation and analysis of such applicable Laws, in compliance with all applicable Laws, including but not limited to those relating to anti-money laundering, Know-Your-Customer, customer identification and similar Laws; (ii) Client is, and will at all times remain, the owner or beneficial owner of all Digital Assets handled under this Agreement, subject only to liens and encumbrances granted to Anchorage pursuant to this Agreement or otherwise created as part of the Client’s business; (iii) Client shall only use the Account(s) for the purpose of custody of Digital Assets by Client as beneficial owner, and under no circumstances shall Client use or cause Account(s) to receive third party payments; (iv) any Digital Assets or fiat currency deposited into any Account are not proceeds of a crime; and (v) Client is not directly or indirectly owned or controlled by any person or entity (a) included on the Specially Designated Nationals and Blocked Persons or the Consolidated Sanctions List maintained by the Office of Foreign Assets Controls (“OFAC”) or similar list maintained by any government entity from time to time; or (b) located, organized, or resident in a country or territory that is the target of sanctions imposed by OFAC or any government entity. |

| 6.4. | Anchorage Disclaimers. Except to the extent set forth in Sections 6.1 and 6.2 above, THE SERVICES ARE PROVIDED “AS IS” AND “AS AVAILABLE,” WITHOUT WARRANTY OF ANY KIND, EITHER EXPRESS OR IMPLIED. WITHOUT LIMITING THE GENERALITY OF THE FOREGOING, ANCHORAGE EXPLICITLY DISCLAIMS ANY WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, OR NON-INFRINGEMENT, AND ANY WARRANTIES ARISING OUT OF THE COURSE OF DEALING OR USAGE OF TRADE. The Parties further acknowledge and agree that Anchorage has no obligation to inquire into, and shall not be liable for any damages or other liabilities or harm to any person or entity relating to: (i) the ownership, validity or genuineness of any Digital Asset; (ii) the authority of any Authorized Person to act on behalf of the Client with respect to a Digital Asset; (iii) the accuracy or completeness of any Client Data or information provided by Client or any Authorized Person with respect to a Digital Asset or Direction; or (iv) the collectability, insurability, effectiveness, marketability or suitability of any Digital Asset. Client additionally understands and agrees that Anchorage will follow the Directions from Client, is considered by this Agreement to be an “excluded fiduciary” under SDCL 55-1B-2 and shall be released and held harmless for following the Directions from Client, who is considered by the Agreement to be a Trust Advisor (in its capacity as a custody account holder) under SDCL 55-1B-1(3). |

| Page |

Confidential & Proprietary |

| 6.5 | Prohibition Against Nested Transactions. Client shall not permit any transactions and/or activities of a financial institution from passing through any of the Account(s). Client shall provide Anchorage with such assurances and/or confirmation regarding Client’s compliance with the foregoing prohibition as Anchorage may require, at its sole discretion from time to time, within such time frames as Anchorage may require and in form and substance acceptable to Anchorage. Should Client become aware of the use of an Account by any other financial institution, directly or indirectly, Client will promptly cause such use and/or activity to immediately cease and shall promptly notify Anchorage, in writing, of such circumstances. |

| 7. | Security Requirements; Personal Information. |

| 7.1. | Security Requirements; Personal Information. Client and Anchorage hereby agree that the Data Processing Addendum provided at: https://anchorage-digital.docsend.com/view/8v28dnjv9wk25xtr shall apply to and is hereby incorporated into this Agreement. Client will comply with and cause Authorized Persons and its Representatives to comply with the terms and conditions set forth in the Data Processing Addendum. |

| 7.2. | Breach Notifications. Anchorage agrees to use commercially reasonable efforts to notify Client of any Personal Data Breach involving Client Data within forty-eight (48) hours of becoming aware of the Personal Data Breach. |

| 7.3. | Changes in Law. To the extent that applicable data protection Laws impose any additional compliance obligations that are not sufficiently addressed in this Agreement, the Parties agree to enter into good faith discussions regarding amending this Agreement or taking such other steps as may be mutually agreed as reasonably necessary to achieve compliance with those applicable data protection Laws. |

| 8. | Confidentiality. |

| 8.1. | Use and Disclosure. The Parties acknowledge that, in the course of performance of this Agreement, it may be necessary for one party (“Disclosing Party”) to disclose or permit access to Confidential Information to the other Party (“Receiving Party”) and its Representatives. Disclosing Party’s disclosure of, or provision of access to, Confidential Information to Receiving Party’s Representatives is solely for the purposes agreed to under this Agreement. |

| Page |

Confidential & Proprietary |

| 8.2. | Confidential Treatment. Confidential Information disclosed to a Receiving Party will be held in confidence by the Receiving Party and not disclosed to others or used except as expressly permitted under this Agreement or as expressly authorized in writing by the Disclosing Party. Each Party will use the same degree of care to protect the other Party’s Confidential Information as it uses to protect its own information of like nature, but in no circumstances less than reasonable care. At the Disclosing Party’s written request, the Receiving Party will return or destroy any or all of the Disclosing Party’s Confidential Information. |

| 8.3. | Allowances. Notwithstanding anything to the contrary in this Section 8, Confidential Information may be disclosed by a Receiving Party to its Representatives, service providers, including Vendors, and professional advisors who require it in connection with their duties in performing such Party’s obligations under this Agreement and who are bound by confidentiality obligations substantially similar to those of this Agreement and which would extend to the Disclosing Party’s Confidential Information. If disclosure is compelled by law, pursuant to a duly authorized subpoena, court order, or government authority, unless otherwise prohibited by law, the Receiving Party shall provide the Disclosing Party with prompt notice to permit the Disclosing Party to seek a protective order or other appropriate remedy protecting its Confidential Information from disclosure. If disclosure is required, the Receiving Party shall limit the disclosure of the Confidential Information to only the portions required to be disclosed. Notwithstanding the foregoing, Anchorage may disclose any Confidential Information of client to the OCC, or that is requested from, or required or appropriate to be provided to, any other state, federal, or international governmental or regulatory body with jurisdiction over Anchorage, without prior notice to client. In addition, notwithstanding the foregoing, Anchorage may disclose the existence and terms of this Agreement in connection with an actual or prospective sale or transfer of Anchorage’s assets or stock. |

| 8.4. | Exceptions. Except with respect to Personal Information, which will in all circumstances remain confidential Information, obligations under this Section 8 will not apply to information which: (a) is or becomes available in the public domain without breach of this Agreement; (b) was lawfully received by the Receiving Party from a Third Party without confidentiality restrictions; (c) was known or legally in the possession of to the Receiving Party and its Representatives without confidentiality obligations prior to disclosure from the Disclosing Party; and (d) was independently developed by the Receiving Party without breach of this Agreement. |

| 9. | Indemnification. |

| 9.1. | Indemnification Obligation. |

| a) | Client will defend, indemnify, and hold harmless Anchorage, its directors, officers, employees and agents (collectively, the “Anchorage Indemnified Party”) from and against losses, damages, fines, fees (including reasonable fees of attorneys and accountants), and penalties (“Losses”) asserted in or incurred as a result of claims, demands, suits, or proceedings (“Claims”) by a Third Party arising out of or in connection with this Agreement, except to the extent arising out of (i) Anchorage’s gross negligence, willful misconduct or fraud as determined by a non-appealable, adjudication by an arbiter of competent jurisdiction (“Bad Acts”), provided, however, that Anchorage shall be released and held harmless for Direction from the Client, and any results thereof, as it would be pursuant to SDCL 55-1B, which is agreed to be applicable hereunder, even if following such Client Direction constitutes gross negligence or misconduct by Anchorage; and (ii) any breach by Anchorage of its obligations, warranties and representations hereunder. |

| Page |

Confidential & Proprietary |

| b) | Client further agrees to indemnify Anchorage for actual, reasonable legal costs and expenses directly related to Client’s Account(s) or any related account that are a result of any regulatory inquiry, legal action, litigation, dispute, or investigation whether such situations occur or are anticipated, that arise or relate to Client. Client further agrees to defend, indemnify and hold Anchorage Indemnified Party and any financial institution harmless from and against any Losses or Claims arising from or related to (i) Anchorage’s execution of the Directions instituted by Client or anyone acting on Client’s behalf or at its direction (such as a Client Service Provider or Control Party), including but not limited to requests for withdrawals by wire transfer made from Client’s portion of the Deposit Accounts; (ii) instructions submitted via the Anchorage API, provided that such instructions were submitted pursuant to a validly generated Anchorage API key; and (iii) the actions or omissions of any party to whom the Client may have given access to an Anchorage API key. |

| 9.2. | Notice and Settlement of a Claim. Anchorage will provide Client with prompt notice of any Claim for which indemnification will be sought hereunder and will cooperate in all reasonable respects with Client in connection with any such Claims, at Client’s expense. Client will defend Anchorage at Anchorage’s request, but failure to give notice will not relieve Client of its obligations under this Section 9. Client will be entitled to control the handling of any such Claim and to defend or settle any such Claim, in its sole discretion, with counsel of its own choosing, except that any settlement for other than money damages will be subject to the approval of the Anchorage, which approval will not be unreasonably withheld. Client may not settle any Claim without the prior written consent of Anchorage where such proposed settlement may limit, materially interfere with, or otherwise adversely affect the rights of Anchorage herein. |

| 10. | Liability. |

| 10.1. | LIMITATION OF LIABILITY. EXCEPT FOR ANCHORAGE’S BAD ACTS, ANCHORAGE SHALL NOT BE LIABLE FOR ANY LOSSES, WHETHER IN CONTRACT, TORT OR OTHERWISE, INCURRED BY CLIENT, FOR ANY AMOUNT IN EXCESS OF FEES PAID BY CLIENT IN THE TWELVE (12) MONTHS PRIOR TO WHEN THE LIABILITY ARISES. |

| Page |

Confidential & Proprietary |

| 10.2. | DAMAGES LIMITATION. IN NO EVENT WILL ANCHORAGE BE LIABLE FOR (I) LOSSES WHICH ARISE FROM ANCHORAGE’S COMPLIANCE WITH APPLICABLE LAWS, INCLUDING SANCTIONS LAWS ADMINISTERED BY OFAC; OR (II) SPECIAL, INDIRECT OR CONSEQUENTIAL DAMAGES, OR LOST PROFITS OR LOSS OF BUSINESS ARISING IN CONNECTION WITH THIS AGREEMENT. IN ADDITION TO THE FOREGOING, ANCHORAGE SHALL NOT BE LIABLE FOR ANY LOSSES WHICH ARISE AS A RESULT OF THE NON-RETURN OF DIGITAL ASSETS THAT CLIENT HAS DELEGATED TO ANCHORAGE OR A THIRD PARTY FOR ON-CHAIN SERVICES, SUCH AS STAKING, VOTING, VESTING, AND SIGNALING, UNLESS SUCH LOSSES OCCUR AS A RESULT OF ANCHORAGE’S FRAUD OR INTENTIONAL MISCONDUCT. |

| FOR THE AVOIDANCE OF DOUBT, THE LIMITATION OF LIABILITY IN THIS SECTION 10.1 IS A SEPARATE LIMITATION OF LIABILITY AS TO EACH CLIENT AND SHALL NOT INCLUDE ANY AMOUNT PAID BY CLIENTS IN THE AGGREGATE. |

| 11. | Dispute Resolution; Binding Arbitration. |

| [***] | [***] | |

| [***] | [***] | |

| [***] | ||

| No Party shall bring a putative or certified class action to arbitration, nor seek to enforce any pre-dispute arbitration agreement against any person who has initiated in court a putative class action; or who is member of a putative class who has not opted out of the class with respect to any claims encompassed by the putative class action until: (i) the class certification is denied; (ii) the class is decertified; or (iii) the customer is excluded from the class by the court. Such forbearance to enforce any agreement to arbitrate shall not constitute a waiver of any rights under this Agreement except to the extent stated herein. |

| Page |

Confidential & Proprietary |

| 11.3. | Exception for Protection of Confidential Information. The Parties each agree that the protection of Confidential Information is necessary and reasonable in order to protect the Disclosing Party and its business. The Parties each expressly agree that monetary damages would be inadequate to compensate the Disclosing Party for any breach of its Confidential Information. Accordingly, each Party agrees and acknowledges that any such violation or threatened violation would cause irreparable injury to the Disclosing Party and that, in addition to any other remedies that may be available, in law, in equity or otherwise, the Disclosing Party shall be entitled to obtain injunctive relief against the threatened breach or continued breach by the Receiving Party, without the necessity of proving actual damages. |

| 12. | General Provisions. |

| 12.1. | Independent Contractor. It is understood by the Parties that Anchorage is an independent contractor, and that this Agreement does not create or constitute a partnership, joint venture or employment relationship between the Parties. |

| 12.2. | No Third Party Beneficiaries. This Agreement is not intended to and shall not be construed to give any Third Party any interest or rights (including, without limitation, any Third Party beneficiary rights) with respect to or in connection with any agreement or provision contained herein or contemplated hereby, except as otherwise expressly provided for in this Agreement. |

| 12.3. | Publicity and Client Identification. The existence and subject matter of this Agreement, including Fees, is deemed the Confidential Information of Anchorage. Notwithstanding the foregoing, for the Term of the Agreement, Client may use Anchorage’s name and approved or publicly available trademarks to identify Anchorage as its Digital Asset custodian services provider, and Anchorage may use Client’s name and approved or publicly available trademarks to identify Client as a customer of Anchorage. Any use of a Party’s trademarks shall be in a form reasonably acceptable to that Party. Any other use of a Party’s name or trademarks by the other may only be made with its prior written consent. |

| 12.4. | Force Majeure. Neither Party will be liable to the other Party for the failure to perform or delay in the performance of its obligations under this Agreement to the extent such failure or delay is caused by or results from a Force Majeure Event. The affected Party will not be held liable by the other Party for such non-performance or delay as long as the fact of the occurrence of such Force Majeure Event is duly proven or is reasonably provable. In addition, Anchorage will not be liable to Client for any costs or expenses incurred by Client as a result of any Force Majeure Event. Notwithstanding the foregoing, if the delay in performance exceeds thirty (30) days, the Party awaiting performance will be permitted to terminate this Agreement upon five (5) days’ prior written notice to the other Party, with no further obligation to the Party claiming excusable delay. |

| Page |

Confidential & Proprietary |

| 12.5. | Notices. All notices required or permitted under this Agreement will be in writing and delivered by courier, mail, electronic mail, or within the Anchorage application (except for service of legal process which shall be by courier). A Party’s email addresses, or physical address may be changed from time to time by either Party by providing written notice to the other in the manner set forth above. |

| 12.6. | Execution in Counterparts and by Electronic Means. This Agreement may be executed in counterparts and by electronic means and the Parties agree that such electronic means and delivery will have the same force and effect as delivery of an original document with original signatures. |

| 12.7. | Entire Agreement; Amendment. This Agreement includes all exhibits, schedules, and attachments referenced herein, all of which are incorporated herein by this reference. This Agreement is the final, complete, and entire agreement of the Parties. There are no other promises or conditions in any other agreement, oral or written. This Agreement supersedes any prior written agreements or oral agreements between the Parties. The Agreement may only be modified or amended in writing and signed by both Parties. |

| 12.8. | Remedies Cumulative. Each Party will have all of the rights and remedies provided by law in addition to the rights and remedies set forth in this Agreement and in any other agreement or writing between the Parties. All of a Party’s rights and remedies are cumulative and may be exercised from time to time, and the pursuit of one right or remedy will not constitute an exclusive election or otherwise preclude or limit its pursuit of any other or additional right or remedy. |

| 12.9. | Severability. If any provision of this Agreement will be held to be invalid or unenforceable for any reason, the remaining provisions will continue to be valid and enforceable. If a court finds that any provision of this Agreement is invalid or unenforceable, but that by limiting such provision it would become valid and enforceable, then such provisions will be deemed to be written, construed and enforced as so limited. |