UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

☐ Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

or

☒ Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2023 | Commission File Number 001-40370 |

Bitfarms

Ltd.

(Exact name of Registrant as specified in its charter)

Canada | 6199 | N/A |

||

| (Province or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

110 Yonge Street

Suite 1601

Toronto, Ontario, M5C 1T4

(647) 259-1790

(Address and telephone number of Registrant’s principal executive offices)

Cogency Global Inc.

122 E. 42nd Street, 18th Floor

New York, New York 10168

(800) 221-0102

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

||

| Common Shares | BITF | Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this Form:

☒ Annual information form | ☒ Audited annual financial statements |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 334,153,000 of the Registrant’s common shares were issued and outstanding as of December 31, 2023.

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☒

EXPLANATORY NOTE

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☒ Bitfarms Ltd. (the “Registrant”) is a Canadian issuer whose common shares are listed on the Toronto Stock Exchange and is eligible to file this annual report (this “Annual Report”) pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on Form 40-F pursuant to the U.S.-Canadian Multijurisdictional Disclosure System. The Registrant is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act. Equity securities of the Registrant are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3.

FORWARD LOOKING STATEMENTS

This Annual Report and the exhibits incorporated by reference herein contain forward-looking statements or information (collectively, “forward-looking statements”). All statements, other than statements of historical fact, incorporated by reference are forward-looking information. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases including, but not limited to, and including grammatical tense variations of such words as: “may”, “assume”, “anticipates”, “contemplate”, “is expected to”, “estimates”, “intends”, “plans”, “projection”, “could”, “vision”, “goals”, “objective” and “outlook”) are not historical facts and may be forward-looking and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. In making these forward-looking statements, the Registrant has assumed that the current market will continue and grow and that the risks listed below will not adversely impact the Registrant.

By their nature, forward-looking statements involve numerous assumptions, inherent risks and uncertainties, both general and specific, which contribute to the possibility that the predicted outcomes may not occur or may be delayed. Forward-looking statements may relate to future financial conditions, results of operations, plans, objectives, performance or business developments. These statements speak only as of the date they are made and are based on information currently available and on the then current expectations and assumptions concerning future events, which are subject to a number of known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from that which was expressed or implied by such forward-looking statements, including, but not limited to, risks and uncertainties related to:

| ● | the availability of financing opportunities, risks associated with economic conditions, dependence on management and conflicts of interest; |

| ● | the ability to service debt obligations and maintain flexibility in respect of debt covenants; |

| ● | economic dependence on regulated terms of service and electricity rates; |

| ● | the speculative and competitive nature of the industry; |

| ● | dependency in continued growth in blockchain and cryptocurrency usage; |

| ● | lawsuits and other legal proceedings and challenges; |

| ● | conflict of interests with directors and management; |

| ● | government regulations; |

| ● | other risks described in this Annual Report and the exhibits incorporated by reference herein; and |

| ● | other factors beyond the Registrant’s control. |

Other factors which may cause the actual results, performance or achievements of the Registrant to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information include, among others, risks relating to: a Bitcoin halving event; insolvency, bankruptcy or cessation of operations of mining pool operators; reliance on foreign mining pool operators; mining pool agreements being governed by foreign laws; independent mining; indemnification of mining pools; reliance on manufacturing in foreign countries and the importation of equipment into jurisdictions in which the Registrant operates; emerging markets; valuation and price volatility of cryptocurrencies; share price fluctuations; future capital needs and the uncertainty of additional financing and dilution; indebtedness; hedges; global financial conditions; the possibility of Bitcoin mining algorithms transitioning to proof of stake validation; the Registrant’s limited operating history; employee retention and growth; cybersecurity threats and hacking; the limited history of the de-centralized financial system; technological obsolescence and difficulty in obtaining hardware; cryptocurrency network difficulty and the impact of increased global computing power; economic dependence on regulated terms of service and electricity rates; increases in commodity prices or reductions in the availability of such commodities; future profits/losses and production revenues/expenses; fraud and failure of cryptocurrency exchanges, custodians and other trading venues; the costs and demands upon management and the Company’s accounting and finance resources as a result of complying with the laws and regulations affecting public companies; the expense and impact of restatement of the Registrant’s historical financial statements; the lack of comprehensive accounting guidance for cryptocurrencies under IFRS Accounting Standards; a material weakness in internal control over financial reporting and the costs to remediate that material weakness or any future material weaknesses; political conditions and regulations; permits and licenses; server or internet failures; tax consequences; environmental regulations; environmental liability; the adoption of ESG practices and the impacts of climate change; emerging legislation and scrutiny regarding human rights issues; erroneous transactions and human error; facility developments; insurance risks; competition; uncertainty of the acceptance and/or widespread use of cryptocurrencies; hazards associated with high-voltage electricity transmission and industrial operations; corruption; the U.S. Foreign Corrupt Practices Act and similar legislation; political instability; third-party suppliers; the potential of the Registrant being classified as a passive foreign investment company; and pandemic and infectious disease.

A description of assumptions used to develop such forward-looking information and a description of additional risk factors that may cause actual results to differ materially from forward-looking information can be found in the Registrant’s disclosure documents, such as the Registrant’s Annual Information Form for the year ended December 31, 2023, dated March 7, 2024, on the SEDAR+ website at www.sedarplus.ca, attached hereto as Exhibit 99.1. Although the Registrant has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Readers are cautioned that the foregoing list of factors is not exhaustive. Readers are further cautioned not to place undue reliance on forward-looking information as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Forward-looking information contained this Annual Report and the exhibits incorporated by reference herein are expressly qualified by this cautionary statement. The forward-looking statements contained in this Annual Report and the exhibits incorporated by reference herein represents the expectations of the Registrant as of the date of this Annual Report or the applicable exhibit incorporated by reference herein and, accordingly, is subject to change after such date. However, the Registrant expressly disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities law.

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Registrant is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this report in accordance with Canadian disclosure requirements, which are different from those of the United States. The Registrant prepares its financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”), and the audit is subject to Public Company Accounting Oversight Board auditing standards. IFRS Accounting Standards differ in certain respects from United States generally accepted accounting principles (“U.S. GAAP”) and from practices prescribed by the Securities and Exchange Commission (the “SEC”). Therefore, the Registrant’s financial statements filed with this Annual Report may not be comparable to financial statements prepared in accordance with U.S. GAAP.

CURRENCY

Unless otherwise indicated, all dollar amounts in this Annual Report are in United States dollars.

ANNUAL INFORMATION FORM

The Registrant’s Annual Information Form for the year ended December 31, 2023 is attached as Exhibit 99.1 to this Annual Report and is incorporated by reference herein.

AUDITED ANNUAL FINANCIAL STATEMENTS

The Registrant’s audited annual consolidated financial statements as at and for the years ended December 31, 2023 and 2022, are attached as Exhibit 99.2 to this Annual Report and are incorporated by reference herein.

MANAGEMENT’S DISCUSSION AND ANALYSIS

The Registrant’s Management’s Discussion and Analysis for the year ended December 31, 2023 is attached as Exhibit 99.3 to this Annual Report and is incorporated by reference herein.

DISCLOSURE CONTROLS AND PROCEDURES

As of the end of the period covered by this Annual Report, the Registrant carried out an evaluation, under the supervision of the Registrant’s Chief Executive Officer and Chief Financial Officer, of the effectiveness of the Registrant’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act). Based upon that evaluation and the material weakness in the Registrant’s internal control over financial reporting described below, the Registrant’s Chief Executive Officer and Chief Financial Officer have concluded that, as of the end of the period covered by this Annual Report, the Registrant’s disclosure controls and procedures were not effective to give reasonable assurance that information required to be disclosed by the Registrant in reports that it files or submits under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and (ii) accumulated and communicated to the Registrant’s management, including its principal executive officer and principal financial officer, to allow timely decisions regarding required disclosure, in each case, because of the material weakness in its internal control over financial reporting, which is further discussed below.

INTERNAL CONTROL OVER FINANCIAL REPORTING

Management’s Report on Internal Control Over Financial Reporting

Management of the Registrant, under the supervision of the Registrant’s Chief Executive Officer and Chief Financial Officer, is responsible for establishing and maintaining an adequate system of “internal control over financial reporting” as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act. Internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS Accounting Standards. Management, including the Chief Executive Officer and the Chief Financial Officer, has evaluated the effectiveness of the Registrant’s internal control over financial reporting in accordance with Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). Based on this assessment, management, including the Chief Executive Officer and the Chief Financial Officer, concluded that the Registrant’s internal control over financial reporting was not effective as of December 31, 2023, as a result of a material weakness identified in the Registrant’s internal control over financial reporting, which is further described below.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the Registrant’s annual or interim financial statements will not be prevented or detected on a timely basis. In conjunction with the preparation of the Registrant’s financial statements for the year ended December 31, 2023, and specifically, in connection with the accounting for private placement warrants that were issued in the fourth quarter of 2023, management identified an error in its accounting for previously issued warrants that were issued in connection with certain private placement financings in 2021. Management has determined that the control over accounting for complex financing transactions did not operate effectively in 2021 as the warrants issued in 2021 should have been classified as a financial liability and accounted for at fair value through profit and loss, and not as equity instruments. The restatement to correct the classification and subsequent accounting for those warrants impacted the Registrant’s consolidated financial statements for the year ended December 31, 2022, which has been reflected in the restated comparative periods (including an opening balance sheet as of January 1, 2022) presented in the consolidated financial statements for the year ended December 31, 2023. Management considers these restatements to constitute a material weakness that requires remediation, and management is in the process of implementing remediation measures to address the material weakness.

The Registrant’s remediation efforts to date comprise expanding the finance team to include more Chartered Professional Accountants with technical expertise and experience in evaluating more complex areas of IFRS, involving the Company's legal counsel on evaluating complex agreements involving financial instruments and engaging with external third-party consultants to assist with assessing the accounting for complex financial instruments and review of financial statements. Management’s efforts are ongoing and its remediation plan is expected to be completed during 2024. If these remedial measures are insufficient to address the material weakness described above, or are not implemented timely, or additional deficiencies arise in the future, material misstatements in the Registrant’s interim or annual financial statements may occur in the future and could have the effects described in the “Risk Factors” section of the Registrant’s Management’s Discussion and Analysis for the year ended December 31, 2023, which is attached as Exhibit 99.3 to this Annual Report.

Changes in Internal Control Over Financial Reporting

Except as otherwise described above, no change occurred in the Registrant’s internal control over financial reporting during the fiscal year ended December 31, 2023 that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

Attestation Report of the Registered Public Accounting Firm

Under the Jumpstart Our Business Startups Act, “emerging growth companies” are exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002, which generally requires that a public company’s registered public accounting firm provide an attestation report relating to management’s assessment of internal control over financial reporting. As of December 31, 2023, the Registrant qualifies as an “emerging growth company” and, therefore, has not included in, or incorporated by reference into, this Annual Report such an attestation report as of the end of the period covered by this Annual Report.

NOTICES PURSUANT TO REGULATION BTR

The Registrant was not required by Rule 104 of Regulation BTR to send any notices to any of its directors or executive officers during the fiscal year ended December 31, 2023.

AUDIT COMMITTEE

Identification of the Audit Committee

The Board of Directors has a separately designated standing Audit Committee established for the purpose of overseeing the accounting and financial reporting processes of the Registrant and audits of the financial statements of the Registrant in accordance with Section 3(a)(58)(A) of the Exchange Act and Rule 5602(c) of the NASDAQ Stock Market Rules. As of the date of this Annual Report, the Registrant’s Audit Committee is comprised of Brian Howlett (who serves as the committee’s chair), Andrés Finkielsztain and Edith Hofmeister, all of whom are considered independent based on the criteria for independence prescribed by Rule 10A-3 of the Exchange Act and Rules 5605(a)(2) and (c)(2) of the listing rules of the Nasdaq Stock Market LLC (the “Nasdaq Stock Market Rules”).

The Board of Directors has also determined that each member of the Audit Committee is financially literate, meaning each such member has the ability to read and understand a set of financial statements that present a breadth and level of complexity of the issues that can reasonably be expected to be raised by the Registrant’s financial statements.

Audit Committee Financial Expert

The Board of Directors has determined that Brian Howlett qualifies as a financial expert (as defined in Item 407(d)(5)(ii) of Regulation S-K under the Exchange Act) and Rule 5605(c)(2)(A) of the Nasdaq Stock Market Rules; and (ii) is independent (as determined under Exchange Act Rule 10A-3 and Rule 5605(a)(2) of the Nasdaq Stock Market Rules).

The SEC has indicated that the designation or identification of a person as an audit committee financial expert does not make such person an “expert” for any purpose, impose any duties, obligations or liability on such person that are greater than those imposed on members of the audit committee and the board of directors who do not carry this designation or identification, or affect the duties, obligations or liability of any other member of the audit committee or board of directors.

CODE OF ETHICS

The Registrant has adopted a Code of Business, Conduct and Ethics that applies to directors, officers and employees of, and consultants to, the Registrant (the “Code”). The Code is posted on the Registrant’s website at https://investor.bitfarms.com/corporate-governance/governance-documents. The Code meets the requirements for a “code of ethics” within the meaning of that term in General Instruction 9(b) of Form 40-F. Unless and to the extent specifically referred to herein, the information on the Registrant’s website shall not be deemed to be incorporated by reference in this Annual Report.

All waivers of the Code with respect to any of the employees, officers or directors covered by it will be promptly disclosed as required by applicable securities rules and regulations. Since adopted by the Registrant, and until December 31, 2023, the Registrant did not waive or implicitly waive any provision of the Code with respect to any of the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Tabular disclosure of the amounts billed to us by our independent registered public accounting firm, PricewaterhouseCoopers LLP, Chartered Professional Accountants (PCAOB ID 271) for the fiscal years ended December 31, 2023 and 2022 as Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees appears on page 86 of the Annual Information Form, filed as Exhibit 99.1 to this Annual Report.

PRE-APPROVAL OF SERVICES PROVIDED BY INDEPENDENT AUDITOR

The audit committee pre-approves all audit and non-audit services to be provided to the Registrant by its independent registered public accounting firm, PricewaterhouseCoopers LLP, Chartered Professional Accountants. The audit committee sets forth its pre-approval and/or confirmation of services authorized by the audit committee in the minutes of its meetings.

RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

The Registrant has adopted a compensation recovery policy (the “Executive Compensation Clawback Policy”) as required by the Nasdaq listing rules and Rule 10D-1 of the Exchange Act. A copy of the Executive Compensation Clawback Policy is filed as Exhibit 97.1 to this Annual Report. As described above, the Registrant was required to prepare an accounting restatement of its consolidated financial statements for the year ended December 31, 2022, which has been reflected in the restated comparative periods (including an opening balance sheet as of January 1, 2022) presented in the consolidated financial statements for the year ended December 31, 2023 that are filed as Exhibit 99.2 to this Annual Report. The Registrant concluded that it was not required under the Executive Compensation Clawback Policy to recover any previously awarded incentive-based compensation because the Executive Compensation Clawback Policy applies only to incentive-based compensation received on or after October 2, 2023, and no current or former executive officer who is subject to said policy received any incentive-based compensation on or after such date. The Registrant also notes that current and former executive officers who are subject to the Executive Compensation Clawback Policy have never received incentive-based compensation based on any financial reporting measure that was impacted by the referenced restatement.

NASDAQ CORPORATE GOVERNANCE

A foreign private issuer that follows home country practices in lieu of certain provisions of the Nasdaq Stock Market Rules must disclose the ways in which its corporate governance practices differ from those followed by U.S. domestic companies. As required by Nasdaq Rule 5615(a)(3), the Registrant discloses on its website, www.bitfarms.com, each requirement of the Nasdaq Stock Market Rules that it does not follow and describes the home country practice it follows in lieu of such requirements.

BOARD DIVERSITY MATRIX

The director diversity matrix required by Nasdaq Marketplace Rule 5606 is available on the Registrant’s website, www.bitfarms.com, in the “Governance” section under the “Investors” tab.

MINE SAFETY DISCLOSURE

None.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

None.

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

A. Undertaking. The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the SEC staff, and to furnish promptly, when requested to do so by the SEC staff, information relating to the securities registered pursuant to Form 40-F, in relation to which the obligation to file an annual report on Form 40-F arises or transactions in said securities.

B. Consent to Service of Process. The Registrant has previously filed a Form F-X in connection with its common shares. Any change to the name or address of the Registrant’s agent for service shall be communicated promptly to the Commission by amendment to the Form F-X referencing the file number of the Registrant.

EXHIBIT INDEX

The following documents are being filed with the Commission as Exhibits to this Registration Statement:

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report to be signed on its behalf by the undersigned, thereto duly authorized.

| BITFARMS LTD. | |||

| By: | /s/ L. Geoffrey Morphy | ||

| Name: | L. Geoffrey Morphy | ||

| Title: | President and Chief Executive Officer | ||

Date: March 7, 2024

9

Exhibit 97.1

Clawback Policy

| 1.0 | Purpose |

The purpose of this Clawback Policy (this “Policy”) is to enable Bitfarms Ltd. (the “Company”) to recover Erroneously Awarded Compensation from Covered Executive Officers in the event that the Company is required to prepare an Accounting Restatement. This Policy is designed to comply with, and shall be interpreted to be consistent with, Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, as codified in Section 10D of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Rule 10D-1 promulgated under the Exchange Act (“Rule 10D-1”) and Listing Rule 5608 of the corporate governance rules of The Nasdaq Stock Market (“Nasdaq”) (the “Listing Standards”). Unless otherwise defined in this Policy, capitalized terms shall have the meaning ascribed to such terms in Section 2.

| 2.0 | Definitions |

As used in this Policy, the following capitalized terms shall have the meanings set forth below.

| a. | “Accounting Restatement” means an accounting restatement of the Company’s financial statements due to the Company’s material noncompliance with any financial reporting requirement under the securities laws, including any required accounting restatement to correct an error in previously issued financial statements that (i) is material to the previously issued financial statements (i.e., a “Big R” restatement) or (ii) is not material to the previously issued financial statements but would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period (i.e., a “little r” restatement). |

| b. | “Accounting Restatement Date” means the earlier to occur of (i) the date the Board, a committee of the Board, or the officer or officers of the Company authorized to take such action if the Board’s action is not required, concludes, or reasonably should have concluded, that the Company is required to prepare an Accounting Restatement and (ii) the date a court, regulator, or other legally authorized body directs the Company to prepare an Accounting Restatement. |

| c. | “Applicable Period” means, with respect to any Accounting Restatement, the three completed fiscal years immediately preceding the Accounting Restatement Date, as well as any transition period (that results from a change in the Company’s fiscal year) within or immediately following those three completed fiscal years (except that a transition period that comprises a period of at least nine months shall count as a completed fiscal year). |

| d. | “Board” means the board of directors of the Company. |

| e. | “Code” means the U.S. Internal Revenue Code of 1986, as amended. Any reference to a section of the Code or regulation thereunder includes such section or regulation, any valid regulation or other official guidance promulgated under such section, and any comparable provision of any future legislation or regulation amending, supplementing, or superseding such section or regulation. |

| f. | “Covered Executive Officer” means an individual who is currently or previously served as the Company’s president, principal financial officer, principal accounting officer (or, if there is no such accounting officer, the controller), vice president of the Company in charge of a principal business unit, division, or function (such as sales, administration, or finance), an officer who performs (or performed) a policy-making function, or any other person who performs (or performed) similar policy-making functions for the Company or is otherwise determined to be an executive officer of the Company pursuant to Item 401(b) of Regulation S-K. An executive officer of the Company’s parent (if any) or subsidiary is deemed a “Covered Executive Officer” if the executive officer performs (or performed) such policy-making functions for the Company. |

| g. | “Erroneously Awarded Compensation” means, in the event of an Accounting Restatement, the amount of Incentive-Based Compensation previously received that exceeds the amount of Incentive-Based Compensation that otherwise would have been received had it been determined based on the restated amounts in such Accounting Restatement, and must be computed without regard to any taxes paid by the relevant Covered Executive Officer; provided, however, that for Incentive-Based Compensation based on stock price or total stockholder return, where the amount of Erroneously Awarded Compensation is not subject to mathematical recalculation directly from the information in an Accounting Restatement: (i) the amount of Erroneously Awarded Compensation must be based on a reasonable estimate of the effect of the Accounting Restatement on the stock price or total stockholder return upon which the Incentive-Based Compensation was received and (ii) the Company must maintain documentation of the determination of that reasonable estimate and provide such documentation to Nasdaq. |

| h. | “Financial Reporting Measure” means any measure that is determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements and any measure that is derived wholly or in part from such measure. Financial Reporting Measures include, but are not limited to, the following (and any measures derived from the following): the Company’s stock price; total shareholder return; revenues; net income; operating income; profitability of one or more reportable segments; financial ratios; earnings before interest, taxes, depreciation and amortization; and earnings measures (e.g., earnings per share). A Financial Reporting Measure is not required to be presented within the Company’s financial statements or included in a filing with the U.S. Securities and Exchange Commission (the “SEC”) to qualify as a “Financial Reporting Measure.” |

| i. | “Incentive-Based Compensation” means any compensation that is granted, earned, or vested based wholly or in part upon the attainment of a Financial Reporting Measure. Incentive-Based Compensation is deemed “received” for purposes of this Policy in the Company’s fiscal period during which the Financial Reporting Measure specified in the Incentive-Based Compensation award is attained, even if the payment or grant of such Incentive-Based Compensation occurs after the end of that fiscal period. |

| 3.0 | Administration |

This Policy shall be administered by the Compensation Committee of the Board (the “Compensation Committee”). For purposes of this Policy, the Compensation Committee shall be referred to herein as the “Administrator.” The Administrator is authorized to interpret and construe this Policy and to make all determinations necessary, appropriate or advisable for the administration of this Policy, in each case, to the extent permitted under the Listing Standards and in compliance with (or pursuant to an exemption from the application of) Section 409A of the Code. All determinations and decisions made by the Administrator pursuant to the provisions of this Policy shall be final, conclusive and binding on all persons, including the Company, its affiliates, its stockholders and Covered Executive Officers, and need not be uniform with respect to each person covered by this Policy.

In the administration of this Policy, the Administrator is authorized and directed to consult with the full Board, the Audit Committee of the Board and/or any such other committee of the Board as may be necessary or appropriate as to matters within the scope of such other committee’s responsibility and authority. Subject to any limitation at applicable law, the Administrator may authorize and empower any officer or employee of the Company to take any and all actions necessary or appropriate to carry out the purpose and intent of this Policy (other than with respect to any recovery under this Policy involving such officer or employee). Any action or inaction by the Administrator with respect to a Covered Executive Officer under this Policy in no way limits the Administrator’s decision to act or not to act with respect to any other Covered Executive Officer under this Policy or under any similar policy, agreement or arrangement, nor shall any such action or inaction serve as a waiver of any rights the Company may have against any Covered Executive Officer other than as set forth in this Policy.

| 4.0 | Application |

This Policy applies to all Incentive-Based Compensation received by a Covered Executive Officer on or after October 2, 2023: (i) after beginning service as a Covered Executive Officer; (ii) who served as a Covered Executive Officer at any time during the performance period for such Incentive-Based Compensation; (iii) while the Company had a listed class of securities on a US national securities exchange; and (iv) during the Applicable Period. For the avoidance of doubt, Incentive-Based Compensation that is subject to both a Financial Reporting Measure vesting condition and a service- based vesting condition shall be considered received when the relevant Financial Reporting Measure is achieved, even if the Incentive-Based Compensation continues to be subject to the service-based vesting condition. In the event of any inconsistency between this Policy and the terms of any employment agreement or other similar agreement to which a Covered Executive Officer is a party, or the terms of any compensation plan, program or agreement under which any compensation has been granted, awarded, earned or paid to a Covered Executive Officer, in each case, by or with the Company or any of its subsidiaries, the terms of this Policy shall govern.

| 5.0 | Recovery Requirement |

In the event of an Accounting Restatement, the Company must recover Erroneously Awarded Compensation reasonably promptly, in amounts determined pursuant to this Policy. The Company’s obligation to recover Erroneously Awarded Compensation is not dependent on the filing of restated financial statements. Recovery under this Policy with respect to a Covered Executive Officer shall not require the finding of any misconduct by such Covered Executive Officer or such Covered Executive Officer being found responsible for the accounting error leading to an Accounting Restatement. In the event of an Accounting Restatement, the method for recouping Erroneously Awarded Compensation shall be determined by the Administrator in its sole and absolute discretion, to the extent permitted under the Listing Standards and in compliance with (or pursuant to an exemption from the application of) Section 409A of the Code. Recovery may include, without limitation, (i) reimbursement of all or a portion of any incentive compensation award, (ii) cancellation of incentive compensation awards and (iii) any other method authorized by applicable law or contract. To the extent that a Covered Executive Officer fails to repay all Erroneously Awarded Compensation to the Company when due, the Company shall take all actions reasonable and appropriate to recover such Erroneously Awarded Compensation from the applicable Covered Executive Officer, subject to the provisions of the immediately following paragraph. The applicable Covered Executive Officer shall be required to reimburse the Company for any and all expenses reasonably incurred by the Company (including legal fees) in recovering such Erroneously Awarded Compensation in accordance with the immediately preceding sentence.

The Company is authorized and directed pursuant to this Policy to recover Erroneously Awarded Compensation in compliance with this Policy unless the Compensation Committee has determined that recovery would be impracticable solely for the following limited reasons, and subject to the following procedural and disclosure requirements:

| a. | The direct expenses paid to a third party to assist in enforcing this Policy would exceed the amount to be recovered. Before reaching such conclusion, the Administrator must make a reasonable attempt to recover such Erroneously Awarded Compensation, document such reasonable attempt(s) to recover, and provide that documentation to Nasdaq; |

| b. | Recovery would violate home country law where that law was adopted prior to November 28, 2022. Before reaching such conclusion, the Administrator must obtain an opinion of home country counsel, acceptable to Nasdaq, that recovery would result in such a violation, and must provide such opinion to Nasdaq; or |

| c. | Recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly available to employees of the Company, to fail to meet the requirements of Section 401(a)(13) or Section 411(a) of the Code. |

| 6.0 | Prohibition on Indemnification and Insurance Reimbursement |

The Company shall not indemnify any Covered Executive Officer against or with respect to the loss of any Erroneously Awarded Compensation. Further, the Company shall not pay or reimburse a Covered Executive Officer for the cost of purchasing insurance to cover any such loss. The Company shall also not enter into any agreement or arrangement whereby this Policy would not apply or fail to be enforced against a Covered Executive Officer.

| 7.0 | Required Filings |

The Company shall file all disclosures with respect to this Policy in accordance with the requirements of US federal securities laws, including disclosures required to be included in SEC filings. A copy of this Policy and any amendments hereto shall be posted on the Company’s website and filed as an exhibit to the Company’s annual report on Form 40-F.

| 8.0 | Acknowledgment |

Each Covered Executive Officer shall sign and return to the Company within thirty (30) calendar days following the later of (i) the effective date of this Policy set forth below or (ii) the date such individual becomes a Covered Executive Officer, the Acknowledgement Form attached hereto as Exhibit A, pursuant to which the Covered Executive Officer agrees to be bound by, and to comply with, the terms and conditions of this Policy; provided, however, that this Policy shall be effective in respect of each Covered Executive Officer regardless of whether such Covered Executive Officer signs and returns the Acknowledgment Form.

| 9.0 | Amendment; Termination |

The Compensation Committee may amend this Policy from time to time in its sole and absolute discretion and shall amend this Policy as it deems necessary to reflect the Listing Standards or to comply with (or maintain an exemption from the application of) Section 409A of the Code. The Compensation Committee may terminate this Policy at any time; provided, that the termination of this Policy would not cause the Company to violate any federal securities laws, rules promulgated by the SEC or the Listing Standards.

| 10.0 | Effective Date |

This Policy shall be effective as of November 29, 2023 (the “Effective Date”). The terms of this Policy shall apply to any Incentive-Based Compensation that is received by Covered Executive Officers on or after October 2, 2023, even if such Incentive-Based Compensation was approved, awarded or granted to Covered Executive Officers prior to the Effective Date and shall not limit any right of recovery with respect to compensation received prior to the Effective Date.

| 11.0 | Other Recovery Obligations; General Rights. |

The Board intends that this Policy shall be applied to the fullest extent of the law. To the extent that the application of this Policy would provide for recovery of Incentive-Based Compensation that the Company already recovered pursuant to Section 304 of the Sarbanes-Oxley Act or other recovery obligation, any such amount recovered from a Covered Executive Officer will be credited to any recovery required under this Policy in respect of such Covered Executive Officer.

This Policy shall not limit the rights of the Company to take any other actions or pursue other remedies that the Company may deem appropriate under the circumstances and under applicable law, in each case, to the extent permitted under the Listing Standards and in compliance with (or pursuant to an exemption from the application of) Section 409A of the Code.

This Policy is binding and enforceable against all Covered Executive Officers and their beneficiaries, heirs, executors, administrators or other legal representatives.

| Dated: | November 29, 2023 (the “Effective Date”) |

| Approved by: | Board of Directors |

EXHIBIT A

CLAWBACK POLICY

ACKNOWLEDGEMENT

FORM

By signing below, the undersigned acknowledges and confirms that the undersigned has received and reviewed a copy of the Bitfarms Ltd. Clawback Policy (the “Policy”).

By signing this Acknowledgement Form, the undersigned acknowledges and agrees that the undersigned is and will continue to be subject to the Policy and that the Policy will apply both during and after the undersigned’s employment or service with the Company. Further, by signing below, the undersigned agrees to abide by the terms of the Policy, including, without limitation, by returning any Erroneously Awarded Compensation (as defined in the Policy) to the Company to the extent required by, and in a manner consistent with, the Policy and notwithstanding anything to the contrary in any other policy, plan, program, agreement or other arrangement to which the undersigned is subject or a party or in which the undersigned participates.

| EXECUTIVE OFFICER | |

| Signature | |

| Print Name | |

| Date |

6

Exhibit 99.1

BITFARMS LTD.

ANNUAL INFORMATION FORM

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

March 6, 2024

| BITFARMS LTD. |

| 2023 Annual Information Form |

TABLE OF CONTENTS

| GLOSSARY OF DEFINED TERMS | 4 | |||

| 1 | GENERAL INFORMATION | 9 | ||

| 1.1 | INFORMATION REGARDING BITFARMS | 9 | ||

| 1.2 | EXEMPTION | 9 | ||

| 1.3 | CURRENCY | 9 | ||

| 1.4 | CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 9 | ||

| 2 | CORPORATE STRUCTURE | 11 | ||

| 2.1 | INCORPORATION OF THE COMPANY | 11 | ||

| 2.2 | SUBSIDIARIES | 11 | ||

| 3 | GENERAL DEVELOPMENT OF THE BUSINESS | 12 | ||

| FISCAL 2021 | 12 | |||

| FISCAL 2022 | 18 | |||

| FISCAL 2023 | 21 | |||

| FISCAL 2024 | 25 | |||

| 4 | DESCRIPTION OF BUSINESS | 26 | ||

| 4.1 | GENERAL | 26 | ||

| 4.2 | MINING POOL PARTICIPATION | 27 | ||

| 4.3 | PRODUCTS AND SERVICES | 28 | ||

| 4.4 | CRYPTOCURRENCY BACKGROUND | 29 | ||

| 4.5 | MINING | 29 | ||

| 4.6 | BUSINESS AND STRATEGY | 30 | ||

| 4.7 | MINING PROFITABILITY | 30 | ||

| 4.8 | DIGITAL ASSET MANAGEMENT PROGRAM | 31 | ||

| 4.9 | CUSTODY OF CRYPTO ASSETS | 32 | ||

| 4.10 | HEDGING PROGRAM OF DIGITAL ASSETS | 32 | ||

| 4.11 | SYNTHETIC HODL PROGRAM OF DIGITAL ASSETS | 33 | ||

| 4.12 | CURRENT MINING OPERATIONS | 33 | ||

| 4.13 | COMPETITIVE CONDITIONS | 34 | ||

| 4.14 | HARDWARE AND SOFTWARE | 34 | ||

| 4.15 | REVENUE | 34 | ||

| 4.16 | EMPLOYEES | 35 | ||

| 4.17 | INTANGIBLE PROPERTIES | 35 | ||

| 4.18 | BANKRUPTCY PROCEEDINGS | 35 | ||

| 4.19 | RISK FACTORS | 35 | ||

| 4.20 | SUPPLY OF ELECTRICAL POWER, ELECTRICITY RATES, TERMS OF SERVICE AND THE RÉGIE DE L’ÉNERGIE | 62 | ||

| 4.21 | SPECIALIZED SKILL KNOWLEDGE | 67 |

| |

| BITFARMS LTD. |

| 2023 Annual Information Form |

TABLE OF CONTENTS (continued)

| 5 | FUTURE GROWTH PLANS | 68 | ||

| 5.1 | CAUTIONARY STATEMENTS | 68 | ||

| 5.2 | ARGENTINA EXPANSION | 68 | ||

| 5.3 | PARAGUAY EXPANSION | 71 | ||

| 5.4 | WASHINGTON EXPANSION | 73 | ||

| 5.5 | CANADA EXPANSION | 74 | ||

| 6 | DIVIDENDS | 75 | ||

| 7 | DESCRIPTION OF CAPITAL STRUCTURE | 75 | ||

| 8 | MARKET FOR SECURITIES | 75 | ||

| 8.1 | TRADING PRICE AND VOLUME | 75 | ||

| 8.2 | ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER | 76 | ||

| 8.3 | PRIOR SALES | 76 | ||

| 9 | DIRECTORS AND OFFICERS | 77 | ||

| 9.1 | NAME, OCCUPATION AND SECURITY HOLDING | 77 | ||

| 9.2 | BIOGRAPHY | 79 | ||

| 9.3 | CEASE TRADE ORDERS, BANKRUPTCIES, PENALTIES OR SANCTIONS | 81 | ||

| 9.4 | CODE OF CONDUCT AND CONFLICTS OF INTEREST | 82 | ||

| 10 | LEGAL PROCEEDINGS | 82 | ||

| 11 | INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 83 | ||

| 12 | TRANSFER AGENT AND REGISTRAR | 83 | ||

| 13 | MATERIAL CONTRACTS | 84 | ||

| 14 | INTERESTS OF EXPERTS | 84 | ||

| 15 | COMMITTEES | 85 | ||

| 15.1 | AUDIT COMMITTEE | 85 | ||

| 15.2 | GOVERNANCE AND NOMINATING COMMITTEE | 86 | ||

| 15.3 | COMPENSATION COMMITTEE | 87 | ||

| 15.4 | ENVIRONMENTAL AND SOCIAL RESPONSIBILITY COMMITTEE | 87 | ||

| 15.5 | RISK COMMITTEE | 87 | ||

| 16 | PROMOTERS | 88 | ||

| 17 | REGULATORY COMPLIANCE | 89 | ||

| 18 | ADDITIONAL INFORMATION | 89 | ||

| SCHEDULE A | 90 |

| |

| BITFARMS LTD. |

| 2023 Annual Information Form |

GLOSSARY OF DEFINED TERMS

In this Annual Information Form, the following capitalized words and terms shall have the following meanings:

| Terms | Definition |

| 2021 F-10 Registration Statement | Form F-10 that included the August SFBS Prospectus filed with SEC as described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - E. Prospectus Filings |

| AIF | This annual information form dated March 6, 2024. |

| Anchorage Digital | Anchorage Digital Bank N.A. |

| ANDE | The National Electricity Administration, the operator of Paraguay’s national electricity grid. |

| Argentina Expansion | The existing and planned construction of a server farm facility in stages in Argentina. Sect. 5.2 - ARGENTINA EXPANSION |

| ASIC | Application specific integrated circuit. |

| ATM Agreement | The at-the-market offering agreement dated August 16, 2021, between the Company and H.C. Wainwright & Co. |

| ATM program | At-the-market equity program that commenced on August 16, 2021 by means of a prospectus supplement dated August 16, 2021, to the Company’s short form base shelf prospectus dated August 12, 2021, and U.S. registration statement on Form-F-10, which included a prospectus supplement related to the ATM. The ATM program expired on September 12, 2023. |

| ATM Prospectus Supplement | A Prospectus Supplement to the August SFBS Prospectus filed with SEC as described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - E. Prospectus Filings. |

| Audit Committee Charter | The Charter of the Audit Committee as described in section 15.1 - AUDIT COMMITTEE. |

| August SFBS Prospectus | The final base shelf short form prospectus filed by the Company on August 12, 2021. |

| Backbone | Backbone Hosting Solutions Inc. |

| Backbone Argentina | Backbone Hosting Solutions S.A.U. (Argentina). |

| Backbone Paraguay | Backbone Hosting Solutions Paraguay S.A. |

| Bitcoin Halving | Has the meaning ascribed thereto in RISK FACTORS of the MD&A. |

| Bitfarms | The operating business name and trademarked name of Backbone. |

| Bitfarms or the Company | Bitfarms Ltd., a corporation incorporated pursuant to the laws of Canada and continued under the Ontario Business Corporation Act., listed on the TSX and Nasdaq under the symbol BITF, including all subsidiaries thereof. |

| Bitfarms

Board or the Board |

The board of directors of Bitfarms. |

| Bitfarms

Shares or Common Shares |

The common shares in the capital of Bitfarms. |

| BMS | Backbone Mining Solutions, Inc. |

| BTC or Bitcoin | Bitcoin, a decentralized digital currency that can be sent from user to user on the BTC network without the need for intermediaries to clear transactions. |

| Bunker | The Company’s leased property in Sherbrooke, Québec in 2021 to develop a mining facility. The project was completed in 2022. Refer to Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - I. Quebec Expansion. |

| CEO | Chief Executive Officer. |

| |

| BITFARMS LTD. |

| 2023 Annual Information Form |

GLOSSARY OF DEFINED TERMS (continued)

| Terms | Definition |

| CFO | Chief Financial Officer. |

| CLYFSA | Compañía Luz y Fuerza S.A., a private electricity distribution company located in the city of Villarrica, Paraguay. |

| Coinbase Custody | Coinbase Trust Company, LLC. |

| Compensation Committee | Has the meaning as provided in Section 15.3 - COMMITTEES – COMPENSATION COMMITTEE. |

| CORE IR Agreement | The agreement between the Company and CORE IR for investor relations, public relations and shareholder communications services entered into on March 12, 2021, and terminated in October 2021. |

| Cryptocurrency | A form of encrypted and decentralized digital currency, transferred directly between peers across the Internet, with transactions being settled, confirmed and recorded in a distributed public ledger through Mining. Cryptocurrency is either newly “minted” through an initial coin/token offering or Mined, which results in a new coin generated as a reward to incentivize miners for verifying transactions on the blockchain. |

| Current Facilities | The eleven operational Mining facilities operated by the Company in the Province of Québec, Washington State, Paraguay and Argentina as of March 6, 2024, namely the facilities at Farnham, Saint-Hyacinthe, Cowansville, Magog, Sherbrooke (Leger, Garlock, the Bunker), Baie-Comeau, Villarrica, Washington State and Rio Cuarto. |

| December 2021 Debt Facility | The US$100 million credit facility between the Company and Galaxy Digital entered into on December 30, 2021 and repaid and retired on December 2022. This is described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - C. Debt Financing. |

| De la Pointe Property | The Company’s former 78,000 square foot facility located in Sherbrooke, Quebec, which ceased production and was sold on December 2022. |

| Digital Asset Management Program | The Company’s BTC holding strategy implemented in January 2021 as described in Section 4.8 - DESCRIPTION OF BUSINESS - DIGITAL ASSET MANAGEMENT PROGRAM. |

| Dominion | Dominion Capital. |

| Dominion Facility | Has the meaning as provided for in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - C. Debt Financing. |

| Environmental and Social Responsibility Committee | Has the meaning as provided in Section 15.4 - COMMITTEES - ENVIRONMENTAL AND SOCIAL RESPONSIBILITY COMMITTEE. |

| ESG | Environment, social and governance. |

| February 2021 Offering | The February 2021 private placement of 11,560,695 common shares and associated warrants as per described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - B. Private Placements. |

| February

2022 BlockFi Loan Facility |

The US$32 million credit facility between the Company and BlockFi Lending LLC., a private lender entered into on February 24, 2022 and repaid and retired on February 2023 as described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2022 - C. Debt Financing. |

| Financial Risk Management | means, without being limited to, the strategy and processes for implementing hedges to mitigate the risk introduced by the volatility of bitcoin to the Company’s operating cashflows and its mining assets as described in section 15.5 - RISK COMMITTEE. |

| |

| BITFARMS LTD. |

| 2023 Annual Information Form |

GLOSSARY OF DEFINED TERMS (continued)

| Terms | Definition |

| Fiscal 2021 | The fiscal year ended December 31, 2021. |

| Fiscal 2022 | The fiscal year ended December 31, 2022. |

| Fiscal 2023 | The fiscal year ended December 31, 2023. |

| Fiscal 2024 | The fiscal year ending December 31, 2024. |

| Foundry

Loans #1, #2, #3 and #4 |

Which are fully repaid, has the meaning as provided for in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - C. Debt Financing. |

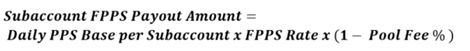

| FPPS | Full Pay Per Share, the formula-driven rate at which the Company sells computational power to Mining Pools. |

| Garlock | The building acquired by the Company on March 11, 2022 located in Sherbrooke, Québec. |

| GMSA | Generacion Mediterranea S.A., one of the subsidiaries of Grupo Albanesi, an Argentine private corporate group focused on the energy market which provides natural gas and electrical energy to its clients. |

| Governance and Nominating Committee | Has the meanings as provided in Section 15.2 - COMMITTEES - GOVERNANCE AND NOMINATING COMMITTEE. |

| Grant PUD | The Grant County Power Utility District in Washington State. |

| Hash | The output of a hash function, i.e., the output of the fundamental mathematical computation of a particular cryptocurrency’s computer code which Miners execute. |

| Hosting Agreement | Has the meaning as provided for in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - J. Washington Expansion. |

| Hydro-Magog | The regional public utility company that manages the generation and distribution of electricity in the region of Magog, Québec. |

| Hydro-Québec | Means “Commission hydroélectrique du Québec”, the provincial public utility company that manages the generation and distribution of electricity in the Province of Québec. |

| Hydro-Sherbrooke | The regional public utility company that manages the generation and distribution of electricity in the region of Sherbrooke, Québec. |

| Ingenia | Ingenia Grupo Consultor and Gieco S.A., as described in Section 5.2 - ARGENTINA EXPANSION. |

| Initial Draw | The initial US$60 million draw on the December 2021 Debt Facility as described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - C. Debt Financing - Galaxy Digital LLC. |

| January 7, 2021 Offering | The January 2021 private placement offering of 8,888,889 Common Shares and associated warrants as per described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - B. Private Placements. |

| January 13, 2021 Offering | The January 2021 private placement offering of 5,586,593 Common Shares and associated warrants as per described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - B. Private Placements. |

| July 2021 Hosting Agreement | The hosting agreement entered into by the Company for 12 MW in Washington State, US entered into on November 11, 2021 and terminated upon the closing of the November 2021 Washington Acquisition as per described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - J. Washington Expansion. |

| |

| BITFARMS LTD. |

| 2023 Annual Information Form |

GLOSSARY OF DEFINED TERMS (continued)

| Terms | Definition |

| June 2022 NYDIG Financing | The equipment financing agreement dated June 17, 2022 between the Company and NYDIG for initial funding of US$37,000,000 as described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2022 - C. Debt Financing. |

| Leger | The Company’s 36,000 square foot facility in Sherbrooke, Québec as per described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - I. Quebec Expansion. |

| Lender Warrants | Has the meaning as provided for in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - C. Debt Financing. |

| LHA IR Agreement | Has the meaning as provided for in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - F. IR Agreement. |

| LPZ | LPZ Hosting S.A.S, as described in Section 5.2 - FUTURE GROWTH PLANS - ARGENTINA EXPANSION. |

| May 2021 Offering | The May 2021 private placement of 14,150,940 Common Shares and associated warrants as per described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - B. Private Placements. |

| MD&A | Management’s discussion and analysis of Bitfarms for the fiscal year ended December 31, 2023. as per described in Section 1.1 - GENERAL INFORMATION - INFORMATION REGARDING BITFARMS. |

| Miners | A computer configured for the purpose of performing blockchain computer operations. See Section 4.1 - DESCRIPTION OF BUSINESS - GENERAL. |

| Mine or Mining | The process of using Miners to provide the service of verifying and validating cryptographic blockchain transactions and being rewarded with cryptocurrency in return for such service. See Section 4.1 - DESCRIPTION OF BUSINESS - GENERAL. |

| Mining Pool | Refers to when cryptocurrency Miners aggregate their processing power over a network and Mine transactions together. |

| Nasdaq | The Nasdaq Stock Market. |

| NI 52-110 | National Instrument 52-110 – Audit Committees as per described in Section 15.1 - COMMITTEES - AUDIT COMMITTEE. |

| NEO or Named Executive Officer | Has the meaning ascribed to that term in Form 51-102F6 Statement of Executive Compensation. See section 15.3 - COMMITTEES - COMPENSATION COMMITTEE. |

| November 2021 Washington Acquisition | The Company’s acquisition of a Bitcoin Mining production facility in Washington State, US on November 11, 2021 as provided for in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - J. Washington Expansion. |

| NYDIG | NYDIG ABL LLC as per described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2022 - C. Debt Financing. |

| November 2023 Offering | The November 2023 private placement of 44,444,446 common shares and associated warrants as per described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2023 - D. 2023 Private Placements. |

| November 2023 SFBS Prospectus | The final base shelf short form prospectus filed by the Company on November 10, 2023 as described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2023 - E. Prospectus Filings. |

| OBCA | The Ontario Business Corporations Act as per described in Section 2.1 - CORPORATE STRUCTURE - INCORPORATION OF THE COMPANY. |

| Petahash

or PH and Exahash or EH |

Mean, respectively, 1x1015 and 1x1018 Hashes. |

| Power Producer | Has the meaning ascribed to that term in Section 5.2 - FUTURE GROWTH PLANS - ARGENTINA EXPANSION. |

| |

| BITFARMS LTD. |

| 2023 Annual Information Form |

GLOSSARY OF DEFINED TERMS (continued)

| Terms | Definition |

| PROA | Proyectos y Obras Americanas S.A. as per described in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - K. Argentina Expansion. |

| PSU | Power supply unit. See Section 4.14 - DESCRIPTION OF BUSINESS - HARDWARE AND SOFTWARE. |

| Rio Cuarto Facility | The facility located in the Province of Córdoba, Argentina, for which the Company entered into an eight-year lease agreement in July 2021. See Section 5.2 - FUTURE GROWTH PLANS - ARGENTINA EXPANSION. |

| SEC | The U.S. Securities and Exchange Commission. |

| Server farms | Specialized computers often held in large warehouses where the computers, also known as Miners, validate and verify transactions on a public blockchain. Digital coins or tokens are issued by the applicable cryptocurrency network when miners solve hash functions. |

| Sherbrooke Expansion | The planned and completed construction of server farm facilities in stages in Sherbrooke, Québec. |

| Synthetic HODL | Synthetic HODL is the use of financial instruments to create BTC-equivalent exposure. |

| Tranche #2 Restructuring | Has the meaning as provided for in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - C Debt Financing. |

| Tranche #3 Restructuring | Has the meaning as provided for in Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - C Debt Financing. |

| TSX or the Exchange | The Toronto Stock Exchange. |

| TSXV | The TSX Venture Exchange. |

| Villarrica Facility | The Company’s 10 MW facility located in Villarrica, Paraguay. See Section 3 - GENERAL DEVELOPMENT OF THE BUSINESS - FISCAL 2021 - L. Paraguay Expansion. |

| Volta | 9159-9290 Québec Inc., a wholly owned subsidiary of the Company, which also operates under the name Volta Électrique Inc. |

| Warrants | Has the meaning ascribed thereto in “PRIOR SALES” in Section 8.3 - MARKET FOR SECURITIES - MARKET FOR SECURITIES - PRIOR SALES. |

| |

| BITFARMS LTD. |

| 2023 Annual Information Form |

1. GENERAL INFORMATION

1.1 INFORMATION REGARDING BITFARMS

In this annual information form (“AIF”), Bitfarms Ltd., together with its subsidiaries, as the context requires, is referred to as the “Company” and “Bitfarms”. All information contained in this AIF is as of March 6, 2024, unless otherwise stated.

Reference is made in this AIF to the Financial Statements, together with the auditor’s report thereon, and Management’s discussion and analysis (“MD&A”) for Bitfarms for Fiscal 2023. The Financial Statements and MD&A are available for review on the SEDAR+ website located at www.sedarplus.ca and on the U.S. Securities and Exchange Commission’s EDGAR website at www.sec.gov/EDGAR.

1.2 EXEMPTION

The Company is not relying on any exemptions of NI 52-110.

1.3 CURRENCY

Unless otherwise indicated, all references to “$”, “US$” or “dollars” refer to United States dollars, and references to CAD$ refer to Canadian dollars.

1.4 CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This AIF contains forward-looking statements about the Company’s objectives, plans, goals, aspirations, strategies, financial condition, results of operations, cash flows, performance, prospects, opportunities and legal and regulatory matters. Specific forward-looking statements in this AIF include, but are not limited to, statements with respect to the Company’s anticipated future results, events and plans, strategic initiatives, future liquidity, and planned capital investments. Forward-looking statements are typically identified by words such as “expect”, “anticipate”, “believe”, “foresee”, “could”, “estimate”, “goal”, “intend”, “plan”, “seek”, “strive”, “will”, “may”, “maintain”, “achieve”, “grow”, “should” and similar expressions, as they relate to the Company and its Management. Forward-looking statements reflect the Company’s current estimates, beliefs and assumptions, which are based on management’s perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate under the circumstances. The Company’s expectation of operating and financial performance is based on certain assumptions including assumptions about operational growth, anticipated cost savings, operating efficiencies, anticipated benefits from strategic initiatives, future liquidity, and planned capital investments. The Company’s estimates, beliefs and assumptions are inherently subject to significant business, economic, competitive and other uncertainties and contingencies regarding future events and as such, are subject to change. The Company can give no assurance that such estimates, beliefs and assumptions will prove to be correct.

| |

| BITFARMS LTD. |

| 2023 Annual Information Form |

1. GENERAL INFORMATION (continued)

1.4 CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS (continued)

Numerous risks and uncertainties could cause the Company’s actual results to differ materially from those expressed, implied or projected in the forward-looking statements. Such risks and uncertainties include:

| ● | Bitcoin Halving event; |

| ● | insolvency, bankruptcy, or cessation of operations of mining pool operator; |

| ● | reliance on foreign mining pool operator; |

| ● | counterparty risk; |

| ● | emerging markets operating risks; |

| ● | reliance on manufacturing in foreign countries and the importation of equipment to the jurisdictions in which the company operates; |

| ● | dependency on continued growth in blockchain and cryptocurrency usage; |

| ● | the availability of financing opportunities and risks associated with economic conditions, including BTC price, Bitcoin network difficulty and share price fluctuations; |

| ● | global financial conditions; |

| ● | employee retention and growth; |

| ● | cybersecurity threats and hacking; |

| ● | limited operating history and limited history of de-centralized financial system; |

| ● | risk related to technological obsolescence and difficulty in obtaining hardware; |

| ● | economic dependence on regulated terms of service and electricity rates; | |

| ● | costs and demands upon Management and accounting and finance resources as a result of complying with the laws and regulations affecting public companies; | |

| ● | expense and impact of restatement of the Company’s historical financial statements; | |

| ● | lack of comprehensive accounting guidance for cryptocurrencies under IFRS Accounting Standards; | |

| ● | internal control material weakness; |

| ● | increases in commodity prices or reductions in the availability of such commodities could adversely impact the Company’s results of operations; |

| ● | permits and licenses; |

| ● | server or internet failures; |

| ● | tax consequences; |

| ● | environmental regulations and liability; |

| ● | adoption of environmental, social, and governance practices and the impacts of climate change; |

| ● | erroneous transactions and human error; |

| ● | facility developments; |

| ● | non-availability of insurance; |

| ● | competition; |

| ● | hazards associated with high-voltage electricity transmission and industrial operations; |

| ● | corruption, political and regulatory risk; |

| ● | potential being classified as a passive foreign investment company; |

| ● | lawsuits and other legal proceedings and challenges; |

| ● | conflict of interests with directors and management; and |

| ● | other factors beyond the Company’s control. |

The above is not an exhaustive list of the factors that may affect the Company’s forward-looking statements. For a more comprehensive discussion of factors that could affect the Company, refer to the risk factors contained in the Section 4.19 - RISK FACTORS of this AIF. Other risks and uncertainties not presently known to the Company or that the Company presently believes are not material could also cause actual results or events to differ materially from those expressed, implied or projected in its forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect the Company’s expectations only as of the date of this AIF. Except as required by law, the Company does not undertake to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

| |

| BITFARMS LTD. |

| 2023 Annual Information Form |

2. CORPORATE STRUCTURE

2.1 INCORPORATION OF THE COMPANY

Bitfarms was incorporated under the Canada Business Corporations Act on October 11, 2018, and continued under the Business Corporations Act (Ontario) (“OBCA”) on August 27, 2021. Bitfarms has its registered and head office located at 110 Yonge Street, Suite 1601, Toronto ON M5C 1T4. The Company’s common shares are listed under the symbol “BITF” on the Toronto Stock Exchange (the “TSX”) and on the Nasdaq Stock Market (“Nasdaq”) in the United States.

2.2 SUBSIDIARIES

Bitfarms has the following main controlled subsidiaries:

| |

| BITFARMS LTD. |

| 2023 Annual Information Form |

3. GENERAL DEVELOPMENT OF THE BUSINESS

The highlights relating to the development of the Company’s business over the past three years are described below.

| FISCAL 2021 |

A. Board and Management Changes

In Fiscal 2021, the following changes to the Company’s board of directors (the “Board”) and Management were made:

| ● | On January 14, 2021, Mathieu Vachon resigned as the Chief Information Officer and director of the Company. |

| ● | On March 31, 2021, Darcy Donelle was appointed as Vice-President of Corporate Development. |

| ● | On June 3, 2021, the Company announced Jeffrey Lucas was appointed as Chief Financial Officer of the Company effective June 14, 2021, and was issued 364,050 incentive stock options exercisable into one common share at a price of CAD$5.45 for a period of five years, pursuant to the Company’s stock option plan. |

| ● | On June 3, 2021, the Company announced Ben Gagnon was appointed Chief Mining Officer and Nathaniel Port, Director of Finance, was appointed Senior Vice President of Finance and Accounting, both effective June 1, 2021. |

| ● | On September 6, 2021, Darcy Donelle resigned as Vice President of Corporate Development. |

| ● | On November 1, 2021, Patricia Osorio was appointed as Vice President of Corporate Affairs. |

| ● | On November 1, 2021, Benoit Gobeil was appointed as Senior Vice President of Operations and Infrastructure. |

| ● | On December 9, 2021, Geoff Morphy was appointed as Chief Operating Officer in addition to his role as President of the Company. |

B. Private Placements

On January 7, 2021, the Company closed a private placement (the “January 7, 2021 Offering”) for gross proceeds of approximately CAD$20.0 million, comprised of 8,888,889 common shares along with warrants to purchase an aggregate of up to 8,888,889 common shares at a purchase price of CAD$2.25 per common share and associated warrant. The warrants have an exercise price of CAD$2.75 per common share and an exercise period of three years. The net proceeds of the private placement were used by the Company principally to acquire additional miners, expand infrastructure, and improve its working capital position. H.C. Wainwright & Co. acted as the agent and received (i) a cash commission equal to 8.0% of the gross proceeds of the January 7, 2021 Offering and (ii) broker warrants exercisable for up to 711,111 common shares of the Company at a per share price of CAD$2.81 at any time on or before January 8, 2024.

| |

| BITFARMS LTD. |

| 2023 Annual Information Form |

3. GENERAL DEVELOPMENT OF THE BUSINESS (continued)

FISCAL 2021 (continued) |

B. Private Placements (continued)

On January 13, 2021, the Company closed a private placement (the “January 13, 2021 Offering”) for gross proceeds of approximately CAD$20.0 million, comprised of 5,586,593 common shares along with warrants to purchase an aggregate of up to 5,586,593 common shares at a purchase price of CAD$3.58 per common share and associated warrant. The warrants have an exercise price of US$3.10 per common share and exercise period of three and a half years. The net proceeds of the private placement were used by the Company principally to acquire additional miners, expand infrastructure, and improve its working capital position. H.C. Wainwright & Co. acted as the agent and received (i) a cash commission equal to 8.0% of the gross proceeds of the January 13, 2021 Offering and (ii) broker warrants exercisable for up to 446,927 common shares of the Company at a per share price of US$3.53 at any time on or before July 15, 2024.

Ten percent of the gross proceeds of the January 7, 2021 Offering and January 13, 2021 Offering were utilized to reduce the amount of the respective outstanding Loans due in March and November 2021.

On February 10, 2021, the Company closed a private placement (the “February 2021 Offering”) for gross proceeds of approximately CAD$40.0 million, comprised of 11,560,695 common shares along with warrants to purchase an aggregate of up to 11,560,695 common shares at a purchase price of CAD$3.46 per common share and associated warrant. The warrants have an exercise price of US$3.01 per common share and exercise period of three and one-half years. The net proceeds of the private placement were used by the Company principally to acquire additional miners, expand infrastructure, and improve its working capital position. H.C. Wainwright & Co. acted as the agent and received (i) a cash commission equal to 8.0% of the gross proceeds of the February 2021 Offering and (ii) broker warrants exercisable for up to 924,856 common shares of the Company at a per share price of US$3.39 at any time on or before August 12, 2024.

On May 20, 2021, the Company closed a private placement (the “May 2021 Offering”) for gross proceeds of approximately CAD$75.0 million, comprised of 14,150,940 common shares along with warrants to purchase an aggregate of up to 10,613,208 common shares at a purchase price of CAD$5.30 per common share and associated warrant. The warrants have an exercise price of US$4.87 per common share and an exercise period of three years (through May 20, 2024). The net proceeds were used by the Company principally to acquire additional miners, expand infrastructure and improve its working capital position. H.C. Wainwright & Co. acted as the agent and received (i) a cash commission equal to 8.0% of the gross proceeds of the May 2021 Offering, and (ii) broker warrants exercisable for up to 1,132,076 common shares of the Company at a per share price of US$5.49 at any time on or before May 20, 2024.

C. Debt Financing

Dominion

The Company had previously entered into a secured debt financing facility with Dominion Capital (“Dominion”) for up to $20 million (the “Dominion Facility”) on March 14, 2019. The Dominion Facility was structured into four separate loans in tranches of $5.0 Million, with each such tranche bearing interest at 10% per annum on the initial principal balance of each tranche. The Company also agreed to issue 1,666,667 warrants (“Lender Warrants”) to purchase Bitfarms’ common shares at US$0.40 for each loan tranche drawn. In September 2020, the Company entered into an agreement with Dominion to amend its second loan tranche and third loan tranche. The amendment in respect of the second loan tranche of $5.0 Million resulted in the extension of the maturity date from the original due date of April 17, 2021, to November 1, 2021 (the “Tranche #2 Restructuring”). As consideration for the Tranche #2 Restructuring, the Company issued 1,000,000 common shares to Dominion, and reduced the term of the 1,666,667 warrants exercisable at US$0.40 from April 16, 2024, to November 1, 2021.

| |

| BITFARMS LTD. |

| 2023 Annual Information Form |

3. GENERAL DEVELOPMENT OF THE BUSINESS (continued)

FISCAL 2021 (continued) |